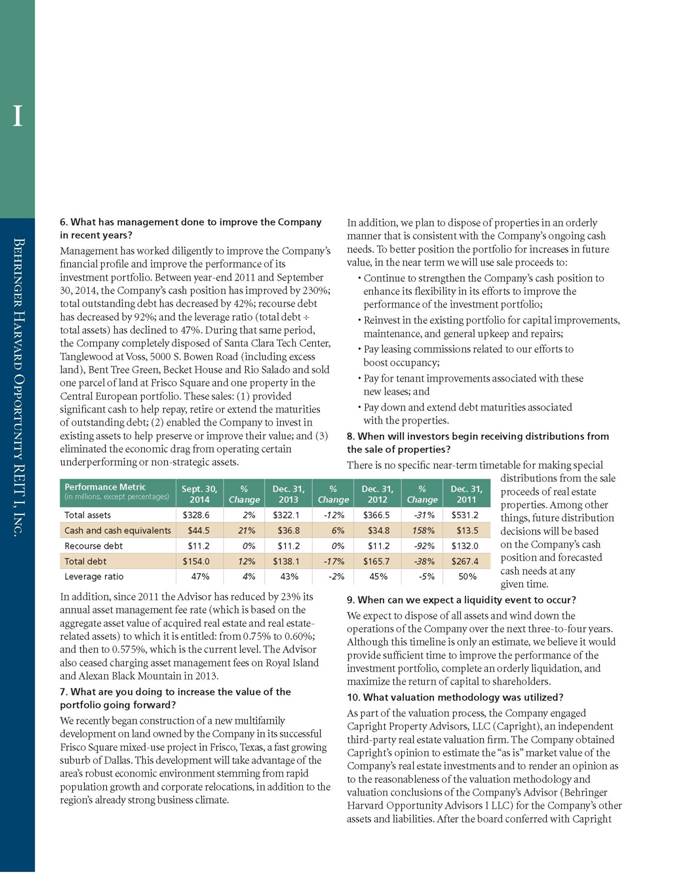

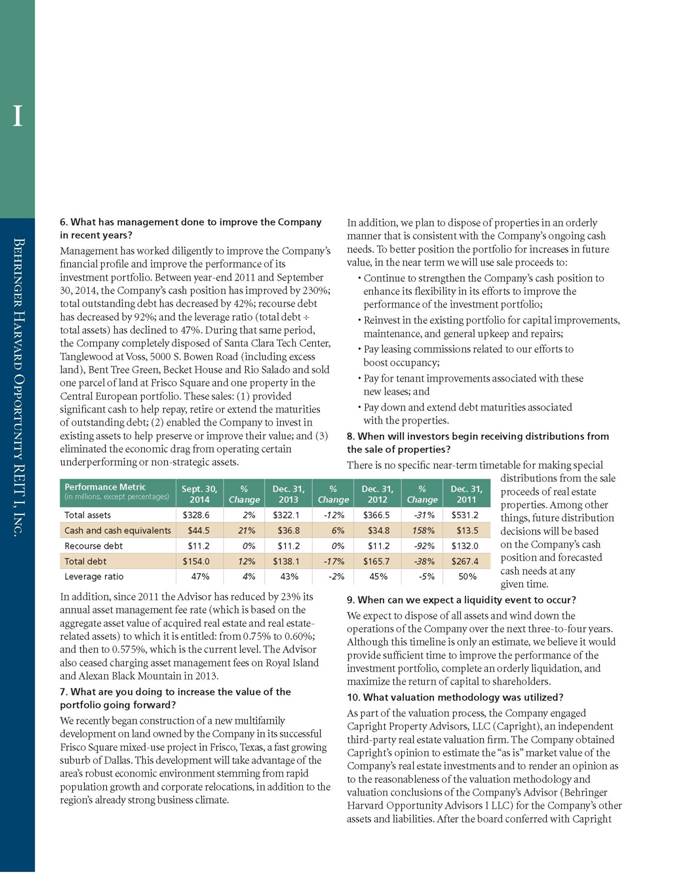

| 6. What has management done to improve the Company in recent years? Management has worked diligently to improve the Company’s financial profile and improve the performance of its investment portfolio. Between year-end 2011 and September 30, 2014, the Company’s cash position has improved by 230%; total outstanding debt has decreased by 42%; recourse debt has decreased by 92%; and the leverage ratio (total debt ÷ total assets) has declined to 47%. During that same period, the Company completely disposed of Santa Clara Tech Center, Tanglewood at Voss, 5000 S. Bowen Road (including excess land), Bent Tree Green, Becket House and Rio Salado and sold one parcel of land at Frisco Square and one property in the Central European portfolio. These sales: (1) provided significant cash to help repay, retire or extend the maturities of outstanding debt; (2) enabled the Company to invest in existing assets to help preserve or improve their value; and (3) eliminated the economic drag from operating certain underperforming or non-strategic assets. In addition, since 2011 the Advisor has reduced by 23% its annual asset management fee rate (which is based on the aggregate asset value of acquired real estate and real estate- related assets) to which it is entitled: from 0.75% to 0.60%; and then to 0.575%, which is the current level. The Advisor also ceased charging asset management fees on Royal Island and Alexan Black Mountain in 2013. 7. What are you doing to increase the value of the portfolio going forward? We recently began construction of a new multifamily development on land owned by the Company in its successful Frisco Square mixed-use project in Frisco, Texas, a fast growing suburb of Dallas. This development will take advantage of the area’s robust economic environment stemming from rapid population growth and corporate relocations, in addition to the region’s already strong business climate. In addition, we plan to dispose of properties in an orderly manner that is consistent with the Company’s ongoing cash needs. To better position the portfolio for increases in future value, in the near term we will use sale proceeds to: • Continue to strengthen the Company’s cash position to enhance its flexibility in its efforts to improve the performance of the investment portfolio; • Reinvest in the existing portfolio for capital improvements, maintenance, and general upkeep and repairs; • Pay leasing commissions related to our efforts to boost occupancy; • Pay for tenant improvements associated with these new leases; and • Pay down and extend debt maturities associated with the properties. 8. When will investors begin receiving distributions from the sale of properties? There is no specific near-term timetable for making special distributions from the sale proceeds of real estate properties. Among other things, future distribution decisions will be based on the Company’s cash position and forecasted cash needs at any given time. 9. When can we expect a liquidity event to occur? We expect to dispose of all assets and wind down the operations of the Company over the next three-to-four years. Although this timeline is only an estimate, we believe it would provide sufficient time to improve the performance of the investment portfolio, complete an orderly liquidation, and maximize the return of capital to shareholders. 10. What valuation methodology was utilized? As part of the valuation process, the Company engaged Capright Property Advisors, LLC (Capright), an independent third-party real estate valuation firm. The Company obtained Capright’s opinion to estimate the “as is” market value of the Company’s real estate investments and to render an opinion as to the reasonableness of the valuation methodology and valuation conclusions of the Company’s Advisor (Behringer Harvard Opportunity Advisors I LLC) for the Company’s other assets and liabilities. After the board conferred with Capright I Behringer Harvard Opportunity REIT I, Inc. Performance Metric (in millions, except percentages) Sept. 30, 2014 % Change Dec. 31, 2013 % Change Dec. 31, 2012 % Change Dec. 31, 2011 Total assets $328.6 2% $322.1 -12% $366.5 -31% $531.2 Cash and cash equivalents $44.5 21% $36.8 6% $34.8 158% $13.5 Recourse debt $11.2 0% $11.2 0% $11.2 -92% $132.0 Total debt $154.0 12% $138.1 -17% $165.7 -38% $267.4 Leverage ratio 47% 4% 43% -2% 45% -5% 50% FOR BROKER-DEALER USE ONLY Ameriprise Financial Use Only Registered Representatives Use Only |