EXHIBIT 2

LETTER TO BOARD OF DIRECTORS OF CHICOPEE BANCORP, INC.

iDear Board of Directors of Chicopee Bancorp,

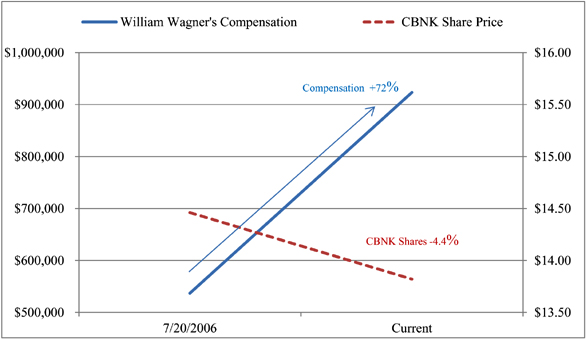

I am writing to request that the Board of Directors formally retain an investment bank to explore strategic alternatives for the institution. Shareholders have patiently waited for over six years for the management team to create shareholder value to no avail. To be sure, the stock price has declined from the initial trading day by approximately 5%. Notwithstanding the erosion of shareholder value, management has consistently rewarded themselves with compensation increases, which now stand at egregious levels relative to peers.

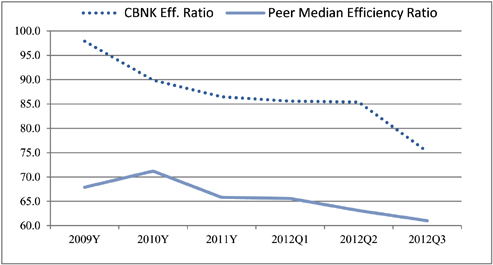

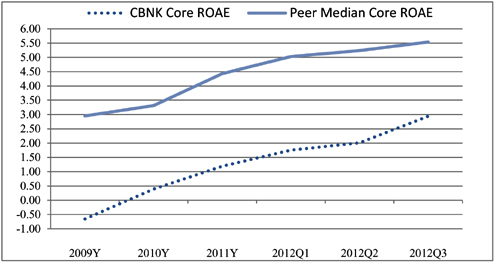

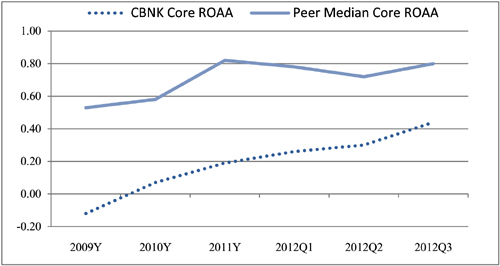

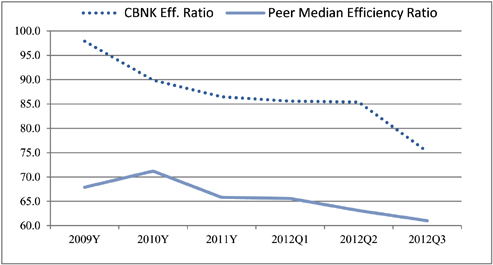

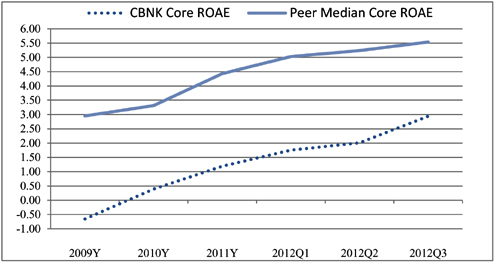

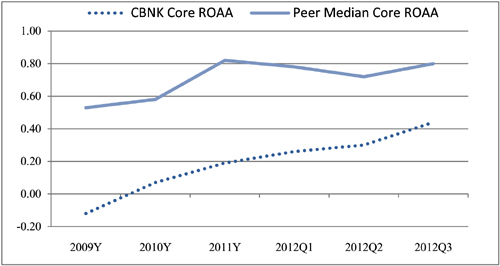

We have been shareholders for almost five years, and during that period we conducted extensive due diligence leading us to believe that it is not plausible for the bank to earn its cost of capital over the next three to five years if ever (we estimate CBNK’s cost of capital to be between 9% and 11%). Furthermore, Chicopee has some of the poorest operational metrics when compared to other public banks in the Springfield market, and we believe it is highly unlikely that these metrics will improve to the point of being accretive to shareholder value. The exhibits below outline Chicopee’s efficiency ratio, return on average equity and return on average assets. These metrics fall well below those of overcapitalized peers.

Source: SNL Financial

Source: SNL Financial

Source: SNL Financial

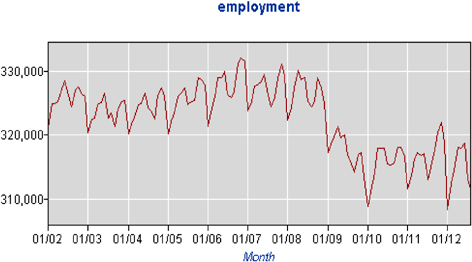

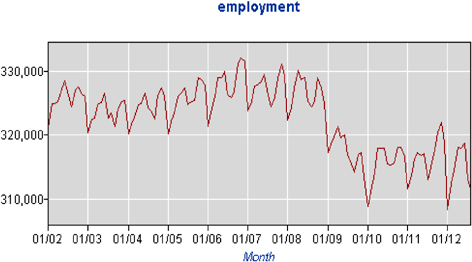

Beyond the operational deficiencies, the greater Springfield market is mature and does not have demographic trends that suggest substantive future growth is achievable. By management’s own admission, the market is growing in the low single digits. Furthermore, the employment level for the Springfield area is currently at decade lows. This anemic growth rate is further complicated by the level of competition from other banks in the area.

Source: U.S. Bureau of Labor Statistics

We believe that the Springfield banking market is in great need of consolidation and therein lies the opportunity for Chicopee’s shareholders. Many of the bank’s competitors trade at considerably higher multiples of tangible book value relative to Chicopee. These competitors can utilize their currency to structure an accretive acquisition while paying a substantive premium to Chicopee’s current share price. According to our research, we conservatively estimate that a strategic buyer would pay somewhere in the range of 1.25x-1.4x tangible book value, resulting in a premium of 48%-65% to the current share price. In light of the losses that shareholders have experienced over the past six and a half years, we feel that most would consider this a terrific outcome. We have attached a list of comparable M&A transactions below.

| | | | | | | | | | | | | | | | | | | | | | |

Buyer Name | | St. | | Target Name | | St. | | Ann’d

Date | | | Deal

Value | | | Price to

TBV | | | Prem./

Core Dep. | |

2011-2012 Total Deal Value Above $25 Mil | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

F.N.B. Corporation | | PA | | Annapolis Bancorp, Inc. | | MD | | | 10/22/2012 | | | | 50 | | | | 160 | | | | NA | |

Penns Woods Bancorp, Inc. | | PA | | Luzerne National Bank Corporation | | PA | | | 10/18/2012 | | | | 46 | | | | 165 | | | | 7.5 | |

NBT Bancorp Inc. | | NY | | Alliance Financial Corporation | | NY | | | 10/07/2012 | | | | 231 | | | | 212 | | | | 12.4 | |

M&T Bank Corporation | | NY | | Hudson City Bancorp, Inc. | | NJ | | | 08/27/2012 | | | | 3,813 | | | | 84 | | | | NA | |

WesBanco, Inc. | | WV | | Fidelity Bancorp, Inc. | | PA | | | 07/19/2012 | | | | 73 | | | | 167 | | | | 5.5 | |

Old Line Bancshares, Inc. | | MD | | WSB Holdings, Inc. | | MD | | | 07/11/2012 | | | | 49 | | | | 89 | | | | -2.8 | |

Investors Bancorp, Inc. (MHC) | | NJ | | Marathon Banking Corporation | | NY | | | 06/14/2012 | | | | 135 | | | | 151 | | | | 7.4 | |

Berkshire Hills Bancorp, Inc. | | MA | | Beacon Federal Bancorp, Inc. | | NY | | | 05/31/2012 | | | | 130 | | | | 111 | | | | 3.4 | |

Independent Bank Corp. | | MA | | Central Bancorp, Inc. | | MA | | | 04/30/2012 | | | | 65 | | | | 165 | | | | 8.4 | |

Commerce Bancshares Corp. | | MA | | Mercantile Capital Corp | | MA | | | 03/21/2012 | | | | 30 | | | | 194 | | | | 6.1 | |

United Financial Bancorp, Inc. | | MA | | New England Bancshares, Inc. | | CT | | | 03/19/2012 | | | | 86 | | | | 155 | | | | 6.5 | |

Tompkins Financial Corporation | | NY | | VIST Financial Corp. | | PA | | | 01/25/2012 | | | | 109 | | | | 116 | | | | 1.4 | |

Provident New York Bancorp | | NY | | Gotham Bank of New York | | NY | | | 01/17/2012 | | | | 41 | | | | 128 | | | | 4.1 | |

ESSA Bancorp, Inc. | | PA | | First Star Bancorp, Inc. | | PA | | | 12/21/2011 | | | | 25 | | | | 84 | | | | -1.0 | |

Beneficial Mutual Bancorp, Inc. (MHC) | | PA | | SE Financial Corp. | | PA | | | 12/05/2011 | | | | 32 | | | | 111 | | | | NA | |

NBT Bancorp Inc. | | NY | | Hampshire First Bank | | NH | | | 11/16/2011 | | | | 45 | | | | 144 | | | | 7.6 | |

Berkshire Hills Bancorp, Inc. | | MA | | Connecticut Bank and Trust Company | | CT | | | 10/25/2011 | | | | 36 | | | | 143 | | | | 5.8 | |

Sandy Spring Bancorp, Inc. | | MD | | CommerceFirst Bancorp, Inc. | | MD | | | 10/06/2011 | | | | 25 | | | | 107 | | | | 1.1 | |

S&T Bancorp, Inc. | | PA | | Mainline Bancorp, Inc. | | PA | | | 09/14/2011 | | | | 26 | | | | 126 | | | | 2.5 | |

Susquehanna Bancshares, Inc. | | PA | | Tower Bancorp, Inc. | | PA | | | 06/20/2011 | | | | 342 | | | | 149 | | | | 6.0 | |

Capital One Financial Corporation | | VA | | ING Bank, FSB | | DE | | | 06/16/2011 | | | | 9,000 | | | | 102 | | | | 0.2 | |

F.N.B. Corporation | | PA | | Parkvale Financial Corporation | | PA | | | 06/15/2011 | | | | 163 | | | | 198 | | | | 5.2 | |

BankUnited, Inc. | | FL | | Herald National Bank | | NY | | | 06/02/2011 | | | | 70 | | | | 132 | | | | 4.7 | |

Valley National Bancorp | | NJ | | State Bancorp, Inc. | | NY | | | 04/28/2011 | | | | 267 | | | | 188 | | | | NA | |

Brookline Bancorp, Inc. | | MA | | Bancorp Rhode Island, Inc. | | RI | | | 04/19/2011 | | | | 234 | | | | 193 | | | | 11.8 | |

Susquehanna Bancshares, Inc. | | PA | | Abington Bancorp, Inc. | | PA | | | 01/26/2011 | | | | 274 | | | | 124 | | | | 9.1 | |

People’s United Financial, Inc. | | CT | | Danvers Bancorp, Inc. | | MA | | | 01/20/2011 | | | | 489 | | | | 184 | | | | 13.4 | |

| | | | | | | |

2011-2012 Total Deal Value Above $25 Mil. | | | | | | | | | | | | | 15,885 | | | | | | | | | |

2011-2012 Median Deal Value Above $25 Mil. | | | | | | | | | | | 73 | | | | 144 | | | | 5.8 | |

Source: SNL Financial

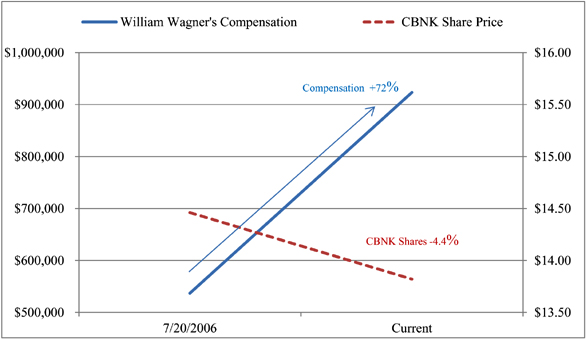

Despite abysmal share price and operational performance, the Board has increased CEO Bill Wagner’s compensation by 72% since the IPO. We would be interested to know how the compensation committee evaluates performance and if shareholder return factors into the equation. According to the latest proxy, Mr. Wagner will get approximately $5,312,000 in a change of control (with termination), which is equivalent to 7% of the market capitalization of the bank. This sum is staggering when you consider that Mr. Wagner currently owns shares valued at approximately $1,100,000. Again, this is largely the product of policies that look out for senior management but are indifferent to shareholder interests. It seems clear that executive compensation is in no way tied to the bank’s performance and that management may be incentivized to maintain thestatus quo as opposed to taking action towards maximizing shareholder value.

Source: SNL Financial

| | | | | | | | | | | | |

Initial Trading Date | | 7/20/2006 | | | 12/3/2012 | | | % Change | |

CBNK | | $ | 14.46 | | | $ | 13.82 | | | | -4.4 | % |

| | | |

Compensation | | 2006 | | | 2011 | | | % Change | |

William J. Wagner | | | 537,070 | | | | 923,485 | | | | 71.9 | % |

Source: SNL Financial

We strongly believe that shareholders will be best served by finding a buyer for Chicopee. Continuing to stay independent merely to enrich senior management is not consistent with your fiduciary duties as Board members of a public company. Time is of the essence, and as potential acquirers begin consummating transactions with other candidates, Chicopee’s strategic value may decrease, further jeopardizing shareholder value. We hope that the Board will heed our advice and that we will not need to run for board seats. However, we are preparing a slate for the 2013 annual meeting to ensure that shareholder interests are protected in the event that the Board fails to act.

Sincerely,

Johnny Guerry

| i | Please note that many of our projections and estimates included in this letter are subject to uncertainties and other changes to market conditions. In addition, we do not have access to material non-public information regarding Chicopee’s business or future plans. Our views and analyses are solely based on publicly available information. Any discussions herein regarding our investment strategy with respect to our holdings in Chicopee represents our current intentions only. Depending upon conditions and trends in the securities markets and the economy in general, we may pursue a different strategy that we determine to be in the best interests of our clients. |

This letter contains estimates and “forward looking statements” based on publicly available information. Any statements about our estimates, expectations, beliefs, plans, objectives, assumptions, future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases such as “anticipate,” “estimate,” “projects,” “expects,” “we believe,” and similar words or phrases. Accordingly, these statements involve estimates, assumptions and uncertainties that could cause actual results to differ materially from those expressed in them. The actual results could differ materially from those anticipated in such estimates or forward-looking statements as a result of many different factors. Our projections contained in this letter are only estimates of future results and there can be no assurance that actual results will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements.

For the purpose of our analysis the peer group (listed by ticker symbol) used for comparison includes: BRKL, ORIT, HBNK, UBNK, NWBI, BHLB, PBCT, ESSA and WFD.

Annex A

Except as set forth below, there have been no transactions in the Common Stock by the Reporting Persons or, to the knowledge of the Reporting Persons, by any of the other persons named in Item 2 during the past sixty days.

During the past sixty days, the Reporting Persons effected the following purchases and sales of shares of Common Stock in open market transactions:

| | | | | | | | | | | | |

| Trade Date | | Settle Date | | | Amount | | | Unit

Price | |

9/21/2012 | | | 9/26/2012 | | | | 500 | | | | (14.51 | ) |

10/11/2012 | | | 10/16/2012 | | | | 1,000 | | | | (15.03 | ) |

11/9/2012 | | | 11/14/2012 | | | | 1,000 | | | | (14.28 | ) |

11/27/2012 | | | 11/30/2012 | | | | 200 | | | | (14.13 | ) |