UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant o |

| Filed by a Party other than the Registrant x |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

| | |

| HAMPDEN BANCORP, INC. |

| (Name of Registrant as Specified In Its Charter) |

MHC MUTUAL CONVERSION FUND, L.P. CLOVER PARTNERS, L.P. CLOVER INVESTMENTS, L.L.C. MICHAEL C. MEWHINNEY JOHNNY GUERRY GAROLD R. BASE |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

Clover Partners Responds to Hampden Bancorp’s Most Recent Presentation and First Quarter Performance

Vote to protect the value of your investment. Vote the WHITE proxy card.

October 16, 2013

Dear fellow Hampden Bancorp stockholders:

We are soliciting your support to elect new directors to the Board of Directors (the “Board”) of Hampden Bancorp, Inc. (“Hampden Bancorp”, “Hampden”, or the “Company”) (NASDAQGM: HBNK) at the Annual Meeting of Stockholders, which will be held on November 5, 2013 in Springfield, Massachusetts. MHC Mutual Conversion Fund, L.P., a fund managed by Clover Partners L.P., is a long-time stockholder of Hampden Bancorp with a significant amount of its capital at risk – 459,660 shares worth $7.8 million, or approximately 8.1% of Hampden Bancorp’s outstanding common stock. As one of the largest stockholders of Hampden Bancorp, we believe our interests are aligned with ALL stockholders, as the value of our investment, just like any other stockholder’s investment, rises and falls based on the performance of the Company.

In order to protect the value of our investment, we have nominated two independent directors who we believe will put the interests of stockholders first. We believe you should elect our director nominees to help protect your investment for the reasons described below.

Management Interests are Not Aligned With Stockholders

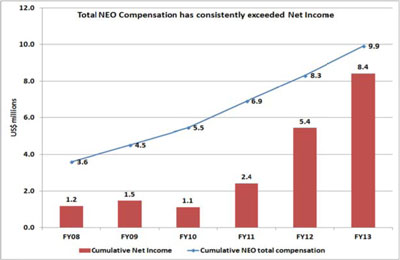

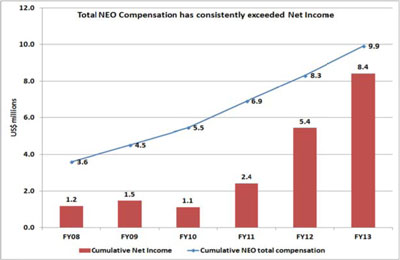

| · | From 2008 to 2013 the Company paid its executives more than Hampden Bank’s net income! Based on the Company’s filings with the Securities and Exchange Commission (SEC),cumulative named executive officer (NEO) compensation totaled $9.9 million over that period, while Hampden Bank only made $8.4 million (see chart below)! We believe this disconnect between operational performance and management’s compensation underscores the need for change at the board level. |

| · | The Company’s management has stated that they“believe the company is undervalued by the market,” so we would expect the Company’s officers to be aggressive buyers of the Company’s stock. Unfortunately, that couldn’t be further from the truth. Based on the Company’s and management’s SEC filings,since 2008, there have been 63 insider transactions. Of the 63, only 3 have been insider purchases, while there have been 60 sales! Furthermore, the dollar value of those purchases totaled $17,025, while the dollar value of the sales totaled $1,351,288 (see chart below)! This evidence strongly suggests that insider’s interests are not aligned with stockholders. |

| Insider Transactions Since 2008 | | Number of Transactions | | | Dollar Value | | | % of Total Dollar Value | |

| Buys | | | 3 | | | $ | 17,025 | | | | 1% | |

| Sells | | | 60 | | | $ | 1,351,288 | | | | 99% | |

| Total | | | 63 | | | $ | 1,368,313 | | | | 100% | |

| | | | | | | | | | | | | |

| Source: SNL Financial | | | | | | | | | | | | |

Aggressive Loan Growth in a Slow-Growth Market May Significantly Raise Risk of Future Loses

| · | Compared to the quarter ended June 30, 2013, net loans increased 6.7% sequentially (an annualized rate of almost 30%!). Since going public, Hampden Bank has grown its loans at a compounded annual growth rate of 5.3%, and management has regularly noted:“HBNK operates in a market growing in the low single digits.”We wonder how the Company grew loans at a pace far exceeding that of its geographic footprint. |

| · | We are deeply concerned that the Company may be compromising loan underwriting standards and pricing to produce unsustainable loan growth in the short-term, with long-term risks. |

| · | We believe loan growth rates well in excess of what the market affords could be detrimental to the long-term financial health the Company. Again, we believe there is a need for new oversight at the board level. |

| · | Considering the Company’s unprecedented loan growth rates,we wonder why the loan loss reserve as a percentage of loans (LLR/Loans) declined so much year over year? In the latest quarter, the LLR/Loans ratio equaled 1.13% as compared to 1.21% in last year’s quarter. If the Company would have merely maintained this ratio at 1.21%, the latest quarter’s earnings per share (EPS) would have been $0.05 lower than the $0.20 operating EPS the Company reported.Again, we are concerned that the Company may be putting its long-term health at risk for the sake of short term results. |

| | | Reported | | | As Adjusted | | | | |

| | | 09/30/13 | | | 09/30/13 | | | 09/30/12 | |

| Net Interest Income (NII) | | $ | 4,888 | | | $ | 4,888 | | | $ | 4,801 | |

| Loan Loss Provision (LLP) | | $ | 100 | | | $ | 500 | | | $ | 50 | |

| NII less LLP | | $ | 4,788 | | | $ | 4,388 | | | $ | 4,751 | |

| | | | | | | | | | | | | |

| Non-Interest Income | | $ | 1,103 | | | $ | 1,103 | | | $ | 966 | |

| Non-Recurring MSR Gain | | | — | | | $ | 170 | | | | — | |

| Operating Non-Interest Income | | | — | | | $ | 933 | | | | — | |

| Non-Interest Expense | | $ | 4,005 | | | $ | 4,005 | | | $ | 4,464 | |

| | | | | | | | | | | | | |

| Net Income | | $ | 1,207 | | | $ | 842 | | | $ | 761 | |

| | | | | | | | | | | | | |

| EPS | | $ | 0.22 | | | $ | 0.15 | | | $ | 0.14 | |

| | | | | | | | | | | | | |

| Loan Loss Reserve to Total Loans | | | 1.13 | % | | | 1.21 | % | | | 1.21 | % |

| Source: SNL Financial and Company Data | | | | | | | | | | | | |

Company’s Reported Numbers Don’t Tell the Whole Story

| · | Excluding approximately $170,000 in a mortgage servicing right (MSR) revaluation, operating EPS for the quarter equaled $0.20, $0.02 lower than the reported EPS of $0.22. Excluding the non-recurring gain related to the MSR revaluation, operating fee income decreased 5.3% sequentially. |

| · | The run off of the expense associated with the Company’s 2008 Equity Incentive Plan is not associated with any expense reduction plan initiated by the Company as the plan’s cost is simply amortized over 5 yrs.We estimate the savings from the equity incentive plan accounted for over half of the Company’s sequential expense reduction. |

One Quarter Does Not Identify a Trend

| · | Including the Company’s most recent quarter’s operating results, HBNK’s metrics for the last twelve months continue to lag the peer medians, as noted below. |

| LTM | | Peer Median | | | HBNK | |

| ROAA | | | 0.72% | | | | 0.49% | |

| ROAE | | | 6.1% | | | | 3.8% | |

| Efficiency | | | 72% | | | | 75% | |

| NIM | | | 3.32% | | | | 3.08% | |

| | | | | | | | | |

| Source: SNL Financial and Company data |

There Has Been No Real Change in the Management Team

On October 10, 2013, Hampden announced its first quarter operating results. The Company’s press release stated“…the strategy being implemented by Hampden’s new management team is working”. We do not believe these assertions.First, there is NO new management team, as demonstrated below.

On November 20, 2012, the Company announced that Glenn S. Welch would be appointed as the CEO effective as of January 1, 2013, succeeding Thomas R. Burton, who now serves on the Board. Stockholders should consider the following facts when deciding whether there is a real management change.

Prior to his appointment as the CEO, Glenn Welch served as the President and Chief Operating Officer of the Company from January 2012 to December 2012, as the Executive Vice President since 2006 and as the Senior Vice President and Division Executive for Business Banking of Hampden Bank since 2001. Mr. Welch has served as a director of the Company and Bank since January 2012. Where is the management change?What will Mr. Welch do differently as the CEO that he could not do during his 10+ year tenure at Hampden?

Moreover, Thomas Burton, CEO from 1994 to December 2012, continues to serve as a director.What is the benefit of having such a long tenured CEO on the board, especially when the Company under his tenure failed to perform, as discussed in our proxy statement? Will the presence of a former CEO affect Mr. Welch’s ability to take the Company in a different direction?

Other members of the Company’s senior management team include Robert A. Massey (CFO since 2008, employed since 1991), Luke D. Kettles (employed since 2003), Robert J. Michel (employed since 1974) and Sheryl Shinn (employed since 2007).Considering that the core senior management team has been together for an extended period, is it reasonable to expect them to perform differently now?

NEW OVERSIGHT AND ACCOUNTABILITY ARE IMPERATIVE!

We believe you need to act NOW in order to protect the value of your investment. The current Board and management have paid themselves more than the total profit earned by the bank since going public in 2007. More importantly, we fear the Company may be aggressively increasing balance sheet risk by growing the loan book in a slow-growth market, with potential negative impacts to the Company’s long-term health. The Company appears to have inaccurately depicted one-time gains and expense fall-offs as the benefits of a turnaround plan, when our review of the Company’s SEC filings reveals no such plan. So, to help protect the value of your investment, we urge you to elect our two nominees - Mr. Garold R. Base and Mr. Johnny Guerry.

Contrary to Hampden’s assertions, our nominees have extensive banking industry and operational experience.

Mr. Base served as a charter member of the Federal Reserve Bank’s Community Depository Institutions Advisory Council, the Office of Thrift Supervision’s Mutual Savings Association Advisory Committee, Trustee of the School District, Member of the Federal Reserve Advisory Board, Chairman of the Chamber of Commerce and Chairman of a State Commission for 10 years. During his tenure with ViewPoint Bank, Mr. Base oversaw the bank’s growth from two locations and $179 million in assets to the $4 billion community bank that it is today.

Mr. Guerry has managed the MHC Mutual Conversion Fund since its inception in 2007. The fund invests exclusively in bank holding companies and banks, and managing the fund to achieve positive performance requires a solid understanding of the banking industry, banks and their performance. Under Mr. Guerry’s management, the fund has advanced 85% since inception while the SNL thrift index has declined approximately 50%. In addition, in his role managing the fund Mr. Guerry regularly collaborates with bank management teams to advise on their strategic direction and suggest ways to improve operational performance.

VOTE THE WHITE CARD!

Please disregard and discard the Company’s BLUE proxy card.

Please sign, date and return the WHITE proxy card TODAY by mailing it in the enclosed pre-addressed, stamped envelope, or follow the instructions on the enclosed WHITE proxy card to vote by Internet or telephone.

YOUR VOTE IS IMPORTANT. No matter how many shares you may own, we encourage you to make your shares count by making an informed vote. If you have any questions or need any assistance voting your shares, please contact Alliance Advisors, the proxy firm assisting us in this matter, toll-free at 1-877-777-5216.

Thank you for your support.

Sincerely,

Please also feel free to call or email MHC Mutual Conversion Fund, L.P. at the following

Johnny Guerry

Clover Partners LP

100 Crescent Court Suite 575

Dallas, Texas 75201

(214) 273 5200

(214) 273 5199 (fax)

JGuerry@cloverpartners.com

Important Information

MHC Mutual Conversion Fund, L.P. has nominated Johnny Guerry and Garold R. Base as nominees to the board of directors of the Company and is soliciting votes for the election of Mr. Guerry and Mr. Base as members of the board. On October 8, 2013, MHC Mutual Conversion Fund, L.P. filed its definitive proxy statement and related proxy materials with the Securities and Exchange Commission (“SEC”), and has sent the definitive proxy statement, WHITE proxy card and related proxy materials to shareholders of the Company seeking their support of Mr. Guerry and Mr. Base at the Company’s 2013 Annual Meeting of Stockholders. Stockholders are urged to read the definitive proxy statement and WHITE proxy card because they contain important information about the participants in the solicitation, Mr. Guerry and Mr. Base, the Company and related matters. Stockholders may obtain a free copy of the definitive proxy statement and WHITE proxy card and other documents filed by MHC Mutual Conversion Fund, L.P. with the SEC at the SEC’s web site at www.sec.gov. The definitive proxy statement and other related SEC documents filed by MHC Mutual Conversion Fund, L.P. with the SEC may also be obtained free of charge from the MHC Mutual Conversion Fund, and bycontacting Alliance Advisors LLC, proxy solicitors for MHC Mutual Conversion Fund, L.P., at the following address and telephone number:

Alliance Advisors LLC

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

Shareholders Call Toll Free: 1-877-777-5216

Banks and Brokers Call Collect: 973-873-7700

Participants in Solicitation

The participants in the solicitation by MHC Mutual Conversion Fund, L.P. consist of the following persons: MHC Mutual Conversion Fund, L.P., Clover Partners, L.P., Clover Investments, L.L.C., Michael C. Mewhinney, Johnny Guerry and Garold R. Base. Such participants may have interests in the solicitation, including as a result of holding shares of the Company’s common stock. Information regarding the participants and their interests may be found in the definitive proxy statement filed with the SEC on October 8, 2013, which is incorporated herein by reference.