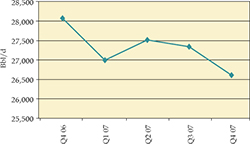

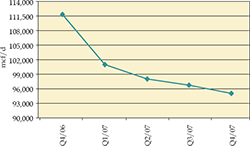

The table and discussion below highlight our fourth quarter 2007 performance over the preceding seven quarters on select measures:

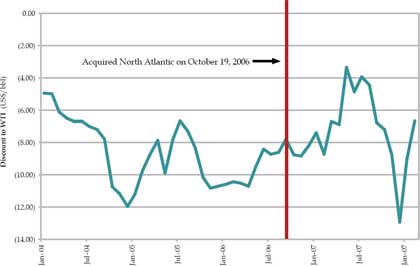

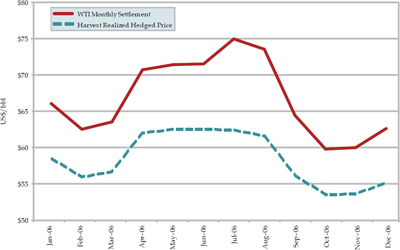

Net revenues have generally increased steadily over the eight quarters with significantly higher revenue in the Second and Third Quarters of 2006 over the preceding quarters due to the incremental revenue from the Viking acquisition in February 2006 along with stronger commodity prices including narrowing crude oil differentials. In the Fourth Quarter of 2006, the significant increase in revenue over the prior quarter is attributed to the North Atlantic acquisition which is a margin business with significant revenues coupled with significant costs for crude oil feedstock. In the second half of 2007 net revenues decreased from the first half of 2007 due to the Refinery’s lower realized prices and decreased throughput due to two planned shutdowns. The growth in cash from operating activities is closely aligned with the growth in net revenues and is attributed to the same factors as the growth in net revenues, reflecting the cyclical nature of the downstream segment in 2007.

Net income reflects both cash and non-cash items. Changes in non-cash items, including future income tax, DDA&A expense, unrealized foreign exchange gains and losses, unrealized gains and losses on risk management contracts and Trust Unit right compensation expense cause net income to vary significantly from period to period. In the Second Quarter of 2007 Bill C-52 was substantively enacted, which imposed a new tax on distributions from publicly traded income trusts resulting in a large future income tax expense in the quarter. In the Fourth Quarter of 2007 Bill C-28 implemented reductions in the federal corporate income tax rates which will also apply to the tax on distributions from publicly traded mutual fund trusts, resulting in a significant future income tax recovery in the quarter. Additionally, the volatility in net income (loss) between quarters in 2006 and 2007 is due to the changes in the fair value of our risk management contracts and this is the primary reason why our net income (loss) does not reflect the same trends as net revenues or cash from operating activities.

Growth in total assets over the last eight quarters is directly attributed to our acquisition of Viking in the first quarter of 2006, Birchill in the Third Quarter of 2006 and North Atlantic in the Fourth Quarter of 2006. The changes in our total long term financial liabilities is primarily due to the impact of our acquisitions, offset by our issuance of Trust Units and the net cash surplus of cash from operating activities over our distributions to Unitholders.

| |

| |

Management’s Discussion and Analysis | |

| |

CRITICAL ACCOUNTING ESTIMATES

There are a number of critical estimates underlying the accounting policies applied when preparing the consolidated financial statements due to timing differences between when certain activities take place and when these activities are reported. Changes in these estimates could have a material impact on our reported results.

Reserves

The process of estimating reserves is complex. It requires significant judgments and decisions based on available geological, geophysical, engineering and economic data. In the process of estimating the economically recoverable oil and natural gas reserves and related future net cash flows, we incorporate many factors and assumptions, such as:

| |

• | Expected reservoir characteristics based on geological, geophysical and engineering assessments; |

| |

• | Future production rates based on historical performance and expected future operating and investment activities; |

| |

• | Future oil and gas prices and quality differentials; and |

| |

• | Future development costs. |

We follow the full cost method of accounting for our oil and natural gas activities. All costs of acquiring oil and natural gas properties and related exploration and development costs, including overhead charges directly related to these activities, are capitalized and accumulated in one cost centre. Maintenance and repairs are charged against income, and renewals and enhancements that extend the economic life of the capital assets are capitalized. The provision for depletion and depreciation of petroleum and natural gas assets is calculated on the unit-of-production method, based on proved reserves as estimated by independent petroleum engineers.

Reserve estimates impact net income through depletion, the determination of asset retirement obligations and the application of an impairment test. Revisions or changes in the reserve estimates can have either a positive or a negative impact on net income, capital assets and asset retirement obligations.

Asset Retirement Obligations

In the determination of our asset retirement obligations, management is required to make a significant number of estimates with respect to activities that will occur in many years to come. In arriving at the recorded amount of the asset retirement obligation numerous assumptions are made with respect to ultimate settlement amounts, inflation factors, credit adjusted risk free discount rates, timing of settlement and expected changes in legal, regulatory, environmental and political environments. The asset retirement obligation also results in an increase to the carrying cost of capital assets. The obligation accretes to a higher amount with the passage of time as it is determined using discounted present values. A change in any one of the assumptions could impact the estimated future obligation and in return, net income. It is difficult to determine the impact of a change in any one of our assumptions. As a result, a reasonable sensitivity analysis cannot be performed.

Impairment of Capital Assets

Numerous estimates and judgments are involved in determining any potential impairment of capital assets. The most significant assumptions in determining future cash flows are future prices and reserves for our upstream operations and expected future refining margins for our downstream operations.

The estimates of future prices and refining margins require significant judgments about highly uncertain future events. Historically, oil, natural gas and refined product prices have exhibited significant volatility. The prices used in carrying out our impairment tests for each operating segment are based on prices derived from a consensus of future price forecasts among industry analysts. Given the number of significant assumptions required and the possibility that actual conditions will differ, we consider the assessment of impairment to be a critical accounting estimate.

If forecast WTI crude oil prices were to fall by 20%, the initial assessment of impairment of our upstream assets would not change; however, below that level, we would likely experience an impairment. Although oil and natural gas prices fluctuate a great deal in the short-term, they are typically stable over a longer time horizon. This mitigates potential for impairment. Similarly, for our downstream operations, if forecast refining margins were to fall by more than 25%, it is likely that our downstream assets would experience an impairment despite the expected seasonal volatility in earnings.

Reductions in estimated future prices may also have an impact on estimates of economically recoverable proved reserves.

Any impairment charges would reduce our net income.

| |

| |

| Management’s Discussion and Analysis |

| |

It is difficult to determine and assess the impact of a decrease in our proved reserves on our impairment tests. The relationship between the reserve estimate and the estimated undiscounted cash flows is complex. As a result, we are unable to provide a reasonable sensitivity analysis of the impact that a reserve estimate decrease would have on our assessment of impairment.

Goodwill

Goodwill is recorded on a business combination when the total purchase consideration exceeds the fair value of the net identifiable assets and liabilities of the acquired entity. The goodwill balance is not amortized, however, must be assessed for impairment at least annually. Impairment is initially determined based on the fair value of a reporting unit compared to its book value. Any impairment must be charged to earnings in the period the impairment occurs. Harvest has a goodwill balance for each of our upstream and downstream operations. As at December 31, 2007, we have determined there was no goodwill impairment in either of our reporting units.

Employee Future Benefits

We maintain a defined benefit pension plan for the employees of North Atlantic. Obligations under employee future benefit plans are recorded net of plan assets where applicable. An independent actuary determines the costs of our employee future benefit programs using the projected benefit method. The determination of these costs requires management to estimate or make assumptions regarding the expected plan investment performance, salary escalation, retirement ages of employees, expected health care costs, employee turnover, discount rates and return on plan assets. The obligation and expense recorded related to our employee future benefit plans could increase or decrease if there were to be a change in these estimates. Pension expense represented less than 0.5% of our total expenses for 2007 (0.5% in 2006).

Purchase Price Allocations

Business acquisitions are accounted for by the purchase method of accounting. Under this method, the purchase price is allocated to the assets acquired and the liabilities assumed based on the fair values at the time of the acquisitions. The excess of the purchase price over the assigned fair values of the identifiable assets and liabilities is allocated to goodwill. In determining the fair value of the assets and liabilities we are often required to make assumptions and estimates about future events, such as future oil and gas prices, refining margins and discount rates. Changes in any of these assumptions would impact amounts assigned to assets and liabilities and goodwill in the purchase price allocation and as a result, future net earnings.

RECENT CANADIAN ACCOUNTING AND RELATED PRONOUNCEMENTS

Convergence of Canadian GAAP with International Financial Reporting Standards

In early 2007, Canada’s Accounting Standards Board (“AcSB”) issued a decision summary with respect to a previously issued strategic plan that will result in Canadian GAAP, as used by public companies, being converged with International Financial Reporting Standards (“IFRS”). In early 2008, it was confirmed by the AcSB that the transitions date from Canadian GAAP to IFRS will be January 1, 2011. We are currently evaluating our options with respect to this change and accordingly it is premature to assess the impact of the initiative, if any, on our financial statements at this time.

Financial Instruments – Disclosures and Presentation

On December 1, 2006, the AcSB issued the following two new standards regarding the disclosure and presentation of financial instruments with an implementation date for annual and interim financial statements beginning on or after October 1, 2007.

| |

• | Section 3862 –Financial Instruments – Disclosures |

| |

| This standard requires entities to provide disclosures in their financial statements that enable users to evaluate the significance of financial instruments to the entity’s financial position and performance. It also requires that entities disclose the nature and extent of risks arising from financial instruments and how the entity manages those risks. |

| |

• | Section 3863 –Financial Instruments – Presentation |

| |

| This standard establishes standards for presentation of financial instruments and non-financial derivatives and deals with the classification of financial instruments, from the perspective of the issuer, between liabilities and equity, the classification of related interest, dividends, losses and gains, and the circumstances in which financial assets and financial liabilities are offset. |

Also on December 1, 2006, the AcSB issued a new standard regardingCapital Disclosurerequiring the disclosure of information about an entity’s objectives, policies and processes for managing capital; quantitative data about what the entity regards as capital; whether the entity has complied with any externally imposed capital requirements; and if it has not complied, the consequences of such non-compliance. This standard also has an implementation date for annual and interim financial statements beginning on or after October 1, 2007.

| |

| |

Management’s Discussion and Analysis | |

| |

In June 2007, the AcSB issued section 3031, Inventories, which replaces the existing inventories standard. This new standard provides additional guidance with respect to the measurement and disclosure requirements for inventories, requiring inventories to be valued at the lower of cost and net realizable value. This standard is to be adopted for fiscal years beginning on or after January 1, 2008. We do not expect the adoption of this section to have a material impact on our net income or financial position.

In February 2008, the CICA issued Section 3064, Goodwill and Intangible Assets, replacing Section 3062 Goodwill and Other Intangible Assets and Section 3450, Research and Development Costs. The new Section will be effective on January 1, 2009. Section 3062 establishes standards for the recognition, measurement, presentation and disclosure of goodwill and intangible assets subsequent to its initial recognition. Standards concerning goodwill are unchanged from the standards included in the previous Section 3062. We are currently evaluating the impact of the adoption of this new Section, however do not expect a material impact on our Consolidated Financial Statements.

OPERATIONAL AND OTHER BUSINESS RISKS

Our financial and operating performance is subject to risks and uncertainties which include, but are not limited to: upstream operations, downstream operations, reserve estimates, commodity prices, ability to obtain financing, environmental, health and safety risk, regulatory risk, disruptions in the supply of crude oil and delivery of refined products, employee relations, and other risks specifically discussed previously in this MD&A. We intend to continue executing our business plan to create value for Unitholders by paying stable monthly distributions and increasing the net asset value per Trust Unit. All of our risk management activities are carried out under policies approved by the Board of Directors of Harvest Operations, and are intended to mitigate the risks noted above as follows:

The following summarizes the more significant risks of our upstream and downstream operations. See our Annual Information Form for a full description of these risks as well as risks associated with our royalty trust structure.

Operation of oil and natural gas properties:

| |

• | Applying a proactive management approach to our properties; |

| |

• | Selectively adding skilled and experienced employees and providing encouragement and opportunities to maintain and improve technical competence; and |

Operation of a refining and petroleum marketing business:

| |

• | Maintaining a proactive approach to managing the supply of feedstock and sale of refined products (including the Supply and Offtake Agreement with Vitol Refining S.A.) to ensure the continuity of supply of crude oil to the refinery and the delivery of refined products from the refinery; |

| |

• | Allocating sufficient resources to ensure good relations are maintained with our non-unionized and unionized work force; and |

| |

• | Selectively adding experienced refining management to further strengthen our “in-house” management team. |

Estimates of the quantity of recoverable reserves:

| |

• | Acquiring oil and natural gas properties that have high-quality reservoirs combined with mature, predictable and reliable production and thus reduce technical uncertainty; |

| |

• | Subjecting all property acquisitions to rigorous operational, geological, financial and environmental review; and |

| |

• | Pursuing a capital expenditure program to reduce production decline rates, improve operating efficiency and increase ultimate recovery of the resource-in-place. |

Commodity price exposures:

| |

• | Maintaining a risk-management policy and committee to continuously review effectiveness of existing actions, identify new or developing issues and devise and recommend to the Board of Directors of Harvest Operations action to be taken; |

| |

• | Executing risk management contracts with a portfolio of credit-worthy counterparties; |

| |

• | Maintaining an efficient cost structure to maximize product netbacks; and |

| |

• | Limiting the period of exposure to price fluctuations between crude oil prices and product prices by entering into contracts such that crude oil feedstock will be priced based on the price at or near the time of delivery to the refinery, which may be as much as 24 days subsequent to the time the feedstock is initially loaded onto the shipping vessel. Thereby, minimizing the time between the pricing of the feedstock and the refined products with the objective of maintaining margins. |

| |

| |

| Management’s Discussion and Analysis |

| |

Financial risk:

| |

• | Monitoring financial markets to ensure the cost of debt and equity capital is kept as low as reasonably possible; |

| |

• | Retaining a portion of cash flows to finance capital expenditures and future property acquisitions; and |

| |

• | Carrying adequate insurance to cover property and business interruption losses. |

Environmental, health and safety risks:

| |

• | Adhering to our safety programs and keeping abreast of current industry practices for both the oil and natural gas industry as well as the refining industry; and |

| |

• | Committing funds on an ongoing basis toward the remediation of potential environmental issues. |

Changing government policy, including revisions to royalty legislation, income tax laws, and incentive programs related to theoil and natural gas industry:

| |

• | Retaining an experienced, diverse and actively involved Board of Directors to ensure good corporate governance; and |

| |

• | Engaging technical specialists when necessary to advise and assist with the implementation of policies and procedures to assist in dealing with the changing regulatory environment. |

CHANGES IN REGULATORY ENVIRONMENT

On October 25, 2007, the Government of Alberta released its New Royalty Framework outlining changes that effective January 1, 2009 will increase the royalty rates on conventional oil and gas, oil sands and coalbed methane using a price-sensitive and volume-sensitive sliding rate formula for both conventional oil and natural gas. While there are considerable details to be provided, our preliminary assessment is that the impact of the changes on Harvest will be modest, as many of our oil and natural gas wells will be considered low productivity wells that continue to attract favourable royalty treatment. Based on the information available and assuming royalties will continue to be based on field gate prices realized by producers, our analysis indicates that if our field gate prices are less than $53.00, our oil royalties will be lower and if prices are higher, our royalties will increase and similarly for natural gas, if our gas plant prices are less than $7.00, our royalties will be lower and if prices are higher, our royalties will increase. Of particular concern is the royalty rates on natural gas where production from recently drilled wells may qualify as high productivity for a period of time and attract a royalty that is 15% to 20% higher than under the current royalty regime and this could significantly penalize the economics of our drilling natural gas wells. Generally, we will pay higher royalties if commodity prices are high and lower royalties on most of our wells as they will be considered to be low productivity wells.

In 2007, the Government of Alberta introduced the Climate Change and Emissions Management Amendment Act which intends to reduce greenhouse gas emissions intensity from large emitting facilities. On January 24, 2008, the Government of Alberta announced their plan to reduce projected emissions in the province by 50% under the new climate change plan by 2050. This will result in real reductions of 14% below 2005 levels. The Government of Alberta stated they will form a government-industry council to determine a go-forward plan for implementing technologies, which will significantly reduce greenhouse gas emissions by capturing air emissions from industrial sources and locking them permanently underground in deep rock formations.

In 2002, the Government of Canada ratified the Kyoto Protocol which calls for Canada to reduce its greenhouse gas emissions to specified levels. On April 26, 2007, the Government of Canada released its Action Plan to Reduce Greenhouse Gases and Air Pollution (the “Action Plan”) which includes a regulatory framework for air emissions. This Action Plan is to regulate the fuel efficiency of vehicles and the strengthening of energy standards for a number of energy-using products. On March 10, 2008, the Government of Canada released “Turning the Corner” outlining additional details to implement their April 2007 commitment to cut greenhouse gas emissions by an absolute 20% by 2020. “Turning the Corner” sets out a framework to establish a market price for carbon emissions and sets up a carbon emission trading market to provide incentives for Canadians to reduce their greenhouse gas emissions. In addition, the regulations include new measures for oil sands developers that require an 18% reduction from 2006 levels by 2010 for existing operations and for oil sands operations commencing in 2012, a carbon capture and storage capability. There is no mention of targeting reductions for unintentional fugitive emissions for conventional producers. Companies will be able to choose the most cost effective way to meet their emissions reduction targets from in-house reductions, contributions to time-limited technology funds, domestic emissions trading and the United Nations’ Clean Development Mechanism. Companies that have already reduced their greenhouse gas emissions prior to 2006 will have access to a limited one-time credit for early adoption. Giving the evolving nature of the debate related to climate change and the control of greenhouse gases and resulting requirements, and the lack of detail in the Government of Canada’s announcement, it is not possible to assess the impact of the requirements on our operations and financial performance.

| |

| |

Management’s Discussion and Analysis | |

| |

NON-GAAP MEASURES

Throughout this MD&A we have referred to certain measures of financial performance that are not specifically defined under Canadian GAAP. Cash G&A and Operating Netbacks are non-GAAP measures used extensively in the Canadian energy trust sector for comparative purposes. Cash G&A are G&A expenses excluding the effect of our unit based compensation plans, while Operating Netbacks are always reported on a per boe basis, and include gross revenue, royalties, operating expenses, and transportation and marketing expenses. Gross Margin is commonly used in the refining industry to reflect the net funds received from the sale of refined products after considering the cost to purchase the feedstock and is calculated by deducting purchased products for resale and processing from total revenue. Earnings From Operations is also commonly used in the petroleum and natural gas and refining industries to reflect operating results before items not directly related to operations.

Disclosure Controls and Procedures and Internal Control over Financial Reporting

Under the supervision of our Chief Executive Officer and Chief Financial Officer, we have evaluated the effectiveness of our disclosure controls and procedures as of December 31, 2007 as defined under the rules adopted by the Canadian securities regulatory authorities and the US Securities and Exchange Commission. Based on this evaluation, our Chief Executive Officer and Chief Financial Officer have concluded that as of December 31, 2007, our disclosure controls and procedures were effective to ensure that information required to be disclosed by Harvest in reports it files or submits to Canadian and US securities authorities was recorded, processed, summarized and reported within the time period specified in Canadian and US securities laws and was accumulated and communicated to Harvest’s management, including its Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required disclosures.

Management is responsible for establishing and maintaining internal control over our financial reporting. Our internal control is designed to provide reasonable assurance regarding the reliability of financial reporting and preparation of financial statements for external purposes in accordance with Canadian Generally Accepted Accounting Principles. Management, with the participation of our Chief Executive Officer and Chief Financial Officer, has evaluated in the effectiveness of our internal control over financial reporting as of December 31, 2007. The evaluation was based on the Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on that evaluation, management has concluded that as of December 31, 2007, we had effective internal control over financial reporting.

The effectiveness of our internal control over financial reporting as of December 31, 2007 was audited by KPMG, an independent registered public accounting firm, as stated in their report, which is included in our audited consolidated financial statements for the year ended December 31, 2007.

During the year ended December 31, 2007, there were no changes in our internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting except for the appointment of a Chief Operating Officer - Downstream. The appointment enhanced our oversight of these operations.

Based on their inherent limitations, disclosure controls and procedures and internal controls over financial reporting may not prevent or detect misstatements, errors or fraud. Control systems, no matter now well conceived or operated, can provide only reasonable, but not absolute, assurance that the objectives of the control systems are met.

ADDITIONAL INFORMATION

Further information about us, including our Annual Information Form, can be accessed under our public filings found on SEDAR at www.sedar.com or at www.harvestenergy.ca. Information can also be found by contacting our Investor Relations department at (403) 265-1178 or at 1-866-666-1178.

| |

| |

| Consolidated Financial Statements |

| |

MANAGEMENT’S REPORT

In management’s opinion, the accompanying consolidated financial statements of Harvest Energy Trust (the “Trust”) have been prepared within reasonable limits of materiality and in accordance with Canadian generally accepted accounting principles. Since a precise determination of many assets and liabilities is dependent on future events, the preparation of financial statements necessarily involves the use of estimates and approximations. These have been made using careful judgment and with all information available up to March 12, 2008. Management is responsible for all information in the annual report and for the consistency, therewith, of all other financial and operating data presented in this report.

To meet its responsibility for reliable and accurate financial statements, management has established and monitors systems of internal control which are designed to provide reasonable assurance that financial information is relevant, reliable and accurate, and that assets are safeguarded and transactions are executed in accordance with management’s authorization.

Under the supervision of our Chief Executive Officer and our Chief Financial Officer we have conducted an evaluation of the effectiveness of our internal control over financial reporting based on theInternal Control-Integrated Frameworkissued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). We have concluded that as of December 31, 2007, our internal controls over financial reporting were effective.

Because of inherent limitations, internal control over financial reporting may not prevent or detect misstatements and even those systems determined to be effective can provide only reasonable assurance with respect to the financial statement preparation and presentation.

The consolidated financial statements and the Trusts’ internal control over financial reporting have been examined by KPMG LLP, Independent Registered Public Accountants. Their responsibility is to express a professional opinion on the fair presentation of the consolidated financial statements in accordance with Canadian generally accepted accounting principles. The Independent Registered Public Accountants Report outlines the scope of their examination and sets forth their opinion.

The Audit Committee, consisting exclusively of independent directors, has reviewed these statements with management and the Independent Registered Public Accountants and has recommended their approval to the Board of Directors. The Board of Directors has approved the consolidated financial statements of the Trust.

| |

|

|

|

John E. Zahary | Robert W. Fotheringham |

President and Chief Executive Officer | Chief Financial Officer |

Calgary, Alberta

March 12, 2008

| |

| |

Consolidated Financial Statements | |

| |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors of Harvest Operations Corp. on behalf of Harvest Energy Trust and

the Unitholders of Harvest Energy Trust

We have audited Harvest Energy Trust’s (“the Trust”) internal control over financial reporting as of December 31, 2007, based on the criteria established inInternal Control — Integrated Frameworkissued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). The Trust’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting included in the accompanying Management’s Report. Our responsibility is to express an opinion on the Trust’s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audit also included such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

An entity’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. An entity’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the entity; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the entity are being made only in accordance with authorizations of management and directors of the entity; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the entity’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, the Trust maintained, in all material respects, effective internal control over financial reporting as of December 31, 2007, based on the criteria established inInternal Control — Integrated Frameworkissued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

We also have conducted our audits on the consolidated financial statements in accordance with Canadian generally accepted auditing standards. With respect to the years ended December 31, 2007 and 2006, we also have conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Our report dated March 12, 2008, expressed an unqualified opinion on those consolidated financial statements.

KPMG LLP

Chartered Accountants

Calgary, Canada

March 12, 2008

| |

| |

| Consolidated Financial Statements |

| |

AUDITORS’ REPORT

To the Unitholders of Harvest Energy Trust

We have audited the consolidated balance sheets of Harvest Energy Trust (the “Trust”) as at December 31, 2007 and 2006 and the consolidated statements of income and comprehensive (loss) income, unitholders’ equity and cash flows for the years then ended. These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with Canadian generally accepted auditing standards. With respect to the consolidated financial statements for the years ended December 31, 2007 and 2006, we also conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation.

In our opinion, these consolidated financial statements present fairly, in all material respects, the financial position of the Trust as at December 31, 2007 and 2006 and the results of its operations and its cash flows for the years then ended in accordance with Canadian generally accepted accounting principles.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the Trust’s internal control over financial reporting as of December 31, 2007, based on the criteria established inInternalControl — Integrated Frameworkissued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), and our report dated March 12, 2008 expressed an unqualified opinion on the effectiveness of the internal control over financial reporting.

KPMG LLP

Chartered Accountants

Calgary, Canada

March 12, 2008

COMMENTS BY AUDITORS FOR UNITED STATES READERS ON CANADA –

UNITED STATES REPORTING DIFFERENCES

In the United States, reporting standards for auditors require the addition of an explanatory paragraph (following the opinion paragraph) when there is a change in accounting principles that has a material effect on the comparability of the Trust’s financial statements, such as the change described in note 3 to the consolidated financial statements as at December 31, 2007 and 2006 and for the years then ended. Our report to the unitholders dated March 12, 2008, is expressed in accordance with Canadian reporting standards, which do not require a reference to such a change in accounting principles in the auditors’ report when the change is properly accounted for and adequately disclosed in the financial statements.

KPMG LLP

Chartered Accountants

Calgary, Canada

March 12, 2008

| |

| |

Consolidated Financial Statements | |

| |

CONSOLIDATED BALANCE SHEETS

As at December 31

| | | | | | | | |

| | | | | | | | | |

|

(thousands of Canadian dollars) | | | 2007 | | | | 2006 | |

| | | | | | | | | |

ASSETS | | | | | | | | |

Current assets | | | | | | | | |

Cash | | $ | - | | | $ | 10,006 | |

Accounts receivable and other | | | 215,803 | | | | 257,131 | |

Fair value of risk management contracts[Note 18] | | | 16,442 | | | | 17,914 | |

Prepaid expenses and deposits | | | 15,144 | | | | 12,713 | |

Inventories[Note 5] | | | 58,934 | | | | 23,792 | |

| | | | | | | | | |

| | | 306,323 | | | | 321,556 | |

| | | | | | | | |

Deferred charges and other non-current assets[Note 8] | | | - | | | | 25,067 | |

Fair value of risk management contracts[Note 18] | | | - | | | | 9,843 | |

Property, plant and equipment[Note 6] | | | 4,197,507 | | | | 4,400,552 | |

Intangible assets[Note 7] | | | 95,075 | | | | 122,362 | |

Goodwill[Note 4] | | | 852,778 | | | | 866,178 | |

| | | | | | | | | |

| | $ | 5,451,683 | | | $ | 5,745,558 | |

| | | | | | | | | |

| | | | | | | | |

LIABILITIES AND UNITHOLDERS’ EQUITY | | | | | | | | |

Current liabilities | | | | | | | | |

Accounts payable and accrued liabilities[Note 9] | | $ | 270,243 | | | $ | 294,582 | |

Cash distribution payable | | | 44,487 | | | | 46,397 | |

Current portion of convertible debentures[Note 12] | | | 24,273 | | | | - | |

Fair value deficiency of risk management contracts[Note 18] | | | 131,020 | | | | 26,764 | |

| | | | | | | | | |

| | | 470,023 | | | | 367,743 | |

| | | | | | | | | |

| | | | | | | | |

Bank loan[Note 11] | | | 1,279,501 | | | | 1,595,663 | |

77/8% Senior notes[Note 13] | | | 241,148 | | | | 291,350 | |

Convertible debentures[Note 12] | | | 627,495 | | | | 601,511 | |

Fair value deficiency of risk management contracts[Note 18] | | | 35,095 | | | | 2,885 | |

Asset retirement obligation[Note 10] | | | 213,529 | | | | 202,480 | |

Employee future benefits[Note 17] | | | 12,168 | | | | 12,227 | |

Deferred credit | | | 710 | | | | 794 | |

Future income tax[Note 16] | | | 86,640 | | | | - | |

| | | | | | | | |

Unitholders’ equity | | | | | | | | |

Unitholders’ capital[Note 14] | | | 3,736,080 | | | | 3,046,876 | |

Equity component of convertible debentures | | | 39,537 | | | | 36,070 | |

Accumulated income | | | 246,865 | | | | 271,155 | |

Accumulated distributions | | | (1,340,349 | ) | | | (730,069 | ) |

Accumulated other comprehensive (loss) income[Note 3] | | | (196,759 | ) | | | 46,873 | |

| | | | | | | | | |

| | | 2,485,374 | | | | 2,670,905 | |

| | | | | | | | | |

| | $ | 5,451,683 | | | $ | 5,745,558 | |

| | | | | | | | | |

Commitments, contingencies and guarantees [Note 20].

Subsequent events [Note 22].

See accompanying notes to these consolidated financial statements.

Approved by the Board of Directors:

| |

|

|

Hector J. McFadyen | Verne G. Johnson |

Director | Director |

| |

| |

| Consolidated Financial Statements |

| |

CONSOLIDATED STATEMENTS OF INCOME (LOSS) AND

COMPREHENSIVE INCOME (LOSS)

For the Years Ended December 31

| | | | | | | | |

| | | | | | | |

|

(thousands of Canadian dollars, except per Trust Unit amounts) | | 2007 | | | 2006 | |

| | | | | | | | | |

REVENUE | | | | | | | | |

Petroleum, natural gas, and refined product sales | | $ | 4,283,013 | | | $ | 1,580,934 | |

Royalty expense | | | (213,413 | ) | | | (200,109 | ) |

| | | | | | | | | |

| | | 4,069,600 | | | | 1,380,825 | |

| | | | | | | | |

EXPENSES | | | | | | | | |

Purchased products for processing and resale | | | 2,667,714 | | | | 386,014 | |

Operating | | | 530,208 | | | | 276,537 | |

Transportation and marketing | | | 46,916 | | | | 17,202 | |

General and administrative[Note 15] | | | 36,328 | | | | 28,372 | |

Transaction costs | | | - | | | | 12,072 | |

Realized net losses on risk management contracts | | | 26,291 | | | | 44,808 | |

Unrealized net losses (gains) on risk management contracts | | | 147,781 | | | | (52,179 | ) |

Interest and other financing charges on short term debt, net | | | 5,584 | | | | 4,864 | |

Interest and other financing charges on long term debt | | | 152,201 | | | | 78,828 | |

Depletion, depreciation, amortization and accretion | | | 526,741 | | | | 429,470 | |

Foreign exchange loss (gain) | | | (109,316 | ) | | | 21,100 | |

Large corporations tax and other tax | | | (974 | ) | | | (9 | ) |

Future income tax expense (recovery)[Note 16] | | | 65,802 | | | | (2,300 | ) |

| | | | | | | | | |

| | | 4,095,276 | | | | 1,244,779 | |

| | | | | | | | | |

NET INCOME (LOSS) FOR THE YEAR | | | (25,676 | ) | | | 136,046 | |

| | | | | | | | |

Cumulative Translation Adjustment | | | (243,632 | ) | | | - | |

| | | | | | | | | |

COMPREHENSIVE INCOME (LOSS) FOR THE PERIOD[Note 3] | | $ | (269,308 | ) | | $ | 136,046 | |

| | | | | | | | | |

| | | | | | | | |

Net income per Trust Unit, basic[Note 14] | | $ | (0.19 | ) | | $ | 1.34 | |

Net income per Trust Unit, diluted[Note 14] | | $ | (0.19 | ) | | $ | 1.33 | |

| | | | | | | | | |

See accompanying notes to these consolidated financial statements.

| |

| |

Consolidated Financial Statements | |

| |

|

CONSOLIDATED STATEMENTS OF UNITHOLDERS’ EQUITY |

|

For the Years Ended December 31 |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

(thousands of Canadian dollars) | | Unitholders’

Capital | | Equity

Component

of Convertible

Debentures | | Accumulated

Income | | Accumulated

Distributions | | Accumulated

Other

Comprehensive

(Loss) Income

[Note 3] | | Total | |

| | | | | | | | | | | | | | |

At December 31, 2005 | | $ | 747,312 | | $ | 2,639 | | $ | 135,665 | | $ | (261,282 | ) | $ | - | | $ | 624,334 | |

Issued in exchange for assets of Viking | | | | | | | | | | | | | | | | | | | |

[Note 4(e)] | | | 1,638,131 | | | - | | | - | | | - | | | - | | | 1,638,131 | |

Issued for cash | | | | | | | | | | | | | | | | | | | |

August 17, 2006 | | | 230,118 | | | - | | | - | | | - | | | - | | | 230,118 | |

November 22, 2006 | | | 258,848 | | | - | | | - | | | - | | | - | | | 258,848 | |

Equity component of convertible debenture issuances | | | | | | | | | | | | | | | | | | | |

10.5% Debentures Due 2008 | | | - | | | 9,301 | | | - | | | - | | | - | | | 9,301 | |

6.40% Debentures Due 2012 | | | - | | | 14,822 | | | - | | | - | | | - | | | 14,822 | |

7.25% Debentures Due 2013 | | | - | | | 11,800 | | | - | | | - | | | - | | | 11,800 | |

Convertible debenture conversions | | | | | | | | | | | | | | | | | | | |

9% Debentures Due 2009 | | | 551 | | | - | | | - | | | - | | | - | | | 551 | |

8% Debentures Due 2009 | | | 1,550 | | | (12 | ) | | - | | | - | | | - | | | 1,538 | |

6.5% Debentures Due 2010 | | | 3,563 | | | (223 | ) | | - | | | - | | | - | | | 3,340 | |

10.5% Debentures Due 2008 | | | 10,761 | | | (2,238 | ) | | - | | | - | | | - | | | 8,523 | |

6.40% Debentures Due 2012 | | | 231 | | | (19 | ) | | - | | | - | | | - | | | 212 | |

Exchangeable share retraction | | | 2,648 | | | - | | | (556 | ) | | - | | | - | | | 2,092 | |

Exercise of unit appreciation rights and other | | | 12,034 | | | - | | | - | | | - | | | - | | | 12,034 | |

Issue costs | | | (26,414 | ) | | - | | | - | | | - | | | - | | | (26,414 | ) |

Foreign currency translation adjustment | | | - | | | - | | | - | | | - | | | 46,873 | | | 46,873 | |

Net income | | | - | | | - | | | 136,046 | | | - | | | - | | | 136,046 | |

Distributions and distribution reinvestment plan | | | 167,543 | | | - | | | - | | | (468,787 | ) | | - | | | (301,244 | ) |

| | | | | | | | | | | | | | | | | | | | |

At December 31, 2006 [Note 3] | | | 3,046,876 | | | 36,070 | | | 271,155 | | | (730,069 | ) | | 46,873 | | | 2,670,905 | |

Adjustment arising from change in accounting policies [Note 3] | | | (49 | ) | | - | | | 1,386 | | | - | | | - | | | 1,337 | |

Issued for cash | | | | | | | | | | | | | | | | | | | |

February 1, 2007 | | | 143,834 | | | - | | | - | | | - | | | - | | | 143,834 | |

June 1, 2007 | | | 230,029 | | | - | | | - | | | - | | | - | | | 230,029 | |

Equity component of convertible debenture issuances | | | | | | | | | | | | | | | | | | | |

7.25% Debentures Due 2014 | | | - | | | 13,100 | | | - | | | - | | | - | | | 13,100 | |

Convertible debenture conversions | | | | | | | | | | | | | | | | | | | |

9% Debentures Due 2009 | | | 250 | | | - | | | - | | | - | | | - | | | 250 | |

8% Debentures Due 2009 | | | 513 | | | (4 | ) | | - | | | - | | | - | | | 509 | |

6.5% Debentures Due 2010 | | | 882 | | | (55 | ) | | - | | | - | | | - | | | 827 | |

10.5% Debentures Due 2008 | | | 2,999 | | | (627 | ) | | - | | | - | | | - | | | 2,372 | |

6.40% Debentures Due 2012 | | | 122 | | | (10 | ) | | - | | | - | | | - | | | 112 | |

7.25% Debentures Due 2013 | | | 244 | | | (8 | ) | | - | | | - | | | - | | | 236 | |

7.25% Debentures Due 2014 | | | 157,139 | | | (8,929 | ) | | - | | | - | | | - | | | 148,210 | |

Exercise of unit appreciation rights and other | | | 658 | | | - | | | - | | | - | | | - | | | 658 | |

Issue costs | | | (25,906 | ) | | - | | | - | | | - | | | - | | | (25,906 | ) |

Foreign currency translation adjustment | | | - | | | - | | | - | | | - | | | (243,632 | ) | | (243,632 | ) |

Net income | | | - | | | - | | | (25,676 | ) | | - | | | - | | | (25,676 | ) |

Distributions and distribution reinvestment plan | | | 178,489 | | | - | | | - | | | (610,280 | ) | | - | | | (431,791 | ) |

| | | | | | | | | | | | | | | | | | | | |

At December 31, 2007 | | $ | 3,736,080 | | $ | 39,537 | | $ | 246,865 | | $ | (1,340,349 | ) | $ | (196,759 | ) | $ | 2,485,374 | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying notes to these consolidated financial statements.

| |

| |

| Consolidated Financial Statements |

| |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

For the Years Ended December 31 |

| | | | | | | | |

| | | | | | | | | |

| | | | | | | | |

(thousands of Canadian dollars) | | 2007 | | | 2006 | |

| | | | | | | |

Cash provided by (used in) | | | | | | | | |

OPERATING ACTIVITIES | | | | | | | | |

Net (loss) income for the year | | $ | (25,676 | ) | | $ | 136,046 | |

Items not requiring cash | | | | | | | | |

Depletion, depreciation, amortization and accretion | | | 526,741 | | | | 429,470 | |

Unrealized foreign exchange loss (gain) | | | (55,725 | ) | | | 23,956 | |

Non-cash interest expense | | | 7,534 | | | | 1,577 | |

Amortization of deferred finance charges | | | 4,509 | | | | 8,432 | |

Unrealized loss (gain) on risk management contracts[Note 18] | | | 147,781 | | | | (52,179 | ) |

Future income tax expense (recovery) | | | 65,802 | | | | (2,300 | ) |

Non-controlling interest | | | - | | | | (65 | ) |

Unit based compensation expense | | | 743 | | | | 775 | |

Amortization of office lease premiums and deferred rent expense | | | 139 | | | | (161 | ) |

Employee benefit obligation | | | (61 | ) | | | (328 | ) |

Settlement of asset retirement obligations[Note 10] | | | (13,090 | ) | | | (9,186 | ) |

Change in non-cash working capital | | | (17,384 | ) | | | (28,152 | ) |

| | | | | | | | | |

| | | 641,313 | | | | 507,885 | |

| | | | | | | | | |

| | | | | | | | |

FINANCING ACTIVITIES | | | | | | | | |

Issue of Trust Units, net of issue costs | | | 354,549 | | | | 463,160 | |

Issue of convertible debentures, net of issue costs[Note 12] | | | 220,488 | | | | 363,742 | |

Redemption of exchangeable shares | | | - | | | | (1,022 | ) |

Bank borrowings (repayments), net [Note 11] | | | (291,947 | ) | | | 1,452,138 | |

Financing costs | | | (273 | ) | | | (13,071 | ) |

Cash distributions | | | (433,699 | ) | | | (273,391 | ) |

Change in non-cash working capital | | | (1,223 | ) | | | (12,604 | ) |

| | | | | | | | | |

| | | (152,105 | ) | | | 1,978,952 | |

| | | | | | | | | |

| | | | | | | | |

INVESTING ACTIVITIES | | | | | | | | |

Additions to property, plant and equipment | | | (344,785 | ) | | | (398,292 | ) |

Business acquisitions | | | (170,782 | ) | | | (2,044,640 | ) |

Property acquisitions | | | (27,943 | ) | | | (65,773 | ) |

Property dispositions | | | 60,569 | | | | 20,856 | |

Increase in other non-current assets | | | - | | | | (165 | ) |

Change in non-cash working capital | | | (14,710 | ) | | | 10,886 | |

| | | | | | | | | |

| | | (497,651 | ) | | | (2,477,128 | ) |

| | | | | | | | | |

| | | | | | | | |

Change in cash and cash equivalents | | | (8,443 | ) | | | 9,709 | |

| | | | | | | | |

Effect of exchange rate changes on cash | | | (1,563 | ) | | | 297 | |

| | | | | | | | |

Cash and cash equivalents, beginning of year | | | 10,006 | | | | - | |

| | | | | | | | |

| | | | | | | | | |

Cash and cash equivalents, end of year | | $ | - | | | $ | 10,006 | |

| | | | | | | | | |

| | | | | | | | |

Interest paid | | $ | 130,990 | | | $ | 53,434 | |

Large corporation tax and other tax paid | | $ | 442 | | | $ | 862 | |

| | | | | | | | | |

See accompanying notes to these consolidated financial statements.

| |

| |

Consolidated Financial Statements | |

| |

Notes To Consolidated Financial Statements

|

December 31, 2007 and 2006 |

(tabular amounts in thousands of Canadian dollars, except Trust Unit, and per Trust Unit amounts) |

Harvest Energy Trust (the “Trust”) is an open-ended, unincorporated investment trust established under the laws of the Province of Alberta on July 10, 2002 and is governed pursuant to the Amended and Restated Trust Indenture dated February 3, 2006 between Harvest Operations Corp. (“Harvest Operations”), a wholly owned subsidiary and manager of the Trust, and Valiant Trust Company as Trustee (the “Trust Indenture”). The purpose of the Trust is to indirectly exploit, develop and hold interests in petroleum and natural gas properties and refining and marketing assets through investments in the securities of its subsidiaries and net profits interests in petroleum and natural gas properties. The beneficiaries of the Trust are the holders of its Trust Units (the “Unitholders”) who receive monthly distributions from the Trust’s net cash flow from its various investments after the provision for interest due to the holders of convertible debentures. Pursuant to the Trust Indenture, the Trust is required to distribute 100% of its taxable income to its Unitholders each year and to comply with the mutual fund trust requirements of the Income Tax Act (Canada). The Trusts’ activities are limited to holding and administering permitted investments and making distributions to its Unitholders.

The business of the Trust is carried on by Harvest Operations and other operating subsidiaries of the Trust, including North Atlantic Refining Limited Partnership. The activities of Harvest Operations and the Trust’s subsidiaries are financed through interest bearing notes from the Trust, net profit interests issued to the Trust, and third party debt such as the bank debt and the 77/8% senior notes.

The net profit interests are determined pursuant to the terms of each respective net profit interest agreement. The Trust is entitled to net profit interests equal to the amount by which 99% of the gross proceeds from the sale of production from petroleum and natural gas properties exceed 99% of certain deductible expenditures. Under the terms of the net profits interests agreements, deductible expenditures may include discretionary amounts to fund capital expenditures, to repay third party debt and to provide for working capital required to carry out the operations of the operating subsidiaries.

References to “Harvest” refers to the Trust on a consolidated basis. References to “North Atlantic” refers to North Atlantic Refining Limited Partnership and it subsidiaries, all of which are 100% owned by Harvest.

| |

2. | SIGNIFICANT ACCOUNTING POLICIES |

These financial statements have been prepared by management in accordance with Canadian generally accepted accounting principles (“Canadian GAAP”). These principles differ in certain respects from accounting principles generally accepted in the United States of America (“US GAAP”) and to the extent that the differences materially affect Harvest, they are described in Note 21.

| |

(a) | Consolidation |

| |

| These consolidated financial statements include the accounts of Harvest and its subsidiaries. All inter-entity transactions and balances have been eliminated upon consolidation. |

| |

(b) | Use of Estimates |

| |

| The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingencies, if any, as at the date of the financial statements and the reported amounts of revenues and expenses during the period. Specifically, amounts recorded for depletion, depreciation, amortization and accretion expense, asset retirement obligations, fair value of risk management contracts, employee future benefits and amounts used in the impairment tests for intangible assets, goodwill, inventory and property, plant and equipment are based on estimates. These estimates include petroleum and natural gas reserves, future petroleum and natural gas prices, future interest rates and future costs required to develop those reserves as well as other fair value assumptions. By their nature, these estimates are subject to measurement uncertainty and the effect on the financial statements of changes in such estimates in future years could be material. |

| |

| |

| Consolidated Financial Statements |

| |

| |

(c) | Revenue Recognition |

| |

| Revenues associated with the sale of crude petroleum, natural gas, natural gas liquids and refined products are recognized when title passes to customers and payment has either been received or collection is reasonably certain. Concurrent with the recognition of revenue from the sale of refined products and included in purchased products for resale and processing are associated transportation charges. Revenues for retail services are recorded when the services are provided. |

| |

| The sales price of residential home heating fuels and automotive gasoline and diesel within the Province of Newfoundland and Labrador is subject to regulation under the Petroleum Products Act. The Petroleum Products Pricing Commissioner sets the maximum wholesale and retail prices that a wholesaler and a retailer may charge and sets the maximum mark-up between the wholesale price to the retailer and the retail price to the consumer. Prices are set biweekly using a price adjustment formula based on an allowable premium above Platt’s with an interruption formula. The full effect of rate regulation is reflected in the product sales revenue as recorded by Harvest. |

| |

(d) | Inventories |

| |

| Inventories are carried at the lower of cost or net realizable value. The costs of in process inventory are determined using the weighted average cost method. The costs of purchased goods and petroleum products held for resale are determined under the first in, first out method. The costs of parts and supplies inventories are determined under the average cost method. |

| |

(e) | Joint Venture and Partnership Accounting |

| |

| The subsidiaries of Harvest conduct substantially all of their petroleum and natural gas production activities through joint ventures and through partnerships. The consolidated financial statements reflect only Harvest’s proportionate interest in such activities. |

| |

(f) | Property, Plant, and Equipment |

| |

| Petroleum and Natural Gas |

| |

| Harvest follows the full cost method of accounting for its petroleum and natural gas activities. All costs of acquiring petroleum and natural gas properties, whether productive or unproductive, related development costs, and overhead charges directly related to these activities, are capitalized and accumulated in one cost centre. Maintenance and repair costs that do not extend or enhance the recoverable reserves are charged against income. |

| |

| Proceeds from the sale of petroleum and natural gas properties are applied against capital costs. Gains and losses are not recognized on the disposition of petroleum and natural gas properties unless that disposition would alter the rate of depletion and depreciation by 20% or more. |

| |

| Provision for depletion and depreciation of petroleum and natural gas assets is calculated using the unit-of-production method, based on proved reserves net of royalties as evaluated by independent petroleum engineers. The cost basis used for the depletion and depreciation provision is the capitalized costs of petroleum and natural gas assets plus the estimated future development costs of proved undeveloped reserves. Reserves are converted to equivalent units on the basis of six thousand cubic feet of natural gas to one barrel of petroleum, reflecting the approximate relative energy content. |

| |

| Harvest places a limit on the aggregate carrying amount of property, plant and equipment associated with petroleum and natural gas activities which may be amortized to depletion and depreciation in future periods. Impairment is recognized when the carrying amount of the petroleum and natural gas assets exceeds the sum of the undiscounted future cash flows expected from the proved reserves. |

| |

| To recognize impairment, Harvest would then measure the amount of impairment by comparing the carrying amounts of the petroleum and natural gas assets to an amount equal to the estimated net present value of future cash flows from proved plus probable reserves using Harvest’s risk-free discount rate. Any excess carrying amount above the net present value of Harvest’s future cash flows would be a permanent impairment and reflected as a charge to net income for the period. |

| |

| Cash flows are calculated based on future price estimates, adjusted for Harvest’s contractual arrangements related to pricing and quality differentials. |

| |

| The cost of unproved properties is excluded from the impairment test calculation described above and subject to a separate impairment test. An impairment of unproved properties is recognized when the cost base exceeds the fair value determined by a reference to market prices, historical experience or a third party independent evaluator. There were no impairment write downs for petroleum and natural gas assets for the years ended December 31, 2007 and 2006. |

| |

| |

Consolidated Financial Statements | |

| |

| |

| Refining and Marketing |

| |

| Property, plant and equipment related to the refining assets are recorded at cost. Depreciation of recorded cost less salvage value is provided on a straight-line basis over the estimated useful life of the assets as set out below. Any gains or losses on disposal of individual assets are recognized in the year of disposal. |

| |

| | |

Asset | Period |

| | |

Refining and production plant: | |

| | |

Processing equipment | 5 – 25 years |

| | |

Structures | 15 – 20 years |

| | |

Catalysts | 2 – 5 years |

| | |

Tugs | 25 years |

| | |

Vehicles | 2-5 years |

| | |

| |

| Maintenance and repair costs including major maintenance activities, are expensed as incurred. Improvements that increase or prolong the service life or capacity of an asset are capitalized. |

| |

| Property, plant and equipment related to refining assets are tested for recovery whenever events or changes in circumstances indicate that their carrying amount may not be recoverable. Property, plant and equipment related to refining assets are not recoverable if their carrying amounts exceed the sum of the undiscounted cash flows expected to result from their use and eventual disposition. If property, plant and equipment related to refining assets are not recoverable, an impairment loss is recognized in an amount by which their carrying amount exceed their fair value, with fair value determined based on discounted estimated net cash flows. There was no impairment write-down for refining assets for the years ended December 31, 2007 and 2006. |

| |

(g) | Goodwill and Other Intangible Assets |

| |

| Goodwill is recognized when the purchase price of an acquired business exceeds the fair value of the net identifiable assets and liabilities of the acquired business. Goodwill is carried at cost less impairment and is not amortized. The carrying amount of goodwill is assessed for impairment annually at year-end, or more frequently if events occur that could result in an impairment. The goodwill impairment test is a two step test. In the first step, the carrying amount of the assets and liabilities, including goodwill, is compared to the fair value of the reporting unit. The fair value of a reporting unit is determined by calculating the present value of the expected future cash flows from the reporting unit. If the fair value is less than the carrying amount of the reporting unit, a potential impairment of goodwill may exist requiring the second test to be performed. Impairment is measured by allocating the fair value of the reporting unit, as determined in the first test, over the identifiable assets and liabilities. The excess of the fair value of the reporting unit over the fair value of the identifiable assets and liabilities represents the fair value of goodwill. The excess of the book value of goodwill over this implied fair value is then recognized as an impairment and charged to income in the period in which it occurs. There were no impairment write-downs for each of the years ended December 31, 2007 and 2006. |

| |

| Intangible assets with determinable useful lives are amortized using the straight line method over the estimated lives of the assets, which range from 5–20 years. The amortization methods and estimated service lives are reviewed annually. The carrying amounts of intangible assets are tested for recoverability whenever events or changes in circumstances indicate that their carrying amounts may not be recoverable. Intangibles are not recoverable if their carrying amounts exceed the sum of the undiscounted cash flows expected to result from their use and eventual disposition. If intangibles are not recoverable, an impairment loss is recognized in an amount by which their carrying amount exceeds their fair value, with fair value determined based on discounted estimated net cash flows. There was no impairment write-down for the years ended December 31, 2007 and 2006. |

| |

(h) | Asset Retirement Obligations |

| |

| Harvest recognizes the fair value of any asset retirement obligations as a liability in the period in which it incurs a legal obligation associated with the retirement of tangible long-lived assets that result from the acquisition, construction, development, and normal use of the assets. Harvest uses a credit-adjusted risk free discount rate to estimate this fair value. The associated asset retirement costs are capitalized as part of the carrying amount of the long-lived asset and depleted and depreciated using the method described under “Property, Plant and Equipment”. Subsequent to the initial measurement of the asset retirement obligation, the obligation is adjusted at the end of each subsequent period to reflect the passage of time and changes in the timing and amount of estimated future cash flows underlying the obligation. Actual costs incurred upon settlement of the retirement obligation are charged against the obligation to the extent of the liability recorded. |

| |

(i) | Income Taxes |

| |

| Under the Income Tax Act (Canada) the Trust and its trust subsidiary entities are taxable only on income that is not distributed or distributable to their Unitholders. As both the Trust and its Trust subsidiaries distribute all of their taxable income to their respective Unitholders pursuant to the requirements of their trust indentures, neither the Trust nor its trust |

|

|

Consolidated Financial Statements |

|

| |

| subsidiaries are currently subject to income tax. However, pursuant to newly enacted legislation in 2007, the Trust and its flow-through subsidiaries will become subject to a distribution tax beginning in 2011, provided that Harvest maintains its current structure. Harvest now makes provisions for future income taxes to reflect this new legislation. |

| |

| Harvest follows the liability method of accounting for income taxes. Under this method, income tax liabilities and assets are recognized for the estimated tax consequences attributable to differences between the amounts reported in the financial statements of the corporate subsidiaries and their respective tax bases, using enacted or substantively enacted income tax rates. The effect of a change in income tax rates on future tax liabilities and assets is recognized in income in the period in which the change occurs. A valuation allowance is recorded against any future income tax asset if it is more likely than not that the asset will not be realized. |

| |

(j) | Unit-based Compensation |

| |

| Harvest determines compensation expense for the Trust Unit Rights Incentive Plan (“Trust Unit Incentive Plan”) and the Unit Award Incentive Plan (“Unit Award Incentive Plan”) by estimating the intrinsic value of the rights at each period end and recognizing the amount in income over the vesting period. After the rights have vested, further changes in the intrinsic value are recognized in income in the period of change. |

| |

| The intrinsic value is the difference between the market value of the Units and the exercise price of the right in the case of the Trust Unit Incentive Plan, and in the case of the Unit Award Incentive Plan the market value of the Units represents the intrinsic value of the Award. Under the Trust Unit Incentive Plan, the intrinsic value method is used as participants in the plan have the option to either purchase the Units at the exercise price or to receive a cash payment or Trust Unit equivalent, equal to the excess of the market value of the Units over the exercise price. Under the Unit Award Incentive Plan participants have the option upon exercise to receive a cash payment or Trust Unit equivalent, equal to the value of awards outstanding, which is equivalent to the market value of the Units. |

| |

(k) | Employee Future Benefits |

| |

| North Atlantic maintains defined benefit and defined contribution plans and provides certain post-retirement health care benefits, which cover the majority of its employees and their surviving spouses. |

| |

| (i) Defined Contribution Plan |

| |

| Under the defined contribution plan, the annual contribution of each participating employee’s pensionable earnings is as follows: |

| | | | | | | | |

| | Employee category | | | | | | |

| | Permanent | | | 5.0 | % | | |

| | | | | | | | |

| | Part-time | | | 2.5 | % | | |

| | | | | | | | |

| |

| The contributions associated with the defined contribution plan is expensed as incurred. |

| |

| (ii) Defined Benefit Plans |

| |

| The cost of providing the defined benefits and other post-retirement benefits is actuarially determined based upon an independent actuarial valuation using management’s best estimates of discount rates, rate of return on plan assets, rate of compensation increase, retirement ages of employees, and expected health care costs. The cost of pensions earned by employees is actuarially determined using the projected benefit method prorated on credited service. Funding of the defined benefit pension plans complies with Canadian federal and provincial regulations, and requires contributions to the plans be made based on independent actuarial valuation. Pension plan assets are measured at fair values with the difference between the fair value of the plan assets and the total employee benefit obligation recorded on the balance sheet. For the purpose of calculating the expected return on assets, the fair value of the plan assets is used. |

| |

| The defined benefit plans provide benefits based on length of service and the best five years of the last ten years’ average earnings. There is no recognition or amortization of actuarial gains or losses less than 10% of the greater of the accrued benefit obligations and the fair value of plan assets for the defined benefit pension plans. Actuarial gains and losses over 10% are amortized on a straight-line basis over the average remaining service period of the plan participants. Actuarial gains or losses related to the other post-retirements benefits are recognized in income immediately. Past service costs are amortized on a straight-line basis over the expected average remaining service life of plan participants. |

| |

(l) | Currency Translation |

| |

| Monetary assets and liabilities denominated in a currency other than Canadian dollars are translated at the rate of exchange in effect at the balance sheet date. Revenues and expenses denominated in a foreign currency are translated at the monthly average rate of exchange. Translation gains and losses are included in income in the period in which they arise. |

| |

| |

Consolidated Financial Statements | |

| |

| |

| Harvest’s investment in a subsidiary with a functional currency denominated in a currency other than the Canadian dollars is translated using the current rate method as the subsidiary is considered a self-sustaining operation. Gains and losses resulting from this translation are recorded in the cumulative translation adjustment in unitholders’ equity. |

| |

(m) | Rate Regulation |

| |

| The sales price of residential home heating fuels and automotive gasoline and diesel within the Province of Newfoundland and Labrador is subject to regulation under the Petroleum Products Act. The Petroleum Products Pricing Commissioner sets the maximum mark-up between the wholesale price to the retailer and the retail price to the consumer. The full effect of rate regulation is reflected in the product sales revenue as recorded. |

| |

3. | CHANGE IN ACCOUNTING POLICY |

Financial Instruments and Comprehensive Income

Effective January 1, 2007, Harvest adopted three new and revised Canadian accounting standards as issued by the Canadian Institute of Chartered Accountants respecting “Financial Instruments – Recognition and Measurement”, “Financial Instruments – Presentation and Disclosure” and “Comprehensive Income”.

Financial Instruments

The revised standard on financial instruments provides new guidance on how to recognize and measure financial instruments. It requires all financial instruments to be recorded at fair value when initially recognized. Subsequent measurement is either at fair value or amortized cost, depending on the classification of the financial instrument. Financial assets and liabilities that are held-for-trading are measured at fair value with changes in those fair values recognized in net income. Available-for-sale financial assets are measured at fair value with unrealized gains or losses recognized in other comprehensive income. Held-to-maturity assets, loans and receivables and other liabilities are all measured at amortized cost with any related expenses or income recognized in net income. Price risk management contracts are classified as held-for-trading and are measured at fair value at initial recognition and at subsequent measurement dates. Any derivatives embedded in other financial or non-financial contracts that were entered into on or after January 1, 2001 must also be measured at fair value and recorded in the financial statements if the embedded derivative is not closely related to the host contract. Fair value of financial instruments is based on market prices where available, otherwise it is calculated as the net present value of expected future cash flows. For those items measured at amortized cost, interest expense is calculated using an effective interest rate that accretes any discount or premium over the life of the instrument so that the carrying value equals the face value at maturity.

Harvest does not have any financial assets classified as available-for-sale or held-to-maturity. The only items on Harvest’s balance sheet that are classified as held-for-trading and subsequently measured at fair value are cash and our price risk management contracts. The remainder of the financial instruments are measured at amortized cost. As well, there are no significant embedded derivatives that need to be recorded in the financial statements.

Transaction costs relating to financial instruments classified as held-for-trading are expensed in net income in the period that they are incurred. Harvest has elected to add all other transaction costs that are directly attributable to the acquisition or issue of a financial asset or liability to the amount of the financial asset or liability that is recorded on initial recognition.

The transitional provisions of the financial instruments standard require retrospective adoption without restatement of prior period financial statements. The provisions also require all financial instruments to be remeasured using the criteria of the new standard and any change in the previous carrying amount to be recognized as an adjustment to retained earnings on January 1, 2007. As our price risk management contracts were already measured at fair value, the most significant change for Harvest was reclassifying the deferred charges relating to our senior notes and convertible debentures and netting these amounts against the respective liability. These charges are then amortized to income using an effective interest rate. The effect of applying this new standard on January 1, 2007 was to reduce the carrying value of the following accounts as indicated with an offsetting reduction to deferred charges:

| | | | |

| | | | |

Deferred charges | | $ | (25,067 | ) |

77/8% Senior notes | | | (9,522 | ) |

Convertible debentures | | | (16,882 | ) |

Unitholders’ capital | | | (49 | ) |

Accumulated income | | | 1,386 | |

| | | | | |

See Note 18 for the additional presentation and disclosure requirements for Financial Instruments.

|

|

Consolidated Financial Statements |

|

Other Comprehensive Income

The new standards introduce the concept of comprehensive income, which consists of net income and other comprehensive income. Other comprehensive income represents changes in Unitholders’ equity during a period arising from transactions and other events with non-owner sources. The transitional provisions of this section require that the comparative statements are restated to reflect the application of this standard only on certain items.

For Harvest, the only such item is the unrealized foreign currency translation gains or losses arising from our downstream operations, which is considered a self-sustaining operation with a US dollar functional currency. As the cumulative translation adjustment was presented as a separate component of Unitholders’ equity already, this restatement simply required the cumulative translation adjustment to be reclassified to accumulated other comprehensive income on the balance sheet and statement of Unitholders’ equity.

Future Accounting Changes

The AcSB issued new accounting standards on December 1, 2006 that require increased disclosure on financial instruments, particularly with regard to the nature and extent of risks arising from financial instruments and how the entity manages those risks. This standard has an implementation date for annual and interim financial statements beginning on or after October 1, 2007.