Exhibit 99.1

The “New” DryShipsDryShips Inc. NASDAQ: DRYS Investor Presentation – Capital Link ConferenceMarch 12, 2018

Disclaimer About this PresentationThis presentation (this “Presentation”) has been prepared by DryShips Inc. (the “Company”) and is provided solely for the purposes set forth herein and does not purport to give a complete description of the Company, its business or any other matter described herein. Neither the U.S. Securities and Exchange Commission (“SEC”) nor any securities regulatory body of any state or other jurisdiction of the United States of America, nor any securities regulatory body of any other country or subdivision thereof, has passed on the accuracy or adequacy of the contents of this Presentation. Any representation to the contrary is unlawful.Furthermore, this Presentation contains certain tables and other statistical analyses (the “Statistical Information”). Numerous assumptions were used in preparing the Statistical Information, which may not be reflected herein. Certain Statistical Information is derived from estimates and subjective judgments made by third parties. As such, no assurance can be given as to the accuracy, appropriateness or completeness of the Statistical Information as used in any particular context; nor as to whether the Statistical Information and/or the judgments and assumptions upon which they are based reflect present market conditions or future market performance.Forward-Looking StatementsMatters discussed in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. The Company desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection with such safe harbor legislation.Forward-looking statements concern future circumstances and results and other statements that are not historical facts, sometimes identified by the words “will,” “believes”, expects”, “predicts”, “intends”, “projects”, “plans”, “estimates”, “aims”, “foresees”, “anticipates”, “targets”, and similar expressions. The forward-looking statements in this Presentation are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management’s examination of historical operating trends, data contained in the Company’s records and other data available from third parties. Although the Company believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies that are difficult or impossible to predict and are beyond the Company’s control, the Company cannot assure you that it will achieve or accomplish these expectations, beliefs or projections. Forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. The Company’s actual results may differ materially from those discussed in the forward-looking statements. Important factors that, in the Company’s view, could cause actual results to differ materially from those discussed in the forward-looking statements include the completion of the spin-off of the Company’s gas business, the strength of world economies and currencies, general market conditions, including changes in charter rates, utilization of vessels and vessel values, failure of a seller or shipyard to deliver one or more vessels, failure of a buyer to accept delivery of a vessel, the Company’s inability to procure acquisition financing, default by one or more charterers of the Company’s ships, changes in demand for drybulk, oil or natural gas commodities, changes in demand that may affect attitudes of time charterers, scheduled and unscheduled drydockings, changes in the Company’s voyage and operating expenses, including bunker prices, dry-docking and insurance costs, changes in governmental rules and regulations, changes in the Company’s relationships with the lenders under its debt agreements, potential liability from pending or future litigation, domestic and international political conditions, potential disruption of shipping routes due to accidents, international hostilities and political events or acts by terrorists.Risks and uncertainties are further described in reports filed by the Company with the SEC, including the Company’s most recently filed Annual Report on Form 20-F.No UpdatesUnless otherwise specified all information in this Presentation is as of the date of this Presentation. Neither the delivery of this Presentation nor any other communication with you shall, under any circumstances, create any implication that there has been no change in the Company’s affairs since such date. Except as otherwise noted herein, the Company does not intend to, nor will it assume any obligation to, update this Presentation or any of the information included herein. 2

Agenda 3 Financial Highlights & Company Update Industry Overview DRYS looking forward

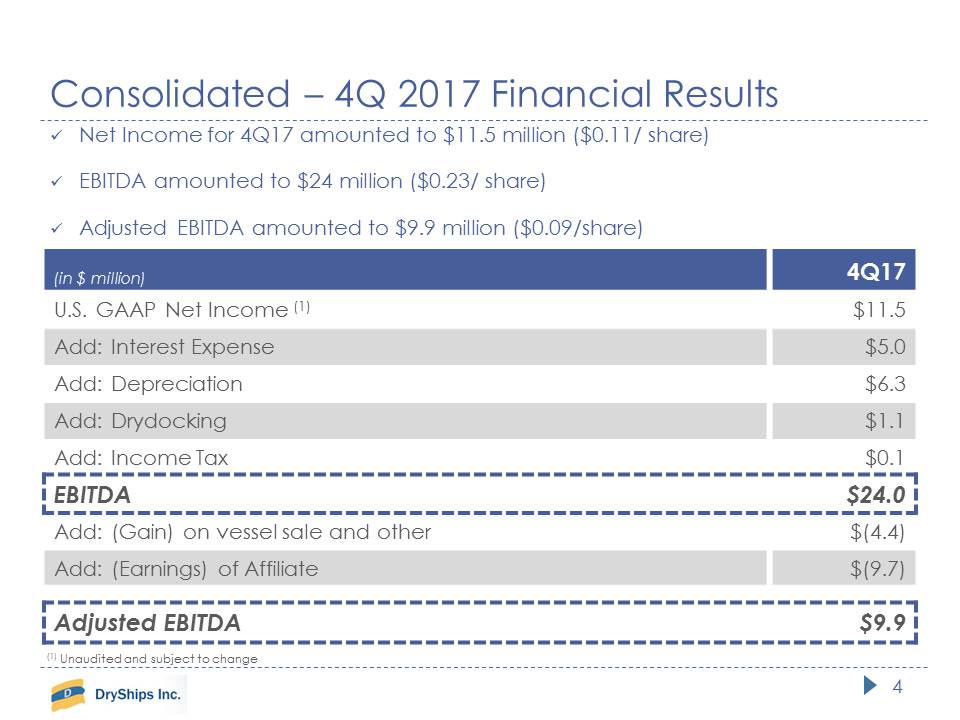

Consolidated – 4Q 2017 Financial Results 4 (in $ million) 4Q17 U.S. GAAP Net Income (1) $11.5 Add: Interest Expense $5.0 Add: Depreciation $6.3 Add: Drydocking $1.1 Add: Income Tax $0.1 EBITDA $24.0 Add: (Gain) on vessel sale and other $(4.4) Add: (Earnings) of Affiliate $(9.7) Adjusted EBITDA $9.9 Net Income for 4Q17 amounted to $11.5 million ($0.11/ share)EBITDA amounted to $24 million ($0.23/ share)Adjusted EBITDA amounted to $9.9 million ($0.09/share) (1) Unaudited and subject to change

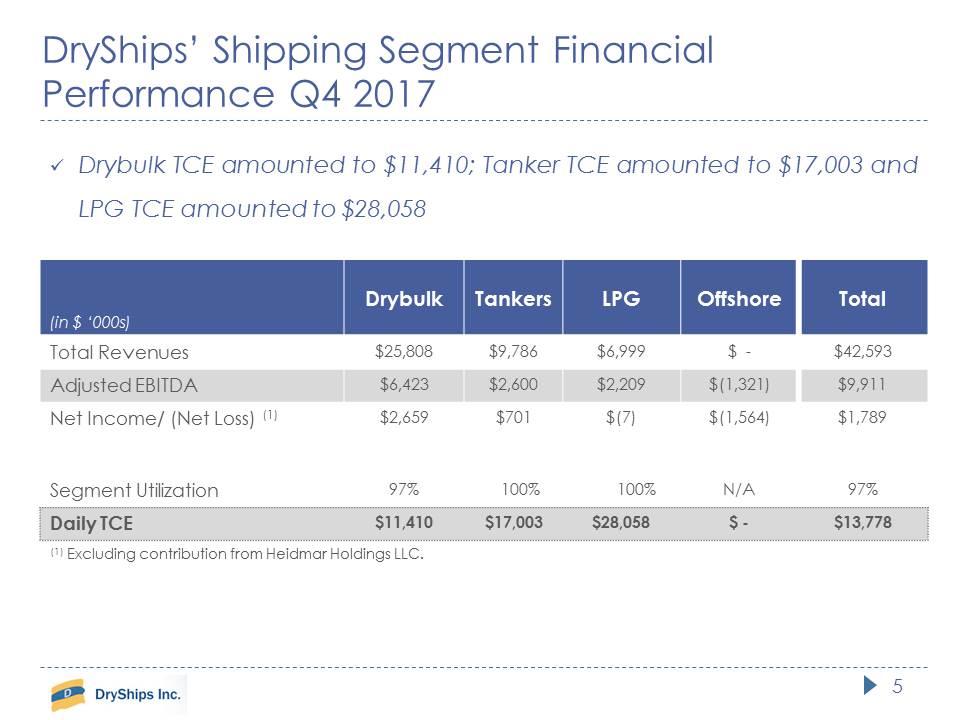

DryShips’ Shipping Segment Financial Performance Q4 2017 5 Drybulk TCE amounted to $11,410; Tanker TCE amounted to $17,003 and LPG TCE amounted to $28,058 (in $ ‘000s) Drybulk Tankers LPG Offshore Total Total Revenues $25,808 $9,786 $6,999 $ - $42,593 Adjusted EBITDA $6,423 $2,600 $2,209 $(1,321) $9,911 Net Income/ (Net Loss) (1) $2,659 $701 $(7) $(1,564) $1,789 Segment Utilization 97% 100% 100% N/A 97% Daily TCE $11,410 $17,003 $28,058 $ - $13,778 (1) Excluding contribution from Heidmar Holdings LLC.

“New” DryShips at a Glance 6 Based on Nordic Shipping Values as of February 23, 2018; T/C contracts are taken into account for the VLGC FMV calculationNet Leverage defined as Net Debt/AssetsPro-forma adjusted for the $65 million drawn/ expected to be drawn down under the two singed senior credit facilities on March 7, 2018 and on March 13, 2018 respectively

Latest Developments 7 Since the fourth quarter of 2017:On January 26, 2018, the Company fully drew down $90 million under a senior secured facilityOn January 29, 2018, the Company signed a second senior secured credit facility of up to $35 million. The full amount was fully drawn down on March 7, 2018On February 1, 2018, the Company fully repaid the outstanding balance of appx. $73.8 million under the Sierra Credit FacilityOn February 5, 2018, the Company received a firm commitment from a major European commercial bank for an additional senior secured credit facility of up to $30 million to be secured by two modern drybulk carriersOn February 7, 2018, the Company announced its intention to initiate a stock buy-back program of up to $50 millionOn February 7, 2018, the Company announced a fixed quarterly dividend of an aggregate $2.5 million to all common shareholders for a fifth consecutive quarterOn March 8, 2018, the Company signed another senior secured credit facility of up to $ 30 million to be secured by two drybulk carriers. The full amount is expected to be drawn the first half of March 2018

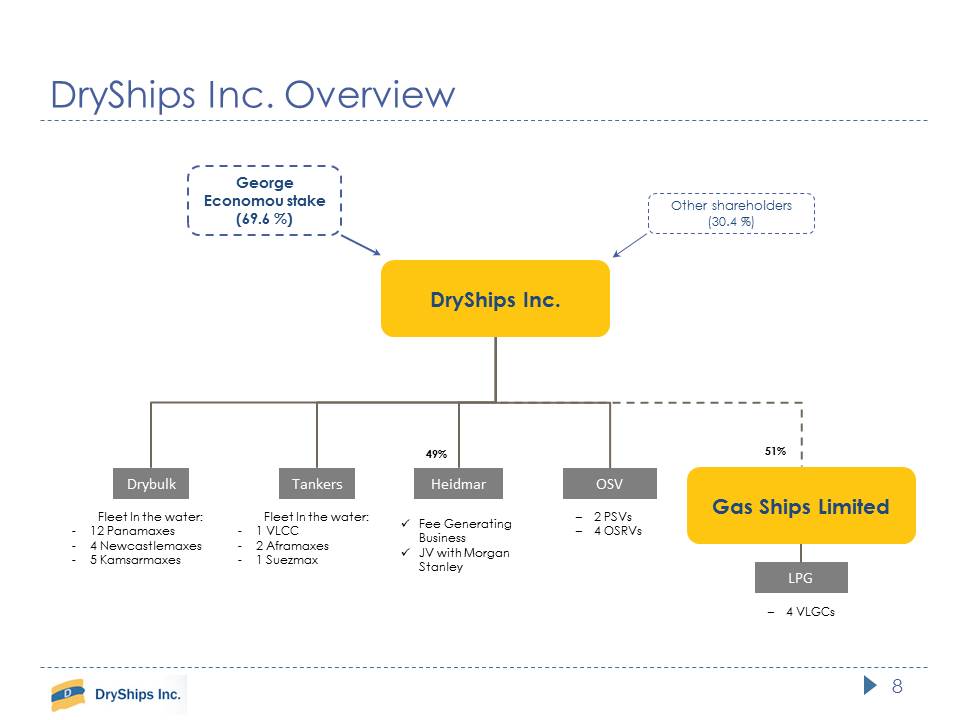

DryShips Inc. Overview 8 Fleet In the water: 12 Panamaxes4 Newcastlemaxes5 Kamsarmaxes OSV 2 PSVs4 OSRVs 4 VLGCs Heidmar Fee Generating BusinessJV with Morgan Stanley 49% George Economou stake (69.6 %) Other shareholders (30.4 %) DryShips Inc. Drybulk Tankers Fleet In the water: 1 VLCC2 Aframaxes1 Suezmax Gas Ships Limited LPG 51%

Gas Ships Limited 9 On February 8, 2018, the Company announced the filing with the SEC of a Form F-1 Registration Statement relating to the spin-off of 49% of Gas Ships LimitedNet FMV: $173 million Secured contracted backlog of approximately $300m until 2028 Experienced technical management team:Excellent vetting record, no unplanned off-hires and 100% approval ratingExperienced and seasoned commercial management team of TMS Cardiff Gas Ltd:Strategy is based on building of long-term fixed rate charters with high-end reputable clients offering stable stream of cash flows well above B/E levels.TMS Cardiff Gas’ selected client base includes but is not limited to:

Agenda 10 Market Overview DRYS looking forward Financial Highlights & Company Update

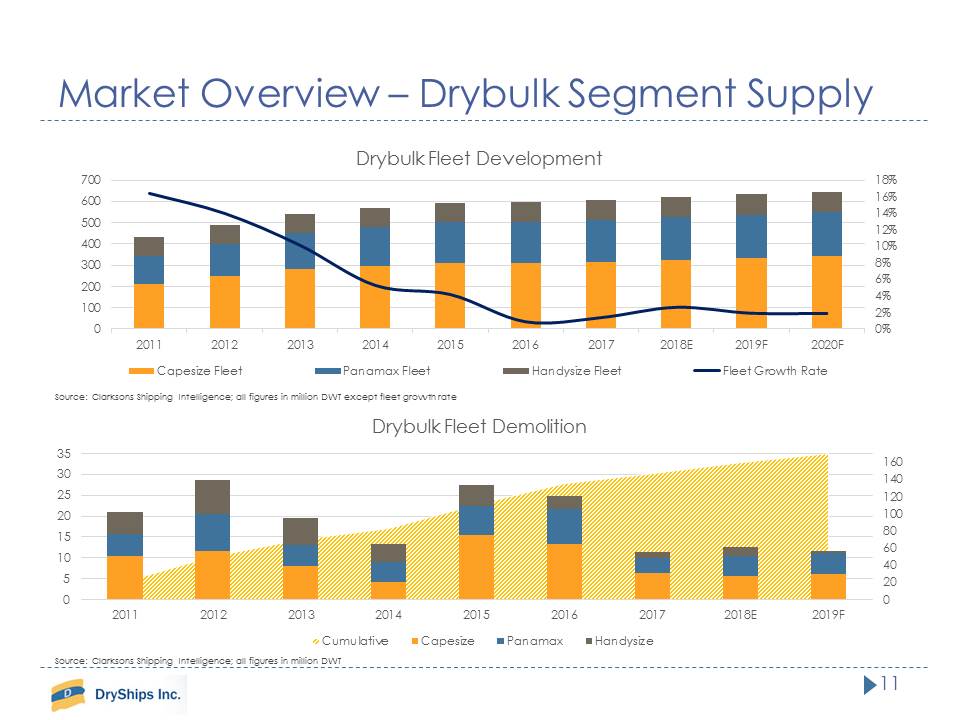

Market Overview – Drybulk Segment Supply 11 Source: Clarksons Shipping Intelligence; all figures in million DWT Source: Clarksons Shipping Intelligence; all figures in million DWT except fleet growth rate

Market Overview – Tanker Segment Supply 12 Source: Clarksons Shipping Intelligence; all figures in million DWT except fleet growth rate Source: Clarksons Shipping Intelligence; all figures in million DWT

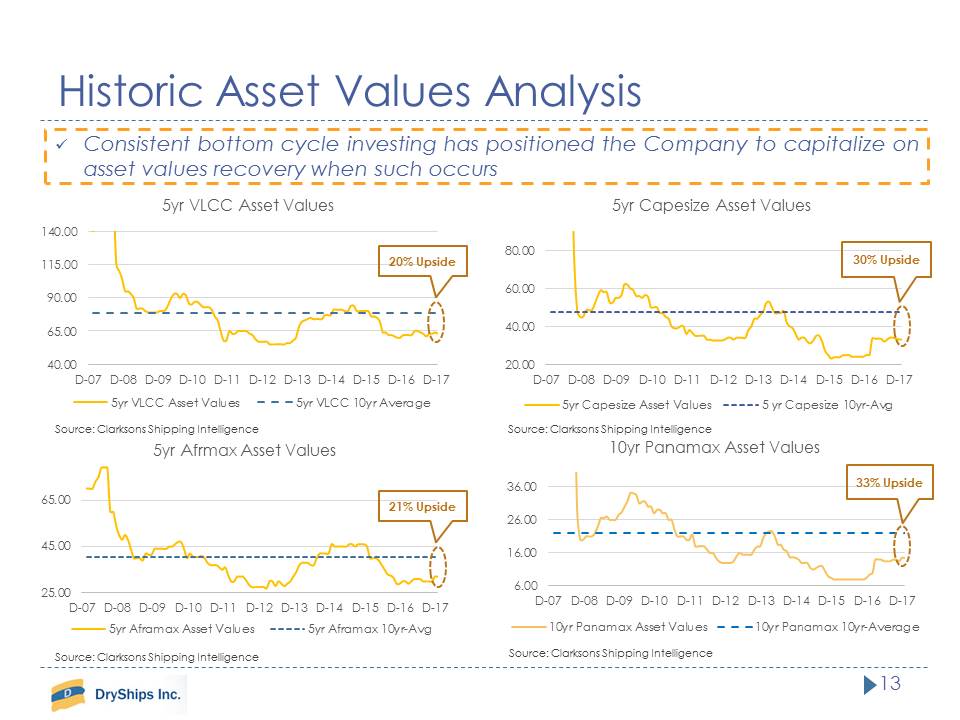

Historic Asset Values Analysis 13 Consistent bottom cycle investing has positioned the Company to capitalize on asset values recovery when such occurs 30% Upside 33% Upside Source: Clarksons Shipping Intelligence Source: Clarksons Shipping Intelligence Source: Clarksons Shipping Intelligence Source: Clarksons Shipping Intelligence 20% Upside 21% Upside

Agenda 14 DRYS looking forward Industry Overview Financial Highlights & Company Overview

Investment Highlights 15 (1) As of February 23, 2018(2) Based on Nordic Shipping Values as of February 23, 2018

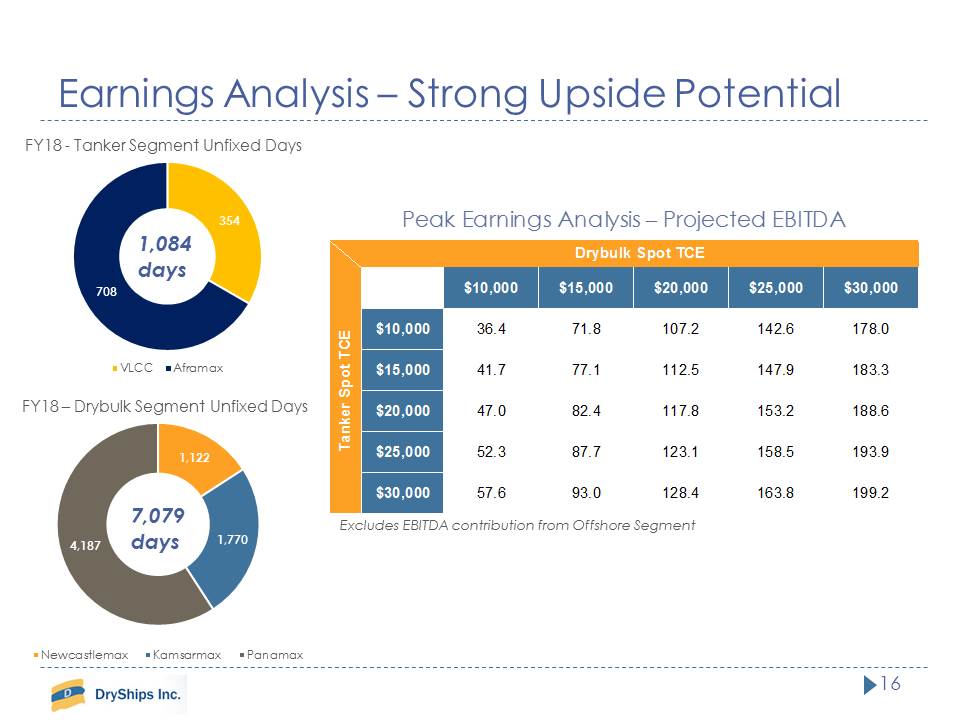

Earnings Analysis – Strong Upside Potential 16 1,084days 7,079days Excludes EBITDA contribution from Offshore Segment

17 Asset Value Analysis – Deep Discount to NAV (1) As of February 27, 2018 c.50% Discount to NAV +200% NAV Upside (2) Assuming Asset Values revert to 10 year Avg (1) (2) (1)