Filed Pursuant to Rule 424(B)(1 )

Registration No: 333-157700

THE MONEY TREE INC.

$35,000,000 Subordinated Demand Notes

We are offering up to $35,000,000 in aggregate principal amount of our Subordinated Demand Notes on a continuous basis. A minimum initial investment of $100 is required.

We will issue the Demand Notes in denominations of at least $1, subject to the initial minimum investment requirement of $100. The Demand Notes shall have no stated maturity and shall be payable or redeemable, in whole or in part, at any time at your option, subject to the subordination provisions. The Demand Notes shall bear interest at a variable rate (compounded daily based upon a 365-day year), which will vary depending upon the daily average balance held by you ranging from $1.00 to $9,999.99; $10,000.00 to $49,999.99; $50,000.00 to $99,999.99; and $100,000.00 and over. When we set interest rates for each range of balances, such rates become effective for and applied to all Demand Notes with a daily average balance within that range, whether existing or newly issued. These interest rates may be the same or different for each range of balances and we may increase or decrease the rate for any range independently of the other ranges without advance notice to you after the date of purchase. We will only pay interest on a Demand Note when you make a demand for payment of principal of the Demand Note.

You may obtain the current interest rates payable on the Demand Notes by calling our executive offices in Bainbridge, Georgia at (877) 468-7878 (toll free) or (229) 248-0990 or by visiting our web site at www.themoneytreeinc.com. We will file a Rule 424(b)(2) prospectus supplement setting forth the current interest rates with the Securities and Exchange Commission upon any change in the interest rates.

We are offering the Demand Notes through our designated selling officer, Jennifer Ard, without an underwriter and on a continuous basis. We do not have to sell any minimum amount of Demand Notes to accept and use the proceeds of this offering. We cannot assure you that all or any portion of the Demand Notes we are offering will be sold. We have not made any arrangement to place any of the proceeds from this offering in an escrow, trust or similar account. Therefore, you will not be entitled to the return of your investment. The Demand Notes are not listed on any securities exchange, and there is no public trading market for the Demand Notes. We have the right to reject any subscription, in whole or in part, for any reason.

We may at our option redeem at any time the Demand Notes (1) upon at least 30 days written notice to you, or (2) if the principal balance falls below $100, for a redemption price equal to the principal amount plus any unpaid interest thereon to the date of redemption.

You should read this prospectus and any applicable prospectus supplement carefully before you invest in the Demand Notes. These Demand Notes are our general unsecured obligations and are subordinated in right of payment to all of our present and future senior debt. As of December 25, 2008, we had $81,045,645 of debt outstanding that ranks equal with or senior to the Demand Notes offered pursuant to this prospectus. We expect to incur additional debt in the future, including, without limitation, the Demand Notes offered pursuant to this prospectus.

The Demand Notes are not certificates of deposit or similar obligations guaranteed by any depository institution, and they are not insured by the Federal Deposit Insurance Corporation (FDIC) or any governmental or private insurance fund, or any other entity. We do not contribute funds to a separate account such as a sinking fund to use to repay the Demand Notes.

See “Risk Factors” beginning on page 10 for certain factors you should consider before buying the Demand Notes. These risks include the following:

| | • | | The Demand Notes are risky and speculative investments for suitable investors only. |

| | • | | We suffered significant losses during fiscal year 2008 and the first fiscal quarter of 2009 and such losses will likely continue through 2009. |

| | • | | The collectability of our finance receivables has been affected by general economic conditions, which has resulted in significant increases to our allowance for credit losses and provision for credit losses. |

| | • | | We are substantially reliant upon the net offering proceeds we receive from the sale of debentures and demand notes to meet our liquidity needs. |

| | • | | We may be unable to meet our debenture and demand note obligations, which could force us to sell off our loan receivables and other operating assets or cease our operations. |

| | • | | Our Demand Notes are not insured or guaranteed by the FDIC, so you are dependent upon our ability to manage our business and generate adequate cash flows. |

These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission, and neither the Securities and Exchange Commission nor any state securities commission has passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | |

| | | Price to Public | | Underwriting Discount

And Commission | | Proceeds

to Company |

Per Demand Note | | 100% | | None | | 100% |

Total | | $35,000,000 | | None | | $35,000,000(1) |

(1) | We will receive all of the net proceeds from the sale of the Demand Notes, which, if we sell all of the Demand Notes covered by this prospectus, we estimate will total approximately $34,385,000 after expenses. |

The date of this prospectus is April 10, 2009.

TABLE OF CONTENTS

i

ii

You should rely only upon the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. We are offering to sell the Demand Notes only in jurisdictions where offers and sales are permitted.

iii

QUESTIONS AND ANSWERS

Below we have provided some of the more frequently asked questions and answers relating to the offering of the Demand Notes. Please see the “Prospectus Summary” and the remainder of the prospectus for more information about the offering of the Demand Notes.

| Q: | Who is The Money Tree Inc.? |

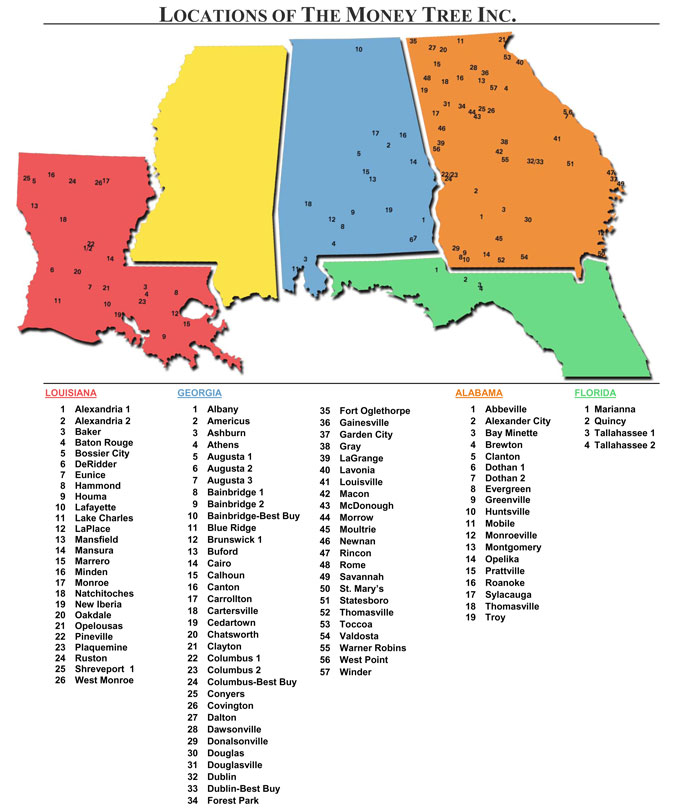

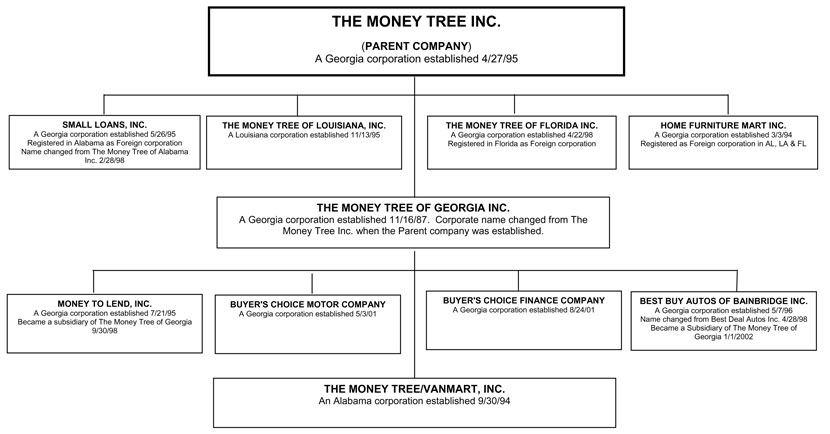

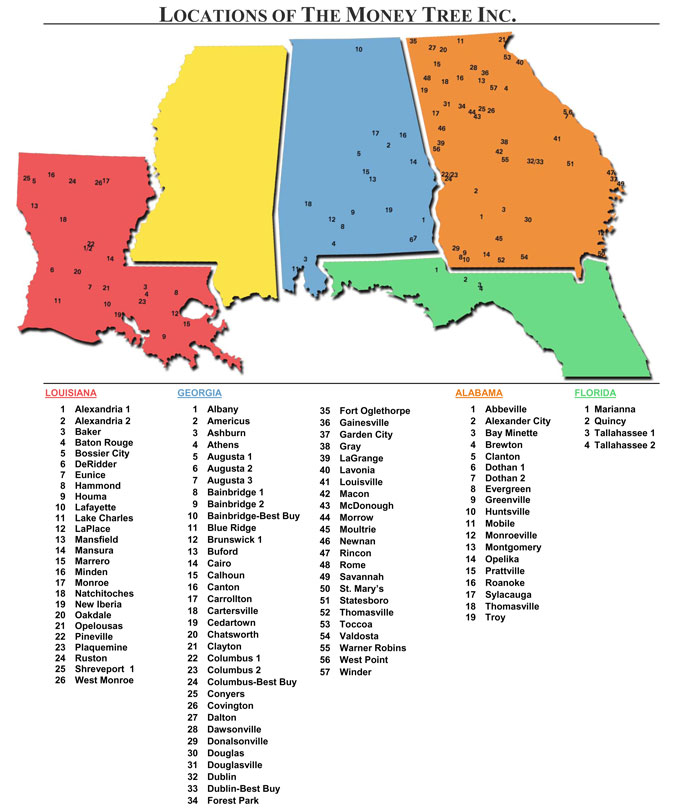

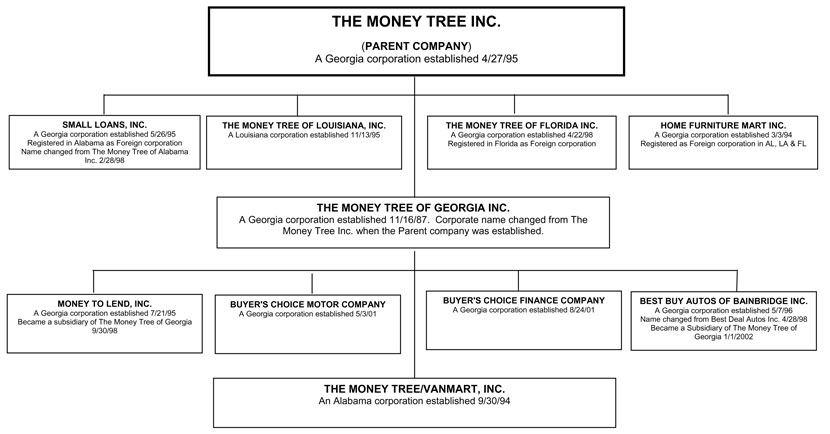

| A: | We are a consumer finance company operating since our inception in 1987 through our branch offices in 103 locations throughout Georgia, Alabama, Louisiana and Florida. |

| Q: | What are your primary business activities? |

| A: | We primarily make, purchase and service direct consumer loans, consumer sales finance contracts and motor vehicle installment sales contracts. Direct consumer loans are direct loans to customers for general use, which are collateralized by existing automobiles or consumer goods, or are unsecured. Consumer sales finance contracts consist of retail installment sales contracts for purchases of specific consumer goods by customers either from one of our branch locations or from a retail store and are collateralized by such consumer goods. Motor vehicle installment sales contracts are initiated by us or purchased from automobile dealers subject to our credit approval. We originate direct consumer loans and consumer sales finance contracts primarily in our branch office locations. As of December 25, 2008, direct consumer loans comprised 41.4%, motor vehicle sales contracts comprised 37.4% and consumer sales finance contracts comprised 21.3% of the gross amount of our outstanding loans and contracts, excluding amounts in bankruptcy. Most of our customers have “subprime” credit ratings and are considered higher than average credit risks. We sell retail merchandise, principally furniture, appliances and electronics, at certain of our branch office locations and operate three used automobile dealerships in the State of Georgia. We also offer, among other products and services, credit and non-credit insurance products, prepaid phone services and automobile club memberships to our loan customers. Insurance products include credit life, credit accident and sickness, and collateral protection, which are issued by a non-affiliated insurance company. |

| Q: | What kind of offering is this? |

| A: | We are offering up to $35,000,000 of Subordinated Demand Notes to residents of the State of Georgia. |

| Q: | What is a Subordinated Demand Note? |

| A: | A Demand Note is our promise to repay your principal investment on demand by you plus interest earned to that date. The Demand Notes are our general unsecured obligations and are subordinated in right of payment to all of our present and future |

1

| | senior debt. Subordinated means that if we are unable to pay our debts as they come due, all of the senior debt would be paid first, before any payment would be made on the Demand Notes. As of December 25, 2008, we had the following debt outstanding that ranks equal with or senior to the Demand Notes: |

| | | |

Senior debt | | $ | 422,505 |

Debentures | | | 77,410,936 |

Demand Notes | | | 3,212,204 |

| | | |

Total | | $ | 81,045,645 |

| | | |

We expect to incur additional debt in the future, including, without limitation, the Demand Notes offered pursuant to this prospectus.

| Q: | Is my investment in the Demand Notes insured? |

| A: | No.The Demand Notes are not certificates of deposit or similar obligations or guaranteed by any depository institution, and they are not insured by the FDIC or any governmental or private insurance fund, or any other entity. They are backed only by the faith and credit of our company and our operations. |

| Q: | How is the interest rate determined? |

| A: | The interest rate offered on the Demand Notes varies depending on the average daily balances in the following ranges: $1.00 to $9,999.99; $10,000.00 to $49,999.99; $50,000.00 to $99,999.99; and $100,000.00 and over. When we establish an interest rate for each range of balances, it becomes effective for and applied to all Demand Notes with a daily balance within that range, whether existing or newly issued. If your average daily balance changes at any time during which you hold Demand Notes, your interest rate will change accordingly. |

| Q: | How is interest calculated and paid to me? |

| A: | The interest rate is a variable rate, and interest is compounded daily (based on a 365-day year). The interest rate may be the same or different for each range of balances, and we may increase or decrease the rate for any range independently of the others without notice to you after the date of purchase. In other words, we can change the interest rate payable to you at any time in our discretion. Interest is only payable when you make a demand for payment of principal of the Demand Note. |

| Q: | Do the Demand Notes have a maturity date? |

| A: | No. A Demand Note is payable to you on your demand. |

2

| Q: | When may I redeem the Demand Note? |

| A: | Subject to the subordination provisions, you may redeem or demand payment on the Demand Note at any time. In such event, we will pay you the outstanding principal balance plus interest earned to the date of redemption. |

| Q: | Can you force me to redeem my Demand Note? |

| A: | Yes, we may call your Demand Note for redemption at any time upon 30 to 60 days notice. We may, in our sole discretion, redeem any Demand Note in full if the principal balance falls below $100 at any time. Any such redemptions by us will be for a price equal to the principal amount plus accrued interest to the date of redemption. |

| Q: | How are the Demand Notes sold? |

| A: | The Demand Notes are offered by our designated selling officer without an underwriter. We intend to market the offering primarily by placing advertisements in local newspapers, purchasing roadway sign advertisements and placing signs in our branch office locations in states in which we have properly registered the offerings or qualified for an exemption from registration. |

| Q: | What will you do with the proceeds raised from this offering? |

| A: | If all the Demand Notes offered by this prospectus are sold, we expect to receive approximately $34,385,000 in net proceeds after deducting all costs and expenses associated with this offering. We intend to use substantially all of the net cash proceeds from this offering in the following order of priority: |

| | • | | to redeem (1) debentures and demand notes of our subsidiary, The Money Tree of Georgia Inc. and (2) Series A Variable Rate Subordinated Debentures, the Series B Variable Rate Subordinated Debentures (“Debentures”) and the Demand Notes issued by us; |

| | • | | to make interest payments to holders of all of our debentures and demand notes; |

| | • | | to the extent we have remaining net proceeds and adequate cash on hand, to fund the following activities: |

| | ¡ | | to make additional consumer loans; |

| | ¡ | | to fund the purchase of inventory of used cars; |

| | ¡ | | to open new branch office locations; |

3

| | ¡ | | to acquire loan receivables from competitors; and |

| | ¡ | | for working capital and other general corporate purposes. |

| Q: | What are some of the significant risks of my investment in the Demand Notes? |

| A: | You should carefully read and consider all risk factors beginning on page 10 of the prospectus prior to investing. Below is a summary of some of the significant risks of an investment in the Demand Notes: |

| | • | | the Demand Notes are risky and speculative investments for suitable investors only; |

| | • | | we are substantially reliant upon the net offering proceeds from the sale of debentures and demand notes to meet our liquidity needs; |

| | • | | we may be unable to meet our debenture and demand note redemption obligations, which could force us to sell off our loan receivables and other operating assets or cease our operations; |

| | • | | we can provide no assurance that any of the Demand Notes will be sold or that we will raise sufficient proceeds to carry out our business plans; |

| | • | | if we or our operations suffer from severe negative publicity, we could be faced with significantly greater payment or redemption obligations from holders of the Demand Notes than we have cash available for such payments or redemptions; |

| | • | | the Demand Notes are not insured or guaranteed by any third party, so you are dependent upon our ability to manage our business and generate adequate cash flows; |

| | • | | payment on the Demand Notes is subordinate to the payment of all of our present and future outstanding senior debt, and the indenture does not limit the amount of senior debt we may incur; |

| | • | | payment of interest and principal on the Demand Notes is effectively subordinate to the payment of the secured and unsecured creditors of our subsidiaries, including holders of debentures and demand notes issued by The Money Tree of Georgia Inc.; |

| | • | | our internal controls over financial reporting may not be effective in preventing or detecting misstatements in our financial statements, and if we fail to detect material misstatements in our financial statements, our financial condition and operating results could be severely and negatively affected; |

| | • | | if we find errors in our previously issued financial statements, we may choose to suspend our offerings of demand notes and debentures until such time as the |

4

| | financial misstatements can be corrected, and if correcting those errors requires an extended period of time, our ability to meet our financial obligations could be severely and negatively affected; |

| | • | | the indenture does not contain covenants restricting us from taking certain actions, and therefore, the indenture provides very little protection of your investment; |

| | • | | we suffered significant losses during fiscal year 2008 and the first quarter of 2009 and we anticipate such losses will likely continue through 2009; |

| | • | | we suffered significant credit losses in 2008 and due to current economic conditions, including inflation and rising fuel costs, there is no guarantee such credit losses will not continue during this downturn in the economy or that our operations and profitability will not continue to be negatively affected; |

| | • | | our shareholders’ deficit balance may limit our ability to obtain future financing, which could have a negative effect on our operations and our liquidity; |

| | • | | our lack of a significant line of credit could affect our liquidity in the future; |

| | • | | our focus towards smaller, shorter-term loans has resulted in a significant decrease in loan volume, which has negatively affected our net revenues before retail sales; |

| | • | | we have substantial funds held at four financial institutions that exceed the insurance coverage offered by the FDIC, the loss of which would have a severe negative affect on our operations, liquidity and ability to repay our Demand Note obligations; and |

| | • | | we are controlled by the Martin family and do not have any independent board members overseeing our operations. |

| Q: | Who may I contact for more information? |

| A: | While our branch office personnel would be happy to provide you with a prospectus and may accept your investment check and documentation, they are not allowed to answer any substantive questions about your investment. If you have questions about the offering of the Demand Notes or need additional information, please call our executive office at (877) 468-7878 (toll free) or (229) 248-0990 (in Georgia). |

5

PROSPECTUS SUMMARY

This summary highlights selected information most of which was not otherwise addressed in the “Questions and Answers” section of this prospectus. For more information about us, you should carefully read the entire prospectus, including the section entitled “Risk Factors,” the financial statements and other financial data, any related prospectus supplement and the documents we have referred you to in “Where You Can Find More Information” on page 69.

Our Company

We were incorporated in Georgia in 1987, and our principal corporate office is located at 114 South Broad Street, Bainbridge, Georgia 39817. Our general telephone number is (229) 246-6536. Information about us can be found atwww.themoneytreeinc.com. The information contained on this website is not part of this prospectus.

The Offering

| | |

| Securities Offered | | We are offering up to $35,000,000 in aggregate principal amount of our Demand Notes. The Demand Notes are governed by an indenture between us and U.S. Bank National Association, as trustee. The Demand Notes do not have the benefit of a sinking fund. See “Description of Demand Notes – General.” |

| |

| Denominations | | Increments of at least $1. |

| |

| Minimum Investment | | A minimum initial investment of $100 is required. |

| |

| Form of Investment | | Investments in Demand Notes may be made by check or by automatic debit of your bank account. |

| |

| Interest Rate | | Variable interest rate, compounded daily based on a 365-day year, which will vary depending upon the average daily balances in the following ranges: $1.00 to $9,999.99; $10,000.00 to $49,999.99; $50,000.00 to $99,999.99; and $100,000.00 and over. |

| |

| Payment of Interest | | Interest is payable only when you make a demand for payment of principal of the Demand Note. |

| |

| No Maturity | | Demand Notes shall have no stated maturity. |

| |

| Payment/Redemption | | Demand Notes shall be payable or redeemable, in whole or in part, at your option at any time, subject to subordination. |

6

| | |

| Redemption by Us | | We may redeem the Demand Note at any time upon 30 to 60 days written notice to you for a price equal to principal plus interest accrued to the date of redemption. |

| |

| Redemption if Balance Falls Below $100 | | We may, at our sole option, redeem any Demand Note in full, if the principal balance of such Demand Note falls below $100 at any time, for a price equal to principal plus interest accrued to the date of redemption. |

| |

| Subordination | | Demand Notes are subordinated, in all rights to payment and in all other respects, to all of our debt except for debt that by its terms expressly provides that such debt is not senior in right to payment of the Demand Notes. Senior debt includes, without limitation, all of our bank and finance company debt and any line of credit we may obtain in the future. This means that if we are unable to pay our debts when due, all of the senior debt would be paid first, before any payment would be made on the Demand Notes. |

| |

| Event of Default | | Under the indenture, an event of default is generally defined as (1) a default in the payment of principal and interest on the Demand Notes that is not cured for 30 days, (2) our becoming subject to certain events of bankruptcy or insolvency, or (3) our failure to comply with provisions of the Demand Notes or the indenture if such failure is not cured or waived within 60 days after receipt of a specific notice. |

| |

| Transfer Restrictions | | Transfer of a Demand Note is effective only upon the receipt of valid transfer instructions by the registrar from the Demand Note holder of record. |

| |

| Trustee | | U.S. Bank National Association, a national banking association. |

| |

| Risk Factors | | See “Risk Factors” beginning on page 10 and other information included in this prospectus and any prospectus supplement for a discussion of factors you should carefully consider before investing in the Demand Notes. |

Summary Consolidated Financial Data

The following table summarizes certain financial data of our business. You should read this summary together with “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and related notes included elsewhere in this prospectus. The summary balance sheet data, as of September 25, 2008 and 2007, and the summary statement of operations data, for the fiscal years ended September 25, 2008, 2007 and 2006, have been derived from our audited consolidated financial statements and related notes included in this prospectus. The summary balance sheet data, as of September 25, 2006, 2005 and 2004, and the summary statement of operations data, for the fiscal years ended September 25, 2005 and 2004, have been

7

derived from our audited financial statements that are not included in this prospectus. Our summary balance sheet data, as of December 25, 2008, and summary statement of operations data, for the three months ended December 25, 2008 and 2007, have been derived from our unaudited consolidated financial statements and related notes included in this prospectus. Our summary balance sheet data, as of December 25, 2007, have been derived from our unaudited consolidated financial statements that are not included in this prospectus.

[REMAINDER OF THIS PAGE INTENTIONALLY LEFT BLANK]

8

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the three months

ended December 25, | | | As of, and for, the Fiscal Year Ended September 25, | |

| Consolidated Operations Data | | 2008 | | | 2007 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

(in thousands except ratios) | | | | |

Net interest and fee income (loss)(1) | | $ | 443 | | | $ | 880 | | | $ | (2,807 | ) | | $ | 6,472 | | | $ | 7,961 | | | $ | 9,720 | | | $ | 8,281 | |

Insurance commissions | | | 2,565 | | | | 2,563 | | | | 9,615 | | | | 10,120 | | | | 11,263 | | | | 10,490 | | | | 6,477 | |

Delinquency fees | | | 403 | | | | 412 | | | | 1,720 | | | | 1,776 | | | | 1,565 | | | | 1,676 | | | | 1,638 | |

Other income(2) | | | 597 | | | | 664 | | | | 2,491 | | | | 2,698 | | | | 2,729 | | | | 2,434 | | | | 2,891 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net revenue before retail sales | | | 4,008 | | | | 4,519 | | | | 11,019 | | | | 21,066 | | | | 23,518 | | | | 24,320 | | | | 19,287 | |

Gross margin on retail sales | | | 1,614 | | | | 1,956 | | | | 6,033 | | | | 6,832 | | | | 6,361 | | | | 5,703 | | | | 4,959 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net revenues | | | 5,622 | | | | 6,475 | | | | 17,052 | | | | 27,898 | | | | 29,879 | | | | 30,023 | | | | 24,246 | |

Operating expenses | | | (7,251 | ) | | | (6,831 | ) | | | (28,469 | ) | | | (27,604 | ) | | | (29,151 | ) | | | (29,205 | ) | | | (24,854 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net operating income (loss) | | | (1,629 | ) | | | (356 | ) | | | (11,417 | ) | | | 294 | | | | 728 | | | | 818 | | | | (608 | ) |

Other non-operating income | | | - | | | | - | | | | - | | | | - | | | | 151 | | | | - | | | | - | |

Loss on sale of property & equipment | | | - | | | | (14 | ) | | | (21 | ) | | | (19 | ) | | | (75 | ) | | | (81 | ) | | | (31 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | (1,629 | ) | | | (370 | ) | | | (11,438 | ) | | | 275 | | | | 804 | | | | 737 | | | | (639 | ) |

Income tax benefit (expense) | | | - | | | | (210 | ) | | | (528 | ) | | | 101 | | | | (274 | ) | | | (304 | ) | | | 208 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (1,629 | ) | | $ | (580 | ) | | $ | (11,966 | ) | | $ | 376 | | | $ | 530 | | | $ | 433 | | | $ | (431 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of earnings to fixed charges(3) | | | (4 | ) | | | (4 | ) | | | (4 | ) | | | 1.03 | | | | 1.10 | | | | 1.10 | | | | (4 | ) |

Cash and cash equivalents | | $ | 5,260 | | | $ | 16,292 | | | $ | 12,541 | | | $ | 17,854 | | | $ | 12,920 | | | $ | 9,619 | | | $ | 8,373 | |

Finance receivables, net(5) | | | 67,214 | | | | 77,421 | | | | 67,730 | | | | 75,838 | | | | 76,658 | | | | 74,660 | | | | 63,010 | |

Other receivables | | | 1,904 | | | | 1,116 | | | | 957 | | | | 863 | | | | 1,013 | | | | 1,099 | | | | 4,904 | |

Inventory | | | 2,766 | | | | 2,846 | | | | 3,167 | | | | 3,057 | | | | 2,195 | | | | 2,402 | | | | 2,293 | |

Property and equipment, net | | | 4,824 | | | | 4,147 | | | | 4,906 | | | | 4,220 | | | | 4,581 | | | | 4,850 | | | | 4,657 | |

Total assets | | | 84,378 | | | | 105,681 | | | | 91,800 | | | | 105,784 | | | | 101,487 | | | | 96,005 | | | | 86,091 | |

Senior debt | | | 423 | | | | 630 | | | | 695 | | | | 512 | | | | 669 | | | | 1,186 | | | | 2,062 | |

Subordinated debt | | | - | | | | - | | | | - | | | | - | | | | 970 | | | | 1,800 | | | | 1,500 | |

Debentures(6) | | | 77,411 | | | | 82,147 | | | | 82,209 | | | | 81,861 | | | | 77,910 | | | | 68,905 | | | | 61,582 | |

Demand notes(6) | | | 3,212 | | | | 5,063 | | | | 3,658 | | | | 5,991 | | | | 8,137 | | | | 12,867 | | | | 11,702 | |

Shareholders’ deficit | | $ | (14,525 | ) | | $ | (1,510 | ) | | $ | (12,896 | ) | | $ | (930 | ) | | $ | (1,305 | ) | | $ | (1,835 | ) | | $ | (2,268 | ) |

(1) | Net of interest expense and provision for credit losses. |

(2) | Includes commissions from motor club memberships received from Interstate Motor Club, Inc., an affiliated entity, and income from income tax return preparation services received from Cash Check Inc. of Ga., a previously affiliated entity that was dissolved in December 2007. |

(3) | The ratio of earnings to fixed charges represents the number of times fixed charges are covered by earnings. For purposes of this ratio, “earnings” is determined by adding pre-tax income to “fixed charges,” which consists of interest on all indebtedness and an interest factor attributable to rent expense. |

(4) | Calculation results in a deficiency in the ratio (i.e., less than one-to-one coverage). The deficiency in earnings to cover fixed charges was $1,628,864 for the three months ended December 25, 2008; $370,244 for the three months ended December 25, 2007; $638,918 for the year ended September 25, 2004 and $11,438,560 for the year ended September 25, 2008. |

(5) | Net of unearned insurance commissions, unearned finance charges, unearned discounts and allowance for credit losses. |

(6) | Issued, in part, by our subsidiary, The Money Tree of Georgia Inc. See Note 8 to our audited financial statements for the year ended September 25, 2008. |

9

RISK FACTORS

Our operations and your investment in the Demand Notes are subject to a number of risks. You should carefully read and consider these risks, together with all other information in this prospectus, before you decide to buy the Demand Notes. If any of the following risks actually occur, our business, financial condition or operating results and our ability to repay the Demand Notes could be materially adversely affected.

Risks Related to Our Offering

The Demand Notes are risky and speculative investments for suitable investors only.

You should be aware that the Demand Notes are risky and speculative investments suitable only for investors of adequate financial means. If you cannot afford to lose your entire investment, you should not invest in the Demand Notes. Potential investors are required to complete a purchaser suitability questionnaire to assist our executive officers in determining whether an investment in the Demand Notes is a suitable investment, and such executive officers have the right to reject any potential investor. If we accept an investment, you should not assume that the Demand Notes are a suitable and appropriate investment for you.

We are substantially reliant upon the net offering proceeds we receive from the sale of our debentures and demand notes to meet our liquidity needs.

Since 2003, we or our subsidiary, The Money Tree of Georgia Inc., have sold $107,067,590 of debentures and $45,635,665 of demand notes. We are substantially reliant upon the net offering proceeds we receive from the sale of our debentures and demand notes to meet our liquidity needs. We use these net offering proceeds to fund redemption obligations, make interest payments and to fund other working capital. If we are unable to sell our debentures or demand notes, our liquidity and capital needs will be severely and negatively affected.

We may be unable to meet our debenture and demand note redemption obligations, which could force us to sell off our loan receivables and other operating assets or cease our operations.

In addition to the Demand Notes we issue pursuant to this prospectus, we may issue Debentures or similar debt instruments to investors in order to raise funds for our operations. As of December 25, 2008, we had a total of $3,212,204 of demand notes and $77,410,936 of debentures outstanding, which demand notes may be redeemed by our investors at any time. Of this amount, our subsidiary, The Money Tree of Georgia Inc. has issued $507,800 of demand notes and $41,575,953 of debentures. Additionally, we have $14,359,353 accrued interest associated with the outstanding obligations. We intend to pay these and any other redemption obligations using our normal cash sources, such as collections on finance receivables and used car sales, as well as proceeds from the sale of the Demand Notes and Debentures. However, our operations and other sources of funds may not provide sufficient available cash flow to meet our redemption obligations, especially if the amount of redemptions at any given time is significantly greater than anticipated or if cash on hand is less than expected due to losses or other circumstances. As of the month ended February 25, 2009, we had redeemed $3.1 million in debentures and $0.3 million in demand notes, and our cash and cash equivalents decreased by approximately $1.5 million to a balance of $3.8 million due primarily to these redemptions. If we are unable to repay or redeem the principal amount of debentures or demand notes when due,

10

and we are unable to obtain additional financing or other sources of capital, we may be forced to sell off our loan receivables and other operating assets, or we might be forced to cease our operations, and you could lose some or all of your investment.

We can provide no assurance that any Demand Notes will be sold or that we will raise sufficient proceeds to carry out our business plans.

We are offering the Demand Notes through our designated selling officer without a firm underwriting commitment. While we intend to sell up to $35,000,000 in principal amount of Demand Notes, there is no minimum amount of proceeds that must be received from the sale of the Demand Notes in order to accept proceeds from the Demand Notes actually sold. Accordingly, we can provide no assurance about the total principal amount of Demand Notes that will be sold. Therefore, we cannot assure you that we will raise sufficient proceeds to carry out our business plans.

Our Demand Notes are not insured or guaranteed by any third party, so you are dependent upon our ability to manage our business and generate adequate cash flows.

Our Demand Notes are not insured or guaranteed by the FDIC, any governmental agency or any other public or private entity as are certificates of deposit or other accounts offered by banks, savings and loan associations or credit unions. You are dependent upon our ability to effectively manage our business to generate sufficient cash flow, including cash flow from our financing activities, for the repayment of principal and interest on the Demand Notes. If these sources are inadequate, you could lose your entire investment.

If we redeem the Demand Notes, you may not be able to reinvest the proceeds at comparable rates.

We may redeem, at our option, at any time, the Demand Notes (1) upon at least 30 days written notice, or (2) if the principal balance falls below $100. In the event we redeem your Demand Note, you would have the risk of reinvesting the proceeds at the then-current market rates, which may be higher or lower.

If we or our operations suffer from severe negative publicity, we could be faced with significantly greater payment or redemption obligations from holders of the Demand Notes than we have cash available for such payments or redemptions.

Because the Demand Notes are payable or redeemable at any time by holders, we cannot control the amount or timing of such payments or redemptions. If we or our operations suffer from severe negative publicity, we may receive significantly greater payment or redemption requests in a short time period than we have cash available to fund such payments or redemptions. In such event, we could be declared in default on the Demand Notes and other debt instruments. If we are unable to cure such default or otherwise meet our payment or redemption obligations, you could lose your entire investment.

An increase in market interest rates may result in a reduction in our liquidity and profitability and impair our ability to pay interest and principal on the Demand Notes.

Interest rates are currently at or near historic lows. Sustained, significant increases in interest rates could unfavorably impact our liquidity and profitability by reducing the interest rate spread between the rate of interest we receive on loans and interest rates we must pay under our

11

Demand Notes and Debentures and any bank debt we incur. Any reduction in our liquidity and profitability would diminish our ability to pay principal and interest on the Demand Notes.

Payment on the Demand Notes is subordinate to the payment of all outstanding present and future senior debt, and the indenture does not limit the amount of senior debt we may incur.

The Demand Notes are subordinate and junior to any and all of our senior debt. There are no restrictions in the indenture regarding the amount of senior debt or other indebtedness that we or our subsidiaries may incur. Upon the maturity of our senior debt, by lapse of time, acceleration or otherwise, the holders of our senior debt have first right to receive payment in full prior to any payments being made to you as a Demand Note holder. Therefore, you would only be repaid if funds remain after the repayment of our senior debt. As of December 25, 2008, we had $422,505 of senior debt outstanding.

Payment of interest and principal on the Demand Notes is effectively subordinate to the payment of the secured and unsecured creditors of our subsidiaries, including holders of debentures and demand notes issued by The Money Tree of Georgia Inc.

Substantially all of our assets and operations are conducted through our subsidiaries. As a result, all the creditors of our subsidiaries, including the holders of the demand notes and debentures issued by The Money Tree of Georgia Inc., would be paid prior to our subsidiaries being allowed to distribute any amounts to us. As of December 25, 2008, $507,800 of demand notes and $41,575,953 of debentures issued by The Money Tree of Georgia Inc. were outstanding. If our subsidiaries did not have sufficient funds to pay their debts, our ability to pay principal and interest on the Demand Notes would be impaired.

Our operations are not subject to the stringent banking regulatory requirements designed to protect investors, so your investment is completely dependent upon our successful operation of our business.

Our operations are not subject to the stringent regulatory requirements imposed upon the operations of commercial banks, savings banks and thrift institutions and are not subject to periodic compliance examinations by federal banking regulators. Therefore, an investment in our Demand Notes does not have the regulatory protections that the holder of a demand account or a certificate of deposit at a bank does. The return on your investment is completely dependent upon our successful operation of our business. To the extent that we do not successfully operate our business, our ability to repay the principal and interest on the Demand Notes will be impaired.

Our internal controls over financial reporting may not be effective in preventing or detecting misstatements in our financial statements, and if we fail to detect material misstatements in our financial statements, our financial condition and operating results could be severely and negatively affected.

During our fiscal year ended September 25, 2008, we concluded that our system of internal controls over financial reporting contained a material weakness and was not operating effectively. This resulted in errors in our previously issued quarterly financial statements. There can be no assurance that, in the future, our system of internal controls would detect misstatements in our financial statements. If we fail to detect material misstatements in our financial statements in the future, our financial condition and operating results could be severely and negatively affected.

12

If we find errors in our previously issued financial statements, we may choose to suspend our offerings of demand notes and debentures until such time as the financial misstatements can be corrected, and if correcting those errors requires an extended period of time, our ability to meet our financial obligations could be severely and negatively affected.

On November 18, 2008, we concluded that the previously issued unaudited consolidated financial statements contained in our Quarterly Reports on Form 10-Q, for each of the first three quarters for fiscal year 2008, should no longer be relied upon because of an error in the statements. We subsequently filed amended Quarterly Reports on Form 10-Q to accurately reflect our restated financial position and results of operations, and we terminated our public offerings of Series A Variable Rate Subordinated Debentures (SEC File No. 333-122531) and Subordinated Demand Notes (SEC File No. 333-122533), which offerings were set to expire under Securities and Exchange Commission rules on December 1, 2008. The error in the financial statements was, in part, caused by a material weakness in our internal control over financing reporting. In the future, if we conclude that our previously issued financial statements contain errors and cannot be relied upon, we may suspend the sale of debentures and demand notes under our current offerings until such time as the errors are corrected. If correcting these errors requires an extended period of time, our ability to meet our financial obligations could be severely and negatively affected.

The indenture does not contain covenants restricting us from taking certain actions, and therefore, the indenture provides very little protection of your investment.

The Demand Notes do not have the benefit of extensive covenants. The covenants in the indenture are not designed to protect your investment if there is a material adverse change in our financial condition or results of operations. For example, the indenture does not contain any restrictions on our ability to create or incur senior debt or other debt or to pay dividends or any financial covenants (such as a fixed charge coverage or minimum net worth covenants) to help ensure our ability to repay the principal and interest on the Demand Notes. In addition, the indenture does not contain covenants specifically designed to protect you if we engage in a highly leveraged transaction. Therefore, the indenture provides very little protection of your investment.

There is no sinking fund to ensure repayment of the Demand Notes, so you are totally reliant upon our ability to generate adequate cash flows.

We do not contribute funds to a separate account, commonly known as a sinking fund, to repay the Demand Notes. Because funds are not set aside periodically for the repayment of the Demand Notes, you must rely on our cash flow from operations and other sources of financing for repayment, such as funds from the sale of the Demand Notes and Debentures and credit facilities, if any. To the extent cash flow from operations and other sources are not sufficient to repay the Demand Notes, you may lose all or a part of your investment.

Risks Related to Our Business

We suffered significant losses during fiscal year 2008 and the first fiscal quarter of 2009 and we anticipate such losses will likely continue throughout 2009.

During fiscal year 2008, our net losses were approximately $12.0 million. During the first quarter of 2009, our net losses were $1.6 million. We anticipate that such significant losses

13

will likely continue throughout 2009.

We suffered significant credit losses in 2008 due to weakening economic conditions, including inflation and rising fuel costs, and there is no guarantee such credit losses will not continue during this downturn in the economy or that our operations and profitability will not continue to be negatively affected.

Because our business consists mainly of making loans to individuals who depend on their earnings to make their repayments, our ability to operate on a profitable basis depends to a large extent on the continued employment of those individuals and their ability to meet their financial obligations as they become due. Inflation, fuel costs and other factors typical of recessionary economic cycles have affected our customers’ disposable income, confidence, and spending patterns and preferences, which in turn are negatively impacting our sales of consumer goods and vehicles and our customers’ ability to repay their obligations to us. As a result, we have increased our provision for credit losses in order to set our allowance for credit losses at a level deemed appropriate by management. For the fiscal year ended September 25, 2008, our provision for credit losses was $13.8 million, an increase of approximately $8.8 million over fiscal year 2007. Accordingly, our allowance for credit losses was $8.9 million as of September 25, 2008. This increase in our provision for credit losses had a negative impact on our operations and profitability. There is no guarantee that we will not continue to suffer such credit loss increases during this downturn in the economy.

Our shareholders’ deficit balance may limit our ability to obtain future financing, which could have a negative effect on our operations and our liquidity.

As of December 25, 2008, we had a shareholders’ deficit of $14,524,930, which means our total liabilities exceed our total assets. Bankruptcy law defines this state of a company’s liabilities exceeding its assets as balance-sheet insolvency. The existence of a shareholders’ deficit may limit our ability to obtain future debt or equity financing. If we are unable to obtain financing in the future, it could have a negative effect on our operations and our liquidity.

Our lack of a significant line of credit could affect our liquidity in the future.

We have operated without a significant line of credit for the past several years. We are constantly analyzing opportunities to obtain a line of credit as an additional source of long-term financing. If we fail to obtain a line of credit, we will be more dependent on the proceeds from the Demand Notes and Debentures for our continued liquidity. If the sale of the Demand Notes and Debentures is significantly curtailed for any reason and we fail to obtain a line of credit, our ability to meet our obligations, including our obligations with respect to the Demand Notes offered hereby, could be materially adversely affected.

The collectability of our finance receivables has been affected by general economic conditions, and we may not be able to recover the full amount of delinquent accounts by resorting to sale of collateral or receipt of non-file insurance proceeds.

Our liquidity is dependent on, among other things, the collection of our finance receivables. We continually monitor the delinquency status of our finance receivables and promptly institute collection efforts on delinquent accounts. Collections of our consumer finance receivables have been affected by general economic conditions. Furthermore, because we do not ordinarily perfect our security interest in collateral for loans, we may not be able to recover

14

the full amount of outstanding receivables by resorting to the sale of collateral or receipt of non-file insurance proceeds.

Our focus towards smaller, shorter-term loans has resulted in a significant decrease in loan volume, which has resulted in a negative effect on our net revenues before retail sales.

In the fiscal year 2006, we modified our business plan to curtail larger, longer-term loans to our customers and to focus on smaller, shorter-term lending. Although our default risk may decrease by this change in focus, we have experienced a decrease in our overall gross loan volume by approximately $11.9 million (11%) from fiscal year 2006. This lower gross loan volume has, in turn, resulted in corresponding decreases in interest income, fees and related charges earned on customers’ loans, as well as decreases in ancillary products being sold to customers, and ultimately, a decrease in sales and profit margin. Accordingly, this change in focus towards smaller, shorter-term loans may continue to result in a negative effect on our net revenues before retail sales.

Our typical customer base has “subprime” credit ratings and is a higher than average credit risk, which could result in increased risk of loan defaults.

We typically lend money to individuals who have difficulty receiving loans from banks and other financial institutions because of credit problems or other adverse financial circumstances. Therefore, we may have a higher risk of loan default among our customers than other lending companies. If we suffer increased loan defaults in any given period, our operations could be materially adversely affected, and we may have difficulty making our principal and interest payments on the Demand Notes.

Hurricanes or other adverse weather events could negatively affect our local economies or cause disruption to our branch office locations, which could have an adverse effect on our business or results of operations.

Our operations are conducted in the States of Georgia, Florida, Alabama and Louisiana, including areas susceptible to hurricanes or tropical storms. See our locations map on page 42 of the prospectus showing that there are several branch office locations in or near coastal towns. Such weather events can disrupt our operations, result in damage to our branch office locations and negatively affect the local economies in which we operate. We cannot predict whether or to what extent future hurricanes will affect our operations or the economies in our market areas, but such weather events could result in a decline in loan originations and an increase in the risk of delinquencies, foreclosures or loan losses. Our business or results of operations may be adversely affected by these and other negative effects of future hurricanes.

Additional competition may decrease our liquidity and profitability, which would adversely affect our ability to repay the Demand Notes.

We compete for business with a number of large national companies and banks that have substantially greater resources, lower cost of funds, and a more established market presence than we have. If these companies increase their marketing efforts to include our market niche of borrowers or if additional competitors enter our markets, we may be forced to reduce our interest rates and fees in order to maintain or expand our market share. Any reduction in our interest rates or fees could have an adverse impact on our liquidity and profitability and our ability to repay the Demand Notes.

15

We have substantial funds held at four financial institutions that exceed the insurance coverage offered by the FDIC, the loss of which would have a severe negative affect on our operations, liquidity and ability to repay our Demand Note obligations.

As of December 25, 2008, we had approximately $2.6 million held in money market and other accounts at four financial institutions (with approximately $2.5 million at one financial institution). Although the FDIC insures deposits in banks and thrift institutions up to $250,000 per eligible account, the amount that we have deposited at these banks substantially exceeds the FDIC insured limit. If any of the financial institutions where we have deposited funds were to fail, we may lose some or all of our deposited funds that exceed the FDIC’s $250,000 insurance coverage limit. Such a loss would have a severe negative affect on our operations, liquidity and ability to repay our Debenture obligations.

We are subject to many laws and governmental regulations, and any changes in these laws or regulations may materially adversely affect our financial condition and business operations.

Our operations are subject to regulation by federal authorities and state banking, finance, consumer protection and insurance authorities and are subject to various laws and judicial and administrative decisions imposing various requirements and restrictions on our operations, which, among other things, require that we obtain and maintain certain licenses and qualifications and limit the interest rates, fees and other charges we may impose in our consumer finance business. Although we believe we are in compliance in all material respects with applicable laws, rules and regulations, we cannot assure you that we are in compliance or that any change in such laws, or in the interpretations thereof, will not make our compliance with such laws more difficult or expensive or otherwise adversely affect our financial condition or business operations.

We are devoting resources to comply with various provisions of the Sarbanes-Oxley Act, including Section 404 relating to internal controls testing and auditor attestation, and this may reduce the resources we have available to focus on our core business.

For fiscal year ended September 25, 2008, we were subject to the requirements of Section 404 of the Sarbanes-Oxley Act, and in order to ensure compliance with the various provisions of the Sarbanes-Oxley Act, evaluated our internal controls over financial reporting to allow management to report on our internal controls systems. Among other things, we may not be able to conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404. Any failure to comply with the various requirements of the Sarbanes-Oxley Act may require significant management time and expenses and divert attention or resources away from our core business.

Beginning no earlier than the fiscal year ending September 25, 2010, our independent registered public accounting firm will attest to our internal controls systems and may not be able or willing to issue a favorable assessment of our internal controls over financial reporting.

We are controlled by the Martin family and do not have any independent board members overseeing our operations.

Our board of directors consists of Bradley D. Bellville, our President, and Jefferey V. Martin. We do not have any independent directors on our board. In addition, the Vance R. Martin Family Trust owns a majority of our outstanding voting common stock. While W. Derek

16

Martin, our former Chairman and brother of Jefferey V. Martin, is no longer an officer or actively involved in our operations, he serves as the sole trustee of the Trust. Therefore, the Martin family will be able to exercise significant control over our affairs, including the election of our directors.

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of federal securities law. Words such as “may,” “will,” “expect,” “anticipate,” “believe,” “estimate,” “continue,” “predict,” or other similar words identify forward-looking statements. Forward-looking statements appear in a number of places in this prospectus, including, without limitation, “Use of Proceeds” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and they include statements regarding our intent, belief or current expectation about, among other things, trends affecting the markets in which we operate, our business, our financial condition and our growth strategies. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially from those predicted in the forward-looking statements as a result of various factors, including those set forth in the “Risk Factors” section of this prospectus. If any of the events described in “Risk Factors” occur, they could have an adverse effect on our business, financial condition and results of operations. When considering forward-looking statements, you should keep these risk factors, as well as the other cautionary statements in this prospectus, in mind. You should not place undue reliance on any forward-looking statement. We are not obligated to update forward-looking statements.

USE OF PROCEEDS

If we sell all of the Demand Notes offered by this prospectus, we estimate that the net proceeds will be approximately $34,385,000 after deduction of estimated offering expenses of $615,000. We will pay all of the expenses related to this offering.

We will receive cash proceeds in varying amounts from time to time as the Demand Notes are sold. Due to our inability to predict with any certainty whatsoever the amount of offering proceeds we will receive from the sale of the Demand Notes or when holders of the Demand Notes will redeem or which holders of the Debentures will redeem at or prior to maturity, we cannot provide any specific allocation of proceeds we will use for any particular purpose. However, we intend to use substantially all of the net offering proceeds in the following order of priority:

| | • | | to redeem (1) debentures listed in the maturity table below and any other debentures and demand notes of our subsidiary, The Money Tree of Georgia Inc., and (2) the Series A Variable Rate Subordinated Debentures, the Demand Notes offered in this offering and Debentures issued by us; |

| | • | | to make interest payments to holders of all of our debentures and demand notes; |

| | • | | to the extent that net proceeds remain and we have adequate cash on hand, to fund the following company activities: |

17

| | ¡ | | to make additional consumer loans; |

| | ¡ | | to fund the purchase of inventory of used cars; |

| | ¡ | | to open new branch office locations; |

| | ¡ | | to acquire loan receivables from competitors; and |

| | ¡ | | for working capital and other general corporate purposes. |

Although we are unable to predict with any certainty when holders of the Demand Notes will redeem or which holders of the Debentures will redeem their Debentures, below is a schedule showing the scheduled maturity dates (i.e., debentures which have reached their extended eight-year maturity dates) of the debentures issued by our subsidiary, The Money Tree of Georgia Inc. over the next several years. We anticipate primarily using net proceeds from this offering of the Demand Notes to fund the below scheduled redemptions of the debentures of our subsidiary, The Money Tree of Georgia Inc., and any other redemptions that occur prior to the scheduled maturity dates.

| | |

| The Money Tree of Georgia Inc. |

| |

Debentures Maturity Schedule | | 8 Year Maturities |

4/2009 thru 12/2009 | | 7,691,000 |

1/2010 thru 12/2010 | | 7,558,000 |

1/2011 thru 12/2011 | | 8,667,000 |

1/2012 thru 12/2012 | | 8,876,000 |

| | |

Total | | 32,792,000 |

There is no minimum number or amount of Demand Notes that we must sell to receive and use the proceeds from the sale of the Demand Notes, and we cannot assure you that all or any portion of the Demand Notes will be sold. In the event that we do not raise sufficient proceeds from our offerings of the Demand Notes and Debentures to adequately fund our operations, we could curtail the amount of funds we loan to our customers and focus on cash collections to increase cash flow. Please see “Risk Factors – Risks Related to Our Offering – We are substantially reliant upon the net offering proceeds we receive from the sale of our debentures and demand notes to meet our liquidity needs,” “Risk Factors – Risks Related to Our Offering – We can provide no assurance that any Demand Notes will be sold or that we will raise sufficient proceeds to carry out our business plans,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources.”

SELECTED CONSOLIDATED FINANCIAL DATA

The following selected consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited consolidated financial statements and related notes included elsewhere in this prospectus. The selected consolidated balance sheet data, as of September 25, 2008 and 2007, and the selected consolidated statement of operations data, for the fiscal years ended September 25, 2008, 2007 and 2006, have been derived from our audited consolidated financial statements and related notes included in this prospectus. The selected consolidated balance sheet data, as of September 25, 2006, 2005 and 2004 and the selected consolidated statement of

18

operations data, for the fiscal years ended September 25, 2005 and 2004, have been derived from our audited financial statements that are not included in this prospectus. The selected consolidated balance sheet data, as of December 25, 2008, and the selected consolidated statement of operations data, for the three months ended December 25, 2008 and 2007, have been derived from our unaudited consolidated financial statements and related notes included in this prospectus. The selected consolidated balance sheet data, as of December 25, 2007, have been derived from our unaudited consolidated financial statements that are not included in this prospectus.

The unaudited financial statements include, in the opinion of management, all adjustments, consisting only of normal, recurring adjustments, that management considers necessary for a fair statement of the results for those aforementioned periods. The historical results are not necessarily indicative of results to be expected in any future period, and the results for the three months ended December 25, 2008 should not be considered indicative of results expected for the full fiscal year.

[Remainder of this page intentionally left blank]

19

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As of, and for, the Three

Months Ended December 25, | | | As of, and for, the Fiscal Year Ended September 25, | |

| | | 2008 | | | 2007 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | | | 2004 | |

| | | | | | | | | (in thousands except ratios) | | | | | | | |

| | | | | | | |

Interest and fee income | | $ | 4,594 | | | $ | 4,988 | | | $ | 19,280 | | | $ | 19,481 | | | $ | 20,048 | | | $ | 18,843 | | | $ | 17,052 | |

Interest expense | | | (1,917 | ) | | | (2,065 | ) | | | (8,275 | ) | | | (8,026 | ) | | | (7,350 | ) | | | (6,355 | ) | | | (5,848 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest and fee income before provision for credit losses | | | 2,677 | | | | 2,923 | | | | 11,005 | | | | 11,455 | | | | 12,698 | | | | 12,488 | | | | 11,204 | |

Provision for credit losses | | | (2,234 | ) | | | (2,043 | ) | | | (13,812 | ) | | | (4,983 | ) | | | (4,737 | ) | | | (2,768 | ) | | | (2,923 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest and fee income (loss) after provision for credit losses | | | 443 | | | | 880 | | | | (2,807 | ) | | | 6,472 | | | | 7,961 | | | | 9,720 | | | | 8,281 | |

Insurance commissions | | | 2,565 | | | | 2,563 | | | | 9,615 | | | | 10,120 | | | | 11,263 | | | | 10,490 | | | | 6,477 | |

Commissions from motor club memberships(1) | | | 464 | | | | 512 | | | | 1,844 | | | | 1,947 | | | | 1,957 | | | | 1,475 | | | | 1,995 | |

Delinquency fees | | | 403 | | | | 412 | | | | 1,720 | | | | 1,776 | | | | 1,565 | | | | 1,676 | | | | 1,638 | |

Income tax service income(2) | | | - | | | | - | | | | - | | | | 3 | | | | 83 | | | | 162 | | | | 400 | |

Other income | | | 133 | | | | 152 | | | | 647 | | | | 748 | | | | 689 | | | | 797 | | | | 496 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net revenues before retail sales | | | 4,008 | | | | 4,519 | | | | 11,019 | | | | 21,066 | | | | 23,518 | | | | 24,320 | | | | 19,287 | |

Retail sales | | | 4,594 | | | | 5,035 | | | | 17,164 | | | | 19,002 | | | | 17,972 | | | | 15,061 | | | | 14,360 | |

Cost of sales | | | (2,980 | ) | | | (3,078 | ) | | | (11,131 | ) | | | (12,170 | ) | | | (11,611 | ) | | | (9,358 | ) | | | (9,401 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross margin on retail sales | | | 1,614 | | | | 1,957 | | | | 6,033 | | | | 6,832 | | | | 6,361 | | | | 5,703 | | | | 4,959 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net revenues | | | 5,622 | | | | 6,476 | | | | 17,052 | | | | 27,898 | | | | 29,879 | | | | 30,023 | | | | 24,246 | |

Operating expenses | | | (7,251 | ) | | | (6,831 | ) | | | (28,469 | ) | | | (27,604 | ) | | | (29,151 | ) | | | (29,205 | ) | | | (24,854 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net operating income (loss) | | | (1,629 | ) | | | (355 | ) | | | (11,417 | ) | | | 294 | | | | 728 | | | | 818 | | | | (608 | ) |

Other non-operating income | | | - | | | | - | | | | - | | | | - | | | | 151 | | | | - | | | | - | |

Loss on sale of property and equipment | | | - | | | | (15 | ) | | | (21 | ) | | | (19 | ) | | | (75 | ) | | | (81 | ) | | | (31 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | (1,629 | ) | | | (370 | ) | | | (11,438 | ) | | | 275 | | | | 804 | | | | 737 | | | | (639 | ) |

Income tax (expense) benefit | | | - | | | | (210 | ) | | | (528 | ) | | | 101 | | | | (274 | ) | | | (304 | ) | | | 208 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (1,629 | ) | | $ | (580 | ) | | $ | (11,966 | ) | | $ | 376 | | | $ | 530 | | | $ | 433 | | | $ | (431 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of earnings to fixed charges(3) | | | (4 | ) | | | (4 | ) | | | (4 | ) | | | 1.03 | | | | 1.10 | | | | 1.10 | | | | (4 | ) |

| | | | | | | |

Cash and cash equivalents | | $ | 5,260 | | | $ | 16,292 | | | $ | 12,541 | | | $ | 17,854 | | | $ | 12,920 | | | $ | 9,619 | | | $ | 8,373 | |

Finance receivables(5) | | | 75,813 | | | | 81,729 | | | | 76,606 | | | | 79,549 | | | | 79,797 | | | | 77,292 | | | | 65,066 | |

Allowance for credit losses | | | (8,599 | ) | | | (4,308 | ) | | | (8,876 | ) | | | (3,711 | ) | | | (3,139 | ) | | | (2,632 | ) | | | (2,056 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Finance receivables, net | | | 67,214 | | | | 77,421 | | | | 67,730 | | | | 75,838 | | | | 76,658 | | | | 74,660 | | | | 63,010 | |

Other receivables | | | 1,904 | | | | 1,116 | | | | 957 | | | | 863 | | | | 1,013 | | | | 1,099 | | | | 4,904 | |

Inventory | | | 2,766 | | | | 2,846 | | | | 3,167 | | | | 3,057 | | | | 2,195 | | | | 2,402 | | | | 2,293 | |

Property and equipment, net | | | 4,824 | | | | 4,147 | | | | 4,906 | | | | 4,220 | | | | 4,581 | | | | 4,850 | | | | 4,657 | |

Total assets | | | 84,378 | | | | 105,681 | | | | 91,800 | | | | 105,784 | | | | 101,487 | | | | 96,005 | | | | 86,091 | |

Senior debt | | | 423 | | | | 630 | | | | 695 | | | | 512 | | | | 669 | | | | 1,186 | | | | 2,062 | |

Senior subordinated debt | | | - | | | | - | | | | - | | | | - | | | | 600 | | | | 1,000 | | | | 700 | |

Subordinated debt, related parties | | | - | | | | - | | | | - | | | | - | | | | 370 | | | | 800 | | | | 800 | |

Debentures(6) | | | 77,411 | | | | 82,147 | | | | 82,209 | | | | 81,861 | | | | 77,910 | | | | 68,905 | | | | 61,582 | |

Demand notes(6) | | | 3,212 | | | | 5,063 | | | | 3,658 | | | | 5,991 | | | | 8,137 | | | | 12,867 | | | | 11,702 | |

Shareholders’ deficit | | $ | (14,525 | ) | | $ | (1,510 | ) | | $ | (12,896 | ) | | $ | (930 | ) | | $ | (1,305 | ) | | $ | (1,835 | ) | | $ | (2,268 | ) |

(1) | Received from Interstate Motor Club, Inc., an affiliated entity. |

(2) | Received from Cash Check Inc. of Ga., a previously affiliated entity that was dissolved in December 2007. |

(3) | The ratio of earnings to fixed charges represents the number of times fixed charges are covered by earnings. For purposes of this ratio, “earnings” is determined by adding pre-tax income to “fixed charges,” which consists of interest on all indebtedness and an interest factor attributable to rent expense. |

(4) | Calculation results in a deficiency in the ratio (i.e., less than one-to-one coverage). The deficiency in earnings to cover fixed charges was $1,628,864 for the three months ended December 25, 2008; $370,244 for the three months ended December 25, 2007; $638,918 for the year ended September 25, 2004 and $11,438,560 for the year ended September 25, 2008. |

(5) | Net of unearned insurance commissions, unearned finance charges and unearned discounts. |

(6) | Issued, in part, by our subsidiary, The Money Tree of Georgia Inc. See Note 8 to our audited financial statements for the year ended September 25, 2008. |

20

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the information under “Selected Consolidated Financial Data” and our audited consolidated financial statements and related notes and other financial data included elsewhere in this prospectus.

Overview

We make consumer finance loans and provide other financial products and services through our branch offices in Georgia, Alabama, Louisiana and Florida. We sell retail merchandise, principally furniture, appliances and electronics, at certain of our branch office locations and operate three used automobile dealerships in the State of Georgia. We also offer insurance products, prepaid phone services and automobile club memberships to our loan customers.

We fund our consumer loan demand through a combination of cash collections from our consumer loans, proceeds raised from the sale of debentures and demand notes and loans from various banks and other financial institutions. Our consumer loan business consists of making, purchasing and servicing direct consumer loans, consumer sales finance contracts and motor vehicle installment sales contracts. Direct consumer loans generally serve individuals with limited access to other sources of consumer credit, such as banks, savings and loans, other consumer finance businesses and credit cards. Direct consumer loans are general loans made typically to people who need money for some unusual or unforeseen expense, for the purpose of paying off an accumulation of small debts or for the purchase of furniture and appliances. The following table sets forth certain information about the components of our finance receivables for the periods presented:

| | | | | | | | | | | | | | | | | | | | |

| | | As of, or for, the Three Months

Ended December 25, | | | As of, or for, the Year Ended September 25, | |

| | | 2008 | | | 2007 | | | 2008 | | | 2007 | | | 2006 | |

Direct Consumer Loans: | | | | | | | | | | | | | | | | | | | | |

Number of Loans Made to New Borrowers | | | 15,666 | | | | 5,498 | | | | 27,770 | | | | 20,838 | | | | 22,068 | |

Number of Loans Made to Former Borrowers | | | 12,441 | | | | 15,162 | | | | 57,862 | | | | 55,117 | | | | 54,794 | |

Number of Loans Made to Existing Borrowers | | | 13,794 | | | | 20,660 | | | | 85,329 | | | | 110,364 | | | | 98,386 | |

Total Number of Loans Made | | | 41,901 | | | | 41,320 | | | | 170,961 | | | | 186,319 | | | | 175,248 | |

Total Volume of Loans Made | | $ | 15,792,769 | | | $ | 19,941,082 | | | $ | 66,766,194 | | | $ | 73,350,400 | | | $ | 81,634,461 | |

Average Size of Loans Made | | $ | 377 | | | $ | 483 | | | $ | 391 | | | $ | 394 | | | $ | 466 | |

Number of Loans Outstanding | | | 68,072 | | | | 78,905 | | | | 66,862 | | | | 76,284 | | | | 73,440 | |

Total of Loans Outstanding* | | $ | 33,498,425 | | | $ | 41,477,349 | | | $ | 34,859,944 | | | $ | 40,719,291 | | | $ | 46,071,669 | |

Percent of Loans Outstanding | | | 41.4 | % | | | 46.1 | % | | | 42.3 | % | | | 46.6 | % | | | 51.7 | % |

Average Balance on Outstanding Loans | | $ | 492 | | | $ | 526 | | | $ | 521 | | | $ | 534 | | | $ | 627 | |

| | | | | |

Motor Vehicle Installment Sales Contracts: | | | | | | | | | | | | | | | | | | | | |

Total Number of Contracts Made | | | 184 | | | | 190 | | | | 763 | | | | 977 | | | | 964 | |

Total Volume of Contracts Made | | $ | 3,323,862 | | | $ | 3,496,254 | | | $ | 14,217,234 | | | $ | 17,965,678 | | | $ | 17,425,293 | |

Average Size of Contracts Made | | $ | 18,064 | | | $ | 18,401 | | | $ | 18,633 | | | $ | 18,389 | | | $ | 18,076 | |

Number of Contracts Outstanding | | | 2,703 | | | | 2,799 | | | | 2,726 | | | | 2,798 | | | | 2,550 | |

Total of Contracts Outstanding* | | $ | 30,260,514 | | | $ | 31,895,347 | | | $ | 30,707,329 | | | $ | 32,259,968 | | | $ | 31,280,840 | |

Percent of Total Loans and Contracts | | | 37.4 | % | | | 35.5 | % | | | 37.3 | % | | | 36.9 | % | | | 35.1 | % |

Average Balance on Outstanding Contracts | | $ | 11,195 | | | $ | 11,395 | | | $ | 11,265 | | | $ | 11,530 | | | $ | 12,267 | |

21

| | | | | | | | | | | | | | | | | | | | |

| | | As of, or for, the Three Months

Ended December 25, | | | As of, or for, the Year Ended September 25, | |

| | | 2008 | | | 2007 | | | 2008 | | | 2007 | | | 2006 | |

| | | | | |

Consumer Sales Finance Contracts: | | | | | | | | | | | | | | | | | | | | |

Number of Contracts Made to New Customers | | | 860 | | | | 38 | | | | 865 | | | | 137 | | | | 124 | |

Number of Loans Made to Former Customers | | | 30 | | | | 1,008 | | | | 3,161 | | | | 2,684 | | | | 2,250 | |

Number of Loans Made to Existing Customers | | | 1,104 | | | | 1,097 | | | | 3,211 | | | | 3,120 | | | | 2,432 | |

Total Contracts Made | | | 1,994 | | | | 2,143 | | | | 7,237 | | | | 5,941 | | | | 4,806 | |

Total Volume of Contracts Made | | $ | 5,902,407 | | | $ | 6,421,213 | | | $ | 18,883,178 | | | $ | 16,869,906 | | | $ | 12,749,329 | |

Number of Contracts Outstanding | | | 7,439 | | | | 7,638 | | | | 7,532 | | | | 7,067 | | | | 6,310 | |

Total of Contracts Outstanding* | | $ | 17,222,368 | | | $ | 16,543,773 | | | $ | 16,793,743 | | | $ | 14,466,682 | | | $ | 11,813,566 | |

Percent of Total Loans and Contracts | | | 21.3 | % | | | 18.4 | % | | | 20.4 | % | | | 16.5 | % | | | 13.2 | % |

Average Balance of Outstanding Contracts | | $ | 2,315 | | | $ | 2,166 | | | $ | 2,230 | | | $ | 2,047 | | | $ | 1,872 | |

* Contracts outstanding are exclusive of the following aggregate amounts of bankrupt accounts: $7,123,854 as of December 25, 2008; $6,367,294 as of December 25, 2007; $6,794,358 as of September 25, 2008; $6,115,375 as of September 25, 2007; and $5,618,931 as of September 25, 2006.

Below is a table showing our total gross outstanding finance receivables and bankrupt accounts:

| | | | | | | | | | | | | | | |

| | | As of

December 25,

2008 | | As of

December 25,

2007 | | As of

September 25,

2008 | | As of

September 25,

2007 | | As of

September 25,

2006 |

Total Loans and Contracts Outstanding (gross): | | | | | | | | | | | | | | | |

| | | | | |

Direct Consumer Loans | | $ | 33,498,425 | | $ | 41,477,349 | | $ | 34,859,944 | | $ | 40,719,291 | | $ | 46,071,669 |

Motor Vehicle Installment | | | 30,260,514 | | | 31,895,347 | | | 30,707,329 | | | 32,259,968 | | | 31,280,840 |

Consumer Sales Finance | | | 17,222,368 | | | 16,543,773 | | | 16,793,743 | | | 14,466,682 | | | 11,813,566 |

Bankrupt Accounts | | | 7,123,584 | | | 6,367,294 | | | 6,794,358 | | | 6,115,375 | | | 5,618,931 |

| | | | | | | | | | | | | | | |

Total Gross Outstanding | | $ | 88,104,891 | | $ | 96,283,763 | | $ | 89,155,374 | | $ | 93,561,316 | | $ | 94,785,006 |

| | | | | | | | | | | | | | | |

Below is a roll-forward of the balance of each category of our outstanding finance receivables. Loans originated reflect the gross amount of loans made or purchased during the period presented inclusive of pre-computed interest, fees and insurance premiums. Collections represent cash receipts in the form of repayments made on our loans as reflected in our Consolidated Statements of Cash Flows. Refinancings represent the amount of the pay off of loans refinanced. Charge offs represent the gross amount of loans charged off as uncollectible (charge offs are shown net of non-file insurance receipts in our Allowance for Credit Losses). Rebates represent reductions to gross loan amounts of precomputed interest and insurance premiums resulting from loans refinanced and other loans paid off before maturity. Other adjustments primarily represent accounts transferred to and from the department that administers bankrupt accounts.

22

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months

Ended

December 25,

2008 | | | Three Months

Ended

December 25,

2007 | | | Fiscal Year

Ended

September 25,

2008 | | | Fiscal Year

Ended

September 25,

2007 | | | Fiscal Year

Ended

September 25,

2006 | |

Direct Consumer Loans: | | | | | | | | | | | | | | | | | | | | |

Balance – beginning | | $ | 34,859,944 | | | $ | 40,719,291 | | | $ | 40,719,291 | | | $ | 46,071,669 | | | $ | 48,840,570 | |

Loans originated | | | 15,792,769 | | | | 19,941,082 | | | | 66,766,194 | | | | 73,350,400 | | | | 81,634,461 | |

Collections | | | (10,694,706 | ) | | | (12,145,282 | ) | | | (47,076,723 | ) | | | (52,252,511 | ) | | | (57,356,295 | ) |

Refinancings | | | (3,424,774 | ) | | | (4,639,566 | ) | | | (14,791,503 | ) | | | (18,154,981 | ) | | | (16,545,531 | ) |

Charge offs, gross | | | (2,111,910 | ) | | | (1,393,669 | ) | | | (7,357,665 | ) | | | (4,066,752 | ) | | | (4,753,034 | ) |

Rebates/other adjustments | | | (922,898 | ) | | | (1,004,507 | ) | | | (3,399,650 | ) | | | (4,228,534 | ) | | | (5,748,502 | ) |

| | | | | | | | | | | | | | | | | | | | |

Balance – end | | $ | 33,498,425 | | | $ | 41,477,349 | | | $ | 34,859,944 | | | $ | 40,719,291 | | | $ | 46,071,669 | |

Consumer Sales Finance Contracts: | | | | | | | | | | | | | | | | | | | | |

Balance – beginning | | $ | 16,793,743 | | | $ | 14,466,682 | | | $ | 14,466,682 | | | $ | 11,813,566 | | | $ | 9,661,474 | |

Loans originated | | | 5,902,407 | | | | 6,421,213 | | | | 18,883,178 | | | | 16,869,906 | | | | 12,749,329 | |

Collections | | | (1,881,695 | ) | | | (1,619,504 | ) | | | (7,267,346 | ) | | | (6,058,209 | ) | | | (5,003,968 | ) |

Refinancings | | | (1,879,975 | ) | | | (1,783,135 | ) | | | (5,460,970 | ) | | | (4,993,560 | ) | | | (3,527,789 | ) |

Charge offs, gross | | | (1,229,080 | ) | | | (238,958 | ) | | | (1,862,589 | ) | | | (1,110,556 | ) | | | (513,941 | ) |

Rebates/other adjustments | | | (483,032 | ) | | | (702,525 | ) | | | (1,965,212 | ) | | | (2,054,465 | ) | | | (1,551,539 | ) |

| | | | | | | | | | | | | | | | | | | | |

Balance – end | | $ | 17,222,368 | | | $ | 16,543,773 | | | $ | 16,793,743 | | | $ | 14,466,682 | | | $ | 11,813,566 | |

Motor Vehicle Installment Sales Contracts: | | | | | | | | | | | | | | | | | | | | |