Exhibit 99.3

MANAGEMENT’S DISCUSSION AND ANALYSIS

Management’s discussion and analysis (“MD&A”) of the financial condition and results of operations of Harvest Energy Trust should be read in conjunction with our audited consolidated financial statements and accompanying notes for the years ended December 31, 2008 and 2007, our MD&A for the year ended December 31, 2008 as well as our interim consolidated financial statements and notes for the three and six month periods ended June 30, 2009 and 2008. The information and opinions concerning our future outlook are based on information available at August 10, 2009.

In this MD&A, reference to "Harvest", "we", "us" or "our" refers to Harvest Energy Trust and all of its controlled entities on a consolidated basis. All references are to Canadian dollars unless otherwise indicated. Tabular amounts are in thousands of dollars unless otherwise stated. Natural gas volumes are converted to barrels of oil equivalent (“boe”) using the ratio of six thousand cubic feet (“mcf”) of natural gas to one barrel of oil (“bbl”). Boes may be misleading, particularly if used in isolation. A boe conversion ratio of 6 mcf to 1 bbl is based on an energy equivalent conversion method primarily applicable at the burner tip and does not represent a value equivalent at the wellhead. In accordance with Canadian practice, petroleum and natural gas revenues are reported on a gross basis before deduction of Crown and other royalties. In addition to disclosing reserves under the requirements of National Instrument 51-101, we also disclose our reserves on a company interest basis which is not a term defined under National Instrument 51-101. This information may not be comparable to similar measures by other issuers.

NON-GAAP MEASURES

Throughout this MD&A we have referred to certain measures of financial performance that are not specifically defined under Canadian GAAP. Cash G&A and Operating Netbacks are non-GAAP measures used extensively in the Canadian energy trust sector for comparative purposes. Cash G&A are G&A expenses excluding the effect of our unit based compensation plans, while Operating Netbacks are always reported on a per boe basis, and include gross revenue, royalties, operating expenses, and transportation and marketing expenses. Gross Margin is also a non-GAAP measure and is commonly used in the refining industry to reflect the net funds received from the sale of refined products after considering the cost to purchase the feedstock and is calculated by deducting purchased products for resale and processing from total revenue. Earnings From Operations and Cash From Operations are also non-GAAP measures and are commonly used for comparative purposes in the petroleum and natural gas and refining industries to reflect operating results before items not directly related to operations. This information may not be comparable to similar measures by other issuers.

FORWARD-LOOKING INFORMATION

This MD&A highlights significant business results and statistics from our consolidated financial statements for the three and six months ended June 30, 2009 and the accompanying notes thereto. In the interest of providing our Unitholders and potential investors with information regarding Harvest, including our assessment of our future plans and operations, this MD&A contains forward-looking statements that involve risks and uncertainties. Such risks and uncertainties include, but are not limited to, risks associated with conventional petroleum and natural gas operations; risks associated with refining and marketing operations; the volatility in commodity prices and currency exchange rates; risks associated with realizing the value of acquisitions; general economic, market and business conditions; changes in environmental legislation and regulations; the availability of sufficient capital from internal and external sources and such other risks and uncertainties described from time to time in our regulatory reports and filings made with securities regulators.

Forward-looking statements in this MD&A include, but are not limited to, the forward looking statements made in the “Outlook” section as well as statements made throughout with reference to production volumes, refinery throughput volumes, royalty rates, operating costs, commodity prices, administrative costs, price risk management activity, acquisitions and dispositions, capital spending, reserve estimates, distributions, access to credit facilities, income taxes, cash from operating activities, and regulatory changes. For this purpose, any statements that are contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements often contain terms such as “may”, “will”, “should”, “anticipate”, “expects”, and similar expressions.

1

Readers are cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions or expectations upon which they are based will occur. Although we consider such information reasonable at the time of preparation, it may prove to be incorrect and actual results may differ materially from those anticipated. We assume no obligation to update forward-looking statements should circumstances, estimates or opinions change, except as required by law. Forward-looking statements contained in this MD&A are expressly qualified by this cautionary statement.

Consolidated Financial and Operating Highlights – Second Quarter 2009

Quarterly cash flow from operating activities of $75.9 million as compared to $210.5 million in the prior year reflects a $188.7 million decrease in the contribution from our Upstream operations as well as a $40.2 million decrease in the contribution from our Downstream operations partially offset by a $113.9 million favourable change in the settlements of our corporate price risk management contracts.

Upstream operating cash flow of $121.1 million reflects substantially weaker commodity prices as compared to the prior year along with a decline in our average daily production to 52,745 boe/d from 55,574 boe/d in the prior year primarily due to a reduced level of investment in heavy oil prospects due to weak commodity prices.

Upstream capital spending of $33.4 million including the drilling of three wells and the tie-in and completion of our First Quarter drilling program at Hay River and central Alberta. In addition, the sale of two non-core properties generated net proceeds of approximately $63 million which were applied to reduce bank borrowings.

In our Downstream operations, we successfully completed a 42-day turnaround of the hydrocracking and hydrogen units, including the replacement of catalyst, resulting in a significant curtailment of throughput and a cash flow deficiency of $38.8 million compared to $1.3 million generated in the prior year.

Cash receipts totaled $20.1 million on the settlement of 20,000 bbl/d of refined products price risk management contracts during the quarter as compared to payments of $85.3 million in the prior year.

Raised $120.2 million of net proceeds with the issuance of 17,330,000 Trust Units and applied the net proceeds to reduce our bank borrowings which at the end of the quarter totaled $1,097.8 million.

On June 23, 2009, we offered to purchase all of the outstanding shares of Pegasus Oil & Gas Inc, a junior oil and natural gas producer, in exchange for the issuance of approximately 670,000 Trust Units and the assumption of approximately $14 million of bank debt. With slightly less than 90% of the outstanding shares tendered by July 30, 2009, this offer has been extended to August 11, 2009.

Maintained monthly distributions of $0.05 per Trust Unit during the quarter aggregating to $25.2 million, representing 33% of cash from operating activities.

2

SELECTED INFORMATION

The table below provides a summary of our financial and operating results for the three and six months ended June 30, 2009 and 2008.

| | | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| | | | | | | | | | | | | | | | | | | |

| ($000s except where noted) | | 2009 | | | 2008 | | | Change | | | 2009 | | | 2008 | | | Change | |

| | | | | | | | | | | | | | | | | | | |

| Revenue, net(1) | | 562,997 | | | 1,622,079 | | | (65% | ) | | 1,294,092 | | | 2,999,431 | | | (57% | ) |

| | | | | | | | | | | | | | | | | | | |

| Cash From Operating Activities | | 75,879 | | | 210,534 | | | (64% | ) | | 297,624 | | | 338,653 | | | (12% | ) |

| Per Trust Unit, basic | $ | 0.45 | | $ | 1.39 | | | (68% | ) | $ | 1.83 | | $ | 2.24 | | | (18% | ) |

| Per Trust Unit, diluted | $ | 0.45 | | $ | 1.26 | | | (64% | ) | $ | 1.75 | | $ | 2.05 | | | (15% | ) |

| | | | | | | | | | | | | | | | | | | |

| Net Loss(2) | | (265,779 | ) | | (162,063 | ) | | 64% | | | (208,915 | ) | | (162,409 | ) | | 29% | |

| Per Trust Unit, basic | $ | (1.59 | ) | $ | (1.07 | ) | | 49% | | $ | (1.28 | ) | $ | (1.08 | ) | | 19% | |

| Per Trust Unit, diluted | $ | (1.59 | ) | $ | (1.07 | ) | | 49% | | $ | (1.28 | ) | $ | (1.08 | ) | | 19% | |

| | | | | | | | | | | | | | | | | | | |

| Distributions declared | | 25,193 | | | 137,001 | | | (82% | ) | | 128,495 | | | 272,168 | | | (53% | ) |

| Distributions declared, per Trust Unit | $ | 0.15 | | $ | 0.90 | | | (83% | ) | $ | 0.80 | | $ | 1.80 | | | (56% | ) |

| Distributions declared as a percentage | | | | | | | | | | | | | | | | | | |

| of Cash From Operating Activities | | 33% | | | 65% | | | (32% | ) | | 43% | | | 80% | | | (37% | ) |

| | | | | | | | | | | | | | | | | | | |

| Bank debt | | | | | | | | | | | 1,097,820 | | | 1,035,285 | | | 6% | |

| 77/8% Senior Notes | | | | | | | | | | | 285,708 | | | 248,836 | | | 15% | |

| Convertible Debentures(3) | | | | | | | | | | | 832,924 | | | 821,877 | | | 1% | |

| Total debt(3) | | | | | | | | | | | 2,216,452 | | | 2,105,998 | | | 5% | |

| | | | | | | | | | | | | | | | | | | |

| Total assets | | | | | | | | | | | 5,296,596 | | | 5,637,879 | | | (6% | ) |

| | | | | | | | | | | | | | | | | | | |

| UPSTREAM OPERATIONS | | | | | | | | | | | | | | | | | | |

| Daily Production | | | | | | | | | | | | | | | | | | |

| Light to medium oil (bbl/d) | | 24,316 | | | 25,365 | | | (4% | ) | | 24,275 | | | 25,439 | | | (5% | ) |

| Heavy oil (bbl/d) | | 10,365 | | | 12,092 | | | (14% | ) | | 10,751 | | | 12,534 | | | (14% | ) |

| Natural gas liquids (bbl/d) | | 2,675 | | | 2,614 | | | 2% | | | 2,756 | | | 2,549 | | | 8% | |

| Natural gas (mcf/d) | | 92,335 | | | 93,014 | | | (1% | ) | | 93,870 | | | 97,792 | | | (4% | ) |

| Total daily sales volumes (boe/d) | | 52,745 | | | 55,574 | | | (5% | ) | | 53,427 | | | 56,820 | | | (6% | ) |

| | | | | | | | | | | | | | | | | | | |

| Operating Netback ($/boe) | | 26.88 | | | 62.98 | | | (57% | ) | | 21.64 | | | 53.97 | | | (60% | ) |

| | | | | | | | | | | | | | | | | | | |

| Cash capital expenditures | | 33,391 | | | 39,669 | | | (16% | ) | | 142,101 | | | 119,240 | | | 19% | |

| Business and property dispositions, net | | (61,403 | ) | | (4,734 | ) | | 1,197% | | | (60,728 | ) | | (4,549 | ) | | 1,235% | |

| | | | | | | | | | | | | | | | | | | |

| DOWNSTREAM OPERATIONS | | | | | | | | | | | | | | | | | | |

| Average daily throughput (bbl/d) | | 52,808 | | | 100,422 | | | (47% | ) | | 78,410 | | | 106,211 | | | (26% | ) |

| Average Refining Gross Margin (US$/bbl) | | 6.50 | | | 5.66 | | | 15% | | | 12.51 | | | 7.36 | | | 70% | |

| | | | | | | | | | | | | | | | | | | |

| Cash capital expenditures | | 19,929 | | | 8,619 | | | 131% | | | 26,833 | | | 14,646 | | | 83% | |

| (1) | Revenues are net of royalties. |

| (2) | Net Loss includes a goodwill impairment of $206.5 million for the three and six months ended June 30, 2009 (nil for the three and six months ended June 30, 2008), a future income tax recovery of $12.1 million and $10.1 million for the three and six months ended June 30, 2009, respectively ($95.2 million and $117.0 million for the three and six months ended June 30, 2008) and an unrealized net loss from risk management activities of $15.0 million and $25.2 million for the three and six months ended June 30, 2009, respectively ($305.1 million and $366.0 million for the three and six months ended June 30, 2008). |

| (3) | Includes current portion of Convertible Debentures and excludes the equity component of Convertible Debentures. |

3

REVIEW OF OVERALL PERFORMANCE

Harvest is an integrated energy trust with our petroleum and natural gas business focused on the operation and further development of assets in western Canada (our “upstream operations”) and our refining and marketing business focused on the safe operation of a medium gravity sour crude oil hydrocracking refinery and a retail and wholesale petroleum marketing business both located in the Province of Newfoundland and Labrador (our “downstream operations”). Our earnings and cash flow from operating activities are largely determined by the realized prices for our crude oil and natural gas production as well as refined product crack spreads, including the effects of changes in the U.S. dollar to Canadian dollar exchange rate. Recently, changes in crude oil and natural gas prices and the exchange rate between U.S. dollars and Canadian dollars have moved together with changes in the currency exchange rate partially offsetting changes in crude oil and natural gas prices.

Cash flow from operating activities of $75.9 million in the Second Quarter of 2009 is comprised of $121.1 million cash flow contributions from our Upstream operations plus $19.4 million of net cash receipts from our corporate price risk management activities and a $2.9 million net increase in non-cash working capital offset by a $38.8 cash flow deficiency from our Downstream operations and $25.9 million of financing and other costs. As compared to $210.5 million reported in the Second Quarter of 2008, the year-over-year $134.6 million decrease in cash flow from operating activities is comprised of a $188.7 million and $40.2 million decrease in contribution from our Upstream operations and Downstream operations, respectively, along with a $25.7 million reduced non-cash working capital adjustment offset by a $113.9 million improvement in price risk management settlements and a $6.6 million reduction in financing costs. The $25.7 million reduction in the non-cash working capital adjustment is primarily the result of the impact of commodity price fluctuations on our Downstream inventories and a significantly lower Upstream capital spending program during the Second Quarter.

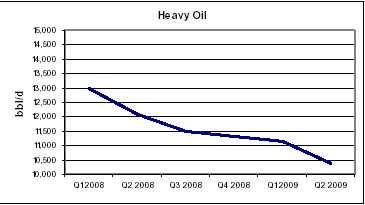

Cash flow provided from our Upstream operations totaled $121.1 million during the Second Quarter of 2009, an increase of $49.7 million from the First Quarter of the year and a drop of $188.7 million compared to the $309.8 million reported in the prior year. The principal factor impacting our Second Quarter financial performance is an average West Texas Intermediate benchmark price of US$59.62 as compared to US$123.98 in the prior year offset somewhat by a relative weakening in Canadian/U.S. dollar exchange rate. Our Second Quarter production of 52,745 boe/d is 5% lower than in the prior year primarily due to a 14% decline in heavy oil production, the result of a lower level of investment since mid-2008. Operating costs of $12.77 per boe reflect a 50% reduction in power costs driven by significantly lower electric power prices in Alberta and represent a 12% improvement over the $14.45 per boe incurred in the prior year. Our netback price for the Second Quarter of 2009 was $26.88 per boe as compared to $62.99 per boe in the prior year and $16.45 per boe in the First Quarter of this year. Capital spending of $33.4 million primarily focused on the tie-in and completion of the 82 wells drilled in the First Quarter of the year as well as the drilling of 3 wells in the quarter.

During the Second Quarter, we closed the sale of two non-operated properties with net proceeds of approximately $63 million. The sale of our natural gas interests in Channel Lake for $43 million resulted in a disposition metric of approximately $53,000 per boe based on its current production of 4,860 mcf/d and approximately $2.30 per mcf based on proved plus probable reserves of approximately 19 bcf. Our sale of certain non-operated interests in the Pembina area for $20 million resulted in a disposition metric of approximately $94,800 per boe based on its current production of 211 boe/d (weighted 70% light oil and natural gas liquids and 30% natural gas) and approximately $13.00 per boe based on proved plus probable reserves of 1,520 mboe. The net proceeds were applied to reduce our bank borrowings.

During the Second Quarter, the successful execution of a planned 42-day turnaround enabled our refinery to exit the quarter with throughput established at 117,000 bbl/d as compared to the 104,296 bbl/d averaged in the First Quarter as throughput was curtailed to accommodate the reduced activity level of hydrocracker catalyst. The turnaround included the refurbishment of our hydrocracker and hydrogen units including the replacement of hydrocracking and distillate hydrotreating catalysts at an aggregate cost of $47.5 million of which $43.3 million was incurred in the Second Quarter. In addition to the turnaround, capital expenditures totaled $19.9 million during the quarter including $7.0 million to upgrade heaters and $2.5 million related to debottlenecking projects. Late in the First Quarter and continuing through the Second Quarter, our refining gross margins were significantly impacted by a deterioration in heating oil crack spreads and a tightening of the quality discounts of our feedstock as well as strengthening of the Canadian dollar. While gasoline margins remained steady, the improvement in fuel oil margins and a lower cost for purchased energy to operate the refinery were not sufficient to offset the aggregate impact of the reduced heating oil crack spreads and tightening of feedstock discounts. During the Second Quarter, our Downstream operations incurred a $38.8 million operating cash flow deficiency primarily attributed to the 42-day turnaround. Year-to-date, our Downstream operations have generated operating cash flow of $103.2 million as compared to $25.9 million in the prior year, with the 2009 performance heavily influenced by the $142.0 million reported in the First Quarter. Included in the 2009 year-to-date gross margin and cash flows are US$57.2 million (US$45.0 million in the First Quarter of 2009) of operational hedging gains generated by the month-to-month hedging of the WTI price component of our crude oil feedstock purchase commitments.

4

On June 4, 2009, we issued 17,330,000 Trust Units at an issue price of $7.30 per Trust Unit with net proceeds of $120.2 million after issue costs. The net proceeds were applied to reduce our bank borrowings which at the end of the Second Quarter totaled $1,097.8 million with our bank debt to cash flow before interest being 1.5 times and our senior debt to cash flow before interest being 2.0 times. This reduction in bank borrowings is another meaningful step in the de-leveraging of our balance sheet in advance of the maturity of our credit facilities in April 2010.

On June 23, 2009, we offered to purchase all of the outstanding shares of Pegasus Oil and Gas Inc., a natural gas weighted producer with approximately 650 boe/d of production, in exchange for Trust Units. On July 30, 2009, the offer expired with slightly less than 90% of the outstanding shares tendered at which time, we extended the offer to August 11, 2009 in an effort to increase the number of tendered shares to the 90% minimum condition of our offer. Including the obligation to assume approximately $14 million of bank debt, the acquisition metrics are approximately $30,000 per boe/d of production and approximately $4.25 per boe of reserves on a proved plus probable basis. The principal asset in this acquisition is a 7% working interest in liquids rich natural gas production from a property in the Crossfield area which is operated by Harvest. This potential acquisition includes access to over 150,000 acres of land and over $50 million of income tax pools.

Our monthly distributions of $0.05 per Trust Unit during the quarter represent 33% of our cash from operating activities as compared to a monthly distribution of $0.30 per Trust Unit and 65% for cash from operating activities in the prior year. Year-to-date, our cash from operating activities, before adjustment for non-cash working capital and asset retirement expenditures, aggregated to $284.4 million while capital expenditures totaled $168.9 million and distributions declared were $128.5 million ($93.4 million net of Unitholder participation in our distribution reinvestment programs).

5

Business Segments

| | | | | | | | | | | | | | | | | | |

| The following table presents selected financial information for our two business segments: | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Three Months Ended June 30 | | | | | | | |

| | | | | | 2009 | | | | | | | | | 2008 | | | | |

| | | | | | | | | | | | | | | | | | | |

| (in $000s) | | Upstream | | | Downstream | | | Total | | | Upstream | | | Downstream | | | Total | |

| Revenue(1) | | 193,916 | | | 369,081 | | | 562,997 | | | 394,953 | | | 1,227,126 | | | 1,622,079 | |

| Earnings From Operations(2) | | 2,522 | | | (264,377 | ) | | (261,855 | ) | | 198,428 | | | (15,692 | ) | | 182,736 | |

| Cash From Operations(2) | | 121,052 | | | (38,843 | ) | | 82,209 | | | 309,796 | | | 1,314 | | | 311,110 | |

| Capital expenditures | | 33,391 | | | 19,929 | | | 53,320 | | | 39,669 | | | 8,619 | | | 48,288 | |

| Total assets(3) | | 3,798,159 | | | 1,487,628 | | | 5,296,596 | | | 3,903,959 | | | 1,684,003 | | | 5,637,879 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Six Months Ended June 30 | | | | | | | |

| | | | | | 2009 | | | | | | | | | 2008 | | | | |

| | | | | | | | | | | | | | | | | | | |

| (in $000s) | | Upstream | | | Downstream | | | Total | | | Upstream | | | Downstream | | | Total | |

| Revenue(1) | | 352,307 | | | 941,785 | | | 1,294,092 | | | 709,886 | | | 2,289,545 | | | 2,999,431 | |

| Earnings From Operations(2) | | (41,760 | ) | | (143,803 | ) | | (185,563 | ) | | 311,679 | | | (7,952 | ) | | 303,727 | |

| Cash From Operations(2) | | 192,394 | | | 103,173 | | | 295,567 | | | 540,569 | | | 25,851 | | | 566,420 | |

| Capital expenditures | | 142,101 | | | 26,833 | | | 168,934 | | | 119,240 | | | 14,646 | | | 133,886 | |

| Total assets(3) | | 3,798,159 | | | 1,487,628 | | | 5,296,596 | | | 3,903,959 | | | 1,684,003 | | | 5,637,879 | |

| (1) | Revenues are net of royalties. |

| (2) | This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. |

| (3) | Total assets on a consolidated basis as June 30, 2009 include $10.8 million (2008 - $19.5 million) relating to the fair value of risk management contracts and nil related to future income tax (2008 - $30.4 million). |

Our Upstream and Downstream operations are each discussed separately in the sections that follow. Additionally, we have included a section entitled “Risk Management, Financing and Other” that discusses, among other things, our cash flow risk management program.

UPSTREAM OPERATIONS

Second Quarter Highlights

- Second Quarter 2009 operating cash flow of $121.1 million, as compared to $309.8 in the prior year, reflecting a year-over-year drop in commodity prices as well as lower heavy oil production.

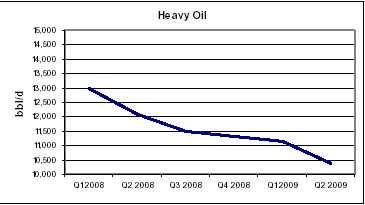

- Average production of 52,745 boe/d during the Second Quarter of 2009 as compared to production of 55,574 boe/d in the Second Quarter of 2008 and 54,115 boe/d during the First Quarter of 2009 reflects normal decline rates and in heavy oil, the impact of reduced capital spending.

- Second Quarter 2009 operating netback of $26.88/boe, representing a $36.11/boe (57%) drop over the same period in the prior year, attributed to substantially lower commodity prices.

- Capital spending of $33.4 million including the drilling of three wells and the tie-in and completion of our First Quarter drilling program at Hay River and central Alberta. In addition, the sale of two non-core properties generated net proceeds of approximately $63 million which were applied to reduce bank borrowings.

6

| Summary of Financial and Operating Results | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| (in $000s except where noted) | | 2009 | | | 2008 | | | Change | | | 2009 | | | 2008 | | | Change | |

| | | | | | | | | | | | | | | | | | | |

| Revenues | | 222,115 | | | 471,766 | | | (53% | ) | | 405,035 | | | 849,099 | | | (52% | ) |

| Royalties | | (28,199 | ) | | (76,813 | ) | | (63% | ) | | (52,728 | ) | | (139,213 | ) | | (62% | ) |

| Net revenues | | 193,916 | | | 394,953 | | | (51% | ) | | 352,307 | | | 709,886 | | | (50% | ) |

| | | | | | | | | | | | | | | | | | | |

| Operating expenses | | 61,317 | | | 73,092 | | | (16% | ) | | 136,652 | | | 145,415 | | | (6% | ) |

| General and administrative | | 8,874 | | | 12,710 | | | (30% | ) | | 16,268 | | | 24,619 | | | (34% | ) |

| Transportation and marketing | | 3,584 | | | 3,352 | | | 7% | | | 6,516 | | | 6,377 | | | 2% | |

| Depreciation, depletion, amortization and accretion | | 117,619 | | | 107,371 | | | 10% | | | 234,631 | | | 221,796 | | | 6% | |

| | | | | | | | | | | | | | | | | | | |

| Earnings (Loss) From Operations(1) | | 2,522 | | | 198,428 | | | (99% | ) | | (41,760 | ) | | 311,679 | | | (113% | ) |

| | | | | | | | | | | | | | | | | | | |

| Cash capital expenditures (excluding acquisitions) | | 33,391 | | | 39,669 | | | (16% | ) | | 142,101 | | | 119,240 | | | 19% | |

| Property and business acquisitions, net of | | | | | | | | | | | | | | | | | | |

| dispositions | | (61,403 | ) | | (4,734 | ) | | 1,197% | | | (60,728 | ) | | (4,549 | ) | | 1,235% | |

| | | | | | | | | | | | | | | | | | | |

| Daily sales volumes | | | | | | | | | | | | | | | | | | |

| Light to medium oil (bbl/d) | | 24,316 | | | 25,365 | | | (4% | ) | | 24,275 | | | 25,439 | | | (5% | ) |

| Heavy oil (bbl/d) | | 10,365 | | | 12,092 | | | (14% | ) | | 10,751 | | | 12,534 | | | (14% | ) |

| Natural gas liquids (bbl/d) | | 2,675 | | | 2,614 | | | 2% | | | 2,756 | | | 2,549 | | | 8% | |

| Natural gas (mcf/d) | | 92,335 | | | 93,014 | | | (1% | ) | | 93,870 | | | 97,792 | | | (4% | ) |

| Total (boe/d) | | 52,745 | | | 55,574 | | | (5% | ) | | 53,427 | | | 56,820 | | | (6% | ) |

| (1)This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Commodity Price Environment | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| Benchmarks | | 2009 | | | 2008 | | | Change | | | 2009 | | | 2008 | | | Change | |

| | | | | | | | | | | | | | | | | | | |

| West Texas Intermediate crude oil (US$ per barrel) | | 59.62 | | | 123.98 | | | (52% | ) | | 51.35 | | | 110.94 | | | (54% | ) |

| Edmonton light crude oil ($ per barrel) | | 65.88 | | | 125.88 | | | (48% | ) | | 57.74 | | | 111.62 | | | (48% | ) |

| Bow River blend crude oil ($ per barrel) | | 61.97 | | | 104.38 | | | (41% | ) | | 53.03 | | | 91.05 | | | (42% | ) |

| AECO natural gas daily ($ per mcf) | | 3.45 | | | 10.22 | | | (66% | ) | | 4.18 | | | 9.06 | | | (54% | ) |

| | | | | | | | | | | | | | | | | | | |

| Canadian / U.S. dollar exchange rate | | 0.858 | | | 0.990 | | | (13% | ) | | 0.831 | | | 0.993 | | | (16% | ) |

The average WTI benchmark price in the Second Quarter 2009 of US$59.62 was 38% higher than in the First Quarter of 2009, which was greater than the increase in the average Edmonton light crude oil price (“Edmonton Par”) of 33% due to the 7% appreciation in the Canadian dollar. For the three and six months ended June 30, 2009, the average WTI benchmark price was 52% and 54% lower, respectively, as compared to the prior year as the declining global economy continued to precipitate a significant decrease in commodity prices. Edmonton Par also decreased significantly, resulting in a Second Quarter 2009 price of $65.88, a decrease of 48% compared to the prior year and an average price of $57.74 for the six months ended June 30, 2009, a decrease of 48% compared to the prior year. The decrease in the Edmonton Par benchmark price has been less than that of the WTI benchmark price due to the weakening of the Canadian dollar relative to the U.S. dollar as compared to the prior year.

Heavy oil differentials fluctuate based on a combination of factors including the level of heavy oil inventories, pipeline capacity to deliver heavy crude to U.S. markets and the seasonal demand for heavy oil. During the three and six months ended June 30, 2009, the Bow River heavy oil differential relative to Edmonton Par averaged $3.91/bbl and $4.71/bbl, respectively, as compared $21.50/bbl and $20.57/bbl, respectively, in the prior year. On a per barrel basis, heavy oil differentials have tightened since the Second Quarter of 2008 as production shortfalls and increased refinery demand for heavier grades of oil put upward pressure on pricing.

7

| | | | | | | | |

| | 2009 | | 2008 | | | 2007 | |

| Differential Benchmarks | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | Q4 | Q3 |

| Bow River Blend differential to Edmonton Par ($/bbl) | 3.91 | 5.50 | 14.07 | 16.48 | 21.50 | 19.63 | 29.51 | 23.87 |

| Bow River Blend differential as a % of Edmonton Par | 5.9% | 11.1% | 22.2% | 13.5% | 17.1% | 20.2% | 34.2% | 30.0% |

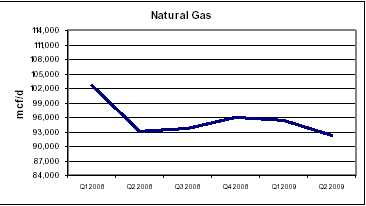

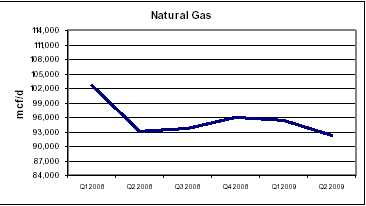

Compared to the prior year, the average AECO daily natural gas price was 66% and 54% lower during the three and six months ended June 30, 2009, respectively, due to increased storage levels and decreased economic activity which has led to a decline in industrial consumption.

Realized Commodity Prices(1)

The following table summarizes our average realized price by product for the three and six months ended June 30, 2009 and 2008.

| | | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| | | 2009 | | | 2008 | | | Change | | | 2009 | | | 2008 | | | Change | |

| Light to medium oil ($/bbl) | | 57.54 | | | 109.26 | | | (47% | ) | | 49.33 | | | 97.86 | | | (50% | ) |

| Heavy oil ($/bbl) | | 55.12 | | | 96.79 | | | (43% | ) | | 45.86 | | | 82.44 | | | (44% | ) |

| Natural gas liquids ($/bbl) | | 42.26 | | | 88.87 | | | (52% | ) | | 41.73 | | | 83.59 | | | (50% | ) |

| Natural gas ($/mcf) | | 3.87 | | | 10.86 | | | (64% | ) | | 4.61 | | | 9.51 | | | (52% | ) |

| Average realized price ($/boe) | | 46.28 | | | 93.29 | | | (50% | ) | | 41.89 | | | 82.11 | | | (49% | ) |

| (1)Realized commodity prices exclude the impact of price risk management activities. | | | | | | | | | | | | | |

Our realized price for light to medium oil sales decreased by $51.72/bbl (47%) in the Second Quarter of 2009 as compared to the prior year, reflecting the $60.00/bbl (48%) decrease in Edmonton Par pricing. During the six months ended June 30, 2009, our realized price for light to medium oil sales decreased by $48.53/bbl (50%) as compared to the prior year reflecting the $53.88/bbl (48%) decrease in Edmonton Par Pricing.

Harvest’s heavy oil price decreased by $41.67/bbl (43%) in the Second Quarter of 2009 as compared to the prior year, reflecting the $42.41/bbl (41%) decrease in the Bow River price. During the six months ended June 30, 2009, our realized price for heavy oil decreased by $36.58/bbl (44%) as compared to the prior year reflecting the $38.02/bbl (42%) decrease in the Bow River price.

Our average realized price for our natural gas production decreased by $6.99/mcf (64%) in the Second Quarter of 2009 as compared to the prior year, reflecting the $6.77/mcf (66%) decrease in the AECO daily price. During the six months ended June 30, 2009, our realized price for natural gas decreased by $4.90/mcf (52%), reflecting the $4.88/mcf (54%) decrease in the AECO daily price.

8

| Sales Volumes | | | | | | | | | | | | | | | |

| The average daily sales volumes by product were as follows: | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | Three Months Ended June 30 | | | | | | | |

| | | | | | 2009 | | | 2008 | | | | | | | |

| | | Volume | | | Weighting | | | Volume | | | Weighting % Volume Change | |

| Light to medium oil (bbl/d)(1) | | 24,316 | | | 46% | | | 25,365 | | | 45% | | | (4% | ) |

| Heavy oil (bbl/d) | | 10,365 | | | 20% | | | 12,092 | | | 22% | | | (14% | ) |

| Natural gas liquids (bbl/d) | | 2,675 | | | 5% | | | 2,614 | | | 5% | | | 2% | |

| Total liquids (bbl/d) | | 37,356 | | | 71% | | | 40,071 | | | 72% | | | (7% | ) |

| Natural gas (mcf/d) | | 92,335 | | | 29% | | | 93,014 | | | 28% | | | (1% | ) |

| Total oil equivalent (boe/d) | | 52,745 | | | 100% | | | 55,574 | | | 100% | | | (5% | ) |

| | | | | | | | | | | | | | | | |

| | | | | | Six Months Ended June 30 | | | | | | | |

| | | | | | 2009 | | | 2008 | | | | | | | |

| | | Volume | | | Weighting | | | Volume | | | Weighting % Volume Change | |

| Light to medium oil (bbl/d)(1) | | 24,275 | | | 45% | | | 25,439 | | | 45% | | | (5% | ) |

| Heavy oil (bbl/d) | | 10,751 | | | 20% | | | 12,534 | | | 22% | | | (14% | ) |

| Natural gas liquids (bbl/d) | | 2,756 | | | 5% | | | 2,549 | | | 4% | | | 8% | |

| Total liquids (bbl/d) | | 37,782 | | | 70% | | | 40,522 | | | 71% | | | (7% | ) |

| Natural gas (mcf/d) | | 93,870 | | | 30% | | | 97,792 | | | 29% | | | (4% | ) |

| Total oil equivalent (boe/d) | | 53,427 | | | 100% | | | 56,820 | | | 100% | | | (6% | ) |

| (1) | Harvest classifies our oil production, except that produced from Hay River, as light to medium and heavy according to NI 51-101 guidance. The oil produced from Hay River has an average API of 24o(medium grade) and is classified as a light to medium oil, notwithstanding that, it benefits from a heavy oil royalty regime and therefore would be classified as heavy oil according to NI 51-101. |

| Harvest’s Second Quarter 2009 light/medium oil production was 24,316 bbl/d, a 1,049 bbl/d or 4% reduction from the prior year and substantially unchanged from the First Quarter of 2009. Production in the Second Quarter of 2009 was impacted by downtime at Hay River, our largest production area, due to a scheduled turnaround at a third party facility. The reduction in light/medium oil production for the three and six months ended June 30, 2009 of 4% and 5%, respectively, as compared to the prior year is largely the result of normal decline. |

| During the Second Quarter of 2009, our heavy oil production averaged 10,365 bbls/d, a 1,727 bbl/d or 14% decrease from the prior year. Relative to the First Quarter of 2009, our Second Quarter heavy oil production decreased by 776 bbl/d or 7%, mainly due to downtime for servicing work at Lloydminster and Hayter and a reduced level of investment due to weak commodity prices. The reduction in heavy oil production for the three and six months ended June 30, 2009 of 1,727 bbl/d and 1,783 bbl/d, respectively, as compared to the prior year is largely the result of, increased water cuts on our larger producing wells in the west central Saskatchewan and Lloydminster areas, and reduced spending on our heavy oil properties due to weak commodity prices. |

9

| Natural gas production averaged 92,335 mcf/d in the Second Quarter of 2009, a 679 mcf/d or 1% reduction from the Second Quarter of 2008. Relative to the First Quarter of 2009, our Second Quarter natural gas production decreased by 3,086 mcf/d or 3%, primarily due to downtime at certain third-party processing facilities, including in the Chedderville, Sylvan Lake, Innisfail and Crossfield areas, coupled with the divestment of approximately 5,000 mcf/d at the end of May 2009 of our Channel Lake properties. The reduction in natural gas production for the three and six months ended June 30, 2009 of 1% and 4%, respectively, as compared to the same period in the prior year is mainly due to natural declines offset by the acquisitions completed in the Third Quarter of 2008 and the incremental production from the 2009 winter drilling program. |

| Revenues | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| | | | | | | | | | | | | | | | | | | |

| (000s) | | 2009 | | | 2008 | | | Change | | | 2009 | | | 2008 | | | Change | |

| Light to medium oil sales | $ | 127,320 | | $ | 252,206 | | | (50% | ) | $ | 216,725 | | $ | 453,081 | | | (52% | ) |

| Heavy oil sales | | 51,992 | | | 106,506 | | | (51% | ) | | 89,247 | | | 188,057 | | | (53% | ) |

| Natural gas sales | | 32,514 | | | 91,912 | | | (65% | ) | | 78,249 | | | 169,183 | | | (54% | ) |

| Natural gas liquids sales and other | | 10,289 | | | 21,142 | | | (51% | ) | | 20,814 | | | 38,778 | | | (46% | ) |

| Total sales revenue | | 222,115 | | | 471,766 | | | (53% | ) | | 405,035 | | | 849,099 | | | (52% | ) |

| Royalties | | (28,199 | ) | | (76,813 | ) | | (63% | ) | | (52,728 | ) | | (139,213 | ) | | (62% | ) |

| Net Revenues | $ | 193,916 | | $ | 394,953 | | | (51% | ) | $ | 352,307 | | $ | 709,886 | | | (50% | ) |

Our revenue is impacted by changes to production volumes, commodity prices and currency exchange rates. Our total sales revenue for the three months ended June 30, 2009 of $222.1 million is $249.7 million lower than the same period of the prior year, of which $223.9 million is attributed to lower realized prices and $25.8 million is attributed to lower production volumes. The price decrease reflects the 48% decrease in Edmonton Par pricing and the 66% decrease in AECO daily natural gas pricing in the Second Quarter of 2009 as compared to 2008, while our decreased production volumes are attributed to natural decline rates and reduced spending. Our revenues were also impacted by the weakening in the Canadian/US dollar exchange rate, which resulted in a favourable variance of approximately $29.6 million. For the six months ended June 30, 2009, our total sales revenue of $405.0 million is $444.1 million lower than the same period of the prior year, of which $388.6 million is attributed to lower realized prices, as the Edmonton Par Price decrease by 48% and the AECO daily natural gas price decrease by 54%, and $55.5 million is attributed to lower production.

As discussed earlier, light to medium oil sales revenue for the Second Quarter of 2009 was $124.9 million lower than the comparative period due to a $114.5 million unfavourable price variance and a $10.4 million unfavourable volume variance. For the six months ended June 30, 2009, light to medium oil sales revenue was $236.4 million lower than the comparative period due to a $213.3 million unfavourable price variance and a $23.1 million unfavourable volume variance. Heavy oil sales revenue in the Second Quarter of 2009 was $54.5 million lower than in the prior year due to a $39.3 million unfavourable price variance and a $15.2 million unfavourable volume variance. For the six months ended June 30, 2009, heavy oil revenue was $98.8 million lower than the comparative period due to a $71.2 million unfavourable price variance and a $27.6 million unfavourable volume variance. Natural gas sales revenue in the Second Quarter of 2009 was $59.4 million lower than in the prior year due to a $58.7 million unfavourable price variance and a $0.7 million unfavourable volume variance. For the six months ended June 30, 2009, natural gas sales revenue was $90.9 million lower than the comparative period due to an $83.2 million unfavourable price variance and a $7.7 million unfavourable volume variance.

10

During the Second Quarter of 2009, natural gas liquids and other sales revenue decreased by $10.9 million compared to the prior year resulting from an $11.3 million unfavourable price variance offset by a $0.4 million favourable volume variance. For the six months ended June 30, 2009, natural gas liquids and other sales revenue decreased by $18.0 million as compared to the prior year resulting from a $20.9 million unfavourable price variance offset by a $2.9 million favourable volume variance. Generally, the natural gas liquids volume variance will be aligned with our production of natural gas while the price variances will be aligned with the prices realized for our oil production. The positive volume variances for the three and six months ended June 30, 2009, is attributed to a few natural gas wells drilled in 2008 and the First Quarter of 2009 which yielded significant natural gas liquids.

Royalties

We pay Crown, freehold and overriding royalties to the owners of mineral rights from which production is generated. These royalties vary for each property and product and our Crown royalties are based on a sliding scale dependent on production volumes and commodity prices.

For the Second Quarter of 2009, net royalties as a percentage of gross revenue were 12.7% (2008 – 16.3%) and aggregated to $28.2 million (2008 - - $76.8 million). For the six months ended June 30, 2009, net royalties as a percentage of gross revenue were 13.0% (2008 – 16.4%) and aggregated to $52.7 million (2008 – $139.2 million). The decrease in our royalty rate for the three and six months ended June 30, 2009 is due to reduced royalty rates in a lower commodity price environment as mandated by the Government of Alberta’s New Royalty Framework.

| Operating Expenses | | | | | | | | | | | | | | | |

| | | | | | Three Months Ended June 30 | | | | |

| | | | | | | | | | | | | | | | |

| | | 2009 | | | | | | 2008 | | | | | | Per BOE | |

| (000s except per boe amounts) | | Total | | | Per BOE | | | Total | | | Per BOE | | | Change | |

| Operating expense | | | | | | | | | | | | | | | |

| Power and fuel | $ | 11,376 | | $ | 2.37 | | $ | 22,633 | | $ | 4.47 | | | (47% | ) |

| Well servicing | | 12,403 | | | 2.58 | | | 11,121 | | | 2.20 | | | 17% | |

| Repairs and maintenance | | 10,079 | | | 2.10 | | | 10,269 | | | 2.03 | | | 3% | |

| Lease rentals and property taxes | | 6,750 | | | 1.41 | | | 7,107 | | | 1.40 | | | 1% | |

| Processing and other fees | | 3,275 | | | 0.68 | | | 2,856 | | | 0.56 | | | 21% | |

| Labour – internal | | 5,332 | | | 1.11 | | | 5,769 | | | 1.14 | | | (3% | ) |

| Labour – contract | | 4,452 | | | 0.93 | | | 4,131 | | | 0.82 | | | 13% | |

| Chemicals | | 3,818 | | | 0.80 | | | 4,837 | | | 0.96 | | | (17% | ) |

| Trucking | | 2,860 | | | 0.60 | | | 2,910 | | | 0.58 | | | 3% | |

| Other | | 972 | | | 0.19 | | | 1,459 | | | 0.29 | | | (34% | ) |

| Total operating expense | $ | 61,317 | | $ | 12.77 | | $ | 73,092 | | $ | 14.45 | | | (12% | ) |

| Transportation and marketing expense | $ | 3,584 | | $ | 0.75 | | $ | 3,352 | | $ | 0.66 | | | 14% | |

| | | | | | | | | | |

| | | | | | Six Months Ended June 30 | | | | |

| | | | | | | | | | | | | | | | |

| | | 2009 | | | | | | 2008 | | | | | | Per BOE | |

| (000s except per boe amounts) | | Total | | | Per BOE | | | Total | | | Per BOE | | | Change | |

| Operating expense | | | | | | | | | | | | | | | |

| Power and fuel | $ | 29,404 | | $ | 3.04 | | $ | 41,133 | | $ | 3.98 | | | (24% | ) |

| Well servicing | | 25,452 | | | 2.63 | | | 23,159 | | | 2.24 | | | 17% | |

| Repairs and maintenance | | 22,292 | | | 2.31 | | | 22,832 | | | 2.21 | | | 5% | |

| Lease rentals and property taxes | | 14,348 | | | 1.48 | | | 14,612 | | | 1.41 | | | 5% | |

| Processing and other fees | | 8,473 | | | 0.88 | | | 5,229 | | | 0.51 | | | 73% | |

| Labour – internal | | 11,594 | | | 1.20 | | | 12,091 | | | 1.17 | | | 3% | |

| Labour – contract | | 8,238 | | | 0.85 | | | 8,032 | | | 0.78 | | | 9% | |

| Chemicals | | 7,822 | | | 0.81 | | | 9,233 | | | 0.89 | | | (9% | ) |

| Trucking | | 5,990 | | | 0.62 | | | 5,707 | | | 0.55 | | | 13% | |

| Other | | 3,039 | | | 0.31 | | | 3,387 | | | 0.32 | | | (3% | ) |

| Total operating expense | $ | 136,652 | | $ | 14.13 | | $ | 145,415 | | $ | 14.06 | | | -% | |

| Transportation and marketing expense | $ | 6,516 | | $ | 0.67 | | $ | 6,377 | | $ | 0.62 | | | 8% | |

11

Second Quarter 2009 operating costs totaled $61.3 million, a decrease of $11.8 million as compared to the same period in the prior year primarily due to lower power and fuel costs. On a per barrel basis, operating costs have decreased to $12.77/boe in the Second Quarter 2009 as compared to $14.45/boe during the same period in the prior year, a 12% decrease substantially attributed to reduced power and fuel costs partially offset by lower production volumes. On a year-to-date basis, operating costs totaled $136.7 million, a decrease of $8.8 million as compared to the same period in the prior year. On a per barrel basis, year-to-date operating costs have remained relatively consistent as lower power and fuel costs have been substantially offset by higher well servicing and processing fees coupled with lower production volumes.

Power and fuel costs, comprised primarily of electric power costs, represented approximately 19% of our total operating costs during the Second Quarter of 2009. The average Alberta electric power price of $32.31/MWh in the Second Quarter of 2009 was 70% lower than the average price of $107.56/MWh in the Second Quarter of 2008. Similarly, the average Alberta electric power price for the first six months of 2009 of $47.66/MWh was 48% lower than the same period in the prior year. However, the decrease is not fully reflected in our three and six month period ending June 30, 2009 power and fuel costs due to increased power consumption at Hay River as we began purchasing power from BC Hydro late in the First Quarter of 2008. During the First Quarter of 2009, Harvest electricity usage in Alberta was exposed to market prices. Beginning in April 2009, we have electric power price risk management contracts on 10 MWh at an average price of $61.90 per MWh through December 2009, which resulted in a loss of $0.6 million for the three and six months ended June 30, 2009 as compared to gains of $3.6 million and $5.2 million, respectively, in the prior year. The following table details the electric power costs per boe before and after the impact of our price risk management program.

| | | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| (per boe) | | 2009 | | | 2008 | | | Change | | | 2009 | | | 2008 | | | Change | |

| Electric power and fuel costs | $ | 2.37 | | $ | 4.47 | | | (47% | ) | $ | 3.04 | | $ | 3.98 | | | (24% | ) |

| Realized losses (gains) on electricity risk managementcontracts | | 0.13 | | | (0.71 | ) | | (118% | ) | | 0.07 | | | (0.50 | ) | | (114% | ) |

| Net electric power and fuel costs | $ | 2.50 | | $ | 3.76 | | | (34% | ) | $ | 3.11 | | $ | 3.48 | | | (11% | ) |

| Alberta Power Pool electricity price (per MWh) | $ | 32.31 | | $ | 107.56 | | | (70% | ) | $ | 47.66 | | $ | 92.13 | | | (48% | ) |

For the three and six months ended June 30, 2009, transportation and marketing expense remained relatively unchanged at $3.6 million and $6.5 million, respectively, as compared to the prior year when transportation and marketing expense totaled $3.4 million and $6.4 million, respectively. These costs relate primarily to delivery of natural gas to Alberta’s natural gas sales hub, the AECO Storage Hub, and to a lesser extent, our costs of trucking clean crude oil to pipeline receipt points. As a result, the total dollar amount of costs fluctuates in relation with our natural gas production volumes while the cost per boe typically remains relatively constant.

| Operating Netback | | | | | | | | | | | | |

| | | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| (per boe) | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Revenues | $ | 46.28 | | $ | 93.29 | | $ | 41.89 | | $ | 82.11 | |

| Royalties | | (5.88 | ) | | (15.19 | ) | | (5.45 | ) | | (13.46 | ) |

| Operating expense | | (12.77 | ) | | (14.45 | ) | | (14.13 | ) | | (14.06 | ) |

| Transportation and marketing expense | | (0.75 | ) | | (0.66 | ) | | (0.67 | ) | | (0.62 | ) |

| Operating netback(1) | $ | 26.88 | | $ | 62.99 | | $ | 21.64 | | $ | 53.97 | |

| (1)This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A. | | | | | | | | | | |

Harvest’s operating netback represents the net amount realized on a per boe basis after deducting directly related costs. For the three and six months ended June 30, 2009, our operating netback decreased by $36.11/boe and $32.33/boe, respectively, as compared to the prior year. The decreases are primarily attributed to lower realized commodity prices, reflecting the decrease in Edmonton Par, Bow River and AECO pricing, partially offset by a decrease in royalties.

12

| General and Administrative (“G&A”) Expense | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| | | | | | | | | | | | | | | | | | | |

| (000s except per boe) | | 2009 | | | 2008 | | | Change | | | 2009 | | | 2008 | | | Change | |

| Cash G&A | $ | 7,945 | | $ | 8,318 | | | (4% | ) | $ | 16,598 | | $ | 16,787 | | | (1% | ) |

| Unit based compensation (recovery) expense | | 929 | | | 4,392 | | | (79% | ) | | (330 | ) | | 7,832 | | | (104% | ) |

| Total G&A | $ | 8,874 | | $ | 12,710 | | | (30% | ) | $ | 16,268 | | $ | 24,619 | | | (34% | ) |

| | | | | | | | | | | | | | | | | | | |

| Cash G&A per boe | $ | 1.66 | | $ | 1.64 | | | 1% | | $ | 1.72 | | $ | 1.62 | | | 6% | |

For the three months ended June 30, 2009, cash G&A costs decreased by $0.4 million (4%) as compared to the same period in the prior year, primarily due to cost reduction efforts made in the first half of 2009. For the six months ended June 30, 2009, cash G&A costs decreased by $0.2 million (1%), as the majority of the cost saving benefits were not realized until the Second Quarter of 2009. Generally, approximately 75% of our cash G&A expenses are related to salaries and other employee related costs.

Our unit based compensation plans provide employees with the option of settling outstanding awards with cash. As a result, unit based compensation expense is determined using the intrinsic method, being the difference between the Trust Unit trading price and the strike price of the unit awards adjusted for the proportion that is vested. For the three and six months ended June 30, 2009, total unit based compensation expense decreased $3.5 million and $8.2 million, respectively, as compared to the same periods in the prior year as the market price of our Trust Units dropped in 2009, while appreciating in 2008.

| Depletion, Depreciation, Amortization and Accretion Expense | | | | | | | | | | | | | |

| | | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| (000s except per boe) | | 2009 | | | 2008 | | | Change | | | 2009 | | | 2008 | | | Change | |

| Depletion, depreciation and amortization | $ | 106,841 | | $ | 99,421 | | | 7% | | $ | 213,050 | | $ | 205,625 | | | 4% | |

| Depletion of capitalized asset retirement costs | | 4,741 | | | 3,354 | | | 41% | | | 9,489 | | | 6,978 | | | 36% | |

| Accretion on asset retirement obligation | | 6,037 | | | 4,596 | | | 31% | | | 12,092 | | | 9,193 | | | 32% | |

| Total depletion, depreciation, amortization and accretion | $ | 117,619 | | $ | 107,371 | | | 10% | | $ | 234,631 | | $ | 221,796 | | | 6% | |

| Per boe | $ | 24.50 | | $ | 21.23 | | | 15% | | $ | 24.26 | | $ | 21.45 | | | 13% | |

Our overall depletion, depreciation, amortization and accretion (“DDA&A”) expense for the three and six months ended June 30, 2009 was $10.2 million and $12.8 million higher, respectively, compared to the prior year. The increase is attributed to higher accretion expense due to an increase in the asset retirement obligation balance quarter over quarter and slightly higher finding, development and acquisition costs that have increased our depletion rate, which was offset by lower production volumes.

| Capital Expenditures | | | | | | | | | | | | |

| | | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| (000s) | | 2009 | | | 2008 | | | 2009 | | | 2008 | |

| Land and undeveloped lease rentals | $ | 354 | | $ | 1,164 | | $ | 1,188 | | $ | 2,149 | |

| Geological and geophysical | | 237 | | | 811 | | | 1,252 | | | 3,947 | |

| Drilling and completion | | 11,829 | | | 16,910 | | | 71,851 | | | 73,286 | |

| Well equipment, pipelines and facilities | | 18,616 | | | 18,259 | | | 62,426 | | | 34,667 | |

| Capitalized G&A expenses | | 2,532 | | | 2,467 | | | 5,294 | | | 5,133 | |

| Furniture, leaseholds and office equipment | | (177 | ) | | 58 | | | 90 | | | 58 | |

| Development capital expenditures excluding | | | | | | | | | | | | |

| acquisitions and non-cash items | | 33,391 | | | 39,669 | | | 142,101 | | | 119,240 | |

| Non-cash capital (recoveries) additions | | 194 | | | 812 | | | (108 | ) | | 1,355 | |

| Total development capital expenditures excluding acquisitions | $ | 33,585 | | $ | 40,481 | | $ | 141,993 | | $ | 120,595 | |

13

Our activity in the Second Quarter of 2009 was focused on the completion of our Hay River project in northeast British Columbia. Hay River is a winter access only property requiring that all heavy equipment, such as drilling rigs, only operate from December to March. Early in the Second Quarter we started the completion and tie-in of the 39 wells we drilled at Hay River over the winter season, resulting in expenditures of approximately $19 million. The new wells were brought on stream during the quarter with production for our Hay River property reaching 7,000 boe/d. In our Rimbey area, we completed the tie-in of 3 wells at Chedderville drilled during the First Quarter, and drilled a new Ostracod discovery well at Wilson Creek for total capital expenditures of approximately $5 million. Drilling activity was significantly reduced in the Second Quarter, as we drilled 3 wells (2.5 net) as compared to 82 wells (62.1 net) in the First Quarter of 2009 due to spring breakup.

Polymer injection at our Wainwright project commenced in June and we will be monitoring the performance over the Third and Fourth Quarters of 2009.

The following summarizes Harvest’s participation in gross and net wells drilled during the three months ended June 30, 2009:

| | Total Wells | Successful Wells | Abandoned Wells |

| Area | Gross | Net | Gross | Net | Gross | Net |

| | | | | | | |

| Hay River | - | - | - | - | - | - |

| Southeast Saskatchewan | 2.0 | 1.5 | 2.0 | 1.5 | - | - |

| Southeast Alberta | - | - | - | - | - | - |

| Red Earth | - | - | - | - | - | - |

| Suffield | - | - | - | - | - | - |

| Lloydminster/Hayter | - | - | - | - | - | - |

| Rimbey | 1.0 | 1.0 | 1.0 | 1.0 | - | - |

| Markerville | - | - | - | - | - | - |

| Northwest Alberta | - | - | - | - | - | - |

| Other Areas | - | - | - | - | - | - |

| Total | 3.0 | 2.5 | 3.0 | 2.5 | - | - |

The following summarizes Harvest’s participation in gross and net wells drilled during the six months ended June 30, 2009:

| | Total Wells | Successful Wells | Abandoned Wells |

| Area | Gross(1) | Net | Gross | Net | Gross | Net |

| | | | | | | |

| Hay River | 43.0 | 43.0 | 43.0 | 43.0 | - | - |

| Southeast Saskatchewan | 4.0 | 3.5 | 4.0 | 3.5 | - | - |

| Southeast Alberta | 25.0 | 11.5 | 25.0 | 11.5 | - | - |

| Red Earth | 1.0 | 1.0 | 1.0 | 1.0 | - | - |

| Suffield | 1.0 | 1.0 | 1.0 | 1.0 | - | - |

| Lloydminster/Hayter | - | - | - | - | - | - |

| Rimbey | 10.0 | 3.6 | 10.0 | 3.6 | - | - |

| Markerville | - | - | - | - | - | - |

| Northwest Alberta | - | - | - | - | - | - |

| Other Areas | 1.0 | 1.0 | 1.0 | 1.0 | - | - |

| Total | 85.0 | 64.6 | 85.0 | 64.6 | - | - |

| (1)Excludes 1 additional well that we have an overriding royalty interest in. | | | | |

Asset Retirement Obligation (“ARO”)

In connection with property acquisitions and development expenditures, we record the fair value of the ARO as a liability in the same year the expenditures occur. The associated asset retirement costs are capitalized as part of the carrying amount of the assets and are depleted and depreciated over our estimated net proved reserves. Once the initial ARO is measured, it is adjusted at the end of each period to reflect the passage of time as well as changes in the estimated future cash flows of the underlying obligation. Our asset retirement obligation increased by $4.9 million during the first six months of 2009 as a result of accretion expense of $12.1 million and new liabilities recorded of $0.4 million, offset by $5.0 million of asset retirement expenditures and net dispositions of $2.5 million.

14

Acquisitions and Divestitures

During the Second Quarter, we closed the sale of two non-operated properties with net proceeds of approximately $63 million. The sale of our natural gas interests in Channel Lake for $43 million resulted in a disposition metric of approximately $53,000 per boe based on its current production of 4,860 mcf/d and approximately $2.30 per mcf based on proved plus probable reserves of approximately 19 bcf. Our sale of certain non-operated interests in the Pembina area for $20 million resulted in a disposition metric of approximately $94,800 per boe based on its current production of 211 boe/d (weighted 70% light oil and natural gas liquids and 30% natural gas) and approximately $13.00 per boe based on proved plus probable reserves of 1,520 mboe. The net proceeds were applied to reduce our bank borrowings.

On June 23, 2009, we offered to purchase all of the outstanding shares of Pegasus Oil and Gas Inc., a natural gas weighted producer with approximately 650 boe/d of production, in exchange for Trust Units. On July 30, 2009, the offer expired with slightly less than 90% of the outstanding shares tendered at which time, we extended the offer to August 11, 2009 in an effort to increase the number of tendered shares to the 90% minimum condition of our offer. Including the obligation to assume approximately $14 million of bank debt, the acquisition metrics are approximately $30,000 per boe/d of production and approximately $4.25 per boe of reserves on a proved plus probable basis. The principal asset in this acquisition is a 7% working interest in liquids rich natural gas production from a property in the Crossfield area which is operated by Harvest. This potential acquisition includes access to over 150,000 acres of land and over $50 million of income tax pools. The President and Chief Executive Officer of Harvest as well as two Directors of Harvest each hold a nominal number of shares in Pegasus Oil and Gas Inc.

DOWNSTREAM OPERATIONS

Second Quarter Highlights

Successfully completed a 42-day planned turnaround of the hydrocracking and hydrogen units, replacement of distillate hydrotreating and hydrocracking catalyst, and regeneration of the naphtha reforming unit catalyst for a total cost of approximately $47.5 million, with the refinery exiting the quarter with throughput averaging approximately 117,000 bbls/d comprised of 110,000 bbls/d of crude oil feedstock and 7,000 bbls/d of Vacuum Gas Oil.

In addition to the turnaround, capital expenditures totaled $19.9 million during the quarter including $7.0 million to upgrade heaters and $2.5 million related to debottlenecking projects.

During the Second Quarter of 2009, the operational hedging of the WTI component of our feedstock costs through the Supply and Offtake Agreement resulted in a US$12.2 million reduction in our feedstock costs (US$2.54/bbl of throughput). Further, the weakening of the Canadian dollar relative to the U.S. dollar in the Second Quarter of 2009 as compared to the Second Quarter of 2008, added $4.2 million to our gross margin in 2009 as our U.S. dollar denominated margins are translated to Canadian dollars.

During the Second Quarter of 2009, downstream refining gross margins averaged US$6.50/bbl reflecting a US$0.84/bbl increase over the prior year mainly due to improved margins on high sulphur fuel oil (“HSFO”) and gasoline products, partially offset by lower margins on distillate products and lower discounts on our feedstock purchases, all relative to the WTI benchmark price.

15

| Summary of Financial and Operational Results | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30 | | | Six Months Ended June 30 | |

| (in $000’s except where noted below) | | 2009 | | | 2008 | | | Change | | | 2009 | | | 2008 | | | Change | |

| | | | | | | | | | | | | | | | | | | |

| Revenues | | 369,081 | | | 1,227,126 | | | (70% | ) | | 941,785 | | | 2,289,545 | | | (59% | ) |

| Purchased feedstock for processing and | | | | | | | | | | | | | | | | | | |

| products purchased for resale | | 322,855 | | | 1,160,558 | | | (72% | ) | | 704,692 | | | 2,120,550 | | | (67% | ) |

| Gross margin(1) | | 46,226 | | | 66,568 | | | (31% | ) | | 237,093 | | | 168,995 | | | 40% | |

| | | | | | | | | | | | | | | | | | | |

| Costs and expenses | | | | | | | | | | | | | | | | | | |

| Operating expense | | 26,974 | | | 25,617 | | | 5% | | | 50,940 | | | 51,512 | | | (1% | ) |

| Purchased energy expense | | 11,161 | | | 29,899 | | | (63% | ) | | 27,768 | | | 73,026 | | | (62% | ) |

| Turnaround and catalyst expense | | 43,285 | | | - | | | 100% | | | 47,487 | | | - | | | 100% | |

| Marketing expense | | 3,122 | | | 9,401 | | | (67% | ) | | 6,101 | | | 17,998 | | | (66% | ) |

| General and administrative expense | | 520 | | | 600 | | | (13% | ) | | 875 | | | 1,168 | | | (25% | ) |

| Depreciation and amortization expense | | 19,076 | | | 16,743 | | | 14% | | | 41,260 | | | 33,243 | | | 24% | |

| Goodwill impairment | | 206,465 | | | - | | | 100% | | | 206,465 | | | - | | | 100% | |

| Loss From Operations(1) | | (264,377 | ) | | (15,692 | ) | | 1,585% | | | (143,803 | ) | | (7,952 | ) | | 1,708% | |

| | | | | | | | | | | | | | | | | | | |

| Cash capital expenditures | | 19,929 | | | 8,619 | | | 131% | | | 26,833 | | | 14,646 | | | 83% | |

| | | | | | | | | | | | | | | | | | | |

| Feedstock volume (bbl/day)(2) | | 52,808 | | | 100,422 | | | (47% | ) | | 78,410 | | | 106,211 | | | (26% | ) |

| | | | | | | | | | | | | | | | | | | |

| Yield (000’s barrels) | | | | | | | | | | | | | | | | | | |

| Gasoline and related products | | 1,372 | | | 2,627 | | | (48% | ) | | 4,693 | | | 6,044 | | | (22% | ) |

| Ultra low sulphur diesel and jet fuel | | 1,830 | | | 3,755 | | | (51% | ) | | 5,324 | | | 8,016 | | | (34% | ) |

| High sulphur fuel oil | | 1,183 | | | 2,534 | | | (53% | ) | | 3,553 | | | 5,100 | | | (30% | ) |

| Total | | 4,385 | | | 8,916 | | | (51% | ) | | 13,570 | | | 19,160 | | | (29% | ) |

| | | | | | | | | | | | | | | | | | | |

| Average refining gross margin (US$/bbl)(3) | | 6.50 | | | 5.66 | | | 15% | | | 12.51 | | | 7.36 | | | 70% | |

| (1) | These are non-GAAP measures; please refer to “Non-GAAP Measures” in this MD&A. |

| (2) | Barrels per day are calculated using total barrels of crude oil feedstock and vacuum gas oil. |

| (3) | Average refining gross margin is calculated based on per barrel of feedstock throughput. |

Refining Benchmark Prices

The following average benchmark prices and currency exchange rates are the reference points from which we discuss our refinery’s financial performance:

| | Three Months Ended June 30 | Six Months Ended June 30 |

| | 2009 | 2008 | Change | 2009 | 2008 | Change |

| WTI crude oil (US$/bbl) | 59.62 | 123.98 | (52%) | 51.35 | 110.94 | (54%) |

| Brent crude oil (US$/bbl) | 59.76 | 122.94 | (51%) | 52.72 | 108.17 | (51%) |

| Basrah Official Sales Price Discount (US$/bbl) | (1.88) | (8.07) | (77%) | (2.82) | (7.93) | (64%) |

| RBOB gasoline (US$/bbl/gallon) | 71.87/1.71 | 133.44/3.18 | (46%) | 62.00/1.48 | 118.90/2.83 | (48%) |

| Heating Oil (US$/bbl/gallon) | 65.33/1.56 | 148.62/3.54 | (56%) | 60.90/1.45 | 131.86/3.14 | (54%) |

| High Sulphur Fuel Oil (US$/bbl) | 50.93 | 85.23 | (40%) | 43.96 | 77.60 | (43%) |

| Canadian / U.S. dollar exchange rate | 0.858 | 0.990 | (13%) | 0.831 | 0.993 | (16%) |

During the Second Quarter of 2009, the Heating Oil Crack Spread averaged US$5.71/bbl, a decrease of US$7.67/bbl over the First Quarter of 2009 and a decrease of US$18.93/bbl over the US$24.64/bbl averaged in the prior year, due to soft demand resulting from the global economic slowdown. The RBOB Gasoline Crack Spread averaged US$12.25/bbl in the Second Quarter of 2009, an increase of US$3.20/bbl from the First Quarter of 2009 and an increase of US$2.79/bbl from the US$9.46/bbl in the prior year, as North American refinery output was curtailed to balance weak demand resulting in the improvement in gasoline margins. The HSFO price averaged US$8.69/bbl less than WTI in the Second Quarter of 2009, a decrease of US$2.60/bbl over the First Quarter of 2009 and an improvement of US$30.06/bbl over the prior year, all relative to the WTI benchmark price. Similarly, for the six month period ended June 30, 2009, as compared to the same period in the prior year, the Heating Oil Crack Spread decreased by US$11.37/bbl to US$9.55/bbl, the RBOB Gasoline Crack Spread increased by US$2.69/bbl to US$10.65/bbl, and the HSFO price relative to WTI improved by US$25.95/bbl to US$7.39/bbl less WTI.

16

During the three and six months ended June 30, 2009, the Canadian/U.S. dollar exchange rate averaged 0.858 and 0.831, respectively, as compared to 0.990 and 0.993, respectively, in the prior year. The weakening of the Canadian dollar in 2009 has improved the contribution from our Downstream operations as substantially all of its gross margin, cost of purchased energy and marketing expense are denominated in U.S. dollars. The net impact of a weakening Canadian dollar increased our refining gross margin by $4.2 million in the Second Quarter as compared to the prior year.

Summary of Gross Margin

The following table summarizes our downstream gross margin for the three and six months ended June 30, 2009 and 2008 segregated between refining activities and petroleum marketing and other related businesses.

| | | | | | | | | Three Months Ended June 30 | | | | | | | |

| | | | | | 2009 | | | | | | | | | 2008 | | | | |

| (000’s of Canadian dollars) | | Refining | | | Marketing | | | Total | | | Refining | | | Marketing | | | Total | |

| Sales revenue(1) | | 350,845 | | | 102,833 | | | 369,081 | | | 1,200,950 | | | 180,217 | | | 1,227,126 | |

| Cost of feedstock for processing and products | | | | | | | | | | | | | | | | | | |

| for resale(1) | | 314,455 | | | 92,997 | | | 322,855 | | | 1,148,750 | | | 165,849 | | | 1,160,558 | |

| Gross margin(2) | | 36,390 | | | 9,836 | | | 46,226 | | | 52,200 | | | 14,368 | | | 66,568 | |

| | | | | | | | | | | | | | | | | | | |

| Average refining gross margin (US$/bbl) | | 6.50 | | | | | | | | | 5.66 | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Six Months Ended June 30 | | | | | | | |

| | | | | | 2009 | | | | | | | | | 2008 | | | | |

| (000’s of Canadian dollars) | | Refining | | | Marketing | | | Total | | | Refining | | | Marketing | | | Total | |

| Sales revenue(1) | | 901,059 | | | 203,508 | | | 941,785 | | | 2,237,581 | | | 324,223 | | | 2,289,545 | |

| Cost of feedstock for processing and products | | | | | | | | | | | | | | | | | | |

| for resale(1) | | 687,438 | | | 180,036 | | | 704,692 | | | 2,094,349 | | | 298,460 | | | 2,120,550 | |

| Gross margin(2) | | 213,621 | | | 23,472 | | | 237,093 | | | 143,232 | | | 25,763 | | | 168,995 | |

| | | | | | | | | | | | | | | | | | | |

| Average refining gross margin (US$/bbl) | | 12.51 | | | | | | | | | 7.36 | | | | | | | |

(1)

Downstream sales revenue and cost of products for processing and resale are net of intra-segment sales of $84.6 million and $162.8 million for the three and six months ended June 30, 2009 ($154.0 million and $272.3 million – three and six months ended June 30, 2008) reflecting the refined products produced by the refinery and sold by the Marketing Division.

(2)

This is a non-GAAP measure; please refer to “Non-GAAP Measures” in this MD&A.

For the three months ended June 30, 2009, our refining gross margin was $36.4 million, a decrease of $140.8 million as compared to the First Quarter of 2009 and a decrease of $15.8 million as compared to the prior year. The decrease in refining gross margin is primarily due to the reduction in throughput due to the planned turnaround completed in the Second Quarter of 2009 resulting in average throughput of 52,808 bbl/d as compared to 100,422 bbl/d in the same period of the prior year, as well as an US$18.93/bbl decrease in the Heating Oil benchmark crack spread, and a US$3.28/bbl reduction in our feedstock discount. These factors were partially offset by a US$30.06/bbl improvement in the HSFO benchmark crack spread, a US$2.79/bbl improvement in the RBOB gasoline benchmark crack spread, a US$12.2 million operational hedging gain on our feedstock purchases, and the translation of our U.S. dollar denominated gross margin to Canadian dollars resulted in an increase to gross margin of $4.2 million. The reduction in throughput resulted in an unfavourable volume variance of $24.7 million while the net impact of the changes in refined product and feedstock prices resulted in a favourable price variance of $8.9 million, of which $4.2 million relates to the change in the Canadian/U.S. dollar exchange rate.

For the six months ended June 30, 2009, our refining gross margin was $213.6 million as compared to $143.2 million in the prior year, an increase of $70.4 million. The increase in refining gross margin is primarily due to US$25.95/bbl improvement in the HSFO benchmark crack spread, a US$2.69/bbl improvement in the RBOB gasoline benchmark crack spread, a US$57.2 million operational hedging gain on our feedstock purchases, and the translation of our U.S. dollar denominated gross margin to Canadian dollars in light of the weakening Canadian dollar. These factors were partially offset by an US$11.37/bbl decrease in the Heating Oil benchmark crack spread. The reduction in throughput resulted in an unfavourable volume variance of $38.1 million while the net impact of the changes in refined product and feedstock prices resulted in a favourable price variance of $108.5 million, of which $20.5 million relates to the change in the Canadian/U.S. dollar exchange rate.

17

For the three and six months ended June 30, 2009, our marketing division earned a gross margin of $9.8 million and $23.5 million, respectively, as compared to $14.4 million and $25.8 million, respectively, in the prior year. The decrease for the three and six months ended June 30, 2009 of 32% and 9% respectively, compared to the prior year is primarily due to reduced margins on sulphur sales.

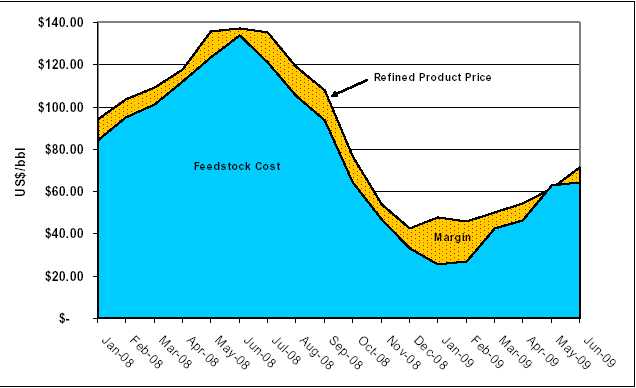

Refining Gross Margin

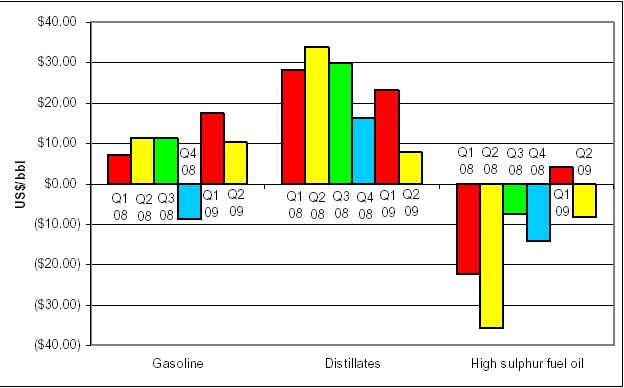

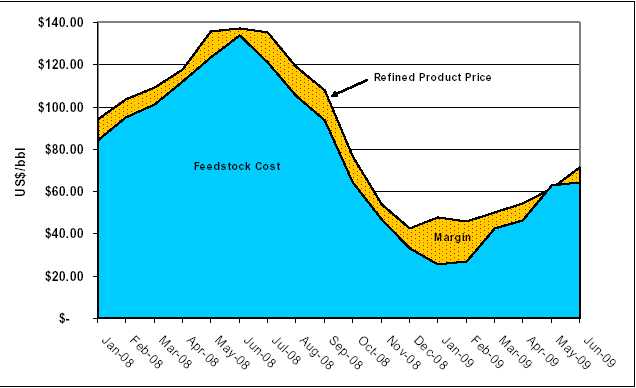

We analyze our refining gross margin on each refined product and our sales revenue relative to benchmark prices for the refined product and the WTI benchmark price. With respect to feedstock costs, we analyze our price discounts relative to the WTI benchmark price and segregate crude oil sources by country of origin. The following graph summarizes our average refining gross margin relative to the cost of feedstock for the period of January 2008 to June 2009:

18

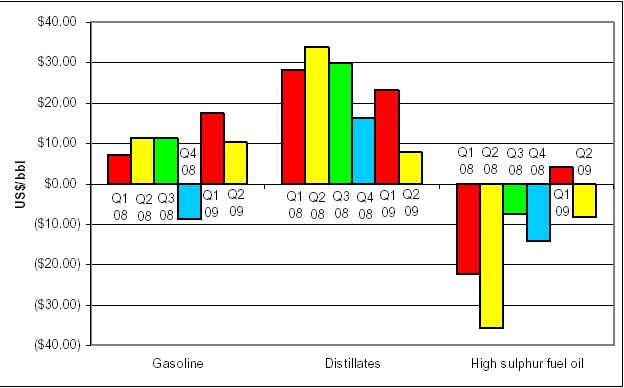

The following chart summarizes our refining gross margin by refined product over the same time period by quarter:

Our gasoline margins in the Second Quarter of 2009 decreased from the First Quarter of 2009, however they remained relatively unchanged from the Second Quarter of 2008. Margins on distillate products have decreased significantly in the Second Quarter as compared to the First Quarter of 2009 and the Second Quarter of 2008. Refining gross margins on HSFO decreased in the Second Quarter of 2009 relative to the First Quarter of 2009, however they have improved significantly relative to the Second Quarter of 2008.

Refinery Sales Revenue

Our refinery sales revenue is dependent on the selling price as well as the yield of refined products produced from the crude oil and other feedstocks. Although our yield can be altered slightly by adjusting refinery operations to react to market conditions and seasonal demand, product yields are primarily impacted by the type of crude oil feedstock processed and refinery performance. A comparison of our refinery yield, product pricing and revenue for the three and six months ended June 30, 2009 and 2008 is presented below:

| | | | | | | | | Three Months Ended June 30 | | | | | | | |

| | | | | | 2009 | | | | | | | | | 2008 | | | | |

| | | Refinery | | | Volume | | | Sales | | | Refinery | | | Volume | | | Sales | |

| | | Revenues | | | | | | Price(1) | | | Revenues | | | | | | Price(1) | |

| | | (000’s of Cdn $) | | | (000s of bbls) | | | (US$ per bbl/ | | | (000’s of Cdn $) | | | (000s of bbls) | | | (US$ per bbl/ | |

| | | | | | | | | US$ per US gal) | | | | | | | | | US$ per US gal) | |

| | | | | | | | | | | | | | | | | | | |

| Gasoline products | | 120,889 | | | 1,449 | | | 71.58/1.70 | | | 366,304 | | | 2,710 | | | 133.82/3.19 | |

| Distillates | | 164,499 | | | 2,042 | | | 69.12/1.65 | | | 606,578 | | | 3,844 | | | 156.22/3.72 | |

| High sulphur fuel oil | | 65,457 | | | 1,058 | | | 53.08 | | | 228,068 | | | 2,606 | | | 86.64 | |

| | | 350,845 | | | 4,549 | | | 66.17 | | | 1,200,950 | | | 9,160 | | | 129.80 | |

| Inventory adjustment | | | | | (164 | ) | | | | | | | | (244 | ) | | | |

| Total production | | | | | 4,385 | | | | | | | | | 8,916 | | | | |

| Yield (as a % of Feedstock)(2) | | | 91% | | | | | | | | | 98% | | | | |

19

| | | | | | | | | Six Months Ended June 30 | | | | | | | |

| | | | | | 2009 | | | | | | | | | 2008 | | | | |

| | | Refinery | | | Volume | | | Sales | | | Refinery | | | Volume | | | Sales | |

| | | Revenues | | | | | | Price(1) | | | Revenues | | | | | | Price(1) | |

| | | (000’s of Cdn $) | | | (000s of bbls) | | | (US$ per bbl/ | | | (000’s of Cdn $) | | | (000s of bbls) | | | (US$ per bbl/ | |

| | | | | | | | | US$ per US gal) | | | | | | | | | US$ per US gal) | |

| | | | | | | | | | | | | | | | | | | |

| Gasoline products | | 335,360 | | | 4,941 | | | 56.40/1.34 | | | 721,868 | | | 6,238 | | | 114.91/2.74 | |

| Distillates | | 388,953 | | | 5,315 | | | 60.81/1.45 | | | 1,119,164 | | | 8,060 | | | 137.88/3.28 | |

| High sulphur fuel oil | | 176,746 | | | 3,531 | | | 41.60 | | | 396,549 | | | 4,968 | | | 79.26 | |

| | | 901,059 | | | 13,787 | | | 54.31 | | | 2,237,581 | | | 19,266 | | | 115.33 | |

| Inventory adjustment | | | | | (217 | ) | | | | | | | | (106 | ) | | | |

| Total production | | | | | 13,570 | | | | | | | | | 19,160 | | | | |

| Yield (as a % of Feedstock)(2) | | | 96% | | | | | | | | | 99% | | | | |

| (1) | Average product sales prices are based on the deliveries at our refinery loading facilities. |

| (2) | After adjusting for changes in inventory held for resale. |

For the three months ended June 30, 2009, our refinery yield was comprised of 31% gasoline products, 42% distillates and 27% HSFO which is relatively consistent with the prior year when refinery yield averaged 30%, 42% and 28% for the same products respectively. For the six months ended June 30, 2009, our refinery yield was comprised of 35% gasoline products, 39% distillates and 26% HSFO as compared to 32%, 42%, and 26%, respectively, in the prior year. The shift in product yield in 2009 from distillates to gasoline is attributed to end of run activity of the hydrocracker catalyst as well as other end of run conditions in the First Quarter of 2009 prior to the scheduled turnaround completed in the Second Quarter of 2009 and operational changes to capitalize on the higher gasoline margins.

In the Second Quarter of 2009, our average sales price was US$66.17/bbl (a premium of US$6.55/bbl over WTI) as compared to an average selling price of US$129.80/bbl in the prior year (a premium of US$5.82/bbl over WTI). This increase in premium relative to WTI represents a $3.9 million favourable price variance. For the six months ended June 30, 2009, our average sales price was US$54.31/bbl (a premium of US$2.96/bbl over WTI) as compared to an average selling price of US$115.33/bbl in the prior year (a premium of US$4.39/bbl over WTI). This decrease in premium relative to WTI represents a $23.7 unfavourable price variance.

During the Second Quarter of 2009, the average sales price of our gasoline products of US$71.58/bbl was an US$11.96/bbl premium to the average WTI price as compared to a US$9.84/bbl premium over WTI realized in the prior year, representing a $3.6 million increase in gross margin. This US$2.12/bbl increase in our gasoline refining gross margin relative to WTI is reflective of the US$2.79/bbl increase in the NYMEX benchmark RBOB gasoline crack spread. For the six months ended June 30, 2009, the average sales price of our gasoline products of $56.40/bbl was a US$5.05/bbl premium to the average WTI price as compared to a US$3.97/bbl premium over WTI realized in the prior year, representing a $6.4 million increase in gross margin. This US$1.08/bbl increase in our gasoline refining gross margin relative to WTI is attributed to the US$2.69/bbl increase in the NYMEX benchmark RBOB gasoline crack spread, offset by increased freight costs and timing under the Supply and Offtake Agreement with Vitol.