Exhibit 10.1

ASSUMPTION AGREEMENT

This Assumption Agreement (this“Agreement”), dated effective as of September 26, 2018 (the“Effective Date”), is by and among:

International Bank of Commerce, a Texas state banking corporation (the“Lender”), whose mailing address is 130 East Travis Street, San Antonio, Texas 78205, Attention: Mr. Bernardo de la Garza;

Camber Energy, Inc. f/k/a Lucas Energy, Inc., a Nevada corporation (“Original Borrower”), whose mailing address is 1415 Louisiana Street, Suite 3500, Houston, Texas 77002;

CE Operating, LLC, an Oklahoma limited liability company (“Original Borrower Pledgor”), whose mailing address is 1415 Louisiana Street, Suite 3500, Houston, Texas 77002;

N&B Energy, LLC, a Texas limited liability company (the“Assumptor”), whose mailing address is 4040 Broadway, Suite 305, San Antonio, Texas 78209;

Richard Nathan Azar, II., an individual (“Azar”), whose mailing address is 4040 Broadway, Suite 305, San Antonio, Texas 78209;

RAD2 Minerals, Ltd., a Texas limited partnership (“RAD2”), whose mailing address is 4040 Broadway, Suite 305, San Antonio, Texas 78209;

Donnie Baker Seay, an individual (“Seay”), whose mailing address is 105 Nadine, San Antonio, Texas 78209; and

DBS Investments, Ltd., a Texas limited partnership (“DBS”), whose mailing address is 105 Nadine, San Antonio, Texas 78209.

Azar, Seay, RAD2, and DBS are collectively referred to herein as the“Assumptor Guarantors”).

Lender, Original Borrower, Original Borrower Pledgor, Assumptor, and the Assumptor Guarantors are sometimes collectively referred to herein as the“Parties” and individually as a“Party.”

REFERENCE IS HEREBY MADE FOR ALL PURPOSES TO THE FOLLOWING:

A.

That certain Real Estate Lien Note dated August 25, 2016, executed by Original Borrower, payable to the order of Lender, in the principal face amount of FORTY MILLION AND NO/100 DOLLARS ($40,000,000.00) (the“Note”), said Note being secured by, among other instruments, the following:

| Assumption Agreement | Page 1 |

1.

Oil and Gas Mortgage, Security Agreement, Financing Statement and Assignment of Production (Oklahoma) dated August 25, 2016 (the“2016 Mortgage”) by and between Original Borrower, as Mortgagor, and Lender, as Mortgagee, securing, among other indebtedness owed by Original Borrower to Lender, the Note, covering all of Original Borrower’s right, title and interest in and to the oil, gas and mineral leases and/or minerals, mineral interests and estates more particularly described on Exhibit “A”, attached hereto and incorporated herein for all purposes (collectively, the“2016 Oklahoma Interests”) in Lincoln, Payne, and Logan Counties, Oklahoma, recorded in Book 2223, Page 274 of the Real Property Records of Lincoln County, Oklahoma, recorded in Book 2353, Page 597 of the Real Property Records of Payne County, Oklahoma, and recorded in Book 2678, Page 558 of the Real Property Records of Logan County, Oklahoma;

2.

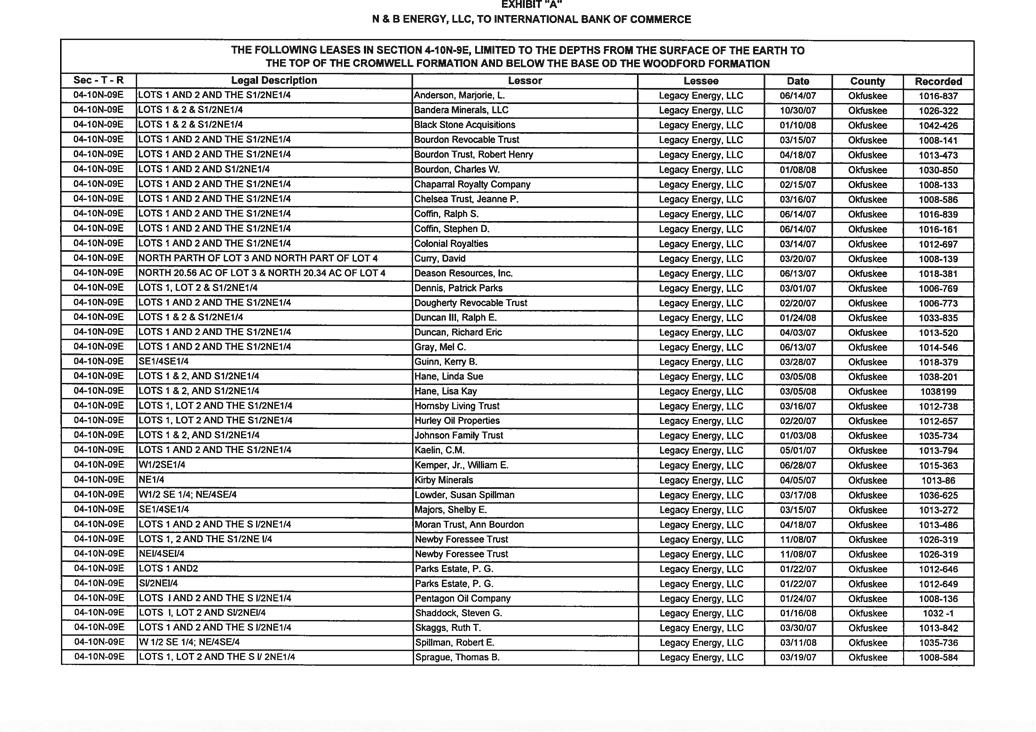

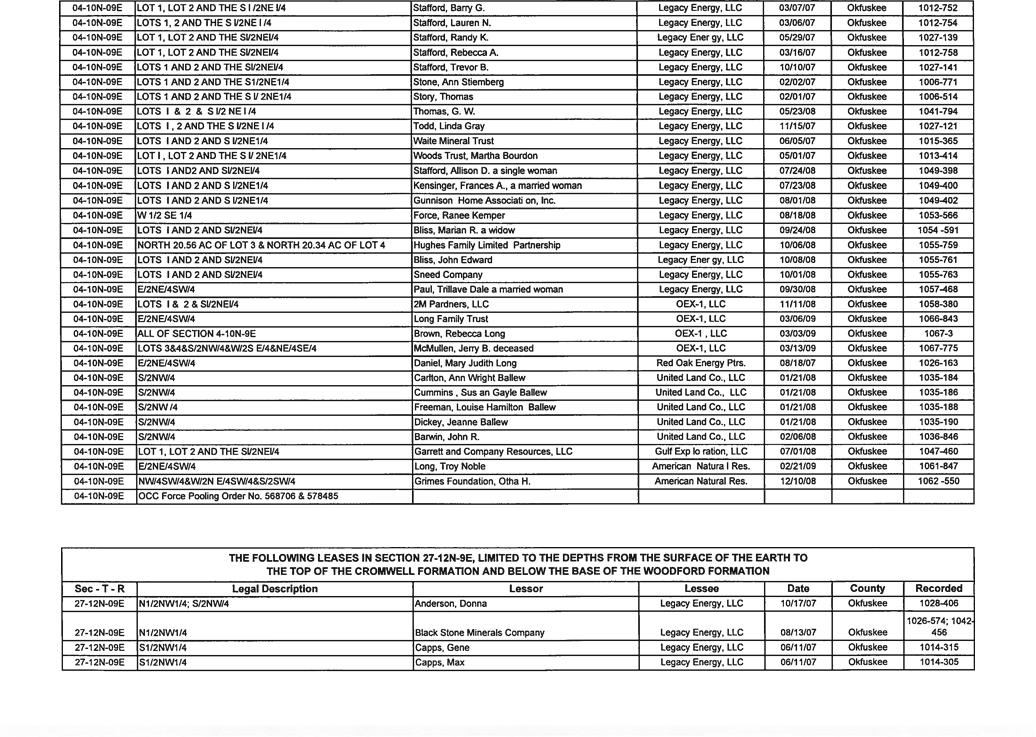

Oil and Gas Mortgage, Security Agreement, Financing Statement and Assignment of Production (Oklahoma) dated August 1, 2018 (the“2018 Mortgage”) by and between Original Borrower Pledgor, as Mortgagor, and Lender, as Mortgagee, securing among other indebtedness owed by Original Borrower to Lender, the Note, covering all of Original Borrower Pledgor’s right, title, and interest in and to the oil, gas, and mineral leases and/or mineral interests and estates more particularly described on Exhibit “A-1”, attached hereto and incorporated herein for all purposes (collectively, the“Orion Interests”) in Okfuskee County, Oklahoma, recorded in Book 1237, Page 206 of the Real Property Records of Okfuskee County, Oklahoma; and

3.

Mortgage, Deed of Trust, Assignment, Security Agreement and Financing Statement dated as of August 25, 2016 (the“2016 Deed of Trust”) from Original Borrower to Michael K. Sohn, Trustee, securing, among other indebtedness, the Note, covering the mineral interests as more particularly described on Exhibit “A” thereto, recorded in Volume 324, Page 403 of the Real Property Records of Glasscock County, Texas (collectively, the“West Texas Properties”).

B.

Asset Purchase Agreement dated as of July 12, 2018, as amended by that certain First Amendment to Asset Purchase Agreement dated August 2, 2018, as amended from time to time (collectively, the“APA”) by and between Assumptor, as purchaser, and Original Borrower, as seller, regarding the purchase and sale of the Assets, as defined in the APA, which consist of, in part, the 2016 Oklahoma Interests and the Orion Interests (collectively, the“Oklahoma Interests”). The term“Assets”as used herein shall have the same meaning as set forth in the APA.

The following are collectively referred to herein as the“Loan Instruments”:(i)the Note,(ii) that certain Loan Agreement of even date with the Note (the“Loan Agreement”), by and among Original Borrower, Lender, the Assumptor Guarantors, Richard E. Menchaca (“Menchaca”), and Saxum Energy, LLC, a Texas limited liability company (“Saxum”),(iii) the 2016 Mortgage,(iv) the 2016 Deed of Trust;(v) the 2018 Mortgage,(vi)those certain Limited Guaranty Agreements dated August 25, 2016 (collectively, the“Guaranty Agreements”) executed by the Assumptor Guarantors, Menchaca and Saxum (collectively, the“Camber Guarantors”), guaranteeing a portion of the Indebtedness evidenced by the Note,(vii) that certain Agreement in Connection With the Loan dated effective August 1, 2018 (the“2018 Agreement”) by and between Original Borrower and Lender,(viii) that certain Consent Agreement dated effective August 1, 2018 (the“Consent Agreement”) executed by the Assumptor Guarantors for the benefit of Lender, and(ix) all other documents, instruments, and agreements which affect and/or secure the payment of the Note or are otherwise executed in connection with the Note by and among Lender and Original Borrower, and the other parties thereto.

The term“Indebtedness” herein means the Note and interest payable thereto together with any fees, late charges, and all other sums due under, or secured by, the Loan Instruments.

| Assumption Agreement | Page 2 |

I. RECITALS

1.1

Loan. Pursuant to the terms of the Loan Agreement, Lender made a loan (the“Loan”) to Original Borrower evidenced by the Note. All capitalized terms not otherwise defined herein shall have the meaning ascribed to them in the Loan Agreement.

1.2

Pledge. In connection with and to further secure the Loan, and in addition to the pledge of the Oklahoma Interests and the West Texas Properties, certain of the Camber Guarantors pledged shares of common stock of Original Borrower (collectively, the“Pledged Stock”) by those certain Certificated Investment Property Pledge Agreements and Uncertificated Investment Property Pledge Agreements executed by such Camber Guarantors for the benefit of Lender (collectively, the“Pledge Agreements”).

1.3

Loan Instruments. Lender is the holder of the Note and all liens and security interests securing the Note created under the Loan Instruments. The 2016 Mortgage and the 2018 Mortgage are collectively referred to herein as the“Mortgages.”

1.4

Defaults. Several defaults have occurred under the Loan Agreement, the Note, and the other Loan Instruments; however, pursuant to the terms of the 2018 Agreement, Lender has agreed not to take any action to collect from Original Borrower the Indebtedness until the Standstill Date occurs, as defined in the 2018 Agreement.

1.5

APA. As permitted by the terms of the 2018 Agreement, Original Borrower has entered into the APA with Assumptor for the sale and purchase of the Assets, which includes, without limitation, the Oklahoma Interests, along with certain additional assets more particularly described in the 2018 Agreement and the APA, including without limitation, the following:(i) all of Original Borrower’s right, title, and interest in and to the “Many Drinks” disposal well and equipment, all associated agreements and other property or assets located on and/or associated with the “Many Drinks” disposal well owned by Original Borrower (collectively, the“Many Drinks Assets”), and(ii) all of Original Borrower’s right, title, and interest in and to the leasehold estate acquired around the temporarily abandoned wells previously operated by and formerly owned by Midstates Petroleum or Equal Energy, Inc. or its subsidiary Petroflow Energy Corporation, and all other property and assets located on and/or associated therewith (collectively, the“TAW Assets”) (all of the above assets being collectively referred to herein as the“Camber Assets”).

| Assumption Agreement | Page 3 |

1.6

Acquisition of Camber Assets. Pursuant to the terms of the APA, Assumptor shall acquire the Camber Assets by those certain assignments and bills of sale dated effective August 1, 2018 (collectively, the“Assignment”, whether one or more), executed by Original Borrower and/or Original Borrower Pledgor, as applicable, as assignor, to Assumptor, as assignee, to be recorded in the Real Property Records of Lincoln, Logan, Payne, and Okfuskee Counties, Oklahoma, encumbered by the liens and security interests created by the Mortgages and the mortgages to be obtained by Lender as more particularly discussed below covering the Many Drinks Assets and the TAW Assets and any of the other interests constituting the Camber Assets not previously pledged to Lender.

1.7

Purpose of Agreement. Because(i) Assumptor desires to assume the payment of the Note and become obligated to pay the Indebtedness and to assume and become obligated to perform all of the obligations and liabilities of Original Borrower under the Loan Agreement, the Mortgages and the other Loan Instruments executed by Original Borrower, and to otherwise become the successor in interest to Original Borrower in all respects under the Loan Instruments executed by Original Borrower (collectively, the“Assumption”),(ii) Lender desires to approve and confirm the Assumption,(iii) the Assumptor Guarantors desire to approve and confirm the Assumption, and(iv) Original Borrower desires to assign to Assumptor all of its rights, duties, obligations, and liabilities under the Loan Instruments, and that Assumptor assume the same and succeed to all of the interest of Original Borrower under the Loan Instruments, the Parties have agreed to the terms of this Agreement.

II. AGREEMENTS

NOW THEREFORE, for and in consideration of these premises and for other good and valuable consideration, the receipt and sufficiency of which is acknowledged and confessed, the Parties agree as follows:

2.1

Recitals Accurate. The Parties acknowledge and agree that the recitals set forth above are true, correct, and accurate in all respects.

2.2

Assumption. Effective as of the Effective Date:

a)

Assignment and Assumption. Original Borrower irrevocably assigns and transfers to Assumptor all of Original Borrower’s rights under the Loan Instruments (the“Assumed Rights”) and all of Original Borrower’s duties, liabilities, and obligations under the Loan Instruments whether accruing on, prior to, or after the Effective Date (collectively, the“Obligations”), and Assumptor irrevocably(i) assumes all of the Assumed Rights and(ii) assumes and agrees to perform all of the Obligations including, without limitation, any and all claims, liabilities, or obligations arising from any failure of Original Borrower to perform any of its covenants, agreements, commitments, and/or obligations to be performed under the Loan Instruments prior to, on, or after the Effective Date.

b)

Assumptor’s Performance Obligation. Assumptor shall duly perform and discharge and be liable for all of the Obligations as if Assumptor was (and had at all times been) named a party to the Loan Instruments instead of Original Borrower.

c)

Assignment of Loan Instruments. All of Original Borrower’s liability and obligations under the Loan Instruments shall be deemed automatically transferred to, and assumed by, Assumptor.

d)

Assumption and Ratification. Assumptor hereby assumes and agrees to comply with and perform all of the Obligations and henceforth shall be bound by all the terms of the Loan Instruments to the same extent Original Borrower is bound prior to the Effective Date. Without limiting any other provision of this Agreement, Assumptor hereby assumes and agrees to pay in full as and when due all payments, the Obligations and other Indebtedness evidenced by the Loan Instruments. Assumptor hereby authorizes the Lender to file any and all UCC financing statements and mortgages as Lender may deem necessary including, without limitation, financing statements containing the description“all assets of Assumptor” or“all personal property of Assumptor” or similar language. As assumed hereby, the Obligations owed by, and the Loan Instruments executed by, Original Borrower shall remain in full force and effect. Assumptor hereby adopts, ratifies and confirms as of the Effective Date all of the Obligations and all of the representations, warranties and covenants of Original Borrower contained in the Loan Instruments. Without limiting any other provision of this Agreement, Assumptor expressly confirms that it is personally liable and obligated (a) for the timely payment, as the same becomes due, of all principal and interest now or hereafter due and payable under the Note until the Note shall have been fully paid and satisfied, and (b) for all other Indebtedness now or hereafter existing, whether accrued or contingent, under this Agreement and all other Loan Instruments.

| Assumption Agreement | Page 4 |

e)

Binding Effect; Construction. By this Agreement, the Obligations and the Indebtedness, including without limitation, the Note, are the primary and unconditional obligations of Assumptor. Lender shall not be required, before enforcing the liability of Assumptor, to assert or exhaust its remedies against any other person or against the Camber Assets or any other security for the repayment of the Indebtedness. All provisions of the Note, the Mortgages and the other Loan Instruments remain in full force and effect as therein written, and as assigned and assumed hereby.

f)

Liens. By this Agreement, all liens, security interests, assignments, superior titles, rights, remedies, powers, equities and priorities securing the Note (collectively, the“Liens”), including without limitation, the Mortgages, and any other Liens set forth and/or created in or under the Loan Instruments, are hereby ratified and affirmed as valid, subsisting and continuing to secure the Indebtedness, including without limitation, the Note and burden and encumber the Camber Assets. Nothing in this Agreement shall in any manner diminish, impair or extinguish any of the Liens or the Loan Instruments or the Indebtedness or be construed as a novation in any respect except as expressly set forth in this Agreement. The Liens are not waived.

2.3

Release by Lender. Effective as of the Effective Date:

a)

Lender’s Release of Original Borrower. Lender releases and forever discharges Original Borrower, Original Borrower Pledgor, each of their subsidiaries and their current and former officers, directors, and shareholders (collectively, the“Original Borrower Parties”), from all covenants, agreements, obligations, claims and demands of any kind, whether in law or at equity, which Lender now has, or which any successor or assign of Lender shall subsequently have, against any Original Borrower Party, arising out of or related to the Obligations or the Loan Instruments. Furthermore, by a Release of Lien approved by Lender in its sole and absolute discretion, within a reasonable time hereafter, Lender shall release the Lien created by the 2016 Deed of Trust covering the West Texas Properties.

b)

Lender’s Acceptance of Assumption by Assumptor. Lender accepts the liability of Assumptor in place of the liability of Original Borrower arising out of or related to the Obligations and Loan Instruments.

c)

Terms of Loan Instruments. From and after the Effective Date, all references in the Loan Instruments to“Maker,” “Mortgagor,” “Debtor,” “Borrower,” “Lucas,”or other similar references that prior to the Effective Date referred to Original Borrower shall now refer to Assumptor.

| Assumption Agreement | Page 5 |

2.4

Consent of Lender. By executing this Agreement, the Lender approves and consents to the APA and the terms and conditions thereof, including, but not limited to, the acquisition by Assumptor of the Camber Assets as set forth therein. Notwithstanding the foregoing, this consent shall not be deemed to be a waiver of the right of the Lender under the Loan Instruments to prohibit any future transfers of the Camber Assets or any interest therein, or of the right of the Lender to deny consent to any such transaction in the future in accordance with the provisions of the Loan Instruments. Furthermore, the consent of Lender to the APA and the terms of this Agreement are subject to, contemporaneously with the execution of this Agreement by all Parties hereto,(i) Assumptor pledging the Many Drinks Assets and the TAW Assets to Lender and any other interests constituting the Camber Assets not previously pledged to Lender by such instruments required by Lender in such forms as required by Lender in its sole discretion, and (ii) the Assumptor Guarantors guaranteeing the Indebtedness of Assumptor to Lender by such instruments upon such terms as required by Lender in its sole discretion.

2.5

Consent of Guarantors. By signing this Agreement below, each of the Assumptor Guarantors, individually, and not jointly, agrees to, consents to, and hereby approves, the Assumption and the other terms and conditions of this Agreement relating to, among other things, Assumptor’s assumption of the Obligations and the Loan Instruments. The Guarantors agree that the Guaranty Agreements shall continue to apply to, and guaranty the repayment of, the Obligations, including without limitation, the Indebtedness, as assigned to, and assumed by, Assumptor and that all Pledged Stock shall remain pledged to secure the repayment of the Loan under the Pledge Agreements.

2.6

Amendments of and Additional Loan Instruments. Following the Parties’ entry into this Agreement, Assumptor, Original Borrower, Original Borrower Pledgor, and the Assumptor Guarantors (collectively,“Obligors” and individually, an“Obligor”) shall execute any and all documents and/or instruments that Lender may request or require from any Obligor in connection with the Assumption as determined by Lender in its sole discretion in such form as required by Lender in its sole discretion on or before ten (10) days after such request is made by Lender to such Obligor.

2.7

No Offsets or Defenses. Original Borrower hereby acknowledges, confirms and warrants to Lender that as of the Effective Date, Original Borrower neither has nor claims any offset, defense, claim, right of set-off or counterclaim against Lender under, arising out of or in connection with this Agreement, the Obligations or Loan Instruments. Original Borrower covenants and agrees with Lender that if any offset, defense, claim, right of set-off or counterclaim exists as of the Effective Date, Original Borrower does hereby irrevocably and expressly release and waive the right to assert such matter. Original Borrower understands and agrees that the foregoing release is in consideration for the agreements of Lender contained herein, and Original Borrower will receive no further consideration for such release. Assumptor warrants and represents to Lender that the Indebtedness, including without limitation, the Note, is subject to no credit, charge, claim, or right of offset or deduction of any kind whatsoever. Assumptor warrants and represents to Lender that the assumption of the Obligations is voluntary and without coercion by Lender or any other person. Assumptor releases and discharges the Lender from any and all claims and causes of action, whether known or unknown and whether now existing or hereafter arising, that have at any time been owned or claimed, or that are hereafter owned or claimed, by Assumptor, that arise out of or in any manner relate to the Obligations or to any one or more circumstances or events that occurred at or prior to the Effective Date. Assumptor acknowledges and agrees that the Obligations are ratified, affirmed and acknowledged as valid, subsisting and enforceable, subject to no offsets, claims or defenses. The Lender makes no representation to Assumptor in connection with the Obligations, including without limitation, the Loan Instruments or the Liens, and Assumptor hereby disclaims, waives and releases any representation of the Lender and warrants and represents to the Lender that Assumptor has not relied upon any representation or warranty of the Lender or any other person in voluntarily entering into this Agreement and assuming the Indebtedness, including without limitation, the Note.

| Assumption Agreement | Page 6 |

2.8

Effective Date. The“Effective Date” of this Agreement shall be the Closing Date as defined in the APA.

2.9

Mutual Representations, Covenants, and Warranties. Each of the Parties, for themselves and for the benefit of each of the other Parties to this Agreement, represents, covenants, and warrants that:

a)

Each Party has all requisite power and authority, corporate or otherwise, to execute and deliver this Agreement and to consummate the transactions contemplated by this Agreement. This Agreement constitutes the legal, valid, and binding obligation of each Party enforceable against each other Party in accordance with its terms, except as enforcement may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, or similar laws affecting creditors’ rights generally and general equitable principles.

b)

The execution and delivery by each Party and the consummation of the transactions contemplated by this Agreement do not and shall not, by the lapse of time, the giving of notice, or otherwise:(i) constitute a violation of any law; or(ii)constitute a breach of any provision contained in, or a default under, any governmental approval, or any writ, injunction, order, judgment, or decree of any governmental authority, or any agreement, contract, or understanding to which the Party or its assets are bound or affected; and

c)

Any individual executing this Agreement on behalf of an entity has authority to act on behalf of the entity and has been duly and properly authorized to sign this Agreement on behalf of the entity.

2.10

Severability. Every provision of this Agreement is intended to be severable. If, in any jurisdiction, any term or provision of this Agreement is determined to be invalid or unenforceable, (a) the remaining terms and provisions of this Agreement shall be unimpaired, (b) any determination of invalidity or unenforceability in any jurisdiction shall not invalidate or render unenforceable the term or provision in any other jurisdiction, and (c) the invalid or unenforceable term or provision shall, for purposes of jurisdiction, be deemed replaced by a term or provision that is valid and enforceable and that comes closest to expressing the intention of the invalid or unenforceable term or provision. In the event a court of competent jurisdiction determines that any provision of this Agreement is invalid or against public policy and cannot be reduced or modified to make it enforceable, the remaining provisions of this Agreement shall not be affected by the determination of invalidity of that provision, and all other provisions of this Agreement shall remain in full force and effect.

2.11

Remedies. Each Obligor agrees that the covenants and obligations contained in this Agreement relate to special, unique, and extraordinary matters and that a violation of any of the terms of this Agreement would cause irreparable injury in an amount which would be impossible to estimate or determine and for which any remedy at law would be inadequate. Therefore, the Parties agree that if any Obligor fails or refuses to fulfill any of its obligations under this Agreement or to make any payment or deliver any instrument required under this Agreement, then Lender shall have the remedy of specific performance, and this remedy shall be cumulative and nonexclusive and shall be in addition to any other rights and remedies otherwise available under any other contract or at law or in equity and to which Lender might be entitled.

2.12

Venue. Subject to Section 2.25 below regarding arbitration, each of the Parties: (a) irrevocably agrees that venue for any claim or dispute under this Agreement is proper in Bexar County, Texas, irrevocably agrees that all claims and disputes may be heard and determined in Bexar County, Texas courts; and (b) irrevocably waives, to the fullest extent permitted by applicable law, any objection it may now or subsequently have to venue in any proceeding brought in a Bexar County, Texas court.

2.13

No Presumption from Drafting. This Agreement has been negotiated at arm’s-length between persons knowledgeable in the matters set forth within this Agreement. Accordingly, given that all Parties have had the opportunity to draft, review, and/or edit the language of this Agreement, no presumption for or against any Party arising out of drafting all or any part of this Agreement will be applied in any action relating to, connected with, or involving this Agreement. In particular, any rule of law, legal decisions, or common law principles of similar effect that would require interpretation of any ambiguities in this Agreement against the Party that has drafted it, is of no application and is expressly waived by all Parties. The provisions of this Agreement shall be interpreted in a reasonable manner to affect the intentions of the Parties.

| Assumption Agreement | Page 7 |

2.14

Review and Construction of Loan Instruments. Each Party expressly represents and warrants to all other Parties that (a) before executing this Agreement, the Party has fully informed itself of the terms, contents, conditions, and effects of this Agreement; (b) the Party has relied solely and completely upon its own judgment in executing this Agreement; (c) the Party has had the opportunity to seek and has obtained the advice of its own legal, tax, and business advisors before executing this Agreement; (d) the Party has acted voluntarily and of its own free will in executing this Agreement; and (e) this Agreement is the result of arm’s length negotiations conducted by and among the Parties and their respective counsel.

2.15

Counterparts; Effect of Facsimile, Emailed, and Photocopied Signatures. This Agreement and any signed agreement or instrument entered into in connection with this Agreement, and any amendments to them, may be executed in one or more counterparts, all of which shall constitute one and the same instrument. Any signed counterpart, to the extent delivered by means of a facsimile machine or attached as a .pdf, .tif, .gif, .jpeg or similar file to an electronic mail (including email) or as an electronic download, all of which are referred to as an“Electronic Delivery”) shall be treated in all manner and respects as an original executed counterpart and shall be considered to have the same binding legal effect as if it were the original signed version of the Agreement or instrument delivered in person. At the request of any Party, each other Party shall re-execute the original form of this Agreement and deliver it to all other Parties. No Party shall raise the use of Electronic Delivery to deliver a signature or the fact that any signature or agreement or instrument was transmitted or communicated through the use of Electronic Delivery as a defense to the formation of a contract, and each Party forever waives any similar defense, except to the extent the defense relates to lack of authenticity.

2.16

Claims against Lender.

a)

Each Obligor hereby represents and warrants that there are no known claims, causes of action, suits, debts, liens, obligations, liabilities, demands, losses, costs and expenses (including attorneys’ fees) of any kind, character or nature whatsoever, fixed or contingent, which such Obligor may have or claim to have against Lender, which might arise out of or be connected with any act of commission or omission of Lender existing or occurring on or prior to the Effective Date, including, without limitation, any claims, liabilities or obligations arising with respect to the Loan or arising under any of the Loan Instruments.

b)

In consideration of Lender’s agreements as provided herein, each Obligor hereby releases, acquits, waives and forever discharges Lender, its partners, affiliates, subsidiaries and related parties and their respective directors, officers, employees, agents, predecessors, successors, assigns, attorneys, and representatives (collectively the“Lender Parties”) from any and all claims, demands, cross-actions, cause or causes of action, at law or in equity, costs and expenses, including legal expenses, as well as any other kind or character of claim or action, in each case to the extent held by such Obligor on or before the Effective Date, whether based upon tort, fraud, breach of any duty of fair dealing, breach of confidence, undue influence, duress, economic coercion, conflict of interest, negligence, bad faith, intentional or negligent infliction of mental distress, tortious interference with contractual relations, tortious interference with corporate governance or prospective business advantage, breach of contract, deceptive trade practices, libel, slander, conspiracy, contract, usury, common law or statutory right, known or unknown, arising, directly or indirectly, proximately or remotely, out of any of the Loan Instruments or any of the documents, instruments or any other transactions relating thereto, solely with respect to such claims, which arise in connection with events which occurred on or prior to the Effective Date (collectively, the“Released Claims”), to the fullest and maximum extent permitted by applicable law. Without limiting the generality of the foregoing, this release shall include all aspects of the negotiations between and among each Obligor and Lender. This release is intended to release all liability of any character claimed for damages, of any type or nature, for injunctive or other relief, for attorneys’ fees, interest or any other liability whatsoever, whether statutory, contractual or tort in character, or of any other nature or character, now or henceforth in any way related to the Released Claims, including, without limitation, any loss, cost or damage in connection with, or based upon, any breach of fiduciary duty, breach of any duty of fair dealing or good faith, breach of confidence, breach of funding commitment, breach of any other duty, breach of any statutory right, fraud, usury, undue influence, duress, economic coercion, conflict of interest, negligence, bad faith, malpractice, violations of the Racketeer Influenced and Corrupt Organizations Act, intentional or negligent infliction of mental distress, tortious interference with corporate or other governance or prospective business advantage, breach of contract, deceptive trade practices, libel, slander, conspiracy, or any other cause of action, any of which arise in connection with events which occurred on or prior to the Effective Date. Each Obligor understands and agrees that this is a full, final and complete release of the Released Claims and agrees that this release may be pleaded as an absolute and final bar to any or all suit or suits pending or which may hereafter be filed or prosecuted by Obligor, or anyone claiming, by, through or under such Obligor in respect of the Released Claims, and that no recovery on account of the Released Claims may hereafter be had from anyone whomsoever, and that the consideration given for this release is no admission of liability and that Obligor, nor those claiming under such Obligor will ever claim that it is.

| Assumption Agreement | Page 8 |

2.17

Insolvency Provisions. In the event any proceeding (an“Insolvency Proceeding”) is brought by or against any Obligor and/or the Camber Assets under or pursuant to any bankruptcy, insolvency, receivership or similar law or laws of the United States or any other state or other jurisdiction, including the Bankruptcy Code, and any other law or laws of the United States or any other state or other jurisdiction which affect the rights of debtors and/or creditors generally, including, without limitation:(i) any proceeding seeking to appoint or appointing a receiver or trustee;(ii) any proceeding filed by or against any Obligor under the Bankruptcy Code;(iii) any assignment by any Obligor of all or substantially all of their respective assets for the benefit of creditors; and(iv) any proceeding or other action wherein all or substantially all of any Obligor’s assets are attached, seized, subjected to a writ or distress warrant, or otherwise levied upon, such Obligor hereby agrees as follows:

a)

Venue for an Insolvency Proceeding, without waiving the provisions requiring arbitration as set forth in the Loan Instruments, shall lie exclusively in the United States Bankruptcy Court for the Western District of Texas, San Antonio Division.

b)

Each Obligor agrees that, subject to court approval, Lender shall be deemed pursuant to this Agreement to have and be entitled to relief from the automatic stay under Section 362 of the Bankruptcy Code, and each Obligor hereby unconditionally and irrevocably consents to the granting to Lender of relief from the automatic stay under Section 362 of the Bankruptcy Code to permit Lender to exercise any and all of its rights, recourses and remedies under the Loan Instruments, at law and/or in equity, including, without limitation, foreclosure of the Mortgages and sale of the Camber Assets pursuant thereto and/or collection of the rents, income, revenue from oil and gas production or in relation thereto, proceeds, and profits directly by Lender. Further, if Lender requests such relief, no Obligor shall object to or oppose Lender’s request for immediate relief from the automatic stay for purposes of exercising any and all rights, recourses, remedies and benefits Lender may have under the Loan Instruments, at law and/or in equity, including, without limitation, foreclosure of the Mortgages and sale of the Camber Assets pursuant thereto and/or collection of the rents and profits directly by Lender.

c)

Each Obligor hereby acknowledges and agrees that Lender has a properly perfected, valid and enforceable lien upon and security interest in all or any portion of the Camber Assets including, without limitation, the leases, rents, income, revenue from oil and gas production or in relation thereto, and profits, and each Obligor will acknowledge the same in any Insolvency Proceeding. Further, no Obligor shall contest that Lender holds a properly perfected, valid and enforceable first priority lien on and security interest in each and every portion of the Camber Assets, including, without limitation, the leases, rents, income, and profits.

d)

Subject to court approval, the value of the Camber Assets alone without other collateral, cash, or other assets satisfactory to Lender, in its reasonable discretion, is not adequate to offer adequate protection to Lender in the event any Obligor seeks financing as a debtor in possession. Each Obligor specifically agrees not to seek debtor in possession financing without providing adequate protection reasonably satisfactory to Lender.

e)

Each Obligor hereby agrees to indemnify, defend and hold Lender harmless from and against any and all loss, cost, liability, damage or expense Lender may suffer or incur as a result of such Obligor’s breach of their respective obligations, covenants and agreements under this Section.

| Assumption Agreement | Page 9 |

2.18

No Waiver. The execution of this Agreement by Lender is not intended nor shall it be construed as an actual or implied waiver of (a) any default under the Note, the Loan Agreement, or the other Loan Instruments, including without limitation, the Mortgages; (b) any requirement under the Note, the Loan Agreement or the other Loan Instruments, including without limitation, the Mortgages; (c) any right to demand immediate payment of the Note and any other sums due under the Note, the Loan Agreement or the other Loan Instruments, including without limitation, the Mortgages; or (d) any rights Lender may have against any person not a party hereto.

2.19

Binding. This Agreement binds and benefits the parties hereto and their respective successors and assigns (provided, that no Obligor may assign its rights hereunder without Lender’s prior written consent which may be withheld in Lender’s sole discretion).

2.20

Costs and Expenses. Assumptor and the Assumptor Guarantors shall pay, or reimburse Lender for, all costs and expenses reasonably paid or incurred by Lender from time to time to one or more third parties in connection with(i) the preparation and acceptance of this Agreement,(ii) the evaluation of, and protection of Lender’s rights with respect to, the Camber Assets; and(iii) the creation, perfection or realization upon the Liens or the exercise of Lender’s rights and remedies under the Loan Instruments, such costs and expenses to include, without limitation, attorney’s fees, appraisal fees, fees and expenses of environmental inspections and other professional services and recording fees.

2.21

Controlling Agreement. The Parties intend to comply with applicable usury laws. All existing and future agreements regarding the Indebtedness are hereby limited and controlled by the provisions of this paragraph. In no event (including but not limited to prepayment, default, demand for payment, or acceleration) shall the interest taken, reserved, contracted for, charged or received under the Note or otherwise exceed the maximum amount of non-usurious rate of interest permitted by applicable law (the“Maximum Amount”). If from any possible construction of any document, interest would otherwise be payable in excess of the Maximum Amount, such document shall be automatically reformed and the interest payable automatically reduced to the Maximum Amount, without necessity of execution of any amendment or new document. If Lender ever receives interest in an amount which apart from this provision would exceed the Maximum Amount, the excess shall, without penalty, be applied to principal of the Note in inverse order of maturity of installments or be refunded to the payor if the Note is paid in full. Lender does not intend to charge or receive unearned interest on acceleration. All interest paid or agreed to be paid shall be spread throughout the full term (including extensions) of the indebtedness so that the amount of interest does not exceed the Maximum Amount.

2.22

Gender; Person. As used herein, the masculine gender includes the other gender and the singular number includes the plural, and vice versa, unless the context otherwise requires. The term“Person” and words importing persons shall include firms, associations, partnerships (including limited partnerships), joint ventures, trusts, corporations and other legal entities, including public or governmental bodies, agencies or instrumentalities, as well as natural persons. Headings and titles used in this Agreement are only for convenience and shall be disregarded in construing it.

2.23

Entire Agreement. This Agreement may be executed in several identical counterparts all of which shall constitute one and the same instrument.THIS AGREEMENT AND THE OTHER LOAN INSTRUMENTS, AS MODIFIED HEREBY, SHALL BE CONSTRUED AND ENFORCED IN ACCORDANCE WITH THE LAWS OF THE STATE OF TEXAS AND APPLICABLE UNITED STATES FEDERAL LAW. This Agreement embodies the entire agreement and understanding between the parties with respect to assumption provided for herein and supersedes all prior conflicting or inconsistent agreements, consents and understandings relating to such subject matter.

| Assumption Agreement | Page 10 |

2.24

NO ORAL AGREEMENTS. THIS WRITTEN LOAN AGREEMENT REPRESENTS THE FINAL AGREEMENT BETWEEN THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES.

2.25

ARBITRATION.

BINDING ARBITRATION AGREEMENT

PLEASE READ THIS CAREFULLY. IT AFFECTS YOUR RIGHTS.

OBLIGORS AND LENDER AGREE TO ARBITRATION AS FOLLOWS (hereinafter referred to as the “Arbitration Provisions”):

I.

Special Provisions and Definitions applicable to both CONSUMER DISPUTES and BUSINESS DISPUTES:

(a)

Informal Resolution of Customer Concerns. Most customer concerns can be resolved quickly and to the customer’s satisfaction by contacting your account officer, branch manager or by calling the Customer Service Department in your region. The region and numbers are:

| 1. | Laredo | 956-722-7611 |

| 2. | Austin | 512-397-4506 |

| 3. | Brownsville | 956-547-1000 |

| 4. | Commerce Bank | 956-724-1616 |

| 5. | Corpus Christi | 361-888-4000 |

| 6. | Eagle Pass | 830-773-2313 |

| 7. | Houston | 713-526-1211 |

| 8. | McAllen | 956-686-0263 |

| 9. | Oklahoma | 405-841-2100 |

| 10. | Port Lavaca | 361-552-9771 |

| 11. | San Antonio | 210-518-2500 |

| 12. | Zapata | 956-765-8361 |

In the unlikely event that your account officer, branch manager or the customer service department is unable to resolve a complaint to your satisfaction or if the Lender has not been able to resolve a dispute it has with you after attempting to do so informally, you and the Lender agree to resolve those disputes through binding arbitration or small claims court instead of in courts of general jurisdiction.

| Assumption Agreement | Page 11 |

(b)

Sending Notice of Dispute. If either you or the Lender intend to seek arbitration, then you or the Lender must first send to the other by certified mail, return receipt requested, a written Notice of Dispute. The Notice of Dispute to the Lender should be addressed to: Dennis E. Nixon, President, at International Bancshares Corporation, P.O. Drawer 1359, Laredo, Texas 78042-1359 or if by email, ibcchairman@ibc.com. The Notice of Dispute must (a) describe the nature and basis of the claim or dispute; and (b) explain specifically what relief is sought. You may download a copy of the Notice of Dispute at www.ibc.com or you may obtain a copy from your account officer or branch manager.

(c)

If the Dispute is not Informally Resolved. If you and the Lender do not reach an agreement to resolve the claim or dispute within thirty (30) days after the Notice of Dispute is received, you or the Lender may commence a binding arbitration proceeding. During the binding arbitration proceeding, any settlement offers made by you or the Lender shall not be disclosed to the Arbitrator.

(d)

“DISPUTE(S).” As used herein, the word“DISPUTE(S)”includes any and all controversies or claims between thePARTIESof whatever type or manner, including without limitation, any and all claims arising out of or relating to this Assignment, compliance with applicable laws and/or regulations, any and all services or products provided by the Lender, any and all past, present and/or future loans, lines of credit, letters of credit, credit facilities or other form of indebtedness and/or agreements involving thePARTIES, any and all transactions between or involving thePARTIES, and/or any and all aspects of any past or present relationship of thePARTIES, whether banking or otherwise, specifically including but not limited to any claim founded in contract, tort, fraud, fraudulent inducement, misrepresentation or otherwise, whether based on statute, regulation, common law or equity.

(e)

“CONSUMER DISPUTE” and“BUSINESS DISPUTE.” As used herein,“CONSUMER DISPUTE” means aDISPUTE relating to an account (including a deposit account), agreement, extension of credit, loan, service or product provided by the Lender that is primarily for personal, family or household purposes.“BUSINESS DISPUTE”means anyDISPUTE that is not aCONSUMER DISPUTE.

(f)

“PARTIES” or “PARTY.” As used in these Arbitration Provisions, the term“PARTIES” or “PARTY” means each of the Obligors, Lender, and each and all persons and entities signing this Assignment or any other agreements between or among any of thePARTIES as part of this transaction.“PARTIES” or“PARTY”shall be broadly construed and include individuals, beneficiaries, partners, limited partners, limited liability members, shareholders, subsidiaries, parent companies, affiliates, officers, directors, employees, heirs, agents and/or representatives of any party to such documents, any other person or entity claiming by or through one of the foregoing and/or any person or beneficiary who receives products or services from the Lender and shall include any other owner and holder of this Assignment. Throughout these Arbitration Provisions, the term“you” and“your” refer to Assumptor, and the term“Arbitrator”refers to the individual arbitrator or panel of arbitrators, as the case may be, before which theDISPUTE is arbitrated.

| Assumption Agreement | Page 12 |

(g)

BINDING ARBITRATION. ThePARTIES agree that anyDISPUTE between thePARTIES shall be resolved by mandatory binding arbitration pursuant to these Arbitration Provisions at the election of eitherPARTY.BY AGREEING TO RESOLVE A DISPUTE IN ARBITRATION, THE PARTIES ARE WAIVING THEIR RIGHT TO A JURY TRIAL OR TO LITIGATE IN COURT (except for matters that may be taken to small claims court for aCONSUMER DISPUTE as provided below).

(h)

CLASS ACTION WAIVER. ThePARTIES agree that(i) no arbitration proceeding hereunder whether aCONSUMER DISPUTEor aBUSINESS DISPUTE shall be certified as a class action or proceed as a class action, or on a basis involving claims brought in a purported representative capacity on behalf of the general public, other customers or potential customers or persons similarly situated, and(ii) no arbitration proceeding hereunder shall be consolidated with, or joined in any way with, any other arbitration proceeding.THE PARTIES AGREE TO ARBITRATE A CONSUMER DISPUTE OR BUSINESS DISPUTE ON AN INDIVIDUAL BASIS AND EACH WAIVES THE RIGHT TO PARTICIPATE IN A CLASS ACTION.

(i)

FEDERAL ARBITRATION ACT AND TEXAS LAW. ThePARTIES acknowledge that this Assignment evidences a transaction involving interstate commerce. The Federal Arbitration Act shall govern(i) the interpretation and enforcement of these Arbitration Provisions, and(ii)all arbitration proceedings that take place pursuant to these Arbitration Provisions.THE PARTIES AGREE THAT, EXCEPT AS OTHERWISE EXPRESSLY AGREED TO BY THE PARTIES IN WRITING, OR UNLESS EXPRESSLY PROHIBITED BY LAW, TEXAS SUBSTANTIVE LAW (WITHOUT REGARD TO ANY CONFLICT OF LAWS PRINCIPLES) WILL APPLY IN ANY BINDING ARBITRATION PROCEEDING OR SMALL CLAIMS COURT ACTION REGARDLESS OF WHO INITIATES THE PROCEEDING, WHERE YOU RESIDE OR WHERE THE DISPUTE AROSE.

II.

Provisions applicable only to a CONSUMER DISPUTE:

(a)

Any and allCONSUMER DISPUTES shall be resolved by arbitration administered by the American Arbitration Association (“AAA”) under the Commercial Arbitration Rules and the Supplemental Procedures for Resolution of Consumer Disputes and Consumer Due Process Protocol (which are incorporated herein for all purposes). It is intended by thePARTIES that these Arbitration Provisions meet and include all fairness standards and principles of the American Arbitration Association’s Consumer Due Process Protocol and due process in predispute arbitration. If aCONSUMER DISPUTE is for a claim of actual damages above $250,000 it shall be administered by the AAA before three neutral arbitrators at the request of anyPARTY.

(b)

Instead of proceeding in arbitration, anyPARTY hereto may pursue its claim in your local small claims court, if theCONSUMER DISPUTE meets the small claims court’s jurisdictional limits. If the small claims court option is chosen, thePARTY pursuing the claim must contact the small claims court directly.The PARTIES agree that the class action waiver provision also applies to any CONSUMER DISPUTE brought in small claims court.

(c)

For any claim for actual damages that does not exceed $2,500, the Lender will pay all arbitration fees and costs provided you submitted a Notice of Dispute with regard to theCONSUMER DISPUTE prior to initiation of arbitration. For any claim for actual damages that does not exceed $5,000, the Lender also agrees to pay your reasonable attorney’s fees and reasonable expenses your attorney charges you in connection with the arbitration (even if the Arbitrator does not award those to you) plus an additional $2,500 if you obtain a favorable arbitration award for your actual damages which is greater than any written settlement offer for your actual damages made by the Lender to you prior to the selection of the Arbitrator.

(d)

Under the AAA’s Supplemental Procedures for Consumer Disputes, if your claim for actual damages does not exceed $10,000, you shall only be responsible for paying up to a maximum of $125 in arbitration fees and costs. If your claim for actual damages exceeds $10,000 but does not exceed $75,000, you shall only be responsible for paying up to a maximum of $375 in arbitration fees and costs. For any claim for actual damages that does not exceed $75,000, the Lender will pay all other arbitrator’s fees and costs imposed by the administrator of the arbitration. With regard to aCONSUMER DISPUTE for a claim of actual damages that exceeds $75,000, or if the claim is a non-monetary claim, the Lender agrees to pay all arbitration fees and costs you would otherwise be responsible for that exceed $1,000. The fees and costs stated above are subject to any amendments to the fee and cost schedules of the AAA. The fee and cost schedule in effect at the time you submit your claim shall apply. The AAA rules also permit you to request a waiver or deferral of the administrative fees and costs of arbitration if paying them would cause you financial hardship.

(e)

Although under some laws, the Lender may have a right to an award of attorney’s fees and expenses if it prevails in arbitration, the Lender agrees that it will not seek such an award in a binding arbitration proceeding with regard to aCONSUMER DISPUTEfor a claim of actual damages that does not exceed $75,000.

(f)

To request information on how to submit an arbitration claim, or to request a copy of the AAA rules or fee schedule, you may contact the AAA at 1-800-778-7879 (toll free) or atwww.adr.org.

| Assumption Agreement | Page 13 |

III.

Provisions applicable only to a BUSINESS DISPUTE:

(a)

Any and allBUSINESS DISPUTES between thePARTIES shall be resolved by arbitration in accordance with the Commercial Arbitration Rules of the AAA in effect at the time of filing, as modified by, and subject to, these Arbitration Provisions. ABUSINESS DISPUTE for a claim of actual damages that exceeds $250,000 shall be administered by AAA before at least three (3) neutral arbitrators at the request of anyPARTY. In the event the aggregate of all affirmative claims asserted exceeds $500,000, exclusive of interest and attorney’s fees, or upon the written request of anyPARTY, the arbitration shall be conducted under the AAA Procedures for Large, Complex Commercial Disputes. If the payment of arbitration fees and costs will cause you extreme financial hardship you may request that AAA defer or reduce the administrative fees or request the Lender to cover some of the arbitration fees and costs that would be your responsibility.

(b)

ThePARTIES shall have the right to(i) invoke self-help remedies (such as setoff, notification of account debtors, seizure and/or foreclosure of collateral, and nonjudicial sale of personal property and real property collateral) before, during or after any arbitration, and/or(ii) request ancillary or provisional judicial remedies (such as garnishment, attachment, specific performance, receiver, injunction or restraining order, and sequestration) before or after the commencement of any arbitration proceeding (individually, and not on behalf of a class). ThePARTIES need not await the outcome of the arbitration proceeding before using self-help remedies. Use of self-help or ancillary and/or provisional judicial remedies shall not operate as a waiver of eitherPARTY’s right to compel arbitration. Any ancillary or provisional judicial remedy which would be available from a court at law shall be available from the Arbitrator. ThePARTIES agree that the AAA Optional Rules for Emergency Measures of Protection shall apply in an arbitration proceeding where emergency interim relief is requested.

(c)

Except to the extent the recovery of any type or types of damages or penalties may not by waived under applicable law, the Arbitrator shall not have the authority to award eitherPARTY (i) punitive, exemplary, special or indirect damages,(ii)statutory multiple damages, or(iii) penalties, statutory or otherwise.

(d)

The Arbitrator may award attorney’s fees and costs including the fees, costs and expenses of arbitration and of the Arbitrator as the Arbitrator deems appropriate to the prevailingPARTY. The Arbitrator shall retain jurisdiction over questions of attorney’s fees for fourteen (14) days after entry of the decision.

IV.

General provisions applicable to both CONSUMER DISPUTES and BUSINESS DISPUTES:

(a)

The Arbitrator is bound by the terms of these Arbitration Provisions. The Arbitrator shall have exclusive authority to resolve anyDISPUTES relating to the scope or enforceability of these Arbitration Provisions, including(i) all arbitrability questions, and(ii) any claim that all or a part of these Arbitration Provisions are void or voidable (including any claims that they are unconscionable in whole or in part).

(b)

These Arbitration Provisions shall survive any termination, amendment, or expiration of this Assignment, unless all of the PARTIES otherwise expressly agree in writing.

(c)

If aPARTY initiates legal proceedings, the failure of the initiatingPARTY to request arbitration pursuant to these Arbitration Provisions within 180 days after the filing of the lawsuit shall be deemed a waiver of the initiatingPARTY’Sright to compel arbitration with respect to the claims asserted in the litigation. The failure of the defendingPARTY in such litigation to request arbitration pursuant to these Arbitration Provisions within 180 days after the defendingPARTY’Sreceipt of service of judicial process, shall be deemed a waiver of the right of the defendingPARTY to compel arbitration with respect to the claims asserted in the litigation. If a counterclaim, cross-claim or third party action is filed and properly served on aPARTY in connection with such litigation, the failure of suchPARTY to request arbitration pursuant to these Arbitration Provisions within ninety (90) days after suchPARTY’S receipt of service of the counterclaim, cross-claim or third party claim shall be deemed a waiver of suchPARTY’S right to compel arbitration with respect to the claims asserted therein. The issue of waiver pursuant to these Arbitration Provisions is an arbitrable dispute. Active participation in any pending litigation described above by aPARTY shall not in any event be deemed a waiver of suchPARTY’Sright to compel arbitration. All discovery obtained in the pending litigation may be used in any subsequent arbitration proceeding.

| Assumption Agreement | Page 14 |

(d)

AnyPARTY seeking to arbitrate shall serve a written notice of intent to any and all opposingPARTIESafter aDISPUTEhas arisen. ThePARTIES agree a timely written notice of intent to arbitrate by eitherPARTY pursuant to these Arbitration Provisions shall stay and/or abate any and all action in a trial court, save and except a hearing on a motion to compel arbitration and/or the entry of an order compelling arbitration and staying and/or abating the litigation pending the filing of the final award of the Arbitrator.

(e)

Any Arbitrator selected shall be knowledgeable in the subject matter of theDISPUTE and be licensed to practice law.

(f)

For a one (1) member arbitration panel, thePARTIES are limited to an equal number of strikes in selecting the arbitrator from the AAA neutral list, such that at least one arbitrator remains after thePARTIES exercise all of their respective strikes. For a three (3) member arbitration panel, thePARTIES are limited to an equal number of strikes in selecting the arbitrators from the AAA neutral list, such that at least three arbitrators remain after thePARTIES exercise all of their respective strikes. After exercising all of their allotted respective strikes, thePARTIES shall rank those potential arbitrators remaining numerically in order of preference (with “1” designating the most preferred). The AAA shall review thePARTIESrankings and assign a score to each potential arbitrator by adding together the ranking given to such potential arbitrator by eachPARTY. The arbitrator(s) with the lowest score total(s) will be selected. In the event of a tie or ties for lowest score total and if the selection of both or all of such potential arbitrators is not possible due to the required panel size, the AAA shall select the arbitrator(s) it believes to be best qualified.

(g)

ThePARTIES and the Arbitrator shall treat all aspects of the arbitration proceedings, including, without limitation, any documents exchanged, testimony and other evidence, briefs and the award, as strictly confidential; provided, however, that a written award or order from the Arbitrator may be filed with any court having jurisdiction to confirm and/or enforce such award or order.

(h)

Any statute of limitation which would otherwise be applicable shall apply to any claim asserted in any arbitration proceeding under these Arbitration Provisions, and the commencement of any arbitration proceeding tolls such statute of limitations.

(i)

If the AAA is unable for any reason to provide arbitration services, then thePARTIES agree to select another arbitration service provider that has the ability to arbitrate theDISPUTE pursuant to and consistent with these Arbitration Provisions. If thePARTIES are unable to agree on another arbitration service provider, anyPARTY may petition a court of competent jurisdiction to appoint an Arbitrator to administer the arbitration proceeding pursuant to and consistent with these Arbitration Provisions.

(j)

The award of the Arbitrator shall be final and Judgment upon any such award may be entered in any court of competent jurisdiction. The arbitration award shall be in the form of a written reasoned decision and shall be based on and consistent with applicable law.

(k)

Unless thePARTIES mutually agree to hold the binding arbitration proceeding elsewhere, venue of any arbitration proceeding under these Arbitration Provisions shall be in the county and state where Lender is located, which is Lender’s address set out in the first paragraph on page 1 hereof.

(l)

If any of these Arbitration Provisions are held to be invalid or unenforceable, the remaining provisions shall be enforced without regard to the invalid or unenforceable term or provision.

JURY WAIVER: IF A DISPUTE BETWEEN YOU AND LENDER PROCEEDS IN COURT RATHER THAN THROUGH MANDATORY BINDING ARBITRATION, THEN YOU AND LENDER BOTH WAIVE THE RIGHT TO A JURY TRIAL, AND SUCH DISPUTE WILL BE TRIED BEFORE A JUDGE ONLY.

| Assumption Agreement | Page 15 |

2.26

Further Assurances. Upon the request of Lender, each Obligor shall execute and deliver such further documents, including financing statements, and take such further actions as may be required by Lender to carry out the intent of this Agreement and the other Loan Instruments and to perfect and preserve the rights, interests, and priority of Lender hereunder on or before ten (10) days after Lender’s request is made to any Obligor.

2.27

Assumptor Release of Original Borrower. Assumptor hereby(i) consents to the release of Original Borrower from personal liability for payment and performance of the Obligations now or hereafter outstanding, and(ii) confirms that such release of Original Borrower from personal liability shall not affect in any manner the joint and several personal liability of Assumptor for the full payment and performance of all Obligations now or hereafter outstanding under the Note, and all other Loan Instruments.

2.28

Notices.

All notices, demands, requests, approvals and other communications required or permitted hereunder shall be in writing and shall be deemed to have been given when presented personally or deposited in a regularly maintained mail receptacle of the United States Postal Service, postage prepaid, registered or certified, return receipt requested, addressed to an Obligor, or Lender, as the case may be, at the respective addresses set forth on the first page of this Agreement, or such other address as Obligors, or Lender may from time to time designate by written notice to the other as herein required.

2.29

No Impairment.

Notwithstanding any other provision of this Agreement herein to the contrary, this Agreement shall not affect or impair any liability of or representation in regard to any warranty of title heretofore made by Original Borrower and Original Borrower Pledgor as to the Camber Assets, including without limitation, the Oklahoma Interests, all of which shall remain in force and inure to the benefit of Lender.

IN WITNESS WHEREOF, the Parties have duly executed this Agreement as of the Effective Date.

[Signature and acknowledgment pages follow.]

| Assumption Agreement | Page 16 |

LENDER:

INTERNATIONAL BANK OF COMMERCE,

a Texas state banking corporation

| By: | /s/ Bernardo de la Garza | ||

| Bernardo de la Garza, Vice President |

| STATE OF TEXAS | § | |

| COUNTY OF BEXAR | § |

This instrument was acknowledged before me on the 26th day of Sept. 2018, by Bernardo de la Garza, Vice President of International Bank of Commerce, a Texas state banking corporation, on behalf of said corporation.

| /s/ Delia Sandoval | |

| Notary Public, State of Texas | ||

| Assumption Agreement | Page 17 |

ORIGINAL BORROWER:

CAMBER ENERGY, INC. f/k/a LUCAS ENERGY, INC.,

a Nevada corporation

| By: | /s/ Louis G. Schott | ||

| Louis G. Schott, Interim Chief Executive Officer |

| STATE OF TEXAS | § | |

| COUNTY OF BEXAR | § |

This instrument was acknowledged before me on the 26th day of Sept. 2018, by Louis G. Schott, Interim Chief Executive Officer of Camber Energy, Inc. f/k/a Lucas Energy, Inc., a Nevada corporation, on behalf of said corporation.

| /s/ Delia Sandoval | |

| Notary Public, State of Texas | ||

| Assumption Agreement | Page 18 |

ORIGINAL BORROWER PLEDGOR:

CE OPERATING, LLC,

an Oklahoma limited liability company

By:

Camber Energy, Inc.,

a Nevada corporation,

its Manager

| By: | /s/ Louis G. Schott | ||

| Louis G. Schott, Interim Chief Executive Officer |

| STATE OF TEXAS | § | |

| COUNTY OF BEXAR | § |

This instrument was acknowledged before me on the 26th day of Sept. 2018, by Louis G. Schott, Interim Chief Executive Officer of Camber Energy, Inc., Nevada corporation, the Manager of CE Operating, LLC, an Oklahoma limited liability company, on behalf of said limited liability company.

| /s/ Delia Sandoval | |

| Notary Public, State of Texas | ||

| Assumption Agreement | Page 19 |

ASSUMPTOR:

N&B ENERGY, LLC,

a Texas limited liability company

| By: | /s/ Richard N. Azar, II | ||

| Name: | Richard N. Azar, II | ||

| Title: | Manager | ||

| STATE OF TEXAS | § | |

| COUNTY OF BEXAR | § |

This instrument was acknowledged before me on the 26th day of Sept. 2018, by Richard N. Azar, II, the Manager of N&B Energy, LLC, a Texas limited liability company, on behalf of said limited liability company.

| /s/ Delia Sandoval | |

| Notary Public, State of Texas | ||

| Assumption Agreement | Page 20 |

AZAR:

| /s/ Richard Nathan Azar, II. | ||

| RICHARD NATHAN AZAR, II. | ||

| STATE OF TEXAS | § | |

| COUNTY OF BEXAR | § |

This instrument was acknowledged before me on the 26th day of Sept. 2018, by Richard Nathan Azar, II.

| /s/ Delia Sandoval | |

| Notary Public, State of Texas | ||

| Assumption Agreement | Page 21 |

SEAY:

DONNIE BAKER SEAY

| By: | /s/ Gregory Don Seay | ||

| Gregory Don Seay, attorney-in-fact |

| STATE OF TEXAS | § | |

| COUNTY OF BEXAR | § |

This instrument was acknowledged before me on the 26th day of Sept. 2018, by Gregory Don Seay, attorney-in-fact on behalf of Donnie Baker Seay.

| /s/ Delia Sandoval | |

| Notary Public, State of Texas | ||

| Assumption Agreement | Page 22 |

RAD2:

RAD2 MINERALS, LTD.,

a Texas limited partnership

By:

RAD2 Management, LLC,

a Texas limited liability company,

its General Partner

| By: | /s/ Richard N. Azar, II | ||

| Richard N. Azar, II, Manager |

| STATE OF TEXAS | § | |

| COUNTY OF BEXAR | § |

This instrument was acknowledged before me on the 26th day of Sept. 2018, by Richard N. Azar, II, Manager of RAD2 Management, LLC, a Texas limited liability company, the General Partner of RAD2 Minerals, Ltd., a Texas limited partnership, on behalf of said limited partnership.

| /s/ Delia Sandoval | |

| Notary Public, State of Texas | ||

| Assumption Agreement | Page 23 |

DBS:

DBS INVESTMENTS, LTD.,

a Texas limited partnership

By:

DBS Management, LLC,

a Texas limited liability company,

its General Partner

| By: | /s/ Gregory Don Seay | ||

| Gregory Don Seay, Authorized Agent |

| STATE OF TEXAS | § | |

| COUNTY OF BEXAR | § |

This instrument was acknowledged before me on the 26th day of Sept. 2018, by Gregory Don Seay, Authorized Agent of DBS Management, LLC, a Texas limited liability company, the General Partner of DBS Investments, Ltd., a Texas limited partnership, on behalf of said limited partnership.

| /s/ Delia Sandoval | |

| Notary Public, State of Texas | ||

| Assumption Agreement | Page 24 |

EXHIBIT “A”

2016 Oklahoma Interests

| Assumption Agreement | Page 25 |

EXHIBIT “A-1”

The Orion Assets

[see following pages]