Exhibit 99.1

Exhi

ExhiINAUGURAL INVESTOR DAY Tuesday, December 9, 2014 The St. Regis, New York

December 9, 2014 Opening Remarks Micky Thomas VP Investor Relations and Treasurer

Today’s presentations contain statements about future plans and expectations, which constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward looking statements are generally stated in terms of the Company’s plans, expectations and intentions. Any statements that are not statements of historical facts are forward-looking statements. The words “may,” “could,” “anticipate,” “plan,” “continue,” “project,” “intend,” “estimate,” “believe,” “expect” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such words. Forward-looking statements involve known and unknown risks and uncertainties and other factors that may cause the actual results or performance to be materially different from future results or performance expressed or implied by these forward-looking statements. The following factors, among others, could cause actual results to differ materially from those contained in forward-looking statements made in these materials and in oral statements made by our authorized officers: the effects of general economic conditions on fueling patterns as well as payments and transaction processing activity; the effects of the Company’s business expansion and acquisition efforts; the Company’s failure to successfully integrate the businesses it has acquired; the Company's failure to consummate a previously announced transaction; the failure of corporate investments to result in anticipated strategic value; the impact and size of credit losses; the impact of changes to the Company's credit standards; breaches of the Company’s technology systems and any resulting negative impact on our reputation, liabilities, or loss of relationships with customers or merchants; fuel price volatility; the Company’s failure to maintain or renew key agreements; failure to expand the Company’s technological capabilities and service offerings as rapidly as the Company’s competitors; the actions of regulatory bodies, including banking and securities regulators, or possible changes in banking regulations impacting the Company’s industrial bank and the Company as the corporate parent; the impact of foreign currency exchange rates on the Company’s operations, revenue and income; changes in interest rates; the impact of the Company’s outstanding notes on its operations; financial loss if the Company determines it necessary to unwind its derivative instrument position prior to the expiration of a contract; the incurrence of impairment charges if our assessment of the fair value of certain of our reporting units changes; the uncertainties of litigation; as well as other risks and uncertainties identified in Item 1A of our Annual Report for the year ended December 31, 2013, filed on Form 10-K with the Securities and Exchange Commission on February 27, 2014. Our forward-looking statements do not reflect the potential future impact of any alliance, merger, acquisition, disposition or stock repurchases. The forward-looking statements speak only as of today and undue reliance should not be placed on these statements. We disclaim any obligation to update any forward-looking statements as a result of new information, future events or otherwise. Non-GAAP Information: For additional important information and disclosure regarding non-GAAP metrics, specifically adjusted net, please see our most recent earnings release, issued on October 29, 2014, for an explanation and reconciliation of non-GAAP adjusted net income (or “ANI”) to GAAP net income.

Today’s Agenda 8:00 – 8:30 AM 8:30 – 9:45 AM 9:45 – 10:00 AM 10:00 – 11:00 AM 11:00 – 11:15 AM 11:15 – 11:30 AM 11:30 – 12:00 PM Welcome & Strategic Overview – Melissa Smith, President & CEO Senior Management Presentations Fleet Overview - Ken Janosick, SVP & GM, Fleet Payment Solutions Travel Overview - Alison Vanderhoof, SVP & GM, Emerging Industries & Jim Pratt, VP, Virtual Health Overview - Jeff Young, SVP & GM, Evolution1 Break International Panel – Moderator: George Hogan, SVP, International Jay Collins, Managing Director, WEX Europe Services José Roberto Kracochansky, CEO, UNIK Myles Stephenson, Managing Director , WEX Europe Jeff Ames, Managing Director, WEX Asia Q&A Session Closing Remarks & Expectations – Melissa Smith, President & CEO Financial Overview – Steve Elder, CFO 12:00 – 1:00 PM Lunch

CEO Introduction Melissa Smith President & CEO

December 9, 2014 Strategic Overview Melissa Smith President & Chief Executive Officer

Agenda Expanding into a Leading Global Payments Provider Execution Against Strategic Objectives Achieving Long-Term, Sustainable Growth

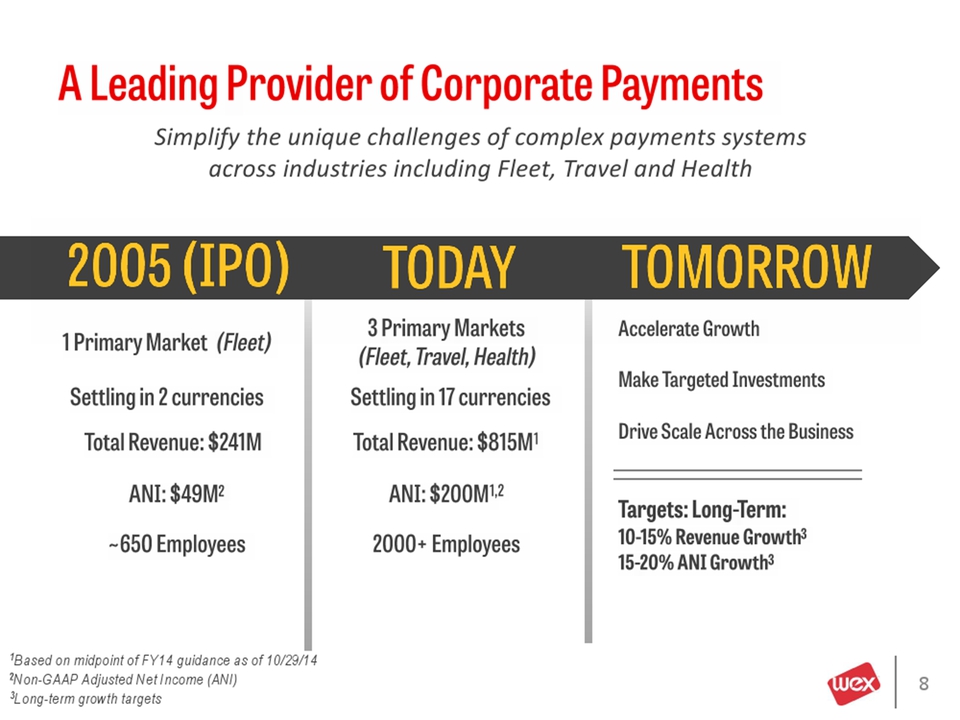

Accelerate Growth Make Targeted Investments Drive Scale Across the Business Targets: Long-Term: 10-15% Revenue Growth315-20% ANI Growth3 Simplify the unique challenges of complex payments systems across industries including Fleet, Travel and Health 3Long-term growth targets A Leader Provider of Corporate Payments 1 Primary Market (Fleet)Settling in 2 currencies; Operating in 2 countries Total Revenue: $241M ANI: $49M ~ 650 Employees 1 Primary Market (Fleet) Settling in 2 currencies; Total Revenue: $241M ANI: $49M2 ~650 Employees 3 Primary Markets (Fleet, Travel, Health) Settling in 17 currencies; Total Revenue: $815M1 ANI: $200M1,2 2000+ Employees 1Based on midpoint of FY14 guidance as of 10/29/14 2Non-GAAP Adjusted Net Income (ANI)

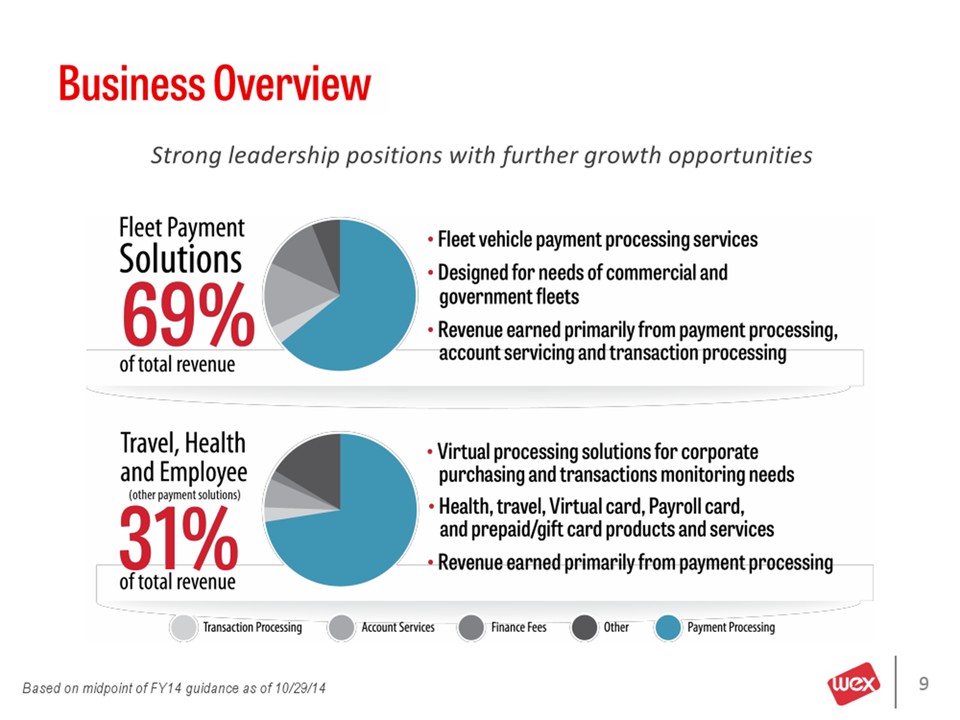

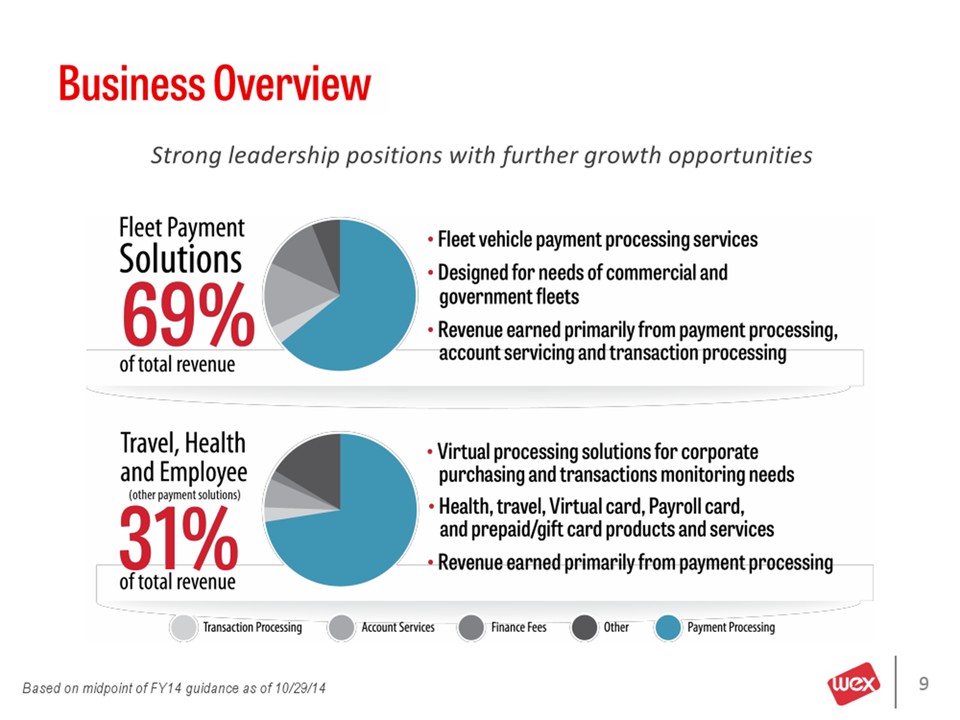

Strong leadership positions with further growth opportunities Business Overview Based on midpoint of FY14 guidance as of 10/29/14 Fleet Payment Solutions 69% of total revenue Fleet vehicle payment processing services Designed for needs of commercial and government fleets Revenue earned primarily from payment processing, account servicing and transaction processing Travel, Health and Employee (other payment solutions) 31% of total revenue Virtual processing solutions for corporate purchasing and transactions monitoring needs Health, travel, Virtual card, Payroll card, and prepaid/gift card products and services revenue earned primarily from payment processing Transaction processing Account Services Finance Fees Other Payment Processing Based on midpoint of FY14 guidance as of 10/29/14

FLEET Technology, combined with our customer-centric approach, has driven success in Fleet and creates further opportunity for WEX in Travel and Health Leveraging Strengths Across Industries TRAVEL HEALTH

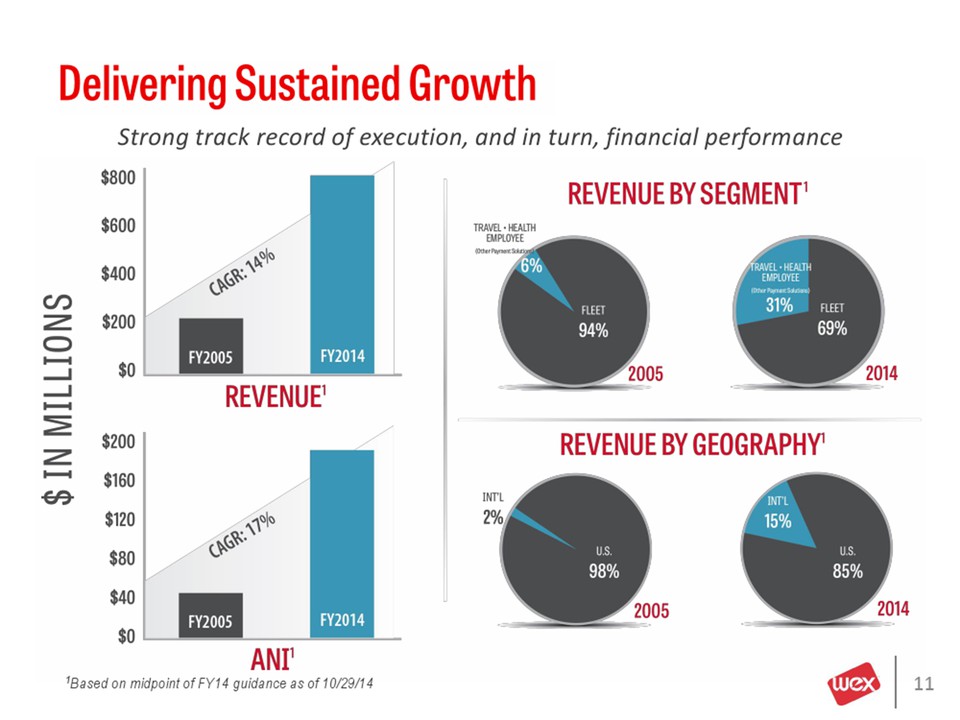

Delivering Sustained Growth 1Based on midpoint of FY14 guidance as of 10/29/14 Strong track record of execution, and in turn, financial performance $ in millionsCAGR: 14% CAGR: 17% FY2005 FY2014 REVENUE BY SEGMENT TRAVEL HEALTH EMPLOYEE (other payment solutions) INT’L REVENUE ANI1 6% 94% FLEET 69% U.S. 98% U.S. 85%

EXPANDING OUR LEADERSHIP POSITION

2014 has been a year of great success, due to strong execution on our strategic objectives Executing Against our Strategic Objectives

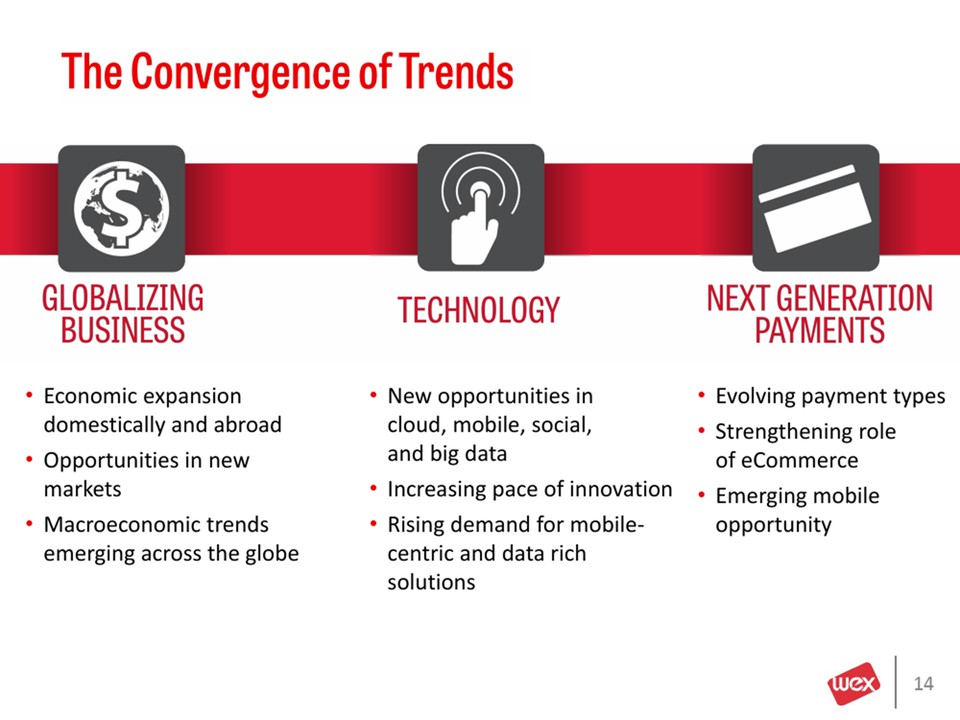

The Convergence of Trends Economic expansion domestically and abroad Opportunities in new markets Macroeconomic trends emerging across the globe New opportunities in cloud, mobile, social, and big data

Increasing pace of innovation Rising demand for mobile-centric and data rich solutions Evolving payment types Strengthening role of eCommerce Emerging mobile opportunity

Implications for WEX MARKET EXPANSION AND INNOVATION will capture growth across new products, geographies and industries. There is a lot of growth available globally from the decreased reliance on cash, the move to eCommerce and the increasing importance of data insights.

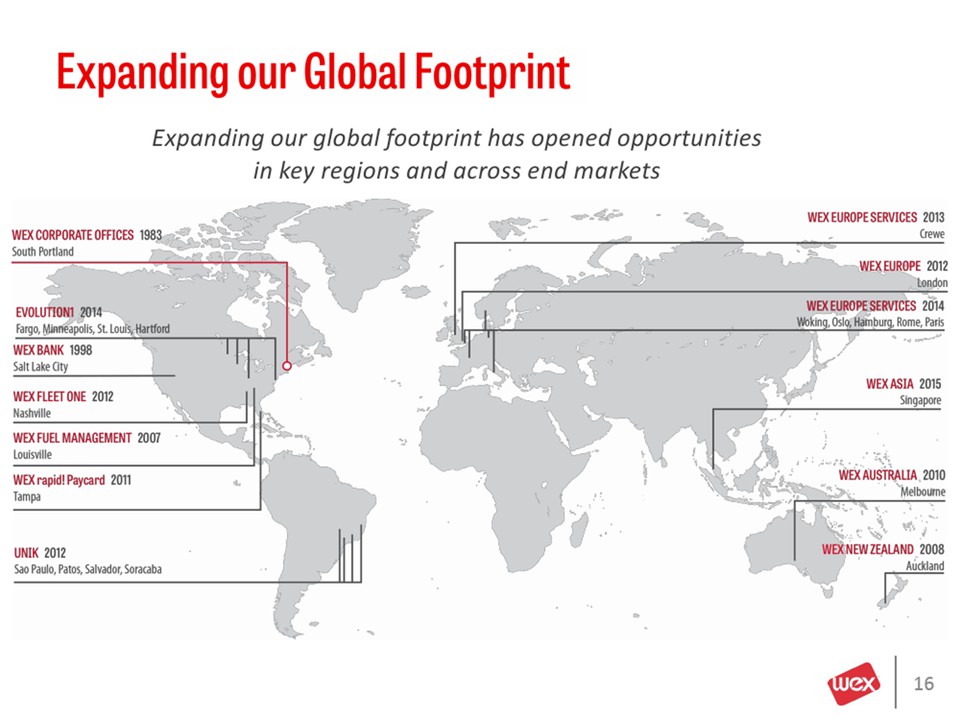

Expanding our global footprint has opened opportunities in key regions and across end markets Expanding our Global Footprint WEX CORPORATE OFFICES EVOLUTION1 WEX BANK WEX FLEET ONE WEX FUEL MANAGEMENT WEX rapid! Paycard UNIK WEX EUROPE SERVICES WEX EUROPE WEX EUROPE SERVICES WEX ASIA WEX AUSTRALIA WEX NEW ZEALAND 1983 2014 1998 2012 2007 2011 2012 2013 2012 2014 2015 2010 2008 South Portland Fargo, Minneapolis, St. Louis, Hartford, Salt Lake City Nashville Louisville Tampa Sao Paulo, Patos, Salvador, Soracaba Crewe London Woking, Oslo, Hamburg, Rome, Paris Singapore Melbourne Auckland

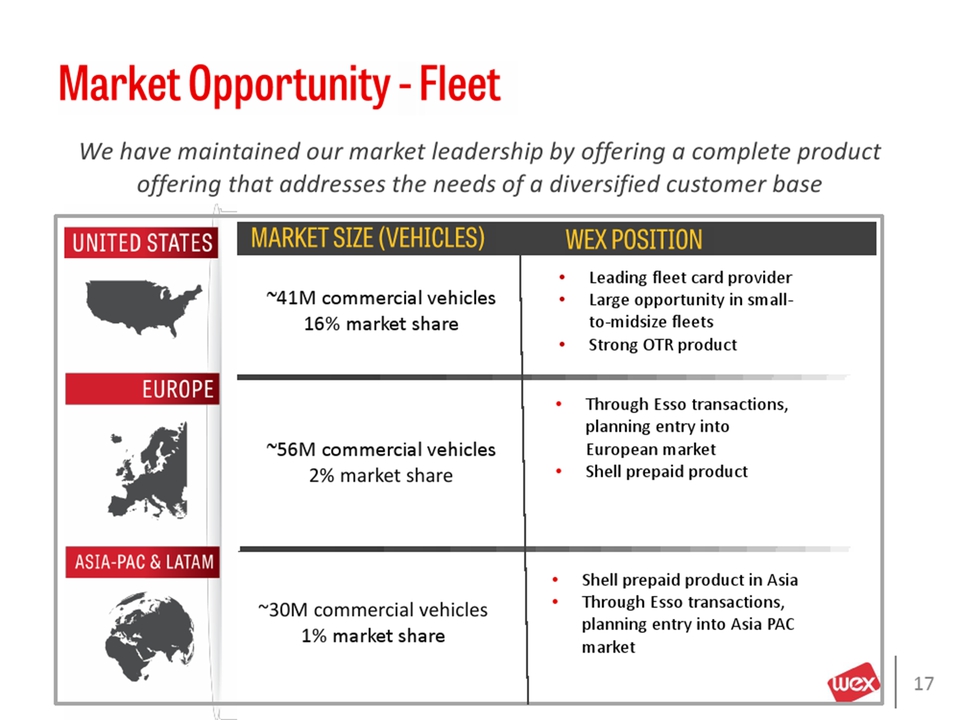

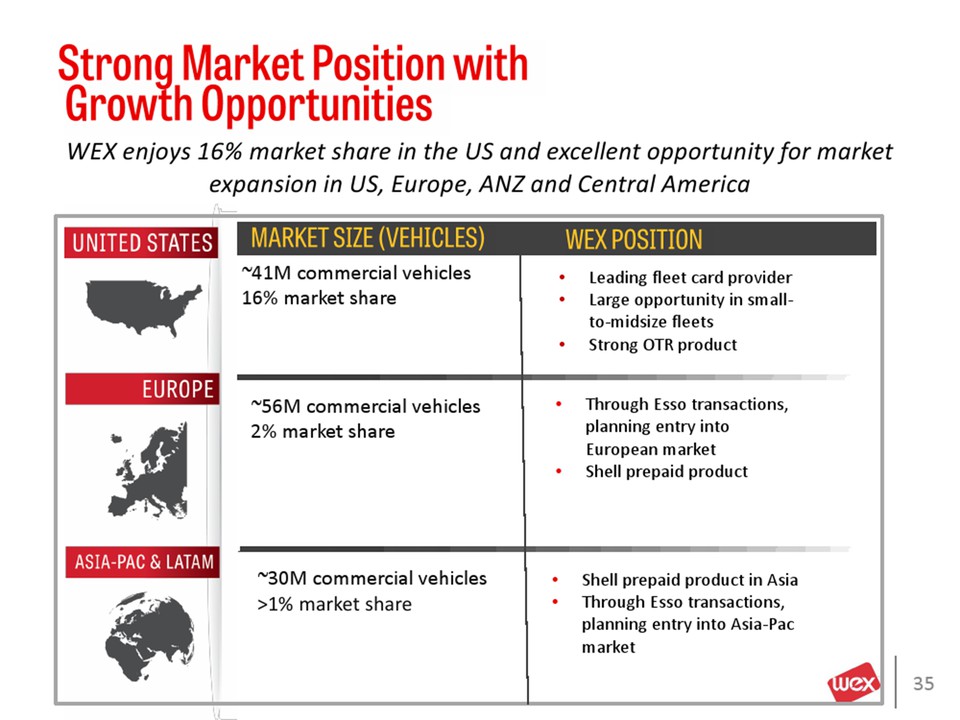

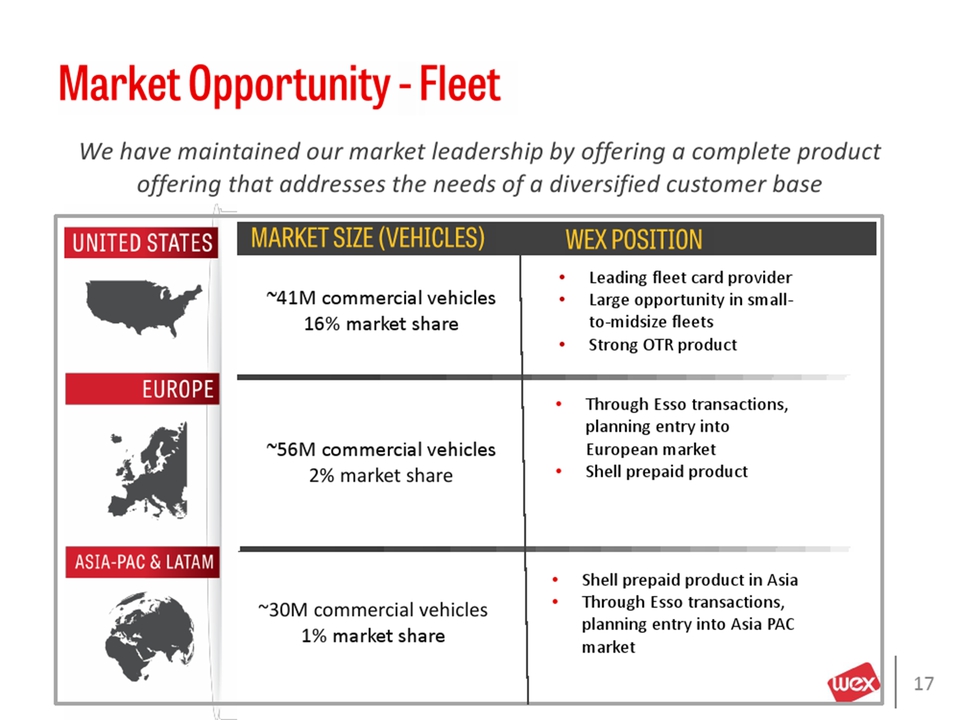

Market Opportunity – Fleet We have maintained our market leadership by offering a complete product offering that addresses the needs of a diversified customer base WEX POSITION ~41M commercial vehicles 16% market share MARKET SIZE (VEHICLES) ~56M commercial vehicles 2% market share ~30M commercial vehicles 1% market share Leading fleet card provider Large opportunity in small-to-midsize fleets Strong OTR product Through Esso transactions, planning entry into European market Shell prepaid product Shell prepaid product in Asia Through Esso transactions, planning entry into Asia PAC market

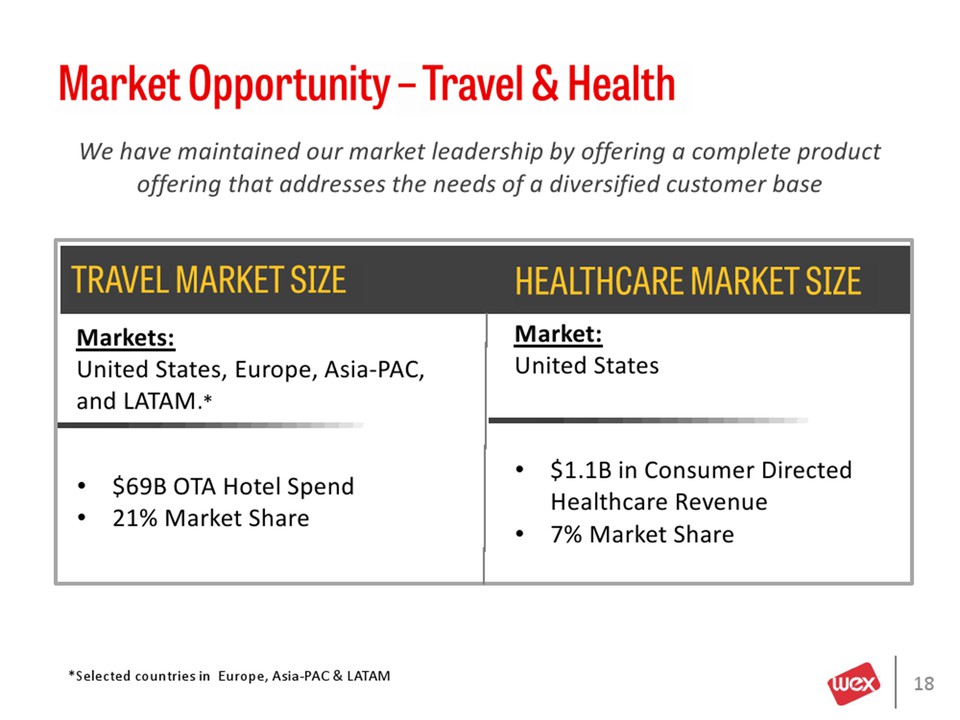

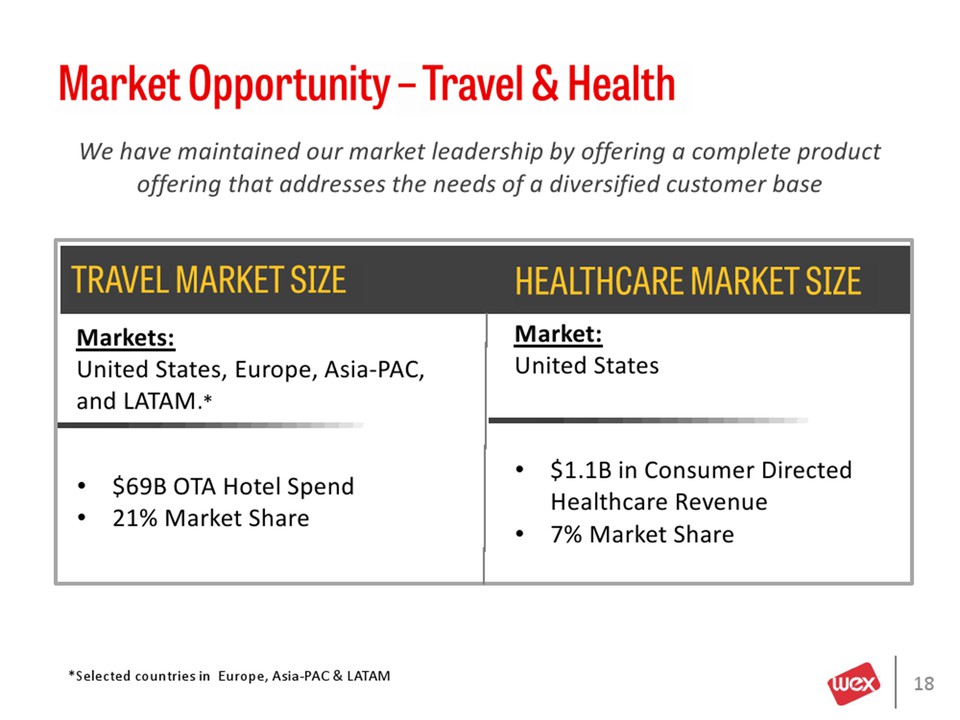

Market Opportunity – Travel & Health We have maintained our market leadership by offering a complete product offering that addresses the needs of a diversified customer base TRAVEL MARKET SIZE HEALTHCARE MARKET SIZE Markets: United States, Europe, Asia-PAC, and LATAM.* Market: United States $69B OTA Hotel Spend 21% Market Share $1.1B in Consumer Directed Healthcare Revenue 7% Market Share *Selected countries in Europe, Asia-PAC & LATAM

Accelerating Growth within Fleet Payments Expanded offer drives globalization and customer-centric focus drives growth in Fleet

Cultivating our Leadership in Travel Domestic leadership position paving the way for global expansion

Healthcare presents a growing opportunity in a complex payments ecosystem Targeted Investments in High Growth Markets

Scaling our capabilities across verticals and businesses drives operational efficiency and strengthen our offering in diverse markets Driving Scale in the Business

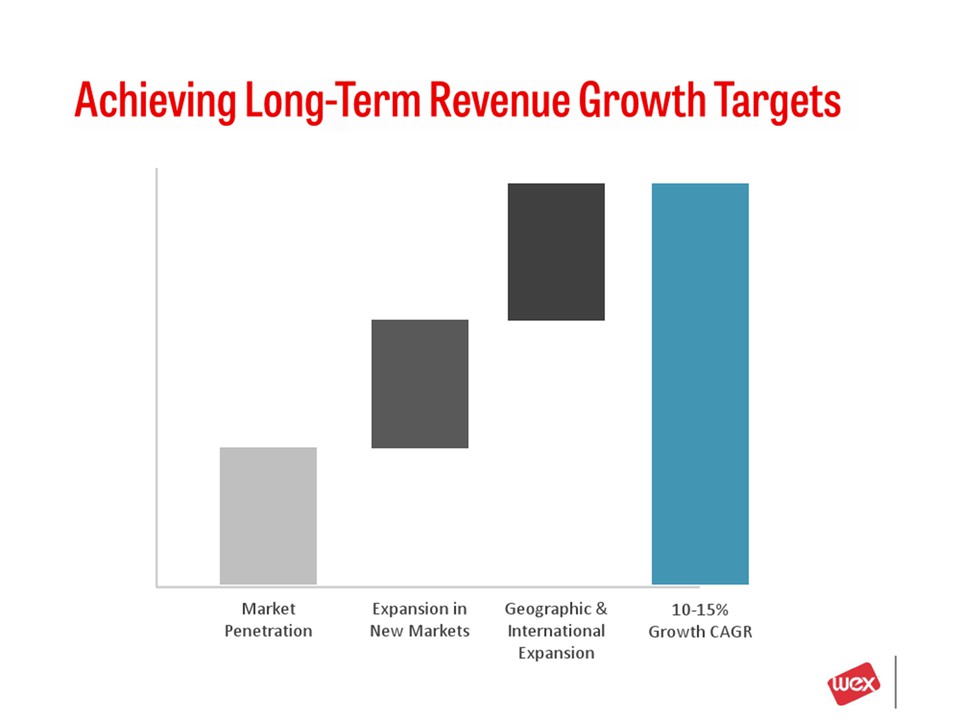

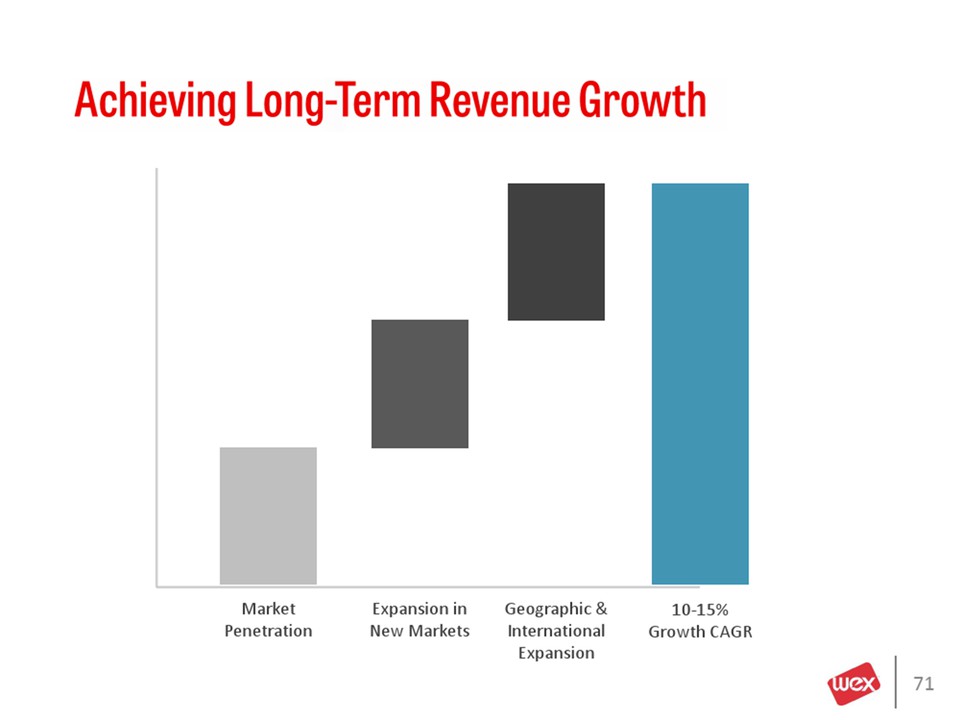

Achieving Long-Term Revenue Growth Targets Market Penetration Expansion in New Markets Geographic & International Expansion 10-15% Growth CAGR

WEX Senior Leadership WEX ASIA Jeff Ames WEX EUROPE SERVICES Jay Collins CUSTOMER ACQUISITIONS Bill Cooper SHARED SERVICES Steve Crowley CORPORATE FINANCE Steve Elder INTERNATIONAL

George Hogan FLEET PAYMENT SOLUTIONSKen Janosick CORPORATE DEVELOPMENT Nicola Morris VIRTUAL PAYMENTS Jim Pratt LEGAL & HR Hilary Rapkin UNIK Jose Roberto Krakochansky IR & TREASURY

Micky Thomas WEX EUROPE Myles Stephenson EMERGING INDUSTRIES Alison Vanderhoof EVOLUTION1 Jeff Young

WEX has demonstrated great success and is well-positioned to continue its profile as a leader across the payments space Positioned for Success Accelerating Growth Making Targeted Investments Driving Scale Strong Foundation Expanded Market Opportunity Long-term Sustainable Growth

December 9, 2014 Fleet Overview Ken Janosick SVP and GM, Fleet Payment Solutions

Agenda Business Model Competitive Differentiation Accelerating Growth

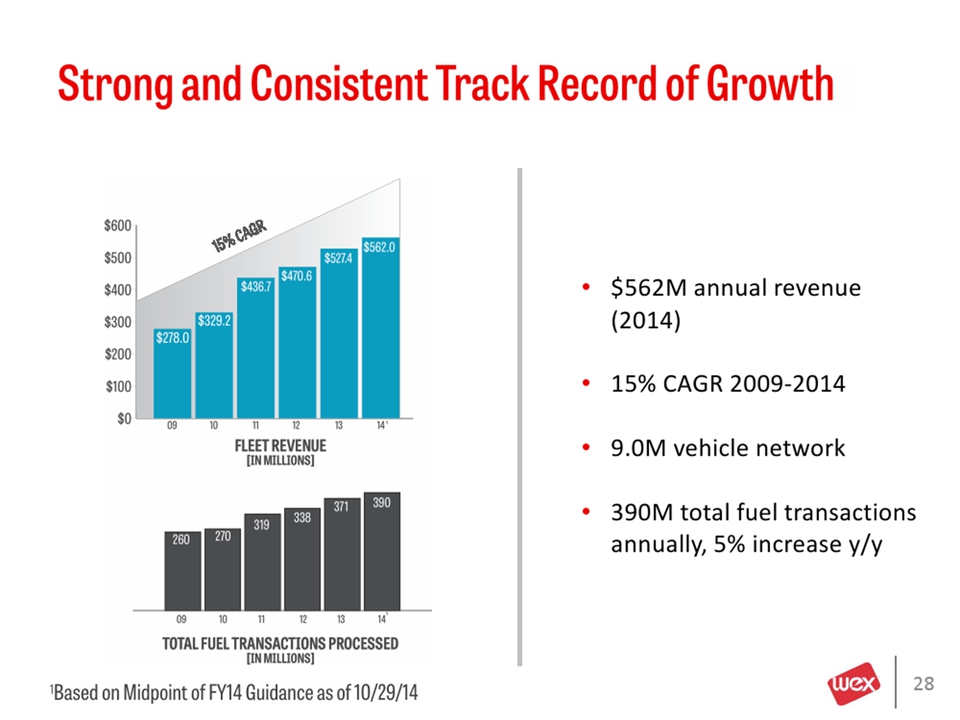

Strong and Consistent Track Record of Growth $562M annual revenue (2014) 15% CAGR 2009-2014 9.0M vehicle network 390M total fuel transactions annually, 5% increase y/y 15% CAGR 1Based on Midpoint of FY14 Guidance as of 10/29/14

Customer Centric Business Model Operating savings Increased efficiency and productivity Lower risk Better convenience Security Driver IDs Real-Time Updates Purchase controls Products Alerts Flag Unusual Items Customized Reporting WEXOnline® - Customer Portal Query by driver location Innovative products Valuable data for customers Outstanding customer service Closed loop network WEX began as a domestic fleet card company in 1983 and currently stands as a leading provider across various aspects of the Fleet market WHY WE ARE UNIQUE…WHAT WE DELIVER…WHAT OUR CUSTOMERS GET…High customer satisfaction and retention rates

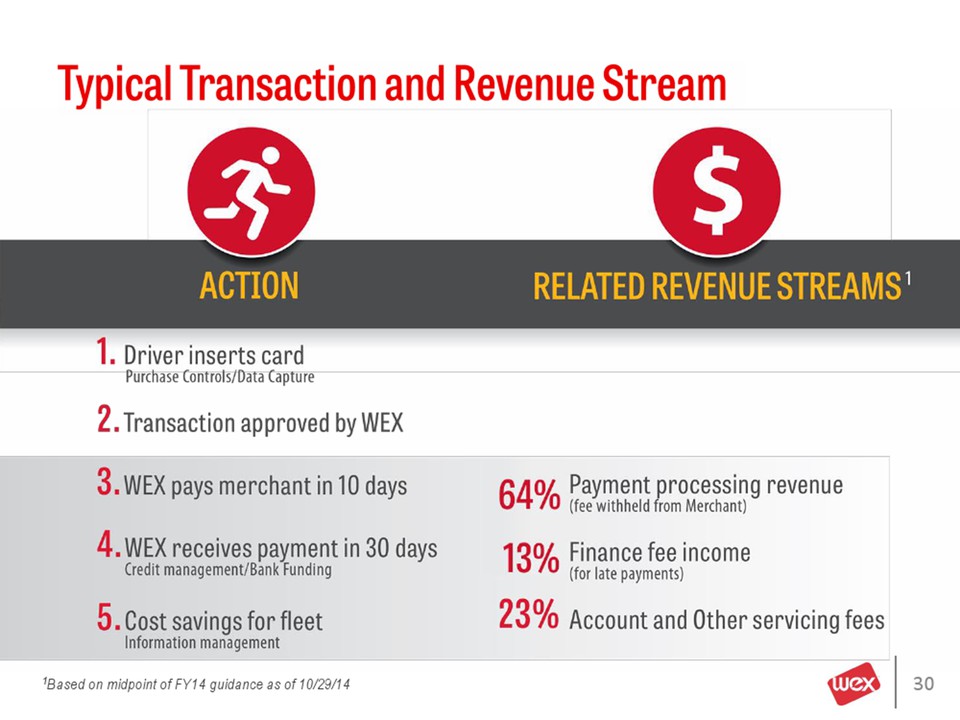

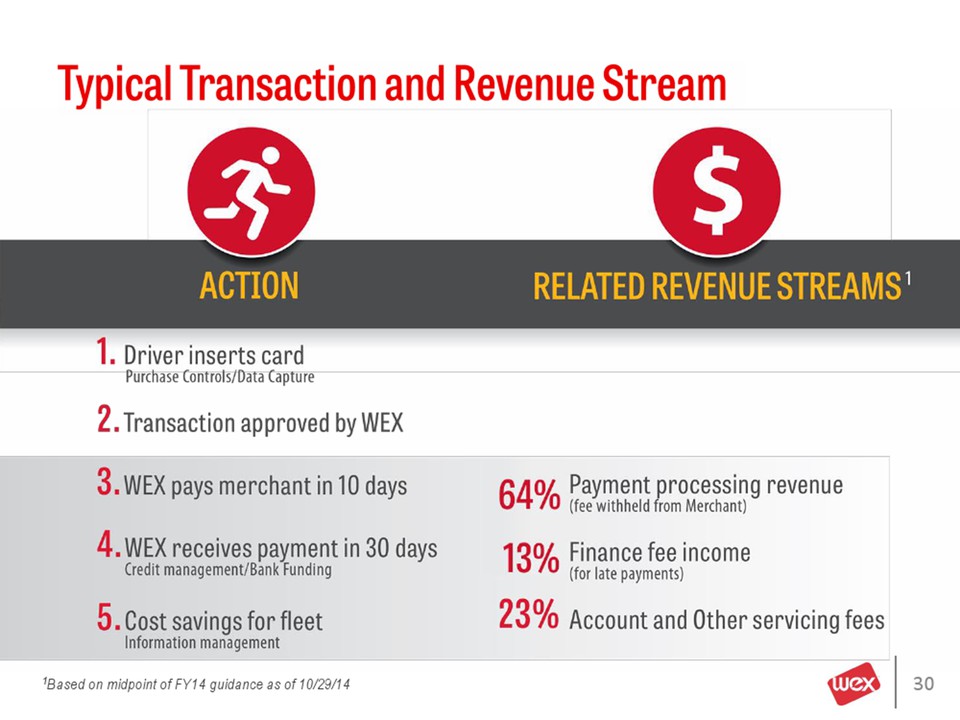

Typical Transaction and Revenue Stream 1Based on midpoint of FY14 guidance as of 10/29/14 ACTION RELATED REVENUE STREAMS1 1. 2. 3. 4. 5. 64% 13% 23% Driver inserts card Purchase Controls/Data Capture Transaction approved by WEX WEX pays merchant in 10 days WEX receives payment in 30 days Credit management/Bank Funding Cost savings for fleet Information management Payment processing revenue (fee withheld from Merchant) Finance fee income (for late payments) Account and Other servicing fees

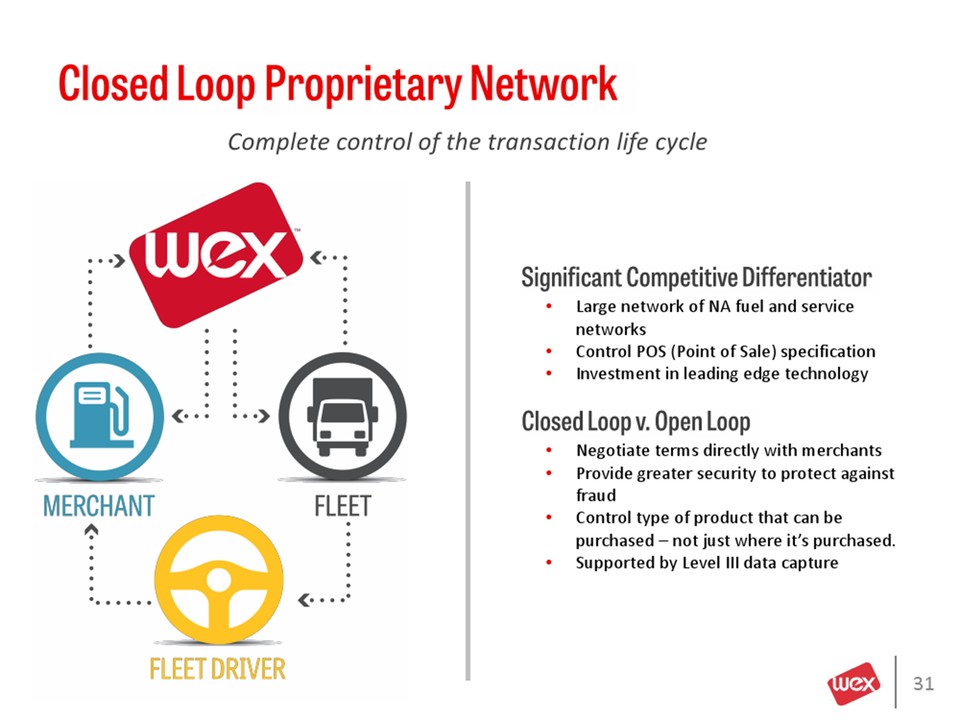

Closed Loop Proprietary Network Significant Competitive Differentiator Large network of NA fuel and service networks Control POS (Point of Sale) specification Investment in leading edge technology Closed Loop v. Open Loop Negotiate terms directly with merchants Provide greater security to protect against fraud Control type of product that can be purchased – not just where it’s purchased. Supported by Level III data capture Complete control of the transaction life cycle

Proven Partner Go To Market Capabilities Deep Fleet market understanding built from 30 years of experience, fleet behavioral data and robust customer research Proprietary response and sales coverage models

Comprehensive understanding of partner brands and business models New Partner Programs Portfolio Growth Customer Cross Sell Recognized effective go-to- market capabilities drive… …business growth

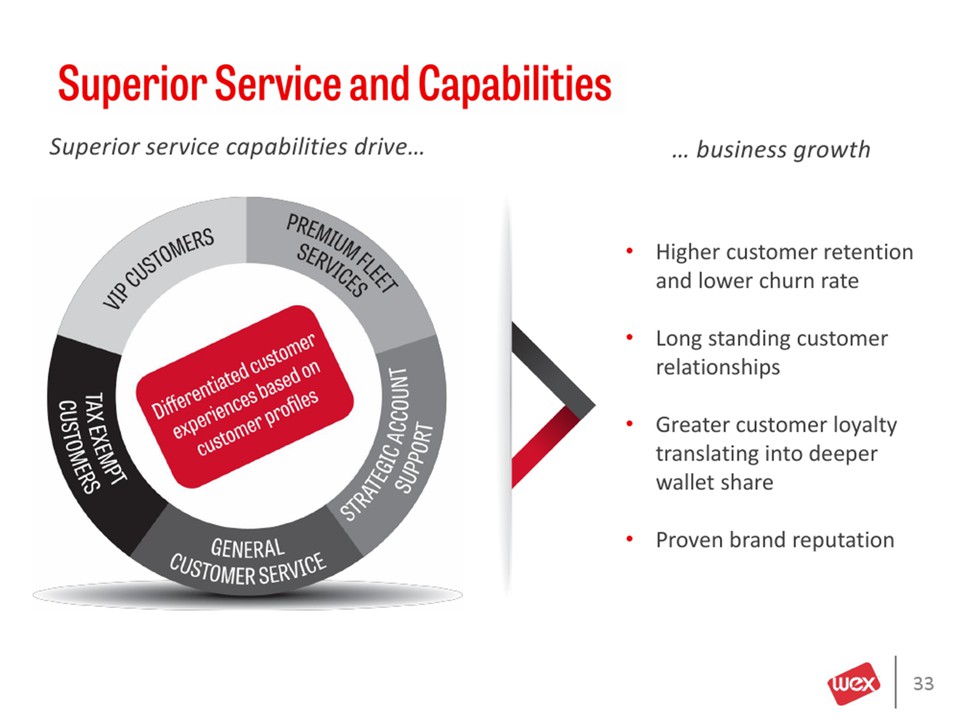

Superior Service and Capabilities Superior service capabilities drive… … business growth Higher customer retention and lower churn rate Long standing customer relationships Greater customer loyalty translating into deeper wallet share Proven brand reputation VIP CUSTOMERS PREMIUM FLEET SERVICES STRATEGIC ACCOUNT SUPPORT GENERAL CUSTOMER SERVICE TAX EXEMPT CUSTOMERS Differentiated customer experiences based on customer profiles

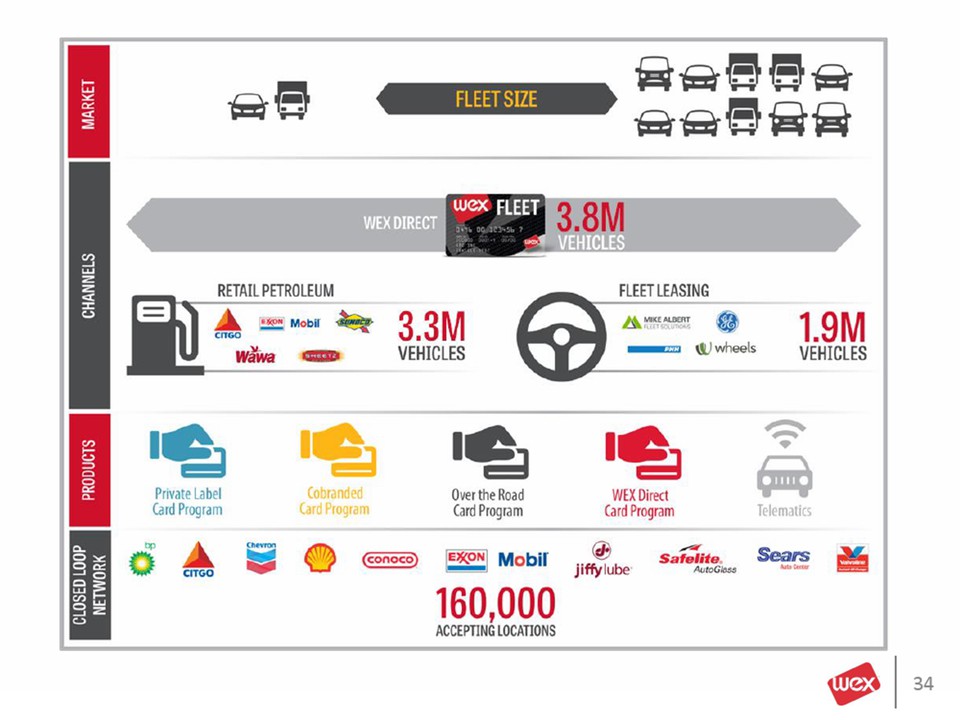

CLOSED LOOP NETWORK PRODUCTS CHANNELS MARKET FLEET SIZE 160,000 ACCEPTING LOCATIONS WEX DIRECT WEX FLEET 3.8M VEHICLES 3.3 VEHICLES RETAIL PETROLEUM FLEET LEASING 1.9M VEHICLES Private Lable Card Program Cobranded Card Program Over the Road Card Program WEX Direct Card Program Telematics

Strong Market Position with Growth Opportunities WEX enjoys 16% market share in the US and excellent opportunity for market expansion in US, Europe, ANZ and Central America WEX POSITION ~41M commercial vehicles 16% market share MARKET SIZE (VEHICLES) ~56M commercial vehicles 2% market share ~30M commercial vehicles >1% market share Leading fleet card provider Large opportunity in small-to-midsize fleets Strong OTR product Through Esso transactions, planning entry into European market Shell prepaid product Shell prepaid product in Asia Through Esso transactions, planning entry into Asia-Pac market

Evolving Market Poses Unique Opportunity Taking our capabilities mobile so that customers can interact with us across channels and reduce cost of service driving scale Mobile technology that enables self service and sourcing of lower cost fuel Data analytics and reporting helps fleets manage the total cost of ownership

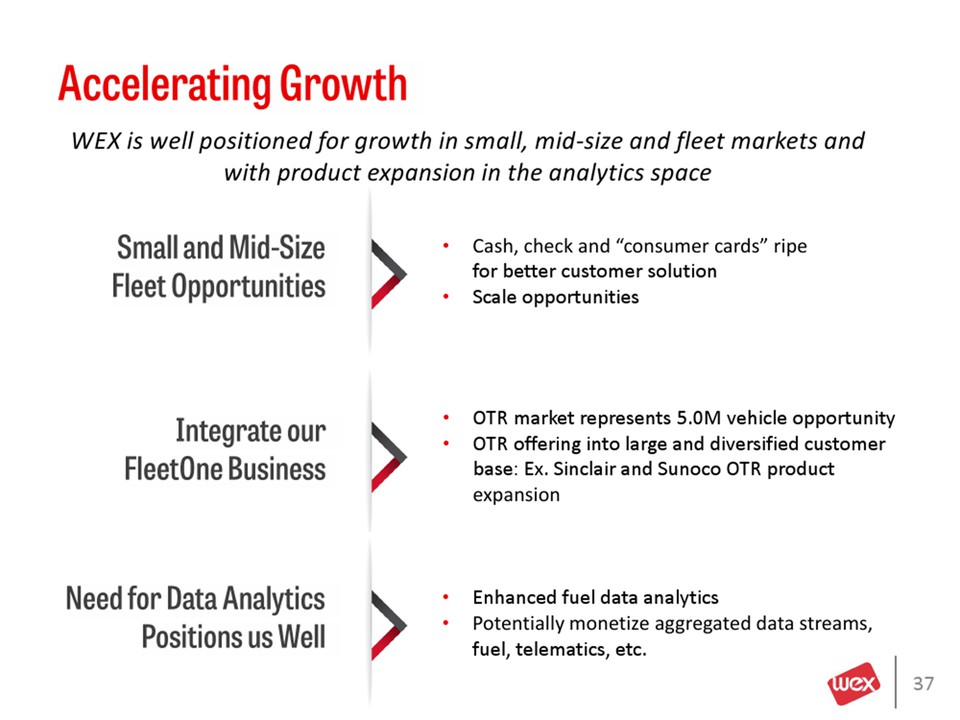

Integrate our FleetOne Business Small and Mid-Size Fleet Opportunities Cash, check and “consumer cards” ripe for better customer solution Scale opportunities OTR market represents 5.0M vehicle opportunity

OTR offering into large and diversified customer base: Ex. Sinclair and Sunoco OTR product expansion Need for Data Analytics Positions us Well Enhanced fuel data analytics Potentially monetize aggregated data streams, fuel, telematics, etc. Accelerating Growth WEX is well positioned for growth in small, mid-size and fleet markets and with product expansion in the analytics space

Leadership, Growth and Scale Sustainable long term growth based on proven Business Model New Business pipelines are strong; high customer retention continues Positioned to ride the next wave of growth; integrated data and mobile Rolling out scale initiatives; continuous improvement and pricing

December 9, 2014 Travel Overview Alison Vanderhoof SVP and GM, Emerging Industries Jim Pratt VP, Virtual

Agenda Expanding Our Business Across Verticals Success in Travel Go-Forward Strategy

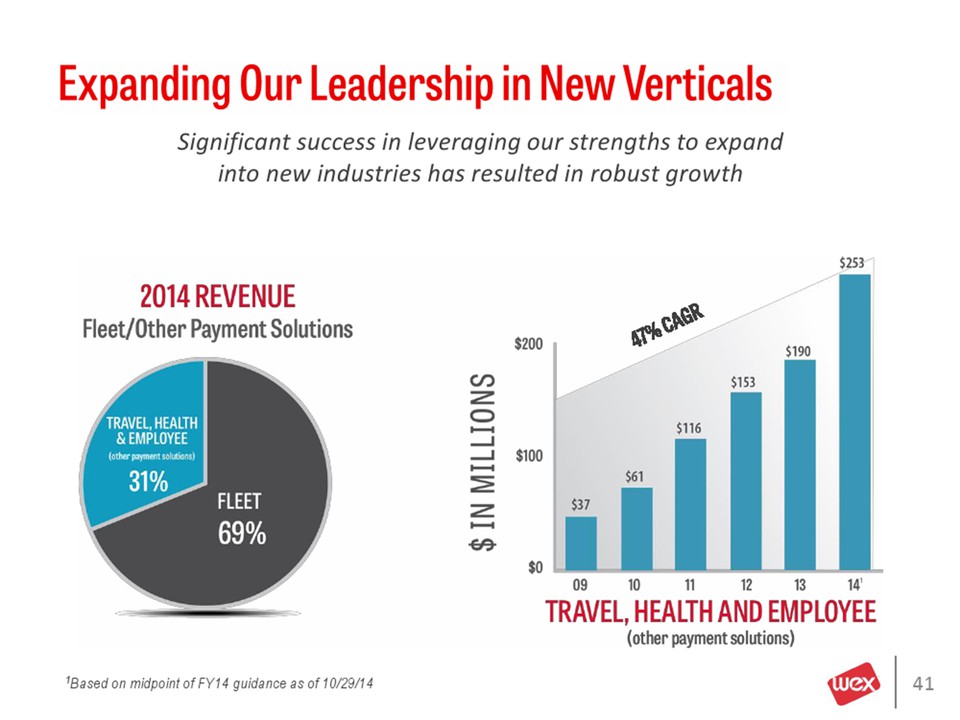

Expanding Our Leadership in New Verticals Significant success in leveraging our strengths to expand into new industries has resulted in robust growth 1Based on midpoint of FY14 guidance as of 10/29/14 47% CAGR 2014 REVENUE Fleet/Other Payment Solutions TRAVEL, HEALTH & EMPLOYEE (other payment solutions) 31% FLEET 69% $ IN MILLIONS

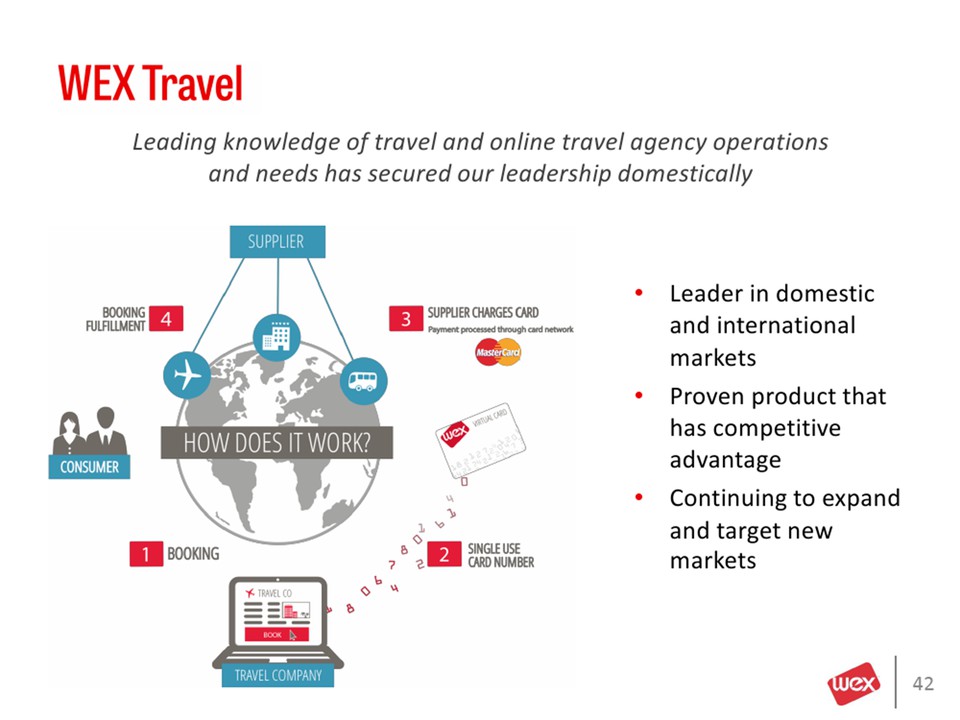

WEX Travel Leading knowledge of travel and online travel agency operations and needs has secured our leadership domestically Leader in domestic and international markets Proven product that has competitive advantage Continuing to expand and target new markets

The Global Opportunity Established leadership in the US market, with significant runway in a global $69 billion OTA market Domestic customers include all the major OTA’s in the U.S. International Expansion Europe Asia-Pac LATAM WEX TRAVEL IS USED IN OVER 200 COUNTRIES AND TERRITORIES

The Future of WEX Travel Driving scale and global expansion will enable continued growth in an attractive vertical PENETRATE MARKETS EXPAND GLOBALLY DRIVE SCALE

Assessment of New Verticals Thoughtful approach will uncover new verticals and adjacencies that will benefit from WEX’s unique capabilities and expertise of complex payment systems NEED FOR AGGREGATOR OR INTERMEDIARY B2B MODEL VERTICAL MARKET SHARE HOLDERS HIGH VOLUME OF PAYMENTS PAYMENT COMPLEXITIES DESIRED TRAITS

Looking Forward Entry into new verticals will drive continued contribution from our Other Payments Solutions segment

December 9, 2014 Health Overview Jeff Young SVP and GM, Evolution1

Agenda Business Model Market Opportunities Competitive Advantage Go-Forward Strategy

Industry Leading Technology Large and Growing Market Innovative Partner Network WEX Will Simplify the Business of Consumer Driven Healthcare Evolution1 strengthens our healthcare vertical, we will continue our mission of simplifying complex payment systems in a high-growth market

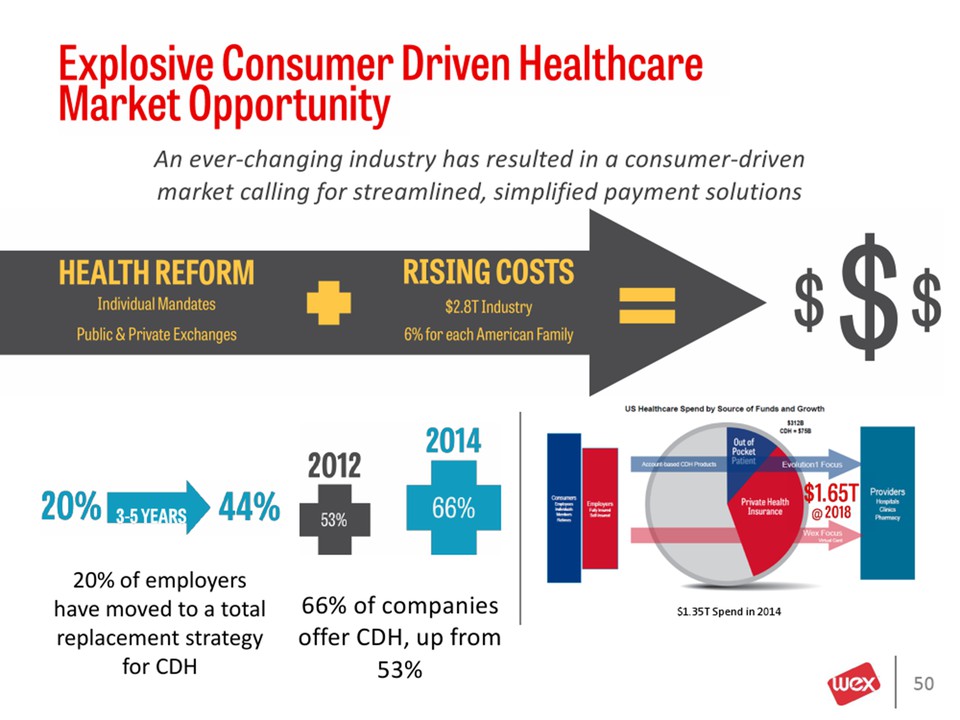

Explosive Consumer Driven Healthcare Market Opportunity An ever-changing industry has resulted in a consumer-driven market calling for streamlined, simplified payment solutions 66% of companies offer CDH, up from 53% 20% of employers have moved to a total replacement strategy for CDH $1.35T Spend in 2014 HEALTH REFORM RISING COSTS Individual Mandates Public & Private Exchanges $2.8T Industry 6% for each American Family 44% 3-5 YEARS 2012 53% 66%

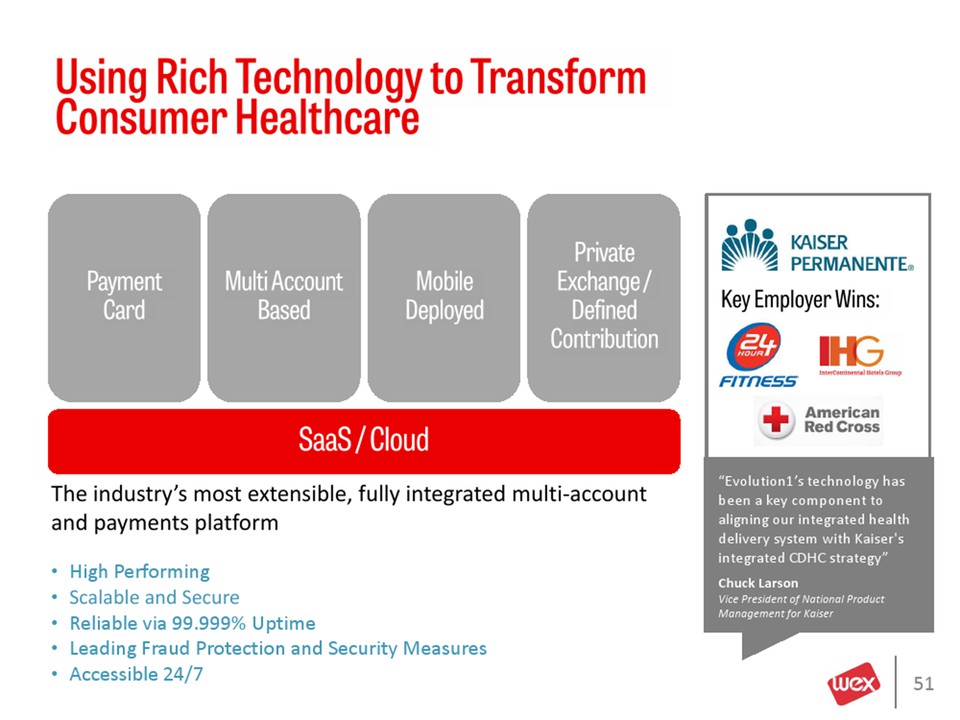

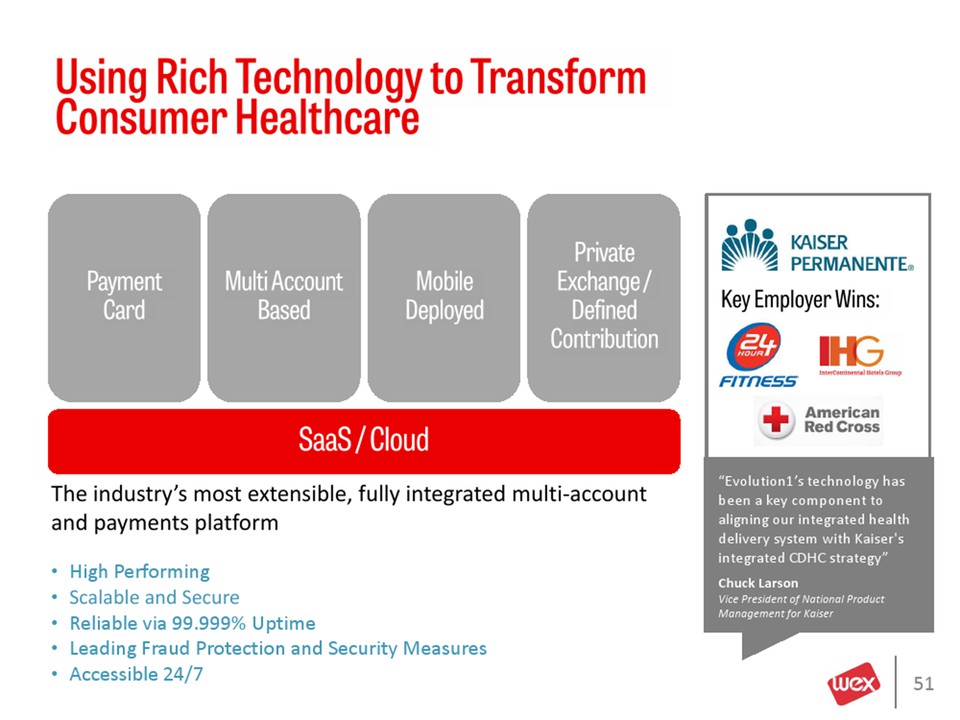

Using Rich Technology to Transform Consumer Healthcare Payment Card Multi Account Based Mobile Deployed Private Exchange / Defined Contribution SaaS / Cloud “Evolution1’s technology has been a key component to aligning our integrated health delivery system with Kaiser's integrated CDHC strategy” Chuck Larson Vice President of National Product Management for Kaiser Key Employer Wins: The industry’s most extensible, fully integrated multi-account and payments platform High Performing Scalable and Secure Reliable via 99.999% Uptime Leading Fraud Protection and Security Measures Accessible 24/7

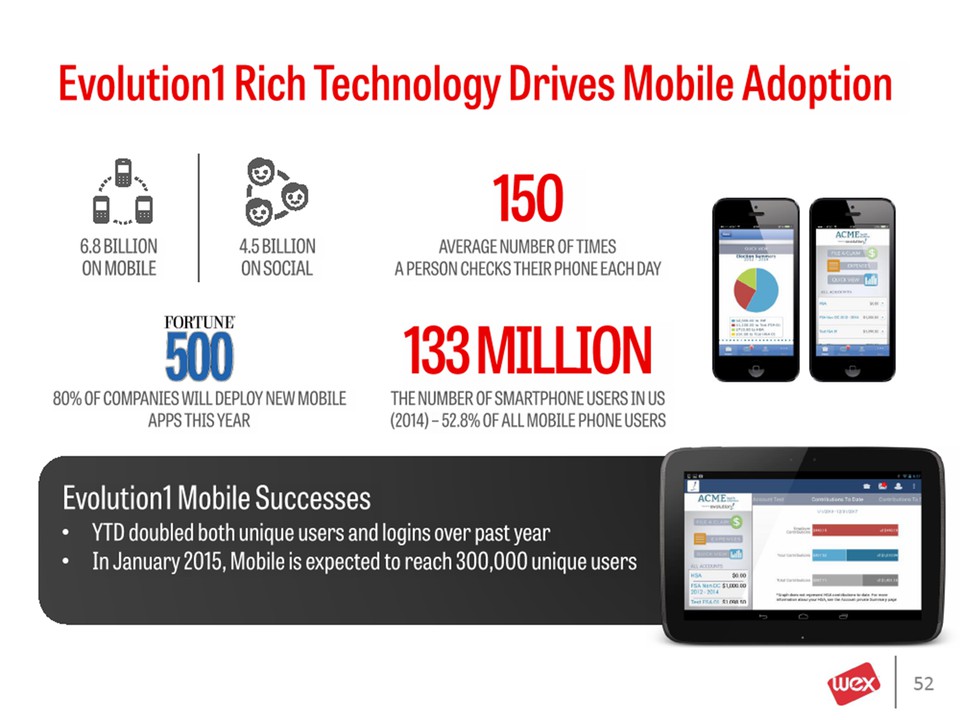

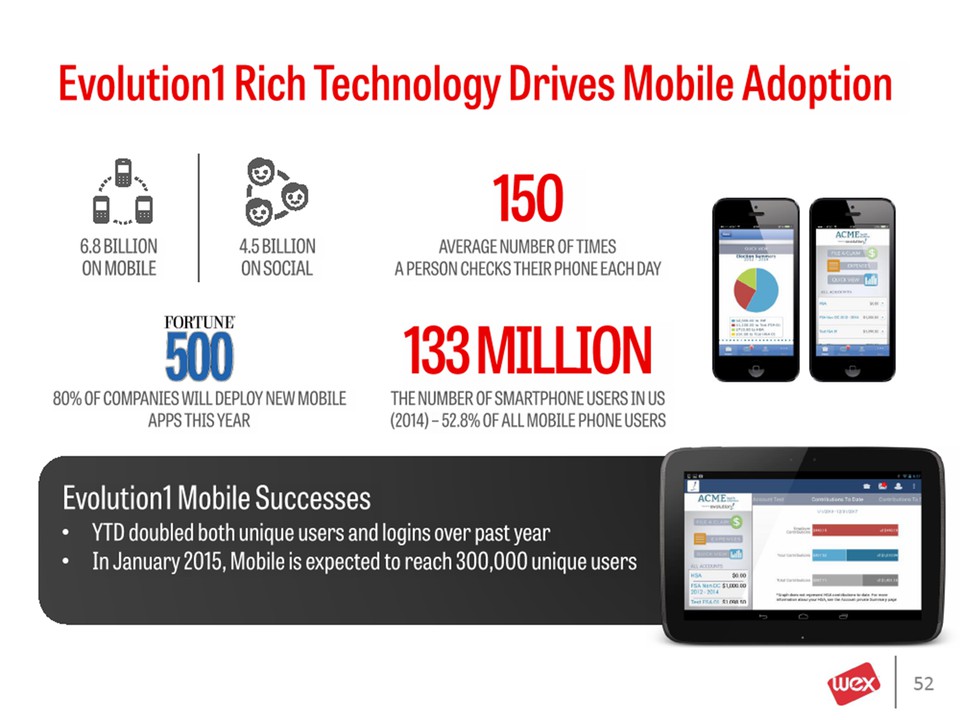

Evolution1 Rich Technology Drives Mobile Adoption AVERAGE NUMBER OF TIMES A PERSON CHECKS THEIR PHONE EACH DAY 150 80% OF COMPANIES WILL DEPLOY NEW MOBILE APPS THIS YEAR THE NUMBER OF SMARTPHONE USERS IN US (2014) – 52.8% OF ALL MOBILE PHONE USERS 133 MILLION 6.8 BILLION ON MOBILE 4.5 BILLION ON SOCIAL YTD doubled both unique users and logins over past year In January 2015, Mobile is expected to reach 300,000 unique users Evolution1 Mobile Successes

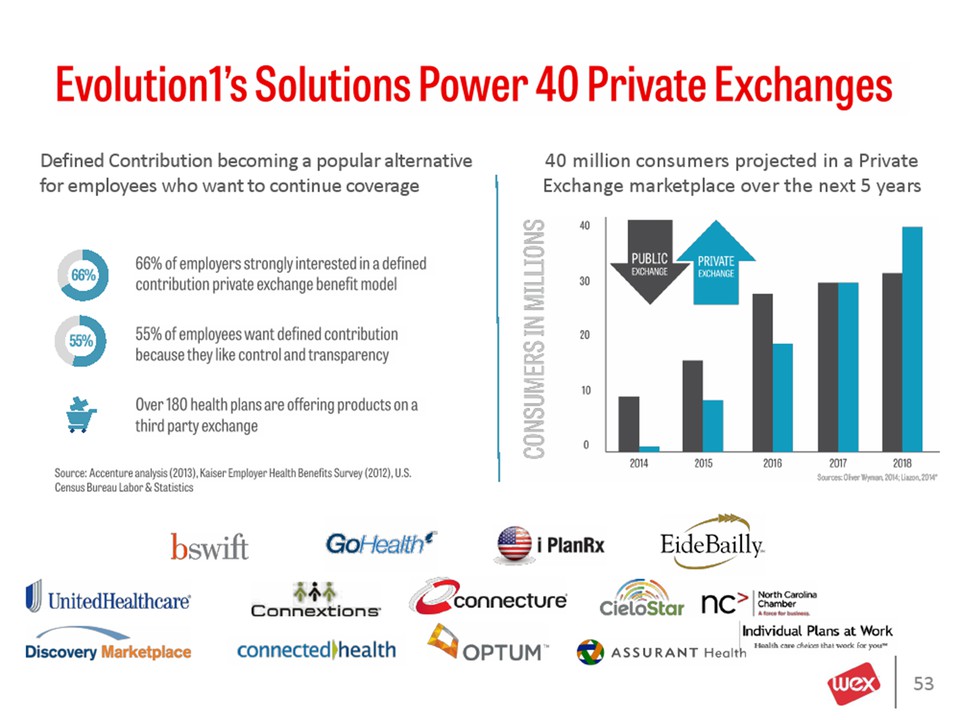

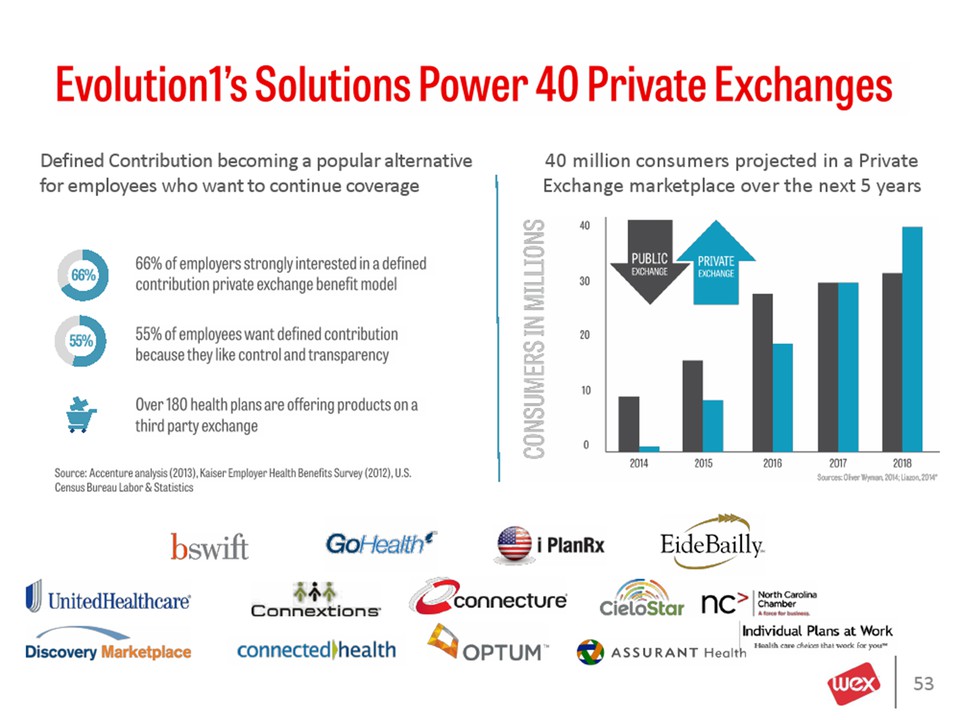

40 million consumers projected in a Private Exchange marketplace over the next 5 years Evolution1’s Solutions Power 40 Private Exchanges Defined Contribution becoming a popular alternative for employees who want to continue coverage 66% 55% Source: Accenture analysis (2013), Kaiser Employer Health Benefits Survey (2012), U.S. Census Bureau Labor & Statistics of employers strongly interested in a defined contribution private exchange benefit model of employees want defined contribution because they like control and transparency Over 180 health plans are offering products on a third party exchange

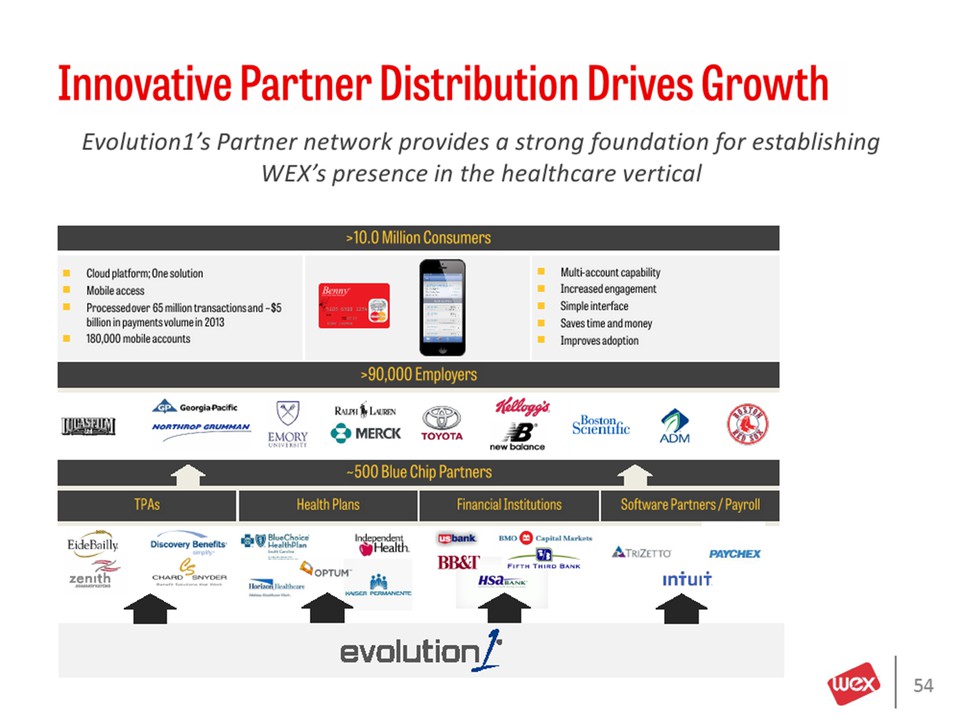

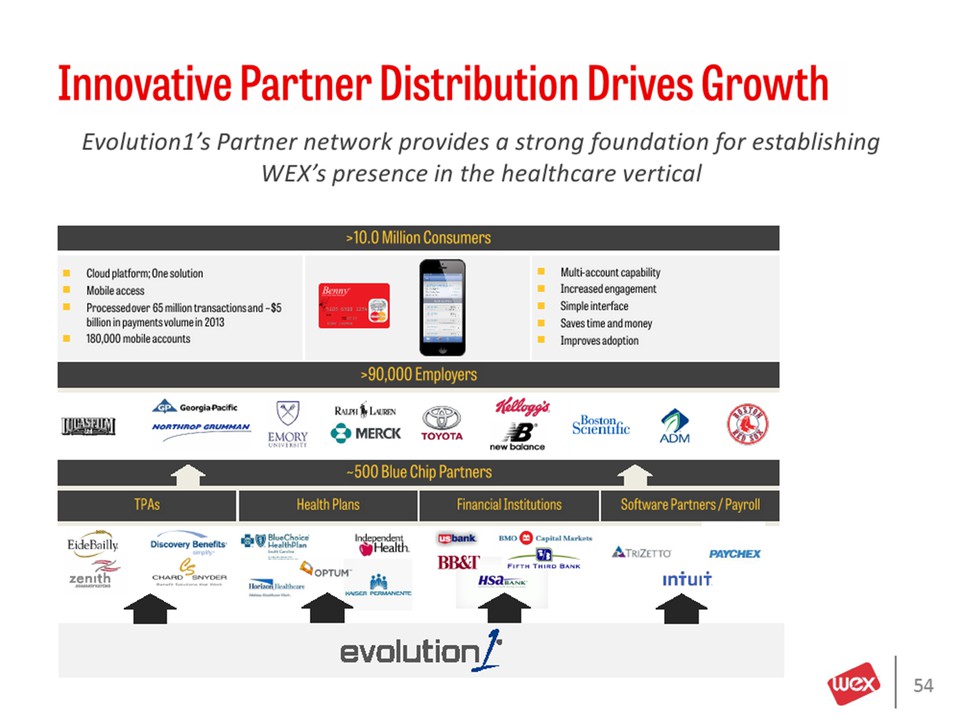

Innovative Partner Distribution Drives Growth Evolution1’s Partner network provides a strong foundation for establishing WEX’s presence in the healthcare vertical Cloud platform; One solution Mobile access Processed over 65 million transactions and $5 billion in payments volume in 2013 180,000 mobile accounts Multi-account capability Increased engagement Simple interface Saves time and money Improves adoption >10.0 Million Consumers >90,000 Employers 500 Blue Chip Partners TPAs Health Plans Financial Institutions Software Partners/Payroll

“This acquisition will solidify HSA Bank’s position as a leading provider of health savings accounts and will accelerate HSA Bank’s strategy to increase penetration of the carrier and large employer markets,” James C. Smith Chairman and Chief Executive Officer of Webster Webster Financial intends to acquire JPMorgan Chase’s health savings account (HSA) business 700,000 accounts $1.3 billion in deposits and $175 million in investments, will migrate from JPMorgan Chase Bank to HSA Bank “Great conference. One of the best I have attended and I have attended numerous software conferences. Thanks!”380 Attendees in 2014 April 7-10 2015 Scottsdale, AZ AWARDS 1000+ Membership Free Newsletters Blog Advisory board members include: Evolution1 Partner Focus Drives Competitive Advantage

WEX Will Simplify the Business of Consumer Driven Healthcare Evolution1 Team, Technology Investments, and Partner Base will position WEX as a leader in consumer healthcare Team, Technology Investments, Expanded Partner Base Industry Leading Technology Large and Growing Market Innovative Partner Network

December 9, 2014 International Overview George Hogan SVP and General Manager, International

Agenda Business Model Market Opportunities Panel Discussion

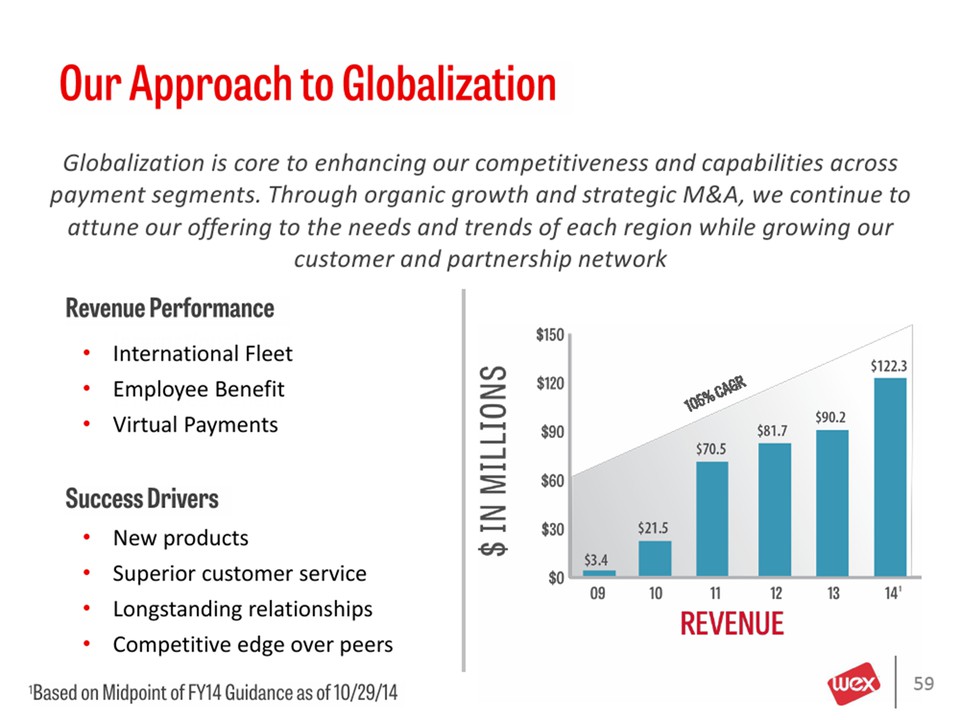

Our Approach to Globalization Globalization is core to enhancing our competitiveness and capabilities across payment segments. Through organic growth and strategic M&A, we continue to attune our offering to the needs and trends of each region while growing our customer and partnership network Revenue Performance International Fleet Employee Benefit Success Drivers New products Superior customer service Longstanding relationships

Competitive edge over peers 105% CAGR International Fleet Employee Benefit Virtual Payments 1Based on Midpoint of FY14 Guidance as of 10/29/14

Expanding our Reach Across Sectors We have made notable strides in expanding our Fleet and Travel businesses on a global scale, laying the groundwork and adapting our capabilities to gain share in Asia-Pac, Europe and Latin America Differentiated offering delivers tremendous efficiencies for our customers Global reach of key clients accelerates international growth Sophisticated technologies and web services enable best-in-class integration and enhance competitiveness in the space Global platform equipped to handle multiple languages, currencies and cross-border functionality Infrastructure in place to convert legacy platforms to new systems Partnership network offers valuable returns and propels business opportunities with new customers

Market Opportunities We play in businesses that are seeing rapid evolution and increasing demand across regions and are building the infrastructure needed to lead the market and define the space EUROPE ASIA-PAC BRAZIL & LATAM

Global Panel Discussion JAY COLLINS MYLES STEPHENSON JOSE ROBERTO KRACOCHANSKY JEFF AMES Managing Director, WEX Europe Services Managing Director, WEX Europe, CEO, UNIK Managing Director, WEX Asia

December 9, 2014 Financial Overview Steve Elder Chief Financial Officer

Agenda Historical Financials Review of Current Year Results Esso Update Long-Term Targets Capital Allocation

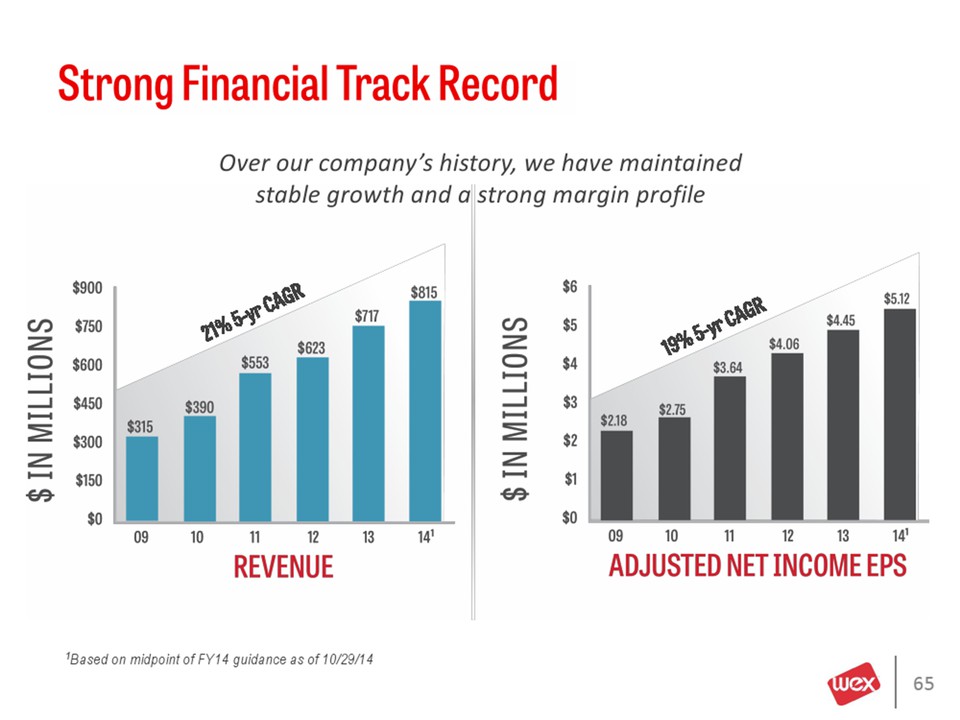

Strong Financial Track Record Over our company’s history, we have maintained stable growth and a strong margin profile 21% 5-yr CAGR 19% 5-yr CAGR 1Based on midpoint of FY14 guidance as of 10/29/14

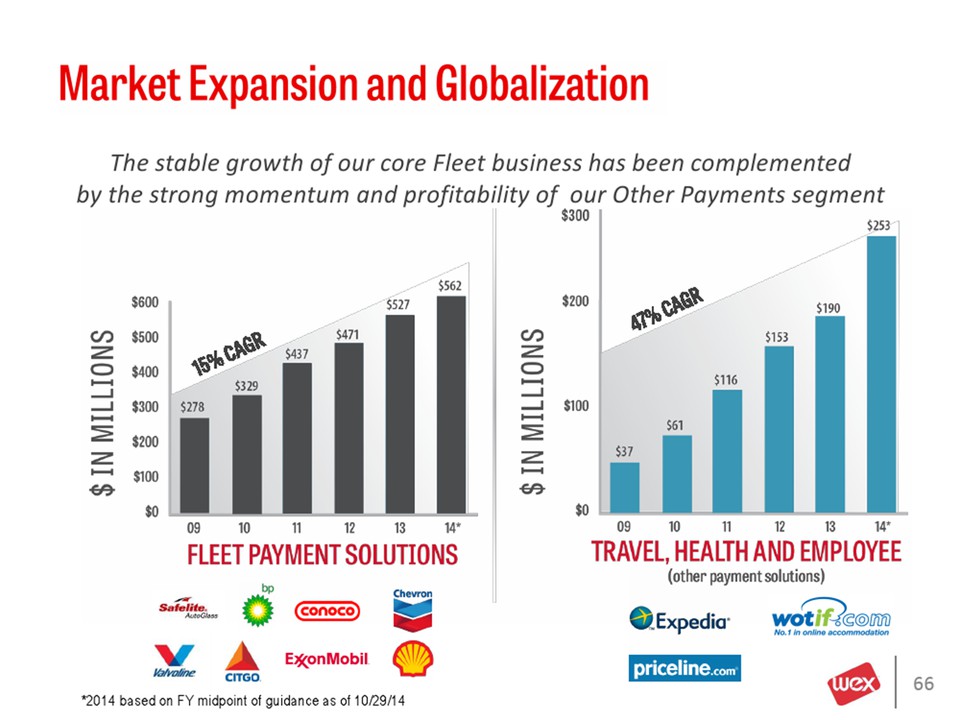

Market Expansion and Globalization The stable growth of our core Fleet business has been complemented by the strong momentum and profitability of our Other Payments segment *2014 based on FY midpoint of guidance as of 10/29/14 47% CAGR 15% CAGR FLEET PAYMENT SOLUTIONS TRAVEL, HEALTH AND EMPLOYEE (other payment solutions) $ IN MILLIONS

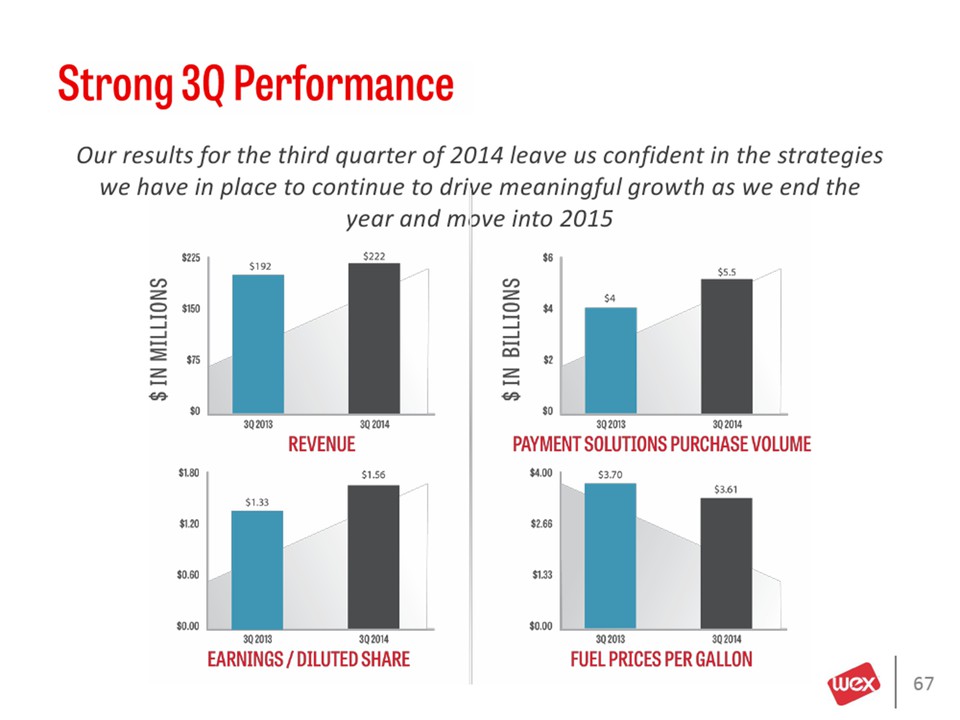

Strong 3Q Performance Our results for the third quarter of 2014 leave us confident in the strategies we have in place to continue to drive meaningful growth as we end the year and move into 2015 REVENUE PAYMENT SOLUTIONS PURCHASE VOLUME EARNINGS/DILUTED SHARE FUEL PRICES PER GALLON $ IN MILLIONS

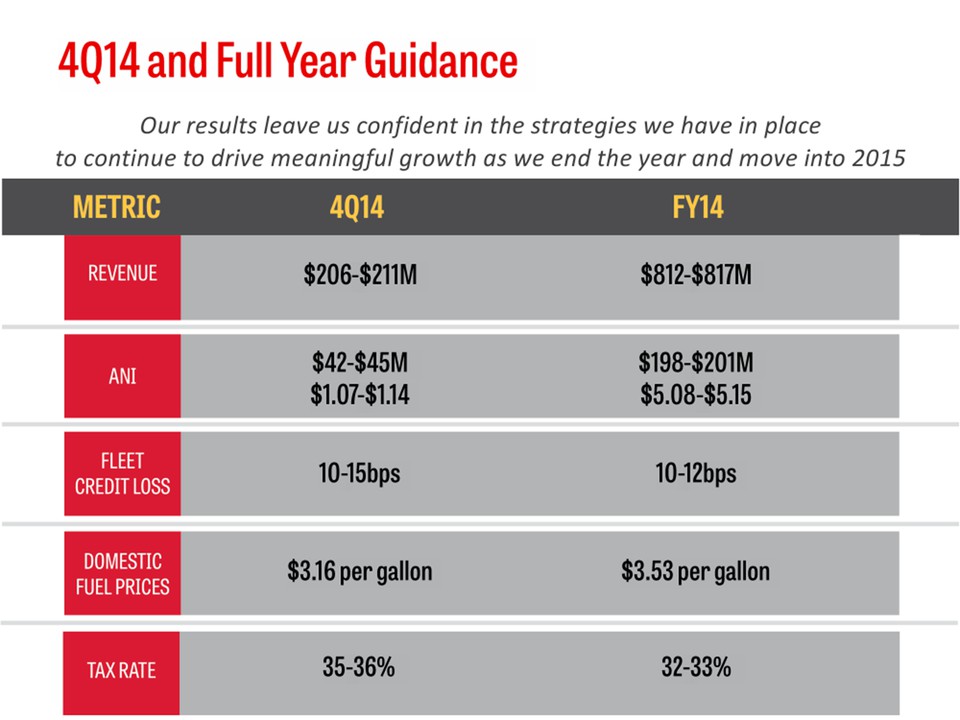

4Q14 and Full Year Guidance Our results leave us confident in the strategies we have in place to continue to drive meaningful growth as we end the year and move into 2015 $206-$211M $812-$817M $42-$45M $1.07-$1.14 $198-$201M $5.08-$5.15 10-15bps 10-12bps $3.16 per gallon $3.53 per gallon 35-36% 32-33%

Exxon Mobil Europe Update We are excited to be collaborating with ExxonMobil and we are encouraged by our progress to date

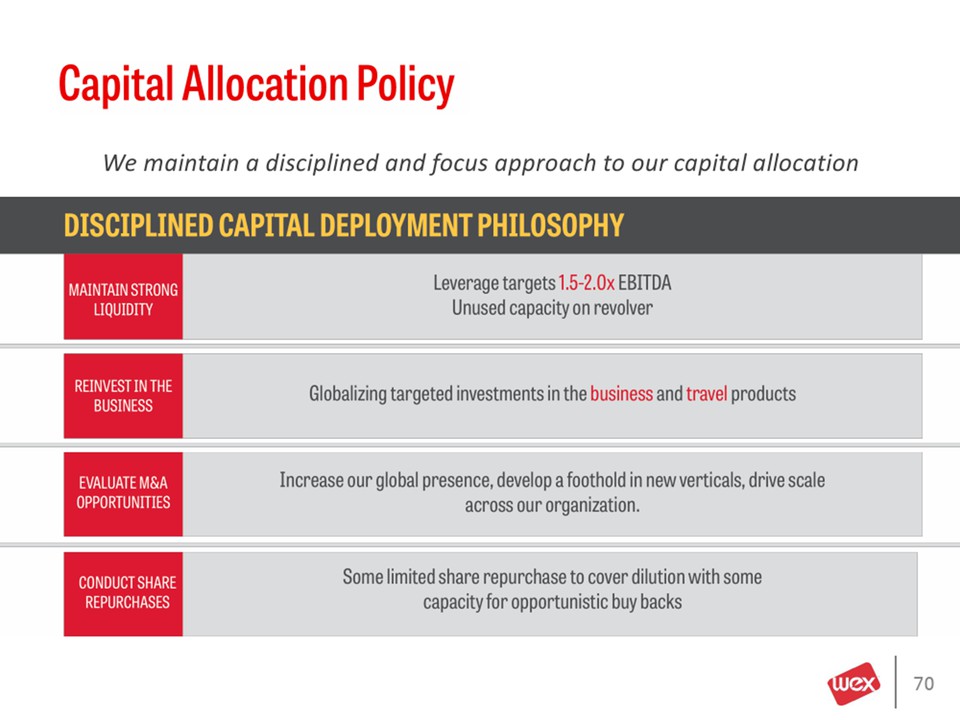

Capital Allocation Policy We maintain a disciplined and focus approach to our capital allocation DISCIPLINED CAPITAL DEPLOYMENT PHILOSOPHY MAINTAIN STRONG LIQUIDITY REINVEST IN THE BUSINESS EVALUATE M&A OPPORTUNITIES CONDUCT SHARE REPURCHASES Leverage targets 1.5-2.0x EBITDA Unused capacity on revolver Globalizing targeted investments in the business and travel products Increase our global presence, develop a foothold in new verticals, drive scale across our organization. Some limited share repurchase to cover dilution with some capacity for opportunistic buy backs

Achieving Long-Term Revenue Growth Market Penetration Expansion in New Markets Geographic & International Expansion 10-15% Growth CAGR

CLOSING REMARKS MELISSA SMITH ACCELERATING GROWTH MAKING TARGETED INVESTMENTS DRIVING SCALE

Summary Expanding into a Leading Global Payments Provider Execution Against Strategic Objectives Achieving Long-Term, Sustainable Growth

Positioned for Success WEX has demonstrated great success and is well-positioned to continue its profile as a leader across the payments space ACCELERATING GROWTH MAKING TARGETED INVESTMENTS DRIVING SCALE Strong Foundation Expanded Market Opportunity Long-term Sustainable Growth

We see corporate payments differently.

Exhi

Exhi