| | | OMB APPROVAL |

| | | OMB Number: 3235-0621 |

| | | Expires: August 31,2020 |

| | | Estimated average burden |

| | | hours per response 30.00 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 15F

CERTIFICATION OF A FOREIGN PRIVATE ISSUER’S TERMINATION OF REGISTRA- TION OF A CLASS OF SECURITIES UNDER SECTION 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ITS TERMINATION OF THE DUTY TO FILE REPORTS UNDER SECTION 13(a) OR SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 33-121620

HARVEST OPERATIONS CORP.

Suite 1500, 700 – 2nd Street S.W,

Calgary, Alberta, Canada T2P 2W1

(403) 265-1178

67/8% Senior Notes Due October 1, 2017 (CUSIP: 41754WAN1; ISIN:US41754WAN11) Redeemed & Repaid

(Title of each class of securities covered by this Form)

Place an X in the appropriate box(es) to indicate the provision(s) relied upon to terminate the duty to file reports under the Securities Exchange Act of 1934:

| Rule 12h-6(a) | o | Rule 12h-6(d) | o |

| (for equity securities) | (for successor registrants) |

| | |

Rule 12h-6(c) | x | Rule 12h-6(i) | o |

| (for debt securities) | (for prior Form 15 filers) |

PART I

The purpose of this part is to provide information to investors and to assist the Commission in assessing whether you meet the requirements for terminating your Exchange Act reporting under Rule 12h-6. If, pursuant to Rule 12h-6, there is an item that does not apply to you, mark that item as inapplicable.

Item 1. Exchange Act Reporting History

A. State when you first incurred the duty to file reports under section 13(a) or section 15(d) of the Exchange Act.

A registration statement on Form F-4 (file number 333-182132) for the above noted Securities was declared effective by the United States Securities and Exchange Commission on July 3, 2012 and the Securities were issued pursuant to a registered exchange offering on August 1, 2012.

B. State whether you have filed or submitted all reports required under Exchange Act section 13(a) or section15(d) and corresponding Commission rules for the 12 months preceding the filing of this form, and whether you have filed at least one annual report under section 13(a).

Harvest Operations Corp. has filed all reports required under Exchange Act section 13(a) and section 15(d) and has filed at least one annual report under section 13(a) on Form 20-F.

Item 2. Recent United States Market Activity

State when your securities were last sold in the United States in a registered offering under the Securities Act of 1933 (15 U.S.C. 77a et seq.) (“Securities Act”).

August 1, 2012.

Item 3. Foreign Listing and Primary Trading Market

A. Identify the exchange or exchanges outside the United States, and the foreign jurisdiction in which the exchange or exchanges are located, on which you have maintained a listing of the class of securities that is the subject of this Form, and which, either singly or together with the trading of the same class of the issuer’s securities in another foreign jurisdiction, constitutes the primary trading market for those securities.

Not applicable.

B. Provide the date of initial listing on the foreign exchange or exchanges identified in response to Item 3.A. In addition, disclose whether you have maintained a listing of the subject class of securities on one or more of those foreign exchanges for at least the 12 months preceding the filing of this Form.

Not applicable.

C. Disclose the percentage of trading in the subject class of securities that occurred in the identified jurisdiction or jurisdictions of your foreign listing as of a recent 12-month period.

Not applicable.

Item 4. Comparative Trading Volume Data

If relying on Rule 12h-6(a)(4)(i), provide the following information:

A. Identify the first and last days of the recent 12-month period used to meet the requirements of that rule Provision.

Not applicable.

B. For the same recent 12-month period, disclose the average daily trading volume of the class of securities that is the subject of this Form both in the United States and on a worldwide basis.

Not applicable.

C. For the same recent 12-month period, disclose the average daily trading volume of the subject class of securities in the United States as a percentage of the average daily trading volume for that class of securities on a worldwide basis.

Not applicable.

D. Disclose whether you have delisted the subject class of securities from a national securities exchange or inter-dealer quotation system in the United States. If so, provide the date of delisting, and, as of that date, disclose the average daily trading volume of the subject class of securities in the United States as a percentage of the average daily trading volume for that class of securities on a worldwide basis for the preceding 12-month period.

Not applicable.

E. Disclose whether you have terminated a sponsored American depositary receipt (ADR) facility regarding the subject class of securities. If so, provide the date of the ADR facility termination, and, as of that date, disclose the average daily trading volume of the subject class of securities in the United States as a percentage of the average daily trading volume for that class of securities on a worldwide basis for the preceding 12-month period.

Not applicable.

F. Identify the sources of the trading volume information used for determining whether you meet the requirements of Rule 12h-6. If you used more than one source, disclose the reasons why you used each source.

Not applicable.

Item 5. Alternative Record Holder Information

If relying on Rule 12h-6(a)(4)(ii) (17 CFR 240.12h-6(a)(4)(ii)):

Disclose the number of record holders of the subject class of equity securities on a worldwide basis or who are United States residents at a date within 120 days before filing this Form. Disclose the date used for the purpose of Item 5.

Not applicable.

Item 6. Debt Securities

If relying on Rule 12h-6(c) (17 CFR 240.12h-6(c)):

Disclose the number of record holders of your debt securities either on a worldwide basis or who are United States residents at a date within 120 days before the date of filing of this Form. Disclose the date used for the purpose of Item 6.

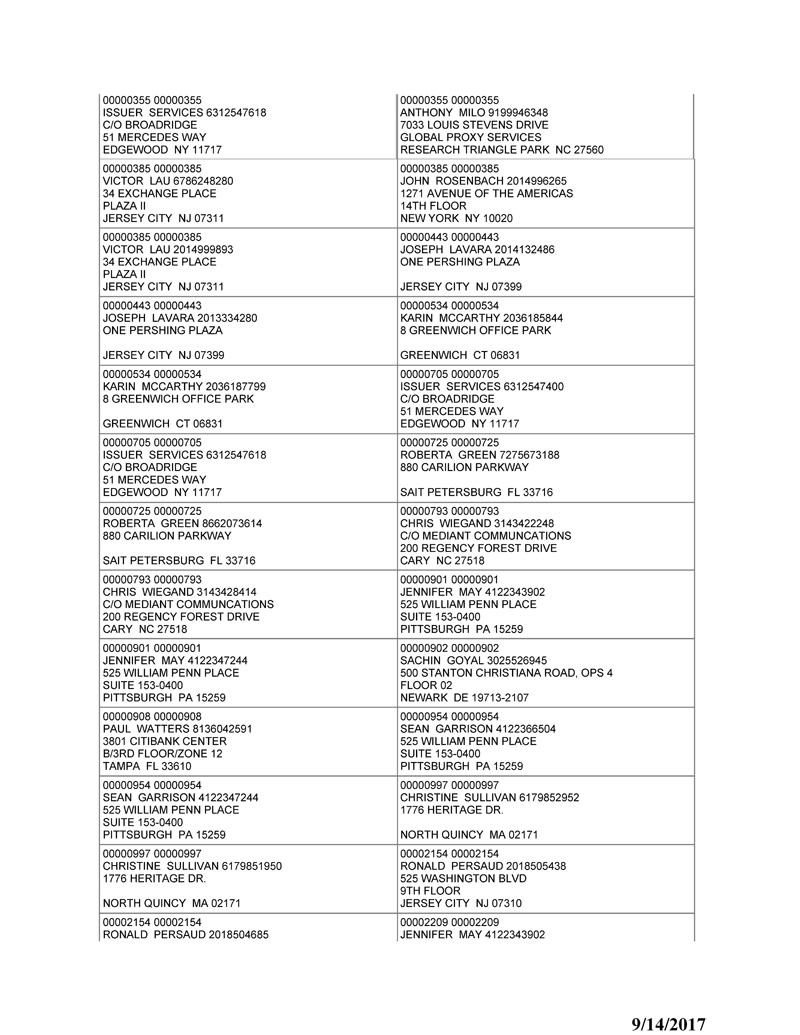

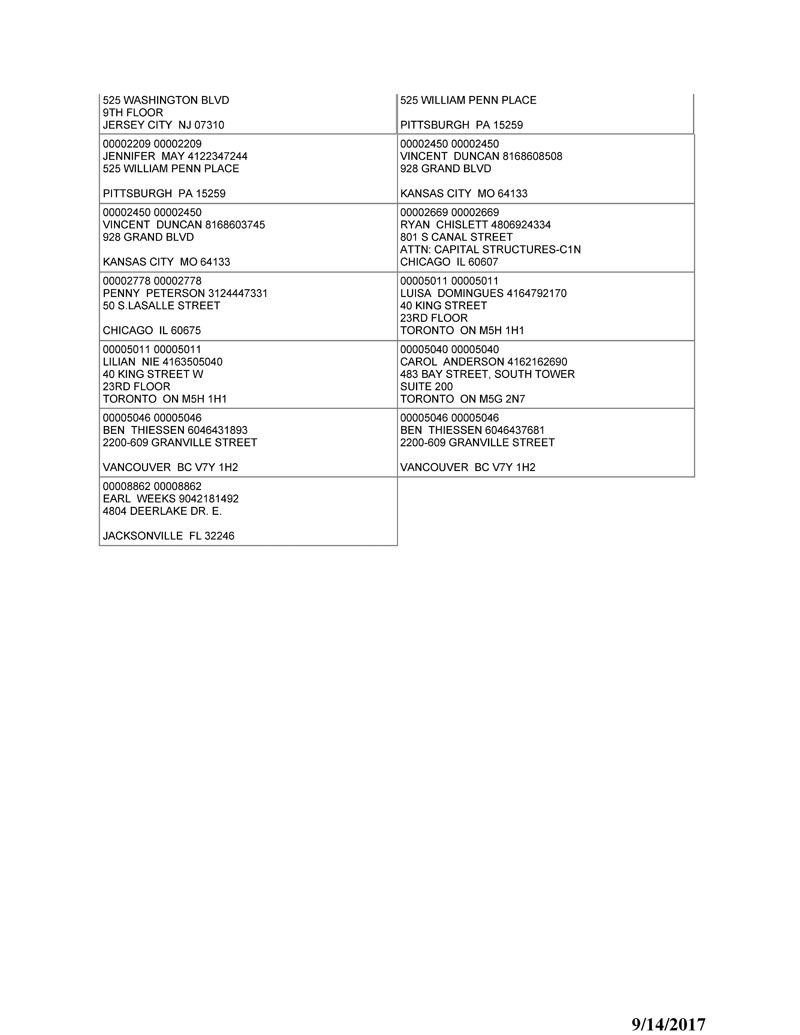

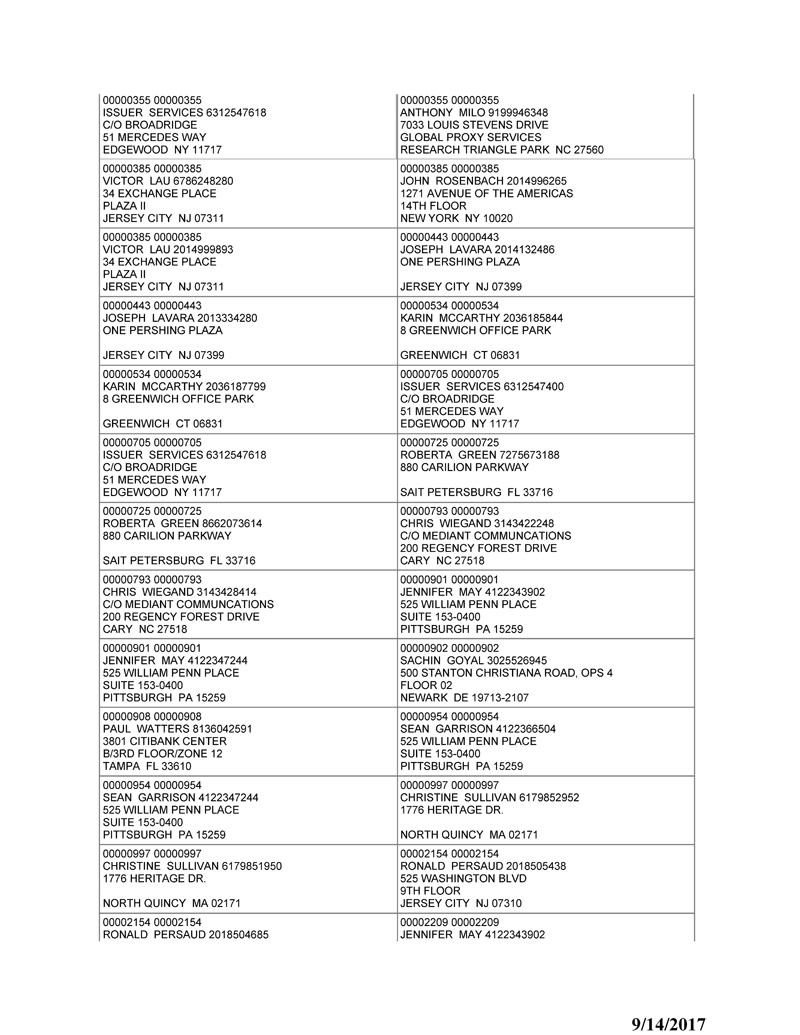

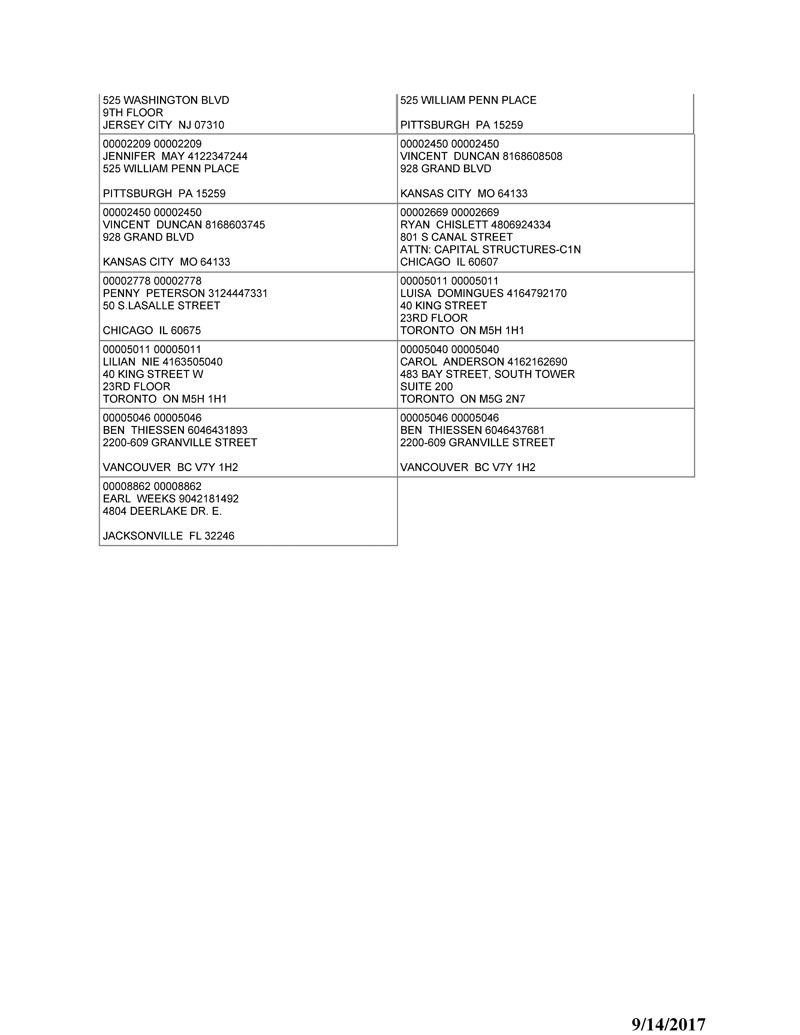

Refer to Exhibit A: Security Position Report from The Depository Trust Company, provided by U.S. Bank Global Corporate Trust Services (as Trustee) as at September 12, 2017. There were 32 participants, per the Special Security Report and 57 participants per the Participant Contact List.

Item 7. Notice Requirement

If filing Form 15F pursuant to Rule 12h-6(a), (c) or (d):

A. Disclose the date of publication of the notice, required by Rule 12h-6(h) (17 CFR 240.12h-6(h)), disclosing your intent to terminate your duty to file reports under section 13(a) or 15(d) of the Exchange Act or both.

October 2, 2017

B. Identify the means, such as publication in a particular newspaper or transmission by a particular wire service, used to disseminate the notice in the United States.

Nasdaq Marketwire (news release service provider) and as filed on EDGAR. See copy of notice under cover of a Form 6-K ( Exhibit B)

Item 8. Prior Form 15 Filers

If relying on Rule 12h-6(i):

A. Disclose whether, before the effective date of Rule 12h-6, you filed a Form 15 (17 CFR 249.323) to

terminate the registration of a class of equity securities pursuant to Rule 12g-4 (17 CFR 240.12g-4) or to suspend your reporting obligations under section 15(d) of the Act regarding a class of equity or debt securities pursuant to Rule 12h-3 (17 CFR 240.12h-3). If so, disclose the date that you filed the Form 15. If you suspended your reporting obligations by the terms of section 15(d), disclose the effective date of that suspension as well as the date that you filed a Form 15 to notify the Commission of that suspension pursuant to Rule 15d-6 (17 CFR 240.15d-6).

B. If you terminated the registration of a class of securities pursuant to Rule 12g-4 or suspended your reporting obligations pursuant to Rule 12h-3 or by the terms of section 15(d) of the Act regarding a class of equity securities, provide the disclosure required by Item 3 of this Form, “Primary Trading Market.” Further provide the disclosure required by Item 4 of this Form, “Comparative Trading Volume Data,” or the disclosure required by Item 5 of the Form, “Alternative Record Holder Information.”

C. If you suspended your reporting obligations pursuant to Rule 12h-3 or by the terms of section 15(d) of the Act regarding a class of debt securities, provide the disclosure required by Item 6 of this Form, “Debt Securities.”

Not applicable.

PART II

Item 9. Rule 12g3-2(b) Exemption

Disclose the address of your Internet Web site or of the electronic information delivery system in your primary trading market on which you will publish the information required under Rule 12g3-2(b)(1)(iii) (17 CFR 240.12g3-2(b) (1)(iii)).

See System for Electronic Document Analysis and Retrieval (SEDAR): http://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00021007 and also published on www.harvestoperations.com and SGXNet (www.sgx.com).

PART III

Item 10. Exhibits

List the exhibits attached to this Form.

Exhibit A: Security Position Report from The Depository Trust Company, provided by U.S. Bank Global Corporate Trust Services (as Trustee) as at September 12, 2017.

Exhibit B: Copy of relevant Form 6-K.

Item 11. Undertakings

Furnish the following undertaking:

The undersigned issuer hereby undertakes to withdraw this Form 15F if, at any time before the effectiveness of its termination of reporting under Rule 12h-6, it has actual knowledge of information that causes it reasonably to believe that, at the time of filing the Form 15F:

(1) The average daily trading volume of its subject class of securities in the United States exceeded 5 percent of the average daily trading volume of that class of securities on a worldwide basis for the same recent 12-month period that the issuer used for purposes of Rule 12h-6(a)(4)(i);

(2) Its subject class of securities was held of record by 300 or more United States residents or 300 or more persons worldwide, if proceeding under Rule 12h-6(a)(4)(ii) or Rule 12h-6(c); or

(3) It otherwise did not qualify for termination of its Exchange Act reporting obligations under Rule 12h-6.

Agreed – see below.

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, Harvest Operations Corp. has duly authorized the undersigned person to sign on its behalf this certification on Form 15F. In so doing, Harvest Operations Corp. certifies that, as represented on this Form, it has complied with all of the conditions set forth in Rule 12h-6 for terminating its registration under section 12(g) of the Exchange Act, or its duty to file reports under section 13(a) or section 15(d) of the Exchange Act, or both.

| HARVEST OPERATIONS CORP. | |

| | (Registrant) | |

| | | | |

| Date: October 2, 2017 | By: | "Signed" | |

| | | Mark Tysowski | |

| | | General Counsel & Corporate Secretary |

Exhibit A

Security Position Report from The Depository Trust Company, provided by U.S. Bank Global Corporate Trust Services (as Trustee) as at September 12, 2017.

Exhibit B:

Copy of relevant Form 6-K.

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

October 2, 2017

Commission File Number: 333-121620

HARVEST OPERATIONS CORP.

(Exact name of registrant as specified in its charter)

Suite 1500, 700 – 2nd Street S.W,

Calgary, Alberta, Canada T2P 2W1

(403) 265-1178

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1). ____

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s "home country"), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No X

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

| EXHIBIT | TITLE |

| | |

| 1 | News Release dated October 2, 2017 Announcing Repayment of U.S. $282.5 Million 6 7/8% Senior Notes |

| | |

| 2 | Material Change Report filed as filed on SEDAR October 2, 2017. |

| | �� | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | HARVEST OPERATIONS CORP. | |

| | (Registrant) | |

| | | | |

| Date: October 2, 2017 | By: | "Signed" | |

| | | Mark Tysowski | |

| | | General Counsel & Corporate Secretary |

INDEX TO EXHIBITS

| EXHIBIT | TITLE |

| | |

| 1 | News Release dated October 2, 2017 Announcing Repayment of U.S. $282.5 Million 6 7/8% Senior Notes |

| | |

| 2 | Material Change Report filed as filed on SEDAR October 2, 2017. |

| | | |

Exhibit 1

| Press Release |

Harvest OPERATIONS CORP. ANNOUNCES repayment of U.S. $282.5 MILLION 6⅞% SENIOR NOTEs

Calgary, Alberta – October 2, 2017: Harvest Operations Corp. (“Harvest” or the “Company”) is pleased to announce that it has repaid in full Harvest’s outstanding approximately U.S.$282,500,000 aggregate principal amount of 67/8% Senior Notes (the “Notes”) that were due October 1, 2017.

In connection with the repayment of the Notes, Harvest has filed Form 15-F with the U.S. Securities and Exchange Commission (the “Commission”) in order to terminate its reporting obligations under the U.S. Securities Exchange Act of 1934 as amended (the “Exchange Act”) in connection with the Notes.

In accordance with the Exchange Act, Harvest’s reporting obligations will be suspended upon filing Form 15-F and will formally terminate in 90 days or such shorter period as the Commission may determine.

HARVEST CORPORATE PROFILE

Harvest is a wholly-owned, subsidiary of Korea National Oil Corporation ("KNOC"). Harvest is a significant operator in Canada's energy industry offering stakeholders exposure to exploration, development and production of crude oil and natural gas (Upstream) and an oil sands project under construction and development in northern Alberta (BlackGold).

KNOC is a state owned oil and gas company engaged in the exploration and production of oil and gas along with storing petroleum resources. KNOC will fully establish itself as a global government-run petroleum company by applying ethical, sustainable and environment-friendly management and by taking corporate social responsibility seriously at all times. For more information on KNOC, please visit their website at www.knoc.co.kr/ENG/main.jsp.

ADVISORY

Certain information in this press release contains forward-looking information that involves risk and uncertainty. For this purpose, any statements that are contained in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements often contain terms such as "may", "will", "should", "anticipate", "expects" and similar expressions. Such risks and uncertainties in respect of such forward-looking information include, but are not limited to, risks associated with: imprecision of reserve estimates; conventional oil and natural gas operations; the volatility in commodity prices and currency exchange rates; risks associated with realizing the value of acquisitions; general economic, market and business conditions; changes in environmental legislation and regulations; the availability of sufficient capital from internal and external sources; and, such other risks and uncertainties described from time to time in Harvest's regulatory reports and filings made with securities regulators.

Readers are cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions or expectations upon which they are based will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Harvest assumes no obligation to update forward-looking statements should circumstances or management's estimates or opinions change. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

FOR FURTHER INFORMATION PLEASE CONTACT:

Harvest Operations Corp.

INVESTOR & MEDIA CONTACT:

Greg Foofat, Manager Investor Relations & Corporate Communications

Harvest Operations Corp.

Toll Free Investor Mailbox: (866) 666-1178

Email: investor.relations@harvestenergy.ca

Harvest Operations Corp.

1500, 700 – 2nd Street S.W.

Calgary, AB Canada T2P 2W1

Website: www.harvestoperations.com

Exhibit 2

Form 51-102F3

Material Change Report

| 1. | Name and Address of Company: |

Harvest Operations Corp. ("Harvest" or the "Corporation")

1500, 700 – 2nd Street S.W.

Calgary, Alberta T2P 2W1

| 2. | Date of Material Change: |

October 2, 2017.

A news release announcing the repayment of U.S. $282.5 million 67/8% Senior Notes that were due October 1, 2017 in this material change report was issued on October 2, 2017 through the facilities of Nasdaq (formerly Marketwire).

| 4. | Summary of Material Change: |

On October 2, 2017 Harvest announced that it has repaid in full Harvest’s outstanding approximately U.S.$282,500,000 aggregate principal amount of 67/8% Senior Notes (the “Notes”) that were due October 1, 2017.

| 5. | Full Description of Material Change: |

On October 2, 2017, Harvest announced that it has repaid in full Harvest’s outstanding approximately U.S.$282,500,000 aggregate principal amount of 67/8% Senior Notes (the “Notes”) that were due October 1, 2017.

In connection with the repayment of the Notes, Harvest has filed Form 15-F with the U.S. Securities and Exchange Commission (the “Commission”) in order to terminate its reporting obligations under the U.S. Securities Exchange Act of 1934 as amended (the “Exchange Act”) in connection with the Notes.

In accordance with the Exchange Act, Harvest’s reporting obligations will be suspended upon filing Form 15-F and will formally terminate in 90 days or such shorter period as the Commission may determine.

| 6. | Reliance on Subsection 7.1(2) of National Instrument 51-102: |

N/A

N/A

2

For further information, please contact Grant Ukrainetz, Vice President, Finance, by telephone at (403) 265-1178

October 2, 2017.

ADVISORY:

Certain information in this press release contains forward-looking information that involves risk and uncertainty. For this purpose, any statements that are contained in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements often contain terms such as "may", "will", "should", "anticipate", "expects" and similar expressions. Such risks and uncertainties in respect of such forward-looking information include, but are not limited to, risks associated with: imprecision of reserve estimates; conventional oil and natural gas operations; the volatility in commodity prices and currency exchange rates; risks associated with realizing the value of acquisitions; general economic, market and business conditions; changes in environmental legislation and regulations; the availability of sufficient capital from internal and external sources; and, such other risks and uncertainties described from time to time in Harvest's regulatory reports and filings made with securities regulators.

Readers are cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions or expectations upon which they are based will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Harvest assumes no obligation to update forward-looking statements should circumstances or management's estimates or opinions change. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement.