About Spirit Spirit Realty Capital, Inc. (NYSE:SRC) is a premier net-lease real estate investment trust (REIT) that primarily invests in high-quality, operationally essential real estate, subject to long-term, net leases. Over the past decade, Spirit has become an industry leader and owner of income-producing, strategically located retail, industrial, office and data center properties. As of June 30, 2019, our diversified portfolio was comprised of 1,563 owned properties and 43 properties securing mortgage loans. Our owned properties, with an aggregate gross leasable area of approximately 29.3 million square feet, are leased to 255 tenants across 48 states and 32 industries. Corporate Headquarters 2727 N. Harwood St. Suite 300 Dallas, Texas 75201 Phone: 972-476-1900 www.spiritrealty.com Transfer Agent American Stock Transfer & Trust Company, LLC Phone: 866-703-9065 www.amstock.com Investor Relations (972) 476-1903 InvestorRelations@spiritrealty.com CORPORATE OVERVIEW Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Portfolio and Financial Overview 4 Condensed Consolidated Statements of Operations 5 Funds and Adjusted Funds From Operations 6 Consolidated Balance Sheets 7 Capitalization and Debt Summary 8 Investment and Disposition Activity 11 Tenant / Industry / Portfolio Diversification 13 Same Store Performance 17 Occupancy 18 Lease Structure and Expirations 19 Net Asset Value (NAV) Components 20 Analyst Coverage 21 Appendix: 22 Reporting Definitions and Explanations 23 Non-GAAP Reconciliations 27 Forward-Looking Statements and Risk Factors 28 TABLE OF CONTENTS

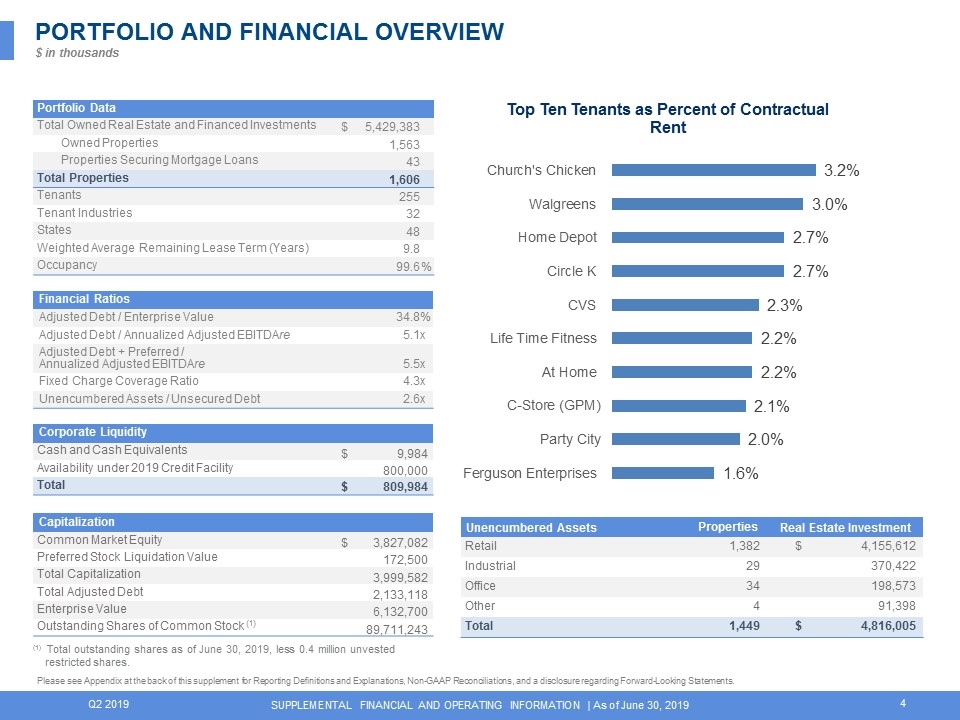

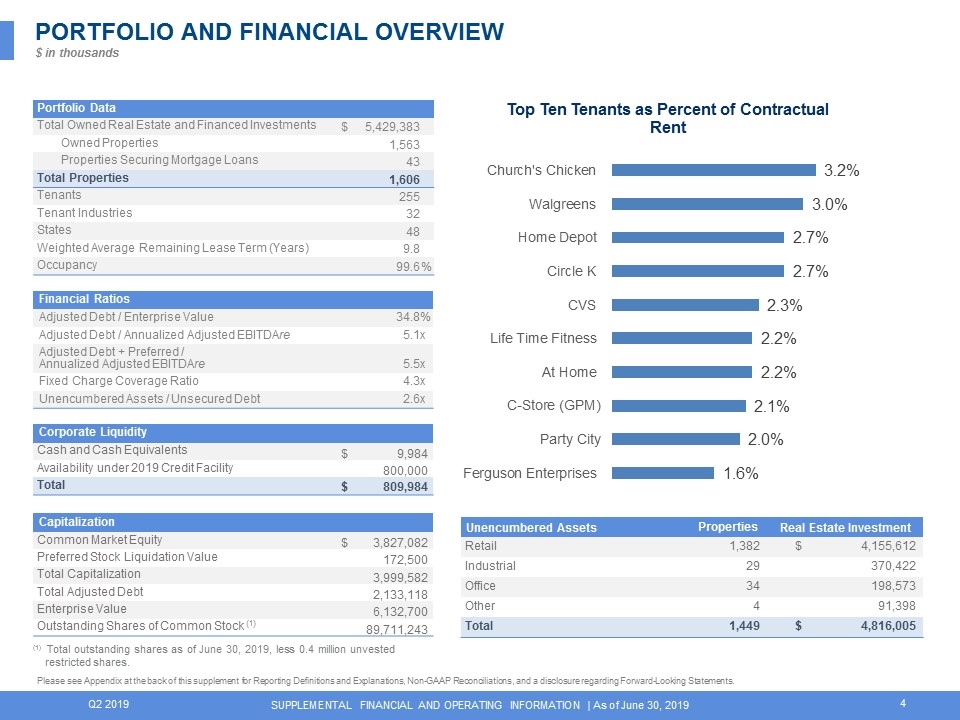

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Portfolio Data Total Owned Real Estate and Financed Investments $ 5,429,383 Owned Properties 1,563 Properties Securing Mortgage Loans 43 Total Properties 1,606 Tenants 255 Tenant Industries 32 States 48 Weighted Average Remaining Lease Term (Years) 9.8 Occupancy 99.6 % Capitalization Common Market Equity $ 3,827,082 Preferred Stock Liquidation Value 172,500 Total Capitalization 3,999,582 Total Adjusted Debt 2,133,118 Enterprise Value 6,132,700 Outstanding Shares of Common Stock (1) 89,711,243 Financial Ratios Adjusted Debt / Enterprise Value 34.8 % Adjusted Debt / Annualized Adjusted EBITDAre 5.1 x Adjusted Debt + Preferred / Annualized Adjusted EBITDAre 5.5 x Fixed Charge Coverage Ratio 4.3 x Unencumbered Assets / Unsecured Debt 2.6 x Corporate Liquidity Cash and Cash Equivalents $ 9,984 Availability under 2019 Credit Facility 800,000 Total $ 809,984 Unencumbered Assets Properties Real Estate Investment Real Estate Investment Retail 1,382 $ 4,155,612 Industrial 29 370,422 Office 34 198,573 Other 4 91,398 Total 1,449 $ 4,816,005 PORTFOLIO AND FINANCIAL OVERVIEW$ in thousands (1) Total outstanding shares as of June 30, 2019, less 0.4 million unvested restricted shares. Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements.

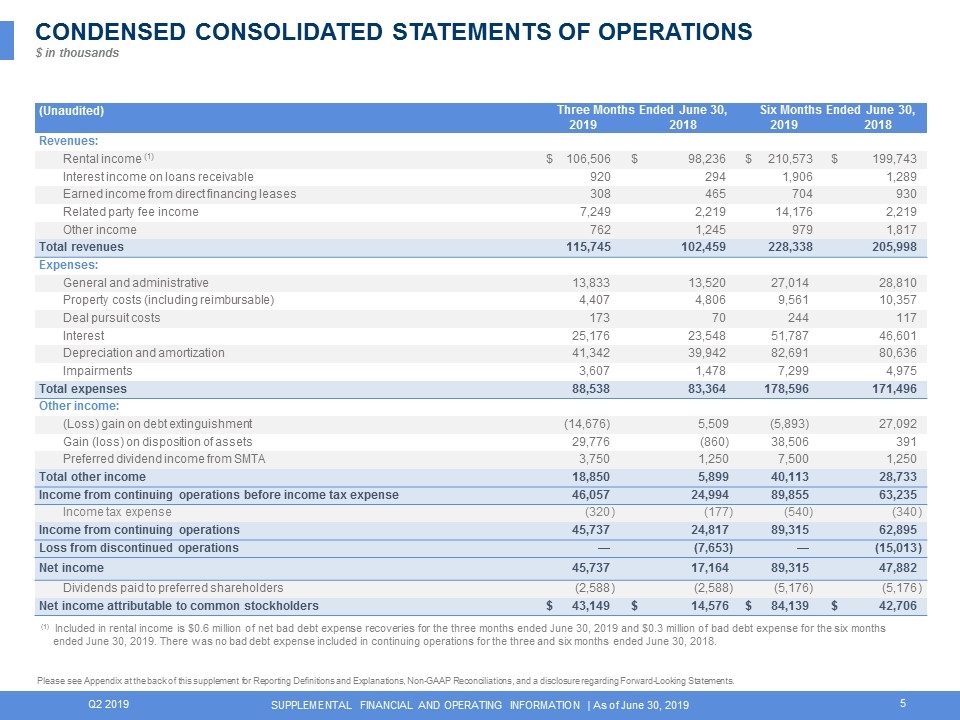

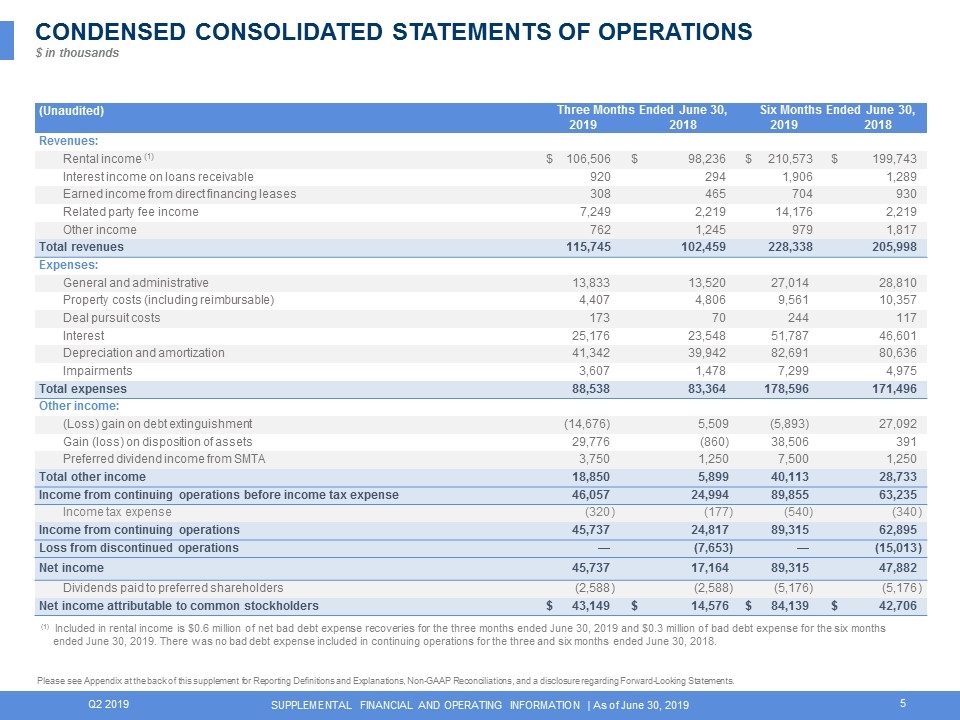

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. (Unaudited) Three Months Ended June 30, Three Months Ended March 31, Six Months Ended June 30, Three Months Ended March 31, 2019 2019 2018 2018 2019 2019 2018 2018 Revenues: Rental income (1) $ 104,067 106,506 $ 98,236 98,236 $ 104,067 210,573 $ 98,236 199,743 Interest income on loans receivable 986 920 294 294 986 1,906 294 1,289 Earned income from direct financing leases 396 308 465 465 396 704 465 930 Related party fee income 6,927 7,249 2,219 2,219 6,927 14,176 2,219 2,219 Other income 217 762 1,245 1,245 217 979 1,245 1,817 Total revenues 112,593 115,745 102,459 102,459 112,593 228,338 102,459 205,998 Expenses: General and administrative 13,833 13,520 27,014 28,810 Property costs (including reimbursable) 4,407 4,806 9,561 10,357 Deal pursuit costs 173 70 244 117 Interest 25,176 23,548 51,787 46,601 Depreciation and amortization 41,342 39,942 82,691 80,636 Impairments 3,607 1,478 7,299 4,975 Total expenses 88,538 83,364 178,596 171,496 Other income: (Loss) gain on debt extinguishment (14,676) 5,509 (5,893) 27,092 Gain (loss) on disposition of assets 29,776 (860) 38,506 391 Preferred dividend income from SMTA 3,750 1,250 7,500 1,250 Total other income 18,850 5,899 40,113 28,733 Income from continuing operations before income tax expense 46,057 24,994 89,855 63,235 Income tax expense (320 ) (177 ) ) (540 ) (340 ) Income from continuing operations 45,737 24,817 89,315 62,895 Loss from discontinued operations — (7,653 ) ) — (15,013 ) Net income 45,737 17,164 89,315 47,882 Dividends paid to preferred shareholders (2,588 ) (2,588 ) ) (5,176 ) (5,176 ) Net income attributable to common stockholders $ 43,149 $ 14,576 $ 84,139 $ 42,706 CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS$ in thousands (1) Included in rental income is $0.6 million of net bad debt expense recoveries for the three months ended June 30, 2019 and $0.3 million of bad debt expense for the six months ended June 30, 2019. There was no bad debt expense included in continuing operations for the three and six months ended June 30, 2018.

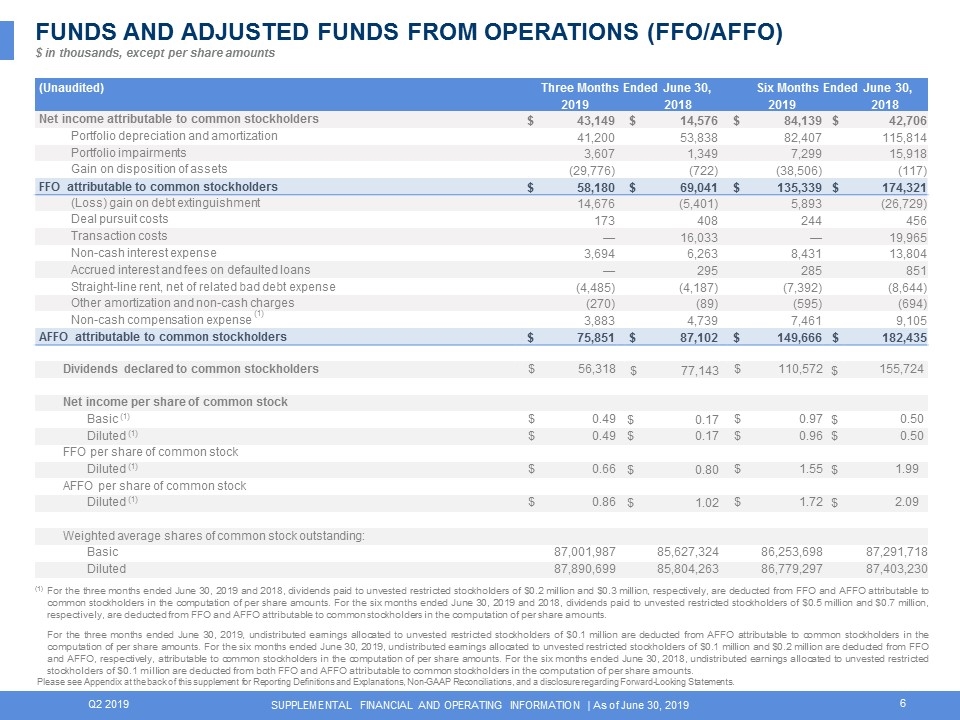

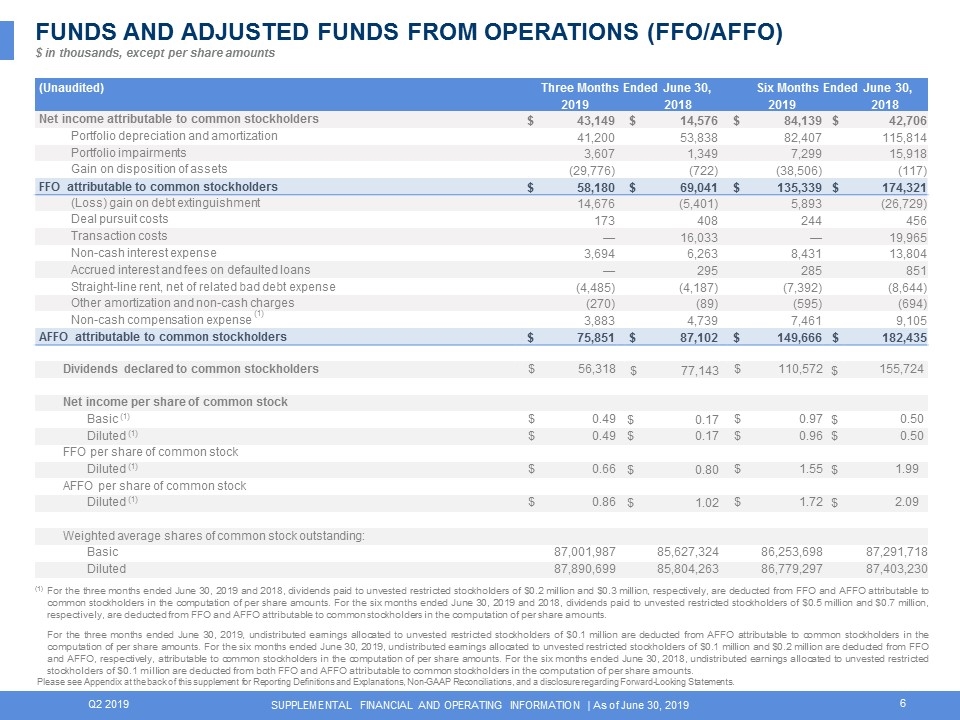

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. FUNDS AND ADJUSTED FUNDS FROM OPERATIONS (FFO/AFFO)$ in thousands, except per share amounts (1) For the three months ended June 30, 2019 and 2018, dividends paid to unvested restricted stockholders of $0.2 million and $0.3 million, respectively, are deducted from FFO and AFFO attributable to common stockholders in the computation of per share amounts. For the six months ended June 30, 2019 and 2018, dividends paid to unvested restricted stockholders of $0.5 million and $0.7 million, respectively, are deducted from FFO and AFFO attributable to common stockholders in the computation of per share amounts. For the three months ended June 30, 2019, undistributed earnings allocated to unvested restricted stockholders of $0.1 million are deducted from AFFO attributable to common stockholders in the computation of per share amounts. For the six months ended June 30, 2019, undistributed earnings allocated to unvested restricted stockholders of $0.1 million and $0.2 million are deducted from FFO and AFFO, respectively, attributable to common stockholders in the computation of per share amounts. For the six months ended June 30, 2018, undistributed earnings allocated to unvested restricted stockholders of $0.1 million are deducted from both FFO and AFFO attributable to common stockholders in the computation of per share amounts. (Unaudited) Three Months Ended June 30, Six Months Ended June 30, 2019 2018 2019 2018 Net income attributable to common stockholders $ 43,149 $ 14,576 $ 84,139 $ 42,706 Portfolio depreciation and amortization 41,200 53,838 82,407 115,814 Portfolio impairments 3,607 1,349 7,299 15,918 Gain on disposition of assets (29,776) (722) (38,506) (117) FFO attributable to common stockholders $ 58,180 $ 69,041 $ 135,339 $ 174,321 (Loss) gain on debt extinguishment 14,676 (5,401) 5,893 (26,729) Deal pursuit costs 173 408 244 456 Transaction costs — 16,033 — 19,965 Non-cash interest expense 3,694 6,263 8,431 13,804 Accrued interest and fees on defaulted loans — 295 285 851 Straight-line rent, net of related bad debt expense (4,485) (4,187) (7,392) (8,644) Other amortization and non-cash charges (270) (89) (595) (694) Non-cash compensation expense (1) 3,883 4,739 7,461 9,105 AFFO attributable to common stockholders $ 75,851 $ 87,102 $ 149,666 $ 182,435 Dividends declared to common stockholders $ 56,318 $ 77,143 $ 110,572 $ 155,724 Net income per share of common stock Basic (1) $ 0.49 $ 0.17 $ 0.97 $ 0.50 Diluted (1) $ 0.49 $ 0.17 $ 0.96 $ 0.50 FFO per share of common stock Diluted (1) $ 0.66 $ 0.80 $ 1.55 $ 1.99 AFFO per share of common stock Diluted (1) $ 0.86 $ 1.02 $ 1.72 $ 2.09 Weighted average shares of common stock outstanding: Basic 87,001,987 85,627,324 86,253,698 87,291,718 Diluted 87,890,699 85,804,263 86,779,297 87,403,230

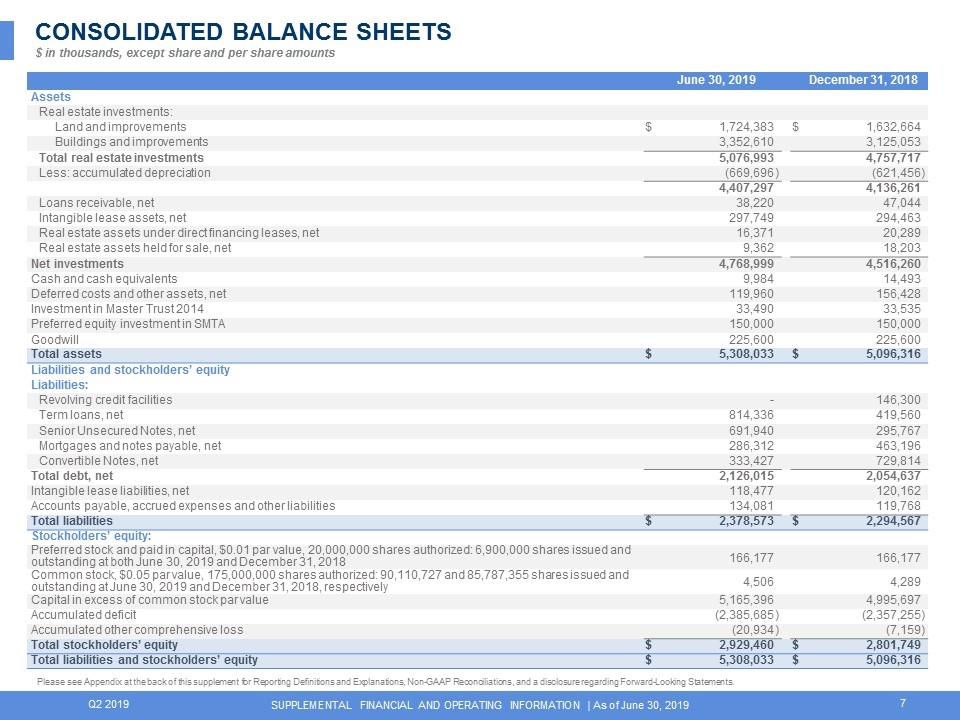

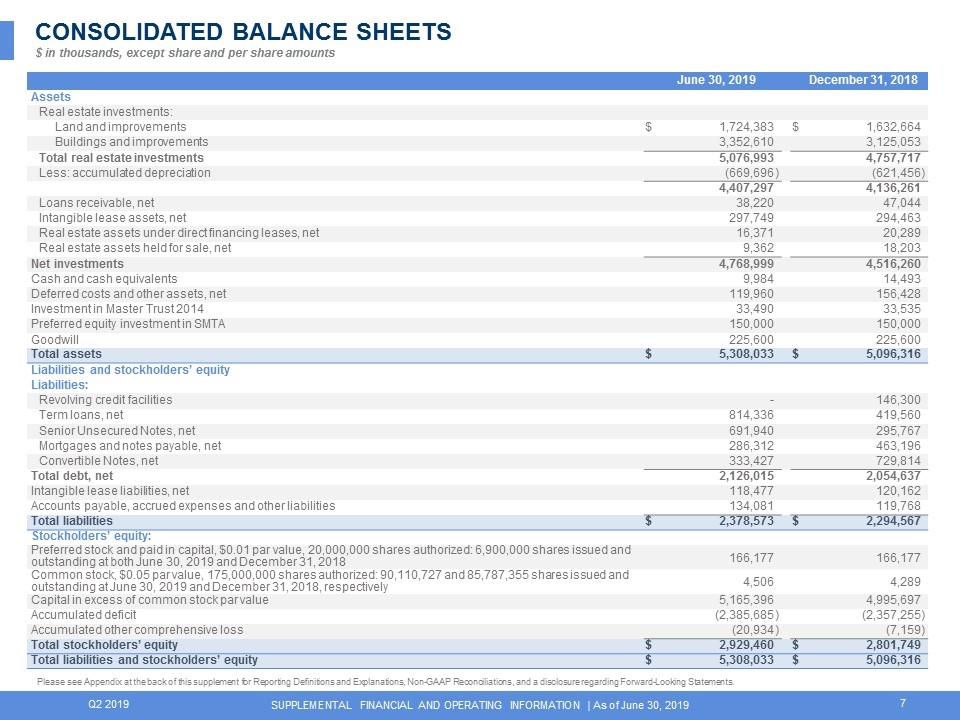

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. CONSOLIDATED BALANCE SHEETS$ in thousands, except share and per share amounts June 30, 2019 March 31, 2019 December 31, 2018 December 31, 2018 Assets Real estate investments: Land and improvements $ 1,724,383 $ 1,632,664 Buildings and improvements 3,352,610 3,125,053 Total real estate investments 5,076,993 4,757,717 Less: accumulated depreciation (669,696 ) (621,456 ) 4,407,297 4,136,261 Loans receivable, net 38,220 47,044 Intangible lease assets, net 297,749 294,463 Real estate assets under direct financing leases, net 16,371 20,289 Real estate assets held for sale, net 9,362 18,203 Net investments 4,768,999 4,516,260 Cash and cash equivalents 9,984 14,493 Deferred costs and other assets, net 119,960 156,428 Investment in Master Trust 2014 33,490 33,535 Preferred equity investment in SMTA 150,000 150,000 Goodwill 225,600 225,600 Total assets $ 5,308,033 $ 5,096,316 Liabilities and stockholders’ equity Liabilities: Revolving credit facilities - 146,300 Term loans, net 814,336 419,560 Senior Unsecured Notes, net 691,940 295,767 Mortgages and notes payable, net 286,312 463,196 Convertible Notes, net 333,427 729,814 Total debt, net 2,126,015 2,054,637 Intangible lease liabilities, net 118,477 120,162 Accounts payable, accrued expenses and other liabilities 134,081 119,768 Total liabilities $ 2,378,573 $ 2,294,567 Stockholders’ equity: Preferred stock and paid in capital, $0.01 par value, 20,000,000 shares authorized: 6,900,000 shares issued and outstanding at both June 30, 2019 and December 31, 2018 166,177 166,177 Common stock, $0.05 par value, 175,000,000 shares authorized: 90,110,727 and 85,787,355 shares issued and outstanding at June 30, 2019 and December 31, 2018, respectively 4,506 4,289 Capital in excess of common stock par value 5,165,396 4,995,697 Accumulated deficit (2,385,685 ) (2,357,255 ) Accumulated other comprehensive loss (20,934 ) (7,159 ) Total stockholders’ equity $ 2,929,460 $ 2,801,749 Total liabilities and stockholders’ equity $ 5,308,033 $ 5,096,316

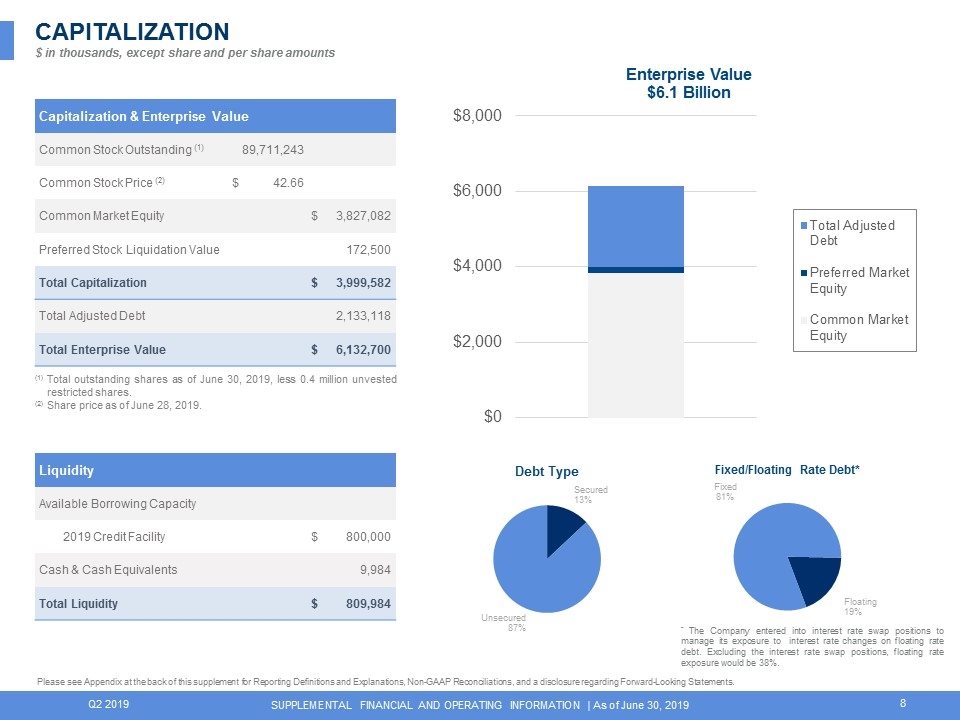

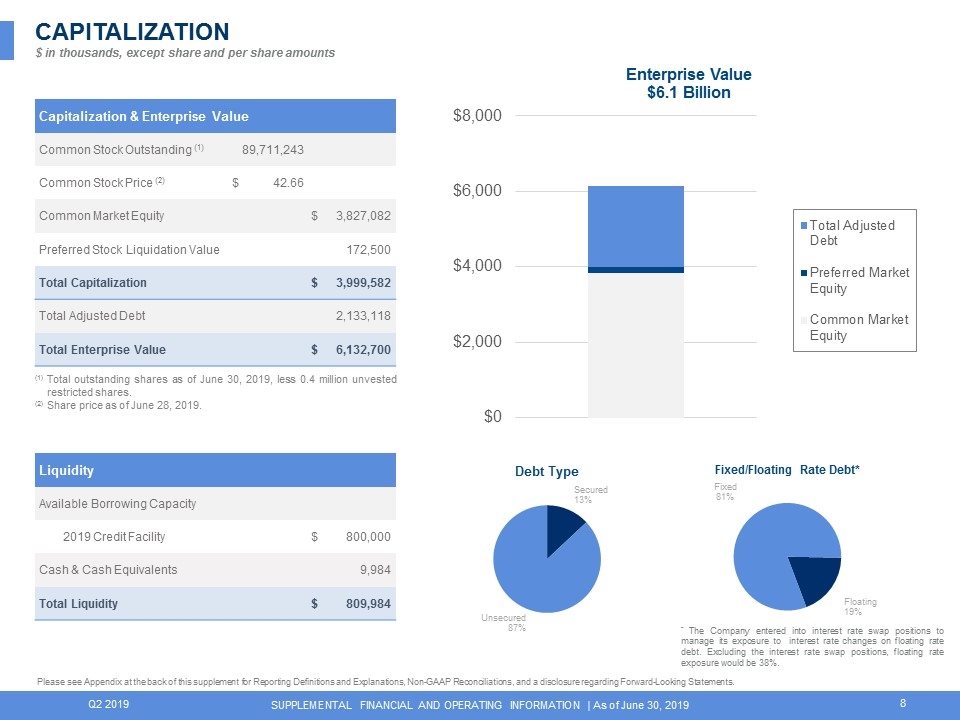

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. CAPITALIZATION$ in thousands, except share and per share amounts Capitalization & Enterprise Value Common Stock Outstanding (1) 89,711,243 Common Stock Price (2) $ 42.66 Common Market Equity $ 3,827,082 Preferred Stock Liquidation Value 172,500 Total Capitalization $ 3,999,582 Total Adjusted Debt 2,133,118 Total Enterprise Value $ 6,132,700 Liquidity Available Borrowing Capacity 2019 Credit Facility $ 800,000 Cash & Cash Equivalents 9,984 Total Liquidity $ 809,984 (1)Total outstanding shares as of June 30, 2019, less 0.4 million unvested restricted shares. (2)Share price as of June 28, 2019. * The Company entered into interest rate swap positions to manage its exposure to interest rate changes on floating rate debt. Excluding the interest rate swap positions, floating rate exposure would be 38%.

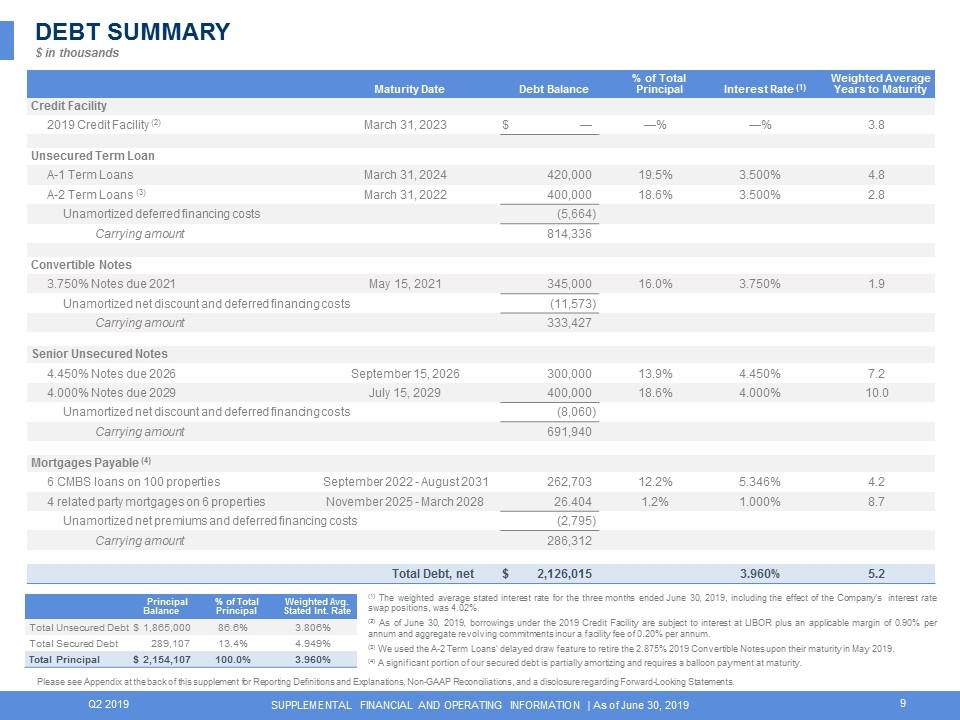

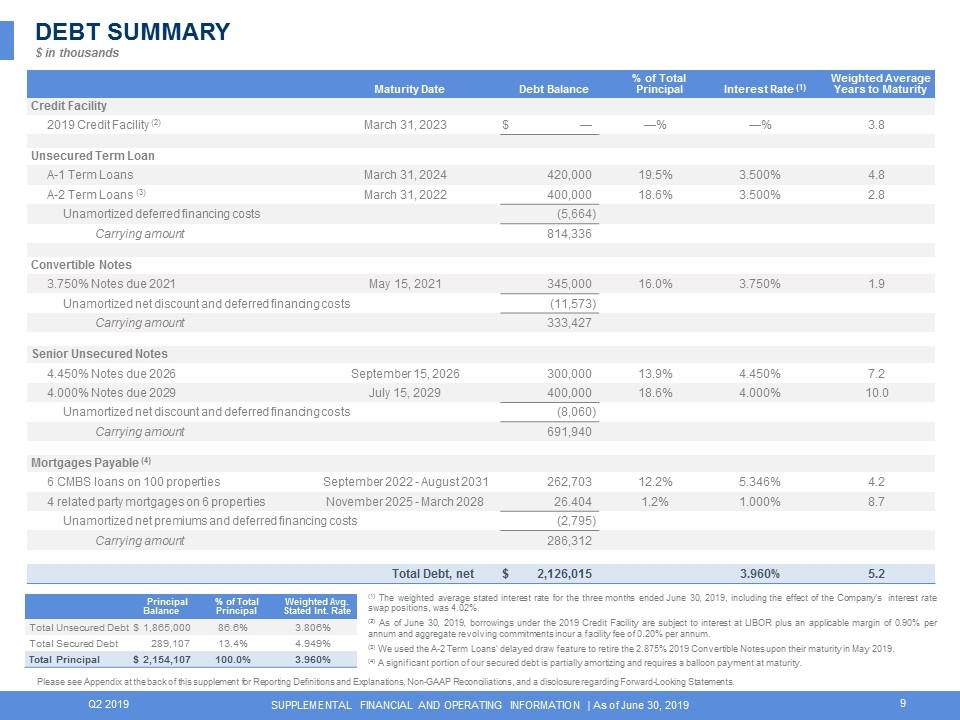

Maturity Date Debt Balance Debt Balance % of Total Principal Interest Rate (1) Weighted Average Years to Maturity Credit Facility 2019 Credit Facility (2) March 31, 2023 $ — —% —% 3.8 Unsecured Term Loan A-1 Term Loans March 31, 2024 420,000 19.5% 3.500% 4.8 A-2 Term Loans (3) March 31, 2022 400,000 18.6% 3.500% 2.8 Unamortized deferred financing costs (5,664 ) Carrying amount 814,336 Convertible Notes 3.750% Notes due 2021 May 15, 2021 345,000 16.0% 3.750% 1.9 Unamortized net discount and deferred financing costs (11,573 ) Carrying amount 333,427 Senior Unsecured Notes 4.450% Notes due 2026 September 15, 2026 300,000 13.9% 4.450% 7.2 4.000% Notes due 2029 July 15, 2029 400,000 18.6% 4.000% 10.0 Unamortized net discount and deferred financing costs (8,060 ) Carrying amount 691,940 Mortgages Payable (4) 6 CMBS loans on 100 properties September 2022 - August 2031 262,703 12.2% 5.346% 4.2 4 related party mortgages on 6 properties November 2025 - March 2028 26.404 1.2% 1.000% 8.7 Unamortized net premiums and deferred financing costs (2,795 ) Carrying amount 286,312 Total Debt, net $ 2,126,015 3.960% 5.2 Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. (1) The weighted average stated interest rate for the three months ended June 30, 2019, including the effect of the Company's interest rate swap positions, was 4.02%. (2) As of June 30, 2019, borrowings under the 2019 Credit Facility are subject to interest at LIBOR plus an applicable margin of 0.90% per annum and aggregate revolving commitments incur a facility fee of 0.20% per annum. (3) We used the A-2 Term Loans’ delayed draw feature to retire the 2.875% 2019 Convertible Notes upon their maturity in May 2019. (4) A significant portion of our secured debt is partially amortizing and requires a balloon payment at maturity. Principal Balance Principal Balance % of Total Principal Weighted Avg. Stated Int. Rate Total Unsecured Debt $ 1,865,000 86.6% 3.806% Total Secured Debt 289,107 13.4% 4.949% Total Principal $ 2,154,107 100.0% 3.960% DEBT SUMMARY$ in thousands

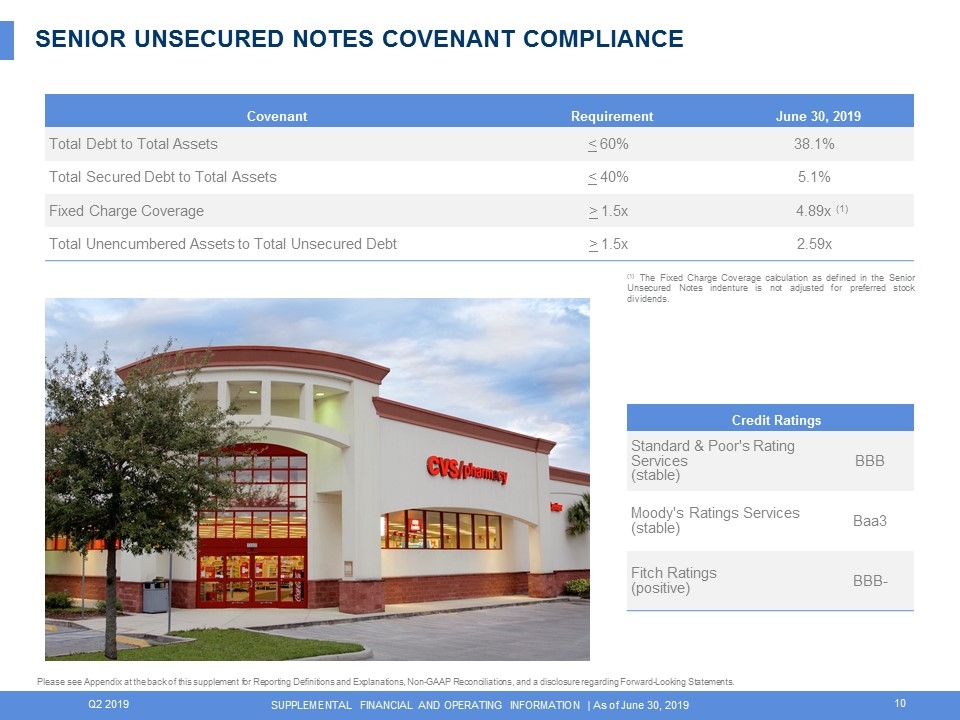

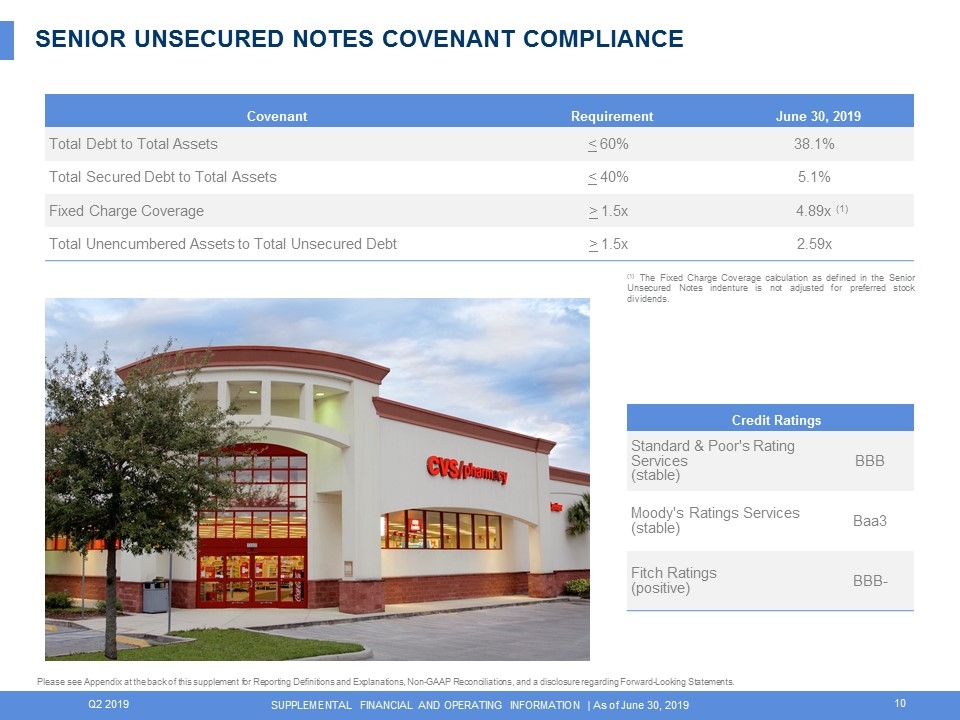

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. Covenant Requirement June 30, 2019 Total Debt to Total Assets < 60% 38.1% Total Secured Debt to Total Assets < 40% 5.1% Fixed Charge Coverage > 1.5x 4.89x (1) Total Unencumbered Assets to Total Unsecured Debt > 1.5x 2.59x Credit Ratings Standard & Poor's Rating Services (stable) BBB Moody's Ratings Services (stable) Baa3 Fitch Ratings (positive) BBB- SENIOR UNSECURED NOTES COVENANT COMPLIANCE (1) The Fixed Charge Coverage calculation as defined in the Senior Unsecured Notes indenture is not adjusted for preferred stock dividends.

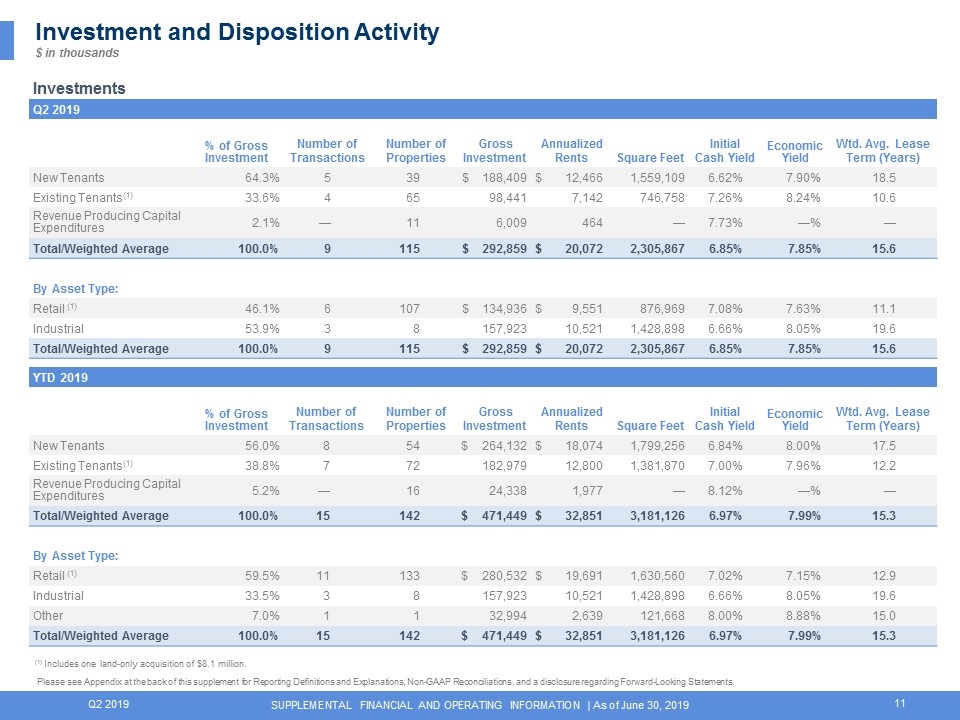

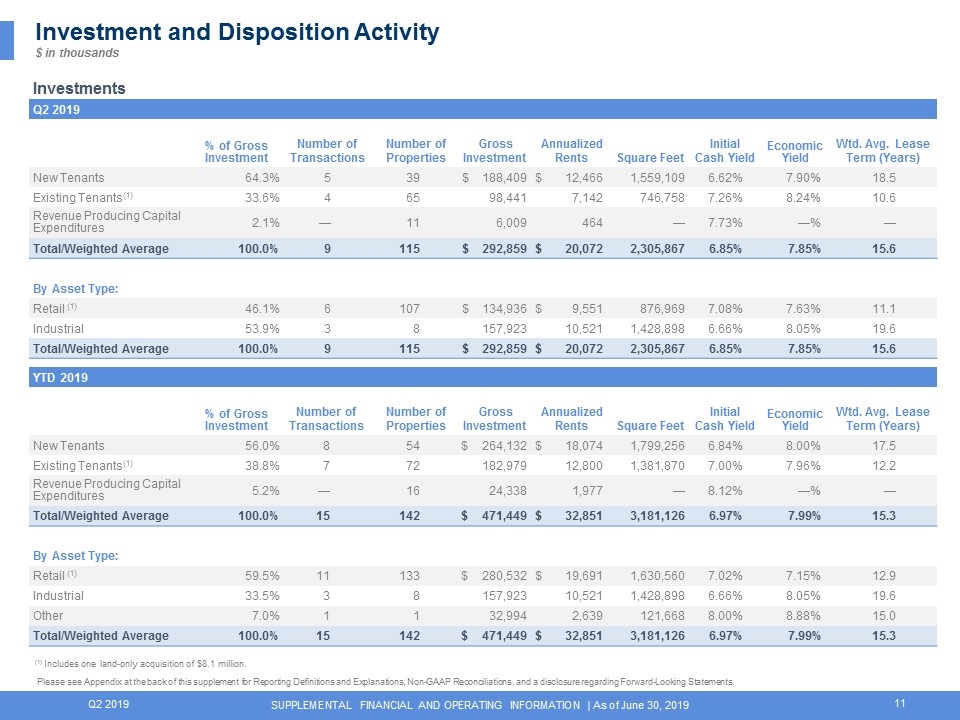

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. Investments Q2 2019 % of Gross Investment Number of Transactions Number of Properties Gross Investment Gross Investment Annualized Rents Annualized Rents Square Feet Initial Cash Yield Economic Yield Wtd. Avg. Lease Term (Years) New Tenants 64.3 % 5 39 $ 188,409 $ 12,466 1,559,109 6.62% 7.90% 18.5 Existing Tenants(1) 33.6 % 4 65 98,441 7,142 746,758 7.26% 8.24% 10.6 Revenue Producing Capital Expenditures 2.1 % — 11 6,009 464 — 7.73% —% — Total/Weighted Average 100.0 % 9 115 $ 292,859 $ 20,072 2,305,867 6.85% 7.85% 15.6 By Asset Type: Retail (1) 46.1 % 6 107 $ 134,936 $ 9,551 876,969 7.08% 7.63% 11.1 Industrial 53.9 % 3 8 157,923 10,521 1,428,898 6.66% 8.05% 19.6 Total/Weighted Average 100.0 % 9 115 $ 292,859 $ 20,072 2,305,867 6.85% 7.85% 15.6 (1) Includes one land-only acquisition of $8.1 million. YTD 2019 % of Gross Investment Number of Transactions Number of Properties Gross Investment Gross Investment Annualized Rents Annualized Rents Square Feet Initial Cash Yield Economic Yield Wtd. Avg. Lease Term (Years) New Tenants 56.0 % 8 54 $ 264,132 $ 18,074 1,799,256 6.84% 8.00% 17.5 Existing Tenants(1) 38.8 % 7 72 182,979 12,800 1,381,870 7.00% 7.96% 12.2 Revenue Producing Capital Expenditures 5.2 % — 16 24,338 1,977 — 8.12% —% — Total/Weighted Average 100.0 % 15 142 $ 471,449 $ 32,851 3,181,126 6.97% 7.99% 15.3 By Asset Type: Retail (1) 59.5 % 11 133 $ 280,532 $ 19,691 1,630,560 7.02% 7.15% 12.9 Industrial 33.5 % 3 8 157,923 10,521 1,428,898 6.66% 8.05% 19.6 Other 7.0 % 1 1 32,994 2,639 121,668 8.00% 8.88% 15.0 Total/Weighted Average 100.0 % 15 142 $ 471,449 $ 32,851 3,181,126 6.97% 7.99% 15.3 Investment and Disposition Activity$ in thousands

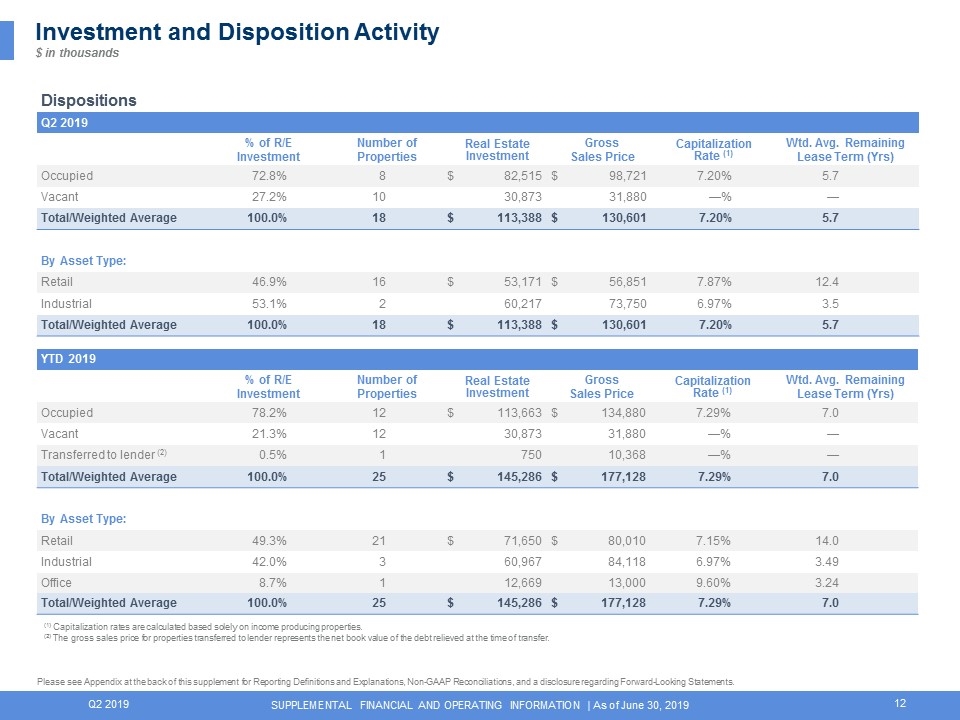

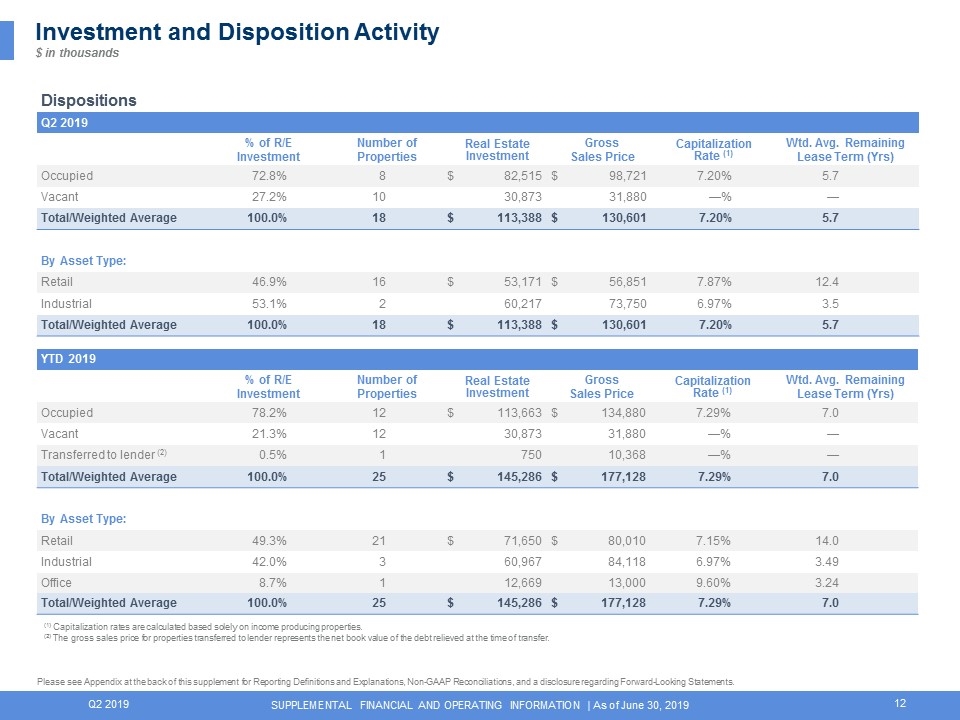

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. Investment and Disposition Activity$ in thousands Dispositions Q2 2019 % of R/E Investment Number of Properties Real Estate Investment Gross Investment Gross Sales Price Gross Sales Price Capitalization Rate (1) Wtd. Avg. Remaining Lease Term (Yrs) Occupied 72.8% 8 $ 82,515 $ 98,721 7.20% 5.7 Vacant 27.2% 10 30,873 31,880 —% — Total/Weighted Average 100.0% 18 $ 113,388 $ 130,601 7.20% 5.7 By Asset Type: Retail 46.9% 16 $ 53,171 $ 56,851 7.87% 12.4 Industrial 53.1% 2 60,217 73,750 6.97% 3.5 Total/Weighted Average 100.0% 18 $ 113,388 $ 130,601 7.20% 5.7 (1) Capitalization rates are calculated based solely on income producing properties. (2) The gross sales price for properties transferred to lender represents the net book value of the debt relieved at the time of transfer. YTD 2019 % of R/E Investment Number of Properties Real Estate Investment Gross Investment Gross Sales Price Gross Sales Price Capitalization Rate (1) Wtd. Avg. Remaining Lease Term (Yrs) Occupied 78.2% 12 $ 113,663 $ 134,880 7.29% 7.0 Vacant 21.3% 12 30,873 31,880 —% — Transferred to lender (2) 0.5% 1 750 10,368 —% — Total/Weighted Average 100.0% 25 $ 145,286 $ 177,128 7.29% 7.0 By Asset Type: Retail 49.3% 21 $ 71,650 $ 80,010 7.15% 14.0 Industrial 42.0% 3 60,967 84,118 6.97% 3.49 Office 8.7% 1 12,669 13,000 9.60% 3.24 Total/Weighted Average 100.0% 25 $ 145,286 $ 177,128 7.29% 7.0

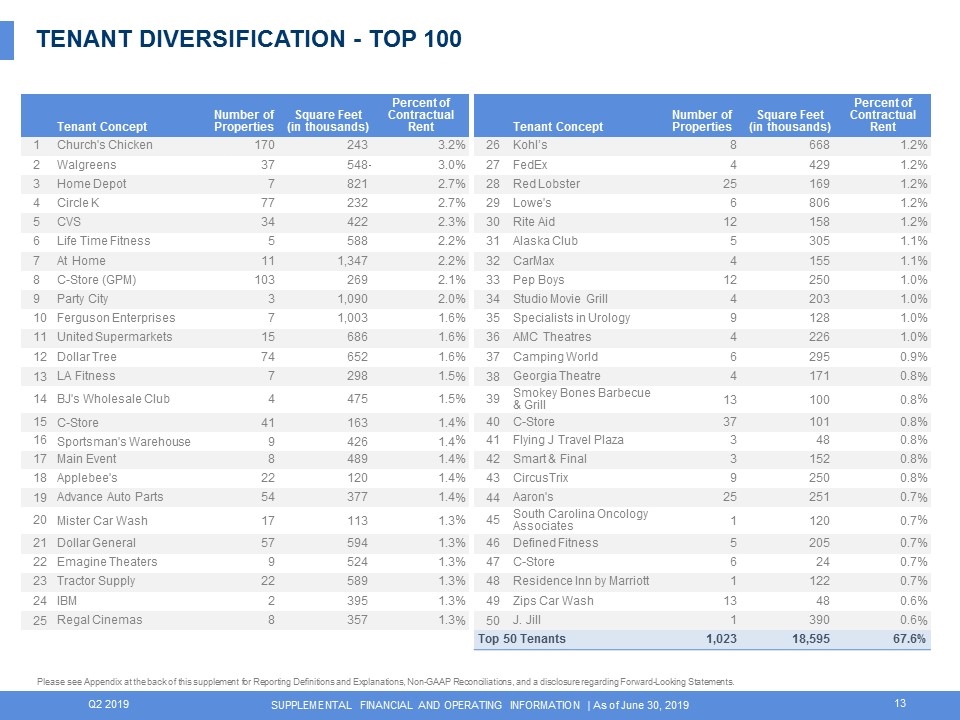

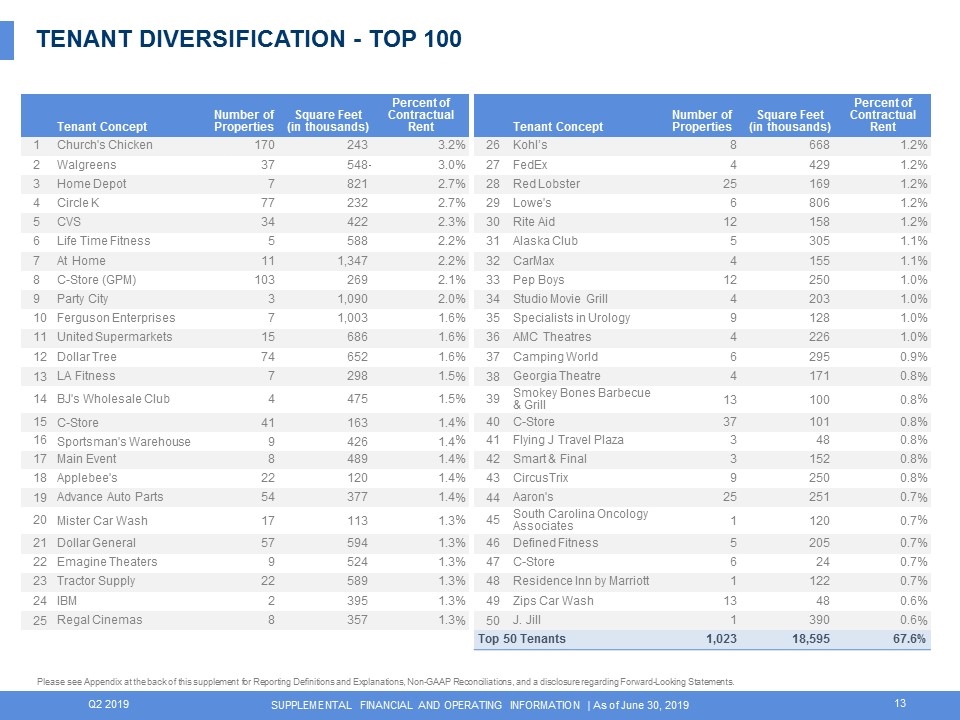

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. TENANT DIVERSIFICATION - TOP 100 Tenant Concept Number of Properties Square Feet (in thousands) Percent of Contractual Rent Tenant Concept Number of Properties Square Feet (in thousands) Percent of Contractual Rent 1 Church's Chicken 170 243 3.2 % 26 Kohl’s 8 668 1.2 % 2 Walgreens 37 548 48 3.0 % 27 FedEx 4 429 1.2 % 3 Home Depot 7 821 2.7 % 28 Red Lobster 25 169 1.2 % 4 Circle K 77 232 2.7 % 29 Lowe's 6 806 1.2 % 5 CVS 34 422 2.3 % 30 Rite Aid 12 158 1.2 % 6 Life Time Fitness 5 588 2.2 % 31 Alaska Club 5 305 1.1 % 7 At Home 11 1,347 2.2 % 32 CarMax 4 155 1.1 % 8 C-Store (GPM) 103 269 2.1 % 33 Pep Boys 12 250 1.0 % 9 Party City 3 1,090 2.0 % 34 Studio Movie Grill 4 203 1.0 % 10 Ferguson Enterprises 7 1,003 1.6 % 35 Specialists in Urology 9 128 1.0 % 11 United Supermarkets 15 686 1.6 % 36 AMC Theatres 4 226 1.0 % 12 Dollar Tree 74 652 1.6 % 37 Camping World 6 295 0.9 % 13 LA Fitness 7 298 1.5 % 38 Georgia Theatre 4 171 0.8 % 14 BJ's Wholesale Club 4 475 1.5 % 39 Smokey Bones Barbecue & Grill 13 100 0.8 % 15 C-Store 41 163 1.4 % 40 C-Store 37 101 0.8 % 16 Sportsman's Warehouse 9 426 1.4 % 41 Flying J Travel Plaza 3 48 0.8 % 17 Main Event 8 489 1.4 % 42 Smart & Final 3 152 0.8 % 18 Applebee's 22 120 1.4 % 43 CircusTrix 9 250 0.8 % 19 Advance Auto Parts 54 377 1.4 % 44 Aaron's 25 251 0.7 % 20 Mister Car Wash 17 113 1.3 % 45 South Carolina Oncology Associates 1 120 0.7 % 21 Dollar General 57 594 1.3 % 46 Defined Fitness 5 205 0.7 % 22 Emagine Theaters 9 524 1.3 % 47 C-Store 6 24 0.7 % 23 Tractor Supply 22 589 1.3 % 48 Residence Inn by Marriott 1 122 0.7 % 24 IBM 2 395 1.3 % 49 Zips Car Wash 13 48 0.6 % 25 Regal Cinemas 8 357 1.3 % 50 J. Jill 1 390 0.6 % Top 50 Tenants 1,023 18,595 67.6%

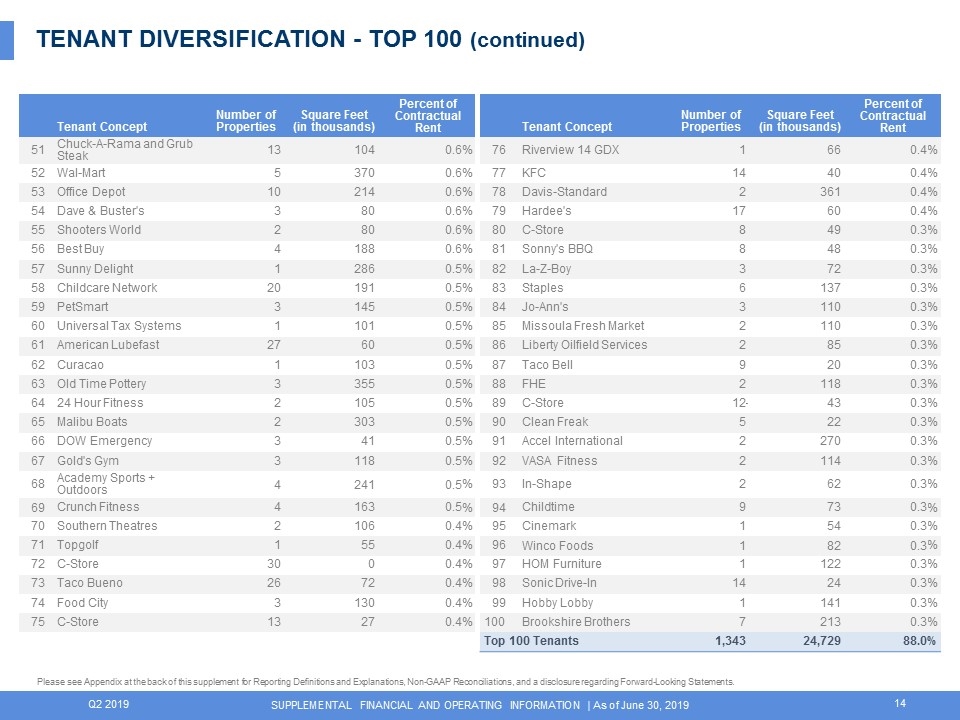

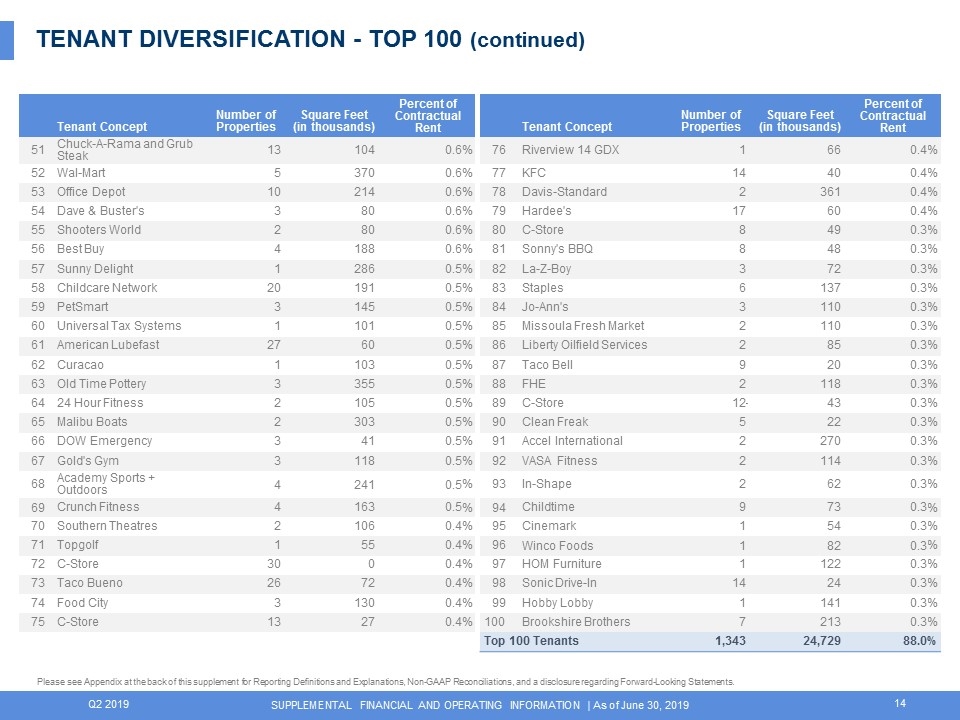

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. TENANT DIVERSIFICATION - TOP 100 (continued) Tenant Concept Number of Properties Square Feet (in thousands) Percent of Contractual Rent Tenant Concept Number of Properties Square Feet (in thousands) Percent of Contractual Rent 51 Chuck-A-Rama and Grub Steak 13 104 0.6 % 76 Riverview 14 GDX 1 66 0.4 % 52 Wal-Mart 5 370 0.6 % 77 KFC 14 40 0.4 % 53 Office Depot 10 214 0.6 % 78 Davis-Standard 2 361 0.4 % 54 Dave & Buster's 3 80 0.6 % 79 Hardee's 17 60 0.4 % 55 Shooters World 2 80 0.6 % 80 C-Store 8 49 0.3 % 56 Best Buy 4 188 0.6 % 81 Sonny's BBQ 8 48 0.3 % 57 Sunny Delight 1 286 0.5 % 82 La-Z-Boy 3 72 0.3 % 58 Childcare Network 20 191 0.5 % 83 Staples 6 137 0.3 % 59 PetSmart 3 145 0.5 % 84 Jo-Ann's 3 110 0.3 % 60 Universal Tax Systems 1 101 0.5 % 85 Missoula Fresh Market 2 110 0.3 % 61 American Lubefast 27 60 0.5 % 86 Liberty Oilfield Services 2 85 0.3 % 62 Curacao 1 103 0.5 % 87 Taco Bell 9 20 0.3 % 63 Old Time Pottery 3 355 0.5 % 88 FHE 2 118 0.3 % 64 24 Hour Fitness 2 105 0.5 % 89 C-Store 12 43 43 0.3 % 65 Malibu Boats 2 303 0.5 % 90 Clean Freak 5 22 0.3 % 66 DOW Emergency 3 41 0.5 % 91 Accel International 2 270 0.3 % 67 Gold's Gym 3 118 0.5 % 92 VASA Fitness 2 114 0.3 % 68 Academy Sports + Outdoors 4 241 0.5 % 93 In-Shape 2 62 0.3 % 69 Crunch Fitness 4 163 0.5 % 94 Childtime 9 73 0.3 % 70 Southern Theatres 2 106 0.4 % 95 Cinemark 1 54 0.3 % 71 Topgolf 1 55 0.4 % 96 Winco Foods 1 82 0.3 % 72 C-Store 30 0 0.4 % 97 HOM Furniture 1 122 0.3 % 73 Taco Bueno 26 72 0.4 % 98 Sonic Drive-In 14 24 0.3 % 74 Food City 3 130 0.4 % 99 Hobby Lobby 1 141 0.3 % 75 C-Store 13 27 0.4 % 100 Brookshire Brothers 7 213 0.3 % Top 100 Tenants 1,343 24,729 88.0%

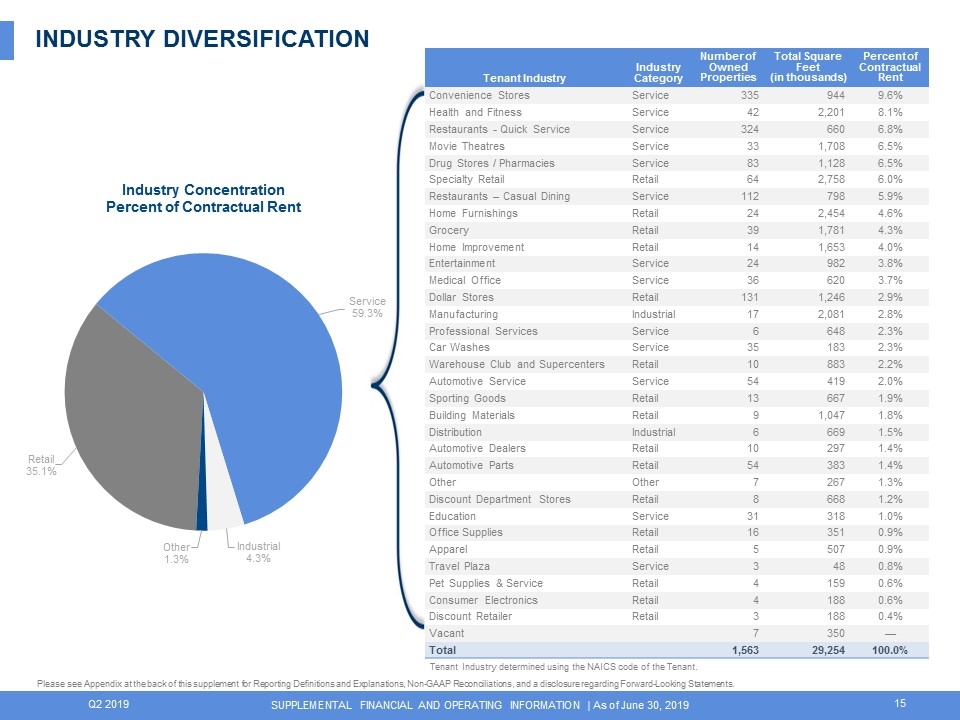

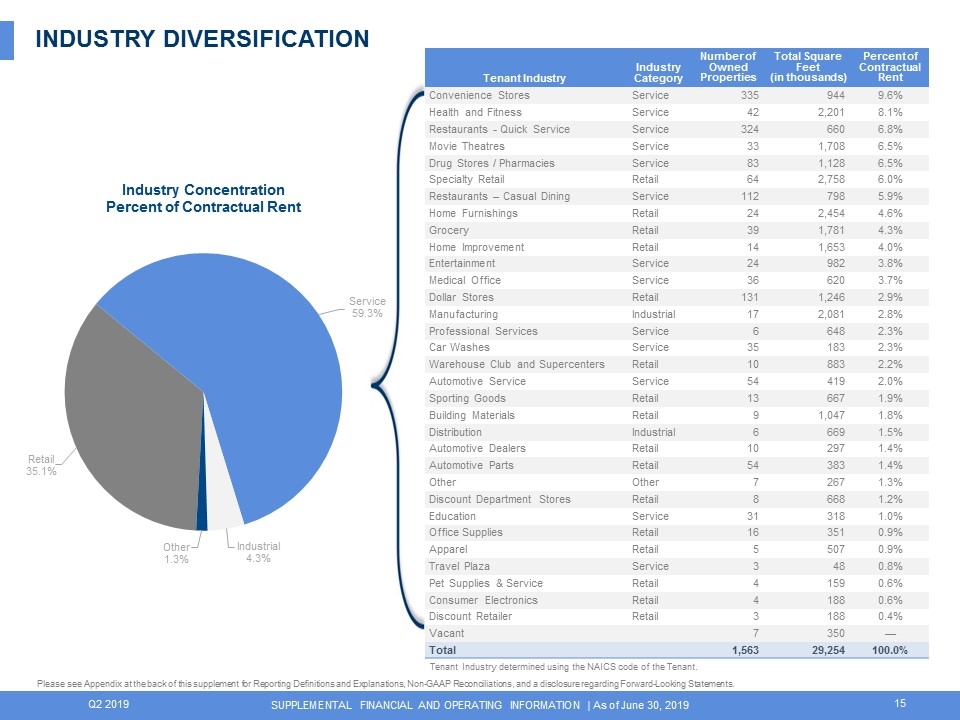

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. INDUSTRY DIVERSIFICATION Tenant Industry Industry Category Number of Owned Properties Total Square Feet (in thousands) Percent of Contractual Rent Convenience Stores Service 335 944 9.6% Health and Fitness Service 42 2,201 8.1% Restaurants - Quick Service Service 324 660 6.8% Movie Theatres Service 33 1,708 6.5% Drug Stores / Pharmacies Service 83 1,128 6.5% Specialty Retail Retail 64 2,758 6.0% Restaurants – Casual Dining Service 112 798 5.9% Home Furnishings Retail 24 2,454 4.6% Grocery Retail 39 1,781 4.3% Home Improvement Retail 14 1,653 4.0% Entertainment Service 24 982 3.8% Medical Office Service 36 620 3.7% Dollar Stores Retail 131 1,246 2.9% Manufacturing Industrial 17 2,081 2.8% Professional Services Service 6 648 2.3% Car Washes Service 35 183 2.3% Warehouse Club and Supercenters Retail 10 883 2.2% Automotive Service Service 54 419 2.0% Sporting Goods Retail 13 667 1.9% Building Materials Retail 9 1,047 1.8% Distribution Industrial 6 669 1.5% Automotive Dealers Retail 10 297 1.4% Automotive Parts Retail 54 383 1.4% Other Other 7 267 1.3% Discount Department Stores Retail 8 668 1.2% Education Service 31 318 1.0% Office Supplies Retail 16 351 0.9% Apparel Retail 5 507 0.9% Travel Plaza Service 3 48 0.8% Pet Supplies & Service Retail 4 159 0.6% Consumer Electronics Retail 4 188 0.6% Discount Retailer Retail 3 188 0.4% Vacant 7 350 — Total 1,563 29,254 100.0% Tenant Industry determined using the NAICS code of the Tenant.

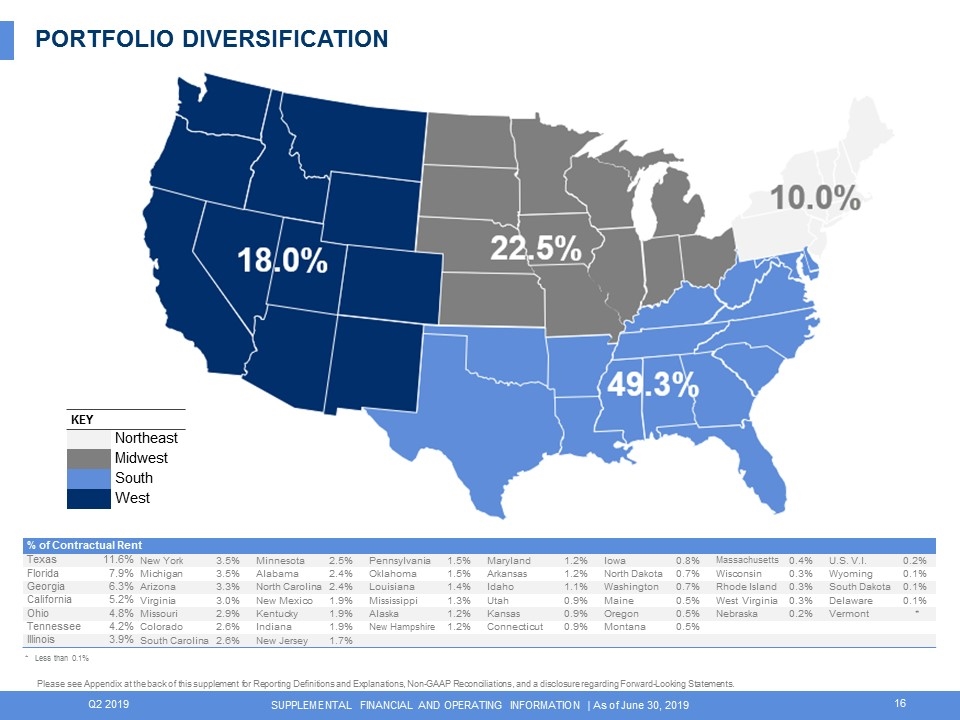

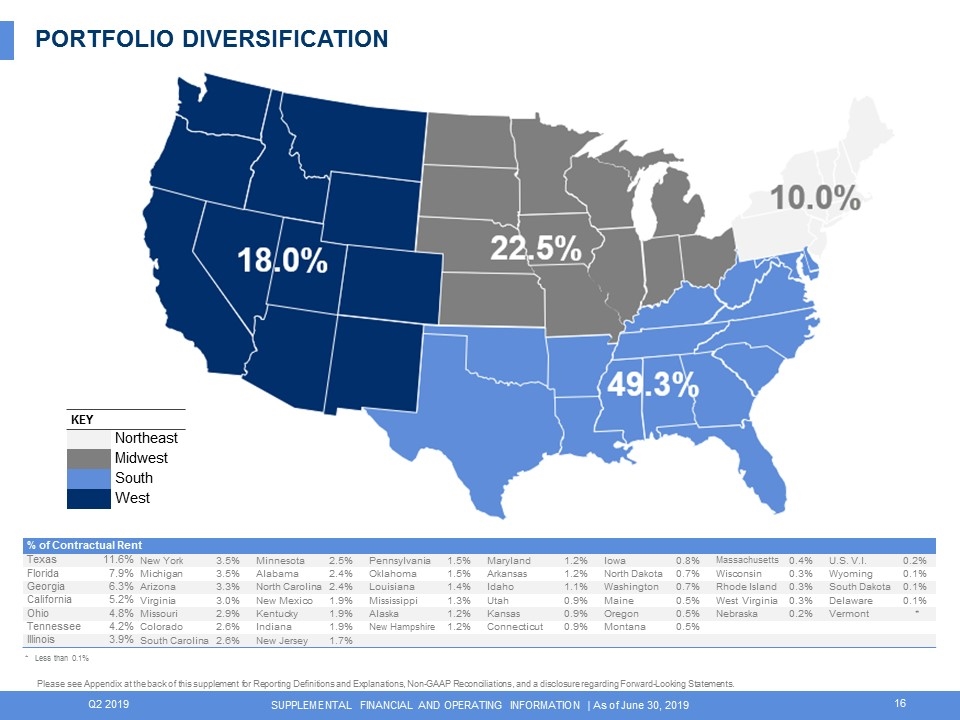

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. * Less than 0.1% PORTFOLIO DIVERSIFICATION KEY Northeast Midwest South West % of Contractual Rent Texas 11.6 % New York 3.5% Minnesota 2.5% Pennsylvania 1.5% Maryland 1.2% Iowa 0.8% Massachusetts 0.4% U.S. V.I. 0.2% Florida 7.9 % Michigan 3.5% Alabama 2.4% Oklahoma 1.5% Arkansas 1.2% North Dakota 0.7% Wisconsin 0.3% Wyoming 0.1% Georgia 6.3 % Arizona 3.3% North Carolina 2.4% Louisiana 1.4% Idaho 1.1% Washington 0.7% Rhode Island 0.3% South Dakota 0.1% California 5.2 % Virginia 3.0% New Mexico 1.9% Mississippi 1.3% Utah 0.9% Maine 0.5% West Virginia 0.3% Delaware 0.1% Ohio 4.8 % Missouri 2.9% Kentucky 1.9% Alaska 1.2% Kansas 0.9% Oregon 0.5% Nebraska 0.2% Vermont * Tennessee 4.2 % Colorado 2.6% Indiana 1.9% New Hampshire 1.2% Connecticut 0.9% Montana 0.5% Illinois 3.9 % South Carolina 2.6% New Jersey 1.7%

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. Same Store Results Number of Properties 1,337 Total Square Feet (in thousands) 21,314 June 2019 $ 26,419 June 2018 $ 26,071 Increase (in dollars) $ 348 Increase (percent) 1.3 % Asset Type Contractual Rent for theMonth Ended June 30,2019 2018 Contractual Rent for theMonth Ended March 31,2019 2018 Net Change Net Change % Change by Asset Type % of Total Asset Type Contribution Retail $ 22,367 $ 22,153 $ 214 1.0 % 84.6 % Industrial 2,212 2,132 80 3.7 % 8.4 % Office 1,342 1,299 43 3.3 % 5.1 % Other 498 487 11 2.3 % 1.9 % Total $ 26,419 $ 26,071 $ 348 1.3 % 100.0 % Same Store Pool Defined We include all properties owned throughout the measurement period in both the current and prior year and exclude: multi-tenant properties, properties that were vacant, renewed or relet at any point during the measurement period, construction in progress, and properties where contractual rent was fully or partially reserved in either the current or prior measurement period. Industry Contractual Rent for theMonth Ended June 30,2019 2018 Contractual Rent for theMonth Ended March 31,2019 2018 Net Change Net Change % Change by Industry Type % of Total Industry Contribution Convenience Stores $ 3,098 $ 3,107 $ (9 ) (0.3 )% 11.7 % Restaurants - Quick Service 2,228 2,214 14 0.6 % 8.4 % Drug Stores / Pharmacies 1,888 1,900 (12 ) (0.7 )% 7.1 % Movie Theaters 1,838 1,797 41 2.3 % 7.0 % Restaurants - Casual Dining 1,746 1,714 32 1.8 % 6.6 % Health and Fitness 1,445 1,404 41 3.0 % 5.5 % Grocery 1,246 1,223 23 1.8 % 4.7 % Medical Office 1,224 1,201 23 1.9 % 4.6 % Remaining Tenant Categories 11,706 11,511 195 1.7 % 44.4 % Total $ 26,419 $ 26,071 $ 348 1.3 % 100.0 % SAME STORE PERFORMANCE$ in thousands

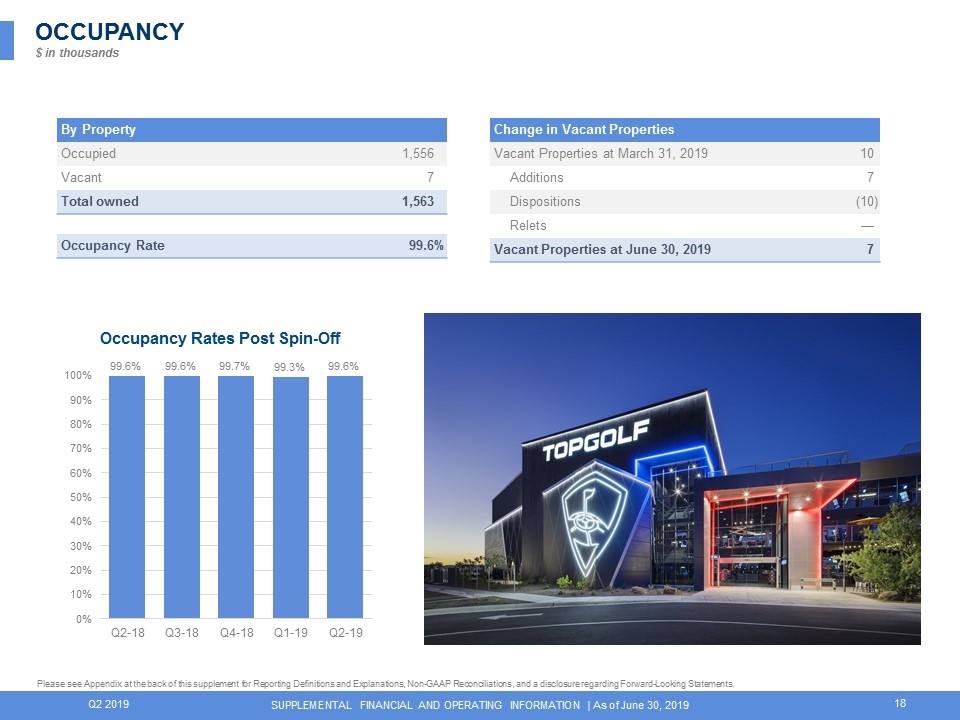

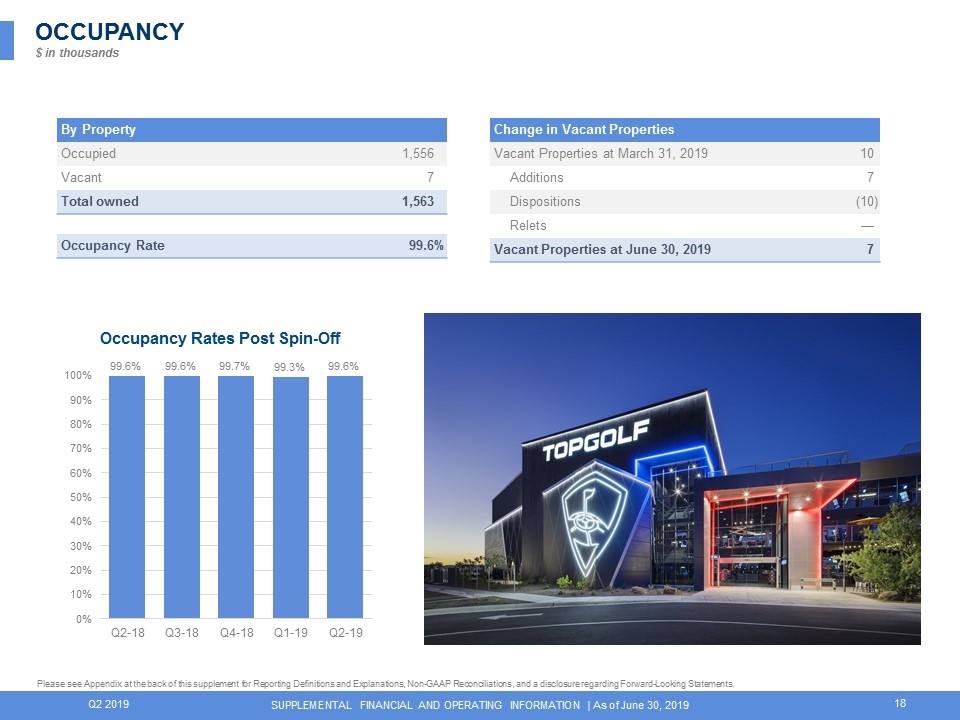

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. OCCUPANCY $ in thousands By Property Occupied 1,556 Vacant 7 Total owned 1,563 Occupancy Rate 99.6 % Change in Vacant Properties Vacant Properties at March 31, 2019 10 Additions 7 Dispositions (10 ) Relets — Vacant Properties at June 30, 2019 7

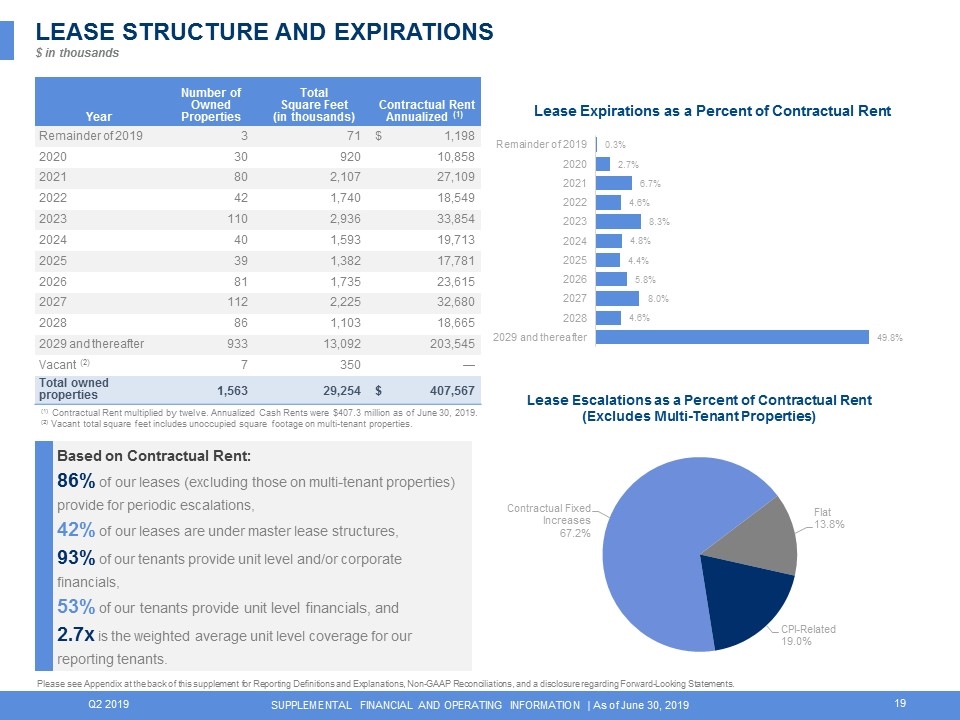

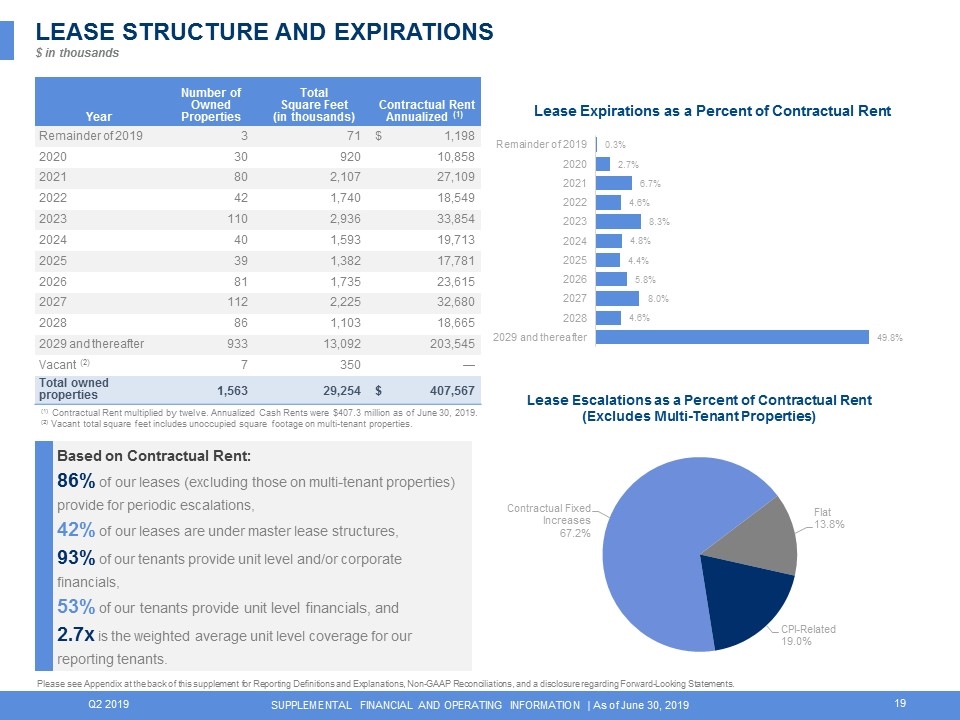

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. Year Number of Owned Properties Total Square Feet (in thousands) Contractual Rent Annualized (1) Contractual Rent Annualized (1) Remainder of 2019 3 71 $ 1,198 2020 30 920 10,858 2021 80 2,107 27,109 2022 42 1,740 18,549 2023 110 2,936 33,854 2024 40 1,593 19,713 2025 39 1,382 17,781 2026 81 1,735 23,615 2027 112 2,225 32,680 2028 86 1,103 18,665 2029 and thereafter 933 13,092 203,545 Vacant (2) 7 350 — Total owned properties 1,563 29,254 $ 407,567 Based on Contractual Rent: 86% of our leases (excluding those on multi-tenant properties) provide for periodic escalations, 42% of our leases are under master lease structures, 93% of our tenants provide unit level and/or corporate financials, 53% of our tenants provide unit level financials, and 2.7x is the weighted average unit level coverage for our reporting tenants. (1) Contractual Rent multiplied by twelve. Annualized Cash Rents were $407.3 million as of June 30, 2019. (2) Vacant total square feet includes unoccupied square footage on multi-tenant properties. LEASE STRUCTURE AND EXPIRATIONS$ in thousands

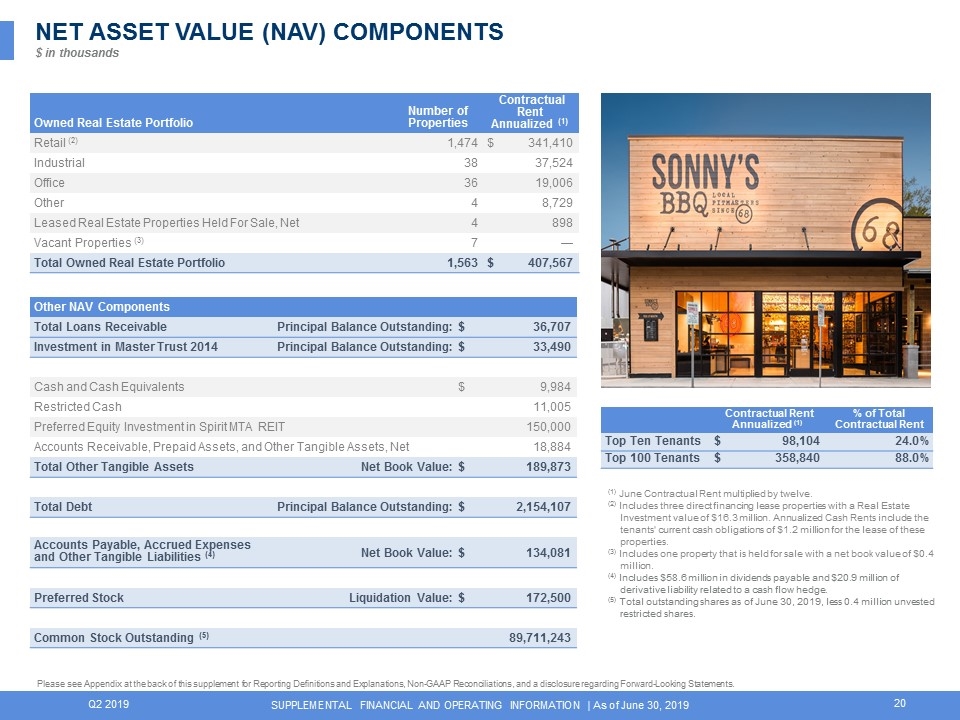

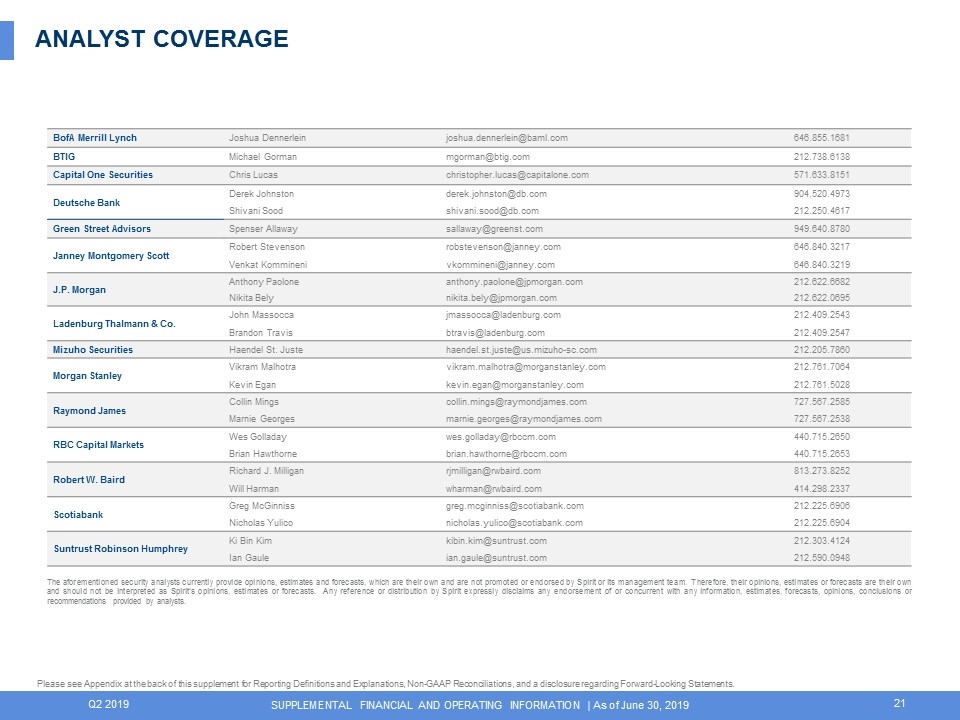

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. Owned Real Estate Portfolio Number of Properties Contractual Rent Annualized (1) Contractual Rent Annualized (1) Retail (2) 1,474 $ 341,410 Industrial 38 37,524 Office 36 19,006 Other 4 8,729 Leased Real Estate Properties Held For Sale, Net 4 898 Vacant Properties (3) 7 — Total Owned Real Estate Portfolio 1,563 $ 407,567 (1) June Contractual Rent multiplied by twelve. (2) Includes three direct financing lease properties with a Real Estate Investment value of $16.3 million. Annualized Cash Rents include the tenants' current cash obligations of $1.2 million for the lease of these properties. (3) Includes one property that is held for sale with a net book value of $0.4 million. (4) Includes $58.6 million in dividends payable and $20.9 million of derivative liability related to a cash flow hedge. (5) Total outstanding shares as of June 30, 2019, less 0.4 million unvested restricted shares. NET ASSET VALUE (NAV) COMPONENTS$ in thousands Other NAV Components Total Loans Receivable Principal Balance Outstanding: $ 36,707 Investment in Master Trust 2014 Principal Balance Outstanding: $ 33,490 Cash and Cash Equivalents $ 9,984 Restricted Cash 11,005 Preferred Equity Investment in Spirit MTA REIT 150,000 Accounts Receivable, Prepaid Assets, and Other Tangible Assets, Net 18,884 Total Other Tangible Assets Net Book Value: $ 189,873 Total Debt Principal Balance Outstanding: $ 2,154,107 Accounts Payable, Accrued Expenses and Other Tangible Liabilities (4) Net Book Value: $ 134,081 Preferred Stock Liquidation Value: $ 172,500 Common Stock Outstanding (5) 89,711,243 Contractual Rent Annualized (1) Contractual Rent Annualized (1) % of Total Contractual Rent Top Ten Tenants $ 98,104 24.0 % Top 100 Tenants $ 358,840 88.0 %

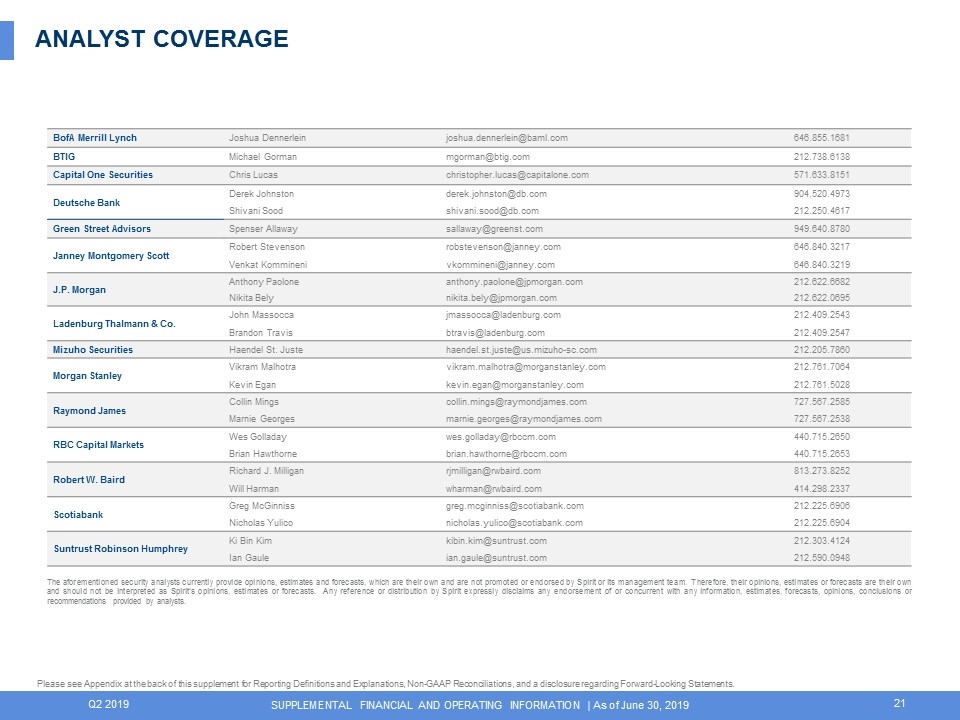

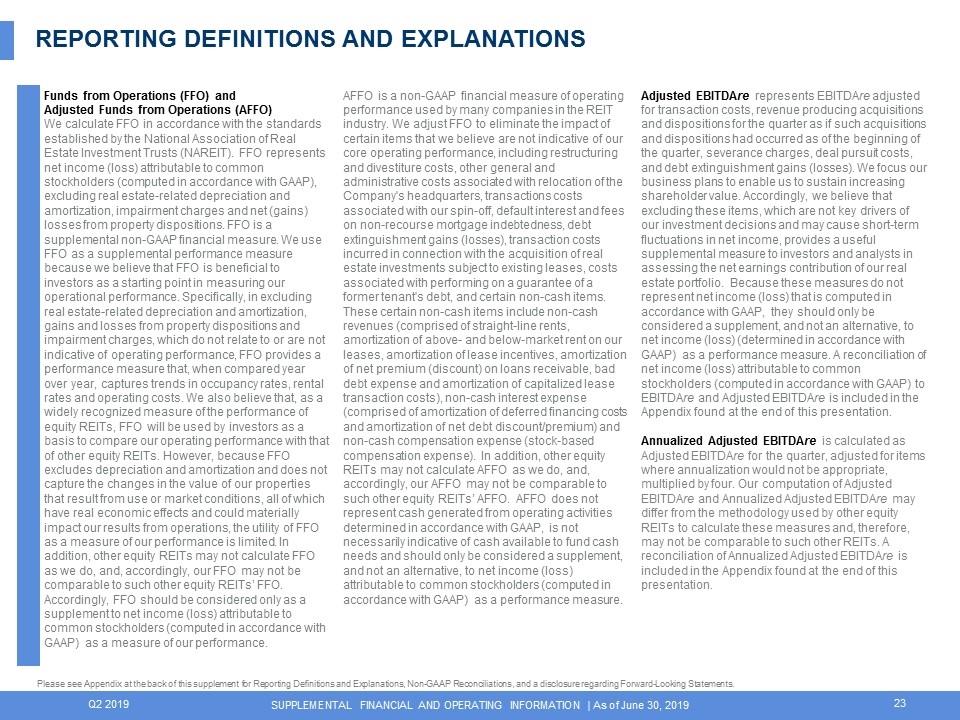

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. BofA Merrill Lynch Joshua Dennerlein joshua.dennerlein@baml.com 646.855.1681 BTIG Michael Gorman mgorman@btig.com 212.738.6138 Capital One Securities Chris Lucas christopher.lucas@capitalone.com 571.633.8151 Deutsche Bank Derek Johnston derek.johnston@db.com 904.520.4973 Shivani Sood shivani.sood@db.com 212.250.4617 Green Street Advisors Spenser Allaway sallaway@greenst.com 949.640.8780 Janney Montgomery Scott Robert Stevenson robstevenson@janney.com 646.840.3217 Venkat Kommineni vkommineni@janney.com 646.840.3219 J.P. Morgan Anthony Paolone anthony.paolone@jpmorgan.com 212.622.6682 Nikita Bely nikita.bely@jpmorgan.com 212.622.0695 Ladenburg Thalmann & Co. John Massocca jmassocca@ladenburg.com 212.409.2543 Brandon Travis btravis@ladenburg.com 212.409.2547 Mizuho Securities Haendel St. Juste haendel.st.juste@us.mizuho-sc.com 212.205.7860 Morgan Stanley Vikram Malhotra vikram.malhotra@morganstanley.com 212.761.7064 Kevin Egan kevin.egan@morganstanley.com 212.761.5028 Raymond James Collin Mings collin.mings@raymondjames.com 727.567.2585 Marnie Georges marnie.georges@raymondjames.com 727.567.2538 RBC Capital Markets Wes Golladay wes.golladay@rbccm.com 440.715.2650 Brian Hawthorne brian.hawthorne@rbccm.com 440.715.2653 Robert W. Baird Richard J. Milligan rjmilligan@rwbaird.com 813.273.8252 Will Harman wharman@rwbaird.com 414.298.2337 Scotiabank Greg McGinniss greg.mcginniss@scotiabank.com 212.225.6906 Nicholas Yulico nicholas.yulico@scotiabank.com 212.225.6904 Suntrust Robinson Humphrey Ki Bin Kim kibin.kim@suntrust.com 212.303.4124 Ian Gaule ian.gaule@suntrust.com 212.590.0948 The aforementioned security analysts currently provide opinions, estimates and forecasts, which are their own and are not promoted or endorsed by Spirit or its management team. Therefore, their opinions, estimates or forecasts are their own and should not be interpreted as Spirit’s opinions, estimates or forecasts. Any reference or distribution by Spirit expressly disclaims any endorsement of or concurrent with any information, estimates, forecasts, opinions, conclusions or recommendations provided by analysts. ANALYST COVERAGE

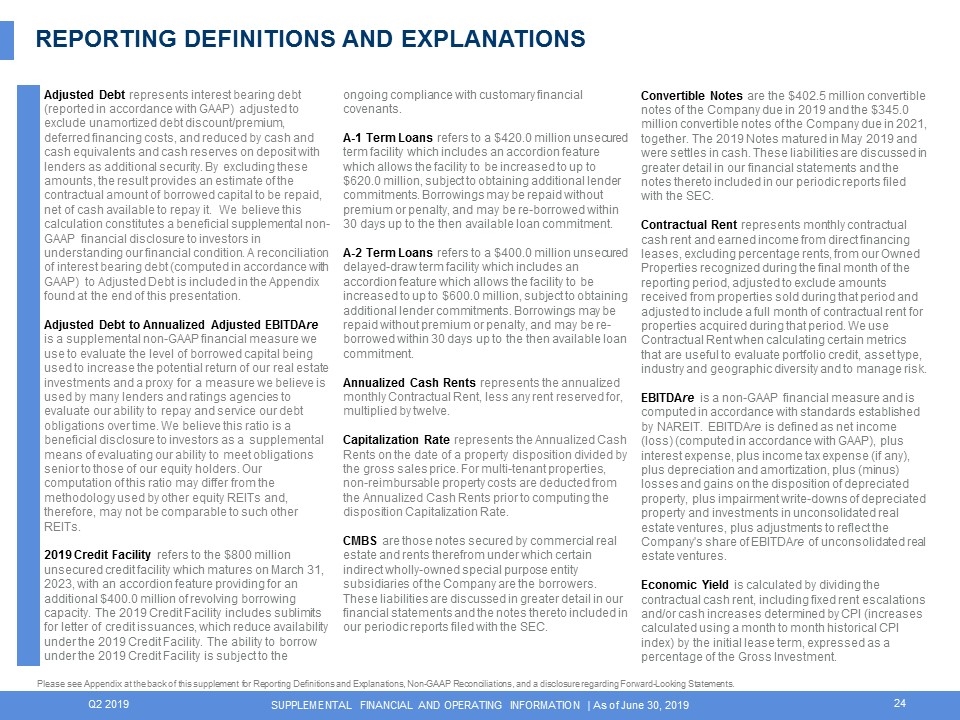

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. REPORTING DEFINITIONS AND EXPLANATIONS Funds from Operations (FFO) and Adjusted Funds from Operations (AFFO) We calculate FFO in accordance with the standards established by the National Association of Real Estate Investment Trusts (NAREIT). FFO represents net income (loss) attributable to common stockholders (computed in accordance with GAAP), excluding real estate-related depreciation and amortization, impairment charges and net (gains) losses from property dispositions. FFO is a supplemental non-GAAP financial measure. We use FFO as a supplemental performance measure because we believe that FFO is beneficial to investors as a starting point in measuring our operational performance. Specifically, in excluding real estate-related depreciation and amortization, gains and losses from property dispositions and impairment charges, which do not relate to or are not indicative of operating performance, FFO provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We also believe that, as a widely recognized measure of the performance of equity REITs, FFO will be used by investors as a basis to compare our operating performance with that of other equity REITs. However, because FFO excludes depreciation and amortization and does not capture the changes in the value of our properties that result from use or market conditions, all of which have real economic effects and could materially impact our results from operations, the utility of FFO as a measure of our performance is limited. In addition, other equity REITs may not calculate FFO as we do, and, accordingly, our FFO may not be comparable to such other equity REITs’ FFO. Accordingly, FFO should be considered only as a supplement to net income (loss) attributable to common stockholders (computed in accordance with GAAP) as a measure of our performance. AFFO is a non-GAAP financial measure of operating performance used by many companies in the REIT industry. We adjust FFO to eliminate the impact of certain items that we believe are not indicative of our core operating performance, including restructuring and divestiture costs, other general and administrative costs associated with relocation of the Company's headquarters, transactions costs associated with our spin-off, default interest and fees on non-recourse mortgage indebtedness, debt extinguishment gains (losses), transaction costs incurred in connection with the acquisition of real estate investments subject to existing leases, costs associated with performing on a guarantee of a former tenant's debt, and certain non-cash items. These certain non-cash items include non-cash revenues (comprised of straight-line rents, amortization of above- and below-market rent on our leases, amortization of lease incentives, amortization of net premium (discount) on loans receivable, bad debt expense and amortization of capitalized lease transaction costs), non-cash interest expense (comprised of amortization of deferred financing costs and amortization of net debt discount/premium) and non-cash compensation expense (stock-based compensation expense). In addition, other equity REITs may not calculate AFFO as we do, and, accordingly, our AFFO may not be comparable to such other equity REITs’ AFFO. AFFO does not represent cash generated from operating activities determined in accordance with GAAP, is not necessarily indicative of cash available to fund cash needs and should only be considered a supplement, and not an alternative, to net income (loss) attributable to common stockholders (computed in accordance with GAAP) as a performance measure. Adjusted EBITDAre represents EBITDAre adjusted for transaction costs, revenue producing acquisitions and dispositions for the quarter as if such acquisitions and dispositions had occurred as of the beginning of the quarter, severance charges, deal pursuit costs, and debt extinguishment gains (losses). We focus our business plans to enable us to sustain increasing shareholder value. Accordingly, we believe that excluding these items, which are not key drivers of our investment decisions and may cause short-term fluctuations in net income, provides a useful supplemental measure to investors and analysts in assessing the net earnings contribution of our real estate portfolio. Because these measures do not represent net income (loss) that is computed in accordance with GAAP, they should only be considered a supplement, and not an alternative, to net income (loss) (determined in accordance with GAAP) as a performance measure. A reconciliation of net income (loss) attributable to common stockholders (computed in accordance with GAAP) to EBITDAre and Adjusted EBITDAre is included in the Appendix found at the end of this presentation. Annualized Adjusted EBITDAre is calculated as Adjusted EBITDAre for the quarter, adjusted for items where annualization would not be appropriate, multiplied by four. Our computation of Adjusted EBITDAre and Annualized Adjusted EBITDAre may differ from the methodology used by other equity REITs to calculate these measures and, therefore, may not be comparable to such other REITs. A reconciliation of Annualized Adjusted EBITDAre is included in the Appendix found at the end of this presentation.

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 REPORTING DEFINITIONS AND EXPLANATIONS Adjusted Debt represents interest bearing debt (reported in accordance with GAAP) adjusted to exclude unamortized debt discount/premium, deferred financing costs, and reduced by cash and cash equivalents and cash reserves on deposit with lenders as additional security. By excluding these amounts, the result provides an estimate of the contractual amount of borrowed capital to be repaid, net of cash available to repay it. We believe this calculation constitutes a beneficial supplemental non-GAAP financial disclosure to investors in understanding our financial condition. A reconciliation of interest bearing debt (computed in accordance with GAAP) to Adjusted Debt is included in the Appendix found at the end of this presentation. Adjusted Debt to Annualized Adjusted EBITDAre is a supplemental non-GAAP financial measure we use to evaluate the level of borrowed capital being used to increase the potential return of our real estate investments and a proxy for a measure we believe is used by many lenders and ratings agencies to evaluate our ability to repay and service our debt obligations over time. We believe this ratio is a beneficial disclosure to investors as a supplemental means of evaluating our ability to meet obligations senior to those of our equity holders. Our computation of this ratio may differ from the methodology used by other equity REITs and, therefore, may not be comparable to such other REITs. 2019 Credit Facility refers to the $800 million unsecured credit facility which matures on March 31, 2023, with an accordion feature providing for an additional $400.0 million of revolving borrowing capacity. The 2019 Credit Facility includes sublimits for letter of credit issuances, which reduce availability under the 2019 Credit Facility. The ability to borrow under the 2019 Credit Facility is subject to the ongoing compliance with customary financial covenants. A-1 Term Loans refers to a $420.0 million unsecured term facility which includes an accordion feature which allows the facility to be increased to up to $620.0 million, subject to obtaining additional lender commitments. Borrowings may be repaid without premium or penalty, and may be re-borrowed within 30 days up to the then available loan commitment. A-2 Term Loans refers to a $400.0 million unsecured delayed-draw term facility which includes an accordion feature which allows the facility to be increased to up to $600.0 million, subject to obtaining additional lender commitments. Borrowings may be repaid without premium or penalty, and may be re-borrowed within 30 days up to the then available loan commitment. Annualized Cash Rents represents the annualized monthly Contractual Rent, less any rent reserved for, multiplied by twelve. Capitalization Rate represents the Annualized Cash Rents on the date of a property disposition divided by the gross sales price. For multi-tenant properties, non-reimbursable property costs are deducted from the Annualized Cash Rents prior to computing the disposition Capitalization Rate. CMBS are those notes secured by commercial real estate and rents therefrom under which certain indirect wholly-owned special purpose entity subsidiaries of the Company are the borrowers. These liabilities are discussed in greater detail in our financial statements and the notes thereto included in our periodic reports filed with the SEC. Convertible Notes are the $402.5 million convertible notes of the Company due in 2019 and the $345.0 million convertible notes of the Company due in 2021, together. The 2019 Notes matured in May 2019 and were settles in cash. These liabilities are discussed in greater detail in our financial statements and the notes thereto included in our periodic reports filed with the SEC. Contractual Rent represents monthly contractual cash rent and earned income from direct financing leases, excluding percentage rents, from our Owned Properties recognized during the final month of the reporting period, adjusted to exclude amounts received from properties sold during that period and adjusted to include a full month of contractual rent for properties acquired during that period. We use Contractual Rent when calculating certain metrics that are useful to evaluate portfolio credit, asset type, industry and geographic diversity and to manage risk. EBITDAre is a non-GAAP financial measure and is computed in accordance with standards established by NAREIT. EBITDAre is defined as net income (loss) (computed in accordance with GAAP), plus interest expense, plus income tax expense (if any), plus depreciation and amortization, plus (minus) losses and gains on the disposition of depreciated property, plus impairment write-downs of depreciated property and investments in unconsolidated real estate ventures, plus adjustments to reflect the Company's share of EBITDAre of unconsolidated real estate ventures. Economic Yield is calculated by dividing the contractual cash rent, including fixed rent escalations and/or cash increases determined by CPI (increases calculated using a month to month historical CPI index) by the initial lease term, expressed as a percentage of the Gross Investment. Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements.

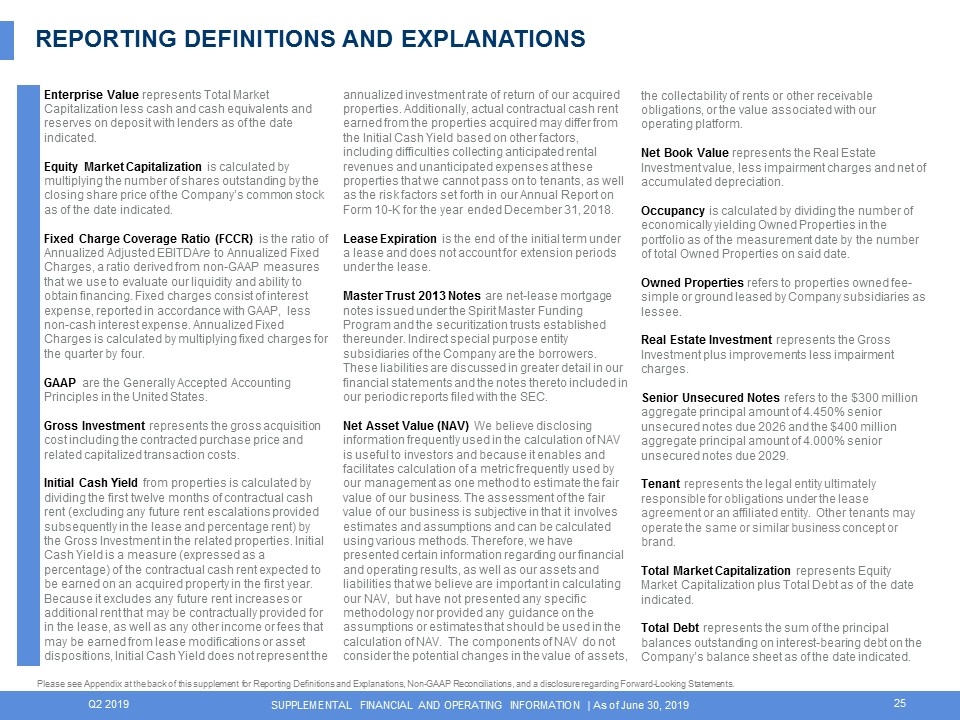

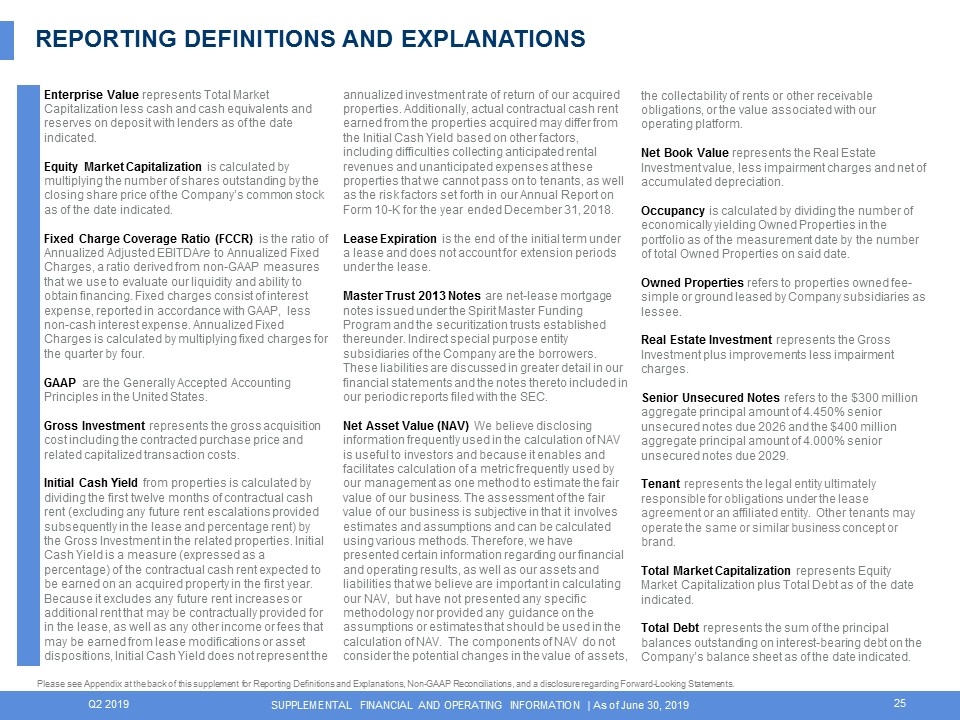

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 REPORTING DEFINITIONS AND EXPLANATIONS Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. Enterprise Value represents Total Market Capitalization less cash and cash equivalents and reserves on deposit with lenders as of the date indicated. Equity Market Capitalization is calculated by multiplying the number of shares outstanding by the closing share price of the Company’s common stock as of the date indicated. Fixed Charge Coverage Ratio (FCCR) is the ratio of Annualized Adjusted EBITDAre to Annualized Fixed Charges, a ratio derived from non-GAAP measures that we use to evaluate our liquidity and ability to obtain financing. Fixed charges consist of interest expense, reported in accordance with GAAP, less non-cash interest expense. Annualized Fixed Charges is calculated by multiplying fixed charges for the quarter by four. GAAP are the Generally Accepted Accounting Principles in the United States. Gross Investment represents the gross acquisition cost including the contracted purchase price and related capitalized transaction costs. Initial Cash Yield from properties is calculated by dividing the first twelve months of contractual cash rent (excluding any future rent escalations provided subsequently in the lease and percentage rent) by the Gross Investment in the related properties. Initial Cash Yield is a measure (expressed as a percentage) of the contractual cash rent expected to be earned on an acquired property in the first year. Because it excludes any future rent increases or additional rent that may be contractually provided for in the lease, as well as any other income or fees that may be earned from lease modifications or asset dispositions, Initial Cash Yield does not represent the annualized investment rate of return of our acquired properties. Additionally, actual contractual cash rent earned from the properties acquired may differ from the Initial Cash Yield based on other factors, including difficulties collecting anticipated rental revenues and unanticipated expenses at these properties that we cannot pass on to tenants, as well as the risk factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2018. Lease Expiration is the end of the initial term under a lease and does not account for extension periods under the lease. Master Trust 2013 Notes are net-lease mortgage notes issued under the Spirit Master Funding Program and the securitization trusts established thereunder. Indirect special purpose entity subsidiaries of the Company are the borrowers. These liabilities are discussed in greater detail in our financial statements and the notes thereto included in our periodic reports filed with the SEC. Net Asset Value (NAV) We believe disclosing information frequently used in the calculation of NAV is useful to investors and because it enables and facilitates calculation of a metric frequently used by our management as one method to estimate the fair value of our business. The assessment of the fair value of our business is subjective in that it involves estimates and assumptions and can be calculated using various methods. Therefore, we have presented certain information regarding our financial and operating results, as well as our assets and liabilities that we believe are important in calculating our NAV, but have not presented any specific methodology nor provided any guidance on the assumptions or estimates that should be used in the calculation of NAV. The components of NAV do not consider the potential changes in the value of assets, the collectability of rents or other receivable obligations, or the value associated with our operating platform. Net Book Value represents the Real Estate Investment value, less impairment charges and net of accumulated depreciation. Occupancy is calculated by dividing the number of economically yielding Owned Properties in the portfolio as of the measurement date by the number of total Owned Properties on said date. Owned Properties refers to properties owned fee-simple or ground leased by Company subsidiaries as lessee. Real Estate Investment represents the Gross Investment plus improvements less impairment charges. Senior Unsecured Notes refers to the $300 million aggregate principal amount of 4.450% senior unsecured notes due 2026 and the $400 million aggregate principal amount of 4.000% senior unsecured notes due 2029. Tenant represents the legal entity ultimately responsible for obligations under the lease agreement or an affiliated entity. Other tenants may operate the same or similar business concept or brand. Total Market Capitalization represents Equity Market Capitalization plus Total Debt as of the date indicated. Total Debt represents the sum of the principal balances outstanding on interest-bearing debt on the Company’s balance sheet as of the date indicated.

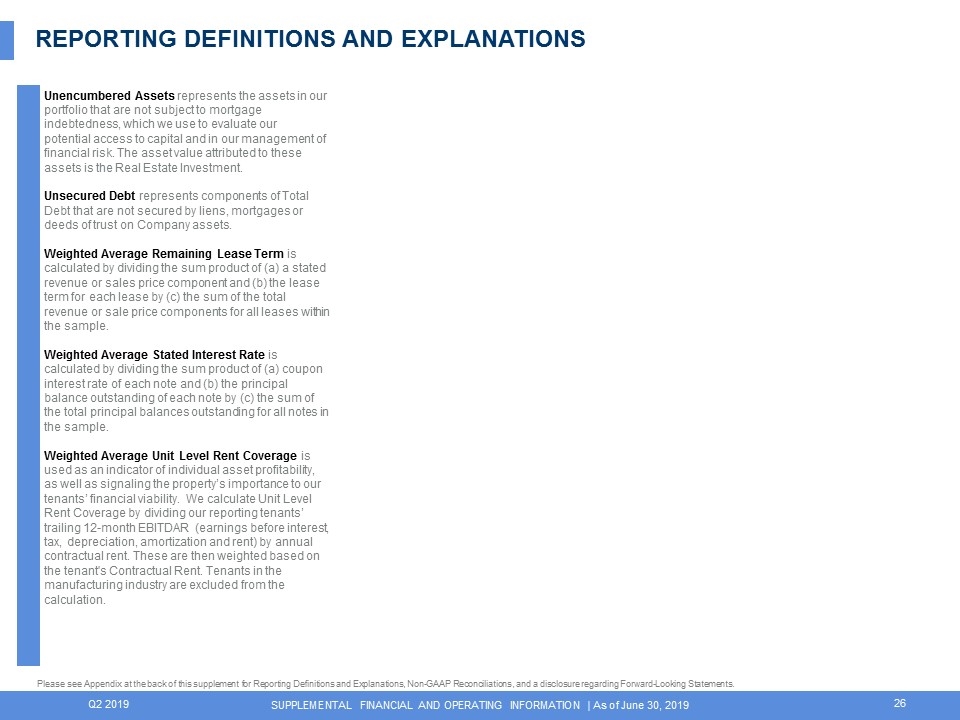

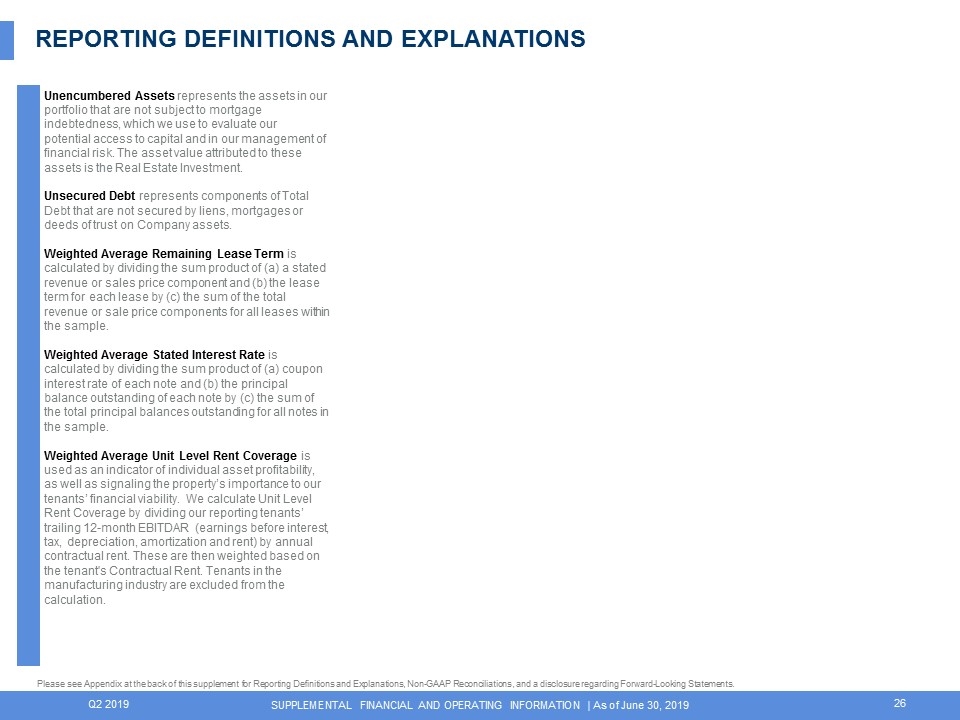

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 REPORTING DEFINITIONS AND EXPLANATIONS Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. Unencumbered Assets represents the assets in our portfolio that are not subject to mortgage indebtedness, which we use to evaluate our potential access to capital and in our management of financial risk. The asset value attributed to these assets is the Real Estate Investment. Unsecured Debt represents components of Total Debt that are not secured by liens, mortgages or deeds of trust on Company assets. Weighted Average Remaining Lease Term is calculated by dividing the sum product of (a) a stated revenue or sales price component and (b) the lease term for each lease by (c) the sum of the total revenue or sale price components for all leases within the sample. Weighted Average Stated Interest Rate is calculated by dividing the sum product of (a) coupon interest rate of each note and (b) the principal balance outstanding of each note by (c) the sum of the total principal balances outstanding for all notes in the sample. Weighted Average Unit Level Rent Coverage is used as an indicator of individual asset profitability, as well as signaling the property’s importance to our tenants’ financial viability. We calculate Unit Level Rent Coverage by dividing our reporting tenants’ trailing 12-month EBITDAR (earnings before interest, tax, depreciation, amortization and rent) by annual contractual rent. These are then weighted based on the tenant's Contractual Rent. Tenants in the manufacturing industry are excluded from the calculation.

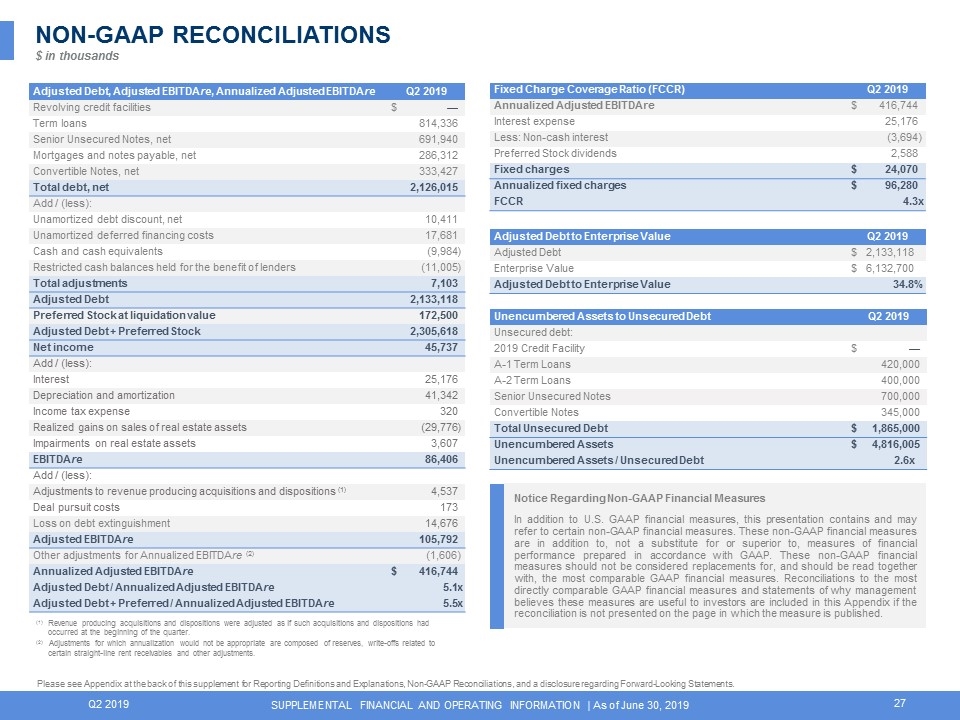

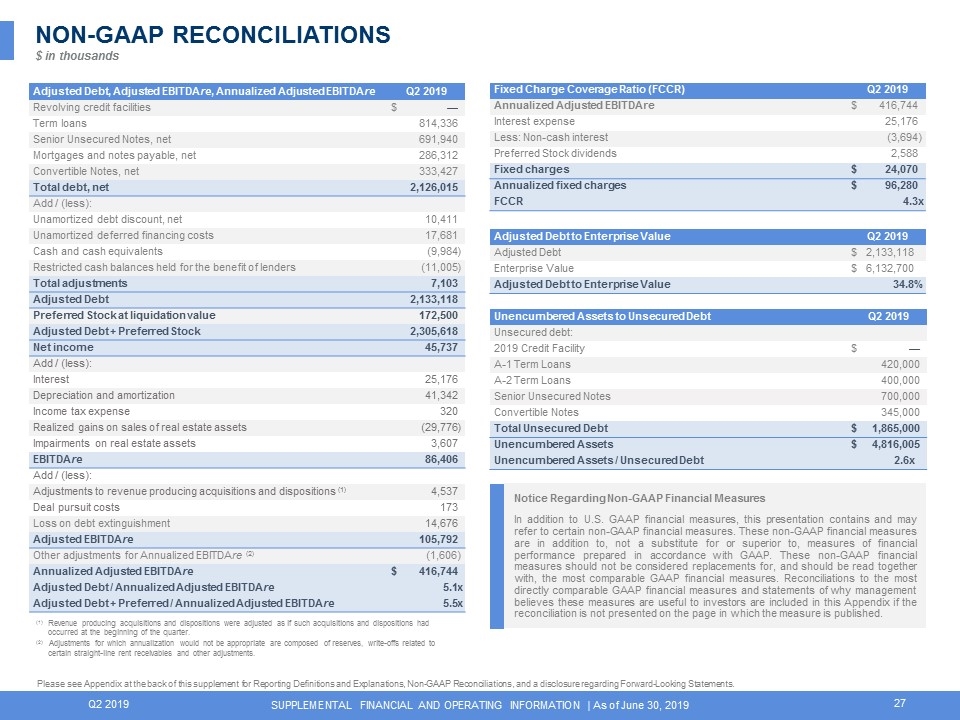

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. Notice Regarding Non-GAAP Financial Measures In addition to U.S. GAAP financial measures, this presentation contains and may refer to certain non-GAAP financial measures. These non-GAAP financial measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. These non-GAAP financial measures should not be considered replacements for, and should be read together with, the most comparable GAAP financial measures. Reconciliations to the most directly comparable GAAP financial measures and statements of why management believes these measures are useful to investors are included in this Appendix if the reconciliation is not presented on the page in which the measure is published. Fixed Charge Coverage Ratio (FCCR) Q2 2019 Q1 2019 Annualized Adjusted EBITDAre $ 416,744 Interest expense 25,176 Less: Non-cash interest (3,694 ) Preferred Stock dividends 2,588 Fixed charges $ 24,070 Annualized fixed charges $ 96,280 FCCR 4.3 x NON-GAAP RECONCILIATIONS$ in thousands Adjusted Debt to Enterprise Value Q2 2019 Q1 2019 Adjusted Debt $ 2,133,118 Enterprise Value $ 6,132,700 Adjusted Debt to Enterprise Value 34.8 % Unencumbered Assets to Unsecured Debt Q2 2019 Q1 2019 Unsecured debt: 2019 Credit Facility $ — A-1 Term Loans 420,000 A-2 Term Loans 400,000 Senior Unsecured Notes 700,000 Convertible Notes 345,000 Total Unsecured Debt $ 1,865,000 Unencumbered Assets $ 4,816,005 Unencumbered Assets / Unsecured Debt 2.6x 2.5x Adjusted Debt, Adjusted EBITDAre, Annualized Adjusted EBITDAre Q2 2019 Q1 2019 Revolving credit facilities $ — Term loans 814,336 Senior Unsecured Notes, net 691,940 Mortgages and notes payable, net 286,312 Convertible Notes, net 333,427 Total debt, net 2,126,015 Add / (less): Unamortized debt discount, net 10,411 Unamortized deferred financing costs 17,681 Cash and cash equivalents (9,984 ) Restricted cash balances held for the benefit of lenders (11,005 ) Total adjustments 7,103 Adjusted Debt 2,133,118 Preferred Stock at liquidation value 172,500 Adjusted Debt + Preferred Stock 2,305,618 Net income 45,737 Add / (less): Interest 25,176 Depreciation and amortization 41,342 Income tax expense 320 Realized gains on sales of real estate assets (29,776 ) Impairments on real estate assets 3,607 EBITDAre 86,406 Add / (less): Adjustments to revenue producing acquisitions and dispositions (1) 4,537 Deal pursuit costs 173 Loss on debt extinguishment 14,676 Adjusted EBITDAre 105,792 Other adjustments for Annualized EBITDAre (2) (1,606) 980 Annualized Adjusted EBITDAre $ 416,744 Adjusted Debt / Annualized Adjusted EBITDAre 5.1 x Adjusted Debt + Preferred / Annualized Adjusted EBITDAre 5.5 x (1) Revenue producing acquisitions and dispositions were adjusted as if such acquisitions and dispositions had occurred at the beginning of the quarter. (2) Adjustments for which annualization would not be appropriate are composed of reserves, write-offs related to certain straight-line rent receivables and other adjustments.

Q2 2019 SUPPLEMENTAL FINANCIAL AND OPERATING INFORMATION | As of June 30, 2019 Please see Appendix at the back of this supplement for Reporting Definitions and Explanations, Non-GAAP Reconciliations, and a disclosure regarding Forward-Looking Statements. The information in this supplemental report should be read in conjunction with the accompanying earnings press release, as well as the Company's Annual Report on Form 10-K and other information filed with the Securities and Exchange Commission. This supplemental report is not incorporated into such filings. This document is not an offer to sell or a solicitation to buy securities of Spirit Realty Capital, Inc. Any offer or solicitation shall be made only by means of a prospectus approved for that purpose. Forward-Looking and Cautionary Statements This supplemental report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended. When used in this supplemental report, the words “estimate,” “anticipate,” “expect,” “believe,” “intend,” “may,” “will,” “should,” “seek,” “approximately” or “plan,” or the negative of these words or similar words or phrases that are predictions of or indicate future events or trends and which do not relate solely to historical matters are intended to identify forward-looking statements. You can also identify forward-looking statements by discussions of strategy, plans or intentions of management. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise, and Spirit may not be able to realize them. Spirit does not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following risks and uncertainties, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: industry and economic conditions; volatility and uncertainty in the financial markets, including potential fluctuations in the CPI; Spirit's success in implementing its business strategy and its ability to identify, underwrite, finance, consummate, integrate and manage diversifying acquisitions or investments; the financial performance of Spirit's retail tenants and the demand for retail space, particularly with respect to challenges being experienced by general merchandise retailers; Spirit's ability to diversify its tenant base; the nature and extent of future competition; increases in Spirit's costs of borrowing as a result of changes in interest rates and other factors; Spirit's ability to access debt and equity capital markets; Spirit's ability to pay down, refinance, restructure and/or extend its indebtedness as it becomes due; Spirit's ability and willingness to renew its leases upon expiration and to reposition its properties on the same or better terms upon expiration in the event such properties are not renewed by tenants or Spirit exercises its rights to replace existing tenants upon default; the impact of any financial, accounting, legal or regulatory issues or litigation that may affect Spirit or its major tenants; Spirit's ability to manage its expanded operations; Spirit's ability and willingness to maintain its qualification as a REIT under the Internal Revenue Code of 1986, as amended; the ability of SMTA to satisfy the conditions to closing the proposed sale of the assets held in Master Trust 2014 (including its ability to obtain shareholder approval of such transaction); the timing of the completion of the sale of the Master Trust 2014 assets; Spirit's ability to manage and liquidate the remaining SMTA assets; and other risks inherent in the real estate business, including tenant defaults, potential liability relating to environmental matters, illiquidity of real estate investments and potential damages from natural disasters discussed in Spirit's most recent filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this supplemental report. While forward-looking statements reflect Spirit's good faith beliefs, they are not guarantees of future performance. Spirit disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes, except as required by law. FORWARD-LOOKING STATEMENTS AND RISK FACTORS