UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Proxy Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

|

Virtus Total Return Fund |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | Total fee paid: |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | (3) | | Filing Party: |

| | | | |

| | (4) | | Date Filed: |

| | | | |

V IRTUS T OTAL R ETURN F UND (DCA) A P RESENTATION TO I NSTITUTIONAL S HAREHOLDER S ERVICES I NC . May 13, 2016

D ISCLAIMER This presentation is neither an offer to sell nor a solicitation of an offer to buy the Virtus Total Return Fund 2

E XECUTIVE S UMMARY DCA continues to deliver on its investment objective of total return by providing strong investment performance and attractive and consistent distributions to shareholders DCA’s discount is attractive relative to peers and the broader closed end fund market DCA benefits from the investment expertise of Duff & Phelps and Newfleet for generating income and total return across the global investment opportunity set The Board is highly qualified and experienced with 80% of the board comprised of independent directors The Board has a demonstrated track record of taking action to further enhance shareholder value Bulldog’s proposal seeks to benefit short - term investors, such as activist investors, and does not take into consideration the interests of the Fund’s long - term shareholders which could be harmed should Bulldog’s proposal be approved 3

I NVESTMENT P ERFORMANCE NAV/ MKT YTD 1 Year 3 Years 5 Years Since Adoption 1 Since Inception 2 DCA – NAV $4.64 6.75% 0.92% 7.95% 8.36% 10.77% - 1.21% DCA – Market Price $4.24 14.44% 3.01% 9.13% 9.63% 12.79% - 2.41% Composite Benchmark 3 6.45% - 1.12% 4.33% 5.17% 5.76% 5.51% Lipper Rank 4 4% 17% 14% 10% 10% 90% Total Return as of 03/31/16 1 Adoption date of the fund is calculated as of 12/09/11 close. 2 Inception date of the fund is 2/24/05. 3 Composite Benchmark consists of 60% MSCI World Infrastructure Sector Capped Index (Net) and 40% Barclays Capital U.S. Aggrega te Bond Index 4 Lipper Global Funds peer group currently consists of 24 closed - end funds that invest at least 25% of their portfolio in securit ies traded outside of the United States and that may own U.S. securities as well. Percentile rank ranges from 0 - 100% with 0 being best. Performance data quoted represents past results. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate so shares, when redeemed, may be worth more or less than their original cost. Virtus Investment Advisers adopted the Fund on December 9, 2011 Since the adoption, DCA has outperformed its benchmark and Lipper peers over all annualized time periods ending 3/31/16 based on both NAV and market price The Fund has returned 10.8% per year on a NAV basis (12.8% on a market price basis) and outperformed 90% of the funds in its Lipper category since adoption 4

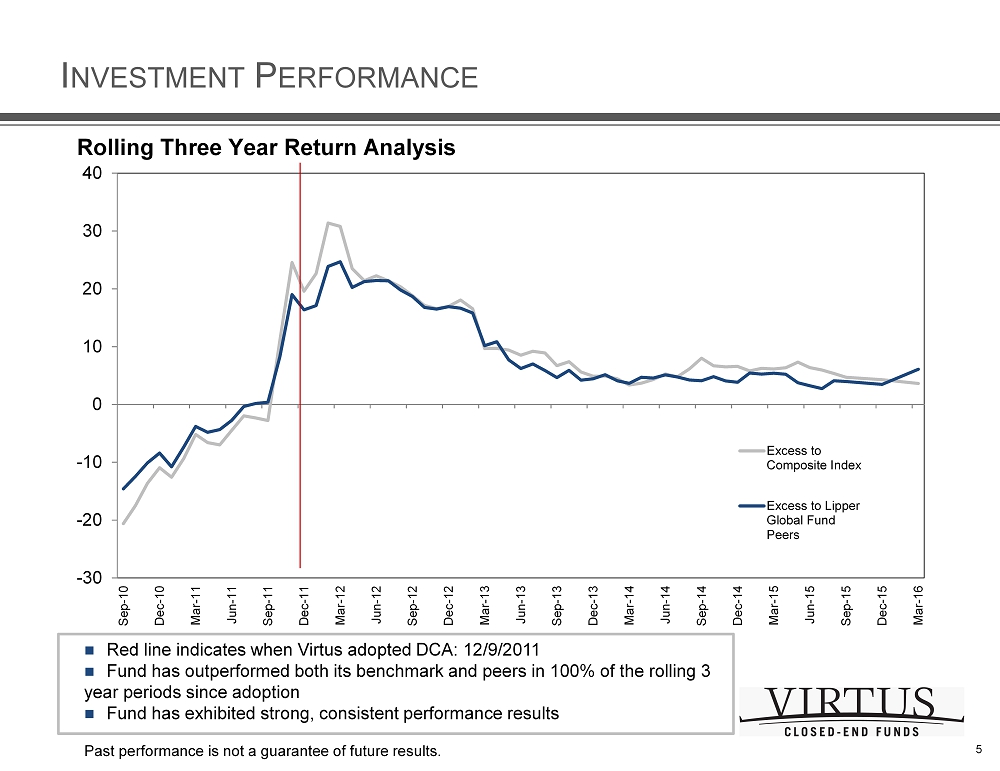

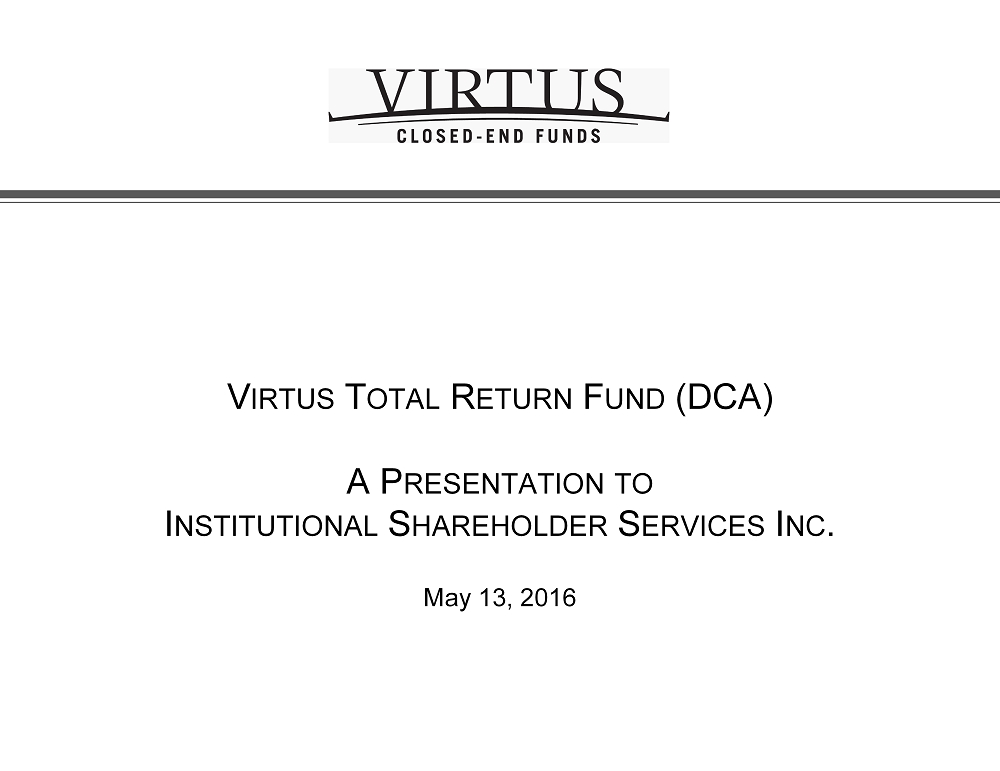

I NVESTMENT P ERFORMANCE -30 -20 -10 0 10 20 30 40 Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Excess to Composite Index Excess to Lipper Global Fund Peers Rolling Three Year Return Analysis Red line indicates when Virtus adopted DCA: 12/9/2011 Fund has outperformed both its benchmark and peers in 100% of the rolling 3 year periods since adoption Fund has exhibited strong, consistent performance results Past performance is not a guarantee of future results. 5

D ISTRIBUTION I NFORMATION Since the current portfolio managers began managing the Fund in 2011, DCA has paid $1.39 per share, totaling $38.3 million, to shareholders in distributions The Fund has not had any return of capital to shareholders for all the full fiscal years (2012 - 2015) that the current portfolio managers have managed the Fund DCA has had a level distribution plan in place since 2014 that seeks to maintain a consistent distribution level – DCA has paid a quarterly distribution of $.10 per share since April 2014. DCA provides a competitive yield on both an NAV and market price basis – Equates to an annualized rate of 8.62% based on NAV and 9.34% on market price 1 – The average annualized distribution rate of the 24 funds in the Lipper Global Funds peer group is 7.93% and 8.96% on NAV and market price, respectively 1 6 1 As of 5/3/16. Past performance is not a guarantee of future results.

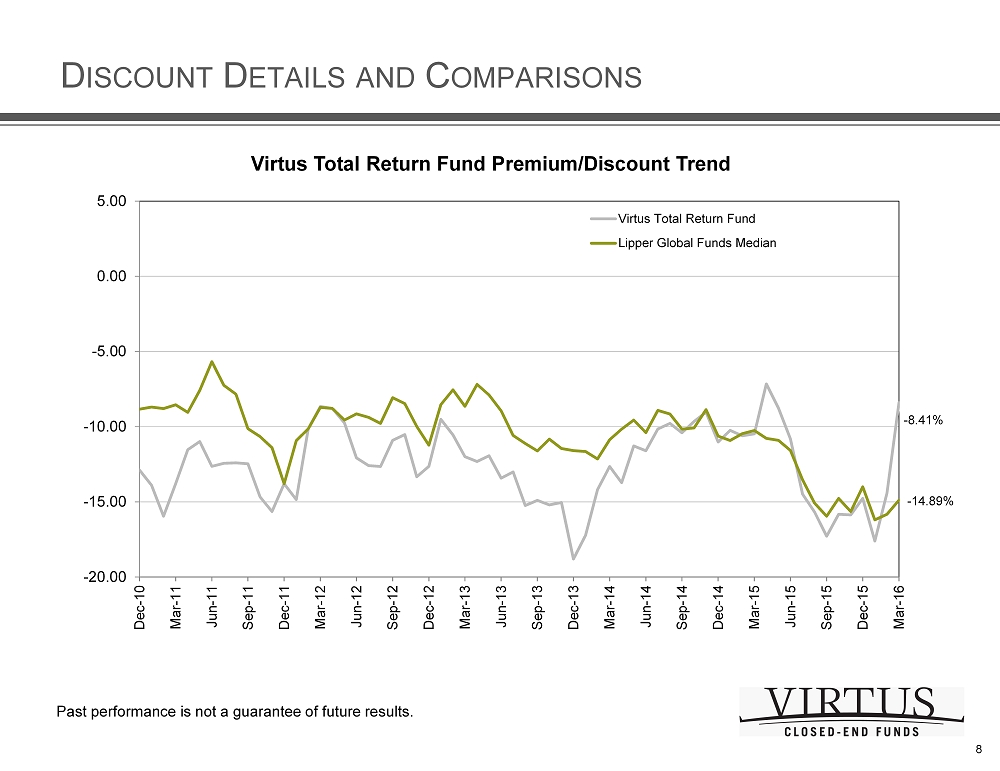

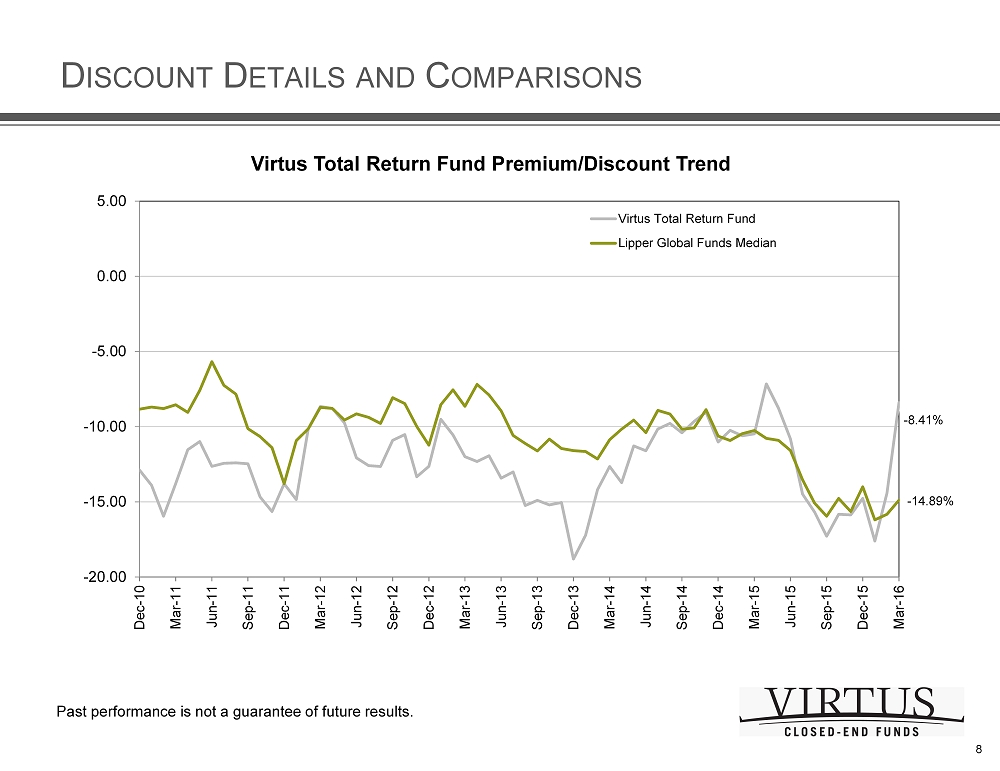

D ISCOUNT D ETAILS AND C OMPARISONS The Fund’s trading discount to NAV has narrowed significantly since the adoption of the Fund in December of 2011 – Fund traded at a discount of - 16.38 as of market close on December 8, 2011 – As of May 3, 2016, the discount had narrowed to - 7.54 % – The average and median discount of the 24 closed end funds in the Lipper Global Funds category is - 12.96% and - 14.97%, respectively 1 The Fund’s discount has traded in line with Lipper peers since early 2014 – Experienced discount widening in late 2013 relative to peer group – Board took action at that time to raise distribution – Discount has traded in line since then through February 2016 – Since late February 2016, discount significantly narrower than peer group 7 1 As of 5/3/16. Past performance is not a guarantee of future results.

-20.00 -15.00 -10.00 -5.00 0.00 5.00 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Jun-13 Sep-13 Dec-13 Mar-14 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Virtus Total Return Fund Lipper Global Funds Median Virtus Total Return Fund Premium/Discount Trend - 8.41% - 14.89% D ISCOUNT D ETAILS AND C OMPARISONS 8 Past performance is not a guarantee of future results.

B OARD E XPERIENCE AND O VERSIGHT The Board is comprised of five highly qualified professionals with extensive experience and a proven track record – please see biographies in appendix Four of the five directors are independent under the Investment Company Act of 1940 and NYSE rules The Board has taken several actions to demonstrate its commitment to the Fund’s shareholders: – In September 2013, increased the distribution by 20 percent – In February 2014, increased the distribution by an additional 67 percent and adopted a level distribution plan – Also in February 2014, approved implementation of an options overlay strategy by Newfleet Asset Management, LLC The Board reviews and discusses performance and premium / discount trends at each quarterly meeting The Board believes that liquidating the Fund undermines long term shareholders’ choice to invest in a Fund that has performed well Bulldog’s proposal benefits Bulldog’s investors and not all DCA shareholders – The Board believes (for reasons summarized on the following two pages) the proposal by Bulldog will not benefit shareholders in the long term 9

B ULLDOGS A CTIONS AND C LAIMS Bulldog is focused on a short term agenda to benefit its own shareholders – From December 31, 2015 to April 11, 2016, Bulldog purchased over 71% of its current holdings resulting in reported ownership of 13.75% Bulldog’s proposal, if enacted, would deprive long term shareholders of their choice to invest in a fund that has provided attractive returns and distribution rate since the current portfolio managers began managing the Fund in 2011 The Board’s nominee for Director, Thomas F. Mann, is highly qualified, with 40 years of experience in various senior management positions at large global finance institutions; he is also a Chartered Financial Analyst (CFA) and holds both MBA and law degrees. Through this experience, Mr. Mann is able to provide significant risk management and financial expertise to the Board and is better able to represent the interests of all shareholders than is Bulldog’s nominee. Bulldog’s proposal does not provide a plan for liquidation and there are costs associated with liquidation – costs that would be borne by common shareholders 10

C ONCLUSION DCA continues to deliver on its investment objectives of capital appreciation and income to shareholders The Fund’s discount is in line with its peers and has narrowed significantly since the current portfolio managers began managing the Fund in 2011 as a result of the various actions taken by the Board The Board is focused on increasing value for all shareholders over the long term The Board disagrees with the proposals put forth by Bulldog as they benefit short - term investors and do not take into consideration the interests of the Fund’s long - term shareholders The Board carefully considers any option that is in the long - term best interest of all shareholders 11

D ISCLAIMER The Fund has filed with the Securities and Exchange Commission (SEC) and mailed to shareholders a notice of annual meeting and a definitive proxy statement dated April 18, 2016 together with a White Proxy Card that can be used to elect the Board’s current incumbent nominee and vote against the proposed liquidation. BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS ARE URGED TO READ THE NOTICE OF ANNUAL MEETING AND PROXY STATEMENT, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE FUND AND THE UPCOMING JUNE 2, 2016 ANNUAL MEETING OF SHAREHOLDERS. Shareholders can obtain additional copies of the notice of annual meeting and proxy statement and other documents filed by the Fund with the SEC when they become available, by contacting the Fund, 101 Munson Street, Greenfield, MA 01301, or by calling 1 - 866 - 270 - 7788. Additional copies of the proxy materials will be delivered promptly upon request. Free copies of these materials can also be found on the SEC’s Web site at http://www.sec.gov . 12

A PPENDIX

T RUSTEES ’ B IOGRAPHIES Independent Trustees Philip R. McLoughlin (Chair) Trustee of DCA since 2011 Mr. McLoughlin has extensive knowledge regarding asset management and the financial services industry, having served for a number of years in various executive and director positions of the company that is now Virtus and its affiliates, culminating in his role as Chairman and Chief Executive Officer. He also served as legal counsel and Chief Compliance Officer to the investment companies associated with those companies at the time, giving him an understanding of the legal and compliance issues applicable to mutual funds. Mr. McLoughlin also has worked with U.S. and foreign companies in the insurance and reinsurance industry. He is also a director of other closed - end funds managed by the Adviser and its affiliates. 14

T RUSTEES ’ B IOGRAPHIES Independent Trustees Thomas F Mann Trustee of DCA since 2011 Mr. Mann has over 40 years of experience in various senior management positions at large global finance institutions and small entrepreneurial environments. He is also a Chartered Financial Analyst (CFA) and holds both MBA and law degrees. Through this experience, Mr. Mann is able to provide significant risk management, managerial and financial expertise to the Board and its committees. In addition, Mr. Mann’s extensive service on other Boards of Directors allows him to bring valuable knowledge of corporate governance best practices to the Board and its committees . William R Moyer Trustee of DCA since 2011 Mr. Moyer has substantial experience in the asset management and accounting industries. He currently serves as a partner at an investment management consulting firm. Previously, he served for a number of years as Executive Vice President and Chief Financial Officer of the company that is now Virtus and its affiliates. Mr. Moyer also is a certified public accountant and has an extensive background in accounting matters relating to investment companies. 15

T RUSTEES ’ B IOGRAPHIES Independent Trustees James M Oates Trustee of DCA since 2013 Mr. Oates was instrumental in the founding of a private global finance, portfolio management and administration company, and he has also served in executive and director roles for various types of financial services companies. As a senior officer and director of investment management companies, Mr. Oates has experience in investment management. He also previously served as chief executive officer of two banks, and holds an MBA. Mr. Oates also has experience as a director of other publicly traded companies and has served for a number of years as the Chairman of the Board of a large family of mutual funds unaffiliated with the Fund. 16

T RUSTEES ’ B IOGRAPHIES Interested Trustee George R Aylward Trustee of DCA since 2011 In addition to his positions with the Fund, Mr. Aylward is a Director and the President and Chief Executive Officer of Virtus, the ultimate parent company of the Adviser. He also holds various executive positions with the Adviser, and previously held such positions with the former parent company of Virtus. He therefore has experience in all aspects of the development and management of registered investment companies, and the handling of various financial, staffing, regulatory and operational issues. Mr. Aylward is a certified public accountant and holds an MBA, and he also serves as an officer and director of other closed - end funds managed by the Adviser and its affiliates. 17

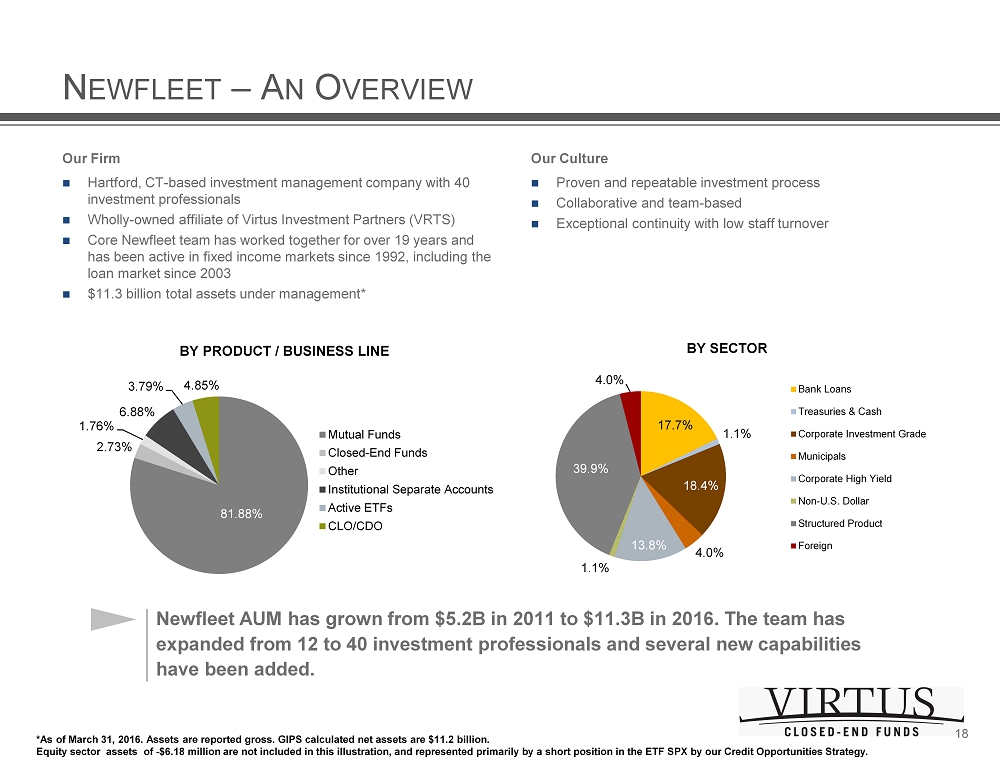

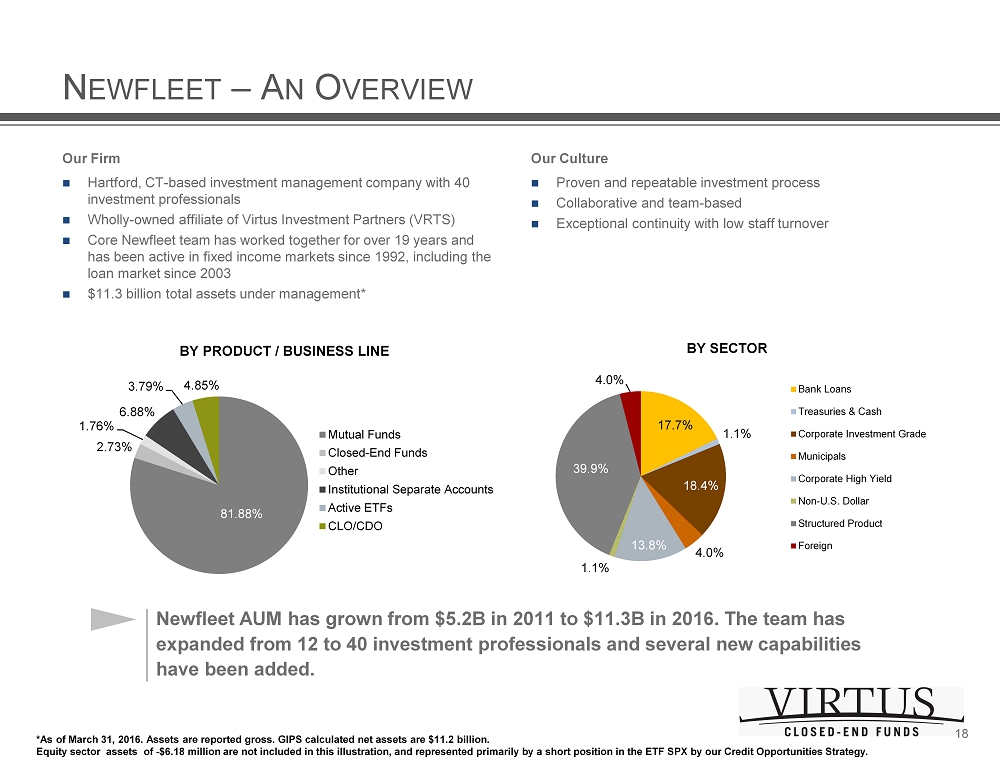

N EWFLEET – A N O VERVIEW Our Firm Hartford, CT - based investment management company with 40 investment professionals Wholly - owned affiliate of Virtus Investment Partners (VRTS ) Core Newfleet team has worked together for over 19 years and has been active in fixed income markets since 1992, including the loan market since 2003 $11.3 billion total assets under management* Our Culture Proven and repeatable investment process Collaborative and team - based Exceptional continuity with low staff turnover *As of March 31, 2016. Assets are reported gross. GIPS calculated net assets are $ 11.2 billion. Equity sector assets of - $6.18 million are not included in this illustration, and represented primarily by a short position in the ET F SPX by our Credit Opportunities Strategy. 81.88% 2.73% 1.76% 6.88% 3.79% 4.85% BY PRODUCT / BUSINESS LINE Mutual Funds Closed-End Funds Other Institutional Separate Accounts Active ETFs CLO/CDO 17.7% 1.1% 18.4% 4.0% 13.8% 1.1% 39.9% 4.0% BY SECTOR Bank Loans Treasuries & Cash Corporate Investment Grade Municipals Corporate High Yield Non-U.S. Dollar Structured Product Foreign 18 Newfleet AUM has grown from $5.2B in 2011 to $11.3B in 2016. The team has expanded from 12 to 40 investment professionals and several new capabilities have been added.

N EWFLEET – I NVESTMENT O VERVIEW 19 ► Investment Strategy • Multi - Sector manager with a credit bias • Investment approach is a combination of top down sector selection and bottom up issue selection • Based on relative valuations • Specialists across 14 sectors perform in - depth fundamental research • Investment team uses its expertise to find the best total return and income opportunities for DCA ► Investment Process • Step 1: Sector analysis and allocation • Step 2: Security selection • Step 3: Build a diversified portfolio • Continuous risk management • Well defined process that is continuous and dynamic

N EWFLEET – I NVESTMENT O VERVIEW Portable Yield Strategy (PYS) PYS targets 2 - 3% of annual income , net of fees and commissions. It aims to achieve its objective through a fully transparent, systematic options strategy. The strategy generates option premium, and features a clearly defined target return and maximum downside. Risk management is central to the implementation of PYS. The methodology imposes a maximum loss of 2% (of the notional amount) for any given week. In addition to a fixed downside , it offers income with limited credit, counterparty, or duration risk. PYS is an overlay, not an allocation. The strategy requires no initial funding. Existing assets are posted as eligible collateral to cover maximum loss potential required by broker and cash to settle any losing trades . Key Benefits Seeks to provide steady income in a variety of market conditions Manages drawdown risk and volatility Can be implemented with no asset allocation impact or sizing constraints Provides an alternative risk source away from duration and credit Maintains liquidity in stressed markets 20

If the market level is within the green area of the chart at expiration, all premium generated is retained. A loss will be incurred if the Index falls in the blue area at expiration. In this example, the maximum loss will occur when the Index level has moved more than +/ - 9%. Note: only one side (put or call spread) may result in a loss at expiration. N EWFLEET – I NVESTMENT O VERVIEW 21 Portable Yield Strategy (PYS)

D UFF & P HELPS – A N O VERVIEW Founded in 1932 as a research firm, Duff & Phelps began investment management in 1979 and now focuses on listed real assets as a liquid alternative to direct investments We apply disciplined bottom - up investment processes to listed real assets with the objective of producing superior risk - adjusted returns We benefit from the exceptional continuity of our investment team, averaging 15 years with the firm, which leads to a consistent and repeatable investment process Wholly owned by Virtus Investment Partners, Duff & Phelps operates independently in Chicago Firm Assets Under Management: $9.6 B Infrastructure and Utility Equities $4.0 42% Other Equities $0.3 3% REIT $2.3 24% Fixed Income $2.3 24% MLP $0.7 7% As of March 31, 2016 22

We believe a rigorous fundamentally driven investment process will uncover securities that are mispriced which will provide superior risk - adjusted returns. We invest globally in the owners/operators of scarce infrastructure assets given their consistent and predictable business models. We have a total return approach designed to provide distinct portfolio benefits including growing income, capital appreciation, low volatility and long - term inflation protection. Our team approach allows us to have multiple perspectives which is essential in uncovering new opportunities and identifying changes in the investment thesis. D UFF & P HELPS – I NVESTMENT O VERVIEW 23