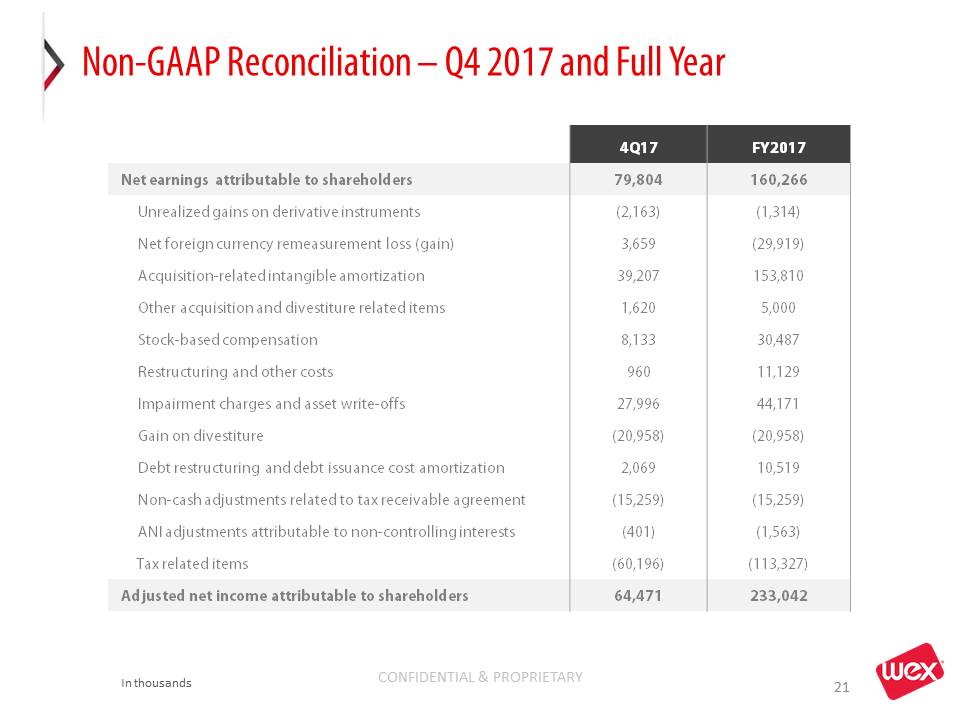

Non-GAAP Reconciliation The Company's non-GAAP adjusted net income excludes unrealized gains and losses on derivatives, net foreign currency remeasurement gains and losses, acquisition-related ticking fees, acquisition-related intangible amortization, other acquisition and divestiture related items, stock-based compensation, restructuring and other costs, gain on divestiture, a one time vendor settlement, debt restructuring and debt issuance cost amortization, non-cash adjustments related to tax receivable agreement, similar adjustments attributed to our non-controlling interest and certain tax related items. In addition, for the three months and year ended December 31, 2017, we have excluded certain impairment charges and asset write-offs as described below.Although adjusted net income is not calculated in accordance with generally accepted accounting principles (“GAAP”), this non-GAAP measure is integral to the Company's reporting and planning processes and the chief operating decision maker of the Company uses adjusted operating income to allocate resources among our operating segments The Company considers this measure integral because it excludes specified items that the Company's management excludes in evaluating the Company's performance. Specifically, in addition to evaluating the Company's performance on a GAAP basis, management evaluates the Company's performance on a basis that excludes the above items because:• Exclusion of the non-cash, mark-to-market adjustments on derivative instruments, including fuel price related derivatives and interest rate swap agreements, helps management identify and assess trends in the Company's underlying business that might otherwise be obscured due to quarterly non-cash earnings fluctuations associated with these derivative contracts.• Net foreign currency gains and losses primarily result from the remeasurement to functional currency of cash, receivable and payable balances, certain intercompany notes denominated in foreign currencies and any gain or loss on foreign currency hedges relating to these items. The exclusion of these items helps management compare changes in operating results between periods that might otherwise be obscured due to currency fluctuations.• The Company considers certain acquisition-related costs, including certain financing costs, ticking fees, investment banking fees, warranty and indemnity insurance, certain integration related expenses and amortization of acquired intangibles, as well as gains and losses from divestitures to be unpredictable, dependent on factors that may be outside of our control and unrelated to the continuing operations of the acquired or divested business or the Company. During the year ended December 31, 2017, the Company determined that our Telapoint business did not align with the long-term strategy of our core Fleet business and as result sold the net assets of the business. In prior periods not reflected above, the Company has adjusted for goodwill impairments and acquisition related asset impairments. In addition, the size and complexity of an acquisition, which often drives the magnitude of acquisition-related costs, may not be indicative of such future costs. The Company believes that excluding acquisition-related costs and gains or losses of divestitures facilitates the comparison of our financial results to the Company's historical operating results and to other companies in our industry.• Stock-based compensation is different from other forms of compensation, as it is a non-cash expense. For example, a cash salary generally has a fixed and unvarying cash cost. In contrast, the expense associated with an equity-based award is generally unrelated to the amount of cash ultimately received by the employee, and the cost to the Company is based on a stock-based compensation valuation methodology and underlying assumptions that may vary over time.• Restructuring costs are related to employee termination benefits from certain identified initiatives to further streamline the business, improve the Company's efficiency, create synergies, and to globalize the Company's operations, all with an objective to improve scale and increase profitability going forward. We exclude these items when evaluating our continuing business performance as such items are not consistently occurring and do not reflect expected future operating expense, nor provide insight into the fundamentals of current or past operations of our business.• Impairment charges and asset write-offs represent non-cash asset write offs related to the following: - Impairment of certain prepaid services following a strategic decision to in-source certain technology functions. - Impairments of certain payment processing software following the acquisition of AOC and as part of our ongoing platform consolidation strategy, designed to ensure we continue to deliver superior technology to our customers. - These charges do not reflect recurring costs that are relevant to our continuing operations. The Company believes that excluding these nonrecurring expenses facilitates the comparison of our financial results to the Company's historical operating results and to other companies in our industry.• Vendor settlement represents a payment made in 2016 in exchange for the release of potential claims related to insourcing certain technology, and does not reflect recurring costs that would be relevant to the continuing operations of the Company. The Company believes that excluding this nonrecurring expense facilitates the comparison of our financial results to the Company's historical operating results and to other companies in our industry.• Debt restructuring and debt issuance cost amortization are non-cash items that are unrelated to the continuing operations of the Company. Debt restructuring costs are not consistently occurring and do not reflect expected future operating expense, nor provide insight into the fundamentals of current or past operations of our business. In addition, since debt issuance cost amortization is dependent upon the financing method which can vary widely company to company, we believe that excluding these costs helps to facilitate comparison to historical results as well as to other companies within our industry.• The adjustments attributable to non-controlling interests, including adjustments to the redemption value of a non-controlling interest, and the non-cash adjustments related to tax receivable agreement have no significant impact on the ongoing operations of the business.• The tax related items are the difference between the Company’s U.S. GAAP tax provision and a pro forma tax provision based upon the Company’s adjusted net income before taxes as well as the impact from certain discrete tax items including various impacts from the tax reform act passed in December 2017. The methodology utilized for calculating the Company’s adjusted net income tax provision is the same methodology utilized in calculating the Company’s U.S. GAAP tax provision.For the same reasons, WEX believes that adjusted net income may also be useful to investors as one means of evaluating the Company's performance. However, because adjusted net income is a non-GAAP measure, it should not be considered as a substitute for, or superior to, net income, operating income or cash flows from operating activities as determined in accordance with GAAP. In addition, adjusted net income as used by WEX may not be comparable to similarly titled measures employed by other companies. 20