As filed with the Securities and Exchange Commission on February 9, 2005.

Registration No. 333-120780

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

AMENDMENT NO. 1

TO

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CROWN HOLDINGS, INC.

(Exact name of Registrants as specified in their charter)

| | | | |

| Pennsylvania | | 3411 | | 75-3099507 |

(State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

One Crown Way

Philadelphia, Pennsylvania 19154

(215) 698-5100

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

CROWN EUROPEAN HOLDINGS SA

| | | | |

| Republic of France | | 3411 | | Not Applicable |

(State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

Le Colisée I

Rue Fructidor

75830 Paris Cedex 17

France

(331) 49-18-4000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

William T. Gallagher, Esquire

Senior Vice President, Secretary and General Counsel

Crown Holdings, Inc.

One Crown Way

Philadelphia, Pennsylvania 19154

(215) 698-5100

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

See Table of Additional Registrants Below

Copies to:

William G. Lawlor, Esquire

Gil C. Tily, Esquire

Dechert LLP

4000 Bell Atlantic Tower

1717 Arch Street

Philadelphia, Pennsylvania 19103

(215) 994-4000

Approximate Date Of Commencement Of Proposed Sale to The Public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are to be offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Additional Registrants

| | | | |

Exact Name of Additional Registrants

| | Jurisdiction of Incorporation

| | I.R.S. Employer Identification Number

|

Central States Can Co. of Puerto Rico, Inc. | | Ohio | | Not Applicable |

Crown Beverage Packaging, Inc. | | Delaware | | 13-2853410 |

Crown Consultants, Inc. | | Pennsylvania | | 23-2846356 |

CROWN Americas, Inc. | | Pennsylvania | | 75-3099510 |

Crown Cork & Seal Company (DE), LLC | | Delaware | | Not Applicable |

Crown Cork & Seal Company (PA), Inc. | | Pennsylvania | | 23-1742532 |

CROWN Cork & Seal USA, Inc. | | Delaware | | 23-2869494 |

Crown Cork & Seal Company, Inc. | | Pennsylvania | | 23-1526444 |

CROWN Packaging Technology, Inc. | | Delaware | | 52-2006645 |

CROWN Beverage Packaging Puerto Rico, Inc. | | Delaware | | Not Applicable |

Crown Financial Corporation | | Pennsylvania | | 23-1603914 |

Crown Financial Management, Inc. | | Delaware | | 23-2869496 |

Crown Holdings (PA), LLC | | Pennsylvania | | Not Applicable |

Crown International Holdings, Inc. | | Delaware | | 75-3099512 |

Foreign Manufacturers Finance Corporation | | Delaware | | 51-0099971 |

NWR, Inc. | | Pennsylvania | | 22-2463801 |

CROWN Risdon USA, Inc. | | Delaware | | 23-2162641 |

CROWN Zeller USA, Inc. | | Delaware | | 06-0511010 |

CROWN Verpakking België NV | | Belgium | | Not Applicable |

889273 Ontario Inc. | | Canada | | Not Applicable |

CROWN Risdon Canada Inc. | | Canada | | Not Applicable |

CROWN Zeller Plastic Closures Canada Inc. | | Canada | | Not Applicable |

Crown Canadian Holdings ULC | | Canada | | Not Applicable |

CROWN Metal Packaging Canada LP | | Canada | | Not Applicable |

CROWN Metal Packaging Canada Inc. | | Canada | | Not Applicable |

3079939 Nova Scotia Company/3079939 Compagnie de la Nouvelle Ecosse | | Canada | | Not Applicable |

CROWN Zeller France S.A.S. | | France | | Not Applicable |

Société de Participations CarnaudMetalbox SAS | | France | | Not Applicable |

CROWN Astra S.A.S. | | France | | Not Applicable |

CROWN Polyflex S.A.S. | | France | | Not Applicable |

CROWN Emballage France S.A.S. | | France | | Not Applicable |

CROWN Bevcan France S.A.S. | | France | | Not Applicable |

Crown Développement S.A.S. | | France | | Not Applicable |

Crown Cork & Seal Deutschland Holdings GmbH | | Germany | | Not Applicable |

CROWN Bender GmbH | | Germany | | Not Applicable |

CROWN Nahrungsmitteldosen Deutschland GmbH | | Germany | | Not Applicable |

CROWN Nahrungsmitteldosen GmbH | | Germany | | Not Applicable |

CROWN Specialty Packaging Deutschland GmbH | | Germany | | Not Applicable |

CROWN Raku GmbH | | Germany | | Not Applicable |

CROWN Verpackungen Deutschland GmbH | | Germany | | Not Applicable |

CROWN Verschlüsse Deutschland GmbH | | Germany | | Not Applicable |

CROWN Zeller Deutschland GmbH | | Germany | | Not Applicable |

CROWN Zeller Engineering GmbH | | Germany | | Not Applicable |

CROWN Envases Mexico, S.A. de C.V. | | Mexico | | Not Applicable |

CROWN Zeller Mexico, S.A. de C.V. | | Mexico | | Not Applicable |

CROWN Mexican Holdings, S. de R.L. de C.V. | | Mexico | | Not Applicable |

CROWN Obrist AG (Switzerland) | | Switzerland | | Not Applicable |

CROWN Vogel AG | | Switzerland | | Not Applicable |

Crown UK Holdings Limited | | United Kingdom | | Not Applicable |

CROWN Aerosols UK Limited | | United Kingdom | | Not Applicable |

CarnaudMetalbox Overseas Limited | | United Kingdom | | Not Applicable |

Crown Cork & Seal Finance plc | | United Kingdom | | Not Applicable |

CROWN Packaging UK PLC | | United Kingdom | | Not Applicable |

CROWN UCP plc | | United Kingdom | | Not Applicable |

CarnaudMetalbox Engineering PLC | | United Kingdom | | Not Applicable |

CROWN Massmould Ltd. | | United Kingdom | | Not Applicable |

CROWN Speciality Packaging UK plc | | United Kingdom | | Not Applicable |

CarnaudMetalbox Group UK Limited | | United Kingdom | | Not Applicable |

The address for service of each of the additional registrants is c/o Crown Holdings, Inc., One Crown Way, Philadelphia, Pennsylvania, telephone (215) 698-5100. The primary industrial classifications number for each of the additional registrants is 3411.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 9, 2005

PROSPECTUS

Crown European Holdings SA

OFFER TO EXCHANGE

€460,000,000 6 1/4% First Priority Senior Secured Notes due 2011 and related Guarantees for all outstanding 6 1/4% First Priority Senior Secured Notes due 2011

The exchange offer expires at 5:00 p.m., New York City time, on , 2005, unless extended. Crown European Holdings will exchange all old notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer. You may withdraw tenders of outstanding notes at any time before the exchange offer expires.

The form and terms of the new notes will be identical in all material respects to the form and terms of the old notes, except that the new notes:

| | • | | will have been registered under the Securities Act; |

| | • | | will not bear restrictive legends restricting their transfer under the Securities Act; |

| | • | | will not be entitled to the registration rights that apply to the old notes; and |

| | • | | will not contain provisions relating to increased interest rates in connection with the old notes under circumstances related to the timing of the exchange offer. |

The new notes will be senior obligations of Crown European Holdings and initially guaranteed on a senior basis by its indirect parent, Crown Holdings, Inc., or Crown, each of Crown’s U.S. subsidiaries that guarantees obligations under Crown’s credit facilities and, subject to applicable law, each of Crown European Holdings’ subsidiaries that guarantees obligations under Crown’s credit facilities. The new notes and new note guarantees will be effectively junior in right of payment to any indebtedness of Crown European Holdings and the guarantors that is secured by assets not securing the notes and will be junior in right of payment to all indebtedness of Crown’s non-guarantor subsidiaries.

See “Risk Factors” beginning on page 21 for a discussion of risks that should be considered by holders prior to tendering their old notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is February , 2005.

TABLE OF CONTENTS

This prospectus incorporates important business and financial information that is not included in or delivered with this document. This information is available without charge upon written or oral request. To obtain timely delivery, note holders must request the information no later than five business days before the expiration date. The expiration date is , 2005. See “Incorporation of Documents by Reference.”

You should rely only on the information contained in this document and any supplement, including the periodic reports and other information we file with the Securities and Exchange Commission or to which we have referred you. See “Where You Can Find Additional Information.” Neither Crown European Holdings nor Crown has authorized anyone to provide you with information that is different. If anyone provides you with different or inconsistent information, you should not rely on it. Neither Crown European Holdings nor Crown is making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted, where the person making the offer is not qualified to do so, or to any person who cannot legally be offered the securities.

Each broker-dealer that receives new notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with re-sales of new notes received in exchange for old notes where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. Crown has agreed that, starting on the expiration date of the exchange offer and ending on the close of business one year after the expiration date, it will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

The distribution of this prospectus and the offer or sale of the new notes may be restricted by law in certain jurisdictions. Persons who possess this prospectus must inform themselves about, and observe, any such restrictions. See “Plan of Distribution.” None of Crown European Holdings, Crown or any of their respective representatives is making any representation to any offeree or purchaser under applicable legal investment or similar laws. Each prospective investor must comply with all applicable laws and regulations in force in any

i

jurisdiction in which it purchases, offers or sells notes or possesses or distributes this prospectus and must obtain any consent, approval or permission required by it for the purchase, offer or sale by it of notes under the laws and regulations in force in any jurisdiction to which it is subject or in which it makes such purchases, offers or sales, and none of Crown European Holdings, Crown or any of their respective representatives shall have any responsibility therefor.

This prospectus does not constitute an offer to sell or a solicitation of an offer to buy securities to any person in any jurisdiction where it is unlawful to make such an offer or solicitation.

MARKET, RANKING AND OTHER DATA

The data included in this prospectus regarding markets and ranking, including the position of Crown and its competitors within these markets, are based on independent industry publications, reports of government agencies or other published industry sources and the estimates of Crown based on its management’s knowledge and experience in the markets in which it operates. Crown’s estimates have been based on information obtained from customers, suppliers, trade and business organizations and other contacts in the markets in which it operates. Crown believes these estimates to be accurate in all material respects as of the date of this prospectus. However, this information may prove to be inaccurate because of the method by which Crown obtained some of the data for these estimates or because this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other inherent limitations and uncertainties.

ii

SUMMARY

The following summary should be read in connection with, and is qualified in its entirety by, the more detailed information and financial statements (including the accompanying notes) included elsewhere in this prospectus. See “Risk Factors” for a discussion of certain factors that should be considered in connection with this offering. Unless the context otherwise requires:

| | • | | “Crown” refers to Crown Holdings, Inc. and its subsidiaries on a consolidated basis; |

| | • | | “we,” “us,” “our” and “Crown European Holdings” refers to Crown European Holdings SA and not its subsidiaries; |

| | • | | “initial notes” refers to the €350 aggregate principal amount of 6 1/4% First Priority Senior Secured Notes due 2011 issued on September 1, 2004 prior to the exchange; |

| | • | | “add-on notes” refers to the €110 aggregate principal amount of 6 1/4% First Priority Senior Secured Notes due 2011 issued on October 6, 2004 prior to the exchange; |

| | • | | “old notes” refers to the initial notes and the add-on notes prior to the exchange; |

| | • | | “new notes” refers to the €460 aggregate principal amount of 6 1/4% First Priority Senior Secured Notes due 2011 offered in exchange for the old notes pursuant to this prospectus; |

| | • | | “notes” refers collectively to the old notes and the new notes. |

Crown Holdings, Inc.

Crown is a worldwide leader in the design, manufacture and sale of packaging products for consumer goods with 185 plants throughout 43 countries and approximately 27,600 employees. Crown’s primary products include steel and aluminum cans for food, beverage, household and other consumer products and a wide variety of metal and plastic caps, closures and dispensing systems. Crown believes that, based on the number of units sold, it is the largest global supplier of food cans and metal vacuum closures and the third largest global supplier of beverage cans. In addition, Crown believes that it is one of the largest producers of aerosol cans and plastic closures in the world and the largest rigid packaging company in Europe and Asia, excluding Japan.

2004 Refinancing Plan

On September 1, 2004, Crown European Holdings issued the initial notes as part of a plan to refinance all of Crown’s first priority term loans, which consisted of $428 million and €48 million of borrowings plus accrued but unpaid interest thereon, outstanding under Crown’s then existing credit facility and entered into new $625 million senior secured credit facilities. The purpose of the refinancing was to extend the average maturity of Crown’s indebtedness at what Crown believed to be favorable interest rates.

The new senior secured credit facilities consist of (a) a revolving credit facility that will mature on February 15, 2010 in an aggregate principal amount of $400 million, of which up to $200 million is available to Crown Americas, Inc. in U.S. dollars and up to $200 million is available to Crown European Holdings and certain of its subsidiaries in euros and pound sterling in amounts to be agreed, (b) a revolving letter of credit facility that will mature on February 15, 2010 in an aggregate principal amount of $100 million which is available to Crown Americas, Inc. in U.S. dollars and (c) a term loan facility that was scheduled to mature on September 1, 2011 in an aggregate principal amount of $125 million which was available to Crown Americas, Inc. in U.S. dollars.

On October 6, 2004, Crown European Holdings issued the add-on notes. The net proceeds from the issuance of the add-on notes were used to repay its outstanding term loan under the new senior secured credit facilities, with any remaining proceeds being used for general corporate purposes.

See “Description of Certain Indebtedness.”

1

Recent Developments

On February 1, 2004 Crown announced its unaudited financial results for the fourth quarter and year ended December 31, 2004.

Crown intends to file its Annual Report on Form 10-K for the year ended December 31, 2004 with the Securities and Exchange Commission on or prior to March 16, 2005 and this Recent Developments section is qualified by such annual report when filed.

2004 Fourth Quarter Results

Net sales in the fourth quarter of 2004 were $1,748 million, a 9.9% increase compared to the $1,591 million in the fourth quarter of 2003. Fourth quarter net sales for Crown’s Americas, European and Asian Divisions increased 6.9%, 12.5% and 7.4% respectively, compared to last year’s fourth quarter.

Gross profit increased 20.3% in the fourth quarter to $190 million compared to the $158 million in the 2003 fourth quarter. As a percentage of net sales, gross profit increased to 10.9% in the fourth quarter compared to 9.9% in the same quarter last year. The improvements reflect increased operating efficiencies, the positive effects of Crown’s cost containment and restructuring programs in recent years, firm unit volumes and stronger foreign currencies.

Interest expense in the fourth quarter was $91 million compared to $99 million in the fourth quarter of 2003. The decrease reflects the impact of lower average debt outstanding compared to the prior year fourth quarter partially offset by higher average interest rates.

2004 Fourth Quarter Charges

Crown recorded a charge in the fourth quarter of $35 million to increase its asbestos litigation reserve. Crown estimates that its asbestos liability for pending and future asbestos claims will range between $233 million and $351 million. The reported range at December 31, 2003 was $239 million to $406 million. After the $35 million charge, Crown’s reserve at December 31, 2004 was $233 million compared to $239 million at December 31, 2003. Asbestos-related payments totaled $41 million in 2004, including $22 million under existing settlement agreements, compared to 2003 payments of $68 million, which included $41 million under existing settlement agreements.

During the fourth quarter, Crown recorded a charge of $6 million for restructuring activities in European operations. For the year, restructuring charges totaled $7 million. Crown also recorded a non-cash charge of $47 million in the fourth quarter primarily to recognize cumulative translation amounts relating to Crown’s exit from certain markets.

Crown accepted for purchase and payment, pursuant to its offer to purchase, all of the $33 million aggregate principal amount of outstanding 7.00% Notes due December 15, 2006 validly tendered in the offer for a purchase price of $1,050 per $1,000 principal amount ($235 million remain outstanding). In connection with the acceptance, Crown recorded a charge of $2 million in the fourth quarter. Additionally, in the fourth quarter Crown retired the entire $40 million remaining aggregate principal amount of outstanding 8.375% Notes due January 15, 2005. For the full year, Crown recorded a charge of $39 million related to the early extinguishments of debt.

Crown recorded a gain of $91 million in the fourth quarter of 2004 on the translation of net U.S. dollar denominated debt in Europe. For the year, the gain was $98 million.

In sum, for the fourth quarter, Crown reported a net loss of $27 million. In the 2003 fourth quarter, the net loss was $54 million.

2

2004 Full Year Results

For 2004, net sales were $7,199 million, an increase of 8.6% compared to the $6,630 million in 2003. The Americas Division’s net sales increased 5.3% in 2004 compared to 2003, the European Division’s net sales increased 11.3% and the Asian Division’s net sales increased 6.5% compared to last year.

Gross profit for the year was $907 million, up 18.6% over the $765 million reported for 2003. Gross profit as a percentage of net sales was 12.6% compared to 11.5% of net sales in 2003. The improvements reflect increased operating efficiencies, stronger foreign currencies and firm volumes.

For 2004, interest expense was $361 million, down from the $379 million for 2003. The decrease was the result of lower average debt outstanding compared to the prior year partially offset by higher average interest rates.

Debt and cash amounts were:

| | | | | | | | | |

| (dollars in millions) | | December 31, 2004

| | September 30,

2004

| | December 31, 2003

|

Total debt | | $ | 3,872 | | $ | 3,959 | | $ | 3,939 |

Cash | | | 471 | | | 295 | | | 401 |

| | |

|

| |

|

| |

|

|

| | | $ | 3,401 | | $ | 3,664 | | $ | 3,538 |

| | |

|

| |

|

| |

|

|

Receivables securitization | | $ | 120 | | $ | 160 | | $ | 90 |

| | |

|

| |

|

| |

|

|

Net income for 2004 was $51 million. This compares to a net loss of $32 million for 2003.

3

Consolidated Statements of Operations (Unaudited)

(dollars in millions, except share and per share data)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended

December 31,

| | | Twelve Months Ended

December 31,

| |

| | | 2004

| | | 2003

| | | 2004

| | | 2003

| |

Net sales | | $ | 1,748 | | | $ | 1,591 | | | $ | 7,199 | | | $ | 6,630 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Cost of products sold | | | 1,454 | | | | 1,327 | | | | 5,884 | | | | 5,442 | |

Depreciation and amortization | | | 78 | | | | 79 | | | | 308 | | | | 326 | |

Pension expense | | | 26 | | | | 27 | | | | 100 | | | | 97 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Gross profit | | | 190 | | | | 158 | | | | 907 | | | | 765 | |

Selling and administrative expense | | | 94 | | | | 95 | | | | 363 | | | | 337 | |

Provision for restructuring | | | 6 | | | | 16 | | | | 7 | | | | 19 | |

Provision for asbestos | | | 35 | | | | 44 | | | | 35 | | | | 44 | |

Provision for asset impairments and loss/(gain) on sale of assets | | | 47 | | | | 30 | | | | 47 | | | | 73 | |

Loss from early extinguishments of debt | | | 2 | | | | 3 | | | | 39 | | | | 12 | |

Interest expense | | | 91 | | | | 99 | | | | 361 | | | | 379 | |

Interest income | | | (3 | ) | | | (4 | ) | | | (8 | ) | | | (11 | ) |

Translation and foreign exchange adjustments | | | (91 | ) | | | (90 | ) | | | (98 | ) | | | (207 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income/(loss) before income taxes, minority interests and equity earnings | | | 9 | | | | (35 | ) | | | 161 | | | | 119 | |

Provision for income taxes | | | 26 | | | | 11 | | | | 82 | | | | 95 | |

Minority interests and equity earnings | | | (10 | ) | | | (8 | ) | | | (28 | ) | | | (56 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net (loss)/income | | | ($27 | ) | | | ($54 | ) | | $ | 51 | | | | ($32 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

(Loss)/income per average common share: | | | | | | | | | | | | | | | | |

Basic | | | ($.16 | ) | | | ($.33 | ) | | $ | .31 | | | | ($.19 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Diluted | | | ($.16 | ) | | | ($.33 | ) | | $ | .30 | | | | ($.19 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | |

Weighted average common shares outstanding: | | | | | | | | | | | | | | | | |

Basic | | | 165,448,481 | | | | 164,992,990 | | | | 165,251,267 | | | | 164,676,110 | |

Diluted | | | 170,465,839 | | | | 166,663,913 | | | | 168,809,775 | | | | 165,972,972 | |

Actual common shares outstanding | | | 165,559,558 | | | | 165,024,153 | | | | 165,559,558 | | | | 165,024,153 | |

Diluted earnings per share for the three months ended December 31, 2004 and 2003 and for the twelve months ended December 31, 2003 were the same as basic because common shares contingently issuable upon the exercise of stock options were anti-dilutive.

4

Consolidated Balance Sheets (Condensed & Unaudited)

(dollars in millions)

| | | | | | |

December 31,

| | 2004

| | 2003

|

Assets | | | | | | |

Current assets | | | | | | |

Cash and cash equivalents | | $ | 471 | | $ | 401 |

Receivables, net | | | 900 | | | 794 |

Inventories | | | 894 | | | 815 |

Prepaid expenses and other current assets | | | 78 | | | 112 |

| | |

|

| |

|

|

Total current assets | | | 2,343 | | | 2,122 |

| | |

|

| |

|

|

| | |

Goodwill | | | 2,592 | | | 2,442 |

Property, plant and equipment, net | | | 2,002 | | | 2,112 |

Other non-current assets | | | 1,188 | | | 1,097 |

| | |

|

| |

|

|

Total | | $ | 8,125 | | $ | 7,773 |

| | |

|

| |

|

|

| | |

Liabilities and shareholders’ equity | | | | | | |

Current liabilities | | | | | | |

Short-term debt | | $ | 51 | | $ | 69 |

Current maturities of long-term debt | | | 25 | | | 161 |

Other current liabilities | | | 2,004 | | | 1,806 |

| | |

|

| |

|

|

Total current liabilities | | | 2,080 | | | 2,036 |

| | |

|

| |

|

|

| | |

Long-term debt, excluding current maturities | | | 3,796 | | | 3,709 |

Other non-current liabilities and minority interests | | | 1,972 | | | 1,888 |

Shareholders’ equity | | | 277 | | | 140 |

| | |

|

| |

|

|

Total | | $ | 8,125 | | $ | 7,773 |

| | |

|

| |

|

|

Consolidated Supplemental Financial Data (Unaudited)

(dollars in millions)

| | | | | | | | | | | | |

| | | Three Months

Ended

December 31,

| | Twelve Months

Ended

December 31,

|

| | | 2004

| | 2003

| | 2004

| | 2003

|

Net Sales | | | | | | | | | | | | |

| | | | |

Americas | | $ | 699 | | $ | 654 | | $ | 2,858 | | $ | 2,715 |

Europe | | | 948 | | | 843 | | | 3,962 | | | 3,559 |

Asia | | | 101 | | | 94 | | | 379 | | | 356 |

| | |

|

| |

|

| |

|

| |

|

|

| | | $ | 1,748 | | $ | 1,591 | | $ | 7,199 | | $ | 6,630 |

| | |

|

| |

|

| |

|

| |

|

|

5

Consolidated Statements of Cash Flows (Condensed & Unaudited)

(dollars in millions)

| | | | | | | | |

Twelve months ended December 31,

| | 2004

| | | 2003

| |

Cash flows from operating activities | | | | | | | | |

Net income/(loss) | | $ | 51 | | | | ($32 | ) |

Depreciation and amortization | | | 308 | | | | 326 | |

Other, net | | | 45 | | | | 140 | |

| | |

|

|

| |

|

|

|

Net cash provided by operating activities | | | 404 | | | | 434 | |

| | |

|

|

| |

|

|

|

Cash flows from investing activities | | | | | | | | |

Capital expenditures | | | (138 | ) | | | (120 | ) |

Proceeds from sales of property, plant and equipment | | | 39 | | | | 35 | |

Other, net | | | (8 | ) | | | (15 | ) |

| | |

|

|

| |

|

|

|

Net cash used for investing activities | | | (107 | ) | | | (100 | ) |

| | |

|

|

| |

|

|

|

Cash flows from financing activities | | | | | | | | |

Net change in debt | | | (177 | ) | | | (157 | ) |

Debt issue costs | | | (31 | ) | | | (141 | ) |

Other, net | | | (38 | ) | | | (30 | ) |

| | |

|

|

| |

|

|

|

Net cash used for financing activities | | | (246 | ) | | | (328 | ) |

| | |

|

|

| |

|

|

|

Effect of exchange rate changes on cash and cash equivalents | | | 19 | | | | 32 | |

| | |

|

|

| |

|

|

|

Net change in cash and cash equivalents | | | 70 | | | | 38 | |

Cash and cash equivalents at January 1 | | | 401 | | | | 363 | |

| | |

|

|

| |

|

|

|

Cash and cash equivalents at December 31 | | $ | 471 | | | $ | 401 | |

| | |

|

|

| |

|

|

|

6

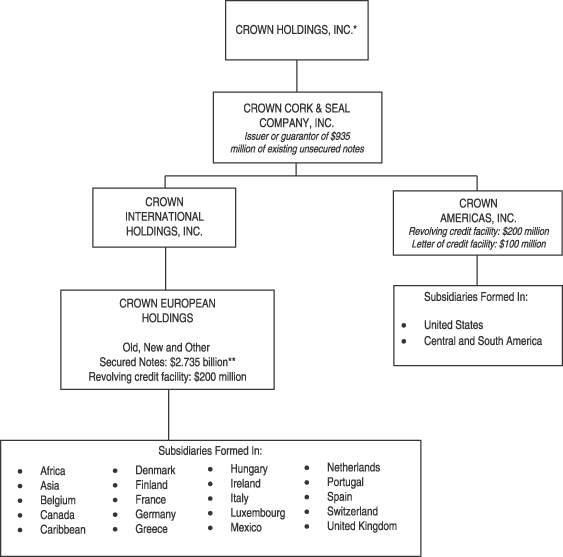

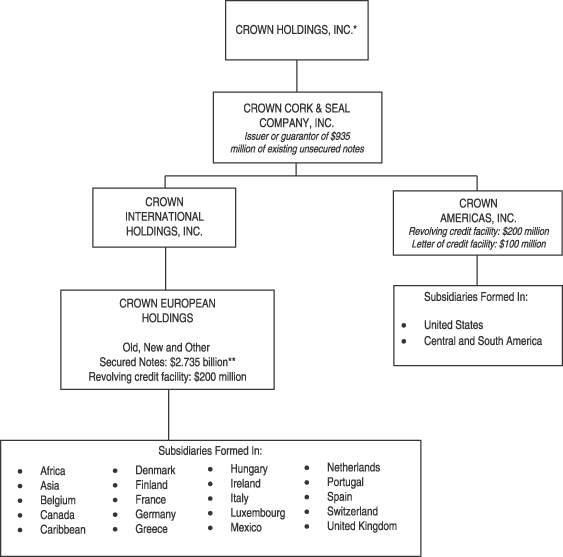

Organizational Structure

The following chart shows a summary of Crown’s current organizational structure, as well as the applicable obligor under the refinancing plan indebtedness, other outstanding secured and unsecured notes, and Crown’s senior secured credit facilities as of the date of this prospectus. See “Capitalization.”

| * | | Guarantor of Crown Cork’s obligations under the unsecured notes. See “Description of Certain Indebtedness.” |

| ** | | Based on U.S. dollar equivalents of euro as of September 30, 2004. |

Crown is a Pennsylvania corporation. Crown’s principal executive offices are located at One Crown Way, Philadelphia, Pennsylvania 19154, and its telephone number is (215) 698-5100. Crown European Holdings (formerly known as CarnaudMetalbox SA) is a French holding company (société anonyme) and an indirect, wholly-owned subsidiary of Crown.

7

The Exchange Offer

On September 1, 2004, we issued and sold €350 million principal amount of 6 1/4% First Priority Senior Secured Notes due 2011. On October 6, 2004, we issued and sold an additional €110 million principal amount of 6 1/4% First Priority Senior Secured Notes due 2011, bringing the aggregate principal amount of the 6 1/4% First Priority Senior Secured Notes due 2011 to €460 million.

In connection with each of these sales, we entered into a registration rights agreement with the initial purchasers of the old notes in which we agreed to deliver this prospectus to you and to complete an exchange offer for the old notes.

Notes Offered | €460 million principal amount of 6 1/4% First Priority Senior Secured Notes due 2011. |

| | The issuance of the new notes will be registered under the Securities Act. The terms of the new notes and old notes are identical in all material respects, except for transfer restrictions, registration rights relating to the old notes and certain provisions relating to increased interest rates in connection with the old notes under circumstances related to the timing of the exchange offer. You are urged to read the discussions under the heading “The New Notes” in this Summary for further information regarding the new notes. |

The Exchange Offer | We are offering to exchange the old notes for up to €460 million principal amount of the new notes. |

| | Old notes may be exchanged only in integral multiples of €1,000, as the case may be. In this prospectus, the term “exchange offer” means this offer to exchange new notes for old notes in accordance with the terms set forth in this prospectus and the accompanying letter of transmittal. You are entitled to exchange your old notes for new notes. |

Expiration Date; Withdrawal of Tender | The exchange offer will expire at 12:00 p.m., New York City time, on , 2005, or such later date and time to which it may be extended by us. The tender of old notes pursuant to the exchange offer may be withdrawn at any time prior to the expiration date of the exchange offer. Any old notes not accepted for exchange for any reason will be returned without expense to the tendering holder thereof promptly after the expiration or termination of the exchange offer. |

Conditions to the Exchange Offer | Our obligation to accept for exchange, or to issue new notes in exchange for, any old notes is subject to customary conditions relating to compliance with any applicable law or any applicable interpretation by the staff of the Securities and Exchange Commission, the receipt of any applicable governmental approvals and the absence of any actions or proceedings of any governmental agency or court which could materially impair Crown European Holdings’ ability to consummate the exchange offer. See “The Exchange Offer—Conditions to the Exchange Offer.” |

8

Procedures for Tendering Old Notes | If you wish to accept the exchange offer and tender your old notes, you must either: |

| | • | | complete, sign and date the Letter of Transmittal, or a facsimile of the Letter of Transmittal, in accordance with its instructions and the instructions in this prospectus, and mail or otherwise deliver such Letter of Transmittal, or the facsimile, together with the old notes and any other required documentation, to the exchange agent at the address set forth herein; or |

| | • | | instruct Euroclear or Clearstream, Luxembourg to transmit on your behalf a computer-generated message to the exchange agent in which you acknowledge and agree to be bound by the terms of, and to make all of the representations contained in, the Letter of Transmittal, which computer-generated message must be received by the exchange agent prior to 12:00 p.m., New York City time, on the expiration date. |

Broker-Dealers | Each broker-dealer that receives new notes for its own account in exchange for old notes, where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. See “Plan of Distribution.” |

Use of Proceeds | We will not receive any proceeds from the exchange offer. See “Use of Proceeds.” |

Exchange Agent | JPMorgan Chase Bank, N.A. is serving as the exchange agent in connection with the exchange offer. |

Federal Income Tax Consequences | The exchange of old notes for new notes pursuant to the exchange offer should not be a taxable event for federal income tax purposes. See “Material Tax Considerations.” |

9

Consequences of Exchanging Old Notes Pursuant to the Exchange Offer

Based on certain interpretive letters issued by the staff of the Securities and Exchange Commission to third parties in unrelated transactions, Crown European Holdings is of the view that holders of old notes (other than any holder who is an “affiliate” of Crown European Holdings within the meaning of Rule 405 under the Securities Act) who exchange their old notes for new notes pursuant to the exchange offer generally may offer the new notes for resale, resell such new notes and otherwise transfer the new notes without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that:

| | • | | the new notes are acquired in the ordinary course of the holders’ business; |

| | • | | the holders have no arrangement or understanding with any person to participate in a distribution of the new notes; and |

| | • | | neither the holder nor any other person is engaging in or intends to engage in a distribution of the new notes. |

Each broker-dealer that receives new notes for its own account in exchange for old notes must acknowledge that it will deliver a prospectus in connection with any resale of the new notes. See “Plan of Distribution.” In addition, to comply with the securities laws of applicable jurisdictions, the new notes may not be offered or sold unless they have been registered or qualified for sale in the applicable jurisdiction or in compliance with an available exemption from registration or qualification. Crown European Holdings has agreed, under the registration rights agreements and subject to limitations specified in the registration rights agreements, to register or qualify the new notes for offer or sale under the securities or blue sky laws of the applicable jurisdictions as any holder of the notes reasonably requests in writing. If a holder of old notes does not exchange the old notes for new notes according to the terms of the exchange offer, the old notes will continue to be subject to the restrictions on transfer contained in the legend printed on the old notes. In general, the old notes may not be offered or sold, unless registered under the Securities Act, except under an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Holders of old notes do not have any appraisal or dissenters’ rights in connection with the exchange offer. See “The Exchange Offer—Resales of New Notes.”

Crown European Holdings has applied to list the old notes on the Luxembourg Stock Exchange.

10

The New Notes

For a more complete description of the terms of the new notes, see “Description of the New Notes.”

Issuer | Crown European Holdings, asociété anonyme organized under the laws of France. |

Notes Offered | €460 million principal amount of 6 1/4% First Priority Senior Secured Notes due 2011. |

Maturity | September 1, 2011. |

Interest | Interest on the new notes is payable on March 1 and September 1 of each year beginning on March 1, 2005. |

Ranking and Guarantees | The new notes will be senior obligations of Crown European Holdings, ranking senior in right of payment to all subordinated indebtedness of Crown European Holdings, and will be guaranteed on a senior basis by: |

| | • | | Crown and each of Crown’s U.S. restricted subsidiaries that are obligors under Crown’s credit facilities or that guarantee or otherwise become liable with respect to any indebtedness of Crown, Crown European Holdings or any guarantor including, without limitation, any indebtedness under Crown’s credit facilities; and |

| | • | | each of Crown European Holdings’ present and future restricted subsidiaries that guarantees or otherwise becomes liable with respect to any indebtedness of Crown, Crown European Holdings or any guarantor including, without limitation, any indebtedness under Crown’s credit facilities, or is otherwise an obligor under the credit facilities, unless the incurrence of such guarantee is prohibited by the laws of the jurisdiction of incorporation or formation of such restricted subsidiary. |

The new notes and the new note guarantees will be structurally subordinated to all indebtedness of Crown’s non-guarantor subsidiaries, including certain of its non-U.S. subsidiaries, and will be effectively junior in right of payment to any indebtedness of Crown, Crown European Holdings and the subsidiary guarantors that is secured by assets not securing the new notes.

Upon the release of any note guarantor from its guarantee of all indebtedness of Crown or any of its subsidiaries, unless there is existing a default or event of default under the indenture governing the new notes, the guarantee of such new notes and any security securing the new notes by such guarantor will also be released.

Senior Indebtedness | As of September 30, 2004, Crown and its subsidiaries had approximately $4.0 billion of indebtedness, including $119 million |

11

| | that ranked effectively senior to the new notes (consisting of total indebtedness of non-guarantor subsidiaries of $146 million, less $27 million of finance subsidiary debt guaranteed by Crown). Borrowings under Crown’s senior secured credit facilities, to the extent they are secured by assets that do not secure the new notes, also rank effectively senior to the new notes. |

Additional Indebtedness | Crown may be able to incur additional debt in the future, including debt secured by the collateral that secures the new notes as well as other assets that do not secure the new notes. Although Crown’s credit facilities contain, and the indenture governing the new notes offered hereby contains, restrictions on Crown’s ability to incur indebtedness, those restrictions are subject to a number of exceptions. Crown is able to borrow up to an aggregate of $500 million of indebtedness under its new senior secured credit facilities. |

Net Sales and Gross Profit from Non-Guarantors | For the nine months ended September 30, 2004, the non-guarantor subsidiaries of Crown represented in the aggregate approximately 32% of consolidated net sales (calculated using $1.7 billion of net sales by non-guarantor subsidiaries for the nine months ended September 30, 2004, divided by consolidated net sales of $5.5 billion). |

For the nine months ended September 30, 2004, the non-guarantor subsidiaries of Crown represented in the aggregate approximately 38% of consolidated gross profit (calculated using $269 million of gross profit from non-guarantor subsidiaries for the nine months ended September 30, 2004, divided by consolidated gross profit of $717 million).

Security | The new notes will be secured by first priority liens on the assets of Crown and its subsidiaries that from time to time secure Crown’s obligations under Crown’s credit facilities (which include substantially all of the assets of Crown and Crown’s U.S. subsidiaries and substantially all the assets of Crown European Holdings and certain of Crown European Holdings’ subsidiaries), except, in each case, for the additional bank collateral described below. Crown’s credit facilities are also secured by pari passu first priority liens on those assets including the additional bank collateral. |

The additional bank collateral that secures the obligations of Crown and its subsidiaries under Crown’s credit facilities, but not the new notes, includes:

| | • | | the capital stock of each of Crown’s U.S. subsidiaries (provided that the capital stock of Crown Cork is also pledged to secure the new notes); and |

| | • | | all of the capital stock of Crown European Holdings and certain of its non-U.S. subsidiaries. |

12

The indenture governing the new notes permits, under certain circumstances, additional indebtedness to be secured by the collateral securing the new notes.

Principal Property | Under the terms of Crown’s outstanding unsecured notes (of which approximately $1.0 billion was outstanding as of September 30, 2004), if at any time the amount of Crown’s indebtedness secured by liens on its principal property (defined as a manufacturing or processing plant or warehouse, but excluding equipment or personalty therein) or the capital stock or indebtedness of its subsidiaries that own, operate or lease such principal properties under the applicable indentures and agreements exceeds 10% of its consolidated net tangible assets, Crown will be required to secure its obligations under such outstanding unsecured notes on an equal and ratable basis together with the new notes offered hereby and Crown’s outstanding first, second and third priority secured notes, the credit facilities and any other indebtedness secured by such assets. The security documents contain a provision limiting the amount of debt secured by such principal properties, capital stock and indebtedness to the extent necessary to prevent such outstanding unsecured notes from being so secured; provided that if such outstanding unsecured notes shall for any reason become entitled pursuant to their terms to be secured by a first priority lien on such principal properties, capital stock or indebtedness, then the full amount of the obligations under the new notes offered hereby and Crown’s outstanding first, second and third priority secured notes, the credit facilities and any other permitted secured indebtedness will be secured by first priority liens on such principal properties, capital stock and indebtedness. |

Intercreditor Agreements | The trustee, on behalf of the holders of the new notes offered hereby, the bank agents, on behalf of the lenders under the credit facilities, and the trustees, on behalf of the holders of Crown’s outstanding second priority and third priority secured notes, have entered into two amended and restated intercreditor agreements which provide, among other things, that the bank agents, on behalf of the lenders under the credit facilities, hold a first priority security interest in the shared collateral (as well as the additional bank collateral), the trustee for the new notes offered hereby holds a first priority lien in the shared collateral (which excludes the additional bank collateral), the trustee for the second priority notes holds a second priority security interest in the shared collateral (which excludes the additional bank collateral), and the trustee for the third priority notes holds a third priority security interest in the shared collateral (which excludes the additional bank collateral). The amended and restated intercreditor agreements provide that, for so long as any obligations are outstanding under Crown’s credit facilities, the designated bank agent thereunder will have the exclusive right to instruct the collateral agent to manage, perform and enforce the terms of the security documents relating to the collateral and to exercise and enforce all privileges, rights and remedies thereunder according to its direction. Further, |

13

| | unless a default or event of default has occurred and is continuing under the new notes, the lenders under Crown’s credit facilities may, without the consent of the holders of the new notes, release any or all of the collateral securing both the new notes and the credit facilities including, without limitation, in connection with the repayment of the credit facilities, and, during the occurrence of an event of default, the lenders under the credit facilities may release collateral in connection with the foreclosure, sale or other disposition of such collateral to satisfy obligations under the credit facilities or upon consummation of any transfer or sale of assets permitted under the indentures. In addition, if the credit facilities are repaid in full and not refinanced with other secured debt, and there is no default or event of default then existing under the indentures, the liens securing the new notes and the second and third priority notes will be released. The amended and restated intercreditor agreements each provide that the holders of new notes will not enjoy any security interest in the additional bank collateral described in the second paragraph of “Security” above. |

Global Participation and Proceeds Sharing Agreement | The trustee, on behalf of the holders of the new notes offered hereby, the bank agents, on behalf of the lenders under the credit facilities, and the trustees, on behalf of the holders of Crown’s outstanding second priority and third priority secured notes, have entered into an amended and restated global participation and proceeds sharing agreement. The amended and restated proceeds sharing agreement provides that from and after the occurrence of a principal payment default on or an acceleration of the new notes offered hereby, the credit facilities, the second priority notes, the third priority notes or any other debt subject to such agreement, which has not been waived, each obligor under the new notes, the credit facilities, the second and third priority notes and such other covered debt will be required to make all payments due under the new notes, the credit facilities the second and third priority notes and such other covered debt directly to a sharing agent to be placed into a sharing account. Generally, the sharing agent will disburse amounts to the trustee on behalf of the holders of the new notes, the bank agents on behalf of the lenders under the credit facilities, the trustees for the second and third priority notes and the representatives of such other covered debt on their behalf only after such item of debt has matured, whether at its final scheduled maturity or by acceleration, and then in the following priority: |

| | • | | in the case of proceeds received in respect of collateral securing any such debt, first to the bank agents under the credit facilities and to any other holder of debt (including the new notes offered hereby) secured by a first priority lien on any such collateral pro rata based on the amount of indebtedness secured, until all such debt is paid in full, second to the trustee under the indenture governing the second priority notes and to any other holder of debt secured by a second priority lien on any such collateral, until all such debt is paid in full, and third to the trustee under |

14

| | the indenture governing the third priority notes and to any other holder of debt secured by a third priority lien on any such collateral, until all such debt is paid in full; and |

| | • | | in the case of proceeds received other than in respect of collateral securing such debt, to the bank agents under the credit facilities, the trustee under the indenture governing the new notes offered hereby, the trustees under the indentures governing the second and third priority notes and to the holders of any other senior indebtedness subject to the amended and restated proceeds sharing agreement on a pro rata basis and, thereafter, to the holders of any subordinated indebtedness subject to the amended and restated proceeds sharing agreement. See “Description of the New Notes—Global Participation and Proceeds Sharing Agreement.” |

Optional Redemption | Crown European Holdings may redeem some or all of the new notes at any time by paying a “make-whole” premium as set forth under “Description of the New Notes—Optional Redemption,” plus accrued and unpaid interest, if any, to the redemption date. |

Optional Redemption After Certain Equity Offerings | Prior to September 1, 2007, Crown European Holdings may use the net cash proceeds from certain equity offerings of capital stock of Crown Holdings that are contributed to the common equity capital or are used to subscribe for qualified capital stock of Crown European Holdings to redeem up to 35% of the principal amount of the new notes, at a redemption price equal to 106.25% of their principal amount, plus accrued and unpaid interest, if any, to the redemption date; provided that at least 65% of the aggregate principal amount of the new notes originally issued remain outstanding immediately after such redemption. See “Description of the New Notes—Optional Redemption.” |

Redemption for Changes in Withholding Taxes | In the event Crown European Holdings has or would become obligated to pay additional amounts as a result of changes affecting certain withholding tax laws applicable to payments on the new notes, Crown European Holdings may redeem all, but not less than all, of such new notes at any time at a redemption price equal to 100% of their principal amount, plus accrued and unpaid interest, if any, to the redemption date. See “Description of the New Notes—Redemption of Notes for Changes in Withholding Taxes” and “—Additional Amounts.” |

Change of Control | Upon a change of control of Crown, as defined under the caption “Description of the New Notes—Repurchase at the Option of Holders,” you will have the right, as a holder of new notes, to require Crown European Holdings to repurchase all or part of your new notes at a repurchase price equal to 101% of their principal amount, plus accrued and unpaid interest, if any, to the repurchase date. |

15

Asset Sales | Crown European Holdings may have to use a portion of the net cash proceeds from selling assets to offer to purchase your new notes at a purchase price equal to 100% of their principal amount, plus accrued and unpaid interest, if any, to the purchase date. See “Description of the New Notes—Repurchase at the Option of Holders.” |

Additional Amounts | All payments made by Crown European Holdings or any guarantor with respect to the new notes will be made without withholding or deduction for taxes unless required by law or the interpretation or administration thereof. Subject to certain exceptions, if Crown European Holdings or any guarantor is required to withhold or deduct any amount for taxes from any payment made with respect to the new notes, Crown European Holdings or the guarantor will pay such additional amounts as may be necessary so that the net amount received by the holders after such withholding or deduction will not be less than the amount that would have been received in the absence of such withholding or deduction. See “Description of the New Notes—Additional Amounts.” |

Restrictive Covenants | The indenture governing the new notes limits, among other things, Crown’s ability and the ability of its restricted subsidiaries (including Crown European Holdings) to: |

| | • | | pay dividends or make other distributions, repurchase capital stock, repurchase subordinated debt and make certain investments; |

| | • | | create liens and engage in sale and leaseback transactions; |

| | • | | create restrictions on the payment of dividends and other amounts to Crown or Crown European Holdings from restricted subsidiaries; |

| | • | | sell assets or merge or consolidate with or into other companies; and |

| | • | | engage in transactions with affiliates. |

These covenants are subject to a number of important exceptions and limitations that are described under the caption “Description of the New Notes—Certain Covenants.”

Covenant Termination | If at any time the new notes are rated investment grade by both Moody’s Investors Service, Inc. and Standard & Poor’s Ratings Services and no default or event of default has occurred and is continuing under the indenture governing the new notes, Crown and its subsidiaries will no longer be subject to most of the covenants described under the captions “Restrictive Covenants” and “Change of Control” above with respect to the new notes and will not be required to offer to purchase the new notes from the net cash proceeds from selling assets that do not constitute collateral as described under the |

16

| | caption “Asset Sales” above. Crown and its subsidiaries will not subsequently become subject to such covenants notwithstanding that one or both of such rating agencies may subsequently decrease their ratings of the new notes to below investment grade status. See “Description of the New Notes—Certain Covenants.” |

Risk Factors

An investment in the new notes involves risks. You should carefully consider all of the information in this prospectus. In particular, you should evaluate the specific risk factors set forth under the caption “Risk Factors” in this prospectus.

17

Summary Historical Consolidated Condensed Financial Data

The following table sets forth summary historical consolidated condensed financial data for Crown. The summary of operations and other data for each of the years in the three-year period ended December 31, 2003 and the balance sheet data as of December 31, 2001, 2002 and 2003 have been derived from Crown’s audited consolidated financial statements. The summary of operations and other data for the nine-month period ended September 30, 2004, the nine-month period ended September 30, 2003, and the balance sheet data as of September 30, 2004 and 2003 have been derived from Crown’s unaudited consolidated financial statements. You should read the following financial information in conjunction with, and it is qualified in reference to, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Crown’s consolidated financial statements, the related notes and the other financial information in each of our Annual Report on Form 10-K for the year ended December 31, 2003 and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2004, which are incorporated by reference in this prospectus.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

| | | Nine Months Ended September 30,

| |

| | | 2001(1)

| | | 2002(1)

| | | 2003

| | | 2003

| | | 2004

| |

Summary of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 7,187 | | | $ | 6,792 | | | $ | 6,630 | | | $ | 5,039 | | | $ | 5,451 | |

Cost of products sold (excluding depreciation and amortization) | | | 6,063 | | | | 5,619 | | | | 5,539 | | | | 4,185 | | | | 4,504 | |

Depreciation and amortization | | | 386 | | | | 375 | | | | 326 | | | | 247 | | | | 230 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Gross profit | | | 738 | | | | 798 | | | | 765 | | | | 607 | | | | 717 | |

Goodwill amortization | | | 113 | | | | — | | | | — | | | | — | | | | — | |

Selling and administrative expense | | | 310 | | | | 317 | | | | 337 | | | | 242 | | | | 269 | |

Provision for asbestos | | | 51 | | | | 30 | | | | 44 | | | | — | | | | — | |

Provision for restructuring | | | 48 | | | | 19 | | | | 19 | | | | 3 | | | | 1 | |

Provision for asset impairments and loss/(gain) on sale of assets | | | 213 | | | | 247 | | | | 73 | | | | 43 | | | | — | |

Loss/(gain) from early extinguishments of debt | | | — | | | | (28 | ) | | | 12 | | | | 9 | | | | 37 | |

Interest expense | | | 455 | | | | 342 | | | | 379 | | | | 280 | | | | 270 | |

Interest income | | | (18 | ) | | | (11 | ) | | | (11 | ) | | | (7 | ) | | | (5 | ) |

Translation and exchange adjustments | | | 10 | | | | 27 | | | | (207 | ) | | | (117 | ) | | | (7 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income/(loss) before income taxes, minority interests, equity earnings and cumulative effect of a change in accounting (2) | | | (444 | ) | | | (145 | ) | | | 119 | | | | 154 | | | | 152 | |

Provision for income taxes | | | 528 | | | | 30 | | | | 95 | | | | 84 | | | | 56 | |

Minority interests and equity earnings | | | (4 | ) | | | (16 | ) | | | (56 | ) | | | (48 | ) | | | (18 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income/(loss) before cumulative effect of a change in accounting (2) | | $ | (976 | ) | | $ | (191 | ) | | $ | (32 | ) | | $ | 22 | | | $ | 78 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Other Financial Data: | | | | | | | | | | | | | | | | | | | | |

Cash flows provided by/(used in): | | | | | | | | | | | | | | | | | | | | |

Operating activities | | $ | 310 | | | $ | 415 | | | $ | 434 | | | $ | 70 | | | $ | 30 | |

Investing activities | | | (163 | ) | | | 591 | | | | (100 | ) | | | (209 | ) | | | (91 | ) |

Financing activities | | | (63 | ) | | | (1,128 | ) | | | (328 | ) | | | 45 | | | | (43 | ) |

Capital expenditures | | | 168 | | | | 115 | | | | 120 | | | | 82 | | | | 97 | |

Ratio of earnings to fixed charges (3)(4) | | | — | | | | — | | | | 1.3 | x | | | 1.5 | x | | | 1.6 | x |

18

| | | | | | | | | | | | | | |

| | | (dollars in millions)

|

| | | December 31,

| | September 30, 2004

|

| | | 2001

| | | 2002

| | | 2003

| |

Balance Sheet Data (at end of period): | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 456 | | | $ | 363 | | | $ | 401 | | $ | 295 |

Working capital (5) | | | (84 | ) | | | (246 | ) | | | 86 | | | 268 |

Total assets | | | 9,620 | | | | 7,505 | | | | 7,773 | | | 7,904 |

Total debt | | | 5,320 | | | | 4,054 | | | | 3,939 | | | 3,959 |

Shareholders’ equity/(deficit) | | | 804 | | | | (87 | ) | | | 140 | | | 233 |

| (1) | | The summary of operations and other data for the years ended December 31, 2001 and 2002 include the historical financial results of the following operations divested in 2002: |

| | • | | U.S. fragrance pumps business; |

| | • | | European pharmaceutical packaging business; |

| | • | | 15% shareholding in Crown Nampak (Pty) Limited; |

| | • | | Central and East African packaging interests; and |

| | • | | 89.5% of the equity interests of Constar International Inc. |

Excluding the historical financial results of these divested operations, Net Sales for 2001 and 2002 would have been $6,283 million and $6,118 million, respectively, and Gross Profit for 2001 and 2002 would have been $668 million and $731 million, respectively. The following tables show a reconciliation of historical Net Sales and Gross Profit to Net Sales and Gross Profit excluding these divested operations (which is a non-GAAP measurement):

| | | | | | | | | | | | |

| | | (dollars in millions)

| |

| | | Year Ended December 31, 2001

| |

| | | Historical

Amounts

| | | Disposition

Adjustments

| | | Adjusted

for

Dispositions

| |

Summary of Operations Data: | | | | | | | | | | | | |

Net sales | | $ | 7,187 | | | $ | (904 | ) | | $ | 6,283 | |

Cost of products sold (excluding depreciation and amortization) | | | 6,063 | | | | (758 | ) | | | 5,305 | |

Depreciation and amortization | | | 386 | | | | (76 | ) | | | 310 | |

| | |

|

|

| |

|

|

| |

|

|

|

Gross profit | | | 738 | | | | (70 | ) | | | 668 | |

Goodwill amortization | | | 113 | | | | — | | | | 113 | |

Selling and administrative expense | | | 310 | | | | (28 | ) | | | 282 | |

Provision for asbestos | | | 51 | | | | — | | | | 51 | |

Provision for restructuring | | | 48 | | | | (2 | ) | | | 46 | |

Provision for asset impairments and loss/(gain) on sale of assets | | | 213 | | | | (204 | ) | | | 9 | |

Interest expense | | | 455 | | | | (44 | ) | | | 411 | |

Interest income | | | (18 | ) | | | — | | | | (18 | ) |

Translation and exchange adjustments | | | 10 | | | | (1 | ) | | | 9 | |

| | |

|

|

| |

|

|

| |

|

|

|

Income/(loss) before income taxes, minority interests, equity earnings and cumulative effect of a change in accounting | | | (444 | ) | | | 209 | | | | (235 | ) |

Provision for income taxes | | | 528 | | | | (6 | ) | | | 522 | |

Minority interests and equity earnings | | | (4 | ) | | | (1 | ) | | | (5 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Income/(loss) before cumulative effect of a change in accounting | | $ | (976 | ) | | $ | 214 | | | $ | (762 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

19

| | | | | | | | | | | | |

| | | (dollars in millions)

| |

| | | Year Ended December 31, 2002

| |

| | | Historical

Amounts

| | | Disposition

Adjustments

| | | Adjusted

for

Dispositions

| |

Summary of Operations Data: | | | | | | | | | | | | |

Net sales | | $ | 6,792 | | | $ | (674 | ) | | $ | 6,118 | |

Cost of products sold (excluding depreciation and amortization) | | | 5,619 | | | | (558 | ) | | | 5,061 | |

Depreciation and amortization | | | 375 | | | | (49 | ) | | | 326 | |

| | |

|

|

| |

|

|

| |

|

|

|

Gross profit | | | 798 | | | | (67 | ) | | | 731 | |

Selling and administrative expense | | | 317 | | | | (22 | ) | | | 295 | |

Provision for asbestos | | | 30 | | | | — | | | | 30 | |

Provision for restructuring | | | 19 | | | | — | | | | 19 | |

Provision for asset impairments and loss/(gain) on sale of assets | | | 247 | | | | (243 | ) | | | 4 | |

Gain from early extinguishments of debt | | | (28 | ) | | | — | | | | (28 | ) |

Interest expense | | | 342 | | | | (15 | ) | | | 327 | |

Interest income | | | (11 | ) | | | — | | | | (11 | ) |

Translation and exchange adjustments | | | 27 | | | | (1 | ) | | | 26 | |

| | |

|

|

| |

|

|

| |

|

|

|

Income/(loss) before income taxes, minority interests, equity earnings and cumulative effect of a change in accounting | | | (145 | ) | | | 214 | | | | 69 | |

Provision for income taxes | | | 30 | | | | (15 | ) | | | 15 | |

Minority interests and equity earnings | | | (16 | ) | | | 1 | | | | (15 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Income/(loss) before cumulative effect of a change in accounting | | $ | (191 | ) | | $ | 230 | | | $ | 39 | |

| | |

|

|

| |

|

|

| |

|

|

|

| (2) | | Excludes a credit of $4 million in 2001 for the cumulative effect of a change in accounting for the adoption of SFAS 133, “Accounting for Derivatives and Hedging Activities.” Also excludes a charge of $1.014 billion in 2002 for the cumulative effect of a change in accounting for the adoption of SFAS 142, “Goodwill and Other Intangible Assets.” |

| (3) | | For purposes of computing the ratio of earnings to fixed charges, earnings consist of income before income taxes, equity in earnings of affiliates, minority interests and cumulative effect of accounting changes plus fixed charges (exclusive of interest capitalized during the period), amortization of interest previously capitalized and distributed income from less-than-50%-owned companies. Fixed charges include interest incurred, expensed and capitalized, amortization of debt issue costs and the portion of rental expense that is deemed representative of an interest factor. For purposes of the covenants in the indenture governing the notes, the ratio of earnings to fixed charges is defined differently. |

| (4) | | Earnings did not cover fixed charges by $442 million and $140 million for the years ended December 31, 2001 and 2002, respectively. |

| (5) | | Working capital consists of current assets less current liabilities. |

20

RISK FACTORS

An investment in the new notes involves a high degree of risk. You should consider carefully the following risks involved in investing in the new notes, as well as the other information contained in this prospectus, before deciding whether to exchange your old notes in the exchange offer. The risk factors related to the new notes and Crown’s business are also generally applicable to the old notes.

Risks Related to the Exchange Offer

If you fail to exchange your old notes for new notes your old notes will continue to be subject to restrictions on transfer.

We did not register the old notes under the Securities Act or any state securities laws, nor do we intend to after the exchange offer. In general, you may only offer or sell the old notes if they are registered under the Securities Act and applicable state securities laws, or offered and sold under an exemption from these requirements. If you do not exchange your old notes in the exchange offer, you will lose your right to have the old notes registered under the Securities Act, subject to certain limitations. If you continue to hold old notes after the exchange offer, you may be unable to sell the old notes.

If an active trading market for the new notes does not develop, the liquidity and value of the new notes could be harmed.

While application has been made to list the old notes on the Luxembourg Stock Exchange, there is no existing market for the new notes. An active public market for the new notes may not develop or, if developed, may not continue. If an active public market does not develop or is not maintained, you may not be able to sell your new notes at their fair market value or at all.

You must comply with the exchange offer procedures in order to receive new notes.

The new notes will be issued in exchange for the old notes only after timely receipt by the exchange agent of the old notes or a book-entry confirmation related thereto, a properly completed and executed letter of transmittal or an agent’s message and all other required documentation. If you want to tender your old notes in exchange for new notes, you should allow sufficient time to ensure timely delivery. None of us, Crown nor the exchange agent are under any duty to give you notification of defects or irregularities with respect to tenders of old notes for exchange. Old notes that are not tendered or are tendered but not accepted will, following the exchange offer, continue to be subject to the existing transfer restrictions. In addition, if you tender the old notes in the exchange offer to participate in a distribution of the new notes, you will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction. For additional information, please refer to the sections entitled “The Exchange Offer” and “Plan of Distribution” later in this prospectus.

Risks Related to the New Notes

The substantial indebtedness of Crown could prevent it from fulfilling its obligations under the new notes and the new note guarantees.

Crown is highly leveraged. As a result of Crown’s substantial indebtedness, a significant portion of Crown’s cash flow will be required to pay interest and principal on its outstanding indebtedness, and Crown may not generate sufficient cash flow from operations, or have future borrowings available under its credit facilities, to enable it to pay its indebtedness, including the notes, or to fund other liquidity needs. As of September 30, 2004, Crown had approximately $4.0 billion of total indebtedness, including $119 million that ranked effectively senior to the notes, €22 million ($27 million U.S. dollar equivalent at September 30, 2004) of unsecured notes due in December 2004 (which were repaid in December 2004), $40 million of unsecured notes due in January 2005 (which were repaid in December 2004) and $269 million of unsecured notes due in December 2006 ($33 million of which were purchased by Crown in December 2004), and shareholders’ equity of $233 million. Crown’s senior secured revolving credit facilities will mature in February 2010.

21

The substantial indebtedness of Crown could have important consequences to you. For example, it could:

| | • | | make it more difficult for Crown and its subsidiaries to satisfy their obligations with respect to the new notes, such as Crown European Holdings’ obligation to purchase new notes tendered as a result of a change in control of Crown; |

| | • | | increase Crown’s vulnerability to general adverse economic and industry conditions, including rising interest rates; |

| | • | | require Crown to dedicate a substantial portion of its cash flow from operations to service its indebtedness, thereby reducing the availability of its cash flow to fund future working capital, capital expenditures and other general corporate requirements; |

| | • | | require Crown to sell assets used in its business; |

| | • | | limit Crown’s flexibility in planning for, or reacting to, changes in its business and the industry in which it operates; and |

| | • | | place Crown at a competitive disadvantage compared to its competitors that have less debt. |

If its financial condition, operating results and liquidity deteriorate, Crown’s creditors may restrict its ability to obtain future financing and its suppliers could require prepayment or cash on delivery rather than extend credit to it. If Crown’s creditors restrict advances, Crown’s ability to generate cash flows from operations sufficient to service its short and long-term debt obligations will be further diminished.

Some of Crown’s indebtedness is subject to floating interest rates, which would result in Crown’s interest expense increasing if interest rates rise.

As of September 30, 2004, approximately $1.2 billion of Crown’s $4.0 billion of total indebtedness (including interest rate swaps) and other outstanding obligations were subject to floating interest rates. Changes in economic conditions could result in higher interest rates, thereby increasing Crown’s interest expense and reducing funds available for operations or other purposes. Crown’s annual interest expense was $379 million for 2003 and $270 million for the first nine months of 2004. Based on the amount of variable rate debt outstanding during 2003 (including interest rate swaps), a 1% increase in variable interest rates for 2003 would have increased its annual interest expense by $14 million. At September 30, 2004, four interest rate swaps were outstanding with a combined notional value of $900 million, which effectively convert $900 million of 9.5% fixed rate debt into variable rate debt, thereby increasing Crown’s exposure to variable interest rate fluctuations. Accordingly, Crown may experience economic losses and a negative impact on earnings as a result of interest rate fluctuations. Although Crown may use interest rate protection agreements from time to time to reduce its exposure to interest rate fluctuations in some cases, it may not elect or have the ability to implement hedges or, if it does implement them, they may not achieve the desired effect. See “Capitalization,” “Description of Certain Indebtedness” included in this prospectus and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Financial Position—Market Risk,” in each of our Annual Report on Form 10-K for the year ended December 31, 2003 and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2004, which are incorporated by reference in this prospectus.

Despite current indebtedness levels and restrictive covenants, Crown may still be able to incur substantial additional debt, which could exacerbate the risks described above.

Crown may be able to incur additional debt in the future, including debt secured by the collateral that secures the notes as well as other assets that do not secure the notes. Although Crown’s new credit facilities and the indenture governing the new notes contain restrictions on Crown’s ability to incur indebtedness, those restrictions are subject to a number of exceptions. In addition, if Crown is able to designate some of its restricted subsidiaries under the indenture governing the new notes as unrestricted subsidiaries, those unrestricted subsidiaries would be permitted to borrow beyond the limitations specified in the indenture and engage in other activities in which restricted subsidiaries may not engage. Adding new debt to current debt levels could intensify the related risks that Crown and its subsidiaries now face. See “Capitalization” and “Description of Certain Indebtedness.”

22

Restrictive covenants in the indenture governing the notes, the new credit facilities and indentures and agreements governing Crown’s other current or future indebtedness could restrict Crown’s operating flexibility.

The new credit facilities, the indenture governing the new notes and the indentures and agreements governing Crown’s outstanding secured and unsecured notes contain, affirmative and negative covenants that limit the ability of Crown and its subsidiaries to take certain actions. These restrictions may limit Crown’s ability to operate its businesses and may prohibit or limit its ability to enhance its operations or take advantage of potential business opportunities as they arise. The new credit facilities require Crown to maintain specified financial ratios and satisfy other financial conditions. The new credit facilities and the indenture governing the new notes restrict, and the agreements or indentures governing Crown’s outstanding secured notes restrict, among other things, the ability of Crown and the ability of all or substantially all of its subsidiaries to:

| | • | | pay dividends or make other distributions, repurchase capital stock, repurchase subordinated debt and make certain investments; |