MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE YEAR AND QUARTER ENDED DECEMBER 31, 2022

| | | | | | | | |

|

925 West Georgia Street, Suite 1800, Vancouver, B.C., Canada V6C 3L2

Phone: 604.688.3033 | Fax: 604.639.8873| Toll Free: 1.866.529.2807 | Email: info@firstmajestic.com

www.firstmajestic.com |

| | | | | | | | |

| |

| |

| |

| |

| |

| | |

| |

| |

| |

| |

| |

| |

| OVERVIEW OF OPERATING RESULTS | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| OVERVIEW OF FINANCIAL PERFORMANCE | |

| | |

| | |

| | |

| | |

| OTHER DISCLOSURES | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 2 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION

This Management’s Discussion and Analysis of Results of Operations and Financial Condition (“MD&A”) should be read in conjunction with the audited consolidated financial statements of First Majestic Silver Corp. (“First Majestic” or “the Company”) as at and for the year ended December 31, 2022 which are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”). All dollar amounts are expressed in United States (“US”) dollars and tabular amounts are expressed in thousands of US dollars, unless otherwise indicated. Certain amounts shown in this MD&A may not add exactly to total amounts due to rounding differences.

This MD&A contains “forward-looking statements” that are subject to risk factors set out in a cautionary note contained at the end of this MD&A. All information contained in this MD&A is current and has been approved by the Board of Directors of the Company as of February 22, 2023 unless otherwise stated.

First Majestic is a multinational mining company headquartered in Vancouver, Canada, focused on primary silver and gold production in North America, pursuing the exploration and development of its existing mineral properties and acquiring new assets. The Company owns one producing mine in the USA, the Jerritt Canyon Gold Mine, three producing mines in Mexico: the San Dimas Silver/Gold Mine, the Santa Elena Silver/Gold Mine, the La Encantada Silver Mine and four mines currently in care and maintenance in Mexico: the San Martin Silver Mine, the Del Toro Silver Mine, the La Parrilla Silver Mine and the La Guitarra Silver/Gold Mine. The Company has entered into agreements to sell each of the La Guitarra and the La Parrilla mines. As at December 31, 2022, the La Guitarra and the La Parrilla mines were classified as assets held-for-sale.

First Majestic is publicly listed on the New York Stock Exchange under the symbol “AG”, on the Toronto Stock Exchange under the symbol “FR” and on the Frankfurt Stock Exchange under the symbol “FMV”.

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 3 |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Key Performance Metrics | | 2022 | | 2021 | | 2020 | | Change

'22 vs '21 |

| Operational | | | | | | | | |

| Ore Processed / Tonnes Milled | | 3,468,987 | | | 3,339,394 | | | 2,213,954 | | | 4 | % |

| Silver Ounces Produced | | 10,522,051 | | | 12,842,945 | | | 11,598,380 | | | (18 | %) |

| Gold Ounces Produced | | 248,394 | | | 192,353 | | | 100,081 | | | 16 | % |

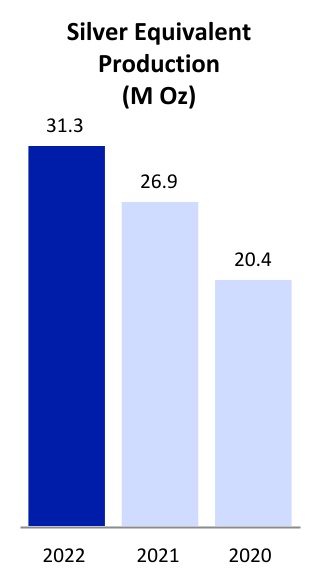

| Silver Equivalent Ounces Produced | | 31,252,920 | | | 26,855,783 | | | 20,379,010 | | | 16 | % |

Cash Costs per Silver Equivalent Ounce (1) | | $14.39 | | | $13.23 | | | $9.00 | | | 9 | % |

All-in Sustaining Cost per Silver Equivalent Ounce (1) | | $19.74 | | | $18.84 | | | $14.03 | | | 5 | % |

Total Production Cost per Tonne (1) | | $124.64 | | | $102.77 | | | $79.59 | | | 21 | % |

Average Realized Silver Price per Ounce (1) | | $22.49 | | | $25.16 | | | $21.15 | | | (11 | %) |

| | | | | | | | |

| Financial (in $millions) | | | | | | | | |

| Revenues | | $624.2 | | | $584.1 | | | $363.9 | | | 7 | % |

| Mine Operating Earnings | | $16.8 | | | $101.4 | | | $105.1 | | | (83 | %) |

| | | | | | | | |

| (Loss) Earnings before Income Taxes | | ($61.4) | | | $25.3 | | | $29.7 | | | NM |

| Net (Loss) Earnings | | ($114.3) | | | ($4.9) | | | $23.1 | | | NM |

| Operating Cash Flows before Working Capital and Taxes | | $109.4 | | | $176.8 | | | $107.3 | | | (38 | %) |

| Cash and Cash Equivalents | | $151.4 | | | $237.9 | | | $238.6 | | | (36 | %) |

Working Capital (1) | | $202.9 | | | $224.4 | | | $254.4 | | | (10 | %) |

Free Cash Flow (1) | | ($64.9) | | | ($16.9) | | | $30.7 | | | NM |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Shareholders | | | | | | | | |

| (Loss) Earnings per Share ("EPS") - Basic | | ($0.43) | | | ($0.02) | | | $0.11 | | | NM |

Adjusted EPS (1) | | ($0.21) | | | $0.02 | | | $0.18 | | | NM |

| | | | | | | | |

NM - Not meaningful

(1)The Company reports non-GAAP measures which include cash costs per ounce produced, all-in sustaining cost per ounce, total production cost per tonne, average realized silver price per ounce sold, working capital, adjusted EPS and free cash flow. These measures are widely used in the mining industry as a benchmark for performance, but do not have a standardized meaning under the Company's financial reporting framework and the methods used by the Company to calculate such measures may differ from methods used by other companies with similar descriptions. See “Non-GAAP Measures” on pages 42 to 51 for further details on each measure and a reconciliation of non-GAAP to GAAP measures.

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 4 |

Operational Highlights

| | | | | | | | | | | | | | | | | | | | | |

| Annual Production Summary | San Dimas | Santa Elena | La Encantada | Jerritt Canyon | | | | | Consolidated |

| Ore Processed / Tonnes Milled | 787,636 | | 851,973 | | 1,025,172 | | 804,206 | | | | | | 3,468,987 | |

| Silver Ounces Produced | 6,201,090 | | 1,229,612 | | 3,091,349 | | — | | | | | | 10,522,051 | |

| Gold Ounces Produced | 80,814 | | 94,684 | | 413 | | 72,483 | | | | | | 248,394 | |

| Silver Equivalent Ounces Produced | 12,957,826 | | 9,147,215 | | 3,125,761 | | 6,022,118 | | | | | | 31,252,920 | |

Cash Costs per Silver Equivalent Ounce(1) | $9.81 | | $11.59 | | $15.30 | | $27.99 | | | | | | $14.39 | |

All-in Sustaining Cost per Silver Equivalent Ounce(1) | $13.76 | | $13.97 | | $18.48 | | $33.07 | | | | | | $19.74 | |

Cash Cost per Gold Equivalent Ounce(1) | N/A | N/A | N/A | $2,323 | | | | | | N/A |

All-in Sustaining Costs per Gold Equivalent Ounce(1) | N/A | N/A | N/A | $2,745 | | | | | | N/A |

Total Production Cost per Tonne(1) | $155.76 | | $114.99 | | $45.01 | | $205.87 | | | | | | $124.64 | |

(1)See "Non-GAAP Measures" for further details of these measures.

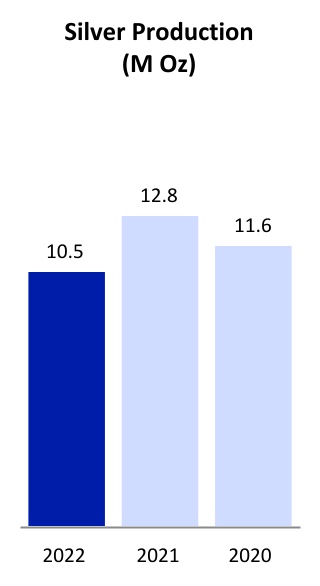

•Annual silver production of 10.5 million ounces compared to 12.8 million ounces in 2021, which was below the lower end of the Company’s revised guidance range of between 11.2 to 11.9 million ounces of silver primarily due to prioritizing higher gold grade ores from the Ermitaño mine at Santa Elena and lower-than-expected silver grades at San Dimas.

•Annual gold production reached a new Company record of 248,394 ounces compared to 192,353 in 2021 but slightly below the lower end of the Company’s revised guidance range of between 256,000 to 273,000 ounces primarily due to lower-than-expected gold grades and throughput at Jerritt Canyon.

•Santa Elena produced a new annual record of 9.1 million silver equivalent ("AgEq") ounces in 2022, representing an 81% increase compared to 2021.

•The Santa Elena operation was awarded the prestigious “Silver Helmet Award” in the category of “Underground Mining of More Than 500 Workers” by the Mining Chamber of Mexico for its outstanding performance in occupational safety and health. The distinguished annual award of excellence is only awarded to a select handful of mining operations in Mexico.

•Received the 2022 Distinctive ESR Award in Mexico: The Mexican Center for Philanthropy (CEMEFI) and the Alliance for Corporate Social Responsibility (AliaRSE) awarded First Majestic's San Dimas, Santa Elena and La Encantada mining units with the Socially Responsible Business Distinction for 2022 (Distintivo Empressa Socialmente Responsable 2022). This annual award of distinction was accomplished after having demonstrated continued responsibility, transparency and sustainability at its operations in Mexico.

•Successfully expanded Santa Elena’s liquid natural gas (“LNG”) powerplant from 12 MW to 24 MW to supply lower-cost, cleaner power to the Santa Elena operation which includes the Ermitaño mine and the recently completed dual-circuit plant.

•Sold a record 444,576 ounces of silver bullion, representing a 27% increase compared to 2021 and approximately 4.2% of the Company’s silver production, on First Majestic’s online bullion store at an average silver price of $26.20 per ounce for total proceeds of $11.6 million.

•Cash cost per AgEq ounce in the year was $14.39, compared to $13.23 in the previous year. The increase in cash cost per AgEq ounce was primarily due to lower than expected production at Jerritt Canyon and lower production at San Dimas in addition to increased costs due to inflation. These decreases in production were primarily attributed to lower head grade at both Jerritt Canyon and San Dimas. The increase in costs were partially offset by increased production from the Santa Elena operation driven by higher-grade ore from the Ermitaño mine and cost savings measures implemented throughout the Company in an effort to combat the impact of inflationary pressures on costs.

•All-in sustaining cost ("AISC") per AgEq ounce in the year was $19.74, compared to $18.85 in the previous year. The increase in AISC per AgEq ounce was primarily attributed to higher cash costs.

Financial Highlights

•Cash position and liquidity: The Company ended the year with cash and cash equivalents of $151.4 million compared to $237.9 million at the end of the previous year, while working capital decreased to $202.9 million compared to $224.4 million. Cash and cash equivalents exclude $125.2 million that is held in restricted cash.

•Revenue: The Company generated record annual revenues of $624.2 million in 2022, or 7% higher than the previous year primarily related to a full year of production from Ermitaño as the mine went into production in the fourth quarter

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 5 |

of 2021. Additionally, there was a 17% increase in payable silver equivalent ounces sold despite an 11% decrease in the average realized silver price per ounce which averaged $22.49 per ounce compared to $25.16 per ounce in 2021.

•Mine operating earnings: During the year, the Company recognized mine operating earnings of $16.8 million compared to $101.4 million in 2021. The decrease in mine operating earnings was primarily driven by lower than expected production at Jerritt Canyon resulting in higher production costs per ounce, a decrease in the average realized silver price per ounce during the year as well as an increase in depreciation and depletion during the year. The Company also saw an increase in cost of sales due to higher consumables, materials, energy, labour and maintenance costs during the first half of the year as a result of inflationary pressures. However, cost cutting initiatives implemented by management helped combat the impact of inflationary pressures on costs during the second half of the year.

•Net loss: The Company recognized a net loss of $114.3 million (EPS of $(0.43)) in 2022 compared to a net loss of $4.9 million (EPS of $(0.02)) in 2021. The increase in net loss was primarily attributable to an increase in income tax expense during the year, lower than expected production at Jerritt Canyon, along with an impairment related to the La Parrilla mine ($9.6 million) as it was classified as an asset held-for-sale during the year. This was partially offset by an impairment reversal related to the agreed upon sale of the La Guitarra mine, which was classified as an asset held-for-sale along with a gain on the sale of the Company's royalty portfolio. During the year, the Company has recorded non-recurring severance costs of $2.7 million relating to restructuring efforts to optimize the workforce.

•Adjusted net loss: Adjusted net loss (see “Non-GAAP Measures”), normalized for non-cash or non-recurring items such as tax settlements, impairment and impairment reversals, write-down of mineral inventory, share-based payments and deferred income taxes for the year ended December 31, 2022 was $55.4 million ($0.21 per share), compared to adjusted earnings of $6.0 million ($0.02 per share) in 2021.

•Cash flow from operations: During the year, cash flow from operations before changes in working capital and income taxes was $109.4 million compared to $176.8 million in 2021.

Corporate Development and Other:

•During the year, the Company announced that it had entered into agreements to sell the La Guitarra and La Parrilla mines in Mexico to Sierra Madre Gold and Silver Ltd. ("Sierra Madre") and Golden Tag Resources Ltd. ("Golden Tag"), respectively. The La Guitarra mine will be sold for a total consideration of $35 million, made up of 69,063,077 Sierra Madre shares. The La Parrilla mine will be sold for total consideration of up to $33.5 million, made up of 143,673,684 Golden Tag shares with a deemed value as of the date of the sale agreement of $20 million, and up to $13.5 million in the form of three milestone payments in either cash or shares in Golden Tag. Closing of both transactions is pending and remains subject to customary closing conditions, including receipt of all necessary regulatory approvals.

•During the year, the Company announced and closed an agreement to sell a portfolio of royalty interests to Metalla Royalty and Streaming Ltd. ("Metalla") for total consideration of $20 million in common shares of Metalla. The royalty portfolio includes a 2% net smelter royalty on six of the Company's non-producing properties, a 2% net smelter royalty on the Plomosas Silver Project (owned by GR Silver Mining Ltd.) and a 100% gross value royalty ("GVR") on gold produced at the La Encantada Silver Mine. The GVR is limited to the first 1,000 ounces of gold produced at La Encantada annually. On the closing date, the Company received 4,168,056 Metalla shares, that had a fair value as of such date of $21.5 million. The Company recorded a gain of $4.3 million related to the disposition of the underlying mining interests that made up each royalty.

•During the year, following the completion of tax audits, conclusive agreements with the SAT were signed by Corporación First Majestic S.A. de C.V. (“CFM”) and First Majestic Plata S.A. de C.V. ("FMP") through Mexico’s Office of the Taxpayer Ombudsman (“PRODECON”) to settle an uncertain tax position concerning Mexican back-to-back loan provisions. The provisions were originally conceived from an anti-avoidance rule and a literal interpretation of the rules would convert most debt financing in Mexico into back-to-back loans. The back-to-back loan provisions establish that interest expense derived from back-to-back loans can be recharacterized as dividends resulting in significant changes to the tax treatment of interest, including withholding taxes. As a result of this recharacterization and in accordance with the conclusive agreement, CFM and FMP made one-time payments of approximately $21.3 million and $6.3 million in fiscal 2022 which have been recognized as current tax expense during the year. In addition to the payment made, CFM agreed to surrender certain tax loss carry forwards resulting in a deferred tax expense of approximately $55.7 million.

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 6 |

| | | | | |

| 2022 FOURTH QUARTER HIGHLIGHTS |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Key Performance Metrics | | 2022-Q4 | | 2022-Q3 | Change

Q4 vs Q3 | | 2021-Q4 | Change

Q4 vs Q4 | | | | | |

| Operational | | | | | | | | | | | | | |

| Ore Processed / Tonnes Milled | | 851,564 | | | 836,514 | | 2 | % | | 955,810 | | (11 | %) | | | | | |

| Silver Ounces Produced | | 2,396,696 | | | 2,736,100 | | (12 | %) | | 3,358,809 | | (29 | %) | | | | | |

| Gold Ounces Produced | | 63,039 | | | 67,072 | | (6 | %) | | 67,411 | | (6 | %) | | | | | |

| Silver Equivalent Ounces Produced | | 7,558,791 | | | 8,766,192 | | (14 | %) | | 8,561,023 | | (12 | %) | | | | | |

Cash Costs per Silver Equivalent Ounce (1) | | $15.36 | | | $13.34 | | 15 | % | | $12.32 | | 25 | % | | | | | |

All-in Sustaining Cost per Silver Equivalent Ounce (1) | | $20.69 | | | $17.83 | | 16 | % | | $17.26 | | 20 | % | | | | | |

Total Production Cost per Tonne(1) | | $131.41 | | | $135.07 | | (3 | %) | | $105.37 | | 25 | % | | | | | |

Average Realized Silver Price per Silver Equivalent Ounce (1) | | $23.24 | | | $19.74 | | 18 | % | | $24.18 | | (4 | %) | | | | | |

| | | | | | | | | | | | | |

| Financial (in $millions) | | | | | | | | | | | | | |

| Revenues | | $148.2 | | | $159.8 | | (7) | % | | $204.9 | | (28 | %) | | | | | |

| Mine Operating Earnings | | ($13.3) | | | $3.3 | | NM | | $40.4 | | (133 | %) | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net loss | | ($16.8) | | | ($20.7) | | (19 | %) | | ($4.0) | | NM | | | | | |

Operating Cash Flows before Movements in Working Capital and Taxes | | $13.4 | | | $27.7 | | (52 | %) | | $71.8 | | (81 | %) | | | | | |

| Cash and Cash Equivalents | | $151.4 | | | $148.8 | | 2 | % | | $237.9 | | (36 | %) | | | | | |

Working Capital (1) | | $202.9 | | | $148.2 | | 37 | % | | $224.4 | | (10 | %) | | | | | |

Free Cash Flow (1) | | ($32.3) | | | $45.3 | | NM | | $66.4 | | (149 | %) | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Shareholders | | | | | | | | | | | | | |

| Loss per Share ("EPS") - Basic | | ($0.06) | | | ($0.08) | | (25 | %) | | ($0.02) | | NM | | | | | |

Adjusted EPS (1) | | ($0.07) | | | ($0.09) | | (22 | %) | | $0.02 | | NM | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

NM - Not meaningful

(1)The Company reports non-GAAP measures which include cash costs per silver equivalent ounce produced, all-in sustaining cost per silver equivalent ounce produced, total production cost per tonne, average realized silver price per silver equivalent ounce sold, average realized gold price per ounce sold, working capital, adjusted EPS and free cash flow. These measures are widely used in the mining industry as a benchmark for performance, but do not have a standardized meaning under the Company's financial reporting framework and the methods used by the Company to calculate such measures may differ from methods used by other companies with similar descriptions. See “Non-GAAP Measures” on pages 42 to 51 for further details on each measure and a reconciliation of non-GAAP to GAAP measures.

| | | | | | | | | | | | | | | | | | | | | |

| Fourth Quarter Production Summary | San Dimas | Santa Elena | La Encantada | Jerritt Canyon | | | | | Consolidated |

| Ore Processed / Tonnes Milled | 210,108 | | 207,188 | | 254,766 | | 179,502 | | | | | | 851,564 | |

| Silver Ounces Produced | 1,392,506 | | 199,388 | | 804,802 | | — | | | | | | 2,396,696 | |

| Gold Ounces Produced | 20,257 | | 25,830 | | 107 | | 16,845 | | | | | | 63,039 | |

| Silver Equivalent Ounces Produced | 3,054,098 | | 2,302,904 | | 813,649 | | 1,388,140 | | | | | | 7,558,791 | |

| Cash Costs per Silver Equivalent Ounce | $11.54 | | $11.20 | | $15.48 | | $30.56 | | | | | | $15.36 | |

| All-in Sustaining Cost per Silver Equivalent Ounce | $16.79 | | $12.75 | | $19.39 | | $34.75 | | | | | | $20.69 | |

| Cash Cost per Gold Equivalent Ounce | N/A | N/A | N/A | $2,519 | | | | | | N/A |

| All-In Sustaining Costs per Gold Equivalent Ounce | N/A | N/A | N/A | $2,865 | | | | | | N/A |

| Total Production Cost per Tonne | $162.68 | | $114.29 | | $47.69 | | $233.39 | | | | | | $131.41 | |

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 7 |

Operational Highlights

•After an all-time record third quarter, production decreased by 14% in the fourth quarter: The Company produced 7.6 million AgEq ounces, consisting of 2.4 million ounces of silver and 63,039 ounces of gold representing a 14% decrease when compared to the record production of 8.8 million AgEq ounces in the previous quarter. The production decrease was primarily due to lower production at San Dimas and Santa Elena, partially offset by higher gold production at Jerritt Canyon and higher silver production at La Encantada. Silver and gold grades decreased 13% and 6%, respectively versus the prior quarter. During the quarter, AgEq production at San Dimas decreased 19% compared to the prior quarter, as a result of lower ore grades and higher dilution, combined with maintenance issues in the filtration plant during the month of December, which reduced planned throughput. Further, a 9% decrease in the AgEq conversion ratio compared to the prior quarter, contributed to a quarter-over-quarter decrease in the AgEq ounces produced.

•Transitioning to 100% Ermitaño ores at Santa Elena: Continued strong metal production from the Ermitaño mine, having achieved its second highest quarter of production, enabled Santa Elena to produce 2.3 million AgEq ounces in the fourth quarter, or 16% below the record 2.7 million AgEq in the prior quarter. In 2023, Santa Elena is expected to produce between 7.8 and 8.7 million AgEq ounces as it transitions to full production from Ermitaño while exploration continues at the recently discovered Silvanna vein within the Santa Elena mine.

•Increase in Production Guidance at Jerritt Canyon in 2023: The secondary escapeway in the West Generator mine was completed in November allowing for improved ore production although a severe cold weather disturbance in December limited haulage and deliveries to the plant. With the additional ramp up of Smith Zone 10 and the restart of the Saval II mine, gold production at Jerritt Canyon is expected to be between 119,000 to 133,000 ounces in 2023, representing a mid-point increase of 74% as it relates to guidance compared to 2022 actual production.

•Santa Elena's Dual-Circuit Completed: The Company successfully completed the commissioning of the dual-circuit processing plant at Santa Elena during the quarter which includes the new 3,000 tonne per day (“tpd”) filter press, designed to improve the leaching performance and reduce operating costs.

•Cash Cost per AgEq Ounce for the quarter was $15.36 per ounce, compared to $13.34 per ounce in the previous quarter. The increase in cash costs per AgEq ounce was primarily attributed to a decrease in gold and silver ore grades and AgEq ounces produced at San Dimas and Santa Elena. This was partially offset by lower cash costs per ounce at Jerritt Canyon during the quarter, driven by higher gold production as the completion of the rehabilitation and restart at the West Generator mine at Jerritt Canyon allowed for improved ore production as well as cost saving measures implemented throughout the Company in an effort to combat the higher costs due to inflation.

•AISC per AgEq Ounce in the fourth quarter was $20.69 per ounce compared to $17.83 per ounce in the previous quarter. The increase in AISC per AgEq ounce was primarily attributed to an increase in cash costs per AgEq ounce.

•10 Drill Rigs Active: The Company concluded its 2022 exploration program during the quarter by completing a total of 16,086 metres of exploration drilling across the Company’s mines. Throughout the quarter a total of 10 drill rigs were active consisting of four rigs at San Dimas, two rigs at Jerritt Canyon, three rigs at Santa Elena and one rig at La Encantada.

Financial Highlights

•In the fourth quarter, the Company generated revenues of $148.2 million compared to $204.9 million representing a 28% decrease compared to the fourth quarter of 2021. The decrease in revenues was primarily attributed to a decrease in production at San Dimas and Jerritt Canyon of 24% per mine site, a lower average realized silver price which averaged $23.24 per ounce during the quarter, representing a 4% decrease compared to $24.18 in the fourth quarter of 2021.

•The Company realized mine operating losses of $13.3 million compared to mine operating earnings of $40.4 million in the fourth quarter of 2021. The decrease in mine operating earnings was primarily attributed to lower production and metal prices and an increase in cost of sales and depreciation and depletion from La Encantada and Jerritt Canyon.

•Net loss for the quarter was $16.8 million (EPS of ($0.06)) compared to net loss of $4.0 million (EPS of ($0.02)) in the fourth quarter of 2021.

•During the quarter, the Company recorded non-recurring severance costs of $2.1 million relating to restructuring efforts to optimize the workforce.

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 8 |

•Adjusted net loss (a non-GAAP measure)1 for the quarter, normalized for non-cash or non-recurring items such as tax settlements, impairment and impairment reversal, share-based payments, unrealized gains on marketable securities and write-downs on mineral inventory for the quarter ended December 31, 2022, was $17.4 million (Adjusted EPS of ($0.07)) compared to an adjusted net earnings of $4.1 million (Adjusted EPS of $0.02) in the fourth quarter of 2021.

•Operating cash flow before movements in working capital and taxes in the quarter was an inflow of $13.4 million compared to a cash inflow of $71.8 million in the fourth quarter of 2021.

•As of December 31, 2022, the Company had cash and cash equivalents of $151.4 million and working capital of $202.9 million. Cash and cash equivalents excludes $125.2 million that is held in restricted cash.

1 This measure does not have a standardized meaning under the Company's financial reporting framework and the methods used by the Company to calculate this measure may differ from methods used by other companies with similar descriptions. See “Non-GAAP Measures” on pages 42 to 51 for further details on each measure and a reconciliation of non-GAAP to GAAP measures.

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 9 |

| | | | | |

| 2023 PRODUCTION OUTLOOK AND COST GUIDANCE UPDATE |

This section provides management’s revised production outlook and cost guidance for 2023. These are forward-looking estimates and are subject to the cautionary note regarding the risks associated with relying on forward-looking statements at the end of this MD&A. Actual results may vary based on production throughputs, grades, recoveries and changes in economic circumstances.

The Company expects 2023 total production from its four operating mines to reach a new Company record of between 33.2 to 37.1 million AgEq ounces consisting of 10.0 to 11.1 million ounces of silver and 277,000 to 310,000 ounces of gold. Based on the midpoint of the guidance range the Company expects AgEq ounces to increase 12% when compared to 2022. Silver production is expected to remain consistent with 2022 rates whereas gold production is expected to increase by 18% year-over-year. The increase in forecast gold production is primarily due to improvements in mine production at Jerritt Canyon resulting in an expected 74% increase in gold ounces in 2023 when compared to the prior year. In addition, strong gold production is expected to continue at Santa Elena as the plant will only process Ermitaño ores in 2023. The Company has identified a new vein in the Santa Elena mine, called Silvanna, and plans to drill test the area in 2023 with the goal of developing a mine plan to bring the vein into production by 2024.

A mine-by-mine breakdown of the 2023 production guidance is included in the table below. The Company reports cost guidance to reflect cash costs and AISC on a per AgEq payable ounce. For 2023, the Company is using an 84:1 silver to gold ratio compared to an 85:1 silver to gold ratio in its revised 2022 guidance. Metal price and foreign currency assumptions for calculating equivalents are silver: $21.50/oz, gold: $1,800/oz, MXN:USD 20:1.

GUIDANCE FOR FULL YEAR 2023

| | | | | | | | | | | | | | | | | |

| Silver Oz (M) | Gold Oz (k) | Silver Eqv Oz (M) | Cash Cost | AISC |

|

| Silver: | | | | ($ per AgEq oz) | ($ per AgEq oz) |

| San Dimas, Mexico | 6.4 – 7.2 | 72 – 81 | 12.5 – 14.0 | 9.62 – 10.19 | 13.02 – 13.91 |

| Santa Elena, Mexico | 0.7 – 0.7 | 86 – 95 | 7.8 – 8.7 | 11.59 – 12.21 | 14.60 – 15.53 |

| La Encantada, Mexico | 2.9 – 3.2 | – | 2.9 – 3.2 | 16.73 – 17.69 | 19.86 – 21.14 |

| Mexico Consolidated: | 10.0 – 11.1 | 158 – 176 | 23.2 – 25.9 | 12.12 – 12.77 | 16.69 – 17.83 |

| | | | | |

| Gold: | | | | ($ per AuEq oz) | ($ per AuEq oz) |

| Jerritt Canyon, USA | – | 119 – 133 | 10.0 – 11.2 | 1,502 – 1,592 | 1,733 – 1,842 |

| Total Production | | | | ($ per AgEq oz) | ($ per AgEq oz) |

| Consolidated* | 10.0 – 11.1 | 277 - 310 | 33.2 – 37.1 | 13.88 – 14.66 | 18.47 – 19.72 |

*Certain amounts shown may not add exactly to the total amount due to rounding differences.

*Cash Costs and AISC are non-GAAP measures and are not standardized financial measures under the Company's financial reporting framework. The Company calculates cash costs and consolidated AISC in the manner set out in the table below. These measures have been calculated on a basis consistent with historical periods. See “Non-GAAP Measures” on pages 42 to 51 for further details on each measure and a reconciliation of non-GAAP to GAAP measures.

The Company is projecting its 2023 AISC to be within a range of $18.47 to $19.72 on a per consolidated payable AgEq ounce basis. Excluding non-cash items, the Company anticipates its 2023 AISC to be within a range of $17.92 to $19.10 per payable AgEq ounce. An itemized AISC cost table is provided below:

| | | | | |

| FY 2023 |

| All-In Sustaining Cost Calculation |

| ($ per AgEq oz) |

| Total Cash Costs per Payable Silver Ounce | 13.88 – 14.66 |

| General and Administrative Costs | 0.98 – 1.09 |

| Sustaining Development Costs | 1.36 – 1.45 |

| Sustaining Property, Plant and Equipment Costs | 0.73 – 0.82 |

| |

| Profit Sharing | 0.57 – 0.63 |

| Share-based Payments (non-cash) | 0.39 – 0.43 |

| Lease Payments | 0.41 – 0.45 |

| Accretion and Reclamation Costs (non-cash) | 0.16 – 0.18 |

| All-In Sustaining Costs (Ag Eq Oz) | 18.47 – 19.72 |

| All-In Sustaining Costs: (Ag Eq Oz excluding non-cash items) | 17.92 – 19.10 |

| |

1.AISC is a non-GAAP measure and is calculated based on the Company’s consolidated operating performance. Other mining companies may calculate AISC differently as a result of differences in underlying accounting principles, the definition of “sustaining costs” and the distinction

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 10 |

between sustaining and expansionary capital costs. See “Non-GAAP Measures” on pages 42 to 51 for further details on each measure and a reconciliation of non-GAAP to GAAP measures.

2.Total cash cost per payable AgEq ounce includes estimated royalties and 0.5% Mexico mining environmental fee of $0.40 to $0.44 per payable AgEq ounce.

CAPITAL INVESTMENTS IN 2023

In 2023, the Company plans to invest a total of $187.8 million on capital expenditures consisting of $78.4 million for sustaining activities and $109.5 million for expansionary projects. This represents a 6% decrease compared to the 2022 revised capital expenditures and is aligned with the Company’s future growth strategy of increasing underground and plant processing rates at Jerritt Canyon, San Dimas and Santa Elena.

| | | | | | | | | | | |

| 2023 Capital Guidance ($millions) | Sustaining | Expansionary | Total |

| Underground Development | $51.2 | $43.6 | $94.8 |

| Exploration | 0.0 | 39.8 | 39.8 |

| Property, Plant and Equipment | 25.4 | 19.9 | 45.3 |

| Corporate Projects | 1.7 | 6.2 | 7.9 |

| Total* | $78.4 | $109.5 | $187.8 |

*Certain amounts shown may not add exactly to the total amount due to rounding differences.

The 2023 annual guidance includes total capital investments of $94.8 million to be spent on underground development; $45.3 million towards property, plant and equipment; $39.8 million in exploration; and $7.9 million towards corporate innovation projects. Management may revise the guidance during the year to reflect actual and anticipated changes in metal prices or to the business.

The Company plans to complete approximately 40,700 metres of underground development in 2023 compared to 45,614 metres completed in 2022. The 2023 development program consists of approximately 17,900 metres at San Dimas; 9,000 metres at Jerritt Canyon; 10,500 metres at Santa Elena and 3,300 metres at La Encantada. At San Dimas, the Company is planning to concentrate development metres in the Perez Vein, located in the Sinaloa Graben block, and continue development activities in the Noche Buena sector. At Santa Elena, underground development will focus exclusively in the Ermitaño mine to achieve 2,500 tonnes per day of underground ore extraction throughout all of 2023. At Jerritt Canyon, development activities will be focused in newly discovered areas within the Smith and SSX mines while also ramping up production at West Generator and Saval II mines. At La Encantada, the Company is developing the second levels of both the Ojuelas and Milagros orebodies for 2023 production.

The Company is planning approximately 245,350 metres of exploration drilling in 2023 compared to 248,124 metres completed in 2022. The 2023 drilling program is expected to consist of:

•At San Dimas, approximately 77,450 metres of drilling are planned with infill, step-out and exploratory holes focused on near mine and brownfield targets including major ore controlling structures in the West, Central, Sinaloa and Tayoltita blocks. Exploration efforts will focus on adding Inferred Resources along known veins and identifying new veins in locations where post mineral cover has deferred work to date.

•At Jerritt Canyon, approximately 112,900 metres are planned to drill a mixture of surface and underground infill, step-out, and exploratory holes to support the life of mine and test the presence of new ore bodies. Surface exploration will aim to test newly identified targets on the property, including follow up drilling from recent positive drill intercepts at Winters Creek and Waterpipe II. Underground drilling is planned for SSX, Smith and West Generator where the focus is to replicate the Smith Zone 10 success by targeting above the water table, near active development mineralization to facilitate a fast turnaround to mining.

•At Santa Elena, approximately 47,000 metres are planned with near mine drilling to continue testing the newly identified Silvanna vein in Santa Elena and infill drilling at the Ermitaño vein to convert Inferred Resources to Indicated Resources. Greenfield drilling at Santa Elena will focus on several targets within a 5-kilometre radius around the processing plant where the goal is to find a new mineralized vein. The Company is also planning to return to the Los Hernandez property, nearby to the Las Chispas mine, to test updated targets and projections of mineralized structures.

•Finally, at La Encantada the Company has planned approximately 8,000 metres to continue searching for a new mineralized breccia body as well as extend and de-risk some of the known veins and vein systems.

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 11 |

| | | | | |

| OVERVIEW OF OPERATING RESULTS |

Selected Production Results for the Past Eight Quarters | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2022 | | 2021 | | | | | | | | | | | |

| PRODUCTION HIGHLIGHTS | | Q4 | Q3 | Q2 | Q1 | | Q4 | Q3 | Q2(2) | Q1 | | | | | | | | | | | | | | | | | | |

| Ore processed/tonnes milled | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| San Dimas | | 210,108 | | 185,126 | | 197,102 | | 195,300 | | | 206,738 | | 214,205 | | 202,382 | | 199,466 | | | | | | | | | | | | | | | | | | | |

| Santa Elena | | 207,188 | | 214,387 | | 228,487 | | 201,911 | | | 224,459 | | 234,862 | | 234,381 | | 185,358 | | | | | | | | | | | | | | | | | | | |

| La Encantada | | 254,766 | | 255,945 | | 264,555 | | 249,906 | | | 268,239 | | 263,645 | | 242,839 | | 229,421 | | | | | | | | | | | | | | | | | | | |

| Jerritt Canyon | | 179,502 | | 181,056 | | 213,647 | | 230,001 | | | 256,374 | | 230,415 | | 146,611 | | — | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | | 851,564 | | 836,514 | | 903,791 | | 877,118 | | | 955,810 | | 943,126 | | 826,213 | | 614,245 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver equivalent ounces produced | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| San Dimas | | 3,054,098 | | 3,776,124 | | 3,046,664 | | 3,080,940 | | | 4,015,346 | | 3,422,032 | | 3,176,725 | | 2,910,946 | | | | | | | | | | | | | | | | | | | |

| Santa Elena | | 2,302,904 | | 2,733,761 | | 2,241,763 | | 1,868,787 | | | 1,955,550 | | 1,061,657 | | 1,140,398 | | 884,332 | | | | | | | | | | | | | | | | | | | |

| La Encantada | | 813,649 | | 788,872 | | 871,365 | | 651,875 | | | 768,796 | | 913,481 | | 847,502 | | 745,018 | | | | | | | | | | | | | | | | | | | |

| Jerritt Canyon | | 1,388,140 | | 1,467,435 | | 1,546,143 | | 1,620,400 | | | 1,821,331 | | 1,922,270 | | 1,270,398 | | — | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | | 7,558,791 | | 8,766,192 | | 7,705,935 | | 7,222,002 | | | 8,561,023 | | 7,319,441 | | 6,435,023 | | 4,540,296 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Silver ounces produced | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| San Dimas | | 1,392,506 | | 1,649,002 | | 1,527,465 | | 1,632,117 | | | 2,174,353 | | 1,888,371 | | 1,868,031 | | 1,716,143 | | | | | | | | | | | | | | | | | | | |

| Santa Elena | | 199,388 | | 308,070 | | 384,953 | | 337,201 | | | 426,870 | | 508,641 | | 565,453 | | 453,528 | | | | | | | | | | | | | | | | | | | |

| La Encantada | | 804,802 | | 779,028 | | 863,510 | | 644,009 | | | 757,586 | | 905,074 | | 840,541 | | 738,354 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | | 2,396,696 | | 2,736,100 | | 2,775,928 | | 2,613,327 | | | 3,358,809 | | 3,302,086 | | 3,274,026 | | 2,908,024 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gold ounces produced | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| San Dimas | | 20,257 | | 23,675 | | 18,354 | | 18,528 | | | 23,795 | | 20,767 | | 19,227 | | 17,448 | | | | | | | | | | | | | | | | | | | |

| Santa Elena | | 25,830 | | 26,989 | | 22,309 | | 19,556 | | | 19,810 | | 7,498 | | 8,453 | | 6,327 | | | | | | | | | | | | | | | | | | | |

| Jerritt Canyon | | 16,845 | | 16,299 | | 18,632 | | 20,707 | | | 23,660 | | 26,145 | | 18,762 | | — | | | | | | | | | | | | | | | | | | | |

| Consolidated | | 62,932 | | 66,963 | | 59,295 | | 58,791 | | | 67,265 | | 54,410 | | 46,442 | | 23,775 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash cost per Ounce(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| San Dimas (per AgEq Ounce) | | $ | 11.54 | | $ | 8.25 | | $ | 10.41 | | $ | 9.41 | | | $ | 7.98 | | $ | 8.29 | | $ | 10.17 | | $ | 10.00 | | | | | | | | | | | | | | | | | | | |

| Santa Elena (per AgEq Ounce) | | $ | 11.20 | | $ | 10.37 | | $ | 12.34 | | $ | 12.96 | | | $ | 11.56 | | $ | 17.09 | | $ | 16.70 | | $ | 20.18 | | | | | | | | | | | | | | | | | | | |

| La Encantada (per AgEq Ounce) | | $ | 15.48 | | $ | 15.55 | | $ | 14.09 | | $ | 16.41 | | | $ | 14.51 | | $ | 12.25 | | $ | 13.66 | | $ | 13.77 | | | | | | | | | | | | | | | | | | | |

| Jerritt Canyon (per Au Ounce) | | $ | 2,519 | | $ | 2,767 | | $ | 1,989 | | $ | 2,120 | | | $ | 1,674 | | $ | 1,735 | | $ | 1,407 | | $ | — | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated (per AgEq Ounce) | | $ | 15.36 | | $ | 13.34 | | $ | 14.12 | | $ | 14.94 | | | $ | 12.32 | | $ | 14.09 | | $ | 13.89 | | $ | 12.61 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

All-in sustaining cost per Ounce(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| San Dimas (per AgEq Ounce) | | $ | 16.79 | | $ | 10.97 | | $ | 14.97 | | $ | 12.98 | | | $ | 11.29 | | $ | 11.58 | | $ | 14.22 | | $ | 14.31 | | | | | | | | | | | | | | | | | | | |

| Santa Elena (per AgEq Ounce) | | $ | 12.75 | | $ | 12.29 | | $ | 15.34 | | $ | 16.31 | | | $ | 14.02 | | $ | 21.10 | | $ | 21.31 | | $ | 25.66 | | | | | | | | | | | | | | | | | | | |

| La Encantada (per AgEq Ounce) | | $ | 19.39 | | $ | 18.61 | | $ | 16.65 | | $ | 19.63 | | | $ | 19.41 | | $ | 15.28 | | $ | 15.97 | | $ | 16.30 | | | | | | | | | | | | | | | | | | | |

| Jerritt Canyon (per Au Ounce) | | $ | 2,865 | | $ | 3,317 | | $ | 2,429 | | $ | 2,488 | | | $ | 2,077 | | $ | 2,286 | | $ | 1,679 | | $ | — | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated (per AgEq Ounce) | | $ | 20.69 | | $ | 17.83 | | $ | 19.91 | | $ | 20.87 | | | $ | 17.26 | | $ | 19.93 | | $ | 19.42 | | $ | 19.35 | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Production cost per tonne | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| San Dimas | | $ | 162.68 | | $ | 161.41 | | $ | 155.09 | | $ | 143.66 | | | $ | 146.30 | | $ | 128.67 | | $ | 153.43 | | $ | 140.29 | | | | | | | | | | | | | | | | | | | |

| Santa Elena | | $ | 114.29 | | $ | 124.94 | | $ | 109.50 | | $ | 111.36 | | | $ | 93.78 | | $ | 75.76 | | $ | 79.17 | | $ | 94.15 | | | | | | | | | | | | | | | | | | | |

| La Encantada | | $ | 47.69 | | $ | 46.29 | | $ | 44.58 | | $ | 41.43 | | | $ | 39.70 | | $ | 41.08 | | $ | 45.71 | | $ | 42.99 | | | | | | | | | | | | | | | | | | | |

| Jerritt Canyon | | $ | 233.39 | | $ | 245.66 | | $ | 169.16 | | $ | 187.15 | | | $ | 151.23 | | $ | 192.17 | | $ | 177.30 | | $ | — | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | | $ | 131.41 | | $ | 135.07 | | $ | 114.55 | | $ | 118.51 | | | $ | 105.37 | | $ | 106.52 | | $ | 104.94 | | $ | 90.03 | | | | | | | | | | | | | | | | | | | |

1) Effective January 1, 2021, the Company is reporting its cash costs and all-in sustaining costs on a per silver equivalent ("AgEq") ounce basis. Cash cost and AISC per AgEq Ounce for previous comparative periods were updated based on the new metric. See “Non-GAAP Measures” on pages 42 to 51 for further details on each measure and a reconciliation of non-GAAP to GAAP measures.

2) Jerritt Canyon quarterly production was from April 30, 2021 to June 30, 2021, or 62 days.

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 12 |

Operating Results – Consolidated Operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED | | 2022-Q4 | 2022-Q3 | 2022-Q2 | 2022-Q1 | | | 2022-YTD | | 2021-YTD | | Change

Q4 vs Q3 | | Change

'22 vs '21 |

| | | | | | | | | | | | | | |

| Ore processed/tonnes milled | | 851,564 | 836,514 | 903,791 | 877,118 | | | 3,468,987 | | 3,339,394 | | 2 | % | | 4 | % |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Production | | | | | | | | | | | | | | |

| Silver ounces produced | | 2,396,696 | 2,736,100 | 2,775,928 | 2,613,327 | | | 10,522,051 | | 12,842,945 | | (12 | %) | | (18 | %) |

| | | | | | | | | | | | | | |

| Gold ounces produced | | 63,039 | 67,072 | 59,391 | 58,891 | | | 248,394 | | 192,353 | | (6 | %) | | 29 | % |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Silver equivalent ounces produced | | 7,558,791 | 8,766,192 | 7,705,935 | 7,222,002 | | | 31,252,920 | | 26,855,783 | | (14 | %) | | 16 | % |

| | | | | | | | | | | | | | |

| Cost | | | | | | | | | | | | | | |

| Cash cost per AgEq Ounce | | $15.36 | $13.34 | $14.12 | $14.94 | | | $14.39 | | $13.23 | | 15 | % | | 9 | % |

| All-in sustaining costs per AgEq ounce | | $20.69 | $17.83 | $19.91 | $20.87 | | | $19.74 | | $18.85 | | 16 | % | | 5 | % |

| Total production cost per tonne | | $131.41 | $135.07 | $114.55 | $118.51 | | | $124.64 | | $102.77 | | (3 | %) | | 21 | % |

| | | | | | | | | | | | | | |

| Underground development (m) | | 9,815 | 11,242 | 13,404 | 11,153 | | | 45,614 | | 50,558 | | (13 | %) | | (10 | %) |

| Exploration drilling (m) | | 16,086 | 80,370 | 76,444 | 75,225 | | | 248,123 | | 227,845 | | (80 | %) | | 9 | % |

Production

During the year, the Company produced 31.3 million silver equivalent ounces, consisting of 10.5 million ounces of silver and 248,394 ounces of gold, representing a decrease of 18% and an increase of 29% respectively, compared to the prior year. The decrease in silver production and increase in gold production was primarily due to lower-than-expected silver grades at San Dimas and prioritizing higher gold grade ores from the Ermitaño mine at Santa Elena.

Total production in the fourth quarter was 7.6 million silver equivalent ounces consisting of 2.4 million ounces of silver and 63,039 ounces of gold representing a 14% decrease when compared to the record production of 8.8 million AgEq ounces in the previous quarter. The production decrease was primarily due to lower production at San Dimas and Santa Elena, partially offset by higher gold production at Jerritt Canyon and higher silver production at La Encantada. During the quarter, AgEq production at San Dimas decreased 19% compared to the prior quarter, as a result of lower ore grades and higher dilution, combined with maintenance issues in the filtration plant during the month of December, which reduced planned throughput. Further, a 9% decrease in the AgEq conversion ratio compared to the prior quarter, contributed to a quarter-over-quarter decrease in the AgEq ounces produced.

Total ore processed amounted to 3.5 million tonnes during the year and 851,564 tonnes during the quarter, representing a 4% and 2% increase compared to the prior year and quarter, respectively. The Company completed the Dual Circuit project at the Santa Elena processing plant which includes an additional leaching tank, a fourth CCD thickener and the new 3,000 tpd tailings filter-press. Going forward, the Dual Circuit will be able to treat a higher volume of finer grind sized material which is expected to improve metallurgical recoveries, reduce moisture in the tailings and reduce material handling costs.

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 13 |

Cash Cost and All-In Sustaining Cost per Ounce

Cash cost per AgEq ounce for the year was $14.39 per ounce, compared to $13.23 per ounce in the previous year. The increase in cash cost per AgEq ounce was primarily due to lower than expected production at Jerritt Canyon and lower production at San Dimas in addition to increased costs due to inflation. These decreases in production were primarily attributed to lower head grade at both Jerritt Canyon and San Dimas. The increase in costs were partially offset by increased production from the Santa Elena operation driven by higher-grade ore from the Ermitaño mine and cost savings measures implemented throughout the Company in an effort to combat the impact of inflationary pressures on costs.

Cash cost per AgEq ounce for the quarter was $15.36 per ounce, compared to $13.34 per ounce in the previous quarter. The increase in cash costs per AgEq ounce was primarily attributed to a decrease in gold and silver ore grades and AgEq ounces produced at San Dimas and Santa Elena. This was partially offset by lower cash costs per ounce at Jerritt Canyon during the quarter, driven by higher gold production as the completion of the rehabilitation and restart at the West Generator mine at Jerritt Canyon allowed for improved ore production as well as cost saving measures implemented throughout the Company in an effort to combat the higher costs due to inflation.

All-in Sustaining Cost per AgEq ounce in the year was $19.74 per ounce compared to $18.84 per ounce in the previous year. The increase in AISC per AgEq ounce was primarily attributed to higher cash costs.

All-in Sustaining Cost per AgEq ounce in the fourth quarter was $20.69 per ounce compared to $17.83 per ounce in the previous quarter. The increase in AISC per AgEq ounce was primarily attributed to an increase in cash costs per AgEq ounce.

Management has developed a series of cost reduction initiatives across the organization to improve efficiencies, lower production costs, capital spending, care and maintenance holding costs and corporate G&A costs while also increasing production which includes:

•Renegotiating certain contracts and reducing the use of external consultants;

•Restructuring to optimize workforce and reduce labour costs;

•Optimizing use of reagent consumption;

•Conversion to LNG power versus diesel power with long-term contracts;

•Increasing metal production at Santa Elena by leveraging the higher grade of the Ermitaño ore while exploration activities continue in the Santa Elena mine to better define mineralized structures like Silvanna;

•Completing the Dual Circuit project at Santa Elena to improve metal recovery rates and allow higher plant throughput;

•Improving dilution controls at San Dimas and prioritizing long hole stoping of the Jessica and Regina veins which is expected to improve ore grade and production and continue developing the Perez vein;

•Continue developing the newly identified Zone 10 in the Smith mine and increasing throughput from the rehabilitation and restart of the West Generator and Saval II mines at Jerritt Canyon which is expected to increase ore volume and improve ore grades while reducing the planned maintenance downtime at the plant; and

•Advancing mining at La Encantada towards the Ojuelas and Beca-Zone orebodies to extract higher-grade ores.

Development and Exploration

During the year, the Company completed 45,614 metres of underground development and 248,123 metres of exploration drilling, compared to 50,558 metres and 227,845 metres, respectively, in the previous year.

During the quarter, the Company completed 9,815 metres of underground development and 16,086 metres of exploration drilling, compared to 11,242 metres and 80,370 metres, respectively, in the previous quarter. Throughout the quarter a total of 10 drill rigs were active consisting of four rigs at San Dimas, two rigs at Jerritt Canyon, three rigs at Santa Elena and one rig at La Encantada.

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 14 |

San Dimas Silver/Gold Mine, Durango, México

The San Dimas Silver/Gold Mine is located approximately 130 km northwest of Durango, Durango State, Mexico and consists of 71,868 hectares of mining claims located in the states of Durango and Sinaloa, Mexico. San Dimas is one of the country’s most prominent silver and gold mines and the largest producing underground mine in the state of Durango with over 250 years of operating history. The San Dimas operating plan involves processing ore from several underground mining areas with a 2,500 tpd capacity milling operation which produces silver/gold doré bars. The mine is accessible via a 40-minute flight from the Durango International Airport to the private airstrip in the town of Tayoltita, or by improved roadway. The Company owns 100% of the San Dimas mine.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| San Dimas | 2022-Q4 | 2022-Q3 | 2022-Q2 | 2022-Q1 | | | | 2022-YTD | | 2021 YTD | | Change

Q4 vs Q3 | | | Change

'22 vs '21 | |

| | | | | | | | | | | | | | | | |

| Total ore processed/tonnes milled | 210,108 | 185,126 | 197,102 | 195,300 | | | | 787,636 | | 822,791 | | 13 | % | | | (4 | %) | |

| Average silver grade (g/t) | 220 | 289 | 257 | 282 | | | | 261 | | 305 | | (24 | %) | | | (14 | %) | |

| Average gold grade (g/t) | 3.12 | 4.10 | 3.01 | 3.09 | | | | 3.31 | | 3.19 | | (24 | %) | | | 4 | % | |

| Silver recovery (%) | 94 | % | 96 | % | 94 | % | 92 | % | | | | 94 | % | | 95 | % | | (2 | %) | | | (1 | %) | |

| Gold recovery (%) | 96 | % | 97 | % | 96 | % | 96 | % | | | | 96 | % | | 96 | % | | (1 | %) | | | 0 | % | |

| | | | | | | | | | | | | | | | |

| Production | | | | | | | | | | | | | | | | |

| Silver ounces produced | 1,392,506 | 1,649,002 | 1,527,465 | 1,632,117 | | | | 6,201,090 | | 7,646,898 | | (16 | %) | | | (19 | %) | |

| Gold ounces produced | 20,257 | 23,675 | 18,354 | 18,528 | | | | 80,814 | | 81,237 | | (14 | %) | | | (1 | %) | |

| Silver equivalent ounces produced | 3,054,098 | 3,776,124 | 3,046,664 | 3,080,940 | | | | 12,957,826 | | 13,525,049 | | (19 | %) | | | (4 | %) | |

| | | | | | | | | | | | | | | | |

| Cost | | | | | | | | | | | | | | | | |

| Cash cost per AgEq Ounce | $11.54 | $8.25 | $10.41 | $9.41 | | | | $9.81 | | $9.01 | | 40 | % | | | 9 | % | |

| All-In sustaining costs per AgEq Ounce | $16.79 | $10.97 | $14.97 | $12.98 | | | | $13.76 | | $12.70 | | 53 | % | | | 8 | % | |

| Total production cost per tonne | $162.68 | $161.41 | $155.09 | $143.66 | | | | $155.76 | | $142.00 | | 1 | % | | | 10 | % | |

| | | | | | | | | | | | | | | | |

| Underground development (m) | 4,451 | 4,209 | 5,856 | 6,005 | | | | 20,521 | | 25,220 | | 6 | % | | | (19 | %) | |

| Exploration drilling (m) | 8,799 | 14,292 | 22,356 | 19,344 | | | | 64,791 | | 99,825 | | (38 | %) | | | (35 | %) | |

2022 vs. 2021

In 2022, San Dimas produced 6,201,090 ounces of silver and 80,814 ounces of gold for a total production of 12,957,826 silver equivalent ounces, a 4% decrease compared to 13,525,049 silver equivalent ounces in 2021. The mill processed a total of 787,636 tonnes, a 4% decrease compared to 822,791 tonnes processed in the previous year.

During the year, silver and gold grades averaged 261 g/t and 3.31 g/t, respectively, compared to 305 g/t and 3.19 g/t in the previous year. Silver recoveries averaged 94% compared to 95% in 2021, while gold recoveries averaged 96%, which was consistent with 2021. Silver and gold grades were lower in 2022 compared to 2021 due to higher dilution from the long hole stopes in the Jessica Vein during the first half of the year. The Company has developed a series of initiatives in San Dimas to improve dilution controls and prioritizing long hole stoping of the Jessica and Regina veins to improve ore grade and production.

During the year, cash cost per AgEq ounce averaged $9.81 compared to $9.01 per ounce in 2021. AISC averaged $13.76 per ounce in 2022 compared to $12.70 per ounce in 2021. The increase in cash costs and AISC during the year was primarily due to a 4% decrease in silver equivalent ounces produced.

The San Dimas mine is subject to a gold and silver streaming agreement with Wheaton Precious Metals Corp. ("Wheaton" or "WPM") which entitles Wheaton to receive 25% of the gold equivalent production (based on a fixed exchange ratio of 70 silver ounces to 1 gold ounce) at San Dimas in exchange for ongoing payments equal to the lesser of $600 (subject to a 1% annual inflation adjustment commencing in May 2019) and the prevailing market price, for each gold ounce delivered. Should the average gold to silver ratio over a six-month period exceed 90:1 or fall below 50:1, the fixed exchange ratio

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 15 |

would be increased to 90:1 or decreased to 50:1, respectively. The fixed gold to silver exchange ratio as at December 31, 2022 was 70:1. During the year ended December 31, 2022, the Company delivered 41,841 ounces (2021 - 48,015 ounces) of gold to WPM at $623 per ounce (2021 - $617 per ounce).

During the year, a total of 20,521 metres of underground development and 64,791 metres of exploration drilling were completed compared to 25,220 metres and 99,825 metres, respectively, in the prior year.

2022 Q4 vs. 2022 Q3

During the fourth quarter, San Dimas produced 3,054,098 silver equivalent ounces consisting of 1,392,506 ounces of silver and 20,257 ounces of gold, representing decreases of 16% and 14%, respectively, when compared to the prior quarter.

The mill processed a total of 210,108 tonnes of ore with average silver and gold grades of 220 g/t and 3.12 g/t, respectively, compared to 185,126 tonnes milled with average silver and gold grades of 289 g/t and 4.10 g/t, in the previous quarter. Silver and gold grades were lower in the fourth quarter primarily due to the processing of lower grade development ores from the Perez vein and higher tonnages from underground areas with challenging ground conditions within the Jessica and Regina veins in the Noche Buena area.

Silver and gold recoveries averaged 94% and 96%, respectively, compared to 96% and 97% in the prior quarter.

The Central Block and Sinaloa Graben areas contributed approximately 75% and 25%, respectively, of the total production during the quarter.

In the fourth quarter, cash cost per AgEq ounce was $11.54 per ounce compared to $8.25 per ounce in the prior quarter. The increase in cash costs during the quarter was primarily due to a 19% decrease in silver equivalent ounces produced, which was partially offset by lower operating expenses during the quarter.

AISC per AgEq ounce for the quarter was $16.79 per ounce compared to $10.97 per ounce in the prior quarter. The increase was primarily due to an increase in cash costs per AgEq ounce along with an increase in worker participation costs in the fourth quarter of the year.

A total of 4,451 metres of underground development was completed in the fourth quarter, compared to 4,209 metres in the prior quarter. During the fourth quarter, a total of four underground drill rigs were active on the property and completed 8,799 metres of exploration drilling compared to 14,292 metres in the prior quarter.

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 16 |

Santa Elena Silver/Gold Mine, Sonora, México

The Santa Elena Silver/Gold Mine is located approximately 150 kilometres northeast of the city of Hermosillo, Sonora, Mexico. The operating plan for Santa Elena involves the processing of ore in a 3,000 tpd cyanidation circuit from a combination of underground reserves. The Company owns 100% of the Santa Elena mine including mining concessions totaling over 102,244 hectares.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SANTA ELENA | 2022-Q4 | 2022-Q3 | 2022-Q2 | 2022-Q1 | | | | 2022-YTD | | 2021-YTD | | Change

Q4 vs Q3 | | | Change

'22 vs '21 | | |

| | | | | | | | | | | | | | | | | |

| Total ore processed/tonnes milled | 207,188 | 214,387 | 228,487 | 201,911 | | | | 851,973 | | 879,060 | | (3 | %) | | | (3 | %) | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Average silver grade (g/t) | 47 | 62 | 67 | 69 | | | | 61 | | 77 | | (24 | %) | | | (21 | %) | | |

| Average gold grade (g/t) | 4.33 | 4.26 | 3.26 | 3.18 | | | | 3.75 | | 1.58 | | 2 | % | | | 137 | % | | |

| Silver recovery (%) | 64 | % | 72 | % | 78 | % | 76 | % | | | | 73 | % | | 90 | % | | (11 | %) | | | (19 | %) | | |

| Gold recovery (%) | 90 | % | 92 | % | 93 | % | 95 | % | | | | 92 | % | | 94 | % | | (2 | %) | | | (2 | %) | | |

| | | | | | | | | | | | | | | | | |

| Production | | | | | | | | | | | | | | | | | |

| Silver ounces produced | 199,388 | 308,070 | 384,953 | 337,201 | | | | 1,229,612 | | 1,954,492 | | (35 | %) | | | (37 | %) | | |

| Gold ounces produced | 25,830 | 26,989 | 22,309 | 19,556 | | | | 94,684 | | 42,088 | | (4 | %) | | | 125 | % | | |

| Silver equivalent ounces produced | 2,302,904 | 2,733,761 | 2,241,763 | 1,868,787 | | | | 9,147,215 | | 5,041,937 | | (16 | %) | | | 81 | % | | |

| | | | | | | | | | | | | | | | | |

| Cost | | | | | | | | | | | | | | | | | |

| Cash cost per AgEq Ounce | $11.20 | $10.37 | $12.34 | $12.96 | | | | $11.59 | | $15.40 | | 8 | % | | | (25 | %) | | |

| All-In sustaining costs per AgEq Ounce | $12.75 | $12.29 | $15.34 | $16.31 | | | | $13.97 | | $19.20 | | 4 | % | | | (27 | %) | | |

| Total production cost per tonne | $114.29 | $124.94 | $109.50 | $111.36 | | | | $114.99 | | $85.15 | | (9 | %) | | | 35 | % | | |

| | | | | | | | | | | | | | | | | |

| Underground development (m) | 2,299 | 3,201 | 4,381 | 3,043 | | | | 12,924 | | 18,119 | | (28 | %) | | | (29 | %) | | |

| Exploration drilling (m) | 2,232 | 8,438 | 19,079 | 13,241 | | | | 42,990 | | 63,977 | | (74 | %) | | | (33 | %) | | |

2022 vs. 2021

In 2022, Santa Elena produced 1,229,612 ounces of silver and 94,684 ounces of gold for a total production of 9,147,215 AgEq ounces, a 81% increase compared to 5,041,937 AgEq ounces in 2021. The mill processed a total of 851,973 tonnes of ore compared to 879,060 tonnes in the previous year, representing a 3% decrease compared to 2021. Overall metal production in 2022 increased compared to the prior year primary due to ore from the Ermitaño mine contributing more than 60% of the 2022 plant feed, as the Ermitaño mine went into production in the fourth quarter of 2021.

Silver and gold grades from Santa Elena averaged 61 g/t and 3.75 g/t, respectively, compared to 77 g/t and 1.58 g/t in the previous year as higher volume of ore was processed from the Ermitaño mine which contains lower silver grades but much higher gold grades than ore from other deposits at Santa Elena. Silver recoveries decreased from 90% in 2021 to 73% in 2022 while gold recoveries decreased from 94% to 92% in the current year. The Company completed the dual-circuit project at the Santa Elena processing plant during the fourth quarter which includes an additional leaching tank, a fourth CCD thickener and the new 3,000 tpd tailings filter-press. Going forward, the Dual Circuit will be able to treat higher volumes of finer grind sized material which is expected to improve metallurgical recoveries, reduce moisture in the tailings and reduce material handling costs.

During the year, the Company successfully expanded Santa Elena’s liquid natural gas (“LNG”) powerplant from 12 MW to 24 MW to supply lower-cost and cleaner power to the Ermitaño mine. The connection, which joined Ermitaño to Santa Elena's LNG powerplant was completed in September allowing the mine to run on 100% LNG power for the first time and eliminated the use of temporary diesel generators.

During the year, cash cost per AgEq ounce averaged $11.59 compared to $15.40 per ounce in 2021, representing a decrease of 25% while AISC averaged $13.97 per AgEq ounce compared to $19.20 per AgEq ounce in the previous year, a decrease of 27%. The decrease in cash costs and AISC was primarily attributed to an 81% increase in AgEq ounces produced compared

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 17 |

to the previous year, along with cost savings measures implemented in an effort to combat the impact of inflationary pressures on costs.

The Santa Elena mine is subject to a gold streaming agreement with Sandstorm Gold Ltd. (“Sandstorm”), which requires the mine to sell 20% of its gold production from the leach pad and a designated area of its underground operations over the life of mine to Sandstorm. The selling price to Sandstorm is currently the lesser of $450 per ounce (subject to a 1% annual inflation increase every April) and the prevailing market price. During the year ended December 31, 2022, the Company delivered 2,433 ounces of gold (2021 - 5,327 ounces) to Sandstorm at an average price of $472 per ounce (2021 - $467 per ounce).

Orogen Royalties Inc., formerly Evrim Resource Corp., retains a 2% net smelter return ("NSR") royalty from the sale of mineral products extracted from the Ermitaño mining concessions. In addition, there is an underlying NSR royalty where Osisko Gold Royalties Ltd. retains a 2% NSR from the sale of mineral products extracted from the Ermitaño mining concessions. During the year ended December 31, 2022, the Company has incurred $5.8 million (December 31, 2021 - $1 million) in NSR payments from the production of Ermitaño.

During the year, a total of 12,924 metres of underground development and 42,990 metres of exploration drilling were completed compared to 18,119 metres of underground development and 63,977 metres of exploration drilling in the prior year.

2022 Q4 vs. 2022 Q3

During the fourth quarter, Santa Elena produced 2,302,904 AgEq ounces consisting of 199,388 ounces of silver and 25,830 ounces of gold representing a 35% decrease in silver ounces and a 4% decrease in gold ounces when compared to the prior quarter. The decrease in silver production was primarily due to processing a higher percentage of ore from the Ermitaño mine with higher gold grades than the Santa Elena mine.

The mill processed 207,188 tonnes of ore during the quarter consisting of 41,953 tonnes (20% of total) from Santa Elena and 165,235 tonnes (80% of total) from Ermitaño, compared to 214,387 tonnes in the prior quarter.

Silver and gold grades from Santa Elena averaged 47 g/t and 4.33 g/t, respectively, compared to 62 g/t and 4.26 g/t in the previous quarter.

Silver and gold recoveries in the fourth quarter averaged 64% and 90%, respectively, compared to 72% and 92%, respectively, in the prior quarter. The Company completed the dual-circuit project at the Santa Elena processing plant which includes an additional leaching tank, a fourth CCD thickener and the new 3,000 tpd tailings filter-press. Going forward, the Dual Circuit will be able to treat finer grind sized material which is expected to improve metallurgical recoveries, reduce moisture in the tailings and reduce material handling costs.

Cash cost per AgEq ounce in the fourth quarter was $11.20 per ounce compared to $10.37 per ounce in the previous quarter. The increase in cash cost was primarily attributed to a 16% decrease in AgEq ounces produced compared to the previous quarter.

AISC per AgEq ounce for the quarter was $12.75 per ounce compared to $12.29 per ounce in the prior quarter. The increase in AISC was primarily driven by the increase in cash costs per AgEq ounce.

In October 2022, the Santa Elena operation has been awarded the prestigious “Silver Helmet Award” in the category of “Underground Mining of More Than 500 Workers” by the Mining Chamber of Mexico for its outstanding performance in occupational safety and health. The distinguished annual award of excellence is only awarded to a select handful of miners in Mexico.

In the fourth quarter, Santa Elena completed a total of 2,299 metres of underground development, compared to 3,201 metres in the previous quarter. A total of three drill rigs consisting of two surface rigs and one underground rig, were active at the end of the quarter, completing 2,232 metres of exploration drilling compared to 8,438 metres in the prior quarter.

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 18 |

La Encantada Silver Mine, Coahuila, México

The La Encantada Silver Mine is an underground mine located in the northern México State of Coahuila, 708 kilometres northeast of Torreon. La Encantada has 4,076 hectares of mineral concessions and surface land ownership of 1,343 hectares. La Encantada also has a 4,000 tpd cyanidation plant, a camp with 120 houses as well as administrative offices, laboratory, general store, hospital, airstrip and all the necessary infrastructure required for such an operation. The mine is accessible via a two-hour flight from the Durango International Airport to the mine’s private airstrip, or via an improved road from the closest city, Muzquiz, Coahuila State, which is 225 kilometres away. The Company owns 100% of the La Encantada Silver Mine.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| LA ENCANTADA | 2022-Q4 | 2022-Q3 | 2022-Q2 | 2022-Q1 | | | | 2022-YTD | | 2021-YTD | | Change

Q4 vs Q3 | | | Change

'22 vs '21 | |

| | | | | | | | | | | | | | | | |

| Ore processed/tonnes milled | 254,766 | 255,945 | 264,555 | 249,906 | | | | 1,025,172 | | 1,004,144 | | 0 | % | | | 2 | % | |

| Average silver grade (g/t) | 120 | 121 | 141 | 108 | | | | 123 | | 130 | | 0 | % | | | (5 | %) | |

| Silver recovery (%) | 82 | % | 78 | % | 72 | % | 74 | % | | | | 76 | % | | 77 | % | | 4 | % | | | (1 | %) | |

| | | | | | | | | | | | | | | | |

| Production | | | | | | | | | | | | | | | | |

| Silver ounces produced | 804,802 | 779,028 | 863,510 | 644,009 | | | | 3,091,349 | | 3,241,555 | | 3 | % | | | (5 | %) | |

| Gold ounces produced | 107 | 109 | 96 | 100 | | | | 413 | | 460 | | (2 | %) | | | (10 | %) | |

| Silver equivalent ounces produced | 813,649 | 788,872 | 871,365 | 651,875 | | | | 3,125,761 | | 3,274,798 | | 3 | % | | | (5 | %) | |

| | | | | | | | | | | | | | | | |

| Cost | | | | | | | | | | | | | | | | |

| Cash cost per AgEq Ounce | $15.48 | $15.55 | $14.09 | $16.41 | | | | $15.30 | | $13.49 | | 0 | % | | | 13 | % | |

| All-In sustaining costs per AgEq Ounce | $19.39 | $18.61 | $16.65 | $19.63 | | | | $18.48 | | $16.66 | | 4 | % | | | 11 | % | |

| Total production cost per tonne | $47.69 | $46.29 | $44.58 | $41.43 | | | | $45.01 | | $42.25 | | 3 | % | | | 7 | % | |

| | | | | | | | | | | | | | | | |

| Underground development (m) | 903 | 552 | 590 | 510 | | | | 2,555 | | 3,304 | | 64 | % | | | (23 | %) | |

| Exploration drilling (m) | 870 | 3,926 | 3,942 | 1,284 | | | | 10,020 | | 15,373 | | (78%) | | | | (35%) | | |

2022 vs. 2021

In 2022, La Encantada produced 3,091,349 ounces of silver and 413 ounces of gold for a total of 3,125,761 AgEq ounces, a decrease of 5% compared to 3,274,798 AgEq ounces in 2021. The decrease was primarily due to a 5% decrease in silver head grade and a 1% decrease in silver recovery, partially offset by a 2% increase in tonnes milled.

Silver recoveries averaged 76% during the year, compared to 77% in 2021. Silver grades during the year averaged 123 g/t, a decrease of 5% compared to 130 g/t in 2021. The Company began processing development ores from the Beca-Zone orebody in the fourth quarter and expects to begin stope production to access higher grade ore in the second quarter of 2023.

During the year, cash cost per AgEq ounce averaged $15.30 compared to $13.49 per ounce in 2021, and AISC averaged $18.48 per ounce in 2022 compared to $16.66 per ounce in 2021. The increase in cash costs per AgEq ounce during the year was primarily due to the 5% decrease in silver equivalent ounces produced driven by a 5% decrease in recovery. The increase in AISC per AgEq ounce for the year was due to higher cash costs incurred during the year.

A total of 2,555 metres of underground development and 10,020 metres of exploration drilling were completed in 2022 compared to 3,304 metres of underground development and 15,373 metres of exploration drilling in the prior year.

On November 28, 2022, the Company announced that it had agreed to sell a portfolio of royalty interests to Metalla Royalty & Streaming Ltd. ("Metalla") in exchange for common shares of Metalla having an aggregate value of US$20 million. The royalty portfolio includes a 100% gross value royalty ("GVR") on gold produced at the La Encantada Silver Mine. The GVR is limited to the first 1,000 ounces of gold produced at La Encantada annually. Pursuant to the GVR, the Company has agreed to pay Metalla an amount equal to the fair market value of the first 1,000 ounces of gold produced from La Encantada each year (determined using the average London Bullion Market Association's LBMA Gold Price during the applicable payment

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 19 |

period) less the amount of any refining costs, which may not exceed 5% of the fair market value of the gold. The transaction completed on December 21, 2022 and, during the year ended December 31, 2022, the Company paid a total of $nil on account of the GVR (2021 - $nil).

2022 Q4 vs. 2022 Q3

During the quarter, La Encantada produced 804,802 silver ounces compared to 779,028 silver ounces in the previous quarter, representing a 3% increase in production primarily due to a 4% increase in silver recoveries.

The mill processed a total of 254,766 tonnes of ore with an average silver grade and recovery during the quarter of 120 g/t and 82%, respectively, compared to 255,945 tonnes, 121 g/t and 78%, respectively, in the previous quarter. The Company began processing development ores from the Beca-Zone orebody in the quarter and expects to begin stope production to access higher grade ore in the second quarter of 2023.

Cash cost per AgEq ounce for the quarter was $15.48, which was consistent with the prior quarter. AISC per AgEq ounce for the quarter was $19.39 per ounce compared to $18.61 per ounce in the previous quarter. The 4% increase in AISC per AgEq ounce during the quarter was primarily due to an increase in sustaining capital expenditures during the quarter.

During the quarter, one underground rig completed 870 metres of drilling compared to 3,926 metres in the previous quarter. A total of 903 metres of underground development was completed in the fourth quarter compared to 552 metres in the prior quarter.

| | | | | | | | |

|

| First Majestic Silver Corp. 2022 Annual Report | Page 20 |

Jerritt Canyon Gold Mine, Nevada, United States

The Jerritt Canyon Gold mine is an underground mine located in Northern Nevada, United States. Jerritt Canyon was discovered in 1972 and has been in production since 1981 having produced over 9.5 million ounces of gold over its 40-year production history. The mine was purchased by the Company on April 30, 2021, and currently operates as an underground mine and has one of three permitted gold processing plants in Nevada that uses roasting in its treatment of ore. This processing plant has a capacity of 4,000 tonnes per day (“tpd”). The property consists of a large, under explored land package consisting of 30,821 hectares (119 square miles). Jerritt Canyon is 100% owned by the Company.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Jerritt Canyon | 2022-Q4 | 2022-Q3 | 2022-Q2 | 2022-Q1 | | | | | | 2022-YTD | | 2021-YTD | | Change

Q4 vs Q3 | | Change

'22 vs '21 |

| | | | | | | | | | | | | | | | |

| Ore processed/tonnes milled | 179,502 | 181,056 | 213,647 | 230,001 | | | | | | 804,206 | | 633,400 | | (1 | %) | | 27 | % |