| MANAGEMENT’S DISCUSSION AND ANALYSIS |

MANAGEMENT’S DISCUSSION AND ANALYSIS

This Management’s Discussion and Analysis (“MD&A”) should be read in conjunction with the unaudited condensed interim consolidated financial statements of Harvest Operations Corp. (“Harvest”, “we”, “us”, “our” or the “Company”) for the three months ended March 31, 2016 and the MD&A and audited annual consolidated financial statements for the year ended December 31, 2015 together with the accompanying notes. The information and opinions concerning the future outlook are based on information available at May 11, 2016.

In this MD&A, all dollar amounts are expressed in Canadian dollars unless otherwise indicated. Tabular amounts are in millions of dollars, except where noted.

Natural gas volumes are converted to barrels of oil equivalent (“boe”) using the ratio of six thousand cubic feet (“mcf”) of natural gas to one barrel of oil (“bbl”). Boes may be misleading, particularly if used in isolation. A boe conversion ratio of 6 mcf to 1 bbl is based on an energy equivalent conversion method primarily applicable at the burner tip and does not represent a value equivalent at the wellhead. In accordance with Canadian practice, petroleum and natural gas revenues are reported on a gross basis before deduction of Crown and other royalties.

Additional information concerning Harvest, including its audited annual consolidated financial statements and Annual Information Form (“AIF”) can be found on SEDAR atwww.sedar.com.

ADVISORY

This MD&A contains non-GAAP measures and forward-looking information about our current expectations, estimates and projections. Readers are cautioned that the MD&A should be read in conjunction with the “Non-GAAP Measures” and “Forward-Looking Information” sections at the end of this MD&A.

1

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

FINANCIAL AND OPERATING HIGHLIGHTS

| | | Three Months Ended March 31 | |

| | | 2016 | | | 2015 | |

| Upstream | | | | | | |

| Daily sales volumes (boe/d)(1) | | 36,986 | | | 43,770 | |

| Deep Basin Partnership | | | | | | |

| Daily sales volumes (boe/d) | | 5,720 | | | 1,572 | |

| Harvest's share of daily sales volumes (boe/d)(3) | | 4,689 | | | 1,223 | |

| Average realized price | | | | | | |

| Oil and NGLs ($/bbl)(2) | | 27.53 | | | 40.40 | |

| Gas ($/mcf)(2) | | 1.72 | | | 2.81 | |

| Operating netback prior to hedging($/boe)(3) | | 4.85 | | | 9.80 | |

| Operating loss(4) | | (95.3 | ) | | (110.1 | ) |

| Cash contribution from operations(3) | | 0.8 | | | 19.1 | |

| | | | | | | |

| Capital asset additions (excluding acquisitions) | | 2.1 | | | 56.6 | |

| Corporate acquisition(5) | | — | | | 36.8 | |

| Property dispositions, net | | (4.5 | ) | | (0.5 | ) |

| | | | | | | |

| Net wells drilled | | 0.3 | | | 19.2 | |

| Net undeveloped land additions (acres) | | 5,566 | | | 20,338 | |

| Net undeveloped land dispositions (acres) | | (7,586 | ) | | — | |

| | | | | | | |

| BlackGold | | | | | | |

| Capital asset additions | | 0.1 | | | 60.8 | |

| Pre-operating loss(4)(6) | | (4.5 | ) | | - | |

| | | | | | | |

| NET LOSS | | (13.1 | ) | | (223.5 | ) |

| (1) | Excludes volumes from Harvest’s equity investment in the Deep Basin Partnership. |

| (2) | Excludes the effect of derivative contracts designated as hedges. |

| (3) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

| (4) | This is an additional GAAP measure; please refer to “Additional GAAP Measures” in this MD&A. |

| (5) | Corporate acquisition represents the total consideration for the transaction including working capital assumed. |

| (6) | BlackGold was substantially completed in Q1 2015, all pre-operating expenses prior to Q1 2015 were capitalized. |

REVIEW OF OVERALL PERFORMANCE

Harvest is an energy company with a petroleum and natural gas business focused on the exploration, development and production of assets in western Canada (“Upstream”) and an in-situ oil sands project in the pre-commissioning phase in northern Alberta (“BlackGold”). Harvest is a wholly owned subsidiary of Korea National Oil Corporation (“KNOC”). Our earnings and cash flow from continuing operations are largely determined by the realized prices for our crude oil and natural gas production.

2

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

The latter part of 2014, 2015 and the first three months of 2016 have been very challenging for the oil and gas industry. The approximate 70% and 72% percent declines in crude oil prices and natural gas respectively since June 2014 has resulted in widespread reductions in capital spending programs and extensive efforts to reduce costs across the industry. We are confident that commodity prices will eventually improve; however, the timing of that improvement is uncertain and we expect continued commodity price and cash flow volatility in the near term. In the meantime, we are focused on identifying sustainable cost reductions as well as keeping our capital program focused on necessary spending to meet our commitments and maintaining assets.

Upstream

| • | Sales volumes for the quarter ended March 31, 2016 decreased by 6,784 boe/d as compared to the same period in 2015. The decrease was primarily due to the dispositions of certain non-core producing properties during 2015 and natural declines exceeding the volume additions from our drilling program. |

| • | Harvest’s share of Deep Basin Partnership (“DBP’) volumes for the quarter ended March 31, 2016 increased 3,466 boe/d as compared to the same period in 2015. The increase is due primarily to the contribution of certain gas assets by Harvest in the fourth quarter of 2015 and volume additions from the drilling program. The construction of the HK MS Partnership (“HKMS”) natural gas processing plant was completed and operational in early 2015. Strategically, this facility provides the DBP an advantage of access to firm processing capability, the ability to extract maximum liquids from the natural gas produced by DBP wells and will allow DBP to pursue both acquisition and drilling opportunities in the region. |

| • | Operating netback prior to hedging for the first quarter of 2016 was $4.85/boe, a decrease of $4.95/boe from the same period in 2015. The decreases from 2015 was mainly due to lower realized prices per boe as a result of commodity benchmarks price declines, partially offset by lower royalties, and operating per boe. |

| • | Operating losses for the first quarter ended 2016 was $95.3 million (2015 – $110.1 million) a decrease in loss of $14.8 million. The decrease in operating loss from 2015 was due to lower royalties, operation expenses, general and administrative expenses, impairment and depreciation, depletion and amortization expense partialy offset by lower realized prices, sales volumes, and losses from the joint ventures. |

| • | Cash contributions from Harvest’s Upstream operations for the first quarter of 2016 was $0.8 million (2015 – $19.1 million). The decrease in cash contribution was mainly due to lower sales volumes and lower realized prices, partially offset by lower royalties, operating expenses, and general and administrative expenses. |

| • | Capital asset additions to Harvest’s Upstream operations of $2.1 million mainly related to well equipment, pipelines and facilities during the first quarter of 2016. One gross well (0.3 net) was rig-released during the first quarter of 2016. |

3

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

BlackGold

| • | Pre-operating losses for the first quarter 2016 was $4.5 million (2015 – nil). The pre-operating losses was mainly due to pre-operating and general and administrative expenses. |

| • | The central processing facility (“CPF’) was substantially completed in early 2015. The decision to complete commissioning of the CPF and commence steam injection depends on a number of factors including the bitumen price environment. |

CORPORATE

| • | The weakening of the U.S. dollar against the Canadian dollar during the latter part of the first quarter of 2016 resulted in net unrealized foreign exchange gains of $118.7 million (2015 - $138.9 million loss), primarily related to the translation of U.S. dollar denominated debts that includes certain related party loans into Canadian dollars. |

| • | During 2015 Harvest entered into a US$171 million loan agreement with KNOC with the maturity date of December 31, 2017. During the first quarter of 2016 Harvest drew the remaining US$51.0 million available on the loan. |

| • | The net repayment to the credit facility during the first quarter ended 2016 was $33.0 million (2015 - $249.6 million net borrowings). At March 31, 2016, Harvest had $893.2 million drawn under the credit facility (December 31, 2015 - $926.6 million). |

| • | During 2015, Harvest amended the terms of its $1.0 billion syndicated revolving credit facility and replaced it with a KNOC guaranteed $1.0 billion syndicated revolving credit facility maturing April 30, 2017. Under the amended credit facility, applicable interest and fees are based on a margin pricing grid based on the Moody’s and S&P credit ratings of KNOC. The financial covenants under the previous credit facility were deleted and replaced with a new covenant: Total Debt to Capitalization ratio of 70% or less. At December 31, 2015, Harvest was in violation of the debt covenant and the carrying value of the credit facility, $923.8 million, was reclassified from long-term debt to a current liability. Subsequent to December 31, 2015, Harvest’s syndicate banks consented to a waiver of this covenant for the duration of the term of the credit facility and the maturity date remains at April 30, 2017, and the credit facility was reclassified from current to long-term debt. |

4

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

UPSTREAM

Summary of Financial and Operating Results

| | | Three Months Ended March 31 | |

| | | 2016 | | | 2015 | |

| FINANCIAL | | | | | | |

| Petroleum and natural gas sales(1) | | 70.2 | | | 126.4 | |

| Royalties | | (5.8 | ) | | (13.1 | ) |

| Loss from joint ventures | | (18.5 | ) | | (5.9 | ) |

| Revenues and other income(2) | | 45.9 | | | 107.4 | |

| | | | | | | |

| Expenses | | | | | | |

| Operating | | 46.7 | | | 72.5 | |

| Transportation and marketing | | 1.3 | | | 1.2 | |

| Realized losses on derivative contracts(3) | | 0.5 | | | 1.4 | |

| Operating netback after hedging(4) | | (2.6 | ) | | 32.3 | |

| | | | | | | |

| General and administrative | | 14.8 | | | 19.0 | |

| Depreciation, depletion and amortization | | 74.7 | | | 98.4 | |

| Exploration and evaluation | | 2.1 | | | 0.9 | |

| Impairment | | — | | | 23.5 | |

| Unrealized losses (gains) on derivative contracts(5) | | 0.7 | | | 1.1 | |

| Losses (gains) on disposition of assets | | 0.4 | | | (0.5 | ) |

| Operating loss(2) | | (95.3 | ) | | (110.1 | ) |

| | | | | | | |

| Capital asset additions (excluding acquisitions) | | 2.1 | | | 56.6 | |

| Corporate acquisition(6) | | — | | | 36.8 | |

| Property dispositions, net | | (4.5 | ) | | (0.5 | ) |

| | | | | | | |

| OPERATING | | | | | | |

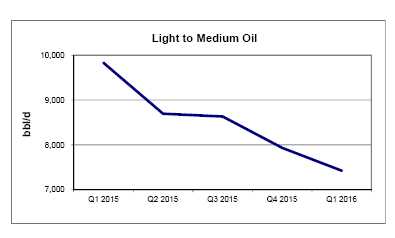

| Light to medium oil (bbl/d) | | 7,423 | | | 9,832 | |

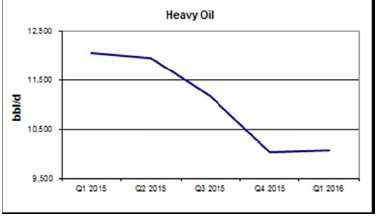

| Heavy oil (bbl/d) | | 10,081 | | | 12,058 | |

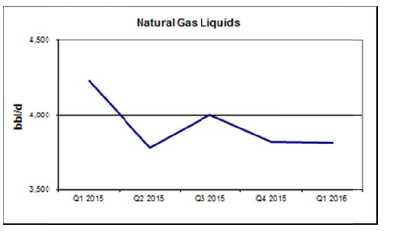

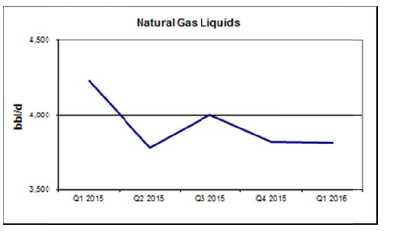

| Natural gas liquids (bbl/d) | | 3,810 | | | 4,231 | |

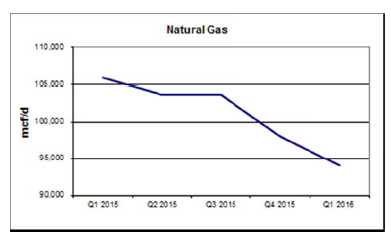

| Natural gas (mcf/d) | | 94,034 | | | 105,887 | |

| Total (boe/d)(7) | | 36,986 | | | 43,770 | |

| (1) | Includes the effective portion of Harvest’s realized natural gas and oil hedges. |

| (2) | This is an additional GAAP measure; please refer to “Additional GAAP Measures” in this MD&A. |

| (3) | Realized gains on derivative contracts include the settlement amounts for power, crude oil, natural gas and foreign exchange derivative contracts, excluding the effective portion of realized gains from Harvest’s designated accounting hedges. See “Risk Management, Financing and Other” section of this MD&A for details. |

| (4) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

| (5) | Unrealized gains on derivative contracts reflect the change in fair value of derivative contracts that are not designated as accounting hedges and the ineffective portion of changes in fair value of designated hedges. See “Risk Management, Financing and Other” section of this MD&A for details. |

| (6) | Corporate acquisition represents the total consideration for the transaction, including working capital assumed. |

| (7) | Excludes volumes from Harvest’s equity investment in the Deep Basin Partnership. |

5

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Commodity Price Environment

| | | Three Months Ended March 31 | |

| | | 2016 | | | 2015 | | | Change | |

| West Texas Intermediate ("WTI") crude oil (US$/bbl) | | 33.45 | | | 48.63 | | | (31% | ) |

| West Texas Intermediate crude oil ($/bbl) | | 45.86 | | | 60.38 | | | (24% | ) |

| Edmonton light sweet crude oil ("EDM") ($/bbl) | | 40.84 | | | 51.95 | | | (21% | ) |

| Western Canadian Select ("WCS") crude oil ($/bbl) | | 26.61 | | | 42.08 | | | (37% | ) |

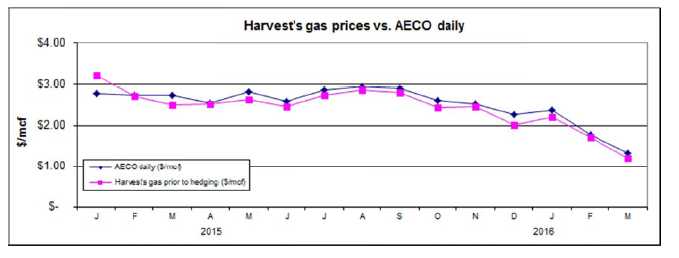

| AECO natural gas daily ($/mcf) | | 1.83 | | | 2.75 | | | (33% | ) |

| U.S. / Canadian dollar exchange rate | | 0.728 | | | 0.806 | | | (10% | ) |

| | | | | | | | | | |

| Differential Benchmarks | | | | | | | | | |

| EDM differential to WTI ($/bbl) | | 5.02 | | | 8.43 | | | (40% | ) |

| EDM differential as a % of WTI | | 10.9% | | | 14.0% | | | (22% | ) |

| WCS differential to WTI ($/bbl) | | 19.25 | | | 18.30 | | | 5% | |

| WCS differential as a % of WTI | | 42.0% | | | 30.3% | | | 39% | |

The average WTI benchmark price decreased 31% for the first quarter of 2016 as compared to the same period in 2015. The average Edmonton light sweet crude oil price (“Edmonton Light”) decreased 21% compared to 2015, due to the decrease in the WTI price, partially offset by the strengthening of the U.S. dollar against the Canadian dollar and the narrowing of the Edmonton light sweet differential.

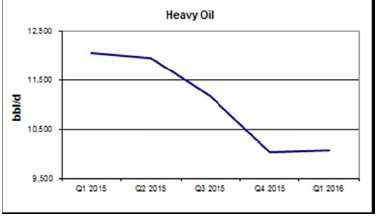

Heavy oil differentials fluctuate based on a combination of factors including the level of heavy oil production and inventories, pipeline and rail capacity to deliver heavy crude to U.S. and offshore markets and the seasonal demand for heavy oil. The 37% decrease in the WCS price for the first quarter ended 2016, as compared to the same period in 2015 was mainly the result of the decrease in the WTI price, the widening of the WCS differential to WTI partially offset by the strengthening of the U.S. dollar.

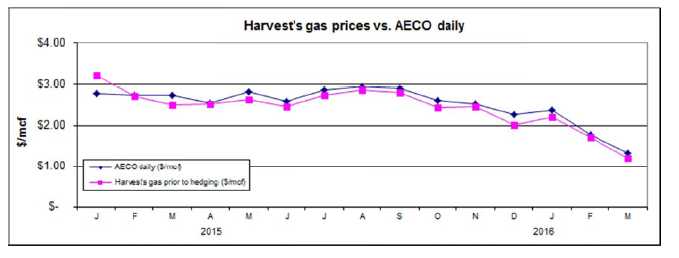

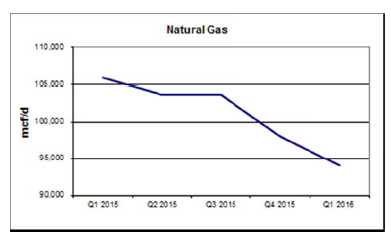

North American natural gas prices continued to weaken during the first quarter of 2016. Harvest’s realized natural gas price is referenced to the AECO hub, which decreased 33% in the first quarter of 2016 when compared to the same period in 2015.

Realized Commodity Prices

| | | Three Months Ended March 31 | |

| | | 2016 | | | 2015 | | | Change | |

| Light to medium oil ($/bbl) | | 33.95 | | | 45.56 | | | (25% | ) |

| Heavy oil prior to hedging($/bbl) | | 24.86 | | | 39.53 | | | (37% | ) |

| Natural gas liquids ($/bbl) | | 22.08 | | | 30.91 | | | (29% | ) |

| Natural gas prior to hedging($/mcf) | | 1.72 | | | 2.81 | | | (39% | ) |

| Average realized price prior to hedging ($/boe)(1) | | 20.86 | | | 31.85 | | | (35% | ) |

| | | | | | | | | | |

| Natural gas after hedging ($/mcf)(2) | | 1.72 | | | 2.86 | | | (40% | ) |

| Average realized price after hedging ($/boe)(1)(2) | | 20.86 | | | 31.98 | | | (35% | ) |

| (1) | Inclusive of sulphur revenue. |

| (2) | Inclusive of the realized gains (losses) from contracts designated as hedges. Foreign exchange swaps and power contracts are excluded from the realized price. |

6

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Harvest’s realized prices prior to any hedging activity for light to medium oil generally trends with the Edmonton Light benchmark price. Harvest’s realized prices prior to any hedging activity for heavy oil are a function of both the WCS and Edmonton Light benchmarks due to a portion of our heavy oil volumes being sold based on a discount to the Edmonton Light benchmark. For the first quarter of 2016, the period-over-period variances and movements of light to medium oil and heavy oil were relatively consistent with the changes in their related benchmarks.

7

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Harvest’s realized prices prior to any hedging activity for natural gas generally trend with the AECO benchmark prices. For the first quarter of 2016, the period-over-period variances and movements of natural gas price prior to hedging were relatively consistent with the changes in their related benchmark.

Realized natural gas liquids prices decreased by 39% for the first quarter ended March 31, 2016 as compared to the same period in 2015. The decreases are consistent with the decrease in oil prices.

In order to partially mitigate the risk of fluctuating cash flows due to natural gas, Harvest had AECO derivative contracts in place for a portion of its production during the firs st quarter of 2015, however none were in place in the first quarter of 2016.

Please see “Cash Flow Risk Management” section in this MD&A for further discussion with respect to the cash flow risk management program.

8

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Sales Volumes

| | | | | | Three Months Ended March 31 | | | | |

| | | 2016 | | | 2015 | | | | | | | |

| | | | | | | | | | | | | | | % Volume | |

| | | Volume | | | Weighting | | | Volume | | | Weighting | | | Change | |

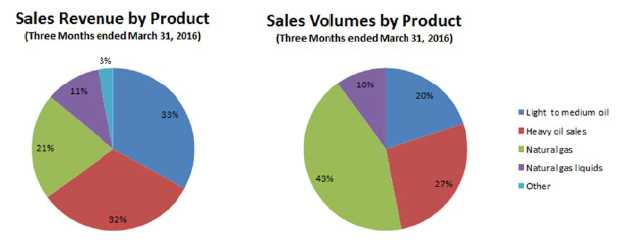

| Light to medium oil (bbl/d) | | 7,423 | | | 20% | | | 9,832 | | | 22% | | | (25% | ) |

| Heavy oil (bbl/d) | | 10,081 | | | 27% | | | 12,058 | | | 28% | | | (16% | ) |

| Natural gasliquids (bbl/d) | | 3,810 | | | 10% | | | 4,231 | | | 10% | | | (10% | ) |

| Total liquids (bbl/d) | | 21,314 | | | 57% | | | 26,121 | | | 60% | | | (18% | ) |

| Natural gas(mcf/d) | | 94,034 | | | 43% | | | 105,887 | | | 40% | | | (11% | ) |

| Total oil equivalent (boe/d) | | 36,986 | | | 100% | | | 43,770 | | | 100% | | | (15% | ) |

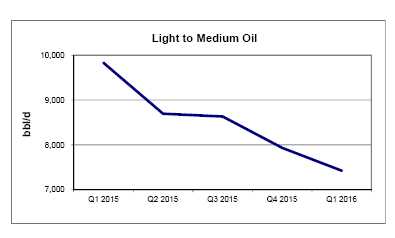

| | Harvest’s average daily sales of light to medium oil decreased 25% in the first quarter of 2016, as compared to the same period in 2015. The decrease was mainly due to the disposition of non-core properties, natural declines, and reflect a greatly reduced drilling program in 2016. |

| | | |

Harvest’s average daily sales of light to medium oil decreased 25% in the first quarter of 2016, as compared to the same period in 2015. The decrease was mainly due to the disposition of non-core properties, natural declines, and reflect a greatly reduced drilling program in 2016. | |

|

9

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | Natural gas sales during the first quarter of 2016 decreased 11%, as compared to the same period in 2015. The decrease was mainly a result of disposition of assets to the Deep Basin Partnership during the fourth quarter of 2015, natural dec clines and reflect a greatly reduced drilling program in 2016. |

| | | |

Natural gas liquids sales for the first quarter of 2016 decreased by 10% from the same period in 2015 due to third party facility constraints and natural declines. | |

|

Revenues

Sales Revenue by Product

| | | Three Months Ended March 31 | |

| | | 2016 | | | 2015 | | | Change | |

| Light to medium oil sales | | 22.9 | | | 40.3 | | | (43% | ) |

| Heavy oilsales after hedging(1) | | 22.8 | | | 42.9 | | | (47% | ) |

| Natural gassales after hedging(1) | | 14.7 | | | 27.3 | | | (46% | ) |

| Natural gasliquids sales | | 7.7 | | | 11.8 | | | (35% | ) |

| Other(2) | | 2.1 | | | 4.1 | | | (49% | ) |

| Petroleum and natural gas sales | | 70.2 | | | 126.4 | | | (44% | ) |

| Royalties | | (5.8 | ) | | (13.1 | ) | | (56% | ) |

| Revenues | | 64.4 | | | 113.3 | | | (43% | ) |

| (1) | Inclusive of effective portion of realized gains ( losses ) from natural gas and crude oil contracts designated as hedges. |

| (2) | Inclusive of sulphur revenue and miscellaneous income. |

Harvest’s revenue is subject to changes in sales volumes, commodity prices, currency exchange rates and hedging activities. Total petroleum and natural gas sales decreased in the first quarter of 2016 as compared to 2015, mainly due to the decrease in sales volumes and the decrease in the realized prices.

10

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Sulphur revenue represented $2.1 million of the total in other revenues for the first quarter of 2016 (2015 - $3.7 million).

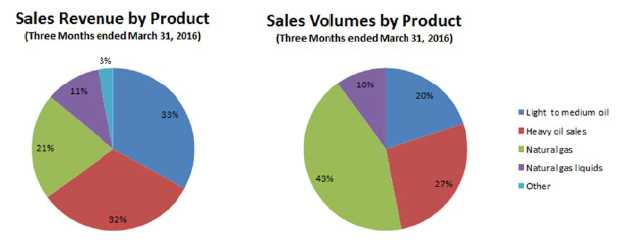

Revenue by Product Type as % of Total Revenue

| | | Three Months Ended March 31 | |

| | | 2016 | | | 2015 | |

| Light to medium oil sales | | 33% | | | 32% | |

| Heavy oilsales after hedging | | 32% | | | 34% | |

| Natural gassales after hedging | | 21% | | | 22% | |

| Natural gasliquids sales | | 11% | | | 9% | |

| Other | | 3% | | | 3% | |

| Total Sales Revenue | | 100% | | | 100% | |

Although Harvest’s product mix on a volumetric basis is slightly weighted heavier towards crude oil and natural gas liquids than natural gas, revenue contribution is more heavily weighted to crude oil and liquids as shown by the graphs above. Compared to the prior year period, reve enue contributions by product have remained relatively consistent year over year.

Royalties

Harvest pays Crown, freehold and overriding royalties to the owners of mineral rights from which production is generated. These royalties vary for each property and product and Crown royalties are based on various sliding scales dependent on incentives, production volumes and commodity prices.

For the first quarter ended March 31, 2016, royalties as a percentage of gross revenue averaged 8.3% (2015 –10.4%) . The decrease in royalties as a percentage of gross revenue was mainly due to lower commodity prices.

In January of 2016, the provincial government of Alberta announced the key highlights of a proposed Modernized Royalty Framework (“MRF”) that will be effective on January 1, 2017 based on the royalty review panels recommendations. The highlights include providing g royalty incentives for efficient development of conventional crude oil, natural gas and natural gas liquids resources, no changes to the royalty structure of wells drilled prior to 2017 for a period of ten years from the enactment, the replacement of royalty credits/holidays on conventional wells by a revenue minus cost framework with a post-payout royalty rate based on commodity prices, the reduction of royalty rates for mature wells and a neutral internal rate of return for any given play compared to the current royalty framework.

11

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Details of these programs were released simultaneously with the finalization of the MRF, on April 21, 2016. More specific information will be provided by the provincial government in the coming months to help oil and natural gas producers better understand the economics of investments in Alberta. The MRF structure consists of three stages during the life cycle of a well; pre-payout, post payout, and post payout mature well.

The royalty formulas are price sensitive and product specific. The actual royalty rate is the sum of a price component and a quantity adjustment component that applies when monthly production from the well is below the Maturity Threshold, equivalent of 40 barrels of oil equivalent per day. The royalty rate has a minimum of 5% and a maximum of 40%.

Operating and Transportation Expenses

| | | | | | Three Months Ended March 31 | | | | |

| | | 2016 | | | $/boe | | | 2015 | | | $/boe | | | $/boe Change | |

| Power and purchased energy | | 10.1 | | | 2.99 | | | 13.7 | | | 3.48 | | | (0.49 | ) |

| Lease rentals and property tax | | 8.8 | | | 2.62 | | | 8.3 | | | 2.11 | | | 0.51 | |

| Processing and other fees | | 8.1 | | | 2.41 | | | 8.9 | | | 2.26 | | | 0.15 | |

| Repairs and maintenance | | 6.9 | | | 2.06 | | | 12.7 | | | 3.22 | | | (1.16 | ) |

| Labour - internal | | 6.1 | | | 1.81 | | | 9.2 | | | 2.34 | | | (0.53 | ) |

| Chemicals | | 5.8 | | | 1.71 | | | 7.5 | | | 1.90 | | | (0.19 | ) |

| Well servicing | | 2.9 | | | 0.85 | | | 7.8 | | | 1.98 | | | (1.13 | ) |

| Labour - contract | | 2.8 | | | 0.84 | | | 3.5 | | | 0.89 | | | (0.05 | ) |

| Trucking | | 1.5 | | | 0.44 | | | 2.1 | | | 0.53 | | | (0.09 | ) |

| Other(1) | | (6.3 | ) | | (1.84 | ) | | (1.2 | ) | | (0.31 | ) | | (1.53 | ) |

| Total operating expenses | | 46.7 | | | 13.89 | | | 72.5 | | | 18.40 | | | (4.51 | ) |

| Transportation and marketing | | 1.3 | | | 0.39 | | | 1.2 | | | 0.31 | | | 0.08 | |

| (1) | Other operating expenses include EH&S $1.4 million (2015 – $2.3 million), insurance, overhead and net impact of accruals adjustments. |

Operating expenses for the first quarter of 2016 decreased by $25.8 million compared to the same period in 2015, mainly due to overall lower activity levels which have resulted in a decrease in the cost of power, reduced levels of well servicing and repairs and maintenance activity, processing fees, chemicals, reductions in labour and asset dispositions. Operating expenses on a per barrel basis decreased by 25% to $13.89 for the first quarter mainly due to lower activity levels and spending, partially offset by the lower sales volumes.

12

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | | Three Months Ended March 31 | |

| ($/boe) | | 2016 | | | 2015 | | | Change | |

| Power and purchased energy costs | | 2.99 | | | 3.48 | | | (0.49 | ) |

| Realized losses on electricity derivative contracts | | 0.14 | | | 0.34 | | | (0.20 | ) |

| Net power and purchased energy costs | | 3.13 | | | 3.82 | | | (0.69 | ) |

| Alberta Power Pool electricity price ($/MWh) | | 18.09 | | | 29.15 | | | (11.06 | ) |

Power and purchased energy costs, comprised primarily of electric power costs, represented approximately 22% (2015 – 19%) of total operating expenses for the first quarter of 2016. Power and purchased energy costs per boe were lower in the first quarter of 2016 as compared to 2015 primarily due to the lower average Alberta electricity price.

Transportation and marketing expenses relate primarily to the cost of trucking crude oil to pipeline or rail receipt points. Transportation and marketing expenses in the first quarter of 2016 remained relatively consistent compared to the same period in 2015.

Operating Netback(1)

| | | Three Months Ended March 31 | | | | |

| ($/boe) | | 2016 | | | 2015 | | | Change | |

| Petroleum and natural gas sales prior to hedging(2) | | 20.86 | | | 31.85 | | | (10.99 | ) |

| Royalties | | (1.73 | ) | | (3.34 | ) | | 1.61 | |

| Operating expenses | | (13.89 | ) | | (18.40 | ) | | 4.51 | |

| Transportation and marketing | | (0.39 | ) | | (0.31 | ) | | (0.08 | ) |

| Operating netback prior to hedging(1) | | 4.85 | | | 9.80 | | | (4.95 | ) |

| Hedging loss(3) | | (0.14 | ) | | (0.21 | ) | | 0.07 | |

| Operating netback after hedging(1) | | 4.71 | | | 9.59 | | | (4.88 | ) |

| (1) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

| (2) | Excludes miscellaneous income not related to oil and gas production |

| (3) | Includes the settlement amounts for natural gas, crude oil and power contracts. |

For the first quarter ended March 31, 2016 netback prior to hedging were $4.85 per boe representing a decrease of 51 percent compared to the same period in 2015.

For the first quarter ended March 31, 2016 netback after hedging were $4.71 per boe representing a decrease of 51 percent compared to the same period in 2015.

The decrease in period was mainly due to lower realized sale prices, partially offset by reduced royalty and operating expenses.

13

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

General and Administrative (“G&A”) Expenses

| | | Three Months Ended March 31 | |

| | | 2016 | | | 2015 | |

| Gross G&A expenses | | 15.3 | | | 20.7 | |

| Capitalized G&A | | (0.5 | ) | | (1.7 | ) |

| Net G&A expenses | | 14.8 | | | 19.0 | |

| Net G&A expenses ($/boe ) | | 4.40 | | | 4.83 | |

For the first quarter ended March 31, 2016 G&A expenses net of capitalized G&A decreased $4.2 million, while gross G&A expenses expenses decreased $5.4 million when compared to the same period in the prior year. The decrease in the G&A expenses from the same period in the prior year were mainly due to comparative lower staffing levels, reversal of prior year bonus and LTI accruals, decreases in employee benefits expenses, partially offset by increases due to severance charge related to staff layoff completed in Q1 2016. The reduction in capitalized G&A is mainly related to reduced capital spending in 2016.

On a per boe basis, G&A expenses decreased $0.43 in the first quarter of 2016, from the same period in the prior year mainly due to lower expenses in the current year periods partially offset by lower sales volumes. Harvest does not have a stock option program, however there is a long-term incentive program which is a cash settled plan that has been included in the G&A expense.

Depletion, Depreciation and Amortization (“DD&A”) Expenses

| | | Three Months Ended March 31 | |

| | | 2016 | | | 2015 | |

| DD&A | | 74.7 | | | 98.4 | |

| DD&A ($/boe) | | 22.19 | | | 24.99 | |

DD&A expense for the first quarter of 2016 decreased by $23.7 million as compared to the same period in 2015, mainly due to lower sales volumes and the impact of impairment charges recorded during fiscal 2015.

Impairment Expense

For the first quarter of 2016, Harvest recognized no impairment loss (2015 – $23.5 million) against PP&E relating to the cash generating units (“CGU”).

Acquisitions & Dispositions

During the first quarter ended March 31, 2016 Harvest closed the sale of various minor non-core oil and gas assets in Alberta for approximately $0.5 million in net proceeds. Harvest recognized a loss of $0.4 million for the three months ended March 31, 2016 (2015 - $0.5 million gain) relating to the de-recognition of PP&E, E&E, goodwill and decommissioning and environmental liabilities on the assets sold. As a result of these dispositions, during the first quarter of 2016, $4.6 million of PP&E was de-recognized.

14

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Capital Asset Additions

| | | Three Months Ended March 31 | |

| | | 2016 | | | 2015 | |

| Drilling and completion | | (0.2 | ) | | 38.0 | |

| Well equipment, pipelines and facilities | | 2.4 | | | 15.6 | |

| Land and seismic | | — | | | 1.2 | |

| Corporate | | (0.4 | ) | | 1.8 | |

| Other | | 0.3 | | | — | |

| Total additions excluding acquisitions | | 2.1 | | | 56.6 | |

Total capital additions were lower for the first quarter of 2016 compared to 2015 mainly due to reduced capital activity for the current year in response to a low commodity price environment. Harvest’s capital expenditures in the first quarter of 2016 related to well equipment, pipelines and facilities as well as participation in one partner-operated well drilled in the Deep Basin.

The following table summarizes the wells drilled in our core growth areas and the related drilling and completion costs incurred in the period. A well is recorded in the table as having being drilled after it has been rig-released, however related drilling costs may be incurred in a period before a well has been spud (including survey, lease acquisition and construction costs) and related completion and tie-in costs may be incurred in a period afterwards, depending on the timing of the completion work.

| | | Three Months Ended March 31, 2016 | |

| | | | | | | | | Drilling and | |

| Area | | Gross | | | Net | | | completion | |

| Deep Basin | | 1.0 | | | 0.3 | | $ | (1.3 | ) |

| Other areas | | — | | | — | | | 1.1 | |

| Total | | 1.0 | | | 0.3 | | $ | (0.2 | ) |

During the first quarter months of 2016, the primary areas of focus for Harvest’s Upstream drilling program were as follows:

| | • | Deep Basin – participated in a horizontal multi-stage fractured well to develop the liquids-rich Falher gas formations |

During the first quarter ended March 31, 2016, Harvest’s net undeveloped land additions were 5,566 acres (2015 – 20,338 acres).

Decommissioning Liabilities

Harvest’s Upstream decommissioning liabilities at March 31, 2016 was $787.1 million (December 31, 2015 – $796.6 million) for future remediation, abandonment, and reclamation of Harvest’s oil and gas properties. The total of the decommissioning liabilities are based on management’s best estimate of costs to remediate, reclaim, and abandon wells and facilities. The costs will be incurred over the operating lives of the assets with the majority being at or after the end of reserve life. Please refer to the “Contractual Obligations and Commitments” section of this MD&A for the payments expected for each of the next five years and thereafter in respect of the decommissioning liabilities.

15

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Investments in Joint Ventures

Harvest has equity investments in Deep Basin Partnership (“DBP”) and HK MS Partnership (“HKMS”) joint ventures with KERR Canada Co. Ltd. (“KERR”) which are accounted for as equity investments. Harvest derives its income or loss from its investments based upon Harvest’s share in the change of the net assets of the joint venture. Harvest’s share of the change in the net assets does not directly correspond to its ownership interest because of contractual preference rights to KERR and changes based on contributions made by either party during the year. For the first quarter ended March 31, 2016, Harvest recognized a loss of $18.5 million (2015 – $5.9 million) from its investment in the DBP and HKMS joint venture.

Below is an overview of operational and financial highlights of the DBP and HKMS investments for the first quarter ended March 31, 2016. Unless otherwise noted the following discussion relates to 100% of the joint venture results and not based on Harvest ownership share.

Deep Basin Partnership

DBP was established for the purposes of exploring, developing and producing from certain oil and gas properties in the Deep Basin area in Northwest Alberta. During the year ended 2015 and first quarter ended March 31, 2016 Harvest made various contributions to the DBP that resulted in increase in its ownership percentage as reflected in the table below.

| | | March 31, | | | December 31, | | | September 30, | | | June 30, | | | March 31, | | | December 31, | |

| | | 2016 | | | 2015 | | | 2015 | | | 2015 | | | 2015 | | | 2014 | |

| Harvest's ownership interest | | 81.98% | | | 81.71% | | | 81.05% | | | 79.30% | | | 77.81% | | | 77.81% | |

| KERR's ownership interest | | 18.02% | | | 18.29% | | | 18.95% | | | 20.70% | | | 22.19% | | | 22.19% | |

| Total | | 100.00% | | | 100.00% | | | 100.00% | | | 100.00% | | | 100.00% | | | 100.00% | |

As at March 31, 2016, the fair value of the top-up obligation was estimated as $1.7 million (December 31, 2015 - $4.3 million).

At March 31, 2016, Harvest received a total of $5.5 million (2015 - $2.4 million) in distributions from the DBP from inception of the joint venture.

| | | Three Months Ended March 31 | | | | |

| | | 2016 | | | 2015 | | | Change | |

| Natural gas (mcf/d) | | 25,534 | | | 7,350 | | | 247% | |

| Natural gas liquids (bbl/d) | | 1,463 | | | 345 | | | 324% | |

| Light to medium oil (bbl/d) | | 1 | | | 2 | | | (50% | ) |

| Total (boe/d) | | 5,720 | | | 1,572 | | | 264% | |

| Harvest's share(1) | | 4,689 | | | 1,223 | | | 283% | |

| (1) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

Sales volumes for the first quarter ended March 31, 2016 increased by 4,148 boe/d as compared to the same period in 2015. The increase was primarily due to new wells being brought online through the HKMS natural gas processing plant that commenced operations in early 2015 and additional assets contributed on October 1, 2015 by Harvest, partially offset by production curtailments due to third party restrictions.

16

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | | Three Months Ended March 31 | |

| | | 2016 | | | 2015 | | | Change | |

| Revenues | | 7.6 | | | 2.5 | | | 204% | |

| Operating expenses and Other | | (7.1 | ) | | (3.1 | ) | | (129% | ) |

| Depletion, depreciation and amortization | | (9.4 | ) | | (4.3 | ) | | (119% | ) |

| Finance costs | | (0.7 | ) | | (0.7 | ) | | 0% | |

| Impairment | | (1.4 | ) | | - | | | - | |

| Losses on disposition of assets | | (9.8 | ) | | - | | | - | |

| Net loss(1) | | (20.8 | ) | | (5.6 | ) | | (271% | ) |

| (1) | Balances represent 100% share of the DBP. |

The higher sales revenues in the first quarter ended 2016 reflect the higher volumes, partially offset by lower commodity prices, and lower royalties compared to the same period in the prior year.

Operating expenses and other expenses for the first quarter were $13.64/boe, a decrease of $8.28/boe from the same period in 2015. The decrease from 2015 was mainly due to the higher sales volume being processed thought the HKMS natural gas processing plant resulting in lower operating expense on a boe basis.

Depletion for the first quarter ended March 31, 2016 was $18.06/boe (2015 – $30.40/boe) . The decrease from 2015 was mainly due to the impairment charge recorded during the fourth quarter of 2015 and additional proved reserves recognized in the fourth quarter of 2015.

For the first quarter of 2016, the DBP recognized an impairment loss of $1.4 million relating to a final statement of adjustments for a corporate acquisition completed in the fourth quarter of 2015. As the partnerships property, plant and equipment (PP&E) assets were impaired as at December 31, 2015 the additions to PP&E as a result of the statement of adjustment were followed through as an expense in the current quarter.

On January 15, 2016 the DBP closed an asset exchange whereby the carrying value of assets given up exceeded the fair value of assets received based on the booked reserves associated with the properties exchanged. This transaction resulted in a loss on disposition of PP&E of $9.8 million.

| | | Three Months Ended March 31 | |

| | | 2016 | | | 2015 | |

| Drilling and completion | | 6.3 | | | 40.1 | |

| Well equipment, pipelines and facilities | | 2.9 | | | 14.1 | |

| Land and seismic | | 0.1 | | | - | |

| Total(1) | | 9.3 | | | 54.2 | |

| (1) | Balances represent 100% share of the DBP. |

17

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Capital asset additions was $9.3 million in the first quarter ended March 31, 2016, mainly related to drilling, completion and tie-in of wells. During the first quarter of 2016, DBP drilled 3 gross (2.5 net) wells which was a successful drill for liquids rich Montney and Falher gas.

HKMS Partnership

During the year ended 2015 and first quarter ended March 31, 2016 Harvest made various contributions to the HKMS that resulted in increase in its ownership percentage as reflected in the table below.

| | | March 31, | | | December 31, | | | September 30, | | | June 30, | | | March 31, | | | December 31, | |

| | | 2016 | | | 2015 | | | 2015 | | | 2015 | | | 2015 | | | 2014 | |

| Harvest's ownership | | 70.15% | | | 69.93% | | | 69.16% | | | 68.69% | | | 49.49% | | | 47.01% | |

| KERR's ownership interest | | 29.85% | | | 30.07% | | | 30.84% | | | 31.31% | | | 50.51% | | | 52.99% | |

| Total | | 100.00% | | | 100.00% | | | 100.00% | | | 100.00% | | | 100.00% | | | 100.00% | |

| | | Three Months Ended March 31 | | | | |

| | | 2016 | | | 2015 | | | Change | |

| Revenues | | 6.1 | | | 1.4 | | | 336% | |

| Operating expenses and Other | | (0.5 | ) | | (0.5 | ) | | 0% | |

| Depreciation and amortization | | (0.9 | ) | | (0.6 | ) | | (50% | ) |

| Finance costs | | (4.9 | ) | | (0.9 | ) | | (444% | ) |

| Net loss(1) | | (0.2 | ) | | (0.6 | ) | | 67% | |

| (1) | Balances represent 100% share of the HKMS. |

The Gas Processing Agreement between the HKMS and DBP ensures that HKMS receives an 18% internal rate of return on capital deployed over the term of the contract. In order to guarantee this return, DBP is required to provide HKMS with a minimum monthly capital fee that is currently $1.9 million a month. This capital fee is accounted for as revenue for HKMS and an operating expense for the DBP. In addition HKMS also generates revenue from charging an operating fee to recover operating expenses incurred. For the first quarter ended March 31, 2016 the partnership generated revenues of $6.1 million (2015 – $1.4 million).

Operating expenses of the facility are recovered through charging an operating fee to the producers. For the first quarter ended March 31, 2016 the partnership operating expense was $0.5 million (2015 – $0.5 million).

Depreciation has been calculated on a straight-line basis over a 30 year useful life. Based on the capital expenditures incurred to date, the depreciation on a monthly basis is approximately $0.3 million per month. For the first quarter ended March 31, 2016 the partnership depreciation expense was $0.9 million (2015 – $0.6 million).

Finance costs mainly represent an accounting charge resulting from the Partner’s contributions being classified as liabilities, as a result of the Gas Processing Agreement guaranteed returns. The finance costs represent the 18% rate of return on the partner’s contributions. For the first quarter ended March 31, 2016 the partnership finance costs was $4.9 million (2015 – $0.9 million).

See note 8 of the March 31, 2016 condensed interim consolidated financial statements for discussion of the accounting implications of these joint ventures.

18

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

BLACKGOLD OIL SANDS

Pre-Operating Results

| | | Three Months Ended | |

| | | 2016 | | | 2015 | |

| Expenses | | | | | | |

| Pre-operating | | 3.8 | | | — | |

| General and administrative | | 0.5 | | | — | |

| Depreciation and amortization | | 0.2 | | | — | |

| Pre-Operating loss(1) | | (4.5 | ) | | — | |

| (1) | This is an additional GAAP measure; please refer to “Additional GAAP Measures” in this MD&A. |

As the CPF was substantially completed during the first quarter of 2015, the operating expenses that were previously capitalized to property plant and equipment are now expensed on the income statement. For the first quarter ended March 31, 2016, Harvest recognized an operating loss of $4.5 million (2015 – $nil) respectively, mainly relating to labour, power, maintenance and general and administrative expenses.

Capital Asset Additions

| | | Three Months Ended March 31 | |

| | | 2016 | | | 2015 | |

| Well equipment, pipelines and facilities | | — | | | 40.4 | |

| Pre-operating costs | | — | | | 6.8 | |

| Drilling and completion | | — | | | 0.4 | |

| Capitalized borrowing costs and other | | 0.1 | | | 13.2 | |

| Total BlackGold additions | | 0.1 | | | 60.8 | |

During the first quarter of 2016, Harvest invested nil on the central processing facility (“CPF”) (2015 – $40.4 million).

Decommissioning Liabilities

Harvest’s BlackGold decommissioning liabilities at March 31, 2016 was $50.8 million (December 31, 2015 - $50.1 million) relating to the future remediation, abandonment, and reclamation of the steam assisted gravity drainage (“SAGD”) wells and CPF. Please see the “Contractual Obligations and Commitments” section of this MD&A for the payments expected for each of the next five years and thereafter in respect of the decommissioning liabilities.

Project Development

Harvest has been developing its BlackGold oil sands CPF under the engineering, procurement and construction (“EPC”) contract. Initial drilling of 30 SAGD wells (15 well pairs) was completed by the end of 2012 and the majority of the well completion activities were completed by the end of 2014. More SAGD wells will be drilled in the future to compensate for the natural decline in production of the initial well pairs and maintain the Phase 1 production capacity of 10,000 bbl/d. During the first quarter of 2015 construction had been substantially completed, including the building of the CPF plant site, well pads, and connecting pipelines. Several systems have since been commissioned and others will be progressed slowly within a limited budget. The decision to complete commissioning of the CPF and commence steam injection depends on a number of factors including the bitumen price environment.

19

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Harvest has recorded $1,080.5 million of costs on the entire project since acquiring the BlackGold assets in 2010. This $1,080.5 million includes certain Phase 2 pre-investment which is expected to improve the capital efficiency over the project lifecycle. Under the EPC contract, $94.9 million of the EPC costs will be paid in equal installments, without interest, over 10 years. Payments commenced during the second quarter of 2015 with two payments made on April 30, 2015. The liability is considered a financial liability and is initially recorded at fair value, which is estimated as the present value of all future cash payments discounted using the prevailing market rate of interest for similar instruments. As at March 31, 2016, Harvest recognized a liability of $62.9 million (December 31, 2015 - $62.0 million) using a discount rate of 5.5% (December 31, 2015 - 5.5%) .

As Harvest uses the unit of production method for depletion and the BlackGold assets currently have no production, no depletion on the BlackGold property, plant and equipment has been recorded. Minor depreciation has been recorded during the first quarter of 2016 on administrative assets.

RISK MANAGEMENT, FINANCING AND OTHER

Cash Flow Risk Management

The Company at times enters into natural gas, crude oil, electricity and foreign exchange contracts to reduce the volatility of cash flows from some of its forecast sales and purchases, and when allowable, will designate these contracts as cash flow hedges. The following is a summary of Harvest’s derivative contracts outstanding at March 31, 2016:

| Contracts Not Designated as Hedges | | | | | | | | | | |

| Contract Quantity | | Type of Contract | | | Term/Expiry | | | Contract Price | | | Fair value | |

| 12 MWh | | AESO power swap | | | Apr - Dec 2016 | | $ | 34.63/MWh | | $ | (0.2 | ) |

| US$76 million | | Foreign exchange swap | | | April 25, 2016 | | | 1.23% | (1) | | (0.8 | ) |

| | | | | | | | | | | $ | (1.0 | ) |

| (1) | As at March 31, 2016, Harvest had an outstanding U.S. dollar currency swap related to a LIBOR borrowing in the amount of US$76.0 million ($99.6 million at a rate of 1.28%) at a rate of 1.23% expiring on April 25, 2016 (December 31. 2015 - $nil). |

| | | | | | | | | Three Months Ended March 31 | | | | | | | | | | |

| | | | | | | | | 2016 | | | | | | | | | | | | 2015 | | | | |

Realized (gains) losses | | | | | Crude | | | | | | Natural | | | Top-Up | | | | | | | | | Natural | | | | |

recognized in: | | Power | | | Oil | | | Currency | | | Gas | | | Obligation | | | Total | | | Power | | | Gas | | | Total | |

Revenues | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (0.5 | ) | | (0.5 | ) |

Derivative contract (gains) losses | | 0.5 | | | — | | | — | | | — | | | — | | | 0.5 | | | 1.4 | | | — | | | 1.4 | |

Unrealized (gains) lossesrecognized in: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

OCI, before tax | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Derivative contract (gains) losses | | 0.2 | | | — | | | 0.8 | | | — | | | (0.3 | ) | | 0.7 | | | 1.1 | | | — | | | 1.1 | |

20

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Finance Costs

| | | Three Months Ended March 31 | |

| | | 2016 | | | 2015 | |

| Credit facility(1) | | 5.0 | | | 5.7 | |

| 6⅞% senior notes | | 12.6 | | | 11.3 | |

| 2⅛% senior notes(1) | | 6.1 | | | 5.4 | |

| Related party loans | | 8.6 | | | 5.8 | |

| Amortization of deferred finance charges and other | | 0.7 | | | 0.4 | |

| Interest and other financing charges | | 33.0 | | | 28.6 | |

| Accretion of decommission and environmental remediation liabilities | | 4.9 | | | 4.7 | |

| Accretion of long-term liability | | 0.9 | | | — | |

| Less: capitalized interest | | — | | | (9.7 | ) |

| Total finance costs | | 38.8 | | | 23.6 | |

| (1) | Includes guarantee fee to KNOC. |

Currency Exchange

| | | Three Months Ended March 31 | |

| | | 2016 | | | 2015 | |

| Realized (gains) losses on foreign exchange | | (6.8 | ) | | 1.6 | |

| Unrealized (gains) losses on foreign exchange | | (118.7 | ) | | 138.9 | |

| Total (gains) losses on foreign exchange | | (125.5 | ) | | 140.5 | |

Currency exchange gains and losses are attributed to the changes in the value of the Canadian dollar relative to the U.S. dollar on the U.S. dollar denominated 6⅞% and 2⅛% senior notes, the ANKOR and KNOC related party loan and on any U.S. dollar denominated monetary assets or liabilities. At March 31, 2016, the Canadian dollar had strengthened compared to the US dollar as at December 31, 2015 resulting in an unrealized foreign exchange gain of $118.7 million for the first quarter of 2016 (2015 – $138.9 million loss). Harvest recognized a realized foreign exchange gain of $6.8 million for the first quarter of 2016 (2015 – $1.6 million loss) as a result of the settlement of U.S. dollar denominated transactions.

Deferred Income Taxes

For the three months ended March 31, 2016 Harvest did not record a deferred income tax recovery (2015 – $50.7 million). Harvest’s deferred income tax asset (liability) will fluctuate during each accounting period to reflect changes in the temporary differences between the book value and tax basis of assets and liabilities. Currently, the principal sources of temporary differences relate to the Company’s property, plant and equipment, decommissioning liabilities and the unclaimed tax pools.

Related Party Transactions

The following provides a summary of the related party transactions between Harvest and KNOC for the quarter ended March 31, 2016:

Related Party Loans

In 2015, Harvest entered into a US$171 million loan agreement with KNOC with a maturity date of December 31, 2017 and the interest rate was increased to 5.91% per annum. As at March 31, 2016, the carrying value of this loan was $228.3 million including $222.1 million (US$171 million) principal and $6.2 million interest accrual. As at December 31, 2015, the carrying value of this loan was $170.2 million including $166.1 million (US$120 million) principal and $4.1 million interest accrual. At March 31, 2016, interest expense was $2.5 million (2015 – nil) for the three months of 2016.

21

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

In 2013, Harvest entered into a subordinated loan agreement with KNOC to borrow up to $200 million at a fixed interest rate of 5.3% per annum. The full principal and accrued interest is payable on December 30, 2018. As of March 31, 2016, Harvest has drawn $200.0 million from the loan agreement (December 31, 2015 - $200.0 million). The loan amount was recorded at fair value on initial recognition by discounting the future cash payments at the rate of 7% which is considered the market rate applicable to the liability. As at March 31, 2016, the carrying value of the KNOC loan was $193.7 million (December 31, 2015 - $193.2 million). The difference between the fair value and the loan amount was recognized in contributed surplus. As at March 31, 2016, $10.5 million (December 31, 2015 – $10.5 million) has been recognized in contributed surplus related to the KNOC loan. For the three months ended March 31, 2016, interest expense of $3.4 million was recorded (2015 – $3.4 million), of which $19.7 million remains outstanding as at March 31, 2016 (December 31, 2015 – $16.7 million).

In 2012, Harvest entered into a subordinated loan agreement with ANKOR to borrow US$170 million at a fixed interest rate of 4.62% per annum. The principal balance and accrued interest is payable on October 2, 2017. At March 31, 2016, Harvest’s related party loan from ANKOR included $220.8 million (December 31, 2015 – $235.3 million) of principal and $16.2 million (December 31, 2015 – $14.6 million) of accrued interest. Interest expense was $2.7 million for the three months and year ended March 31, 2016 respectively (2015 – $2.4 million).

The related party loans are unsecured and the loan agreements contain no restrictive covenants.

| | | Transactions | | | | | | | | | Balance Outstanding | | | | |

| | | Three Months Ended | | | Accounts Receivable as at | | | Accounts Payable as at | |

| | | March 31 | | | March 31 | | | December 31 | | | March 31 | | | December 31 | |

| | | 2016 | | | 2015 | | | 2016 | | | 2015 | | | 2016 | | | 2015 | |

| G&A Expenses | | | | | | | | | | | | | | | | | | |

| KNOC(1) | | 0.1 | | | (1.8 | ) | | - | | | - | | | 0.7 | | | 0.8 | |

| Finance costs | | | | | | | | | | | | | | | | | | |

| KNOC(2) | | 2.3 | | | 1.1 | | | - | | | - | | | 5.7 | | | 3.5 | |

| (1) | Amounts relate to the payments to (reimbursement from) KNOC for secondee salaries. |

| (2) | Charges from KNOC for the irrevocable and unconditional guarantee they provided on Harvest’s 2⅛% senior notes and the senior unsecured credit facility. A guarantee fee of 52 basis points per annum is charged by KNOC on the 2⅛% senior notes and 37 basis points per annum on the credit facility (see note 13 – Long Term Debt). |

The Company identifies its related party transactions by making inquiries of management and the Board of Directors, reviewing KNOC’s subsidiaries and associates, and performing a comprehensive search of transactions recorded in the accounting system. Material related party transactions require the Board of Directors’ approval. Also see note 8, “Investment in Joint Ventures” in the March 31, 2016 condensed interim consolidated financial statements for details of related party transactions with DBP and HKMS.

22

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

CAPITAL RESOURCES

The following table summarizes Harvest’s capital structure and provides the key financial ratios defined in the credit facility agreement.

| | | March 31 , 20163 | | | December 31, 2015 | |

| Credit facility(1) | | 893.2 | | | 926.6 | |

| 6⅞% senior notes (US$500 million)(1)(2) | | 649.4 | | | 692.0 | |

| 2⅛% senior notes (US$630 million)(1)(2) | | 818.2 | | | 871.9 | |

| Related party loans (US$341 million and CAD$200 million)(2) | | 642.9 | | | 601.4 | |

| | | 3,003.7 | | | 3,091.9 | |

| Shareholder's equity | | | | | | |

| 386,078,649 common shares issued | | (288.4 | ) | | (275.3 | ) |

| | | 2,715.3 | | | 2,816.6 | |

| (1) | Excludes capitalized financing fees |

| (2) | Face value converted at the period end exchange rate |

| (3) | As at December 31, 2015, related party loans comprised of US$170 million from ANKOR, US$120 million from KNOC and $ million from KNOC. |

During 2015, Harvest amended its $1 billion syndicated revolving credit facility and replaced it with a KNOC guaranteed $1.0 billion revolving credit facility that matures on April 30, 2017, with a syndicate of eight financial institutions. A guarantee fee of 0.37% per annum of the principal balance is payable to KNOC semi-annually.

Under the amended credit facility, applicable interest and fees are based on a margin pricing grid based on the Moody’s and S&P credit ratings of KNOC. The financial covenants under the previous credit facility were deleted and replaced with a new covenant: Total Debt to Capitalization ratio of 70% or less. At December 31, 2015, Harvest was in violation of the debt covenant and the carrying value of the credit facility, $923.8 million, was reclassified from long-term debt to a current liability. Subsequent to December 31, 2015, Harvest’s syndicate banks consented to a waiver of this covenant for the duration of the term of the credit facility and the maturity date remains at April 30, 2017, and the credit facility was reclassified from current to long-term debt.

LIQUIDITY

The Company’s liquidity needs are met through the following sources: cash generated from operations,proceeds from asset dispositions, joint arrangements, borrowings under the credit facility, related party loans, long-term debt issuances and capital injections by KNOC. Harvest’s primary uses of funds are operating expenses, capital expenditures, and interest and principal repayments on debt instruments.

Cash from operating activities for the three months ended March 31, 2016 was $0.2 million (2015 – cash flows used in operating activities $10.6 million). The increase in the first quarter of 2016 is mainly a result of reduced expense, changes in working capital requirement, partially offset by decreased in revenue.

Cash contributions from Harvest’s Upstream operations for the first quarter March 31, 2016 was $0.8 million (2015 – $19.1 million). The decrease in Upstream’s cash contribution for the first quarter as compared to 2015 is mainly due to the decreases in average realized prices and lower sales volumes, partially offset by lower expenses.

23

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Harvest funded capital expenditures for the quarter ended March 31, 2016 of $2.2 million (2015 – $151.4 million) with the proceeds from property dispositions and borrowings under both the credit facility and KNOC subordinated loan.

Harvest net repayment to the credit facility was $33.0 million during the period ended March 31, 2016 (2015 – $249.6 million net drawings).

Harvest had a working capital deficiency of $134.2 million as at March 31, 2016, as compared to a $1,070.5 million deficiency at December 31, 2015, mainly due to the inclusion of the credit facility as current due to the covenant violation at year end. As a result of obtaining a covenant waiver subsequent to year end, the credit facility has been reclassified as long term in the first quarter to 2016. Harvest’s working capital is expected to fluctuate from time to time, and will be funded from cash flows from operations and borrowings from the credit facility managing the collection and payment of accounts receivables and accounts payables respectively and using the proceeds from possible sale of assets, as required.

Harvest ensures its liquidity through the management of its capital structure, seeking to balance the amount of debt and equity used to fund investment in each of our operating segments. Harvest evaluates its capital structure using the same financial covenant ratios as the ones that were externally imposed under the Company’s credit facility and the senior notes. The Company continually monitors its credit facility covenants and actively takes steps, such as reducing borrowings, increasing capitalization, amending or renegotiating covenants as and when required.

In response to the low commodity price environment, Harvest plans to constrain its capital expenditures in 2016, focusing on capital maintenance and regulatory activities. Harvest also continues to postpone first steam for the BlackGold project in response to the unfavourable heavy oil prices and will continually assess the commodity price environment to determine when to complete commissioning of the CPF and first steam injection.

Harvest is a significant subsidiary for KNOC in terms of production and reserves. KNOC has directly or indirectly invested and provided financial support to Harvest since 2009 and, as at the date of preparation of this MD&A, it is the Company’s expectation that such support will continue for at least next twelve months so that Harvest is able to continue as a going concern.

24

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Contractual Obligations and Commitments

Harvest has recurring and ongoing contractual obligations and estimated commitments entered into in the normal course of operations. As at March 31, 2016, Harvest has the following significant contractual obligations and estimated commitments:

| | | Payments Due by Period | |

| | | 1 year | | | 2-3 years | | | 4-5 years | | | After 5 years | | | Total | |

| Debt repayments(1) | | — | | | 3,000.9 | | | — | | | — | | | 3,000.9 | |

| Debt interest payments(1) (2) | | 76.4 | | | 183.7 | | | — | | | — | | | 260.1 | |

| Purchase commitments(3) | | 12.5 | | | 21.0 | | | 19.0 | | | 68.7 | | | 121.2 | |

| Operating leases | | 7.3 | | | 14.4 | | | 14.5 | | | 32.9 | | | 69.1 | |

| Firm processing commitments | | 17.8 | | | 30.5 | | | 23.4 | | | 55.1 | | | 126.8 | |

| Firm transportation agreements | | 19.8 | | | 55.9 | | | 40.3 | | | 56.8 | | | 172.8 | |

| Employee benefits(4) | | — | | | 1.6 | | | — | | | — | | | 1.6 | |

| Decommissioning and environmental liabilities(5) | | 11.9 | | | 123.8 | | | 45.5 | | | 1,254.1 | | | 1,435.3 | |

| Total | | 145.7 | | | 3,431.8 | | | 142.7 | | | 1,467.6 | | | 5,187.8 | |

| (1) | Assumes constant foreign exchange rate. |

| (2) | Assumes interest rates as at March 31, 2016 will be applicable to future interest payments. |

| (3) | Relates to the BlackGold deferred payment under the EPC contract (see “BlackGold Oil Sands” section of this MD&A for details), and revised estimated capital costs for the Bellshill area (see “Impairment of Property, Plant & Equipment” section of this MD&A for details). |

| (4) | Relates to the long-term incentive plan payments. |

| (5) | Represents the undiscounted obligation by period. |

Off Balance Sheet Arrangements

See “Investments in Joint Ventures” section in this MD&A and note 8, “Investment in Joint Ventures” in the March 31, 2016 condensed interim consolidated financial statements.

25

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

SUMMARY OF QUARTERLY RESULTS

The following table and discussion highlights the first quarter of 2016 results relative to the preceding 7 quarters:

| | | | | | 2015 | | | 2014 | |

| | | Q1 | | | Q4 | | | Q3 | | | Q2 | | | Q1 | | | Q4 | | | Q3 | | | Q2 | |

FINANCIAL | | | | | | | | | | | | | | | | | | | | | | | | |

Revenue, Upstream | | 45.9 | | | 25.6 | | | 110.6 | | | 120.7 | | | 107.4 | | | 172.7 | | | 223.1 | | | 244.3 | |

Revenue, Downstream(1) | | — | | | — | | | — | | | — | | | — | | | 321.2 | | | 877.0 | | | 1,120.4 | |

Total Revenues and other income(2) | | 45.9 | | | 25.6 | | | 110.6 | | | 120.7 | | | 107.4 | | | 493.9 | | | 1,100.1 | | | 1,364.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income (loss) from continuing operations | | (13.1 | ) | | (894.2 | ) | | (588.7 | ) | | (87.0 | ) | | (223.5 | ) | | (275.8 | ) | | 197.0 | | | 45.1 | |

Net loss from discontinued operations | | — | | | (15.5 | ) | | — | | | — | | | — | | | (61.7 | ) | | (277.9 | ) | | (69.9 | ) |

Net loss | | (13.1 | ) | | (909.7 | ) | | (588.7 | ) | | (87.0 | ) | | (223.5 | ) | | (337.5 | ) | | (80.9 | ) | | (24.8 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

OPERATIONS | | | | | | | | | | | | | | | | | | | | | | | | |

Continuing Operations | | | | | | | | | | | | | | | | | | | | | | | | |

Daily sales volumes (boe/d) | | 36,986 | | | 38,141 | | | 43,356 | | | 41,716 | | | 43,770 | | | 42,539 | | | 44,794 | | | 47,556 | |

Realized price prior to hedging ($/boe) | | 20.86 | | | 27.89 | | | 31.47 | | | 37.85 | | | 31.85 | | | 47.99 | | | 62.99 | | | 69.30 | |

Discontinued Operations(1) | | | | | | | | | | | | | | | | | | | | | | | | |

Average daily throughput (bbl/d) | | — | | | — | | | — | | | — | | | — | | | 76,455 | | | 73,495 | | | 95,410 | |

Average refining gross margin ($US/bbl)(3) | | — | | | — | | | — | | | — | | | — | | | 2.76 | | | 4.09 | | | 0.25 | |

| (1) | Downstream operations have been classified as “Discontinued Operations” as a result of disposition on November 13, 2014. |

| (2) | This is an additional GAAP measure; please refer to “Additional GAAP Measures” in this MD&A. |

| (3) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

The quarterly revenues and cash from operating activities are mainly impacted by the Upstream sales volumes, realized prices and operating expenses and previously, Downstream throughput volumes, cost of feedstock and refined product prices. Significant items that impacted Harvest’s quarterly revenues include:

| | • | Total revenues were highest in the second quarter of 2014, as a result of high daily sales volumes and throughput volumes from discontinued operations and lowest in the fourth quarter of 2015 due to low realized prices combined with low sales volumes from continuing operations and the absence of revenues from discontinued operations. |

| | • | The declines in Upstream’s sales volumes since 2014 were mainly due to asset dispositions and a

capital program that was insufficient to offset declines in production. |

|

Net income (loss) reflects both cash and non-cash items. Changes in non-cash items including deferred income tax, DD&A expense, accretion of decommissioning and environmental remediation liabilities, impairment of long-lived assets, unrealized foreign exchange gains and losses, and unrealized gains and losses on derivative contracts impact net loss from period to period. For these reasons, the net loss may not necessarily reflect the same trends as revenues or cash from operating activities, nor is it expected to. The net loss from continuing operations in the first quarter of 2016 is mainly a result of lower realized prices and sales volumes, and a $18.5 million loss from joint ventures. The net loss from continuing operations in the fourth quarter of 2015 is mainly a result of lower realized prices and sales volumes, a $620.1 million impairment expense, and a $71.5 million loss from joint ventures. The net loss from continuing operations in the third quarter of 2015 is mainly a result of lower realized prices and sales volumes and a $542.0 million impairment expense. The net loss from continuing operations in the second quarter of 2015 is mainly a result of a result of lower realized prices and sales volumes and a $70.7 million impairment expense. The net loss from continuing operations in the first quarter of 2015 was mainly a result of lower realized prices and sales volumes, a $140.5 million foreign exchange loss and a $23.5 million impairment expense. The net loss from continuing operations in the fourth quarter of 2014 was mainly due to the $267.6 million impairment expense.

26

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

CRITICAL ACCOUNTING ESTIMATES

The preparation of financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimates are revised and in any future periods affected. Further information on the basis of preparation and significant accounting policies and estimates can be found in the notes to the audited consolidated financial statements for the year ended December 31, 2015. There have been no changes to the accounting policies and critical accounting estimates in the first quarter of 2016.

RECENT ACCOUNTING PRONOUNCEMENTS

There were no new or amended standards issued during the three months ended March 31, 2016 that are applicable to Harvest in future periods. A description of additional accounting pronouncements that will be adopted by Harvest in future periods can be found in note 3 of the audited consolidated financial statements for the year ended December 31, 2015.

OPERATIONAL AND OTHER BUSINESS RISKS FOR CONTINUING OPERATIONS

Harvest’s operational and other business risks remain unchanged from those discussed in the annual MD&A and AIF for the year ended December 31, 2015 as filed on SEDAR at www.sedar.com.

CHANGES IN REGULATORY ENVIRONMENT

Harvest’s regulatory environment remains unchanged from that discussed in the annual MD&A and AIF for the year ended December 31, 2015 as filed on SEDAR atwww.sedar.com.

INTERNAL CONTROL OVER FINANCIAL REPORTING

Harvest is required to comply with National Instrument 52-109 “Certification of Disclosure in Issuers’ Annual and Interim Filings”. The certificate requires that Harvest disclosure in the interim MD&A any significant changes or material weaknesses in Harvest’s internal control over financial reporting that occurred during the period that have materially affected, or are reasonably likely to materially affect Harvest’s internal controls over financial reporting. Harvest confirms that no such significant changes or weaknesses were identified in Harvest’s internal controls over financial reporting during the first quarter of 2016 described in the annual MD&A for the year ended December 31, 2015 as filed on SEDAR atwww.sedar.com.

27

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

ADDITIONAL GAAP MEASURES

Throughout this MD&A, Harvest uses additional GAAP measures that are not defined under IFRS (hereinafter also referred to as “GAAP”). “Operating income (loss)” is commonly used for comparative purposes in the petroleum and natural gas and refining industries to reflect operating results before items not directly related to operations. Harvest uses this measure to assess and compare the performance of its operating segments. “Revenues and other income” comprises sales of petroleum and natural gas net of related royalties, and Harvest’s share of the net income from its joint ventures.

NON-GAAP MEASURES

Throughout this MD&A, the Company has referred to certain measures of financial performance that are not specifically defined under GAAP such as “operating netback”, “operating netback prior to/after hedging”, “average refining gross margin”, “cash contribution (deficiency) from operations” and “total debt to total capitalization”. “Operating netbacks” are reported on a per boe basis and used extensively in the Canadian energy sector for comparative purposes. “Operating netbacks” include revenues, operating expenses, transportation and marketing expenses, and realized gains or losses on derivative contracts. “Average refining gross margin” is commonly used in the refining industry to reflect the net funds received from the sale of refined products after considering the cost to purchase the feedstock and is calculated by deducting purchased products for resale and processing from total revenue. “Cash contribution (deficiency) from operations” is calculated as operating income (loss) adjusted for non-cash items. The measure demonstrates the ability of the each segment of Harvest to generate the cash from operations necessary to repay debt, make capital investments, and fund the settlement of decommissioning and environmental remediation liabilities. “Total debt to total capitalization” is a term defined in Harvest’s amended credit facility agreement for the purpose of calculation of the financial covenant. The non-GAAP measures do not have any standardized meaning prescribed by GAAP and may not be comparable to similar measures used by other issuers. The determination of the non-GAAP measures have been illustrated throughout this MD&A, with reconciliations to IFRS measures and/or account balances, except for cash contribution (deficiency) which is shown below.

Cash Contribution (Deficiency) from Operations

Cash contribution (deficiency) from operations represents operating income (loss) adjusted for non-cash expense items within: operating, general and administrative, exploration and evaluation, depletion, depreciation and amortization, gains on disposition of assets, derivative contracts gains or losses, impairment and other charges, and the inclusion of cash interest, realized foreign exchange gains or losses and other cash items not included in operating income (loss). The measure demonstrates the ability of Harvest’s upstream segment to generate cash from operations and is calculated before changes in non-cash working capital. The most directly comparable additional GAAP measure is operating income (loss). Operating income (loss) as presented in the notes to Harvest’s consolidated financial statements is reconciled to cash contribution (deficiency) from operations below. Comparative results include results from both continued and discontinued operations.

28

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | | | | | Three Months Ended March 31 | | | | |

| | | Upstream | | | BlackGold | | | Total | |

| | | 2016 | | | 2015 | | | 2016 | | | 2015 | | | 2016 | | | 2015 | |

| Operating loss | | (95.3 | ) | | (110.1 | ) | | (4.5 | ) | | — | | | (99.8 | ) | | (110.1 | ) |

| Adjustments: | | | | | | | | | | | | | | | | | | |

| Loss from joint ventures | | 18.5 | | | 5.9 | | | — | | | — | | | 18.5 | | | 5.9 | |

| Operating, non-cash | | 0.2 | | | (0.5 | ) | | — | | | — | | | 0.2 | | | (0.5 | ) |

| General and administrative, non-cash | | (0.5 | ) | | 0.4 | | | — | | | — | | | (0.5 | ) | | 0.4 | |

| Exploration and evaluation, non-cash | | 2.1 | | | 0.9 | | | — | | | — | | | 2.1 | | | 0.9 | |

| Depletion, depreciation and amortization | | 74.7 | | | 98.4 | | | 0.2 | | | — | | | 74.9 | | | 98.4 | |

| (Gains) losses on disposition of assets | | 0.4 | | | (0.5 | ) | | — | | | — | | | 0.4 | | | (0.5 | ) |

| Unrealized losses on derivative contracts | | 0.7 | | | 1.1 | | | — | | | — | | | 0.7 | | | 1.1 | |

| Impairment and other charges, non-cash | | — | | | 23.5 | | | — | | | — | | | — | | | 23.5 | |

| Cash contribution (deficiency) from operations | | 0.8 | | | 19.1 | | | (4.3 | ) | | — | | | (3.5 | ) | | 19.1 | |

| Inclusion of items not attributable to segments: | | | | | | | | | | | | | | | | | | |

| Net cash interest | | | | | | | | | | | | | | 24.0 | | | 11.3 | |

| Realized foreign exchange losses (gains) | | | | | | | | | | | | | | (6.8 | ) | | 1.6 | |

| Consolidated cash contribution from operations | | | | | | | | | | | | | | (20.7 | ) | | 6.2 | |

FORWARD-LOOKING INFORMATION

This MD&A highlights significant business results and statistics from the consolidated financial statements for the three months ended March 31, 2016 and the accompanying notes thereto. In the interest of providing Harvest’s lenders and potential lenders with information regarding Harvest, including the Company’s assessment of future plans and operations, this MD&A contains forward-looking statements that involve risks and uncertainties.

Such risks and uncertainties include, but are not limited to: risks associated with conventional petroleum and natural gas operations; risks associated with the construction of the oil sands project; the volatility in commodity prices, interest rates and currency exchange rates; risks associated with realizing the value of acquisitions; general economic, market and business conditions; changes in environmental legislation and regulations; the availability of sufficient capital from internal and external sources; and, such other risks and uncertainties described from time to time in regulatory reports and filings made with securities regulators. The impact of any one risk, uncertainty or factor on a particular forward-looking statement is not determinable with certainty as these factors are interdependent, and management’s future course of action would depend on the assessment of all information at that time. Please also refer to “Operational and Other Business Risks” in this MD&A and “Risk Factors” in the Annual Information Form for detailed discussion on these risks.

Forward-looking statements in this MD&A include, but are not limited to: commodity prices, price risk management activities, acquisitions and dispositions, capital spending and allocation of such to various projects, reserve estimates and ultimate recovery of reserves, potential timing and commerciality of Harvest’s capital projects, the extent and success rate of Upstream and BlackGold drilling programs, the ability to achieve the maximum capacity from the BlackGold central processing facilities, availability of the credit facility, access and ability to raise capital, ability to maintain debt covenants, debt levels, recovery of long-lived assets, the timing and amount of decommission and environmental related costs, income taxes, cash from operating activities, regulatory approval of development projects and regulatory changes. For this purpose, any statements that are contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements often contain terms such as “may”, “will”, “should”, “anticipate”, “expect”, “target”, “plan”, “potential”, “intend”, and similar expressions.

29

| MANAGEMENT’S DISCUSSION AND ANALYSIS |