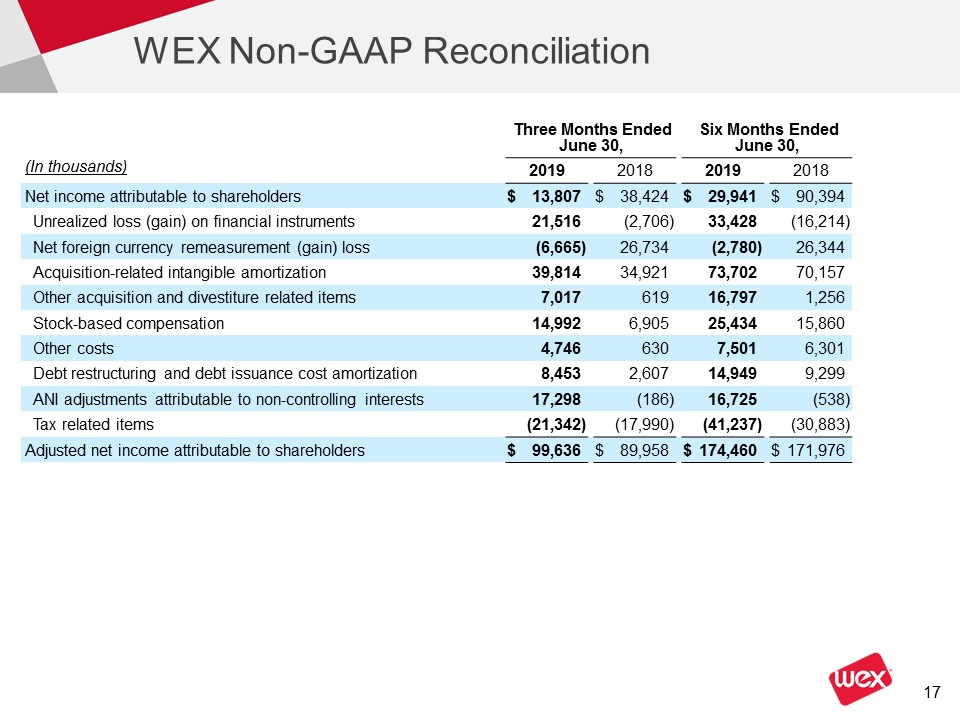

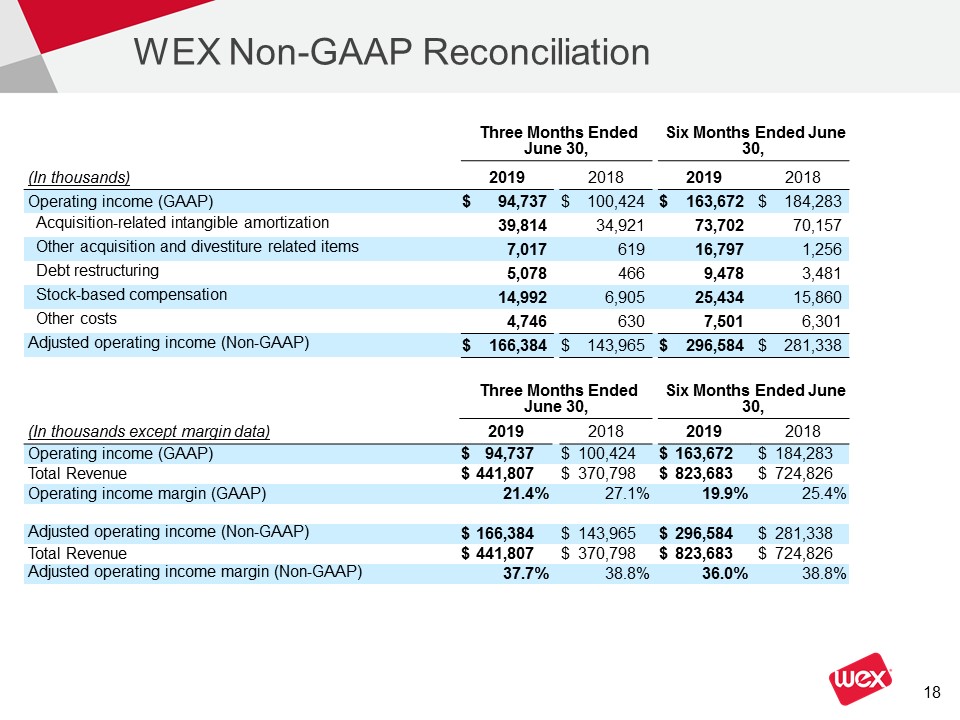

WEX Non-GAAP Reconciliation The Company's non-GAAP adjusted net income excludes unrealized gains and losses on financial instruments, net foreign currency remeasurement gains and losses, acquisition-related intangible amortization, other acquisition and divestiture related items, stock-based compensation, other costs, debt restructuring and debt issuance cost amortization, similar adjustments attributable to our non-controlling interests and certain tax related items. The Company's non-GAAP adjusted operating income excludes acquisition-related intangible amortization, other acquisition and divestiture related items, stock-based compensation, other costs, and debt restructuring costs. Total segment adjusted operating income incorporates the same adjustments and further excludes unallocated corporate expenses.Although adjusted net income, adjusted operating income and total segment adjusted operating income are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”), these non-GAAP measures are integral to the Company's reporting and planning processes and the chief operating decision maker of the Company uses segment adjusted operating income to allocate resources among our operating segments. The Company considers these measures integral because they exclude the above-specified items that the Company's management excludes in evaluating the Company's performance. Specifically, in addition to evaluating the Company's performance on a GAAP basis, management evaluates the Company's performance on a basis that excludes the above items because:Exclusion of the non-cash, mark-to-market adjustments on financial instruments, including interest rate swap agreements and investment securities, helps management identify and assess trends in the Company's underlying business that might otherwise be obscured due to quarterly non-cash earnings fluctuations associated with these financial instruments. Net foreign currency gains and losses primarily result from the remeasurement to functional currency of cash, receivable and payable balances, certain intercompany notes denominated in foreign currencies and any gain or loss on foreign currency hedges relating to these items. The exclusion of these items helps management compare changes in operating results between periods that might otherwise be obscured due to currency fluctuations.The Company considers certain acquisition-related costs, including certain financing costs, investment banking fees, warranty and indemnity insurance, certain integration related expenses and amortization of acquired intangibles, as well as gains and losses from divestitures to be unpredictable, dependent on factors that may be outside of our control and unrelated to the continuing operations of the acquired or divested business or the Company. In addition, the size and complexity of an acquisition, which often drives the magnitude of acquisition-related costs, may not be indicative of such future costs. The Company believes that excluding acquisition-related costs and gains or losses of divestitures facilitates the comparison of our financial results to the Company's historical operating results and to other companies in our industry.Stock-based compensation is different from other forms of compensation as it is a non-cash expense. For example, a cash salary generally has a fixed and unvarying cash cost. In contrast, the expense associated with an equity-based award is generally unrelated to the amount of cash ultimately received by the employee, and the cost to the Company is based on a stock-based compensation valuation methodology and underlying assumptions that may vary over time.Other costs includes other immaterial costs that the Company has incurred and are non-operational and non-recurring. We exclude these items when evaluating our continuing business performance as such items are not consistently occurring and do not reflect expected future operating expense, nor do they provide insight into the fundamentals of current or past operations of our business. This also includes costs related to certain identified initiatives to further streamline the business, improve the Company's efficiency, create synergies and globalize the Company's operations, remediate the prior year material weaknesses, all with an objective to improve scale and efficiency and increase profitability going forward. Debt restructuring and debt issuance cost amortization are unrelated to the continuing operations of the Company. Debt restructuring costs are not consistently occurring and do not reflect expected future operating expense, nor do they provide insight into the fundamentals of current or past operations of our business. In addition, since debt issuance cost amortization is dependent upon the financing method which can vary widely company to company, we believe that excluding these costs helps to facilitate comparison to historical results as well as to other companies within our industry.The adjustments attributable to non-controlling interests, including adjustments to the redemption value of a non-controlling interest, have no significant impact on the ongoing operations of the business.The tax related items are the difference between the Company’s U.S. GAAP tax provision and a pro forma tax provision based upon the Company’s adjusted net income before taxes as well as the impact from certain discrete tax items. The methodology utilized for calculating the Company’s adjusted net income tax provision is the same methodology utilized in calculating the Company’s U.S. GAAP tax provision.For the same reasons, WEX believes that adjusted net income, adjusted operating income and total segment adjusted operating income may also be useful to investors as one means of evaluating the Company's performance. However, because adjusted net income, adjusted operating income and total segment adjusted operating income are non-GAAP measures, they should not be considered as a substitute for, or superior to, net income, operating income or cash flows from operating activities as determined in accordance with GAAP. In addition, adjusted net income, adjusted operating income and total segment adjusted operating income as used by WEX may not be comparable to similarly titled measures employed by other companies.