QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on December 17, 2004.

Registration No. 333-120876

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM F-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

INMARSAT FINANCE II PLC

(Exact name of co-registrant as

specified in its charter) |

England and Wales

(State or other jurisdiction of

incorporation or organization) |

|

4899

(Primary Standard Industrial

Classification Code Number) |

|

98–0440041

(I.R.S. Employer

Identification Number) |

INMARSAT HOLDINGS LIMITED

(Exact name of co-registrant as

specified in its charter) |

England and Wales

(State or other jurisdiction of

incorporation or organization) |

|

4899

(Primary Standard Industrial

Classification Code Number) |

|

98–0440043

(I.R.S. Employer

Identification Number) |

c/o Inmarsat Holdings Limited

99 City Road, London EC1Y 1AX, United Kingdom; +44 (0)20 7728 1000

(Address, including zip code, and telephone number, including area code, of registrants' principal executive offices)

CT Corporation System

111 Eighth Avenue, 13th Floor, New York, NY 10011; +1 212 894 8600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

John W. Connolly III

Clifford Chance Limited Liability Partnership

10 Upper Bank Street, London E14 5JJ, United Kingdom; +44 (0)20 7006 1000

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, or the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

THE CO-REGISTRANTS HEREBY AMEND THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE CO-REGISTRANTS SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

| | Amount to

be Registered

| | Proposed Maximum

Offering Price per $1,000 principal amount

| | Proposed Maximum

Aggregate(1) Offering Price

| | Amount of

Registration Fee

|

|---|

|

| 103/8% Senior Discount Notes due 2012 | | $450,000,000 | | 66.894% | | $301,023,000 | | $38,139.61 |

| Guarantee of 103/8% Senior Discount Notes due 2012 | | — | | — | | — | | —(2) |

|

- (1)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(f) under the Securities Act.

- (2)

- In accordance with Rule 457(n) of the Securities Act, no separate fee for the registration of the guarantee is required.

PROSPECTUS

Inmarsat Finance II plc

a public limited company incorporated under the laws of England and Wales and a direct subsidiary of

Inmarsat Holdings Limited, the guarantor of the notes

Exchange Offer for

103/8% Senior Discount Notes due 2012

This is an offer by Inmarsat Finance II plc to exchange any 103/8% Senior Discount Notes due 2012 that you now hold, for newly issued 103/8% Senior Discount Notes due 2012. This offer will expire at 12:00 midnight New York City time on January 19, 2005, unless we extend the offer. You must tender your existing notes by this deadline in order to receive the new notes. If we decide to extend the offer, we do not currently intend to extend the expiration period beyond January 21, 2005.

We may redeem some or all of the new notes at any time at our option on the terms set forth in this prospectus. We will be required to redeem a portion of each of the new notes upon the occurrence of specified events and on the terms described in this prospectus.

See "Risk Factors" beginning on page 13 for a description of the business and financial risks associated with the new notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 20, 2004.

TABLE OF CONTENTS

| | Page

|

|---|

| FORWARD-LOOKING STATEMENTS | | ii |

PRESENTATION OF FINANCIAL INFORMATION AND CERTAIN OTHER DATA |

|

iv |

PROSPECTUS SUMMARY |

|

1 |

RISK FACTORS |

|

13 |

THE ACQUISITION AND FINANCING |

|

30 |

CAPITALIZATION |

|

32 |

UNAUDITED PRO FORMA COMBINED FINANCIAL DATA |

|

33 |

EXCHANGE RATES |

|

43 |

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA |

|

44 |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

|

50 |

THE MOBILE SATELLITE COMMUNICATIONS SERVICES INDUSTRY |

|

79 |

BUSINESS |

|

81 |

REGULATION |

|

103 |

DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

|

112 |

PRINCIPAL SHAREHOLDERS |

|

120 |

MATERIAL CONTRACTS |

|

126 |

DESCRIPTION OF CERTAIN FINANCING ARRANGEMENTS |

|

141 |

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS |

|

159 |

DESCRIPTION OF THE NOTES |

|

160 |

THE EXCHANGE OFFER |

|

216 |

TAX CONSIDERATIONS |

|

225 |

ERISA AND OTHER CONSIDERATIONS |

|

232 |

PLAN OF DISTRIBUTION |

|

234 |

ENFORCEMENT OF JUDGMENTS |

|

235 |

LEGAL MATTERS |

|

237 |

EXPERTS |

|

237 |

WHERE YOU CAN FIND MORE INFORMATION |

|

237 |

LISTING INFORMATION |

|

238 |

INDEX TO FINANCIAL STATEMENTS AND OTHER SUPPLEMENTAL FINANCIAL INFORMATION |

|

F-1 |

We refer to the 103/8% Senior Discount Notes due 2012 in this prospectus as the notes. Unless we indicate differently, when we use the terms "notes" and "new notes," in this prospectus, we mean the new notes that we intend to issue to you if you exchange your existing notes.

i

FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements. These forward-looking statements include all matters that are not historical facts. Statements containing the words "believe," "expect," "intend," "plan," "may," "estimate" or, in each case, their negative and words of similar meaning are forward-looking.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual financial condition, results of operations and cash flows, and the development of the industry in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this prospectus. In addition, even if our financial condition, results of operations and cash flows, and the development of the industry in which we operate, are consistent with the forward-looking statements contained in this prospectus, those results or developments may not be indicative of results or developments in subsequent periods. Important facts that could cause our actual results of operations, financial condition or cash flows, or development of the industry in which we operate, to differ from our current expectations include, but are not limited to:

- •

- our reliance on third-party distributors to market and sell our services effectively;

- •

- our dependence on five master distributors, who generate a significant portion of our revenues;

- •

- our possible inability to offset declining revenues from voice services with revenues from data services;

- •

- possible decreases in global security activity in the Middle East;

- •

- significant competition from other operators;

- •

- our possible inability to retain sufficient rights to the L-band spectrum required to operate our satellite system to its expected capacity;

- •

- applications by our competitors to use L-band spectrum for terrestrial services leading to interference with our services;

- •

- factors beyond our control with respect to the manufacture and supply of user terminals by third parties;

- •

- possible operational failures of the Thuraya satellite, which could adversely affect our ability to deliver Regional BGAN services;

- •

- our possible inability to recruit and retain the necessary management or employees;

- •

- the significant operational risks relating to our satellite network;

- •

- the potential for our satellites to fail or suffer a reduction in their expected useful lives;

- •

- the significant risks related to the timely manufacture and launch of our Inmarsat-4 satellites;

- •

- our possible inability to obtain and maintain in-orbit insurance to cover our satellites;

- •

- the possibility that new technologies could render our technologies obsolete;

- •

- our possible inability to protect our intellectual property;

- •

- the possible adverse impact of increasing regulation relating to the transmission of our satellite signals and the provision of our services in certain countries;

- •

- the implementation risks associated with our BGAN network;

ii

- •

- the significant influence certain of our shareholders have over us;

- •

- the possible adverse impact of additional governmental regulation;

- •

- the possible adverse impact of our substantial leverage and ability to meet significant debt service obligations; and

- •

- our possible inability to access the cash flow and other assets of our subsidiaries.

As a consequence, our current plans, anticipated actions and future financial condition, results of operations and cash flows, as well as the anticipated development of the industry in which we operate, may differ from those expressed in any forward-looking statements made by us or on our behalf. We urge you to read this prospectus, including the sections entitled "Risk Factors," "Operating and Financial Review and Prospects" and "Business" for a more complete discussion of the factors that could affect our future performance and the industry in which we operate. These factors and this cautionary statement expressly qualify all forward-looking statements.

Following this exchange offer, we will be subject to the reporting requirements of the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act, and will be required to make periodic reports to the SEC about us and our business, which will be publicly available. In addition, we are subject to the ongoing reporting requirements of the Luxembourg Stock Exchange. Our subsidiary, Inmarsat Group Limited, and certain of its subsidiaries are currently subject to the reporting requirements of the Exchange Act. Apart from any requirements pursuant to these laws and rules, we have no obligation to update publicly or revise any forward-looking statements in this prospectus, whether as a result of new information, future events or otherwise. You are cautioned not to rely unduly on forward-looking statements when evaluating the information presented in this prospectus.

iii

PRESENTATION OF FINANCIAL INFORMATION AND CERTAIN OTHER DATA

Financial Data

Unless otherwise indicated, all historical consolidated and pro forma combined financial information included herein has been prepared in accordance with UK GAAP, with a reconcilliation to U.S. GAAP of certain key financial data. UK GAAP differs in certain significant respects from U.S. GAAP. For a discussion of the principal differences between UK GAAP and U.S. GAAP as they apply to us, see Note 32 to the audited consolidated financial statements of Inmarsat Holdings Limited, Note 9 to the unaudited interim consolidated financial statements of Inmarsat Holdings Limited and Note 3 to the Unaudited Pro Forma Combined Financial Data, in each case, included elsewhere in this prospectus.

Some of the financial information in this prospectus has been rounded and, as a result, the totals of the data presented in this prospectus may vary slightly from the actual arithmetic totals of such information.

Non-GAAP Financial Measures

EBITDA from continuing operations

EBITDA from continuing operations and the related ratios presented in this prospectus are supplemental measures of our performance and liquidity that are not required by, or presented in accordance with, UK GAAP or U.S. GAAP. Furthermore, EBITDA from continuing operations is not a measure of our financial performance or liquidity under UK GAAP or U.S. GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with UK GAAP or U.S. GAAP or as an alternative to cash flow from operating activities as a measure of our liquidity.

We believe EBITDA from continuing operations facilitates operating performance comparisons from period to period and company to company by eliminating potential differences caused by variations in capital structures (affecting interest expense), tax positions (such as the impact on periods or companies of changes in effective tax rates or net operating losses) and the age and book depreciation of tangible assets (affecting relative depreciation expense). We also present EBITDA from continuing operations because we believe it is frequently used by securities analysts, investors and other interested parties in evaluating similar issuers. Finally, we present EBITDA from continuing operations as a supplemental measure of our ability to service our debt.

Nevertheless, EBITDA from continuing operations has limitations as an analytical tool, and you should not consider it in isolation from, or as a substitute for analysis of, our results of operations, as reported under UK GAAP or U.S. GAAP. Some of these limitations are:

- •

- it does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments;

- •

- it does not reflect changes in, or cash requirements for, our working capital needs;

- •

- it does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt;

- •

- although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA measures, such as EBITDA from continuing operations, do not reflect any cash requirements for such replacements;

- •

- it is not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows; and

iv

- •

- other companies in our industry may calculate this measure differently than we do, limiting its usefulness as a comparative measure.

Because of these limitations, EBITDA from continuing operations should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. We compensate for these limitations by relying primarily on our UK GAAP results and using EBITDA measures only supplementally. See "Unaudited Pro Forma Combined Financial Data" and "Operating and Financial Review and Prospects" and the historical consolidated financial statements and consolidated unaudited financial statements and accompanying notes appearing elsewhere in this prospectus.

Aggregated 2003 Financial Information

Our indirect subsidiary, Inmarsat Investments Limited, acquired all of the shares of Inmarsat Ventures Limited on December 17, 2003, and we account for the acquisition of Inmarsat Ventures Limited from that date. Inmarsat Ventures Limited and its consolidated subsidiaries prior to the acquisition are referred to as the "predecessor." Inmarsat Holdings Limited and its consolidated subsidiaries, from and after the acquisition of Inmarsat Ventures Limited, are referred to as the "successor."

Our results for the year ended December 31, 2003 are presented in this prospectus on an aggregated basis. Aggregated data is derived by adding amounts for our predecessor for the period from January 1, 2003 to (and including) December 17, 2003 and for the successor for the period from (but excluding) December 17, 2003 to December 31, 2003. We have aggregated the information to provide investors with 2003 data for a full year period. However, data for the successor period includes the effect of purchase accounting related to the acquisition and therefore is not directly comparable with predecessor data for prior periods.

Unless otherwise stated in this prospectus, all references to our results for the year ended December 31, 2003 refer to the aggregated data for 2003 discussed above.

Trademarks

The names "Inmarsat," "BGAN" and "Swift64," as well as the Inmarsat logo and Fleet logo, are our principal trademarks. Other significant trademarks include the name "Universal Calling" and its devices.

"Inmarsat" is owned by the International Maritime Satellite Organization and licensed exclusively to Inmarsat Limited and Inmarsat Ventures Limited pursuant to a perpetual, irrevocable license. All other trademarks listed above are owned by Inmarsat (IP) Company Limited, a subsidiary of Inmarsat Ventures Limited. All of those trademarks are either registered or registration is pending in our key markets.

CNN is an end user of our services. "CNN" is owned by Cable News Network LP, a Time Warner Company. All rights reserved.

v

PROSPECTUS SUMMARY

This summary highlights selected information about the offering and us. It does not contain all the information that may be important to you. You should read the entire prospectus, including the financial information and the related notes and the risks of investing in the notes under the "Risk Factors" section, before making an investment decision.

In this prospectus, references to "we," "us" and "our" are to Inmarsat Holdings Limited, its subsidiaries and its predecessor (Inmarsat Ventures Limited), except that on the cover page, references to "we," "us" and "our" refer only to Inmarsat Holdings Limited. References to the "Issuer" are to Inmarsat Finance II plc, the issuer of the notes. References to the "guarantor" are to Inmarsat Holdings Limited.

Our Business

We are a leading provider of global mobile satellite communications services. We have been designing, implementing and operating satellite networks for over 24 years. From our fleet of nine geostationary satellites, we provide a wide range of voice and data services, including telephony, fax, video, email and intranet and internet access. End users of our services operate at sea, on land and in the air, and include enterprise-level users, such as Maersk (one of the world's largest shipping firms), Shell, CNN, BBC, British Airways, governments and governmental agencies including the UK Ministry of Defence, and international aid organizations such as the International Red Cross. Our revenues for the nine-month period ended September 30, 2004 were $359.5 million.

We own and operate all of our satellites. We have a successful launch and operating record, and have never experienced a satellite failure at launch or in orbit. Our current fleet of satellites includes four Inmarsat-2 satellites, which were launched in the early 1990s, and five Inmarsat-3 satellites, which were launched between 1996 and 1998. We currently anticipate that our Inmarsat-2 and Inmarsat-3 satellites will remain in commercial operation beyond their design lives, until between 2006-2011 and 2010-2014, respectively. We currently intend to launch two next-generation Inmarsat-4 satellites during 2005, subject to the launch providers' schedules. The Inmarsat-4 satellites will extend the commercial life of our satellite fleet to beyond 2017, and will serve as the platform for the introduction of next-generation higher-bandwidth services, such as broadband global area network, or BGAN, which will offer more sophisticated and significantly faster communication to end users.

We provide our mobile satellite services to the maritime, land and aeronautical sectors. During the nine-month period ended September 30, 2004, the maritime, land and aeronautical sectors of our business accounted for 52.5%, 29.3% and 3.4% of our total consolidated revenues, respectively. Our services are available at transmission rates of up to 64 kilobits per second and, through our Regional BGAN service, of up to 144 kilobits per second. The launch of our Inmarsat-4 satellites and the introduction of our BGAN services will allow us to offer a more sophisticated range of high-bandwidth services, including internet access, videoconferencing, local area network, or LAN, access and other services, all at speeds of up to 432 kilobits per second.

We also lease excess capacity on our satellites. During the nine-month period ended September 30, 2004, approximately 11.8% of our total revenues was attributable to leases, typically to governmental entities, including the U.S. Navy.

We sell our mobile satellite communications services to distributors, who then provide services to end users, either directly or indirectly through other distributors or service providers. Some of our 25 master distributors are affiliated with the largest incumbent communications companies in the world, and include affiliates of Telenor, KPN, Telstra and France Telecom. As of September 30, 2004, a global network of approximately 450 distributors and service providers, including our 25 master distributors, distributed our mobile satellite communications services to end users in approximately 170 countries on six continents.

1

Recent Developments

New Chief Financial Officer

Rick Medlock joined us as Executive Director and Chief Financial Officer on September 27, 2004. Mr. Medlock previously served as chief financial officer and company secretary of NDS Group plc, a pay-TV technology company. See "Directors, Senior Management and Employees—Management of Inmarsat Group Holdings Limited."

Sale and Leaseback of Headquarters Building

On November 30, 2004, we completed the sale and leaseback of our headquarters building at 99 City Road, London. The gross proceeds from the sale of our headquarters building were $125.1 million, and the contract provides for a 25 year lease by us of the building.

Finalization of Inmarsat-4 Insurance Cover

We recently obtained launch plus one year of in-orbit insurance for all of our Inmarsat-4 satellites. Under that coverage, each Inmarsat-4 satellite will be insured for $225 million. See "Business—Insurance of Our Business and Insurable Assets."

ORBIT Act

Until recently, the U.S. Open-Market Reorganization for the Betterment of International Telecommunications Act, or ORBIT Act, would have required us to undertake an initial public offering of equity securities in order to continue to offer certain of our existing and future services to users in the United States. In October 2004, the ORBIT Act was amended to extend the deadline for our compliance from December 31, 2004 to June 30, 2005, and to permit us to certify to the FCC that we have satisfied the intent of the ORBIT Act by means other than an initial public offering of equity securities. We intend to file a certification to that effect with the FCC in the near future. See "Regulation—Market access in the United States."

New Advisor to the Board

Admiral James O. Ellis, Jr. (Ret.) joined us as an advisor to the Board of Directors in December 2004. Admiral Ellis previously served as Commander, United States Strategic Command, headquartered at Offutt Air Force Base, Nebraska, where he was responsible for the global command and control of U.S. strategic forces. Admiral Ellis is also a member of the boards of directors of Lockheed Martin Corporation and America First Companies, LLC.

2

The Acquisition and Financing

Acquisition

Effective as of December 17, 2003, our indirect subsidiary, Inmarsat Investments Limited, acquired all of the issued and outstanding share capital of Inmarsat Ventures Limited. The transaction, or the acquisition, was completed by way of a scheme of arrangement under the UK Companies Act 1985.

Financing of the Acquisition

The purchase price for the acquisition, as well as related fees and expenses, were financed with a combination of funding provided by funds advised by Apax Partners and funds advised by Permira, the rollover shareholders and certain members of our management, and with external debt financing.

3

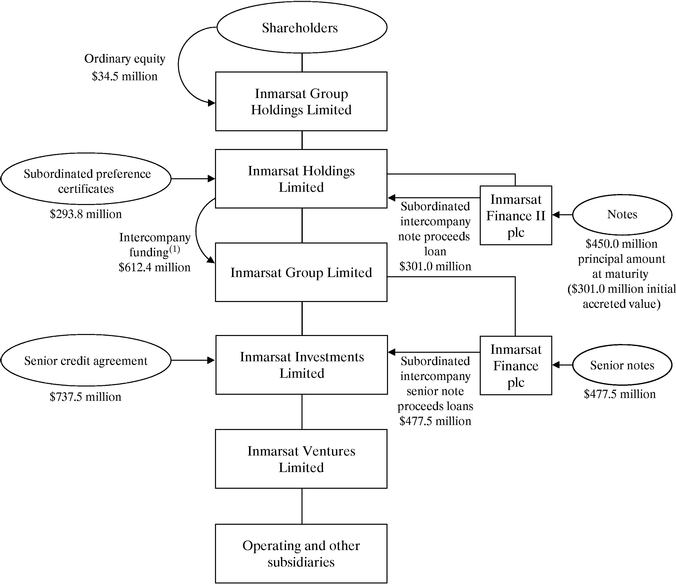

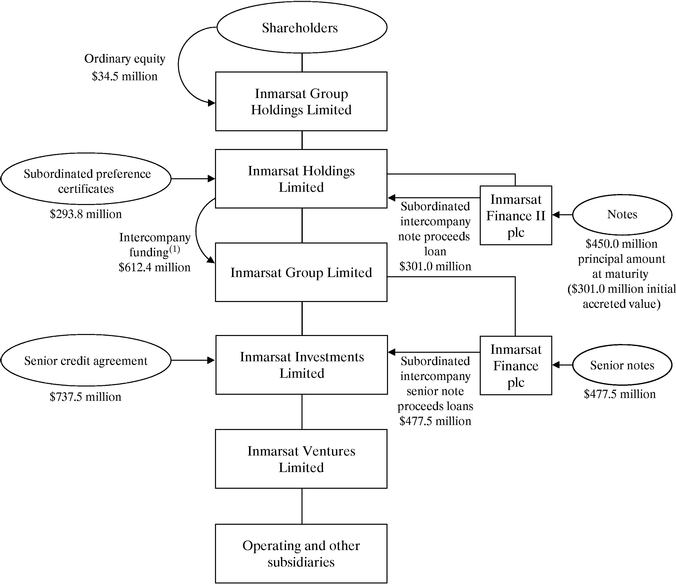

Summary Corporate and Financial Structure

The following table sets forth a summary of our corporate and financing structure following (i) the acquisition and related financing transactions (including the issuance of the senior notes and the notes) and (ii) the sale and leaseback of our headquarters building. Please refer to "Principal Shareholders," "Description of Certain Financing Arrangements" and "Description of the Notes" for more information.

- (1)

- Comprised of $34.5 million of ordinary equity and a $577.9 million subordinated intercompany funding loan. See "Description of Certain Financing Arrangements—Subordinated Intercompany Funding Loan." The subordinated intercompany funding loan will be pledged to secure Inmarsat Holdings Limited's guarantee of the notes on a first priority basis, and to secure Inmarsat Holdings Limited's obligations under the subordinated intercompany note proceeds loan on a second priority basis.

4

Our Address

Our principal executive offices are located at 99 City Road, London EC1Y 1AX, United Kingdom, and our telephone number is +44 (0)20 7728 1000. Our website iswww.inmarsat.com. Information contained on our website does not constitute a part of this prospectus and is not incorporated by reference herein.

5

The Exchange Offer

| Notes Offered for Exchange | | We are offering up to $450,000,000 in aggregate principal amount at maturity of our new 103/8% senior discount notes due 2012 in exchange for an equal aggregate principal amount at maturity of our existing 103/8% senior discount notes due 2012 on a one-for-one basis. The new notes have substantially the same terms as the existing notes you currently hold, except that we have registered the new notes under the Securities Act, and therefore, they will be freely tradable and will not contain the provisions for an increase in the interest rate related to defaults in our agreement to execute this exchange offer. |

| The Exchange Offer | | We are offering to exchange $1,000 principal amount at maturity of new notes for each $1,000 principal amount at maturity of your existing notes. In order for you to exchange your existing notes, you must tender them properly and we must accept them. We will exchange all existing notes that you tender validly and do not withdraw from tender. |

| Ability to Resell Notes | | We believe that you may offer for resale, resell and otherwise transfer the new notes issued in the exchange offer without compliance with the registration and prospectus delivery provisions of the Securities Act if: |

| | | • | you acquire the new notes in the exchange offer in the ordinary course of your business; |

| | | • | you are not participating, do not intend to participate and have no arrangement with any person to participate in the distribution of new notes we issue to you in the exchange offer; |

| | | • | you are not an affiliate of Inmarsat Finance II plc; and |

| | | • | you are not a broker-dealer tendering existing notes that you acquired directly from us for your own account. |

| | | By tendering your existing notes as described below, you will be making representations to this effect. See "The Exchange Offer—Representations We Need From You Before You May Participate in the Exchange Offer." |

| Those Excluded from the Exchange Offer | | You may not participate in the exchange offer if you are: |

| | | • | a holder of existing notes in any jurisdiction in which the exchange offer is not, or your acceptance will not be, legal under the applicable securities or "blue sky" laws of that jurisdiction, or |

| | | • | a holder of existing notes who is an affiliate of Inmarsat Finance II plc. |

| Consequences of Failure to Exchange Your Existing Notes | | After the exchange offer is complete, you will no longer be entitled to exchange your existing notes for new notes. If you do not exchange your existing notes for new notes in the exchange offer, your existing notes will continue to have the restrictions on transfer contained in the existing notes and in the indenture governing the existing notes. In general, your existing notes may not be offered or sold absent registration under the Securities Act, unless there is an exemption from, or unless the transaction is not governed by, the Securities Act and applicable state "blue sky" securities laws. We have no plans to register your existing notes under the Securities Act. |

| | | | | |

6

| Expiration Date | | The exchange offer expires at 12:00 midnight, New York City time, on January 19, 2005, the expiration date, unless we extend the offer. If we decide to extend the offer, we do not currently intend to extend the expiration period beyond January 21, 2005. |

| Conditions to the Exchange Offer | | The exchange offer has customary conditions that we may waive. There is no minimum amount of existing notes that holders must tender for us to complete the exchange offer. |

| Procedures for Tendering Your Existing Notes | | If you wish to tender your existing notes for exchange in the exchange offer, you or the custodial entity through which you hold your existing notes must send to The Bank of New York referred to as the exchange agent, on or before the expiration date of the exchange offer: |

| | | • | a properly completed and executed letter of transmittal, which you have received with this prospectus, together with your existing notes and any other documentation that the letter of transmittal requests; and |

| | | • | for holders who hold their positions through the Depository Trust Company, which we refer to as DTC: |

| | | | • | an agent's message from DTC stating that the tendering participant agrees to be bound by the letter of transmittal and the terms of the exchange offer; |

| | | | • | your existing notes by timely confirmation of book-entry transfer through DTC; and |

| | | | • | all other documents that the letter of transmittal requires. |

| | | Holders who hold their positions through Euroclear and Clearstream, Luxembourg must adhere to the procedures described in "The Exchange Offer—Procedures for Tendering Your Existing Notes." |

| Special Procedures for Beneficial Owners | | If you beneficially own existing notes registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender your existing notes in the exchange offer, you should contact the registered holder promptly and instruct the registered holder to tender on your behalf. |

| Guaranteed Delivery Procedures for Tendering Existing Notes | | If you wish to tender your existing notes, and the existing notes are not immediately available, or time will not permit your existing notes or other required documents to reach The Bank of New York by the expiration date, or the procedure for book-entry transfer cannot be completed on a timely basis, you may tender your existing notes according to the guaranteed delivery procedures set forth under "The Exchange Offer—Guaranteed Delivery Procedures." |

| | | | | |

7

| Withdrawal Rights | | You may withdraw the tender of your existing notes at any time prior to 12:00 midnight, New York City time, on the expiration date. |

| U.S. Tax Considerations | | The exchange of existing notes for the new notes will not be treated as a taxable transaction for U.S. federal income tax purposes. Rather, the notes you receive in the exchange offer will be treated as a continuation of your investment in the existing notes. For additional information regarding U.S. federal income tax considerations, you should read the discussion under "Tax Considerations—U.S. Taxation." |

| Use of Proceeds | | We will not receive any proceeds from the issuance of the new notes in the exchange offer. We will pay all expenses incidental to the exchange offer. |

| | | Inmarsat Finance II plc used the gross proceeds of the offering of the existing notes to make a subordinated intercompany note proceeds loan to Inmarsat Holdings Limited. See "Description of Certain Financing Arrangements—Subordinated Intercompany Note Proceeds Loan." Inmarsat Holdings Limited used the gross proceeds of the subordinated intercompany note proceeds loan to (i) redeem approximately $290.0 million euro equivalent accreted principal amount of subordinated preference certificates and (ii) pay fees and expenses of the offering of the notes. See "The Acquisition and Financing" for more information. |

| Exchange Agent | | The Bank of New York is serving as the exchange agent. Its address, telephone number and facsimile number are: |

| | | | | The Bank of New York

Corporate Trust Operations

Reorganization Unit

101 Barclay Street - 7 East

New York, New York 10286

Telephone: +1 212 815 3687

Fax: +1 212 298 1915

Attention: David Mauer |

Please review the information under the heading "The Exchange Offer" for more detailed information concerning the exchange offer.

8

The Notes

The summary below describes the principal terms of the notes and the guarantee relating to the notes. Certain of the terms and conditions described below are subject to important limitations and exceptions. The "Description of the Notes" section of this prospectus contains a more detailed description of the terms and conditions of the notes, including the definitions of certain terms used in this summary.

| Issuer | | Inmarsat Finance II plc, a subsidiary of Inmarsat Holdings Limited. |

Guarantor |

|

Inmarsat Holdings Limited. |

The Notes |

|

The terms of the new notes will be identical in all material respects to the terms of the existing notes, except that the new notes have been registered under the Securities Act and therefore they will not contain transfer restrictions, and will not contain the provisions for an increase in the interest rate related to defaults in our agreement to carry out this exchange offer. |

Maturity Date |

|

November 15, 2012. |

Accretion/Interest |

|

The notes have an initial accreted value of $668.94 per $1,000 principal amount at maturity and accrete at the rate of 10.375% per annum, compounded semi-annually on May 15 and November 15 of each year. From and after November 15, 2008, interest on the notes will accrue at the rate of 10.375% per annum, and will be payable in cash semi-annually in arrears on May 15 and November 15 of each year, commencing on May 15, 2009, until maturity. |

Original Issue Discount |

|

The notes were offered with original issue discount for U.S. federal income tax purposes. Although interest will not be payable on the notes prior to May 15, 2009, original issue discount must be included as gross income for U.S. federal income tax purposes in advance of the receipt of any payments to which the income is attributable. See "Tax Considerations—U.S. Taxation." |

Ranking and Guarantee |

|

The Notes |

|

|

The notes are senior obligations of the issuer and are its only debt (save for any additional notes issued by it in the future). The notes are effectively subordinated to all obligations of the subsidiaries of the guarantor that do not guarantee the notes. |

|

|

The issuer is a finance subsidiary which does not conduct any operations and its only asset is the subordinated intercompany note proceeds loan. The issuer and the trustee are party to a pledge agreement pursuant to which the issuer has pledged as security for its obligations under the notes the subordinated intercompany note proceeds loan. |

| | | | | |

9

|

|

The Guarantee |

|

|

The guarantee of the notes: |

|

|

• |

|

is a general obligation of the guarantor; |

|

|

• |

|

rankspari passu in right of payment with all unsubordinated indebtedness and other obligations of the guarantor; and |

|

|

• |

|

ranks senior in right of payment with any future subordinated indebtedness of the guarantor. |

|

|

The guarantor is a holding company which does not conduct any operations, and its only significant assets are the shares of Inmarsat Finance II plc and of Inmarsat Group Limited (whose only significant asset is the shares of Inmarsat Investments Limited) and, as of September 30, 2004, a $577.9 million subordinated intercompany funding loan owed to it by Inmarsat Group Limited. The guarantor and the trustee are party to an assignment agreement pursuant to which the guarantor has assigned as security its interest in the subordinated intercompany funding loan on a first priority basis. |

|

|

The guarantee is effectively subordinated to all obligations of the subsidiaries of the guarantor. |

|

|

Impact of subordination |

|

|

As of September 30, 2004, Inmarsat Group Limited and its subsidiaries had total obligations of $1,600.3 million (excluding Inmarsat Group Limited's obligations under the subordinated intercompany funding loan of $577.9 million). The notes and the guarantees are effectively subordinated to all of the obligations of Inmarsat Group Limited and its subsidiaries. |

Optional Redemption |

|

At any time, the issuer may redeem all or a part of the notes at a redemption price equal to 100% of the accreted value plus an applicable make-whole premium computed using a discount rate equal to the rate on U.S. treasuries maturing on or about November 15, 2008 plus 50 basis points, plus accrued and unpaid interest, if any. |

|

|

The issuer may also redeem up to 35%, or 100% but not less than 100%, of the principal amount at maturity of the notes outstanding prior to November 15, 2007 at a redemption price of 110.375% of the accreted value of the notes, plus accrued and unpaid additional interest, if any, with the proceeds of certain equity offerings. The issuer may make that redemption only if, after the redemption, at least 65% of the principal amount at maturity of the notes, or no notes, remain outstanding. |

|

|

In addition, the issuer may redeem some or all of the notes after November 15, 2008 at the redemption price described in the section entitled "Description of the Notes—Optional Redemption." |

Tax Redemption |

|

The issuer may redeem the notes in whole, but not in part, at any time, following certain changes in tax laws or their interpretation. If the issuer decides to redeem the notes following such change, the issuer must redeem the notes at a price equal to the accreted value or principal amount at maturity, as applicable, of the notes plus accrued and unpaid interest to the date of redemption. See "Description of the Notes—Tax Redemption." |

| | | | | |

10

Mandatory Offers |

|

Upon certain change of control events, each holder of the notes may require us to repurchase all or a portion of its notes at a price equal to 101% of the accreted value of the notes, plus accrued and unpaid interest to the date of repurchase. See "Description of the Notes—Repurchase at the Option of Holders—Change of Control." The issuer is also required to offer to repurchase the notes with the excess proceeds, if any, following certain asset sales and certain recoveries under the insurance policies relating to our satellites. The repurchase price will be equal to 100% of the accreted value or principal amount at maturity, as applicable, of the notes, plus accrued and unpaid interest to the date of repurchase. See "Description of the Notes—Repurchase at the Option of Holders—Asset Sales and Events of Loss." |

Covenants |

|

The terms of the notes place certain limitations on the ability of Inmarsat Holdings Limited and its restricted subsidiaries to, among other things: |

|

|

• |

|

incur additional indebtedness and issue preferred shares; |

|

|

• |

|

make certain restricted payments and investments; |

|

|

• |

|

transfer or sell assets; |

|

|

• |

|

create certain liens; |

|

|

• |

|

create restrictions on the ability of our restricted subsidiaries to pay dividends or other payments; |

|

|

• |

|

issue guarantees of indebtedness by its restricted subsidiaries; |

| | | | | |

11

|

|

• |

|

enter into sale and leaseback transactions; |

|

|

• |

|

issue or sell shares of our restricted subsidiaries; |

|

|

• |

|

merge, consolidate, amalgamate or combine with other entities; |

|

|

• |

|

designate restricted subsidiaries as unrestricted subsidiaries; and |

|

|

• |

|

engage in any business other than a permitted business. |

|

|

In addition, the indenture requires the guarantor and its restricted subsidiaries to maintain certain launch and in-orbit insurance for their Inmarsat-3 and Inmarsat-4 satellites. |

|

|

Each of the covenants is subject to a number of important exceptions and qualifications. See "Description of the Notes—Certain Covenants." |

Form of Notes |

|

The global notes representing the notes were deposited with The Bank of New York (or its affiliate), as book-entry depositary. The book-entry depositary issued depositary interests, or CDIs, to the Depositary Trust Company, or its nominee, and recorded the CDIs in its books and records in the name of DTC or its nominee. Ownership of interests in the global notes deposited with the book-entry depositary, or the book-entry interests, are limited to participants in DTC, or persons that may hold interests through those participants. Book-entry interests will be shown on, and transfers thereof will be effected only through, records maintained in book-entry form by DTC and its participants. |

Trustee |

|

The Bank of New York. |

Listing Agent and Luxembourg Paying Agent |

|

The Bank of New York (Luxembourg) S.A. |

Governing law of the notes |

|

New York law. |

Risk Factors

You should refer to "Risk Factors" beginning on page 13 for an explanation of certain risks involved in investing in the notes.

12

RISK FACTORS

In addition to the other information in this prospectus, you should carefully consider the risks described below before deciding whether to invest in the notes.

Risks Relating to Our Business

We rely on third-party distributors to sell our services to end users and to determine the prices at which those services are sold. If our distributors and service providers were to fail to market or distribute our services effectively or to offer our services at prices which are competitive, our revenues, profitability, liquidity and brand image could be adversely affected.

We sell our services exclusively to third-party distributors, the majority of whom operate the land earth stations that transmit and receive those services to and from our satellites. These distributors then market and distribute our services to end users, either directly or through other distributors and service providers.

Pursuant to our arrangements with our distributors:

- •

- we do not set the prices end users pay for our services;

- •

- we cannot contract with end users of our services; and

- •

- with respect to our existing services (other than Regional BGAN), except for very limited circumstances, we are not permitted to have a direct contractual relationship with any third party for distribution of those services, other than with the distributors that operate land earth stations that transmit and receive those services, whom we refer to as our master distributors.

As a result of these arrangements, we are dependent on the performance of our master distributors to generate substantially all of our revenues. If our master distributors were to fail to market or distribute our services effectively, or if they offered our services at prices which were not competitive, our revenues, profitability, liquidity and brand image could be adversely affected.

Sales to five of our master distributors represent a significant portion of our revenues and the loss of any of these distributors could adversely affect our revenues, profitability and liquidity.

As of September 30, 2004, we had 25 master distributors. For the nine-month period ended September 30, 2004, our five largest master distributors in terms of our revenue were Stratos Global, Telenor, Xantic (a joint venture between KPN and Telstra), France Telecom Mobile Satellite Communications and KDDI. Sales to these five distributors represented 27.3%, 23.7%, 18.5%, 13.1% and 5.3%, respectively, of our revenue during the nine-month period ended September 30, 2004. Any further consolidation among our master distributors would likely increase our reliance on a few key distributors of our services. The loss of any of these distributors, or the failure by any of them to market or distribute our services effectively, could cause end users to seek alternative service providers, which could adversely affect our revenues, profitability or liquidity.

We may not be able to offset declining revenues from voice services with revenues from data services.

Since 1999, our revenues from voice services (across each of our market sectors) have been declining, in part driven by less expensive voice services offered by our competitors. For example, revenues from voice services in the maritime sector decreased by 6.6% in the nine-month period ended September 30, 2004, as compared to the nine-month period ended September 30, 2003, and decreased by 13.5% in the year ended December 31, 2003 as compared to the year ended December 31, 2002, and decreased by 13.6% during the year ended December 31, 2002 as compared to the year ended December 31, 2001. In addition, revenues from voice services in the land sector decreased by 26.2% in the nine-month period ended September 30, 2004, as compared to the nine-month period ended September 30, 2003, decreased by 11.5% in the year ended December 31, 2003 as compared with the

13

year ended December 31, 2002, and decreased by 12.5% in the year ended December 31, 2002 as compared to the year ended December 31, 2001. Although overall declines in our voice revenue have generally been offset by increasing overall revenues from data services (which have not been subject to the same pricing pressures), our GAN land data revenues were lower in the nine-month period ended September 30, 2004 as compared to the nine-month period ended September 30, 2003 as a result of lower global security revenues in 2004 and the effect (during the three-month period ended September 30, 2004) of volume discounts (which increase over the course of each fiscal year as our distributors reach certain traffic levels). Our future profitability depends, in part, on our ability to offset declining revenues from voice services with revenues from data services. If revenues from our data services do not continue to increase at a rate sufficient to offset the decline in revenues from our voice services, our total future revenues will be adversely affected.

A decrease in global security activity in the Middle East could negatively impact our revenues.

Global security events in recent years have had a positive impact on our revenues. Demand from government, media and aid organizations for our services in areas affected by global security events has continued in 2004, although at a lower level than in 2003, reflecting a sustained level of global security activity in the Middle East region. It is unclear whether this level of demand will continue in future periods. Although a portion of those revenues may be sustainable, a decrease in global security activity in the region may have a corresponding adverse impact on our future revenues and results of operations.

The global communications industry is highly competitive. It is likely that we will face significant competition in the future from other network operators, which may adversely affect end user take-up of our services and affect our revenues.

The global communications industry is highly competitive. We face competition from a number of communications technologies in the various target markets for our services. It is likely that we will continue to face significant competition from other network operators in some or all of our target market segments in the future, particularly from satellite network operators. Competition from Iridium and Globalstar, two global satellite network operators, has been increasing, particularly with respect to voice and low-speed data services. In addition, we also face competition for voice and low-speed data services from Thuraya and (to a lesser extent) other regional mobile satellite network operators, which has influenced the price at which our distributors and service providers offer our services. Thuraya's satellites are also capable of delivering high speed data services comparable to our Regional BGAN services, although only on a regional basis. Thuraya has announced plans to introduce a 144 kilobit per second mobile data communications service in 2005 on a regional basis. Communications providers who operate private networks using very small aperture terminals, or VSATs, are also increasingly targeting users of mobile satellite services. Furthermore, the gradual extension of terrestrial wireline and wireless communications networks to areas not currently served by them may reduce demand for our services in those areas. If we were to fail to offer services that compete effectively, we could experience lower end user take-up, which would have an adverse impact on our revenues, profitability and liquidity.

We may not retain sufficient rights to the spectrum required to operate our satellite system to its expected capacity.

We must retain rights to use sufficient L-band spectrum necessary for the transmission of signals between our satellites and end user terminals. Our right to spectrum is granted on an annual basis and evaluated and established, in part, through two annual, regional multilateral meetings of satellite operators—one for operators whose satellites cover North America, and a second for those which cover Europe, Africa, Asia and the Pacific. Since 1999, the North American operators have been unable to agree on new spectrum allocations and rights have been frozen at 1999 levels. Additionally, Mobile Satellite Ventures, or MSV, has challenged our right to some of our current North American spectrum,

14

claiming that MSV loaned us that spectrum in 1999. We have rejected that claim, and we believe the appropriate forum for spectrum allocation would be the next round of multilateral coordination meetings of North American operators. Competition for spectrum from new operators or services (for example, ancillary terrestrial components, or ATC services) could make it more difficult for us to retain rights to spectrum. If we were unable to retain sufficient rights to spectrum, our ability to provide our services in the future would be limited, which would have an adverse effect on our business and results of operations. We cannot assure you that we will be able to retain sufficient rights to spectrum in the future.

Applications by our competitors to use L-band spectrum for terrestrial services or on an ancillary basis could interfere with our services.

On January 29, 2003, the Federal Communications Commission, or FCC, promulgated a general ruling that mobile satellite service spectrum, including the L-band spectrum we use to operate our services, could be used by mobile satellite service operators to integrate ATC services into their satellite networks in order to provide combined terrestrial and satellite communications services to mobile terminals in the United States. The implementation of ATC services by other mobile satellite service operators in the United States or other countries may result in increased competition for the right to use L-band spectrum, and such competition may make it difficult for us to obtain or retain spectrum resources we require for our existing and future services. In addition, the FCC's decision to permit ATC services was based on certain assumptions, particularly relating to the level of interference that the provision of ATC services would likely cause to operators of other services, such as us, who use the L-band spectrum. If the FCC's assumptions with respect to the use of mobile satellite service spectrum for ATC services prove inaccurate, or a significant level of ATC services is provided in the United States, the provision of ATC services could interfere with our satellites and user terminals, which may adversely impact our services. For example, the use of certain L-band spectrum to provide ATC services in the United States could interfere with our satellites providing communications services outside the United States where the satellites' "footprint" overlaps the United States. Such interference could limit our ability to provide services that are transmitted through any satellite visible to the United States. Three of our Inmarsat-3 satellites are visible to the United States. In addition, users of our terminals in the United States could suffer interruptions to our services if they try to use their terminals near ATC terrestrial base stations used to provide ATC services.

Additionally, MSV petitioned the FCC to reconsider its ATC service rules in order to relax certain technical requirements applicable to ATC operations. On November 8, 2004, the FCC issued an order granting MSV an ATC licence and approving several of the waivers of the ATC technical rules that MSV requested, while deferring ruling on certain additional waivers. The order sets forth various limitations and conditions to MSV's use of ATC, including requirements to submit test data for equipment to ensure compliance with the ATC technical rules (as modified by the granted waivers). We are currently reviewing the FCC order and we cannot predict the impact to our business and results of operations. The FCC order or increased interference into our satellite network and to mobile terminals communicating with our network could have a material adverse effect on our business or results of operations. On December 8, 2004, we petitioned the FCC to reconsider its order. We expect MSV to respond to our petition, at which point we would expect to file a rebuttal.

Other jurisdictions are considering, and could implement, similar regulatory regimes in the future. In May 2004, Industry Canada, the Canadian regulator, decided in principle to allow ATC services in Canada.

Any or all of the preceding could have a material adverse effect on our revenues, profitability or liquidity.

15

We rely on third parties to manufacture and supply terminals used to access our existing services, and as a result, we cannot control the availability of terminals.

Terminals used to access our existing services are built by a limited number of independent manufacturers. Although we provide manufacturers with key performance specifications for the terminals, these manufacturers could:

- •

- reduce production of, or cease to manufacture, terminals that access our services;

- •

- manufacture terminals with defects that fail to perform to our specifications;

- •

- fail to build or upgrade terminals that meet end users' requirements within our target market segments;

- •

- fail to meet delivery schedules or to market or distribute terminals effectively; or

- •

- sell our terminals at prices that end users or potential end users do not consider attractive.

Any of the foregoing could adversely affect the ability of our distributors to sell our services, which, in turn, could adversely affect our revenues, profitability and liquidity, as well as our brand image.

We rely on Thuraya to provide leased satellite capacity for our Regional BGAN service, and factors beyond our control with respect to the Thuraya satellite could affect our Regional BGAN revenues. Our Regional BGAN revenues could be affected by the operational failure of our land earth station in Fucino, Italy.

We lease capacity on a Thuraya satellite to provide our Regional BGAN service. The Thuraya satellite, like all satellites, could experience technical and operational failures that would adversely affect our ability to provide our Regional BGAN service. Furthermore, the lease can be terminated following consultation, if we become insolvent. A loss of access to the Thuraya satellite could adversely affect our revenue and/or our brand image and make it more difficult to market our Regional BGAN or future BGAN services.

We land satellite transmission of our Regional BGAN services exclusively at our land earth station in Fucino, Italy. While our Fucino land earth station has substantial redundancy, our Regional BGAN revenues would be adversely affected by its operational failure.

We may not be able to recruit and retain the number and caliber of management or employees necessary for our business, which may adversely affect our revenues and profitability.

Technological competence and innovation is critical to our business and depends, to a significant degree, on the work of technically skilled employees. Competition for the services of these types of employees is intense. We may not be able to attract and retain these employees. If we are unable to attract and retain adequate technically skilled employees, including the development and provision of our higher-bandwidth services, our competitive position could be materially adversely affected.

Risks Relating to Our Technology and the Operation and Development of Our Network

Our satellites and satellites systems are subject to significant operational risks while in orbit which, if they were to occur, could adversely affect our revenues, profitability and liquidity.

Satellites are subject to significant operational risk while in orbit. These risks include malfunctions, commonly referred to as anomalies, that have occurred in our satellites and the satellites of other operators as a result of various factors, such as satellite manufacturers' errors, problems with the power or control systems of the satellites and general failures resulting from operating satellites in the harsh environment of space.

Although we work closely with satellite manufacturers to determine and eliminate the cause of anomalies in new satellites and provide redundancy for many critical components in our satellites, we

16

may experience anomalies in the future, whether of the types described above or arising from the failure of other systems or components.

Any single anomaly or series of anomalies could materially adversely affect our operations, as well as our ability to attract new customers for our services. Anomalies could also reduce the expected useful life of a satellite, thereby reducing the revenue that we could generate with that satellite, or create additional expenses due to the need to provide replacement or back-up satellites. For example, we recently experienced an anomaly with respect to one of our Inmarsat-2 satellites that helps to provide redundancy to our fleet and carries leased traffic. As a consequence of that anomaly, we utilized approximately half of the satellite's remaining fuel in successfully recovering the satellite, and now expect its useful life to end in 2006 based on normal fuel consumption rates. However, the satellite that experienced the anomaly has been operating for over 13 years and its original design life was 10 years. Finally, the occurrence of anomalies could materially adversely affect our ability to insure our satellites at commercially reasonable premiums, if at all.

Meteoroid events pose a potential threat to all in-orbit geosynchronous satellites. The probability that a meteor will damage those satellites increases significantly when the earth passes through the particulate stream left behind by comets. Occasionally, increased solar activity poses a potential threat to all in-orbit satellites.

Some decommissioned spacecraft are in uncontrolled orbits that pass through the geostationary belt at various points, and present hazards to operational spacecraft, including our satellites. We may be required to perform maneuvers to avoid collisions, and these maneuvers may prove unsuccessful, or could reduce the useful life of the satellite by necessitating the expenditure of fuel to perform these maneuvers. The loss, damage or destruction of any of our satellites as a result of an electrostatic storm, collision with space debris, malfunction or other event could have a material adverse effect on our business.

In addition, our satellite system includes five tracking, telemetry and control ground stations and four network coordination stations located around the world. If two or more of these stations were to fail at the same time, our ability to operate our satellites effectively may be limited, which could adversely effect our revenues, profitability or liquidity.

Our satellites have minimum design lives of 10 years, but could fail or suffer reduced capacity before then.

Our ability to generate revenue depends on the useful lives of our satellites. Each satellite has a limited useful life. A number of factors affect the useful lives of the satellites, including, among other things, the quality of their construction, the durability of their component parts, the ability to continue to maintain proper orbit and control over the satellite's functions, the efficiency of the launch vehicle used, and the remaining on-board fuel following orbit insertion. Generally, the minimum design life of each of our satellites is 10 years. However, the actual useful lives of the satellites could be shorter.

Our next-generation satellites are subject to possible delivery delays and launch risks, the occurrence of which could materially and adversely affect our performance.

Our next-generation satellites are subject to possible delivery delays and risks relating to launches, including launch failure or incorrect orbital placement. We have entered into a contract with Astrium for the manufacture of three Inmarsat-4 satellites. The manufacture of these satellites is technically complex and, therefore, subject to possible delay. The delivery of our Inmarsat-4 satellites could be delayed, which may, in turn, delay migration of our Regional BGAN service from leased Thuraya satellite capacity to our Inmarsat-4 satellite or delay implementation of our Inmarsat-4 program and the introduction of our planned BGAN service.

We have entered into contracts with an affiliate of Lockheed Martin and with Sea Launch to provide launch vehicles for two of our Inmarsat-4 satellites. We also have options with both companies

17

for additional launch vehicles. As a result of the relatively large mass of our Inmarsat-4 satellites, we have been required to select versions of launch vehicles that, as of the date hereof, have a limited history of prior use. The use of a launch vehicle with a less-established history could increase the risk of launch delay and failure. Furthermore, it is not uncommon for technical or other issues relating to a satellite or launch vehicle to cause launch delays. Launch failures preceding any of our launches could cause extensive delays while the cause of the failure is under investigation. A launch failure affecting our first Inmarsat-4 satellite would also require us to launch our spare Inmarsat-4 satellite. A second failure would require the construction of a replacement Inmarsat-4 satellite (which could take three years or more and would be costly). A significant delay in the deployment of our Inmarsat-4 satellites could materially adversely affect our ability to generate revenues from next-generation services and could significantly increase the cost thereof.

The occurrence of future launch failures could materially adversely affect our ability to insure the launch of our satellites at commercially reasonable premiums, if at all.

We may be unable to obtain and maintain insurance for our satellites, and the insurance we obtain may not cover all losses we experience. Even if our insurance were sufficient, delays in launching a replacement satellite could adversely affect our revenues, profitability and liquidity.

We are required by our debt instruments to obtain insurance for certain risks associated with the launch and in-orbit operation of our Inmarsat-4 satellites. In addition, prior to acceptance of one Inmarsat-4 satellite in orbit, the debt instruments require us to maintain in-orbit insurance for our Inmarsat-3 satellites. We have obtained in-orbit insurance for our Inmarsat-3 satellites through December 2004, and we have also obtained launch plus one year in-orbit insurance for our Inmarsat-4 satellites, as described under "Business—Insurance of Our Business and Insurable Assets."

The price, terms and availability of insurance have fluctuated significantly since we began offering commercial satellite services. The cost of obtaining insurance has been rising substantially, and may continue to rise, as a result of either satellite failures or general conditions in the insurance industry. Insurance policies on satellites may not continue to be available on commercially reasonable terms, or at all. In addition to higher premiums, insurance policies may provide for higher deductibles, shorter coverage periods and additional satellite-health-related policy exclusions. An uninsured failure of one or more of our satellites could have a material adverse effect on our financial condition and results of operations. In addition, higher premiums on insurance policies will increase our costs, thereby reducing our operating income by the amount of such increased premiums.

Furthermore, insurance for launch and in-orbit operation will not protect us against all satellite-related losses in the event of a failure. For example, our in-orbit Inmarsat-3 satellite insurance excludes the first loss and provides for the exclusion of losses ensuing out of, among other things, acts of war and terrorism. In addition, our insurance for the Inmarsat-4 satellites will exclude, among other things, losses arising from a propulsion anomaly similar to that recently experienced by the Amazonas satellite (which is also manufactured by Astrium) unless our insurance providers are satisfied, prior to the launch of our Inmarsat-4 satellites that our satellites do not have a similar propulsion anomaly. Even if the proceeds from our insurance were sufficient to replace a destroyed or malfunctioning satellite, the delay in deployment of a replacement satellite could adversely affect our revenues, profitability or liquidity.

New technologies used by our competitors may reduce demand for our services or render our technologies obsolete, which may have a material adverse effect on the cost structure and competitiveness of our services, possibly resulting in a negative effect on our revenues, profitability or liquidity.

The space and communications industries are subject to rapid advances and innovations in technology. We expect to face competition in the future from companies using new technologies and new satellite and terrestrial systems. Advances or innovations in technology could render our

18

technologies obsolete or less competitive by satisfying consumer demand in more attractive or cost-effective ways, or by introducing standards incompatible with ours. Obsolescence of the technologies that we use could have a material adverse effect on our revenues, profitability or liquidity.

Our business relies on intellectual property, some of which third parties own, and we may inadvertently infringe upon their patents and proprietary rights.

Many entities, including some of our competitors, currently (or may in the future) hold patents and other intellectual property rights that cover or affect products or services related to those that we offer. We cannot assure you that we are aware of all intellectual property rights that our products may infringe upon. In general, if a court were to determine that one or more of our products infringes upon intellectual property held by others, we may be required to cease developing or marketing those products, to obtain licenses from the holders of the intellectual property, or to redesign those products in such a way as to avoid infringing upon others' patents. We cannot estimate the extent to which we may be required in the future to obtain intellectual property licenses, or the availability and cost of any such licenses. To the extent that we are required to pay royalties to third parties to whom we are not currently making payments, these increased costs of doing business could negatively affect our profitability or liquidity.

If a competitor holds intellectual property rights, it may not allow us to use its intellectual property at any price, which could adversely affect our competitive position.

Our BGAN network has not been completed and is subject to implementation risks.

Our next-generation BGAN infrastructure, which will include a ground network and user terminals, as well as a business support system, is currently under development and is complex and innovative. We will face significant challenges related to the timely delivery of that infrastructure. In particular, we will need to integrate all components of the infrastructure, including the radio access network to be delivered by Thrane & Thrane, the core network infrastructure that was recently delivered by Ericsson Limited, and the user terminals, which are to be delivered by multiple manufacturers. See "Material Contracts—Radio Access Network Contract with Thrane & Thrane" and "—Core Network Infrastructure Contract with Ericsson" and "Business—Our Services and End Users—End User Terminals." We have also contracted with Danet for a BGAN business support system which will, among other things, provide billing and customer administration functions. See "Material Contracts—BGAN Business Support System Contract with Danet." We intend to migrate our Regional BGAN end users onto this new system, which may also present challenges. If we were to encounter difficulties integrating the network and billing systems, or individual components were delivered late, the availability of our BGAN service to customers could be delayed, which, in turn, could adversely affect our revenues, profitability or liquidity.

Risks Relating to Concentration of Ownership

Certain of our shareholders have a significant influence over us, and are parties to a shareholders' agreement.

Funds advised by Apax Partners and funds advised by Permira currently own 25.87% and 25.87% of our outstanding shares, respectively. As a result, these significant shareholders are able to exercise significant influence over matters requiring a simple majority vote of the shareholders at a general meeting of the shareholders, such as the appointment of a majority of the members of our board of directors, the approval of our annual financial statements and our declaration of dividends. In addition, these significant shareholders can exercise significant influence over our business through their representation on our board of directors.

The funds advised by Apax Partners and the funds advised by Permira are parties to a shareholders' agreement dated October 16, 2003 that requires the agreement of these significant

19

shareholders for us to take certain actions outside the ordinary course of business. Failure of these shareholders to reach unanimous agreement concerning such corporate actions or otherwise may adversely affect our ability to conduct our business.

Regulatory Risks

Our business is subject to regulation and we face increasing regulation with respect to the transmission of our satellite signals and the provision of our mobile satellite communications services in some countries, which could require us to incur additional costs, could expose us to fines and could limit our ability to provide existing and new services in some countries.

The maintenance and expansion of our business is dependent upon, among other things, our ability to obtain required governmental licenses and authorizations in a timely manner, at reasonable costs and on satisfactory terms and conditions.

Our business is subject to the regulatory authority of the government of the United Kingdom and the national authorities of the countries in which we operate, as well as to the regulations of various international organizations. See "Regulation." Governmental authorities generally regulate, among other things, the construction, launch and operation of satellites, the use of satellite spectrum at specific orbital locations, the licensing of land earth stations and mobile terminals, and the provision of satellite services.

In particular, under the UK Outer Space Act 1986, we must obtain licenses to conduct our business. The terms of these licenses provide that we indemnify the UK government (without limit) for any claim brought against it as a result of our licensed activities and that we must maintain insurance of up to £100 million per satellite to be used to pay any sums to the UK government in respect of this indemnity.

Increasingly, regulatory authorities are imposing fees and introducing new regulatory requirements on businesses that use spectrum or offer communications services. This could significantly affect our business. In addition to the licenses issued to us by the UK government for the launch and operation of our satellites, to date, we have obtained specific telecommunications or frequency licenses with respect to our existing services in Australia, Brazil, Ecuador, Egypt, Germany, Iraq, Italy, Jordan, Kenya and Switzerland. Additionally, Algeria, France and Honduras require us to obtain such licenses, and additional countries are considering whether to implement such license requirements. These license requirements could require us to incur new and unforeseen additional costs, could expose us to fines if we were unable to obtain or retain any licenses or meet all regulatory requirements, and could limit our ability to provide existing or new services in some countries, which could adversely affect our revenues, profitability or liquidity.

It is also possible that regulatory authorities in some countries may require us to establish a land earth station or a point-of-presence in their countries as a condition to distribute our BGAN services in those countries. Some countries may also require us to provide traffic reports on a regular basis or maintain a domestic billing database in their country. To the extent we own and/or operate the land earth stations for our BGAN services, we will be required to obtain licenses for the operation of those stations as network facilities, and also will need to obtain rights to C-band spectrum for communications between the stations and our satellites. Approval of the offering of our services or operation of land earth stations will be contingent upon us or our distributors providing any countries as may so require with the ability to legally monitor calls made to or from such countries and/or to report BGAN traffic. Although we believe that we will be able to address the concerns of many of these countries as they arise, there is no assurance that we or our distributors will be able to do so. In addition, some countries in which we or our distributors operate have laws and regulations relating to privacy and the protection of data which may impair our ability to obtain licenses or offer our services on a timely basis.

20