| MANAGEMENT’S DISCUSSION AND ANALYSIS |

MANAGEMENT’S DISCUSSION AND ANALYSIS

This Management’s Discussion and Analysis (“MD&A”) should be read in conjunction with the audited annual consolidated financial statements of Harvest Operations Corp. (“Harvest”, “we”, “us”, “our” or the “Company”) for the year ended December 31, 2012, together with the accompanying notes. The information and opinions concerning our future outlook are based on information available at February 28, 2013.

In this MD&A, all dollar amounts are expressed in Canadian dollars unless otherwise indicated. Tabular amounts are in millions of dollars, except where noted. All financial data has been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board except where otherwise noted.

Natural gas volumes are converted to barrels of oil equivalent (“boe”) using the ratio of six thousand cubic feet (“mcf”) of natural gas to one barrel of oil (“bbl”). Boes may be misleading, particularly if used in isolation. A boe conversion ratio of 6 mcf to 1 bbl is based on an energy equivalent conversion method primarily applicable at the burner tip and does not represent a value equivalent at the wellhead. In accordance with Canadian practice, petroleum and natural gas revenues are reported on a gross basis before deduction of Crown and other royalties.

Additional information concerning Harvest, including its audited annual consolidated financial statements and Annual Information Form (“AIF”) can be found on SEDAR atwww.sedar.com.

ADVISORY

This MD&A contains non-GAAP measures and forward-looking information about our current expectations, estimates and projections. Readers are cautioned that the MD&A should be read in conjunction with the “Non-GAAP Measures” and “Forward-Looking Information” sections at the end of this MD&A.

Effective October 1, 2012, Harvest reclassified certain properties that were previously reported as light to medium oil to heavy oil as classified under National Instrument 51-101. Tabular amounts have been updated for this reclassification. See the “Reclassification of Heavy Oil and Light to Medium Oil Volumes” section of this MD&A.

1

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

FINANCIAL AND OPERATING HIGHLIGHTS

| | | Three Months Ended | | | Year Ended | |

| | | December 31 | | | December 31 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| UPSTREAM OPERATIONS | | | | | | | | | | | | |

| Daily sales volumes (boe/d) | | 58,228 | | | 61,324 | | | 59,327 | | | 57,161 | |

| Average realized price | | | | | | | | | | | | |

| Oil and NGLs ($/bbl)(2) | | 68.50 | | | 84.82 | | | 72.39 | | | 79.60 | |

| Gas ($/mcf) | | 3.44 | | | 3.42 | | | 2.58 | | | 3.83 | |

| Operating netback prior to hedging ($/boe)(1) | | 30.61 | | | 36.57 | | | 28.46 | | | 34.54 | |

| Operating income (loss) | | 36.1 | | | 37.0 | | | (12.7 | ) | | 111.2 | |

| Cash contribution from operations(1) | | 160.4 | | | 193.7 | | | 581.9 | | | 661.0 | |

| | | | | | | | | | | | | |

| Capital asset additions (excluding acquisitions) | | 87.8 | | | 148.8 | | | 445.2 | | | 632.2 | |

| Property and business acquisitions (dispositions), net | | (78.4 | ) | | (8.0 | ) | | (87.2 | ) | | 505.3 | |

| Net wells drilled | | 12.8 | | | 39.4 | | | 100.9 | | | 202.3 | |

| Net undeveloped land additions (acres)(3) | | 39,543 | | | 19,549 | | | 131,394 | | | 387,754 | |

| BLACKGOLD OIL SANDS | | | | | | | | | | | | |

| Capital asset additions | | 44.4 | | | 30.8 | | | 164.1 | | | 101.2 | |

| Net wells drilled | | 4.0 | | | – | | | 30.0 | | | 12.0 | |

| DOWNSTREAM OPERATIONS | | | | | | | | | | | | |

| Average daily throughput (bbl/d) | | 114,065 | | | 89,468 | | | 103,355 | | | 68,046 | |

| Average refining margin (loss) (US$/bbl)(1) | | 6.43 | | | (4.11 | ) | | 4.87 | | | 5.15 | |

| Operating loss | | (593.4 | ) | | (124.7 | ) | | (706.8 | ) | | (140.6 | ) |

| Cash deficiency from operations(1) | | (3.0 | ) | | (97.9 | ) | | (41.7 | ) | | (49.7 | ) |

| Capital asset additions | | 21.5 | | | 37.5 | | | 54.2 | | | 284.2 | |

| (1) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

| (2) | Excludes the effect of risk management contracts designated as hedges. |

| (3) | Includes lands acquired in business combinations. |

REVIEW OF OVERALL PERFORMANCE

Harvest is an integrated energy company with a petroleum and natural gas business focused on the exploration, development and production of assets in western Canada (“Upstream”), an oil sands project under construction and development in northern Alberta (“BlackGold”), and a refining and marketing business focused on the operation of a medium gravity sour crude oil hydrocracking refinery and a retail and wholesale petroleum marketing business both located in the Province of Newfoundland and Labrador (“Downstream”). Harvest is a wholly owned subsidiary of Korea National Oil Corporation (“KNOC”). Our earnings and cash flow from operating activities are largely determined by the realized prices for our crude oil and natural gas production as well as refined product crack spreads.

Harvest completed 2012 with actual results comparable to most of the previously disclosed guidance. Noticeable differences include Upstream fourth quarter production and royalties as a percentage of revenue. Upstream fourth quarter production exceeded guidance by 1,228 boe/day due to late closing of certain dispositions. Royalties came to 13.8% of revenue, lower than guidance of 16%, due to lower commodity prices especially in the fourth quarter, and higher Alberta Crown gas cost allowance credits in 2012.

2

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Upstream

Sales volumes for the fourth quarter of 2012 decreased by 3,096 boe/d compared to 2011 primarily due to natural declines, a smaller 2012 capital drilling program and dispositions of certain non-core producing properties in 2012. Sales volumes for the year ended December 31, 2012 increased by 2,166 boe/d compared to 2011 primarily due to the results of a very active capital program in the prior year, reduced production in 2011 from the Plains Rainbow Pipeline outage and an extra two months of production in 2012 from the Hunt assets acquired in February 2011.

Operating netback prior to hedging for the fourth quarter and year ended December 31, 2012 were $30.61/boe (2011 – $36.57/boe) and $28.46/boe (2011 – $34.54/boe), respectively, decreases of $5.96/boe and $6.08/boe from 2011, mainly due to lower realized prices.

Operating income was $36.1 million (2011 - $37.0 million) for the fourth quarter of 2012. The slight decrease in operating income is mainly attributable to the lower realized prices, largely offset by decreased operating expense and $25.0 million of gains on disposition of non-core assets. The annual operating loss was $12.7 million for 2012 as compared to operating income of $111.2 million for 2011. The decrease in operating income is attributable to the lower realized prices, increased depreciation, depletion and amortization and the recognition of a $21.8 million impairment loss, partially offset by $30.3 million of gains on disposition.

Cash contribution from operations was $160.4 million for the fourth quarter of 2012, a $33.3 million decrease from the prior period driven by lower realized prices, partially offset by a decrease in operating expenses. Cash contribution from operations was $581.9 million for the year ended December 31, 2012, a $79.1 million decrease from the prior year driven by lower realized prices.

Capital asset additions of $87.8 million during the fourth quarter 2012 includes the drilling of 14 gross (12.8 net) wells with a success rate of 100%. Capital asset additions of $445.2 million during the year 2012 includes the drilling of 116 gross (100.9 net) wells with a success rate of approximately 99%.

BlackGold

Capital asset additions of $44.4 million for the fourth quarter and $164.1 million for the year 2012 include the drilling of 4 and 30 SAGD wells, respectively, and construction of the processing facility.

The engineering, procurement and construction (“EPC”) contract was amended such that the net costs are now expected to be $520 million.

The engineering, procurement and construction portion of the EPC contract relating to the central processing facility is approximately 83% complete. The facility construction portion of the contract is approximately 43% complete. Production is expected to start in 2014.

Downstream

Throughput volume averaged 114,065 bbl/d for the fourth quarter of 2012, an increase of 24,597 bbl/d as compared to 2011 mainly due to reduced throughput rates in 2011 as a result of declining refining margins. Refining gross margin averaged US$6.43/bbl for fourth quarter of 2012, an improvement of US$10.54/bbl from 2011. The annual throughput volume averaged 103,355 bbl/d for the year ended December 31, 2012, an increase of 35,309 bbl/d as compared to 2011 mainly due to the planned maintenance of the refinery units which occurred in the prior year. Refining gross margin averaged $4.87/bbl for the year ended 2012, a slight decrease of $0.28/bbl from 2011.

3

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Operating losses totaled $593.4 million and $706.8 million for the fourth quarter and year ended December 31, 2012, respectively, as compared to operating losses of $124.7 million and $140.6 million for the same periods in 2011. The increase in operating losses is primarily due to an impairment charge of $563.2 million on the refining assets.

Cash deficiency from operations was $3.0 million for the fourth quarter of 2012, a $94.9 million improvement from the prior year mainly due to higher daily throughput and a higher average refining margin per bbl as compared to 2011. Cash deficiency from operations was $41.7 million for the year ended December 31, 2012, an $8.0 million improvement from the prior year mainly due to higher daily throughput, partially offset by lower average refining margin per bbl and increased operating and purchased energy expense.

Capital asset additions of $21.5 million (2011 - $37.5 million) and $54.2 million (2011 - $284.2 million) for the fourth quarter and year ended December 31, 2012, respectively, include turnaround costs and various capital improvement projects. Capital asset additions decreased from 2011 as a result of a lower capital budget and less intensive turnaround in 2012.

Corporate

On July 31, 2012, Harvest agreed with its lenders to extend the credit facility agreement by one year to April 30, 2016.

On August 1, 2012, Harvest completed its offer to exchange US$500 million in aggregate principal amount of its 6ì% Senior Notes that had been registered under the United States Securities Act of 1933, as amended, for the same principal amount of outstanding unregistered 6ì% Senior Notes with 100% of the notes being exchanged. The terms of the exchanged notes are substantially identical but with the new notes having greater transferability.

On August 16, 2012, Harvest entered into a subordinated loan agreement with ANKOR, a subsidiary of KNOC, to borrow US$170 million at a fixed interest rate of 4.62% per annum. No payments of principal or interest are required before maturity on October 2, 2017.

On September 19, 2012, Harvest redeemed the outstanding 6.40% series of convertible debentures for $106.8 million.

4

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

UPSTREAM OPERATIONS

Summary of Financial and Operating Results

| | | Three Months Ended | | | Year Ended December 31 | |

| | | December 31 | | | | | | | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| FINANCIAL | | | | | | | | | | | | |

| Petroleum and natural gas sales(1) | | 291.3 | | | 363.6 | | | 1,193.5 | | | 1,286.9 | |

| Royalties | | (35.7 | ) | | (56.0 | ) | | (164.6 | ) | | (195.5 | ) |

| Revenues | | 255.6 | | | 307.6 | | | 1,028.9 | | | 1,091.4 | |

| Expenses | | | | | | | | | | | | |

| Operating | | 77.4 | | | 96.4 | | | 359.0 | | | 350.4 | |

| Transportation and marketing | | 5.9 | | | 5.7 | | | 22.2 | | | 29.6 | |

| Realized (gains) losses on risk management contracts(2) | | (2.6 | ) | | (2.1 | ) | | (1.6 | ) | | (6.0 | ) |

| Operating netback after hedging(3) | | 174.9 | | | 207.6 | | | 649.3 | | | 717.4 | |

| General and administrative | | 18.2 | | | 17.8 | | | 65.0 | | | 60.8 | |

| Depreciation, depletion and amortization | | 145.3 | | | 149.4 | | | 579.5 | | | 535.7 | |

| Exploration and evaluation | | 0.2 | | | 7.0 | | | 24.9 | | | 18.3 | |

| Impairment of property, plant and equipment | | – | | | – | | | 21.8 | | | – | |

| Unrealized (gains) losses on risk management contracts(4) | | 0.1 | | | 3.5 | | | 1.1 | | | (0.7 | ) |

| Gains on disposition of property, plant and equipment | | (25.0 | ) | | (7.1 | ) | | (30.3 | ) | | (7.9 | ) |

| Operating income (loss) | | 36.1 | | | 37.0 | | | (12.7 | ) | | 111.2 | |

| Capital asset additions (excluding acquisitions) | | 87.8 | | | 148.8 | | | 445.2 | | | 632.2 | |

| Property and business acquisitions (dispositions), net | | (78.4 | ) | | (8.0 | ) | | (87.2 | ) | | 505.3 | |

| Decommissioning and environmental remediation expenditures | | 4.3 | | | 9.9 | | | 20.2 | | | 21.5 | |

| OPERATING | | | | | | | | | | | | |

| Light / medium oil (bbl/d)(5) | | 13,817 | | | 15,161 | | | 13,889 | | | 14,376 | |

| Heavy oil (bbl/d)(5) | | 18,402 | | | 20,465 | | | 19,506 | | | 18,995 | |

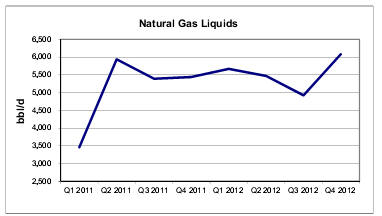

| Natural gas liquids (bbl/d) | | 6,084 | | | 5,440 | | | 5,535 | | | 5,062 | |

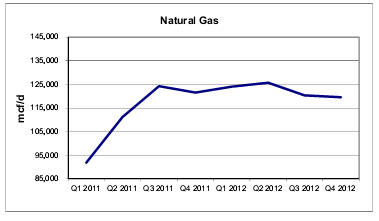

| Natural gas (mcf/d) | | 119,554 | | | 121,547 | | | 122,385 | | | 112,360 | |

| Total (boe/d) | | 58,228 | | | 61,324 | | | 59,327 | | | 57,161 | |

| (1) | Includes the effective portion of Harvest’s realized crude oil hedges. |

| (2) | Realized (gains) losses on risk management contracts include the settlement amounts for power, crude oil and foreign exchange derivative contracts, excluding the effective portion of realized (gains) losses from Harvest’s previously designated crude oil hedges. See “Risk Management, Financing and Other” section of this MD&A for details. |

| (3) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

| (4) | Unrealized (gains) losses on risk management contracts reflect the change in fair value of the power derivative contracts, the ineffective portion of previously designated crude oil hedges and the change in fair value of the crude and foreign exchange derivative contracts subsequent to the discontinuation of hedge accounting. See “Risk Management, Financing and Other” section of this MD&A for details. |

| (5) | Effective October 1, 2012, Harvest reclassified certain properties that were previously reported as light to medium oil to heavy oil as classified under National Instrument 51-101. See the “Reclassification of Heavy Oil and Light to Medium Oil Volumes” section of this MD&A. |

5

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Commodity Price Environment

| | | Three Months Ended | | Year Ended | |

| | | December 31 | | December 31 | |

| | | 2012 | | | 2011 | | | Change | | | 2012 | | | 2011 | | | Change | |

| West Texas Intermediate (“WTI”) crude oil (US$/bbl) | | 88.18 | | | 94.06 | | | (6% | ) | | 94.21 | | | 95.12 | | | (1% | ) |

| West Texas Intermediate (“WTI”) crude oil ($/bbl) | | 87.42 | | | 96.25 | | | (9% | ) | | 94.12 | | | 94.03 | | | – | |

| Edmonton light sweet crude oil ($/bbl) | | 83.98 | | | 97.51 | | | (14% | ) | | 86.15 | | | 95.18 | | | (9% | ) |

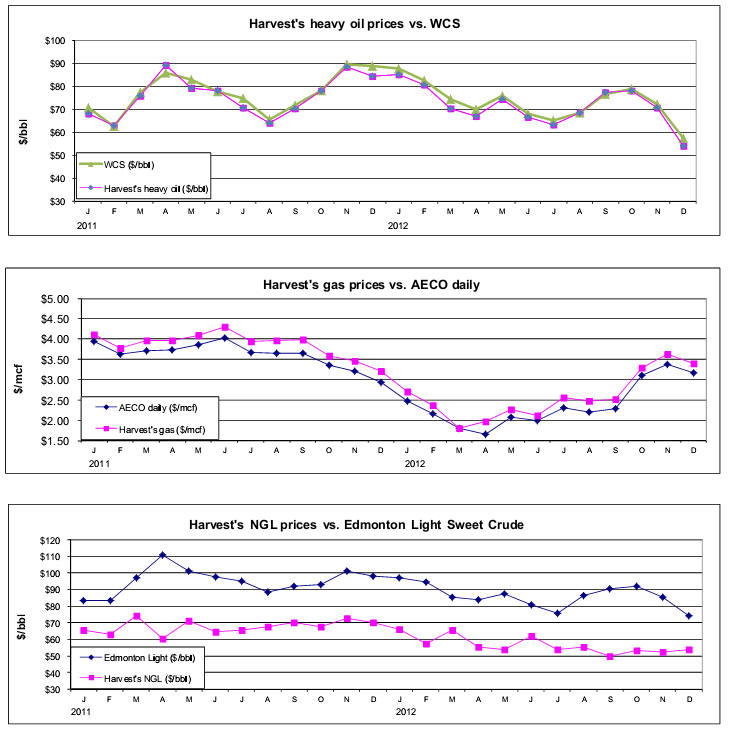

| Western Canadian Select (“WCS”) crude oil ($/bbl) | | 69.43 | | | 85.48 | | | (19% | ) | | 73.09 | | | 77.10 | | | (5% | ) |

| AECO natural gas daily ($/mcf) | | 3.21 | | | 3.17 | | | 1% | | | 2.39 | | | 3.62 | | | (34% | ) |

| U.S. / Canadian dollar exchange rate | | 1.009 | | | 0.977 | | | 3% | | | 1.001 | | | 1.011 | | | (1% | ) |

| | | | | | | | | | | | | | | | | | | |

| Differential Benchmarks | | | | | | | | | | | | | | | | | | |

| WCS differential to WTI ($/bbl) | | 17.99 | | | 10.77 | | | 67% | | | 21.03 | | | 16.93 | | | 24% | |

| WCS differential as a % of WTI | | 20.6% | | | 11.2% | | | 84% | | | 22.3% | | | 18.0% | | | 24% | |

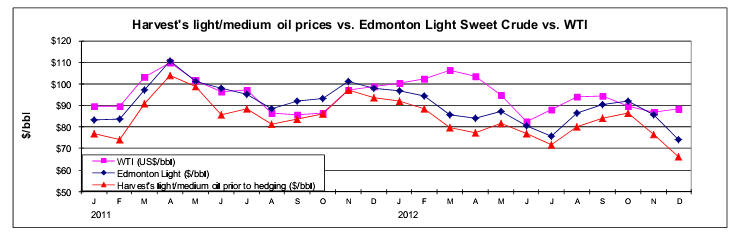

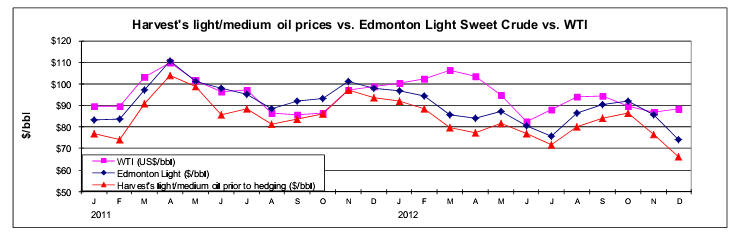

The average WTI benchmark price for the three months and year ended December 31, 2012 was 6% and 1% lower than the same periods in 2011, respectively. The average Edmonton light sweet crude oil price (“Edmonton Light”) decreased 14% in the fourth quarter as well as 9% for the year ended December 31, 2012 mainly due to the lower WTI prices and widening of the light sweet differential.

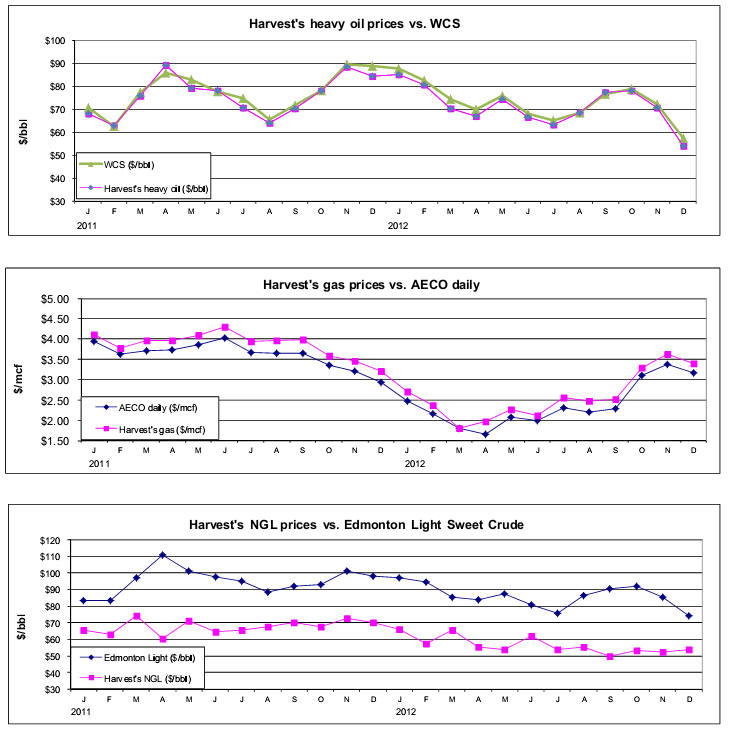

Heavy oil differentials fluctuate based on a combination of factors including the level of heavy oil inventories, pipeline capacity to deliver heavy crude to U.S. markets and the seasonal demand for heavy oil. For the three months ended December 31, 2012, the WCS price decreased 19% as compared to the same period in 2011 as a result of the WTI price decrease and the widening of the WCS differential to WTI. For the year ended December 31, 2012, the WCS price decreased 5% as compared to the same period in 2011 mainly as a result of the widening of the WCS differential to WTI.

Realized Commodity Prices

| | | Three Months Ended | | Year Ended | |

| | | December 31 | | December 31 | |

| | | 2012 | | | 2011 | | | Change | | | 2012 | | | 2011 | | | Change | |

| Light to medium oil prior to hedging ($/bbl)(1) | | 76.42 | | | 92.01 | | | (17% | ) | | 80.17 | | | 88.37 | | | (9% | ) |

| Heavy oil ($/bbl)(1) | | 67.66 | | | 83.40 | | | (19% | ) | | 71.35 | | | 76.07 | | | (6% | ) |

| Natural gas liquids ($/bbl) | | 53.06 | | | 70.14 | | | (24% | ) | | 56.54 | | | 67.93 | | | (17% | ) |

| Natural gas ($/mcf) | | 3.44 | | | 3.42 | | | 1% | | | 2.58 | | | 3.83 | | | (33% | ) |

| Average realized price prior to hedging ($/boe)(2) | | 52.82 | | | 64.61 | | | (18% | ) | | 53.60 | | | 62.13 | | | (14% | ) |

| | | | | | | | | | | | | | | | | | | |

| Light to medium oil after hedging ($/bbl)(1)(3) | | 82.96 | | | 91.35 | | | (9% | ) | | 86.00 | | | 86.58 | | | (1% | ) |

| Average realized price after hedging ($boe)(2)(3) | | 54.38 | | | 64.45 | | | (16% | ) | | 54.97 | | | 61.68 | | | (11% | ) |

| (1) | Effective October 1, 2012, Harvest reclassified certain properties that were previously reported as light to medium oil to heavy oil as classified under National Instrument 51-101. See the “Reclassification of Heavy Oil and Light to Medium Oil Volumes” section of this MD&A. |

| (2) | Inclusive of sulphur revenue. |

| (3) | Inclusive of the realized gains (losses) from crude oil contracts designated as hedges. Foreign exchange swaps and power contracts are excluded from the realized price. |

6

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Prior to hedging activities, our realized prices for light to medium oil for the three months and year ended December 31, 2012 decreased by 17% and 9%, respectively, compared to the same periods in 2011. This is consistent with the downward movement in Edmonton Light prices in 2012.

In order to mitigate the risk of fluctuating cash flows due to crude oil price volatility, Harvest entered into fixed-for-floating swaps which settled during 2012. The impact of this hedging activity resulted in an increase of $6.54/bbl (2011 – $0.66/bbl decrease) in Harvest’s realized light to medium oil price in the fourth quarter of 2012, and an increase of $5.83/bbl (2011 - $1.79/bbl decrease) for the year ended December 31, 2012. Please see “Cash Flow Risk Management” section in this MD&A for further discussion with respect to our cash flow risk management program.

Harvest’s realized heavy oil prices for the three months and year ended December 31, 2012 decreased by 19% and 6%, respectively, mainly due to the decrease in the WCS benchmark prices.

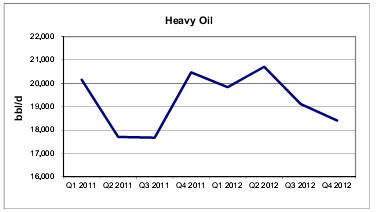

For the three months and year ended December 31, 2012, our realized prices for natural gas liquids decreased by 24% and 17%, respectively, reflecting the decrease in natural gas liquids commodity prices.

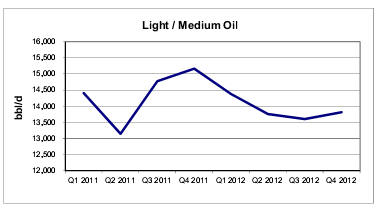

The realized prices for Harvest’s natural gas increased by 1% in the fourth quarter of 2012 and decreased 33% for the year of 2012, reflecting the movement in AECO benchmark prices.

7

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

8

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Sales Volumes

| | Three months Ended December 31 | |

| | 2012 | | 2011 | | | | |

| | | Volume | | | Weighting | | | Volume | | | Weighting | | | % Volume | |

| | | | | | | | | | | | | | | Change | |

| Light to medium oil (bbl/d)(1) | | 13,817 | | | 24% | | | 15,161 | | | 25% | | | (9% | ) |

| Heavy oil (bbl/d)(1) | | 18,402 | | | 32% | | | 20,465 | | | 33% | | | (10% | ) |

| Natural gas liquids (bbl/d) | | 6,084 | | | 10% | | | 5,440 | | | 9% | | | 12% | |

| Total liquids (bbl/d) | | 38,303 | | | 66% | | | 41,066 | | | 67% | | | (7% | ) |

| Natural gas (mcf/d) | | 119,554 | | | 34% | | | 121,547 | | | 33% | | | (2% | ) |

| Total oil equivalent (boe/d) | | 58,228 | | | 100% | | | 61,324 | | | 100% | | | (5% | ) |

| | | | | | | | | | | | | | | | |

| | Year Ended December 31 | |

| | | 2012 | | 2011 | | | | |

| | | Volume | | | Weighting | | | Volume | | | Weighting | | | % Volume | |

| | | | | | | | | | | | | | | Change | |

| Light to medium oil (bbl/d)(1) | | 13,889 | | | 23% | | | 14,376 | | | 25% | | | (3% | ) |

| Heavy oil (bbl/d)(1) | | 19,506 | | | 33% | | | 18,995 | | | 33% | | | 3% | |

| Natural gas liquids (bbl/d) | | 5,535 | | | 9% | | | 5,062 | | | 9% | | | 9% | |

| Total liquids (bbl/d) | | 38,930 | | | 65% | | | 38,433 | | | 67% | | | 1% | |

| Natural gas (mcf/d) | | 122,385 | | | 35% | | | 112,360 | | | 33% | | | 9% | |

| Total oil equivalent (boe/d) | | 59,327 | | | 100% | | | 57,161 | | | 100% | | | 4% | |

| (1) | Effective October 1, 2012, Harvest reclassified certain properties that were previously reported as light to medium oil to heavy oil as classified under National Instrument 51-101. See the “Reclassification of Heavy Oil and Light to Medium Oil Volumes” section of this MD&A. |

Total sales volumes were 58,228 boe/d for the fourth quarter of 2012 and 59,327 boe/d for the year ended December 31, 2012, a decrease of 5% and an increase of 4% respectively, compared to the same periods in 2011. The fourth quarter decrease in sales is mainly due to the impact of lower drilling activity in 2012 combined with the disposition of certain non-core producing properties in the fourth quarter of 2012. The year-over year increase in sales reflects the results of drilling in the liquids rich Deep Basin area, the full year benefit from the assets acquired from Hunt at the end of February 2011 and the current year production recovery from the Plains Rainbow Pipeline outage during the summer of 2011, partially offset by the extended turnaround of a third-party natural gas plant in the Caroline area, generally lower drilling activity in 2012 and the disposition of certain non-core producing properties in the fourth quarter.

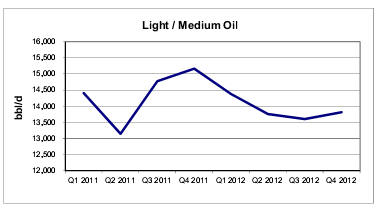

In the fourth quarter of 2012, Harvest’s average daily sales of light/medium oil were 13,817 bbl/d, reflecting a decrease of 9% from the same quarter in 2011. The decrease is due to a lower level of drilling activity in 2012 as well as miscellaneous operational issues and the disposition of non-core properties.

Harvest’s year-to-date light/medium oil sales decreased by 3% from 2011 to 13,889 bbl/d. The decrease is mainly a result of the lower level of drilling activity in 2012 and an extended pipeline outage in the Bashaw area.

9

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

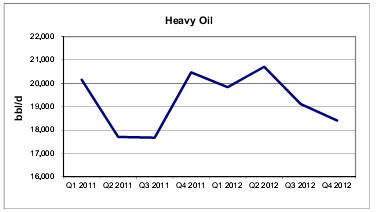

Heavy oil sales for the fourth quarter of 2012 decreased 10% from the same period in 2011, mainly due to the impact of lower drilling activity and natural declines. Heavy oil sales increased by 3% for the year ended December 31, 2012 compared to 2011, mainly due to sales recovering from the Plains Rainbow pipeline outage in 2011.

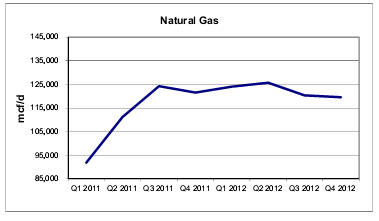

Natural gas sales averaged 119,554 mcf/d during the fourth quarter of 2012 reflecting a 2% decrease from the fourth quarter of 2011. For the year ended December 31, 2012, natural gas sales increased by 9%, due to the full year from the assets acquired from Hunt in 2011 and the results of development drilling in Willesden Green and the liquids rich Deep Basin area, partially offset by the extended Caroline plant turnaround in the summer of 2012.

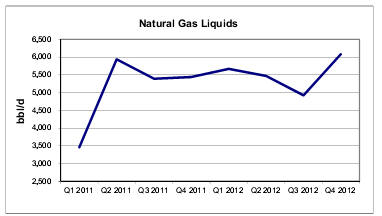

Natural gas liquids sales for the three months ended December 31, 2012 increased by 12% mainly as a result of successful liquids rich drilling in the Deep Basin area. Natural gas liquids sales for the year ended December 31, 2012 increased 9% compared to 2011 for reasons consistent with those describing our natural gas results.

10

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Revenues| | | Three Months Ended December 31 | | | Year Ended December 31 | |

| | | 2012 | | | 2011 | | | Change | | | 2012 | | | 2011 | | | Change | |

| Light / medium oil sales after hedging(1)(2) | | 105.5 | | | 127.4 | | | (17% | ) | | 437.1 | | | 454.3 | | | (4% | ) |

| Heavy oil sales(1) | | 114.6 | | | 157.0 | | | (27% | ) | | 509.4 | | | 527.4 | | | (3% | ) |

| Natural gas sales | | 37.9 | | | 38.2 | | | (1% | ) | | 115.7 | | | 156.9 | | | (26% | ) |

| Natural gas liquids sales | | 29.7 | | | 35.1 | | | (15% | ) | | 114.5 | | | 125.5 | | | (9% | ) |

| Other(3) | | 3.7 | | | 5.9 | | | (37% | ) | | 16.8 | | | 22.8 | | | (26% | ) |

| Petroleum and natural gas sales | | 291.4 | | | 363.6 | | | (20% | ) | | 1,193.5 | | | 1,286.9 | | | (7% | ) |

| Royalties | | (35.7 | ) | | (56.0 | ) | | (36% | ) | | (164.6 | ) | | (195.5 | ) | | (16% | ) |

| Revenues | | 255.7 | | | 307.6 | | | (17% | ) | | 1,028.9 | | | 1,091.4 | | | (6% | ) |

| (1) | Effective October 1, 2012, Harvest reclassified certain properties that were previously reported as light to medium oil to heavy oil as classified under National Instrument 51-101. See the “Reclassification of Heavy Oil and Light to Medium Oil Volumes” section of this MD&A. |

| (2) | Inclusive of the effective portion of realized gains (losses) from crude oil contracts designated as hedges. |

| (3) | Inclusive of sulphur revenue and miscellaneous income. |

Harvest’s revenue is subject to changes in sales volumes, commodity prices and currency exchange rates. In the fourth quarter of 2012, total petroleum and natural gas sales decreased by $72.2 million, mainly due to the 16% decrease in realized prices after hedging activities and the 5% decrease in sales volumes. For the year ended December 31, 2012, total petroleum and natural gas sales decreased by $93.4 million, mainly due to the 11% decrease in realized prices after hedging activities and partially offset by the 4% increase in sales volumes.

Sulphur revenue represented $5.0 million (2011 - $6.0 million) of the total in other revenues for the fourth quarter of 2012 and $16.9 million (2011 - $21.3 million) for the year ended December 31, 2012, with the decrease in the annual amount mainly resulting from the extended turnaround of a third-party natural gas plant in the Caroline area.

Royalties

Harvest pays Crown, freehold and overriding royalties to the owners of mineral rights from which production is generated. These royalties vary for each property and product and our Crown royalties are based on various sliding scales dependent on incentives, production volumes and commodity prices.

For the fourth quarter and year ended December 31, 2012, royalties as a percentage of gross revenue averaged 12.3% (2011 – 15.4%) and 13.8% (2011 – 15.2%), respectively. The lower royalty rates in 2012 are mainly due to lower commodity prices and higher Alberta Crown gas cost allowance credits in 2012. The extended turnaround of the Caroline plant further attributed to the lower natural gas and natural gas liquids royalties for the year.

11

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Operating and Transportation Expenses| | | Three Months Ended December 31 | |

| | | | | | | | | | | | | | | $/boe | |

| | | 2012 | | | $/boe | | | 2011 | | | $/boe | | | Change | |

| Power and purchased energy | | 21.7 | | | 4.06 | | | 22.1 | | | 3.91 | | | 0.15 | |

| Well servicing | | 7.7 | | | 1.43 | | | 17.6 | | | 3.12 | | | (1.69 | ) |

| Repairs and maintenance | | 7.1 | | | 1.33 | | | 17.5 | | | 3.10 | | | (1.77 | ) |

| Lease rentals and property tax | | 11.0 | | | 2.05 | | | 9.7 | | | 1.72 | | | 0.33 | |

| Labor - internal | | 7.2 | | | 1.35 | | | 6.8 | | | 1.21 | | | 0.14 | |

| Labor - contract | | 4.6 | | | 0.85 | | | 5.2 | | | 0.92 | | | (0.07 | ) |

| Chemicals | | 4.1 | | | 0.76 | | | 3.9 | | | 0.70 | | | 0.06 | |

| Trucking | | 3.4 | | | 0.63 | | | 3.8 | | | 0.67 | | | (0.04 | ) |

| Processing and other fees | | 7.4 | | | 1.37 | | | 9.8 | | | 1.74 | | | (0.37 | ) |

| Other | | 3.2 | | | 0.62 | | | – | | | – | | | 0.62 | |

| Total operating expenses | | 77.4 | | | 14.45 | | | 96.4 | | | 17.09 | | | (2.64 | ) |

| Transportation and marketing | | 5.9 | | | 1.10 | | | 5.7 | | | 1.02 | | | 0.08 | |

| | | Year Ended December 31 | |

| | | | | | | | | | | | | | | $/boe | |

| | | 2012 | | | $/boe | | | 2011 | | | $/boe | | | Change | |

| Power and purchased energy | | 79.6 | | | 3.67 | | | 83.1 | | | 3.98 | | | (0.31 | ) |

| Well servicing | | 56.0 | | | 2.58 | | | 61.6 | | | 2.95 | | | (0.37 | ) |

| Repairs and maintenance | | 57.0 | | | 2.63 | | | 60.0 | | | 2.88 | | | (0.25 | ) |

| Lease rentals and property tax | | 38.3 | | | 1.76 | | | 34.7 | | | 1.66 | | | 0.10 | |

| Labor - internal | | 31.5 | | | 1.45 | | | 28.1 | | | 1.35 | | | 0.10 | |

| Labor - contract | | 19.3 | | | 0.89 | | | 19.4 | | | 0.93 | | | (0.04 | ) |

| Chemicals | | 18.0 | | | 0.83 | | | 15.4 | | | 0.74 | | | 0.09 | |

| Trucking | | 16.3 | | | 0.74 | | | 13.3 | | | 0.64 | | | 0.10 | |

| Processing and other fees | | 33.4 | | | 1.54 | | | 22.6 | | | 1.09 | | | 0.45 | |

| Other | | 9.6 | | | 0.45 | | | 12.2 | | | 0.58 | | | (0.13 | ) |

| Total operating expenses | | 359.0 | | | 16.54 | | | 350.4 | | | 16.80 | | | (0.26 | ) |

| Transportation and marketing | | 22.2 | | | 1.02 | | | 29.6 | | | 1.42 | | | (0.4 | ) |

Operating expenses for the fourth quarter of 2012 totaled $77.4 million, a decrease of $19.0 million, or $2.64/boe, compared to the same quarter in 2011. The lower operating expenses are mainly attributable to the decrease in well servicing and repairs and maintenance activities.

On a year-to-date basis, operating expenses for 2012 totaled $359.0 million, an increase of $8.7 million when compared to 2011, mainly due to the increase in processing and other fees and increased production. On a per barrel basis, year-to-date operating expenses decreased by $0.26/boe or 2% which is mainly attributable to lower well servicing, repairs and maintenance and power and purchased energy costs, partially offset by higher processing and other fees.

12

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | | Three Months Ended | | Year Ended | |

| | | December 31 | | December 31 | |

| ($/boe) | | 2012 | | | 2011 | | | Change | | | 2012 | | | 2011 | | | Change | |

| Power and purchased energy costs | | 4.06 | | | 3.91 | | | 0.15 | | | 3.67 | | | 3.98 | | | (0.31 | ) |

| Realized (gains) losses on electricity risk management contracts | | – | | | (0.34 | ) | | 0.34 | | | – | | | (0.37 | ) | | 0.37 | |

| Net power and purchased energy costs | | 4.06 | | | 3.57 | | | 0.49 | | | 3.67 | | | 3.61 | | | 0.06 | |

| Alberta Power Pool electricity price ($/MWh) | | 78.80 | | | 76.42 | | | 2.38 | | | 64.29 | | | 76.65 | | | (12.36 | ) |

Power and purchased energy costs, comprised primarily of electric power costs, represented approximately 22% (2011 – 24%) of our total operating expenses for the year ended December 31, 2012. The power and purchased energy costs for the year ended December 31, 2012 totaled $79.6 million, a decrease of 4% compared to 2011, mainly attributable to the lower average Alberta electricity price and partially offset by higher average power consumption. During 2012, Harvest did not have any risk management contracts relating to electricity.

Transportation and marketing expenses relate primarily to delivery of natural gas to Alberta’s natural gas sales hub, the AECO Storage Hub, and the cost of trucking clean crude oil to pipeline receipt points. As a result, the total dollar amount of costs generally fluctuates in relation to our sales volumes. Transportation and marketing expenses had a modest increase of $0.08/boe or $0.2 million in the fourth quarter of 2012 as compared to the fourth quarter of 2011. The $0.40/boe or $7.4 million year-to-date decrease is mainly due to the higher oil trucking costs at Hay River and Red Earth that Harvest incurred in response to the outage of the Plains Rainbow Pipeline during the summer of 2011.

Operating Netback(1)

| | | Three Months Ended | | | | | | Year Ended | | | | |

| | | | | | December 31 | | | | | | | | | December 31 | | | | |

| | | | | | | | | $/boe | | | | | | | | | $/boe | |

| ($/boe) | | 2012 | | | 2011 | | | Change | | | 2012 | | | 2011 | | | Change | |

| Petroleum and natural gas sales prior to hedging | | 52.82 | | | 64.61 | | | (11.79 | ) | | 53.60 | | | 62.13 | | | (8.53 | ) |

| Royalties | | (6.66 | ) | | (9.93 | ) | | 3.27 | | | (7.58 | ) | | (9.37 | ) | | 1.79 | |

| Operating expenses | | (14.45 | ) | | (17.09 | ) | | 2.64 | | | (16.54 | ) | | (16.80 | ) | | 0.26 | |

| Transportation expenses | | (1.10 | ) | | (1.02 | ) | | (0.08 | ) | | (1.02 | ) | | (1.42 | ) | | 0.40 | |

| Operating netback prior to hedging(1) | | 30.61 | | | 36.57 | | | (5.96 | ) | | 28.46 | | | 34.54 | | | (6.08 | ) |

| Hedging gains (losses)(2) | | 1.87 | | | 0.21 | | | 1.66 | | | 1.38 | | | (0.16 | ) | | 1.54 | |

| Operating netback after hedging(1) | | 32.48 | | | 36.78 | | | (4.30 | ) | | 29.84 | | | 34.38 | | | (4.54 | ) |

| (1) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

| (2) | Hedging gains (losses) include the settlement amounts for crude oil and power contracts. |

Harvest’s operating netback represents the net amount realized on a per boe basis after deducting directly related costs. In the fourth quarter of 2012, our operating netback prior to hedging decreased by $5.96/boe or 16% compared to 2011. On an annual basis, our 2012 operating netback prior to hedging decreased by $6.08/boe or 18% from 2011. The decreases are primarily attributable lower realized commodity prices, partially offset by decreases in royalties and operating expenses.

13

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

General and Administrative (“G&A”) Expenses

| | | Three Months Ended | | | Year Ended | |

| | | December 31 | | | December 31 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| G&A | | 18.2 | | | 17.8 | | | 65.0 | | | 60.8 | |

| G&A ($/boe ) | | 3.40 | | | 3.16 | | | 2.99 | | | 2.91 | |

For the fourth quarter of 2012, G&A expenses increased by $0.4 million or 2% compared to the same period in the prior year. On a year-over-year basis, G&A expenses increased by $4.2 million or 7% in 2012 primarily due to increased salary expenses and consulting fees. Approximately 90% of the G&A expenses are related to salaries and other employee related costs. Harvest does not have a stock option program, however there is a long-term incentive program, which is a cash settled plan that has been included in the G&A expense.

Depletion, Depreciation and Amortization (“DD&A”) Expenses

| | | Three Months Ended | | | Year Ended | |

| | | December 31 | | | December 31 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| DD&A | | 145.3 | | | 149.3 | | | 579.5 | | | 535.7 | |

| DD&A ($/boe) | | 27.12 | | | 26.47 | | | 26.69 | | | 25.68 | |

DD&A expenses for the three months ended December 31, 2012 decreased by $4.0 million as compared to the same period in 2011, mainly due to lower sales volumes. DD&A expenses for the year ended 2012 increased by $43.8 million as compared to 2011 mainly due to a lower depletable proved developed reserve base and higher sales volumes.

Impairment

In the first quarter of 2012, Harvest recorded a pre-tax impairment charge of $21.8 million (2011 – $ nil) against the South Alberta Gas cash generating unit, as a result of the declining forecasted natural gas prices during the quarter. The fair value was determined based on the total proved plus probable reserves estimated by our independent reserves evaluators using the April 1, 2012 commodity price forecast discounted at a pre-tax discount rate of 10%. No impairment was recognized in the fourth quarters of 2012 and 2011.

Property Dispositions

During the fourth quarter of 2012, Harvest disposed of certain non-core producing properties in Alberta and Saskatchewan for proceeds of $88.5 million. The transactions resulted in a gain of $30.3 million, which has been recognized in the consolidated statements of comprehensive loss.

Harvest is in the process of marketing certain non-core properties for sale, to high-grade its asset portfolio and to monetize some of its assets. At December 31, 2012, properties with a net book value of $5.0 million were considered assets held for sale for accounting purposes. These properties were subsequently sold for $9.0 million in February 2013. Harvest continues to review and select non-core properties for disposition. The impact to future production from the future dispositions is difficult to predict, given the occurrence and the timing of the transactions cannot be determined with a high level of certainty. The proceeds from any dispositions would be used to manage Harvest’s liquidity and future developments of core assets.

14

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Capital Asset Additions| | | Three Months Ended | | | Year Ended | |

| | | December 31 | | | December 31 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| Drilling and completion | | 45.5 | | | 98.6 | | | 236.6 | | | 386.4 | |

| Well equipment, pipelines and facilities | | 32.9 | | | 46.0 | | | 159.1 | | | 195.1 | |

| Geological and geophysical | | 0.9 | | | 0.5 | | | 9.7 | | | 15.7 | |

| Land and undeveloped lease rentals | | 5.1 | | | 0.7 | | | 21.8 | | | 18.0 | |

| Corporate | | 0.2 | | | 0.2 | | | 1.5 | | | 2.2 | |

| Other | | 3.2 | | | 2.8 | | | 16.5 | | | 14.8 | |

| Total additions excluding acquisitions | | 87.8 | | | 148.8 | | | 445.2 | | | 632.2 | |

Total capital additions are lower for the three months and year ended December 31, 2012 as compared to the same periods in 2011 due to a lower capital budget for the current year. As a result, the annual drilling and completion expenditures decreased to $236.6 million (2011 - $386.4 million) for the year 2012. However, well equipment, pipelines and facilities expenditures did not decrease to the same degree because costs were incurred in the first and second quarters of 2012 for equipping and tying-in wells that had been drilled in late 2011.

The following table summarizes the wells drilled by Harvest and the related drilling and completion costs incurred in the period. A well is recorded in the table as having being drilled after it has been rig-released, however related drilling costs may be incurred in a period before a well has been rig-released and related completion costs may be incurred in a period afterwards.

| | | Three Months Ended | | | Year Ended | |

| | | December 31, 2012 | | | December 31, 2012 | |

| Area | | Gross | | | Net | | | | | | Gross | | | Net | | | | |

| Hay River | | 4.0 | | | 4.0 | | $ | 11.4 | | | 31.0 | | | 31.0 | | $ | 51.3 | |

| Heavy Oil | | 3.0 | | | 2.4 | | | 5.4 | | | 25.0 | | | 22.5 | | | 21.9 | |

| Red Earth | | 1.0 | | | 1.0 | | | 2.8 | | | 13.0 | | | 11.5 | | | 48.7 | |

| Kindersley | | – | | | – | | | 0.1 | | | 10.0 | | | 8.0 | | | 6.7 | |

| SE Saskatchewan | | 2.0 | | | 1.8 | | | 2.9 | | | 11.0 | | | 10.8 | | | 14.2 | |

| Western Alberta | | 1.0 | | | 1.0 | | | 6.5 | | | 11.0 | | | 6.4 | | | 24.4 | |

| Deep Basin | | 2.0 | | | 1.6 | | | 13.0 | | | 5.0 | | | 3.9 | | | 42.1 | |

| Other areas | | 1.0 | | | 1.0 | | | 3.4 | | | 10.0 | | | 6.8 | | | 27.3 | |

| Total | | 14.0 | | | 12.8 | | $ | 45.5 | | | 116.0 | | | 100.9 | | $ | 236.6 | |

During 2012, Harvest’s Upstream segment drilled or participated in a total of 116 gross (100.9 net) wells (2011 – 239 gross; 202.3 net wells) with an overall success ratio of 99%. Of the total wells drilled in 2012, Harvest drilled 96 gross (85.0 net) oil wells, 9 gross (5.1 net) gas wells, 10 gross (9.8 net) service wells and 1 gross (1.0 net) dry and abandoned well.

In Hay River, Harvest drilled 31 gross (31.0 net) wells pursuing heavy gravity oil in the Bluesky formation, including 22 producing, 8 injection and 1 source water wells. The Company’s remaining heavy oil drilling program included 25 gross (22.5 net) wells in our Heavy Oil and Provost areas which include Lloydminster,

15

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Wildmere, Maidstone and Consort as well as 3 gross (2.0 net) wells in Delbonita and Suffield. At Red Earth, Harvest drilled 13 gross (11.5 net) wells into the Slave Point and Gilwood light oil formations which were generally completed using multi-stage fracturing technology. At the Peace Arch and Cecil Areas, Harvest drilled 6 gross (4.5 net) oil wells in the Charlie Lake formation. Other active oil drilling areas included Kindersley (Eagle Lake) and southeast Saskatchewan where 21 gross (18.8 net) wells were drilled. In Garrington, Wilson Creek, Willesden Green, St. Anne, Rosevear and Waskahigan, Harvest drilled or participated in 11 gross (6.4 net) wells pursuing a variety of formations and well types. Harvest also drilled 5 gross (3.9 net) deep, multi-stage fractured, liquids rich gas wells in the Falher formations in the Deep Basin area and participated in one gas well near Retlaw.

During the fourth quarter of 2012, Harvest drilled or participated in 14 gross (12.8 net) horizontal and vertical wells with an overall success ratio of 100%. Of the wells drilled in the fourth quarter, Harvest drilled 8 gross (8.0 net) oil wells, 2 gross (1.6 net) gas wells and 3 gross (2.8 net) service wells. Harvest also participated in one partner-operated heavy oil well with a 40% working interest in Provost. Harvest was most active in Hay River where 4 gross horizontal wells (3 injectors and 1 producer) were drilled. In the Heavy Oil area 3 gross operated oil wells were drilled and Harvest participated in a fourth, partner-operated well. Harvest also drilled 2 gross (1.6 net) liquids rich gas wells in the Deep Basin area during the fourth quarter of 2012.

Decommissioning Liabilities

Harvest’s Upstream decommissioning liabilities at December 31, 2012 were $709.3 million (2011 - $664.4 million) for future remediation, abandonment, and reclamation of Harvest’s oil and gas properties. Please see note 9 of the audited annual consolidated financial statements for further discussion of decommissioning liabilities. The total of our decommissioning liabilities are based on management’s best estimate of costs to remediate, reclaim, and abandon our wells and facilities. The costs will be incurred over the operating lives of the assets with the majority being at or after the end of reserve life. Please refer to the “Risks Associated with Environment, Health & Safety” section of this MD&A for discussion of risks related to decommissioning liabilities “Contractual Obligations and Commitments” section of this MD&A for the payments expected for each of the next five years and thereafter in respect of the decommissioning liabilities.

Goodwill

Goodwill is recorded when the purchase price of an acquired business exceeds the fair value of the net identifiable assets and liabilities of that acquired business. At December 31, 2012, Harvest had $391.8 million (2011 - $404.9 million) of goodwill on the balance sheet related to the Upstream segment. The $13.1 million reduction of goodwill is a result of the disposition of certain groups of non-core assets to third parties as well as recognizing some assets as held for sale (see note 8 of the audited annual consolidated financial statements). The goodwill balance is assessed annually for impairment or more frequently if events or changes in circumstances occur that would reasonably be expected to reduce the fair value of the acquired business to a level below its carrying amount. Management has assessed goodwill for impairment and determined that there is no impairment at December 31, 2012.

16

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

BLACKGOLD OIL SANDS

Capital Asset Additions

| | | Three Months Ended | | Year Ended | |

| | | December 31 | | December 31 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| Drilling and completion | | 5.5 | | | 8.2 | | | 56.6 | | | 23.5 | |

| Well equipment, pipelines and facilities | | 34.7 | | | 19.6 | | | 93.1 | | | 70.1 | |

| Geological and geophysical | | 0.1 | | | – | | | 1.1 | | | 0.1 | |

| Other | | 4.1 | | | 3.0 | | | 13.3 | | | 7.5 | |

| Total BlackGold additions | | 44.4 | | | 30.8 | | | 164.1 | | | 101.2 | |

Below is a summary of the BlackGold wells drilled by Harvest and the related drilling and completion expenditures in 2012.

| | | Three Months Ended | | Year Ended | |

| | | December 31, 2012 | | December 31, 2012 | |

| | | | | | | | | | | | | | | | | | | |

| Area | | Gross | | | Net | | | | | | Gross | | | Net | | | | |

| BlackGold oil sands | | 4.0 | | | 4.0 $ | | | 5.5 | | | 30.0 | | | 30.0 | | $ | 56.6 | |

During the fourth quarter of 2012, Harvest completed drilling both pads of steam assisted gravity drainage (“SAGD”) producer and injector wells and spent $5.5 million drilling 4 gross wells. Harvest invested $34.7 million on the engineering, procurement and construction (“EPC”) of the central processing facility. For the year ended December 31, 2012, Harvest spent $56.6 million drilling 30 gross SAGD producer and injector wells (15 well pairs) and spent $93.1 million on the engineering, procurement and construction of the central processing facility, including the use of the $24.4 million construction deposit against the costs incurred by the EPC contractor as a result of the EPC contract amendment. As at December 31, 2012, the engineering and procurement portion of the contract relating to the central processing facility is approximately 83% complete and the facility construction portion of the contract is approximately 43% complete. Please see the “Liquidity” section of this MD&A for discussion of the EPC contract amendment and its financial impact.

Oil Sands Project Development

On May 30, 2012, Harvest amended certain aspects of its BlackGold oil sands project engineering, procurement and construction (“EPC”) contract, including revising the compensation terms from a lump sum price to a cost reimbursable price and confirming greater Harvest control over project execution. The cost pressures and resultant contract changes are expected to increase the net EPC costs to approximately $520 million from $311 million, after allowing for certain costs which are not reimbursable to the EPC contractor. Harvest and the EPC contractor also agreed to apply the cumulative progress payments made under the lump sum contract and the remaining deposit of $24.4 million as at May 30, 2012 towards costs incurred to date.

Under the amended EPC contract, a maximum of approximately $101 million of the EPC costs will be paid in equal installments, without interest, over 10 years commencing on the completion of the EPC work in 2014. The liability is considered a financial liability and is initially recorded at fair value, which is estimated as the present value of all future cash payments discounted using the prevailing market rate of interest for similar instruments. As at December 31, 2012, Harvest recognized a liability of $4.7 million (2011 - $nil) using a discount rate of 4.50% (2011 - $nil).

17

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

The Company has designed Phase 1 with 30 SAGD wells (15 well pairs) of which all have been drilled by the end of the fourth quarter of 2012. Engineering of the project is now approximately 85% complete and the site has been cleared and graded and now piling, foundation, and pipe rack module installation work is underway. Other near-term activities include completion of the detailed engineering work, delivery of equipment and modules to the site and the site construction. Phase 2 of the project, which is targeted to increase production capacity to 30,000 bbl/d, is in the regulatory approval process and approval is now anticipated in 2013.

Harvest had originally budgeted 2012 capital spending of $215 million for the BlackGold oil sands project but actual spending was reduced to $164.1 million. Activities that were deferred are primarily related to facility construction. As at December 31, 2012, Harvest has spent $157.5 million (including the $31.1 million deposit) on the EPC contract and has invested $286.4 million in the entire project since acquiring the BlackGold assets in 2010.

The BlackGold project faces similar cost and schedule pressures as other oil sand projects, including shortage of skilled labor, rising costs, and logistics issues surrounding module transportation; phase 1 production is expected to start in 2014.

Decommissioning Liabilities

Harvest’s BlackGold decommissioning liabilities at December 31, 2012 were $19.8 million (2011 - $1.5 million) relating to the future remediation, abandonment, and reclamation of the SAGD wells and central processing facilities. Please see note 9 of the audited annual consolidated financial statements for further discussion of decommissioning liabilities, “Risks Associated with Environment, Health & Safety” section of this MD&A for discussion of risks related to decommissioning liabilities and “Contractual Obligations and Commitments” section of this MD&A for the payments expected for each of the next five years and thereafter in respect of the decommissioning liabilities.

18

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

DOWNSTREAM OPERATIONS

Summary of Financial and Operating Results

| | | Three Months Ended | | Year Ended | |

| | | December 31 | | December 31 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| FINANCIAL | | | | | | | | | | | | |

| Refined products sales(1) | | 1,290.3 | | | 1,162.3 | | | 4,752.1 | | | 3,302.3 | |

| Purchased products for processing and resale(1) | | 1,211.1 | | | 1,176.7 | | | 4,520.3 | | | 3,118.1 | |

| Gross margin (loss)(2) | | 79.2 | | | (14.4 | ) | | 231.8 | | | 184.2 | |

| | | | | | | | | | | | | |

| Operating expense | | 31.7 | | | 32.5 | | | 120.8 | | | 108.4 | |

| Purchased energy expense | | 45.9 | | | 49.5 | | | 140.7 | | | 117.3 | |

| Marketing expense | | 1.3 | | | 1.1 | | | 4.4 | | | 6.3 | |

| General and administrative | | 0.1 | | | 0.4 | | | 0.6 | | | 1.8 | |

| Depreciation and amortization | | 30.4 | | | 26.8 | | | 108.9 | | | 91.0 | |

| Impairment of property, plant and equipment | | 563.2 | | | – | | | 563.2 | | | – | |

| Operating loss(2) | | (593.4 | ) | | (124.7 | ) | | (706.8 | ) | | (140.6 | ) |

| | | | | | | | | | | | | |

| Capital expenditures | | 21.5 | | | 37.5 | | | 54.2 | | | 284.2 | |

| | | | | | | | | | | | | |

| OPERATING | | | | | | | | | | | | |

| Feedstock volume (bbl/d)(3) | | 114,065 | | | 89,468 | | | 103,355 | | | 68,046 | |

| | | | | | | | | | | | | |

| Yield (% of throughput volume)(4) | | | | | | | | | | | | |

| Gasoline and related products | | 32% | | | 33% | | | 30% | | | 32% | |

| Ultra low sulphur diesel and jet fuel | | 40% | | | 44% | | | 40% | | | 40% | |

| High sulphur fuel oil | | 27% | | | 23% | | | 27% | | | 27% | |

| Total | | 99% | | | 100% | | | 97% | | | 99% | |

| | | | | | | | | | | | | |

| Average refining gross margin (loss) (US$/bbl)(5) | | 6.43 | | | (4.11 | ) | | 4.87 | | | 5.15 | |

| | |

| (1) | Refined product sales and purchased products for processing and resale are net of intra-segment sales of $121.8 million and $569.6 million for the three and twelve months ended December 31, 2012, respectively (2011 - $144.8 million and $507.8 million), reflecting the refined products produced by the refinery and sold by the marketing division. |

| (2) | These are non-GAAP measures; please refer to “Non-GAAP Measures” in this MD&A. |

| (3) | Barrels per day are calculated using total barrels of crude oil feedstock and vacuum gas oil. |

| (4) | Based on production volumes after adjusting for changes in inventory held for resale. |

| (5) | Average refining gross margin is calculated based on per barrel of feedstock throughput. |

19

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Refining Benchmark Prices

| | | Three Months Ended | | Year Ended | |

| | | | | | December 31 | | | | | December 31 | |

| | | 2012 | | | 2011 | | | Change | | | 2012 | | | 2011 | | | Change | |

| WTI crude oil (US$/bbl) | | 88.18 | | | 94.06 | | | (6% | ) | | 94.21 | | | 95.12 | | | (1% | ) |

| Brent crude oil (US$/bbl) | | 109.98 | | | 109.08 | | | 1% | | | 111.67 | | | 110.89 | | | 1% | |

| Argus sour crude index (“ASCI”) (US$/bbl) | | 103.58 | | | 106.83 | | | (3% | ) | | 106.73 | | | 107.35 | | | (1% | ) |

| Brent – WTI differential (US$/bbl) | | 21.80 | | | 15.02 | | | 45% | | | 17.46 | | | 15.77 | | | 11% | |

| Brent – ASCI differential (US$/bbl) | | 6.40 | | | 2.25 | | | 184% | | | 4.94 | | | 3.54 | | | 40% | |

| Refined product prices | | | | | | | | | | | | | | | | | | |

| RBOB (US$/bbl) | | 114.74 | | | 110.08 | | | 4% | | | 122.66 | | | 118.52 | | | 3% | |

| Heating Oil (US$/bbl) | | 128.07 | | | 125.01 | | | 2% | | | 127.11 | | | 124.15 | | | 2% | |

| High Sulphur Fuel Oil (US$/bbl) | | 93.67 | | | 98.58 | | | (5% | ) | | 99.64 | | | 96.87 | | | 3% | |

| U.S. / Canadian dollar exchange rate | | 1.009 | | | 0.977 | | | 3% | | | 1.001 | | | 1.011 | | | (1% | ) |

Summary of Gross Margins

| | | Three Months Ended December 31 | |

| | | 2012 | | 2011 | |

| | | | | | Volumes | | | | | | | | | Volumes | | | | |

| | | | | | (bbls) | | | (US$/bbl) | | | | | | (bbls) | | | (US$/bbl) | |

| Refinery | | | | | | | | | | | | | | | | | | |

| Sales | | | | | | | | | | | | | | | | | | |

| Gasoline products | | 435.8 | | | 3.9 | | | 113.33 | | | 355.8 | | | 3.1 | | | 110.02 | |

| Distillates | | 556.3 | | | 4.3 | | | 130.21 | | | 500.6 | | | 3.9 | | | 126.43 | |

| High sulphur fuel oil | | 265.8 | | | 2.9 | | | 92.63 | | | 258.4 | | | 2.6 | | | 98.50 | |

| Total sales | | 1,257.9 | | | 11.1 | | | 114.49 | | | 1,114.8 | | | 9.6 | | | 113.56 | |

| Feedstock(1) | | | | | | | | | | | | | | | | | | |

| Crude oil | | 1,042.9 | | | 9.9 | | | 106.76 | | | 878.0 | | | 7.2 | | | 118.76 | |

| Vacuum Gas Oil (“VGO”) | | 74.6 | | | 0.6 | | | 117.99 | | | 132.8 | | | 1.0 | | | 128.74 | |

| Total feedstock | | 1,117.5 | | | 10.5 | | | 107.45 | | | 1,010.8 | | | 8.2 | | | 119.98 | |

| Other(2) | | 73.6 | | | | | | | | | 138.7 | | | | | | | |

| Total feedstock and other costs | | 1,191.1 | | | | | | | | | 1,149.5 | | | | | | | |

| Refinery gross margin (loss)(3) | | 66.8 | | | | | | 6.43 | | | (34.7 | ) | | | | | (4.11 | ) |

| | | | | | | | | | | | | | | | | | | |

| Marketing | | | | | | | | | | | | | | | | | | |

| Sales | | 154.3 | | | | | | | | | 192.4 | | | | | | | |

| Cost of products sold | | 141.9 | | | | | | | | | 172.1 | | | | | | | |

| Marketing gross margin(3) | | 12.4 | | | | | | | | | 20.3 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Total gross margin (loss)(3) | | 79.2 | | | | | | | | | (14.4 | ) | | | | | | |

| (1) | Cost of feedstock includes all costs of transporting the crude oil to the refinery in Newfoundland. |

| (2) | Includes inventory adjustments and additives and blendstocks |

| (3) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

20

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | | Year Ended December 31 | |

| | | 2012 | | 2011 | |

| | | | | | Volumes | | | | | | | | | Volumes | | | | |

| | | | | | (bbls) | | | (US$/bbl) | | | | | | (bbls) | | | (US$/bbl) | |

| Refinery | | | | | | | | | | | | | | | | | | |

| Sales | | | | | | | | | | | | | | | | | | |

| Gasoline products | | 1,529.2 | | | 12.8 | | | 119.42 | | | 1,055.1 | | | 9.3 | | | 114.57 | |

| Distillates | | 2,083.7 | | | 16.1 | | | 129.24 | | | 1,386.0 | | | 11.1 | | | 126.54 | |

| High sulphur fuel oil | | 1,015.8 | | | 10.5 | | | 97.43 | | | 691.4 | | | 7.3 | | | 96.11 | |

| Total sales | | 4,628.7 | | | 39.4 | | | 117.62 | | | 3,132.5 | | | 27.7 | | | 114.51 | |

| Feedstock(1) | | | | | | | | | | | | | | | | | | |

| Crude oil | | 3,858.3 | | | 35.5 | | | 108.79 | | | 2,350.8 | | | 22.4 | | | 106.11 | |

| Vacuum Gas Oil (“VGO”) | | 274.3 | | | 2.3 | | | 117.93 | | | 286.5 | | | 2.4 | | | 118.80 | |

| Total feedstock | | 4,132.6 | | | 37.8 | | | 109.36 | | | 2,637.3 | | | 24.8 | | | 107.36 | |

| Other(2) | | 312.1 | | | | | | | | | 368.6 | | | | | | | |

| Total feedstock and other costs | | 4,444.7 | | | | | | | | | 3,005.9 | | | | | | | |

| Refinery gross margin(3) | | 184.0 | | | | | | 4.87 | | | 126.6 | | | | | | 5.15 | |

| | | | | | | | | | | | | | | | | | | |

| Marketing | | | | | | | | | | | | | | | | | | |

| Sales | | 693.0 | | | | | | | | | 677.7 | | | | | | | |

| Cost of products sold | | 645.2 | | | | | | | | | 620.1 | | | | | | | |

| Marketing gross margin(3) | | 47.8 | | | | | | | | | 57.6 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Total gross margin(3) | | 231.8 | | | | | | | | | 184.2 | | | | | | | |

| | |

| (1) | Cost of feedstock includes all costs of transporting the crude oil to the refinery in Newfoundland. |

| (2) | Includes inventory adjustments, additives and blendstocks and purchase of product for local sales |

| (3) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

Feedstock throughput averaged 114,065 bbl/d in the fourth quarter of 2012, an increase of 27% from 89,468 bbl/d in the fourth quarter of the prior year, reflecting almost full utilization of the refinery units as compared to the reduced throughput rates in 2011 in light of declining refining margins. The average throughput rate of 103,355 bbl/d for the year ended December 31, 2012 is 52% higher than the prior year. The lower daily average throughput rate for 2011 is a consequence of an extended planned maintenance shutdown during the year combined with the reduction in throughput rates in the fourth quarter of 2011. The average daily rate for 2012 is less than the nameplate capacity as a consequence of an exchanger leak on the amine unit resulting in an outage of the amine, sulphur recovery and hydrocracker units and reduction in crude rate throughput to approximately 80,000 bbls/day for two weeks combined with an operational issue with the sulphur recovery unit resulting in an unplanned outage of all refinery units for approximately three weeks.

The two tables below provide a comparison between the product crack spread realized by our refinery and the benchmark crack spread for the three and twelve months ended December 31, 2012, with both crack spreads referring to the price of Brent crude oil.

21

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | | Three Months Ended December 31 | |

| | | 2012 | | 2011 | |

| | | Refinery | | | Benchmark(1) | | | Difference | | | Refinery | | | Benchmark (1) | | | Difference | |

| Gasoline products (US$/bbl) | | 5.88 | | | 4.76 | (2) | | 1.12 | | | (9.96 | ) | | 1.00 | (2) | | (10.96 | ) |

| Distillates (US$/bbl) | | 22.76 | | | 18.09 | (3) | | 4.67 | | | 6.45 | | | 15.93 | (3) | | (9.48 | ) |

| High Sulphur Fuel Oil (US$/bbl) | | (14.82 | ) | | (16.31 | )(4) | | 1.49 | | | (21.48 | ) | | (10.50 | )(4) | | (10.98 | ) |

| (1) | Benchmark product crack is relative to Brent crude oil. |

| (2) | RBOB benchmark market price sourced from NYMEX. |

| (3) | Heating Oil benchmark market price sourced from NYMEX. Downstream’s distillate products are mainly comprised of ultra-low sulphur diesel which is a higher quality product and sells at a premium to the heating oil benchmark. |

| (4) | High Sulphur Fuel Oil benchmark market price sourced from Platts. Our high sulphur fuel oil normally contains a higher sulphur content than the 3% content reflected in the benchmark price. |

| | | Year Ended December 31 | |

| | | 2012 | | 2011 | |

| | | Refinery | | | Benchmark(1) | | | Difference | | | Refinery | | | Benchmark (1) | | | Difference | |

| Gasoline products (US$/bbl) | | 10.06 | | | 10.99 | (2) | | (0.93 | ) | | 7.21 | | | 7.63 | (2) | | (0.42 | ) |

| Distillates (US$/bbl) | | 19.88 | | | 15.44 | (3) | | 4.44 | | | 19.18 | | | 13.26 | (3) | | 5.92 | |

| High Sulphur Fuel Oil (US$/bbl) | | (11.93 | ) | | (12.03 | )(4) | | 0.10 | | | (11.25 | ) | | (14.02 | )(4) | | 2.77 | |

| (1) | Benchmark product crack is relative to Brent crude oil. |

| (2) | RBOB benchmark market price sourced from NYMEX. |

| (3) | Heating Oil benchmark market price sourced from NYMEX. Downstream’s distillate products are mainly comprised of ultra-low sulphur diesel which is a higher quality product and sells at a premium to the heating oil benchmark. |

| (4) | High Sulphur Fuel Oil benchmark market price sourced from Platts. Our high sulphur fuel oil normally contains a higher sulphur content than the 3% content reflected in the benchmark price. |

Downstream’s product crack spreads are different from the benchmarks due to several factors including timing of actual sales and feedstock purchases differing from the calendar month benchmarks, transportation costs, sour crude differentials, quality differentials and variability in the throughput volume over a given period of time. The refinery sales also include products for which market prices are not reflected in the benchmarks (such as hydrocracker bottoms that sell at spot market prices with a premium to the high sulphur fuel oil benchmark).

The overall gross margin is also impacted by the purchasing of blendstocks to meet summer gasolines specifications, additives to meet product specifications, the build of unfinished saleable products which are recorded at a value lower than cost, and inventory write-downs and reversals. These costs are included in “other costs” in the Summary of Gross Margin Table above.

The refining gross margin per barrel for the three months ended December 31, 2012 improved significantly by US$10.54/bbl from the prior year mainly due to decreased feedstock costs. The cost of Downstream’s feedstock in the fourth quarter of 2012 was a US$2.53/bbl discount to the benchmark Brent crude oil as compared to a premium of US$10.90/bbl in the same period of the prior year. The refining gross margin for the fiscal year 2012 decreased slightly by US$0.28/bbl from 2011 mainly due to reduced sour crude differential, offset by increased product prices.

22

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

The negative refining gross margin in the fourth quarter of 2011 was the result of processing high-cost crude oil when product prices were falling. Generally, the crude feedstock prices are closely linked to Brent prices with a sour crude differential. The sour crude differential includes transportation costs and the impact of timing of purchases of feedstock under the supply and offtake agreement with Macquarie Energy (the “SOA”). Prior to 2012, through a pricing mechanism in the SOA, the crude feedstock prices also included an adjustment factor that was tied to the WTI prices with the objective to provide a better match against the product prices. This adjustment factor created increased volatility to the feedstock prices as the WTI-Brent differentials fluctuated. In the fourth quarter of 2011, a significant premium to the feedstock cost was resulted as the WTI-Brent differential sharply tightened at the beginning of the quarter. In light of the volatility and the growing disconnect of the product prices from the WTI prices, the Downstream removed the adjustment factor in 2012.

The gross margin per barrel for the three months ended December 31, 2012 improved significantly from the prior year mainly as a result of decreased feedstock costs. The negative gross margin in the fourth quarter of 2011 was the result of processing high-cost crude oil when product prices were falling. During the first nine months of 2011, the refinery benefited from lower priced crude feedstock as the feedstock price was linked to WTI-Brent differentials. As the differentials widened in the first nine months of 2011 the feedstock prices decreased. In the fourth quarter of 2011, the decrease in the WTI-Brent differential increased the feedstock costs significantly. In 2012, Downstream no longer linked feedstock costs to the WTI-Brent differential, however, reduced sour crude differentials in 2012 had a negative impact on the overall refinery gross margin.

The sour crude differential includes transportation costs and the impact of timing of purchases of feedstock under the supply and offtake agreement with Macquarie Energy (the “SOA”) that may cause significant variances when measured against a given benchmark.

The cost of Downstream’s feedstock in the fourth quarter of 2012 was a US$2.53/bbl discount to the benchmark Brent crude oil as compared to a premium of US$10.90/bbl in the same period of the prior year. Similarly, the cost of feedstock for the year ended December 31, 2012 was a US$2.31/bbl discount to the benchmark Brent crude oil as compared to a discount of US$3.53/bbl in 2011.

The gross margin from the marketing operations is comprised of the margin from both the retail and wholesale distribution of gasoline and home heating fuels as well as the revenues from marine services including tugboat revenues, and for 2011, the inclusion of the US$10 million settlement from the business interruption claim relating to the fire in the first quarter of 2010.

During the three months ended December 31, 2012, the Canadian dollar strengthened as compared to the US dollar. The stronger Canadian dollar in the fourth quarter of 2012 has had a negative impact to the contribution from the refinery operations relative to the prior year as substantially all of its gross margin, cost of purchased energy and marketing expense are denominated in U.S. dollars. For the year ended December 31, 2012, the Canadian dollar had a negligible change from the US dollar.

23

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Operating Expenses

| | | Three Months Ended December 31 | |

| | | 2012 | | 2011 | |

| | | Refining | | | Marketing | | | Total | | | Refining | | | Marketing | | | Total | |

| Operating cost | | 26.3 | | | 5.4 | | | 31.7 | | | 26.6 | | | 5.9 | | | 32.5 | |

| Purchased energy | | 45.9 | | | – | | | 45.9 | | | 49.5 | | | – | | | 49.5 | |

| | | 72.2 | | | 5.4 | | | 77.6 | | | 76.1 | | | 5.9 | | | 82.0 | |

| ($/bbl of feedstock throughput) | | | | | | | | | | | | | | | | | | |

| Operating cost | | 2.51 | | | – | | | – | | | 3.24 | | | – | | | – | |

| Purchased energy | | 4.37 | | | – | | | – | | | 6.01 | | | – | | | – | |

| | | 6.88 | | | – | | | – | | | 9.25 | | | – | | | – | |

| | | Year Ended December 31 | |

| | | 2012 | | 2011 | |

| | | Refining | | | Marketing | | | Total | | | Refining | | | Marketing | | | Total | |

| Operating cost | | 100.6 | | | 20.2 | | | 120.8 | | | 88.4 | | | 20.0 | | | 108.4 | |

| Purchased energy | | 140.7 | | | – | | | 140.7 | | | 117.3 | | | – | | | 117.3 | |

| | | 241.3 | | | 20.2 | | | 261.5 | | | 205.7 | | | 20.0 | | | 225.7 | |

| ($/bbl of feedstock throughput) | | | | | | | | | | | | | | | | | | |

| Operating cost | | 2.66 | | | – | | | – | | | 3.56 | | | – | | | – | |

| Purchased energy | | 3.72 | | | – | | | – | | | 4.72 | | | – | | | – | |

| | | 6.38 | | | – | | | – | | | 8.28 | | | – | | | – | |

The refining operating cost per barrel of feedstock throughput decreased by 23% and 25% for the three months and year ended December 31, 2012 respectively, as compared to the same periods in the prior year, reflecting higher throughput volumes in 2012.

Purchased energy, consisting of low sulphur fuel oil (“LSFO”) and electricity, is required to provide heat and power to refinery operations. The purchased energy cost per barrel of feedstock throughput in 2012 decreased by 27% and 21% for the three months and year ended December 31, 2012 respectively, as compared to the same periods in the prior year. The decrease in the cost per barrel is mainly the result of higher feedstock throughput volumes in 2012.

Capital Assets Additions

Capital asset additions for the three months and year ended December 31, 2012 totaled $21.5 million and $54.2 million, respectively (2011 - $37.5 million and $284.2 million), relating to various capital projects including $6.1 million and $10.0 million respectively for turnaround costs (2011 - $3.9 million and $102.4 million respectively).

24

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Depreciation and Amortization Expense| | | Three Months Ended | | | Year Ended | |

| | | December 31 | | | December 31 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| Refining | | 29.5 | | | 26.0 | | | 105.3 | | | 87.3 | |

| Marketing | | 0.9 | | | 0.8 | | | 3.6 | | | 3.7 | |

| Total depreciation and amortization | | 30.4 | | | 26.8 | | | 108.9 | | | 91.0 | |

The process units are amortized over an average useful life of 20 to 30 years and turnaround costs are amortized to the next scheduled turnaround. The increase in refining depreciation in 2012 as compared to 2011 is a consequence of the additional annual depreciation and amortization resulting from the capital and turnaround expenditures completed during 2011.

Decommissioning Liabilities

Harvest’s Downstream decommissioning liabilities result from the ownership of the refinery and marketing assets. At December 31, 2012, Downstream’s decommissioning liabilities were $16.2 million (2011 – $14.6 million) relating to the reclamation and abandonment of these assets with an expected abandonment date of 2069. Please see note 9 of the audited annual consolidated financial statements for further discussion of decommissioning liabilities, “Risks Associated with Environment, Health & Safety” section of this MD&A for discussion of risks related to decommissioning liabilities and “Contractual Obligations and Commitments” section of this MD&A for the payments expected for each of the next five years and thereafter in respect of the decommissioning liabilities.

Impairment of Property, Plant and Equipment

During the year ended December 31, 2012, Harvest recorded a pre-tax impairment of $563.2 million on its refinery CGU relating to the property, plant and equipment to reflect the excess of the carrying value over the assessed recoverable amount. The recoverable amount was based on the assets’ value-in-use, estimated using the net present value of future cash flows and a pre-tax discount rate of 16%. The value-in-use model did not include any expected cash flows from capital enhancement projects. The pre-tax discount rate of 16% incorporated the various risks inherent in the industry and in forecasting uncertainties.

RISK MANAGEMENT, FINANCING AND OTHER

Cash Flow Risk Management

The Company at times enters into natural gas, crude oil, electricity and foreign exchange contracts to reduce the volatility of cash flows from some of its forecast sales and purchases, and when allowable, will designate these contracts as cash flow hedges. Please refer to note 22 of the audited annual consolidated financial statements for discussion regarding our risk management contracts, the underlying risk management objectives and strategies, any significant assumptions made in determining the fair value of those contracts and sensitivity analysis on Harvest’s exposure to commodity price risks from these contracts.

During 2011, Harvest entered into crude oil and foreign exchange derivative contracts and designated them as cash flow hedges. Effective July 31, 2012, Harvest discontinued the hedge designation as the hedges were no longer highly effective. Subsequent to the discontinuation of hedge accounting, all changes in the fair value of these derivative contracts were recognized in the consolidated income statement.

25

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Risk management contracts (gains) losses recorded to income include the ineffective portion of the gains or losses on the derivative contracts designated as cash flow hedges, the gains or losses on the derivatives that were not designated as hedges and the gains or losses subsequent to the discontinuation of hedge accounting on the previously designated derivatives.

The following is a summary of Harvest’s risk management contracts outstanding at December 31, 2012:

| Contracts Designated as Hedges | | | |

| Contract Quantity | Type of Contract | Term | Contract Price | Fair Value |

| 10,800 GJs/day | Natural gas swap | Jan – Dec 2013 | $3.42/GJ | 1.8 |

The following is a summary of Harvest’s realized and unrealized (gains) losses on risk management contracts:

| | | | | | Three Months Ended December 31 | | | | |

| | | | | | 2012 | | | | | | | | | 2011 | | | | |

| Contracts not designated as hedges | | Crude | | | Currency | | | Total | | | Power | | | Currency | | | Total | |

| Realized (gains) losses | | (2.8 | ) | | 0.2 | | | (2.6 | ) | | (1.9 | ) | | – | | | (1.9 | ) |

| Unrealized (gains) losses | | 0.2 | | | (0.1 | ) | | 0.1 | | | 2.5 | | | 0.2 | | | 2.7 | |

| (Gains) losses recognized in net income | | (2.6 | ) | | 0.1 | | | (2.5 | ) | | 0.6 | | | 0.2 | | | 0.8 | |

| | | | | | | | | | | | | | | | | | | |

| Contracts designated as hedges | | | | | | | | Crude Oil | | | | | | | | | Crude Oil | |

| Realized (gains) losses | | | | | | | | | | | | | | | | | | |

| Reclassified from other comprehensive income (“OCI”) to revenues, before tax | | | | | | | | (8.3 | ) | | | | | | | | 0.9 | |

| Ineffective portion recognized in net income | | | | | | | | – | | | | | | | | | (0.2 | ) |

| | | | | | | | | (8.3 | ) | | | | | | | | 0.7 | |

| Unrealized (gains) losses | | | | | | | | | | | | | | | | | | |

| Recognized in OCI, net of tax | | | | | | | | (1.5 | ) | | | | | | | | 34.8 | |

| Ineffective portion recognized in net income | | | | | | | | – | | | | | | | | | 0.8 | |

| | | | | | | | | (1.5 | ) | | | | | | | | 35.6 | |

| | | | | | | | | | | | | | | | | | | |

| Total (gains) losses from all risk management contracts | | | | | | | | | | | | | | | | |

| Recognized in OCI, net of tax | | | | | | | | 5.5 | | | | | | | | | 34.1 | |

| Recognized in revenues | | | | | | | | (8.3 | ) | | | | | | | | 0.9 | |

| Recognized in net income outside of revenues | | | | | | | | (2.5 | ) | | | | | | | | 1.4 | |

26

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | | Year Ended December 31 | |

| | | 2012 | | 2011 | |

| Contracts not designated as hedges | | Crude | | | Currency | | | Total | | | Power | | | Currency | | | Total | |

| Realized (gains) losses | | (2.1 | ) | | 0.5 | | | (1.6 | ) | | (7.7 | ) | | – | | | (7.7 | ) |

| Unrealized (gains) losses | | 1.1 | | | – | | | 1.1 | | | 1.0 | | | – | | | 1.0 | |

| (Gains) losses recognized in net income | | (1.0 | ) | | 0.5 | | | (0.5 | ) | | (6.7 | ) | | – | | | (6.7 | ) |

| | | | | | | | | | | | | | | | | | | |

| Contracts designated as hedges | | | | | | | | Crude Oil | | | | | | | | | Crude Oil | |

| Realized (gains) losses | | | | | | | | | | | | | | | | | | |

| Reclassified from OCI to revenues, before tax | | | | | | | | (29.6 | ) | | | | | | | | 9.4 | |

| Ineffective portion recognized in net income | | | | | | | | – | | | | | | | | | 1.7 | |

| | | | | | | | | (29.6 | ) | | | | | | | | 11.1 | |

| Unrealized (gains) losses | | | | | | | | | | | | | | | | | | |

| Recognized in OCI, net of tax | | | | | | | | (9.2 | ) | | | | | | | | (12.3 | ) |

| Ineffective portion recognized in net income | | | | | | | | – | | | | | | | | | (1.7 | ) |

| | | | | | | | | (9.2 | ) | | | | | | | | (14.0 | ) |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Total (gains) losses from all risk management contracts | | | | | | | | | | | | | | | | |

| Recognized in OCI, net of tax | | | | | | | | 13.2 | | | | | | | | | (19.4 | ) |

| Recognized in revenues | | | | | | | | (29.6 | ) | | | | | | | | 9.4 | |

| Recognized in net income outside of revenues | | | | | | | | (0.5 | ) | | | | | | | | (6.7 | ) |

Financing Costs

| | | Three Months Ended | | | Year Ended | |

| | | December 31 | | | December 31 | |

| | | 2012 | | | 2011 | | | 2012 | | | 2011 | |

| Bank loan | | 4.8 | | | 2.9 | | | 16.1 | | | 7.9 | |

| Convertible debentures | | 10.8 | | | 12.5 | | | 47.7 | | | 49.6 | |

| Senior notes | | 9.0 | | | 9.3 | | | 36.2 | | | 35.7 | |

| Related party loan | | 1.9 | | | – | | | 2.9 | | | – | |

| Amortization of deferred finance charges | | 0.2 | | | 0.2 | | | 0.9 | | | 0.9 | |