MEASURED AND INDICATED MINERAL RESOURCES

(with an effective date of December 31, 2018)

update prepared under the supervision of Ramon Mendoza Reyes, PEng, QP for First Majestic

| Mine/Project | Category | Mineral Type | | Tonnage | | | Grades | | | Metal Content | |

|

|

| |

kt | | | Ag

(g/t) | | | Au

(g/t) | | | Pb

(%) | | | Zn

(%) | | | Ag-Eq

(g/t) | | | Ag

(k Oz) | | | Au

(k Oz) | | | Ag-Eq

(k Oz) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

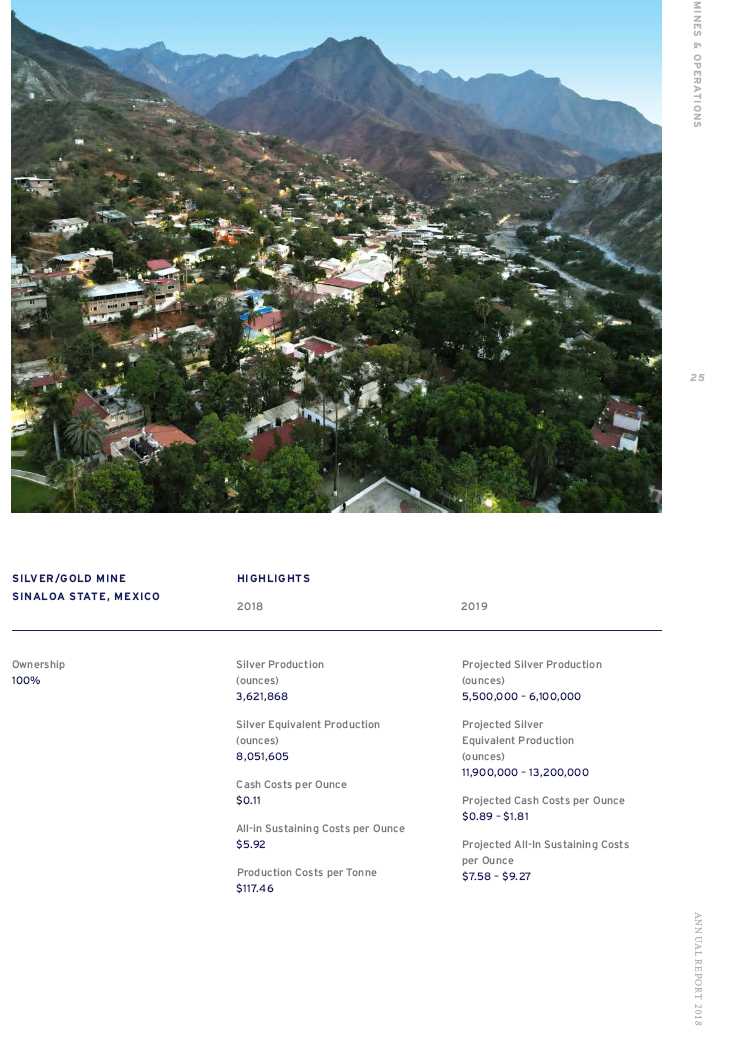

| SAN DIMAS | Measured (UG) | Sulphides | | 1,412 | | | 505 | | | 7.33 | | | – | | | – | | | 1,059 | | | 22,930 | | | 332.7 | | | 48,080 | |

| | Indicated (UG) | Sulphides | | 3,193 | | | 427 | | | 4.93 | | | – | | | – | | | 800 | | | 43,840 | | | 505.7 | | | 82,080 | |

| Total Measuredand Indicated (UG) | Sulphides | | 4,604 | | | 451 | | | 5.66 | | | – | | | – | | | 879 | | | 66,770 | | | 838.4 | | | 130,160 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SANTA ELENA | Measured Santa Elena (UG) | Sulphides | | 2,508 | | | 132 | | | 1.84 | | | – | | | – | | | 280 | | | 10,640 | | | 148.7 | | | 22,550 | |

| | Indicated Santa Elena (UG) | Sulphides | | 915 | | | 124 | | | 1.60 | | | – | | | – | | | 253 | | | 3,650 | | | 47.1 | | | 7,430 | |

| | Indicated Ermitano (UG) | Sulphides | | 704 | | | 65 | | | 4.05 | | | – | | | – | | | 389 | | | 1,460 | | | 91.7 | | | 8,810 | |

| | Indicated (Pad) | Oxides | | 1,179 | | | 39 | | | 1.04 | | | – | | | – | | | 122 | | | 1,480 | | | 39.3 | | | 4,630 | |

| Total Measuredand Indicated (UG+Pad) | Oxides + Sulphides | | 5,306 | | | 101 | | | 1.92 | | | – | | | – | | | 255 | | | 17,230 | | | 326.8 | | | 43,420 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| LA ENCANTADA | Indicated Veins Systems (UG) | Oxides | | 1,339 | | | 255 | | | – | | | – | | | – | | | 255 | | | 10,960 | | | – | | | 10,960 | |

| | Indicated Breccias (UG) | Oxides – Flotation | | 830 | | | 238 | | | – | | | 3.36 | | | – | | | 337 | | | 6,350 | | | 61.5 | | | 8,990 | |

| | Indicated (Tailings) | Oxides | | 4,200 | | | 110 | | | – | | | – | | | – | | | 110 | | | 14,850 | | | – | | | 14,850 | |

| | Total Indicated (UG) | Oxides + Tailings | | 6,370 | | | 157 | | | – | | | 0.44 | | | – | | | 170 | | | 32,160 | | | 62 | | | 34,800 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| LA PARRILLA | Indicated (UG) | Sulphides | | 999 | | | 184 | | | 0.06 | | | 2.01 | | | 1.78 | | | 318 | | | 5,910 | | | 44.3 | | | 10,230 | |

| | Indicated (UG) | Oxides | | 142 | | | 254 | | | 0.15 | | | – | | | – | | | 265 | | | 1,160 | | | – | | | 1,210 | |

| Total Measuredand Indicated (UG) | Oxides + Sulphides | | 1,142 | | | 193 | | | 0.07 | | | 1.76 | | | 1.55 | | | 312 | | | 7,070 | | | 44.3 | | | 11,440 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SAN MART¥N | Measured (UG) | Oxides | | 112 | | | 268 | | | 0.46 | | | – | | | – | | | 302 | | | 960 | | | 1.7 | | | 1,090 | |

| | Indicated (UG) | Oxides | | 1,485 | | | 291 | | | 0.57 | | | – | | | – | | | 334 | | | 13,880 | | | 27.1 | | | 15,940 | |

| Total Measuredand Indicated (UG) | Oxides | | 1,597 | | | 289 | | | 0.56 | | | – | | | – | | | 332 | | | 14,840 | | | 28.8 | | | 17,030 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DEL TORO | Measured (UG) | Transition + Sulphides | | 60 | | | 225 | | | 0.35 | | | 2.60 | | | 0.66 | | | 362 | | | 430 | | | 0.7 | | | 700 | |

| Indicated (UG) | Transition + Sulphides | | 896 | | | 218 | | | 0.30 | | | 4.47 | | | 3.98 | | | 477 | | | 6,290 | | | 8.7 | | | 13,760 | |

| Total Measuredand Indicated (UG) | Transition +Sulphides | | 956 | | | 219 | | | 0.31 | | | 4.35 | | | 3.77 | | | 470 | | | 6,720 | | | 9.4 | | | 14,460 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| LA GUITARRA | Measured (UG) | Sulphides | | 384 | | | 292 | | | 1.84 | | | – | | | – | | | 431 | | | 3,610 | | | 22.7 | | | 5,330 | |

| | Indicated (UG) | Sulphides | | 243 | | | 250 | | | 1.98 | | | – | | | – | | | 399 | | | 1,950 | | | 15.5 | | | 3,120 | |

| Total Measuredand Indicated (UG) | Sulphides | | 627 | | | 276 | | | 1.89 | | | – | | | – | | | 419 | | | 5,560 | | | 38.2 | | | 8,450 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Measuredand Indicated | All mineral types | | 20,601 | | | 227 | | | 1.88 | | | 0.43 | | | 0.26 | | | 392 | | | 150,350 | | | 1,347.4 | | | 259,760 | |

| (1) | Mineral Resources have been classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference into NI 43-101. |

| (2) | The Mineral Resources information provided above is based on internal estimates prepared as of December 31, 2018. The information provided was reviewed and compiled by Ramon Mendoza Reyes, PEng, QP for First Majestic, and is based on internal work prepared under the supervision of First Majestic internal QPs, who have the appropriate relevant qualifications, and experience in geology and resource estimation. |

| (3) | Metal prices considered for Mineral Resources estimates were $17.50/oz Ag, $1,300/oz Au, $1.00/lb Pb, and $1.20/lb Zn. |

| (4) | Silver-equivalent grade is estimated considering: metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of each mine. Estimation details are listed in each mine section of the Annual Information Form (AIF). |

| (5) | The cut-off grades used to estimate Mineral Resources are different for all mines. The cut-off grades and factors are listed in the applicable section describing each mine section of the AIF. |

| (6) | Measured and Indicated Mineral Resources are reported inclusive of Mineral Reserves. |

| (7) | La Guitarra was placed in care and maintenance on August 3, 2018 and is no longer a material property. |

| FIRST MAJESTIC SILVER CORP. | 36 | Reserves and Resources |

INFERRED MINERAL RESOURCES

(with an effective date of December 31, 2018)

update prepared under the supervision of Ramon Mendoza Reyes, PEng, QP for First Majestic

| Mine/Project | Category | Mineral Type | | Tonnage | | | Grades | | | Metal Content | |

|

|

| |

kt | | | Ag

(g/t) | | | Au

(g/t) | | | Pb

(%) | | | Zn

(%) | | | Ag-Eq

(g/t) | | | Ag

(k Oz) | | | Au

(k Oz) | | | Ag-Eq

(k Oz) | |

| SAN DIMAS | Inferred Total (UG) | Sulphides | | 5,708 | | | 341 | | | 3.60 | | | – | | | – | | | 614 | | | 62,640 | | | 661.3 | | | 112,640 | |

| | Inferred Santa Elena Mine (UG) | Sulphides | | 931 | | | 90 | | | 1.09 | | | – | | | – | | | 177 | | | 2,700 | | | 32.7 | | | 5,310 | |

| SANTA ELENA | Inferred Ermitaño (UG) | Sulphides | | 4,637 | | | 59 | | | 3.36 | | | – | | | – | | | 329 | | | 8,820 | | | 501.5 | | | 48,980 | |

| | Inferred Total (UG) | Sulphides | | 5,568 | | | 64 | | | 2.98 | | | – | | | – | | | 303 | | | 11,520 | | | 534.2 | | | 54,290 | |

| LA ENCANTADA | Inferred Veins Systems (UG) | Oxides | | 608 | | | 234 | | | – | | | – | | | – | | | 234 | | | 4,580 | | | – | | | 4,580 | |

| | Inferred Breccias (UG) | Oxides | | 902 | | | 201 | | | – | | | – | | | – | | | 201 | | | 5,830 | | | – | | | 5,830 | |

| | Inferred Ojuelas (UG) | Oxides – Flotation | | 88 | | | lcr183 | | | – | | | 3.41 | | | – | | | 283 | | | 520 | | | 6.7 | | | 810 | |

| | Inferred Total (UG) | Oxides | | 1,598 | | | 213 | | | – | | | 0.19 | | | – | | | 218 | | | 10,930 | | | 6.7 | | | 11,220 | |

| LA PARRILLA | Inferred (UG) | Oxides | | 870 | | | 189 | | | 0.07 | | | 1.83 | | | 1.95 | | | 321 | | | 5,290 | | | 35.1 | | | 8,970 | |

| | Inferred (UG) | Sulphides | | 471 | | | 226 | | | 0.06 | | | – | | | – | | | 231 | | | 3,430 | | | – | | | 3,490 | |

| | Inferred Total (UG) | Oxides + Sulphides | | 1,341 | | | 202 | | | 0.06 | | | 1.19 | | | 1.27 | | | 289 | | | 8,720 | | | 35.1 | | | 12,460 | |

| SAN MARTIN | Inferred Total (UG) | Oxides | | 1,634 | | | 232 | | | 0.30 | | | – | | | – | | | 254 | | | 12,180 | | | 15.7 | | | 13,360 | |

| DEL TORO | Inferred Total (UG) | Transition + Sulphides | | 560 | | | 219 | | | 0.18 | | | 3.33 | | | 1.23 | | | 377 | | | 3,960 | | | 3.3 | | | 6,790 | |

| LA GUITARRA | Inferred Total (UG) | Sulphides | | 164 | | | 268 | | | 1.39 | | | – | | | – | | | 373 | | | 1,420 | | | 7.3 | | | 1,970 | |

| | Total Inferred | All mineral types | | 16,573 | | | 209 | | | 2.30 | | | 0.23 | | | 0.14 | | | 399 | | | 111,370 | | | 1,263.6 | | | 212,730 | |

| (1) | Mineral Resources have been classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference into NI 43-101. |

| (2) | The Mineral Resources information provided above is based on internal estimates prepared as of December 31, 2018. The information provided was reviewed and compiled by Ramon Mendoza Reyes, PEng, QP for First Majestic, and is based on internal work prepared under the supervision of First Majestic internal QPs, who have the appropriate relevant qualifications, and experience in geology and resource estimation. |

| (3) | Metal prices considered for Mineral Resources estimates were $17.50/oz Ag, $1,300/oz Au, $1.00/lb Pb, and $1.20/lb Zn. |

| (4) | Silver-equivalent grade is estimated considering: metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of each mine. Estimation details are listed in each mine section of the Annual Information Form (AIF). |

| (5) | The cut-off grades used to estimate Mineral Resources are different for all mines. The cut-off grades and factors are listed in the applicable section describing each mine section of the AIF. |

| (6) | La Guitarra was placed in care and maintenance on August 3, 2018 and is no longer a material property. |

PROVEN AND PROBABLE MINERAL RESERVES

(with an effective date of December 31, 2018)

update prepared under the supervision of Ramon Mendoza Reyes, PEng, QP for First Majestic

| Mine/Project | Category | Mineral Type | | Tonnage | | | Grades | | | Metal Content | |

|

|

| |

kt | | | Ag

(g/t) | | | Au

(g/t) | | | Pb

(%) | | | Zn

(%) | | | Ag-Eq

(g/t) | | | Ag

(k Oz) | | | Au

(k Oz) | | | Ag-Eq

(k Oz) | |

| SAN DIMAS | Proven (UG) | Sulphides | | 1,629 | | | 323 | | | 4.09 | | | – | | | – | | | 630 | | | 16,940 | | | 214.4 | | | 32,980 | |

| | Probable (UG) | Sulphides | | 3,794 | | | 303 | | | 3.34 | | | – | | | – | | | 553 | | | 36,980 | | | 407.1 | | | 67,450 | |

| | Total Proven and Probable (UG) Sulphides | | 5,423 | | | 309 | | | 3.56 | | | – | | | – | | | 576 | | | 53,920 | | | 621.5 | | | 100,430 | |

| SANTA ELENA | Proven (UG) | Sulphides | | 2,028 | | | 113 | | | 1.58 | | | – | | | – | | | 238 | | | 7,340 | | | 103.2 | | | 15,520 | |

| | Probable (UG) | Sulphides | | 576 | | | 102 | | | 1.28 | | | – | | | – | | | 202 | | | 1,880 | | | 23.6 | | | 3,740 | |

| | Probable (Pad) | Oxides | | 1,349 | | | 36 | | | 0.94 | | | – | | | – | | | 111 | | | 1,570 | | | 40.7 | | | 4,800 | |

| | Total Proven and Probable | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | (UG+Pad) | Oxides + Sulphides | | 3,953 | | | 85 | | | 1.32 | | | – | | | – | | | 189 | | | 10,790 | | | 167.5 | | | 24,060 | |

| LA ENCANTADA | Probable (UG) | Oxides | | 1,311 | | | 189 | | | – | | | – | | | – | | | 189 | | | 7,950 | | | – | | | 7,950 | |

| | Probable (UG) | Oxides – Flotation | | 809 | | | 147 | | | – | | | 2.35 | | | – | | | 196 | | | 3,820 | | | – | | | 5,090 | |

| | Probable (Tailings) | Oxides | | 4,138 | | | 110 | | | – | | | – | | | – | | | 110 | | | 14,630 | | | – | | | 14,630 | |

| | Total Probable (UG) | Oxides + Tailings | | 6,257 | | | 131 | | | – | | | 0.30 | | | – | | | 138 | | | 26,400 | | | – | | | 27,670 | |

| LA PARRILLA | Probable (UG) | Oxides | | 70 | | | 233 | | | 0.17 | | | – | | | – | | | 247 | | | 520 | | | 0.4 | | | 560 | |

| | Probable (UG) | Sulphides | | 308 | | | 166 | | | 0.05 | | | 2.00 | | | 2.10 | | | 308 | | | 1,650 | | | 0.5 | | | 3,050 | |

| | Total Probable (UG) | Oxides | | 378 | | | 179 | | | 0.08 | | | 1.63 | | | 1.71 | | | 297 | | | 2,170 | | | 0.9 | | | 3,610 | |

| SAN MART¥N | Proven (UG) | Oxides | | 79 | | | 175 | | | 0.27 | | | – | | | – | | | 195 | | | 445 | | | 0.7 | | | 495 | |

| | Probable (UG) | Oxides | | 615 | | | 245 | | | 0.50 | | | – | | | – | | | 282 | | | 4,840 | | | 9.9 | | | 5,580 | |

| | Total Proven and Probable (UG) Oxides | | 694 | | | 237 | | | 0.47 | | | – | | | – | | | 272 | | | 5,285 | | | 10.6 | | | 6,075 | |

| DEL TORO | Proven (UG) | Transition + Sulphides | | 42 | | | 205 | | | 0.29 | | | 2.44 | | | 0.65 | | | 325 | | | 280 | | | 0.4 | | | 450 | |

| | Probable (UG) | Transition + Sulphides | | 639 | | | 200 | | | 0.28 | | | 4.41 | | | 4.08 | | | 419 | | | 4,110 | | | 5.7 | | | 8,620 | |

| | Total Proven and Probable (UG) | Transition + Sulphides | | 681 | | | 200 | | | 0.28 | | | 4.29 | | | 3.87 | | | 413 | | | 4,390 | | | 6.1 | | | 9,070 | |

| | Total Proven and Probable | All mineral types | | 17,387 | | | 184 | | | 1.44 | | | 0.31 | | | 0.19 | | | 306 | | | 102,955 | | | 806.6 | | | 170,915 | |

| (1) | Mineral Reserves have been classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference into National Instrument 43-101 (NI43-101). |

| (2) | The Mineral Reserves statement provided in the table above is based on internal estimates prepared as of December 31, 2018. The information provided was reviewed and prepared under the supervision of Ramon Mendoza Reyes, PEng, and a Qualified Person (“QP”) for the purposes of NI43-101. |

| (3) | Silver-equivalent grade is estimated considering metal price assumptions, metallurgical recovery for the corresponding mineral type/mineral process and the metal payable of the corresponding contract of each mine. Estimation details are listed in each mine section of this AIF. |

| (4) | Metal prices considered for Mineral Reserves estimates were $17.00/oz Ag and $1,250/oz Au, $1.00/lb Pb, and $1.20/lb Zn. |

| (5) | A two-step constraining approach has been implemented to estimate reserves for each mining method in use: A General Cut-Off Grade (GC) was used to delimit new mining areas that will require development of access and infrastructure and all sustaining costs. A second Incremental Cut-Off Grade (IC) was considered to include adjacent mineralized material which recoverable value pays for all associated costs, including but not limited to the variable cost of mining and processing, indirect costs, treatment, administration costs and plant sustaining costs. The cut-off grades, metallurgical recoveries, payable terms and modifying factors used to convert Mineral Reserves from Mineral Resources are different for all mines. These cut-off grades and economic parameters are listed in the applicable section describing each mine below in this AIF. |

| (6) | Dilution for underground mining includes consideration for planned dilution due to geometric aspects of the designed stopes and economic zones, and additional dilution consideration due to material handling and other operating aspects. Dilution and mining recovery factors are listed in the applicable section describing each mine below in this AIF. |

| (7) | Tonnage is expressed in thousands of tonnes, metal content is expressed in thousands of ounces. |

| (8) | Totals may not add up due to rounding. |

| (9) | The technical reports from which the above-mentioned information is derived are cited under the heading “Current Technical Reports for Material Properties” of the AIF. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

TO THE SHAREHOLDERS AND THE BOARD OF DIRECTORS OF FIRST MAJESTIC SILVER CORP.

OPINION ON THE FINANCIAL STATEMENTS

We have audited the accompanying consolidated statements of financial position of First Majestic Silver Corp. and subsidiaries (the “Company”) as of December 31, 2018 and 2017, the related consolidated statements of (loss) earnings, comprehensive (loss) income, changes in equity and cash flows, for each of the two years in the period ended December 31, 2018, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2018 and 2017, and its financial performance and its cash flows for each of the two years in the period ended December 31, 2018, in conformity with International Financial Reporting Standards as issued by the International Accounting Standards Board.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the Company’s internal control over financial reporting as of December 31, 2018, based on criteria established inInternal Control – Integrated Framework(2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission and our report dated February 22, 2019, expressed an unqualified opinion on the Company’s internal control over financial reporting.

BASIS FOR OPINION

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Chartered Professional Accountants

Vancouver, Canada

February 22, 2019

We have served as the Company’s auditor since 2005.

| FIRST MAJESTIC SILVER CORP. | 40 | CONSOLIDATED FINANCIAL STATEMENTS |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

TO THE SHAREHOLDERS AND THE BOARD OF DIRECTORS OF FIRST MAJESTIC SILVER CORP.

OPINION ON INTERNAL CONTROL OVER FINANCIAL REPORTING

We have audited the internal control over financial reporting of First Majestic Silver Corp. and subsidiaries (the “Company”) as of December 31, 2018, based on criteria established inInternal Control – Integrated Framework(2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). In our opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2018, based on criteria established inInternal Control – Integrated Framework(2013) issued by COSO.

We have also audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the consolidated financial statements as of and for the year ended December 31, 2018, of the Company and our report dated February 22, 2019, expressed an unqualified opinion on those financial statements.

As described in Management’s Report on Internal Control Over Financial Reporting, management excluded from its assessment the internal control over financial reporting at Primero Mining Corp., which was acquired on May 10, 2018 and whose financial statements constitute 53% and 39% of net and total assets, respectively, and 34% of revenues of the consolidated financial statement amounts as of and for the year ended December 31, 2018. Accordingly, our audit did not include the internal control over financial reporting at Primero Mining Corp.

BASIS FOR OPINION

The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management’s Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

DEFINITION AND LIMITATIONS OF INTERNAL CONTROL OVER FINANCIAL REPORTING

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Chartered Professional Accountants

Vancouver, Canada

February 22, 2019

| CONSOLIDATED FINANCIAL STATEMENTS | 41 | ANNUAL REPORT 2018 |

| CONSOLIDATED STATEMENTS OF (LOSS) EARNINGS |

| for the years ended December 31, 2018 and 2017 |

| (in thousands of US dollars, except share and per share amounts) |

The Consolidated Statements of (Loss) Earnings provide a summary of the Company’s financial performance and net earnings or loss over the reporting periods.

| | | | | | YEAR ENDED DECEMBER 31, | |

| | | Note | | | 2018 | | | 2017 | |

| REVENUES | | 6 | | $ | 300,929 | | $ | 252,288 | |

| Mine operating costs | | | | | | | | | |

| Cost of sales | | 7 | | | 219,162 | | | 159,265 | |

| Depletion, depreciation and amortization | | | | | 93,667 | | | 77,045 | |

| | | | | | 312,829 | | | 236,310 | |

| Mine operating (loss) earnings | | | | | (11,900 | ) | | 15,978 | |

| General and administrative expenses | | 8 | | | 21,428 | | | 17,493 | |

| Share-based payments | | | | | 7,375 | | | 8,295 | |

| Impairment of non-current assets | | 17 | | | 199,688 | | | 65,500 | |

| Mine care and maintenance costs | | 17 | | | 2,109 | | | — | |

| Acquisition costs | | 4 | | | 4,893 | | | — | |

| Foreign exchange loss (gain) | | | | | 1,874 | | | (4,314 | ) |

| Operating loss | | | | | (249,267 | ) | | (70,996 | ) |

| Investment and other loss | | 9 | | | (744 | ) | | (34 | ) |

| Finance costs | | 10 | | | (13,036 | ) | | (4,271 | ) |

| Loss before income taxes | | | | | (263,047 | ) | | (75,301 | ) |

| Income taxes | | | | | | | | | |

| Current income tax expense | | | | | 2,148 | | | 7,177 | |

| Deferred income tax recovery | | | | | (61,031 | ) | | (29,206 | ) |

| | | | | | (58,883 | ) | | (22,029 | ) |

| Net loss for the year | | | | $ | (204,164 | ) | $ | (53,272 | ) |

| Loss per common share | | | | | | | | | |

| Basic | | 11 | | | ($1.11 | ) | | ($0.32 | ) |

| Diluted | | 11 | | | ($1.11 | ) | | ($0.32 | ) |

| Weighted average shares outstanding | | | | | | | | | |

| Basic | | 11 | | | 183,650,405 | | | 165,293,893 | |

| Diluted | | 11 | | | 183,650,405 | | | 165,293,893 | |

Approved by the Board of Directors

The accompanying notes are an integral part of the audited consolidated financial statements.

| FIRST MAJESTIC SILVER CORP. | 42 | CONSOLIDATED FINANCIAL STATEMENTS |

CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

for the years ended December 31, 2018 and 2017

(in thousands of US dollars)

The Consolidated Statements of Comprehensive (Loss) Income provide a summary of total comprehensive earnings or loss and summarizes items recorded in other comprehensive income that may or may not be subsequently reclassified to profit or loss depending on future events.

| | | | | | YEAR ENDED DECEMBER 31, | |

| | | Note | | | 2018 | | | 2017 | |

| NET LOSS FOR THE YEAR | | | | $ | (204,164 | ) | $ | (53,272 | ) |

| Other comprehensive income (loss) | | | | | | | | | |

| Items that will not be subsequently reclassified to profit or loss: | | | | | | | | | |

| Unrealized loss on fair value of investments in marketable securities | | 14 | | | (510 | ) | | (479 | ) |

| Remeasurement of retirement benefit plan | | | | | 665 | | | — | |

| Other comprehensive income (loss) | | | | | 155 | | | (479 | ) |

| Total comprehensive loss | | | | $ | (204,009 | ) | $ | (53,751 | ) |

| CONSOLIDATED FINANCIAL STATEMENTS | 43 | ANNUAL REPORT 2018 |

CONSOLIDATED STATEMENTS OF CASH FLOWS

for the years ended December 31, 2018 and 2017

(in thousands of US dollars)

The Consolidated Statements of Cash Flows provide a summary of movements in cash and cash equivalents during the reporting periods by classifying them as operating, investing or financing activities.

| | | | | YEAR ENDED DECEMBER 31, | |

| | | Note | | 2018 | | | 2017 | |

| OPERATING ACTIVITIES | | | | | | | | |

| Net loss for the year | | | $ | (204,164 | ) | $ | (53,272 | ) |

| Adjustments for: | | | | | | | | |

| Depletion, depreciation and amortization | | | | 94,522 | | | 78,077 | |

| Share-based payments | | | | 7,375 | | | 8,295 | |

| Impairment of non-current assets | | 17 | | 199,688 | | | 65,500 | |

| Income tax recovery | | | | (58,883 | ) | | (22,028 | ) |

| Finance costs | | 10 | | 13,036 | | | 4,271 | |

| Acquisition costs | | 4 | | 4,893 | | | — | |

| Other | | 25 | | 5,094 | | | 143 | |

| Operating cash flows before movements in working capital and taxes | | | | 61,561 | | | 80,986 | |

| Net change in non-cash working capital items | | 25 | | (21,167 | ) | | (4,419 | ) |

| Income taxes paid | | | | (7,132 | ) | | (6,116 | ) |

| Cash generated by operating activities | | | | 33,262 | | | 70,451 | |

| INVESTING ACTIVITIES | | | | | | | | |

| Expenditures on mining interests | | | | (76,303 | ) | | (54,571 | ) |

| Acquisition of property, plant and equipment | | | | (35,005 | ) | | (20,941 | ) |

| Deposits paid for acquisition of non-current assets | | | | (2,942 | ) | | (416 | ) |

| Purchase of marketable securities and silver futures derivatives | | | | (720 | ) | | — | |

| Primero acquisition costs, net of cash acquired | | 4 | | (1,022 | ) | | — | |

| Cash spent on settlement of derivatives | | | | (1,049 | ) | | — | |

| Cash used in investing activities | | | | (117,041 | ) | | (75,928 | ) |

| FINANCING ACTIVITIES | | | | | | | | |

| Proceeds from exercise of stock options | | | | 3,943 | | | 5,740 | |

| Net proceeds from convertible debentures | | 19 (a) | | 151,079 | | | — | |

| Net proceeds from debt facilities | | 19 (b) | | 34,006 | | | — | |

| Repayment of debt facilities | | 19 (b) | | (16,000 | ) | | — | |

| Repayment of Scotia debt facilities | | 19 (c) | | (32,072 | ) | | (12,726 | ) |

| Repayment of Primero’s debt facilities | | 19 (d) | | (106,110 | ) | | — | |

| Proceeds from equipment financing obligations | | 20 (b) | | — | | | 7,894 | |

| Repayment of equipment financing obligations | | 20 (b) | | (3,546 | ) | | (6,781 | ) |

| Finance costs paid | | | | (4,471 | ) | | (2,779 | ) |

| Shares repurchased and cancelled | | 23 (d)(e) | | (1,386 | ) | | — | |

| Cash provided by (used in) financing activities | | | | 25,443 | | | (8,652 | ) |

| Effect of exchange rate on cash and cash equivalents held in foreign currencies | | | | (2,792 | ) | | 3,221 | |

| Decrease in cash and cash equivalents | | | | (58,336 | ) | | (14,129 | ) |

| Cash and cash equivalents, beginning of the year | | | | 118,141 | | | 129,049 | |

| Cash and cash equivalents, end of year | | | $ | 57,013 | | $ | 118,141 | |

| Cash | | | $ | 40,352 | | $ | 77,411 | |

| Short-term investments | | | | 16,661 | | | 40,730 | |

| Cash and cash equivalents, end of year | | | $ | 57,013 | | $ | 118,141 | |

| Supplemental cash flow information | | 25 | | | | | | |

The accompanying notes are an integral part of the audited consolidated financial statements.

| FIRST MAJESTIC SILVER CORP. | 44 | CONSOLIDATED FINANCIAL STATEMENTS |

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

as at December 31, 2018 and 2017

(in thousands of US dollars)

The Consolidated Statements of Financial Position provides a summary of assets, liabilities and equity, as well as their current versus non-current nature, as at the reporting date.

| | | Note | | December 31, 2018 | | | December 31, 2017 | |

| ASSETS | | | | | | | | |

| | | | | | | | | |

| Current assets | | | | | | | | |

| Cash and cash equivalents | | | $ | 57,013 | | $ | 118,141 | |

| Trade and other receivables | | 12 | | 5,599 | | | 5,378 | |

| Value added taxes receivable | | 24 (c) | | 59,665 | | | 14,984 | |

| Income taxes receivable | | | | 982 | | | 493 | |

| Inventories | | 13 | | 32,468 | | | 18,858 | |

| Other financial assets | | 14 | | 8,458 | | | 11,326 | |

| Prepaid expenses and other | | | | 2,089 | | | 1,478 | |

| Total current assets | | | | 166,274 | | | 170,658 | |

| Non-current assets | | | | | | | | |

| Mining interests | | 15 | | 435,613 | | | 374,146 | |

| Property, plant and equipment | | 16 | | 251,084 | | | 192,052 | |

| Deposits on non-current assets | | | | 3,464 | | | 869 | |

| Non-current income taxes receivable | | 26 | | 18,737 | | | — | |

| Deferred tax assets | | 22 | | 50,938 | | | 43,716 | |

| Total assets | | | $ | 926,110 | | $ | 781,441 | |

| LIABILITIES AND EQUITY | | | | | | | | |

| Current liabilities | | | | | | | | |

| Trade and other payables | | 18 | $ | 50,183 | | $ | 35,567 | |

| Unearned revenue | | 6 | | 3,769 | | | 2,190 | |

| Current portion of debt facilities | | 19 | | 1,281 | | | 12,464 | |

| Current portion of equipment financing obligations | | 20 | | 2,904 | | | 4,154 | |

| Total current liabilities | | | | 58,137 | | | 54,375 | |

| Non-current liabilities | | | | | | | | |

| Debt facilities | | 19 | | 148,231 | | | 19,305 | |

| Equipment financing obligations | | 20 | | 2,943 | | | 5,151 | |

| Decommissioning liabilities | | 21 | | 27,796 | | | 16,076 | |

| Other liabilities | | | | 3,787 | | | 655 | |

| Deferred tax liabilities | | 22 | | 90,643 | | | 103,394 | |

| Total liabilities | | | $ | 331,537 | | $ | 198,956 | |

| EQUITY | | | | | | | | |

| Share capital | | | | 827,622 | | | 636,672 | |

| Equity reserves | | | | 88,030 | | | 62,303 | |

| Accumulated deficit | | | | (321,079 | ) | | (116,490 | ) |

| Total equity | | | $ | 594,573 | | $ | 582,485 | |

| Total liabilities and equity | | | $ | 926,110 | | $ | 781,441 | |

Commitments (Note 15; Note 24(c)); Subsequent events (Note 29)

| CONSOLIDATED FINANCIAL STATEMENTS | 45 | ANNUAL REPORT 2018 |

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

for the years ended December 31, 2018 and 2017

(in thousands of US dollars except share and per share amounts)

The Consolidated Statements of Changes in Equity summarizes movements in equity, including common shares, share capital, equity reserves and retained earnings or accumulated deficit.

| | | SHARE CAPITAL | | | EQUITY RESERVES | | | | | | | |

| | | | | | | | | | | | | | | | | | Equity | | | | | | | | | | |

| | | | | | | | | | | | Other | | | | | | component of | | | | | | | | | | |

| | | | | | | | | Share-based | | | comprehensive | | | Retirement | | | convertible | | | Total equity | | | Accumulated | | | | |

| | | Shares | | | Amount | | | payments(a) | | | income(b) | | | Benefit Plan(c) | | | debenture(d) | | | reserves | | | deficit | | | Total equity | |

| Balance atDecember 31, 2016 | | 164,461,567 | | $ | 628,565 | | $ | 58,879 | | $ | (2,525 | ) | $ | — | | $ | — | | $ | 56,354 | | $ | (63,218 | ) | $ | 621,701 | |

| Net loss for the year | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (53,272 | ) | | (53,272 | ) |

| Other comprehensive loss | | — | | | — | | | — | | | (479 | ) | | — | | | — | | | (479 | ) | | — | | | (479 | ) |

| Totalcomprehensive loss | | — | | | — | | | — | | | (479 | ) | | — | | | — | | | (479 | ) | | (53,272 | ) | | (53,751 | ) |

| Share-based payments | | — | | | — | | | 8,295 | | | — | | | — | | | — | | | 8,295 | | | — | | | 8,295 | |

| Shares issued for: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exercise of stock options (Note 23(b)) | | 1,292,206 | | | 7,607 | | | (1,867 | ) | | — | | | — | | | — | | | (1,867 | ) | | — | | | 5,740 | |

| Settlement of liabilities | | 70,391 | | | 500 | | | — | | | — | | | — | | | — | | | — | | | — | | | 500 | |

| Balance atDecember 31, 2017 | | 165,824,164 | | $ | 636,672 | | $ | 65,307 | | $ | (3,004 | ) | $ | — | | $ | — | | $ | 62,303 | | $ | (116,490 | ) | $ | 582,485 | |

| Net loss for the year | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (204,164 | ) | | (204,164 | ) |

| Other comprehensive income | | — | | | — | | | — | | | (510 | ) | | 665 | | | — | | | 155 | | | — | | | 155 | |

| Totalcomprehensive(loss) income | | — | | | — | | | — | | | (510 | ) | | 665 | | | — | | | 155 | | | (204,164 | ) | | (204,009 | ) |

| Share-based payments | | — | | | — | | | 7,375 | | | — | | | — | | | — | | | 7,375 | | | — | | | 7,375 | |

| Equity component of convertible debenture, net of tax (Note 19(c)) | | — | | | — | | | | | | — | | | — | | | 19,164 | | | 19,164 | | | — | | | 19,164 | |

| Shares issued for: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Exercise of stock options (Note 23(b)) | | 973,948 | | | 4,910 | | | (967 | ) | | — | | | — | | | — | | | (967 | ) | | — | | | 3,943 | |

| Acquisition of Primero (Note 4) | | 27,333,184 | | | 186,959 | | | | | | — | | | — | | | — | | | — | | | — | | | 186,959 | |

| Settlement of liabilities | | 92,110 | | | 500 | | | — | | | — | | | — | | | — | | | — | | | — | | | 500 | |

| Shares cancelled | | (105,728 | ) | | (458 | ) | | — | | | — | | | — | | | — | | | — | | | — | | | (458 | ) |

| Shares repurchased and cancelled (Note 23(d)) | | (230,000 | ) | | (899 | ) | | | | | — | | | — | | | — | | | — | | | (390 | ) | | (1,289 | ) |

| Shares repurchased for delisting from Bolsa (Note 23(e)) | | (14,343 | ) | | (62 | ) | | | | | — | | | — | | | — | | | — | | | (35 | ) | | (97 | ) |

| Balance atDecember 31, 2018 | | 193,873,335 | | $ | 827,622 | | $ | 71,715 | | $ | (3,514 | ) | $ | 665 | | $ | 19,164 | | $ | 88,030 | | $ | (321,079 | ) | $ | 594,573 | |

| (a) | Share-based payments reserve records the cumulative amount recognized under IFRS 2 share-based payments in respect of options granted and shares purchase warrants issued but not exercised to acquire shares of the Company. |

| | |

| (b) | Other comprehensive income reserve principally records the unrealized fair value gains or losses related to fair value through other comprehensive income (“FVTOCI”) financial instruments. |

| | |

| (c) | Retirement benefit plan reserve records re-measurements arising from actuarial gains or losses and return on plan assets in relation to San Dimas’ retirement benefit plan. |

| | |

| (d) | Equity component of convertible debenture reserve represents the estimated fair value of its conversion option of $26.3 million, net of deferred tax effect of $7.1 million. This amount is not subsequently remeasured and will remain in equity until the conversion option is exercised, in which case, the balance recognized in equity will be transferred to share capital. Where the conversion option remains unexercised at the maturity date of the convertible note, the balance will remain in equity reserves. |

The accompanying notes are an integral part of the audited consolidated financial statements.

| FIRST MAJESTIC SILVER CORP. | 46 | CONSOLIDATED FINANCIAL STATEMENTS |

NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS

(tabular amounts are expressed in thousands of US dollars)

| 1. | NATURE OF OPERATIONS |

| | |

| First Majestic Silver Corp. (the “Company” or “First Majestic”) is in the business of silver production, development, exploration, and acquisition of mineral properties with a focus on silver production in Mexico. |

| | |

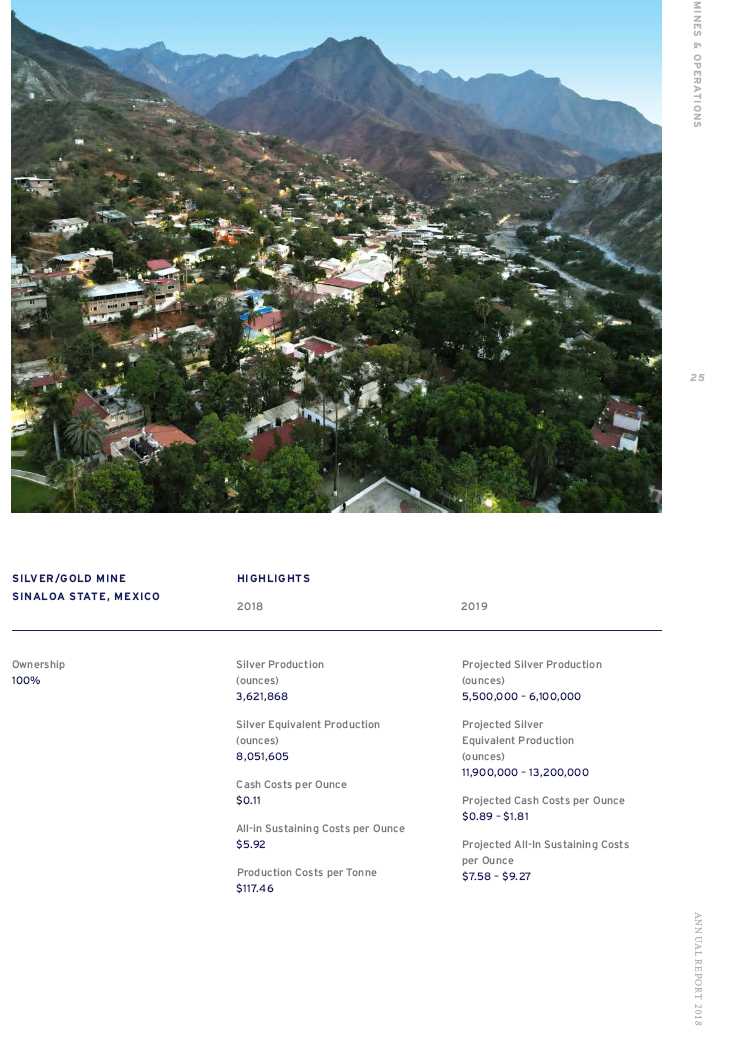

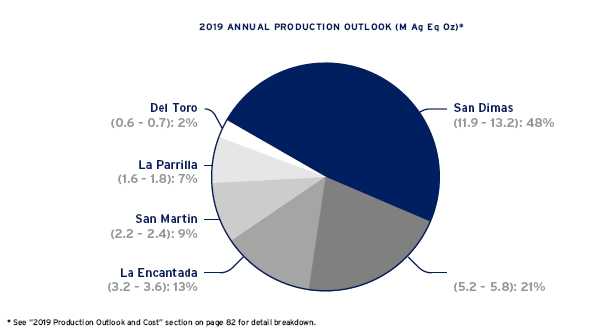

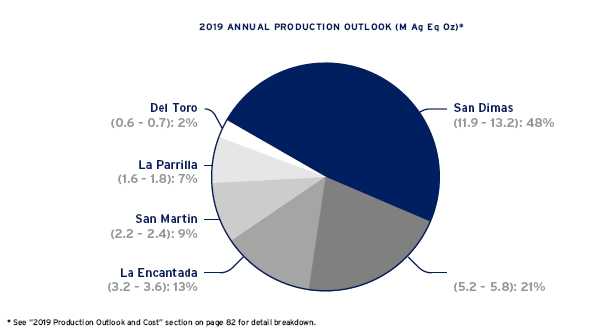

| With the addition of the San Dimas Silver/Gold Mine on May 10, 2018 (Note 4), the Company owns and operates six producing mines: the San Dimas Silver/Gold Mine, the Santa Elena Silver/ Gold Mine, the La Encantada Silver Mine, the San Martin Silver Mine, the La Parrilla Silver Mine and the Del Toro Silver Mine. |

| | |

| In August 2018, the Company placed the La Guitarra Silver Mine under care and maintenance and is currently reviewing strategic options including the potential sale of the operation. |

| | |

| First Majestic is incorporated in Canada with limited liability under the legislation of the Province of British Columbia and is publicly listed on the New York Stock Exchange under the symbol “AG”, on the Toronto Stock Exchange under the symbol “FR” and on the Frankfurt Stock Exchange under the symbol “FMV”. The Company’s head office and principal address is located at 925 West Georgia Street, Suite 1800, Vancouver, British Columbia, Canada, V6C 3L2. |

| | |

| 2. | BASIS OF PRESENTATION |

| | |

| These audited consolidated financial statements have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). The significant accounting policies, estimates and judgments applied in preparing these consolidated financial statements are summarized in Note 3 of the consolidated financial statements and have been consistently applied throughout all periods presented. |

| | |

| These audited consolidated financial statements have been prepared on an historical cost basis except for certain items that are measured at fair value including derivative financial instruments (Note 24(a)) and other financial assets (Note 14). All dollar amounts presented are in thousands of United States dollars unless otherwise specified. |

| | |

| These audited consolidated financial statements incorporate the financial statements of the Company and its controlled subsidiaries. Control exists when the Company has the power, directly or indirectly, to govern the financial and operating policies of an entity so as to obtain benefits from its activities. The consolidated financial statements include the accounts of the Company and its subsidiaries (see Note 27). Intercompany balances, transactions, income and expenses are eliminated on consolidation. |

| | |

| These audited consolidated financial statements of First Majestic Silver Corp. for the years ended December 31, 2018 and 2017 were approved and authorized for issue by the Board of Directors on February 22, 2019. |

| 3. | SIGNIFICANT ACCOUNTING POLICIES, ESTIMATES AND JUDGMENTS |

| | |

| The preparation of audited consolidated financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions about future events that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Although these estimates are based on management’s best knowledge of the amounts, events or actions, actual results may differ from these estimates. |

| | |

| New and amended IFRS standards that are effective for the current year |

| | |

| Financial Instruments |

| | |

| On January 1, 2018, the Company adopted IFRS 9 –Financial Instruments(“IFRS 9”) which replaced IAS 39 –Financial Instruments: Recognition and Measurement(“IAS 39”) using the modified retrospective approach. IFRS 9 is effective for annual periods beginning on or after January 1, 2018 and provides a revised model for recognition and measurement of financial instruments; a single, forward-looking expected loss impairment model; and includes significant changes to hedge accounting. IFRS 9 did not impact the Company’s classification and measurement of financial assets and liabilities except for equity securities as described below. The standard also had negligible impact on the carrying amounts of our financial instruments at the transition date. |

| | |

| The following summarizes the significant changes in IFRS 9 compared to the previous standard: |

| | • | IFRS 9 uses a single approach to determine whether a financial asset is classified and measured at amortized cost or fair value. The classification and measurement of financial assets is based on the Company’s business models for managing its financial assets and whether the contractual cash flows represent solely payments for principal and interest. Most of the requirements in IAS 39 for classification and measurement of financial liabilities were carried forward in IFRS 9. The change did not impact the carrying amounts of any of our financial assets on transition date. Upon adoption of IFRS 9, the Company designated its marketable securities previously designated as available- for-sale (“AFS”) as financial assets at fair value through other comprehensive income (“FVTOCI”), where they will be recorded initially at fair value. Subsequent changes in fair value will be recognized in other comprehensive income only and will not be transferred into earnings (loss) upon disposition. This did not impact the Company’s financial statements as at the date of adoption. However, as a result of this designation, the net change in fair value of the marketable securities classified at FVTOCI, including realized and unrealized gains and losses, if any, is now presented as an item that will not be reclassified subsequently to net earnings. The Company’s investments in marketable securities previously classified as held for trading continue to be measured at fair value with changes in fair value recognized in profit or loss (“FVTPL”). |

| CONSOLIDATED FINANCIAL STATEMENTS | 47 | ANNUAL REPORT 2018 |

NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS

(tabular amounts are expressed in thousands of US dollars)

| 3. | SIGNIFICANT ACCOUNTING POLICIES, ESTIMATES AND JUDGMENTS(continued) |

| | |

| New and amended IFRS standards that are effective for the current year(continued) |

| | |

| Financial Instruments(continued) |

| | • | The adoption of the new “expected credit loss” impairment model under IFRS 9, as opposed to an incurred credit loss model under IAS 39, had a negligible impact on the carrying amounts of our financial assets on the transition date given the Company transacts exclusively with large international financial institutions and other organizations with strong credit ratings and the negligible historical level of customer default. |

| | | |

| | • | The new general hedge accounting requirements retain the three types of hedge accounting mechanisms previously available under IAS 39. Under IFRS 9 however, greater flexibility has been introduced to the types of transactions eligible for hedge accounting, specifically broadening the types of instruments that qualify for hedging instruments and the types of risk components of non-financial items that are eligible for hedge accounting. In addition, the effectiveness test has been replaced with the principle of an “economic relationship” and retrospective assessment of hedge effectiveness is no longer required. Enhanced disclosure requirements about an entity’s risk management activities have also been introduced. The Company did not have any hedges in place as at December 31, 2017 and has not designated any of its financial instruments as hedges upon adoption of IFRS 9. |

The Company has also adopted a narrow scope amendment to IFRS 7 –Financial Instruments – Disclosures.As a result of applying the amendment, the Company will add disclosure relating to its risk management strategies if hedge accounting is applied.

Revenue Recognition

On January 1, 2018, the Company adopted IFRS 15 –“Revenue from Contracts with Customers”(“IFRS 15”) which supersedes IAS 18 –“Revenue”(“IAS 18”). IFRS 15 establishes a single five-step model framework for determining the nature, amount, timing and uncertainty of revenue and cash flows arising from a contract with a customer. The standard is effective for annual periods beginning on or after January 1, 2018. The Company adopted the standard on January 1, 2018 using the full retrospective approach without applying any practical expedients.

IFRS 15 requires entities to recognize revenue when control of goods or services transfers to the customer whereas the previous standard, IAS 18, required entities to recognize revenue when the risks and rewards of the goods or services transfer to the customer. The Company concluded there is no change in the timing of revenue recognition of its doré and concentrate sales under IFRS 15 compared to the previous standard as the point of transfer of risks and rewards of goods and services and transfer of control occur at the same time. Therefore, no adjustment was required to the Company’s financial statements.

In addition, IFRS 15 requires entities to apportion the transaction price attributable to contracts from customers to distinct performance obligations on a relative standalone selling price basis. In accordance with the terms of some of the Company’s concentrate agreements, the Company must contract for and pay the shipping and insurance costs necessary to bring the goods to the named destination. Therefore a portion of the revenue earned under these contracts, representing the obligation to fulfill the shipping and insurance services that occur after the transfer of control, is deferred and recognized over time as the obligations are fulfilled. The impact of this change was insignificant to the Company’s financial statements.

IFRS 15 also requires that variable consideration should only be recognized to the extent that it is highly probable that a significant reversal in the amount of cumulative revenue recognized will not occur. The Company concluded that the adjustments relating to the final assay results for the quantity and quality of concentrate sold are not significant and does not constrain the recognition of revenue.

IFRS 15 contains presentation and disclosure requirements which are more detailed than the previous standards, including disclosures for each of the Company’s material revenue streams, the timing of completion of the Company’s performance obligations and the portion of revenue related to provisional pricing adjustments on concentrate sales. These disclosures were included in the revenue note disclosure (Note 6).

Other narrow scope amendments/interpretations

The Company has adopted narrow scope amendments/ interpretations to IFRIC 22 –Foreign Currency Transactions and Advance Consideration,IFRS 2 –Share-Based Paymentsand IAS 1 –Presentation of Financial Statements,which did not have an impact on the Company’s Consolidated Financial Statements.

In preparing the Company’s consolidated financial statements for the years ended December 31, 2018 and 2017, the Company applied the following significant accounting policies and associated significant estimates and critical judgments:

Business Combinations

ACCOUNTING POLICY:

Acquisitions of businesses are accounted for using the acquisition method. The consideration of each business combination is measured, at the date of the exchange, as the aggregate of the fair value of assets given, liabilities incurred or assumed and equity instruments issued by the Company to the former owners of the acquiree in exchange for control of the acquiree. Acquisition-related costs incurred for the business combination are expensed. The acquiree’s identifiable assets, liabilities and contingent liabilities are recognized at their fair value at the acquisition date.

Goodwill arising on acquisition is recognized as an asset and initially measured at cost, being the excess of the consideration of the acquisition over the Company’s interest in the fair value of the net identifiable assets, liabilities and contingent liabilities recognized. If the Company’s interest in the fair value of the acquiree’s net identifiable assets, liabilities and contingent liabilities exceeds the cost of the acquisition, the excess is recognized in earnings or loss immediately. Goodwill may also arise as a result of the requirement under IFRS to record a deferred tax liability on the excess of the fair value of the acquired assets over their corresponding tax bases, with the corresponding offset recorded as goodwill.

The accompanying notes are an integral part of the audited consolidated financial statements.

| FIRST MAJESTIC SILVER CORP. | 48 | CONSOLIDATED FINANCIAL STATEMENTS |

NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS

(tabular amounts are expressed in thousands of US dollars)

| 3. | SIGNIFICANT ACCOUNTING POLICIES, ESTIMATES AND JUDGMENTS(continued) |

| | | |

| Business Combinations(continued) ACCOUNTING ESTIMATES AND JUDGMENTS: |

| Determination of a Business |

| | | |

| Determination of whether a set of assets acquired and liabilities assumed constitute a business may require the Company to make certain judgments, taking into account all facts and circumstances. A business consists of inputs, including non-current assets and processes, including operational processes, that when applied to those inputs have the ability to create outputs that provide a return to the Company and its shareholders. |

| | | |

| In 2018, the Company concluded that Primero Mining Corp. (“Primero”) met the definition of a business and, accordingly, the acquisition was accounted for as a business combination (Note 4). |

| | | |

| ACCOUNTING ESTIMATES AND JUDGMENTS: |

| Fair Value Estimates |

| | | |

| In business combinations, it generally requires time to obtain the information necessary to identify and measure the following as of the acquisition date: |

| | | |

| (i) | The identifiable assets acquired and liabilities assumed; |

| | | |

| (ii) | The consideration transferred in exchange for an interest in the acquiree; |

| | | |

| (iii) | The resulting goodwill. |

If the initial accounting for a business combination is incomplete by the end of the reporting period in which the combination occurs, the Company reports in its consolidated financial statements provisional amounts for the items for which the accounting is incomplete.

During the allowable measurement period, the Company will retrospectively adjust the provisional amounts recognized at the acquisition date to reflect new information obtained about facts and circumstances that existed as of the acquisition date and, if known, would have affected the measurement of the amounts recognized as of that date. The Company may also recognize additional assets or liabilities if new information is obtained about facts and circumstances that existed as of the acquisition date and, if known, would have resulted in the recognition of those assets and liabilities as of that date. The measurement period ends as soon as the Company receives the information it was seeking about facts and circumstances that existed as of the acquisition date or learns that more information is not obtainable and shall not exceed one year from the acquisition date.

As at December 31, 2018, the purchase consideration for the acquisition of Primero Mining Corp. (“Primero”) has been allocated on a preliminary basis based on management’s best estimates at the time these consolidated financial statements were prepared. The Company is continuing its review to determine the fair value of mining interests, the recoverability of value added tax receivables that are in arrears (see Note 24(c)) and the outcome of the APA Ruling (see Note 26) during the allowable measurement period, which shall not exceed one year from the acquisition date. Any future changes to the purchase price allocation may result in adjustments to recognized assets, acquired liabilities and/or goodwill.

ACCOUNTING ESTIMATES AND JUDGMENTS:

Consideration for the Acquisition of Primero

Acquisitions of businesses are accounted for using the acquisition method. The consideration of each business combination is measured, at the date of the exchange, as the aggregate of the fair value of assets given, liabilities incurred or assumed and equity instruments issued by the Company to the former owners of the acquiree in exchange for control of the acquiree.

In determining the total consideration for the acquisition of Primero, the Company included consideration issued to Wheaton Precious Metals Corp. (“WPM”) on the basis that WPM is, in substance, an owner of Primero given the following:

| | (i) | The requirement of consent by WPM to a change in control for Primero; |

| | | |

| | (ii) | WPM was a guarantor of certain of Primero’s debt facilities and also guarantees through the previous stream agreement which would have resulted in WPM having a significant interest in the residual assets of Primero in the event of a bankruptcy or default; and |

| | | |

| | (iii) | The plan of arrangement for the acquisition of Primero was contemplated together and neither transactions would have been economical without considering the other. |

Therefore, management included consideration issued to WPM for the restructuring of the New Stream as part of the consideration for the business combination.

Goodwill

ACCOUNTING POLICY:

Goodwill arising on the acquisition of a business is carried at cost as established at the date of the acquisition less accumulated impairment losses, if any. As at December 31, 2018, the Company had $nil goodwill (2017 – $nil).

Goodwill is allocated to each of the Company’s cash-generating units that is expected to benefit from the synergies of the acquisition. A cash-generating unit to which goodwill has been allocated is tested for impairment annually, or more frequently when there is an indication that the unit may be impaired. If the recoverable amount of the cash-generating unit is less than its carrying amount, the impairment loss is allocated first to reduce the carrying amount of any goodwill allocated to the unit and then to the other assets of the unit pro-rata based on the carrying amount of each asset in the unit. Any impairment loss for goodwill is recognized directly in profit or loss in the consolidated statements of earnings or loss. An impairment loss recognized for goodwill is not reversed in subsequent periods.

Foreign Currency

ACCOUNTING POLICY:

The consolidated financial statements are presented in U.S. dollars. The individual financial statements of each entity are presented in their functional currency, which is the currency of the primary economic environment in which the entity operates.

Transactions in foreign currencies are translated into the entities’ functional currencies at the exchange rates at the date of the transactions. Monetary assets and liabilities of the Company’s operations denominated in a currency other than the U.S. dollar are translated using exchange rates prevailing at the date of the statement of financial position.

| CONSOLIDATED FINANCIAL STATEMENTS | 49 | ANNUAL REPORT 2018 |

NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS

(tabular amounts are expressed in thousands of US dollars)

| 3. | SIGNIFICANT ACCOUNTING POLICIES, ESTIMATES AND JUDGMENTS(continued) |

| | |

| Foreign Currency(continued) ACCOUNTING POLICY (continued) |

| | |

| Non-monetary items that are measured in terms of historical cost in a foreign currency are translated using the exchange rates on the dates of the transactions. Revenue and expense items are translated at the exchange rates in effect at the date of the underlying transaction, except for depletion and depreciation related to non-monetary assets, which are translated at historical exchange rates. Exchange differences are recognized in the statements of earnings or loss in the period in which they arise. |

| | |

| ACCOUNTING ESTIMATES AND JUDGMENTS: |

| | |

| Determination of Functional Currency |

| | |

| The functional currency for each of the Company’s subsidiaries is the currency of the primary economic environment in which the entity operates. The Company has determined that the functional currency of each entity is the U.S. dollar. Determination of functional currency may involve certain judgments to determine the primary economic environment and the Company reconsiders the functional currency of its entities if there is a change in events and conditions which determined the primary economic environment. |

| | |

| Revenue Recognition(Note 5) ACCOUNTING POLICY: |

| | |

| The Company’s primary product is silver. Other metals, such as gold, lead and zinc, produced as part of the extraction process are considered to be by-products arising from the production of silver. Smelting and refining charges are net against revenue from the sale of metals. |

| | |

| Revenue relating to the sale of metals is recognized when control of the metal or related services are transferred to the customer in an amount that reflects the consideration the Company expects to receive in exchange for the metals. |

| | |

| When considering whether the Company has satisfied its performance obligation, it considers the indicators of the transfer of control, which include, but are not limited to, whether: the Company has a present right to payment; the customer has legal title to the asset; the Company has transfered physical possession of the asset to the customer; and the customer has the significant risks and rewards of ownership of the asset. |

| | |

| Metals in doré sold are priced on date of transfer of control. Final weights and assays are adjusted on final settlement which is approximately one month after delivery. Metals in concentrate sold are provisionally priced at the date of transfer of control as the final selling price is subject to movements in the monthly average prices up to the final settlement date, typically one to three months after delivery to the customer. Upon transfer of control of the concentrate, the Company recognizes revenue on a provisional basis based on spot price and, at each period end, subsequently re-estimated by reference to forward market prices of the estimated month of settlement, with the impact of changes in the forward market prices recognized as revenue adjustments as they occur until final settlement. |

Revenue from the sale of coins, ingots and bullion is recorded when the products have been shipped and funds have been received. When cash was received from customers prior to shipping of the related finished goods, the amounts are recorded as unearned revenue until the products are shipped.

ACCOUNTING ESTIMATES AND JUDGMENTS:

Determination of Performance Obligations

The Company applied judgment to determine if a good or service that is promised to a customer is distinct based on whether the customer can benefit from the good or service on its own or together with other readily available resources and whether the good or service is separately identifiable.

Based on these criteria, the Company determined the primary performance obligation relating to its sales contracts is the delivery of the bullion, doré and concentrates. Shipping and insurance services arranged by the Company for its concentrate sales customers that occur after the transfer of control are also considered to be performance obligations.

ACCOUNTING ESTIMATES AND JUDGMENTS:

Variable Consideration

Variable consideration should only be recognized to the extent that it is highly probable that a significant reversal in the amount of cumulative revenue recognized will not occur.

The Company identified a variable component of its revenue for concentrate sales relating to adjustments to the final sales price based on differences between the original and final assay results relating to the quantity and quality of concentrate shipments. Based on the Company’s proficiency in its assaying process, evidenced by the insignificant amount of historical adjustments from the initial to final assays, the Company concluded the variability in consideration caused by assaying results was negligible. Therefore, the Company does not expect a significant amount of reversal in revenue related to assaying differences.

The Company applied judgment to determine the amount of variable consideration to be recognized during the period for which the likelihood of significant reversal is low.

Inventories(Note 13)

ACCOUNTING POLICY:

Mineral inventories, including stockpiled ore, work in process and finished goods, are valued at the lower of weighted average cost and estimated net realizable value. Cost includes all direct costs incurred in production including direct labour and materials, freight, depreciation and amortization and directly attributable overhead costs. Net realizable value is calculated as the estimated price at the time of sale based on prevailing and future metal prices less estimated future production costs to convert the inventories into saleable form.

Any write-downs of inventory to net realizable value are recorded as cost of sales. If there is a subsequent increase in the value of inventories, the previous write-downs to net realizable value are reversed to the extent that the related inventory has not been sold.

The accompanying notes are an integral part of the audited consolidated financial statements.

| FIRST MAJESTIC SILVER CORP. | 50 | CONSOLIDATED FINANCIAL STATEMENTS |

NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS

(tabular amounts are expressed in thousands of US dollars)

| 3. | SIGNIFICANT ACCOUNTING POLICIES, ESTIMATES AND JUDGMENTS(continued) |

| | |

| Inventories (Note 13) (continued) ACCOUNTING POLICY(continued) |

| | |

| Stockpiled ore inventory represents ore that has been extracted from the mine and is available for further processing. Costs added to stockpiled ore inventory are valued based on current mining cost per tonne incurred up to the point of stockpiling the ore and are removed at the weighted average cost per tonne. Stockpiled ore tonnage is verified by periodic surveys and physical counts. |

| | |

| Work in process inventory includes precipitates, inventories in tanks and in the milling process. Finished goods inventory includes metals in their final stage of production prior to sale, including primarily doré and dried concentrates at our operations and finished goods in-transit. |

| | |

| Materials and supplies inventories are valued at the lower of weighted average cost and net realizable value. Costs include acquisition, freight and other directly attributable costs. |

| | |

| Exploration and Evaluation Expenditures (Note 15) ACCOUNTING POLICY: Exploration and evaluation activity involves the search for mineral resources, the determination of technical feasibility and the assessment of commercial viability of an identified resource. Exploration and evaluation activity includes: |

| | • | acquiring the rights to explore; |

| | | |

| | • | researching and analyzing historical exploration data; |

| | | |

| | • | gathering exploration data through topographical, geochemical and geophysical studies; |

| | | |

| | • | exploratory drilling, trenching and sampling; |

| | | |

| | • | determining and examining the volume and grade of the resource; |

| | | |

| | • | surveying transportation and infrastructure requirements; and |

| | | |

| | • | compiling pre-feasibility and feasibility studies. |

Capitalization of exploration and evaluation expenditures commences on acquisition of a beneficial interest or option in mineral rights. Capitalized costs are recorded as mining interests at cost less impairment charges, if applicable. No amortization is charged during the exploration and evaluation phase as the asset is not available for use.

The majority of the Company’s exploration and evaluation expenditures focus on mineral deposits in proximity to its existing mining operations. Where the Company is acquiring a new property, the Company makes a preliminary evaluation to determine that the property has significant potential to develop an economic ore body.

Exploration and evaluation expenditures are transferred to development or producing mining interests when technical feasibility and commercial viability of the mineral resource have been demonstrated. Factors taken into consideration include:

| | • | there is sufficient geological certainty of converting the mineral deposit into proven and probable reserves; |

| | | |

| | • | life of mine plan and economic modeling support the economic extraction of such reserves and resources; |

| | • | for new properties, a scoping study and/or feasibility study demonstrates that the additional reserves and resources will generate a positive economic outcome; and |

| | | |

| | • | operating and environmental permits exist or are reasonably assured as obtainable. |

Exploration and evaluation expenditures remain as exploration mining interests and do not qualify as producing mining interests until the aforementioned criteria are met. Exploration and evaluation expenditures are transferred to development or producing mining interests when the technical feasibility and commercial viability of a mineral resource has been demonstrated according to the above mentioned factors.

ACCOUNTING ESTIMATES AND JUDGMENTS:

Economic recoverability and probability of future economic benefits of exploration, evaluation and development costs

Management has determined that exploratory drilling, evaluation, development and related costs incurred which were capitalized have potential future economic benefits and are potentially economically recoverable, subject to impairment analysis. Management uses several criteria in its assessments of economic recoverability and probability of future economic benefit including geologic and metallurgic information, history of conversion of mineral deposits to proven and probable reserves, scoping and feasibility studies, accessible facilities, existing permits and life of mine plans.

Mining Interests (Note 15)

ACCOUNTING POLICY:

Exploration, development and field support costs directly related to mining interests are deferred until the property to which they directly relate is placed into production, sold, abandoned or subject to a condition of impairment. The deferred costs are amortized over the useful life of the ore body following commencement of production, or written off if the property is sold or abandoned. Administration costs and other exploration costs that do not relate to any specific property are expensed as incurred.

Upon commencement of commercial production, mining interests are depleted on a units-of-production basis over the estimated economic life of the mine. In applying the units of production method, depletion is determined using quantity of material extracted from the mine in the period as a portion of total quantity of material to be extracted in current and future periods based on reserves and resources considered to be highly probable to be economically extracted over the life of mine. If no published reserves and resources are available, the Company may rely on internal estimates of economically recoverable mineralized material, prepared on a basis consistent with that used for determining reserves and resources, for purpose of determining depletion.

From time to time, the Company acquires or disposes of properties pursuant to the terms of option agreements.

Options are exercisable entirely at the discretion of the optionee with no obligation or sale until exercised or expired and, accordingly, are recorded as mineral property costs or recoveries when the payments are made or received.

| CONSOLIDATED FINANCIAL STATEMENTS | 51 | ANNUAL REPORT 2018 |

NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS

(tabular amounts are expressed in thousands of US dollars)

| 3. | SIGNIFICANT ACCOUNTING POLICIES, ESTIMATES AND JUDGMENTS(continued) |

| | |

| Mining Interests (Note 15)(continued) ACCOUNTING ESTIMATES AND JUDGMENTS: |

| | |

| Mineral Reserve and Resource Estimates |

| | |

| Mineral reserve and resource estimates affect the determination of recoverable value used in impairment assessments, the depletion and depreciation rates for non-current assets using the units of production method and the expected timing of reclamation and closure expenditures. |

| | |

| The figures for mineral reserves and mineral resources are determined in accordance with National Instrument 43-101 (“NI 43-101”) Technical Report standards. There are numerous uncertainties inherent in estimating mineral reserves and mineral resources, including many factors beyond the Company’s control. Such estimation is a subjective process and the accuracy of any mineral reserve or mineral resource estimate is a function of the quantity and quality of available data and of the assumptions made and judgments used in engineering and geological interpretation. Differences between management’s assumptions including economic assumptions such as metal prices and market conditions could have a material effect in the future on the Company’s financial position, results of operation and cash flows. |

| | |

| ACCOUNTING ESTIMATES AND JUDGMENTS: |

| | |

| Depletion Rate for Mining Interests |

| | |

| Depletion expenses are allocated based on estimated useful life of the asset. Should the expected asset life and associated depletion rate differ from the initial estimate, the change in estimate would be made prospectively in the consolidated statements of earnings or loss. |

| | |

| Property, Plant and Equipment (Note 16) ACCOUNTING POLICY: |

| | |

| Property, plant and equipment are recorded at cost less accumulated depreciation and accumulated impairment losses. The cost of an item of property, plant and equipment includes the purchase price or construction cost, any costs directly attributable to bringing the asset to the location and condition necessary for its intended use, an initial estimate of the costs of dismantling and removing the item and restoring the site on which it is located, and borrowing costs related to the acquisition or construction of qualifying assets. |

| | |

| Property, plant and equipment are depreciated using either the straight-line or units-of-production method over the shorter of the estimated useful life of the asset or the expected life of mine. Where an item of property, plant and equipment comprises of major components with different useful lives, the components are accounted for as separate items of property, plant and equipment. Assets under construction are recorded at cost and re-allocated to machinery and equipment when it becomes available for use. |

| | |

| Depreciation commences when the asset is in the condition and location necessary for it to operate in the manner intended by management. Depreciation charges on assets that are directly related to mineral properties are allocated to those mineral properties. |

The Company conducts an annual review of residual balances, useful lives and depreciation methods utilized for property, plant and equipment. Any changes in estimate that arise from this review are accounted for prospectively.

ACCOUNTING ESTIMATES AND JUDGMENTS:

Commencement of Commercial Production

Prior to reaching commercial production levels intended by management, costs incurred are capitalized as part of the related mine or mill and proceeds from mineral sales are offset against costs capitalized. Depletion of capitalized costs for mining properties and depreciation and amortization of property, plant and equipment begin when operating levels intended by management have been reached.

Determining when a mine or mill is in the condition necessary for it to be capable of operating in the manner intended by management is a matter of judgment dependent on the specific facts and circumstances. The following factors may indicate that commercial production has commenced:

| | • | substantially all major capital expenditures have been completed to bring the asset to the condition necessary to operate in the manner intended by management; |

| | | |

| | • | the mine or mill has reached a pre-determined percentage of design capacity; |

| | | |

| | • | the ability to sustain a pre-determined level of design capacity for a significant period of time (i.e. the ability to process ore continuously at a steady or increasing level); |

| | | |

| | • | the completion of a reasonable period of testing of the mine plant and equipment; |

| | | |

| | • | the ability to produce a saleable product (i.e. the ability to produce concentrate within required sellable specifications); |

| | | |

| | • | the mine or mill has been transferred to operating personnel from internal development groups or external contractors; and |

| | | |

| | • | mineral recoveries are at or near the expected production levels. |

ACCOUNTING ESTIMATES AND JUDGMENTS:

Depreciation and Amortization Rates for Property, Plant and Equipment

Depreciation and amortization expenses are allocated based on estimated useful life of the asset. Should the expected asset life and associated depreciation rates differ from the initial estimate, the change in estimate would be made prospectively in the consolidated statements of earnings or loss.

Borrowing Costs

ACCOUNTING POLICY:

Borrowing costs directly attributable to the acquisition, construction or production of a qualifying asset that takes a substantial period of time to get ready for its intended use are capitalized as part of the cost of the asset until the asset is substantially ready for its intended use. Other borrowing costs are recognized as an expense in the period incurred. As at December 31, 2018 and 2017, the Company does not have any qualifying assets under construction.

The accompanying notes are an integral part of the audited consolidated financial statements.

| FIRST MAJESTIC SILVER CORP. | 52 | CONSOLIDATED FINANCIAL STATEMENTS |

NOTES TO AUDITED CONSOLIDATED FINANCIAL STATEMENTS

(tabular amounts are expressed in thousands of US dollars)

| 3. | SIGNIFICANT ACCOUNTING POLICIES, ESTIMATES AND JUDGMENTS (continued) |

| | |

| Impairment of Non-Current Assets(Note 17) ACCOUNTING POLICY: |

| | |