UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended:DECEMBER 31, 2012

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from n/a to n/a

Commission file number333-121620

HARVEST OPERATIONS CORP.

(Exact name of Registrant as specified in its charter)

HARVEST OPERATIONS CORP.

(Translation of Registrant’s name into English)

ALBERTA, CANADA

(Jurisdiction of incorporation or organization)

2100, 330 - 5th Ave. SW Calgary, Alberta, Canada T2P 0L4

(Address of principal executive offices)

Mr. Myunghuhn Yi, President & CEO

2100, 330 - 5th Ave. SW Calgary, Alberta, Canada T2P 0L4

myunghuhn.yi@harvestenergy.ca

403-268-3189

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

(none)

Securities registered or to be registered pursuant to Section 12(g) of the Act.

(none)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

(none)

1

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Common shares as of December 31, 2012: 386,078,649

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

[ ] Yes [X] No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[ ]Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

[ ] Large accelerated filer [ ] Accelerated filer [X] Non-accelerated filer

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

[ ] U.S. GAAP

[X] International Financial Reporting Standards as issued by the International Accounting Standards Board

[ ] Other

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

[ ]Item 17 [ ] Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[ ] Yes [X] No

2

Table of Contents

GLOSSARY OF TERMS

In this annual report, the following terms shall have the meanings set forth below, unless otherwise indicated.

Certain other terms used herein but not defined herein are defined in SEC regulations and, unless the context otherwise requires, shall have the same meanings herein as in SEC regulations.

“6.40% Debentures Due 2012” means the 6.40% convertible unsecured subordinated debentures of the Corporation due October 31, 2012, which were assumed by the Corporation from VERT on February 3, 2006 pursuant to the plan of arrangement under the ABCA by which the Corporation merged with VERT.

“7.25% Debentures Due 2013” means the 7.25% convertible unsecured subordinated debentures of the Corporation due September 30, 2013.

“7.25% Debentures Due 2014” means the 7.25% convertible unsecured subordinated debentures of the Corporation due February 28, 2014.

“7.50% Debentures Due 2015” means the 7.50% convertible unsecured subordinated debentures of the Corporation due May 31, 2015.

“67/8% Senior Notes” and Senior Notes mean the Corporation’s 67/8% Senior Notes due October 1, 2017.

“77/8% Senior Notes” means the Corporation’s 77/8% Senior Notes due October 15, 2011.

“ABCA” means theBusiness Corporations Act (Alberta), together with any or all regulations promulgated thereunder, as amended from time to time.

“APEGA” means the Association of Professional Engineers and Geoscientists of Alberta.

“BlackGold” means the BlackGold operating segment, with a core focus on the exploration and development of the BlackGold oil sands assets acquired from KNOC on August 6, 2010.

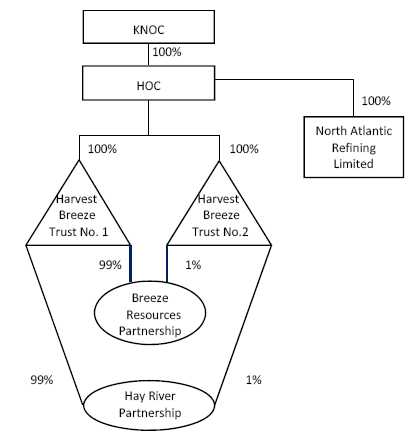

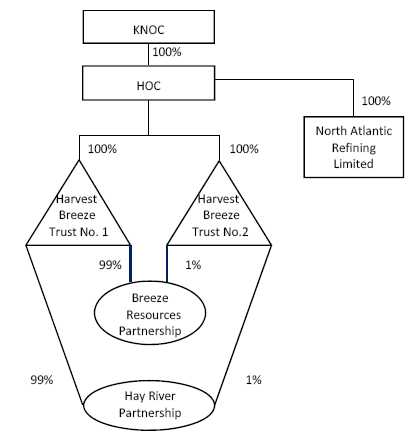

“Breeze Trust No. 1” means Harvest Breeze Trust No. 1, a trust established under the laws of the Province of Alberta, wholly owned by the Corporation.

“Breeze Trust No. 2” means Harvest Breeze Trust No. 2, a trust established under the laws of the Province of Alberta, wholly owned by the Corporation.

“Canadian GAAP” means accounting principles generally accepted in Canada.

“COGE Handbook” means the Canadian Oil and Gas Evaluation Handbook prepared jointly by the Society of Petroleum Evaluation Engineers (Calgary chapter) and the Canadian Institute of Mining, Metallurgy & Petroleum.

“Corporation” means Harvest Operations Corp.

“Credit Facility” means the $800 million revolving credit facility, as amended, provided by a syndicate of lenders to Harvest Operations as more fully described in Item 10C “Material Contracts” and in note 10 of the Corporation’s audited consolidated financial statements for the year ended December 31, 2012 under Item 18 in this annual report.

“Debentures” means, collectively, the 6.40% Debentures Due 2012, the 7.25% Debentures Due 2013, the 7.25% Debentures Due 2014 and the 7.50% Debentures Due 2015.

“Debenture Indenture” means (i) the trust indenture dated January 29, 2004 among Harvest Operations and Valiant Trust Company, as trustee, providing for the issue of debentures, as supplemented by the third supplemental indenture dated November 22, 2006 in respect of the 7.25% Debentures Due 2013, in respect of the fourth supplemental indenture dated February 1, 2007 in respect of the 7.25% Debentures Due 2014 and in respect of the fifth supplemental indenture dated April 25, 2008 in respect of the 7.50% Debentures Due 2015 and (ii) the trust indenture dated January 15, 2003 between VERT and Computershare Trust Company of Canada as trustee, providing for the issue of debentures, as supplemented by the first supplemental indenture dated October 20, 2005 in respect of the 6.40% Debentures Due 2012.

“Downstream”means the Corporation’s petroleum refining and marketing segment operating under the North Atlantic trade name, comprised of a medium gravity sour crude hydrocracking refinery with a 115,000 bbls/d nameplate capacity and a marketing division with 52 gasoline outlets, 3 commercial cardlock locations, a retail heating fuels business and a commercial and wholesale petroleum products business, all located in the Province of Newfoundland and Labrador.

“EPC”means engineering, procurement and construction.

“Farmout”means an agreement whereby a third party agrees to pay for all or a portion of the drilling of a well on one or more of the Properties in order to earn an interest therein, with an Operating Subsidiary retaining a residual interest in such Properties.

1

“Future Net Revenue”means the estimated net amount to be received with respect to the development and production of reserves computed by deducting, from estimated future revenues, estimated future royalty obligations, costs related to the development and production of reserves and abandonment and reclamation costs (corporate general and administrative expenses and financing costs are not deducted).

“GLJ” means GLJ Petroleum Consultants Ltd., independent oil and natural gas reserves evaluators of Calgary, Alberta.

“GAAP” means generally accepted accounting principles.

“Gross” means:

| | (a) | in relation to Harvest and the Operating Subsidiaries' interest in production and reserves, its "Corporation gross reserves", which are Harvest and the Operating Subsidiaries' interest (operating and non-operating) share before deduction of royalties and without including any royalty interest of Harvest and the Operating Subsidiaries; |

| | | |

| | (b) | in relation to wells, the total number of wells in which Harvest and the Operating Subsidiaries have an interest; and |

| | | |

| | (c) | in relation to properties, the total area of properties in which Harvest and the Operating Subsidiaries have an interest. |

“Harvest Board” means the board of directors of Harvest Operations.

“Harvest” and“Harvest Operations”means Harvest Operations Corp., a corporation amalgamated under the laws of the Province of Alberta.

“Independent Reserves Evaluators” means McDaniel and GLJ, who evaluated the crude oil, natural gas liquids and natural gas reserves of Harvest and the Operating Subsidiaries as at December 31, 2012, in accordance with the standards contained in Rule 4–10 of Regulation S–X.

“IFRS” means International Financial Reporting Standards as issued by the International Accounting Standards Board.

“KNOC” means Korea National Oil Corporation.

“KNOC Acquisition” means the purchase by KNOC Canada of all of the issued and outstanding Trust Units of the Trust for total consideration of approximately $1.8 billion and the assumption of approximately $2.3 billion of debt.

“KNOC Arrangement” means the plan of arrangement for the KNOC Acquisition implemented pursuant to Section 193 of the ABCA involving, among others, the Trust, Harvest Operations, KNOC Canada, KNOC and the holders of Trust Units, which became effective on December 22, 2009.

“KNOC Canada” means KNOC Canada Ltd., a corporation incorporated under the laws of the Province of Alberta.

“McDaniel” means McDaniel & Associates Consultants Ltd., independent oil and natural gas reserves evaluators of Calgary, Alberta.

“MEC” means Macquarie Energy Canada Ltd.

“Net” means:

| | (a) | in relation to Harvest and the Operating Subsidiaries' interest in production and reserves, Harvest and the Operating Subsidiaries' interest (operating and non-operating) share after deduction of royalties obligations, plus Harvest and the Operating Subsidiaries' royalty interest in production or reserves; |

| | | |

| | (b) | in relation to wells, the number of wells obtained by aggregating Harvest and the Operating Subsidiaries' working interest in each of its gross wells; and |

| | | |

| | (c) | in relation to Harvest and the Operating Subsidiaries' interest in a property, the total area in which Harvest and the Operating Subsidiaries have an interest multiplied by the working interest owned by Harvest and the Operating Subsidiaries. |

“NI 51-101” means National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities.

“North Atlantic” means North Atlantic Refining Limited, a private company, and all wholly owned subsidiaries of North Atlantic Refining Limited.

“Note Indenture” means the trust indenture made as of October 4, 2010 between U.S. Bank National Association as trustee thereunder and Harvest Operations, providing for the issuance of the 67/8% Senior Notes.

“NYSE”means the New York Stock Exchange.

“Operating Subsidiaries” means Redearth Partnership (prior to September 30, 2010), Breeze Resource Partnership, Breeze Trust No. 1, Breeze Trust No. 2, and Hay River Partnership, each (other than Redearth Partnership with respect to which the Corporation held a 60% interest prior to its dissolution) a direct or indirect wholly-owned subsidiary of the Corporation, and "Operating Subsidiary" means any of them.

2

“Person” includes an individual, a body corporate, a trust, a union, a pension fund, a government and a governmental agency.

“Production” means, with respect to the Upstream operations the produced petroleum, natural gas and natural gas liquids attributed to the Properties and with respect to the Downstream operations, the production of refined petroleum products at the Refinery.

“Properties” means the working, royalty or other interests of Harvest and the Operating Subsidiaries in any petroleum and natural gas rights, tangibles and miscellaneous interests, including properties which may be acquired by Harvest and the Operating Subsidiaries from time to time.

“Purchase and Sale Agreement” means the purchase and sale agreement dated August 22, 2006 between the Corporation and Vitol Refining Group B.V. providing for the purchase of the outstanding shares of North Atlantic and the entering into of the Supply and Offtake Agreement.

“Redearth Partnership”means the general partnership formed on August 23, 2002 under the laws of the Province of Alberta. In September 2010 Harvest acquired 100% ownership interest, thereafter, Redearth Partnership was dissolved and Harvest Operations became the owner of all the assets and assumed all of the liabilities of the Redearth Partnership. “Refinery”means the 115,000 barrel per day medium gravity sour crude hydrocracking refinery located in the Province of Newfoundland and Labrador, owned by North Atlantic.

“Related Party Loan” means the subordinated loan agreement with Ankor E&P Holdings Corp., a 100% owned subsidiary of KNOC, entered into on August 16, 2012 with a maximum borrowing limit of US$170 million at a fixed interest rate of 4.62% per annum.

“Reserves Report” means, collectively, the reports prepared by the Independent Reserve Evaluators evaluating the crude oil, natural gas liquids and natural gas reserves of Harvest and the Operating Subsidiaries as at December 31, 2011, in accordance with the standards contained in the COGE Handbook and the reserve definitions and other requirements contained in NI 51-101 and SEC regulations.

“SEC” means the United States Securities and Exchange Commission.

“Security Acts” means the United States Securities Act of 1933, as amended.

“Senior Unsecured Credit Facility” has the meaning ascribed thereto under the heading “Senior Unsecured Credit Facility” in Item 10C “Material Contracts”.

“Supply and Offtake Agreement”or“SOA”means the supply and offtake agreement dated October 19, 2006 and as amended October 12, 2009 entered into between North Atlantic and Vitol Refining, S.A. (“Vitol”).

“Supply and Offtake Agreement (2011)”or “SOA (2011)”means the supply and offtake agreement dated October 11, 2011 and as amended on December 19, 2011, April 19, 2012 and July 23, 2012 entered into between North Atlantic and MEC the terms of which are summarized under Item 10C "Material Contracts".

“Trust” means Harvest Energy Trust.

“Trust Indenture” means the fifth amended and restated trust indenture dated May 20, 2008 between the Trustee and Harvest Operations, as amended on December 22, 2009 pursuant to the KNOC Arrangement.

“Trust Unit” means a trust unit of the Trust and unless the context otherwise requires means ordinary Trust Units of the Trust.

“Trustee” means 1496965 Alberta Ltd in its capacity as trustee of the Trust.

“TSX” means the Toronto Stock Exchange.

“Upstream”means Harvest’s petroleum and natural gas segment, consisting of the exploitation, production and subsequent sale of petroleum, natural gas and natural gas liquids in Alberta, Saskatchewan and British Columbia.

“U.S. GAAP”means accounting principles generally accepted in the United States.

“VERT”means Viking Energy Royalty Trust, a trust established under the laws of the Province of Alberta, wholly owned by the Trust.

“Viking” means Viking Holdings Inc., a corporation incorporated under the laws of the Province of Alberta that formerly acted as administrator of VERT, which amalgamated with Harvest Operations on July 1, 2006.

“Working Interest” means an undivided interest held by a party in an oil and/or natural gas or mineral lease granted by a Crown or freehold mineral owner, which interest gives the holder the right to "work" the property (lease) to explore for, develop, produce and market the lease substances but does not include, among other things, a royalty, overriding royalty, gross overriding royalty, net profits interest or other interest that entitles the holder thereof to a share of production or proceeds of sale of production without a corresponding right or obligation to "work" the property.

3

ABBREVIATIONS AND CONVERSIONS

In this annual report, the following abbreviations have the meanings set forth below:

| /d | Per day |

| 3-D | Three dimensional |

| AECO | AECO “C” hub price index for Alberta natural gas |

| oAPI | The measure of the density or gravity of liquid petroleum products |

| boe(1) | Barrel of oil equivalent on the conversion factor of 6 mcf of natural gas to one bbl of oil |

| bbl | Barrel |

| bbls | Barrels |

| EOR | Enhanced oil recovery |

| GHG | Greenhouse gas |

| GJ | Gigajoule |

| H2S | Hydrogen sulfide gas |

| Mbbls | Thousand barrels |

| Mboe | Thousand barrels of oil equivalent |

| mcf | Thousand cubic feet |

| MMboe | Million barrels of oil equivalent |

| MMcf | Million cubic feet |

| NGLs | Natural gas liquids |

| NOx | The general oxides of nitrogen (NO, NO2, N2O2, etc.) |

| SAGD | Steam-assisted gravity drainage is an enhanced oil recovery technology for producing heavy crude oil and bitumen |

| SOx | The general oxides of sulfur (SO2, SO3, etc.) |

| WTI | West Texas Intermediate, the reference price in U.S. dollars at Cushing, Oklahoma for crude oil of standard grade |

| $000 | Thousands of dollars |

| $millions | Millions of dollars |

| (1) | Boes may be misleading, particularly if used in isolation. A boe conversion ratio of 6 mcf:1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. |

The following table sets forth certain conversions between Standard Imperial Units and the International System of Units (or metric units):

| To Convert From | To | Multiply By |

| mcf | cubic metres | 28.174 |

| cubic metres | cubic feet | 35.494 |

| bbls | cubic metres | 0.159 |

| feet | metres | 0.305 |

| metres | feet | 3.281 |

| miles | kilometres | 1.609 |

| kilometres | miles | 0.621 |

| acres | hectares | 0.405 |

| hectares | acres | 2.471 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this annual report and documents incorporated by reference herein, constitute forward-looking statements. These statements relate to future events and future performance. All statements other than statements of historical fact may be forward-looking statements. Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those included in the forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as: “budget”, “outlook”, “forecast”, "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "project", "predict", "potential", "targeting", "intend", "could", "might", "should", "believe" and similar expressions. Harvest believes the expectations reflected in these forward-looking statements are reasonable but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in, or incorporated by reference into, this annual report should not be unduly relied upon. These statements speak only as of the date of this annual report or as of the date specified in the documents incorporated by reference into this annual report, as the case may be.

4

In particular, this annual report, and the documents incorporated by reference herein, contains forward-looking statements pertaining to:

- expected financial and operational performance in future periods, including but not limited to, production volumes, refinery throughput volumes, royalty rates, operating costs, commodity prices, general and administrative costs, refinery utilization rates and results from its price risk management activities;

- expected increases in revenue, net income and cash flows attributable to development and production activities;

- expectations regarding the development and production potential of Upstream and BlackGold properties;

- reserves estimates, ultimate recoverability of reserves and estimates of the present value of Harvest’s future net cash flows;

- estimated capital expenditures,

- factors upon which to decide whether or not to undertake a capital project;

- future sources of funding, debt levels and availability of committed credit facilities;

- future allocation of funding to various activities;

- plans to make acquisitions and dispositions, and expected synergies from acquisitions made;

- possible financial and operational impact from planned dispositions;

- possible commerciality of exploration and development projects;

- the ability to achieve the maximum capacity from the BlackGold central processing facilities;

- expected timing, cost and associated impact of facility turnaround and maintenance;

- treatment under government regulatory regimes including without limitation, royalty, environmental and tax regulations;

- ultimate recoverability of the Harvest’s assets;

- competitive advantages and ability to compete successfully; and

- global demand and supply of crude oil, natural gas, bitumen, refined products and other related products.

With respect to forward-looking statements contained in this annual report and the documents incorporated by reference herein, Harvest has made assumptions regarding, among other things:

- future oil and natural gas prices and differentials among light, medium and heavy oil prices;

- Harvest’s ability to conduct its operations and achieve results of operations as anticipated;

- Harvest’s ability to achieve the expected results from its development plans and sustaining maintenance programs;

- the continued availability of adequate cash flow and debt and/or equity financing to fund Harvest’s capital and operating requirements as needed;

- Harvest’s ability to obtain financing with favorable terms;

- the general continuance of current or, where applicable, assumed industry conditions;

- the general continuation of assumed tax, royalty and regulatory regimes;

- the accuracy of the Corporation’s reserves;

- the ability to obtain equipment in a timely manner to carry out development and other capital activities;

- the ability to market oil and natural gas successfully to current and new customers;

- the cost of expanding Harvest's property holdings;

- the impact of increasing competition;

- the ability to add production and reserves through development and exploitation activities; and

- the ability to produce gasoline, low sulphur diesel, jet fuel, furnace oil, and other refined products that meet customer specifications.

5

Some of the significant risks and uncertainties that could affect Harvest's future results and could cause results to differ materially from those expressed in forward-looking statements include but is not limited to:

- volatility of commodity prices, especially the price differentials between light oil and heavy oil and the refining margins;

- uncertainties in the estimation of reserves;

- costs associated with developing and producing Upstream and BlackGold reserves, and operating Downstream business;

- outages and disruptions to Harvest’s operations due to operational issues, severe weather conditions, accidents or natural hazards;

- difficulties encountered in delivering Upstream and Downstream products to commercial markets;

- difficulties encountered during the drilling for and production of crude oil, natural gas, bitumen and other related products;

- difficulties encountered in the integration of acquisitions;

- uncertainties around realizing the value of acquisitions;

- uncertainties around Harvest's ability to attract capital;

- interest rate and foreign currency fluctuations;

- non-performance risks associated with Harvest’s counterparties;

- changes in, or the introduction of, new government laws and regulations relating to the crude oil and natural gas business including without limitation, tax, royalty and environmental law and regulation;

- the extent and timing of decommissioning liabilities and environmental remediation obligations;

- liabilities stemming from accidental damage to the environment;

- adverse changes in the economy generally, such as global demand and supply for commodities;

- the impact of technology on operations and developments of Harvest’s assets;

- loss of the services of any of Harvest's senior management or directors;

- the impact of competition; and

- labour and material shortages.

Statements relating to "reserves" are deemed to be forward-looking statements, as they involve the implied assessment, based on certain estimates and assumptions, that the resources and reserves described can be profitably produced in the future. Readers are cautioned that the foregoing lists of assumptions and factors are not exhaustive. The forward-looking statements contained in this annual report and the documents incorporated by reference herein are expressly qualified by this cautionary statement. Except as required by law, Harvest Operations does not undertake any obligation to publicly update or revise any forward-looking statements and readers should also carefully consider the matters discussed under Item 3D “Risk Factors".

NON-GAAP MEASURES

Throughout this annual report, Harvest has referred to certain measures of financial performance that are not specifically defined under the U.S. GAAP or IFRS such as “operating netbacks”, “operating netback prior to/after hedging”, “gross margin (loss)”, “cash contribution (deficiency) from operations”, “total debt”, “total financial debt”, “total capitalization”, “Annualized EBITDA”, “senior debt to Annualized EBITDA”, “total debt to Annualized EBITDA”, “senior debt to total capitalization”, and “total debt to total capitalization”.

“Operating netbacks” are reported on a per boe basis and used extensively in the Canadian energy sector for comparative purposes. “Operating netbacks” include revenues, operating expenses, transportation and marketing expenses, and realized gains or losses on risk management contracts. “Gross margin (loss)” is commonly used in the refining industry to reflect the net funds received from the sale of refined products after considering the cost to purchase the feedstock and is calculated by deducting purchased products for resale and processing from total revenue. “Cash contribution (deficiency) from operations” is calculated as operating income (loss) adjusted for non-cash items. This measure demonstrates the ability of the each segment of Harvest to generate cash from our operations necessary to repay debt, make capital investments, and fund the settlement of decommissioning and environmental remediation liabilities. “Total debt”, “total financial debt”, “total capitalization”, and “Annualized EBITDA” are used to assist management in assessing liquidity and Harvest’s ability to meet financial obligations. “Senior debt to Annualized EBITDA”, “total debt to Annualized EBITDA”, “senior debt to total capitalization” and “total debt to total capitalization” are terms corresponding to defined terms in the Credit Facility agreement for the purpose of calculation of our financial covenants. These non-GAAP measures do not have any standardized meaning prescribed by GAAP and may not be comparable to similar measures used by other issuers. The determination of these non-GAAP measures have been illustrated throughout this annual report, with reconciliations to IFRS measures and/or account balances, except for Annualized EBITDA and cash contribution (deficiency) which are shown below.

6

Annualized EBITDA

The measure of Consolidated EBITDA (hereinafter referred to as “Annualized EBITDA”) used in the Credit Facility agreement is defined as earnings before finance costs, income tax expense or recovery, DD&A, exploration and evaluation costs, impairment of assets, unrealized gains or losses on risk management contracts, unrealized gains or losses on foreign exchange, gains or losses on disposition of assets and other non-cash items. The following is a reconciliation of Annualized EBITDA to the nearest GAAP measure, net loss:

| | | December 31, 2012 | | | December 31, 2011 | |

| Net loss | | (720.1 | ) | | (104.7 | ) |

| DD&A | | 688.4 | | | 626.7 | |

| Finance costs | | 111.0 | | | 109.1 | |

| Income tax recovery | | (109.1 | ) | | (29.8 | ) |

| EBITDA | | (29.8 | ) | | 601.3 | |

| Unrealized (gains) losses on risk management contracts | | 1.1 | | | (0.7 | ) |

| Unrealized (gains) losses on foreign exchange | | (1.2 | ) | | 2.6 | |

| Unsuccessful exploration and evaluation costs | | 22.0 | | | 17.8 | |

| Impairment of PP&E | | 585.0 | | | – | |

| Gains on disposition of PP&E | | (30.3 | ) | | (7.9 | ) |

| Other non-cash items | | (6.7 | ) | | 4.7 | |

| Adjustments on acquisitions and dispositions(1) | | (13.4 | ) | | 6.5 | |

| Less earnings from non-restricted subsidiaries(1) | | (0.8 | ) | | (1.5 | ) |

| Annualized EBITDA(1) | | 525.9 | | | 622.8 | |

| (1) | Annualized EBITDA is on a consolidated basis for any period, the aggregate of the last four quarters of the earnings (calculated in accordance with GAAP) and accordingly is a twelve month rolling measure which, as well, is required to be adjusted to the net income impact from acquisitions or dispositions (with net proceeds over $20 million) as if the transaction had been effected at the beginning of the period and excludes earnings attributable to the BlackGold assets and non-restricted subsidiaries. |

Cash Contribution (Deficiency) from Operations

Cash contribution (deficiency) from operations represents operating income (loss) adjusted for non-cash expense items within: general and administrative, exploration and evaluation, DD&A, gains on disposition of PP&E, risk management contracts gains or losses, impairment on PP&E, and the inclusion of cash interest, realized foreign exchange gains or losses and other cash items not included in operating income (loss). The measure demonstrates the ability of Harvest's Upstream and Downstream segments to generate cash from its operations. There are no operating activities to report for the BlackGold segment as it is under development. The most directly comparable GAAP measure to cash contribution (deficiency) from operations is operating income (loss). Operating income (loss) as presented in the notes to Harvest’s consolidated financial statements is reconciled to cash contribution (deficiency) from operations below:

7

| | | Year Ended December 31 | |

| | | Downstream | | | Upstream | | | Total | |

| | | 2012 | | | 2011 | | | 2010 | | | 2012 | | | 2011 | | | 2010 | | | 2012 | | | 2011 | | | 2010 | |

| Operating income (loss) | | (706.8 | ) | | (140.6 | ) | | (94.7 | ) | | (12.7 | ) | | 111.2 | | | 45.6 | | | (719.5 | ) | | (29.4 | ) | | (49.1 | ) |

| Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating | | (7.0 | ) | | (0.1 | ) | | (1.0 | ) | | 1.6 | | | – | | | – | | | (5.4 | ) | | (0.1 | ) | | (1.0 | ) |

| General and administrative | | – | | | – | | | – | | | (1.1 | ) | | 4.9 | | | (0.1 | ) | | (1.1 | ) | | 4.9 | | | (0.1 | ) |

| Exploration and evaluation | | – | | | – | | | – | | | 22.0 | | | 17.8 | | | 2.9 | | | 22.0 | | | 17.8 | | | 2.9 | |

| Depletion, depreciation and amortization | | 108.9 | | | 91.0 | | | 83.1 | | | 579.5 | | | 535.7 | | | 470.6 | | | 688.4 | | | 626.7 | | | 553.7 | |

| Gains on disposition of PP&E | | – | | | – | | | – | | | (30.3 | ) | | (7.9 | ) | | (0.7 | ) | | (30.3 | ) | | (7.9 | ) | | (0.7 | ) |

| Unrealized (gains) losses on risk management contracts | | – | | | – | | | – | | | 1.1 | | | (0.7 | ) | | (2.4 | ) | | 1.1 | | | (0.7 | ) | | (2.4 | ) |

| Impairment on PP&E | | 563.2 | | | – | | | – | | | 21.8 | | | – | | | 13.7 | | | 585.0 | | | – | | | 13.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash contribution (deficiency) fromoperations | | (41.7 | ) | | (49.7 | ) | | (12.6 | ) | | 581.9 | | | 661.0 | | | 529.6 | | | 540.2 | | | 611.3 | | | 517.0 | |

| Inclusion of items not attributable to segments: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net cash interest paid | | | | | | | | | | | | | | | | | | | | 87.9 | | | 86.2 | | | 85.2 | |

| Realized foreign exchange gains | | | | | | | | | | | | | | | | | | | | (0.1 | ) | | (6.6 | ) | | (6.6 | ) |

| Consolidated cash contribution from operations | | | | | | | | | | | | | | | | | | | | 452.4 | | | 531.7 | | | 438.4 | |

PREDECESSOR PRESENTATION

On December 22, 2009, KNOC Canada purchased all of the issued and outstanding Trust Units of Harvest Energy Trust. The acquisition of all the issued and outstanding Trust Units of the Trust resulted in a change of control in which KNOC Canada became the sole unit holder of the Trust. On May 1, 2010, an internal reorganization was completed pursuant to which the Trust was dissolved and the Trust’s wholly owned subsidiary and the manager of the Trust, Harvest Operations Corp., was amalgamated into KNOC Canada to continue as one corporation under the name Harvest Operations Corp. The carrying values of Harvest’s assets and liabilities were determined from the existing carrying values of KNOC Canada’s assets and liabilities and therefore reflect the fair values established through the purchase.

The Trust meets the definition of a predecessor as described in Exchange Act Rule 12b-2 and Securities Act Rule 405; therefore, certain historical financial information related to the Trust is included in this annual report. Accordingly, the financial information presented in this annual report for the year ended and as at December 31, 2012, 2011 and 2010 is that of Harvest Operations Corp. (the successor company) while any comparative periods represent the financial information of Harvest Energy Trust (the predecessor company). As at December 31, 2009 the internal reorganization had not yet taken place; therefore, both Harvest Energy Trust and KNOC Canada existed at this date. However, KNOC Canada was incorporated on October 9, 2009 and did not have any results of operations or cash flows between October 9, 2009 and December 31, 2009, aside from capital contributions from KNOC to finance the KNOC Acquisition and cash used in the KNOC Acquisition; as such, the financial information presented for the year ended and as at December 31, 2009 is that of the Trust, unless otherwise stated, as this provides more relevant information in comparing the results of operations.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

8

ITEM 3. KEY INFORMATION

A. Selected Financial Information

The financial data presented below for Harvest Operations and Harvest Energy Trust is derived from the audited consolidated financial statements. Harvest adopted IFRS with a transition date of January 1, 2010. As such, the consolidated financial statements of Harvest Operations for 2012, 2011 and 2010 have been prepared in accordance with IFRS, and the consolidated financial statements of Harvest Energy Trust for 2009 and 2008 were prepared in accordance with Canadian GAAP. The selected historical consolidated financial information presented below is condensed and may not contain all of the information that readers should consider. This selected financial data should be read in conjunction with the annual audited consolidated financial statements, the notes thereto and the section entitled “Item 5 Operating and Financial Review and Prospects”. The amounts presented below for the years 2009 and 2008, reflect the adjustments made to conform to U.S. GAAP.

| In accordance with IFRS | | | | | | | | | |

| (millions of Canadian dollars, except for per share amounts) | | 2012 | | | 2011 | | | 2010 | |

| Income statement data | | | | | | | | | |

| Net revenues | | | | | | | | | |

| Upstream | $ | 1,028.9 | | $ | 1,091.4 | | $ | 852.2 | |

| Downstream | | 4,752.1 | | | 3,302.3 | | | 3,193.3 | |

| Total | $ | 5,781.0 | | $ | 4,393.7 | | $ | 4,045.5 | |

| | | | | | | | | | |

| Operating loss | $ | (719.5 | ) | $ | (29.4 | ) | $ | (49.1 | ) |

| Net loss | $ | (720.1 | ) | $ | (104.7 | ) | $ | (81.2 | ) |

| Net loss per common share | | | | | | | | | |

| Basic and diluted | $ | (1.87 | ) | $ | (0.28 | ) | $ | (0.27 | ) |

| | | | | | | | | | |

| Distributions/dividends declared | $ | - | | $ | - | | $ | - | |

| Distributions/dividends declared - U.S. dollars(1) | $ | - | | $ | - | | $ | - | |

| Distributions declared, per common share | $ | - | | $ | - | | $ | - | |

| | | | | | | | | | |

| | | | | | | | | | |

| Balance sheet data | | | | | | | | | |

| Total assets | $ | 5,654.6 | | $ | 6,284.4 | | $ | 5,388.7 | |

| Net assets | $ | 2,691.9 | | $ | 3,453.7 | | $ | 3,017.0 | |

| Shareholder’s capital | $ | 3,860.8 | | $ | 3,860.8 | | $ | 3,355.4 | |

| Temporary equity | $ | - | | $ | - | | $ | - | |

| | | | | | | | | | |

| Capital expenditures (including acquisitions, net of dispositions) | | | | | | | | | |

| Upstream | $ | 360.4 | | $ | 1,144.9 | | $ | 932.9 | |

| Downstream | | 54.2 | | | 284.2 | | | 71.2 | |

| BlackGold | | 164.1 | | | 101.2 | | | 20.8 | |

| Total | $ | 578.7 | | $ | 1,530.3 | | $ | 1,024.9 | |

| | | | | | | | | | |

| Share data | | | | | | | | | |

| Weighted average common shares outstanding | | | | | | | | | |

| Basic and diluted | | 386,078,649 | | | 377,908,587 | | | 303,005,645 | |

(1) Translated using the average noon buying rate as disclosed in “Exchange Rate Information” under Item 3A below

9

| In accordance with US GAAP | | | | | | |

| (millions of Canadian dollars, except for per Trust | | 2009 | | | 2008 | |

| Unit amounts) | | | | | | |

| Income statement data | | | | | | |

| Net revenues | | | | | | |

| Upstream | $ | 757.4 | | $ | 1,294.8 | |

| Downstream | | 2,381.6 | | | 4,194.6 | |

| Total | $ | 3,139.0 | | $ | 5,489.4 | |

| | | | | | | |

| Operating income (loss) | $ | (603.8 | ) | $ | 550.7 | |

| Net loss | $ | (641.9 | ) | $ | (1,343.3 | ) |

| Net loss per Trust Unit | | | | | | |

| Basic and diluted | $ | (3.69 | ) | $ | (8.79 | ) |

| | | | | | | |

| Distributions/dividends declared | $ | 164.8 | | $ | 551.3 | |

| Distributions/dividends declared - U.S. dollars(1) | $ | 144.3 | | $ | 517.2 | |

| Distributions declared, per Trust Unit | $ | 1.00 | | $ | 3.60 | |

| | | | | | | |

| Balance sheet data | | | | | | |

| Total assets | $ | 2,476.4 | | $ | 3,561.5 | |

| Net assets | $ | (2,073.8 | ) | $ | (997.7 | ) |

| Shareholder’s capital | $ | - | | $ | - | |

| Temporary equity | $ | 2,422.1 | | $ | 1,562.8 | |

| | | | | | | |

| Capital expenditures | | | | | | |

| Upstream | $ | 124.2 | | $ | 400.0 | |

| Downstream | | 43.8 | | | 56.2 | |

| Total | $ | 168.0 | | $ | 456.2 | |

| | | | | | | |

| Share data | | | | | | |

| Weighted average Trust Units outstanding | | | | | | |

| Basic and diluted | | 173,785,806 | | | 152,836,717 | |

(1) Translated using the average noon buying rate as disclosed in “Exchange Rate Information” under Item 3A below

EXCHANGE RATE INFORMATION

All dollar amounts set forth in this annual report are expressed in Canadian dollars, except where otherwise indicated. References to Canadian dollars, Cdn$, C$ or $ are to the currency of Canada and references to U.S. dollars or US$ are to the currency of the United States.

The exchange rate information presented below is based on the Bank of Canada noon rates. Such rates are set forth as U.S. dollars per $1.00.

The exchange rate between the Canadian dollar and the U.S. dollar on April 26, 2013 was US$0.9833.

The high and low exchange rates between the Canadian dollar and the U.S. dollar for each month during the previous six months are as follows:

10

| | High | | Low |

| March 2013 | 0.9846 | | 0.9696 |

| February 2013 | 1.0040 | | 0.9723 |

| January 2013 | 1.0164 | | 0.9923 |

| December 2012 | 1.0162 | | 1.0048 |

| November 2012 | 1.0074 | | 0.9972 |

| October 2012 | 1.0243 | | 0.9996 |

The average exchange rates between the Canadian dollar and the U.S. dollar for the five most recent financial years calculated by using the average of the exchange rate on the last day of each month during the period are as follows:

| | Average |

| 2012 | 1.0004 |

| 2011 | 1.0110 |

| 2010 | 0.9709 |

| 2009 | 0.8757 |

| 2008 | 0.9381 |

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Harvest’s Upstream, BlackGold and Downstream operations are conducted in the same business environment as most other operators in the respective businesses. The risk factors set forth below have been separated into those applicable to each of the segments and those applicable to Harvest’s structure.

RISKS ASSOCIATED WITH COMMODITY PRICES

Prices received for Upstream production are volatile. The widening oil price differentials compound the commodity price risk.

The Upstream segment is more sensitive to crude oil prices given its oil-weighted portfolio of assets. Similar to other western North American oil producers, Harvest has been negatively impacted by the discounted WTI prices. The discounted WTI prices in relation to other international benchmarks, such as Brent, were caused by transportation constraints and the inability to bring crude oil production to other international markets. It is uncertain when the transportation issues will be resolved and the impact to the future oil prices.

In addition to the discounted WTI prices, Harvest has been facing a widening light oil and heavy oil price differential. Heavy oil generally receives lower market prices than light crude due to quality differences. However, the light oil and heavy oil price differential widened significantly in the past 12 months, primarily due to supply and demand imbalances caused by pipeline constraints between Canada and the U.S. The magnitudes of the future differentials are uncertain. As 55%-65% of Upstream’s crude oil production is in heavy oil, continued widening of these differentials could have a significant negative impact on Harvest.

Certain prices Harvest receives for its Upstream production are referenced to U.S. dollar benchmark prices, though Harvest receives revenues in Canadian dollars. As such, Harvest’s Upstream revenue is impacted by changes in the Canadian/U.S. currency exchange rates. The strengthening of the Canadian dollar could have a material adverse effect on the Corporation’s revenue and cash from operating activities.

11

Any prolonged period of low commodity prices, especially oil prices, could result in deterioration of Harvest’s liquidity and profitability, which may lead to a decision by the Corporation to suspend production and/or to curtail development projects. Suspension of production could result in a corresponding substantial decrease in revenues and earnings, which in turn could materially impact Harvest’s liquidity. The Corporation could also be exposed to significant additional expense as a result of failure to meet certain commitments relating to development and production activities. Furthermore, low commodity prices could also lead to reserve write-downs and impairment of Upstream’s assets.

The Downstream refining margins fluctuate significantly, reflecting the volatility experienced in both the feedstock costs and refined products prices.

The Downstream earnings and cash flows from refining and wholesale and retail marketing operations are dependent on a number of factors including fixed and variable expenses (including the cost of crude oil and other feedstocks) and the prices at which Harvest is able to sell refined products. In recent years, the market prices for crude oil and refined products have fluctuated substantially. These prices depend on a number of factors beyond Harvest’s control, including the supply and demand for crude oil and refined products, which are subject to, among other things:

- changes in the global demand for crude oil and refined products;

- the level of foreign and domestic production of crude oil and refined products and their price;

- threatened or actual terrorist incidents, acts of war, and other worldwide political conditions in both crude oil producing and refined product consuming regions;

- the availability of crude oil and refined products and the infrastructure to transport crude oil and refined products;

- supply and operational disruptions including accidents, weather conditions, hurricanes or other natural disasters;

- actions of other crude oil producing regions, such as OPEC;

- government regulations including changes in fuel specifications required by environmental and other laws;

- local factors including market conditions and the operations of other refineries in the markets in which Harvest competes; and

- the development and marketing of competitive alternative fuels.

Generally, fluctuations in the price of gasoline and other refined products are correlated with fluctuations in the price of crude oil; however, the prices for crude oil and prices for refined products can fluctuate in different directions as a result of worldwide market conditions. Further, the timing of the relative movement in prices as well as the magnitude of the change could significantly influence refining margins as could price changes occurring during the period between purchasing crude oil feedstock and selling the respective refined products. The Refinery purchases all of its crude oil feedstock at prices that fluctuate with worldwide market conditions and this could significantly impact Harvest’s earnings and cash flows. Harvest also purchases refined products from third parties for sale to its customers and price changes during the period between purchasing and selling these products could also have a material adverse effect on Harvest’s business and results of operations, as well as its financial condition and cash from operating activities.

It can be reasonably expected that Downstream results will fluctuate over time and from period to period. Any prolonged period of low refining margins could result in deterioration of Harvest’s liquidity and profitability, which may lead to a decision by the Corporation to suspend refinery operation and/or to curtail development projects. Suspension of operation could result in a corresponding substantial decrease in revenues and earnings, which in turn could materially impact Harvest’s liquidity. Declining refining margins could also lead to impairment of Harvest’s Downstream assets and the Corporation’s earnings could be adversely impacted (such as the impairment charge recorded in 2012 for Harvest’s Downstream assets). There can be no assurance that further decline in refined product margins will not result in additional impairment charges at some future dates.

Power expenses form a significant portion of Harvest’s operating costs. Harvest is subject to risks associated with changes in electricity prices.

As a result of the deregulation of the electrical power system in Alberta, electrical power prices have been set by the market based on supply and demand and electrical power prices in Alberta have been volatile. To mitigate the Corporation’s exposure to the volatility in electrical power prices, it may enter into fixed priced forward purchase contracts for a portion of the Corporation’s electrical power consumption in Alberta. In respect of the operations in British Columbia, Saskatchewan, Newfoundland and Labrador, the power systems are regulated and as such, electrical power costs are not subject to significant volatility. However, there can be no certainty that these power systems will not deregulate in the future.

12

Electricity prices have been and will continue to be affected by supply and demand for service in both local and regional markets and continued price increases could also have a material adverse effect on Harvest’s business and results of operations, as well as its financial condition and the cash from operating activities.

RISKS ASSOCIATED WITH UPSTREAM OPERATIONS

The Upstream operations are subject to a number of operational risks and natural hazards.

The Upstream business includes the drilling and completion of wells, the construction of associated infrastructures, the operations of crude oil and natural gas wells, equipment and facilities, the transportation, processing and storing of petroleum products, and the reclamation and abandonment of properties. These activities are subject to operational and natural hazards such as blowouts, explosions, fire, flooding, gaseous leaks, equipment failures, migration of harmful substances, spills, adverse weather conditions, environmental damage, trespass, malicious acts, unexpected accidents, natural disasters and other dangerous conditions. These incidents could result in damage to Harvest’s assets, operational interruptions, suspension of development activities, personal injury or death.

Harvest’s corporate environmental health and safety manual has a number of specific policies to minimize the occurrence of incidents, including emergency response should an incident occur. If areas of higher risk are identified, Harvest will undertake to analyze and recommend changes to reduce the risk including replacement of specific infrastructure; however, there can be no assurance that such measures will prevent against harmful incidents. Harvest employs prudent risk management practices and maintains liability insurance in amounts consistent with industry standards. In addition, business interruption insurance has been purchased for selected facilities. The Corporation may become liable for damages arising from such events against which it cannot insure, which it may elect not to insure or that may result in damages in excess of existing insurance coverage. Costs incurred to repair such damage or pay such liabilities would reduce Harvest’s cash flow. The occurrence of a significant event against which the Corporation is not fully insured could have a material adverse effect on Harvest’s financial position, operating results and cash flows.

The Upstream’s exploration and development activities may not yield anticipated production, and the associated cost outlay may not be recovered.

The Upstream’s exploration and development activities may not yield the intended production or the associated costs to meet production targets may exceed the cash flows from such production. Either case could result in adverse impact to Harvest’s future financial condition, cash flows and operating results. There are risks and uncertainties around the ability to commercially produce oil or gas reserves, to meet target production levels, and to complete the activities on schedule and on budget. Seismic data and other exploration technologies Harvest uses do not provide conclusive proof prior to drilling a well that crude oil or natural gas is present or may be produced economically. Even if production is present, Harvest may not be able to achieve or sustain production targets should reservoir production decline sooner than expected. The costs of drilling, completing and tie-in wells are often uncertain, and drilling activities may be extended, delayed or cancelled due to many factors, including but not limited to:

- inability to access drilling locations;

- failure to secure materials, equipment and qualified personnel to perform the activities;

- increased costs of oilfield services;

- delay caused by extreme weather conditions;

- changes in economic conditions, such as commodity prices;

- encountering unexpected formations or pressures;

- blowouts, wellbore collapse, equipment failures and other accidents;

- craterings and sour gas releases;

- accidents and equipment failures;

- uncontrollable flows of oil, natural gas or well fluids; and

- environmental risks.

13

The markets for crude oil, natural gas and related products depend upon available capacity to refine crude oil and process natural gas, pipeline capacity to transport the products to customers, and other factors beyond the Corporation’s control.

Harvest’s ability to market its production depends upon numerous factors beyond the Corporation’s control, including:

- the availability of capacity to refine crude oil;

- the availability of natural gas processing, including liquids fractionation, capacity;

- the availability of pipeline capacity;

- the availability of diluents to blend with heavy oil to enable pipeline transportation; and

- the effects of inclement weather.

Because of these factors, Harvest may be unable to market all of the crude oil, natural gas and related products it is capable of producing or to obtain favorable prices for its production.

Absent capital reinvestment or acquisition and development, production levels and cash flows from crude oil and natural gas properties will decline over time.

Harvest’s cash from operating activities, absent commodity price increases or cost effective acquisition and development activities of properties, will decline over time in a manner consistent with declining production from typical crude oil and natural gas reserves. Accordingly, absent additional capital investment from other sources, production levels and reserves attributable to Harvest’s properties will decline.

Harvest’s future reserves and production, and therefore Harvest’s cash flows, will be highly dependent on the Corporation’s success in exploiting its resource base and acquiring additional reserves. Without reserves additions through acquisition or exploration and development activities, Harvest’s reserves and production will decline over time as reserves are produced. There can be no assurance that Harvest will be successful in exploring for developing or acquiring additional reserves on terms that meet its investment objectives.

If the operators of Harvest’s joint venture properties fail to perform their duties properly, production may be reduced and proceeds from the sale of production may be negatively impacted.

Continuing production from a property and, to a certain extent, the marketing of production are largely dependent upon the capabilities of the operator of the property. To the extent the operator fails to perform its duties properly, production may be reduced and proceeds from the sale of production from properties operated by third parties may be negatively impacted. Although Harvest maintains operative control over the majority of its properties, there is no guarantee that the Corporation will remain the operator of such properties or that the Corporation will operate other properties that it may acquire.

Defects in title may defeat Harvest’s claims to certain properties.

Although title reviews will generally be conducted on the properties in accordance with industry standards, such reviews do not guarantee or certify that a defect in title may not arise to defeat Harvest’s claim to certain properties. If Harvest claims to certain properties are defeated, Harvest’s entitlement to the production and reserves associated with such properties could be jeopardized, which could have a material adverse effect on the Corporation’s financial condition and results of operations.

Harvest’s properties may be subject to aboriginal claims and treaty rights.

In Western Canada, aboriginal groups have filed claims in respect of aboriginal title and rights in certain areas against the Governments of Canada, Alberta and British Columbia, and certain government bodies. No certainty exists that any lands currently unaffected by claims brought by aboriginal groups will remain unaffected by future claims; if a claim arose and was successful, such claim may affect the ability to obtain approvals on a timely basis, or at all, and dependent on the nature of the claim, cause a material adverse effect on Harvest’s business, financial condition and results of operations. In addition, due to traditional lands claims and and treaty rights, aboriginal consultation on surface activities is required and may result in timing uncertainties or delays of future development activities, which, if significant, could have a material material adverse effect on the development of Harvest’s affected properties.

14

RISKS ASSOCIATED WITH RESERVES ESTIMATES

The reservoir and recovery information in reserves reports are estimates and actual production and recovery rates may vary from the estimates and the variations may be significant.

The reserves and recovery information contained in the Reserves Report prepared by the Independent Reserves Evaluators are complex estimates and the actual production and ultimate reserves recovered from the Corporation’s properties may differ. There are numerous uncertainties inherent in estimating quantities of crude oil and natural gas reserves, including many factors beyond the Corporation’s control. The reserves data, as disclosed in the “Reserves and Other Oil and Gas Information” section of Item 4B, represents estimates only. In general, crude oil and natural gas reserves and the future net cash flows are based upon a number of variable factors and assumptions, such as commodity prices, future operating and capital costs, historical production from the properties and the assumed effects of regulation by governmental agencies (including regulations related to royalty payments), all of which may vary considerably from actual results. All such estimates are to some degree uncertain, and classifications of reserves are only attempts to define the degree of uncertainty involved. For these reasons, estimates of the economically recoverable crude oil and natural gas reserves attributable to any particular group of properties, classification of such reserves based on risk of recovery and estimates of future net revenues expected there from, prepared by different evaluators or by the same evaluators at different times, may vary substantially. Harvest’s actual production, revenues, royalties, taxes, operating expenditures, abandonment costs and development costs with respect to the Corporation’s reserves may vary from such estimates, and such variances could be material.

Harvest’s proved reverses and probable reserves include undeveloped reserves that require additional capital to bring them on stream, see Item 5B in this annual report. Reserves may be recognized when plans are in place to make the required investments to convert these undeveloped reserves to producing. Circumstances such as a prolonged decline in commodity prices or poorer than expected results from initial drilling activities could cause a change in the development plans, which could lead to a material change in the reserve estimates.

Estimates with respect to reserves and resources that may be developed and produced in the future are often based upon volumetric calculations, probabilistic methods and upon analogy to similar types of reserves or resources, rather than upon actual production history. Estimates based on these methods generally are less reliable than those based on actual production history. Subsequent evaluation of the same reserves or resources based upon production history will result in variations, which may be material, in the estimated reserves or resources.

The Reserve value of Harvest’s Properties as estimated by Independent Reserves Evaluators is based in part on cash flows to be generated in future years as a result of future capital expenditures. The reserves value of the properties as estimated by the Independent Reserves Evaluators may not be realized to the extent that such capital expenditures on the properties do not achieve the level of success assumed in such engineering reports.

Prices paid for acquisitions are based in part on reserves report estimates and the assumptions made in preparing the reserves report are subject to change as well as geological and engineering uncertainty.

The prices paid for acquisitions are based, in part, on engineering and economic assessments made by the independent reserves evaluators in the related reserves report. These assessments include a number of material assumptions regarding such factors as recoverability and marketability of crude oil, natural gas and natural gas liquids, future commodity prices, operating costs, future capital expenditures and royalties and other government levies which will be imposed over the producing life of the reserves. Many of these factors are subject to change and are beyond Harvest’s control. In particular, the prices of and markets for crude oil and natural gas may change from those anticipated at the time of making such acquisitions. In addition, all engineering assessments involve a measure of geological and engineering uncertainty which could result in lower production and reserves than those currently attributed to Harvest’s properties.

RISKS ASSOCIATED WITH DOWNSTREAM OPERATIONS

The Refinery is a single train integrated interdependent facility which could experience a major shutdown caused by an accident or by severe weather. These potential disruptions may reduce or eliminate Harvest’s cash flow.

The Refinery is a single train integrated and interdependent facility which could be forced to shut down, partially or in full, by an accident in one of the units, fire, leakages, spills, extreme weather conditions, other natural disaster, or other unplanned incidents. A shutdown of one part of the Refinery could significantly impact the production of refined products and may reduce, and even eliminate, cash flow. Any one or more of the Refinery’s processing units may encounter unexpected or extended downtime for maintenance or repair for damages caused by the event or identified during the outage. The time required to complete the work may extend the duration of the outage or take longer than anticipated, and the restoration of operations may otherwise involve unanticipated delay. There are no assurances that the Refinery will produce refined products in the quantities or at the cost anticipated, or that it will not cease production entirely in certain circumstances, which could have a material adverse effect on Harvest’s business and results of operations, as well as its financial condition and cash from operating activities.

15

Harvest’s Downstream operations are subject to hazards which may result in personal injury, damage to Harvest’s property and/or the property of others along with significant liabilities.

Harvest’s Downtream operations, including the operation of the refinery, terminals, marine division, pipelines, storage tanks, and other distribution facilities and service stations, are subject to hazards and inherent risks such as fires, natural disasters, explosions, spills and mechanical failure of the equipment or third-party facilities, any of which can result in personal injury claims as well as damage to Harvest’s properties and the properties of others. While Harvest carries property, casualty and business interruption insurance, the Corporation does not maintain insurance coverage against all potential losses, and could suffer losses for uninsurable or uninsured risks or in amounts in excess of existing insurance coverage. The occurrence of an event that is not fully covered by insurance could have a material adverse effect on Harvest’s business and results of operations, as well as its financial condition and cash from operating activities, as the Corporation could be liable for all costs and penalties associated with their remediation under federal, provincial and local environmental laws or common law, and could be liable for property damage to third parties. In addition, unanticipated costs or reduced operating income may be resulted from any of these incidents, which may further impact Harvest’s profitability and liquidity.

Downstream operates in environmentally sensitive coastal waters where tanker operations are closely regulated by federal, provincial and local agencies and monitored by environmental interest groups. Transportation of crude oil and refined products over water involves inherent risk and subjects North Atlantic to the provisions of Canadian federal laws and the laws of the Province of Newfoundland and Labrador. Among other things, these laws require North Atlantic to demonstrate its capacity to respond to a “worst case discharge” to a maximum 10,000 metric tonne oil spill. Downstream’s marine division manages vessel traffic to the Refinery and works with regulatory authorities on measures to prevent and mitigate the risk of oil spills and other marine related matters. The marine division has two tugboats to assist in berthing and unberthing tankers at Harvest’s dock with one tugboat equipped with firefighting capability. The tugboat operations have a safety management system certified under the International Safety Management Code and are also certified under the International Ship and Port Security Code. In addition, Harvest has contracted the Eastern Canada Response Corporation to supplement Harvest’s resources. However, there may be accidents involving tankers transporting crude oil or refined products, and response services may not respond in a manner to adequately contain a discharge and Harvest may be subject to a significant liability in connection with a discharge.

Harvest has in the past operated service stations with underground storage tanks and currently operates 52 retail gasoline stations and three commercial cardlock locations with underground storage tanks in the Province of Newfoundland and Labrador. Harvest is required to comply with provincial regulations governing such storage tanks in the Province of Newfoundland and Labrador and compliance with these requirements can be costly. The operation of underground storage tanks also poses certain other risks, including damages associated with soil and groundwater contamination. Leaks from underground storage tanks which may occur at one or more of Harvest’s service stations, or which may have occurred at previously operated service stations, may impact soil or groundwater and could result in fines or civil liability. While Harvest maintains insurance in respect of such risks, there are no assurances that such insurance will be adequate to fully compensate for any liability Harvest may incur if such risks were to occur.

The Refinery is subject to regular major maintenance or turnarounds, where a significant portion or the entire Refinery may be shut down. Similar to any large scale maintenance projects, the project may not complete on time or on budget, which may materially impact Harvest’s cash flows and operating results.

The Refinery carries out various scales of major maintenance and turnarounds, some of which require complete shut-down. While Harvest makes every effort to properly plan and execute the scheduled maintenance, the possibility remains that capital cost overruns or schedule delays will occur as a result of fluctuating market conditions and unexpected challenges, including the availability, scheduling and costs of materials and qualified personnel; the complexities around the integration and management of contractors, subcontractors, staff and supplies; competing projects that require the same resources during the same time period; and severe weather conditions. The Refinery is a complicated facility with many integrated and interdependent components. As such, unforeseeable complications may occur or additional work may be identified during major maintenance projects that require more time and effort to complete than anticipated. Any cost overruns, schedule delays and resulting additional down days may cause material adverse effect to Harvest’s cash flows and operating results. As with unplanned outages, scheduled outages could significantly impact the production of refined products and may reduce, and even eliminate, cash flow

16

Crude oil feedstock is delivered to the Refinery via waterborne vessels which could experience delays in transporting supplies due to weather, accidents, government regulations or third party actions.

The Refinery receives all of its crude oil and other feedstocks and its customers lift approximately 90% of its refined products via water borne vessels including very large crude carriers. In addition to environmental risks of handling such vessels discussed above, Harvest could experience a disruption in the supply of crude oil because of accidents, extreme weather conditions, governmental regulation or third party actions. A prolonged disruption in the availability of vessels to deliver crude oil to the Refinery and/or to deliver refined products to market would have a material adverse effect on Harvest’s business and results of operations, as well as the financial condition and cash from operating activities.

Since Harvest’s acquisition of North Atlantic, approximately 71% of its crude oil feedstock has been from sources in the Middle East. The Corporation does not maintain long term supply commitments with any of its crude oil producers. To the extent that crude oil producers reduce the volume of crude oil produced as a result of declining production or competition or otherwise, the business, financial condition and results of operations may be adversely affected to the extent that the Corporation is not able to find a substantial amount and similar type of crude oil. Further, the Corporation has no control over the level of development in the fields that currently produce the crude oil it process at the Refinery nor the amount of reserves underlying such fields, the rate at which production will decline or the production decisions of the producers which are affected by, among other things, prevailing and projected crude oil prices, demand for crude oil, geological considerations, government regulation and the availability and cost of capital.

If MEC terminates the SOA (2011), Harvest’s business could be adversely affected.

Under the SOA (2011), MEC sells all of the Refinery’s feedstock and purchases almost all of the refined products produced. If MEC terminates the SOA (2011), Harvest would seek to enter into a similar agreement with another party that has a similar credit profile and expertise to that of MEC’s. If Harvest were unable to enter into such a replacement agreement, it would be required to enter into separate agreements for the supply and financing of feedstock to the Refinery and the sale of the Refinery’s refined products. No assurance can be given that Harvest will be able either to enter into an agreement similar to the SOA (2011) with another party or to enter into agreements with a number of different parties to replicate the economics of the SOA (2011). If the SOA (2011) were terminated and Harvest was unable to enter into replacement agreements, working capital requirements would likely increase and revenues and cash flows from the Refinery would likely decrease, which could have a material adverse effect on Harvest’s business.

Harvest is relying on the creditworthiness of MEC for Harvest’s purchase of feedstock and should their creditworthiness deteriorate, crude oil suppliers may restrict the sale of crude oil to MEC.

MEC purchases crude oil feedstock from third parties to supply North Atlantic pursuant to the SOA (2011). Should the creditworthiness of MEC deteriorate third party crude oil suppliers may reduce the sale volume to MEC, shorten the payment terms or require additional credit support. MEC may pass on additional costs to Harvest, which then may increase Downstream’s feedstock costs. If MEC fails to secure sufficient amount of feedstock supplies, the Refinery operations may be disrupted. Due to the large dollar amount of credit associated with the volume of crude oil purchases, any imposition of more burdensome payment terms may have a material adverse effect on Harvest’s financial liquidity which could hinder its ability to purchase sufficient quantities of crude oil to operate the Refinery at full capacity. A failure to operate the Refinery at full capacity could have a material adverse effect on its business and results of operations, as well as its financial condition and cash from operating activities.

17

The production of aviation fuels subjects us to liability should contaminants in the fuel result in aircraft engines being damaged and/or aircraft accidents.

The Refinery produces aviation fuels, which involves inherent risks and subjects it to the provisions of Canadian federal laws. Harvest’s product quality assurance programs are extensive; however, these procedures may not be sufficient to detect and prevent contaminants from entering into the aviation fuels which could result in aircraft engines being damaged and/or aircraft accidents. While the Corporation maintains insurance in respect of such risks, there are no assurances that such insurance will be adequate to fully compensate for any liability the Corporation may incur if such risks were to occur.

Collective bargaining agreements with North Atlantic’s employees and the United Steel Workers of America with respect to the Downstream operations may not prevent a strike or work stoppage and future agreements may result in an increase in operating costs.

As of December 31, 2012, 66% full-time employees and 100% of part-time employees in the Downstream operations are represented by the United Steel Workers of America pursuant to collective bargaining agreements. Upon the expiry of existing collective agreements, the Corporation may not be able to renegotiate future collective agreements on satisfactory terms, or at all, which may result in an increase in operating costs. In addition, the existing collective agreements may not prevent a strike or work stoppage in the future, and any such work stoppage could have a material adverse effect on the Downstream business and Harvest’s results of operations as well as the financial condition and cash from operating activities.

RISKS ASSOCIATED WITH BLACKGOLD OIL SANDS PROJECT

Harvest is subject to certain risks associated with the project execution and the commissioning of the SAGD operations.

Each stage of the BlackGold EPC project is subject to execution risks that are inherent in similar projects, such as failure to properly design the project scope and engineering details, difficulties around the procurement and fabrication of key modules and components, failure to carry out construction as planned, and inability to meet performance targets upon commissioning and project start-up.

The development of the BlackGold assets requires substantial capital investment. While Harvest makes every effort to properly and accurately forecast capital and operating expenditures, the possibility remains that capital cost overruns or schedule delays will occur as a result of fluctuating market conditions and unexpected challenges, including but not limited to:

- The availability, scheduling and costs of materials and qualified personnel;

- The complexities around the integration and management of contractors, subcontractors, staff and supplies;

- The ability to obtain the necessary regulatory approvals in various stages of the project;

- Logistic issues relating to the transportation of modules across great distances;

- The availability of auxiliary infrastructures in place to support the project;

- The impact from changing government regulations and public scrutiny over oil sands development; and

- Severe weather conditions.

In May 2012, Harvest amended certain aspects of its BlackGold EPC contract, including revising the compensation terms from a lump sum price to a cost reimbursable price. As such, any cost overruns and schedule delays could have the potential to affect the Corporation’s future financial position and cash flows.

BlackGold is subject to government regulation. The initial phase of the project, targeting production of 10,000 bbl/d, has been approved by provincial regulators. The proposed expansion phase of the BlackGold project is in the application stage and remains subject to approval by provincial regulators. The delay of such approval could impact Harvest’s ability and/or timing of reaching the targeted production of 30,000 bbl/d.