| MANAGEMENT’S DISCUSSION AND ANALYSIS |

MANAGEMENT’S DISCUSSION AND ANALYSIS

This Management’s Discussion and Analysis (“MD&A”) should be read in conjunction with the unaudited interim consolidated financial statements of Harvest Operations Corp. (“Harvest”, “we”, “us”, “our” or the “Company”) for the three months ended March 31, 2015 and the audited annual consolidated financial statements for the year ended December 31, 2014 together with the accompanying notes. The information and opinions concerning the future outlook are based on information available at May 14, 2015.

In this MD&A, all dollar amounts are expressed in Canadian dollars unless otherwise indicated. Tabular amounts are in millions of dollars, except where noted. All financial data has been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board except where otherwise noted.

Natural gas volumes are converted to barrels of oil equivalent (“boe”) using the ratio of six thousand cubic feet (“mcf”) of natural gas to one barrel of oil (“bbl”). Boes may be misleading, particularly if used in isolation. A boe conversion ratio of 6 mcf to 1 bbl is based on an energy equivalent conversion method primarily applicable at the burner tip and does not represent a value equivalent at the wellhead. In accordance with Canadian practice, petroleum and natural gas revenues are reported on a gross basis before deduction of Crown and other royalties.

Additional information concerning Harvest, including its audited annual consolidated financial statements and Annual Information Form (“AIF”) can be found on SEDAR atwww.sedar.com.

ADVISORY

This MD&A contains non-GAAP measures and forward-looking information about our current expectations, estimates and projections. Readers are cautioned that the MD&A should be read in conjunction with the “Non-GAAP Measures” and “Forward-Looking Information” sections at the end of this MD&A.

1

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

FINANCIAL AND OPERATING HIGHLIGHTS

| | | Three Months Ended March 31 | |

| | | 2015 | | | 2014 | |

| CONTINUING OPERATIONS | | | | | | |

| Upstream | | | | | | |

| Daily sales volumes (boe/d)(1) | | 43,770 | | | 48,487 | |

| Average realized price | | | | | | |

| Oil and NGLs ($/bbl)(2) | | 40.40 | | | 82.30 | |

| Gas ($/mcf)(2) | | 2.81 | | | 6.16 | |

| Operating netback prior to hedging($/boe)(3) | | 9.80 | | | 37.27 | |

| Operating (loss) income(4) | | (110.1 | ) | | 21.8 | |

| Cash contribution from operations(3) | | 19.1 | | | 139.8 | |

| | | | | | | |

| Capital asset additions (excluding acquisitions) | | 56.6 | | | 134.3 | |

| Corporate acquisition(5) | | 36.8 | | | — | |

| Property acquisitions (dispositions), net | | (0.5 | ) | | (2.1 | ) |

| | | | | | | |

| Net wells drilled | | 19.2 | | | 31.9 | |

| Net undeveloped land additions (acres) | | 20,338 | | | 6,444 | |

| Net undeveloped land dispositions (acres) | | — | | | (1,897 | ) |

| | | | | | | |

| BlackGold | | | | | | |

| Capital asset additions | | 60.8 | | | 42.2 | |

| | | | | | | |

| NET LOSS(6) | | (223.5 | ) | | (51.9 | ) |

| (1) | Excludes volumes from Harvest’s equity investment in the Deep Basin Partnership. |

| (2) | Excludes the effect of risk management contracts designated as hedges. |

| (3) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

| (4) | This is an additional GAAP measure; please refer to “Additional GAAP Measures” in this MD&A. |

| (5) | Corporate acquisition represents the total consideration for the transaction including working capital assumed. |

| (6) | Net loss relates to Continuing Operations only. |

REVIEW OF OVERALL PERFORMANCE

Harvest is an energy company with a petroleum and natural gas business focused on the exploration, development and production of assets in western Canada (“Upstream”) and an in-situ oil sands project in the pre-commissioning phase in northern Alberta (“BlackGold”). During the year ended December 31, 2014, Harvest’s refining and marketing business (“Downstream”) was sold and has been classified as “Discontinued Operations”. The following MD&A focuses on the financial and operating results of Harvest’s continuing Upstream and BlackGold operations. For Downstream results from the quarter ended March 31, 2014, please see the March 31, 2014 MD&A and interim consolidated financial statements for the quarter ended March 31, 2014 atwww.sedar.com.Harvest is a wholly owned subsidiary of Korea National Oil Corporation (“KNOC”). Our earnings and cash flow from continuing operations are largely determined by the realized prices for our crude oil and natural gas production.

The latter part of 2014 and the first quarter of 2015 have been very challenging for the oil and gas industry. The approximate 55 percent decline in crude oil prices since June 2014 has resulted in widespread reductions in capital spending programs and extensive efforts to reduce costs across the industry. We are confident that commodity prices will eventually improve; however, the timing of that improvement is uncertain and we expect continued crude oil price and cash flow volatility in the near term. In the meantime, we are focused on identifying sustainable cost reductions as well as keeping our capital program focused on high return projects.

2

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

CONTINUING OPERATIONS

Upstream

| • | On February 27, 2015, Harvest closed the acquisition of Hunt Oil Company of Canada, Inc. (“Hunt”) by acquiring all of the issued and outstanding common shares of Hunt for total consideration of approximately $36.8 million, subject to final purchase price adjustments. Current production from the acquired assets is approximately 500 boe/d. |

| • | Sales volumes for the first quarter ended March 31, 2015 decreased by 4,717 boe/d as compared to the same period in 2014. The decrease was primarily due to the disposition of assets to the Deep Basin Partnership (“DBP”) (accounted for as an equity investment) in the second quarter of 2014, dispositions of certain non-core producing properties during 2014 and natural declines exceeding the volume additions from our drilling program. |

| • | Harvest’s share of DBP’s volumes for the quarter ended March 31, 2015 was 1,123 boe/d. The construction of the HK MS Partnership (“HKMS”) facility was completed in early 2015 and was operational in the latter part of the quarter. Strategically, this facility provides the DBP an advantage of access to firm processing capability, the ability to extract maximum liquids from the natural gas produced by DBP wells and will allow DBP to pursue both acquisition and drilling opportunities in the region. |

| • | Operating netback prior to hedging for the first quarter of 2015 was $9.80/boe, a decrease of $27.47/boe from the same period in 2014. The decrease from 2014 was mainly due to lower realized prices per boe, partially offset by lower royalties, operating and transportation expense per boe. |

| • | Operating loss was $110.1 million (2014 – operating income of $21.8 million) for the first quarter of 2015, a decrease in income of $131.9 million mainly due to lower realized prices and sales volumes combined with a $23.5 million asset impairment expense. |

| • | Cash contribution from Harvest’s Upstream operations for the first quarter of 2015 was $19.1 million (2014 – $139.8 million). The decrease in cash contribution was mainly due to lower sales volumes and lower realized prices, partially offset by lower operating expense. |

| • | Capital asset additions of $56.6 million during the first quarter of 2015 mainly related to the drilling, completion and tie-in of wells. Twenty-five gross wells (19.2 net) were rig-released during the first quarter of 2015. |

| • | On April 14, 2015, Harvest entered into a purchase and sale agreement to sell certain non-core oil and gas assets in Eastern Alberta for approximately $28.3 million in cash proceeds, net of any customary closing adjustments. The sale closed on May 1, 2015. |

BlackGold

• | Capital asset additions were $60.8 million for the first quarter of 2015, mainly related to the completion of the central processing facility (“CPF”) (2014 - $42.2 million). |

3

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

• | The CPF was mechanically completed in early 2015 and minor pre-commissioning activities will continue at a measured pace throughout 2015 with first steam occurring once the heavy oil price environment becomes favourable. |

CORPORATE

| • | The strengthening of the U.S. dollar against the Canadian dollar during the first quarter of 2015 resulted in an unrealized foreign exchange loss of $138.9 million (2014 – $54.0 million loss). |

| • | The net borrowing from the credit facility was $249.6 million during the quarter ended March 31, 2015 (2014 - $93.4 net repayment). At March 31, 2015, Harvest had $870.3 million drawn from the $1.0 billion available under the credit facility (December 31, 2014 - $620.7 million). |

| • | On April 2, 2015, Harvest entered into a US$171 million loan agreement with KNOC repayable within one year from the date of the first drawing, which was on April 10, 2015. At May 14, 2015, Harvest had drawn US$120 million under the loan agreement. |

| • | On April 22, 2015, Harvest amended the terms of its credit facility and replaced it with a $940 million syndicated revolving credit facility maturing April 30, 2017. The amended credit facility is guaranteed by KNOC. Under the amended credit facility, applicable interest and fees will be based on a margin pricing grid based on the Moody’s and S&P credit ratings of KNOC. The financial covenants under the previous credit facility were deleted and replaced with a new covenant: Total Debt to Capitalization ratio of 70% or less. At March 31, 2015 Harvest was in compliance with this covenant. |

4

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

CONTINUING OPERATIONS (UPSTREAM)

Summary of Financial and Operating Results

| | | Three Months Ended March 31 | |

| | | 2015 | | | 2014 | |

| FINANCIAL | | | | | | |

| Petroleum and natural gas sales(1) | | 126.4 | | | 287.7 | |

| Royalties | | (13.1 | ) | | (36.2 | ) |

| Loss from joint ventures | | (5.9 | ) | | — | |

| Revenues and other income(2) | | 107.4 | | | 251.5 | |

| | | | | | | |

| Expenses | | | | | | |

| Operating | | 72.5 | | | 88.5 | |

| Transportation and marketing | | 1.2 | | | 6.3 | |

| Realized losses (gains) on risk management contracts(3) | | 1.4 | | | (0.5 | ) |

| Operating netback after hedging(4) | | 32.3 | | | 157.2 | |

| | | | | | | |

| General and administrative | | 19.0 | | | 16.8 | |

| Depreciation, depletion and amortization | | 98.4 | | | 109.5 | |

| Exploration and evaluation | | 0.9 | | | 8.6 | |

| Impairment of property, plant and equipment | | 23.5 | | | — | |

| Unrealized losses (gains) on risk management contracts(5) | | 1.1 | | | (0.2 | ) |

| (Gains) losses on disposition of assets | | (0.5 | ) | | 0.7 | |

| Operating income (loss)(2) | | (110.1 | ) | | 21.8 | |

| | | | | | | |

| Capital asset additions (excluding acquisitions) | | 56.6 | | | 134.3 | |

| Corporate acquisition(6) | | 36.8 | | | — | |

| Property acquisitions (dispositions), net | | (0.5 | ) | | (2.1 | ) |

| | | | | | | |

| OPERATING | | | | | | |

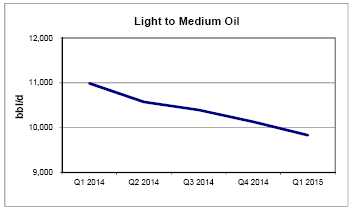

| Light to medium oil (bbl/d) | | 9,832 | | | 10,989 | |

| Heavy oil (bbl/d) | | 12,058 | | | 15,777 | |

| Natural gas liquids (bbl/d) | | 4,231 | | | 4,917 | |

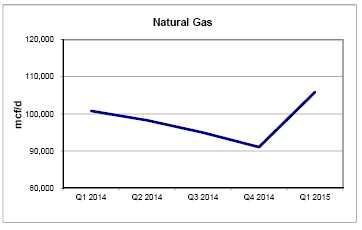

| Natural gas (mcf/d) | | 105,887 | | | 100,823 | |

| Total (boe/d)(7) | | 43,770 | | | 48,487 | |

| (1) | Includes the effective portion of Harvest’s realized natural gas hedges. |

| (2) | This is an additional GAAP measure; please refer to “Additional GAAP Measures” in this MD&A. |

| (3) | Realized gains on risk management contracts include the settlement amounts for power, crude oil, natural gas and foreign exchange derivative contracts, excluding the effective portion of realized gains from Harvest’s designated accounting hedges. See “Risk Management, Financing and Other” section of this MD&A for details. |

| (4) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

| (5) | Unrealized gains on risk management contracts reflect the change in fair value of derivative contracts that are not designated as accounting hedges and the ineffective portion of changes in fair value of designated hedges. See “Risk Management, Financing and Other” section of this MD&A for details. |

| (6) | Corporate acquisition represents the total consideration for the transaction, including working capital assumed. |

| (7) | Excludes volumes from Harvest’s equity investment in the Deep Basin Partnership. |

5

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Commodity Price Environment

| | | Three Months Ended March 31 | |

| | | 2015 | | | 2014 | | | Change | |

| West Texas Intermediate ("WTI") crude oil (US$/bbl) | | 48.63 | | | 98.68 | | | (51% | ) |

| West Texas Intermediate crude oil ($/bbl) | | 60.38 | | | 108.95 | | | (45% | ) |

| Edmonton light sweet crude oil (“EDM”) ($/bbl) | | 51.95 | | | 99.83 | | | (48% | ) |

| Western Canadian Select ("WCS") crude oil ($/bbl) | | 42.08 | | | 83.36 | | | (50% | ) |

| AECO natural gas daily ($/mcf) | | 2.75 | | | 5.66 | | | (51% | ) |

| U.S. / Canadian dollar exchange rate | | 0.806 | | | 0.906 | | | (11% | ) |

| | | | | | | | | | |

| Differential Benchmarks | | | | | | | | | |

| EDM differential to WTI ($/bbl) | | 8.43 | | | 9.12 | | | (8% | ) |

| EDM differential as a % of WTI | | 14.0% | | | 8.4% | | | 67% | |

| WCS differential to WTI ($/bbl) | | 18.30 | | | 25.59 | | | (28% | ) |

| WCS differential as a % of WTI | | 30.3% | | | 23.5% | | | 29% | |

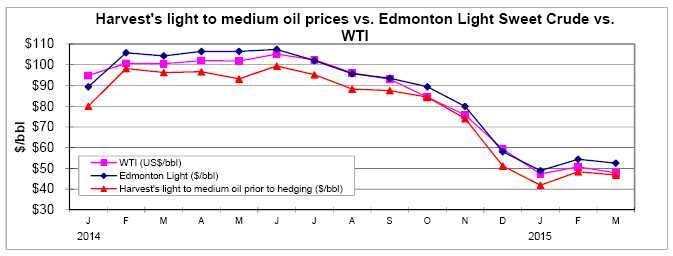

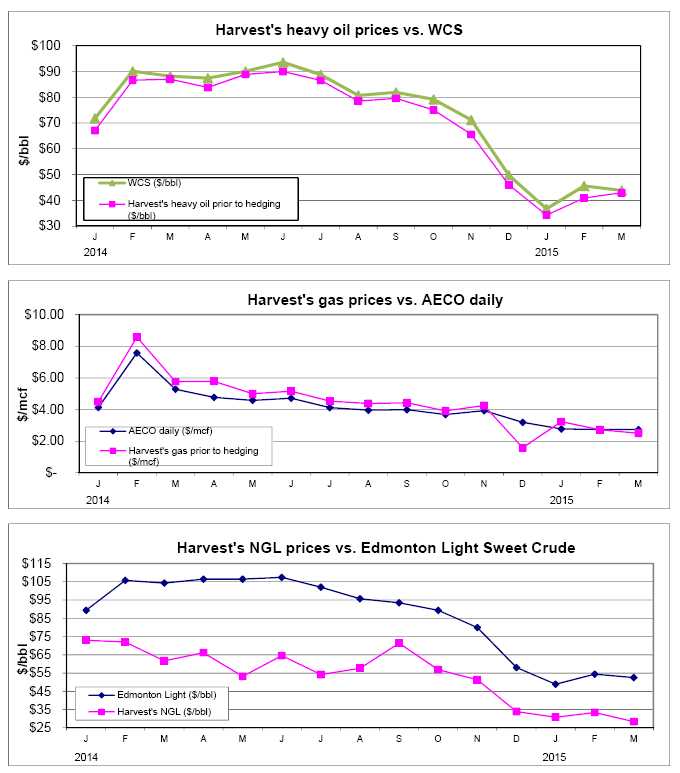

The average WTI benchmark price decreased 51%, for the first quarter ended March 31, 2015 as compared to the same period in 2014. The average Edmonton light sweet crude oil price (“Edmonton Light”) decreased 48% in the first quarter of 2015 compared to 2014, due to the decrease in the WTI price, partially offset by the strengthening of the U.S. dollar against the Canadian dollar and the narrowing of the Edmonton light sweet differential.

Heavy oil differentials fluctuate based on a combination of factors including the level of heavy oil production and inventories, pipeline and rail capacity to deliver heavy crude to U.S. and offshore markets and the seasonal demand for heavy oil. The changes in the WCS price for the first quarter ended March 31, 2015 as compared to the same period in 2014 was mainly the result of the decrease in the WTI price, the narrowing of the WCS differential to WTI and the strengthening of the U.S. dollar.

Realized Commodity Prices

| | | Three Months Ended March 31 | |

| | | 2015 | | | 2014 | | | Change | |

| Light to medium oil ($/bbl) | | 45.56 | | | 91.35 | | | (50% | ) |

| Heavy oil ($/bbl) | | 39.53 | | | 80.25 | | | (51% | ) |

| Natural gas liquids ($/bbl) | | 30.91 | | | 68.67 | | | (55% | ) |

| Natural gas prior to hedging($/mcf) | | 2.81 | | | 6.16 | | | (54% | ) |

| Average realized price prior to hedging ($/boe)(1) | | 31.85 | | | 67.29 | | | (53% | ) |

| | | | | | | | | | |

| Natural gas after hedging ($/mcf)(2) | | 2.86 | | | 5.48 | | | (48% | ) |

| Average realized price after hedging ($/boe)(1)(2) | | 31.98 | | | 65.87 | | | (51% | ) |

| (1) | Inclusive of sulphur revenue. |

| (2) | Inclusive of the realized gains (losses) from contracts designated as hedges. Foreign exchange swaps and power contracts are excluded from the realized price. |

Harvest’s realized prices prior to any hedging activity for light to medium oil and natural gas generally trend with the Edmonton Light and AECO benchmark prices, respectively. Harvest’s realized prices prior to any hedging activity for heavy oil are a function of both the WCS and Edmonton Light benchmarks due to a portion of our heavy oil volumes being sold based on a discount to the Edmonton Light benchmark. For the first quarter of 2015, the period-over-period variances and movements of light to medium oil, heavy oil and natural gas were consistent with the changes in their related benchmarks.

6

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Realized natural gas liquids prices decreased by 55% for the first quarter ended March 31, 2015, as compared to the same period in 2014. The decrease was consistent with the decrease in oil prices.

In order to mitigate the risk of fluctuating cash flows due to natural gas pricing volatility, Harvest had AECO derivative contracts in place during the first quarters of 2015 and 2014. The AECO hedge increased our natural gas price by $0.05/mcf in the first quarter of 2015 (2014 – decreased by $0.68/mcf) .

Please see “Cash Flow Risk Management” section in this MD&A for further discussion with respect to the cash flow risk management program.

7

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

8

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Sales Volumes

| | | Three Months Ended March 31 | |

| | | 2015 | | | 2014 | | | | |

| | | | | | | | | | | | | | | % Volume | |

| | | Volume | | | Weighting | | | Volume | | | Weighting | | | Change | |

| Light to medium oil (bbl/d) | | 9,832 | | | 22% | | | 10,989 | | | 23% | | | (11% | ) |

| Heavy oil (bbl/d) | | 12,058 | | | 28% | | | 15,777 | | | 33% | | | (24% | ) |

| Natural gas liquids (bbl/d) | | 4,231 | | | 10% | | | 4,917 | | | 10% | | | (14% | ) |

| Total liquids (bbl/d) | | 26,121 | | | 60% | | | 31,683 | | | 66% | | | (18% | ) |

| Natural gas (mcf/d) | | 105,887 | | | 40% | | | 100,823 | | | 34% | | | 5% | |

| Total oil equivalent (boe/d) | | 43,770 | | | 100% | | | 48,487 | | | 100% | | | (10% | ) |

| Harvest’s average daily sales of light to medium oil decreased 11% in the first quarter of 2015, as compared to the same period in 2014. The decrease was mainly due to natural declines, partially offset by the results of our 2014/2015 drilling program. |

Heavy oil sales for the first quarter of 2015 decreased 24%, as compared to the same period in 2014 mainly due to non-core asset dispositions in the third and fourth quarters of 2014 and natural declines. |  |

9

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| Natural gas sales during the first quarter of 2015 increased 5% as compared to the same period in 2014. The increase was mainly a result of Harvest’s 2014/2015 drilling program and the acquisition of Hunt during the first quarter of 2015, partially offset by the disposition of assets to the Deep Basin Partnership in the second quarter of 2014, disposition of non-core assets during 2014 and natural declines. |

| | |

Natural gas liquids sales for the first quarter ended March 31, 2015 decreased by 14% from the same period in 2014 due to the disposition of assets to the Deep Basin Partnership in the second quarter of 2014, third party facility constraints and natural declines, partially offset by results from Harvest’s 2014/2015 drilling program. |  |

Revenues

| | | Three Months Ended March 31 | |

| | 2015 | | | 2014 | | | Change | |

| Light to medium oil sales | | 40.3 | | | 90.4 | | | (55% | ) |

| Heavy oil sales | | 42.9 | | | 114.0 | | | (62% | ) |

| Natural gas sales after hedging(1) | | 27.3 | | | 49.7 | | | (45% | ) |

| Natural gas liquids sales | | 11.8 | | | 30.4 | | | (61% | ) |

| Other(2) | | 4.1 | | | 3.2 | | | 28% | |

| Petroleum and natural gas sales | | 126.4 | | | 287.7 | | | (56% | ) |

| Royalties | | (13.1 | ) | | (36.2 | ) | | (64% | ) |

| Revenues | | 113.3 | | | 251.5 | | | (55% | ) |

| (1) | Inclusive of the effective portion of realized gains (losses) from natural gas contracts designated as hedges. |

| (2) | Inclusive of sulphur revenue and miscellaneous income. |

10

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Harvest’s revenue is subject to changes in sales volumes, commodity prices, currency exchange rates and hedging activities. In the first quarter of 2015, total petroleum and natural gas sales decreased by 56% as compared to the first quarter of 2014, mainly due to the 51% decrease in realized prices after hedging activities and the 10% decrease in sales volumes.

Sulphur revenue represented $3.7 million of the total in other revenues for the first quarter of 2015 (2014 - $3.0 million).

Royalties

Harvest pays Crown, freehold and overriding royalties to the owners of mineral rights from which production is generated. These royalties vary for each property and product and Crown royalties are based on various sliding scales dependent on incentives, production volumes and commodity prices.

For the first quarter ended March 31, 2015, royalties as a percentage of gross revenue averaged 10.4% (2014 – 12.6%) . The decrease in royalties as a percentage of gross revenue was mainly due to lower commodity prices.

Operating and Transportation Expenses

| | | Three Months Ended March 31 | |

| | | 2015 | | | $/boe | | | 2014 | | | $/boe | | | $/boe Change | |

| Power and purchased energy | | 13.7 | | | 3.48 | | | 21.0 | | | 4.82 | | | (1.34 | ) |

| Repairs and maintenance | | 12.7 | | | 3.22 | | | 13.3 | | | 3.05 | | | 0.17 | |

| Labour - internal | | 9.2 | | | 2.34 | | | 9.3 | | | 2.13 | | | 0.21 | |

| Processing and other fees | | 8.9 | | | 2.26 | | | 8.8 | | | 2.02 | | | 0.24 | |

| Lease rentals and property tax | | 8.3 | | | 2.11 | | | 9.8 | | | 2.23 | | | (0.12 | ) |

| Well servicing | | 7.8 | | | 1.98 | | | 12.3 | | | 2.81 | | | (0.83 | ) |

| Chemicals | | 7.5 | | | 1.90 | | | 5.6 | | | 1.29 | | | 0.61 | |

| Labour - contract | | 3.5 | | | 0.89 | | | 3.4 | | | 0.78 | | | 0.11 | |

| Trucking | | 2.1 | | | 0.53 | | | 3.4 | | | 0.78 | | | (0.25 | ) |

| Other(1) | | (1.2 | ) | | (0.31 | ) | | 1.6 | | | 0.38 | | | (0.69 | ) |

| Total operating expenses | | 72.5 | | | 18.40 | | | 88.5 | | | 20.29 | | | (1.89 | ) |

| Transportation and marketing | | 1.2 | | | 0.31 | | | 6.3 | | | 1.43 | | | (1.12 | ) |

| (1) | Other operating expenses include Environmental, Health and Safety $2.3 million (2014 – $3.5 million), insurance and accruals. |

Operating expenses for the first quarter of 2015 decreased by $16.0 million compared to the same period in 2014, mainly due to the decrease in the cost of power, reduced levels of well servicing activity and asset dispositions in 2014. Operating expenses on a per barrel basis decreased by 9% to $18.40 per barrel due to the lower spending and partially offset by the lower sales volumes.

| | | Three Months Ended March 31 | |

| ($/boe) | | 2015 | | | 2014 | | | Change | |

| Power and purchased energy costs | | 3.48 | | | 4.82 | | | (1.34 | ) |

| Realized losses (gains) on electricity risk management contracts | | 0.34 | | | (0.11 | ) | | 0.45 | |

| Net power and purchased energy costs | | 3.82 | | | 4.71 | | | (0.89 | ) |

| Alberta Power Pool electricity price ($/MWh) | | 29.15 | | | 61.75 | | | (32.60 | ) |

11

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Power and purchased energy costs, comprised primarily of electric power costs, represented approximately 19% (2014 – 24%) of total operating expenses for the first quarter of 2015. Power and purchased energy costs per boe were lower in the first quarter of 2015 as compared to 2014 primarily due to the lower average Alberta electricity price.

Transportation and marketing expenses relate primarily to the cost of trucking crude oil to pipeline or rail receipt points. Transportation and marketing expenses in the first quarter of 2015 decreased by $5.1 million as compared to the same period in 2014, primarily due to the reclassification of gas transportation costs to revenue (which started during the fourth quarter of 2014), combined with the higher transportation costs incurred in the Deep Basin and Hayter areas during the first quarter of 2014 as a result of facility restrictions.

Operating Netback(1)

| | | Three Months Ended March 31 | |

| ($/boe) | | 2015 | | | 2014 | | | Change | |

| Petroleum and natural gas sales prior to hedging(2) | | 31.85 | | | 67.29 | | | (35.44 | ) |

| Royalties | | (3.34 | ) | | (8.30 | ) | | 4.96 | |

| Operating expenses | | (18.40 | ) | | (20.29 | ) | | 1.89 | |

| Transportation and marketing | | (0.31 | ) | | (1.43 | ) | | 1.12 | |

| Operating netback prior to hedging(1) | | 9.80 | | | 37.27 | | | (27.47 | ) |

| Hedging loss(3) | | (0.21 | ) | | (1.30 | ) | | 1.09 | |

| Operating netback after hedging(1) | | 9.59 | | | 35.97 | | | (26.38 | ) |

| (1) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

| | |

| (2) | Excludes miscellaneous income not related to oil and gas production |

| | |

| (3) | Includes the settlement amounts for natural gas and power contracts. |

General and Administrative (“G&A”) Expenses

| | | Three Months Ended March 31 | |

| | | 2015 | | | 2014 | |

| G&A | | 19.0 | | | 16.8 | |

| G&A ($/boe ) | | 4.83 | | | 3.85 | |

For the first quarter ended March 31, 2015, G&A expenses increased $2.2 million from the same period in 2014 mainly due to severance payments made during the first quarter of 2015. On a per boe basis, G&A expenses increased $0.98 from the same period in 2014, mainly due to the increase in G&A costs combined with lower sales volumes in the current period. Harvest does not have a stock option program, however there is a long-term incentive program which is a cash settled plan that has been included in the G&A expense.

Depletion, Depreciation and Amortization (“DD&A”) Expenses

| | | Three Months Ended March 31 | |

| | | 2015 | | | 2014 | |

| DD&A | | 98.4 | | | 109.5 | |

| DD&A ($/boe) | | 24.99 | | | 25.09 | |

DD&A expense for the quarter ended March 31, 2015 decreased by $11.1 million as compared to 2014, mainly due to lower sales volumes in the current quarter as well as impairment of certain assets in Q4 2014.

12

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Impairment of Property, Plant and Equipment

For the quarter ended March 31, 2015, Harvest recognized an impairment loss of $23.5 million (2014 – $nil) against PP&E relating to the South Oil CGU. Impairment was triggered by reserves write-downs as a result of a decline in oil prices and underperformance assets. The recoverable amount was based on the assets’ value-in-use (“VIU”), estimated using the net present value of proved plus probable reserves discounted at a pre-tax rate of 10%. Please refer to note 7 of the March 31, 2015 interim consolidated financial statements for further discussion.

Acquisitions & Dispositions

On February 27, 2015, Harvest closed the acquisition of Hunt by acquiring all of the issued and outstanding common shares for total consideration of approximately $36.8 million, subject to final purchase price adjustments. Hunt was a private oil and gas company with operations immediately offsetting Harvest’s lands and production in the Deep Basin area of Alberta. Harvest acquired approximately 15,000 acres of net undeveloped land and current production from the assets is approximately 500 boe/d. Please refer to note 5 of the March 31, 2015 interim consolidated financial statements for further discussion.

On April 14, 2015, Harvest entered into a purchase and sale agreement to sell certain non-core oil and gas assets in Eastern Alberta for approximately $28.3 million in cash proceeds, net of any customary closing adjustments. The sale closed on May 1, 2015.

Capital Asset Additions

| | | Three Months Ended March 31 | |

| | | 2015 | | | 2014 | |

| Drilling and completion | | 38.0 | | | 81.8 | |

| Well equipment, pipelines and facilities | | 15.6 | | | 43.2 | |

| Land and undeveloped lease rentals | | 1.1 | | | 0.6 | |

| Geological and geophysical | | 0.1 | | | 4.6 | |

| Corporate | | 1.8 | | | 1.5 | |

| Other | | – | | | 2.6 | |

| Total additions excluding acquisitions | | 56.6 | | | 134.3 | |

Total capital additions were lower for the quarter ended March 31, 2015 compared to 2014 mainly due to reduced capital activity for the current year in response to a low commodity price environment. Harvest’s capital expenditures in the first quarter of 2015 included completions and tie-ins of previously drilled wells, as well as the winter 2014/2015 drilling program in Kakwa (Deep Basin), Hay River and Red Earth.

The following table summarizes the wells drilled in our core growth areas, supplemented with drilling in strategic revenue generating areas in Suffield, and the related drilling and completion costs incurred in the period. A well is recorded in the table as having being drilled after it has been rig-released, however related drilling costs may be incurred in a period before a well has been spud (including survey, lease acquisition and construction costs) and related completion and tie-in costs may be incurred in a period afterwards, depending on the timing of the completion work.

13

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | | Three months ended March 31, 2015 | |

| | | | | | | | | Drilling and | |

| Area | | Gross | | | Net | | | completion | |

| Deep Basin | | 6.0 | | | 3.0 | | $ | 15.3 | |

| Red Earth | | 6.0 | | | 6.0 | | | 11.0 | |

| Hay River | | 9.0 | | | 9.0 | | | 10.9 | |

| Suffield | | 1.0 | | | 1.0 | | | 0.7 | |

| West Central Alberta | | 3.0 | | | 0.2 | | | 0.1 | |

| Total | | 25.0 | | | 19.2 | | $ | 38.0 | |

The primary areas of focus for Harvest’s Upstream drilling program were as follows:

- Deep Basin – participated or drilled horizontal multi-stage fractured wells to develop the liquids-rich Falher and Montney gas formations;

- Red Earth – drilled wells at Loon Lake with completions performed in late March and early April, with tie-ins to be done in late April and May for a June production start-up;

- Hay River – drilled seven producing and two injection wells, pursuing slightly heavy (low 20 degree API) gravity oil in the Bluesky formation using multi-leg horizontal oil wells;

- Suffield – drilled and abandoned one vertical test well;

- West Central Alberta – participated in wells in Wilson Creek with recent efforts targeting the Glauconite formation.

Harvest’s net undeveloped land additions of 20,338 acres during the quarter ended March 31, 2015 (2014 – 6,444 acres) were primarily from the acquisition of Hunt.

Decommissioning Liabilities

Harvest’s Upstream decommissioning liabilities at March 31, 2015 were $757.0 million (December 31, 2014 – $752.0 million) for future remediation, abandonment, and reclamation of Harvest’s oil and gas properties. The total of the decommissioning liabilities are based on management’s best estimate of costs to remediate, reclaim, and abandon wells and facilities. The costs will be incurred over the operating lives of the assets with the majority being at or after the end of reserve life. Please refer to the “Contractual Obligations and Commitments” section of this MD&A for the payments expected for each of the next five years and thereafter in respect of the decommissioning liabilities.

Investments in Joint Arrangements

Harvest is a party to the Deep Basin Partnership (“DBP”) and HK MS Partnership (“HKMS”) joint ventures with KERR Canada Co. Ltd. (“KERR”) both accounted for as equity investments. Below is an overview of operational and financial highlights of these investments for the quarter ended March 31, 2015:

DBP

During the first quarter of 2015, DBP drilled 4 gross (3.75 net) wells in the Deep Basin, targeting the Cardium, Halfway and Montney formations. All wells were horizontal, multi-stage fracture stimulated wells targeting liquids rich gas. Of the 4 gross wells drilled, 1.0 (1.0 net) was dry, 1.0 (1.0 net) was a stratigraphic test well and production from the remaining wells was processed through the new HKMS Bilbo gas plant that was completed during the first quarter of 2015 and commenced operations in March 2015.

14

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

As at March 31, 2015, Harvest’s ownership interest in DBP remains unchanged compared to December 31, 2014. For the first quarter of 2015, Harvest recognized a loss of $5.9 million (2014 – $nil) from its investment in these joint ventures primarily due to lower commodity prices and higher operating costs. Harvest derives its income or loss from its investment in the DBP based upon Harvest’s share in the change of the net assets of the joint venture. Harvest’s share of the change in the net assets does not directly correspond to its ownership interest of 77.81% because of contractual preference rights to KERR. Considering that fact, Harvest’s share of the production of the DBP is as follows:

| | DBP volumes | Harvest's share |

| Three months ended March 31, 2015 (boe/d) | 1,572 | 1,223 |

KERR’s preferred partnership units provide certain preference rights, including a put option right exercisable after 10.5 years, whereby KERR could cause DBP to redeem all of its preferred partnership units for consideration equal to its initial contribution plus a minimum after-tax internal rate of return of two percent. If DBP does not have sufficient funds to complete the redemption obligation and after making efforts to secure funding, whether via issuing new equity, entering into a financing arrangement or selling assets, the partnership can cash-call Harvest to meet such obligation (the “top-up obligation”). This obligation could also arise upon the termination of this arrangement. This top-up obligation is accounted for by Harvest at fair value through profit and loss and is estimated using a probabilistic model of the estimated future cash flows of the DBP. The cash flow forecast is based on management’s internal assumptions of the volumes, commodity prices, royalties, operating costs and capital expenditures specific to the DBP. As at March 31, 2015, the fair value of the top-up obligation was estimated as $nil, therefore, no top-up obligation was recorded by Harvest. Once KERR achieves the minimum after-tax internal rate of return on its investment, Harvest is entitled to increased return on its investment.

The amounts contributed by KERR on formation of the partnership on April 23, 2014 are being spent by the DBP to purchase land, drill and develop partnership properties in the Deep Basin area. As the initial funding from KERR is consumed and additional funds are required to fund the entire agreed initial multi-year development program, Harvest is obligated to fund the balance of the program from its share of partnership distributions from DBP. As at March 31, 2015, total distributions received by Harvest to date was $2.3 million. Although Harvest is not obligated to fund the balance of the program, above the distributions received, Harvest intends to provide additional funding pending further capital contributions from KERR.

HKMS

During the first quarter of 2015, the HKMS facility was completed and commenced operations. This facility provides the DBP an advantage of access to firm processing capability, the ability to extract maximum liquids from the natural gas produced by DBP and will allow DBP to pursue both acquisition and drilling opportunities in the region. A gas processing agreement was signed by the two partnerships. To complete the construction of the facility, Harvest contributed a total of $21.2 million in Q1 2015, increasing its ownership interest to 61.46% as at March 31, 2015 and diluting KERR’s ownership interest to 38.54% (December 31, 2014 – 53.76% and 46.24%, respectively). On the earlier of 10.5 years after the formation of HKMS or when KERR achieves a certain internal rate of return, Harvest will have the right but not the obligation to purchase all of KERR’s interest in HKMS Partnership for nominal consideration.

15

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

See note 9 of the March 31, 2015 interim consolidated financial statements for the summary financial information and related disclosures for these joint arrangements.

BLACKGOLD OIL SANDS

Capital Asset Additions

| | | Three Months Ended March 31 | |

| | | 2015 | | | 2014 | |

| Well equipment, pipelines and facilities | | 40.4 | | | 33.0 | |

| Pre-operating costs | | 6.8 | | | 0.1 | |

| Drilling and completion | | 0.4 | | | — | |

| Capitalized borrowing costs and other | | 13.2 | | | 9.1 | |

| Total BlackGold additions | | 60.8 | | | 42.2 | |

During the quarter ended March 31, 2015, Harvest invested $40.4 million on the CPF (2014 – $ 33.0 million).

Project Development

During the first quarter of 2015, the CPF was substantially completed, including the building of the CPF plant site, well pads, and connecting pipelines. Minor pre-commissioning activities commenced and will continue at a measured pace throughout 2015 with first steam occurring once the heavy oil price environment becomes favourable. Initial drilling of 30 steam assisted gravity drainage (“SAGD”) wells (15 well pairs) was completed by the end of 2012 and the majority of the well completion activities were completed by the end of 2014.

Harvest has recorded $1,075.2 million of costs on the entire project since acquiring the BlackGold assets in 2010. This $1,075.2 million includes certain Phase 2 pre-investment which is expected to improve the capital efficiency over the project lifecycle. Under the EPC contract, a maximum of approximately $101 million of the EPC costs will be paid in equal installments, without interest, over 10 years commencing in the second quarter of 2015. The liability is considered a financial liability and is initially recorded at fair value, which is estimated as the present value of all future cash payments discounted using the prevailing market rate of interest for similar instruments. As at March 31, 2015, Harvest recognized a liability of $78.4 million (December 31, 2014 - $77.8 million) using a discount rate of 4.5% (December 31, 2014 - 4.5%) .

As Harvest uses the unit of production method for depreciation and the BlackGold assets currently have no production, no depreciation on the BlackGold property, plant and equipment was recorded for the quarter ended March 31, 2015.

Decommissioning Liabilities

Harvest’s BlackGold decommissioning liabilities at March 31, 2015 were $48.5 million (December 31, 2014 - $47.5 million) relating to the future remediation, abandonment, and reclamation of the SAGD wells and CPF.

16

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Please see the “Contractual Obligations and Commitments” section of this MD&A for the payments expected for each of the next five years and thereafter in respect of the decommissioning liabilities.

RISK MANAGEMENT, FINANCING AND OTHER

Cash Flow Risk Management

The Company at times enters into natural gas, crude oil, electricity and foreign exchange contracts to reduce the volatility of cash flows from some of its forecast sales and purchases, and when allowable, will designate these contracts as cash flow hedges. The following is a summary of Harvest’s risk management contracts outstanding at March 31, 2015:

| Contracts Designated as Hedges | | | | |

| Contract Quantity | Type of Contract | Term | Contract Price | Fair value |

| 5,400 GJ/day | AECO swap | Apr - Dec 2015 | $3.65/GJ | $ 1.4 |

| Contracts Not Designated as Hedges | | | | |

| Contract Quantity | Type of Contract | Term | Contract Price | Fair value |

| 35 MWh | AESO power swap | Apr - Dec 2015 | $47.07/MWh | $ (2.3) |

The following is a summary of Harvest’s realized and unrealized (gains) losses on risk management contracts:

| | | Three Months Ended March 31 | |

| | | | | | 2015 | | | | | | | | | 2014 | | | | |

| | | | | | Natural | | | | | | | | | Crude | | | Natural | | | | |

| Realized (gains) losses recognized in: | | Power | | | Gas | | | Total | | | Power | | | Oil | | | Gas | | | Total | |

| Revenues | | — | | | (0.5 | ) | | (0.5 | ) | | — | | | — | | | 6.2 | | | 6.2 | |

| Risk management losses (gains) | | 1.4 | | | — | | | 1.4 | | | (0.5 | ) | | — | | | — | | | (0.5 | ) |

| Unrealized (gains) losses recognized in: | | | | | | | | | | | | | | | | | | | | | |

| OCI, before tax | | — | | | — | | | — | | | — | | | 1.7 | | | 14.5 | | | 16.2 | |

| Risk management losses (gains) | | 1.1 | | | — | | | 1.1 | | | (0.4 | ) | | 0.2 | | | — | | | (0.2 | ) |

17

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Finance Costs

| | | Three Months Ended March 31 | |

| | | 2015 | | | 2014 | |

| Credit facility | | 5.7 | | | 6.6 | |

| 67/8% senior notes | | 11.3 | | | 9.9 | |

| 21/8% senior notes(1) | | 5.4 | | | 4.8 | |

| Related party loans | | 5.8 | | | 4.0 | |

| Amortization of deferred finance charges and other | | 0.4 | | | 0.5 | |

| Interest and other financing charges(2) | | 28.6 | | | 25.8 | |

| Accretion of decommission and environmental remediation liabilities | | 4.7 | | | 5.6 | |

| Less: capitalized interest | | (9.7 | ) | | (7.2 | ) |

| Total finance costs(2) | | 23.6 | | | 24.2 | |

| (1) | Includes guarantee fee to KNOC. |

| (2) | Excludes discontinued operations of the Downstream segment. |

Currency Exchange

| | | Three Months Ended March 31 | |

| | | 2015 | | | 2014 | |

| Realized losses on foreign exchange(1) | | 1.6 | | | 2.2 | |

| Unrealized losses on foreign exchange(1) | | 138.9 | | | 54.0 | |

| | | 140.5 | | | 56.2 | |

| (1) | Excludes discontinued operations of the Downstream segment. |

Currency exchange gains and losses are attributed to the changes in the value of the Canadian dollar relative to the U.S. dollar on the U.S. dollar denominated 67/8% and 21/8% senior notes, the ANKOR related party loan and on any U.S. dollar denominated monetary assets or liabilities. At March 31, 2015, the Canadian dollar had weakened compared to the US dollar as at December 31, 2014 resulting in an unrealized foreign exchange loss of $138.9 million for the first quarter of 2015 (2014 – $54.0 million loss). Harvest recognized a realized foreign exchange loss of $1.6 million for the first quarter of 2015 (2014 – $2.2 million loss) as a result of the settlement of U.S. dollar denominated transactions.

Deferred Income Taxes

For the three months ended March 31, 2015 Harvest recorded a deferred income tax recovery of $50.6 million (2014 – $6.7 million) primarily due to increase in taxable losses. Harvest’s deferred income tax asset (liability) will fluctuate during each accounting period to reflect changes in the temporary differences between the book value and tax basis of assets and liabilities. Due to acquisition of Hunt, Harvest recognized deferred tax liability of $7.6 million. Currently, the principal sources of temporary differences relate to the Company’s property, plant and equipment, decommissioning liabilities and the unclaimed tax pools.

Related Party Transactions

The following provides a summary of the related party transactions between Harvest and KNOC for the quarter ended March 31, 2015:

18

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Related Party Loans

On December 30, 2013, Harvest entered into a subordinated loan agreement with KNOC to borrow up to $200 million at a fixed interest rate of 5.3% per annum. The full principal and accrued interest is payable on December 30, 2018. As of March 31, 2015, Harvest has drawn $200.0 million from the loan agreement (December 31, 2014 - $200.0 million). The loan amount was recorded at fair value on initial recognition by discounting the future cash payments at the rate of 7% which is considered the market rate applicable to the liability. As at March 31, 2015, the carrying value of the KNOC loan was $191.7 million (December 31, 2014 - $191.2 million). The difference between the fair value and the loan amount was recognized in contributed surplus. As at March 31, 2015, $10.3 million (December 31, 2014 – $10.3 million) has been recognized in contributed surplus related to the KNOC loan. For the quarter ended March 31, 2015, interest expense of $3.4 million was recorded (2014 – $1.8 million), of which $7.8 million remains outstanding as at March 31, 2015 (December 31, 2014 – $4.9 million).

On August 16, 2012, Harvest entered into a subordinated loan agreement with ANKOR to borrow US$170 million at a fixed interest rate of 4.62% per annum. The principal balance and accrued interest is payable on October 2, 2017. At March 31, 2015, Harvest’s related party loan from ANKOR included $215.3 million (December 31, 2014 – $197.2 million) of principal and $5.9 million (December 31, 2014 – $3.1 million) of accrued interest. Interest expense was $2.4 million for the quarter ended March 31, 2015 (2014 – $2.2 million).

The related party loans are unsecured and the loan agreements contain no restrictive covenants.

| | | Transactions | | | Balance Outstanding | |

| | | Three Months Ended | | | Accounts Receivable as at | | | Accounts Payable as at | |

| | | March 31 | | | March 31 | | | December 31 | | | March 31 | | | December 31 | |

| | | 2015 | | | 2014 | | | 2015 | | | 2014 | | | 2015 | | | 2014 | |

| G&A Expenses | | | | | | | | | | | | | | | | | | |

| KNOC(1) | | (1.8 | ) | | (1.1 | ) | | 0.3 | | | 0.5 | | | 2.1 | | | 3.7 | |

| Finance costs | | | | | | | | | | | | | | | | | | |

| KNOC(2) | | 1.1 | | | 1.0 | | | - | | | - | | | 1.7 | | | 2.7 | |

| (1) | The Global Technology and Research Centre (“GTRC”) is used as a training and research facility for KNOC. Amounts relate to the reimbursement from KNOC for general and administrative expenses incurred by the GTRC. Also included is Harvest’s reimbursement to KNOC for secondee salaries paid by KNOC on behalf of Harvest. |

| | |

| (2) | Charges from KNOC for the irrevocable and unconditional guarantee they provided on Harvest’s 21/8% senior notes. A guarantee fee of 52 basis points per annum is charged by KNOC. |

The Company identifies its related party transactions by making inquiries of management and the Board of Directors, reviewing KNOC’s subsidiaries and associates, and performing a comprehensive search of transactions recorded in the accounting system. Material related party transactions require the Board of Directors’ approval. Also see note 9, “Investment in Joint Ventures” in the March 31, 2015 interim consolidated financial statements for details of related party transactions with DBP and HKMS.

On April 2, 2015, Harvest entered into a US$171 million loan agreement with KNOC, repayable within one year from the date of the first drawing, which was on April 10, 2015. As at May 14, 2015, Harvest had drawn US$120 million under the loan agreement.

19

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

CAPITAL RESOURCES

The following table summarizes Harvest’s capital structure and provides the key financial ratios defined in the credit facility agreement.

| | | March 31, 2015 | | | December 31, 2014 | |

| Credit facility(1) | | 870.3 | | | 620.7 | |

| 67/8% senior notes (US$500 million)(1)(2) | | 633.3 | | | 580.1 | |

| 21/8% senior notes (US$630 million)(1)(2) | | 798.0 | | | 730.9 | |

| Related party loans (US$170 million and CAD$200 million)(2) | | 415.3 | | | 397.2 | |

| | | 2,716.9 | | | 2,328.9 | |

| Shareholder's equity | | | | | | |

| 386,078,649 common shares issued | | 1,310.9 | | | 1,534.8 | |

| | | 4,027.8 | | | 3,863.7 | |

| (1) | Excludes capitalized financing fees |

| (2) | Face value converted at the period end exchange rate |

On April 22, 2015, Harvest amended the terms of its credit facility and replaced it with a $940 million syndicated revolving credit facility maturing April 30, 2017. The amended credit facility includes an accordion feature that permits Harvest to increase the size of the facility to $1.0 billion if Harvest is able to secure additional commitment from an existing or new lender(s). The facility is secured by KNOC’s guarantee (up to $1.0 billion) and by a first floating charge over all of the assets of Harvest and its material subsidiaries. Under the amended credit facility, applicable interest and fees will be based on a margin pricing grid based on the Moody’s and S&P credit ratings of KNOC. The financial covenants under the Credit Facility were deleted and replaced with a new covenant: Total Debt to Capitalization ratio of 70% or less. At March 31, 2015, Harvest’s Total Debt to Capitalization ratio was 55%. See note 11 of the interim consolidated financial statements for details and “Non-GAAP Measures” section of this MD&A.

LIQUIDITY

The Company’s liquidity needs are met through the following sources: cash generated from operations, proceeds from asset dispositions, joint arrangements, borrowings under the credit facility, related party loans and long-term debt issuances. Harvest’s primary uses of funds are operating expenses, capital expenditures, and interest and principal repayments on debt instruments.

Cash flow from continuing and discontinued operations are presented on a combined basis in the 2015 comparative statement of cash flows. Cash used in operating activities for the three months ended March 31, 2015 was $10.6 million (2014 – cash from operating activities of $195.6 million). The decrease from the first quarter of 2015 from 2014 is mainly a result of the decrease in cash contribution from upstream operations, a decrease in the non-cash working capital changes and the absence of a cash contribution from Downstream.

Cash contribution from Harvest’s Upstream operations for the first quarter of 2015 was $19.1 million (2014 – $139.8 million). The decrease in Upstream’s cash contribution for the quarter ended March 31, 2015 compared to 2014 is mainly due to the decreased average realized prices and lower sales volumes, partially offset by lower operating costs in 2015. See the “Cash Contribution (Deficiency) from Operations” section of this MD&A for further detail.

20

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Harvest funded capital expenditures for the quarter ended March 31, 2015 of $151.4 million, including the Hunt acquisition (2014 – $179.6 million) with borrowings under the credit facility.

Harvest’s net drawings from the credit facility was $249.6 million during the quarter ended March 31, 2015 (2014 - $93.4 million net repayment).

Harvest had a working capital deficiency of $233.2 million as at March 31, 2015, as compared to a $300.5 million deficiency at December 31, 2014, mainly due to the decrease in accounts payable partially offset by the decrease in accounts receivable. Harvest’s working capital is expected to fluctuate from time to time, and will be funded from cash flows from operations and borrowings from the credit facility, as required. Due to the decline in commodity prices in late 2014, Harvest plans to manage its working capital by actively managing its capital program and seeking opportunities to reduce operating and G&A expenses throughout 2015.

Harvest ensures its liquidity through the management of its capital structure, seeking to balance the amount of debt and equity used to fund investment in each of our operating segments. Harvest evaluates its capital structure using the same financial covenant ratio as the one externally imposed under the Company’s credit facility. The Company continually monitors its credit facility covenant and actively takes steps, such as reducing borrowings, increasing capitalization, amending or renegotiating covenants as and when required, to ensure compliance. At March 31, 2015, Harvest was in compliance with the debt covenant under the amended credit facility.

Harvest plans to incur capital expenditures in 2015 based on project viability, growth opportunities in certain core development areas, as well as availability of funding. Harvest has also postponed first steam for the BlackGold project in response to the unfavourable heavy oil prices and will continually assess the commodity price environment to determine when the project will become viable. In addition, on April 22, 2015, Harvest amended its existing credit facility to provide for more financial flexibility and entered into a US$171 loan agreement with KNOC on April 2, 2015. Harvest expects to meet its current and long term cash requirements and financial obligations with cash from operations, the undrawn borrowing room under the amended credit facility, the additional loan from KNOC, and proceeds from asset dispositions and joint arrangements. In addition, Harvest plans to refinance its long term debt(s) as they become due.

21

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Contractual Obligations and Commitments

Harvest has recurring and ongoing contractual obligations and estimated commitments entered into in the normal course of operations. As at March 31, 2015, Harvest has the following significant contractual obligations and estimated commitments:

| | | Payments Due by Period | |

| | | 1 year | | | 2-3 years | | | 4-5 years | | | After 5 years | | | Total | |

| Debt repayments(1) | | — | | | 1,719.0 | | | 998.0 | | | — | | | 2,717.0 | |

| Debt interest payments(1)(2) | | 84.7 | | | 184.0 | | | 66.8 | | | — | | | 335.5 | |

| BlackGold long-term liability(3) | | 19.0 | | | 19.0 | | | 19.0 | | | 37.9 | | | 94.9 | |

| Operating leases | | 5.4 | | | 16.1 | | | 14.6 | | | 40.3 | | | 76.4 | |

| Firm processing commitments | | 19.2 | | | 38.7 | | | 31.7 | | | 80.6 | | | 170.2 | |

| Firm transportation agreements | | 24.4 | | | 62.1 | | | 49.6 | | | 73.5 | | | 209.6 | |

| Employee benefits(4) | | 2.0 | | | 1.8 | | | — | | | — | | | 3.8 | |

| Decommissioning and environmental liabilities(5) | | 38.4 | | | 55.5 | | | 43.0 | | | 1,290.7 | | | 1,427.6 | |

| Total | | 193.1 | | | 2,096.2 | | | 1,222.7 | | | 1,523.0 | | | 5,035.0 | |

| (1) | Assumes constant foreign exchange rate. |

| (2) | Assumes interest rates as at March 31, 2015 will be applicable to future interest payments. |

| (3) | Relates to the BlackGold deferred payment under the EPC contract. See “BlackGold Oil Sands” section of this MD&A for details. |

| (4) | Relates to the long-term incentive plan payments. |

| (5) | Represents the undiscounted obligation by period. |

Off Balance Sheet Arrangements

See “Investments in Joint Arrangements” section in this MD&A and note 9, “Investment in Joint Ventures” in the March 31, 2015 interim consolidated financial statements.

22

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

SUMMARY OF QUARTERLY RESULTS

The following table and discussion highlights the first quarter of 2015 results relative to the preceding 7 quarters:

| | | 2015 | | | | | | 2014 | | | | | | | | | 2013 | | | | |

| | | Q1 | | | Q4 | | | Q3 | | | Q2 | | | Q1 | | | Q4 | | | Q3 | | | Q2 | |

| FINANCIAL | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue, Upstream | | 107.4 | | | 172.7 | | | 223.1 | | | 244.3 | | | 251.5 | | | 223.1 | | | 245.3 | | | 243.2 | |

| Revenue, Downstream(1) | | — | | | 321.2 | | | 877.0 | | | 1,120.4 | | | 1,113.4 | | | 1,084.2 | | | 1,054.6 | | | 1,156.1 | |

| Total revenues and other income(2) | | 107.4 | | | 493.9 | | | 1,100.1 | | | 1,364.7 | | | 1,364.9 | | | 1,307.3 | | | 1,299.9 | | | 1,399.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income (loss) from continuing operations | | (223.5 | ) | | (275.8 | ) | | 197.0 | | | 45.1 | | | (51.9 | ) | | (49.8 | ) | | 7.7 | | | (55.3 | ) |

| Net income (loss) from discontinued operations | | — | | | (61.7 | ) | | (277.9 | ) | | (69.9 | ) | | 54.9 | | | (468.0 | ) | | (87.2 | ) | | (33.9 | ) |

| Net income (loss) | | (223.5 | ) | | (337.5 | ) | | (80.9 | ) | | (24.8 | ) | | 3.0 | | | (517.8 | ) | | (79.5 | ) | | (89.2 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| OPERATIONS | | | | | | | | | | | | | | | | | | | | | | | | |

| Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | |

| Daily sales volumes (boe/d) | | 43,770 | | | 42,539 | | | 44,794 | | | 47,556 | | | 48,487 | | | 49,154 | | | 51,783 | | | 53,461 | |

| Realized price prior to hedging ($/boe) | | 31.85 | | | 47.99 | | | 62.99 | | | 69.30 | | | 67.29 | | | 54.01 | | | 60.62 | | | 58.22 | |

| Discontinued Operations(1) | | | | | | | | | | | | | | | | | | | | | | | | |

| Average daily throughput (bbl/d) | | — | | | 76,455 | | | 73,495 | | | 95,410 | | | 95,767 | | | 92,339 | | | 93,798 | | | 106,245 | |

| Average refining gross margin (loss) ($US/bbl)(3) | | — | | | 2.76 | | | 4.09 | | | 0.25 | | | 9.58 | | | 2.50 | | | (1.43 | ) | | 0.74 | |

| (1) | Downstream operations have been classified as “Discontinued Operations” as a result of disposition on November 13, 2014. |

| | |

| (2) | This is an additional GAAP measure; please refer to “Additional GAAP Measures” in this MD&A. |

| | |

| (3) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

The quarterly revenues and cash from operating activities are mainly impacted by the Upstream sales volumes, realized prices and operating expenses and previously, Downstream throughput volumes, cost of feedstock and refined product prices. Significant items that impacted Harvest’s quarterly revenues include:

- Total revenues were highest in the second quarter of 2013, as a result of high daily throughput volumes from discontinued operations and lowest in the first quarter of 2015 due to low realized prices combined with low sales volumes from continuing operations and the absence of revenues from discontinued operations.

- The declines in Upstream’s sales volumes since 2013 were mainly due to asset dispositions and a capital program that was insufficient to offset declines in production.

Net income (loss) reflects both cash and non-cash items. Changes in non-cash items including deferred income tax, DD&A expense, accretion of decommissioning and environmental remediation liabilities, impairment of long-lived assets, unrealized foreign exchange gains and losses, and unrealized gains and losses on risk management contracts impact net loss from period to period. For these reasons, the net loss may not necessarily reflect the same trends as revenues or cash from operating activities, nor is it expected to. The net loss from continuing operations in the first quarter of 2015 is mainly a result of lower realized prices and sales volumes, a $139.5 million foreign exchange loss and a $23.5 million Upstream impairment expense. The net loss from continuing operations from the fourth quarter of 2014 was mainly due to the $267.6 million Upstream impairment expense.

23

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

CRITICAL ACCOUNTING ESTIMATES

The preparation of financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected. Further information on the basis of preparation and significant accounting policies and estimates can be found in the notes to the audited consolidated financial statements for the year ended December 31, 2014. There have been no changes to the accounting policies and critical accounting estimates in the first quarter of 2015.

RECENT ACCOUNTING PRONOUNCEMENTS

There were no new or amended standards issued during the three months ended March 31, 2015 that are applicable to Harvest in future periods. A description of additional accounting pronouncements that will be adopted by Harvest in future periods can be found in note 3 of the audited consolidated financial statements for the year ended December 31, 2014.

OPERATIONAL AND OTHER BUSINESS RISKS FOR CONTINUING OPERATIONS

Harvest’s operational and other business risks remain unchanged from those discussed in the annual MD&A and AIF for the year ended December 31, 2014 as filed on SEDAR atwww.sedar.com.

CHANGES IN REGULATORY ENVIRONMENT

Harvest’s regulatory environment remains unchanged from that discussed in the annual MD&A and AIF for the year ended December 31, 2014 as filed on SEDAR atwww.sedar.com.

INTERNAL CONTROL OVER FINANCIAL REPORTING

There were no significant changes in the internal controls over financial reporting or disclosure controls and procedures described in the annual MD&A for the year ended December 31, 2014 as filed on SEDAR atwww.sedar.comthat have materially affected, or are reasonably likely to affect, internal controls over financial reporting.

ADDITIONAL GAAP MEASURES

Throughout this MD&A, Harvest uses additional GAAP measures that are not defined under IFRS (hereinafter also referred to as “GAAP”). “Operating income (loss)” is commonly used for comparative purposes in the petroleum and natural gas and refining industries to reflect operating results before items not directly related to operations. Harvest uses this measure to assess and compare the performance of its operating segments. “Revenues and other income” comprises sales of petroleum and natural gas net of related royalties, and Harvest’s share of the net income from its joint ventures.

24

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

NON-GAAP MEASURES

Throughout this MD&A, the Company has referred to certain measures of financial performance that are not specifically defined under GAAP such as “operating netback”, “operating netback prior to/after hedging”, “average refining gross margin”, “cash contribution (deficiency) from operations” and “total debt to total capitalization”. “Operating netbacks” are reported on a per boe basis and used extensively in the Canadian energy sector for comparative purposes. “Operating netbacks” include revenues, operating expenses, transportation and marketing expenses, and realized gains or losses on risk management contracts. “Average refining gross margin” is commonly used in the refining industry to reflect the net funds received from the sale of refined products after considering the cost to purchase the feedstock and is calculated by deducting purchased products for resale and processing from total revenue. “Cash contribution (deficiency) from operations” is calculated as operating income (loss) adjusted for non-cash items. The measure demonstrates the ability of the each segment of Harvest to generate the cash from operations necessary to repay debt, make capital investments, and fund the settlement of decommissioning and environmental remediation liabilities. “Total debt to total capitalization” is a term defined in Harvest’s amended credit facility agreement for the purpose of calculation of the financial covenant. The non-GAAP measures do not have any standardized meaning prescribed by GAAP and may not be comparable to similar measures used by other issuers. The determination of the non-GAAP measures have been illustrated throughout this MD&A, with reconciliations to IFRS measures and/or account balances, except for cash contribution (deficiency) which is shown below.

Cash Contribution (Deficiency) from Operations

Cash contribution (deficiency) from operations represents operating income (loss) adjusted for non-cash expense items within: operating, general and administrative, exploration and evaluation, depletion, depreciation and amortization, gains on disposition of assets, risk management contracts gains or losses, impairment and other charges, and the inclusion of cash interest, realized foreign exchange gains or losses and other cash items not included in operating income (loss). The measure demonstrates the ability of Harvest’s upstream segment to generate cash from operations and is calculated before changes in non-cash working capital. The most directly comparable additional GAAP measure is operating income (loss). Operating income (loss) as presented in the notes to Harvest’s consolidated financial statements is reconciled to cash contribution (deficiency) from operations below. Comparative results include results from both continued and discontinued operations.

25

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | | Three Months Ended March 31 | |

| | | Upstream | | | Downstream | | | Total | |

| | | 2015 | | | 2014 | | | 2015 | | | 2014 | | | 2015 | | | 2014 | |

| Operating income (loss) | | (110.1 | ) | | 21.8 | | | — | | | 31.5 | | | (110.1 | ) | | 53.3 | |

| Adjustments: | | | | | | | | | | | | | | | | | | |

| Loss from joint ventures | | 5.9 | | | — | | | — | | | — | | | 5.9 | | | — | |

| Operating, non-cash | | (0.5 | ) | | 1.5 | | | — | | | (1.2 | ) | | (0.5 | ) | | 0.3 | |

| General and administrative, non-cash | | 0.4 | | | (1.8 | ) | | — | | | — | | | 0.4 | | | (1.8 | ) |

| Exploration and evaluation, non-cash | | 0.9 | | | 8.3 | | | — | | | — | | | 0.9 | | | 8.3 | |

| Depletion, depreciation and amortization | | 98.4 | | | 109.5 | | | — | | | 3.6 | | | 98.4 | | | 113.1 | |

| (Gains) losses on disposition of assets | | (0.5 | ) | | 0.7 | | | — | | | (0.2 | ) | | (0.5 | ) | | 0.5 | |

| Unrealized losses (gains) on risk management contracts | | 1.1 | | | (0.2 | ) | | — | | | — | | | 1.1 | | | (0.2 | ) |

| Impairment and other charges, non-cash | | 23.5 | | | — | | | — | | | — | | | 23.5 | | | — | |

| Cash contribution (deficiency) from operations | | 19.1 | | | 139.8 | | | — | | | 33.7 | | | 19.1 | | | 173.5 | |

| Inclusion of items not attributable to segments: | | | | | | | | | | | | | | | | | | |

| Net cash interest | | | | | | | | | | | | | | 11.3 | | | 17.9 | |

| Realized foreign exchange losses | | | | | | | | | | | | | | 1.6 | | | 2.0 | |

| Consolidated cash contribution from operations | | | | | | | | | | | | | | 6.2 | | | 153.6 | |

FORWARD-LOOKING INFORMATION

This MD&A highlights significant business results and statistics from the consolidated financial statements for the three months ended March 31, 2015 and the accompanying notes thereto. In the interest of providing Harvest’s lenders and potential lenders with information regarding Harvest, including the Company’s assessment of future plans and operations, this MD&A contains forward-looking statements that involve risks and uncertainties.

Such risks and uncertainties include, but are not limited to: risks associated with conventional petroleum and natural gas operations; risks associated with the construction of the oil sands project; the volatility in commodity prices, interest rates and currency exchange rates; risks associated with realizing the value of acquisitions; general economic, market and business conditions; changes in environmental legislation and regulations; the availability of sufficient capital from internal and external sources; and, such other risks and uncertainties described from time to time in regulatory reports and filings made with securities regulators. The impact of any one risk, uncertainty or factor on a particular forward-looking statement is not determinable with certainty as these factors are interdependent, and management’s future course of action would depend on the assessment of all information at that time. Please also refer to “Operational and Other Business Risks” in this MD&A and “Risk Factors” in the Annual Information Form for detailed discussion on these risks.

Forward-looking statements in this MD&A include, but are not limited to: commodity prices, price risk management activities, acquisitions and dispositions, capital spending and allocation of such to various projects, reserve estimates and ultimate recovery of reserves, potential timing and commerciality of Harvest’s capital projects, the extent and success rate of Upstream and BlackGold drilling programs, the ability to achieve the maximum capacity from the BlackGold central processing facilities, availability of the credit facility, access and ability to raise capital, ability to maintain debt covenants, debt levels, recovery of long-lived assets, the timing and amount of decommission and environmental related costs, income taxes, cash from operating activities, regulatory approval of development projects and regulatory changes. For this purpose, any statements that are contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements often contain terms such as “may”, “will”, “should”, “anticipate”, “expect”, “target”, “plan”, “potential”, “intend”, and similar expressions.

26

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

All of the forward-looking statements in this MD&A are qualified by the assumptions that are stated or inherent in such forward-looking statements. Although Harvest believes that these assumptions are reasonable based on the information available to us on the date such assumptions were made, this list is not exhaustive of the factors that may affect any of the forward-looking statements and the reader should not place an undue reliance on these assumptions and such forward-looking statements. The key assumptions that have been made in connection with the forward-looking statements include the following: that the Company will conduct its operations and achieve results of operations as anticipated; that its development plans and sustaining maintenance programs will achieve the expected results; the general continuance of current or, where applicable, assumed industry conditions; the continuation of assumed tax, royalty and regulatory regimes; the accuracy of the estimates of the Company’s reserve volumes; commodity price, operation level, and cost assumptions; the continued availability of adequate cash flow and debt and/or equity financing to fund the Company’s capital and operating requirements as needed; and the extent of Harvest’s liabilities. Harvest believes the material factors, expectations and assumptions reflected in the forward-looking statements are reasonable, but no assurance can be given that these factors, expectations and assumptions will prove to be correct.

Although management believes that the forward-looking information is reasonable based on information available on the date such forward-looking statements were made, no assurances can be given as to future results, levels of activity and achievements. Therefore, readers are cautioned not to place undue reliance on forward-looking statements as the plans, intentions or expectations upon which the forward-looking information is based might not occur. Forward-looking statements contained in this MD&A are expressly qualified by this cautionary statement.

ADDITIONAL INFORMATION

Further information about us can be accessed under our public filings found on SEDAR atwww.sedar.comor atwww.harvestenergy.ca.Information can also be found by contacting our Investor Relations department at (403) 265-1178 or at 1-866-666-1178.

27