QuickLinks -- Click here to rapidly navigate through this document

As filed with the Securities and Exchange Commission on January 21, 2005

Registration No. 333-121322

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WMG ACQUISITION CORP.

(Exact Name of Registrant as Specified in Its Charter)

(SEE TABLE OF ADDITIONAL REGISTRANTS)

| Delaware (State or other jurisdiction of incorporation or organization) | 7929 (Primary Standard Industrial Classification Code Number) | 13-35665869 (I.R.S. Employer Identification Number) | ||

75 Rockefeller Plaza New York, NY 10019 (212) 275-2000 |

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

David H. Johnson, Esq.

Executive Vice President and

General Counsel

Warner Music Group

75 Rockefeller Plaza

New York, NY 10019

(212) 275-2030

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

Edward P. Tolley III, Esq.

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, New York 10017-3954

(212) 455-2000

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. / /

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

CALCULATION OF REGISTRATION FEE

| Title of Each Class Of Securities to be Registered | Amount to Be Registered | Proposed Maximum Offering Price Per Unit | Proposed Maximum Aggregate Offering Price | Amount Of Registration Fee | ||||

|---|---|---|---|---|---|---|---|---|

| 73/8% Senior Subordinated Notes due 2014 | $465,000,000 | 100%(1) | $465,000,000(1) | $54,731(2) | ||||

| 81/8% Senior Subordinated Notes due 2014 | £100,000,000 | 100%(1) | £100,000,000(1) | $22,888(2)(3) | ||||

| Guarantees of 73/8% Senior Subordinated Notes due 2014(4) | (5) | (5) | (5) | (5) | ||||

| Guarantees of 81/8% Senior Subordinated Notes due 2014(4) | (5) | (5) | (5) | (5) | ||||

- (1)

- Estimated solely for the purpose of calculating the registration fee under Rule 457 of the Securities Act of 1933, as amended.

- (2)

- Previously paid.

- (3)

- The amount of the registration fee was calculated based on the noon buying rate on December 15, 2004 of $1.9446=£1.00.

- (4)

- See inside facing page for table of additional registrant guarantors.

- (5)

- Pursuant to Rule 457(n) under the Securities Act of 1933, as amended, no separate fee for the guarantees is payable.

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANT GUARANTORS

| Exact Name of Registrant As Specified In Its Charter | State or other Jurisdiction of Incorporation or Organization | IRS Employer Identification Number | Address, Including ZIP Code, And Telephone Number, Including Area Code, Of Registrant's Principal Executive Offices | Phone Number | ||||

|---|---|---|---|---|---|---|---|---|

| A.P. Schmidt Company | Delaware | 36-2669470 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Atlantic Recording Corporation | Delaware | 13-2597725 | 1290 Avenue of the Americas, New York NY 10104 | (212) 707-2000 | ||||

Atlantic/143 L.L.C. | Delaware | 13-3975703 | 1290 Avenue of the Americas, New York NY 10104 | (212) 707-2000 | ||||

Atlantic/MR II INC. | Delaware | 13-3845524 | 1290 Avenue of the Americas, New York NY 10104 | (212) 707-2000 | ||||

Atlantic/MR Ventures Inc. | Delaware | 13-3684268 | 1290 Avenue of the Americas, New York NY 10104 | (212) 707-2000 | ||||

Berna Music, Inc. | California | 95-2565721 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Big Beat Records Inc. | Delaware | 13-3626173 | 1290 Avenue of the Americas, New York NY 10104 | (212) 707-2000 | ||||

Big Tree Recording Corporation | Delaware | 13-2945275 | 1290 Avenue of the Americas, New York NY 10104 | (212) 707-2000 | ||||

Bute Sound LLC | Delaware | 13-4032642 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Cafe Americana Inc. | Delaware | 13-3246931 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Chappell & Intersong Music Group (Australia) Limited | Delaware | 13-3395886 | 1 Cassins Avenue, North Sydney, Australia | (61) 2 9779 4099 | ||||

Chappell And Intersong Music Group (Germany) Inc. | Delaware | 13-3246911 | Alter Wandrahm 14, D-20457 Hamburg, Germany | (49) 40-30339-101 | ||||

Chappell Music Company, Inc. | Delaware | 13-3325475 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Cota Music, Inc. | New York | 13-3523591 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Cotillion Music, Inc. | Delaware | 13-2597937 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

CPP/Belwin, Inc. | Delaware | 65-0051018 | 15800 N.W. 48th Avenue, P.O. Box 4340, Miami FL 33014 | (305) 620-1500 | ||||

CRK Music Inc. | Delaware | 13-3663052 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

E/A Music, Inc. | Delaware | 13-3203221 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Eleksylum Music, Inc. | Delaware | 13-3174021 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Elektra Entertainment Group Inc. | Delaware | 13-4033729 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

Elektra Group Ventures Inc. | Delaware | 13-3808252 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

Elektra/Chameleon Ventures Inc. | Delaware | 13-3626113 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

FHK, INC. | Tennessee | 62-1548343 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Fiddleback Music Publishing Company, Inc | Delaware | 13-2705484 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Foster Frees Music, Inc. | California | 95-3297348 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Foz Man Music LLC | Delaware | 13-4028790 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Inside Job, Inc. | New York | 13-2699020 | 1290 Avenue of the Americas, New York NY 10104 | (212) 707-2000 | ||||

Intersong U.S.A., INC. | Delaware | 13-3246932 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Jadar Music Corp. | Delaware | 13-3246915 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Lava Trademark Holding Company LLC | Delaware | 13-4139472 | 1290 Avenue of the Americas, New York NY 10104 | (212) 707-2000 | ||||

LEM America, INC. | Delaware | 94-2741964 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

London-Sire Records Inc. | Delaware | 13-3954692 | 75 Rockefeller Plaza, New York, NY 10019 | (212) 275-2000 | ||||

McGuffin Music Inc. | Delaware | 13-3663051 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Mixed Bag Music, Inc. | New York | 13-3111989 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

MM Investment Inc. (fka Warner Music Bluesky Holding Inc.) | Delaware | 13-3829389 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

NC Hungary Holdings Inc. | Delaware | 05-0536079 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

New Chappell Inc. | Delaware | 13-3246920 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Nonesuch Records Inc. | Delaware | 20-1926784 | 3300 Warner Boulevard, Burbank CA 91505, United States | (818) 846-9090 | ||||

NVC International Inc. | Delaware | 51-0267089 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

Octa Music, Inc. | New York | 13-3523592 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Penalty Records L.L.C. | New York | 13-3889367 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

Pepamar Music Corp. | New York | 13-2512410 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Revelation Music Publishing Corporation | New York | 13-2705483 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Rhino Entertainment Company | Delaware | 13-3647166 | 3400 West Olive Avenue, Burbank CA 91505 | (818) 238-6100 | ||||

Rick's Music Inc. | Delaware | 13-3246929 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Rightsong Music Inc. | Delaware | 13-3246926 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Rodra Music, Inc. | California | 95-2561531 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Sea Chime Music, Inc. | California | 95-3335535 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

SR/MDM Venture Inc. | Delaware | 13-3647169 | 3300 Warner Boulevard, Burbank CA 91505 | (818) 846-9090 | ||||

Summy-Birchard, Inc. | Wyoming | 36-1026750 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Super Hype Publishing, Inc. | New York | 13-2664278 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

T-Boy Music L.L.C. | New York | 13-3669372 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

T-Girl Music L.L.C. | New York | 13-3669731 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

The Rhythm Method Inc. | Delaware | 13-4141258 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

Tommy Boy Music, Inc. | New York | 13-3070723 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

Tommy Valando Publishing Group, Inc. | Delaware | 13-2705485 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Tri-Chappell Music Inc. | Delaware | 13-3246916 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

TW Music Holdings Inc. | Delaware | 20-0769163 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

Unichappell Music Inc. | Delaware | 13-3246914 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

W.B.M. Music Corp. | Delaware | 13-3166007 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Walden Music, Inc. | New York | 13-6125056 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Warner Alliance Music Inc. | Delaware | 95-4391760 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Warner Brethren Inc. | Delaware | 95-4391762 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Warner Bros. Music International Inc. | Delaware | 13-2839469 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Warner Bros. Publications U.S. Inc. | New York | 13-2670425 | 15800 N.W. 48th Avenue, P.O. Box 4340, Miami FL 33014 | (305) 620-1500 | ||||

Warner Bros. Records Inc. | Delaware | 95-1976532 | 3300 Warner Boulevard, Burbank CA 91505 | (818) 846-9090 | ||||

Warner Custom Music Corp. | California | 94-2990925 | 75 Rockefeller Plaza, New York, NY 10019 | (212) 275-2000 | ||||

Warner Domain Music Inc. | Delaware | 13-3845523 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Warner Music Discovery Inc. | Delaware | 13-3695120 | 3400 West Olive Ave., Burbank CA 91505 | (818) 238-6200 | ||||

Warner Music Distribution Inc. | Delaware | 13-3713729 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

Warner Music Group Inc. | Delaware | 13-3565869 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

Warner Music Latina Inc. | Delaware | 13-3586626 | 555 Washington Avenue, Fourth Floor, Miami Beach FL 33139 | (305) 702-2200 | ||||

Warner Music SP Inc. | Delaware | 13-3802269 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

Warner Sojourner Music Inc. | Delaware | 62-1530861 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Warner Special Products Inc. | Delaware | 13-2788802 | 3400 West Olive Ave., Burbank CA 91505 | (818) 238-6200 | ||||

WarnerSongs Inc. | Delaware | 13-2793164 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Warner Strategic Marketing Inc. | Delaware | 01-0569802 | 3400 West Olive Ave., Burbank CA 91505 | (818) 238-6200 | ||||

Warner-Elektra-Atlantic Corporation | New York | 13-6170726 | 75 Rockefeller Plaza, New York, NY 10019 | (212) 275-2000 | ||||

Warner-Tamerlane Publishing Corp. | California | 13-6132127 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Warner/Chappell Music (Services), Inc. | New Jersey | 95-2685983 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Warner/Chappell Music, Inc. | Delaware | 13-3246913 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

Warprise Music Inc. | Delaware | 13-3845521 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

WB Gold Music Corp. | Delaware | 13-3155100 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

WB Music Corp. | California | 13-6132128 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

WBM/House of Gold Music, Inc. | Delaware | 13-3146335 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

WBPI Holdings LLC | Delaware | 34-2024699 | 15800 N.W. 48th Avenue, P.O. Box 4340, Miami FL 33014 | (305) 620-1500 | ||||

WBR Management Services Inc. | Delaware | 13-3032834 | 3300 Warner Boulevard, Burbank CA 91505 | (818) 846-9090 | ||||

WBR/QRI Venture, Inc. | Delaware | 13-3647168 | 3300 Warner Boulevard, Burbank CA 91505 | (818) 846-9090 | ||||

WBR/Ruffnation Ventures, Inc. | Delaware | 13-4079805 | 3300 Warner Boulevard, Burbank CA 91505 | (818) 846-9090 | ||||

WBR/Sire Ventures Inc. | Delaware | 13-2953720 | 3300 Warner Boulevard, Burbank CA 91505 | (818) 846-9090 | ||||

We Are Musica Inc. | Delaware | 13-3713725 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

WEA Europe Inc. | Delaware | 13-2805638 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

WEA Inc. | Delaware | 13-3862485 | 75 Rockefeller Plaza, New York, NY 10019 | (212) 275-2000 | ||||

WEA International Inc. | Delaware | 13-2805420 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

WEA Latina Musica Inc. | Delaware | 13-3713731 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

WEA Management Services Inc. | Delaware | 52-2280908 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

Wide Music, Inc. | California | 95-3500269 | 10585 Santa Monica Blvd., Los Angeles CA 90025 | (310) 441-8600 | ||||

WEA Rock LLC | Delaware | 86-1120258 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

WEA Urban LLC | Delaware | 86-1120251 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

WMG Management Services Inc. | Delaware | 52-2314190 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 | ||||

WMG Trademark Holding Company LLC | Delaware | 20-0233769 | 75 Rockefeller Plaza, New York NY 10019 | (212) 275-2000 |

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

Subject to Completion, dated , 2005

PRELIMINARY PROSPECTUS

$465,000,000 aggregate principal amount of 73/8% Senior Subordinated Notes due 2014, which have been registered under the Securities Act of 1933 for any and all outstanding 73/8% Senior Subordinated Notes due 2014

£100,000,000 aggregate principal amount of 81/8% Senior Subordinated Notes due 2014, which have been registered under the Securities Act of 1933 for any and all outstanding 81/8% Senior Subordinated Notes due 2014

The exchange notes will be fully and unconditionally guaranteed on an unsecured basis by each of our domestic subsidiaries that guarantees the obligations under our senior secured credit facility.

We are conducting the exchange offers in order to provide you with an opportunity to exchange your unregistered outstanding notes for freely tradeable exchange notes that have been registered under the Securities Act.

The Exchange Offers

- •

- We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradeable.

- •

- You may withdraw tenders of outstanding notes at any time prior to the expiration date of the applicable exchange offer.

- •

- The exchange offers expire at 12:00 a.m. midnight, New York City time, on , 2005, unless extended.

- •

- The exchanges of outstanding notes for exchange notes in the exchange offers will not be a taxable event for U.S. federal income tax purposes.

- •

- The terms of the exchange notes to be issued in the exchange offers are substantially identical to the outstanding notes, except that the exchange notes will be freely tradeable.

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offers, we do not currently anticipate that we will register the outstanding notes under the Securities Act.

You should carefully consider the "Risk Factors" beginning on page 18 of this prospectus before participating in the exchange offers.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the exchange notes to be distributed in the exchange offers or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2005

| | Page | |

|---|---|---|

| Prospectus Summary | 1 | |

| Risk Factors | 18 | |

| Special Note Regarding Forward-Looking Statements | 35 | |

| Use of Proceeds | 37 | |

| Capitalization | 38 | |

| The Transactions | 39 | |

| Pro Forma Consolidated Condensed Financial Statements | 44 | |

| Selected Historical Consolidated Financial and Other Data | 52 | |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | 55 | |

| Industry Overview | 89 | |

| Business | 94 | |

| Management | 109 | |

| Security Ownership of Certain Beneficial Owners and Management | 119 | |

| Certain Relationships and Related Party Transactions | 122 | |

| Description of Other Indebtedness | 126 | |

| The Exchange Offers | 129 | |

| Description of Notes | 143 | |

| Exchange Offers; Registration Rights | 199 | |

| Book-Entry; Delivery and Form | 201 | |

| Material U.S. Federal Income Tax Consequences | 206 | |

| Certain ERISA Considerations | 207 | |

| Plan of Distribution | 209 | |

| Legal Matters | 210 | |

| Experts | 210 | |

| Available Information | 210 | |

| Index to Combined Financial Statements | F-1 |

We have not authorized any dealer, salesperson or other person to give any information or represent anything to you other than the information contained in this prospectus. You must not rely on unauthorized information or representations.

This prospectus does not offer to sell or ask for offers to buy any of the securities in any jurisdiction where it is unlawful, where the person making the offer is not qualified to do so, or to any person who can not legally be offered the securities. The information in this prospectus is current only as of the date on its cover, and may change after that date.

MARKET AND INDUSTRY DATA AND FORECASTS

This prospectus includes industry data and forecasts that we have prepared based, in part, upon industry data and forecasts obtained from industry publications and surveys and internal company surveys. As noted in this prospectus, International Federation of the Phonographic Industry ("IFPI"), Recording Industry Association of America ("RIAA"), Nielsen SoundScan ("SoundScan"), Informa

i

Media Research, Music & Copyright Report ("Music & Copyright"), National Music Publishers' Association ("NMPA"), The NPD Group, Enders Analysis and the U.S. Department of Commerce, U.S. Census Bureau, Bureau of Labor Statistics were the primary sources for third-party industry data and forecasts. These third-party industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of included information. We have not independently verified any of the data from third-party sources nor have we ascertained the underlying economic assumptions relied upon therein. Similarly, industry forecasts and market research, while believed to be reliable, have not been independently verified.

ii

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that is important to you. We urge you to read this entire prospectus, including the "Risk Factors" section and the combined financial statements and related notes, before participating in the exchange offers.

We acquired the business of WMG from Time Warner effective March 1, 2004. In this prospectus, the term "Warner Music Group" refers to WMG Acquisition Corp., which does business under that name, and not its subsidiaries. In this prospectus, the terms "we," "our," "ours," "us," "the Company" and "WMG" refer collectively to Warner Music Group and its consolidated or combined subsidiaries, except where otherwise indicated. For periods prior to March 1, 2004, those terms refer to Warner Music Group's consolidated or combined subsidiaries while they were owned and operated by Time Warner Inc., except where otherwise indicated. In 2004, we changed our fiscal year end from November 30 to September 30. Accordingly, the fiscal year ended September 30, 2004 is a ten-month period. In addition, as a result of our acquisition of Warner Music Group from Time Warner, and as described further in our financial statements and the notes thereto included elsewhere in this prospectus, results discussed for the ten months ended September 30, 2004 represent the mathematical addition of our pre-acquisition three-month period ended February 29, 2004 and our post-acquisition seven-month period ended September 30, 2004. Calculations of market share are based on revenues, except as otherwise noted.

Our Company

We are one of the world's major music companies. Our company is composed of two businesses: Recorded Music and Music Publishing. We are a global company, generating over half of our revenues in more than 50 countries outside of the U.S. Warner Music Group was Time Warner Inc.'s music division until substantially all of it was acquired by the issuer, WMG Acquisition Corp. (which was formed on November 20, 2003 and now does business under the name Warner Music Group), from Time Warner on March 1, 2004 for $2.595 billion in cash and non-cash consideration. See "The Transactions."

Our Recorded Music business produces revenue through the marketing, sale and licensing of recorded music in physical and digital formats. We believe we have one of the world's largest and most varied recorded music catalogs, including 27 of the top 100 U.S. best-selling albums of all time—more than any other recorded music company. Our roster of over 38,000 artists spans all musical genres and includes Led Zeppelin, The Eagles, Madonna, Metallica and Fleetwood Mac. Our more recent successes include Linkin Park, Simple Plan, Jet, Michelle Branch, Sean Paul and Josh Groban. Our Recorded Music business generated 83% of our consolidated revenues during the twelve months ended September 30, 2004.

Our Music Publishing business owns and acquires rights to musical compositions, exploits and markets these compositions and receives royalties or fees for their use. We hold rights in over one million copyrights across a broad range of musical styles from over 65,000 songwriters and composers. Our library includes titles such as "Happy Birthday to You" by Mildred and Patty Hill, "Night and Day" by Cole Porter, "When a Man Loves a Woman" by Calvin Lewis and Andrew Wright, and "Star Wars Theme" by John Williams, as well as more recent popular titles such as "Smooth" by Itaal Shur and Rob Thomas and "Thank You" by Dido Armstrong and Paul Herman. Our Music Publishing business generated 17% of our consolidated revenues during the twelve months ended September 30, 2004.

1

Industry Overview

Recorded music and music publishing focus on different products and benefit from different sources of revenues. The following table summarizes the product, the "artist" that is responsible for creating the product and the means by which the product generates revenue:

| | Recorded Music | Music Publishing | ||||||

|---|---|---|---|---|---|---|---|---|

The Product | • | The recording | • | The song | ||||

| The "Artist" | • | Recording artist | • | Songwriter or composer | ||||

| How revenues are generated | • | When a recording (in physical or digital format) is sold or licensed | • | When a recording (in physical or digital format) of the song is sold or licensed | ||||

| • | When a song is performed publicly (e.g., radio, television, concert or nightclub) | |||||||

| • | When a song is synchronized with visual images (e.g., movies and advertisements) | |||||||

| • | When a song's printed sheet music is sold | |||||||

The recorded music business is the business of discovering and developing recording artists and promoting, selling and licensing their works. In 2003, the recorded music industry generated $32.0 billion in retail sales worldwide. The industry experienced robust growth in the 1990s but in recent years has seen a decline due primarily to the increase in digital piracy. In an effort to curb this decline, the industry launched an intensive campaign in 2003 to limit digital piracy. We believe these anti-piracy efforts are beginning to produce results as evidenced by increased consumer awareness, reduced illegal downloading activity and growth for the one-year ended January 2, 2005 in U.S. music physical unit sales of approximately 1% relative to the comparable one-year ended December 28, 2003, as reported by SoundScan. Moreover, the industry has been encouraged by the recent proliferation and early success of legitimate digital music distribution channels, as evidenced by the 141 million digital tracks sold in the U.S. through the one-year ended January 2, 2005. See "Industry Overview—Recorded Music."

According to the most recent published estimates by Enders Analysis, the worldwide music publishing industry accounted for $3.7 billion in revenues in 2003. See "Industry Overview—Music Publishing."

Competitive Strengths

We believe we benefit from the following competitive strengths:

Industry Leading Recording Artists and Songwriters. We have been able to consistently attract, develop and retain successful recording artists and songwriters. This has enabled us to accumulate over decades a large and varied portfolio of recorded music and music publishing assets that generate stable and recurring cash flows.

Stable, Highly Diversified Revenue Base. Our revenue base is derived primarily from relatively stable and recurring sources such as our music publishing library, our catalog of recorded music and new releases from our existing base of established artists. In any given year, we believe that less than 10% of our total revenues depend on artists without established track records, with each of these artists typically representing less than 1% of our revenues. We have built a large and diverse catalog of

2

recordings and compositions that covers a wide breadth of musical styles and are a significant player in each of our major geographic regions.

High Cash Flow Business Model. We generate relatively high levels of cash flow from operations as a result of our highly variable cost structure, our minimal capital requirements and our ability to adjust the timing and amount of much of our spending. Through our recent restructuring effort, we have substantially streamlined our cost structure. In addition, outsourcing arrangements entered into in October 2003 with Cinram International Inc. ("Cinram") have significantly reduced our exposure to fixed costs and are expected to continue to reduce our future capital expenditure requirements.

Well Positioned For Growth in Digital Distribution and Emerging Technologies. For the one-year ended January 2, 2005, our market share of digital recorded music track sales in the U.S. as measured by SoundScan was higher than our overall recorded music album market share in the U.S., which we believe reflects the relative strength of our content and in particular our catalog content. In addition, we are highly focused on several new media initiatives: supporting existing and new online services in the U.S. and abroad, working with legitimate P2P providers, influencing the evolution of new mobile phone services and formats and simplifying the clearance of all of our content for digital distribution.

Proven and Committed Management Team. We are led by an experienced senior management team with an average of approximately 20 years of entertainment industry expertise. Edgar Bronfman, Jr. is our Chairman of the Board and Chief Executive Officer. Mr. Bronfman, while President and CEO of The Seagram Company Ltd. ("Seagram"), oversaw the merger of Universal Music Group ("Universal") and PolyGram N.V. ("PolyGram"), and successfully managed the combined business, the world's then largest recorded music company.

Strong Equity Sponsorship. Thomas H. Lee Partners, L.P. and its affiliates ("THL"), Bain Capital and its affiliates ("Bain Capital"), Music Capital and Providence Equity Partners Inc. and its affiliates ("Providence Equity") (collectively, the "Investors") are each leading private equity firms with established track records of successful investments and extensive experience in managing investments in entertainment and media assets.

Business Strategy

We intend to increase revenues, operating income and cash flow through the following business strategies:

Attract, Develop and Retain Established and Emerging Recording Artists and Songwriters. A critical element of our strategy is to continue to find, develop and retain recording artists and songwriters who achieve long-term profitable success. We believe our relative size, the strength of our management team, our ability to respond to industry and consumer trends and challenges, our diverse array of genres, our large catalog of hit releases and our valuable music publishing library will help us continue to successfully build our roster of artists and songwriters.

Maximize the Value of Our Music Assets. Our Recorded Music business focuses on marketing our artists and catalog in new ways to retain existing fans of established artists and to generate new demand for our proven hits. Our Music Publishing business seeks to capitalize on the growing demand for the use of musical compositions in media products such as videogames, commercials, other musical works (such as authorized sampling), films, DVDs, mobile phone ring tones and Internet and wireless streaming and downloads by marketing and promoting our libraries to producers of these media in new and innovative ways.

Focus on Continued Management of Our Cost Structure. Immediately following our sale on March 1, 2004, we commenced a broad-based restructuring plan (the "Restructuring Plan.") We intend to continue to maintain a disciplined approach to cost management in our business, and to pursue

3

additional cost savings. We expect to complete substantially all of the Restructuring Plan by May 2005 with annualized cost savings of more than $250 million. We project the one-time costs associated with the Restructuring Plan to be between $225 million to $250 million, of which approximately $105 million has been paid through September 30, 2004. This projection is substantially less than the $310 million original estimate. There are still significant risks associated with the Restructuring Plan. See "Risk Factors" and "Business."

Invest in Accordance with an Improved Asset Allocation Strategy. Our new management has undertaken a rigorous company-wide initiative in conjunction with outside consultants in order to enhance our financial performance through developing a more targeted approach to investments. Implementing the results of this study, we will primarily seek to invest in lines of business, geographic locations and individual projects where we believe we can optimize our return on capital.

Develop and Optimize Our Physical Distribution Channel Strategies. We will continue to develop innovative programs with our physical distribution channel partners in order to implement forward-looking strategies for our mutual benefit. We will invest to meet the needs of our partners to create more efficient collaboration, such as direct-to-retail distribution strategies and vendor managed inventory.

Capitalize on Digital Distribution and Emerging Technologies. We believe new technology formats should represent a fast-growing and high-margin channel for the distribution and exploitation of our music. In particular, new and emerging third-party digital distribution outlets are not only reasonably priced, but also offer a superior customer experience to illegal alternatives, as they are easy to use, offer uncorrupted song files and integrate seamlessly with increasingly popular portable music players such as the Apple iPod, the Dell Digital Jukebox and the iRiver iHP. In addition, as networks and phone handsets become more sophisticated, our music is increasingly becoming available through mobile and other wireless service providers as ring tones, ringback tones and audio and music video downloads.

Contain Digital Piracy. We, along with the rest of the music industry, are actively combating piracy through technological innovation, litigation, education and the promotion of legislation both in the U.S. and internationally.

Recent Developments

Return of Capital. We recently returned an additional $350 million of capital (the "Return of Capital") to the Investors. The Return of Capital was funded out of our cash balance and not from the incurrence of additional debt. We obtained an amendment to our credit agreement to provide for the Return of Capital.

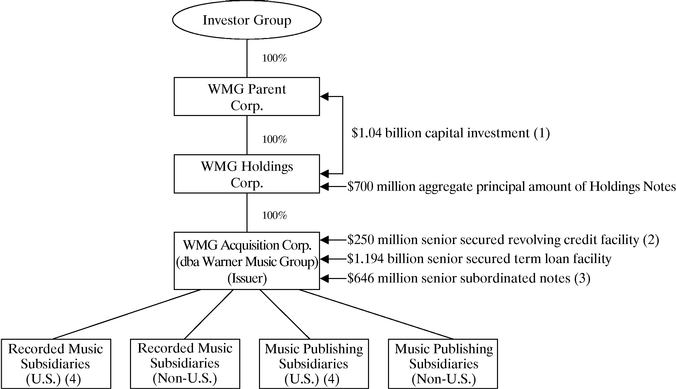

Payment to Investors. On December 23, 2004, our parent company, WMG Holdings Corp. ("Holdings"), incurred approximately $700 million of new debt, consisting of $250 million of Floating Rate Senior Notes due 2011, $250 million in gross proceeds of 9.5% Senior Discount Notes due 2014 (with aggregate principal amount at maturity of $396.8 million) and $200 million of Floating Rate Senior PIK Notes due 2014 (collectively, the "Holdings Notes"). The proceeds from the issuance of the Holdings Notes were used to fund a return of approximately $680 million from Holdings to its shareholders and the shareholders of our ultimate parent company, WMG Parent Corp. ("Parent") (the "Holdings' Payment to Investors") through a combination of dividends on Holdings' common and preferred stock and repurchases of its common and preferred stock. Of the total of $680 million, approximately $631 million was distributed to the Investors with the remainder being held by Parent.

4

New Chief Financial Officer. We recently announced that Michael D. Fleisher has been named as our permanent Chief Financial Officer. He replaces Michael Ward who was our acting Chief Financial Officer while we conducted a search to fill the position on a permanent basis. See "Management."

Warner Music Group was incorporated under Delaware law on November 20, 2003. Our principal executive offices are located at 75 Rockefeller Plaza, New York, NY 10019. Our telephone number is (212) 275-2000.

5

Summary of the Terms of Exchange Offers

On April 8, 2004, Warner Music Group completed a private offering of the outstanding notes. References to the "notes" in this prospectus are references to both the outstanding notes and the exchange notes offered hereby. In addition, we sometimes refer in this prospectus to the notes denominated in U.S. dollars as the "dollar notes" and the notes denominated in pounds sterling as the "sterling notes."

| General | In connection with the private offering, we entered into a registration rights agreement with Deutsche Bank Securities Inc., Bank of America Securities LLC, Lehman Brothers Inc. and Merrill Lynch, Pierce, Fenner & Smith Incorporated (collectively, the "initial purchasers") the initial purchasers of the outstanding notes in which we and the guarantors agreed, among other things, to deliver this prospectus to you and to use our reasonable best efforts complete the exchange offers for the outstanding notes within 360 days after the date of issuance of the outstanding notes. | |||

| You are entitled to exchange in the exchange offers your outstanding notes for exchange notes, which are identical in all material respects to the outstanding notes except: | ||||

| • | the exchange notes have been registered under the Securities Act of 1933, as amended, which we refer to as the "Securities Act"; | |||

| • | the exchange notes are not entitled to certain registration rights which are applicable to the outstanding notes under the registration rights agreement; and | |||

| • | certain additional interest rate provisions are no longer applicable. | |||

| The Exchange Offers | We are offering to exchange up to: | |||

| • | $465,000,000 aggregate principal amount of our 73/8% Senior Subordinated Notes due 2014, which have been registered under the Securities Act, for a like aggregate principal amount of the outstanding 73/8% Senior Subordinated Notes due 2014; and | |||

| • | £100,000,000 aggregate principal amount of 81/8% Senior Subordinated Notes due 2014, which have been registered under the Securities Act, for a like aggregate principal amount of the outstanding 81/8% Senior Subordinated Notes due 2014. | |||

| You may only exchange outstanding notes in denominations of $5,000 and integral multiples of $1,000 in the case of the outstanding dollar notes and denominations of £5,000 and integral multiples of £1,000 in the case of the outstanding sterling notes. | ||||

| Subject to the satisfaction or waiver of specified conditions, we will exchange the exchange notes for all outstanding notes that are validly tendered and not validly withdrawn prior to the expiration of the applicable exchange offer. We will cause the applicable exchange to be effected promptly after the expiration of the applicable exchange offer. | ||||

6

| Upon completion of the applicable exchange offer, there may be no market for the applicable outstanding notes and you may have difficulty selling them. | ||||

| Resales | Based on interpretations by the staff of the Securities and Exchange Commission, or the "SEC", set forth in no-action letters issued to third parties referred to below, we believe that you may resell or otherwise transfer exchange notes issued in the exchange offers without complying with the registration and prospectus delivery requirements of the Securities Act, if: | |||

| (1) | you are acquiring the exchange notes in the ordinary course of your business. | |||

| (2) | you do not have an arrangement or understanding with any person to participate in a distribution of the exchange notes; | |||

| (3) | you are not an "affiliate" of Warner Music Group within the meaning of Rule 405 under the Securities Act; and | |||

| (4) | you are not engaged in, and do not intend to engage in, a distribution of the exchange notes. | |||

| If you are not acquiring the exchange notes in the ordinary course of your business, or if you are engaging in, intend to engage in, or have any arrangement or understanding with any person to participate in, a distribution of the exchange notes, or if you are an affiliate of Warner Music Group, then: | ||||

| (1) | you cannot rely on the position of the staff of the SEC enunciated in Morgan Stanley & Co., Inc. (available June 5, 1991),Exxon Capital Holdings Corporation (available May 13, 1988), as interpreted in the SEC's letter toShearman & Sterling dated July 2, 1993, or similar no-action letters; and | |||

| (2) | in the absence of an exception from the position of the SEC stated in (1) above, you must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale or other transfer of the exchange notes. | |||

| If you are a broker-dealer and receive exchange notes for your own account in exchange for outstanding notes that you acquired as a result of market-making or other trading activities, you must acknowledge that you will deliver a prospectus, as required by law, in connection with any resale or other transfer of the exchange notes that you receive in either exchange offer. See "Plan of Distribution." | ||||

| Expiration Dates | Each exchange offer will expire at 12:00 a.m. midnight, New York City time, on , 2005, unless extended by us. We do not currently intend to extend the expiration date of either exchange offer. | |||

7

| Withdrawal | You may withdraw the tender of your outstanding notes at any time prior to the expiration date of the applicable exchange offer. We will return to you any of your outstanding notes that are not accepted for any reason for exchange, without expense to you, promptly after the expiration or termination of the applicable exchange offer. | |||

| Interest on the Exchange Notes and the Outstanding Notes | Each exchange dollar note and each exchange sterling note will bear interest at the applicable rate per annum set forth on the cover page of this prospectus from the most recent date to which interest has been paid on the outstanding dollar notes or outstanding dollar or outstanding sterling notes, as the case may be or, if no interest has been paid on the outstanding dollar notes or outstanding sterling notes, as the case may be, from April 8, 2004. The interest will be payable semi-annually on each April 15 and October 15, beginning October 15, 2004. No interest will be paid on outstanding notes following their acceptance for exchange. | |||

| Conditions to the Exchange Offers | Each exchange offer is subject to customary conditions, which we may assert or waive. See "The Exchange Offers—Conditions to the Exchange Offers." | |||

| Procedures for Tendering Outstanding Notes | If you wish to participate in any of the exchange offers, you must complete, sign and date the applicable accompanying letter of transmittal, or a facsimile of the letter of transmittal, according to the instructions contained in this prospectus and the letter of transmittal. You must then mail or otherwise deliver the letter of transmittal, or a facsimile of the letter of transmittal, together with the outstanding notes and any other required documents, to the exchange agent at the address set forth on the cover page of the letter of transmittal. If you hold outstanding dollar notes through The Depository Trust Company, or "DTC", and wish to participate in the exchange offer for the outstanding dollar notes, you must comply with the Automated Tender Offer Program procedures of DTC, and, if you hold outstanding sterling notes through Euroclear Bank S.A./N.V. ("Euroclear") or Clearstream Banking, société anonyme ("Clearstream, Luxembourg") and wish to participate in the exchange offer for the outstanding sterling notes, you must comply with the procedures of Euroclear or Clearstream, Luxembourg, as applicable, in each case, by which you will agree to be bound by the letter of transmittal. By signing, or agreeing to be bound by, the letter of transmittal, you will represent to us that, among other things: | |||

| (1) | you are acquiring the exchange notes in the ordinary course of your business; | |||

| (2) | you do not have an arrangement or understanding with any person to participate in a distribution of the exchange notes; | |||

8

| (3) | you are not an "affiliate" of Warner Music Group within the meaning of Rule 405 under the Securities Act; and | |||

| (4) | you are not engaged in, and do not intend to engage in, a distribution of the exchange notes. | |||

| If you are a broker-dealer and receive exchange notes for your own account in exchange for outstanding notes that you acquired as a result of market-making or other trading activities, you must represent to us that you will deliver a prospectus, as required by law, in connection with any resale or other transfer of such exchange notes. | ||||

| If you are not acquiring the exchange notes in the ordinary course of your business, or if you are engaged in, or intend to engage in, or have an arrangement or understanding with any person to participate in, a distribution of the exchange notes, or if you are an affiliate of Warner Music Group, then you cannot rely on the applicable positions and interpretations of the staff of the SEC and you must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale or other transfer of the exchange notes. | ||||

| Special Procedures for Beneficial Owners | If you are a beneficial owner of outstanding notes that are held in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender those outstanding notes in the exchange offers, you should contact such person promptly and instruct such person to tender those outstanding notes on your behalf. | |||

| Guaranteed Delivery Procedures | If you wish to tender your outstanding notes and your outstanding notes are not immediately available or you cannot deliver your outstanding notes, the letter of transmittal and any other documents required by the letter of transmittal or you cannot comply with the DTC procedures for book-entry transfer or the procedures of Euroclear or Clearstream, Luxembourg, as applicable, prior to the expiration date, then you must tender your outstanding notes according to the guaranteed delivery procedures set forth in this prospectus under "The Exchange Offers—Guaranteed Delivery Procedures." | |||

| Effect on Holders of Outstanding Notes | In connection with the sale of the outstanding notes, we entered into a registration rights agreement with the initial purchasers of the outstanding notes that grants the holders of outstanding notes registration rights. By making the exchange offers, we will have fulfilled most of our obligations under the registration rights agreement. Accordingly, we will not be obligated to pay additional interest as described in the registration rights agreement. If you do not tender your outstanding notes in the exchange offers, you will continue to be entitled to all the rights and limitations applicable to the outstanding notes as set forth in the indenture, except we will not have any further obligation to you to provide for the registration of the outstanding notes under the registration rights agreement and we will not be obligated to pay additional interest as described in the registration rights agreement, except in certain limited circumstances. See "Exchange Offers; Registration Rights." | |||

9

| To the extent that outstanding dollar notes or outstanding sterling notes are tendered and accepted in the exchange offers, the trading market for outstanding dollar notes or outstanding sterling notes, as the case may be, could be adversely affected. | ||||

| Consequences of Failure to Exchange | All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the applicable outstanding notes and in the indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. We do not currently anticipate that we will register the outstanding notes under the Securities Act. | |||

| Material Income Tax Considerations | The exchange of outstanding notes for exchange notes in the exchange offers will not be a taxable event for United Stated federal income tax purposes. See "Material U.S. Federal Income Tax Consequences." | |||

| Use of Proceeds | We will not receive any cash proceeds from the issuance of exchange notes in either exchange offer. | |||

| Exchange Agents | Wells Fargo Bank, National Association and HSBC Bank plc, each of whose addresses and telephone numbers are set forth in the section captioned "The Exchange Offers—Exchange Agent" of this prospectus, are the exchange agents for the exchange offers for the dollar notes and sterling notes, respectively. | |||

10

Summary of the Terms of the Exchange Notes

In this prospectus, the terms "outstanding dollar notes" and "outstanding sterling notes" refer to the 73/8% senior subordinated notes due 2014 denominated in U.S. dollars and the 81/8% senior subordinated notes due 2014 denominated in pounds sterling, respectively, each issued in the private offering; the terms "exchange dollar notes" and "exchange sterling notes" refer to the 73/8% senior subordinated notes due 2014 denominated in U.S. dollars and the 81/8% senior subordinated notes due 2014 denominated in pounds sterling, each as registered under the Securities Act of 1933, as amended (the "Securities Act"), respectively; the term "outstanding notes" refers to the outstanding dollar notes and outstanding sterling notes, and the term "exchange notes" refers to the exchange dollar notes and exchange sterling notes; and the term "notes" refers to both the outstanding notes and the exchange notes. The terms of the exchange notes are identical in all material respects to the terms of the outstanding notes, except that the exchange notes will not contain terms with respect to transfer restrictions or additional interest upon a failure to fulfill certain of our obligations under the registration rights agreement. The exchange notes will evidence the same debt as the outstanding notes. The exchange notes will be governed by the same indenture under which the outstanding notes were issued, and the exchange notes and the outstanding notes will constitute a single class and series of notes for all purposes under the indenture. The following summary is not intended to be a complete description of the terms of the notes. For a more detailed description of the notes, see "Description of Notes."

| Issuer | Warner Music Group | |||

| Notes Offered | $465,000,000 aggregate principal amount of 73/8% Senior Subordinated Notes due 2014; and £100,000,000 aggregate principal amount of 81/8% Senior Subordinated Notes due 2014. | |||

| Maturity | April 15, 2014. | |||

| Interest Rate | Dollar notes: 73/8% per annum (calculated using a 360-day year). Sterling notes: 81/8% per annum (calculated using a 360-day year). | |||

| Interest Payment Dates | April 15 and October 15, beginning on October 15, 2004. | |||

| Ranking | The outstanding notes are, and the exchange notes will be, our unsecured senior subordinated obligations and: | |||

| • | rank junior to our existing and future senior debt, including obligations under our senior secured credit facility; | |||

| • | rank equally in right of payment with all of our future senior subordinated debt; | |||

| • | be effectively subordinated in right of payment to all of our existing and future secured debt (including obligations under our senior secured credit facility), to the extent of the value of the assets securing such debt, and be structurally subordinated to all obligations of each of our subsidiaries that are not guarantors; and | |||

| • | rank senior in right of payment to all of our future subordinated debt. | |||

| Similarly, the subsidiary guarantees with respect to the outstanding notes are, and the subsidiary guarantees with respect to the exchange notes will be, senior subordinated unsecured obligations of the guarantors and: | ||||

11

| • | rank junior in right of payment to all of the applicable guarantors' existing and future senior debt, including the applicable guarantor's guarantee under our senior secured credit facility; | |||

| • | rank equally in right of payment with all of the applicable guarantors' future senior subordinated debt; | |||

| • | be effectively subordinated in right of payment to all of the applicable guarantors' existing and future secured debt (including the applicable guarantor's guarantee under our senior secured credit facility), to the extent of the value of the assets securing such debt, and be structurally subordinated to all obligations of any subsidiary of a guarantor if that subsidiary is not a guarantor; and | |||

| • | rank senior in right of payment to all of the applicable guarantors' future subordinated debt. | |||

| As of September 30, 2004, we had $1.194 billion of senior debt outstanding and an additional $250 million available under our revolving credit facility. | ||||

| Guarantees | Each of our domestic, wholly owned subsidiaries that guarantees the obligations under our senior secured credit facility jointly and severally and unconditionally guarantees the outstanding notes, and will jointly and severally and unconditionally guarantee the exchange notes, on an unsecured, senior subordinated basis. | |||

| Optional Redemption | Prior to April 15, 2009, Warner Music Group may redeem some or all of the notes at a price equal to 100% of the principal amount of the notes plus a "make-whole" premium as set forth under "Description of Notes—Optional Redemption." Additionally, Warner Music Group may redeem the notes, in whole or in part, at any time on or after April 15, 2009 at the redemption prices set forth under "Description of Notes—Optional Redemption." | |||

| Optional Redemption After Certain Equity Offerings | At any time (which may be more than once) before April 15, 2007, we may choose to redeem up to 35% of each of the dollar notes and the sterling notes with proceeds that we or one of our parent companies raises in one or more equity offerings, so long as: | |||

| • | Warner Music Group pays 107.375% of the face amount of the dollar notes and 108.125% of the face amount of the sterling notes, in each case, plus accrued and unpaid interest; | |||

| • | Warner Music Group redeems the notes within 90 days of completing the equity offering; and | |||

12

| • | at least 65% of the aggregate principal amount of the applicable series of notes issued remains outstanding afterwards. | |||

| See "Description of Notes—Optional Redemption." | ||||

| Change of Control Offer | Upon the occurrence of a change in control, you will have the right, as holders of the notes, to require Warner Music Group to repurchase some or all of your notes at 101% of their face amount, plus accrued interest. See "Description of Notes—Change of Control." | |||

| Warner Music Group may not be able to pay you the required price for notes you present to it at the time of a change of control, because: | ||||

| • | Warner Music Group may not have enough funds at that time; or | |||

| • | terms of our senior debt may prevent us from paying. | |||

| Asset Sale Proceeds | If we or our restricted subsidiaries engage in asset sales, we generally must either invest the net cash proceeds from such sales in our business within a period of time, prepay senior debt or make an offer to purchase a principal amount of the notes equal to the excess net cash proceeds. The purchase price of the notes will be 100% of their principal amount, plus accrued and unpaid interest. | |||

| Certain Indenture Provisions | The indenture governing the notes contains covenants limiting our ability and the ability of most or all of our subsidiaries to: | |||

| • | incur additional debt or issue certain preferred shares; | |||

| • | pay dividends on or make distributions in respect of our capital stock or make other restricted payments; | |||

| • | make certain investments; | |||

| • | sell certain assets; | |||

| • | create liens on certain debt without securing the notes; | |||

| • | consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; | |||

| • | enter into certain transactions with our affiliates; and | |||

| • | designate our subsidiaries as unrestricted subsidiaries. | |||

| These covenants are subject to a number of important limitations and exceptions. See "Description of Notes." | ||||

| Absence of Public Market | The exchange notes will generally be freely transferable (subject to certain restrictions discussed in "Exchange Offers; Registration Rights") but will be a new issue of securities for which there will not initially be a market. Accordingly, there can be no assurance as to the development or liquidity of any market for the exchange notes. The initial purchasers in the private offering of the outstanding notes have advised us that they currently intend to make a market for the exchange notes, as permitted by applicable laws and regulations. However, they are not obligated to do so and may discontinue any such market making activities at any time without notice. We do not intend to apply for a listing of the exchange dollar notes on any securities exchange or automated dealer quotation system. Application has been made to list the sterling notes on the Luxembourg Stock Exchange, as noted below. | |||

13

| Listing | Application has been made to list the sterling exchange notes on the Luxembourg Stock Exchange. As noted above, we do not intend to apply for a listing of the exchange dollar notes on any securities exchange or automated dealer quotation system. The exchange dollar notes are expected to trade in the over-the-counter market. | |||

| Use of Proceeds | We will not receive any cash proceeds from the exchange offers. For a description of the use of proceeds from the private offering of the outstanding notes, see "Use of Proceeds". | |||

| Risk Factors | See "Risk Factors" for a description of some of the risks you should consider before deciding to participate in either exchange offer. | |||

14

SUMMARY HISTORICAL AND PRO FORMA FINANCIAL AND OTHER DATA

The following table sets forth our summary historical and pro forma financial and other data as of the dates and for the periods indicated. Our summary balance sheet data as of September 30, 2004 and November 30, 2003 and the statement of operations and other data for each of (i) the seven months ended September 30, 2004, (ii) the three months ended February 29, 2004, (iii) the ten months ended September 30, 2003 and (iv) the years ended November 30, 2003 and 2002 have been derived from our audited financial statements included elsewhere in this prospectus. The balance sheet data as of November 30, 2002 are derived from our audited financial statements that are not included in this prospectus. Our summary historical balance sheet data as of the ten months ended September 30, 2003 and our summary historical financial data as of and for each of the two years ended November 30, 2001 and 2000 have been derived from our unaudited financial statements that are not included in this prospectus.

The comparability of our summary historical financial data has been affected by a number of significant events and transactions. These include the Acquisition (as defined below) in 2004, a related change in our fiscal year to September 30 from November 30, which was enacted in 2004, and the acquisition of Time Warner by AOL in 2001 (the "AOL Time Warner Merger"). Due to the change in our year end, financial information for 2004 is a transition period and reflects a shortened ten-month period ended September 30, 2004. This period is also separated into two pre-acquisition and post-acquisition periods as a result of the change in accounting basis that occurred relating to the Acquisition. For all periods prior to the Acquisition, the music and publishing businesses formerly owned by Time Warner are referred to as "Old WMG" or the "Predecessor." For all periods subsequent to the Acquisition, the business is referred to as the "Company" or the "Successor." In addition, summary historical financial data for 2000 does not reflect the pushdown of a portion of the purchase price relating to the AOL Time Warner Merger that occurred in 2001 to our financial statements.

Our summary unaudited pro forma financial data for the twelve months ended September 30, 2004 give effect, in the manner described under "Pro Forma Consolidated Condensed Financial Statements" and the notes thereto, to (i) the acquisition of the business by Warner Music Group effective as of March 1, 2004 (the "Acquisition") and the borrowings under our senior secured credit facility and bridge loan and an initial capital investment by the Investors (the "Original Financing"), (ii) the use of the proceeds from the issuance of the notes, additional borrowings under the senior secured credit facility and cash on hand to repay or return certain amounts incurred in connection with the Original Financing (the "Refinancing"), and (iii) our CD and DVD manufacturing, packaging and physical distribution agreements (the "Cinram Agreements") with Cinram, as if they all occurred as of October 1, 2003 and (iv) the Return of Capital as if it occurred as of September 30, 2004. The summary pro forma financial data are presented for informational purposes only and are not necessarily indicative of our financial position or results of operations that would have occurred had the transactions been consummated as of the dates indicated. In addition, the summary pro forma combined financial data are not necessarily indicative of our future financial condition or operating results.

You should read the information contained in this table in conjunction with "Pro Forma Consolidated Condensed Financial Statements," "Selected Historical Consolidated Financial and Other Data," "Capitalization," "Management's Discussion and Analysis of Financial Condition and Results of Operations," "The Transactions" and our historical financial statements and the accompanying notes thereto included elsewhere in this prospectus.

15

| | Historical | Pro Forma | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Predecessor | Successor | | ||||||||||||||||||||||||

| | | | | | | Three Months Ended February 29, 2004 | Seven Months Ended September 30, 2004 | Twelve Months Ended September 30, 2004(2) | |||||||||||||||||||

| | Fiscal Years Ended November 30, | Ten Months Ended September 30, 2003 | |||||||||||||||||||||||||

| | 2000 | 2001 | 2002 | 2003 | |||||||||||||||||||||||

| | (unaudited) | (unaudited) | (audited)(1) | (audited)(1) | (unaudited) | (audited)(1) | (audited)(1) | (unaudited) | |||||||||||||||||||

| | (in millions) | ||||||||||||||||||||||||||

| Statement of Operations Data: | |||||||||||||||||||||||||||

| Revenues | $ | 3,461 | $ | 3,226 | $ | 3,290 | $ | 3,376 | $ | 2,487 | $ | 779 | $ | 1,769 | $ | 3,436 | |||||||||||

| Cost of revenues | (1,960 | ) | (1,731 | ) | (1,873 | ) | (1,940 | ) | (1,449 | ) | (415 | ) | (944 | ) | (1,843 | ) | |||||||||||

| Selling, general and administrative expenses | (1,297 | ) | (1,402 | ) | (1,282 | ) | (1,286 | ) | (995 | ) | (319 | ) | (677 | ) | (1,291 | ) | |||||||||||

| Impairment of goodwill and other intangible assets | — | — | (1,500 | ) | (1,019 | ) | — | — | — | (1,019 | ) | ||||||||||||||||

| Depreciation and amortization | (282 | ) | (868 | ) | (249 | ) | (328 | ) | (272 | ) | (72 | ) | (140 | ) | (245 | ) | |||||||||||

| Operating income (loss) | (36 | ) | (766 | ) | (1,542 | ) | (1,158 | ) | (197 | ) | (11 | ) | 18 | (929 | ) | ||||||||||||

| Interest expense, net | (13 | ) | (34 | ) | (23 | ) | (5 | ) | (5 | ) | (2 | ) | (80 | ) | (135 | ) | |||||||||||

| Income (loss) before cumulative effect of accounting change | (408 | ) | (910 | ) | (1,230 | ) | (1,353 | ) | (239 | ) | (32 | ) | (104 | ) | (848 | ) | |||||||||||

| Net income (loss) | $ | (408 | ) | $ | (910 | ) | $ | (6,026 | ) | $ | (1,353 | ) | $ | (239 | ) | $ | (32 | ) | $ | (104 | ) | $ | (848 | ) | |||

Segment Data: | |||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||

| Recorded Music | $ | 2,929 | $ | 2,701 | $ | 2,752 | $ | 2,839 | $ | 2,039 | $ | 630 | $ | 1,429 | N/A | ||||||||||||

| Music Publishing | 554 | 547 | 563 | 563 | 467 | 157 | 348 | N/A | |||||||||||||||||||

| Intersegment eliminations | (22 | ) | (22 | ) | (25 | ) | (26 | ) | (19 | ) | (8 | ) | (8 | ) | N/A | ||||||||||||

| Total revenues | $ | 3,461 | $ | 3,226 | $ | 3,290 | $ | 3,376 | $ | 2,487 | $ | 779 | $ | 1,769 | $ | 3,436 | |||||||||||

| Operating income (loss): | |||||||||||||||||||||||||||

| Recorded Music | $ | (22 | ) | $ | (733 | ) | $ | (1,206 | ) | $ | (1,130 | ) | $ | (181 | ) | $ | (9 | ) | $ | 24 | N/A | ||||||

| Music Publishing | 47 | 23 | (273 | ) | 23 | 19 | 17 | 53 | N/A | ||||||||||||||||||

| Corporate expenses | (61 | ) | (56 | ) | (63 | ) | (51 | ) | (35 | ) | (19 | ) | (59 | ) | N/A | ||||||||||||

| Total operating income (loss) | $ | (36 | ) | $ | (766 | ) | $ | (1,542 | ) | $ | (1,158 | ) | $ | (197 | ) | $ | (11 | ) | $ | 18 | $ | (929 | ) | ||||

OIBDA(3): | |||||||||||||||||||||||||||

| Recorded Music | $ | 214 | $ | 73 | $ | 173 | $ | 116 | $ | 8 | $ | 38 | $ | 120 | N/A | ||||||||||||

| Music Publishing | 91 | 81 | 88 | 107 | 88 | 38 | 87 | N/A | |||||||||||||||||||

| Corporate expenses | (59 | ) | (52 | ) | (54 | ) | (34 | ) | (21 | ) | (15 | ) | (49 | ) | N/A | ||||||||||||

| Total OIBDA(3) | $ | 246 | $ | 102 | $ | 207 | $ | 189 | $ | 75 | $ | 61 | $ | 158 | $ | 335 | |||||||||||

Cash Flow Data: | |||||||||||||||||||||||||||

| Cash flows provided by (used in): | |||||||||||||||||||||||||||

| Operating activities | $ | 75 | $ | (122 | ) | $ | (13 | ) | $ | 278 | $ | 257 | $ | 321 | $ | 86 | N/A | ||||||||||

| Investing activities | (153 | ) | (175 | ) | (365 | ) | (65 | ) | (73 | ) | 14 | (2,663 | ) | N/A | |||||||||||||

| Financing activities | 61 | 227 | 385 | (121 | ) | (151 | ) | (10 | ) | 2,661 | N/A | ||||||||||||||||

| Capital expenditures | (64 | ) | (91 | ) | (88 | ) | (51 | ) | (30 | ) | (3 | ) | (15 | ) | N/A | ||||||||||||

Other Financial Data: | |||||||||||||||||||||||||||

| Deficiency in earnings over fixed charges(4) | $ | (365 | ) | $ | (1,066 | ) | $ | (1,570 | ) | $ | (1,317 | ) | $ | (268 | ) | $ | (15 | ) | $ | (74 | ) | (1,161 | ) | ||||

Balance Sheet Data (at period end): | |||||||||||||||||||||||||||

| Cash and equivalents | $ | 106 | $ | 34 | $ | 41 | $ | 144 | $ | 80 | $ | 471 | $ | 555 | $ | 213 | |||||||||||

| Total assets | 6,791 | 17,642 | 5,679 | 4,484 | 5,255 | 4,560 | 5,090 | 4,748 | |||||||||||||||||||

| Total debt (including current portion of long-term debt) | 102 | 115 | 101 | 120 | 115 | 132 | 1,840 | 1,840 | |||||||||||||||||||

| Shareholder's equity | 5,228 | 14,588 | 3,001 | 1,587 | 2,635 | 1,691 | 978 | 636 | |||||||||||||||||||

- (1)

- Audited, except for Other Financial Data.

- (2)

- See "Pro Forma Consolidated Condensed Financial Statements."

- (3)

- We evaluate segment and consolidated performance based on several factors, of which the primary measure is operating income (loss) before non-cash depreciation of tangible assets, non-cash amortization of intangible assets and non-cash impairment charges to

16

reduce the carrying value of goodwill and intangible assets (which we refer to as "OIBDA"). See "Use of OIBDA" under "Management's Discussion and Analysis of Financial Condition and Results of Operations" elsewhere herein. Note that OIBDA is different from Adjusted EBITDA as defined in "Management's Discussion and Analysis of Financial Condition and Results of Operations—Financial Condition and Liquidity—Covenant Compliance", which is presented on a consolidated and combined basis therein as a covenant compliance measure. The following is a reconciliation of operating income, which is a GAAP measure of our operating results, to OIBDA.

| | Historical | Pro Forma | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Predecessor | Successor | | ||||||||||||||||||||||

| | | | | | | Three Months Ended February 29, 2004 | Seven Months Ended September 30, 2004 | Twelve Months Ended September 30, 2004(2) | |||||||||||||||||

| | Fiscal Years Ended November 30, | Ten Months Ended September 30, 2003 | |||||||||||||||||||||||

| | 2000 | 2001 | 2002 | 2003 | |||||||||||||||||||||

| | (unaudited) | (unaudited) | (audited)(1) | (audited)(1) | (unaudited) | (audited)(1) | (audited)(1) | (unaudited) | |||||||||||||||||

| | (in millions) | ||||||||||||||||||||||||

| Operating income (loss) | $ | (36 | ) | $ | (766 | ) | $ | (1,542 | ) | $ | (1,158 | ) | $ | (197 | ) | $ | (11 | ) | $ | 18 | $ | (929 | ) | ||

| Depreciation and amortization expense | 282 | 868 | 249 | 328 | 272 | 72 | 140 | 245 | |||||||||||||||||

| Impairment of goodwill and other intangible assets | — | — | 1,500 | 1,019 | — | — | — | 1,019 | |||||||||||||||||

OIBDA | $ | 246 | $ | 102 | $ | 207 | $ | 189 | $ | 75 | $ | 61 | $ | 158 | $ | 335 | |||||||||

- (4)

- For purposes of calculating the earnings to fixed charges, earnings represent income (loss) before income taxes plus fixed charges. Fixed charges consist of interest expense and one-third of rental expense under operating leases (the portion that has been deemed by management to be representative of the interest factor). In periods where earnings were insufficient to cover fixed charges, the deficiency of earnings over fixed charges has been disclosed. Pretax earnings for 2002 and 2003 have been reduced by a $1.5 billion and $1.0 billion, respectively, non-cash charge to reduce the carrying value of our goodwill and other intangible assets. Accordingly, because this charge was non-cash, it is not indicative of our ability to cover our fixed charges with pretax earnings. Excluding the non-cash impairment charge for 2002 and 2003 on a historical basis, and the twelve months ended September 30, 2004 on a pro forma basis, would result in a deficiency of earnings over fixed charges of $70 million in 2002, $298 million in 2003 and $142 for the twelve months ended September 30, 2004. In addition, deficiency of earnings over fixed charges in each period includes significant non-cash amortization expenses on intangible assets of $178 million, $104 million, $56 million, $201 million, $242 million, $182 million, $821 million and $240 million in each of the pro forma twelve months ended September 30, 2004, the seven months ended September 30, 2004, the three months ended February 29, 2004, the ten months ended September 30, 2003 and fiscal 2003, 2002, 2001 and 2000, respectively.

17

You should carefully consider the risk factors set forth below as well as the other information contained in this prospectus before participating in the exchange offers. Any of the following risks could materially and adversely affect our business, financial condition or results of operations. In such a case, you may lose all or part of your original investment.

Risks Related to the Exchange Offers

If you choose not to exchange your outstanding notes in the exchange offers, the transfer restrictions currently applicable to your outstanding notes will remain in force and the market price of your outstanding notes could decline.

If you do not exchange your outstanding notes for exchange notes in the applicable exchange offer, then you will continue to be subject to the transfer restrictions on the applicable outstanding notes as set forth in the offering memorandum distributed in connection with the private offering of the outstanding notes. In general, the outstanding notes may not be offered or sold unless they are registered or exempt from registration under the Securities Act and applicable state securities laws. Except as required by the registration rights agreement, we do not intend to register resales of the outstanding notes under the Securities Act. You should refer to "Prospectus Summary—Summary of the Terms of the Exchange Offers" and "The Exchange Offers" for information about how to tender your outstanding notes.

The tender of outstanding notes under the exchange offers will reduce the principal amount of the outstanding notes outstanding, which may have an adverse effect upon and increase the volatility of, the market price of the outstanding notes due to reduction in liquidity.

As a result of the exchange offers, increased costs associated with corporate governance compliance may significantly affect our results of operations.

The Sarbanes-Oxley Act of 2002 will require changes in some of our corporate governance and securities disclosure and compliance practices, and will require a review of our internal control procedures. We expect these developments to increase our legal compliance and financial reporting costs. These developments could also make it more difficult and more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur higher costs to obtain coverage. In addition, they could make it more difficult for us to attract and retain qualified members of our board of directors, or qualified executive officers. We are presently evaluating and monitoring regulatory developments and cannot estimate the timing or magnitude or additional costs we may incur as a result.

Our internal controls over financial reporting may not be adequate and our independent auditors may not be able to certify as to their adequacy, which could have a significant and adverse effect on our business and reputation.

We are evaluating our internal controls over financial reporting in order to allow management to report on, and our independent auditors to attest to, our internal controls over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act of 2002 and rules and regulations of the SEC thereunder, which we refer to as Section 404. Section 404 requires a reporting company such as ours to, among other things, annually review and disclose its internal controls over financial reporting, and evaluate and disclose changes in its internal controls over financial reporting quarterly. We will be required to comply with Section 404 as of September 30, 2005. We are currently performing the system and process evaluation and testing required (and any necessary remediation) in an effort to comply

18