HARVEST ENERGY TRUST

FORM 51-102 F4

BUSINESS ACQUISITION REPORT

Item 1 Identity of Reporting Issuer

1.1 Name and Address of Reporting Issuer

Harvest Energy Trust (the "Trust" or "Harvest")

2100, 330 – 5th Avenue S.W.

Calgary Alberta T2P 0L4

1.2 Executive Officer

The name of the executive officer of Harvest Operations Corp. ("Harvest Operations"), administrator of the Trust, who is knowledgeable about the significant acquisition and this Report is Robert Fotheringham, Vice President Finance and Chief Financial Officer and his business telephone number is (403) 268-3197.

Item 2 Details of Acquisition

2.1 Nature of Business Acquired

The Acquisition

On October 19, 2006 Harvest completed the acquisition of all of the shares of North Atlantic Refining Limited ("North Atlantic") and related businesses and the entering into of a supply and off take agreement between North Atlantic and Vitol Refining, S.A. (the "Supply and Offtake Agreement") (collectively, the "Acquisition").

The principal asset of North Atlantic is a 115,000 barrel per stream day sour crude hydrocracking refinery located in the Province of Newfoundland and Labrador (the "Refinery"), and a marketing division with 69 gas stations, a home heating business and a commercial and wholesale petroleum products business, all located in the Province of Newfoundland and Labrador. The Refinery is capable of processing a wide range of crude oils and feedstocks with a sulphur content as high as 3.5% and API gravity in the range of 20° to 40° and has a dock facility capable of handling vessels in excess of 330,000 dead weight tons that carry up to 2 million barrels of crude oil. The Refinery's product slate is weighted towards high quality gasoline, jet fuel and diesel fuel that are currently compliant with product specifications (including sulphur, cetane and aromatic content) that are becoming increasingly restrictive and constraining supply.

Concurrent with the acquisition of North Atlantic by Harvest, North Atlantic entered into the Supply and Offtake Agreement with Vitol Refining S.A. The Supply and Offtake Agreement provides that the ownership of substantially all crude oil feedstock and refined product inventory at the Refinery be retained by Vitol Refining S.A. and that during the term of the Supply and Offtake Agreement, Vitol Refining S.A. will be granted the right and obligation to provide crude oil feedstock for delivery to the Refinery as well as the right and obligation to purchase all refined products produced by the Refinery. The Supply and Offtake Agreement also provides that Vitol Refining S.A. will also receive a time value of money amount (the "TVM") reflecting the cost of financing the crude oil feedstock and sale of refined products as the Supply and Offtake Agreement requires that Vitol Refining S.A. retain ownership of the crude oil feedstock until delivered through the inlet flange to the Refinery as well as immediately take title to the refined products as they are delivered by the Refinery through the inlet flange to designated storage tanks. Further, the Supply and Offtake Agreement provides North Atlantic with the opportunity to share the incremental profits and losses resulting from the sale of products beyond the U.S. East Coast markets.

2

Prior to the Acquisition, North Atlantic and Vitol Refining S.A. operated under an arrangement which effectively resulted in North Atlantic processing crude oil provided by Vitol Refining S.A. on a fee for service basis with Vitol Refining S.A. retaining the economic benefit of and risk for the differences between the purchase price of the crude oil feedstock and the selling price of the refined products. Over the previous four years, this arrangement resulted in the benefits of the increased "sour crack" spread (averaging US$18.08 in 2005 as compared to US$6.70 in 2002) accruing to Vitol Refining S.A. while North Atlantic continued to receive a relatively flat fee for service. The termination of this arrangement effective upon closing of the Acquisition and the entering into the Supply and Offtake Agreement results in a significant change to the economics of North Atlantic as a fee for service relationship has been exchanged for the economics of the "sour crack" spread, subject to a fixed charge of US$0.08 per barrel of crude oil feedstock provided. Accordingly, in the view of Harvest's management the historical financial results of North Atlantic combined with the historical financial results of Vitol Refining S.A. more appropriately reflect the past financial performance of North Atlantic's refinery operations.

Pursuant to the Supply and Offtake Agreement, North Atlantic, in consultation with Vitol Refining S.A., will request a certain slate of crude oil feedstocks and Vitol Refining S.A will be obligated to provide the crude oil feedstocks in accordance with the request. The Supply and Offtake Agreement includes a crude oil feedstock transfer pricing formula that aggregates the pricing formula for the crude oil purchased as correlated to published future contract settlement prices, the cost of transportation from the source of supply to the Refinery and the settlement cost or proceeds for related price risk management contracts plus a fee of US$0.08 per barrel. The purpose of the price risk management contracts is to convert the fixed price of crude oil feedstock purchases to floating prices for the period from the purchase date through to the date the refined products are sold to allow "matching" of crude oil feedstock purchases to refined product sales thereby mitigating the gross margin risk between the time crude oil feedstocks are purchased and the sale of the refined products.

The Supply and Offtake Agreement requires that Vitol Refining S.A. purchase and lift all refined products produced by the Refinery, except for certain excluded refined products to be marketed by North Atlantic in the local Newfoundland market, and provides a product purchase pricing formula that aggregates a deemed price based on the current Boston and New York City markets less the deemed costs of transportation, insurance, port fees, inspection charges and similar costs deemed to be incurred by Vitol Refining S.A., plus the TVM component. The TVM component recognizes the cost of financing the refined products for the time deemed to deliver the refined product from the Refinery through to the date Vitol Refining S.A. is deemed to have received payment for the sale.

The TVM component of the Supply and Offtake Agreement in respect of crude oil feedstock and the sale of refined products will reflect an effective interest rate of 350 basis points over the London Inter Bank Offer Rate ("Libor") and will be included in the weekly settlement of all amounts owing.

The Supply and Offtake Agreement requires that Vitol Refining S.A provide North Atlantic with notice if it plans to sell product outside the U.S. East Coast market which will entitle North Atlantic to the right, but not the obligation, to share in the incremental profit or loss from such sales.

The Supply and Offtake Agreement may be terminated by either party at the end of an initial two year term, and at any time thereafter, by providing notice of termination no later than six months prior to the desired termination date or if the Refinery is sold in an arms length transaction, upon 30 days notice prior to the desired termination date. Further, the Supply and Offtake Agreement may be terminated upon the continuation for more than 180 days of a delay in performance due to force majeure but prior to the recommencing of performance. After an initial 12 month period, Vitol Refining S.A.'s exclusive right and obligation to provide crude oil feedstock to the Refinery may be terminated by either party by providing six months notice. Upon termination of the entire agreement or the right and obligation to provide crude oil feedstock, North Atlantic will be required to purchase the related crude oil feedstock and refined product inventory or crude oil feedstock, respectively, at the prevailing market prices.

3

Description of the Business

Overview

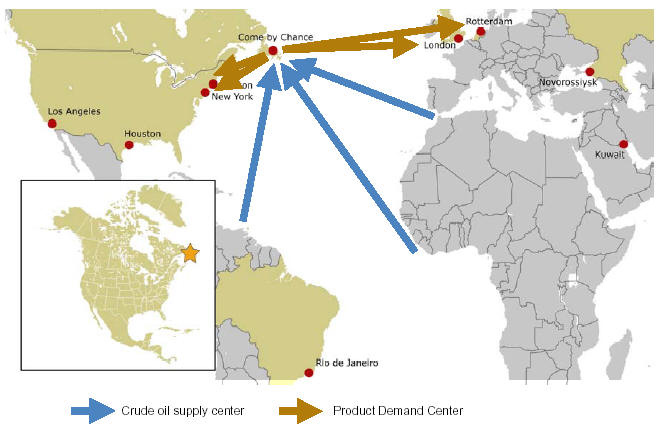

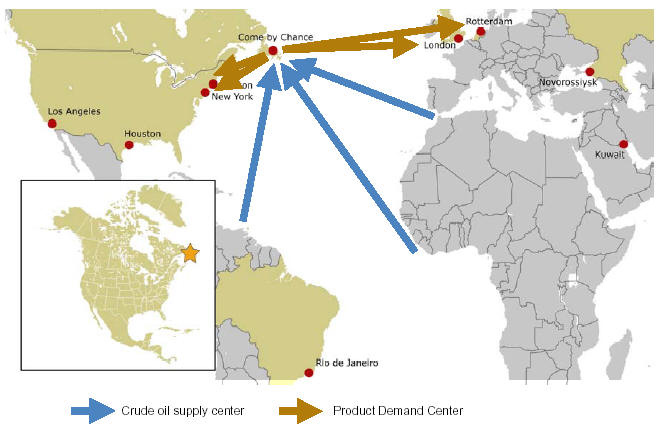

North Atlantic is an independent crude oil refiner that owns and operates a medium gravity, sour crude oil hydrocracking refinery located in the Province of Newfoundland and Labrador with a capacity of 115,000 barrels per stream day. The Refinery's feedstocks are delivered by tanker primarily from the Middle East, Russia and Latin America. The Refinery produces high quality gasoline, ultra low sulphur diesel, jet fuel and furnace oil with a residual of heavy fuel oil. Approximately 10% of North Atlantic's refined products are sold in the Province of Newfoundland and Labrador while approximately 90% are sold in the U.S. east coast markets such as Boston and New York City. North Atlantic enjoys a significant transportation advantage as it operates a deep water docking facility and has approximately seven million barrels of tankage including six 575,000 barrel crude tanks enabling the receipt of crude oil transported on very large crude carriers which typically result in significantly lower per barrel transportation charges. The following map highlights the North Atlantic transportation advantage.

4

North Atlantic's assets include dock facilities for off-loading crude oil feedstock and for loading refined products. These facilities include two berths connected to the onshore tank farm by an 800 foot causeway and a 2,800 foot approach trestle combination. The dock facilities handle approximately 220 vessels each year with North Atlantic owning and operating two tugboats to assist with berthing and unberthing tankers. One tugboat, acquired in 1999, is equipped with firefighting capability while the other is equipped with oil spill response capability.

Through its marketing division, North Atlantic operates a petroleum marketing and distribution business in the Province of Newfoundland and Labrador with average daily sales over 11,000 barrels. The North Atlantic brand has been positioned in the Newfoundland marketplace as a local company with its retail gasoline business operating 66 retail gas stations and 3 cardlock locations capturing a market share of approximately 15%. In addition to its retail operations, North Atlantic has a commercial, wholesale and home heating business.

Brief History

The construction of the Refinery commenced in 1971 with the crude oil distillation unit commissioned in late 1973 and most other process units started-up in 1974. The Refinery was shut down two years later as the owner filed for bankruptcy protection during the oil price shock. In 1980, Petro-Canada purchased the Refinery but did not operate it, and in late 1986, sold the Refinery to a private company. From 1986 through 1994, the new owner invested approximately $132 million in the Refinery including the construction of a new hydrogen furnace. On April 24, 1994, the Refinery experienced a fire at the vacuum tower and, as a consequence, the entire facility was again shut down as the owner was unable to finance the restoration of the Refinery.

The Vitol Refining Group B.V. acquired the Refinery in August 1994 and commenced a major restoration and successfully commissioned the Refinery in late 1994. Since then, more than US$400 million was invested to maintain, upgrade and expand the facility. These investments significantly improved the Refinery's operating performance in terms of refinery throughput, reliability, saleable yield, product quality, safety and environmental performance. In 2005, the Refinery averaged 93,900 bpsd, down from 100,700 bpsd in the prior year due to planned maintenance turnarounds, with a saleable yield of 95.4% while its safety performance was improved to 0.6 lost time accidents per 200,000 man hours. Since 1997, the Refinery's sulphur dioxide emissions have also been reduced by 63% despite a significant increase in throughput.

Refinery Operations

Summary of Crude Oil Feedstock

Crude oil and other feedstocks are delivered to the Refinery via vessels capable of carrying over 2 million barrels of crude oil per vessel. Normally, there is approximately 20 days of crude oil feedstock in tankage at the Refinery to mitigate the effects of any delivery disruptions. Over the past three years, the source of the crude oil feedstock has been as follows:

| | 2005 | 2004 | 2003 |

| | | (000's of bbl) | |

| | | | |

| Middle East | 23,672 | 26,884 | 25,712 |

| Russia | 5,596 | 6,421 | 10,432 |

| Latin America | 2,686 | - | - |

| Other | 5,536 | 7,306 | 5,628 |

| Total Feedstock | 37,490 | 40,611 | 41,772 |

| | | | | |

5

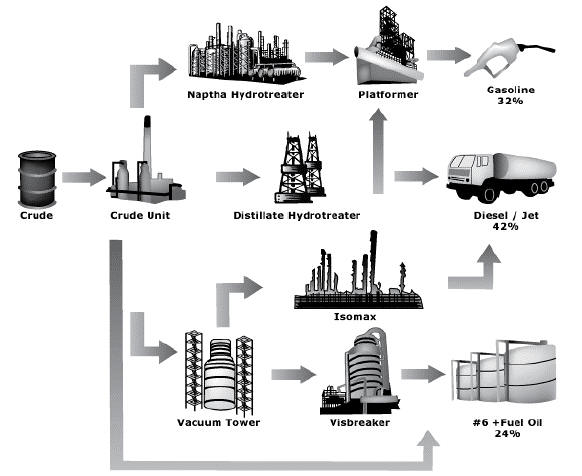

Overview of Crude Oil Processing

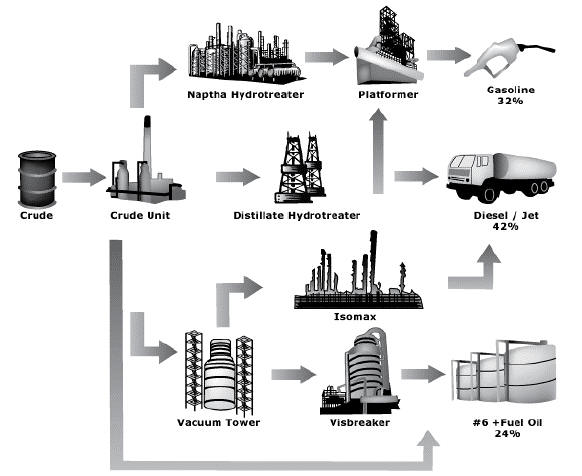

The following is a summary of the primary process flow of North Atlantic's Refinery including a brief description of the process and purpose of the identified processing units. This summary excludes the various utility plants as well as a number of secondary units that add relatively small incremental volume enhancements to higher valued products from the diesel and fuel oil streams.

Crude & Vacuum Distillation Unit

Crude oil from tankage is heated and processed in the crude unit for primary distillation or separation into various components. The crude oil is first processed in the crude distillation tower where the crude is fractionated into the following streams:

Liquid petroleum gas products such as fuel gas, propane, and butane;

Lighter liquid products (naphtha) which are further upgraded in the naphtha hydrotreater and platformer for the production of gasoline;

Distillate materials (kerosene and diesel) which are produced from the middle of the distillation tower. The kerosene goes to either jet fuel blending, the distillate hydrotreater for Ultra Low Sulphur Diesel ("ULSD") production, or No. 6 fuel blending. The crude diesel goes to the distillate hydrotreater for ULSD production;

6

The vacuum tower operates at less than atmospheric pressure and further fractionates the bottom ends. Vacuum gas-oil from the vacuum tower is then routed to the Isomax unit to be upgraded primarily into naphtha, kerosene and ultra-low sulphur diesel. The residual vacuum tower bottoms stream is routed to the visbreaker.

Naphtha Hydrotreater and Platformer and Platformate Hydrogenation Units

The naphtha hydrotreater, uses hydrogen and a catalyst to remove sulphur and nitrogen contaminants from the naphtha to enable it to be used as platformer feed. The platformer then converts the naphtha into high octane gasoline for use in gasoline blending. A portion of the gasoline is further processed in the platformate hydrogenation unit ("PHU"). The PHU enables the refinery to meet the low benzene level requirements of reformulated gasoline.

Distillate Hydrotreater

The distillate hydrotreater operates at high pressure and uses hydrogen over a catalyst bed to remove nearly all of sulphur and nitrogen from the middle distillates for the production of ultra-low sulphur diesel.

Isomax HydroCracker Unit

The Isomax unit (also known as a hydrocracker) uses extremely high heat and pressure to upgrade the heavy gas-oil portions through the injection of hydrogen. This process removes contaminants and produces naphtha for gasoline blending and platformer feed, ultra-low sulphur diesel and jet fuel. The bottom ends from the Isomax unit are also used as a valuable lubricant feedstock.

Visbreaker

The vacuum tower bottoms, an asphalt-like product, are processed in the visbreaker. The visbreaker uses high temperature to crack long chain molecules thereby reducing cutter (kerosene) requirements for No 6 oil blending.

Storage and Shipping

Crude oil feedstock and refined products from the various processing units are temporarily stored in designated tanks. North Atlantic has storage capacity for approximately seven million barrels of crude oil and refined product. This storage capacity is typically allocated approximately 50% to crude oil feedstock and 50% to refined product outputs. Refined products are ultimately shipped for delivery to the United States Atlantic Coast market, including Boston and New York City. These markets typically consume approximately 90% of the Refinery's production. The vessels delivering refined products typically have capacity for approximately 330,000 barrels and are limited to transporting one or two products.

Summary of Refined Products

Over the past three years, the Refinery has produced the following refined products with a total yield of approximately 102% of feedstock as the impact of adding hydrogen swells the barrels offsetting the fuel used by the Refinery:

7

| | 2005 | 2004 | 2003 |

| | | (000's of bbl) | |

| | | | |

| Gasoline and related products | 12,571 | 15,349 | 15,077 |

| Low & ultra low sulphur diesel | 10,307 | 10,544 | 13,008 |

| Heavy fuel oil | 9,444 | 9,582 | 9,577 |

| Jet fuel | 3,429 | 3,179 | 2,070 |

| Fuel consumed by the Refinery | 2,474 | 2,970 | 2,985 |

| Total Products | 38,225 | 41,624 | 42,717 |

| Total Yield (as a % of feedstock) | 102% | 102% | 102% |

Operations Reliability

Improving the reliability of the Refinery has been a major focus for North Atlantic with significant capital expenditures and a change in maintenance philosophy. North Atlantic's maintenance philosophy has evolved to one that emphasizes long term solutions to reliability issues through the conduct of rigorous analyses regarding the root cause of reliability issues. Of particular note, North Atlantic developed the advanced Equipment Integrity Program whereby remaining equipment life calculations are utilized to determine equipment turnaround schedules and ensuring that equipment is repaired or replaced before failure occurs. The most measurable indicator of the Refinery's performance is the level of throughput over the past five years. A summary of North Atlantic's Refinery level of throughput for the period 2001 to 2005 is as follows:

Source: North Atlantic Operating Performance Reports.

The decline in 2004 was due to a planned minor turnaround of the crude oil distillation tower, and in 2005 was due to a planned major turnaround outage to maintain common facilities.

Currently, North Atlantic has the opportunity and intends to consider opportunities to grow its business through the reconfiguration and enhancement of its Refinery assets with a suite of expansion or debottlenecking projects plus a coker project or a visbreaker project for bottoms upgrading.

Marketing Division

North Atlantic's marketing division (the "Marketing Division") is headquartered in St. John's, Newfoundland and is comprised of five business segments: retail, home heating, commercial, wholesale and bunkers. The Marketing Division produced US$9.3 million, US$9.6 million and US$7.1 million of earnings before interest, taxes, depreciation and amortization for the years ended December 31, 2005, 2004 and 2003, respectively.

8

Retail Business

North Atlantic operates 66 retail gasoline stations and 3 commercial cardlock locations with 39 locations branded as "North Atlantic" and 16 locations branded as "Home Town" (a secondary brand for small market areas) with the remaining 11 locations unbranded. Most locations include a convenience store which is independently operated. In 2005, the volume of gasoline and diesel sold at these retail locations represented a market share of approximately 15% of the Newfoundland market. The major competitors in the Newfoundland market are Irving Oil, Imperial Oil and Ultramar.

Home Heating Business

North Atlantic delivers furnace oil and propane to approximately 20,000 residential heating and commercial customers throughout Newfoundland with about 90% of the demand for furnace oil, 9% for propane and 1% for kerosene. North Atlantic is a full service residential heating supplier providing a furnace parts maintenance replacement program, emergency burner service and heating system installations from five "Home Heating" stores. North Atlantic's installation and emergency burner service is provided by independent contractors, as is its bulk hauling.

Commercial Business

North Atlantic delivers distillates, jet fuel, propane and No. 6 fuel oil to commercial heating, marine, aviation, trucking and construction industries from seven storage terminals.

Wholesale Business

North Atlantic provides distillates, jet fuel and propane to a number of wholesale customers from both its wharf and truck rack facilities with current volumes averaging approximately 3,300 barrels per day.

Bunker Business

North Atlantic sells bunkers to crude oil and refined product vessels at its wharf facilities.

Overview of Management Structure

The management structure of North Atlantic consists of a two man executive team (a "President, Refinery Manager" and a "Vice President, Chief Financial Officer") supported by eight director/managers with responsibilities for:

Production;

Economics and Engineering Sciences;

Reliability and Field Services;

Environmental, Health and Safety and Risk Management;

Strategic Planning;

Marketing;

Human Resources; and

Corporate Services.

Gunther Baumgartner, President, Refinery Manager, is a chemical engineer with over 25 years in the oil industry including eight years with North Atlantic: four years as President and prior to that as Director of Economics and Engineering Sciences. Prior to joining North Atlantic in 1998, Mr. Baumgartner was a refinery supply manager and a trader with Vitol. Mr. Baumgartner will continue to serve as President, Refinery Manager through a transition period.

Glenn Mifflin, Vice President, Chief Financial Officer, is a Chartered Accountant with a Masters of Business Administration with over 19 years of experience in the oil industry. Mr. Mifflin has held a number of positions within North Atlantic including serving as President of North Atlantic's Marketing Division. Mr. Mifflin intends to remain with North Atlantic and continue his responsibilities as Vice President, Chief Financial Officer including responsibilities for community, government and public relations.

9

It is anticipated that the vast majority of North Atlantic's management and employees will continue with the company following Harvest's acquisition of North Atlantic.

Employees and Labour Relations

North Atlantic has approximately 570 full-time employees of which 65% are unionized and approximately 140 part-time employees of which 90% are unionized. The unionized employees are represented by the United Steel Workers of America. North Atlantic has had a history of good relations collective bargaining with its union which is evidenced by the lack of any strike action at the Refinery. The collective agreements with the United Steel Workers of America expire in late 2007 and early 2008. See "Risk Factors".

North Atlantic maintains a number of employee benefit programs for its employees including basic life insurance and accidental death and dismemberment insurance, extended healthcare and dental coverage. North Atlantic also maintains defined benefit and defined contribution pension plans for its employees and provides certain post retirement health care benefits which cover substantially all employees and their surviving spouses. At September 30, 2006, the pension plan and other benefit plan obligations exceeded the pension plan and other benefit plan funding by approximately US$10.9 million. For additional information, see note 13 to the combined financial statements of North Atlantic and Vitol Refining S.A. attached as Schedule B to this Report.

Insurance

North Atlantic's operations are subject to the normal hazards of refinery operations including fires, explosions and weather related perils. North Atlantic maintains insurance policies with insurers in amounts, coverage limits and deductibles that management of North Atlantic, with the advice of insurance advisors, believe are reasonable and prudent.

In respect of its refinery operations, North Atlantic has property damage coverage with an aggregate annual loss limit of US$700 million and business interruption insurance for up to 24 months subject to deductibles of $7.5 million for property damage and 45 day for business interruption. In addition, North Atlantic maintains typical property damage and third party liability insurance appropriate for its various machinery and automotive equipment with various deductibles ranging from $1,000 to $50,000. In respect of its owned retail gasoline stations, North Atlantic has $5 million of general liability insurance plus environmental liability coverage of $2 million per incident and aggregate annual limit.

In respect of the unloading of crude oil and loading of refined product at its dock facilities, North Atlantic maintains US$800 million of pollution coverage subject to a US$500,000 deductible and a coverage limit of US$30 million for each occurrence.

In addition, the Supply and Offtake Agreement requires Vitol Refining S.A. to ensure that all vessels nominated to load or unload at North Atlantic's refinery carry US$1 billion of coverage in respect of pollution and related clean up costs and that cargos on board vessels are insured for 110% of their value. Vitol Refining S.A. is also required to carry general liability insurance with a single occurrence limit and annual aggregate limit of $25 million for property damage, personal injury liability, accidental pollution and other contractual liabilities and listing North Atlantic and its affiliates as additional insureds.

North Atlantic has had no property insurance claims for the past ten years and, while it is subject to liability claims in the normal course of business, North Atlantic has had no liability claims exceeding $1 million in the past ten years.

10

Commitments and Contingent Liabilities

North Atlantic has been named a defendant in The State of New Hampshire versus Amerada Hess Corp. et al, one of the more than 100 methyl tertiary butyl ether ("MTBE") U.S. product liability litigation cases that have been consolidated for pre-trial purposes in this matter. The plaintiffs seek relief for alleged contamination of ground water from the various defendants' use of the gasoline additive MTBE. Although the plaintiffs have not made a particular monetary demand, they are asserting collective and joint liability against all defendants. All consolidated law suits are at a preliminary stage and, accordingly, it is too early in the legal process to reach any conclusion regarding the ability of the State of New Hampshire to properly assert jurisdiction over North Atlantic in the lawsuit or to reach any conclusions regarding the substance of the plaintiffs' claims. Accordingly, the evaluation of the risk of liability to North Atlantic is not determinable at this time and no amounts are accrued in the combined financial statements in respect of this matter. In addition, Harvest received an indemnity from Vitol Group B.V. in respect of this contingent liability under the purchase and sale agreement dated August 22, 2006 between the Trust and Vitol Refining Group B.V. providing for the Acquisition.

Newsul Enterprises Inc. has named North Atlantic in a claim in the amount of US$2.7 million and has requested the services of an arbitration board to make a determination on the claim. The claim is for additional costs and lost revenues related to contaminated sulphur delivered by North Atlantic. The evaluation of the risk of liability to North Atlantic is not determinable at this time and no amounts are accrued in the combined financial statements.

For additional information relating to other commitments and contingent liabilities of North Atlantic, see note 14 to the combined financial statements of North Atlantic and Vitol Refining S.A. attached as Schedule B to this Report.

Risk Factors

The following provides a summary of certain risk factors that may impact the operations and assets of North Atlantic.

Investment in North Atlantic

Harvest's investment in North Atlantic will be in the form of interest bearing notes and interests in various partnerships and trusts, and accordingly, Harvest will be dependent upon the ability of North Atlantic to pay its interest obligations under the notes and distributions from the various partnerships. North Atlantic's ability to pay interest and distributions will be entirely dependent on its operations and assets which will be impacted by risks typical of refinery and marketing operations.

Volatility of Commodity Prices

North Atlantic's earnings and cash flows from refining and wholesale and retail marketing operations are dependent on a number of factors including fixed and variable expenses (including the cost of crude oil and other feedstocks) and the price above those expenses at which North Atlantic is able to sell refined products. In recent years, the market prices for crude oil and refined products have fluctuated substantially. These prices depend on a number of factors beyond North Atlantic's control, including the demand for crude oil and other refined products, which are subject to, among other things:

changes in the global demand for crude oil and refined products;

the level of foreign and domestic production of crude oil and refined products;

threatened or actual terrorist incidents, acts of war, and other worldwide political conditions in both crude oil producing and refined product consuming regions;

availability of crude oil and refined products and the infrastructure to transport crude oil and refined products;

11

supply and operational disruptions including accidents, weather conditions, hurricanes or other natural disasters;

government regulations including changes in fuel specifications required by environmental and other laws;

local factors including market conditions and the operations of other refineries in the markets in which North Atlantic competes; and

development and marketing of alternative and competing fuels.

Generally, fluctuations in the price of gasoline and other refined products are correlated with fluctuations in the price of crude oil, however, the prices for crude oil and prices for refined products can fluctuate in different directions as a result of worldwide market conditions. Further, the timing of the relative movement in prices as well as the magnitude of the change could significantly influence refining margins as could price changes occurring during the period between purchasing crude oil feedstocks and selling refined products manufactured from these feedstocks. North Atlantic does not produce crude oil and must purchase all of its crude oil feedstock at prices that fluctuate with worldwide market conditions and this could significantly impact North Atlantic's earnings and cash flow. Although Harvest produces crude oil in western Canada, this crude oil cannot be economically transported to the Refinery. North Atlantic also purchases refined products from third parties for sale to its customers and price changes during the period between purchasing and selling these products may also impact North Atlantic's earnings and cash flow.

North Atlantic purchases approximately 250,000 megawatt hours of electrical power from Newfoundland and Labrador Hydro, a provincial crown corporation. A substantial proportion of Newfoundland and Labrador Hydro's electricity is generated by hydroelectric power, a relatively inexpensive source compared to fossil fuel generators. However, North Atlantic's cost of electrical power has increased from $0.024 per kilowatt hour in 2002 to $0.041 in 2005, a near doubling in price. Electricity prices have been and will continue to be affected by supply and demand for service in both local and regional markets and continued price increases will impact North Atlantic's earnings and cash flow.

Fluctuations in the Canada-United States Exchange Rates

The prices for crude oil and refined products are generally based in U.S. dollar market prices while North Atlantic's operating costs and capital expenditures are primarily in Canadian dollars. Fluctuations in the exchange rates between the U.S. and Canadian dollar will give rise to currency exchange rate exposure for North Atlantic. Although this currency exchange rate exposure may be hedged, there can be no assurance that a currency exchange rate hedging program will be sufficient to effectively cover all of North Atlantic's exposure.

Disruptions in the Supply of Crude Oil and Delivery of Refined Products

North Atlantic's Refinery receives all of its crude oil feedstock and delivers approximately 90% of its refined products via water born vessels including very large crude carriers capable of handling over 2 million barrels of crude oil. In addition to environmental risks of handling such vessels discussed below, North Atlantic could experience a disruption in the supply of crude oil because of accidents, governmental regulation or third party actions. A prolonged disruption in the availability of vessels to deliver crude oil to the Refinery and/or to deliver refined products to market would have a material adverse effect on North Atlantic's business, financial condition and results of operations.

Over the past three years, North Atlantic purchased over 60% of its crude oil feedstock from sources in the Middle East. North Atlantic does not maintain long term contracts with any of its crude oil suppliers. To the extent that its crude oil suppliers, particularly suppliers in the Middle East, reduce the volume of crude oil supplied to North Atlantic as a result of declining production or competition or otherwise, North Atlantic's business, financial condition and results of operations would be adversely affected to the extent that North Atlantic was not able to find another supplier of this substantial amount and type of crude oil. Further, North Atlantic has no control over the level of development in the fields that currently supply the Refinery nor the amount of reserves underlying such fields, the rate at which production will decline or the production decisions of the producers which are affected by, among other things, prevailing and projected crude oil prices, demand for crude oil, geological considerations, government regulation and the availability and cost of capital.

12

North Atlantic will rely on creditworthiness of Vitol Refining S.A. for its purchase of crude oil feedstocks for the Refinery pursuant to the Supply and Offtake Agreement and the creditworthiness of Harvest to enter into price risk management contracts to reduce its exposure to adverse fluctuations in the prices of crude oil and refined products. Accordingly, should the creditworthiness of Vitol Refining S.A. and/or Harvest deteriorate, crude oil suppliers may change their view on supplying North Atlantic with crude oil and price risk management contracts, respectively, and induce them to shorten the payment terms or require additional credit support, such as letters of credit. Due to the large dollar amount of credit associated with the volume of crude oil purchases and long term price risk management contracts, any imposition of more burdensome payment terms on North Atlantic may have a material adverse effect on North Atlantic's and Harvest's financial liquidity which could hinder North Atlantic's ability to purchase sufficient quantities of crude oil to operate the Refinery at full capacity. In addition, if the price of crude oil increases significantly, the credit requirements to purchase enough crude oil to operate the Refinery at full capacity also increase. A failure to operate the Refinery at full capacity could have an adverse material affect on North Atlantic's earnings and cash flows as well as Harvest's financial condition.

Operational Risks

The Refinery is a single integrated and interdependent facility which could experience a major accident, be damaged by severe weather or other natural disaster, or otherwise be forced to shut down. A shutdown of one part of the Refinery could significantly impact the production of refined products and may reduce, and even eliminate, North Atlantic's cash flow. Any one or more of the Refinery's processing units may require a planned turnaround or encounter unexpected downtime to maintain or repair and the time required to complete the work may take longer than anticipated. There are no assurances that the Refinery will produce refined products in the quantities or at the cost anticipated, or that it will not cease production entirely in certain circumstances which could have a material adverse effect on North Atlantic's earnings and cash flow as well as Harvest's financial condition.

North Atlantic's refining operations, including the transportation of and storage of crude oil and refined products, are subject to hazards and inherent risks typical of similar operations such as fires, natural disasters, explosions, spills and mechanical failure of its equipment or third-party facilities, any of which can result in personal injury claims and other damage to North Atlantic's properties and the properties of others. While North Atlantic carries property, casualty and business interruption insurance, North Atlantic does not maintain insurance coverage against all potential losses, and could suffer losses for uninsurable or uninsured risks or in amounts in excess of existing insurance coverage. The occurrence of an event that is not fully covered by insurance could have a material adverse effect on North Atlantic's earnings, cash flow and financial condition as well as Harvest's financial condition.

Currently, North Atlantic has the opportunity and intends to consider opportunities to grow its business through the reconfiguration and enhancement of its Refinery assets with the suite of expansion or debottlenecking projects plus a coker project or a visbreaker project for bottoms upgrading. However, if unanticipated costs occur or North Atlantic's revenues decrease as a result of lower refining margins, operating difficulties or other matters, there may not be sufficient capital to enable North Atlantic to fund all required capital and operating expenses. There can be no assurance that cash generated by North Atlantic's operations or funding available from debt financings or further investment by Harvest will be available to meet capital and operating requirements.

The operation of refineries and related storage tanks is inherently subject to spills, discharges or other releases of petroleum or hazardous substances. If any of these events had previously occurred or occurs in the future in connection with any of North Atlantic's Refinery or storage tanks, or in connection with any facilities to which North Atlantic sends wastes or by-products for treatment or disposal, other than events for which North Atlantic is indemnified, North Atlantic could be liable for all costs and penalties associated with their remediation under federal, provincial and local environmental laws or common law, and could be liable for property damage to third parties caused by contamination from releases and spills. The penalties and clean-up costs that North Atlantic may have to pay for releases or spills, or the amounts that North Atlantic may have to pay to third parties for damage to their property, could be significant and the payment of these amounts could have a material adverse effect on North Atlantic's business, financial condition and results of operations as well as Harvest's financial condition.

13

North Atlantic operates in environmentally sensitive coastal waters where tanker operations are closely regulated by federal, provincial and local agencies and monitored by environmental interest groups. Transportation of crude oil and refined products over water involves inherent risk and subjects North Atlantic to the provisions of Canadian federal laws and the laws of the Province of Newfoundland and Labrador. Among other things, these laws require North Atlantic to demonstrate its capacity to respond to a "worst case discharge" to the maximum extent possible. North Atlantic's marine division manages vessel traffic to the Refinery and works with regulatory authorities on measures to prevent and mitigate the risk of oil spills and other marine related matters. The marine division has two tugboats to assist in berthing and unberthing tankers at North Atlantic's dock with one tugboat equipped with fire fighting capability and the other equipped for spill response capability. The tugboat operations have a safety management system certified under the International Safety Management Code and are also certified under the International Ship and Port Security Code. In addition, North Atlantic has contracted with the Eastern Canada Response Corporation to supplement its resources. However, there may be accidents involving tankers transporting crude oil or refined products, and response services may not respond in a manner to adequately contain a discharge and North Atlantic as well as Harvest may be subject to liability in connection with a discharge.

North Atlantic has in the past operated service stations with underground storage tanks in the Province of Newfoundland and Labrador, and currently operates 13 retail service stations and 2 cardlock locations, with underground storage tanks. North Atlantic is required to comply with provincial regulations governing such storage tanks in the Province of Newfoundland and Labrador and compliance with these requirements can be costly. The operation of underground storage tanks also poses certain other risks, including damages associated with soil and groundwater contamination. Leaks from underground storage tanks which may occur at one or more of North Atlantic's service stations, or which may have occurred at previously operated service stations, may impact soil or groundwater and could result in fines or civil liability for North Atlantic. While North Atlantic maintains insurance in respect of such risks, there are no assurances that such insurance will be adequate to fully compensate for any liability North Atlantic may incur if such risks were to occur.

Environmental, Health and Safety Risks

North Atlantic's operations and properties are subject to extensive federal, provincial and local environmental and health and safety regulations governing, among other things, the generation, storage, handling, use and transportation of petroleum and hazardous substances, the emission and discharge of materials into the environment, waste management and characteristics and composition of gasoline and diesel fuels. If North Atlantic fails to comply with these regulations, it may be subject to administrative, civil and criminal proceedings by governmental authorities, as well as civil proceedings by environmental groups and other entities and individuals. A failure to comply, and any related proceedings, including lawsuits, could result in significant costs and liabilities, penalties, judgments against North Atlantic or governmental or court orders that could alter, limit or stop North Atlantic's operations.

Consistent with the experience of other Canadian refineries, environmental laws and regulations have raised operating costs and required significant capital investments at the Refinery. Harvest believes that the Refinery is substantially compliant with existing laws and regulatory requirements. However, potentially material expenditures could be required in the future may be required to comply with evolving environmental, health and safety laws, regulations or requirements that may be adopted or imposed in the future.

In addition, new environmental laws and regulations, new interpretations of existing laws and regulations, increased governmental enforcement or other developments could require North Atlantic to make additional unforeseen expenditures. Many of these laws and regulations are becoming increasingly stringent, and the cost of compliance with these requirements can be expected to increase over time. Harvest is not able to predict the impact of new or changed laws or regulations or changes in the ways that such laws or regulations are administered, interpreted or enforced. The requirements to be met, as well as the technology and length of time available to meet those requirements, continue to develop and change. To the extent that the costs associated with meeting any of these requirements are substantial and not adequately provided for, there could be a material adverse effect on North Atlantic's earnings, cash flow and financial condition or Harvest's financial condition.

14

North Atlantic is presently subject to litigation and investigations with respect to the use of MTBE and the delivery of contaminated sulphur (see "Commitments and Contingent Liabilities"). North Atlantic may become involved in further litigation or other proceedings, or may be held responsible in any existing or future litigation or proceedings, the costs of which could be material.

Management Risks

North Atlantic's future performance depends to a significant degree upon the continued contributions of its senior management team and key technical and operations employees. The loss of one or more members of the senior management team or a number of key technical and operations employees could result in a disruption to North Atlantic's operations. In addition, North Atlantic faces competition for these key individuals from competitors, customers and other companies operating in the refining industry and to the extent that North Atlantic loses members of its senior management team or key technical and operations employees for any reason, North Atlantic will be required to hire other personnel to manage and operate North Atlantic and it may not be able to locate or employ such qualified personnel on acceptable terms. As a result, the operating history of North Atlantic which has resulted in revenue and profitability growth rates may not be indicative of North Atlantic's future operations, prospects and viability.

Employee Relations

North Atlantic has approximately 570 full-time employees and 140 part-time employees of which approximately 65% and 90%, respectively, are represented by the United Steel Workers of America pursuant to collective bargaining agreements expiring in 2007 and 2008. North Atlantic may not be able to renegotiate these collective agreements on satisfactory terms, or at all, which may result in an increase in operating costs. In addition, the existing collective agreements may not prevent a strike or work stoppage in the future, and any such work stoppage could have a material adverse effect on North Atlantic's financial results.

Competition

North Atlantic competes with a broad range of refining and marketing companies, including multinational oil companies. Because of their geographic diversity, larger and more complex refineries, integrated operations and greater resources, some of North Atlantic's competitors may be better able to withstand volatile market conditions, to compete on the basis of price, to obtain crude oil in times of shortage and to bear the economic risks inherent in all phases of the refining industry.

Terrorist Attacks, Threats of Attacks or Acts of War

North Atlantic's business is affected by general economic conditions as well as fluctuations in consumer confidence and spending which can decline as a result of numerous factors outside of its control, such as terrorist attacks, threatened terrorist attacks or acts of war. Terrorist attacks, as well as events occurring in response to or in connection with them, including future terrorist attacks against Canadian or U.S. targets, rumours or threats of war, actual conflicts involving the military of Canada, the United States or their allies could cause trade disruptions impacting North Atlantic's crude oil suppliers or refined products customers or energy markets generally, and may adversely impact North Atlantic's operations, earnings and cash flow and Harvest's financial condition.

15

Since the terrorist attacks of September 11, 2001, the Government of the United States has issued public warnings that energy-related assets (which could include North Atlantic's Refinery) may be at greater risk of future terrorist attacks than other targets in Canada or the United States. Such occurrences could significantly impact energy prices, including prices for crude oil and refined products which could have a material adverse effect on North Atlantic's earnings and cash flow and Harvest's financial condition.

2.2 Date of Acquisition

The date of the Acquisition was October 19, 2006.

2.3 Consideration

Pursuant to the Acquisition, Harvest paid total cash consideration of U.S. $1.385 billion plus working capital and inventory adjustments.

Concurrent with the closing of the Acquisition, Harvest entered into an amended and restated credit agreement with its lenders that increased its revolving credit facility (the "Revolving Facility") to $1.4 billion and established a $350 million senior secured bridge facility (the "Senior Secured Bridge Facility"). Harvest also entered into another credit agreement that established a $450 million senior unsecured bridge facility (the "Senior Unsecured Bridge Facility"). At the closing of the Acquisition, Harvest withdrew the full amount available under the $350 million Senior Secured Bridge Facility and the $450 million Senior Unsecured Bridge Facility with the remaining funding drawn from its $1.4 billion Revolving Facility.

The terms and conditions of the amended and restated credit agreement remained unchanged except for changes to the security pledged and the addition of a 15 basis point fee applicable so long as the Senior Unsecured Bridge Facility is outstanding. The $350 million Senior Secured Bridge Facility provided Harvest with a single draw on this facility within five days of the closing of its acquisition of North Atlantic and, subject to the repayments requirements of the $450 million Senior Unsecured Bridge Facility, requires repayments equivalent to the net proceeds from an issuance of equity or equity-like securities (including convertible debentures) and, in all events, repayment in full within 18 months of the initial draw. Harvest is entitled to make additional repayments on the $350 million Senior Secured Bridge Facility without penalty or notice. The amended and restated credit agreement required Harvest to increase the first floating charge over all of the assets of Harvest's operating subsidiaries to $2.5 billion plus a first mortgage security interest on the refinery assets of North Atlantic.

The credit agreement that established a $450 million Senior Unsecured Bridge Facility provided for only a single draw on the facility within five days of the closing of Harvest's acquisition of North Atlantic and requires repayments equivalent to the net proceeds from an issuance of equity or equity like securities (including convertible debentures) and repayment in full within 6 months of the initial draw. Amounts borrowed under this facility bear interest at a floating rate based on bankers' acceptances plus a range of 230 to 280 basis points depending on the Harvest senior debt to EBITDA ratio as set forth in the amended and restated credit agreement.

2.4 Effect on Financial Position

Except as noted below, Harvest has no plans or proposals for material changes relating to its business affairs or the affairs of North Atlantic which may have a significant effect on the results of operations and financial position of Harvest as a result of the Acquisition.

Concurrent with the Acquisition, Harvest amended or entered into new credit facilities as described in Section 2.3 of this Report.

On November 22, 2006, Harvest announced that it completed the equity and convertible debenture offering contemplated by the Prospectus. Upon closing, a total of 9,499,000 trust units of Harvest ("Trust Units") were issued at a price of Cdn. $27.25 per Trust Unit and $379,500,000 principal amount of 7.25% convertible unsecured subordinated debentures were issued for gross proceeds of $638,347,750 and net proceeds of $610,225,362. The net proceeds from this offering were used to repay indebtedness incurred to fund the Acquisition. On November 20, 2006, Harvest's lenders unanimously agreed to amend the mandatory repayment terms of the $350 million Senior Secured Bridge Facility to enable $100 million of net proceeds from the offering to be retained by Harvest for general corporate purposes. Accordingly, Harvest fully repaid the $450 Million Unsecured Senior Bridge Facility, repaid approximately $60 million of the $350 million Senior Secured Bridge Facility and reduced the drawn portion on its Revolving Facility by $100 million.

16

2.5 Prior Valuations

None.

2.6 Parties to Transaction

Not applicable.

2.7 Date of Report

December 11, 2006.

Item 3 Financial Statements

The unaudited pro forma combined financial statements of the Trust as at September 30, 2006 and for the nine months ended September 30, 2006 and the year ended December 31, 2005 are attached as Schedule A to this Report.

The audited combined financial statements of North Atlantic Refining Limited and Vitol Refining S.A. as at and for the years ended December 31, 2005, 2004 together with the unaudited combined financial statements of North Atlantic Refining Limited and Vitol Refining S.A. as at September 30, 2006 and for the nine months ended September 30, 2006 and 2005 are attached as Schedule B to this Report.

SCHEDULE A

PRO FORMA COMBINED FINANCIAL STATEMENTS

OF HARVEST ENERGY TRUST

A-1

COMPILATION REPORT

To the Board of Directors of Harvest Operations Corp. on behalf of Harvest Energy Trust

We have read the accompanying unaudited pro forma combined balance sheet of Harvest Energy Trust (the "Trust") as at September 30, 2006 and the unaudited pro forma combined income statements for the nine months then ended and for the year ended December 31, 2005, and have performed the following procedures:

1. Compared the figures in the columns captioned "Harvest Energy Trust" to the unaudited interim consolidated financial statements of the Trust as at September 30, 2006 and for the nine months then ended and found them to be in agreement.

2. Compared the figures in the column captioned "Combined Harvest/Viking Pro Forma" to the unaudited pro forma combined statement of income of Harvest Energy Trust for the year ended December 31, 2005 included in the Business Acquisition Report dated April 18, 2006 and found them to be in agreement.

3. Compared the figures in the columns captioned "North Atlantic Refining and Vitol Refining" to the unaudited combined financial statements of North Atlantic Refining Limited and Vitol Refining S.A., wholly owned subsidiaries of Vitol Refining Group B.V. as at September 30, 2006 and for the nine months then ended, and to the audited combined financial statements of North Atlantic Refining Limited and Vitol Refining S.A., wholly owned subsidiaries of Vitol Refining Group B.V. for the year ended December 31, 2005, respectively, and following their conversion from U.S. to Canadian dollars, found them to be in agreement.

4. Made enquires of certain officials of the Trust who have responsibility for financial and accounting matters about:

(a) the basis for the determination of the pro forma adjustments; and

(b) whether the pro forma financial statements comply as to form in all material respects with the regulatory requirements of the various Securities Commissions and similar regulatory authorities in Canada.

The officials:

(a) described to us the basis for determination of the pro forma adjustments; and

(b) stated that the pro forma financial statements comply as to form in all material respects with the regulatory requirements of the various Securities Commissions and similar regulatory authorities in Canada.

5. Read the notes to the pro forma financial statements, and found them to be consistent with the basis described to us for determination of the pro forma adjustments.

6. Calculated the application of the pro forma adjustments to the aggregate of the amounts in the other applicable columns as at September 30, 2006 and for the nine months then ended, and for the year ended December 31, 2005, and found the amounts in the columns captioned "Pro Forma Combined" to be arithmetically correct.

A pro forma financial statement is based on management assumptions and adjustments which are inherently subjective. The foregoing procedures are substantially less than either an audit or a review, the objective of which is the expression of assurance with respect to management's assumptions, the pro forma adjustments and the application of the adjustments to the historical financial information. Accordingly, we express no such assurance. The foregoing procedures would not necessarily reveal matters of significance to the pro forma financial statements, and we therefore make no representation about the sufficiency of the procedures for the purposes of a reader of such statements.

(signed) "KPMG LLP"

Chartered Accountants

Calgary, Canada

November 14, 2006

A-2

HARVEST ENERGY TRUST

PRO-FORMA COMBINED BALANCE SHEET

As at September 30, 2006

(thousands of dollars, unaudited)

| | Harvest Energy Trust | North Atlantic and Vitol Refining S.A. | Pro Forma Notes | Pro Forma Adjustments | Pro Forma Combined |

| ASSETS | | | | | |

Current Assets | | | | | |

Cash and cash equivalents | $ - | $ 3,757 | 2(i) | (1,006) | $ 2,751 |

Accounts receivable | 180,358 | 31,393 | | - | 211,751 |

Amounts due from affiliates | - | 499,158 | 2(i) | (334,551) | |

| | | 2(ii) | (164,607) | - |

Inventory | - | 396,711 | 2(i) | (385,719) | |

| | | 2(iii) | 24,366 | 35,358 |

Fair value of risk management contracts | 16,422 | 7,912 | 2(i) | (7,912) | 16,422 |

Prepaid expenses | 8,046 | 1,634 | | - | 9,680 |

Future income taxes | - | 210 | 2(iii) | (210) | - |

| | 204,826 | 940,775 | | | 275,962 |

| | | | | | |

Fair value of risk management contracts | 15,167 | - | | - | 15,167 |

Property, plant and equipment | 3,077,821 | 434,064 | 2(iii) | 735,936 | 4,247,821 |

Long term receivables | - | 38,728 | 2(iii) | (36,129) | 2,599 |

Future income taxes | - | 3,308 | 2(iii) | (3,308) | - |

Goodwill | 656,248 | - | 2(iii) | 381,072 | 1,037,320 |

Deferred financing charges and other | 11,417 | 28,605 | 2(iii) | (28,605) | |

| | | 2(iii) | 11,850 | |

| | | 2(iv) | 13,770 | 37,037 |

Deposit on North Atlantic Refinery Limited | 111,292 | - | 2(iii) | (111,292) | - |

| | | | | |

TOTAL ASSETS | $ 4,076,771 | $ 1,445,480 | | | $ 5,615,906 |

| | | | | |

LIABILITIES | | | | | |

Current Liabilities | | | | | |

Accounts payable | $ 228,708 | $ 50,049 | 2(i) | (14,822) | |

| | | 2(iii) | 16,850 | $ 280,785 |

Short term borrowings | - | 135 | 2(ii) | (135) | - |

Amounts due to affiliates | - | 136,974 | 2(i) | (138,770) | |

| | | 2(ii) | 1,796 | - |

Current portion of long term obligations | | 167,741 | 2(ii) | (167,741) | - |

Unitholder distributions and debenture interest payable | 42,163 | - | | - | 42,163 |

Fair value deficiency of risk management contracts | 24,850 | 3,386 | 2(i) | (3,386) | 24,850 |

Senior Unsecured Bridge Loan | - | - | 2(iii) | 450,000 | |

| | | 2(iv) | (450,000) | - |

Future income tax | - | 5,793 | 2(iii) | (5,793) | - |

| 295,721 | 364,078 | | | 347,798 |

| | | | | |

Bank loans | 591,189 | - | 2(iii) | 1,011,089 | |

| | | 2(iv) | (79,681) | 1,522,597 |

Fair value deficiency of risk management contracts | 24,812 | - | | - | 24,812 |

7 7/8 % Senior Notes | 279,425 | - | | - | 279,425 |

Long term obligations | - | 278 | 2(ii) | (278) | - |

Convertible debentures | 235,114 | - | 2(iv) | 308,000 | 543,114 |

Employee Future benefits | - | 11,673 | 2(iii) | 526 | 12,199 |

Deferred credits | 881 | - | | - | 881 |

Asset retirement obligation | 193,182 | - | | - | 193,182 |

Future income taxes | - | 21,653 | 2(iii) | (21,653) | - |

Total Liabilities | 1,620,324 | 397,682 | | | 2,924,008 |

| | | | | |

Unitholders' Equity | | | | | |

Shareholder's equity | - | 1,047,798 | 2(i) | (572,210) | |

| | | 2(ii) | 1,751 | |

| | | 2(iii) | (477,339) | - |

Unitholders' capital | 2,757,381 | - | 2(iv) | 213,451 | 2,970,832 |

Equity component of convertible debentures | 24,539 | - | 2(iv) | 22,000 | 46,539 |

Accumulated income | 269,622 | - | | - | 269,622 |

Accumulated distributions | (595,095) | - | | - | (595,095) |

| 2,456,447 | 1,047,798 | | | 2,691,898 |

| | | | | |

TOTAL LIABILITIES and UNITHOLDERS' EQUITY | $ 4,076,771 | $ 1,445,480 | | | $ 5,615,906 |

A-3

HARVEST ENERGY TRUST

PRO-FORMA COMBINED INCOME STATEMENT

For the year ended December 31, 2005

(thousands of dollars, unaudited)

| | Combined Harvest/Viking Pro Forma | North Atlantic and Vitol Refining S.A. Note 3(i) | Pro Forma Notes | Pro Forma Adjustments | Pro Forma Combined |

| REVENUE | | | | | |

| Petroleum and natural gas sales | $1,185,698 | $- | | $- | $1,185,698 |

| Sale of refined products | - | 2,751,519 | | - | 2,751,519 |

| Royalty expense | (212,027) | - | | - | (212,027) |

| Risk management contracts | | | | | |

Realized net losses | (72,862) | - | | - | (72,862) |

Unrealized net losses | (45,147) | - | | - | (45,147) |

| | 855,662 | 2,751,519 | | | 3,607,181 |

| | | | | | |

EXPENSES | | | | | |

Purchased products for resale and processing | - | 2,267,062 | 3(ii) | 24,616 | 2,291,678 |

Operating | 229,166 | 111,103 | 3(ii) | (1,315) | 338,954 |

General and administrative | 50,211 | - | | - | 50,211 |

Interest and other financing charges on short-term debt | 7,462 | - | 3(iii) | 3,375 | 10,837 |

Interest and other financing charges on long-term debt | 50,352 | 10,472 | 3(iii) | 40,596 | |

| | - | 3(iii) | 8,872 | 110,292 |

Transaction costs | 15,104 | - | | - | 15,104 |

Depletion, depreciation and amortization | 395,432 | 43,454 | 3(iv) | 63,000 | 501,886 |

Foreign exchange gain | (9,728) | (1,937) | | - | (11,665) |

Large corporations tax and other taxes | 835 | - | | - | 835 |

Current and future income tax recovery | (55,399) | 8,756 | 3(v) | (8,756) | (55,399) |

Non-controlling interest | 98 | - | | - | 98 |

| 683,533 | 2,438,910 | | | 3,252,831 |

| | | | | |

NET INCOME | $ 172,129 | $312,609 | | | $354,350 |

| | | | | | |

| Net Income per Trust Unit (Note 4) | | | | | |

Basic | $1.78 | | | | $3.39 |

Diluted | $1.77 | | | | $3.27 |

| | | | | | |

A-4

HARVEST ENERGY TRUST

PRO-FORMA COMBINED INCOME STATEMENT

For the nine months ended September 30, 2006

(thousands of dollars, unaudited)

| | Harvest Energy Trust | Viking Energy Royalty Trust Note 3(vi) | North Atlantic and Vitol Refining S.A. Note 3(vii) | Pro Forma Notes | Pro Forma Adjustments | Pro Forma Combined |

| REVENUE | | | | | | |

| Petroleum and natural gas sales | $ 847,465 | $ 40,785 | $ - | | $ - | $ 888,250 |

| Sale of refined products | - | - | 2,401,863 | | - | 2,401,863 |

| Royalty expense | (149,384) | (7,734) | - | | - | (157,118) |

| Risk management contracts | | | | | | |

Realized net losses | (56,623) | - | - | | - | (56,623) |

Unrealized net losses | 35,966 | - | - | | - | 35,966 |

| 677,424 | 33,051 | 2,401,863 | | | 3,112,338 |

| | | | | | |

EXPENSES | | | | | | |

Operating | 182,399 | 9,757 | 84,412 | 3(viii) | (812) | 275,756 |

Interest and other financing charges on short-term debt | - | - | - | | - | - |

| | | | 3(ix) | 6,217 | 99,277 |

Transaction costs | 12,072 | - | - | | - | 12,072 |

Depletion, depreciation and amortization | 297,726 | 15,230 | 34,951 | 3(x) | 47,250 | 395,157 |

Foreign exchange gain | (11,327) | - | (1,461) | | - | (12,788) |

Large corporations tax and other taxes | 8 | 53 | - | | - | 61 |

Current and future income tax recovery | (2,300) | - | 5,417 | 3(xi) | (5,417) | (2,300) |

Non-controlling interest | (65) | - | - | | - | (65) |

| 542,911 | 33,526 | 2,221,008 | | | 2,911,077 |

| | | | | | |

NET INCOME | $ 134,513 | $ (475) | $ 180,855 | | | $ 201,261 |

| | | | | | | |

| Net Income per Trust Unit (Note 4) | | | | | | |

Basic | $ 1.39 | | | | | $ 1.82 |

Diluted | $ 1.38 | | | | | $ 1.81 |

| | | | | | | |

A-5

HARVEST ENERGY TRUST

NOTES TO PRO FORMA COMBINED FINANCIAL STATEMENTS

(unaudited)

1. BASIS OF PRESENTATION

The accompanying unaudited pro forma combined balance sheet as at September 30, 2006 and the unaudited pro forma combined income statements for the year ended December 31, 2005 and the nine month period ended September 30, 2006 (the "Pro Forma Financial Statements") have been prepared in accordance with Canadian generally accepted accounting principles for inclusion in the Harvest Energy Trust short form prospectus dated November 14, 2006 relating to the qualification for distribution of 330,000 7.25% Convertible Unsecured Subordinated Debentures (the "Debentures") and 8.26 million trust units ("Trust Units"). The Pro Forma Financial Statements reflect the financial position and income assuming the acquisition of North Atlantic Refining Limited ("North Atlantic") and the acquisition of Viking Energy Royalty Trust ("Viking") each occurred on January 1, 2005.

The Pro Forma Financial Statements have been prepared from the following financial information:

- The unaudited pro forma combined statement of income of Harvest Energy Trust ("Harvest") for the year ended December 31, 2005 attached as Schedule A to its Business Acquisition Report dated April 18, 2006;

- The unaudited interim consolidated balance sheet and consolidated statements of income and accumulated income of Harvest for the nine months ended September 30, 2006;

- The audited combined statement of income for Vitol Refining S.A. and North Atlantic Refining Limited, wholly-owned subsidiaries of Vitol Refining Group B.V. for the year ended December 31, 2005;

- The unaudited interim combined balance sheet and related interim combined statement of income for Vitol Refining S.A. and North Atlantic Refining Limited, wholly-owned subsidiaries of Vitol Refining Group B.V. for the nine months ended September 30, 2006; and,

- The unaudited financial information of Viking for the period from January 1, 2006 to February 3, 2006.

These Pro Forma Financial Statements should be read in conjunction with the audited consolidated financial statements, including the notes thereto, of Harvest and Viking for the year ended December 31, 2005 incorporated by reference in this short form prospectus.

In the opinion of the Harvest management, these Pro Forma Financial Statements include all material adjustments necessary for fair presentation. These Pro Forma Financial Statements may not necessarily be indicative of the financial results or operations that would have occurred if the acquisitions and the related events reflected herein and described in note 2 to the Pro Forma Financial Statements had occurred on the assumed dates or the results of operations in future periods. In preparing these Pro Forma Financial Statements, no adjustments have been made to reflect the operating synergies and related cost savings that may result from combining the operations of Harvest, Viking and North Atlantic. Further, adjustments have not been made to reflect the administrative efficiencies of combining the operations of Harvest, Viking and North Atlantic.

2. PRO FORMA COMBINED BALANCE SHEET ASSUMPTIONS AND ADJUSTMENTS

The Pro Forma Combined Balance Sheet has been prepared to reflect the financial position of Harvest assuming its acquisition of 100% of the issued and outstanding shares of North Atlantic and its related businesses pursuant to the Purchase and Sale Agreement between Vitol Refining Group B.V. and Harvest dated August 22, 2006 (the "PSA") occurred on September 30, 2006. Under this PSA, Harvest agreed to acquire 100% of the CDN$1,548 million issued and outstanding shares of North Atlantic and related businesses in exchange for cash consideration of US$1,385 million (CDN$1,548.0 million) plus US$21.8 million (CDN$24.4 million) for inventory, subject to final working capital and inventory adjustments. Harvest's acquisition costs have been estimated to be CDN$5.0 million.

The aggregate consideration for the North Atlantic acquisition consists of the following (in 000's of CDN$):

A-6

| Purchase price for shares of North Atlantic and related businesses | $1,548,015 |

| Estimated inventory at closing | 24,366 |

| | 1,572,381 |

| Estimated acquisition costs | 5,000 |

| Total Purchase Price | $1,577,381 |

The North Atlantic acquisition has been accounted for using the purchase method whereby the assets acquired and liabilities assumed are recorded at their fair values with the excess of the aggregate consideration over the fair value of the identifiable net assets allocated to goodwill. These amounts are estimates made by management based on currently available information. Thefollowing summarizes the allocation of the aggregate consideration for the North Atlantic acquisition (in 000's of CDN$):

| | |

| Working capital, net | $11,543 |

| Inventory | 24,366 |

| Capital assets | 1,170,000 |

| Long term receivables | 2,599 |

| Goodwill | 381,072 |

| Funding deficiency of pension and other benefit plans | (12,199) |

| Total acquisition cost | $1,577,381 |

On August 22, 2006, upon entering into the agreement to purchase North Atlantic, Harvest forwarded a deposit of $111,292,000 to Vital Refining S.A. which was applied against the purchase price at closing. This amount is reflected in the unaudited interim balance sheet of Harvest as at September 30, 2006.

On October 19, 2006, concurrent with the closing of the acquisition of North Atlantic, Harvest entered into credit agreements that established a $1.4 billion Three Year Extendible Revolving Facility, a $350 million Senior Secured Bridge Facility and a $450 million Senior Unsecured Bridge Facility. At closing, Harvest drew the full amount available under the $350 million Senior Secured Bridge Facility and the $450 million Senior Unsecured Bridge Facility, with the remaining $661,089,000 funded from the $1.4 billion Three Year Extendible Revolving Facility.

Harvest entered into an amendment dated November 9, 2006 to the underwriting agreement with a syndicate of underwriters to sell, on a bought deal basis, a combination of $330 million principal amount of Debentures and 8.26 million Trust Units at a price of $1,000 per Debenture and $27.25 per Trust Unit to raise gross proceeds totalling approximately $555.1 million and net proceeds of $529.7 million excluding any proceeds realized on exercise of the Over-allotment Options. Harvest also granted the underwriters an Over-allotment Option to purchase up to an additional 49,500 Debentures and an additional 1,239,000 Trust Units at the same offering prices.

The Pro Forma Combined Balance Sheet has been prepared to reflect the closing of the acquisition of North Atlantic as described above with the subsequent repayment of a significant portion of the bridge facilities with the net proceeds from the issuance of the Debentures and Trust Units.

The following pro forma adjustments have been made to the Pro Forma Combined Balance Sheet to reflect Harvest's acquisition of North Atlantic assuming the acquisition occurred on September 30, 2006:

A-7

(i) Elimination of the Vitol Refining S.A. Assets and Liabilities

The Pro Forma Combined Balance Sheet has been adjusted to reflect the elimination of the following Vitol Refining S.A. assets and liabilities as Harvest's acquisition was limited to the assets and liabilities of North Atlantic (in 000's):

| | In US Dollars | In CDN Dollars |

| Assets | | |

Cash and cash equivalents | $900 | $1,006 |

Due from related parties | $299,321 | $334,551 |

Inventory | $345,101 | $385,719 |

Fair value of risk management contracts | $7,079 | $7,912 |

| Liabilities | | |

Account payable and accrued liabilities | $13,261 | $14,822 |

Due to related parties | $124,157 | $138,770 |

Fair value deficiencies of risk management | | |

contracts | $3,029 | $3,386 |

| Shareholders' Equity | $511,954 | $572,210 |

(ii) Settlement of North Atlantic's Long Term Debt and Amounts Owing To and From Affiliates

The Pro Forma Combined Balance Sheet has been adjusted to reflect the vendor's settlement of North Atlantic's total long term obligations of US$150.3 million (CDN$168.0 million), short term borrowings of US$121 thousand (CDN$135 thousand) and net amounts owing from related parties of US$148.9 million (CDN$166.4 million), prior to closing as required by the PSA with an offsetting amount reflected as a contribution to shareholders' equity (US$1.6 million and CDN$1.8 million).

(iii) Purchase Price Allocation

The Pro Forma Combined Balance Sheet has been adjusted to reflect the purchase of the North Atlantic net assets at their fair values at September 30, 2006, and accordingly, the following adjustments have been made:

The addition of the North Atlantic capital assets at their fair values of $1,170 million reflecting a $735.9 million adjustment;

An allocation of the excess consideration over the fair value of assets acquired resulting in a $381.1 million goodwill amount;

The elimination of North Atlantic's deferred charges of US$25.6 million (CDN$28.6 million);

An increase of North Atlantic's employee future pension provisions by $0.5 million to reflect the underfunded status of the obligations at September 30, 2006;

The addition of $1,461 million of bank financing by Harvest to purchase 100% of the issued and outstanding shares of North Atlantic and the $24.4 million of inventory purchased at closing;

The deferral and accrual of $11.9 million of banking fees related to Harvest's expanded credit facilities as well as the accrual of $5.0 million of acquisition costs in related to North Atlantic acquisition;

The elimination of North Atlantic's future income tax provisions comprised of current future income tax asset of US$0.2 million (CDN$0.2 million), long term future income tax asset of US$3.0 million (CDN$3.3 million), current future income tax liability of US$5.2 million (CDN$5.8 million) and long term future income tax liability of US$19.4 million (CDN$21.7 million). In addition, investment tax credits included in long term receivables aggregating to US$32.3 million (CDN$36.1 million) have been eliminated; and

The elimination of North Atlantic's residual shareholders' equity of US$427.1 million (CDN$477.3 million).

A-8

(iv) Issuance of the Debentures and Trust Units

The Pro Forma Combined Balance Sheet has been adjusted to reflect the issuance of $330 million principal amount of Debentures and 8.26 million Trust units at a price of $27.25 per Trust Unit as at September 30, 2006 with the proceeds used to repay bank borrowings, and accordingly, the following adjustments have been made:

A-9

3. PRO FORMA COMBINED INCOME STATEMENT ASSUMPTIONS AND ADJUSTMENTS

These Pro Forma Combined Income Statements for the year ended December 31, 2005 and the nine months ended September 30, 2006 have been prepared to reflect the earnings of Harvest assuming the following occurred on January 1, 2005:

Harvest's August 2, 2005 acquisition of the Hay River properties (the "Hay River Acquisition") for cash consideration of $237.8 million funded by the issuance of $75 million of 6.5% Series Convertible Debentures for net proceeds of $71.8 million and the issuance of 6,505,600 Trust Units for net proceeds of $166.0 million;

Viking's February 1, 2005 acquisition of Calpine Natural Gas Trust for total consideration of $453.2 million comprised of $373.5 million of ascribed value from the issuance of 54,132,320 Viking Trust Units, $71.0 million of assumed bank debt and $8.7 million of related transaction costs;

Harvest's February 3, 2006 acquisition of Viking for total consideration of $1,961.7 million comprised of $1,638.1 million of ascribed value from the issuance of 46,040,788 Harvest Trust Units, $91.8 million of assumed bank debt, $227.2 million of fair value ascribed to the assumption of Viking's convertible debentures and $4.6 million of related transaction costs;

Harvest's acquisition of 100% of the issued and outstanding shares of North Atlantic and related businesses for cash consideration of US$1,385 million (CDN$1,548.0 million) and inventory for additional cash consideration of US$21.8 million (CDN$24.4 million) plus adjustments for working capital and inventory adjustments. Harvest's acquisition costs are estimated to be $5.0 million;

Harvest drew the full amount available under its $350 million Senior Secured Bridge Facility and $450 million Senior Unsecured Bridge Facility with the remaining $772,381,000, including an initial deposit of $111,292,000 funded from its expanded Three Year Extendible Revolving Facility; and,

The closing of Harvest's issuance of $330 million principal amount of Debentures and 8.26 million Trust Units at a price of $1,000 per Debenture and $27.25 per Trust Unit with gross proceeds totalling approximately $555.1 million and net proceeds of approximately $529.7 million.

A-10

Pro Forma Combined Income Statement – Year ended December 31, 2005

The Pro Forma Combined Income Statement for the year ended December 31, 2005 has been prepared by further adjusting the pro forma combined income statement in Harvest's Business Acquisition Report dated April 18, 2006 which included all of the adjustments required to reflect the acquisition of the Viking assets and the Hay River properties. The following adjustments reflect Harvest's acquisition of North Atlantic and the Debentures and Trust Unit financing assuming these transactions had occurred on January 1, 2005: