UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ¨ |

| Filed by a Party other than the Registrant x |

| Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

| | |

| HAMPDEN BANCORP, INC. |

| (Name of Registrant as Specified In Its Charter) |

CLOVER PARTNERS, L.P. MHC MUTUAL CONVERSION FUND, L.P. CLOVER INVESTMENTS, L.L.C. MICHAEL C. MEWHINNEY JOHNNY GUERRY GAROLD R. BASE |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

Filed by Clover Partners, L.P. and Others

A copy of a letter being sent to shareholders is being filed herewith under Rule 14a-6 of the Securities Exchange Act of 1934, as amended.

Important Information

MHC Mutual Conversion Fund, L.P. has nominated Johnny Guerry and Garold R. Base as nominees to the board of directors of the Company and is soliciting votes for the election of Mr. Guerry and Mr. Base as members of the board. On September 30, 2014, MHC Mutual Conversion Fund, L.P. filed its definitive proxy statement and related proxy materials with the Securities and Exchange Commission (“SEC”), and has sent the definitive proxy statement, WHITE proxy card and related proxy materials to shareholders of the Company seeking their support of Mr. Guerry and Mr. Base at the Company’s 2014 Annual Meeting of Stockholders. Stockholders are urged to read the definitive proxy statement and WHITE proxy card because they contain important information about the participants in the solicitation, Mr. Guerry and Mr. Base, the Company and related matters. Stockholders may obtain a free copy of the definitive proxy statement and WHITE proxy card and other documents filed by MHC Mutual Conversion Fund, L.P. with the SEC at the SEC’s web site at www.sec.gov. The definitive proxy statement and other related SEC documents filed by MHC Mutual Conversion Fund, L.P. with the SEC may also be obtained free of charge from the MHC Mutual Conversion Fund, and by contacting Alliance Advisors LLC, proxy solicitors for MHC Mutual Conversion Fund, L.P., at the following address and telephone number:

Alliance Advisors LLC

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

Shareholders Call Toll Free: 1-877-777-5216

Banks and Brokers Call Collect: 973-873-7700

Participants in Solicitation

The participants in the solicitation by MHC Mutual Conversion Fund, L.P. consist of the following persons: MHC Mutual Conversion Fund, L.P., Clover Partners, L.P., Clover Investments, L.L.C., Michael C. Mewhinney, Johnny Guerry and Garold R. Base. Such participants may have interests in the solicitation, including as a result of holding shares of the Company’s common stock. Information regarding the participants and their interests may be found in the definitive proxy statement filed with the SEC on September 30, 2014, which is incorporated herein by reference.

AN IMPORTANT MESSAGE

FOR FELLOW STOCKHOLDERS OF HAMPDEN BANCORP, INC.

FROM MHC MUTUAL CONVERSION FUND, L.P.

October 17, 2014

Dear Fellow Hampden Bancorp, Inc. Stockholder:

You have by now received a letter from Hampden Bancorp, Inc. (“Hampden”, “Hampden Bancorp” or the “Company”), in which the Company asserts that another large stockholder recommended to the Company an independent director candidate in lieu of Johnny Guerry.THIS IS NOT TRUE

HAMPDEN’S MANAGEMENT AND BOARD HAVE MISLEAD SHAREHOLDERS.

| | · | The large stockholder that Hampden referenced in their last letter did not recommend an independent director candidate in lieu of Mr. Guerry. IN FACT, HIS RECOMMENDATION WAS FOR HAMPDEN TO ADD JOHNNY GUERRY TO THE BOARD OF DIRECTORS. |

| | · | Clover Partners subleased one spare office (out of 14 in our suite) to a construction/real estate executive five years ago, and Hampden continues to lie to shareholders about this arrangement, despite knowing the facts. |

| | · | These actions call into question the qualifications of the current members of the Hampden board, as the Company has lacked the maturity to keep this contest about the professional merits of the candidates and has resorted to misleading stockholders, presumably in an attempt to maintain insulation from shareholder accountability. |

The company stated that “the stockholder recommended an independent director candidate who the Board agreed to add as a director to resolve this fight.”This is not true. In fact, the large stockholder recommended adding Clover’s nominees to the board and has already voted his shares in favor of Clover’s candidates.

Almost five years ago, Clover subleased one spare office out of 14 in our suite to an individual who was the president of a construction company and also a managing director of a real estate firm. This individual’s businesses operated in other parts of the country, and he needed an office for when he was working in Dallas. For a variety of reasons but mainly because our firm was growing, we later asked the individual to move out. This decision had nothing to do with any suspected misconduct on Clover’s premises. Clover has never alleged the individual committed any crimes or nefarious activity on Clover’s premises whatsoever. Clover discovered well after the individual vacated the premises that almost 15 years prior, there had been some sort of criminal charge against the individual.

During the summer, Mr. Guerry communicated this exact sequence of events to numerous board members of Hampden as well as the bank’s management team. Hampden is now misleading stockholders by suggesting this landlord/tenant relationship reflects on Mr. Guerry’s credential as a board member. Clover is not in the office leasing business, and alleging this decision is somehow indicative of Mr. Guerry’s business prowess is foolish and intended to mislead shareholders at any cost.

Hampden references “strength of character…practical wisdom, and mature judgment,” as being attributes of an effective director.And yet,this is the second time Hampden has mislead shareholders about Mr. Guerry, and now intentionally lied about the actions of another major shareholder. So, we question whether the current chairman, management and board members of Hampden possess the necessary qualities of strength of character, practical wisdom and mature judgment to effectively serve stockholders.

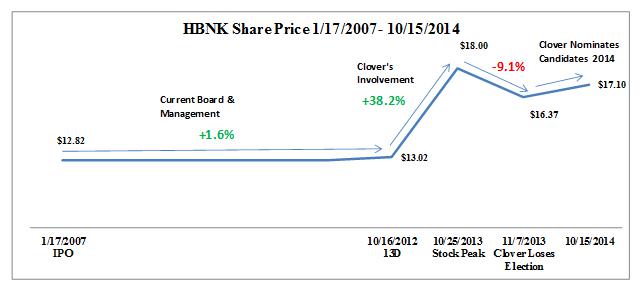

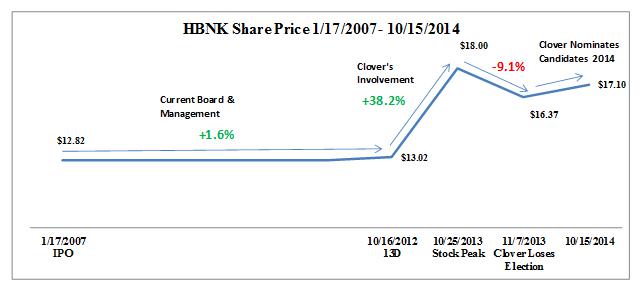

Hampden continues to take credit for share price appreciation that only happened once Clover became involved

As evidenced in the chart below, the bank’s share price consistently responds favorably to our involvement. To be sure, after advancing almost 40% after our initial 13-D filing, the bank’s shares fell approximately 9% after our 2013 campaign was unsuccessful.Most recently, the bank’s shares have improved with our nominations to the board of directors for the 2014 election.

Hampden is a poorly performing bank.

We believe Hampden’s misrepresentations are a desperate attempt to distract shareholders from the facts that show Hampden is a poorly managed bank with a poor and unprofessional board of directors.

Hampden continues to tout its “record” earnings without providing any scale in order to measure this figure. Hampden’s “record” earnings translate into a return on equity of 5.6% (excluding costs related to the contest), well below their cost of equity and what shareholders should demand from a bank touting operational accomplishments. While getting your first C is exciting to a student who has historically averaged Ds, it is still a C and far from laudable. Under reasonable assumptions, it would take Hampden more than a decade to achieve a return on equity in excess of their cost of capital.

It is evident that Hampden’s share price does not correlate with their advertised operational improvements. Hampden touted record earnings during last year’s proxy contest, only to see the share price fall after our campaign was unsuccessful.

Hampden has suggested the share price appreciation that took place once Glenn Welch took over is somehow a result of his efforts. However, we were already involved when Mr. Welch was named CEO, and Hampden is again attempting to mislead shareholders by suggesting the shares have reacted positively to their poor operating history. In fact, the only time the market could possibly grade Mr. Welch’s performance independent from our involvement was after last year’s proxy contest, and we will again reiterate the share price declined 9%. This is a failing grade and more representative of Mr. Welch’s and Hampden’s feats.

Why has Hampden reversed course on the perceived market opportunities?

Hampden has all of sudden reversed course on their historical narrative around the opportunities in their market. At Hampden’s request, we flew to Springfield to meet with Glenn Welch and Richard Kos (Hampden’s Chairman) in July. During that meeting, Glenn lamented over the lack of vibrancy in the Springfield market, characterizing it as “unlike Texas“ and growing merely in the single digit range. It is a sentiment that has been echoed by virtually all of Hampden’s competitors. Furthermore, Glenn said that he knew the bank’s returns were at an unacceptable level. These were his own words, so we wonder what has changed in this short amount of time. It is also interesting that Hampden highlighted the consolidation occurring in the Western Massachusetts’s banking market as an opportunity. We believe the most substantive opportunity to come as a result of United Financials merger with Rockville was the well-respected Massachusetts lending team that recently departed United Financial to go to a competitor. Unfortunately, their destination was First Connecticut Bank (FBNK) and not Hampden. Highlighting yet another failed operational opportunity for Hampden.

Clover’s Candidates are the Best Choice to Protect Your Investment

Clover’s nominees are the best qualified to serve on Hampden’s board. Hampden claims Mr. Guerry has a “total lack of any experience in banking or with public companies,” which is curious because as Hampden knows, Mr. Guerry has done nothing but invest in banks and public companies for almost a decade. Meanwhile, we can find no evidence of experience with public companies for the bank’s chairman or the bank’s board nominees beyond their experience with Hampden, which is to say, their only experience has been with a poorly performing institution. One might reason that a business with an abysmal operating record might welcome the input of individuals who had successfully operated a business like theirs or have a robust history of successfully investing in businesses like theirs. Unfortunately, this concept seems to escape Hampden or perhaps management is more interested in keeping their salaries, board fees or general stature within the community than improving the quality of the board.

Gary Base has 40 years of banking experience, which is more than the other directors on the board, including Mr. Welch. Furthermore, Mr. Base ran a far larger and more successful bank (VPFG) than Hampden. During Mr. Base’s tenure as CEO, the banks shares advanced 52%, while Hampden’s shares only began to appreciate after Clover’s involvement.

While Mr. Base offers years of operational experience, Mr. Guerry offers a unique skillset which no other member of the board possesses and is urgently needed, especially in light of the board’s dilutive buyback activity:

| | · | For approximately 10 years, Mr. Guerry has analyzed and invested in hundreds of banks nationwide and is an expert in the banking sector. Through this experience, he has a strong understanding of the different geographic sectors of the country and their respective opportunities and challenges. The hundreds of in-depth examinations he has made of the financial reports and public disclosures of banks have provided him with a keen sense of the factors that either hinder or enhance the financial performance of banks. This allows him to provide valuable insights into the factors that are impacting the financial performance of the Company. |

| | · | Mr. Guerry has raised over $400 million in assets and delivered strong returns for his investors. While Hampden characterizes Clover, one of their largest shareholders, as a “small” hedge fund, Clover made more money last year for its investors than Hampden has made in cumulative net income since going public. In 2008, during the height of the financial crisis, Mr. Guerry’s fund returned 26%. In other words, Mr. Guerry knows what it means to carry the responsibility of caring for the hard earned money of investors, and will work to ensure that the shareholders of the Company, who have invested their hard earned money in the Company, have their interests protected. |

| | · | Mr. Guerry regularly collaborates with bank management teams and their boards of directors, advising them on capital management strategies and market perspective. |

Curiously, Hampden continues to point to Glenn Welch’s qualifications while making little mention of their other nominees. In point of fact, Clover’s candidates would replace Mary Ellen Scott and Stanley Kowalski, not Glenn. Mrs. Scott and Mr. Kowalski have been directors of the bank since before Hampden even went public, and we believe shareholders would welcome some fresh input from a proven operator and experienced bank investor.

Management and the Board are MISALIGNED with Shareholders.

After spending $410,000 of stockholders money last year on the proxy contest, and expressing insiders’ confidence in the Company’s growth plan, insiders sold 3.5x more stock than was purchased.

You might surmise that at least one of the three nominees up for election and endorsed by the board has purchased stock in the open market at some point in the preceding seven years since the bank went public. Unfortunately, not one of them has.

According to SNL Financial, since going public the Company’s insiders have purchased less than $80,000 of stock in the open market, while selling over $1,600,000.

You Deserve Better

You can vote for Hampden’s entrenched insiders, who have been on the board for approximately 14 and 19 years respectively, never bought the stock, overseen abysmal operating results and lackluster share price performance. OR, you can vote for two industry experts who have a strong history of something greatly lacking at Hampden: creating tremendous value for their investors.

*******

If you share our concerns and views about Hampden Bancorp, please vote FOR Johnny Guerry and Garold R. Base on our WHITE proxy card.

IF YOU ARE A STOCKHOLDER OF RECORD YOU MAY VOTE BY MARKING YOUR VOTE ON THE WHITE PROXY CARD PREVIOUSLY SENT TO YOU.

IF YOUR SHARES ARE HELD IN “STREET NAME” BY A BROKER, NOMINEE, FIDUCIARY OR OTHER CUSTODIAN, FOLLOW THE DIRECTIONS GIVEN BY THE BROKER, NOMINEE, FIDUCIARY OR OTHER CUSTODIAN REGARDING HOW TO INSTRUCT THEM TO VOTE YOUR SHARES. YOUR BROKER, NOMINEE, FIDUCIARY OR OTHER CUSTODIAN MAY PERMIT YOU TO VOTE BY THE INTERNET OR BY TELEPHONE.

If you have any questions, require any assistance, or would like to request copies of the proxy documents, please contact Alliance Advisors LLC, proxy solicitors for MHC Mutual Conversion Fund, L.P., at the following address and telephone number:

Alliance Advisors LLC

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

Shareholders Call Toll Free: 1-877-777-5216

Banks and Brokers Call Collect: 973-873-7700

Important Information

MHC Mutual Conversion Fund, L.P. has nominated Johnny Guerry and Garold R. Base as nominees to the board of directors of the Company and is soliciting votes for the election of Mr. Guerry and Mr. Base as members of the board. On September 30, 2014, MHC Mutual Conversion Fund, L.P. filed its definitive proxy statement and related proxy materials with the Securities and Exchange Commission (“SEC”), and has sent the definitive proxy statement, WHITE proxy card and related proxy materials to shareholders of the Company seeking their support of Mr. Guerry and Mr. Base at the Company’s 2014 Annual Meeting of Stockholders. Stockholders are urged to read the definitive proxy statement and WHITE proxy card because they contain important information about the participants in the solicitation, Mr. Guerry and Mr. Base, the Company and related matters.Stockholders may obtain a free copy of the definitive proxy statement and WHITE proxy card and other documents filed by MHC Mutual Conversion Fund, L.P. with the SEC at the SEC’s web site at www.sec.gov. A proxy given pursuant to our solicitation may be revoked at any time before it is voted.

Participants in Solicitation

The participants in the solicitation by MHC Mutual Conversion Fund, L.P. consist of the following persons: MHC Mutual Conversion Fund, L.P., Clover Partners, L.P., Clover Investments, L.L.C., Michael C. Mewhinney, Johnny Guerry and Garold R. Base. Such participants may have interests in the solicitation, including as a result of holding shares of the Company’s common stock. Information regarding the participants and their interests may be found in the definitive proxy statement filed with the SEC on September 30, 2014.

Contacts

Alliance Advisors, LLC

Peter J. Casey, 973-873-7710

Executive Vice President

pcasey@allianceadvisorsllc.com

or

MHC Mutual Conversion Fund, L.P.

Johnny Guerry, 214-273-5200

fax: 214-273-5199

JGuerry@cloverpartners.com