Exhibit 99.1

June 15, 2016

EFS 2015 MD&A

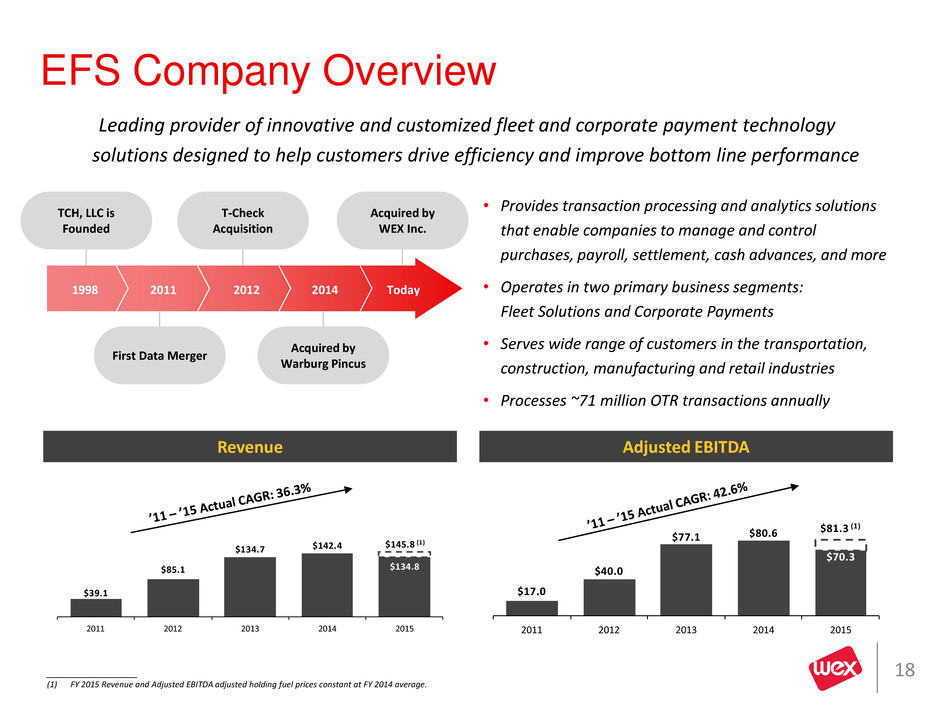

Overall, 2015 EFS net revenue declined 5% to $135 million, from $142 million. This decline was due to a 30% decrease in fuel prices impacting Fleet Solutions revenue offset by an increase in Corporate Payments revenue.

In the Fleet Solutions segments, EFS processed a total of 71 million OTR transactions, up 4% versus 2014. Processing transactions decreased 3% to 16 million and the blended rate per transaction declined 3%, due to declining fuel prices and composition mix within the portfolio.

Corporate Payment revenue increased 17% to $13 million. This was driven by a 23% increase in transaction volume and a 32% increase in spend, partially offset by an increase in rebates to larger Corporate payment customers.

Bad debt expense increased $2 million primarily due to the bankruptcy filing of a single OTR client and higher fraud in the Corporate Payments portfolio.

Depreciation, amortization and impairment expenses increased by $13 million to $72 million driven by a full year purchase accounting impact of amortizing intangibles related to Warburg Pincus’ purchase of EFS in 2014.

Other expenses were $17 million, down 81% or $74 million. In 2014 these expenses included $81 million of transaction costs associated with Warburg Pincus’ purchase of EFS. This decrease was offset by $3 million of costs associated with the current transaction with WEX and other one-time costs. The significant decrease in one-time costs from 2014 were also offset by a $2 million increase in foreign currency expense.

June 15, 2016

June 15, 2016EFS Balance Sheet ($ in millions)

| As of December 31, | As of March 31, | |||||||||||||||||||

| 2012 | 2013 | 2014 | 2015 | 2016 | ||||||||||||||||

| Assets | ||||||||||||||||||||

| Cash and Cash Equivalents | $26.5 | $ | 12.5 | $ | 80.2 | $ | 111.1 | $ | 76.9 | |||||||||||

| Accounts Receivable, net | 128.0 | 122.6 | 116.2 | 94.5 | 119.5 | |||||||||||||||

| PP&E, net | 19.6 | 23.2 | 22.7 | 18.4 | 17.9 | |||||||||||||||

| Goodwill | 268.8 | 269.4 | 586.3 | 586.3 | 586.3 | |||||||||||||||

| Intangible Assets Subject to Amortization, net | 207.1 | 169.1 | 577.0 | 514.2 | 499.1 | |||||||||||||||

| Other Assets | 4.7 | 7.9 | 23.0 | 19.8 | 18.7 | |||||||||||||||

| Total Assets | $654.7 | $ | 604.7 | $ | 1,405.5 | $ | 1,344.4 | $ | 1,318.4 | |||||||||||

| Liabilities | ||||||||||||||||||||

| Accounts Payable | $62.7 | $ | 65.8 | $ | 77.7 | $ | 81.5 | $ | 91.1 | |||||||||||

| Accrued Expenses | 31.8 | 36.7 | 47.4 | 52.6 | 41.7 | |||||||||||||||

| Deposits | 63.3 | 64.7 | 81.9 | 78.6 | 66.3 | |||||||||||||||

| Revolving Line-of-Credit Facility | 41.0 | 117.0 | -- | -- | 732.8 | |||||||||||||||

| Long Term Debt | 233.3 | 97.2 | 736.3 | 733.5 | -- | |||||||||||||||

| Deferred Tax Liability | -- | -- | 1.3 | 0.6 | -- | |||||||||||||||

| Other Liabilities | 8.9 | 0.4 | 0.1 | 0.1 | 3.1 | |||||||||||||||

| Total Liabilities | $441.1 | $ | 381.9 | $ | 944.6 | $ | 946.9 | $ | 935.0 | |||||||||||

| Equity | ||||||||||||||||||||

| Invested Capital | 169.9 | 169.9 | 492.9 | 494.7 | 495.1 | |||||||||||||||

| Non-Controlling Interest | 6.2 | 5.0 | -- | -- | -- | |||||||||||||||

| Retained Earnings | 37.6 | 47.9 | (32.00) | (97.20) | (111.70) | |||||||||||||||

| Total Equity | $213.7 | $ | 222.8 | $ | 460.9 | $ | 397.5 | $ | 383.4 | |||||||||||

| Total Equity and Liabilities | $654.7 | $ | 604.7 | $ | 1,405.5 | $ | 1,344.4 | $ | 1,318.4 | |||||||||||

June 15, 2016

June 15, 2016EFS Income Statement ($ in millions)

| Year Ended December 31, | LTM | |||||||||||||||

| 2013 | 2014 | 2015 | 3/31/16 | |||||||||||||

| Net Revenue | $134.7 | $ | 142.4 | $ | 134.8 | $ | 134.2 | |||||||||

| Expenses | ||||||||||||||||

| Salary and Other Personnel | $37.3 | $ | 38.5 | $ | 40.0 | $ | 41.6 | |||||||||

| Bad Debt Expense | 2.4 | 3.3 | 5.2 | 5.3 | ||||||||||||

| Depreciation | 6.7 | 8.2 | 9.1 | 8.2 | ||||||||||||

| Amortization of Intangibles | 39.2 | 50.3 | 62.8 | 62.3 | ||||||||||||

| Other | 19.4 | 100.0 | 24.9 | 25.8 | ||||||||||||

| Total operating expenses | $104.9 | $200.3 | $142.0 | $143.2 | ||||||||||||

| Operating profit | $29.8 | ($57.90) | ($7.20) | ($9.00) | ||||||||||||

| Other Income (Expense) | (0.80) | -- | (1.80) | (0.90) | ||||||||||||

| Interest Expense | (8.50) | (34.70) | (56.30) | (57.40) | ||||||||||||

| Income Before Taxes | 20.4 | (92.50) | (65.40) | (67.30) | ||||||||||||

| Income Tax Expense (Benefit) | -- | 0.2 | (0.20) | (0.20) | ||||||||||||

| Net Income | $20.4 | ($92.70) | ($65.20) | ($67.10) | ||||||||||||

| Noncontrolling Interest | (0.80) | (0.50) | -- | -- | ||||||||||||

| Net Income Attributable to Shareholders | $19.6 | ($93.10) | ($65.20) | ($67.10) | ||||||||||||

June 15, 2016

June 15, 2016EFS Adjusted EBITDA Reconciliation ($ in millions)

| Year Ended December 31, | LTM | ||||||||||||||||||

| 2013 | 2014 | 2015 | 3/31/2016 | ||||||||||||||||

| Net Income | $19.6 | (93.10) | (65.20) | (67.10) | |||||||||||||||

| Interest Expense (Income) | 8.5 | 34.7 | 56.4 | 57.4 | |||||||||||||||

| Depreciation & Amortization | 45.9 | 58.5 | 71.9 | 70.5 | |||||||||||||||

| Taxes | 0.0 | 0.2 | (0.20) | (0.20) | |||||||||||||||

| Consolidated EBITDA | $73.9 | $ | 0.3 | $ | 62.9 | $ | 60.7 | ||||||||||||

| Non-Cash Management Option Plan | -- | 0.6 | 1.8 | 1.8 | |||||||||||||||

| FX | 0.2 | 0.00 | 1.8 | 0.9 | |||||||||||||||

| A | Deal Expenses | (0.60) | 79.8 | 1.6 | 1.6 | ||||||||||||||

| B | Outside Professional Services | 1.1 | 0.1 | 0.6 | 0.6 | ||||||||||||||

| C | Bad Debt Expense | -- | -- | 1.1 | 1.1 | ||||||||||||||

| Other | 2.4 | (0.10) | 0.6 | 0.5 | |||||||||||||||

| Consolidated Adjusted EBITDA | $77.1 | $ | 80.6 | $ | 70.3 | $ | 67.1 | ||||||||||||

| D | Run Rate Impact of New Customers | 18.8 | |||||||||||||||||

| E | Customer Backlog | 7.7 | |||||||||||||||||

| EFS Pro Forma Adjusted EBITDA | $ | 93.6 | |||||||||||||||||

| A. | Deal Expenses– In connection with the acquisition and divestiture of EFS by Warburg Pincus, its current private equity sponsor. Merger related fees and compensation amounts paid to advisors, legal attorneys, and employees |

| B. | Outside Professional Services – Consulting expenses paid to Alvarez & Marsal to improve efficiency of implementing cards to customers, as well as hire an additional head of sales to assist with the process |

| C. | Bad Debt Expense – $1.1 million write-off in Q4 2015 of bad debt from one account that then quickly went bankrupt thereafter; labeled as a one-time, unique event, as previous largest bad debt was approximately $300k |

| D. | Run Rate Impact of New Customers – Full year run-rate impact of implemented customers who have begun using their cards, but are not yet operating at run-rate |

| E. | Customers Backlog – Run-rate impact of newly signed customer contracts where customers have not yet been received or started using their cards |

| Pro Forma Financial Summary | ||||||||||||||||

| Balance Sheet ($ in millions | ||||||||||||||||

| As of March 31, 2016 | ||||||||||||||||

| Assets | WEX | EFS | Adjustments | Pro Forma | ||||||||||||

| Cash and Cash Equivalents | $515.3 | $ | 76.9 | ($17.80 | ) | $574.4 | ||||||||||

| Account Receivable, net | 1,567.2 | 119.5 | -- | $1686.7 | ||||||||||||

| Securitized Accounts Receivable | 86.3 | -- | -- | 86.3 | ||||||||||||

| Income Taxes Receivable | 6.8 | -- | 44.8 | 51.6 | ||||||||||||

| Available for Sale Securities | 19.2 | -- | -- | 19.2 | ||||||||||||

| Fuel Price Derivatives, at Fair Value | -- | -- | -- | -- | ||||||||||||

| PP&E, net | 146.5 | 17.9 | -- | 164.4 | ||||||||||||

| Deferred Income Taxes, net | 9.2 | -- | 20.0 | 29.2 | ||||||||||||

| Goodwill | 1,123.5 | 586.3 | 326.4 | 2,036.2 | ||||||||||||

| Intangible Assets Subject to Amortization, net | 461.6 | 499.1 | 89.9 | 1,050.6 | ||||||||||||

| Other Assets | 208.3 | 18.7 | -- | 227.0 | ||||||||||||

| Total Assets | $4,143.9 | $1,318.4 | $463.3 | $5,925.6 | ||||||||||||

| Liabilities | ||||||||||||||||

| Accounts Payable | $451.8 | $ | 91.1 | $-- | $542.9 | |||||||||||

| Accrued Expenses | 165.4 | 41.7 | -- | 207.1 | ||||||||||||

| Deposits | 1,041.7 | 66.3 | -- | 1,108.0 | ||||||||||||

| Securitized Debt | 75.1 | -- | -- | 75.1 | ||||||||||||

| Revolving Line-of-Credit Facilities and Term Loan | 671.0 | 732.8 | 434.5 | 1,838.3 | ||||||||||||

| Deferred Income Taxes, net | 94.5 | -- | 105.0 | 199.5 | ||||||||||||

| Notes Outstanding | 395.0 | -- | -- | 395.0 | ||||||||||||

| Other Debt | 50.6 | -- | -- | 50.6 | ||||||||||||

| Amounts Due Under Tax Receivable Agreement | 57.5 | -- | -- | 57.5 | ||||||||||||

| Other Liabilities | 10.0 | 3.1 | -- | 13.1 | ||||||||||||

| Total Liabilities | $3,012.6 | $ | 935.0 | $539.5 | $4,487.1 | |||||||||||

| Equity | ||||||||||||||||

| Common Stock and Additional Paid in Capital | $176.9 | $ | 495.1 | (131.60) | $540.4 | |||||||||||

| Non-Controlling Interest | 13.0 | -- | -- | 13.0 | ||||||||||||

| Retained Earnings | 1,206.7 | (111.70) | 55.4 | 1,150.4 | ||||||||||||

| Accumulated Other Comprehensive Income | (93.00) | -- | -- | (93.00) | ||||||||||||

| Less: Treasury Stock | (172.30) | -- | -- | (172.30) | ||||||||||||

| Total Equity | $1,131.3 | $ | 383.4 | ($76.20) | $1,438.5 | |||||||||||

| Total Equity and Liabilities | $4,143.9 | $1,318.4 | $463.3 | $5,925.6 | ||||||||||||

Note: The Pro Forma Balance Sheet assumes acquisition on January 1, 2015 at a share price of $90.61.

June 15, 2016

June 15, 2016Income Statement ($ in millions)

| LTM as of March 31, 2016 | ||||||||||||||||||

| WEX | EFS | Adjustments | Pro Forma | |||||||||||||||

| Revenue | $858.3 | $ | 134.2 | $-- | $ | 992.5 | ||||||||||||

| Expenses | ||||||||||||||||||

| Salary | $239.6 | $ | 41.6 | $-- | $ | 281.2 | ||||||||||||

| Provision for Credit Loss | 22.8 | 5.3 | -- | 28.1 | ||||||||||||||

| Depreciation | 35.7 | 8.2 | -- | 43.9 | ||||||||||||||

| Amortization of Intangibles | 48.3 | 62.3 | 24.8 | 135.4 | ||||||||||||||

| Other | 290.2 | 25.8 | (4.00 | ) | 312.0 | |||||||||||||

| Total Operating Expenses | $636.6 | $ | 143.2 | $ | 20.8 | $ | 800.6 | |||||||||||

| Operating Profit | $221.7 | (9.00 | ) | (20.80 | ) | $ | 191.9 | |||||||||||

| Other | 20.8 | (0.90 | ) | -- | 19.9 | |||||||||||||

| Interest Expense | (55.70) | (57.40 | ) | 6.1 | (107.00 | ) | ||||||||||||

| Total Other Income (Expense) | (34.90) | (58.30 | ) | 6.1 | (87.10 | ) | ||||||||||||

| Income Before Income Taxes | 186.8 | (67.30 | ) | (14.70 | ) | 104.8 | ||||||||||||

| Income Tax (Expense) Benefit | (74.00) | 0.2 | 34.5 | (39.30 | ) | |||||||||||||

| Net Income | $112.8 | (67.10 | ) | $ | 19.8 | $ | 65.5 | |||||||||||

| Less:Net Gain (Loss) Attributable to NCI | 0.7 | -- | -- | 0.7 | ||||||||||||||

| Net Earnings Attributable to WEX Inc. | $112.1 | (67.10 | ) | $ | 19.8 | $ | 64.8 | |||||||||||

| Accretion of Non-Controlling Interest | (9.40) | -- | -- | (9.40 | ) | |||||||||||||

| Net Earnings Attributable to Shareholders | $102.7 | (67.10 | ) | $ | 19.8 | $ | 55.4 | |||||||||||

Note: Adjustments include addition of amortization expense and the exclusion of fees and acquisition expenses, subject to finalization of purchase accounting.