Exhibit 10.1

AGREEMENT IN CONNECTION WITH THE LOAN

This Agreement in Connection with the Loan (this “Agreement”) dated effective August 1, 2018 (the “Effective Date”), is made by and between the following:

Camber Energy, Inc., a Nevada corporation (“Borrower”), f/k/a Lucas Energy, Inc., a Nevada corporation, whose mailing address is 1415 Louisiana Street, Suite 3500, Houston, Texas 77002; and

International Bank of Commerce, a Texas state banking corporation (“Lender”), whose mailing address is 130 E. Travis St., San Antonio, Texas 78205.

REFERENCE IS HEREBY MADE FOR ALL PURPOSES TOthat certain loan from Lender to Borrower (the “Loan”) evidenced by a Real Estate Lien Note dated August 25, 2016 (the “Note”) in the original principal amount of $40,000,000.00, executed by Borrower, and made payable to the order of Lender, and any and all documents which affect and/or secure the payment of the Note or were otherwise executed in connection with the Loan are herein collectively referred to as the “Loan Instruments,” including without limitation, that certain Loan Agreement dated August 25, 2016 (the “Loan Agreement”) by and among Lender and Borrower. All capitalized terms not otherwise defined herein shall have the meaning ascribed to them in the Loan Agreement.

RECITALS

| 1. | Borrower is indebted to Lender pursuant to the terms of the Loan Instruments. |

| 2. | Several payment defaults and covenant defaults (collectively, the “Defaults”) have occurred and are continuing as referenced in that certain letter dated September 8, 2017, from Martin & Drought, P.C., on behalf of Lender to Borrower (the “Demand Letter”). |

| 3. | Additionally, Defaults have occurred since the date of the Demand Letter up to the date of this Agreement. |

| 4. | So that Borrower may have time to cure the Defaults and to release Lender from any and all claims regarding the Loan and to memorialize the terms of a resolution of the Defaults under the Loan, Borrower and Lender have entered into this Agreement. |

AGREEMENT

NOW THEREFORE, for and in consideration of these premises and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged and confessed, Lender and Borrower (collectively, the “Parties,” and individually, a “Party”) agree as follows:

| 1. | Recitals True, Correct, and Accurate. Borrower acknowledges and agrees that the recitals set forth above are true, correct and accurate. |

Page 1

| 2. | Claims against Lender. |

| a. | Borrower hereby represents and warrants that there are no known claims, causes of action, suits, debts, liens, obligations, liabilities, demands, losses, costs and expenses (including attorneys’ fees) of any kind, character or nature whatsoever, fixed or contingent, which Borrower may have or claim to have against Lender, which might arise out of or be connected with any act of commission or omission of Lender existing or occurring on or prior to the Effective Date, including, without limitation, any claims, liabilities or obligations arising with respect to the Loan or arising under any of the Loan Instruments. |

| b. | In consideration of Lender’s agreements as provided herein, Borrower hereby releases, acquits, waives and forever discharges Lender, its partners, affiliates, subsidiaries and related parties and their respective directors, officers, employees, agents, predecessors, successors, assigns, attorneys, and representatives (collectively the “Lender Parties”) from any and all claims, demands, cross-actions, cause or causes of action, at law or in equity, costs and expenses, including legal expenses, as well as any other kind or character of claim or action, in each case to the extent held by Borrower on or before the Effective Date, whether based upon tort, fraud, breach of any duty of fair dealing, breach of confidence, undue influence, duress, economic coercion, conflict of interest, negligence, bad faith, intentional or negligent infliction of mental distress, tortious interference with contractual relations, tortious interference with corporate governance or prospective business advantage, breach of contract, deceptive trade practices, libel, slander, conspiracy, contract, usury, common law or statutory right, known or unknown, arising, directly or indirectly, proximately or remotely, out of any of the Loan Instruments or any of the documents, instruments or any other transactions relating thereto, solely with respect to such claims, which arise in connection with events which occurred on or prior to the Effective Date (collectively, the “Released Claims”), to the fullest and maximum extent permitted by applicable law. Without limiting the generality of the foregoing, this release shall include all aspects of the negotiations between and among Borrower and Lender. This release is intended to release all liability of any character claimed for damages, of any type or nature, for injunctive or other relief, for attorneys’ fees, interest or any other liability whatsoever, whether statutory, contractual or tort in character, or of any other nature or character, now or henceforth in any way related to the Released Claims, including, without limitation, any loss, cost or damage in connection with, or based upon, any breach of fiduciary duty, breach of any duty of fair dealing or good faith, breach of confidence, breach of funding commitment, breach of any other duty, breach of any statutory right, fraud, usury, undue influence, duress, economic coercion, conflict of interest, negligence, bad faith, malpractice, violations of the Racketeer Influenced and Corrupt Organizations Act, intentional or negligent infliction of mental distress, tortious interference with corporate or other governance or prospective business advantage, breach of contract, deceptive trade practices, libel, slander, conspiracy, or any other cause of action, any of which arise in connection with events which occurred on or prior to the Effective Date. Borrower understands and agrees that this is a full, final and complete release of the Released Claims and agrees that this release may be pleaded as an absolute and final bar to any or all suit or suits pending or which may hereafter be filed or prosecuted by Borrower, or anyone claiming, by, through or under Borrower in respect of the Released Claims, and that no recovery on account of the Released Claims may hereafter be had from anyone whomsoever, and that the consideration given for this release is no admission of liability and that Borrower, nor those claiming under Borrower will ever claim that it is. |

Page 2

| 3. | Insolvency Provisions. In the event any proceeding (an “Insolvency Proceeding”) is brought by or against Borrower and/or the Mortgaged Properties under or pursuant to any bankruptcy, insolvency, receivership or similar law or laws of the United States or any other state or other jurisdiction, including the Bankruptcy Code, and any other law or laws of the United States or any other state or other jurisdiction which affect the rights of debtors and/or creditors generally, including, without limitation: (i) any proceeding seeking to appoint or appointing a receiver or trustee; (ii) any proceeding filed by or against Borrower under the Bankruptcy Code; (iii) any assignment by Borrower of all or substantially all of their respective assets for the benefit of creditors; and (iv) any proceeding or other action wherein all or substantially all of Borrower’s assets are attached, seized, subjected to a writ or distress warrant, or otherwise levied upon, Borrower hereby agrees as follows: |

| a. | Venue for an Insolvency Proceeding, without waiving the provisions requiring arbitration as set forth in the Loan Instruments, shall lie exclusively in the United States Bankruptcy Court for the Western District of Texas, San Antonio Division. |

| b. | Borrower agrees that, subject to court approval, Lender shall be deemed pursuant to this Agreement to have and be entitled to relief from the automatic stay under Section 362 of the Bankruptcy Code, and Borrower hereby unconditionally and irrevocably consents to the granting to Lender of relief from the automatic stay under Section 362 of the Bankruptcy Code to permit Lender to exercise any and all of its rights, recourses and remedies under the Loan Instruments, at law and/or in equity, including, without limitation, foreclosure of the Mortgage and sale of the Mortgaged Properties pursuant thereto and/or collection of the rents, income, revenue from oil and gas production or in relation thereto, proceeds, and profits directly by Lender. Further, if Lender requests such relief, Borrower shall not object to or oppose Lender’s request for immediate relief from the automatic stay for purposes of exercising any and all rights, recourses, remedies and benefits Lender may have under the Loan Instruments, at law and/or in equity, including, without limitation, foreclosure of the Mortgage and sale of the Mortgaged Properties pursuant thereto and/or collection of the rents and profits directly by Lender. |

| c. | Borrower hereby acknowledges and agrees that Lender has a properly perfected, valid and enforceable lien upon and security interest in all or any portion of the Mortgaged Properties, except as provided or otherwise granted in this Agreement and pursuant to the terms of this Agreement, including, without limitation, the leases, rents, income, revenue from oil and gas production or in relation thereto, and profits, and Borrower will acknowledge the same in any Insolvency Proceeding. Further, Borrower shall not contest that Lender holds a properly perfected, valid and enforceable first priority lien on and security interest in each and every portion of the Mortgaged Properties, including, without limitation, the leases, rents, income, and profits. |

Page 3

| d. | Subject to court approval, the value of the Mortgaged Properties alone without other collateral, cash, or other assets satisfactory to Lender, in its reasonable discretion, is not adequate to offer adequate protection to Lender in the event Borrower, or any one of them seeks financing as a debtor in possession. Borrower specifically agrees not to seek debtor in possession financing without providing adequate protection reasonably satisfactory to Lender. |

| e. | Borrower hereby agrees to indemnify, defend and hold Lender harmless from and against any and all loss, cost, liability, damage or expense Lender may suffer or incur as a result of Borrower’s breach of their respective obligations, covenants and agreements only under this Section, which indemnification obligations shall expire and be of no force and effect upon the earlier of two (2) years after (a) the Camber Assets Sale Date; or (b) the Surrender Transfer Date (defined below) (collectively, the “Transfer Date”). |

| 4. | Standstill. Subject to the conditions below (collectively, the “Standstill Conditions”), Lender agrees to stand still and not to take any action to collect the Indebtedness from Borrower, or to enforce or foreclose on the Mortgage and sale of the Mortgaged Properties (the “Standstill”) prior to the earlier of (i) September 30, 2018, unless the Camber Assets Sale Effective Date is required to be extended due to no fault of the Borrower, due to the regulatory requirements of the Securities and Exchange Commission and/or NYSE American, in which case such date shall be automatically extended to no later than October 31, 2018 unless extended by both parties; or (ii) a default of the Standstill Conditions as determined by Lender in its reasonable discretion (collectively, the “Standstill Date”). |

The Standstill Conditions are as follows:

| a. | On or before 5:00 pm San Antonio, Texas time on Tuesday, August 7, 2018 (the “Deadline”), Borrower shall use commercially reasonable efforts to ensure that all of Borrower’s funds over $5,000.00 are deposited with International Bank of Commerce at 130 East Travis Street, San Antonio, Texas 78205, provided that if any such funds are not deposited with accounts held by the Borrower with International Bank of Commerce, such funds shall be transferred to International Bank of Commerce within two business days thereafter (subject to customary bank timing for the transfer of funds)(the “Funds Transfer Requirements”). Borrower confirms and acknowledges that subsequent to the Deadline it will not make any deposits or disbursements into or from its bank account at Frost Bank; however, if a third party makes a deposit into a bank account at Frost Bank, such funds shall be transferred to International Bank of Commerce consistent with the above provision; |

Page 4

| b. | On or before the Deadline, Borrower and/or the owner thereof shall have pledged to Lender eighty-seven and one-half percent (87.5%) of all of the right, title and interest of Borrower and/ or the owner thereof in those certain assets more particularly described on Exhibit “A” and Exhibit “B,” both attached hereto and incorporated herein for all purposes (collectively, the “Orion Assets”) whereby Lender shall receive from Borrower a perfected security interest in an 87.5% working interest in each of the oil and gas leases constituting the Orion Assets, subject to the Orion Production Payment and Orion ORRI defined below; |

| c. | On or before the Deadline, Borrower shall pay to Lender all expenses due under the Note, including without limitation, Lender’s reasonable legal fees to date; |

| d. | On or before the Deadline, Borrower shall pay to Lender the sum of TWO HUNDRED THIRTY-ONE THOUSAND NINE HUNDRED TWENTY-THREE AND 82/100 Dollars ($231,923.82) representing the interest payment due under the Note for June 2018; |

| e. | On or before the Deadline, Borrower shall pay to Lender the sum of TWO HUNDRED THIRTY-ONE THOUSAND NINE HUNDRED TWENTY-THREE AND 82/100 Dollars ($231,923.82) representing an approximation of the interest payment due under the Note for July 2018; |

| f. | Borrower shall not pledge any assets, either real or personal, of Borrower or in which Borrower has any interest, now or in the future and howsoever evidenced, to any other party besides Lender provided however, that nothing herein shall limit the ability of Borrower to grant a purchase money security interest on newly acquired assets so long as such assets are not located in the State of Oklahoma; |

| g. | Borrower shall not pay nor provide any monetary distribution whatsoever to any current officer, director or employee of Borrower outside of the normal course of business, and as to directors of Borrower, no more than a total of $40,000.00 in monetary distributions to such directors shall be made during the Standstill (which limitation shall not apply to stock distributions or stock payments); |

| h. | During the Standstill, the interest rate shall be floating at three percent (3%) per annum above the New York Prime Rate, as defined in the Note, as it fluctuates from time to time; provided, however, that in no event shall the rate of interest to be paid on the unpaid principal of the Note be less than five and one half percent (5.5%) per annum, nor more than the maximum legal rate allowed by applicable law and the starting interest rate as of the Effective Date shall be eight percent (8.0%) per annum; and |

| i. | During the term of the Standstill, the only events of default under this agreement shall be (A) a default of Sections (i) through (vii) of Section 4 hereof by Borrower, and (B) the occurrence of a material adverse event involving the Camber Assets as reasonably determined by Lender, including, but not limited to, failure to pay and maintain insurance. |

Page 5

| 5. | Standstill Date. On and following the Standstill Date, Lender shall be free to be take any action to collect the Indebtedness from Borrower, or to enforce its rights under the Loan Instruments, including without limitation any and all rights to foreclose on the Mortgage and sale of the Mortgaged Properties, as Lender, in its sole discretion shall elect, unless Borrower shall, prior to the Standstill Date, cure all outstanding Defaults upon such terms and conditions as Lender may approve in its sole and absolute discretion. |

Notwithstanding the foregoing, Borrower has the option during the Standstill to sell the Collateral, including without limitation, the Mortgaged Properties and the “Assets”, as defined in the APA (as defined in the Loan Agreement) SAVE AND EXCEPT the West Texas Properties (as defined in the Loan Agreement) (collectively, the “Camber Assets”), to a third party in an arm’s length transaction approved by Lender in its sole discretion (the “Third Party Buyer”) effective as of August 1, 2018 (the “Camber Assets Sale Effective Date”, and the date of closing such Camber Assets sale, the “Camber Asset Sale Date”), subject to (i) any and all liens and security interests of Lender, including without limitation, the Mortgage, (ii) the assumption by the Third Party Buyer of the Indebtedness and the execution of such Loan Instruments as Lender may require in its sole discretion upon such terms as Lender may require in its sole discretion to memorialize the assumption of the Indebtedness by the Third Party Buyer; and (iii) the consent, authorization and confirmations by Richard N. Azar, II, RAD2 Minerals, Ltd., a Texas limited partnership, Donnie B. Seay, and DBS Investments, Ltd., a Texas limited partnership, and acknowledgement of all continuing obligations of Guarantor upon such terms and memorialized by such Loan Instruments as Lender may require. The Camber Assets to be sold to the Third Party Buyer shall expressly be deemed to include certain non-operated interests operated by Equal Energy, Inc, and Bear Energy, Inc., including without limitation, all infrastructure, right of ways, easements, salt water disposal wells and all other non-operated assets in connection therewith. The Camber Assets shall also expressly be deemed to include all of the following:

| a. | All of Borrower’s right, title and interest in and to the “Many Drinks” disposal well and equipment, all associated agreements and other property or assets located on and/or associated with the “Many Drinks” disposal well owned by Borrower; |

| b. | All of Borrower’s right, title and interest in and to the Leasehold Estate acquired around the Temporarily Abandoned Wells previously operated by and formerly owned by Midstates Petroleum or Equal Energy, Inc. or its subsidiary Petroflow Energy Corporation (collectively, the “TAW Leases”), and all other property and assets located on and/or associated therewith, subject to the TAW ORRI, defined below, owned as of the applicable Transfer Date; and |

| c. | The Orion Assets, provided that the Borrower shall have the right to reserve (a) the Orion ORRI, defined below; and (b) the Orion Production Payment, defined below. |

Page 6

In the event of a sale by Borrower during the Standstill and subject to Lender’s prior written consent, which shall not be unreasonably withheld, conditioned or delayed, and Borrower’s compliance with all of the terms as set forth herein, Borrower shall assign and convey to the Third Party Buyer the Camber Assets subject to a production payment reserved by Borrower in the amount of $2,500,000.00 burdening solely 1/8 (12.5%) of the Orion Assets, in the form of Exhibit “C” hereto (the “Orion Production Payment”). In addition to the Orion Production Payment, the Borrower will be provided a three percent (3%) overriding royalty interest reserved by Borrower burdening all of Borrower’s right, title and interest in and to the oil and gas leases constituting the Orion Assets (the “Orion ORRI”), in the form of Exhibit “D” hereto. If the Orion ORRI results in the Third Party Buyer receiving less than a 75.0% net revenue interest in any of the oil and gas leases constituting the Orion Assets, the Orion ORRI shall be reduced as to such oil and gas lease(s) assigned so that the Third Party Buyer shall not receive less than a 75.0% net revenue interest therein. The proceeds from the Orion ORRI shall be credited towards the Orion Production Payment. The Orion ORRI shall continue to remain in effect after the Orion Production Payment has been paid in full.

Furthermore, the Orion ORRI will be subject to the following (collectively, the “ORRI Burdens”):

| a. | The Orion ORRI shall bear all costs born under the oil and gas leases constituting the Orion Assets, including without limitation, taxes and treating, transportation, and marketing costs of the minerals produced thereunder; |

| b. | The Orion ORRI shall include a proportionate reduction clause whereby if (i) the oil and gas leases assigned cover less than the entire mineral interest, and/or (ii) the interest of Borrower in the oil and gas leases assigned cover less than the entire leasehold interest, the Orion ORRI will be proportionately reduced; |

| c. | The Orion ORRI shall contain a provision expressly permitting pooling without the consent of Borrower, and except for the extensions and renewals of the current oil and gas leases constituting the Orion Assets, the Orion ORRI shall not apply to new oil and gas leases covering the same lands burdened by the Orion ORRI obtained after the oil and gas leases burdened by the Orion ORRI have terminated; and |

| d. | Any implied covenants regarding the Orion ORRI shall be expressly waived by Borrower. |

Furthermore, Borrower shall reserve in the TAW Leases an overriding royalty interest in whatever leases remain at the closing of the Asset Purchase Agreement with N&B Energy, Inc. (the “TAW ORRI”), in the form of Exhibit “E” hereto, equal to the difference between existing oil and gas lease burdens, both contractual and of record, in the TAW Leases and an 81.125% net revenue interest. Like the Orion ORRI, the TAW ORRI will be subject to the ORRI Burdens, and if the reservation of the TAW ORRI results in the Third Party Buyer receiving less than an 81.125% net revenue interest in any of the oil and gas leases constituting the TAW Leases, the TAW ORRI shall be reduced as to such oil and gas lease(s) assigned so that the Third Party Buyer shall not receive less than a 81.125% net revenue interest therein. The TAW ORRI may be transferred prior to the applicable Transfer Date.

Page 7

As a part of the consideration for the sale of the Camber Assets within the Standstill, Lender shall agree to release solely the West Texas Properties from Lender’s liens and security interests, which Borrower shall retain and not convey to the Third Party Buyer. Additionally, immediately before the Camber Assets Sale Effective Date, Borrower shall pledge to Lender the remaining right, title and interest of Borrower and/ or the owner thereof in the Orion Assets twelve and one-half percent (12.5%) so that Lender shall then have a perfected security interest in 100% of the working interest in each of the oil and gas leases constituting the Orion Assets. Between the Effective Date and the Camber Assets Sale Effective Date, Borrower covenants and agrees that it shall not burden the Orion Assets with any additional lease burdens, including without limitation, any additional overriding royalty interests, which do not burden the oil and gas leases constituting the Orion Assets as of the Effective Date SAVE AND EXCEPT the Orion Production Payment and the Orion ORRI.

In the event that Borrower is ready, willing and able to close on the sale of the Camber Assets, and either the Third Party Buyer is not ready, willing and able to close and purchase the Camber Assets on or before the Standstill Date, or any reasonable extension agreed upon by Borrower and the Third Party Buyer and approved by Lender in writing, or the Borrower has not received shareholder approval by the Standstill Date or will not be able to hold a shareholder vote by such Standstill Date due to regulatory review of the proxy, Borrower shall surrender the Camber Assets to Lender or Lender’s designee as of the Camber Assets Sale Effective Date, subject to any and all security interests and liens of Lender and subject to the Orion ORRI, the TAW ORRI and the Orion Production Payment upon ten (10) days following the Standstill Date or any agreed-upon extension (collectively, the “Surrender Right” and the “Asset Surrender”). Lender shall, concurrently with its entry into this Agreement, designate an entity to hold the assets surrendered pursuant to the Asset Surrender. The assignment and conveyance instruments for the Asset Surrender shall be in a form approved by Lender in its reasonable discretion. The date that the Camber Assets are transferred to Lender is referred to herein as the “Surrender Transfer Date.” Upon exercising the Surrender Right, Lender shall determine, in its sole discretion, the value of the Camber Assets as of the Surrender Transfer Date (the “Camber Assets Value”), and the amount of the Indebtedness shall be reduced by the amount of the Camber Assets Value. The amount of the remaining Indebtedness (after deduction of the Camber Assets Value) is referred to herein as the “Post-Transfer Deficiency.” The transactions described in this paragraph, if consummated, shall constitute an assignment and conveyance in lieu of foreclosure and not in any way a retention of collateral in full or partial satisfaction of debt under Sections 9.620 of the Texas Business & Commerce Code (the “Code”). Borrower hereby irrevocably and unconditionally waives, to the maximum extent allowed by law, any and all rights under Sections 9.620, 9.621 or 9.623 of the Code.

Page 8

In the event that Borrower complies with the terms of this Agreement and (a) assigns the Camber Assets to a Third Party Buyer, the Lender agrees to only pursue the Camber Assets, the Third Party Buyer and the Guarantor for the repayment of amounts owed under the Loan Instruments (including, but not limited to principal, interest and fees due thereunder) and including the Post Transfer Deficiency, and to provide Borrower a novation and release from any and all liability in connection with the Loan Instruments in a form reasonably approved by Lender; or (b) the Lender exercises the Surrender Right, the Lender agrees to pursue only the Camber Assets and the Guarantor for the repayment of amounts owed under the Loan Instruments (including, but not limited to principal, interest and fees due thereunder) and including the Post Transfer Deficiency, and to provide Borrower a novation and release from any and all liability in connection with the Loan Instruments in a form reasonably approved by Lender. In either case, the Borrower, and its current, past and future shareholders, officers, and directors, except to the extent such are a Guarantor, shall have no liability for any amounts owed under the Loan Instruments effective upon the Camber Assets Sale Effective Date or date of the Asset Surrender, as applicable. It is understood and agreed that any and all protections and benefits under any asset purchase agreement for the sale of the Camber Assets from Borrower to a Third Party Buyer approved by Lender, including without limitation, that certain Asset Purchase Agreement dated July 12, 2018 (the “N&B APA”), by and between Borrower, as Seller, and N&B Energy, LLC, as Buyer, are deemed incorporated herein such that if Lender exercises the Surrender Right, all liabilities of Borrower under such asset purchase agreement, including without limitation, the Excluded Liabilities, as defined in the N&B APA, shall remain with Borrower after Lender exercises the Surrender Right.

| 6. | Default. Failure or refusal of Borrower to (i) comply with any of the requirements hereunder, or (ii) perform any of its obligations hereunder, or the breach of the representations or covenants of this Agreement by Borrower (a “New Default”) shall constitute a default of this Agreement, the Note, the Loan Agreement, and the other Loan Instruments, and the undersigned will be liable for Lender’s attorney’s fees and related costs or expenses in enforcing this Agreement. Furthermore, if any default occurs during the Standstill under this Agreement, subject to written notice thereof provided by the Lender to the Borrower and the Borrower being provided two business days in the event of a default in the Funds Transfer Requirements and/or the payment of any amount due hereunder to the Lender in cash, and ten calendar days in the event of any other default hereunder, to cure any such default, the Standstill shall immediately terminate. |

Upon the happening of any New Default, the Standstill shall terminate, and Lender may declare the entire outstanding principal amount of the Note, all accrued and unpaid interest and all accrued and unpaid late charges thereunder and all other indebtedness of Borrower to Lender, to be immediately due and payable, and the same shall thereupon become and be immediately due and payable without further notice and presentment, demand, notice of intent to accelerate, notice of actual acceleration, protest, notice of protest or other notice of default or dishonor of any kind, all of which are hereby expressly waived by Borrower. Borrower expressly waives the Grace and Curative Period for any default under this Agreement whatsoever.

Page 9

| 7. | No Oral Agreements, Amendments. THIS WRITTEN AGREEMENT REPRESENTS THE FINAL AGREEMENT AMONG THE PARTIES AS OF THIS DATE AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. This Agreement may be amended only by a writing that ratifies, confirms and incorporates as a part thereof the provisions of this Agreement not thereby amended. Each such amendment must be executed and delivered by Borrower and Lender. |

| 8. | Notices. Any notice, request, consent, instrument or other communication required or permitted under this Agreement shall be in writing and shall be deemed to have been duly given on the third calendar day after being sent by registered or certified mail, return receipt requested, postage prepaid, to the respective addresses of Borrower and Lender set forth in the introductory paragraph on Page 1 hereof. Any party hereto may change its mailing address by providing written notice to the other parties hereto. |

| 9. | Governing Law and Venue. Subject to Section 13 below, (i) this Agreement shall in all respects be governed by, and construed in accordance with the laws of the State of Texas, without reference to the conflicts of law rules thereof, and (ii) venue for any legal action involving this Agreement shall be in Bexar County, Texas. |

| 10. | Severability. Each section and subsection of this Agreement constitutes a separate and distinct provision hereof. If any provision of this Agreement shall be adjudicated to be invalid, ineffective or unenforceable, the remaining provisions shall not be affected thereby. The invalid, ineffective or unenforceable provision shall, without further action by the Parties, be automatically construed to affect the original purpose and intent of the invalid, ineffective or unenforceable provision. |

| 11. | Headings; Gender. The section headings in this Agreement have been inserted for convenience of reference only and shall not constitute a part, or be given any effect in the construction or interpretation of this Agreement. All references in this Agreement as to gender shall be interpreted in the applicable gender of the parties. |

| 12. | Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be deemed to be an original, and all of which together shall constitute but one and the same Agreement, and facsimile, PDF/Document Imaging or other electronic signatures shall be just as binding as originals. |

| 13. | Arbitration. |

BINDING ARBITRATION AGREEMENT

PLEASE READ THIS CAREFULLY. IT AFFECTS YOUR RIGHTS.

BORROWER AND LENDER AGREE TO ARBITRATION AS FOLLOWS (hereinafter referred to as the “Arbitration Provisions”):

Page 10

| I. | Special Provisions and Definitions applicable to both CONSUMER DISPUTES and BUSINESS DISPUTES: |

| (a) | Informal Resolution of Customer Concerns. Most customer concerns can be resolved quickly and to the customer’s satisfaction by contacting your account officer, branch manager or by calling the Customer Service Department in your region. The region and numbers are: |

| 1. Laredo | 956-722-7611 |

| 2. Austin | 512-397-4506 |

| 3. Brownsville | 956-547-1000 |

| 4. Commerce Bank | 956-724-1616 |

| 5. Corpus Christi | 361-888-4000 |

| 6. Eagle Pass | 830-773-2313 |

| 7. Houston | 713-526-1211 |

| 8. McAllen | 956-686-0263 |

| 9. Oklahoma | 405-841-2100 |

| 10. Port Lavaca | 361-552-9771 |

| 11. San Antonio | 210-518-2500 |

| 12. Zapata | 956-765-8361 |

In the unlikely event that your account officer, branch manager or the customer service department is unable to resolve a complaint to your satisfaction or if Lender has not been able to resolve a dispute it has with you after attempting to do so informally, you and Lender agree to resolve those disputes through binding arbitration or small claims court instead of in courts of general jurisdiction.

| (b) | Sending Notice of Dispute. If either you or Lender intend to seek arbitration, then you or Lender must first send to the other by certified mail, return receipt requested, a written Notice of Dispute. The Notice of Dispute to Lender should be addressed to: Dennis E. Nixon, President, at International Bancshares Corporation, P.O. Drawer 1359, Laredo, Texas 78042-1359 or if by email, ibcchairman@ibc.com. The Notice of Dispute must (a) describe the nature and basis of the claim or dispute; and (b) explain specifically what relief is sought. You may download a copy of the Notice of Dispute at www.ibc.com or you may obtain a copy from your account officer or branch manager. |

| (c) | If the Dispute is not Informally Resolved. If you and Lender do not reach an agreement to resolve the claim or dispute within thirty (30) days after the Notice of Dispute is received, you or Lender may commence a binding arbitration proceeding. During the binding arbitration proceeding, any settlement offers made by you or Lender shall not be disclosed to the Arbitrator. |

| (d) | “DISPUTE(S)”. As used herein, the word“DISPUTE(S)”includes any and all controversies or claims between thePARTIES of whatever type or manner, including without limitation, any and all claims arising out of or relating to this Agreement, compliance with applicable laws and/or regulations, any and all services or products provided by Lender, any and all past, present and/or future Loan, lines of credit, letters of credit, credit facilities or other form of indebtedness and/or agreements involving thePARTIES, any and all transactions between or involving thePARTIES, and/or any and all aspects of any past or present relationship of thePARTIES, whether banking or otherwise, specifically including but not limited to any claim founded in contract, tort, fraud, fraudulent inducement, misrepresentation or otherwise, whether based on statute, regulation, common law or equity. |

Page 11

| (e) | “CONSUMER DISPUTE” and“BUSINESS DISPUTE”. As used herein,“CONSUMER DISPUTE” means aDISPUTE relating to an account (including a deposit account), agreement, extension of credit, loan, service or product provided by Lender that is primarily for personal, family or household purposes.“BUSINESS DISPUTE” means anyDISPUTE that is not aCONSUMER DISPUTE. |

| (f) | “PARTIES” or “PARTY”. As used in these Arbitration Provisions, the term“PARTIES” or “PARTY” means Borrower, Lender, and each and all persons and entities signing this Agreement or any other agreements between or among any of thePARTIES as part of this transaction.“PARTIES” or“PARTY”shall be broadly construed and include individuals, beneficiaries, partners, limited partners, limited liability members, shareholders, subsidiaries, parent companies, affiliates, officers, directors, employees, heirs, agents and/or representatives of any party to such documents, any other person or entity claiming by or through one of the foregoing and/or any person or beneficiary who receives products or services from Lender and shall include any other owner and holder of this Agreement. Throughout these Arbitration Provisions, the term“you” and“your” refer to Borrower, and the term“Arbitrator”refers to the individual arbitrator or panel of arbitrators, as the case may be, before which theDISPUTE is arbitrated. |

| (g) | BINDING ARBITRATION. ThePARTIES agree that anyDISPUTE between thePARTIES shall be resolved by mandatory binding arbitration pursuant to these Arbitration Provisions at the election of eitherPARTY.BY AGREEING TO RESOLVE A DISPUTE IN ARBITRATION, THE PARTIES ARE WAIVING THEIR RIGHT TO A JURY TRIAL OR TO LITIGATE IN COURT (except for matters that may be taken to small claims court for aCONSUMER DISPUTE as provided below). |

| (h) | CLASS ACTION WAIVER. ThePARTIES agree that (i) no arbitration proceeding hereunder whether aCONSUMER DISPUTE or aBUSINESS DISPUTE shall be certified as a class action or proceed as a class action, or on a basis involving claims brought in a purported representative capacity on behalf of the general public, other customers or potential customers or persons similarly situated, and (ii) no arbitration proceeding hereunder shall be consolidated with, or joined in any way with, any other arbitration proceeding.THE PARTIES AGREE TO ARBITRATE A CONSUMER DISPUTE OR BUSINESS DISPUTE ON AN INDIVIDUAL BASIS AND EACH WAIVES THE RIGHT TO PARTICIPATE IN A CLASS ACTION. |

Page 12

| (i) | FEDERAL ARBITRATION ACT AND TEXAS LAW. ThePARTIES acknowledge that this Agreement evidences a transaction involving interstate commerce. The Federal Arbitration Act shall govern (i) the interpretation and enforcement of these Arbitration Provisions, and (ii) all arbitration proceedings that take place pursuant to these Arbitration Provisions.THE PARTIES AGREE THAT, EXCEPT AS OTHERWISE EXPRESSLY AGREED TO BY THE PARTIES IN WRITING, OR UNLESS EXPRESSLY PROHIBITED BY LAW, TEXAS SUBSTANTIVE LAW (WITHOUT REGARD TO ANY CONFLICT OF LAWS PRINCIPLES) WILL APPLY IN ANY BINDING ARBITRATION PROCEEDING OR SMALL CLAIMS COURT ACTION REGARDLESS OF WHO INITIATES THE PROCEEDING, WHERE YOU RESIDE OR WHERE THE DISPUTE AROSE. |

| II. | Provisions applicable only to a CONSUMER DISPUTE: |

| (a) | Any and allCONSUMER DISPUTES shall be resolved by arbitration administered by the American Arbitration Association (“AAA”) under the Commercial Arbitration Rules and the Supplemental Procedures for Resolution of Consumer Disputes and Consumer Due Process Protocol (which are incorporated herein for all purposes). It is intended by thePARTIES that these Arbitration Provisions meet and include all fairness standards and principles of the American Arbitration Association’s Consumer Due Process Protocol and due process in predispute arbitration. If aCONSUMER DISPUTE is for a claim of actual damages above $250,000 it shall be administered by the AAA before three neutral arbitrators at the request of anyPARTY. |

| (b) | Instead of proceeding in arbitration, anyPARTY hereto may pursue its claim in your local small claims court, if theCONSUMER DISPUTE meets the small claims court’s jurisdictional limits. If the small claims court option is chosen, thePARTY pursuing the claim must contact the small claims court directly.The PARTIES agree that the class action waiver provision also applies to any CONSUMER DISPUTE brought in small claims court. |

| (c) | For any claim for actual damages that does not exceed $2,500, Lender will pay all arbitration fees and costs provided you submitted a Notice of Dispute with regard to theCONSUMER DISPUTE prior to initiation of arbitration. For any claim for actual damages that does not exceed $5,000, Lender also agrees to pay your reasonable attorney’s fees and reasonable expenses your attorney charges you in connection with the arbitration (even if the Arbitrator does not award those to you) plus an additional $2,500 if you obtain a favorable arbitration award for your actual damages which is greater than any written settlement offer for your actual damages made by Lender to you prior to the selection of the Arbitrator. |

Page 13

| (d) | Under the AAA’s Supplemental Procedures for Consumer Disputes, if your claim for actual damages does not exceed $10,000, you shall only be responsible for paying up to a maximum of $125 in arbitration fees and costs. If your claim for actual damages exceeds $10,000 but does not exceed $75,000, you shall only be responsible for paying up to a maximum of $375 in arbitration fees and costs. For any claim for actual damages that does not exceed $75,000, Lender will pay all other arbitrator’s fees and costs imposed by the administrator of the arbitration. With regard to aCONSUMER DISPUTE for a claim of actual damages that exceeds $75,000, or if the claim is a non-monetary claim, Lender agrees to pay all arbitration fees and costs you would otherwise be responsible for that exceed $1,000. The fees and costs stated above are subject to any amendments to the fee and cost schedules of the AAA. The fee and cost schedule in effect at the time you submit your claim shall apply. The AAA rules also permit you to request a waiver or deferral of the administrative fees and costs of arbitration if paying them would cause you financial hardship. |

| (e) | Although under some laws, Lender may have a right to an award of attorney’s fees and expenses if it prevails in arbitration, Lender agrees that it will not seek such an award in a binding arbitration proceeding with regard to aCONSUMER DISPUTE for a claim of actual damages that does not exceed $75,000. |

| (f) | To request information on how to submit an arbitration claim, or to request a copy of the AAA rules or fee schedule, you may contact the AAA at 1-800-778-7879 (toll free) or atwww.adr.org. |

| III. | Provisions applicable only to a BUSINESS DISPUTE: |

| (a) | Any and allBUSINESS DISPUTES between thePARTIES shall be resolved by arbitration in accordance with the Commercial Arbitration Rules of the AAA in effect at the time of filing, as modified by, and subject to, these Arbitration Provisions. ABUSINESS DISPUTE for a claim of actual damages that exceeds $250,000 shall be administered by AAA before at least three (3) neutral arbitrators at the request of anyPARTY. In the event the aggregate of all affirmative claims asserted exceeds $500,000, exclusive of interest and attorney’s fees, or upon the written request of anyPARTY, the arbitration shall be conducted under the AAA Procedures for Large, Complex Commercial Disputes. If the payment of arbitration fees and costs will cause you extreme financial hardship you may request that AAA defer or reduce the administrative fees or request Lender to cover some of the arbitration fees and costs that would be your responsibility. |

| (b) | ThePARTIES shall have the right to (i) invoke self-help remedies (such as setoff, notification of account debtors, seizure and/or foreclosure of collateral, and nonjudicial sale of personal property and real property collateral) before, during or after any arbitration, and/or (ii) request ancillary or provisional judicial remedies (such as garnishment, attachment, specific performance, receiver, injunction or restraining order, and sequestration) before or after the commencement of any arbitration proceeding (individually, and not on behalf of a class). ThePARTIES need not await the outcome of the arbitration proceeding before using self-help remedies. Use of self-help or ancillary and/or provisional judicial remedies shall not operate as a waiver of eitherPARTY’s right to compel arbitration. Any ancillary or provisional judicial remedy which would be available from a court at law shall be available from the Arbitrator. ThePARTIES agree that the AAA Optional Rules for Emergency Measures of Protection shall apply in an arbitration proceeding where emergency interim relief is requested. |

Page 14

| (c) | Except to the extent the recovery of any type or types of damages or penalties may not by waived under applicable law, the Arbitrator shall not have the authority to award eitherPARTY (i) punitive, exemplary, special or indirect damages, (ii) statutory multiple damages, or (iii) penalties, statutory or otherwise. |

| (d) | The Arbitrator may award attorney’s fees and costs including the fees, costs and expenses of arbitration and of the Arbitrator as the Arbitrator deems appropriate to the prevailingPARTY. The Arbitrator shall retain jurisdiction over questions of attorney’s fees for fourteen (14) days after entry of the decision. |

| IV. | General provisions applicable to both CONSUMER DISPUTES and BUSINESS DISPUTES: |

| (a) | The Arbitrator is bound by the terms of these Arbitration Provisions. The Arbitrator shall have exclusive authority to resolve anyDISPUTES relating to the scope or enforceability of these Arbitration Provisions, including (i) all arbitrability questions, and (ii) any claim that all or a part of these Arbitration Provisions are void or voidable (including any claims that they are unconscionable in whole or in part). |

| (b) | These Arbitration Provisions shall survive any termination, amendment, or expiration of this Agreement, unless all of the PARTIES otherwise expressly agree in writing. |

| (c) | If aPARTY initiates legal proceedings, the failure of the initiatingPARTY to request arbitration pursuant to these Arbitration Provisions within 180 days after the filing of the lawsuit shall be deemed a waiver of the initiatingPARTY’S right to compel arbitration with respect to the claims asserted in the litigation. The failure of the defendingPARTY in such litigation to request arbitration pursuant to these Arbitration Provisions within 180 days after the defendingPARTY’S receipt of service of judicial process, shall be deemed a waiver of the right of the defendingPARTY to compel arbitration with respect to the claims asserted in the litigation. If a counterclaim, cross-claim or third party action is filed and properly served on aPARTY in connection with such litigation, the failure of suchPARTY to request arbitration pursuant to these Arbitration Provisions within ninety (90) days after suchPARTY’S receipt of service of the counterclaim, cross-claim or third party claim shall be deemed a waiver of suchPARTY’S right to compel arbitration with respect to the claims asserted therein. The issue of waiver pursuant to these Arbitration Provisions is an arbitrable dispute. Active participation in any pending litigation described above by aPARTY shall not in any event be deemed a waiver of suchPARTY’S right to compel arbitration. All discovery obtained in the pending litigation may be used in any subsequent arbitration proceeding. |

Page 15

| (d) | AnyPARTY seeking to arbitrate shall serve a written notice of intent to any and all opposingPARTIESafter aDISPUTE has arisen. ThePARTIES agree a timely written notice of intent to arbitrate by eitherPARTY pursuant to these Arbitration Provisions shall stay and/or abate any and all action in a trial court, save and except a hearing on a motion to compel arbitration and/or the entry of an order compelling arbitration and staying and/or abating the litigation pending the filing of the final award of the Arbitrator. |

| (e) | Any Arbitrator selected shall be knowledgeable in the subject matter of theDISPUTE and be licensed to practice law. |

| (f) | For a one (1) member arbitration panel, thePARTIES are limited to an equal number of strikes in selecting the arbitrator from the AAA neutral list, such that at least one arbitrator remains after thePARTIES exercise all of their respective strikes. For a three (3) member arbitration panel, thePARTIES are limited to an equal number of strikes in selecting the arbitrators from the AAA neutral list, such that at least three arbitrators remain after thePARTIES exercise all of their respective strikes. After exercising all of their allotted respective strikes, thePARTIES shall rank those potential arbitrators remaining numerically in order of preference (with “1” designating the most preferred). The AAA shall review thePARTIES rankings and assign a score to each potential arbitrator by adding together the ranking given to such potential arbitrator by eachPARTY. The arbitrator(s) with the lowest score total(s) will be selected. In the event of a tie or ties for lowest score total and if the selection of both or all of such potential arbitrators is not possible due to the required panel size, the AAA shall select the arbitrator(s) it believes to be best qualified. |

| (g) | ThePARTIES and the Arbitrator shall treat all aspects of the arbitration proceedings, including, without limitation, any documents exchanged, testimony and other evidence, briefs and the award, as strictly confidential; provided, however, that a written award or order from the Arbitrator may be filed with any court having jurisdiction to confirm and/or enforce such award or order. |

| (h) | Any statute of limitation which would otherwise be applicable shall apply to any claim asserted in any arbitration proceeding under these Arbitration Provisions, and the commencement of any arbitration proceeding tolls such statute of limitations. |

| (i) | If the AAA is unable for any reason to provide arbitration services, then thePARTIES agree to select another arbitration service provider that has the ability to arbitrate theDISPUTE pursuant to and consistent with these Arbitration Provisions. If thePARTIES are unable to agree on another arbitration service provider, anyPARTY may petition a court of competent jurisdiction to appoint an Arbitrator to administer the arbitration proceeding pursuant to and consistent with these Arbitration Provisions. |

Page 16

| (j) | The award of the Arbitrator shall be final and Judgment upon any such award may be entered in any court of competent jurisdiction. The arbitration award shall be in the form of a written reasoned decision and shall be based on and consistent with applicable law. |

| (k) | Unless thePARTIES mutually agree to hold the binding arbitration proceeding elsewhere, venue of any arbitration proceeding under these Arbitration Provisions shall be in the county and state where Lender is located, which is Lender’s address set out in the first paragraph on page 1 hereof. |

| (l) | If any of these Arbitration Provisions are held to be invalid or unenforceable, the remaining provisions shall be enforced without regard to the invalid or unenforceable term or provision. |

JURY WAIVER: IF A DISPUTE BETWEEN YOU AND LENDER PROCEEDS IN COURT RATHER THAN THROUGH MANDATORY BINDING ARBITRATION, THEN YOU AND LENDER BOTH WAIVE THE RIGHT TO A JURY TRIAL, AND SUCH DISPUTE WILL BE TRIED BEFORE A JUDGE ONLY.

| 14. | Time of the Essence. Time is of the essence as to all provisions of this Agreement. |

| 15. | Authority. Each person executing this Agreement on behalf of a Party represents to the other Party that such person is duly authorized and has the legal capacity to execute and deliver this Agreement. Each Party executing this Agreement represents to the other Parties that this Agreement is valid and binding on the Party executing this Agreement, enforceable in accordance with its terms. |

| 16. | No Admission; Buy Peace. This Agreement shall not in any manner be construed as or be deemed to be an admission of any liability on the part of Lender. Instead, this Agreement represents the intent of the Parties to enter into a private compromise in the nature of a workout or voluntary reorganization. The Parties have contemplated the cost of litigation of any dispute between Parties and have determined that it would be cost effective and in their respective best interest to enter into this Agreement. It is the intent of the Parties to buy peace and by this Agreement to avoid the necessity for litigation and to avoid the possibility of bankruptcy of Borrower if possible. The covenants and agreements herein are not mere recitals, but rather the contractual agreement of the Parties with the express desire that they be honored and enforced as written. Each Party has read this entire Agreement and has full knowledge of its effect and acknowledges that it is executing same for the purposes set forth herein with such knowledge and of its own free will. Borrower acknowledges that the relationship of Borrower and Lender is that of borrower and lender and that no special relationship exists which would contradict that relationship and that there is no fiduciary relationship or duty arising from such relationship. |

Page 17

| 17. | Guarantors. It is understood and agreed by Borrower that Guarantor is in no way whatsoever released from their Guaranty Agreements by this Agreement, as Lender has the right, but not the obligation, at any time and from time to time, without prejudice to any claim against Guarantor, and without notice to Guarantor, to enter into this Agreement without waiving any of Lender’s rights against Guarantor, including without limitation, to collect from Guarantor any and all deficiencies on the Indebtedness as determined by Lender in its sole discretion. Borrower also acknowledges and agrees that the Guaranty Agreements signed by the Guarantor contain guaranties of payment, under which Lender at its sole discretion may elect to pursue remedies for collection of debt or deficiencies of any obligations owed by Borrower or Guarantors, jointly or severally at any time upon default, and Lender may make determinations in its sole discretion whether to seek collection of any amount of the Indebtedness from one or all obligors, whether Borrower or Guarantor. |

[Signatures are on the following pages.]

Page 18

EXECUTED as of the Effective Date.

BORROWER:

CAMBER ENERGY, INC. f/k/a LUCAS ENERGY, INC.,

a Nevada corporation

| By: | /s/ Louis G. Schott |

| Printed Name: | Louis G. Schott |

| Title: | Interim Chief Executive Officer |

LENDER:

INTERNATIONAL BANK OF COMMERCE,

a Texas state banking corporation

| By: | /s/ Bernardo De La Garza | |

| Bernardo De La Garza, Vice President |

Signature Page

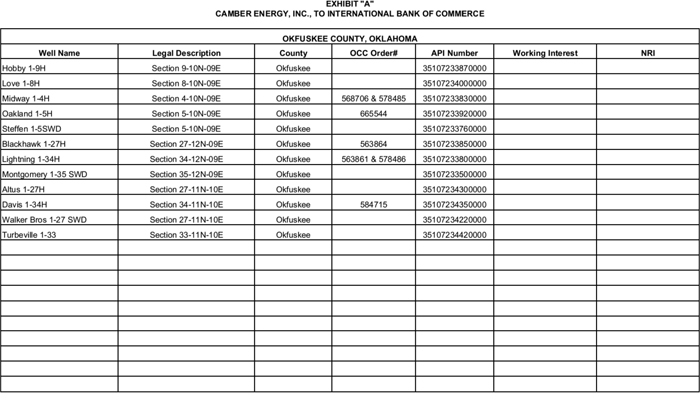

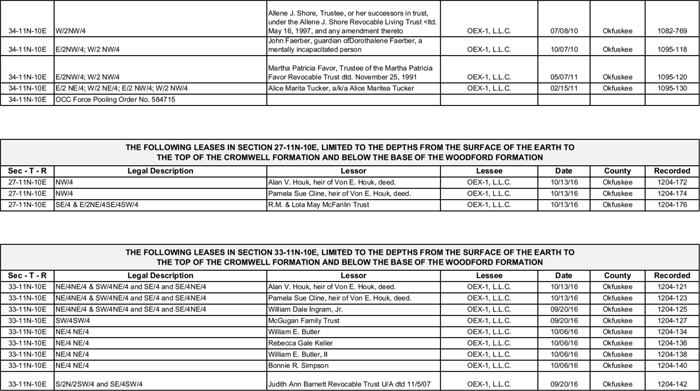

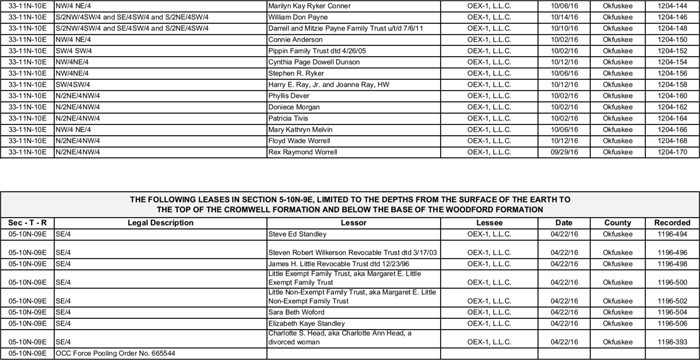

EXHIBIT “A”

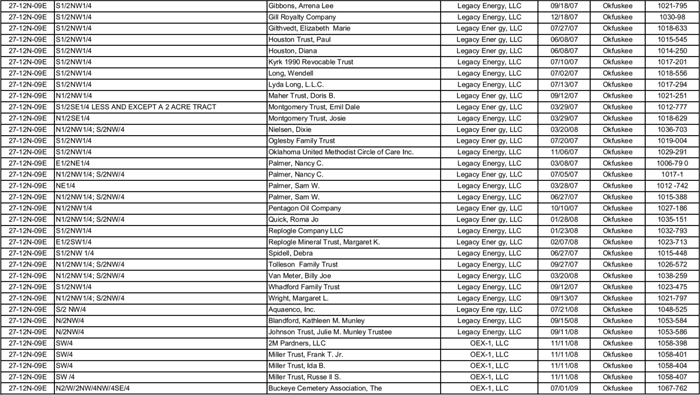

THE ORION ASSETS

[see following page]

Exhibit A, Page 1

Exhibit A, Page 2

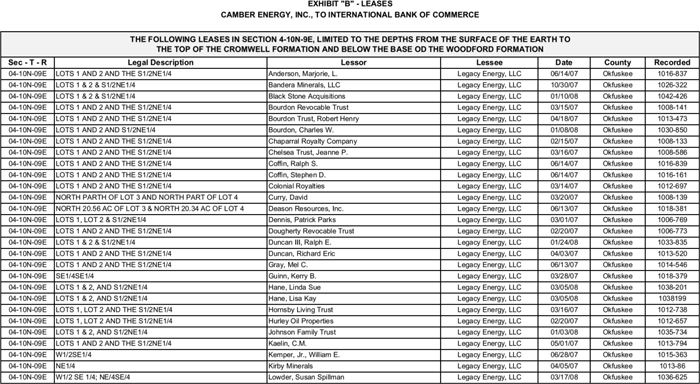

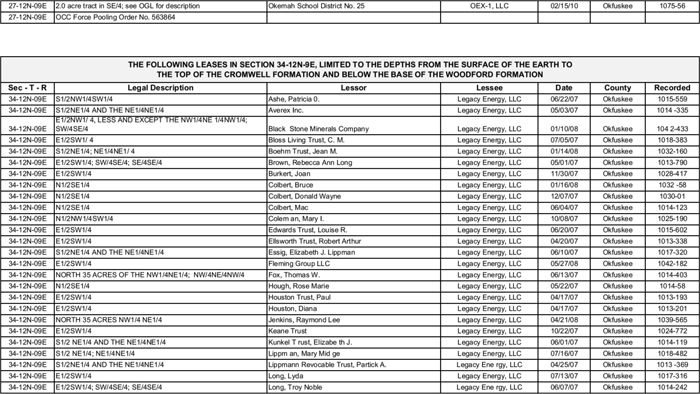

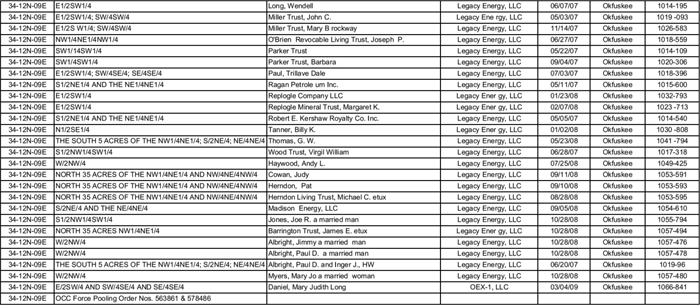

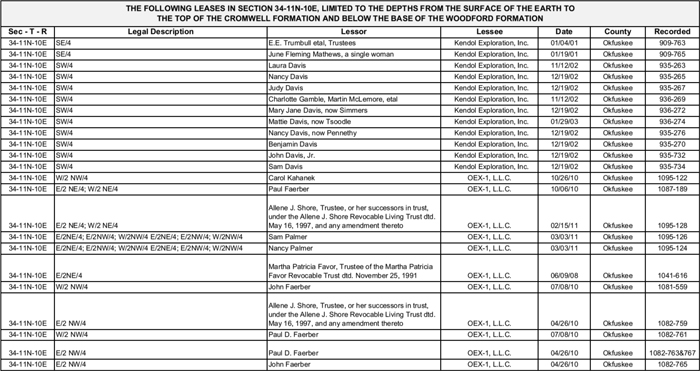

EXHIBIT “B”

THE ORION ASSETS

[see following pages]

Exhibit B, Page 1

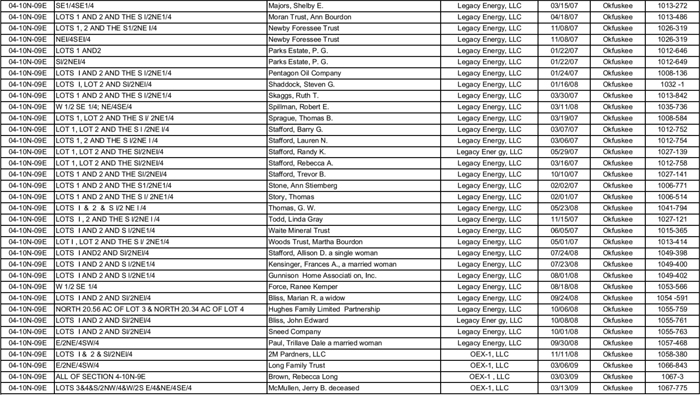

Exhibit B, Page 2

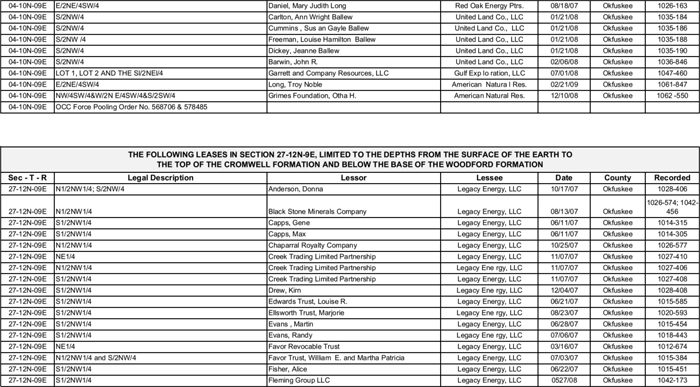

Exhibit B, Page 3

Exhibit B, Page 4

Exhibit B, Page 5

Exhibit B, Page 6

Exhibit B, Page 7

Exhibit B, Page 8

Exhibit B, Page 9

Exhibit B, Page 10

EXHIBIT “C”

FORM OF PRODUCTION PAYMENT AGREEMENT

[see following pages]

Exhibit C, Page 1

ASSIGNMENT OF PRODUCTION PAYMENT

| STATE OF OKLAHOMA | § | |

| § | KNOW ALL MEN BY THESE PRESENTS: | |

| COUNTY OF OKFUSKEE | § |

This Assignment of Production Payment (the“Assignment”), dated as of August 1, 2018 the (“Effective Date”), is by and amongN&B ENERGY, LLC, whose address is [________________] (“Assignor”); andCE Operating, LLC, whose address is 1415 Louisiana Street, Suite 3500 Houston, Texas 77002 (“CE Operating”) or CE Operating’s designee (collectively,“Assignee”). Assignor and Assignee are collectively the“Parties”.

NOW THEREFORE, in consideration of the mutual obligations contained herein, the Parties agree as follows:

Definitions. When used in this Assignment, the following terms shall have the meanings indicated below:

“Gross Proceeds” for each calendar month or portion thereof during the term of this Assignment means the amounts actually received during such period by Assignor or any successor or assignee of Assignor as revenues from the sale of Hydrocarbons (determined before calculating payments hereunder).

“Hydrocarbons” means all oil, gas, and other gaseous and liquid hydrocarbons or any combination of one or more of such substances in and under, and which may be produced, saved, and sold from, and which shall accrue and be attributable to, the Leases described on Exhibit “A”, and all unitization and pooling agreements and the units created thereby which cover or include such Leases or portions thereof.

“Leases” means those leases described on Exhibit “A”, attached hereto and incorporated herein for all purposes.

“Production Costs” are those costs, charges, and expenses incurred by Assignor subsequent to the Effective Date and prior to expiration of the term of this Assignment in connection with the Leases and wells listed on Exhibit “A”, expressly limited to:

(1) costs and expenses incurred in drilling, deepening, side-tracking, plugging--back, coring, testing, logging, completing and equipping for production (including, the cost of wellhead facilities, storage tanks, separators, pumping equipment, flow lines, salt water disposal equipment, and other similar production facilities), all wells now or hereafter located on the lands covered by the Leases or on lands pooled or unitized therewith;

(2) expenditures made and costs incurred in connection with the operation and maintenance of the Leases and the production and marketing of Hydrocarbons therefrom, such items of cost to include: (i) all costs of complying with legal requirements; (ii) all costs of lifting, producing, and handling Hydrocarbons from the Leases, including but not limited to all costs of labor, fuel, repairs, hauling, materials, supplies, utility charges, water and other costs incident thereto; (iii) costs of gathering, compressing, dehydrating, separating, treating, processing, disposing, transporting, and marketing Hydrocarbons produced from the Leases, including the cost of constructing and installing pipelines and other facilities necessary in connection therewith; (iv) all delay rentals, shut-in well payments, minimum royalties and other payments made in connection with the maintenance of the Leases; (v) the costs of all workover and other remedial well servicing operations; and (vi) the cost of all fluid injection, pressure maintenance, secondary recovery, recycling, and other enhanced recovery operations; and

Exhibit C, Page 2

(3) all insurance premiums to the extent insurance is maintained with respect to the Leases.

The term“Production Costs” shallnot include any administrative charges or any overhead charges paid, directly or indirectly, to the operator or operators of the Leases.

Conveyance.

Assignor, for and in consideration of Ten and No/100 Dollars ($10.00) and other good and valuable consideration, the receipt of which is hereby acknowledged, does hereby assign, transfer and convey unto Assignee this Production Payment in the amount(s) set forth below.

The Production Payment shall be twelve and five tenths (12.5%) percent of the Net Revenue (as defined below) attributable to and to the extent of any leasehold interest of Assignor in and to all production from the Leases, and in each case after deducting therefrom the following: (a) royalties reserved in said Lease(s); (b) all severance, production, excise, or other similar taxes measured by the Production Payment for that particular month, limited to the amount of or the value of such production; and (c) any third-party lender’s or investor’s recorded interest, including principal and interest, to the extent it encumbers the leasehold interests or extends into the Net Revenue. Any investments, loans or other contributions received by Assignor, any of its affiliates, from third parties for the purpose of drilling or operating costs which is not expended on direct drilling or operating costs, shall not be included in Production Costs as a deduction againstGross Proceeds from which the Production Payment is payable. The 12.5% share of Assignor’s net revenue interest out of which the Production Payment shall be made will not be burdened by administrative overhead costs.

The Production Payment shall be payable each month running from the Effective Date of this Assignment until Assignee has received Two Million Five Hundred Thousand and No/100 Dollars ($2,500,000.00). Assignor shall also receive credit towards the Two Million Five Hundred Thousand and No/100 Dollars ($2,500,000.00) for the amounts received by Assignee or its designee for the proceeds of the three (3.0) percent overriding royalty interest it has on the same leases and wells listed on Exhibit “A” derived under that certain Assignment of Overriding Royalty Interest dated _______________ 2018, from Assignor to Assignee, recorded as Document No. _____________________ in the Real Property Records of Okfuskee County, Oklahoma.

Exhibit C, Page 3

Net Revenue Account. Assignor shall establish and maintain a Net Revenue account (“Net Revenue Account”) in accordance with consistently applied generally accepted accounting practices and the provisions of this Assignment, as follows:

(a) The Net Revenue Account shall be credited with all Gross Proceeds;

(b) The Net Revenue Account shall be debited for all Production Costs and taxes; and

(c) The balance in the Net Revenue Account, shall be determined as of the end of each calendar month, and, if positive, shall be deemed “Net Revenue” for purposes of this Assignment.

Monthly Statement; Payment. On or before the last business day of the month following the close of each calendar month, (a) Assignor shall deliver to Assignee a statement showing, in reasonable detail, the balance of the Net Revenue Account as of the end of such calendar month, and (b) Assignor shall pay to Assignee an amount equal to 12.50% of the Net Revenue, if any, for such calendar month (the“Production Payment”). Assignee and its representatives shall have the right to audit the Net Revenue Account and records relating to the Net Revenue Account upon request, such request not to be made more than once annually, to be performed at the sole cost and expense of Assignee, except as provided below. Upon such a request, Assignor shall make available to Assignee or its designated representative all records of account and supporting documentation within thirty (30) days. Assignee may specify the time period for such audit, not to exceed twenty-four (24) months. In the event the Assignee finds any discrepancy of more than 5% in the amount of proceeds paid to Assignee and the amount of proceeds which were due to Assignee, the Assignor shall pay all of the costs and expenses of the audit. The Assignor shall promptly pay the amount of any deficiency in the proceeds paid to the Assignee hereunder which are discovered as a result of any audit, from the date originally due.

In accordance with Section 2.7(b) of that certain Asset Purchase Agreement dated July 10, 2018, between Assignor and Camber Energy, Inc., the parent company of Assignee (the “APA”), and provided the Closing (as defined in the APA) occurs and Assignee fails to pay any Unpaid Bills (as defined in the APA), Assignor may be entitled to pay such expenses and deduct the amount of such expenses from any sums payable to Assignee hereunder.

Sales Contracts. Assignor shall use commercially reasonable efforts to market or cause to be marketed all commercial quantities of Hydrocarbons. Assignor may enter into one or more Hydrocarbon processing, sales or exchange contracts (“Marketing Contracts”) under such terms as are acceptable to Assignor in its reasonable judgment; provided Assignor shall not enter into a Marketing Contract with an affiliate, whether wholly or partially owned, by Assignor unless such Marketing Contract is on substantially the same material terms and prices prevailing in the area in marketing contracts entered into by unaffiliated third parties in arm’s-length transactions.

Assignee agrees to execute such documents as may be reasonably requested by Assignor or its permitted successors in interest, from time to time, including to evidence the unliquidated balance of the Production Payment or to evidence the termination of same upon the Production Payment having been paid in full.

Exhibit C, Page 4

Assignor reserves the right to pre-pay to Assignee the unpaid balance of the Production Payment at any time and, upon such payment, the Production Payment shall be in all things satisfied and terminated. A recordable release of the Production Payment shall be prepared to the reasonable satisfaction of Assignor, executed by Assignee, and held in escrow by an escrow officer appointed by Assignor and shall be filed of record within fourteen (14) days of the Production Payment’s termination.

Nothing contained herein shall be deemed to constitute or create a joint venture or partnership between the parties hereto.

Assignee may convey its rights under this Assignment and the Production Payment set forth herein to another party with written notice to Assignor.

TO HAVE AND TO HOLD the Production Payment assigned herein unto Assignee, its successors and assigns forever, subject to the terms and provisions hereof.

The parties agree to take all such further actions and to execute, acknowledge and deliver all such further documents that are reasonably necessary or useful in carrying out the purposes of this Assignment.

IN WITNESS WHEREOF, this Assignment is executed on the dates set forth below.

ASSIGNOR:

N&B ENERGY, LLC

| BY: | ||

| ____________________, Managing Member |

ASSIGNEE:

CAMBER ENERGY, INC.

| BY: | |||

| ITS: | |||

Exhibit C, Page 5

| THE STATE OF TEXAS | § | |

| § | ||

| COUNTY OF ______________ | § |

This instrument was acknowledged before me on this ____ day of _________________, 2018, by _____________, as Managing Member of the Assignor set forth above and on behalf of each such entity.

| Notary Public, in and for The State of Texas |

| THE STATE OF TEXAS | § | |

| § | ||

| COUNTY OF ______________ | § |

This instrument was acknowledged before me on this ____ day of ______________________, 2018, by _______________, as ___________________________________ of the Assignee set forth above and on behalf of each such entity.

| Notary Public, in and for The State of Texas |

Exhibit C, Page 6

EXHIBIT A

Exhibit C, Page 7

EXHIBIT “D”

FORM OF ORION ORRI

[see following pages]

Exhibit D, Page 1

ASSIGNMENT OF OVERRIDING ROYALTY INTEREST

| STATE OF OKLAHOMA | § | |

| § | KNOW ALL MEN BY THESE PRESENTS: | |

| COUNTY OF OKFUSKEE | § |

ThatCE Operating, LLC having a mailing address at 1415 Louisiana Street, Suite 3500, Houston, Texas 77002 (hereinafter “Assignor”), for and in consideration of one dollar ($1.00) and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, does hereby assign, transfer, sell and convey untoCamber Royalties, LLC having a mailing address at 1415 Louisiana Street, Suite 3500 Houston, Texas 77002 (hereinafter “Assignee”) anOverriding Royalty Interestequal to three percent of eight-eights (the “Overriding Royalty Interest”) in and to those Oil and Gas Leases and Orders which cover the lands and wells described on Exhibit “A-1” and Exhibit “B” in Lincoln County, State of Oklahoma.

The Overriding Royalty Interest assigned herein applies to all oil, gas, casinghead gas or other hydrocarbon substances which may be produced, saved and marketed from the lands under the terms of the Oil and Gas Leases described on Exhibit “A-1” or the wells described on Exhibit “B”, if, as and when produced, saved, sold and marketed, but not otherwise, insofar and only insofar as the Oil and Gas Leases cover the lands specifically described on Exhibit “A-1” and the wells on Exhibit “B”, and subject to the provisions and conditions herein set forth. The Overriding Royalty Interest herein shall bear all costs borne under the oil and gas leases constituting the Oil and Gas Leases described on Exhibit “A-1”, including without limitation, taxes and treating, transportation, and marketing costs of the minerals produced thereunder and pay currently its proportionate share of gross production, severance, pipeline taxes and other taxes which may be assessed or levied against said Overriding Royalty Interest or the production attributable thereto. The Overriding Royalty Interest assigned herein shall not impose upon Assignor herein, or Assignor’s successors and assigns, any duty or obligation to develop or operate the lands covered by the Oil and Gas Leases which cover the lands described on Exhibit “A-1” for oil, gas or other hydrocarbons other than as required by the provisions of the Oil and Gas Leases, nor to maintain the Oil and Gas Leases in effect by the payment of delay rentals.

In the event the Oil and Gas Leases cover less than the entire interest in the oil, gas and other hydrocarbons in the lands covered thereby, the Overriding Royalty Interest assigned herein shall be reduced proportionately and shall be payable to Assignee in the proportion which the interests in the oil, gas and other hydrocarbons in the lands covered by the Oil and Gas Leases bear to the entire estate in the oil, gas and other hydrocarbons in and under said lands described on Exhibit “A-1”.

In accordance with Section 2.7(b) of that certain Asset Purchase Agreement dated July 10, 2018, between Camber Energy, Inc. and N&B Energy, LLC (the “APA”), and provided the Closing (as defined in the APA) of such APA occurs and Assignee fails to pay any Unpaid Bills (as defined in the APA), N&B Energy, LLC may be entitled to pay such expenses and deduct the amount of such expenses from any sums payable to Assignee hereunder.

Exhibit D, Page 2

This Overriding Royalty Interest shall attach and apply to all extensions and renewals of the Oil and Gas Leases covering any of the wells described on Exhibit “B”; however, this Overriding Royalty Interest shall expressly not apply to new oil and gas leases covering the same lands burdened by the Overriding Royalty Interest obtained after the Oil and Gas Leases described on Exhibit “A-1” have terminated.

Assignor is hereby authorized to create or form pooled units and thereby pool or unitize the Overriding Royalty Interest in the same manner and to the same extent as provided in the Oil and Gas Leases and Orders which cover the lands and wells described on Exhibit “A-1” and Exhibit “B”, without any further consent of, or consultation with, Assignee. In the event of such pooling or unitization, Assignee shall receive only such proportion of the Overriding Royalty Interest stipulated herein as the amount of the acreage covered by the Oil and Gas Leases and Orders which cover the lands and wells described on Exhibit “A-1” and Exhibit “B”, and placed in the unit bears to the total acreage in the unit. The Overriding Royalty Interests are subject to any and all amendments of the Oil and Gas Leases and Orders, now and in the future.

If the assignment of the Overriding Royalty Interest herein conveyed results in Assignor, or any third-party buyer of Assignor’s interest in the Oil and Gas Leases and Orders which cover the lands and wells described on Exhibit “A-1” and Exhibit “B”, receiving less than a 75.0% net revenue interest in any of the Oil and Gas Leases and Orders which cover the lands and wells described on Exhibit “A-1” and Exhibit “B”, the Overriding Royalty Interest shall apply to such oil and gas lease(s) assigned only to the extent necessary for Assignor or any third-party buyer of Assignor’s interest to receive no less than a 75.0% net revenue interest in any of the Oil and Gas Leases and Orders.

If (i) the Oil and Gas Leases described on Exhibit “A-1” or the wells described on Exhibit “B” cover less than the entire mineral interest, and/or (ii) the interest of Assignor in the Oil and Gas Leases described on Exhibit “A-1” or the wells described on Exhibit “B” cover less than the entire leasehold interest, the overriding royalty interest shall be proportionately reduced.

This Assignment is made without warranty of title, either express or implied. Provided, however, Assignor makes a special limited warranty to Assignee that the interests assigned herein are not subject to any Agreement which has not been disclosed to Assignee which would adversely affect the interests assigned herein. ANY AND ALL IMPLIED COVENANTS RELATING TO THE OVERRIDING ROYALTY INTEREST ASSIGNED HEREBY ARE EXPRESSLY WAIVED BY ASSIGNEE AND OF NO FORCE OR EFFECT.

All of the terms, provisions, covenants and agreements herein contained shall extend to and be binding upon the parties hereto, their respective successors and assigns.

Exhibit D, Page 3

Executed this ____ day of ________________, and effective ________________.

Assignor:

CE OPERATING, LLC

| By: |

| STATE OF TEXAS | § | |

| § | ||

| COUNTY OF BEXAR | § |

Before me, the undersigned, a Notary Public, in and for said County and State on this ____ day of June, 2018, personally appeared_____________________________________________, to me known to be the identical person who subscribed the name of the maker thereof to the within and foregoing instrument, and acknowledged to me that he/she executed the same as his/her free and voluntary act and deed, and the free and voluntary act and deed of such limited liability company for the uses and purposes therein set forth.

IN WITNESS WHEREOF, I have hereunto set my official signature and affixed my official seal the day and year first above written.

| Notary Public, State of ________________ | |

| Commission No.: __________________ | |

| My Commission expires on: __________________ | |

| (SEAL) |

Exhibit D, Page 4

EXHIBIT “A-1”

SCHEDULE OF LEASES

Exhibit D, Page 5

EXHIBIT “B”

SCHEDULE OF WELLS

Exhibit D, Page 6

EXHIBIT “E”

FORM OF TAW ORRI

[see following pages]

Exhibit E, Page 1

ASSIGNMENT OF OVERRIDING ROYALTY INTEREST

| STATE OF OKLAHOMA | § | |

| § | KNOW ALL MEN BY THESE PRESENTS: | |

| COUNTY OF LINCOLN | § |

That__________________ having a mailing address at ____________________________________ (hereinafter “Assignor”), for and in consideration of one dollar ($1.00) and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, does hereby assign, transfer, sell and convey untoCamber Royalties, LLC having a mailing address at 1415 Louisiana Street, Suite 3500, Houston, Texas 77002 (hereinafter “Assignee”) anOverriding Royalty Interestequal to the difference between existing burdens and eighteen and eight hundred seventy-five one thousands percent (18.875%) (the “Overriding Royalty Interest”) in and to those Oil and Gas Leases and Orders which cover the lands and wells described on Exhibit “A-1” and Exhibit “B” in Lincoln County, State of Oklahoma.

The Overriding Royalty Interest assigned herein applies to all oil, gas, casinghead gas or other hydrocarbon substances which may be produced, saved and marketed from the lands under the terms of the Oil and Gas Leases described on Exhibit “A-1” or the Wells described on Exhibit “B”, if, as and when produced, saved, sold and marketed, but not otherwise, insofar and only insofar as the Oil and Gas Leases cover the lands specifically described on Exhibit “A-1” and the Wells on Exhibit “B”, and subject to the provisions and conditions herein set forth. The Overriding Royalty Interest herein shall bear all costs borne under the oil and gas leases constituting the Oil and Gas Leases described on Exhibit “A-1”, including without limitation, taxes and treating, transportation, and marketing costs of the minerals produced thereunder and pay currently its proportionate share of gross production, severance, pipeline taxes and other taxes which may be assessed or levied against said Overriding Royalty Interest or the production attributable thereto. The Overriding Royalty Interest assigned herein shall not impose upon Assignor herein, or Assignor’s successors and assigns, any duty or obligation to develop or operate the lands covered by the Oil and Gas Leases which cover the lands described on Exhibit “A-1” for oil, gas or other hydrocarbons other than as required by the provisions of the Oil and Gas Leases nor to maintain the Oil and Gas Leases in effect by the payment of delay rentals.

In the event the Oil and Gas Leases cover less than the entire interest in the oil, gas and other hydrocarbons in the lands covered thereby, the Overriding Royalty Interest assigned herein shall be reduced proportionately and shall be payable to Assignee in the proportion which the interests in the oil, gas and other hydrocarbons in the lands covered by the Oil and Gas Leases bear to the entire estate in the oil, gas and other hydrocarbons in and under said lands described on Exhibit “A-1”.

In accordance with Section 2.7(b) of that certain Asset Purchase Agreement dated July 10, 2018, between Camber Energy, Inc. and N&B Energy, LLC (the “APA”), and provided the Closing (as defined in the APA) of such APA occurs and Assignee fails to pay any Unpaid Bills (as defined in the APA), N&B Energy, LLC may be entitled to pay such expenses and deduct the amount of such expenses from any sums payable to Assignee hereunder.

Exhibit E, Page 2

This Overriding Royalty Interest shall attach and apply to all extensions and renewals of the Oil and Gas Leases covering any of the wells described on Exhibit “B”; however, this Overriding Royalty Interest shall expressly not apply to new oil and gas leases covering the same lands burdened by the Overriding Royalty Interest obtained after the Oil and Gas Leases described on Exhibit “A-1” have terminated.

If the assignment of the Overriding Royalty Interest herein conveyed results in Assignor, or any third-party buyer of Assignor’s interest in the Oil and Gas Leases and Orders which cover the lands and wells described on Exhibit “A-1” and Exhibit “B”, receiving less than an 81.125% net revenue interest in any of the Oil and Gas Leases and Orders which cover the lands and wells described on Exhibit “A-1” and Exhibit “B”, the Overriding Royalty Interest shall apply to such oil and gas lease(s) assigned only to the extent necessary for Assignor or any third-party buyer of Assignor’s interest to receive no less than an 81.125% net revenue interest in any of the Oil and Gas Leases and Orders.

If (i) the Oil and Gas Leases described on Exhibit “A-1” or the wells described on Exhibit “B” cover less than the entire mineral interest, and/or (ii) the interest of Assignor in the Oil and Gas Leases described on Exhibit “A-1” or the wells described on Exhibit “B” cover less than the entire leasehold interest, the overriding royalty interest shall be proportionately reduced.