As filed with the Securities and Exchange Commission on October 22, 2007

RegistrationNo. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AUSAM ENERGY CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| | | | | |

| Alberta, Canada | | 1311 | | 98-0552537 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

1430, 1122 — 4th Street S.W.

Calgary, Alberta T2R 1M1

(403) 215-2380

(Address, Including Zip Code, and Telephone Number, including Area Code, of Registrant’s Principal Executive Offices)

Mark G. Avery, Chief Executive Officer and President

Ausam Energy Corporation

1430, 1122 — 4th Street S.W.

Calgary, Alberta T2R 1M1

(403) 215-2380

(NAME, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

T. Mark Kelly

Vinson & Elkins L.L.P.

1001 Fannin, Suite 2300

Houston, Texas 77002

(713) 758-2222

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

| | | | | | | | | | | | | |

| | | | | | | Proposed Maximum

| | | Proposed Maximum

| | | |

Title of Each Class of

| | | Amount to be

| | | Offering Price per

| | | Aggregate

| | | |

| Securities to be Registered | | | Registered(1) | | | Share(2) | | | Offering Price(1)(2) | | | Amount of Registration Fee |

| Common shares, without par value | | | 53,096,202 | | | $2.56 | | | $135,926,277 | | | $4,173 |

| | | | | | | | | | | | | |

| | |

| (1) | | Includes (i) 10,148,161 common shares issuable upon exercise of warrants at various exercise prices; (ii) 9,700,453 common shares to be issued upon conversion of the registrant’s outstanding convertible debenture; (iii) up to 2,879,251 additional common shares to be issued upon exercise of options at various exercise prices; and (iv) 30,368,337 outstanding common shares. |

| |

| (2) | | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933 based on the average of the high and low prices of the Registrant’s common shares, as reported on the TSX Venture Exchange on October 19, 2007, and translated into U.S. dollars at the exchange rate of $1.00 = CDN$0.97448, which was the exchange rate in effect on October 19, 2007. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

Subject to Completion, dated October 22, 2007

PROSPECTUS

53,096,202 Shares

Ausam Energy Corporation

Common Shares

This prospectus relates to the offer and sale, from time to time, of up to 53,096,202 common shares (“Common Shares”) of Ausam Energy Corporation, an Alberta corporation, held by or issuable to the selling shareholders listed on page 55 of this prospectus. The Common Shares being offered by the selling shareholders are currently issued and outstanding, issuable upon conversion of outstanding convertible debt securities, issuable upon exercise of outstanding options, or issuable upon exercise of outstanding warrants. See “Selling Shareholders”. Ausam will not receive any proceeds from the sale of the shares by the selling shareholders. All the proceeds from the sale of shares will be for the respective account of each selling shareholder.

For a description of the plan of distribution of the shares, please see page 61 of this prospectus.

Our Common Shares are listed on the TSX Venture Exchange (the “TSXV”) under the symbol “AZE” and we plan to file an application to list our Common Shares in the United States on the American Stock Exchange (“AMEX”), although we cannot be certain that the AMEX will approve our application. On October 19, 2007 the last reported sale price for our common shares on the TSX Venture Exchange was CDN$2.50, or $2.56. At present there is no established public trading market in the United States for our Common Shares.

Investing in our Common Shares involves risks. Please read “Risk Factors” beginning on page 4.

This prospectus has not been filed in respect of, and will not qualify, any distribution of the Common Shares in any province or territory of Canada.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

, 2007

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only. Our business, financial condition, results of operations and prospects may have changed since that date.

Unless otherwise specified or the context otherwise requires, all dollar amounts in this prospectus are expressed in U.S. dollars. Canadian dollars, when used, are expressed with the symbol “CDN$”. Australian dollars, when used, are expressed with the symbol “AU$.” Unless otherwise specified, where dollars are shown on a converted basis, the conversion is based upon an exchange ratio of $1.00 = CDN$0.97448, the exchange rate in effect on October 19, 2007, except for dollars set forth in or derived from the financial statements, where the exchange rate is derived as of the date of the financial statements.

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including the detailed information contained under the heading “Risk Factors”, the consolidated financial statements and the accompanying notes to those financial statements included elsewhere in this prospectus. Unless otherwise indicated or required by the context, (i) “we”, “us”, and “our” refer to Ausam Energy Corporation and its subsidiaries and predecessors, (ii) “SKH Purchase” refers to our February 2007 acquisition from SKH Management L.P. and four affiliated investment partnerships (“SKH” or the “Vendors”) of approximately 60,158 acres (46,852 net acres) controlling 19 prospects in the United States (the “SKH Prospects”), (iii) “Debenture” refers to our 9% senior secured convertible debenture, (iv) “warrants” refers to the warrants to purchase Common Shares issued to investors in connection with certain financing transactions or to our placement agents in connection with the offering of Common Shares, convertible debentures and certain other debt securities as partial compensation for their services, (v) all dollar amounts appearing in this prospectus are stated in U.S. dollars unless specifically noted in Canadian dollars (“CDN$”) or Australian dollars (“AU$”), and (vi) all financial data included in this prospectus has been prepared in accordance with generally accepted accounting principles in the United States unless otherwise specifically noted. We have provided definitions for some of the natural gas and oil industry terms used in this prospectus in the “Glossary of Natural Gas and Oil Terms” onpage A-1 of this prospectus.

AUSAM ENERGY CORPORATION

Our Business

We have been engaged in oil and natural gas development and exploration in Australia since January 2000. Our initial strategy was to acquire prospective acreage, develop discrete prospects and apply underbalanced drilling and completion techniques (“UBD”), to specific hydrocarbon prone formations in known onshore oil and gas provinces of Australia. Our plan developed to include the identification of producing fields that would be suited to UBD, gain control of, or participate in, the target fields and adjacent acreage; and then apply UBD to those features with certain formation and field characteristics. Pursuing this plan, we assembled approximately 800,000 net acres in the highly prospective Surat/Bowen Basin of Queensland, Australia. Through a reverse takeover of Northlinks Limited on the TSX Venture Exchange (“TXSV”) and a series of private placements, we raised more than CDN$24 million at prices ranging from CDN$0.75 to CDN$0.90 per pre-consolidation common share (or in certain cases, units), which included subscriptions for units from Wellington Management, Brickburn Capital, Front Street Capital, and Crestview Capital, as well as several private investors with a legacy of oil and gas experience. We used the majority of the capital to drill 15 wells in Australia, but until 2006 with non-commercial results.

During late 2005, we were offered opportunities for us to invest in, or participate with,and/or acquire certain companies and assets owned or controlled by specific founding shareholders (the “Founders”). The Founders could be described as members of families that have been in the oil business for generations and who have long-standing relationships in the Texas oil and gas community. One of these Founders, who is also an investor in SKH, proposed the SKH transaction to us. After a thorough evaluation of the portfolio of prospects owned by SKH, we determined that the SKH Prospects clearly offered diversity of risk and potential up-side that far exceed the potential returns offered by the opportunities in Australia.

In early 2006, management and our board of directors decided to seek financing to acquire the SKH Prospects and so reposition our company for exploration and production in the United States onshore Gulf Coast. We recently completed a series of private financing transactions, including the issuance of the Debenture, that were specifically designed to permit us to initiate this new strategy by consummating the SKH Purchase and drilling the prospects thereby acquired.

1

Our Strategy

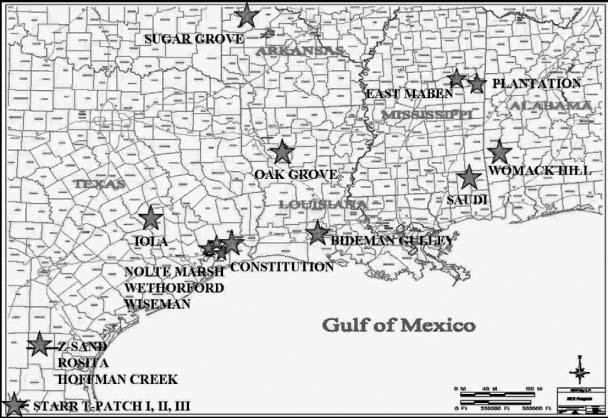

The completion of the SKH Purchase represents a significant change in our strategy. We now have a diverse suite of prospects representing a number of different play types and risk profiles along the United States Gulf Coast that are well suited to conventional drilling, instead of pursuing the application of advanced drilling techniques in Australia. We intend initially to concentrate on developing the lower-risk prospects in the United States in order to establish cash flow either from operations or from the sale of developed prospects to third parties. At the same time, we are marketing the larger higher-risk prospects to parties with localized expertise with the objective of accelerating the drilling timetable of potentially high impact prospects while risk adjusting our participation interest, and exposure to drilling risk, per prospect.

Further, given that we now own 20 prospects in the United States, 18 of which we own approximately 100% interest in, we are in a position to trade percentage interests in our prospects for interests in other prospects, resulting in more prospects and reduced risk. We intend to operate some, but not all, of the SKH Prospects, enabling us to recover a portion of our overhead and administrative costs. Due to our ongoing relationship with SKH as described below under “Business — The SKH Purchase”, we will have access to additional prospects that we may elect to acquire under commercial industry terms. In addition, we expect to evaluate prospects brought to us from time to time by third parties, including our shareholders, and acquire those we deem attractive.

Additional funds would be required if we pursued the entire 20 prospect drilling program at our current participation interest as outlined above. We do not intend or expect to maintain 100% ownership in any of our United States properties and we are actively seeking industry partners. Actual drilling results as well as the evaluation of and participation in other drilling opportunities will change the scope and timing of our plans. We intend to closely manage the timing and participation interest of our drilling program in order to optimize the use of existing funds. Given the scope of the proposed drilling program and the opportunities owned by us we expect that additional funds will be required.

In order to fund the initial development of our prospects, we have entered into an agreement, described in “Recent Developments” below, which provided us with a source of additional financing. This financing, by itself, will not be sufficient to fund our entire proposed drilling program. The funds we have on hand together with funds expected to be received from farmout arrangements are considered by management to be sufficient to finance the majority of the short term drilling and exploration program as well as operating expenses.

In the event our drilling program results in commercial quantities of natural gas and oil, we will need to obtain additional funds for processing facilities and infrastructure. We cannot be certain we will be able to raise additional funds through equity or debt offerings on terms that are satisfactory to the shareholders, the Debenture holder, or management.

Recent Developments

On July 5, 2007, we issued a $25,000,000 (equivalent to CDN$26,500,000 at the then-current exchange rate of $1=CDN$1.06) 9% senior secured convertible debenture due July 3, 2012 (the “Debenture”) and an aggregate of 4,461,100 warrants (the “Debenture Warrants”) to the Huff Energy Fund L.P. (“Huff”). The principal amount of the Debenture is convertible into Common Shares at CDN$3.00 per Common Share (after the September 2007 consolidation described below), subject to adjustment of the conversion price under certain conditions. The Debenture Warrants may be exercised to purchase Common Shares until the close of business on July 3, 2012 at a price of CDN$3.00 per Common Share (as adjusted for the September 2007 consolidation described below), subject to adjustment of the conversion price under certain conditions. Also, Huff received 190,968 Common Shares as a commitment fee.

In connection with this transaction (the “Huff Transaction”), Huff was granted registration rights with respect to the Common Shares issued to it in the transaction and the Common Shares which Huff may acquire upon exercise of its Debenture Warrants and conversion of the Debenture. Under the terms of the Debenture, we may pay the interest due for any period ending on or prior to June 29, 2009 by a deemed increase in the principal amount of the Debenture. If we do this, the Debenture would be convertible into 9,700,453 Common

2

Shares on June 30, 2009 assuming current exchange rates. If our Common Shares become listed on the AMEX and the trading volume there is greater than on the TSXV, the exchange rate becomes fixed at CDN$1=0.9340 resulting in a significantly higher number of Common Shares being issued upon conversion of the Debenture.

On July 8, 2007, we redeemed 3,333,333 First Preferred Shares, Series 2, which were all of the preferred shares that were then issued and outstanding. Under the terms of issuance, the First Preferred Shares, Series 2, were redeemed for $3.00 per share. Mr. William Hitchcock, chairman of our board of directors, held 1,666,666 of the First Preferred Shares, Series 2.

On September 7, 2007, we raised $677,080 through the sale of units at a price of $2.70 per unit, each such unit being comprised of one Common Share and one half of one warrant (the “Common Unit Warrants”). The Common Unit Warrants may be exercised to purchase Common Shares at a price of CDN$3.25 per Common Share (after the September 2007 consolidation described below) for two years from the date of issuance.

On September 26, 2007, all issued and outstanding Common Shares were consolidated on a basis of one new Common Share for each five previously issued and outstanding Common Shares. At the same time, the symbol under which we trade on the TSXV was changed from “AUZ” to “AZE.”

On September 30, 2007, the principal amount of the Debenture is deemed to have increased by $556,250 as payment of the quarterly interest due, increasing the Debenture Amount to $25,556,250.

Corporate Information

We are a public oil and gas exploration and production company trading on the TSXV under the symbol “AZE”, with oil and gas properties and operations in the United States and Australia. On July 30, 2004, through a reverse takeover (the “RTO”), we acquired all of the outstanding shares of Ausam Resources Pty Ltd. (“ARL”), an Australian unlisted public oil and gas company, and subsequently became a listed Canadian based oil and gas company. During 2006, we drilled and participated in four wells in Australia and on September 22, 2006 we executed an agreement relating to the acquisition of certain oil and gas leases (the “Leases”) containing the SKH Prospects. On February 8, 2007, we closed the SKH Purchase and also closed financing transactions aggregating approximately $46 million. On July 5, 2007 we closed the Huff Transaction involving the issuance of the Debenture. To date during 2007, we have participated in two wells in the United States and five wells in Australia.

Risk Factors

Although we are optimistic about the potential results from drilling the SKH Prospects, we do not have significant established oil and gas reserves and we have never made a profit. Although we intend to exert efforts to make profits in the future, there is no assurance that we will ever make profits from our business as our business is subject to a number of risk factors, including all of the risks normally associated with a small company with limited operating history in the oil and natural gas exploration, development and production business. See “RISK FACTORS”.

The Common Shares to be registered hereunder constitute all of our currently issued and outstanding Common Shares, together with those Common Shares which are to be issued pursuant to (i) the exercise of currently outstanding warrants to purchase Common Shares; (ii) the conversion of the Debenture, including the increase in principal amount of the Debenture due to interest that may accrue through March 31, 2009; and (iii) the exercise of options currently issued under our Stock Option Plan (the “Stock Option Plan”) as approved by our shareholders on July 5, 2007.

3

The following are certain risk factors related to our business. The following information is a summary only of certain risk factors and is qualified in its entirety by reference to, and must be read in conjunction with, the detailed information appearing elsewhere in this prospectus.

There can be no assurance that our future exploration and development efforts will result in the discovery and development of additional commercial accumulations of oil and natural gas.

The properties and permits held by us are located in areas historically prospective for oil and natural gas. However, no assurances can be made that any well will produce commercial quantities of hydrocarbons. Furthermore, although there is pipeline infrastructure located in these areas, our ability to market any production will depend in part on the successful negotiation of contracts at prices acceptable to us and on available capacity in the pipeline infrastructure.

Our business is subject to the risks normally encountered in the oil and natural gas industry such as: the marketability of, and prices for, oil and natural gas; competition with companies having greater resources; acquisition, exploration and production risks; the need for capital; fluctuations in the market price and demand for oil and natural gas; and regulation of the oil and natural gas industry by various levels of government. The success of exploration or development projects cannot be assured. Our future performance will depend significantly on the ability, expertise, judgment, discretion, integrity and good faith of our management.

Exploration, Development and Production Risks

Oil and natural gas operations involve many risks that even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our long-term commercial success depends on our ability to find, acquire, develop and commercially produce oil and natural gas reserves. Without the continual addition of new reserves, any existing reserves we may have at any particular time and the production therefrom will decline over time as such existing reserves are exploited. A future increase in our reserves will depend not only on our ability to explore and develop any properties we may have from time to time, but also on our ability to select and acquire suitable producing properties or exploration prospects. No assurance can be given that we will be able to continue to locate satisfactory properties for acquisition or participation. Moreover, even if such acquisitions or participations are identified, we may determine that current markets, terms of acquisition and participation or pricing conditions make such acquisitions or participations uneconomic. There is no assurance that commercial quantities of oil and natural gas will be discovered or acquired by us.

Future oil and natural gas exploration may involve unprofitable efforts, not only from dry wells, but also from wells that are productive but do not produce sufficient net revenues to return a profit after drilling, operating and other costs. Completion of a well does not assure a profit on the investment or recovery of drilling, completion and operating costs. In addition, drilling hazards or environmental damage could greatly increase the cost of operations, and various field operating conditions may adversely affect the production from successful wells. These conditions include delays in obtaining governmental approvals or consents, shut-ins of connected wells resulting from extreme weather conditions, insufficient storage or transportation capacity or other geological and mechanical conditions. While diligent well supervision and effective maintenance operations can contribute to maximizing production rates over time, production delays and declines from normal field operating conditions cannot be eliminated and can be expected to adversely affect revenue and cash flow levels to varying degrees.

Oil and natural gas exploration, development and production operations are subject to all the risks and hazards typically associated with such operations, including hazards such as fire, explosion, blowouts, cratering, sour gas releases and spills, each of which could result in substantial damage to oil and natural gas wells, production facilities, other property and the environment or in personal injury or death. In accordance with industry practice, we are not fully insured against all of these risks, nor are all such risks insurable. Although we maintain liability insurance in amounts that we consider consistent with industry practice, the nature of these risks is such that liabilities could exceed policy limits, in which event we could incur significant costs that could have a material adverse effect upon our financial condition. Oil and natural gas

4

production operations are also subject to all the risks typically associated with such operations, including encountering unexpected formations or pressures, premature decline of reservoirs, the invasion of water into producing formations, and other types of reservoir damage. Losses resulting from the occurrence of any of these risks could have a material adverse effect on future results of operations, liquidity and financial condition.

Competition

The petroleum industry is competitive in all its phases. We compete with numerous other participants in the search for, and the acquisition of, oil and natural gas properties and in the marketing of oil and natural gas. Our competitors include oil and natural gas companies that have substantially greater financial resources, staff and facilities than we do. Our ability to increase reserves in the future will depend not only on our ability to explore and develop our present properties, but also on our ability to select and acquire suitable producing properties or prospects for exploratory drilling. Competitive factors in the distribution and marketing of oil and natural gas include price and methods and reliability of delivery.

Environmental Matters and Regulation

General. Our business involving the acquisition, development and exploitation of natural gas and oil properties is subject to extensive and stringent federal, state and local laws and regulations governing the discharge of materials into the environment or otherwise relating to environmental protection. Our operations are subject to the same environmental laws and regulations as other similarly situated companies in the natural gas and oil industry. These laws and regulations may:

| | |

| | • | require the acquisition of various permits before drilling commences; |

| |

| | • | require the installation of expensive pollution control equipment; |

| |

| | • | restrict the types, quantities and concentration of various substances that can be released into the environment in connection with drilling and production activities; |

| |

| | • | limit or prohibit drilling activities on lands lying within wilderness, wetlands and other protected areas; |

| |

| | • | require remedial measures to prevent pollution from historical and ongoing operations, such as pit closure and plugging of abandoned wells; |

| |

| | • | impose substantial liabilities for pollution resulting from our operations; and |

| |

| | • | with respect to operations affecting federal lands or leases, require preparation of a Resource Management Plan, an Environmental Assessment,and/or an Environmental Impact Statement. |

These laws, rules and regulations may also restrict the rate of natural gas and oil production below the rate that would otherwise be possible. The regulatory burden on the natural gas and oil industry increases the cost of doing business in the industry and consequently affects profitability. Additionally, changes in environmental laws and regulations occur frequently, and any changes that result in more stringent and costly waste handling, disposal andclean-up requirements for the natural gas and oil industry could have a significant impact on our operating costs. We believe that operation of our wells is in substantial compliance with all current applicable environmental laws and regulations and that our continued compliance with existing requirements will not have a material adverse impact on our financial condition and results of operations. However, we cannot predict how future environmental laws and regulations may impact our properties or our operations. For the year ended December 31, 2006 and the six months ended June 30, 2007, we did not incur any material capital expenditures for installation or remediation or pollution control equipment at any of our facilities. As of the date of this prospectus, we are not aware of any environmental issues or claims that will require material capital expenditures during 2007 or that will otherwise have a material impact on our financial position or results of operations.

5

Environmental laws and regulations that could have a material impact on the natural gas and oil exploration and production industry include the following:

National Environmental Policy Act. Natural gas and oil exploitation and production activities on federal lands are subject to the National Environmental Policy Act, or NEPA. NEPA requires federal agencies, including the Department of Interior, to evaluate major agency actions having the potential to significantly impact the environment. In the course of such evaluations, an agency will typically prepare an Environmental Assessment to assess the potential direct, indirect and cumulative impacts of a proposed project and, if necessary, will prepare a more detailed Environmental Impact Statement that may be made available for public review and comment. All of our current exploitation and production activities, as well as proposed exploitation and development plans, on federal lands require governmental permits that are subject to the requirements of NEPA. This process has the potential to delay or limit the development of natural gas and oil projects.

Waste Handling. The Resource Conservation and Recovery Act, or RCRA, and comparable state laws, regulate the generation, transportation, treatment, storage, disposal and cleanup of “hazardous wastes” as well as the disposal of non-hazardous wastes. Under the auspices of the U.S. Environmental Protection Agency, or EPA, individual states administer some or all of the provisions of RCRA, sometimes in conjunction with their own, more stringent requirements. While drilling fluids, produced waters, and many other wastes associated with the exploitation, development, and production of crude oil, natural gas, or geothermal energy constitute “solid wastes,” which are regulated under the less stringent non-hazardous waste provisions, there is no assurance that the EPA or individual states will not in the future adopt more stringent and costly requirements for the handling of non-hazardous wastes or categorize some non-hazardous wastes as hazardous. We believe that we are in compliance with the requirements of RCRA and related state and local laws and regulations, and that we hold all necessary permits and other authorizations to the extent that our wells and the associated operations require them. Although we do not believe the current costs of managing wastes generated by operation of our wells to be significant, any legislative or regulatory reclassification of natural gas and oil exploitation and production wastes could increase our costs to manage and dispose of such wastes.

Hazardous Substances Releases. The Comprehensive Environmental Response, Compensation and Liability Act (CERCLA), also known as “Superfund,” and analogous state laws, impose joint and several liability, without regard to fault or legality of conduct, on persons who are considered to be responsible for the release of a “hazardous substance” into the environment. These persons include the owner or operator of the site where the release occurred and companies that disposed or arranged for the disposal of the hazardous substance at the site. Under CERCLA, such persons may be liable for costs of cleaning up the hazardous substances that have been released into the environment, for damages to natural resources and for the costs of certain health studies. In addition, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the hazardous substances released into the environment. While materials are generated in the course of operation of our wells that may be regulated as hazardous substances, we have not received any pending notifications that we may be potentially responsible for cleanup costs under CERCLA.

We currently own interests in properties that have been used for natural gas and oil exploration in the past. Although we believe that operating and waste disposal practices have been used that were standard in the industry at the time, hazardous substances, wastes, or petroleum hydrocarbons have been released on or under the properties owned or leased by us, or on or under other locations, including off-site locations, where such substances have been taken for disposal. In addition, some of these properties have been operated by third parties or by previous owners or operators whose treatment and disposal of hazardous substances, wastes, or hydrocarbons was not under our control. These properties and the substances disposed or released on them may be subject to CERCLA, RCRA and analogous state laws. Under such laws, we could be required to remove previously disposed substances and wastes, remediate contaminated property, or perform remedial plugging or pit closure operations to prevent future contamination.

6

Water Discharges. The Federal Water Pollution Control Act, also known as the Clean Water Act and analogous state laws impose restrictions and strict controls on the discharge of pollutants, including produced waters and other natural gas and oil wastes, into waters of the United States. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by EPA or the relevant state. The Clean Water Act also prohibits the discharge of dredge and fill material in regulated waters, including wetlands, unless authorized by a permit issued by the U.S. Army Corps of Engineers. Federal and state regulatory agencies can impose administrative, civil and criminal penalties for non-compliance with discharge permits or other requirements of the Clean Water Act and analogous state laws and regulations. We believe we are in compliance with the requirements of the Clean Water Act.

Air Emissions. The Clean Air Act, and associated state laws and regulations, regulate emissions of various air pollutants through the issuance of permits and the imposition of other requirements. In addition, EPA has developed, and continues to develop, stringent regulations governing emissions of toxic air pollutants at specified sources. In order to build new production facilities, we may be required to obtain permits before work can begin. These regulations may increase the costs of compliance for some facilities, and federal and state regulatory agencies can impose administrative, civil and criminal penalties for non-compliance. We believe that we are in compliance with the requirements of the Clean Air Act.

OSHA. We are subject to the requirements of the federal Occupational Safety and Health Act (OSHA) and comparable state statutes. The OSHA hazard communication standard, EPA community right-to-know regulations under the Title III of CERCLA and similar state statutes require that we organizeand/or disclose information about hazardous materials used or produced in our operations. We believe that we are in compliance with these applicable requirements and with other OSHA and comparable requirements.

Other Laws and Regulation. The Kyoto Protocol to the United Nations Framework Convention on Climate Change became effective in February 2005. Under the Protocol, participating nations are required to implement programs to reduce emissions of certain gases, generally referred to as greenhouse gases, that are suspected of contributing to global warming. Methane, a primary component of natural gas, and carbon dioxide, a by product of the burning of oil and natural gas, are examples of greenhouse gases regulated by the Kyoto Protocol. Although the United States is not participating in the Kyoto Protocol, the current session of Congress is considering climate change legislation, with multiple bills having already been introduced that proposed to restrict greenhouse gas emissions. Also, several states, although not those in which our properties are located, have already adopted regulatory initiatives or legislation to reduce emissions of greenhouse gases. For example, California recently adopted the “California Global Warming Solutions Act of 2006,” which requires the California Air Resources Board to achieve a 25% reduction in emissions of greenhouse gases from sources in California by 2020. Additionally, on April 2, 2007, the U.S. Supreme Court issued its decision in Massachusetts, et al. v. EPA, holding that the Federal Clean Air Act provides EPA with the authority to regulate emissions of carbon dioxide and other greenhouse gases from mobile sources. The Supreme Court also determined that EPA had failed to provide an adequate statutory basis for its refusal to regulate greenhouse gases from such sources. The Supreme Court reversed a decision rendered by the U.S. Circuit Court of Appeals for the District of Columbia and remanded the case to the Circuit Court for further proceedings consistent with its ruling, which will presumably require EPA to determine whether greenhouse gases from mobile sources present an endangerment to public health or welfare. Passage of climate control legislation by Congress or a determination by EPA that public health or welfare is endangered by emission of carbon dioxide from mobile sources may result in federal regulation of carbon dioxide emissions and other greenhouse gases. Currently, operation of our properties is not adversely impacted by existing state and local climate change initiatives and, at this time, it is not possible to accurately estimate how potential future laws or regulations addressing greenhouse gas emissions would impact our business.

7

Other Regulation of the Natural Gas and Oil Industry

The natural gas and oil industry is extensively regulated by numerous federal, state and local authorities. Legislation affecting the natural gas and oil industry is under constant review for amendment or expansion, frequently increasing the regulatory burden. Also, numerous departments and agencies, both federal and state, are authorized by statute to issue rules and regulations binding on the natural gas and oil industry and its individual members, some of which carry substantial penalties for failure to comply. Although the regulatory burden on the natural gas and oil industry increases our cost of doing business and, consequently, affects our profitability, these burdens generally do not affect us any differently or to any greater or lesser extent than they affect other companies in the industry with similar types, quantities and locations of production.

Legislation continues to be introduced in Congress and development of regulations continues in the Department of Homeland Security and other agencies concerning the security of industrial facilities, including natural gas and oil facilities. Our operations may be subject to such laws and regulations. Presently, it is not possible to accurately estimate the costs we could incur to comply with any such facility security laws or regulations, but such expenditures could be substantial.

Drilling and Production. Our operations are subject to various types of regulation at the federal, state and local levels. These types of regulation include requiring permits for the drilling of wells, drilling bonds and reports concerning operations. Most states, and some counties and municipalities, in which we operate also regulate one or more of the following:

| | |

| | • | the location of wells; |

| |

| | • | the method of drilling and casing wells; |

| |

| | • | the surface use and restoration of properties upon which wells are drilled; |

| |

| | • | use of roads; |

| |

| | • | the plugging and abandoning of wells; and |

| |

| | • | notice to surface owners and other third parties. |

State laws regulate the size and shape of drilling and spacing units or proration units governing the pooling of natural gas and oil properties. Some states allow forced pooling or integration of tracts to facilitate exploitation while other states rely on voluntary pooling of lands and leases. In some instances, forced pooling or unitization may be implemented by third parties and may reduce our interest in the unitized properties. In addition, state conservation laws establish maximum rates of production from natural gas and oil wells, generally prohibit the venting or flaring of natural gas and impose requirements regarding the ratability of production. These laws and regulations may limit the amount of natural gas and oil we can produce from our wells or limit the number of wells or the locations at which we can drill. Moreover, each state generally imposes a production or severance tax with respect to the production and sale of oil, natural gas and natural gas liquids within its jurisdiction.

Natural Gas Regulation. The availability, terms and cost of transportation significantly affect sales of natural gas. The interstate transportation and sale for resale of natural gas is subject to federal regulation, including regulation of the terms, conditions and rates for interstate transportation, storage and various other matters, primarily by the Federal Energy Regulatory Commission (“FERC”). Federal and state regulations govern the price and terms for access to natural gas pipeline transportation. FERC regulations for interstate natural gas transmission in some circumstances may also affect the intrastate transportation of natural gas.

In August 2005, Congress enacted the Energy Policy Act of 2005 (“EP Act 2005”). Among other matters, EP Act 2005 amends the Natural Gas Act (“NGA”) to make it unlawful for any entity, as defined in the EP Act 2005, including otherwise non-jurisdictional producers such as us, to use any deceptive or manipulative device or contrivance in connection with the purchase or sale of natural gas or the purchase or sale of transportation services subject to regulation by FERC, in contravention of rules prescribed by the FERC. On January 19, 2006, the FERC issued rules implementing the provision. The rules make it unlawful in connection with the purchase or sale of natural gas subject to the jurisdiction of the FERC, or the purchase or sale of

8

transportation services subject to the jurisdiction of the FERC, for any entity, directly or indirectly, to use or employ any device, scheme, or artifice to defraud; to make any untrue statement of material fact or omit to make any such statement necessary to make the statements made not misleading; or to engage in any act or practice that operates as a fraud or deceit upon any person. The EP Act 2005 also gives the FERC authority to impose civil penalties for violations of the NGA up to $1,000,000 per day per violation. The EP Act 2005 reflects a significant expansion of the FERC’s enforcement authority. We do not anticipate that we will be affected by the EP Act 2005 any differently than other producers of natural gas.

Although natural gas prices are currently unregulated, Congress historically has been active in the area of natural gas regulation. We cannot predict whether new legislation to regulate natural gas might be proposed, what proposals, if any, might actually be enacted by Congress or the various state legislatures, and what effect, if any, the proposals might have on the operations of the underlying properties. Sale of condensate and natural gas liquids are not currently regulated and are made at market prices.

State Regulation. The various states regulate the drilling for, and the production, gathering and sale of, natural gas, including imposing severance taxes and requirements for obtaining drilling permits. States also regulate the method of developing new fields, the spacing and operation of wells and the prevention of waste of natural gas resources. States may regulate rates of production and may establish maximum daily production allowables from natural gas wells based on market demand or resource conservation, or both. States do not regulate wellhead prices or engage in other similar direct economic regulation, but there can be no assurance that they will not do so in the future. The effect of these regulations may be to limit the amounts of natural gas that may be produced from our wells, and to limit the number of wells or locations we can drill.

The petroleum industry is also subject to compliance with various other federal, state and local regulations and laws. Some of those laws relate to occupational safety, resource conservation and equal employment opportunity. We do not believe that compliance with these laws will have a material adverse effect upon our shareholders, but there is a risk that we could be wrong about this.

Sale of Gas Production in Australia

Natural gas from our producing property in Australia is sold under an agreement with our joint venture partner. In the event that they are unwilling to sell our share of production, we would have to find a purchaser for relatively small amounts of natural gas. We cannot assure that we will obtain such contracts or that the terms will be beneficial to us.

Australian Gas Market

All of our production in Australia is located in Queensland. If the eastern Australian market for gas does not continue to develop and grow, the market’s gas prices may soften. This could negatively impact our revenues from our Australian properties.

Exploration Rights in Australia

Gas exploration in Queensland, Australia is conducted under Authorities to Prospect (“ATPs”) which are granted at the discretion of the Queensland Department of Natural Resources and Water Minister. Each ATP requires the expenditure of a set amount of exploration costs, and is generally subject to renewal every four years. On renewal of an ATP, the Minister may require reduction of the area to which the ATP applies. We cannot assure that our ATPs will be renewed. Non-renewal or loss of an ATP could adversely affect our exploration and development plans, results of operations, financial condition or cash flows.

Competing Supplies of Gas in Australia

Alternative large-scale supplies of natural gas, whether from within or outside of Queensland, could significantly affect the future supply of natural gas in the Queensland market, the area of our primary focus in Australia. For example, a potential 1,988-mile gas pipeline that would connect Queensland with Papua New Guinea’s southern highlands fields has experienced varying degrees of interest within the industry for several

9

years. Completion of any such pipeline project or the availability of other gas supplies could lower the price of natural gas and as a result, adversely impact our revenues.

We are subject to political and economic risks with respect to our Australian operations.

In Australia, we conduct natural gas exploration, development and production activities, which may be subject to:

| | |

| | • | political and economic uncertainties, including changes, sometimes frequent or marked, in governmental energy and environmental policies or the personnel administering them; |

| |

| | • | cancellation or modification of contract rights, and |

| |

| | • | royalty and tax increases and other risks arising out of governmental sovereignty over the areas in which we conduct our operations. |

Consequently, our Australian operations may be substantially affected by factors beyond our control, any of which could negatively affect our financial results. Further, in the event of a legal dispute in Australia, we may be subject to the exclusive jurisdiction of Australian courts or we may not be successful in subjectingnon-U.S. persons to the jurisdiction of courts in the U.S., either of which could adversely affect the outcome of a dispute.

Availability of Drilling Equipment, Personnel, and Access

Oil and natural gas exploration and development activities are dependent on the availability of drilling and related equipment and skilled operations personnel in the particular areas where such activities will be conducted. Demand for such limited equipment and personnel or access restrictions to particular sites may affect the availability of such equipment and personnel to us and may delay exploration and development activities. To the extent that we are not the operator of our oil and gas properties, we will be dependent on such operators for the timing of activities related to such properties and will be largely unable to direct or control the activities of the operators.

Capital Requirements

We anticipate making substantial capital expenditures for the acquisition, exploration, development and production of oil and natural gas reserves in the future. There can be no assurance that debt or equity financing or cash generated by operations will be available or sufficient to meet these requirements or for other corporate purposes or, if debt or equity financing is available, that it will be on terms acceptable to us. Our inability to access sufficient capital for our operations could have a material adverse effect on our financial condition, results of operations or prospects.

Reserve Estimates

Minimal reserves are currently attributed to our assets. There are numerous uncertainties inherent in estimating quantities of reserves and cash flows to be derived therefrom, including many factors that will be beyond our control. The expected monetary value of the unproved properties has been independently evaluated. This evaluation includes a number of assumptions relating to factors such as initial production rates, production decline rates, ultimate recovery of reserves, timing and amount of capital expenditures, marketability of production, future prices of oil and natural gas, operating costs and royalties and other government levies that may be imposed over the producing life of the reserves. These assumptions were based on price forecasts in use as of the date the evaluation was prepared and many of these assumptions are subject to change and are beyond our control. Actual production and cash flows derived therefrom will vary from the evaluation, and such variations could be material. The evaluation is based almost entirely on the assumed success of exploitation activities intended to be undertaken in future years.

10

Prices, Markets and Marketing

Both oil and natural gas prices are unstable and are subject to fluctuation. Any material decline in prices could result in a reduction of our net production revenue when production occurs. The economics of producing from some wells may change as a result of lower prices, which could result in a reduction in the volumes of our reserves when we have reserves. We might also elect not to produce from certain wells at lower prices. All of these factors could result in a material decrease in our net production revenue causing a reduction in our oil and gas acquisition, development and exploration activities. In addition, bank borrowings available to us will be in part determined by our borrowing base. Although we currently have no debt other than the Debentures, we may obtain additional debt financing in the future. In that event, a sustained material decline in prices from historical average prices could reduce our borrowing base, therefore reducing the bank credit available to us which could require that a portion, or all, of our bank debt be repaid.

The marketability and price of oil and natural gas that may be acquired or discovered by us will be affected by numerous factors beyond our control. Our ability to market our natural gas may depend upon our ability to acquire space on pipelines that deliver natural gas to commercial markets. We may also be affected by deliverability uncertainties related to the proximity of our reserves to pipelines and processing facilities, and related to operation problems with such pipelines and facilities as well as extensive government regulation relating to price, taxes, royalties, land tenure, allowable production, and many other aspects of the oil and natural gas business.

Indebtedness and Capital Changes

As of the date of this prospectus, our only outstanding debt is the Debenture and trade payables. We are permitted to incur significant additional indebtedness, including secured indebtedness, in the future if specified conditions are satisfied. Current or future indebtedness could negatively affect us in several ways: such debt could require us to dedicate a substantial portion of our cash flow to the payment of interest; such debt could subject us to a higher financial risk in an economic downturn due to substantial debt service costs; such debt could limit our ability to obtain financing or raise equity capital in the future; and such debt could place us at a competitive disadvantage to the extent that we are more highly leveraged than some of our peers. Higher levels of indebtedness would increase these risks.

Our exploration and development program will require substantial ongoing capital resources, depending on the level of drilling and the cost of services. Our existing operations will also require ongoing capital expenditures. In addition, if we decide to pursue additional acquisitions, our capital expenditures will increase both to complete such acquisitions and to explore and develop any newly acquired properties.

Substantial acquisitions or other transactions could require significant additional capital and could change our risk and property profile. Acquisition prospects are difficult to assess and may pose additional risks to our operations. If we are unable to raise substantial amounts of additional capital, we may not be able to maximize our business plan. In order to maximize our business plan, we will need to raise substantial amounts of new capital. If we experience difficulties in raising equity or debt capital, we may be required to scale back our business plan by limiting acquisitions and our drilling and development program.

Write-down of Carrying Values

We have incurred a write-down of the carrying values of our properties in the past and could incur additional write-downs in the future. Under the full cost method of accounting, Securities and Exchange Commission (“SEC”) accounting rules require that we review the carrying value of our oil and gas properties on acountry-by-country basis for possible write-down or impairment. Under these rules, capitalized costs of proved reserves may not exceed a ceiling calculated as the present value of estimated future net revenues from those proved reserves, determined using a 10% per year discount and unescalated prices in effect as of the end of each fiscal quarter. Capital costs in excess of the ceiling must be permanently written down. Prior to June 30, 2007, we have not had meaningful reserves, so we have treated the ceiling test calculation as not material for earlier periods.

11

Property Title Risks

In many instances, title opinions on our oil and gas acreage are not obtained if in our judgment it would be uneconomical or impractical to do so. Although we examine title to acreage prior to acquisition in those cases in which the economic significance of the acreage justifies the cost, there can be no assurance that losses will not result from title defects or from defects in the assignment of leasehold rights.

History of Significant Net Losses

We have incurred significant net losses since our inception and we may incur additional net losses in the future. We have not been profitable since we started our business. We incurred net losses of $3,769,084 and $9,444,728 for the years ended December 31, 2006 and 2005, respectively. We have incurred a net loss of $6,405,733 for the six months ended June 30, 2007. Our capital has been employed in an expanding natural gas and oil exploration and development program with a focus on finding commercially economic natural gas and oil reserves and producing from them over the long term rather than generating immediate net income. The uncertainties described in this section may impede our ability to ultimately find, develop and exploit natural gas and oil reserves. As a result, we may not be able to achieve or sustain profitability or positive cash flows from operating activities in the future.

Limited Key Personnel

We depend to a large extent on the services of a limited number of senior management personnel and directors. The loss of any of these personnel could adversely affect our operations and financial performance. We do not carry key man life insurance on any of our personnel.

Limited Public Market for Our Common Shares

Although our Common Shares have been listed on the TSXV since September 2004, there is limited liquidity in the market for our Common Shares. As a result, a trade involving a large number of Common Shares could have an exaggerated effect on the reported market price of our Common Shares. A holder of our Common Shares may not be able to liquidate the investment in a short time period or at the market prices that currently exist at the time the holder decides to sell. The purchase and sale of relatively small Common Share positions may result in disproportionately large increases or decreases in the price of our Common Shares. We will apply to list our Common Shares on the AMEX, but we cannot be certain that our application will be approved.

Volatility of Common Share Price

The trading price of our Common Shares is subject to wide fluctuations in response to a variety of factors, including quarterly variations in operating results, announcements of drilling activity, economic conditions in the natural gas and oil industry, general economic conditions or other events or factors that are beyond our control. See “Price Range of Common Shares”.

In addition, the stock market in general and the market for natural gas and oil exploration companies in particular have experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating results or asset values of those companies. These broad market and industry factors may seriously impact the market price and trading volume of our Common Shares regardless of our actual operating performance. In the past, following periods of volatility in the overall market and in the market price of a company’s securities, securities class action litigation has been instituted against these companies. If this type of litigation were instituted against us following a period of volatility in the trading price of our Common Shares, it could result in substantial costs and a diversion of our management’s attention and resources, which could have a materially adverse impact on our operations.

12

Future Issuance of Common Shares

The future issuance of a substantial number of Common Shares into the public market, or the perception that such issuance could occur, could adversely affect the prevailing market price of our Common Shares. A decline in the price of our Common Shares could make it more difficult to raise funds through future offerings of our Common Shares or securities convertible into Common Shares. Following the effectiveness of the registration statement of which this prospectus is a part, we believe that substantially all of our outstanding options and the Common Shares issued upon conversion and exercise of the Debenture, outstanding options and warrants will be tradable under the United States federal securities laws.

Also, our ability to issue an unlimited number of our Common Shares under our articles of incorporation may result in dilution or make it more difficult to effect a change in control of Ausam, which could adversely affect the price of our Common Shares. Unlike most corporations formed in the United States, our articles of incorporation chartered under the laws of the Province of Alberta, Canada permit the board of directors to issue an unlimited number of new Common Shares without shareholder approval, subject only to the rules of the TSXV or any other stock exchange on which our Common Shares trade. The issuance of a large number of shares could be effected by our directors to thwart a takeover attempt or offer for us by a third party, even if doing so would benefit our shareholders, which could result in the shares being valued less in the market. The issuance, or the threat of issuance, of large numbers of Common Shares, at prices that are dilutive to the outstanding shares could also result in the shares being valued less in the market. Under the Debenture, we are prohibited from issuing shares at below the market price, or the fair value of the shares if our shares are not then being traded on any exchange.

Under the policies of the TSXV, we are prohibited from issuing shares at a discount to the market price except within TSXV guidelines and with TSXV approval. The TSXV may require shareholder approval for a private placement of Common Shares that appears to be undertaken as a defensive tactic to a takeover bid.

Issuance of Common Shares upon conversion of the Debenture for no additional consideration will dilute the ownership interest of existing shareholders and could adversely affect the market price of our common shares.

Foreign Currency Exposure

Following the SKH Purchase, we are engaged in business in the United States, Canada and Australia. We may incur losses or suffer a reduction in revenues from time to time as the value of the currencies of these countries fluctuates in relation to each other. We do not currently hedge our foreign currency fluctuation risk, although we may do so in the future. Although we do not engage in a derivative hedge program, we attempt to match the currency in which we obtain financing with the currency of expected expenditures. If we are unable to successfully match the currency of expenditures with the currency obtained from financing, we could suffer losses due to currency fluctuations.

As described in “Description of Indebtedness,” the Debenture contains a term regarding a fixed exchange rate that will be used under certain circumstances to calculate the conversion price. This exchange rate may be less favorable to us than the market rate existing at the time of conversion.

Stock Exchange Listing

Our Common Shares are currently listed for trading on the TSXV. We will apply for a listing on the AMEX, but we cannot be certain that our application will be approved.

13

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

Some of the information included in this prospectus contains “forward-looking statements”. These statements can be identified by the use of forward-looking words, including “may”, “expect”, “anticipate”, “plan”, “project”, “believe”, “estimate”, “intend”, “will”, “should” or other similar words. Forward-looking statements may include statements that relate to, among other things:

| | |

| | • | Our financial position; |

| |

| | • | Business strategy and budgets; |

| |

| | • | Anticipated capital expenditures; |

| |

| | • | Drilling of wells; |

| |

| | • | Natural gas and oil reserves; |

| |

| | • | Timing and amount of future production of natural gas and oil; |

| |

| | • | Operating costs and other expenses; |

| |

| | • | Cash flow and anticipated liquidity; |

| |

| | • | Prospect development; and |

| |

| | • | Property acquisitions and sales. |

Although we believe the expectations reflected in such forward-looking statements are reasonable, we cannot assure you that such expectations will occur. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from actual future results expressed or implied by the forward-looking statements. These factors include among others:

| | |

| | • | Lowand/or declining prices for natural gas and oil; |

| |

| | • | Natural gas and oil price volatility; |

| |

| | • | The risks associated with exploration, including cost overruns and the drilling of non-economic wells or dry holes; |

| |

| | • | Ability to raise capital to fund capital expenditures; |

| |

| | • | The ability to find, acquire, market, develop and produce new natural gas and oil properties; |

| |

| | • | Uncertainties in the estimation of proved reserves and in the projection of future rates of production and timing of development expenditures; |

| |

| | • | Operating hazards attendant to the natural gas and oil business; |

| |

| | • | Downhole drilling and completion risks that are generally not recoverable from third parties or insurance; |

| |

| | • | Potential mechanical failure or under-performance of significant wells or pipeline mishaps; |

| |

| | • | Weather conditions; |

| |

| | • | Availability and cost of material and equipment; |

| |

| | • | Delays in anticipatedstart-up dates; |

| |

| | • | Actions or inactions of third-party operators of our properties; |

| |

| | • | Ability to find and retain skilled personnel; |

| |

| | • | Strength and financial resources of competitors; |

| |

| | • | Federal and state regulatory developments and approvals; |

14

| | |

| | • | Environmental risks; |

| |

| | • | Worldwide economic conditions; and |

| |

| | • | Operational and financial risks associated with foreign exploration and production. |

You should not unduly rely on these forward-looking statements in this prospectus, as they speak only as of the date of this prospectus. Except as required by law, we undertake no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances occurring after the date of this prospectus or to reflect the occurrence of unanticipated events. See the information under the heading “Risk Factors” in this prospectus for some of the important factors that could affect our financial performance or could cause actual results to differ materially from estimates contained in forward-looking statements.

We will not receive any of the proceeds from the sale of the Common Shares by the selling shareholders under this prospectus. All proceeds from the sale of those shares will be for the respective accounts of the selling shareholders.

PRICE RANGE OF COMMON SHARES

Our Common Shares are listed on the TSXV under the symbol “AZE.” We will apply to list our Common Shares on the AMEX, but we cannot be certain that they will approve our application. The following table sets forth the high and low sale prices of our Common Shares as reported on the TSXV for the periods presented. The prices in the table below have been adjusted to reflect the share consolidation that took place on September 26, 2007.

| | | | | | | | | |

| | | High (CDN$) | | | Low (CDN$) | |

| |

2007 | | | | | | | | |

| Fourth Quarter through October 19 | | | 2.85 | | | | 2.00 | |

| Third Quarter | | | 2.95 | | | | 1.85 | |

| Second Quarter | | | 2.90 | | | | 1.80 | |

| First Quarter | | | 3.15 | | | | 1.95 | |

2006 | | | | | | | | |

| Fourth Quarter | | | 2.85 | | | | 1.20 | |

| Third Quarter | | | 2.20 | | | | 1.30 | |

| Second Quarter | | | 2.90 | | | | 1.05 | |

| First Quarter | | | 3.65 | | | | 1.40 | |

2005 | | | | | | | | |

| Fourth Quarter | | | 5.50 | | | | 2.00 | |

| Third Quarter | | | 6.05 | | | | 4.25 | |

| Second Quarter | | | 5.25 | | | | 3.95 | |

| First Quarter | | | 7.50 | | | | 4.00 | |

2004 | | | | | | | | |

| Fourth Quarter | | | 6.00 | | | | 3.50 | |

As of October 10, 2007, there were 122 holders of record of our Common Shares. The last reported sale price of our Common Shares on the TSXV on October 19, 2007 was CDN$2.50.

As of October 19, 2007, a total of 2,879,251 Common Shares were subject to outstanding stock options granted under the Ausam Energy Stock Option Plan, 1,646,417 shares of which have vested but have not been exercised. Additionally, 10,148,161 Common Shares were issuable pursuant to outstanding warrants, all of which warrants were exercisable as of such date.

15

As of October 19, 2007, we had outstanding a Debenture with a face value of $25,556,250. The holder of the Debenture has the right to convert it into Common Shares at any time at a conversion price of CDN$3.00 per share. In the event that (i) the30-day volume weighted average price (“VWAP”) of our Common Shares exceeds CDN$4.50 and (ii) our average share volume exceeds 200,000 shares per day for a 30 day period, we can require the holder of the Debenture to convert it to Common Shares at CDN$3.00 per share. If the outstanding Debenture were converted into Common Shares today, we would issue 8,301,352 Common Shares using an exchange rate of $1.00 = CDN$0.97448. We have the right to pay interest on the Debenture by a deemed increase in the principal amount through March 31, 2009. If we elect to do so, the face value of the Debenture on that date would be $29,863,475, and conversion at the October 19, 2007 exchange rate would result in the issuance of 9,700,453 Common Shares.

As of October 19, 2007, we had outstanding a total of 10,148,161 warrants which could be converted into Common Shares as shown in the table below.

| | | | | | | | | |

| | | | | | | Funds we Would Receive

| | Number of Common

|

Number of Warrants | | Exercise Price | | Expiration Date | | on Exercise | | Shares Issued on Exercise |

| |

| 2,061,666 | | CDN$3.75 | | February 9, 2009 | | CDN $7,731,248 | | 2,061,666 |

| 3,276,655 | | CDN$3.25 | | February 9, 2009 | | CDN $10,649,129 | | 3,276,655 |

| 125,685 | | CDN$3.25 | | September 7, 2009 | | CDN $408,476 | | 125,685 |

| 4,684,155 | | CDN$3.00 | | July 3, 2012 | | CDN $14,052,465 | | 4,684,155 |

We have never declared or paid any cash dividends on our Common Shares. We anticipate that we will retain future earnings, if any, to satisfy our operational and other cash needs and do not anticipate paying any cash dividends on our Common Shares in the foreseeable future. In addition, our Debenture prohibits us from paying cash dividends as long as such Debenture remains outstanding unless the holders of 662/3% of the principal amount of Debenture then outstanding approve.

Pursuant to the provisions of theBusiness Corporations Act(Alberta), we are prohibited from declaring or paying a dividend if there are reasonable grounds for believing that (1) we are, or would after the payment be, unable to pay our liabilities as they become due or (2) the realizable value of our assets would thereby be less than the aggregate of our liabilities and stated capital of all classes.

For a discussion of Canadian laws, decrees and regulations that restrict the import or export of capital, affect the remittance of dividends or other payments to non-resident holders of our Common Shares, or relate to taxes, including withholding provisions, to which U.S. holders of our common shares are subject, as well as pertinent provisions of the tax treaty between Canada and the United States, please see “Material Income Tax Consequences”.

16

SELECTED HISTORICAL CONSOLIDATED FINANCIAL AND OPERATING DATA

We have set forth below certain summary historical consolidated financial and operating data for the periods indicated for us and our wholly-owned subsidiaries ARL and Noram Resources, Inc. (“Noram”). The historical consolidated financial data for the periods ended December 31, 2004, 2005 and 2006 and the balance sheet data as of December 31, 2005 and 2006 have been derived from our audited consolidated financial statements. The historical financial data for the six months ended June 30, 2007 and 2006 and the balance sheet data as of June 30, 2007 are derived from our unaudited consolidated financial statements.

You should read the following summary financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes appearing elsewhere in this prospectus.

Because of the SKH Purchase, the Huff Transaction and the anticipated rapid drilling of our exploration prospects, our historical results of operations and period-to-period comparisons of these results and certain financial data may not be meaningful or indicative of future results.

Balance Sheet Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | June 30,

| | | December 31, | | | December 31,

| | | June 30,

| | | June 30,

| |

| | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | | | 2003 | | | 2002 | |

| | | (Unaudited) | | | | | | | | | | | | (Unaudited) | | | (Unaudited) | | | (Unaudited) | |

| |

ASSETS |

| Current | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 1,469,750 | | | $ | 2,865,157 | | | $ | 7,405,760 | | | $ | 6,491,002 | | | $ | 1,103,817 | | | $ | 26,157 | | | $ | 137,202 | |

| Accounts receivable | | | 155,694 | | | | 110,108 | | | | 22,146 | | | | 67,613 | | | | 12,455 | | | | 10,011 | | | | 58,584 | |

| Loan receivable from related party | | | — | | | | — | | | | 359,996 | | | | — | | | | — | | | | — | | | | — | |

| Prepaid expenses, deposits, and inventory | | | 286,347 | | | | 83,257 | | | | 14,269 | | | | 76,417 | | | | 83,184 | | | | 73,856 | | | | 235,784 | |

| Deferred Costs | | | 85,036 | | | | 683,956 | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Advances to Joint Venture Partner | | | 79,827 | | | | 412,079 | | | | 539,691 | | | | 858,124 | | | | — | | | | — | | | | — | |

| Property and Equipment | | | 60,425,548 | | | | 8,760,711 | | | | 3,799,471 | | | | 4,698,822 | | | | 2,266,843 | | | | 1,981,347 | | | | 1,574,542 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | $ | 62,502,202 | | | $ | 12,915,268 | | | $ | 12,141,333 | | | $ | 12,191,978 | | | $ | 3,466,299 | | | $ | 2,091,371 | | | $ | 2,006,112 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

LIABILITIES AND UNITHOLDERS’ EQUITY |

| Current | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Accounts payable and accrued liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Legal and Professional | | $ | 330,741 | | | $ | 400,777 | | | $ | 252,134 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Trade | | | 935,762 | | | | 959,782 | | | | 344,489 | | | | 394,809 | | | | 521,580 | | | | 643,205 | | | | 399,632 | |

| Loan payable | | | — | | | | — | | | | — | | | | — | | | | 575,942 | | | | 461,446 | | | | 503,295 | |

| Preferred share dividend payable | | | 116,167 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Asset retirement obligations | | | 457,302 | | | | 166,185 | | | | 140,845 | | | | 66,203 | | | | — | | | | — | | | | — | |

| Shareholders’ Equity | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred shares, no par value, unlimited | | | 8,458,290 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| Common shares, no par value, unlimited(1) | | | 66,536,854 | | | | 25,923,002 | | | | 24,649,132 | | | | 16,480,685 | | | | 6,831,540 | | | | 4,825,711 | | | | 4,039,851 | |

| Share purchase warrants | | | 4,419,269 | | | | 272,592 | | | | 1,051,031 | | | | 1,097,257 | | | | | | | | | | | | | |

| Additional paid — in capital | | | 5,799,346 | | | | 4,358,771 | | | | 1,978,420 | | | | 465,392 | | | | 106,006 | | | | 106,006 | | | | — | |

| Accumulated other comprehensive income | | | 2,363,253 | | | | 734,619 | | | | (143,342 | ) | | | 374,280 | | | | — | | | | — | | | | — | |

| Deficit | | | (26,914,782 | ) | | | (19,900,460 | ) | | | (16,131,376 | ) | | | (6,686,648 | ) | | | (4,568,769 | ) | | | (3,944,997 | ) | | | (2,936,666 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shareholders’ Equity | | | 60,662,231 | | | | 11,388,524 | | | | 11,403,865 | | | | 11,730,966 | | | | 2,368,777 | | | | 986,720 | | | | 1,103,185 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | $ | 62,502,202 | | | $ | 12,915,268 | | | $ | 12,141,333 | | | $ | 12,191,978 | | | $ | 3,466,299 | | | $ | 2,091,371 | | | $ | 2,006,112 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| (1) | | Issued and outstanding: June 30, 2007: 29,925,997; December 31, 2006: 10,939,553; December 31, 2005: 10,064,553; December 31, 2004: 7,701,367. Prior to 2004, ARL as predecessor to Ausam Energy Corporation had a June 30, fiscal year end. Shares of ARL issued and outstanding on December 31, 2003 were 79,295,876; as of June 30, 2003: 46,319,758; and as of June 30, 2002: 39,387,681. These numbers of ARL shares issued and outstanding are not adjusted for the consolidation effected as part of the RTO on July 30, 2004, or the subsequent 1:5 reverse consolidation effected on September 26, 2007. |

17

Income Statement Data

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Six

| | | Twelve

| | | Twelve