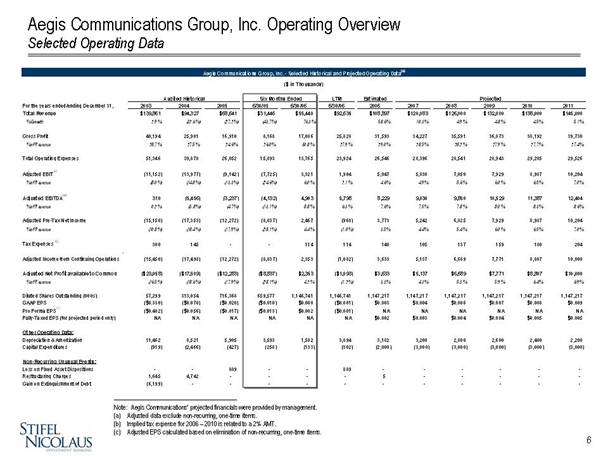

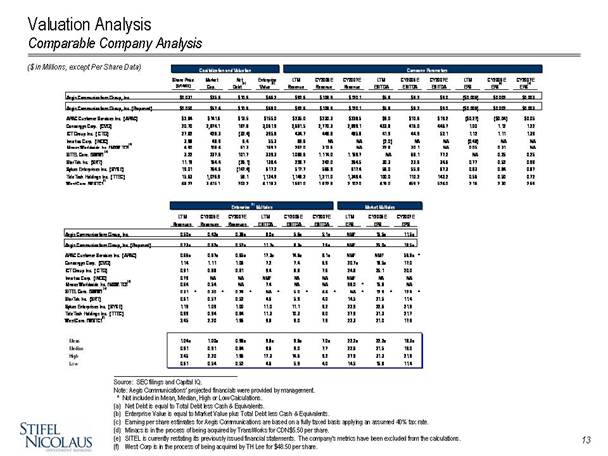

Aegis Communications Group, Inc. Operating Overview Selected Operating Data ________________ Note: Aegis Communications’ projected financials were provided by management. (a) Adjusted data exclude non-recurring, one-time items. (b) Implied tax expense for 2006 – 2010 is related to a 2% AMT. (c) Adjusted EPS calculated based on elimination of non-recurring, one-time items. Aegis Communications Group, Inc. - Selected Historical and Projected Operating Data (a) ($ in Thousands) Audited Historical Six Months Ended LTM Estimated Projected For the years ended/ending December 31, 2003 2004 2005 6/30/05 6/30/06 6/30/06 2006 2007 2008 2009 2010 2011 Total Revenue $139,861 $94,327 $68,641 $31,446 $55,440 $92,635 $108,897 $120,083 $126,000 $132,000 $138,000 $145,000 % Growth 2.9% (32.6%) (27.2%) (43.7%) 76.3% 58.6% 10.3% 4.9% 4.8% 4.5% 5.1% Gross Profit 40,194 25,901 16,910 8,168 17,086 25,828 31,593 34,227 35,591 36,873 38,192 39,730 % of Revenue 28.7% 27.5% 24.6% 26.0% 30.8% 27.9% 29.0% 28.5% 28.2% 27.9% 27.7% 27.4% Total Operating Expenses 51,346 39,878 26,052 15,893 13,765 23,924 26,546 28,396 28,541 28,943 29,205 29,526 Adjusted EBIT (a) (11,152) (13,977) (9,142) (7,725) 3,321 1,904 5,047 5,830 7,050 7,929 8,987 10,204 % of Revenue (8.0%) (14.8%) (13.3%) (24.6%) 6.0% 2.1% 4.6% 4.9% 5.6% 6.0% 6.5% 7.0% Adjusted EBITDA (a) 310 (5,456) (3,237) (4,132) 4,903 5,798 8,229 9,030 9,850 10,529 11,387 12,404 % of Revenue 0.2% (5.8%) (4.7%) (13.1%) 8.8% 6.3% 7.6% 7.5% 7.8% 8.0% 8.3% 8.6% Adjusted Pre-Tax Net Income (15,150) (17,353) (12,272) (8,837) 2,467 (968) 3,773 5,242 6,825 7,929 8,987 10,204 % of Revenue (10.8%) (18.4%) (17.9%) (28.1%) 4.4% (1.0%) 3.5% 4.4% 5.4% 6.0% 6.5% 7.0% Tax Expenses (b) 300 145 - - 114 114 140 105 137 159 180 204 . Adjusted Income from Continuing Operations (15,450) (17,498) (12,272) (8,837) 2,353 (1,082) 3,633 5,137 6,689 7,771 8,807 10,000 Adjusted Net Profit available to Common ($23,058) ($17,509) ($12,283) ($8,837) $2,353 ($1,093) $3,633 $5,137 $6,689 $7,771 $8,807 $10,000 % of Revenue (16.5%) (18.6%) (17.9%) (28.1%) 4.2% (1.2%) 3.3% 4.3% 5.3% 5.9% 6.4% 6.9% Diluted Shares Outstanding (000s) 57,299 313,054 716,368 659,577 1,146,741 1,146,741 1,147,217 1,147,217 1,147,217 1,147,217 1,147,217 1,147,217 GAAP EPS ($0.330) ($0.070) ($0.020) ($0.010) $0.000 ($0.001) $0.003 $0.004 $0.006 $0.007 $0.008 $0.009 Pro Forma EPS (c) ($0.402) ($0.056) ($0.017) ($0.013) $0.002 ($0.001) NA NA NA NA NA NA Fully-Taxed EPS (for projected period only) NA NA NA NA NA NA $0.002 $0.003 $0.004 $0.004 $0.005 $0.005 Other Operating Data: Depreciation & Amortization 11,462 8,521 5,905 3,593 1,582 3,894 3,182 3,200 2,800 2,600 2,400 2,200 Capital Expenditures (919) (2,466) (427) (258) (133) (302) (2,000) (3,000) (3,000) (3,000) (3,000) (3,000) Non-Recurring Unusual Events: Loss on Fixed Asset Dispositions - - 889 - - 889 - - - - - - Restructuring Charges 1,645 4,742 - - - - 5 - - - - - Gain on Extinguishment of Debt (6,199) - - - - - - - - - - - |