ANNUAL INFORMATION FORM

FOR THE YEAR ENDED DECEMBER 31, 2018

March 29, 2019

| 925 West Georgia Street, Suite 1800, Vancouver, B.C., Canada V6C 3L2 |

| Phone: 604.688.3033 | Fax: 604.639.8873| Toll Free: 1.866.529.2807 | Email: info@firstmajestic.com |

| www.firstmajestic.com |

TABLE OF CONTENTS

| PRELIMINARY NOTES | 1 |

| | |

| GLOSSARY OF CERTAIN TECHNICAL TERMS | 4 |

| | |

| CORPORATE STRUCTURE | 7 |

| | |

| DESCRIPTION OF BUSINESS | 9 |

| General | 9 |

| | |

| GENERAL DEVELOPMENT OF THE BUSINESS | 10 |

| Principal Markets for Silver | 15 |

| Mineral Projects | 16 |

| San Dimas Silver/Gold Mine, Durango State, México | 22 |

| Santa Elena Silver/Gold Mine, Sonora State, México | 34 |

| La Encantada Silver Mine, Coahuila State, México | 46 |

| La Parrilla Silver Mine, Durango State, México | 57 |

| San Martín Silver Mine, Jalisco State, México | 69 |

| Del Toro Silver Mine, Zacatecas State, México | 80 |

| La Guitarra Silver Mine, México State, México (currently in care andmaintenance) | 90 |

| Risk Factors | 97 |

| Product Marketing and Sales | 122 |

| Social and Environmental Policies | 123 |

| Taxation | 125 |

| | |

| DIVIDENDS | 126 |

| | |

| CAPITAL STRUCTURE | 126 |

| | |

| MARKET FOR SECURITIES | 127 |

| | |

| PRIOR SALES | 128 |

| Options | 128 |

| Warrants | 129 |

| Other | 129 |

| | |

| DIRECTORS AND OFFICERS | 130 |

| | |

| AUDIT COMMITTEE INFORMATION | 133 |

| | |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 135 |

| | |

| TRANSFER AGENT AND REGISTRAR | 135 |

| | |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 135 |

| | |

| MATERIAL CONTRACTS | 137 |

| | |

| INTERESTS OF EXPERTS | 137 |

| | |

| ADDITIONAL INFORMATION | 138 |

| | |

| APPENDIX “A” | A-1 |

| 925 West Georgia Street, Suite 1800, Vancouver, B.C., Canada V6C 3L2 |

| Phone: 604.688.3033 | Fax: 604.639.8873| Toll Free: 1.866.529.2807 | Email: info@firstmajestic.com |

| www.firstmajestic.com |

PRELIMINARY NOTES

Date of Information

Unless otherwise indicated, all information contained in this Annual Information Form (“AIF”) of First Majestic Silver Corp. (“First Majestic” or the “Company”) is as of December 31, 2018.

Financial Information

The Company’s financial results are prepared and reported in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”) and is presented in United States dollars.

Forward-looking Information

Certain statements contained in this AIF constitute forward-looking information or forward-looking statements under applicable securities laws (collectively, “forward-looking statements”). These statements relate to future events or the Company’s future performance, business prospects or opportunities. Forward-looking statements include, but are not limited to: future financings, the redemption of the Company’s securities, statements with respect to the Company’s business strategy, future planning processes, commercial mining operations, anticipated mineral recoveries, projected quantities of future mineral production, interpretation of drill results and other technical data, anticipated development, expansion, exploration activities and production rates and mine plans and mine life, the estimated cost and timing of plant improvements at the Company’s operating mines and development of the Company’s development projects, the timing of completion of exploration programs and preparation of technical reports, viability of the Company’s projects, anticipated reclamation and decommissioning activities, conversion of mineral resources to proven and probable mineral reserves, potential metal recovery rates, analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable, statements with respect to the Company’s future financial position including operating efficiencies, cash flow, capital budgets, costs and expenditures, cost savings, allocation of capital, the Company’s share price, and statements with respect to the recovery of value added tax receivables and the tax regime in México, the Company’s plans with respect to enforcement of certain judgments in favour of the Company and the likelihood of collection under those judgments, the Company’s ability to comply with future legislation or regulations, the Company’s intent to comply with future regulatory matters, future regulatory trends, future market conditions, future staffing levels and needs, assessment of future opportunities of the Company, future payments of dividends by the Company, assumptions of management, maintaining relations with local communities, renewing contracts related to material properties, the Share Repurchase Program (as hereinafter defined) and maintaining relations with employees. All statements other than statements of historical fact may be forward-looking statements. Statements concerning proven and probable mineral reserves and mineral resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered as and if the property is developed, and in the case of Measured and Indicated Mineral Resources or Proven and Probable Mineral Reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “forecast”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions) are not statements of historical fact and may be “forward-looking statements”.

1

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. These forward-looking statements involve risks and uncertainties relating to, among other things, global economic conditions, changes in commodity prices and, particularly, silver prices, changes in exchange rates, access to skilled mining development and mill production personnel, labour relations, costs of labour, relations with local communities and aboriginal groups, results of exploration and development activities, accuracy of resource estimates, uninsured risks, defects in title, availability and costs of materials and equipment, inability to meet future financing needs on acceptable terms, changes in national or local governments, changes in applicable legislation or application thereof, timeliness of government approvals, actual performance of facilities, equipment, and processes relative to specifications and expectations and unanticipated environmental impacts on operations. Additional factors that could cause actual results to differ materially include, but are not limited to, the risk factors described herein. See “Risk Factors”.

The Company believes that the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in, or incorporated by reference into, this AIF should not be unduly relied upon. These statements speak only as of the date of this AIF or as of the date specified in the documents incorporated by reference into this AIF, as the case may be. The Company does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by applicable laws. Actual results may differ materially from those expressed or implied by such forward-looking statements.

Cautionary Notes to U.S. Investors Concerning Reserve and Resource Estimates

This AIF has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. All mining terms used herein but not otherwise defined have the meanings set forth in National Instrument 43-101 -Standards of Disclosure for Mineral Projects (“NI 43-101”). The definitions of Proven and Probable Reserves (“Mineral Reserves” or “Reserves”) used in NI 43-101 differ from the definitions in the Industry Guide 7. Under SEC Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three year history average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and normally are not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities laws, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in certain specific cases. Additionally, disclosure of “contained ounces” in a resource is permitted disclosure under Canadian securities laws, however the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measurements.

2

Accordingly, information contained in this AIF containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of United States federal securities laws and the rules and regulations thereunder.

Currency and Exchange Rate Information

The Company uses the US dollar as its presentation currency. This AIF contains references to both U.S. dollars and Canadian dollars.All dollar amounts (i.e. “$” or “US$”), unless otherwise indicated, are expressed in U.S. dollars and Canadian dollars are referred to as “C$”.

On December 31, 2018, the exchange rate of Canadian dollars into US dollars, being the average exchange rate published by the Bank of Canada was US$1.00 equals C$1.3642.

3

GLOSSARY OF CERTAIN TECHNICAL TERMS

Following is a description of certain technical terms and abbreviations used in this AIF.

“Ag” means silver.

“Ag-Eq” means silver equivalent.

“AISC” means all-in sustaining costs.

“Au” means gold.

“BQ” means a standard wire line bit size which produces a core diameter of 37 millimetres.

“CCD” means counter-current decantation, a separation technique involving water or solution and a solid.

“Concentrate” means partially purified ore.

“CRMs” means certified reference materials.

“DD” means diamond drill.

“Doré” means a mixture of gold and silver in cast bars, as bullion.

“Fe” means iron.

“g/t” means grams per tonne.

“Grade” means the metal content of ore in grams per tonne or percent.

“HQ” means a standard wire line bit size which produces a core diameter of 63 millimetres.

“Indicated Mineral Resource” means that part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill-holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

“Inferred Mineral Resource” means that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological grade and continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill-holes.

4

“kt” means kilo tonnes

“Life of Mine” or “LOM” means the time in which, through the employment of the available capital, the ore reserves, or such reasonable extension of the ore reserves as conservative geological analysis may justify, will be extracted.

“Merrill-Crowe” or “MC” means a separation technique for extracting silver and gold from a cyanide solution.

“Measured Mineral Resource” means that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill-holes that are spaced closely enough to confirm both geological and grade continuity.

“Mineral Reserve” means the economically mineable part of a Measured Mineral Resource or Indicated Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.

“Mineral Resource” means a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.

“NQ” means a standard wire line bit size which produces a core diameter of 48 millimetres.

“NSR” means net smelter royalty.

“Oxides” or “Oxide Ore” means a mixture of valuable minerals and gangue minerals from which at least one of the minerals can be extracted.

“Pb” means lead.

“Probable Mineral Reserve” means the economically mineable part of an Indicated Mineral Resource, and in some circumstances, a Measured Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

“Proven Mineral Reserve” means the economically mineable part of a Measured Mineral Resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

“QA/QC” means quality assurance and quality control.

5

“RC” means reverse circulation, a type of drilling

“Reserves” means Mineral Reserves.

“Resources” means Mineral Resources.

“Run of Mine” or “ROM” means ore in its natural, unprocessed state.

“SpecificGravity” or “SG” means a measurement that determines the density of minerals.

“Sulphide Minerals” or “Sulphide Ore” means any member of a group of compounds of sulfur with one or more metals.

“tpd” means metric tonnes per day.

“UG” means underground.

“Zn” means zinc.

6

CORPORATE STRUCTURE

Name, Address and Incorporation

First Majestic is the continuing corporation of “Brandy Resources Inc.” which was incorporated pursuant to theCompany Act (British Columbia) (the predecessor legislation of theBusiness Corporations Act (British Columbia) (the “BCBCA”)) on September 26, 1979.

On September 5, 1984, the Company changed its name to Vital Pacific Resources Ltd. and consolidated its share capital on a two for one basis.

On May 26, 1987 the Company continued out of British Columbia and was continued as a federal company pursuant to theCanada Business Corporations Act.

On August 21, 1998, the Company continued out of Canada and was continued into the jurisdiction of the Commonwealth of the Bahamas under theCompanies Act (Bahamas).

On January 2, 2002, the Company continued out of the Commonwealth of the Bahamas and was continued to the Yukon Territory pursuant to theBusinessCorporations Act (Yukon). Concurrently with this continuation, the Company consolidated its share capital on a 10 for one basis.

On January 17, 2005, the Company continued out of the Yukon Territory and was continued to British Columbia pursuant to the BCBCA.

Since incorporation, First Majestic has undergone three name changes. The last name change occurred on November 22, 2006, when the Company adopted its current name.

The Company’s head office is located at Suite 1800 – 925 W. Georgia Street, Vancouver, British Columbia, Canada, V6C 3L2 and its registered office is located at 2600 – 1066 West Hastings Street, Vancouver, British Columbia, V6E 3X1.

The Company is a reporting issuer in each of the provinces of Canada.

Intercorporate Relationships

The chart set out below illustrates the corporate structure of the Company and its material subsidiaries, their respective jurisdictions of incorporation, the percentage of voting securities held and their respective interests in various mineral projects and mining properties.

7

8

DESCRIPTION OF BUSINESS

General

The Company is in the business of the production, development, exploration and acquisition of mineral properties with a focus on silver production in México. As such, the Company’s business is dependent on foreign operations in México. The common shares of the Company trade on the TSX under the symbol “FR” and on the NYSE under the symbol “AG”. The Company’s common shares are also quoted on the Frankfurt Stock Exchange under the symbol “FMV”.

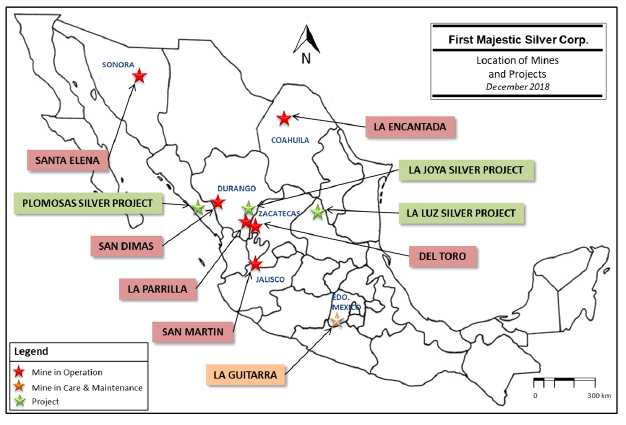

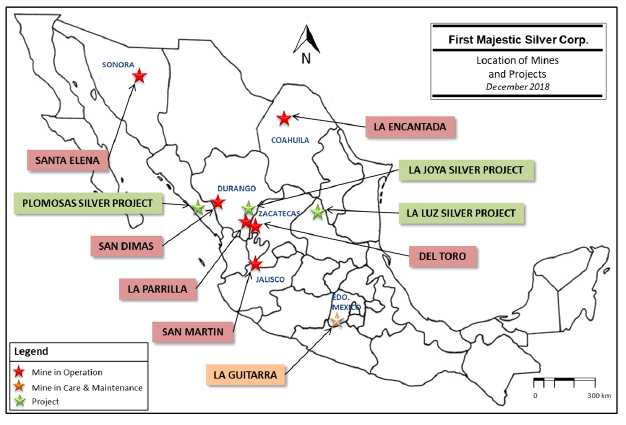

The Company owns and operates six producing mines in México:

| | 1. | the San Dimas Silver/Gold Mine in Durango State (“San Dimas Silver/Gold Mine” or “San Dimas”); |

| | | |

| | 2. | the Santa Elena Silver/Gold Mine in Sonora State (“Santa Elena Silver/Gold Mine”or “Santa Elena”); |

| | | |

| | 3. | the La Encantada Silver Mine in Coahuila State (“La Encantada Silver Mine” or “La Encantada”); |

| | | |

| | 4. | the La Parrilla Silver Mine in Durango State (“La Parrilla Silver Mine” or “La Parrilla”); |

| | | |

| | 5. | the San Martín Silver Mine in Jalisco State (“San Martín Silver Mine” or “San Martín”); and |

| | | |

| | 6. | the Del Toro Silver Mine in Zacatecas State (“Del Toro Silver Mine” or “Del Toro”). |

The Company also owns the La Guitarra Silver Mine in México State (“La Guitarra Silver Mine” or “La Guitarra”) which is presently under care and maintenance.

The Company also owns three advanced-stage silver development projects in México, being the Plomosas Silver Project in Sinaloa State, the La Luz Silver Project in San Luis Potosi State and La Joya Silver Project in Durango State, as well as a number of exploration projects in México.

The Company’s business is not materially affected by intangibles such as licences, patents and trademarks, nor is it significantly affected by seasonal changes other than seasonal weather. The Company is not aware of any aspect of its business which may be affected in the current financial year by renegotiation or termination of contracts.

At December 31, 2018, the Company had 34 employees and contractors based in its Vancouver corporate office, 214 employees and contractors in its Durango offices, 17 employees in its México City office, four employees in Switzerland, two employees in the Netherlands and approximately 4,860 employees, contractors and other personnel in various mining locations in México. Additional consultants are also retained from time to time for specific corporate activities, development and exploration programs.

9

GENERAL DEVELOPMENT OF THE BUSINESS

History

Since inception in 2003, First Majestic has been in the business of acquiring, exploring and developing silver properties and producing primarily silver and other metals from its mines located in México.

Over the past 16 years, the Company has assembled a portfolio of silver mines, properties and projects which presently consists of six producing mines which it owns and operates in México, one mine placed in care and maintenance in August 2018, three advanced-stage development silver projects as well as a number of exploration projects.

The current mines and material properties are as follows:

| Producing Silver Mines | | Location | | Acquired |

| La Parrilla Silver Mine | | Durango State, México | | January 2004 |

| San Martín Silver Mine | | Jalisco State, México | | May 2006 to September 2006 |

| La Encantada Silver Mine | | Coahuila State, México | | November 2006 to March 2007 |

| Del Toro Silver Mine | | Zacatecas State, México | | March 2004 to August 2005 |

| Santa Elena Silver/Gold Mine | | Sonora State, México | | October 2015 |

| San Dimas Silver/Gold Mine | | Durango State, México | | May 2018 |

| Mine in Care and Maintenance | | Location | | Acquired |

| La Guitarra Silver Mine | | México State, México | | July 2012 |

| Development Projects | | Location | | Acquired |

| La Luz Silver Project | | San Luis Potosi State, México | | November 2009 |

| Plomosas Silver Project | | Sinaloa State, México | | July 2012 |

| La Joya Silver Project | | Durango State, México | | October 2015 |

Most Recent Three Years

2016

On February 8, 2016, the Company entered into a credit agreement with The Bank of Nova Scotia (“Scotia Bank”) and Investec Bank PLC as lenders in connection with a senior secured credit facility (the “PriorCredit Facility”) consisting of a $25 million revolving credit line and a $35 million term loan. The Prior Credit Facility was guaranteed by certain subsidiaries of the Company and was secured by a first charge against the assets of the Company and such subsidiaries. The term loan was repayable in quarterly instalments plus related interest. The revolving credit line was to terminate on maturity, being February 8, 2019.

$31.5 million of the term loan was utilized to cancel a $30 million forward sale contract with Bank of America Merrill Lynch for 15,911.3 metric tonnes (“MT”) of lead at a fixed price of $0.945 per pound ($2,083/MT) which the Company entered into in April 2014, while the remaining $3.5 million thereunder was used for general corporate purposes. A portion of the $25 million revolving credit line was used to pay out a $15 million revolving credit facility assumed by the Company in connection with the acquisition by the Company of all of the shares of SilverCrest Mines Inc, which closed in October 2015.

10

The Prior Credit Facility contained market financial covenants, including the following, each tested quarterly, on a consolidated basis: (a) a leverage ratio based on total debt to rolling 4 quarters adjusted EBITDA less 50% of sustaining capital expenditures of not more than 3.00 to 1.00; (b) an interest coverage ratio, based on rolling 4 quarters adjusted EBITDA divided by interest payments, of not less than 4.00:1.00; and (c) tangible net worth of not less than $436 million, plus 80% of its positive earnings subsequent to December 31, 2015. The Prior Credit Facility also provided for negative and positive covenants, customary for these types of facilities, including standard indebtedness baskets such as capital leases (up to $30 million).

Subsequent to the execution of the Prior Credit Facility, the Company completed an intra-group reorganization among its wholly owned subsidiaries, whereby NorCrest Silver Inc. ("Norcrest") merged into the Company's Mexican holding subsidiary, Corporación First Majestic S.A. de C.V. ("CFM") resulting in the subsidiaries of NorCrest becoming subsidiaries of CFM.

On May 12, 2016, the Company closed a bought deal private placement that was co-led by Cormark Securities Inc. and BMO Capital Markets on behalf of a syndicate of underwriters including Desjardins Securities Inc., National Bank Financial Inc. and TD Securities Inc. The Company issued an aggregate of 5,250,900 common shares at a price of C$10.95 per common share for gross proceeds of C$57,497,355 (the "2016Offering"). The proceeds of the 2016 Offering were intended to be used for the mill and mine expansion at La Guitarra mine to 1,000 tpd, to further advance the roasting analysis and testing at La Encantada mine, to allow the Company to increase the amount of development and exploration across the Company's operating mines, and for general corporate and working capital purposes.

2017

On October 3, 2017, the Company reported that an accident had occurred at the La Encantada Silver Mine as part of the construction of the 790 ramp. A total of four miners lost their lives due to gas intoxication. Immediately following the accident First Majestic briefly suspended its mining operations at La Encantada to focus on responding to the accident and supporting the families of the deceased.

In 2017 the Company determined that it was in its best interests to delist from the Bolsa Mexicana de Valores (the Mexican Stock Exchange) (“BMV”). To accomplish this under Mexican securities laws, the Company made an offer to purchase all of its common shares held by residents of México (the “Mexican Share Offer”) at a price of MXP$128.72 per common share (equivalent to US$6.55 as of December 29, 2017). The Company’s shares were delisted from the BMV effective February 21, 2018 and the Company acquired an aggregate of 5,021 Common Shares from Mexican residents in connection with the Mexican Share Offer. The Company has no further obligations in connection with the Mexican Share Offer.

2018

Acquisition of Primero

On January 12, 2018, the Company announced that it had entered into an arrangement agreement (the “Arrangement Agreement”) with Primero Mining Corp. (“Primero”) pursuant to which the Company agreed to acquire all of the issued and outstanding common shares of Primero (each, a “Primero Share”) in exchange for 0.03325 of a common share of the Company (each, a “Common Share”) per Primero Share (the “Exchange Ratio”).

11

In accordance with the plan of arrangement (the "Plan of Arrangement") pursuant to the Arrangement Agreement (the "Arrangement"), each Primero option which was outstanding and had not been duly exercised prior to the effective time of the Arrangement was deemed to be unconditionally vested and exercisable in full and was exchanged for a replacement option to purchase from the Company such number of Common Shares as is equal to the Exchange Ratio. Each replacement option provides for an exercise price per Common Share (rounded up to the nearest whole cent) equal to the exercise price per Primero Share that would otherwise be payable pursuant to the Primero option it replaced, divided by the Exchange Ratio. All terms and conditions of any replacement option, including the term to expiry, conditions to and manner of exercising, are the same as the Primero option for which it was exchanged.

Under the Arrangement all existing warrants of Primero became exercisable to acquire Common Shares at exercise prices adjusted by the Exchange Ratio. All other terms and conditions of such warrants remained the same and such warrants continued to be governed by the terms of the existing Primero warrant indenture.

The Arrangement also provided that upon the Arrangement becoming effective all existing deferred share units and phantom share units of Primero were paid out in cash in an amount equal to C$0.30 per deferred share unit or phantom share unit.

On May 10, 2018 the Company announced the completion of the Arrangement. The Company issued an aggregate of 6,418,594 Common Shares in exchange for all of the issued and outstanding Primero Shares and 221,908 replacement stock options (the "Replacement Stock Options") to the holders of outstanding stock options of Primero. The Replacement Stock Options are excercisable to acquire Common Shares at an exercise price adjusted by the Exchange Ratio. In addition, following closing of the Arrangement all of the existing and outstanding share purchase warrants of Primero ("Primero Warrants") became exercisable to acquire 366,124 Common Shares at an exercise price adjusted by the Exchange Ratio. All such Primero Warrants have subsequently expired. Upon closing of the Arrangement, Primero became a wholly-owned subsidiary of the Company and the former Primero shareholders became shareholders of the Company. A copy of the Arrangement Agreement, as well as the related 51-102F1 –Business Acquisition Report, has been filed under the Company’s profile on SEDAR at www.sedar.com and on EDGAR atwww.sec.gov.

Transactions Related to the Arrangement

Primero Convertible Debentures

On February 9, 2015, Primero issued $75.8 million principal amount of 5.75% convertible unsecured subordinated debentures (the “Primero Debentures”) pursuant to a trust indenture between Primero and Computershare Trust Company of Canada (the “Primero Indenture”). In connection with the Arrangement, on March 13, 2018 the holders of the Primero Debentures approved a resolution pursuant to the Primero Indenture authorizing the acceleration of the maturity date of the Primero Debentures from February 28, 2020 to the next business day following closing of the Arrangement. As a result the Primero Debentures matured on May 11, 2018 and were paid out in full.

Stream Agreements

Primero was a party to a streaming arrangement with Silver Wheaton Corp., now Wheaton Precious Metals Corp. (“Wheaton”), and Silver Wheaton (Caymans) Ltd., now Wheaton Precious Metals International Ltd. (“WPMI”), a subsidiary of Wheaton, pursuant to which Silver Trading (Barbados) Limited (“STB”), a Barbados incorporated subsidiary of Primero, agreed to sell certain amounts of silver produced at the San Dimas Mine to WPMI (the “Prior San Dimas Stream Agreement”).

12

On May 10, 2018 and in connection with the Arrangement, the Prior San Dimas Stream Agreement was terminated between STB and WPMI. The Company concurrently issued to WPMI 20,914,590 Common Shares and entered into a new precious metal purchase agreement (the "New San Dimas Stream Agreement ") with WPMI and FM Metal Trading (Barbados) Inc. ("FMMTB"), a wholly-owned subsidiary of the Company. Pursuant to the New San Dimas Stream Agreement, WPMI is entitled to receive from the San Dimas Mine via FMMTB 25% of the gold production of San Dimas and 25% of the silver production converted to gold equivalent at a fixed exchange ratio of 70:1 in exchange for ongoing payments by WPMI equal to the lesser of (i) US$600 (subject to an annual inflation adjustment) and (ii) the prevailing market price, for each gold ounce delivered to an offtaker under the agreement. WPMI was granted a security interest over the San Dimas Mine securing the obligations of the Company and such security interest ranks pari passu with the security interests provided to the Lenders under the New Credit Facility (as described below) and are governed by an intercreditor and collateral agency and proceeds agreement

New Credit Facility

As described above, on February 8, 2016, the Company entered into the Prior Credit Facility with Scotia Bank and Investec PLC, as lenders.

On May 10, 2018 the Company entered into an amended and restated credit agreement (the "Credit Agreement") with Scotia Bank, Bank of Montreal and Investec Bank PLC, each as lenders (the "Lenders"). Pursuant to the Credit Agreement, the Lenders agreed, among other things, to provide First Majestic with a US$75 million senior secured revolving term credit facility (the “New Credit Facility”). The New Credit Facility replaced the Prior Credit Facility and the prior credit facility of Primero.

The New Credit Facility contains market financial covenants including the following, each tested quarterly on a consolidated basis: (a) a leverage ratio based on total debt to rolling four quarters adjusted EBITDA of not more than 3.00 to 1.00; (b) an interest coverage ratio, based on rolling four quarters adjusted EBITDA divided by interest payments, of not less than 4.00 to 1.00; and (c) tangible net worth of not less than $563.5 million plus 50% of its positive earnings subsequent to June 30, 2018. The New Credit Facility also provides for negative and positive covenants, customary for these types of facilities, including standard indebtedness baskets such as capital leases (up to $30 million).

Scotia Bank, on behalf of the Lenders, took a perfected security interest in all the Company’s present and future assets, both real and personal, and of certain of the Company’s material subsidiaries. Such security interest is first-ranking with the exception of the security granted over the San Dimas mine securing obligations to WPMI under the New San Dimas Stream Agreement. The security interests provided to WPMI rank pari passu with the security interests provided to the Lenders under the New Credit Facility and are governed by an intercreditor and collateral agency and proceeds agreement.

Debt Offering

On January 29, 2018, the Company announced the closing of its offering of $150 million aggregate principal amount of 1.875% unsecured convertible senior notes due 2023 (the “Initial Notes”). The initial conversion rate for the Initial Notes is 104.3297 Common Shares per $1,000 principal amount of Initial Notes, equivalent to an initial conversion price of approximately $9.59 per Common Share. The Company used the net proceeds from the offering of the Initial Notes to fund the pay out of the Primero Debentures, certain costs and expenses associated with the acquisition of Primero and for general corporate purposes.

13

On February 15, 2018, the Company announced the issuance of an additional $6.5 million aggregate principal amount of 1.875% unsecured convertible senior notes due 2023 (the “Over-Allotment Notes”) pursuant to the exercise in part of the over-allotment option granted to the initial purchasers of the Initial Notes. The Over-Allotment Notes have the same terms as the Initial Notes, including an initial conversion rate of 104.3297 Common Shares per $1,000 principal amount of Over-Allotment Notes, equivalent to an initial conversion price of approximately $9.59 per Common Share.

The Initial Notes and Over-Allotment Notes are governed by an indenture (the “Note Indenture”) entered into between the Company and Computershare Trust Company, N.A. on January 29, 2018. A copy of the Note Indenture is available under the Company’s profile on SEDAR atwww.sedar.com.

Other Corporate Events

On May 9, 2018 the Company announced that its board of directors had adopted certain amendments to its advance notice policy (the "Advance Notice Policy") relating to director nominations. Pursuant to the Advance Notice Policy, the board has discretion to require a proposed director nominee to provide such information as the board may reasonably require to determine eligibility to act as a director or that could be material to a reasonable shareholder’s understanding of the independence of the proposed nominee. Pursuant to these amendments, such discretion was limited such that the board may now only require the nominee to provide such information as may be required by law or stock exchange rules to determine eligibilty to act as a director. The amendments further provided that any adjournment or postponement of a shareholder meeting will automatically extend the nomination deadline for a proposed director nominee.

On July 16, 2018 the Company announced its intention to place La Guitarra mine under care and maintenance which became effective on August 3, 2018. The Company considers that the La Guitarra mine is not at present material to its overall business operations. The Company is reviewing strategic options, including the potential sale of the operation, in order to reallocate capital and resources to projects with better economics and internal rates of return such as the newly acquired San Dimas Mine.

On September 10, 2018 the Company announced that it had completed a 100% earn-in on both the Ermitaño and Cumobabi projects in Sonora State, México pursuant to option agreements with Evrim Resrouces Corp ("Evrim"). Pursuant to the exercise of these options, First Majestic made a $1.5 million cash payment to Evrim and granted, in accordance with the original 2014 option agreements, a 2% net smelter royalty ("NSR") in respect of the Ermitaño project and a 1.5% NSR in respect of the Cumobabi project.

On November 5, 2018, the Company announced it filed a final short form base shelf prospectus (the "Base Shelf Prospectus") with the securities regulators in each province of Canada, except for the Province of Quebec, and a corresponding shelf registration statement on Form F-10 (the "Registration Statement") with the United States Securities and Exchange Commission (the "SEC"). The Base Shelf Prospectus and Registration Statement allow the Company to make offerings of Common Shares, subscription receipts, units, warrants or any combination thereof of up to $300 million during the 25 month period that the Base Shelf Prospectus and Registration Statement remain effective in the United States and Canada (except for the territories and the Province of Quebec). The specific terms of any offering of securities, including the use of proceeds from any offering, will be set forth in a shelf prospectus supplement.

14

On December 27, 2018, the Company entered into an equity distribution agreement (the “Sales Agreement”) with BMO Capital Markets Corp. (the “Agent”) pursuant to which the Company may, at its discretion and from time-to-time during the term of the Sales Agreement, sell, through the Agent, such number of Common Shares as would result in aggregate gross proceeds to the Company of up to $50.0 million (the “ATMOffering”). Sales of Common Shares will be made through “at-the-market distributions” as defined in the Canadian Securities Administrators’ National Instrument 44-102-Shelf Distributions, including sales made directly on the New York Stock Exchange (the “NYSE”), or any other recognized marketplace upon which the Common Shares are listed or quoted or where the Common Shares are traded in the United States. The sales, if any, of Common Shares made under the Sales Agreement will be made by means of ordinary brokers’ transactions on the NYSE at market prices, or as otherwise agreed upon by the Company and the Agent. No offers or sales of Common Shares will be made in Canada on the Toronto Stock Exchange (the “TSX”) or other trading markets in Canada.

The ATM Offering will be made by way of a prospectus supplement dated December 27, 2018 (the "ProspectusSupplement") to the base prospectus included in the Company’s existing Registration Statement and Base Shelf Prospectus. The Prospectus Supplement relating to the Offering has been filed with the securities commissions in each of the provinces of Canada (other than Québec) and the SEC. The Company expects to use the net proceeds of the Offering, if any, together with the Company’s current cash resources, to develop and/or improve the Company's existing mines and to add to the Company's working capital.

Republic Metals Corporation ("Republic") filed for protection under Chapter 11 of the United States Bankruptcy Code on November 2, 2018 in the United States Bankruptcy Court for the Southern District of New York. The Company has in the past engaged Republic to refine doré from certain of the Company's properties, and as of such date Republic was in possession of approximately 281,000 ounces of silver and 5,528 ounces of gold delivered by the Company. As of December 31, 2018, the Company wrote down a total of $7.5 million in inventory. The Company has retained legal counsel to assert its legal right for the return of its material and to consider alternative legal remedies. It is not possible at this time to accurately assess the prospects for success of the Company's claims or the length of time it will take to conclude them. The Company maintains relationships with other refineries and does not anticipate any material disruption in its overall production as a result of these matters.

2019 to date

The Company’s share repurchase program(“Share Repurchase Program”) which initially commenced in March 2013, was renewed for a sixth time in March 2019. Pursuant to the renewed Share Repurchase Program, the Company is authorized to repurchase up to 5,000,000 common shares of the Company during the period from March 21, 2019 until March 20, 2020, which represents 2.54% of the 196,626,046 issued and outstanding shares of the Company as of March 1, 2019.

Principal Markets for Silver

Silver is a precious metal that is a very important industrial commodity with growing uses in several technologies and is also desirable for jewellery and for investment purposes. Silver has a unique combination of characteristics including: durability, malleability, ductility, conductivity, reflectivity and anti-bacterial properties, which makes it valuable in numerous industrial applications including solar panels, circuit boards, electrical wiring, semi & superconductors, brazing and soldering, mirror and window coatings, electroplating, chemical catalysts, pharmaceuticals, filtration systems, batteries, televisions, computers, cell phones, household appliances, automobiles and a wide variety of other electronic products.

15

Silver as a global commodity is predominantly traded on the London Bullion Market (“LBM”), an over-the-counter silver market and the COMEX, a futures and options exchange in New York where most fund activity in relation to silver is focused. The LBM is the global hub of over-the-counter trading in silver and is the metal’s main physical market. Here, a bidding process results in a daily reference price known as the fix. Silver is quoted in US dollars per troy ounce. The Company assigns silver from its doré sales to one of two global banks; whereas, for concentrate sales, metal prices are determined by monthly averages based on contract terms with one of three smelter contracts. Smelter contracts are established with an annual tendering process which fix treatment charges normally to an annual basis.

Silver can be supplied as a primary product from mining silver, or as a by-product from the mining of gold or base metals such as lead and zinc. The Company is a primary silver producer with approximately 57% of its revenue in 2018 from the sale of silver.

The Company also maintains an e-commerce website from which it sells a small portion (less than 1%) of its silver production directly to retail buyers (business to consumer) over the internet. See “Product Marketing and Sales”.

Mineral Projects

The following properties are material to First Majestic’s business: the San Dimas Silver/Gold Mine; the Santa Elena Silver/Gold Mine; the La Encantada Silver Mine, the La Parrilla Silver Mine, the San Martín Silver Mine and the Del Toro Silver Mine. Production estimates and throughputs for operating mines are quoted as metric tonnes per day (tpd) related to the tpd capacity of the mine. Production estimates and throughput averages for each mine take into account an average of two days of maintenance per month. Annual estimates of production are based on an average of 365 calendar days per year for each of the operating mines, and these mines generally operate 330 days per year even though the throughput rates are based on 365 calendar days average.

The following map indicates the locations of each of the Company’s mines and projects in México:

16

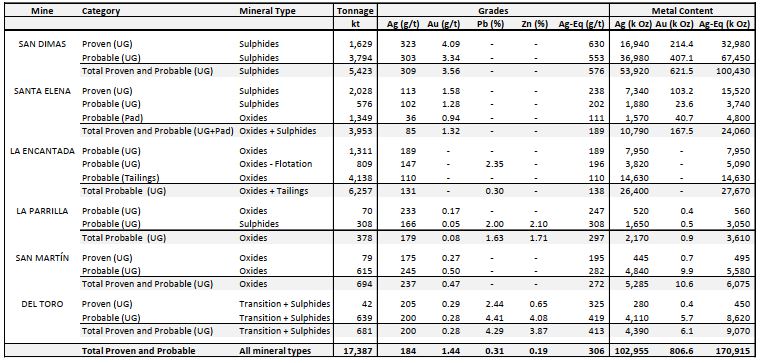

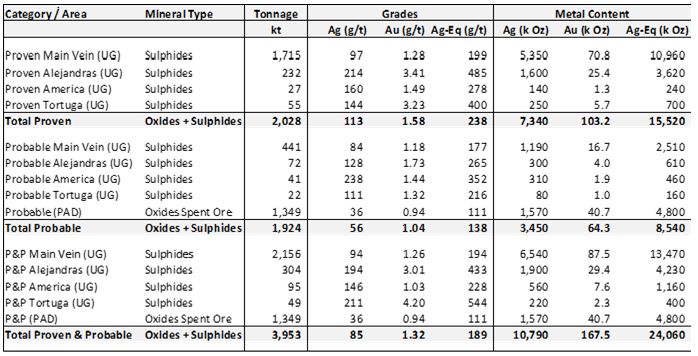

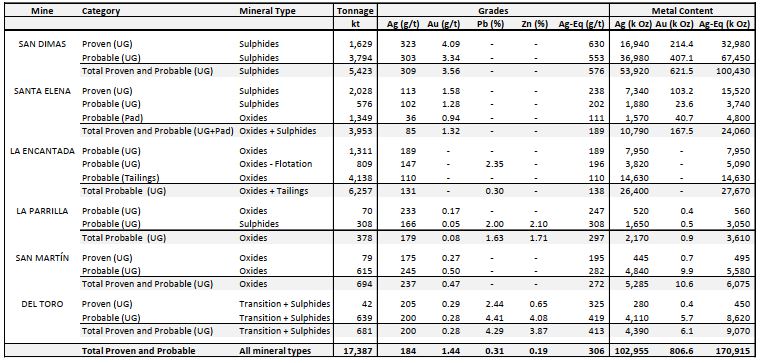

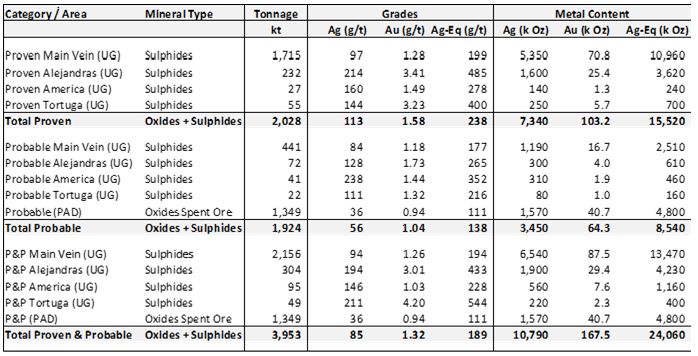

Summary of Mineral Resources and Mineral Reserves

The Mineral Resources and Mineral Reserves internal estimates reported herein represent the most up to date revisions completed by First Majestic. The technical reports from which the following information is derived are set forth under the heading "Current Technical Reports for Material Properties". Readers are cautioned against relying on such reports and upon the Resource and Reserve estimates therein since these estimates are based on certain assumptions regarding future events and performance such as: commodity prices, operating costs, taxes, metallurgical performance and commercial terms. Interpretations and Resource and Reserve estimates are based on limited sampling information that may not be representative of the mineral deposits. The following three tables set out the Company’s Mineral Resources and Mineral Reserves estimated as of December 31, 2018. In general, the consolidated Mineral Reserves for First Majestic, based on the most recent estimate of December 31, 2018, have increased 46% in terms of silver-equivalent (“Ag-Eq”) metal content compared to the prior estimate of December 31, 2017. This variation reflects the incorporation of the high grade reserves of the San Dimas mine after the acquisition of Primero on May 10, 2018 and the results of the infill exploration and development programs, offsetting the effect of depletion originated by mine production, the subtraction of reserves from La Guitarra which was put in care and maintenance in August 2018, as well as the impact of the reduction of 6% in the assumed metal price for silver, 4% in gold, 9% in lead and 14% in zinc.

17

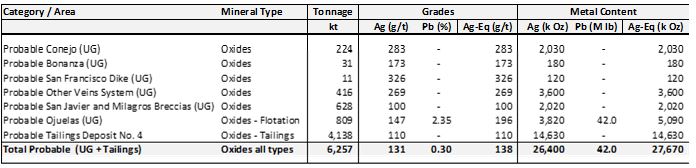

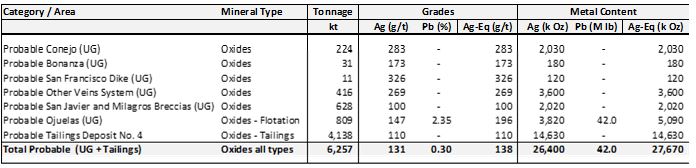

TABLE 1

Proven and Probable Mineral Reserves for the operating mines with an Effective Date of December 31, 2018

prepared under the supervision of Ramon Mendoza Reyes, P. Eng., QP Mining for First Majestic

| (1) | Mineral Reserves have been classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference into National Instrument 43-101 (NI43-101). |

| (2) | The Mineral Reserves statement provided in the table above is based on internal estimates prepared as of December 31, 2018. The information provided was reviewed and prepared under the supervision of Ramon Mendoza Reyes, PEng, and a Qualified Person ("QP") for the purposes of NI43-101. |

| (3) | Silver-equivalent grade is estimated considering metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of each mine. Estimation details are listed in each mine section of this AIF. |

| (4) | Metal prices considered for Mineral Reserves estimates were $17.00/oz Ag and $1,250/oz Au, $1.00/lb Pb, and $1.20/lb Zn. |

| (5) | A two-step constraining approach has been implemented to estimate reserves for each mining method in use: A General Cut-Off Grade (GC) was used to delimit new mining areas that will require development of access and infrastructure and all sustaining costs. A second Incremental Cut-Off Grade (IC) was considered to include adjacent mineralized material which recoverable value pays for all associated costs, including but not limited to the variable cost of mining and processing, indirect costs, treatment, administration costs and plant sustaining costs. |

| The cut-off grades, metallurgical recoveries, payable terms and modifying factors used to convert Mineral Reserves from Mineral Resources are different for all mines. These cut-off grades and economic parameters are listed in the applicable section describing each mine below in this AIF. |

| (6) | Dilution for underground mining includes consideration for planned dilution due to geometric aspects of the designed stopes and economic zones, and additional dilution consideration due to material handling and other operating aspects. Dilution and mining recovery factors are listed in the applicable section describing each mine below in this AIF. |

| (7) | Tonnage is expressed in thousands of tonnes, metal content is expressed in thousands of ounces. |

| (8) | Totals may not add up due to rounding. |

| (9) | The technical reports from which the above-mentioned information is derived are cited under the heading "Current Technical Reports for Material Properties" of the AIF. |

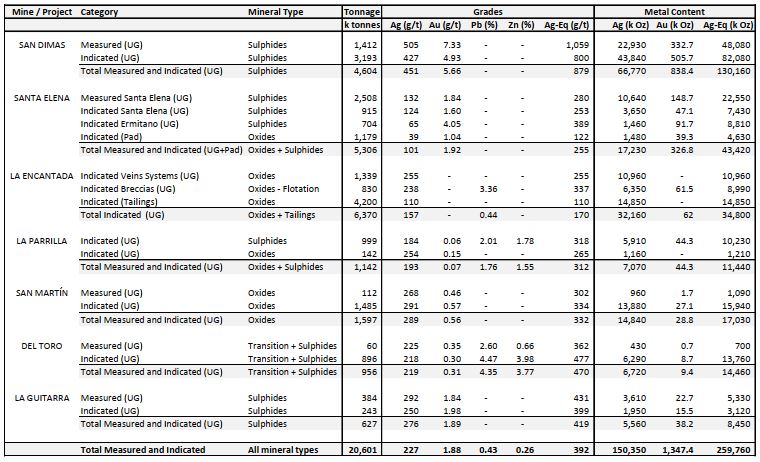

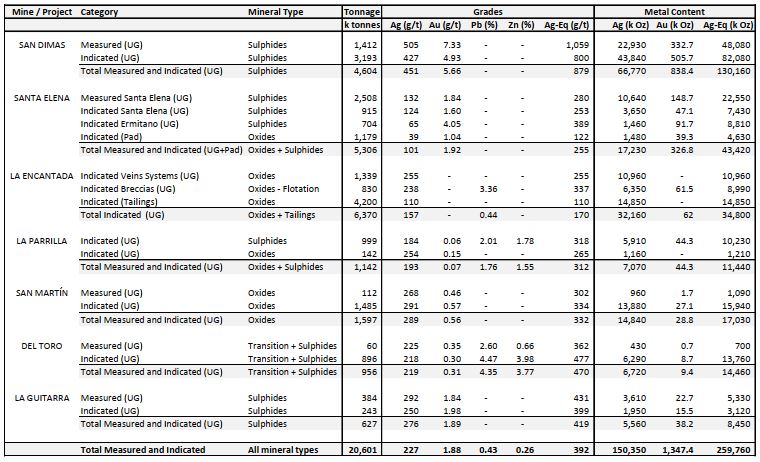

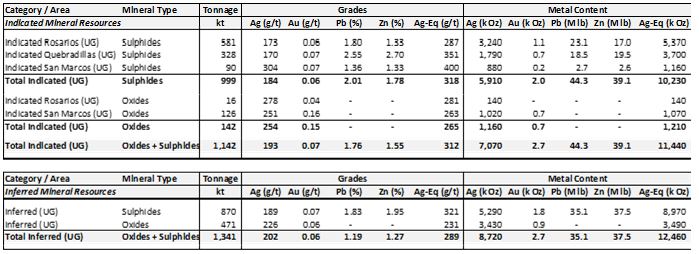

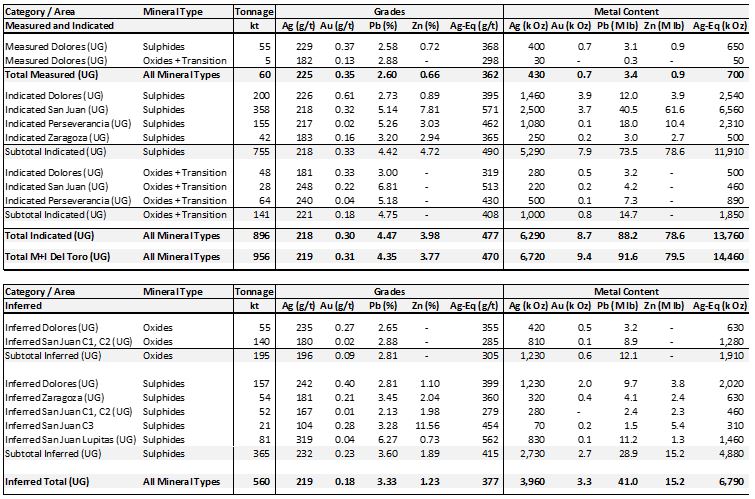

The Company’s consolidated Measured and Indicated Mineral Resources have increased 17% in terms of tonnage and 82% in terms of silver-equivalent metal content as the result of incorporation the high grades resources of San Dimas as well as conversion of Inferred Resources at Ermitaño following the successful 2018 exploration program. These increases were partially offset by depletion from production during 2018 and reductions of 12% in the assumed metal price for silver, 10% in gold, 17% in lead and 20% in zinc.

18

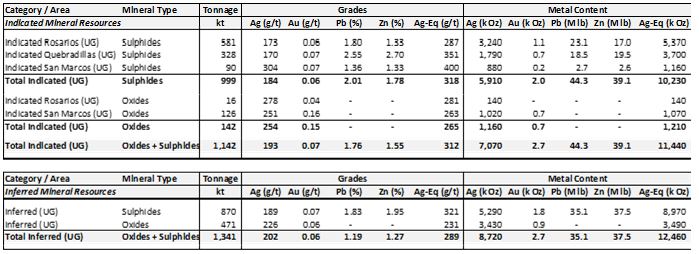

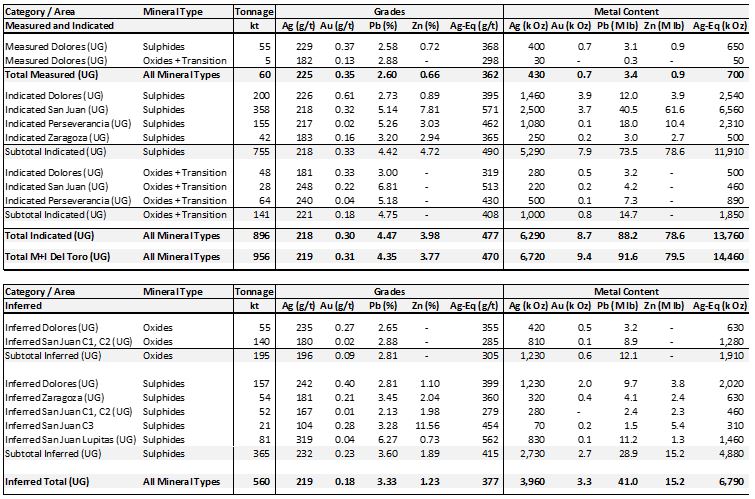

TABLE 2

Measured and Indicated Mineral Resources with an Effective Date of December 31, 2018

update prepared under the supervision of Ramon Mendoza Reyes, P. Eng., QP Mining for First Majestic

| (1) | Mineral Resources have been classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference into NI 43-101. |

| (2) | The Mineral Resources information provided above is based on internal estimates prepared as of December 31, 2018. The information provided was reviewed and compiled by Ramon Mendoza Reyes, PEng, QP for First Majestic, and is based on internal work prepared under the supervision of First Majestic internal QPs, who have the appropriate relevant qualifications, and experience in geology and resource estimation. |

| (3) | Metal prices considered for Mineral Resources estimates were $17.50/oz Ag, $1,300/oz Au, $1.00/lb Pb, and $1.20/lb Zn. |

| (4) | Silver-equivalent grade is estimated considering: metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of each mine. Estimation details are listed in each mine section of the Annual Information Form (AIF). |

| (5) | The cut-off grades used to estimate Mineral Resources are different for all mines. The cut-off grades and factors are listed in the applicable section describing each mine section of the AIF. |

| (6) | Measured and Indicated Mineral Resources are reported inclusive of Mineral Reserves. |

| (7) | La Guitarra was placed in care and maintenance on August 3, 2018 and is no longer a material property. |

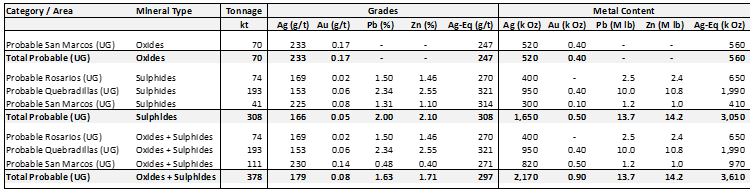

Consolidated Inferred Mineral Resources increased by 3% in terms of silver-equivalent metal content after the incorporation of resources from San Dimas which was offset by the subtraction of resources from La Joya which is considered a historical estimate, and the reduction in the metal price assumptions as mentioned above.

19

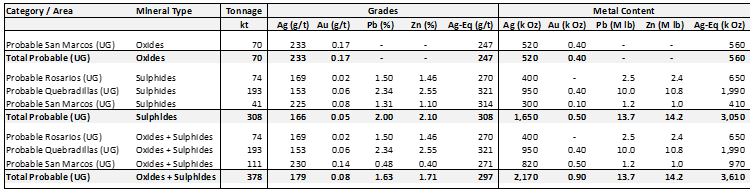

TABLE 3

Inferred Mineral Resources with an Effective Date of December 31, 2018

update prepared under the supervision of Ramon Mendoza Reyes, P. Eng., QP Mining for First Majestic

| (1) | Mineral Resources have been classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference into NI 43-101. |

| | |

| (2) | The Mineral Resources information provided above is based on internal estimates prepared as of December 31, 2018. The information provided was reviewed and compiled by Ramon Mendoza Reyes, PEng, QP for First Majestic, and is based on internal work prepared under the supervision of First Majestic internal QPs, who have the appropriate relevant qualifications, and experience in geology and resource estimation. |

| | |

| (3) | Metal prices considered for Mineral Resources estimates were $17.50/oz Ag, $1,300/oz Au, $1.00/lb Pb, and $1.20/lb Zn. |

| | |

| (4) | Silver-equivalent grade is estimated considering: metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of each mine. Estimation details are listed in each mine section of the Annual Information Form (AIF). |

| | |

| (5) | The cut-off grades used to estimate Mineral Resources are different for all mines. The cut-off grades and factors are listed in the applicable section describing each mine section of the AIF. |

| | |

| (6) | La Guitarra was placed in care and maintenance on August 3, 2018 and is no longer considered to be a material property. |

Technical reports were prepared in respect of each of the Company’s material properties as follows:

| | 1. | A Technical Report titled "La Encantada Silver Mine, Ocampo, Coahuila, México, NI 43-101 Technical Report on Mineral Resource and Mineral Reserve Update" dated December 31, 2015, and prepared by Mr. Ramon Mendoza Reyes, P. Eng., Mr. Jesus M. Velador Beltran, MMSA, Ms. Maria Elena Vazquez Jaimes, P. Geo., and Mr. Peter Oshust, P. Geo. |

| | | |

| | 2. | A Technical Report titled "Del Toro Silver Mine Chalchihuites, Zacatecas, México NI 43-101 Technical Report on Mineral Resource and Mineral Reserve Update" dated December 31, 2016, and prepared by Mr. Ramon Mendoza Reyes, P. Eng., Mr. Jesus M. Velador Beltran, MMSA and Mr. Andrew Hamilton, P. Geo. |

| | | |

| | 3. | A Technical Report titled "San Martin Silver Mine San Martin de Bolaños, Jalisco, Mexico, NI 43-101 Technical Report on Mineral Resource and Mineral Reserve Update" dated December 31, 2016, and prepared by Mr. Ramon Mendoza Reyes, P. Eng., Mr. Jesus M. Velador Beltran, MMSA, Ms. Maria Elena Vazquez Jaimes, P. Geo. and Mr. Phillip J. Spurgeon, P. Geo. |

| | | |

| | 4. | A Technical Report titled "La Parrilla Silver Mine San Jose de La Parrilla, Durango, México, NI 43-101 Technical Report on Mineral Resource and Mineral Reserve Update" dated December 31, 2016, and prepared by Mr. Ramon Mendoza Reyes, P. Eng., Mr. Jesus M. Velador Beltran, MMSA, Ms. Maria Elena Vazquez Jaimes, P. Geo., Mr. Stephen Taylor, P. Eng., Mr. Sebastien Bernier, P. Geo., Mr. Dominic Chartier, P. Geo., Mr. Daniel Sepulveda, SME-RM and Mr. David Maarse, P. Geo. |

20

| | 5. | Technical Report titled "Update to Santa Elena Pre-Feasibility Study, Sonora, México", dated October 1, 2015, and prepared by Mr. N. Eric Fier P.Eng. |

| | | |

| | 6. | Technical Report titled "San Dimas Property, San Dimas District, Durango and Sinaloa State, Mexico, Technical Report for Primero Mining Corp." dated April 18, 2014, and prepared by J. Morton Shannon, P. Geo., Rodney Webster, M.AIG, and Gabriel Voicu, P. Geo. (items 1-6 collectively referred to as the “Technical Reports”) |

The following table shows the total tonnage mined from each of the Company’s producing properties during 2018, including total ounces of silver and silver equivalent ounces produced from each property and the tonnage mined from delineated Reserves and Resources at each property. A portion of the production from each mine came from material other than Reserves or Resources, as set out below under the heading “Material Not in Reserves”.

TABLE 4

First Majestic 2018 Production

| Units | | SANDIMAS | | | SANTA

ELENA | | | LA

ENCANTADA | | | SANMARTIN | | | LA PARRILLA | | | DELTORO | | | LA

GUITARRA | | | TOTAL | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ore Processed | Tonnes | | 435,289 | | | 899,370 | | | 916,894 | | | 284,656 | | | 491,637 | | | 267,170 | | | 80,435 | | | 3,375,452 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Material Mined from Reserves | Tonnes | | 434,838 | | | 876,070 | | | 205,931 | | | 235,154 | | | 472,546 | | | 235,387 | | | 43,963 | | | 2,503,890 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Material Mined from Areas Not In Reserves | Tonnes | | 451 | | | 23,300 | | | 710,963 | | | 49,502 | | | 19,091 | | | 31,783 | | | 36,472 | | | 871,561 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver Produced | Ounces | | 3,621,868 | | | 2,223,246 | | | 1,603,740 | | | 1,746,139 | | | 1,340,385 | | | 785,154 | | | 358,919 | | | 11,679,452 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver-Equivalent Produced from Other Metals(1) | Ounces | | 4,429,737 | | | 3,791,441 | | | 7,155 | | | 423,199 | | | 982,671 | | | 647,158 | | | 282,260 | | | 10,563,619 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver-Equivalent Produced | Ounces | | 8,051,605 | | | 6,014,687 | | | 1,610,895 | | | 2,169,338 | | | 2,323,056 | | | 1,432,312 | | | 641,179 | | | 22,243,071 | |

(1) Silver-equivalent ounces are estimated considering metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of each mine. Details as to the method of calculation can be found in the applicable tables in each mine section of the 2018 Annual Information Form.

21

San Dimas Silver/Gold Mine, Durango State, México

The following description of the San Dimas mine has been summarized from the Technical Report titled "San Dimas Property, San Dimas District, Durango and Sinaloa State, Mexico, Technical Report for Primero Mining Corp." dated April 18, 2014 (the "San Dimas Technical Report") and prepared in accordance with NI 43-101. Readers should consult the San Dimas Technical Report to obtain further particulars regarding the San Dimas mine. The San Dimas Technical Report is available for review under Primero's profile on SEDAR at www.sedar.com.

The scientific and technical information after April 18, 2014 under the headings “Project Description and Location”, “Accessibility, Local Resources, Infrastructure”, “History”, “Geological Setting”, “Mineralization”, “Exploration” and “Sampling Analysis and Data Verification” is based on information reviewed and approved by Mr Greg Kulla, P.Geo. The scientific and technical information after April 18, 2014 under the headings “Mineral Resources and Mineral Reserves”, “Mining and Milling Operations”, “Operations and Production”, “Environmental Matters”, “Capital and Operating Costs” is based on information reviewed and approved by Mr. Ramon Mendoza Reyes, P. Eng.

Project Description and Location

The San Dimas mine is located on the borders of Durango and Sinaloa states, approximately 125 km north-east of Mazatlán, Sinaloa and 150 km west of the city of Durango, Durango, in Mexico. The property is centered on latitude 24°06'N and longitude 105°56'W.

The San Dimas Silver Mine (San Dimas) is an underground producing silver and gold mine and processing facility which the Company acquired in 2018. The mine is owned and operated by the Company’s wholly-owned indirect subsidiary, Primero Empresa Minera S.A. de C.V. (“Minera Primero”).

The San Dimas property consists of 119 concessions covering approximately 71,868 hectares, having expiry dates ranging from 2019 to 2055. As per Mexican requirements for grant of tenure, the concessions comprising the San Dimas mine have been surveyed on the ground by a licensed surveyor. All appropriate payments have been made to the relevant authorities and the licenses are in good standing. The Company obtained surface rights by either acquisition of private and public land or by entering into temporary occupation agreements with surrounding communities.

The Company holds the appropriate permits under local, State and Federal laws to allow mining operations at the San Dimas mine. The main environmental permit is the Licencia Ambiental Única under which the mine operates its "industrial facilities". The mine and mill expansion of the San Dimas operation is also covered by this permit. Other significant permits are those related to water supply and water discharge rights. A waste pad project was commenced in 2013 for which both the environmental impact study and the technical justification were approved by the Secretaría de Medio Ambiente y Recursos Naturales and the Mexican environmental protection agency. In addition, permits were received from the Comisión Nacional de Agua regarding the Piaxtla River diversion that is part of this waste pad project. As of March 2014, the river's course has been diverted through the new canal. The new waste pad construction was completed in May 2014.

22

Accessibility, Local Resources, Infrastructure and Physiography

Access to San Dimas is by air or road from the city of Durango. By road the trip requires approximately 10 hours. The Company maintains a de Havilland Twin Otter aircraft and a helicopter, both of which are based at Tayoltita, the population centre situated closest to the San Dimas operation. Travel from either Mazatlán or Durango to Tayoltita requires an approximate half hour flight in the Twin Otter aircraft. Most of the personnel and light supplies for the San Dimas mine arrive on regular Company flights from Durango. Heavy equipment and supplies are brought in by road from Durango. The mine is accessible and operates year-round.

Mining at San Dimas is done by a mixture of contract mining and personnel of the Company. Tayoltita is the most important population centre in the region with approximately 8,000 inhabitants, including mining personnel, and the population outside of this centre is sparse. Subsistence farming, ranching, mining and timber cutting are the predominant activities of the region's population.

Water for the mining operations is obtained from wells and from the Piaxtla River. Water is also supplied by the Company to the town of Tayoltita from an underground thermal spring at the Santa Rita mine.

Electrical power is provided by a combination of First Majestic's own hydro generation system – Las Truchas – and the Mexican "Federal Electricity Commission" ("CFE"). First Majestic operates hydroelectric and back-up diesel generators, which are interconnected with the MFPA. Since the completion of the Las Truchas phase 2A expansion in August 2014, the hydroelectric facility provides about 95% of the total electrical requirement for the San Dimas operation during four months of the year. During the remaining eight months of the year, corresponding to the dry season, the hydroelectric facility provides approximately 50% of the San Dimas power requirements for operations and the rest is supplied by the utility (CFE) and by diesel generators at the mine site. The recent Las Truchas phase 2A expansion has increased the power generation of the Las Truchas facility from 50 GW to 75 GW per year.

The main infrastructure of the San Dimas district consists of roads, a townsite, an airport, the crushing and processing facilities of the Tayoltita mill, the old San Antonio mill, the Tayoltita/Cupias and San Antonio tailings facilities, the Las Truchas hydro generation facilities, a diesel power plant and the San Dimas Mine, which is divided into five blocks: West Block (San Antonio Mine), Sinaloa Graben Block, Central Block, the Tayoltita and Arana Blocks (Santa Rita Mine). The San Antonio mill and tailings facilities are currently under reclamation. The Company holds sufficient surface rights to support the San Dimas mine operations, and associated infrastructure. Environmental permits are required from various federal, provincial, and municipal agencies, and are in place for all current operations. No new permits are currently required for current exploration activity and mining operations, but existing permit amendments are required from time to time.

Physiography and Vegetation

The San Dimas district is located in the central part of the Sierra Madre Occidental, a mountain range characterized by very rugged topography with steep, often vertical walled valleys and narrow canyons. Elevations vary from 2,400 metres above mean sea level ("amsl") on the high peaks to elevations of 400 metres amsl in the valley floor of the Piaxtla River. Vegetation is dominated by pines, junipers and, to a lesser extent, oaks at higher elevations while lower slopes and valleys are covered with thick brush, cacti and grass.

23

History

Prior Ownership

The San Dimas property contains a series of epithermal gold silver veins that have been mined intermittently since 1757. Modern mining began in the 1880s, when the American San Luis Mining Company acquired the Tayoltita mine and American Colonel Daniel Burns took control of the Candelaria mine and began working in the area and has continued under different owners to the present. By 1940, the San Luis Mining Company had acquired the Candelaria and the Contraestaca mines.

A mining law introduced in 1959 in Mexico required the majority of a Mexican mining company to be held by a Mexican entity and forced the sale of 51% of the shares of the San Luis Mining Company to Mexican nationals. In 1961, the Minas de San Luis S.A. de C.V. was formed and assumed operations of the mine. In 1978, the remaining 49% interest was obtained by Luismin S.A. de C.V ("Luismin").

In 2002, Wheaton River Minerals Ltd. ("Wheaton River") acquired the property and, in 2005, Wheaton River merged with Goldcorp. Through its wholly-owned subsidiary, Primero Empresa, Primero acquired the San Dimas mine from subsidiaries of Goldcorp in August 2010. In May 2018 the Company acquired all of the shares of Primero pursuant to the Arrangement.

Historical Exploration and Development Work

In the San Dimas mining district there are historical records that mention workings since 1757, but it was not until 1890 that there were formal operations by the San Luis Mining Company and Mexican Candelaria Company. In 1904, the first cyanide mill in Mexico was built at Tayoltita. By 1940, the Candelaria mine had been mined out.

In the 1960s, higher grade discoveries led to the first deep drilling campaigns and to the initial long tunnels. In 1975, the first 4.5 kilometre tunnel was completed in the Tayoltita mine, this being an area where ore discoveries such as the San Luis vein had taken place following the "Favourable Zone" concept described under "Deposits and Mineralization" below, aided by field geology. In the 1980s, American and Mexican groups commenced operations that led to the first geophysical and geochemical exploration in the east "Tayoltita-Santa Rita" block.

By the late 1980's and early 1990's, the Favourable Zone concept and Ag/Au ratios supported by fluid inclusion and thermal fusion studies led to discovery of the San Antonio and Santa Rita deposits. After acquisition of the whole property by the Mexican group there was a significant reduction in exploration activities throughout the whole mining district.

In 2002, foreign investment (mainly Canadian) returned and the operation was acquired as a whole, which resulted in a substantial increase in drilling "long" drill-holes combined with the development of long tunnels perpendicular to the general trend of veins. Examples of these tunnels include San Luis, Santa Anita and Sinaloa Graben, where significant intersections and new high grade veins, such as the Elia, Aranza, Victoria and Alexa, were discovered.

24

Geological Setting

Regional Geology

The general geological setting of the San Dimas district includes two major volcanic successions totalling approximately 3,500 metres in thickness, which have been described as the Lower Volcanic Group ("LVG") and the Upper Volcanic Group ("UVG") and are separated by an erosional and depositional unconformity.

The LVG is of Eocene age predominantly composed of andesites and rhyolitic flows and tuffs and has been locally divided into six units. The LVG outcrops along the canyons formed by major westward drainage systems and has been intruded by younger members of the batholith complex of granitic to granodioritic composition.

The Socavón rhyolite is the oldest volcanic unit in the district, its lower contact destroyed by the intrusion of the Piaxtla granite.

The overlying Productive Andesite is more than 750 metres in thickness and has been divided into two varieties based on grain size, but of identical mineralogy. One variety is fragmental (varying from a lapilli tuff to coarse agglomerate), and the other has a porphyritic texture (1 to 2 millimetres plagioclase phenocrysts).

Above the Productive Andesite, the overlying Camichin unit, composed of purple to red interbedded rhyolitic and andesite tuffs and flows, is more than 300 metres thick. It is the host rock of most of the productive ore shoots of Patricia, Patricia 2, Santa Rita and other lesser veins in the Santa Rita mine.

The Las Palmas Formation, at the top of the LVG, consists of green conglomerates at the base and red arkoses and shales at the top, with a total thickness of approximately 300 metres. This unit outcrops extensively in the Tayoltita area. The lower contact between the LVG and the underlying Productive Andesite is unconformable.

The predominant plutonic events in the district resulted in intrusion of the LVG by granitic to granodioritic intrusives, part of the Sinaloa composite batholith.

Other intrusives cutting the LVG include the Intrusive Andesite, the Elena aplite and the Santa Rita dacitic dikes. The even younger Bolaños rhyolite dike and the basic dikes intrude both the LVG and UVG. Intrusive activity in the western portion of the Sierra Madre Occidental has been dated continuously from 102 to 43 million years. The UVG overlies the eroded surface of the LVG unconformably.

Local and Property Geology

In the San Dimas district, the UVG is divided into a subordinate lower unit composed mainly of lavas of intermediate composition called Guarisamey Andesite and an upper unit called the Capping Rhyolite. The Capping Rhyolite is mainly composed of rhyolitic ash flows and air-fall tuffs and is up to 1,500 metres thick in the eastern part of the district; however, within most of the district it is about 1,000 metres thick. The San Dimas district lies within an area of complex normal faulting along the western edge of the Sierra Madre Occidental. Compressive forces first formed predominantly east-west and east-northeast tension gashes that were later cut by transgressive north-northwest striking slip faults. The strike-slip movements caused the development of secondary north-northeast faults, with right lateral displacement.

Mineralization

The deposits of the San Dimas district are high grade, silver-gold-epithermal vein deposits characterized by low sulphidation and adularia-sericitic alteration. They were formed during the final stages of igneous and hydrothermal activity from quartz-monzonitic and andesitic intrusions.

25

Typical of epithermal systems, the gold and silver mineralization at the San Dimas mine exhibits a vertical zonation with a distinct top and bottom that the prior owner of the mine termed the "Favourable Zone". At the time of deposition, this Favourable Zone was deposited in a horizontal position paralleling the erosional surface of the LVG on which the UVG was extruded.

This favourable, or productive, zone at San Dimas is some 300 metres to 600 metres in vertical extent and can be correlated, based both on stratigraphic and geochronologic relationships, from vein system to vein system and from fault block to fault block.

The mineralization is typical of epithermal vein structures with banded and drusy textures. Within the San Dimas district, the veins occupy east-west trending fractures except in the southern part of Tayoltita where they strike mainly northeast and in the Santa Rita mine where they strike north-northwest. The veins were formed in two different systems. The east-west striking veins were the first system developed, followed by a second system of north-northeast striking veins. Veins pinch and swell and commonly exhibit bifurcation, horse-tailing and sigmoidal structures. The veins vary from a fraction of a centimetre in width to 8 metres, but average 1.5 metres. They have been followed underground from a few metres in strike length to more than 1,500 metres.

Three major stages of mineralization have been recognized in the district: (1) early stage; (2) ore forming stage; and (3) late stage quartz. Three distinct sub-stages of the ore forming stage also have been identified, each characterized by distinctive mineral assemblages with ore grade mineralization always occurring in the three sub-stages: (1) quartz-chlorite-adularia; (2) quartz-rhodonite; and (3) quartz-calcite.

The minerals characteristic of the ore forming stage are composed mainly of white, to light grey, medium to coarse grained crystalline quartz with intergrowths of base metal sulphides (sphalerite, chalcopyrite and galena) as well as pyrite, argentite, polybasite, stromeyerite, native silver and electrum.

The ore shoots within the veins have variable strike lengths (5 to 600 metres); however, most average 150 metres in strike length. Down-dip extensions of ore shoots are up to 200 metres but are generally less than the strike length.

Exploration and Drilling

Historically, exploration of the Favourable Zone at San Dimas has been done both by diamond drilling and by underground development work. Diamond drilling is predominantly done from underground stations as both the rugged topography and the great drilling distance from the surface locations to the target(s) makes surface drilling both challenging and expensive. All exploration drilling and the exploration underground development work are done both in-house and by use of contractors.

Between May 10 to December 31, 2018, the Company drilled 43,510 meters in 167 diamond drill holes in the Santa Jessica, Santa Gertrudis, Pozolera, Noche Buena, Santa Regina, Victoria, Alexa and San Jose in the areas of the Central Block and Sinaloa Graben.

Seventy-one diamond drill holes totalling 24,515 were drilled in the Santa Jessica Vein. These holes improved confidence of known mineralization and identified an extension of the vein in the lower West zone.

26

Eleven diamond drill holes totalling 3,399 meters were drilled at Santa Gertrudis delineating mineralization from 450 m to 180 m elevations and allowed continue exploration for the lithological contact of andesite rhyolite at depth.

Two holes were drilled at the Pozolera vein exploring for mineralization similar to the Roberta vein 700 meters to the south. These holes intersected a 6 m wide zone of weakly mineralized quartz veins.

Two diamond drill holes totalling 431 meters in the eastern part of the Noche Buena vein confirmed mineralization that is within the infrastructure of the Santa Jessica vein.

Twenty-two diamond drill holes totalling 7,082 meters drilled in the Santa Regina vein confirmed mineralization and with the advance of the developments towards the west, allows the possibilities of integrating with the veins of san Vicente-San Juan that are partially mined.

Twelve diamond drill holes totalling 1,229 meters were drilled in the Victoria vein exploring east of the intersection with the Limoncito fault.

Ten diamond drill holes totalling 2,143 m were drilled in the Alex Vein, 200 meters north of and sub parallel to the Victoria vein system. The drilling was successful in delineation of mineralization at depth and towards the east.

Thirteen diamond drill holes totalling 3,887 meters were drilled in the San Jose vein which confirmed mineralization close to infrastructure, allowing integration into short and medium term production. The vein remains open at depth and along strike in both directions.

Sampling, Analysis and Data Verification

Diamond drill core of BTW, BQ and NQ diameter is cut in half by saw. One half is submitted to a laboratory for analysis the other half is stored in a core box at site. Sample intervals have an average length of 0.7 metres and, in general, they are no longer than 1.5 metres, although occasionally slightly longer intervals are used.

Underground channel samples are also used in Mineral Resource estimation. Channel samples are routinely taken every three metres in all development in vein, and stoping is sampled every two rounds (6 metres). Sample limits within the vein are based on texture and mineralogy changes. No sample is more than 1.2 metres in length and the minimum sample width is 0.2 metres. A second cut is taken across the vein as a validation and the results averaged for grade control purposes. A tarpaulin is laid down below the sample line. The samples are taken as a rough channel along the marked line, ensuring that the unit is sampled in a representative fashion, with large slabs being broken and sub-sampled. The total sample which has collected on the tarpaulin is broken with a hammer, mixed and "quartered" such that a 2 kilogram sample is bagged and labelled with sample number and location details.

All drill core samples are sent to the SGS laboratory in Durango. Channel samples are sent to the local mine laboratory or to SGS laboratory in Durango. Samples assayed by SGS, are subject to a QA/QC process consisting of the regular insertion of standard reference materials and blank materials. SGS is an ISO certified independent laboratory.