Exhibit 99.3

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

MANAGEMENT’S DISCUSSION AND ANALYSIS

This Management’s Discussion and Analysis (“MD&A”) should be read in conjunction with the unaudited interim consolidated financial statements of Harvest Operations Corp. (“Harvest”, “we”, “us”, “our” or the “Company”) for the three and six months ended June 30, 2011 and the audited consolidated financial statements and MD&A for the year ended December 31, 2010. The information and opinions concerning our future outlook are based on information available at August 10, 2011.

On January 1, 2011, Harvest adopted International Financial Reporting Standards (“IFRS”). Harvest’s previously reported consolidated financial statements in Canadian Generally Accepted Accounting Principles (“Canadian GAAP”) have been adjusted to be in compliance with IFRS on January 1, 2010, the transition date.

In this MD&A, all dollar amounts are expressed in Canadian dollars unless otherwise indicated. Tabular amounts are in thousands of dollars, except where noted. Natural gas volumes are converted to barrels of oil equivalent (“boe”) using the ratio of six thousand cubic feet (“mcf”) of natural gas to one barrel of oil (“bbl”). Boes may be misleading, particularly if used in isolation. A boe conversion ratio of 6 mcf to 1 bbl is based on an energy equivalent conversion method primarily applicable at the burner tip and does not represent a value equivalent at the wellhead. In accordance with Canadian practice, petroleum and natural gas revenues are reported on a gross basis before deduction of Crown and other royalties. In addition to disclosing reserves under the requirements of National Instrument (“NI”) 51-101, Harvest also discloses our reserves on a company interest basis which is not a term defined under NI 51-101. This information may not be comparable to similar measures by other issuers.

Additional information concerning Harvest, including its Annual Information Form (“AIF”) can be found on SEDAR atwww.sedar.com.

NON-IFRS MEASURES

Throughout this MD&A, the Company has referred to certain measures of financial performance that are not specifically defined under IFRS, herein after referred to as GAAP, such as “operating netbacks”, “operating income”, “gross margin”, “total debt”, “total capitalization” and “EBITDA”. “Operating netbacks” are always reported on a per boe basis and used extensively in the Canadian energy sector for comparative purposes. “Operating netbacks” include revenues, operating expenses, transportation and marketing expenses, and realized gains or losses on risk management contracts. “Gross margin” is commonly used in the refining industry to reflect the net funds received from the sale of refined products after considering the cost to purchase the feedstock and is calculated by deducting purchased products for resale and processing from total revenue. “Operating income” is commonly used for comparative purposes in the petroleum and natural gas and refining industries to reflect operating results before items not directly related to operations. “Total debt”, “total capitalization” and “EBITDA” are used to assist management in assessing liquidity and the Company’s ability to meet financial obligations. The non-GAAP measures may not be comparable to similar measures by other issuers.

FORWARD-LOOKING INFORMATION

This MD&A highlights significant business results and statistics from our unaudited interim consolidated financial statements for the three and six months ended June 30, 2011 and the accompanying notes thereto. In the interest of providing our lenders and potential lenders with information regarding Harvest, including our assessment of our future plans and operations, this MD&A contains forward-looking statements that involve risks and uncertainties.

1

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Such risks and uncertainties include, but are not limited to: risks associated with conventional petroleum and natural gas operations; risks associated with refining and marketing operations; the volatility in commodity prices and currency exchange rates; risks associated with realizing the value of acquisitions; general economic, market and business conditions; changes in environmental legislation and regulations; the availability of sufficient capital from internal and external sources; and, such other risks and uncertainties described from time to time in our regulatory reports and filings made with securities regulators.

Forward-looking statements in this MD&A include, but are not limited to, the forward looking statements made in the “Outlook” section as well as statements made throughout with reference to production volumes, refinery throughput volumes, royalty rates, operating costs, commodity prices, administrative costs, price risk management activities, acquisitions and dispositions, capital spending, reserve estimates, access to credit facilities, income taxes, cash from operating activities, and regulatory changes. For this purpose, any statements that are contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements often contain terms such as “may”, “will”, “should”, “anticipate”, “expect”, “target”, “plan”, “potential”, “intend”, and similar expressions.

Readers are cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions or expectations upon which they are based will occur. Although we consider such information reasonable at the time of preparation, it may prove to be incorrect and actual results may differ materially from those anticipated. Harvest assumes no obligation to update forward-looking statements should circumstances, estimates or opinions change, except as required by law. Forward-looking statements contained in this MD&A are expressly qualified by this cautionary statement.

2

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

SELECTED INFORMATION

The table below provides a summary of Harvest’s financial and operating results for the three and six months ended June 30, 2011 and 2010.

| | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| | 2011 | | | 2010 | | | Change | | | 2011 | | | 2010 | | | Change | |

FINANCIAL | | | | | | | | | | | | | | | | | | |

Revenues(1) | $ | 746,066 | | $ | 1,024,565 | | | (27% | ) | $ | 1,964,768 | | $ | 1,594,045 | | | 23% | |

Cash from operating activities | | 107,588 | | | 121,830 | | | (12% | ) | | 254,364 | | | 199,638 | | | 27% | |

Net income (loss) | | (19,529 | ) | | (22,796 | ) | | 14% | | | 18,435 | | | (42,748 | ) | | 143% | |

| | | | | | | | | | | | | | | | | | |

Bank debt | | 171,914 | | | 182,421 | | | (6% | ) | | 171,914 | | | 182,421 | | | (6% | ) |

Senior notes | | 469,247 | | | 224,744 | | | 109% | | | 469,247 | | | 224,744 | | | 109% | |

Convertible debentures | | 743,701 | | | 770,780 | | | (4% | ) | | 743,701 | | | 770,780 | | | (4% | ) |

Total financial debt | | 1,384,862 | | | 1,177,945 | | | 18% | | | 1,384,862 | | | 1,177,945 | | | 18% | |

| | | | | | | | | | | | | | | | | | |

Total assets | $ | 6,121,547 | | $ | 4,764,141 | | | 29% | | $ | 6,121,547 | | $ | 4,764,141 | | | 29% | |

| | | | | | | | | | | | | | | | | | |

UPSTREAM OPERATIONS | | | | | | | | | | | | | | | | | | |

Daily sales volumes (boe/d) | | 55,338 | | | 49,597 | | | 12% | | | 54,340 | | | 49,886 | | | 9% | |

Average realized price | | | | | | | | | | | | | | | | | | |

Oil and NGLs ($/bbl)(2) | | 87.31 | | | 65.18 | | | 34% | | | 80.46 | | | 68.15 | | | 18% | |

Gas ($/mcf) | | 4.12 | | | 4.17 | | | (1% | ) | | 3.99 | | | 4.65 | | | (14% | ) |

Operating netback ($/boe)(2) | | 36.94 | | | 29.68 | | | 24% | | | 35.34 | | | 32.95 | | | 7% | |

| | | | | | | | | | | | | | | | | | |

Capital asset additions (excluding acquisitions) | $ | 125,501 | | $ | 52,295 | | | 140% | | $ | 363,150 | | $ | 165,821 | | | 119% | |

Property and business acquisitions (dispositions), net | $ | 411 | | | ($966 | ) | | 143% | | $ | 515,908 | | $ | 29,972 | | | 1,621% | |

Abandonment and reclamation expenditures | $ | 4,282 | | $ | 2,367 | | | 81% | | $ | 6,249 | | $ | 8,017 | | | (22% | ) |

Net wells drilled | | 14.4 | | | 10.8 | | | 33% | | | 119.3 | | | 76.7 | | | 56% | |

Net undeveloped land acquired in business combination (acres)(3) | | - | | | - | | | - | | | 223,405 | | | - | | | 100% | |

Net undeveloped land additions (acres) | | 54,560 | | | 22,773 | | | 140% | | | 108,040 | | | 45,160 | | | 139% | |

| | | | | | | | | | | | | | | | | | |

DOWNSTREAM OPERATIONS | | | | | | | | | | | | | | | | | | |

Average daily throughput (bbl/d) | | 38,016 | | | 94,833 | | | (60% | ) | | 67,563 | | | 68,073 | | | (1% | ) |

Average Refining Margin (US$/bbl) | | 8.09 | | | 8.56 | | | (5% | ) | | 10.21 | | | 5.86 | | | 74% | |

| | | | | | | | | | | | | | | | | | |

Capital asset additions | | 108,741 | | | 8,459 | | | 1,186% | | | 144,620 | | | 17,142 | | | 744% | |

| (1) | Revenues are net of royalties and the effective portion of Harvest’s realized crude oil hedges. |

| (2) | Excludes the effect of risk management contracts designated as hedges. |

| (3) | Excludes carried interest lands acquired in business combination. |

3

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

REVIEW OF OVERALL PERFORMANCE

Upstream

Sales volumes increased by 5,741 boe/d to 55,338 boe/d from the second quarter of 2010 primarily due to additional production from recently acquired properties, partially offset by production reductions due to the Plains Rainbow Pipeline outage and flooding in the SE Saskatchewan area.

Harvest’s operating netback was $36.94/boe prior to hedging for the second quarter of 2011; an increase of 24% from the same quarter in 2010, reflecting higher realized commodity prices in oil and natural gas liquids. Operating netback after hedging totaled $173.4 million as compared to $135.2 million in the same quarter of 2010. The increase in operating netback after hedging is primarily due to higher commodity prices and sales volume, partially offset by increase in operating, and transportation and marketing costs.

Capital spending of $125.5 million includes the drilling of 19.0 gross (14.4 net) wells with a success rate of 95%. In the second quarter of 2010, capital expenditures of $52.3 million were incurred to drill 13.0 gross (10.8 net) wells.

Downstream

Throughput volume averaged 38,016 bbl/d as compared to 94,833 bbl/d in the same quarter of 2010 due to a planned shutdown of the refinery units during the second quarter of 2011. Refining gross margin averaged $8.09/bbl in the second quarter of 2011, a decrease of 0.47/bbl, as compared to $8.56/bbl in the same quarter of 2010.

Operating loss totaled $9.0 million in the second quarter of 2011 as compared to operating income of $29.1 million in the same quarter of 2010. The decrease is primarily due to lower throughput and refinery margins in 2011.

Capital spending was $108.7 million as compared to $8.5 million in the same quarter of 2010. During the second quarter of 2011 and 2010, $24.9 million and $3.7 million were spent on the debottlenecking project respectively. The remaining increase in capital spending is mainly due to the capitalization of plant turnaround costs of $49.7 million and catalyst replacements of $18.0 million.

Corporate

- During the quarter, Harvest extended the credit facility agreement by two years to April 30, 2015. The minimum rate charged on the credit facility also decreased by 25 bps to 175 bps over the bankers’ acceptance rates.

4

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

UPSTREAM OPERATIONS

Summary of Financial and Operating Results

| | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| | 2011 | | | 2010 | | | Change | | | 2011 | | | 2010 | | | Change | |

FINANCIAL | | | | | | | | | | | | | | | | | | |

Petroleum and natural gas sales(2) | $ | 323,456 | | $ | 245,565 | | | 32% | | $ | 604,506 | | $ | 517,296 | | | 17% | |

Royalties | | (56,561 | ) | | (41,200 | ) | | 37% | | | (92,419 | ) | | (82,956 | ) | | 11% | |

Revenues | | 266,895 | | | 204,365 | | | 31% | | | 512,087 | | | 434,340 | | | 18% | |

| | | | | | | | | | | | | | | | | | |

Operating expenses | | 82,315 | | | 68,328 | | | 20% | | | 165,910 | | | 132,581 | | | 25% | |

Transportation and marketing | | 11,126 | | | 2,068 | | | 438% | | | 14,129 | | | 4,275 | | | 231% | |

Realized loss (gain) on risk management contracts(3) | | 16 | | | (1,200 | ) | | 101% | | | (2,208 | ) | | (187 | ) | | (1,081% | ) |

Operating netback after hedging(1)(3) | | 173,438 | | | 135,169 | | | 28% | | | 334,256 | | | 297,671 | | | 12% | |

| | | | | | | | | | | | | | | | | | |

General and administrative expenses | | 14,817 | | | 11,726 | | | 26% | | | 28,339 | | | 24,143 | | | 17% | |

Depreciation, depletion and amortization | | 127,934 | | | 117,806 | | | 9% | | | 249,278 | | | 234,140 | | | 6% | |

Exploration and evaluation | | 4,243 | | | 2,502 | | | 70% | | | 10,454 | | | 2,528 | | | 314% | |

Gain on disposition of property, plant and equipment | | (440 | ) | | (756 | ) | | (42% | ) | | (680 | ) | | (1,019 | ) | | (33% | ) |

| $ | 26,884 | | $ | 3,891 | | | 591% | | $ | 46,865 | | $ | 37,879 | | | 24% | |

| | | | | | | | | | | | | | | | | | |

Capital asset additions (excluding acquisitions) | $ | 125,501 | | $ | 52,295 | | | 140% | | $ | 363,150 | | $ | 165,821 | | | 119% | |

Property and business acquisitions (dispositions) | $ | 411 | | $ | (966 | ) | | 143% | | $ | 515,908 | | $ | 29,972 | | | 1,621% | |

Abandonment and reclamation expenditures | $ | 4,282 | | $ | 2,367 | | | 81% | | $ | 6,249 | | $ | 8,017 | | | (22% | ) |

| | | | | | | | | | | | | | | | | | |

OPERATING | | | | | | | | | | | | | | | | | | |

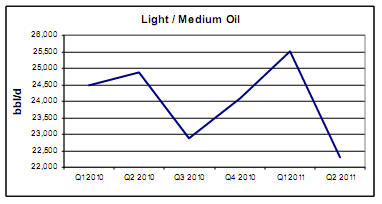

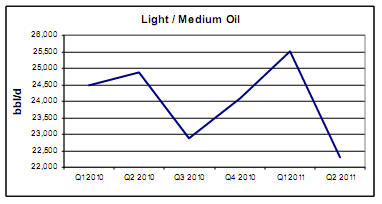

Light / medium oil (bbl/d) | | 22,294 | | | 24,874 | | | (10% | ) | | 23,900 | | | 24,681 | | | (3% | ) |

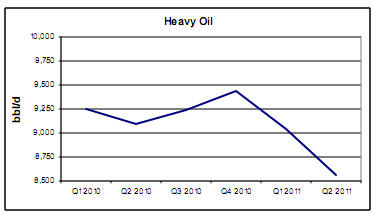

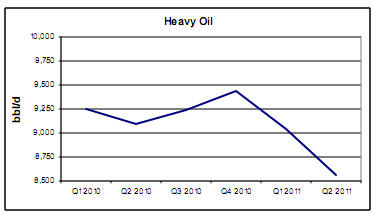

Heavy oil (bbl/d) | | 8,559 | | | 9,090 | | | (6% | ) | | 8,797 | | | 9,170 | | | (4% | ) |

Natural gas liquids (bbl/d) | | 5,937 | | | 2,334 | | | 154% | | | 4,703 | | | 2,574 | | | 83% | |

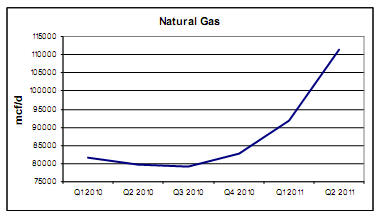

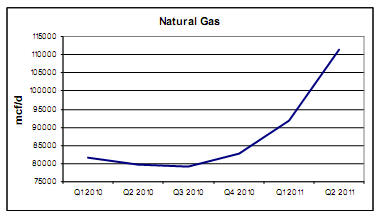

Natural gas (mcf/d) | | 111,291 | | | 79,797 | | | 39% | | | 101,643 | | | 80,769 | | | 26% | |

Total (boe/d) | | 55,338 | | | 49,597 | | | 12% | | | 54,340 | | | 49,886 | | | 9% | |

| (1) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

| (2) | Inclusive of the effective portion of Harvest’s realized crude oil hedges. |

| (3) | Realized loss (gain) on risk management contracts includes the settlement amounts for power derivative contracts and the ineffective portion of realized crude oil hedges. |

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

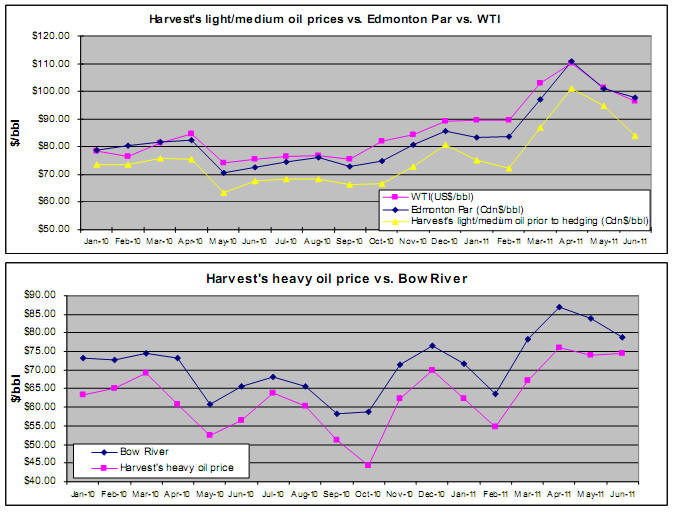

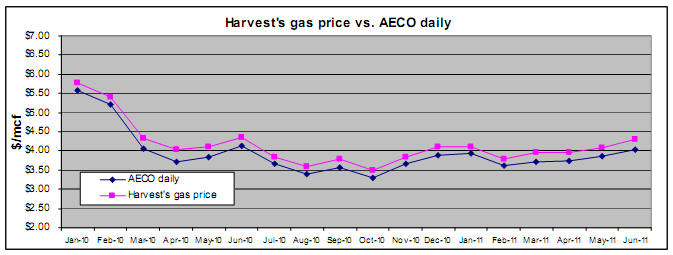

Commodity Price Environment

| | Three Months Ended | | | Six Months Ended | |

| | June 30 | | | June 30 | |

| | 2011 | | | 2010 | | | Change | | | 2011 | | | 2010 | | | Change | |

West Texas Intermediate crude oil (US$ per barrel) | | 102.56 | | | 78.03 | | | 31% | | | 98.33 | | | 78.37 | | | 25% | |

Edmonton light crude oil ($ per barrel) | | 103.26 | | | 75.14 | | | 37% | | | 95.65 | | | 77.71 | | | 23% | |

Bow River blend crude oil ($ per barrel) | | 83.25 | | | 66.56 | | | 25% | | | 77.29 | | | 70.05 | | | 10% | |

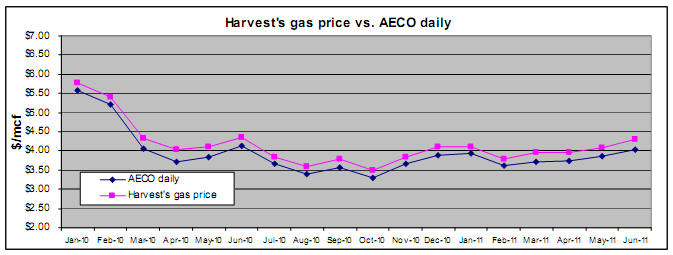

AECO natural gas daily ($ per mcf) | | 3.88 | | | 3.89 | | | - | | | 3.82 | | | 4.42 | | | (14% | ) |

Canadian / U.S. dollar exchange rate | | 1.033 | | | 0.973 | | | 6% | | | 1.024 | | | 0.967 | | | 6% | |

| | | | | | | | | | | | | | | | | | |

Differential Benchmarks | | | | | | | | | | | | | | | | | | |

Bow River blend differential to Edmonton Par ($/bbl) | $ | 20.01 | | $ | 8.58 | | | 133% | | $ | 18.36 | | $ | 7.66 | | | 140% | |

Bow River blend differential as a % of Edmonton Par | | 19.4% | | | 11.0% | | | 76% | | | 19.2% | | | 9.9% | | | 94% | |

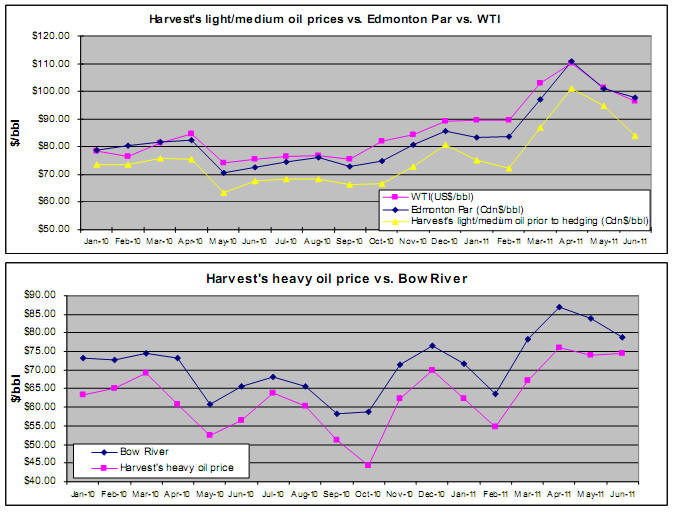

The average WTI benchmark price of $102.56 in the second quarter of 2011 was 31% higher than the second quarter 2010 average price. The average Edmonton light crude oil price (“Edmonton Par”) increased in the second quarter as well as for the six months ended June 2011, due to the higher WTI prices, the improvement of the sweet differential in the second quarter of 2011, partially offset by the stronger Canadian dollar.

During the three and six months ended June 30, 2011, the Bow River heavy oil differential relative to Edmonton Par widened, as compared to the same periods in 2010. Heavy oil differentials fluctuate based on a combination of factors including the level of heavy oil inventories, pipeline capacity to deliver heavy crude to U.S. markets and the seasonal demand for heavy oil. The Bow River blend crude oil price (“Bow River”) increased in 2011 with the higher WTI price, and partially offset by the stronger Canadian dollar and wider Bow River differential.

Realized Commodity Prices

| | Three Months Ended | | | Six Months Ended | |

| | June 30 | | | June 30 | |

| | 2011 | | | 2010 | | | Change | | | 2011 | | | 2010 | | | Change | |

Light to medium oil prior to hedging ($/bbl) | | 94.08 | | | 68.78 | | | 37% | | | 85.91 | | | 71.53 | | | 20% | |

Heavy oil ($/bbl) | | 74.84 | | | 56.51 | | | 32% | | | 68.03 | | | 61.26 | | | 11% | |

Natural gas liquids and others ($/bbl)(2) | | 79.87 | | | 60.68 | | | 32% | | | 76.02 | | | 60.25 | | | 26% | |

Natural gas ($/mcf) | | 4.12 | | | 4.17 | | | (1% | ) | | 3.99 | | | 4.65 | | | (14% | ) |

Average realized price prior to hedging ($/boe) | | 66.73 | | | 54.41 | | | 23% | | | 63.05 | | | 57.29 | | | 10% | |

| | | | | | | | | | | | | | | | | | |

Light to medium oil after hedging ($/bbl)(1) | | 87.87 | | | 68.78 | | | 28% | | | 82.29 | | | 71.53 | | | 15% | |

Average realized price after hedging ($boe)(1) | | 64.23 | | | 54.41 | | | 18% | | | 61.46 | | | 57.29 | | | 7% | |

| (1) | Inclusive of the realized gain (loss) from crude oil contracts designated as hedges. Foreign exchange and power contracts are excluded from the realized price. |

| (2) | Inclusive of sulphur revenue. |

Prior to hedging activities, our realized prices for light to medium oil for the three and six months ended June 30, 2011 increased by 37% and 20%, respectively, compared to the same periods in 2010. This is consistent with the 37% and 23% increase in Edmonton Par prices for the three and six months ended 2011.

6

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

In order to manage commodity price volatility and the impact on cash flow, Harvest has entered into various crude oil fixed-for-floating swaps. The impact of this hedging activity resulted in a decrease of $6.21/bbl (2010 – $nil) in Harvest’s realized light to medium oil price to $87.87/bbl in the second quarter of 2011. For the six months ended 2011, hedging activities resulted in a decrease of $3.62/bbl (2010 - $nil) to the realized light to medium oil price. Please see “Cash Flow Risk Management” section in this MD&A for further discussion with respect to our cash flow risk management program.

Harvest’s realized heavy oil prices for the three and six months ended June 30, 2011 increased by 32% and 11% respectively, mainly due to the increase in the Bow River prices.

For the three and six months ended June 30, 2011, our realized prices for natural gas liquids increased by $19.19/bbl (32%) and $15.77/bbl (26%), respectively, reflecting the increase in sulphur sales due to the Hunt acquisition in the first quarter of 2011 as well as the increase in natural gas liquids commodity prices.

The realized prices for Harvest’s natural gas production for the three and six months ended June 30, 2011 decreased by 1% and 14%, respectively, compared to the same periods in 2010, mainly due to the decrease in AECO benchmark prices.

7

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Sales Volumes

| | | Three Months Ended June 30 | |

| | | 2011 | | | 2010 | |

| | | Volume | | | Weighting | | | Volume | | | Weighting | | | % Volume | |

| | | | | | | | | | | | | | | Change | |

| Light to medium oil (bbl/d)(1) | | 22,294 | | | 40% | | | 24,874 | | | 50% | | | (10% | ) |

| Heavy oil (bbl/d) | | 8,559 | | | 15% | | | 9,090 | | | 18% | | | (6% | ) |

| Natural gas liquids (bbl/d) | | 5,937 | | | 11% | | | 2,334 | | | 5% | | | 154% | |

| Total liquids (bbl/d) | | 36,790 | | | 66% | | | 36,298 | | | 73% | | | 1% | |

| Natural gas (mcf/d) | | 111,291 | | | 34% | | | 79,797 | | | 27% | | | 39% | |

| Total oil equivalent (boe/d) | | 55,338 | | | 100% | | | 49,597 | | | 100% | | | 12% | |

| | | Six Months Ended June 30 | |

| | | 2011 | | | 2010 | |

| | | Volume | | | Weighting | | | Volume | | | Weighting | | | % Volume | |

| | | | | | | | | | | | | | | Change | |

| Light to medium oil (bbl/d)(1) | | 23,900 | | | 44% | | | 24,681 | | | 50% | | | (3% | ) |

| Heavy oil (bbl/d) | | 8,797 | | | 16% | | | 9,170 | | | 18% | | | (4% | ) |

| Natural gas liquids (bbl/d) | | 4,703 | | | 9% | | | 2,574 | | | 5% | | | 83% | |

| Total liquids (bbl/d) | | 37,400 | | | 69% | | | 36,425 | | | 73% | | | 3% | |

| Natural gas (mcf/d) | | 101,643 | | | 31% | | | 80,769 | | | 27% | | | 26% | |

| Total oil equivalent (boe/d) | | 54,340 | | | 100% | | | 49,886 | | | 100% | | | 9% | |

| (1) | Harvest classifies our oil production, except that produced from Hay River, as light to medium and heavy according to NI 51-101 guidance. The oil produced from Hay River has an average API of 24o(medium grade) and is classified as a light to medium oil, notwithstanding that, it benefits from a heavy oil royalty regime and therefore would be classified as heavy oil according to NI 51-101. |

8

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Total sales volumes were 55,338 boe/d for the second quarter of 2011 and 54,340 boe/d for the first six months of 2011, an increase of 12% and 9% respectively, compared to the same periods in 2010. These increases are primarily attributable to the acquisition of assets at the end of the third quarter of 2010 and the acquisition of the Hunt assets at the end of February 2011.

| Harvest’s second quarter of 2011 light/medium oil sales was 22,294 bbl/d, a 2,580 bbl/d (10%) reduction from the same quarter in 2010 and a reduction of 3,229 bbl/d (13%) from the first quarter of 2011. Harvest’s year-to-date 2011 light/medium oil sales also declined by 781 bb/d (3%) from 2010. Sales volumes declined during the second quarter of 2011 mainly due to the impact of the Plains Rainbow Pipeline outage and production disruptions associated with flooding in the SE Saskatchewan area. These decreases were partially offset by the third quarter 2010 acquisition and the Hunt acquisition in the first quarter of 2011. |

| Heavy oil sales decreased by 6% in the second quarter of 2011 and 4% year-to-date, compared to the same periods in 2010. The decreases are primarily due to natural declines. |

|

| Natural gas sales averaged 111,291 mcf/d during the second quarter of 2011 reflecting a 19,403 mcf/d (21%) increase from the first quarter of 2011 and 31,494 mcf/d (39%) increase from the second quarter of 2010. For the six months ended June 30 2011, natural gas sales increased by 20,874 mcf/d (26%), compared to 2010. These increases are mainly due to the acquisition of Hunt assets at the end of February 2011. |

9

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Revenues

| | | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| | | 2011 | | | 2010 | | | Change | | | 2011 | | | 2010 | | | Change | |

| Light / medium oil sales after hedging(1) | $ | 178,265 | | $ | 155,678 | | | 15% | | $ | 355,991 | | $ | 319,535 | | | 11% | |

| Heavy oil sales | | 58,293 | | | 46,747 | | | 25% | | | 108,325 | | | 101,678 | | | 7% | |

| Natural gas sales | | 41,704 | | | 30,253 | | | 38% | | | 73,383 | | | 68,018 | | | 8% | |

| Natural gas liquids sales and other(2) | | 45,194 | | | 12,887 | | | 251% | | | 66,807 | | | 28,065 | | | 138% | |

| Petroleum and natural gas sales | | 323,456 | | | 245,565 | | | 32% | | | 604,506 | | | 517,296 | | | 17% | |

| Royalties | | (56,561 | ) | | (41,200 | ) | | 37% | | | (92,419 | ) | | (82,956 | ) | | 11% | |

| Revenues | $ | 266,895 | | $ | 204,365 | | | 31% | | $ | 512,087 | | $ | 434,340 | | | 18% | |

| (1) | Inclusive of realized gain (loss) from crude oil contracts designated as hedges. Foreign exchange and power contracts are excluded from the sales revenue. |

| (2) | Inclusive of sulphur revenue and miscellaneous income. |

Harvest’s revenue is impacted by changes in sales volumes, commodity prices and currency exchange rates. In the second quarter of 2011, total petroleum and natural gas sales increased by $77.9 million, compared to the second quarter of 2010. The 32% increase is attributable to the increase of 18% in realized prices after hedging activities and 12% in sales volumes. For the first six months of 2011, total petroleum and natural gas sales increased by $87.2 million (17%), reflecting the increase of 7% in realized prices after hedging activities and 9% in sales volumes.

The significant increase in natural gas liquids sales for the three and six months ended June 30, 2011 is mainly due to increases in sales volumes and sulphur revenue from the acquisition of Hunt assets at the end of February 2011. Sulphur revenue represented $7.8 million of the total natural gas liquids sales for the six months ended June 30, 2011 (2010 - $0.1 million). The increase in natural gas liquids prices for the three and six months ended June 30, 2011 further increased the natural gas liquids sales.

Royalties

Harvest pays Crown, freehold and overriding royalties to the owners of mineral rights from which production is generated. These royalties vary for each property and product and our Crown royalties are based on a sliding scale dependent on production volumes and commodity prices.

For the second quarter of 2011, royalties as a percentage of gross revenue averaged 17.5% (2010 – 16.8%) . The higher royalty rate is mainly due to an Alberta Crown gas cost allowance adjustment combined with higher rates on the Hunt assets. For the six months ended June 30, 2011, royalties as a percentage of gross revenue averaged 15.3% (2010 – 16.0%) .

10

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Operating Expenses

| | Three Months Ended June 30 | |

| | | | | | | | | | | | | | Per BOE | |

| | 2011 | | | Per BOE | | | 2010 | | | Per BOE | | | Change | |

Operating expense | | | | | | | | | | | | | | | |

Power and fuel | $ | 16,599 | | $ | 3.30 | | $ | 18,671 | | $ | 4.13 | | $ | (0.83 | ) |

Well servicing | | 16,276 | | | 3.23 | | | 11,328 | | | 2.51 | | | 0.72 | |

Repairs and maintenance | | 13,578 | | | 2.70 | | | 10,199 | | | 2.26 | | | 0.44 | |

Lease rentals and property tax | | 7,977 | | | 1.58 | | | 7,713 | | | 1.71 | | | (0.13 | ) |

Labor - internal | | 6,695 | | | 1.33 | | | 5,484 | | | 1.22 | | | 0.11 | |

Labor - contract | | 5,047 | | | 1.00 | | | 3,897 | | | 0.86 | | | 0.14 | |

Chemicals | | 4,147 | | | 0.82 | | | 4,056 | | | 0.90 | | | (0.08 | ) |

Trucking | | 3,402 | | | 0.68 | | | 2,578 | | | 0.57 | | | 0.11 | |

Processing and other fees | | 4,819 | | | 0.96 | | | 3,064 | | | 0.68 | | | 0.28 | |

Other | | 3,775 | | | 0.75 | | | 1,338 | | | 0.30 | | | 0.45 | |

Total operating expenses | $ | 82,315 | | $ | 16.35 | | $ | 68,328 | | $ | 15.14 | | $ | 1.21 | |

| | | | | | | | | | | | | | | |

Transportation and marketing | $ | 11,126 | | $ | 2.21 | | $ | 2,068 | | $ | 0.46 | | $ | 1.75 | |

| | | Six Months Ended June 30 | |

| | | | | | | | | | | | | | | Per BOE | |

| | | 2011 | | | Per BOE | | | 2010 | | | Per BOE | | | Change | |

Operating expense | | | | | | | | | | | | | | | |

Power and fuel | $ | 38,150 | | $ | 3.88 | | $ | 31,716 | | $ | 3.51 | | $ | 0.37 | |

Well servicing | | 33,189 | | | 3.37 | | | 24,245 | | | 2.69 | | | 0.68 | |

Repairs and maintenance | | 26,449 | | | 2.69 | | | 20,838 | | | 2.31 | | | 0.38 | |

Lease rentals and property tax | | 15,745 | | | 1.60 | | | 15,829 | | | 1.75 | | | (0.15 | ) |

Labor - internal | | 13,743 | | | 1.40 | | | 11,738 | | | 1.30 | | | 0.10 | |

Labor - contract | | 9,120 | | | 0.93 | | | 7,917 | | | 0.88 | | | 0.05 | |

Chemicals | | 7,973 | | | 0.81 | | | 7,857 | | | 0.87 | | | (0.06 | ) |

Trucking | | 5,956 | | | 0.61 | | | 4,683 | | | 0.52 | | | 0.09 | |

Processing and other fees | | 6,126 | | | 0.62 | | | 6,979 | | | 0.77 | | | (0.15 | ) |

Other | | 9,459 | | | 0.96 | | | 779 | | | 0.08 | | | 0.88 | |

Total operating expenses | $ | 165,910 | | $ | 16.87 | | $ | 132,581 | | $ | 14.68 | | $ | 2.19 | |

| | | | | | | | | | | | | | | |

Transportation and marketing | $ | 14,129 | | $ | 1.44 | | $ | 4,275 | | $ | 0.47 | | $ | 0.97 | |

Operating costs for the second quarter of 2011 totaled $82.3 million, an increase of $14.0 million compared to the same period in 2010. The increase in operating costs is attributable to the acquisition of assets at the end of September 2010 and February 2011 combined with increased well servicing and repairs and maintenance activities. Operating costs on a per barrel basis have increased to $16.35/boe as compared to $15.14/boe in the second quarter of 2010. The 8% increase on a per barrel basis is substantially attributed to higher activity levels on well servicing and repairs and maintenance.

On a year-to-date basis, operating costs for 2011 totaled $165.9 million, an increase of $33.3 million when compared to the same period in 2010. On a per barrel basis, year-to-date operating costs increased by $2.19/boe (15%) which is attributable to higher power and fuel, well servicing, and repairs and maintenance costs.

11

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | | Three Months Ended | | | Six Months Ended | |

| | | June 30 | | | June 30 | |

($ per boe) | | 2011 | | | 2010 | | | Change | | | 2011 | | | 2010 | | | Change | |

Electric power and fuel costs | $ | 3.30 | | $ | 4.13 | | $ | (0.83 | ) | $ | 3.88 | | $ | 3.51 | | $ | 0.37 | |

Realized loss (gain) on electricity risk management contracts | | (0.07 | ) | | (0.27 | ) | | 0.20 | | | (0.27 | ) | | (0.02 | ) | | (0.25 | ) |

Net electric power and fuel costs | $ | 3.23 | | $ | 3.86 | | $ | (0.63 | ) | $ | 3.61 | | $ | 3.49 | | $ | 0.12 | |

| | | | | | | | | | | | | | | | | | |

Alberta Power Pool electricity price ($ per MWh) | $ | 52.12 | | $ | 80.56 | | $ | (28.44 | ) | $ | 67.73 | | $ | 60.72 | | $ | 7.01 | |

Power and fuel costs, comprised primarily of electric power costs, represented approximately 20% of our total operating costs during the second quarter of 2011 (2010 – 27%). The 11% decrease from the second quarter of 2010 is primarily attributable to the decrease in the average Alberta electric power price to $52.12/MWh in the second quarter of 2011 from $80.56/MWh in 2010. The power and fuel costs for the first six months of 2011 totaled $38.2 million, an increase of 20% compared to 2010, mainly attributable to the higher average power prices (2011 - $67.73/MWh; 2010 - $60.72/MWh) .

Transportation and marketing costs relate primarily to delivery of natural gas to Alberta’s natural gas sales hub, the AECO Storage Hub, and the cost of trucking clean crude oil to pipeline receipt points. As a result, the total dollar amount of costs fluctuates in relation with our production volumes. The transportation and marketing expense increased by $1.75/boe or $9.1 million in the second quarter of 2011 compared to the second quarter of 2010. Year-to-date 2011 transportation and marketing expense increased by $0.97/boe or $9.9 million compared to the same period in 2010. The primary reason for the increases is due to the outage of the Plains Rainbow Pipeline in the second quarter of 2011. In response to the outage, Harvest incurred higher oil trucking costs at Hay and Red Earth.

Operating Netback

| | | Three Months Ended | | | Six Months Ended | |

| | | June 30 | | | June 30 | |

($ per BOE) | | 2011 | | | 2010 | | | Change | | | 2011 | | | 2010 | | | Change | |

Petroleum and natural gas sales prior to hedging | $ | 66.73 | | $ | 54.41 | | | 23% | | $ | 63.05 | | $ | 57.29 | | | 10% | |

Royalties | | (11.23 | ) | | (9.13 | ) | | 23% | | | (9.40 | ) | | (9.19 | ) | | 2% | |

Operating expense | | (16.35 | ) | | (15.14 | ) | | 8% | | | (16.87 | ) | | (14.68 | ) | | 15% | |

Transportation expense | | (2.21 | ) | | (0.46 | ) | | 380% | | | (1.44 | ) | | (0.47 | ) | | 206% | |

Operating netback prior to hedging(1) | | 36.94 | | | 29.68 | | | 24% | | | 35.34 | | | 32.95 | | | 7% | |

Hedging gain (loss)(2) | | (2.50 | ) | | 0.27 | | | (1,026% | ) | | (1.37 | ) | | 0.02 | | | (6,950% | ) |

Operating netback after hedging(1) | $ | 34.44 | | $ | 29.95 | | | 15% | | $ | 33.97 | | $ | 32.97 | | | 3% | |

| (1) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

| (2) | Hedging gain (loss) includes the settlement amounts for crude oil and power contracts. |

Harvest’s operating netback represents the net amount realized on a per boe basis after deducting directly related costs. In the second quarter of 2011, operating netback prior to hedging increased by $7.26/boe or 24% compared to the second quarter of 2010. For year-to-date 2011, operating netback prior to hedging increased by $2.39/boe, an increase of 7% when compared to the same period in 2010. The increase is primarily attributable to increases in realized commodity prices and sales volumes, partially offset by increases in royalties, operating costs and transportation costs.

12

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

General and Administrative (“G&A”) Expense

| | | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| | | 2011 | | | 2010 | | | Change | | | 2011 | | | 2010 | | | Change | |

| G&A expense | $ | 14,817 | | $ | 11,726 | | | 26% | | $ | 28,339 | | $ | 24,143 | | | 17% | |

| G&A per boe ($/boe ) | $ | 2.94 | | $ | 2.60 | | | 13% | | $ | 2.88 | | $ | 2.67 | | | 8% | |

For the second quarter of 2011, G&A expense increased by $3.1 million compared to $11.7 million in the second quarter of 2010. For the first six months of 2011, G&A expense totaled $28.3 million, an increase of approximately $4.2 million when compared to the same period in 2010. The increase in G&A is primarily due to increased salary expense. Approximately 92% of the G&A expenses are related to salaries and other employee related costs. Harvest does not have a stock option program, however there is a long-term cash incentive program.

Depletion, Depreciation and Amortization (“DDA”)

| | | Three Months Ended | | | Six Months Ended | |

| | | | | | June 30 | | | | | | | | | June 30 | | | | |

| | | 2011 | | | 2010 | | | Change | | | 2011 | | | 2010 | | | Change | |

| | | | | | | | | | | | | | | | | | | |

| Depletion, depreciation and amortization | $ | 127,934 | | $ | 117,806 | | | 9% | | $ | 249,278 | | $ | 234,140 | | | 6% | |

| Per BOE ($/BOE) | $ | 25.41 | | $ | 26.10 | | | (3% | ) | $ | 25.34 | | $ | 25.93 | | | (2% | ) |

DDA expense for the three and six months ended June 30, 2011 increased by $10.1million and $15.1 million, respectively, compared to the same periods in 2010, mainly due to higher sales volumes.

Capital Expenditures

| | | Three Months Ended | | | Six Months Ended | |

| | | June 30 | | | June 30 | |

| | 2011 | | | 2010 | | | Change | | | 2011 | | | 2010 | | | Change | |

Drilling and completion | $ | 55,511 | | $ | 20,998 | | | 164% | | $ | 193,208 | | $ | 94,757 | | | 104% | |

Well equipment, pipelines and facilities | | 40,372 | | | 16,225 | | | 149% | | | 98,061 | | | 45,730 | | | 114% | |

Geological and geophysical | | 3,132 | | | 2,878 | | | 9% | | | 13,932 | | | 11,429 | | | 22% | |

Land and undeveloped lease rentals | | 4,410 | | | 10,236 | | | (57% | ) | | 10,100 | | | 10,407 | | | (3% | ) |

Capitalized G&A expenses | | 2,570 | | | 1,825 | | | 41% | | | 4,922 | | | 3,178 | | | 55% | |

Furniture, leaseholds and office equipment | | 405 | | | 133 | | | 205% | | | 1,051 | | | 320 | | | 228% | |

| | 106,400 | | | 52,295 | | | 103% | | | 321,274 | | | 165,821 | | | 94% | |

BlackGold oil sands | | 19,101 | | | - | | | 100% | | | 41,876 | | | - | | | 100% | |

Total development capital expenditures excluding acquisitions | $ | 125,501 | | $ | 52,295 | | | 140% | | $ | 363,150 | | $ | 165,821 | | | 119% | |

The second quarter of 2011 was more active for Harvest when compared to the same quarter in 2010. Total capital spending excluding BlackGold for the second quarter of 2011 was $106.4 million as compared to $52.3 million in the second quarter of 2010. In particular, capital spending on well equipment, pipelines and facilities increased by 149% as compared to the same quarter in 2010 due to increase in activities related to tie-in of wells drilled in Q1 2011, particularly in the Hay, Red Earth and Crossfield areas. During the second quarter of 2011, Harvest drilled 6 gross (5.8 net) horizontal wells in the Kindersley area in the Viking light oil formation and completed an additional 7 wells drilled in Q1 2011 for a total expenditure of $11.0 million. In SE Saskatchewan, Harvest drilled one (gross/net) light oil well into the Tilston formation. In the heavy oil areas, Harvest drilled 4 gross (3.3 net) wells in the Dina formation in Lloydminster and one (gross/net) well into the Glauc formation at Suffield for a total expenditure of $12.4 million. Building on the success of the Q1 2011 program into the Company’s liquids rich natural gas opportunities, Harvest drilled 5 gross (2.0 net) wells including a Falher horizontal well in the Peace River Arch Deep basin for a total expenditure of $12.3 million. In addition, Harvest spent $18.8 million in the second quarter of 2011 to complete wells drilled in Q1 2011 in the Hay, Crossfield and Red Earth areas.

13

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Capital spending excluding BlackGold for the six months ended June 30, 2011 totaled $321.3 million (2010 - $165.8 million). For the first six months in 2011, Harvest drilled a total of 134.0 gross (119.3 net) wells (2010 – 93.0 gross and 76.7 net wells). The increase in capital spending compared to 2010 is due to a more active winter drilling program in the Company’s large resource oil pools.

Below is a summary of the wells drilled by Harvest during the three and six months ended June 30, 2011. For the second quarter of 2011, Harvest’s overall success rate was 95%.

| | | June 30, 2011 | |

| | | Three Months Ended | | | Six Months Ended | |

| Area | | Gross | | | Net | | | Gross | | | Net | |

| Hay River | | - | | | - | | | 38.0 | | | 38.0 | |

| Red Earth | | - | | | - | | | 23.0 | | | 21.0 | |

| Rimbey/Markerville | | 1.0 | | | 0.4 | | | 10.0 | | | 4.9 | |

| Lloydminster Heavy Oil | | 4.0 | | | 3.3 | | | 12.0 | | | 11.3 | |

| Kindersley | | 6.0 | | | 5.8 | | | 13.0 | | | 12.8 | |

| SE Saskatchewan | | 1.0 | | | 1.0 | | | 4.0 | | | 4.0 | |

| Crossfield | | - | | | - | | | 3.0 | | | 2.4 | |

| Suffield | | 1.0 | | | 1.0 | | | 3.0 | | | 3.0 | |

| Other Areas | | 6.0 | | | 2.9 | | | 16.0 | | | 9.9 | |

| Oil sands | | - | | | - | | | 12.0 | | | 12.0 | |

| Total | | 19.0 | | | 14.4 | | | 134.0 | | | 119.3 | |

BlackGold oil sands

The BlackGold oil sands project continued to progress in the second quarter of 2011 but with reduced site activities due to spring break-up conditions. For the three and six months ended June 30, 2011, Harvest invested a total of $19.1 million (2010 - $nil) and $41.9 million (2010 - $nil) respectively, in the BlackGold oil sands project for the construction of the central processing facility and well pads.

Decommissioning Liabilities

Harvest’s decommissioning liabilities increased by $52.8 million during the first six months of 2011 mainly as a result of $38.0 million of liabilities acquired from Hunt, combined with accretion of $11.7 million, new liabilities of $6.2 million incurred on new drills and a revision of estimates of $3.1 million, partially offset by $6.2 million of reclamation and abandonment expenditures.

14

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

DOWNSTREAM OPERATIONS

| | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| | 2011 | | | 2010 | | | Change | | | 2011 | | | 2010 | | | Change | |

FINANCIAL | | | | | | | | | | | | | | | | | | |

Refined products sales(1) | | 479,171 | | | 820,200 | | | (42% | ) | | 1,452,681 | | | 1,159,705 | | | 25% | |

Purchased products for processing and resale(1) | | 441,037 | | | 732,643 | | | (40% | ) | | 1,302,829 | | | 1,064,039 | | | 22% | |

Gross margin(2) | | 38,134 | | | 87,557 | | | (56% | ) | | 149,852 | | | 95,666 | | | 57% | |

| | | | | | | | | | | | | | | | | | |

Operating expense | | 25,723 | | | 29,082 | | | (12% | ) | | 51,806 | | | 57,737 | | | (10% | ) |

Purchased energy expense | | 20,136 | | | 27,040 | | | (26% | ) | | 47,992 | | | 42,470 | | | 13% | |

Marketing expense | | 1,239 | | | 2,364 | | | (48% | ) | | 2,933 | | | 3,315 | | | (12% | ) |

Operating income (loss)(2) | | (8,964 | ) | | 29,071 | | | (131% | ) | | 47,121 | | | (7,856 | ) | | 700% | |

| | | | | | | | | | | | | | | | | | |

General and administrative | | 441 | | | 441 | | | - | | | 882 | | | 882 | | | - | |

Depreciation and amortization | | 22,276 | | | 20,179 | | | 10% | | | 41,676 | | | 40,624 | | | 3% | |

| | (31,681 | ) | | 8,451 | | | (475% | ) | | 4,563 | | | (49,362 | ) | | 109% | |

| | | | | | | | | | | | | | | | | | |

Capital expenditures | | 108,741 | | | 8,459 | | | 1,186% | | | 144,620 | | | 17,142 | | | 744% | |

| | | | | | | | | | | | | | | | | | |

OPERATING | | | | | | | | | | | | | | | | | | |

Feedstock volume (bbl/d)(3) | | 38,016 | | | 94,833 | | | (60% | ) | | 67,563 | | | 68,073 | | | (1% | ) |

| | | | | | | | | | | | | | | | | | |

Yield (% of throughput volume)(4) | | | | | | | | | | | | | | | | | | |

Gasoline and related products | | 33% | | | 34% | | | (3% | ) | | 32% | | | 31% | | | 3% | |

Ultra low sulphur diesel and jet fuel | | 41% | | | 41% | | | - | | | 37% | | | 38% | | | (3% | ) |

High sulphur fuel oil | | 25% | | | 27% | | | (7% | ) | | 28% | | | 29% | | | (3% | ) |

Total | | 99% | | | 102% | | | (3% | ) | | 97% | | | 98% | | | (1% | ) |

| | | | | | | | | | | | | | | | | | |

Average refining gross margin (US$/bbl)(5) | | 8.09 | | | 8.56 | | | (5% | ) | | 10.21 | | | 5.86 | | | 74% | |

| (1) | Refined product sales and purchased products for processing and resale are net of intra- million for the three and six months ended June 30, 2011 respectively (2010 - $120.8 million the refined products produced by the refinery and sold by the marketing division. |

| (2) | These are non-GAAP measures; please refer to “Non-GAAP Measures” in this MD&A. |

| (3) | Barrels per day are calculated using total barrels of crude oil feedstock and vacuum gas oil. |

| (4) | Based on production volumes after adjusting for changes in inventory held for resale. |

| (5) | Average refining gross margin is calculated based on per barrel of feedstock throughput. |

Refining Benchmark Prices

| | | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| | | 2011 | | | 2010 | | | Change | | | 2011 | | | 2010 | | | Change | |

| WTI crude oil (US$/bbl) | | 102.56 | | | 78.03 | | | 31% | | | 98.33 | | | 78.37 | | | 25% | |

| Brent crude oil (US$/bbl) | | 117.17 | | | 79.94 | | | 47% | | | 111.09 | | | 78.63 | | | 41% | |

| Mars premium (discount) (US$/bbl) | | 9.41 | | | (1.58 | ) | | 696% | | | 8.43 | | | 2.25 | | | 275% | |

| 2-1-1 crack spread (US$/bbl) | | 26.67 | | | 11.78 | | | 126% | | | 23.77 | | | 10.08 | | | 136% | |

| RBOB crack spread (US$/bbl) | | 27.84 | | | 13.04 | | | 113% | | | 22.81 | | | 11.25 | | | 103% | |

| Heating Oil crack spread (US$/bbl) | | 25.50 | | | 10.51 | | | 143% | | | 24.72 | | | 8.90 | | | 178% | |

| High Sulphur Fuel Oil discount (US$/bbl) | | (1.61 | ) | | (8.79 | ) | | (82% | ) | | (3.56 | ) | | (8.38 | ) | | (58% | ) |

| Canadian / U.S. dollar exchange rate | | 1.033 | | | 0.973 | | | 6% | | | 1.024 | | | 0.967 | | | 6% | |

15

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Summary of Gross Margins

| | | Three Months Ended June 30 | |

| | | | | | 2011 | | | | | | | | | 2010 | | | | |

| | | (000’s | | | Volumes | | | | | | (000’s | | | Volumes | | | | |

| | | Cdn $) | | | (000’s bbls) | | | (US$/bbl) | | | Cdn $) | | | (000’s bbls) | | | (US$/ bbl) | |

| Refinery | | | | | | | | | | | | | | | | | | |

| Sales | | | | | | | | | | | | | | | | | | |

| Gasoline products | | 151,725 | | | 1,193 | | $ | 131.38 | | $ | 275,023 | | | 3,025 | | $ | 88.46 | |

| Distillates | | 190,185 | | | 1,515 | | | 129.68 | | | 351,691 | | | 3,838 | | | 89.16 | |

| High sulphur fuel oil | | 96,800 | | | 1,006 | | | 99.40 | | | 164,573 | | | 2,331 | | | 68.70 | |

| Total sales | | 438,710 | | | 3,714 | | | 122.02 | | | 791,287 | | | 9,194 | | | 83.74 | |

| | | | | | | | | | | | | | | | | | | |

| Feedstock(1) | | | | | | | | | | | | | | | | | | |

| Middle Eastern | | 337,646 | | | 3,143 | | | 110.97 | | | 490,136 | | | 6,539 | | | 72.93 | |

| Russian | | - | | | - | | | - | | | 15,897 | | | 194 | | | 79.73 | |

| South American | | - | | | - | | | - | | | 92,971 | | | 1,368 | | | 66.13 | |

| | | 337,646 | | | 3,143 | | | 110.97 | | | 599,004 | | | 8,101 | | | 71.95 | |

| Vacuum gas oil | | 34,633 | | | 316 | | | 113.21 | | | 43,209 | | | 529 | | | 79.48 | |

| Total feedstock | | 372,279 | | | 3,459 | | | 111.18 | | | 642,213 | | | 8,630 | | | 72.41 | |

| Other(2) | | 39,347 | | | | | | | | | 73,172 | | | | | | | |

| Total feedstock and other costs | | 411,626 | | | | | | | | | 715,385 | | | | | | | |

| Refinery gross margin(3) | $ | 27,084 | | | | | $ | 8.09 | | $ | 75,902 | | | | | $ | 8.56 | |

| | | | | | | | | | | | | | | | | | | |

| Marketing | | | | | | | | | | | | | | | | | | |

| Sales | | 164,817 | | | | | | | | | 149,673 | | | | | | | |

| Cost of products sold | | 153,767 | | | | | | | | | 138,018 | | | | | | | |

| Marketing gross margin(3) | $ | 11,050 | | | | | | | | $ | 11,655 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Total gross margin(3) | $ | 38,134 | | | | | | | | $ | 87,557 | | | | | | | |

| (1) | Cost of feedstock includes all costs of transporting the crude oil to the refinery in Newfoundland. |

| (2) | Includes inventory adjustments and additives and blendstocks |

| (3) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

16

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

| | | Six Months Ended June 30 | |

| | | 2011 | | | 2010 | |

| | | | | | Volumes | | | | | | | | | | | | | |

| | | (000’s | | | (000’s | | | | | | (000’s | | | Volumes | | | | |

| | | Cdn $) | | | bbls) | | | (US$/bbl) | | | Cdn $) | | | (000’s bbls) | | | (US$/ bbl) | |

| Refinery | | | | | | | | | | | | | | | | | | |

| Sales | | | | | | | | | | | | | | | | | | |

| Gasoline products | $ | 497,608 | | | 4,387 | | $ | 116.15 | | $ | 360,387 | | | 3,972 | | $ | 87.74 | |

| Distillates | | 564,576 | | | 4,606 | | | 125.52 | | | 463,998 | | | 5,053 | | | 88.80 | |

| High sulphur fuel oil | | 308,838 | | | 3,481 | | | 90.85 | | | 277,942 | | | 3,861 | | | 69.61 | |

| Total sales | | 1,371,022 | | | 12,474 | | | 112.55 | | | 1,102,327 | | | 12,886 | | | 82.72 | |

| | | | | | | | | | | | | | | | | | | |

| Feedstock(1) | | | | | | | | | | | | | | | | | | |

| Middle Eastern | | 1,147,398 | | | 11,791 | | | 99.65 | | | 669,592 | | | 8,788 | | | 73.68 | |

| Russian | | 1,311 | | | 14 | | | 95.89 | | | 128,480 | | | 1,552 | | | 80.05 | |

| South American | | - | | | - | | | - | | | 97,455 | | | 1,430 | | | 65.90 | |

| | | 1,148,709 | | | 11,805 | | | 99.64 | | | 895,527 | | | 11,770 | | | 73.57 | |

| Vacuum gas oil | | 44,683 | | | 423 | | | 108.17 | | | 45,070 | | | 551 | | | 79.10 | |

| Total feedstock | | 1,193,392 | | | 12,228 | | | 99.94 | | | 940,597 | | | 12,321 | | | 73.82 | |

| Other(2) | | 55,743 | | | | | | | | | 87,111 | | | | | | | |

| Total feedstock and other costs | | 1,249,135 | | | | | | | | | 1,027,708 | | | | | | | |

| Refinery gross margin(3) | $ | 121,887 | | | | | $ | 10.21 | | $ | 74,619 | | | | | $ | 5.86 | |

| | | | | | | | | | | | | | | | | | | |

| Marketing | | | | | | | | | | | | | | | | | | |

| Sales | | 322,400 | | | | | | | | | 265,824 | | | | | | | |

| Cost of products sold | | 294,435 | | | | | | | | | 244,777 | | | | | | | |

| Marketing gross margin(3) | $ | 27,965 | | | | | | | | $ | 21,047 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Total gross margin(3) | $ | 149,852 | | | | | | | | $ | 95,666 | | | | | | | |

| (1) | Cost of feedstock includes all costs of transporting the crude oil to the refinery in Newfoundland. |

| (2) | Includes inventory adjustments and additives and blendstocks |

| (3) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

Feedstock throughput averaged 38,016 bbl/d in the second quarter of 2011, a decrease of 60% from 94,833 bbl/d average feedstock throughput in the second quarter of the prior year. The decrease in average throughput rates is a result of the shutdown of the refinery units in May 2011 for a planned turnaround. The daily average throughput rate for the six months ended June 30, 2011 is comparable to the same period in the prior year due to an unplanned shutdown for fire repairs in 2010.

The decrease in the refinery gross margin for the three months ended June 30, 2011 as compared to the second quarter of 2010 reflects the impact from the planned turnaround. For the six months ended June 30, 2011 refinery gross margins increased as compared to the prior year reflecting significantly stronger global refinery margin, partially offset by the increase in sour crude premium. The Downstream operations’ refining gross margin is impacted by several factors including the configuration of the refinery product yields, timing of sales under the Supply and Offtake Agreement (‘SOA”) with Vitol Refining S.A., transportation costs, location differentials, quality differentials and variability in our throughput volume over a given period of time.

17

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Refinery sales decreased by $352.6 million in the second quarter of 2011 from $791.3 million in the same quarter of 2010 due to the shutdown of the refinery units. The increase of $268.7 million for refinery sales for the six months ended June 30, 2011 as compared to the six months ended June 30, 2010 is mainly the result of higher market prices on refined products.

The cost of our crude oil feedstock before vacuum gas oil (“VGO”) in the second quarter of 2011 was US$8.41/bbl premium to the benchmark WTI as compared to a discount of US$6.08/bbl in the same period of the prior year. Similarly, the cost of crude oil feedstock before VGO for the six months ended June 30, 2011 was US$1.31/bbl premium to the benchmark WTI as compared to a discount of US$4.80/bbl in 2010. The change from a discount to a premium is a result of the widening spread between WTI and Brent.

During the three months ended June 30, 2011, the Canadian dollar continued to strengthen as compared to the US dollar. The strengthening of the Canadian dollar in 2011 has negatively impacted the contribution from our refinery operations relative to the prior year as substantially all of its gross margin, cost of purchased energy and marketing expense are denominated in U.S. dollars.

Operating Expenses

| | | Three Months Ended June 30 | |

| | | 2011 | | | 2010 | |

| | | Refining | | | Marketing | | | Total | | | Refining | | | Marketing | | | Total | |

| | | | | | | | | | | | | | | | | | | |

| Operating cost | | 20,922 | | | 4,801 | | | 25,723 | | | 24,509 | | | 4,573 | | | 29,082 | |

| Purchased energy | | 20,136 | | | - | | | 20,136 | | | 27,040 | | | - | | | 27,040 | |

| | | 41,058 | | | 4,801 | | | 45,859 | | | 51,549 | | | 4,573 | | | 56,122 | |

| ($/bbl of feedstock throughput) | | | | | | | | | | | | | | | | |

| Operating cost | | 6.05 | | | - | | | - | | | 2.84 | | | - | | | - | |

| Purchased energy | | 5.82 | | | - | | | - | | | 3.13 | | | - | | | - | |

| | | 11.87 | | | - | | | - | | | 5.97 | | | - | | | - | |

| | | Six Months Ended June 30 | |

| | | 2011 | | | 2010 | |

| | | Refining | | | Marketing | | | Total | | | Refining | | | Marketing | | | Total | |

| | | | | | | | | | | | | | | | | | | |

| Operating cost | | 42,499 | | | 9,307 | | | 51,806 | | | 49,653 | | | 8,084 | | | 57,737 | |

| Purchased energy | | 47,992 | | | - | | | 47,992 | | | 42,470 | | | - | | | 42,470 | |

| | | 90,491 | | | 9,307 | | | 99,798 | | | 92,123 | | | 8,084 | | | 100,207 | |

| ($/bbl of feedstock throughput) | | | | | | | | | | | | | | | | |

| Operating cost | | 3.48 | | | - | | | - | | | 4.03 | | | - | | | - | |

| Purchased energy | | 3.92 | | | - | | | - | | | 3.45 | | | - | | | - | |

| | | 7.40 | | | - | | | - | | | 7.48 | | | - | | | - | |

During the three months ended June 30, 2011, refining operating costs per barrel of feedstock throughput increased 113% as compared to the same period in the prior year. The higher cost per barrel in the second quarter of 2011 reflects the lower throughput volume from the planned maintenance in May. During the six months ended June 30, 2011, refining operating costs per barrel of feedstock throughput decreased 14% as compared to the prior year. Maintenance costs were higher in 2010 due to repairs from the fire.

18

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Purchased energy, consisting of low sulphur fuel oil (“LSFO”) and electricity, is required to provide heat and power to refinery operations. Purchased energy costs in the second quarter of 2011 decreased 26% from the second quarter of 2010 due to a volume variance of US$16.7 million offset by a price variance of US$11.7 million. During the six months ended June 30, 2011 purchased energy costs increased 13% as compared to the prior year. The increase in costs is a result of a price variance of US$13.3 million offset by a volume variance of US$6.0 million. The increase in the per barrel cost of energy is attributable to the decreased throughput rates in 2011.

Capital Expenditures

Capital spending for the three and six months ended June 30, 2011 totaled $108.7 million and $144.6 million respectively (2010 - $8.5 million and $17.1 million respectively) relating to various capital improvement projects including $24.9 million and $40.8 million respectively (2010 - $3.7 million and $9.6 million respectively) for the debottlenecking project. The remaining increase in capital spending for the three and six months ended June 30, 2011 is mainly due to the capitalization of turnaround costs of $49.7 million and $53.9 million, respectively, as well as the replacement of catalysts for $18.0 million and $29.7 million, respectively.

Depreciation and Amortization Expense

| | | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| | | 2011 | | | 2010 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | |

| Refining | | 21,349 | | | 19,340 | | | 39,828 | | | 38,913 | |

| Marketing | | 927 | | | 839 | | | 1,848 | | | 1,711 | |

| Total depreciation and amortization | | 22,276 | | | 20,179 | | | 41,676 | | | 40,624 | |

The process units are amortized over an average useful life of 20 to 30 years.

19

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

RISK MANAGEMENT, FINANCING AND OTHER

Cash Flow Risk Management

The following is a summary of Harvest’s risk management contracts outstanding at June 30, 2011:

| Contracts not Designated as Hedges | |

| Contract Quantity | | Type of Contract | | | Term | | | Contract Price | | | Fair value | |

| 30 MWh | | Electricity price swap contracts | | | Jan - Dec 2011 | | | Cdn $46.87 | | $ | 3,966 | |

| Contracts Designated as Hedges | |

| Contract quantity | | Type of Contract | | | Term | | | Contract Price | | | Fair value | |

| 8200 bbls/d | | Crude oil price swap contract | | | Jan - Dec 2011 | | | US $91.23/bbl | | $ | (8,241 | ) |

| 5000 bbls/d | | Crude oil price swap contract | | | Feb - Dec 2011 | | | US $95.82/bbl | | | (952 | ) |

| 3200 bbls/d | | Crude oil price swap contract | | | Mar - Dec 2011 | | | US $95.87/bbl | | | (581 | ) |

| 4200 bbls/d | | Crude oil price swap contract | | | Jan – Dec 2012 | | | US $111.37/bbl | | | 16,794 | |

| 20,600 bbls/d | | | | | | | | | | $ | 7,020 | |

For the second quarter of 2011, Harvest recognized a realized gain of $0.3 million and an unrealized loss of $0.6 million in the consolidated statement of income relating to the electricity price swap contracts. For the first six months of 2011, the total realized and unrealized gain recognized was $2.6 million and $3.0 million respectively. In comparison to 2010, Harvest had electricity price swap contracts in place for 25.0 MWh from January to December 2010 at an average contract price of $59.22/MWh. Harvest recognized a realized and unrealized gain of $1.2 million and $2.2 million, respectively, for the second quarter of 2010. For the six months ended June 30, 2010, the total realized and unrealized gain recognized was $0.2 million and $2.3 million respectively.

The Company enters into crude oil swap contracts to reduce the volatility of cash flows from some of its forecast sales. The swaps are designated as cash flow hedges and are entered into for periods consistent with the forecast petroleum sales. The effective portion of the unrealized gain for the three months and unrealized loss for the six months ended June 30, 2011 of $41.8million (2010 – $nil) and $0.9 million (2010 – $nil) respectively (net of tax of $15.2 million and $0.3 million recovery, respectively)was included in other comprehensive income. The ineffective portion of the unrealized gains for the three and six months ended June 30, 2011 recognized in net income were $0.4 million and $0.1 million respectively. The amount removed from accumulated other comprehensive income during the period and included in petroleum, natural gas, and refined product sales was $9.2million (2010 – $nil) and $11.5million (2010 – $nil) (net of tax of $3.3 million and $4.2 million) for the three and six months ended June 30, 2011 respectively. The Company expects that the $5.6million of gains reported in accumulated other comprehensive income will be released to net income within the next eighteen months. The ineffective portion of the realized cash flow hedges recognized in net income for the three and six months ended June 30, 2011 was $0.3 million (2010 – $nil) and $0.4 million (2010 – $nil) of losses respectively.

20

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Financing Costs

| | | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| | | 2011 | | | 2010 | | | Change | | | 2011 | | | 2010 | | | Change | |

| Bank loan | $ | 1,413 | | $ | 1,337 | | | 6% | | $ | 3,046 | | $ | 2,707 | | | 13% | |

| Convertible Debentures | | 12,452 | | | 12,816 | | | (3% | ) | | 24,779 | | | 26,307 | | | (6% | ) |

| Senior notes | | 8,702 | | | 3,950 | | | 120% | | | 17,479 | | | 8,356 | | | 109% | |

| Amortization of deferred finance charges | | 257 | | | 187 | | | 37% | | | 538 | | | 187 | | | 188% | |

| Interest and other financing charges | $ | 22,824 | | $ | 18,290 | | | 25% | | $ | 45,842 | | $ | 37,557 | | | 22% | |

| Capitalized interest | | (1,987 | ) | | - | | | (100% | ) | | (3,284 | ) | | - | | | (100% | ) |

| | | 20,837 | | | 18,290 | | | 14% | | | 42,558 | | | 37,557 | | | 13% | |

| Accretion of decommissioning liabilities | | 6,047 | | | 5,733 | | | 5% | | | 11,843 | | | 11,456 | | | 3% | |

| Total finance costs | $ | 26,884 | | $ | 24,023 | | | 12% | | $ | 54,401 | | $ | 49,013 | | | 11% | |

Interest and other financing charges for the three and six months ended June 30, 2011, including the amortization of related financing costs increased by $4.5 million (25%) and $8.3 million (22%), respectively, compared to the same periods in 2010. The increase from prior year is primarily due to the increased amount of senior notes principle outstanding during the three and six months ended 2011, compared to 2010.

Interest expense on Harvest’s bank loan for the three and six months ended June 30, 2011 was $1.4 million (2010 - $1.3 million) and $3.0 million (2010 - $2.7 million) respectively. Interest charges on our bank loan reflected an effective interest rate of 2.94% and 2.99%, respectively, compared to 1.95% and 1.51% for the same periods in 2010. Interest rate for the three and six months ended June 30, 2011 reflects amended terms to our bank loan that was amended on April 29, 2011 whereby the minimum rate charged was amended from 200 bps to 175 bps over the bankers’ acceptance rates. For further discussion of the amendments, please see the “Capital Resources” section of the MD&A.

Interest expense on our senior notes totaled $8.7 million and $17.5 million, respectively, for the three and six months ended June 30, 2011, an increase of $4.8 (120%) million and $9.1 million (109%) when compared to the same periods in 2010. The increase is due to the higher principle balance of the 67/8% senior notes issued in the fourth quarter of 2010, as compared to the 77/8% senior notes outstanding during the first six months of 2010, which were fully redeemed by the end of the 2010 fiscal year.

During the three and six months ended June 30, 2011, a total of $2.0 million and $3.3 million of interest expense, respectively, was capitalized to the BlackGold oil sands project and the Downstream debottlenecking project. No interest expense was capitalized for the same periods in 2010.

Currency Exchange

Currency exchange gains and losses are attributed to the changes in the value of the Canadian dollar relative to the U.S. dollar on our U.S. dollar denominated 67/8% Senior Notes as well as any other U.S. dollar cash balances. At June 30, 2011, the Canadian dollar has strengthened compared to December 31, 2010, resulting in an unrealized foreign exchange gain of $1.5 million (2010 - $3.4 million gain) and $11.1 million (2010 - $3.3 million loss) for the three and six months ended June 30, 2011. Harvest recognized a realized foreign exchange loss of $nil (2010 - $5.6 million loss) and a realized foreign exchange gain of $0.2 million (2010 - $5.2 million loss) for the three and six months ended June 30, 2011, respectively, as a result of the settlement of U.S. dollar denominated transactions.

21

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

The cumulative translation adjustment recognized in other comprehensive income represents the translation of the Downstream operation’s U.S. dollar functional currency financial statements to Canadian dollars using the current rate method. During the three and six months ended June 30 2011, the strengthening of the Canadian dollar relative to the U.S. dollar resulted in a $5.0 million and $28.9 million net cumulative translation loss respectively (2010 – $46.5 million gain and $19.9 million gain respectively), as the weaker U.S. dollar results in a decrease in the relative value of the net assets in our Downstream operations.

Deferred Income Taxes

For the three and six months ended June 30, 2011, Harvest recorded a deferred income tax recovery of $10.8 million and $7.1 million respectively. Our deferred income tax liability will fluctuate during each accounting period to reflect changes in the respective temporary differences between the book value and tax basis of their assets as well as further legislative tax rate changes. Currently, the principal source of our temporary differences is the difference between the net book value of the Company’s property, plant and equipment versus their unclaimed tax pools.

Contractual Obligations and Commitments

Harvest has contractual obligations and commitments entered into in the normal course of operations including the purchase of assets and services, operating agreements, transportation commitments, sales commitments, royalty obligations, and land lease obligations. These obligations are of recurring and consistent nature and impact cash flow in an ongoing manner. As at June 30, 2011, Harvest has the following significant contractual commitments:

| | | | | | | | | Maturity | | | | | | | |

| | | 1 year | | | 2-3 years | | | 4-5 years | | | After 5 years | | | Total | |

| Debt Repayments(1) | $ | - | | $ | 497,394 | | $ | 410,579 | | $ | 482,250 | | $ | 1,390,223 | |

| Debt interest payments(1) | | 90,061 | | | 149,377 | | | 69,493 | | | 58,021 | | | 366,952 | |

| Purchase Commitments(2) | | 224,539 | | | 67,386 | | | - | | | - | | | 291,925 | |

| Operating Leases | | 8,180 | | | 14,325 | | | 4,867 | | | 282 | | | 27,654 | |

| Transportation Agreements(3) | | 9,557 | | | 13,240 | | | 4,530 | | | 2,090 | | | 29,417 | |

| Feedstock & other purchase commitments(4) | | 431,337 | | | - | | | - | | | - | | | 431,337 | |

| Employee benefits(5) | | 5,483 | | | 9,272 | | | 7,917 | | | 2,013 | | | 24,685 | |

| Decommissioning liabilities(6) | | 21,338 | | | 34,227 | | | 40,446 | | | 1,294,935 | | | 1,390,946 | |

| Total | $ | 790,495 | | $ | 785,221 | | $ | 537,832 | | $ | 1,839,591 | | $ | 3,953,139 | |

| (1) | Assumes constant foreign exchange rate. |

| (2) | Relates to drilling commitments, AFE commitments, BlackGold oil sands project commitment and Downstream purchase commitments. |

| (3) | Relates to firm transportation commitments. |

| (4) | Includes commitments to purchase refined products for resale. |

| (5) | Relates to the expected contributions to employee benefit plans. |

| (6) | Represents the undiscounted obligation by period. |

Off Balance Sheet Arrangements

As of June 30, 2011, there were no off balance sheet arrangements in place.

22

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

LIQUIDITY

Cash flow from operating activities for the three and six months ended June 30, 2011 was $107.6 million and $254.4 million, respectively, compared to $121.8 million and $199.6 million for the same periods in 2010. For the second quarter of 2011, the change in non-cash working capital was a deficit of $16.1 million (2010 – deficit of $3.3 million) and $4.3 million (2010 - $2.4 million) was incurred in the settlement of decommissioning liabilities. For the six months ended June 30, 2011, the change in non-cash working capital was a deficit of $48.9 million (2010 – deficit of $9.7 million) and $6.3 million (2010 - $8.0 million) was incurred in the settlement of decommissioning liabilities.

For the second quarter of 2011, Harvest’s financing activities provided $141.6 million of cash from the net borrowings of the credit facility. For the six months ended June 30, 2011, Harvest’s financing activities provided $665.7 million of cash, including $505.4 million of capital injection from KNOC and $160.3 million of net borrowings from its credit facility. The capital injection from KNOC was used to fund the acquisition of the Hunt assets. Harvest funded $511.2 million of capital expenditures and net asset acquisition activities for the first six months of 2011 with cash generated from operating activities and financing activities.

Harvest had working capital deficiency of $54.7 million at June 30, 2011, as compared to a $2.1 million deficiency at December 31, 2010. The negative working capital at June 30, 2011 is primarily related to the use of the $40 million deposit paid in 2010 for the Hunt acquisition, capital expenditures during the period, and offset by increased assets arising from the risk management contracts. The Company’s working capital is expected to fluctuate from time to time, and will be funded from cash flows from operations and borrowings from Harvest’s credit facility, as required.

Through a combination of cash available at June 30, 2011, cash from operating activities and available undrawn credit facility, it is anticipated that Harvest will have adequate liquidity to fund future operations, debt repayments and forecasted capital expenditures (excluding major acquisitions). Refer to the “Contractual Obligations and Commitments”section above for Harvest’s future commitments and the discussion below on certain significant items.

BlackGold Oil Sands Project

Harvest signed a $311 million engineering, procurement and construction (“EPC”) contract in 2010 for phase 1 of our oil sands project, of which $69.7 million (including a $31.1 million deposit), has been paid up to June 30, 2011. Harvest expects to fund the future capital expenditures with capital injections funded by KNOC, future cash flow from operating activities and the undrawn credit facility.

Supply and Offtake Agreement (“SOA”)

The SOA provides working capital financing for its inventories of crude oil and substantially all refined products held for sale. Pursuant to the SOA, Harvest estimates that Vitol held inventories of VGO and crude oil feedstock (both delivered and in-transit) valued at approximately $361.0million at June 30, 2011 and $774.7 million at December 31, 2010, which would have otherwise been assets of Harvest. In April 2011, Vitol provided Harvest a six-month notice to terminate the SOA at the end of October 2011. Harvest has been in discussions to negotiate a new SOA and is currently in the process of finalizing a new agreement.

23

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

CAPITAL RESOURCES

The following table summarizes our capital structure as at June 30, 2011 and December 31, 2010 as well as provides the key financial ratios contained in Harvest’s revolving credit facility.

| | | June 30, 2011 | | | December 31, 2010 | |

Debts | | | | | | |

Revolving credit facility(1) | $ | 174,747 | | $ | 14,000 | |

Senior notes, at principal amount (US$500 million)(2) | | 482,250 | | | 497,300 | |

Convertible debentures, at principal amount | | 733,973 | | | 733,973 | |

Total Debt | $ | 1,390,970 | | $ | 1,245,273 | |

| | | | | | |

Shareholder’s Equity | | | | | | |

386,078,649 issued at June 30, 2011 | $ | 3,522,373 | | $ | - | |

335,535,047 issued at December 31, 2010 | | - | | $ | 3,016,855 | |

| | | | | | |

Total Capitalization | $ | 4,913,343 | | $ | 4,262,128 | |

| | | | | | |

Financial Ratios(3) | | | | | | |

Secured Debt to Annualized EBITDA(4)(5) | | 0.31 | | | 0.06 | |

Total Debt to Annualized EBITDA(4)(6) | | 2.21 | | | 2.38 | |

Secured Debt to Total Capitalization(5)(7) | | 4% | | | 1% | |

Total Debt to Total Capitalization(6)(7) | | 32% | | | 33% | |

| (1) | Net of deferred financing costs – $171.9 million (2010 - $11.4 million). |

| (2) | Principal amount converted at the period end exchange rate. |

| (3) | Calculated based on Harvest’s credit facility covenant requirements (see note 11 of the June 30, 2011 financial statements). |

| (4) | Annualized Earnings Before Interest, Taxes, Depreciation and Amortization based on twelve month rolling average. |

| (5) | “Secured Debt” includes letter of credit, bank debt and guarantees. |

| (6) | “Total Debt” includes the secured debt, convertible debentures and notes. |

| (7) | “Total Capitalization” includes total debt and shareholder’s equity less equity attributed to BlackGold. |

Credit Facility

On April 29, 2011, Harvest’s revolving credit facility (“the Facility”) was extended by two years to April 30, 2015. The minimum rate charged on the Facility was also amended from 200 bps to 175 bps over bankers’ acceptance rates as long as Harvest’s secured debt to EBITDA ratio remains below or equal to one. The borrowing capacity of the Facility remains at $500 million and the financial covenants calculation as disclosed above remain unchanged.

24

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

SUMMARY OF QUARTERLY RESULTS

The following table and discussion highlights our second quarter of 2011 relative to the preceding 5 quarters:

| | 2011 | | | 2010 | |

| | Q2 | | | Q1 | | | Q4 | | | Q3 | | | Q2 | | | Q1 | |

Revenue(1) | $ | 746,066 | | $ | 1,218,702 | | $ | 1,255,403 | | $ | 951,384 | | $ | 1,024,565 | | $ | 569,480 | |

Net income (loss) | | (19,529 | ) | | 37,961 | | | (12,332 | ) | | (26,083 | ) | | (22,796 | ) | | (19,952 | ) |

Cash from operating activities | | 107,588 | | | 146,777 | | | 132,121 | | | 97,412 | | | 121,830 | | | 77,808 | |

Total long-term financial debt | | 1,384,862 | | | 1,244,825 | | | 1,239,024 | | | 1,251,658 | | | 1,153,972 | | | 1,150,321 | |

Total assets | | 6,121,547 | | | 6,041,118 | | | 5,388,740 | | | 5,303,486 | | | 4,764,141 | | | 4,757,865 | |

| | | | | | | | | | | | | | | | | | |

Upstream total daily sales volumes (boe/d) | | 55,338 | | | 53,331 | | | 50,054 | | | 47,777 | | | 49,597 | | | 50,178 | |

Upstream realized price prior to hedges ($/boe) | $ | 66.73 | | $ | 59.19 | | $ | 56.03 | | $ | 52.71 | | $ | 54.41 | | $ | 60.17 | |

Downstream average daily throughput (bbl/d) | | 38,016 | | | 97,438 | | | 111,317 | | | 96,514 | | | 94,833 | | | 41,016 | |

Downstream average refining margin ($US/bbl) | $ | 8.09 | | $ | 10.96 | | $ | 6.13 | | $ | 3.02 | | $ | 8.56 | | $ | - | |

| (1) | Revenues are comprised of revenues net of royalties from Upstream operations as well as sales of refined products from Downstream operations. |

The quarterly revenues and cash from operating activities are impacted by the Upstream sales volume and realized prices and Downstream throughput volume and gross margins. Significant items that impacted Harvest’s quarterly revenues include:

- Revenues were the highest in the fourth quarter of 2010, followed by the first quarter of 2011, reflecting higher commodity prices, strong sales volume in the Upstream operations and improved throughput volumes from the Downstream operations. The decrease in revenue in the second quarter of 2011 was due to lower Downstream sales as a result of lower throughput due to a planned shutdown.

- Revenues were the lowest in the first quarter of 2010, primarily due to the shutdown of the refinery units for repairs in the Downstream operations.

- The increasing Upstream sales volumes since the third quarter of 2010 were mainly attributable to the acquisition of oil and gas assets in the third quarter of 2010 and first quarter of 2011.

- Downstream’s refining margin/bbl increased in the fourth quarter of 2010, and then more prominently in the first quarter of 2011, reflecting the improving global refining crack spreads. The decrease in Downstream’s refining margin/bbl in the second quarter of 2011 is due to a planned shutdown of the refinery units.

Net income (loss) reflects both cash and non-cash items. Changes in non-cash items including future income tax, DDA expense, accretion of decommissioning liabilities, impairment of long-lived assets, unrealized foreign exchange gains and losses, and unrealized gains on risk management contracts impact net income from period to period. For these reasons, the net income (loss) may not necessarily reflect the same trends as net revenues or cash from operating activities, nor is it expected to.

25

| MANAGEMENT’S DISCUSSION AND ANALYSIS |

Total assets have increased significantly from the second quarter of 2010 to the third quarter of 2010 due to the acquisition of the BlackGold assets in August and certain oil and gas assets in September 2010. The significant increase in total assets in the first quarter of 2011 was due to the Hunt acquisition and Harvest’s active winter drilling programs.

OUTLOOK

During the second quarter, we continued to benefit from strong crude oil prices in our Upstream business. Upstream financial performance was favorable as realized liquids prices continue to be better than anticipated. We expect crude oil prices will continue to be subject to volatility as the global economy stabilizes and finds its direction. Natural gas prices were relatively unchanged through the quarter subject to changing supply and weather-driven demand. Refining margins are supported as global demand remains strong.

Production performance in the second quarter was as expected at 55,338 boe/d for the quarter. For the third quarter of 2011, ongoing interruption of the non-operated Rainbow pipeline continues to affect production in our Hay River and Red Earth areas. Our capital investment projects and operations in this area have been very successful but production has been reduced 5,000 to 10,000 bpd by the pipeline shut-in. Harvest’s third quarter 2011 production is expected to average approximately 55,000 to 60,000 boe/d with the upper end of the range based on timely restoration of pipeline operation. Achieving production guidance of 60,000 boe/d for the year is based on pipeline operation resuming soon.

Remaining capital budgeted for the last half of 2011 is approximately $245 million (excluding BlackGold) or approximately 43% of the total capital budget for 2011. Operationally, our focus continues to be on drilling and developing our oil/liquids weighted opportunities and investment in Enhanced Oil Recovery (EOR) projects. Harvest continues to forecast general and administrative costs at $2.75/boe for the year 2011. Operating costs are estimated at $16.00/boe for 2011.