As filed with the Securities and Exchange Commission on January5, 2006

Registration No. 333-122531

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

THE MONEY TREE INC.

(Exact name of registrant as specified in its charter)

| | | | |

| GEORGIA | | 6141 | | 58-2171386 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

114 South Broad Street

Bainbridge, Georgia 39817

(229) 246-6536

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Vance R. Martin

President

114 South Broad Street

Bainbridge, Georgia 39817

(229) 246-6536

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies To:

Michael K. Rafter, Esq.

Schiff Hardin LLP

1230 Peachtree Street, 18th Floor

Atlanta, Georgia 30309

(404) 806-3800

Approximate date of commencement of proposed sale to public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective date registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

[The following is text to a sticker to be attached to the front cover page of the prospectus in a manner that will not obscure the Risk Factors:]

SUPPLEMENTAL INFORMATION – The Series A Variable Rate Subordinated Debentures Prospectus of The Money Tree Inc. consists of this sticker, the prospectus dated January , 2006 and the rate supplement dated January , 2006.

THE MONEY TREE INC.

$75,000,000 Series A Variable Rate Subordinated Debentures

We are offering up to $75,000,000 in aggregate principal amount of our Series A Variable Rate Subordinated Debentures on a continuous basis. A minimum initial investment of $500 is required.

We will issue the Debentures in varying purchase amounts that we will establish each month. For each purchase amount, we will establish an interest rate and an interest adjustment period that may range from one year to four years. The established features will be available for each calendar month and will apply to all Debentures that we sell during that month. At the end of each interest adjustment period, the interest rate will automatically adjust to the then-current rate for that interest adjustment period. The interest rate for the new period could be lower than the interest rate for the previous period.

We will publish the established features in a newspaper of general circulation and you may obtain the established features from our web site atwww.themoneytreeinc.com or by calling our executive offices in Bainbridge, Georgia at (877) 468-7878 (toll free) or (229) 248-0990. We will file a Rule 424(b)(2) prospectus supplement setting forth the established features with the Securities and Exchange Commission upon any change in the established features.

We are offering the Debentures through our executive officers without an underwriter and on a continuous basis. We do not have to sell any minimum amount of Debentures to accept and use the proceeds of this offering. We cannot assure you that all or any portion of the Debentures we are offering will be sold. We have not made any arrangement to place any of the proceeds from this offering in an escrow, trust or similar account. Therefore, you will not be entitled to the return of your investment. The Debentures are not listed on any securities exchange and there is no public trading market for the Debentures. Since it is very unlikely that any trading market will develop, we cannot assure you that the Debentures may be resold at any price. We have the right to reject any subscription, in whole or in part, for any reason.

We may redeem the Debentures, upon at least 30 days written notice, at any time prior to maturity for a redemption price equal to the principal amount plus any unpaid interest thereon to the date of redemption. You may request redemption of the Debentures without penalty at the end of any interest adjustment period for a redemption price equal to the principal amount plus any unpaid interest thereon to the date of redemption. In addition, at your request, we may, at our sole option, redeem your Debentures during any interest adjustment period for a redemption price equal to the principal amount plus interest thereon at the redemption date minus a 90-day interest penalty.

Regardless of the interest adjustment period you select, the Debentures mature four years from the date of issuance, subject to an automatic extension for one additional four-year period. However, you may request redemption of the Debenture at maturity by providing us with notice prior to 15 days after the original maturity date.If you do not provide notice of your intention to redeem the Debenture prior to the end of the 15th day, you will be required to maintain your investment in the Debenture beyond the original maturity date and the interest rate on the extended Debenture may be lower than the interest rate previously being paid to you.

You should read this prospectus and any applicable prospectus supplement carefully before you invest in the Debentures.

These Debentures are our general unsecured obligations and are subordinated in right of payment to all of our present and future senior debt. As of September 25, 2005, we had $83,957,506 in debt outstanding that ranks equal with or senior to the Debentures offered pursuant to this prospectus. We expect to incur additional debt in the future, including without limitation the Debentures offered pursuant to this prospectus.

The Debentures are not certificates of deposit or similar obligations guaranteed by any depository institution, and they are not insured by the Federal Deposit Insurance Corporation (FDIC) or any governmental or private insurance fund, or any other entity. We do not contribute funds to a separate account such as a sinking fund to repay the Debentures upon maturity.

See “Risk Factors” beginning on page 10 for certain factors you should consider before buying the Debentures.

These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission nor has the Securities and Exchange Commission or any state securities commission passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | |

| | | Price to Public

| | Underwriting Discount

And Commission

| | Proceeds to Company

|

Per Debenture | | 100% | | None | | 100% |

Total | | $75,000,000 | | None | | $75,000,000(1) |

| (1) | We will receive all of the net proceeds from the sale of the Debentures, which, if we sell all of the Debentures covered by this prospectus, we estimate will total approximately $74,385,000 after expenses. |

The date of this prospectus is January , 2006.

TABLE OF CONTENTS

i

ii

You should rely only upon the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. We are offering to sell Debentures only in jurisdictions where offers and sales are permitted.

iii

QUESTIONS AND ANSWERS

Below we have provided some of the more frequently asked questions and answers relating to the offering of the Debentures. Please see the “Prospectus Summary” and the remainder of the prospectus for more information about the offering of the Debentures.

| Q: | Who is The Money Tree Inc.? |

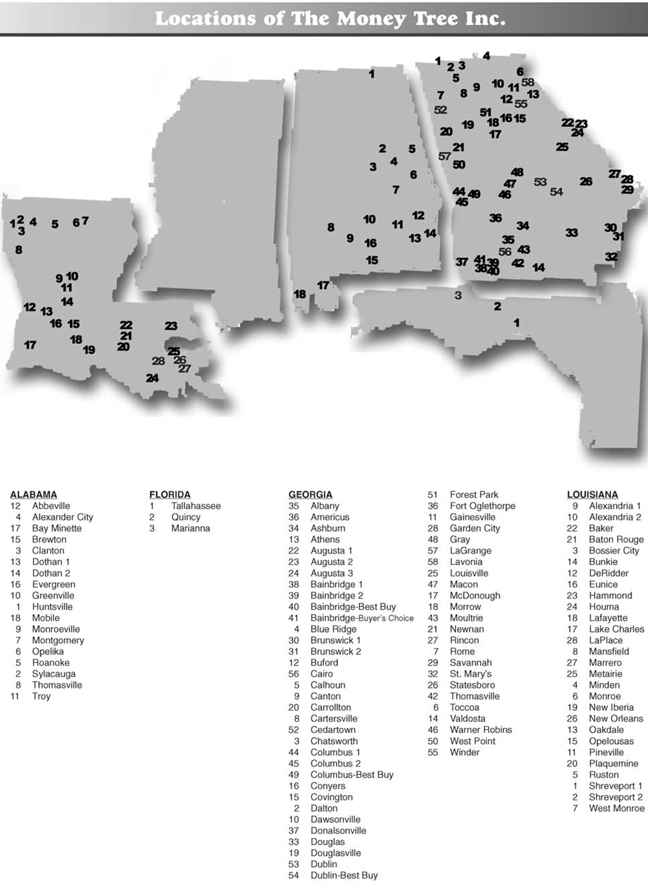

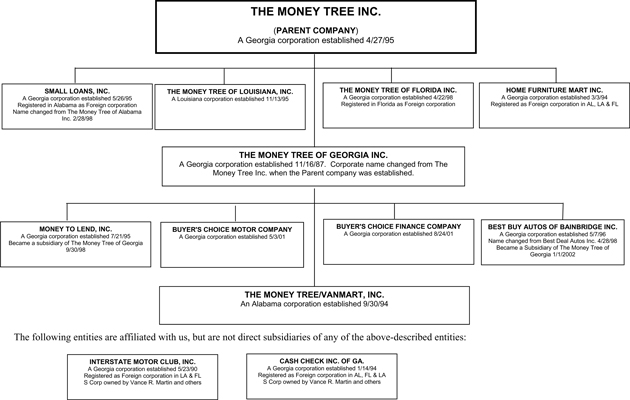

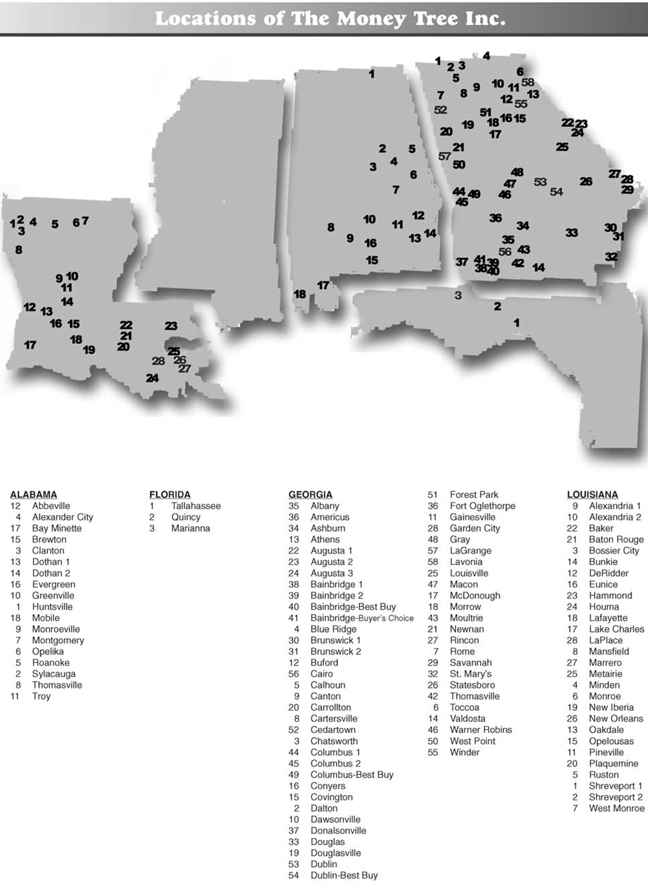

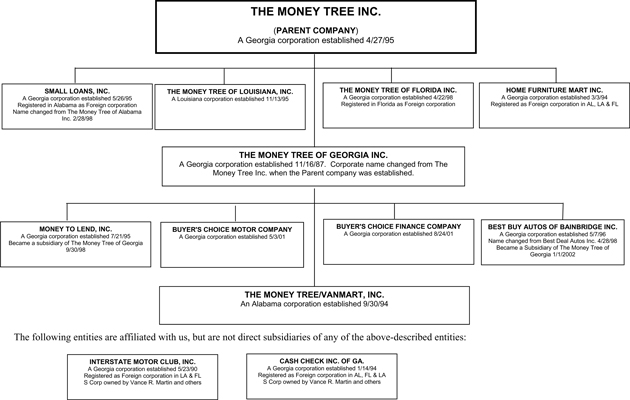

| A: | We are a consumer finance company operating since our inception in 1987 through our branch offices in 103 locations throughout Georgia, Alabama, Louisiana and Florida. |

| Q: | What are your primary business activities? |

| A: | We primarily make, purchase and service direct consumer loans, consumer sales finance contracts and motor vehicle installment sales contracts. Direct consumer loans are direct loans to customers for general use, which are collateralized by existing automobiles or consumer goods, or are unsecured. Consumer sales finance contracts consist of retail installment sales contracts for purchases of specific consumer goods by customers either from one of our branch locations or from a retail store and are collateralized by such consumer goods. Motor vehicle installment sales contracts are initiated by us or purchased from automobile dealers subject to our credit approval. We originate direct consumer loans and consumer sales finance contracts primarily in our branch office locations. At September 25, 2005, direct consumer loans comprised 55.3%, motor vehicle sales contracts comprised 33.7% and consumer sales finance contracts comprised 11.0% of the gross amount of our outstanding loans and contracts. Most of our customers have “subprime” credit ratings and are considered higher than average credit risks. We sell retail merchandise, principally furniture, appliances and electronics, at certain of our branch office locations and operate four used automobile dealerships in the State of Georgia. We also offer, among other products and services, credit and non-credit insurance products, prepaid phone services and automobile club memberships to our loan customers. Insurance products include credit life, credit accident and sickness and collateral protection, which are issued by a non-affiliated insurance company. |

| Q: | What kind of offering is this? |

| A: | We are offering up to $75,000,000 of Series A Variable Rate Subordinated Debentures to residents of the States of Georgia, Florida and Louisiana. |

| Q: | What is a Subordinated Debenture? |

| A: | A Debenture is our promise to pay you a specified rate of interest for a specific period of time and to repay your principal investment upon maturity. The Debentures are our general unsecured obligations and are subordinated in right of payment to all of our |

1

| | present and future senior debt. Subordinated means that if we are unable to pay our debts as they come due, the senior debt would all be paid first before any payment would be made on the Debentures. As of September 25, 2005, we had the following debt outstanding that ranks equal with or senior to the Debentures: |

| | | |

Senior debt | | $ | 2,185,546 |

Debentures* | | | 68,904,753 |

Demand notes* | | | 12,867,207 |

| | |

|

|

Total | | $ | 83,957,506 |

| | |

|

|

| * | Issued by our subsidiary, The Money Tree of Georgia Inc. |

We expect to incur additional debt in the future, including without limitation the Debentures offered pursuant to this prospectus.

| Q: | Is my investment in the Debentures insured? |

| A: | No.The Debentures are not certificates of deposit or similar obligations or guaranteed by any depository institution, and they are not insured by the FDIC or any governmental or private insurance fund, or any other entity. They are backed only by the faith and credit of our company and our operations. |

| Q: | How is the interest rate determined? |

| A: | The interest rate offered on the Debentures depends on the interest adjustment period selected by you. At the time of your initial investment, you will select an interest adjustment period of one year, two years or four years and the corresponding interest rate applicable to such interest adjustment period. During this period, your interest rate will not change. At the end of each interest adjustment period, the interest rate will automatically adjust to the then-current rate offered for that interest adjustment period. At such time, interest rates will at least be equal to the formula under the Minimum Rate subject to the Ceiling set forth in the table below: |

| | | | | |

Debenture

| | Minimum Rate

| | Ceiling

| |

| 1 Year | | Prime Rate minus 1.5% | | 10.5 | % |

| 2 Year | | Prime Rate minus 1.0% | | 11.0 | % |

| 4 Year | | Prime Rate | | 12.0 | % |

The Prime Rate shall be the prime rate published by the Wall Street Journal. See “When may I redeem the Debenture?” below.

2

| Q: | How is interest calculated and paid to me? |

| A: | Interest is compounded daily (based on a 365-day year). We will pay interest to you at any time or at specific intervals (monthly, quarterly, semi-annually or annually) at your request. If you do not request payment of interest prior to maturity, your investment in the Debentures will continue to grow as we will pay interest on the interest you would have received (sometimes referred to as “compounding”). |

| Q: | When do the Debentures mature? |

| A: | Regardless of the interest adjustment period you select, the Debentures mature four years from the date of issuance, subject to an automatic extension for one additional four-year period. However, you may request redemption of the Debenture at maturity by providing us with notice prior to 15 days after the original maturity date.If you do not provide notice of your intention to redeem the Debenture prior to the end of the 15th day, you will be required to maintain your investment in the Debentures beyond the original maturity date and the interest rate on the extended Debenture may be lower than the interest rate previously being paid to you. |

| Q: | When may I redeem the Debenture? |

| A: | You may redeem the Debenture at the end of any interest adjustment period without penalty by giving us notice of such redemption within 10 days after the end of the interest adjustment period. For example, if you select a one-year interest adjustment period, you will only be able to redeem without penalty at your option at the end of each one-year period. We will mail you notice of the new interest rate at least 20 days prior to the end of each interest adjustment period. In addition, your estate may be able to redeem the Debenture upon your death without penalty. Redemption at any other time will be subject to our consent in our sole discretion and a 90-day interest penalty, which means that you will not receive the first 90 days worth of interest during the applicable interest adjustment period. |

| Q: | Can you force me to redeem my Debenture? |

| A: | Yes, we may call your Debenture for redemption at any time upon 30 to 60 days notice for a price equal to the principal amount plus accrued interest to the date of redemption. |

| Q: | How are the Debentures sold? |

| A: | The Debentures are offered by our executive officers without an underwriter. We intend to market the offering primarily by placing advertisements in local newspapers, purchasing roadway sign advertisements and placing signs in our branch office locations |

3

| | in States in which we have properly registered the offerings or qualified for an exemption from registration. |

| Q: | What will you do with the proceeds raised from this offering? |

| A: | If all the Debentures offered by this prospectus are sold, we expect to receive approximately $74,385,000 in net proceeds after deducting all costs and expenses associated with this offering. We intend to use substantially all of the net cash proceeds from this offering in the following order of priority: |

| | • | | to redeem debentures and demand notes of our subsidiary, The Money Tree of Georgia Inc.; |

| | • | | to redeem Demand Notes issued by us; |

| | • | | to make interest payments to holders of all of our debentures and demand notes; |

| | • | | to the extent we have remaining net proceeds and we have adequate cash on hand, to fund the following activities: |

| | • | | to make additional consumer loans; |

| | • | | to fund the purchase of inventory of used cars; |

| | • | | to open new branch office locations; |

| | • | | to acquire loan receivables from competitors; and |

| | • | | for working capital and other general corporate purposes. |

| Q: | What are the most significant risks of my investment in the Debentures? |

| A: | You should carefully read and consider all risk factors beginning on page 10 of the prospectus prior to investing. Below is a summary of the most significant risks of an investment in the Debentures: |

| | • | | the Debentures are risky and speculative investments for suitable investors only; |

| | • | | we may be unable to meet our debenture and demand note redemption obligations which could force us to sell off our loan receivables and other operating assets or cease our operations; |

| | • | | the Debentures are not insured or guaranteed by any third party so you are dependent upon our ability to manage our business and generate adequate cash flows; |

4

| | • | | payment on the Debentures is subordinate to the payment of all of our present and future outstanding senior debt, and the indenture does not limit the amount of senior debt we may incur; |

| | • | | payment of interest and principal on the Debentures is effectively subordinate to the payment of the secured and unsecured creditors of our subsidiaries, including holders of debentures and demand notes issued by The Money Tree of Georgia Inc.; |

| | • | | the Debentures contain an automatic extension feature which could result in the extension of the maturity of the Debentures beyond the original maturity date and a lower interest rate being paid; |

| | • | | the indenture does not contain covenants restricting us from taking certain actions and, therefore, the indenture provides very little protection of your investment; |

| | • | | there will not be any market for the Debentures so you should only purchase them if you do not have any need for liquidity of your investment; |

| | • | | our lack of a significant line of credit could affect our liquidity in the future; |

| | • | | we can provide no assurance that any Debentures will be sold or that we will raise sufficient proceeds to carry out our business plans; and |

| | • | | we are controlled by the Martin family and do not have any independent board members overseeing our operations. |

| Q: | Who may I contact for more information? |

| A: | While our branch office personnel would be happy to provide you with a prospectus and may accept your investment check and documentation, they are not allowed to answer any substantive questions about your investment. If you have questions about the offering of the Debentures or need additional information, please call our executive office at (877) 468-7878 (toll free) or (229) 248-0990 (in Georgia). |

5

PROSPECTUS SUMMARY

This summary highlights selected information most of which was not otherwise addressed in the “Questions and Answers” section of this prospectus. You should carefully read the entire prospectus, including the section entitled “Risk Factors,” any related prospectus supplement and the documents we have referred you to in “Where You Can Find More Information” on page61 for information about us.

Our Company

We were incorporated in Georgia in 1987, and our principal corporate office is located at 114 South Broad Street, Bainbridge, Georgia 39817. Our general telephone number is (229) 246-6536. Information about us can be found atwww.themoneytreeinc.com. The information contained on this website is not part of this prospectus.

The Offering

| | | | | | | |

| |

| Securities Offered | | We are offering up to $75,000,000 in aggregate principal amount of our Debentures. The Debentures are governed by an indenture between us and U.S. Bank National Association, as trustee. The Debentures do not have the benefit of a sinking fund. See “Description of Debentures – General.” | |

| |

| Denominations | | Established monthly by us. | |

| |

| Minimum Investment | | A minimum initial investment of $500 is required. | |

| |

| Interest Rate | | Monthly offering rate, compounded daily based on a 365-day year, for each established denomination. The interest rate offered on the Debentures varies depending on the interest adjustment period selected by you (one year, two years or four years). | |

| |

| Interest Adjustment | | Rate adjusted at the end of each interest adjustment period to the then-current interest rate, compounded daily. At such time, interest rates will at least be equal to the formula under the Minimum Rate subject to the Ceiling set forth in the table below: | |

| | | |

| | | Debenture

| | Minimum Rate

| | Ceiling

| |

| | | 1 Year | | Prime Rate minus 1.5% | | 10.5 | % |

| | | 2 Year | | Prime Rate minus 1.0% | | 11.0 | % |

| | | 4 Year | | Prime Rate 12.0% | | | |

| |

| | | The Prime Rate shall be the prime rate published by the Wall Street Journal. We will mail you notice of the new interest rate at least 20 days prior to the end of each interest adjustment period. | |

6

| | |

| Payment of Interest | | Interest will be earned daily and will be payable at any time at your request. |

| |

| Maturity | | Four years from the date of issuance (subject to one automatic four-year extension). |

| |

| Notice of Extension | | We will provide you notice of the maturity date of your Debenture at least 30 days prior to the maturity date and inform you that your Debenture will be automatically extended unless you notify us otherwise. At this time, we will also provide you with an updated prospectus. |

| |

| Automatic Extension of Maturity | | Maturity of each Debenture isautomatically extended on its original terms for one additional four-year term subject to interest adjustment. You may prevent such extension by notifying us prior to 15 days after the maturity date that you would like to redeem your Debenture at maturity. |

| |

| Redemption by You | | You may redeem the Debenture at the end of any interest adjustment period without penalty by giving us notice within 10 days after the end of the interest adjustment period. In addition, your estate may be able to redeem the Debenture upon your death without penalty. Redemption at any other time will be subject to our consent in our sole discretion and a 90-day interest penalty. |

| |

| Redemption by Us | | We may redeem the Debenture at any time prior to maturity upon 30 to 60 days written notice to you for a price equal to principal plus interest accrued to date of redemption. |

| |

| Subordination | | Debentures are subordinated, in all rights to payment and in all other respects, to all of our debt except debt that by its terms expressly provides that such debt is not senior in right to payment of the Debentures. Senior debt includes, without limitation, all of our bank and finance and company debt and any line of credit we may obtain in the future. This means that if we are unable to pay our debts when due, the senior debt would all be paid first before any payment would be made on the Debentures. |

| |

| Event of Default | | Under the indenture, an event of default is generally defined as a default in the payment of principal or interest on the Debentures which is not cured for 30 days, our becoming subject to certain events of bankruptcy or insolvency, or our failure to comply with provisions of the Debentures or the indenture which failure is not cured or waived within 60 days after receipt of a specific notice. |

7

| | |

| Transfer Restrictions | | Transfer of a Debenture is effective only upon the receipt of valid transfer instructions by the registrar from the Debenture holder of record. |

| |

| Trustee | | U.S. Bank National Association, a national banking association. |

| |

| Risk Factors | | See “Risk Factors” beginning on page 10 and other information included in this prospectus and any prospectus supplement for a discussion of factors you should carefully consider before investing in the Debentures. |

Recent Developments

In late August and September 2005, Hurricanes Katrina and Rita struck the Gulf Coast areas of Texas, Louisiana, Mississippi and Alabama. We operate several offices along the Alabama and Louisiana coastal area including three within the City of New Orleans. A total of 12 offices were affected by these storms. Nine offices were closed for periods ranging from three days to two weeks primarily because of the loss of electrical power. These offices are now open and fully operational. However, because of the flooding problem in New Orleans, those three offices remain closed. One office is currently under repair from the flood damage and we plan to consolidate all New Orleans operations into this office upon completion of these repairs, which we estimate will occur in early 2006. Although the damage to our properties caused by these events was minor, we cannot at this point predict what the effects to our results of operations might be. We may suffer increased loan losses resulting from loss of collateral securing the loans or other negative effects to our customers, such as loss of residence and/or employment or relocation to other parts of the United States. Please see the “Recent Developments” section of “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Summary Consolidated Financial Data

The following table summarizes certain financial data of our business. You should read this summary together with “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and related notes included elsewhere in this prospectus. Our summary balance sheet data, as of September 25, 2005 and 2004, and summary income statement data, for the fiscal years ended September 25, 2005, 2004 and 2003, have been derived from our audited consolidated financial statements and related notes included in this prospectus. The summary balance sheet data, as of September 25, 2003, 2002 and 2001, and the summary income statement data, for the fiscal years ended September 25, 2002 and 2001, have been derived from our audited financial statements that are not included in this prospectus.

8

| | | | | | | | | | | | | | | | | | | | |

| | | As of, and for, the Fiscal Year Ended September 25,

| |

| | | 2005

| | | 2004

| | | 2003

| | | 2002

| | | 2001

| |

Net interest income(1) | | $ | 10,111 | | | $ | 9,084 | | | $ | 7,099 | | | $ | 5,607 | | | $ | 4,982 | |

Insurance commissions | | | 10,490 | | | | 6,477 | | | | 6,177 | | | | 4,893 | | | | 4,652 | |

Other income(2) | | | 4,110 | | | | 4,529 | | | | 3,595 | | | | 4,594 | | | | 3,465 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net revenues before retail sales | | | 24,711 | | | | 20,090 | | | | 16,871 | | | | 15,094 | | | | 13,099 | |

Gross margin on retail sales | | | 5,703 | | | | 4,959 | | | | 5,733 | | | | 4,050 | | | | 1,823 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net revenues | | | 30,414 | | | | 25,049 | | | | 22,604 | | | | 19,144 | | | | 14,922 | |

Operating expenses | | | (29,205 | ) | | | (24,854 | ) | | | (21,728 | ) | | | (18,990 | ) | | | (15,352 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net operating income (loss) | | | 1,209 | | | | 195 | | | | 876 | | | | 154 | | | | (430 | ) |

Loss on sale of property and equipment | | | (81 | ) | | | (31 | ) | | | (20 | ) | | | (17 | ) | | | (7 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income (loss) before income tax expense | | | 1,128 | | | | 164 | | | | 856 | | | | 137 | | | | (437 | ) |

Income tax expense | | | (430 | ) | | | (95 | ) | | | (339 | ) | | | (42 | ) | | | (117 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income (loss) | | $ | 698 | | | $ | 69 | | | $ | 517 | | | $ | 95 | | | $ | (554 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Ratio of earnings to fixed charges(3) | | | 1.15 | | | | 1.02 | | | | 1.15 | | | | 1.03 | | | | (4 | ) |

Cash and cash equivalents | | $ | 9,619 | | | $ | 8,373 | | | $ | 8,749 | | | $ | 6,085 | | | $ | 5,084 | |

Finance receivables, net(5) | | | 77,141 | | | | 65,100 | | | | 57,705 | | | | 39,901 | | | | 27,306 | |

Other receivables | | | 1,099 | | | | 4,904 | | | | 2,074 | | | | 2,142 | | | | 2,643 | |

Inventory | | | 2,402 | | | | 2,293 | | | | 3,009 | | | | 2,957 | | | | 491 | |

Property and equipment, net | | | 4,850 | | | | 4,657 | | | | 3,272 | | | | 3,346 | | | | 2,434 | |

Total assets | | | 99,747 | | | | 88,764 | | | | 77,674 | | | | 57,366 | | | | 41,000 | |

Senior debt | | | 1,186 | | | | 2,062 | | | | 888 | | | | 6,232 | | | | 9,963 | |

Senior subordinated debt | | | 1,000 | | | | 700 | | | | 3,900 | | | | 2,400 | | | | 2,400 | |

Debentures(6) | | | 68,905 | | | | 61,582 | | | | 52,701 | | | | 36,820 | | | | 23,563 | |

Demand notes(6) | | | 12,867 | | | | 11,702 | | | | 10,277 | | | | 6,192 | | | | 593 | |

Shareholders’ equity (deficit) | | $ | 1,103 | | | $ | 405 | | | $ | 335 | | | $ | (182 | ) | | $ | (276 | ) |

| (1) | Net of interest expense and provision for credit losses. |

| (2) | Includes commissions from motor club memberships received from Interstate Motor Club, Inc., an affiliated entity, and income from income tax return preparation services received from Cash Check Inc. of Ga., an affiliated entity. |

| (3) | The ratio of earnings to fixed charges represents the number of times fixed charges are covered by earnings. For purposes of this ratio, “earnings” is determined by adding pre-tax income to “fixed charges,” which consists of interest on all indebtedness and an interest factor attributable to rent expense. |

| (4) | Calculation results in a deficiency in the ratio (i.e., less than one-to-one coverage). The deficiency in earnings to cover fixed charges was $436,540 for the year ended September 25, 2001. |

| (5) | Net of unearned insurance commissions, unearned finance charges, unearned discounts and allowance for credit losses. |

| (6) | Issued by our subsidiary, The Money Tree of Georgia Inc. |

9

RISK FACTORS

Our operations and your investment in the Debentures are subject to a number of risks. You should carefully read and consider these risks, together with all other information in this prospectus, before you decide to buy the Debentures. If any of the following risks actually occur, our business, financial condition or operating results and our ability to repay the Debentures could be materially adversely affected.

The Debentures are risky and speculative investments for suitable investors only.

You should be aware that the Debentures are risky and speculative investments suitable only for investors of adequate financial means. If you cannot afford to lose your entire investment, you should not invest in the Debentures. Potential investors are required to complete a purchaser suitability questionnaire to assist our executive officers in determining whether an investment in the Debentures is a suitable investment, and such executive officers have the right to reject any potential investor. If we accept an investment, you should not assume that the Debentures are a suitable and appropriate investment for you.

We may be unable to meet our debenture and demand note redemption obligations which could force us to sell off our loan receivables and other operating assets or cease our operations.

In addition to the Debentures we issue pursuant to this prospectus, we may issue Demand Notes or similar debt instruments to investors in order to raise funds for our operations. In addition, our subsidiary, The Money Tree of Georgia Inc., has issued debentures and demand notes to Georgia residents over the past several years, including $68,904,753 of debentures and $12,867,207 of demand notes outstanding as of September 25, 2005, which demand notes may be redeemed by our investors at any time. While the maturing debentures of our subsidiary are subject to substantially similar early redemption and automatic extension provisions as the Debentures, we cannot predict with any accuracy the number of debenture holders who will elect to redeem such debentures at or prior to maturity. We intend to pay these and any other redemption obligations using our normal cash sources, such as collections on finance receivables and used car sales, as well as proceeds from the sale of the Debentures and Demand Notes. We are substantially reliant upon the net offering proceeds we receive from the sale of the Debentures and Demand Notes. However, our operations and other sources of funds may not provide sufficient available cash flow to meet our redemption obligations, especially if the amount of redemptions at any given time is significantly greater than anticipated or if cash on hand is less than expected due to losses or other circumstances. If we are unable to repay or redeem the principal amount of debentures or demand notes when due, and we are unable to obtain additional financing or other sources of capital, we may be forced to sell off our loan receivables and other operating assets or we might be forced to cease our operations and you could lose some or all of your investment.

An increase in market interest rates may result in a reduction in our liquidity and profitability and impair our ability to pay interest and principal on the Debentures.

Interest rates are currently at or near historic lows. Sustained, significant increases in interest rates could unfavorably impact our liquidity and profitability by reducing the interest rate spread between the rate of interest we receive on loans and interest rates we must pay under our Debentures and Demand Notes and any bank debt we incur. Any reduction in our liquidity and profitability would diminish our ability to pay interest and principal on the Debentures.

10

Our Debentures are not insured or guaranteed by any third party so you are dependent upon our ability to manage our business and generate adequate cash flows.

Our Debentures are not insured or guaranteed by the FDIC, any governmental agency or any other public or private entity as are certificates of deposit or other accounts offered by banks, savings and loan associations or credit unions. You are dependent upon our ability to effectively manage our business to generate sufficient cash flow, including cash flow from our financing activities, for the repayment of principal at maturity and the ongoing payment of interest on the Debentures. If these sources are inadequate, you could lose your entire investment.

Payment on the Debentures is subordinate to the payment of all outstanding present and future senior debt, and the indenture does not limit the amount of senior debt we may incur.

The Debentures are subordinate and junior to any and all of our senior debt. There are no restrictions in the indenture regarding the amount of senior debt or other indebtedness that we or our subsidiaries may incur. Upon the maturity of our senior debt, by lapse of time, acceleration or otherwise, the holders of our senior debt have first right to receive payment in full prior to any payments being made to you as a Debenture holder. Therefore, you would only be repaid if funds remain after the repayment of our senior debt. As of September 25, 2005, we had $2,185,546 of senior debt outstanding.

Payment of interest and principal on the Debentures is effectively subordinate to the payment of the secured and unsecured creditors of our subsidiaries, including holders of debentures and demand notes issued by The Money Tree of Georgia Inc.

Substantially all of our assets and operations are conducted through our subsidiaries. As a result, all the creditors of our subsidiaries, including the holders of the debentures and demand notes issued by The Money Tree of Georgia Inc., would be paid prior to our subsidiaries being allowed to distribute any amounts to us. As of September 25, 2005, $68,904,753 of debentures and $12,867,207 of demand notes issued by The Money Tree of Georgia Inc. were outstanding. If our subsidiaries did not have sufficient funds to pay their debts, our ability to pay interest and principal on the Debentures would be impaired.

The Debentures contain an automatic extension feature which could result in the extension of the maturity of the Debentures beyond the original maturity date and a lower interest rate being paid.

The Debentures contain an automatic extension provision that extends the maturity date of the Debentures and resets the interest rate to the then-current rate unless you provide us with written notice prior to 15 days after the maturity date of the Debenture stating that you want your Debenture redeemed as of the maturity date. The term of the extended Debenture will be equal to the original term of the Debenture, and the interest rate on the Debenture will be equal to the interest rate we are then paying on Debentures of a like interest adjustment period. Therefore, if you fail to take action, you will be required to maintain your investment in the Debenture beyond the original maturity date of the Debenture and the interest rate on the extended Debenture may be lower than the interest rate previously being paid to you.

11

Our operations are not subject to the stringent banking regulatory requirements designed to protect investors so your investment is completely dependent upon our successful operation of our business.

Our operations are not subject to the stringent regulatory requirements imposed upon the operations of commercial banks, savings banks and thrift institutions and are not subject to periodic compliance examinations by federal banking regulators. Therefore, an investment in our Debentures does not have the regulatory protections that the holder of a demand account or a certificate of deposit at a bank does. The return on your investment is completely dependent upon our successful operation of our business. To the extent that we do not successfully operate our business, our ability to pay interest and principal on the Debentures will be impaired.

The indenture does not contain covenants restricting us from taking certain actions and, therefore, the indenture provides very little protection of your investment.

The Debentures do not have the benefit of extensive covenants. The covenants in the indenture are not designed to protect your investment if there is a material adverse change in our financial condition or results of operations. For example, the indenture does not contain any restrictions on our ability to create or incur senior debt or other debt or to pay dividends or any financial covenants (such as a fixed charge coverage or minimum net worth covenants) to help ensure our ability to pay interest and principal on the Debentures. The indenture does not contain provisions that permit Debenture holders to require that we redeem the Debentures if there is a takeover, recapitalization or similar restructuring. In addition, the indenture does not contain covenants specifically designed to protect you if we engage in a highly leveraged transaction. Therefore, the indenture provides very little protection of your investment.

There will not be any market for the Debentures so you should only purchase them if you do not have any need for liquidity of your investment.

The Debentures will not be listed on a national securities exchange or authorized for quotation on The NASDAQ Stock Market. Further, it is very unlikely that any trading market for the Debentures will develop. Except as described elsewhere in this prospectus, you have no right to require redemption of the Debentures, and there is no assurance that the Debentures will be readily accepted as collateral for loans. Due to the lack of a market for the Debentures, we cannot assure you that you would be able to sell the Debentures. You should only purchase these Debentures if you do not have the need for liquidity for the amount invested in, and the interest payable on, the Debentures.

We are subject to many laws and governmental regulations, and any changes in these laws or regulations may materially adversely affect our financial condition and business operations.

Our operations are subject to regulation by federal authorities and state banking, finance, consumer protection and insurance authorities and are subject to various laws and judicial and administrative decisions imposing various requirements and restrictions on our operations which, among other things, require that we obtain and maintain certain licenses and qualifications, and limit the interest rates, fees and other charges we may impose in our consumer finance business. Although we believe we are in compliance in all material respects with applicable laws, rules and regulations, we cannot assure you that we are or that any change in such laws, or in the interpretations thereof, will not make our compliance with such laws more difficult or expensive or otherwise adversely affect our financial condition or business operations.

12

Our lack of a significant line of credit could affect our liquidity in the future.

We have operated without a significant line of credit for the past two years. We are currently seeking a line of credit as an additional source of long-term financing. If we fail to obtain a line of credit, we will be more dependent on the proceeds from the Debentures and Demand Notes for our continued liquidity. If the sale of the Debentures is significantly curtailed for any reason and we fail to obtain a line of credit, our ability to meet our obligations, including our obligations with respect to the Debentures offered hereby, could be materially adversely affected.

There is no sinking fund to ensure repayment of the Debentures at maturity so you are totally reliant upon our ability to generate adequate cash flows.

We do not contribute funds to a separate account, commonly known as a sinking fund, to repay the Debentures upon maturity. Because funds are not set aside periodically for the repayment of the Debentures over their term, you must rely on our cash flow from operations and other sources of financing for repayment, such as funds from the sale of the Debentures and Demand Notes and credit facilities, if any. To the extent cash flow from operations and other sources are not sufficient to repay the Debentures, you may lose all or a part of your investment.

The collectability of our finance receivables may be affected by general economic conditions and we may not be able to recover the full amount of delinquent accounts by resorting to sale of collateral or receipt of non-file insurance proceeds.

Our liquidity is dependent on, among other things, the collection of our finance receivables. We continually monitor the delinquency status of our finance receivables and promptly institute collection efforts on delinquent accounts. Collections of our consumer finance receivables are likely to be affected by general economic conditions. Although current economic conditions have not had a material adverse effect on our ability to collect such finance receivables, we can make no assurances regarding future economic conditions or their effect on our ability to collect our receivables. Furthermore, since we do not ordinarily perfect our security interest in collateral for loans, we may not be able to recover the full amount of outstanding receivables by resorting to the sale of collateral or receipt of non-file insurance proceeds.

We could suffer increased credit losses if there is a continued downturn in the economy.

Because our business consists mainly of the making of loans to individuals who depend on their earnings to make their repayments, our ability to operate on a profitable basis will depend to a large extent on the continued employment of those individuals and their ability to meet their financial obligations as they become due. In the event of a sustained recession or a continued downturn in the U.S. and local economies in which we operate, with resulting unemployment and increases in the number of personal bankruptcies, we could experience increased credit losses and our collection ratios and profitability could be materially and adversely affected.

Hurricanes or other adverse weather events could negatively affect our local economies or cause disruption to our branch office locations, which could have an adverse effect on our business or results of operations.

Our operations are conducted in the States of Georgia, Florida, Alabama and Louisiana, including areas susceptible to hurricanes or tropical storms. See our locations map on page 38 of the prospectus showing that there are several branch office locations in or near coastal towns. Such weather events can disrupt our operations, result in damage to our branch office locations

13

and negatively affect the local economies in which we operate. In late August 2005, Hurricane Katrina devastated parts of the Gulf Coast of Louisiana and Alabama causing substantial damage to residences and businesses in these areas, including our three branch office locations in New Orleans. In September 2005, Hurricane Rita struck the Gulf Coast of Louisiana and Texas resulting in temporary closure of our Lake Charles, Louisiana branch office location. We cannot predict whether or to what extent damage caused by Hurricanes Katrina and Rita or damage that may be caused by future hurricanes will affect our operations or the economies in our market areas, but such weather events could result in a decline in loan originations and an increase in the risk of delinquencies, foreclosures or loan losses. Our business or results of operations may be adversely affected by these and other negative effects of Hurricanes Katrina and Rita or future hurricanes.

Our typical customer base has “subprime” credit ratings and are higher than average credit risks which could result in increased risk of loan defaults.

We typically lend money to individuals who have difficulty receiving loans from banks and other financial institutions because of credit problems or other adverse financial circumstances. Therefore, we may have a higher risk of loan default among our customers than other lending companies. If we suffer increased loan defaults in any given period, our operations could be materially adversely affected and we may have difficulty making our principal and interest payments on the Debentures.

Additional competition may decrease our liquidity and profitability, which would adversely affect our ability to repay the Debentures.

We compete for business with a number of large national companies and banks that have substantially greater resources, lower cost of funds, and a more established market presence than we have. If these companies increase their marketing efforts to include our market niche of borrowers, or if additional competitors enter our markets, we may be forced to reduce our interest rates and fees in order to maintain or expand our market share. Any reduction in our interest rates or fees could have an adverse impact on our liquidity and profitability and our ability to repay the Debentures.

If we redeem the Debentures, you may not be able to reinvest the proceeds at comparable rates.

We may redeem, at our option, at any time all or a portion of the outstanding Debentures for payment prior to their maturity. However, you may only redeem your Debenture at your option and without penalty at the end of each applicable interest adjustment period. In addition, while the Debentures contain an automatic extension provision, we may nevertheless elect to redeem your debenture in full upon maturity. In the event we elect to redeem your Debenture, you would have the risk of reinvesting the proceeds at the then-current market rates which may be higher or lower.

We can provide no assurance that any Debentures will be sold or that we will raise sufficient proceeds to carry out our business plans.

We are offering the Debentures through our executive officers without a firm underwriting commitment. While we intend to sell up to $75,000,000 in principal amount of Debentures, there is no minimum amount of proceeds that must be received from the sale of Debentures in order to accept proceeds from Debentures actually sold. Accordingly, we can provide no assurance as to the total principal amount of Debentures that will be sold. Therefore, we cannot assure you that we will raise sufficient proceeds to carry out our business plans.

14

We are controlled by the Martin family and don’t have any independent board members overseeing our operations.

Our Chief Executive Officer, Vance R. Martin, and our President, W. Derek Martin, control all of the outstanding shares of our voting capital stock. In addition, we do not have any independent directors on our board. Accordingly, the Martin family will be able to exercise significant control over our affairs, including, without limitation, the election of officers and directors, operational decisions and decisions regarding the Debentures. In addition, there are no contractual or regulatory limits on the amounts we can pay to the Martin family or other affiliates.

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of federal securities law. Words such as “may,” “will,” “expect,” “anticipate,” “believe,” “estimate,” “continue,” “predict,” or other similar words, identify forward-looking statements. Forward-looking statements appear in a number of places in this prospectus, including, without limitation, the “Use of Proceeds” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections, and include statements regarding our intent, belief or current expectation about, among other things, trends affecting the markets in which we operate, our business, financial condition and growth strategies. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially from those predicted in the forward-looking statements as a result of various factors, including those set forth in the “Risk Factors” section of this prospectus. If any of the events described in “Risk Factors” occur, they could have an adverse effect on our business, financial condition and results of operations. When considering forward-looking statements, you should keep these risk factors in mind as well as the other cautionary statements in this prospectus. You should not place undue reliance on any forward-looking statement. We are not obligated to update forward-looking statements.

USE OF PROCEEDS

If we sell all of the Debentures offered by this prospectus, we estimate that the net proceeds will be approximately $74,385,000 after deduction of estimated offering expenses of $615,000. We will pay all of the expenses related to this offering.

We will receive cash proceeds in varying amounts from time to time as the Debentures are sold. Due to our inability to predict with any certainty whatsoever when holders of Demand Notes will redeem or which holders of Debentures will redeem at or prior to maturity, we cannot provide any specific allocation of proceeds we will use for any particular purpose. However, we intend to use substantially all of the net offering proceeds in the following order of priority:

| | • | | to redeem debentures and demand notes of our subsidiary, The Money Tree of Georgia Inc.; |

| | • | | to redeem Demand Notes issued by us; |

| | • | | to make interest payments to holders of all of our debentures and demand notes; |

| | • | | to the extent that net proceeds remain and we have adequate cash on hand, to fund the following company activities: |

15

| | • | | to make additional consumer loans; |

| | • | | to fund the purchase of inventory of used cars; |

| | • | | to open new branch office locations; |

| | • | | to acquire loan receivables from competitors; and |

| | • | | for working capital and other general corporate purposes. |

There is no minimum number or amount of Debentures that we must sell to receive and use the proceeds from the sale of Debentures, and we cannot assure you that all or any portion of the Debentures will be sold. In the event that we do not raise sufficient proceeds from our offerings of Debentures and Demand Notes to adequately fund our operations, we could curtail the amount of funds we loan to our customers and focus on cash collections to increase cash flow. Please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources.”

SELECTED CONSOLIDATED FINANCIAL DATA

The following selected consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and related notes included elsewhere in this prospectus. The selected consolidated balance sheet data, as of September 25, 2005 and 2004, and the selected consolidated income statement data, for the fiscal years ended September 25, 2005, 2004 and 2003, have been derived from our audited consolidated financial statements and related notes included in this prospectus. The selected consolidated balance sheet data, as of September 25, 2003, 2002 and 2001, and the selected consolidated income statement data, for the fiscal years ended September 25, 2002 and 2001, have been derived from our audited financial statements that are not included in this prospectus.

16

| | | | | | | | | | | | | | | | | | | | |

| | | As of, and for, the Fiscal Year Ended September 25,

| |

| | | 2005

| | | 2004

| | | 2003

| | | 2002

| | | 2001

| |

Interest income | | $ | 19,234 | | | $ | 17,855 | | | $ | 14,001 | | | $ | 10,640 | | | $ | 8,004 | |

Interest expense | | | (6,355 | ) | | | (5,848 | ) | | | (4,919 | ) | | | (3,973 | ) | | | (3,237 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net interest income before provision for credit losses | | | 12,879 | | | | 12,007 | | | | 9,082 | | | | 6,667 | | | | 4,767 | |

Provision for credit losses | | | (2,768 | ) | | | (2,923 | ) | | | (1,983 | ) | | | (1,060 | ) | | | 215 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net interest income after provision for credit losses | | | 10,111 | | | | 9,084 | | | | 7,099 | | | | 5,607 | | | | 4,982 | |

Insurance commissions | | | 10,490 | | | | 6,477 | | | | 6,177 | | | | 4,893 | | | | 4,652 | |

Commissions from motor club memberships(1) | | | 1,475 | | | | 1,995 | | | | 1,612 | | | | 2,460 | | | | 2,007 | |

Income tax service income(2) | | | 162 | | | | 400 | | | | 452 | | | | 529 | | | | 572 | |

Other income | | | 2,473 | | | | 2,134 | | | | 1,531 | | | | 1,605 | | | | 886 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net revenues before retail sales | | | 24,711 | | | | 20,090 | | | | 16,871 | | | | 15,094 | | | | 13,099 | |

Retail sales | | | 15,061 | | | | 14,360 | | | | 19,940 | | | | 14,992 | | | | 3,711 | |

Cost of sales | | | (9,358 | ) | | | (9,401 | ) | | | (14,207 | ) | | | (10,942 | ) | | | (1,888 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Gross margin on retail sales | | | 5,703 | | | | 4,959 | | | | 5,733 | | | | 4,050 | | | | 1,823 | |

Net revenues | | | 30,414 | | | | 25,049 | | | | 22,604 | | | | 19,144 | | | | 14,922 | |

Operating expenses | | | (29,205 | ) | | | (24,854 | ) | | | (21,728 | ) | | | (18,990 | ) | | | (15,352 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net operating income (loss) | | | 1,209 | | | | 195 | | | | 876 | | | | 154 | | | | (430 | ) |

Loss on sale of property and equipment | | | (81 | ) | | | (31 | ) | | | (20 | ) | | | (17 | ) | | | (7 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income (loss) before income tax expense | | | 1,128 | | | | 164 | | | | 856 | | | | 137 | | | | (437 | ) |

Income tax expense | | | (430 | ) | | | (95 | ) | | | (339 | ) | | | (42 | ) | | | (117 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income (loss) | | $ | 698 | | | $ | 69 | | | $ | 517 | | | $ | 95 | | | $ | (554 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Ratio of earnings to fixed charges(3) | | | 1.15 | | | | 1.02 | | | | 1.15 | | | | 1.03 | | | | | (4) |

Cash and cash equivalents | | $ | 9,619 | | | $ | 8,373 | | | $ | 8,749 | | | $ | 6,085 | | | $ | 5,084 | |

Finance receivables(5) | | | 79,773 | | | | 67,156 | | | | 59,410 | | | | 41,096 | | | | 28,048 | |

Allowance for credit losses | | | (2,632 | ) | | | (2,056 | ) | | | (1,705 | ) | | | (1,195 | ) | | | (742 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Finance receivables, net | | | 77,141 | | | | 65,100 | | | | 57,705 | | | | 39,901 | | | | 27,306 | |

Other receivables | | | 1,099 | | | | 4,904 | | | | 2,074 | | | | 2,142 | | | | 2,643 | |

Inventory | | | 2,402 | | | | 2,293 | | | | 3,009 | | | | 2,957 | | | | 491 | |

Property and equipment, net | | | 4,850 | | | | 4,657 | | | | 3,272 | | | | 3,346 | | | | 2,434 | |

Total assets | | | 99,747 | | | | 88,764 | | | | 77,674 | | | | 57,366 | | | | 41,000 | |

Senior debt | | | 1,186 | | | | 2,062 | | | | 888 | | | | 6,232 | | | | 9,963 | |

Senior subordinated debt | | | 1,000 | | | | 700 | | | | 3,900 | | | | 2,400 | | | | 2,400 | |

Subordinated debt, related parties | | | 800 | | | | 800 | | | | 271 | | | | 346 | | | | 565 | |

Debentures(6) | | | 68,905 | | | | 61,582 | | | | 52,701 | | | | 36,820 | | | | 23,563 | |

Demand notes(6) | | | 12,867 | | | | 11,702 | | | | 10,277 | | | | 6,192 | | | | 593 | |

Shareholders’ equity (deficit) | | $ | 1,103 | | | $ | 405 | | | $ | 335 | | | $ | (182 | ) | | $ | (276 | ) |

| (1) | Received from Interstate Motor Club, Inc., an affiliated entity. |

| (2) | Received from Cash Check Inc. of Ga., an affiliated entity. |

| (3) | The ratio of earnings to fixed charges represents the number of times fixed charges are covered by earnings. For purposes of this ratio, “earnings” is determined by adding pre-tax income to “fixed charges,” which consists of interest on all indebtedness and an interest factor attributable to rent expense. |

| (4) | Calculation results in a deficiency in the ratio (i.e., less than one-to-one coverage). The deficiency in earnings to cover fixed charges was $436,540 for the year ended September 25, 2001. |

| (5) | Net of unearned insurance commissions, unearned finance charges and unearned discounts. |

| (6) | Issued by our subsidiary, The Money Tree of Georgia Inc. |

17

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the information under “Selected Consolidated Financial Data” and our audited consolidated financial statements and related notes and other financial data included elsewhere in this prospectus.

Overview

We make consumer finance loans and provide other financial products and services through our branch offices in Georgia, Alabama, Louisiana and Florida. We sell retail merchandise, principally furniture, appliances and electronics, at certain of our branch office locations and operate four used automobile dealerships in the State of Georgia. We also offer insurance products, prepaid phone services and automobile club memberships to our loan customers.

We fund our consumer loan demand through a combination of cash collections from our consumer loans, proceeds raised from the sale of debentures and demand notes and loans from various banks and other financial institutions. Our consumer loan business consists of making, purchasing and servicing direct consumer loans, consumer sales finance contracts and motor vehicle installment sales contracts. Direct consumer loans generally serve individuals with limited access to other sources of consumer credit, such as banks, savings and loans, other consumer finance businesses and credit cards. Direct consumer loans are general loans made typically to people who need money for some unusual or unforeseen expense, for the purpose of paying off an accumulation of small debts or for the purchase of furniture and appliances. Please see “Business – General” for a more detailed discussion of the various types of loans we make to our customers. The following table sets forth certain information about the components of our finance receivables:

Description of Loans and Contracts

| | | | | | | | | | | | |

| | | As of, or for, the Year Ended September 25,

| |

| | | 2005

| | | 2004

| | | 2003

| |

Direct Consumer Loans: | | | | | | | | | | | | |

Number of Loans Made to New Borrowers | | | 26,183 | | | | 18,601 | | | | 14,245 | |

Number of Loans Made to Former Borrowers | | | 52,785 | | | | 46,109 | | | | 41,442 | |

Number of Loans Made to Existing Borrowers | | | 100,439 | | | | 84,987 | | | | 74,647 | |

Total Number of Loans Made | | | 179,407 | | | | 149,697 | | | | 130,334 | |

Total Volume of Loans Made | | $ | 89,520,904 | | | $ | 68,593,531 | | | $ | 64,417,672 | |

Average Size of Loans Made | | $ | 499 | | | $ | 458 | | | $ | 494 | |

Number of Loans Outstanding | | | 71,070 | | | | 57,986 | | | | 52,757 | |

Total of Loans Outstanding* | | $ | 48,840,570 | | | $ | 38,281,888 | | | $ | 33,215,821 | |

Percent of Loans Outstanding | | | 55.3 | % | | | 50.3 | % | | | 48.6 | % |

Average Balance on Outstanding Loans | | $ | 687 | | | $ | 660 | | | $ | 630 | |

Number of Contracts Purchased | | | — | | | | 15,014 | | | | 1,200 | |

Total Volume of Contracts Purchased | | | — | | | $ | 5,428,391 | | | $ | 491,049 | |

Average Size of Contracts Purchased | | | — | | | $ | 362 | | | $ | 409 | |

18

Description of Loans and Contracts

| | | | | | | | | | | | |

| | |

| | | As of, or for, the Year Ended September 25,

| |

| | | 2005

| | | 2004

| | | 2003

| |

Motor Vehicle Installment Sales Contracts: | |

Total Number of Contracts Made | | | 851 | | | | 892 | | | | 1,084 | |

Total Volume of Contracts Made | | $ | 14,155,640 | | | $ | 17,043,881 | | | $ | 21,667,826 | |

Average Size of Contracts Made | | $ | 16,634 | | | $ | 19,107 | | | $ | 19,989 | |

Number of Contracts Outstanding | | | 2,385 | | | | 2,160 | | | | 1,855 | |

Total of Contracts Outstanding* | | $ | 29,765,603 | | | $ | 30,557,683 | | | $ | 28,820,071 | |

Percent of Total Loans and Contracts | | | 33.7 | % | | | 40.2 | % | | | 42.2 | % |

Average Balance on Outstanding Contracts | | $ | 12,480 | | | $ | 14,147 | | | $ | 15,536 | |

Number of Contracts Purchased | | | — | | | | — | | | | — | |

Total Volume of Contracts Purchased | | | — | | | | — | | | | — | |

Average Size of Contracts Purchased | | | — | | | | — | | | | — | |

| | | |

Consumer Sales Finance Contracts: | | | | | | | | | | | | |

Number of Contracts Made to New Customers | | | 352 | | | | 419 | | | | 542 | |

Number of Loans Made to Former Customers | | | 3,641 | | | | 3,471 | | | | 3,613 | |

Number of Loans Made to Existing Customers | | | 2,291 | | | | 2,643 | | | | 3,499 | |

Total Contracts Made | | | 6,284 | | | | 6,533 | | | | 7,654 | |

Total Volume of Contracts Made | | $ | 10,904,159 | | | $ | 7,063,894 | | | $ | 8,124,364 | |

Number of Contracts Outstanding | | | 5,468 | | | | 5,551 | | | | 5,737 | |

Total of Contracts Outstanding* | | $ | 9,661,474 | | | $ | 7,240,653 | | | $ | 6,260,905 | |

Percent of Total Loans and Contracts | | | 11.0 | % | | | 9.5 | % | | | 9.2 | % |

Average Balance of Outstanding Contracts | | $ | 1,767 | | | $ | 1,304 | | | $ | 1,091 | |

Number of Contracts Purchased | | | — | | | | — | | | | — | |

Total Volume of Contracts Purchased | | | — | | | | — | | | | — | |

Average Size of Contracts Purchased | | | — | | | | — | | | | — | |

| * | Contracts outstanding are exclusive of the following aggregate amounts of bankrupt accounts: $4,921,905 for the year ended September 25, 2005; $3,531,667 for the year ended September 25, 2004; and $3,710,099 for the year ended September 25, 2003. |

Below is a table showing our total gross outstanding finance receivables and bankrupt accounts:

| | | | | | | | | |

| | | Fiscal Year

Ended

September 25,

2005

| | Fiscal Year

Ended

September 25,

2004

| | Fiscal Year

Ended

September 25,

2003

|

Total Loans and Contracts Outstanding (gross): | | | | | | | | | |

| | | |

Direct Consumer Loans | | $ | 48,840,570 | | $ | 38,281,888 | | $ | 33,215,821 |

Motor Vehicle Installment | | | 29,765,603 | | | 30,557,683 | | | 28,820,071 |

Consumer Sales Finance | | | 9,661,474 | | | 7,240,653 | | | 6,260,905 |

Bankrupt Accounts | | | 4,921,905 | | | 3,531,667 | | | 3,710,099 |

| | |

|

| |

|

| |

|

|

Total Gross Outstanding | | $ | 93,189,552 | | $ | 79,611,891 | | $ | 72,006,896 |

| | |

|

| |

|

| |

|

|

19

Below is a roll-forward of the balance of each category of our outstanding finance receivables. Loans originated reflect the gross amount of loans made or purchased during the period presented inclusive of pre-computed interest, fees and insurance premiums. Collections represent cash receipts in the form of repayments made on our loans as reflected in our Consolidated Statements of Cash Flows. Refinancings represent the amount of the pay off of loans refinanced. Charge offs represent the gross amount of loans charged off as uncollectible (charge offs are shown net of non-file insurance receipts in our Allowance for Credit Losses). Rebates represent reductions to gross loan amounts of precomputed interest and insurance premiums resulting from loans refinanced and other loans paid off before maturity. See page F-9 (Summary of Significant Accounting Policies – Income Recognition) for further discussion related to rebates of interest. Other adjustments primarily represent accounts transferred to and from the department that administers bankrupt accounts.

| | | | | | | | | | | | |

| | | Fiscal Year

Ended

September 25,

2005

| | | Fiscal Year

Ended

September 25,

2004

| | | Fiscal Year

Ended

September 25,

2003

| |

Direct Consumer Loans: | | | | | | | | | | | | |

Balance – beginning | | $ | 38,281,888 | | | $ | 33,215,821 | | | $ | 25,616,555 | |

Loans originated | | | 89,520,904 | | | | 74,021,922 | | | | 64,908,722 | |

Collections | | | (54,192,456 | ) | | | (46,735,923 | ) | | | (39,155,436 | ) |

Refinancings | | | (16,169,389 | ) | | | (13,327,472 | ) | | | (12,461,275 | ) |

Charge offs | | | (2,828,792 | ) | | | (5,593,831 | ) | | | (1,368,678 | ) |

Rebates/other adjustments | | | (5,771,586 | ) | | | (3,298,629 | ) | | | (4,324,066 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Balance – end | | $ | 48,840,570 | | | $ | 38,281,888 | | | $ | 33,215,821 | |

| | |

|

|

| |

|

|

| |

|

|

|

Consumer Sales Finance Contracts: | | | | | | | | | | | | |

Balance – beginning | | $ | 7,240,653 | | | $ | 6,260,905 | | | $ | 4,619,579 | |

Loans originated | | | 10,904,159 | | | | 7,063,894 | | | | 8,124,364 | |

Collections | | | (3,923,845 | ) | | | (3,262,061 | ) | | | (2,854,941 | ) |

Refinancings | | | (2,810,207 | ) | | | (2,248,381 | ) | | | (2,446,595 | ) |

Charge offs | | | (448,951 | ) | | | (199,915 | ) | | | (273,818 | ) |

Rebates/other adjustments | | | (1,300,335 | ) | | | (373,789 | ) | | | (907,684 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Balance – end | | $ | 9,661,474 | | | $ | 7,240,653 | | | $ | 6,260,905 | |

| | |

|

|

| |

|

|

| |

|

|

|

Motor Vehicle Installment Sales Contracts: | | | | | | | | | | | | |

Balance – beginning | | $ | 30,557,683 | | | $ | 28,820,071 | | | $ | 16,219,115 | |

Loans originated | | | 14,155,640 | | | | 17,043,881 | | | | 21,667,826 | |

Collections | | | (12,424,225 | ) | | | (11,115,383 | ) | | | (12,222,839 | ) |

Refinancings | | | — | | | | — | | | | — | |

Charge offs | | | (1,316,489 | ) | | | (1,379,734 | ) | | | (580,151 | ) |

Rebates/other adjustments | | | (1,207,006 | ) | | | (2,811,152 | ) | | | 3,736,120 | |

| | |

|

|

| |

|

|

| |

|

|

|

Balance – end | | $ | 29,765,603 | | | $ | 30,557,683 | | | $ | 28,820,071 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total Active Accounts: | | | | | | | | | | | | |

Balance – beginning | | $ | 76,080,224 | | | $ | 68,296,797 | | | $ | 46,455,249 | |

Loans originated | | | 114,580,703 | | | | 98,129,697 | | | | 94,700,912 | |

Collections | | | (70,540,526 | ) | | | (61,113,367 | ) | | | (54,233,216 | ) |

Refinancings | | | (18,979,595 | ) | | | (15,575,853 | ) | | | (14,907,871 | ) |

Charge offs | | | (4,594,232 | ) | | | (7,173,480 | ) | | | (2,222,647 | ) |

Rebates/other adjustments | | | (8,278,927 | ) | | | (6,483,570 | ) | | | (1,495,630 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Balance – end | | $ | 88,267,647 | | | $ | 76,080,224 | | | $ | 68,296,797 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total Bankrupt Accounts: | | | | | | | | | | | | |

Balance – beginning | | $ | 3,531,667 | | | $ | 3,710,099 | | | $ | 2,906,125 | |

Charge offs | | | (649,741 | ) | | | (1,377,211 | ) | | | (511,908 | ) |

Adjustments | | | 2,039,979 | | | | 1,198,779 | | | | 1,315,882 | |

| | |

|

|

| |

|

|

| |

|

|

|

Balance – end | | $ | 4,921,905 | | | $ | 3,531,667 | | | $ | 3,710,099 | |

| | |

|

|

| |

|

|

| |

|

|

|

Total Gross O/S Receivables | | $ | 93,189,552 | | | $ | 79,611,891 | | | $ | 72,006,896 | |

| | |

|

|

| |

|

|

| |

|

|

|

20

Below is a reconciliation of the amounts of the loans originated and repaid (collections) from the receivable roll-forward to the amounts shown in our Consolidated Statements of Cash Flows.

| | | | | | | | | | | | |

| | | Fiscal Year

Ended

September 25,

2005

| | | Fiscal Year

Ended

September 25,

2004

| | | Fiscal Year

Ended

September 25,

2003

| |

Loans Originated: | | | | | | | | | | | | |

Direct consumer loans | | $ | 89,520,904 | | | $ | 74,021,922 | | | $ | 64,908,722 | |

Consumer sales finance | | | 10,904,159 | | | | 7,063,894 | | | | 8,124,364 | |

Motor vehicle installment sales | | | 14,155,640 | | | | 17,043,881 | | | | 21,667,826 | |

Total gross loans originated | | | 114,580,703 | | | | 98,129,697 | | | | 94,700,912 | |

Gross receivables purchased | | | — | | | | (5,428,391 | ) | | | (491,049 | ) |

Non-cash items included in gross loans* | | | (29,231,875 | ) | | | (24,785,406 | ) | | | (20,595,148 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Loans originated – cash flows** | | $ | 85,348,828 | | | $ | 67,915,900 | | | $ | 73,614,715 | |

| | |

|

|

| |

|

|

| |

|

|

|

| | | |

Loans Repaid: | | | | | | | | | | | | |

Collections | | | | | | | | | | | | |

Direct consumer loans | | $ | 54,192,456 | | | $ | 46,735,923 | | | $ | 39,155,436 | |

Consumer sales finance | | | 3,923,845 | | | | 3,262,061 | | | | 2,854,941 | |

Motor vehicle installment sales | | | 12,424,225 | | | | 11,115,383 | | | | 12,222,839 | |

| | |

|

|

| |

|

|

| |

|

|

|

Loans repaid – cash flows | | $ | 70,540,526 | | | $ | 61,113,367 | | | $ | 54,233,216 | |

| | |

|

|

| |

|

|

| |

|

|

|

| * | Includes precomputed interest and fees (since these amounts are included in the gross amount of loans originated but are not advanced in the form of cash to customers) and refinanced loan balances (since there is no cash generated from the repayment of original loans refinanced). |

| ** | Includes amounts advanced to customers in conjunction with refinancings, which were $10,423,617 for the fiscal year ended September 25, 2005; $9,328,161 for the fiscal year ended September 25, 2004; and $8,402,623 for the fiscal year ended September 25, 2003. |

Segments and Seasonality

We segment our business operations into the following two segments:

| | • | | consumer finance and sales; and |

| | • | | automotive finance and sales. |

The consumer finance and sales segment is comprised primarily of small consumer loans and sales of consumer goods such as furniture, appliances and electronics. We typically experience our strongest financial performance for the consumer finance and sales segment during the holiday season, which is our first fiscal quarter ending December 25.

The automotive finance and sales segment is comprised exclusively of used vehicle sales and their related financing. We typically experience our strongest financial performance for the automotive finance and sales segment during our second fiscal quarter ending March 25 when used car sales are the highest. Please refer to Note 18 in the “Notes to Consolidated Financial Statements” for a breakdown of our operations by segment.

Growth

Further improvement of our profitability is dependent in large part upon the growth in our outstanding finance receivables and the maintenance of loan quality, acceptable levels of borrowing costs and operating expenses and the ongoing introduction of new products and services to our customers. Our finance receivables increased at a

21

17% annual rate during fiscal year 2005. We anticipate that our finance receivables will continue to grow as our loan originations grow through existing and planned new branch office locations.

During 2000, we began implementing our long-range business plan primarily in the State of Georgia of expanding the loan base of existing branch offices, the addition of new branches and the opening of several used car lots. The following table highlights our growth in the past three fiscal years:

| | | | | | | | | | | | |

| | | Fiscal Years Ended September 25,

| |

| | | 2005

| | | 2004

| | | 2003

| |

Branch offices: | | | 103 | | | | 95 | | | | 72 | |

Finance receivables | | | | | | | | | | | | |

Gross | | $ | 93,189,552 | | | $ | 79,611,891 | | | $ | 72,006,896 | |

Unearned revenues | | | (13,416,948 | ) | | | (12,456,133 | ) | | | (12,597,280 | ) |

| | |

|

|

| |

|

|

| |

|

|

|

Net finance receivables before allowance for credit losses | | $ | 79,772,604 | | | $ | 67,155,758 | | | $ | 59,409,616 | |

Net interest income after provision for credit losses | | $ | 10,110,996 | | | $ | 9,083,485 | | | $ | 7,098,793 | |

| | |

|

|

| |

|

|

| |

|

|

|