Exhibit 5.1

March 7, 2012

Lucas Energy, Inc.

3555 Timmons Lane, Suite 1550

Houston, TX 77027

Re: Lucas Energy, Inc. Shelf Registration Statement on Form S-3

Ladies and Gentlemen:

We have acted as special Nevada counsel to Lucas Energy, Inc., a Nevada corporation (the "Company") in connection with the preparation and filing by the Company on March 7, 2012, of a Registration Statement on Form S-3 (the "Registration Statement") with the Securities and Exchange Commission (the "Commission") under the Securities Act of 1933, as amended (the "Securities Act"). The Registration Statement relates to the issuance and sale from time to time of an indeterminate number of shares of the Company's common stock, par value $0.001 per share (the "Common Stock"), an indeterminate number of shares of the Company's preferred stock, par value $0.001 per share ("Preferred Stock", and with the Common Stock, the "Stock"), an indeterminate number of warrants to purchase the Stock (the "Warrants"), debt securities of the Company (the "Debt Securities"), and an indeterminate number of units (the "Units") consisting of shares of Stock, Warrants, Debt Securities, or any combination of the foregoing. The Stock, the Warrants, the Units and the Debt Securities are hereinafter referred to collectively as the "Securities".

The Securities will be sold or delivered from time to time as set forth in the Registration Statement, any amendments thereof, the prospectus included in the Registration Statement (the "Prospectus") and supplements to the Prospectus (the "Prospectus Supplements"). The Stock will be issued pursuant to purchase agreements to be entered into by the Company (each a “Stock Purchase Agreement”) the form of which will be filed as an exhibit to the Registration Statement or the Company’s other reports as filed with the Securities and Exchange Commission (the “SEC”) when the Stock is issued. The Warrants will be issued pursuant to warrant agreements to be entered into by the Company (each a "Warrant Agreement") the form of which will be filed as an exhibit to the Registration Statement or the Company’s other reports as filed with the SEC when the Warrants are issued. The Debt Securities will be issued pursuant to agreements to be entered into by the Company (each a "Debt Security Agreement") the form of which will be filed as an exhibit to the Registration Statement or the Company’s other reports as filed with the SEC when the Debt Securities are issued. The Units will be issued pursuant to unit agreements to be entered into by the Company (each a "Unit Agreement") the form of which will be filed as an exhibit to the Registration Statement or the Company’s other reports as filed with the SEC when the Units are issued.

In connection with the opinions rendered in this letter, we have examined only the following documents:

| a. | Copies of the following documents concerning the company filed with the Nevada Secretary of State (collectively the “Articles”): |

| (i) | Articles of Incorporation of Panorama Investments Corp. filed December 16, 2003; |

| (ii) | Certificate of Amendment changing the Company's name to Lucas Energy, Inc., and splitting the Company’s stock filed June 1, 2006; |

| (iii) | Certificate of Change pursuant to NRS 78.209 filed January 17, 2008; |

| (iv) | Articles of Exchange filed December 11, 2009; |

| (v) | Amendment to Articles of Incorporation increasing the Company's authorized capital filed April 13, 2010; |

| (vi) | Amendment to Articles of Incorporation providing for preferred stock filed January 10, 2011; |

| (vii) | Certificate of Designation designating the rights, privileges and provisions of Preferred Stock filed November 10, 2011; and |

| (viii) | Certificate of Designation designating the rights, privileges and provisions of Preferred Stock filed December 29, 2011. |

| b. | The Bylaws of the Company as filed with Form 10SB12B Registration Statement filed with the SEC on May 20, 2005 (the "Bylaws"); |

| c. | Certificate of Existence with Status in Good Standing with respect to the Company issued by the Nevada Secretary of State on March 6, 2012; |

| d. | Consent to Action Without Meeting of the Board of Directors of the Company dated March 6, 2012, relating to the sale of the Securities; and |

| e. | The Registration Statement. |

The opinions expressed herein are subject to the following assumptions, limitations, qualifications and exceptions:

A. In our examination of the above documents, we have assumed the genuineness of all signatures on original documents, the authenticity and completeness of all documents, certificates and instruments submitted to us as originals, the conformity to original documents of all copies submitted to us as copies thereof, the legal capacity of natural persons, and, except as to the Company, the due execution and delivery of all documents, certificates and instruments where due execution and delivery are a prerequisite to the effectiveness thereof.

B. Our opinion is based upon the facts as of the date hereof and assumes no event will take place in the future which would affect the opinions set forth herein. We assume no duty to communicate with you with respect to any change in law or facts which comes to our attention hereafter.

C. We have made such examination of Nevada law as we have deemed relevant for purposes of this opinion. We do not purport to be experts in the laws of any state other than Nevada and, accordingly, we express no opinion herein as to the laws of any state or jurisdiction other that the State of Nevada. We express no opinion as to the enforceability of the Debt Securities. We express no opinion as to any county, municipal, city, town or village ordinance, rule, regulation or administrative decision.

D. In rendering the opinions below, we have assumed that the necessary number of shares are authorized and available for issuance pursuant to the Company's Articles as they may be amended to the date of the issuance of the Securities in question.

E. The opinions expressed above are subject to the qualification that the validity and binding effect of the Securities may be limited or affected by (i) bankruptcy, insolvency, fraudulent conveyance, fraudulent transfer, reorganization, receivership, moratorium or similar laws affecting the rights and remedies of creditors generally, and (ii) general principles of equity exercisable in the discretion of a court (including, without limitation, obligations and standards of good faith, fair dealing, materiality and reasonableness and defenses relating to unconscionability or to impracticability or impossibility of performance).

F. We have also assumed that (i) the effectiveness of the Registration Statement and any amendments thereto (including post-effective amendments) shall not have been terminated or rescinded, (ii) a Prospectus Supplement will have been prepared and filed with the Commission describing the Securities offered thereby, (iii) all Securities will have been issued and sold in compliance with applicable United States federal and state securities laws, (iv) a definitive underwriting or similar agreement with respect to any Securities will have been duly authorized and validly executed and delivered by the Company and the other parties thereto, if applicable, and (v) at the time of the issuance of the Securities, (A) the Company validly exists and is duly qualified and in good standing under the laws of its respective jurisdiction of incorporation, (B) the Company has the necessary corporate power and due authorization, and (C) the charter documents of the Company are in full force and effect and have not been amended, restated, supplemented or otherwise altered and there has been no authorization of any such amendments, restatements, supplements or other alterations since the date of this letter.

Based on the foregoing and subject to the qualifications and limitations set forth herein, we are of the opinion that:

1. With respect to the Stock being registered under the Registration Statement, when (i) the Board of Directors of the Company has taken all necessary corporate action to approve the issuance and terms of the Stock, the terms of the offering thereof and related matters, (ii) the Registration Statement, as finally amended (including all necessary post-effective amendments), has become effective under the Securities Act and (iii) the Stock has been delivered by the Company upon purchase thereof pursuant to the Stock Purchase Agreements in forms to be included as exhibits to the Registration Statement or the Company’s other filings with the SEC which have been executed and delivered, as applicable, and payment in full therefor as contemplated by the Prospectus contained in the Registration Statement and any Prospectus Supplements relating to the Stock, the Stock will be validly issued, fully paid and non-assessable. Furthermore, when shares of Common Stock have been delivered by the Company upon exercise, conversion or exchange for any convertible Preferred Stock share, pursuant to the terms and conditions set forth in the designation providing for the Preferred Stock or other agreements filed as exhibits to the Registration Statement or the Company’s other filings with the SEC, the Common Stock issued in connection therewith will be validly issued, fully paid and non-assessable.

2. With respect to the Warrants and the Debt Securities, when (i) the Board of Directors of the Company has taken all necessary corporate action to approve the issuance and terms of the Debt Securities or the Warrants and Stock to be issued upon exercise of the Warrants, the terms of the offering thereof and related matters, (ii) the Registration Statement, as finally amended (including all necessary post-effective amendments), has become effective under the Act, (iii) the Warrant Agreements and Debt Security Agreements relating to the Warrants or Debt Securities, as applicable, in forms to be included as exhibits to the Registration Statement or the Company’s other filings with the SEC have been executed and delivered, as applicable, (iv) in the case of the Debt Securities, when the terms and conditions of such Debt Securities have been duly established by supplemental indenture or officer’s certificate in accordance with the terms and conditions of the relevant base indenture, any such supplemental indenture has been duly executed and delivered by the Company and the relevant trustee, and such Debt Securities have been executed (in the case of certificated Debt Securities), delivered and authenticated in accordance with the terms of the applicable Indenture and issued and sold for the consideration set forth in the applicable definitive purchase, underwriting or similar agreement, and (v) the Warrants or Debt Securities have been duly executed, countersigned and delivered in the applicable form by the Company upon the purchase thereof and payment in full as contemplated by the Prospectus contained in the Registration Statement and any Prospectus Supplements relating to the Warrants or the Debt Securities, the Warrants or the Debt Securities, as applicable, will be validly issued, and the Warrants will be fully paid and non-assessable. Furthermore, when shares of Stock have been delivered by the Company upon payment therefore pursuant to the terms of the Warrants or Debt Securities, in connection with the terms of the Warrant Agreements or Debt Security Agreements filed as exhibits to the Registration Statement or the Company’s other filings with the SEC, as applicable, the Stock issued in connection with the conversion or exercise thereof will be validly issued, fully paid and non-assessable.

3. With respect to the Units, when (i) the Board of Directors of the Company has taken all necessary corporate action to approve the issuance and terms of the Units, the terms of the offering thereof and related matters, (ii) the Registration Statement, as finally amended (including all necessary post-effective amendments), has become effective under the Securities Act, (iii) the Unit Agreements relating to the Units in a form to be included as an exhibit to the Registration Statement or the Company’s other filings with the SEC have been executed and delivered, as applicable, and (iv) the Units have been duly executed, countersigned, delivered and sold in the applicable form as contemplated by the Prospectus contained in the Registration Statement and any Prospectus Supplements relating to the Units, the Warrants and the Debt Securities comprising part of the Units will constitute valid and legally binding obligations of the Company, any Stock, Warrants or Debt Securities comprising part of the Units will be validly issued, fully paid and non-assessable and by reason of the Securities comprising the Units being valid and legally binding obligations of the Company and/or validly issued, fully paid and non-assessable, the Units themselves will constitute valid and legally binding obligations of the Company.

We hereby consent to the filing of this opinion with the Commission as Exhibit 5.1 to the Registration Statement. We also consent to the reference to our firm under the caption “Legal Matters” in the Registration Statement. In giving this consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 and Section 17 of the Securities Act or the Rules and Regulations of the Commission promulgated thereunder. This opinion is expressed as of the date hereof unless otherwise expressly stated and we disclaim any undertaking to advise you of any subsequent changes of the facts stated or assumed herein or any subsequent changes in applicable law.

Very truly yours,

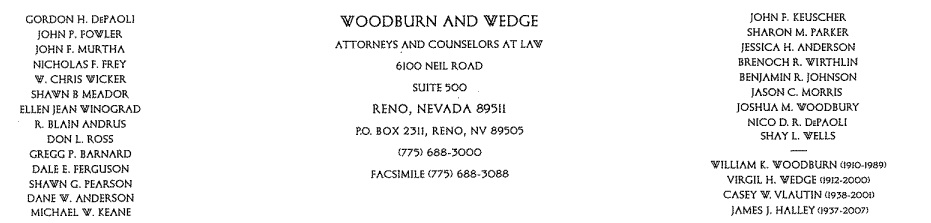

WOODBURN AND WEDGE

/s/ John P. Fowler

John P. Fowler

JPF:jan