As filed with the Securities and Exchange Commission on February 8, 2005

Registration Statement No. 333-121176

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Sheffield Steel Corporation

(Exact name of registrant as specified in its charter)

| | | | |

| Delaware | | 3312 | | 74-2191157 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

220 N. Jefferson Street

Sand Springs, Oklahoma 74063

(918) 245-1335

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

James Nolan

President and Chief Executive Officer

Sheffield Steel Corporation

220 N. Jefferson Street

Sand Springs, Oklahoma 74063

(918) 245-1335

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Matthew J. Gardella, Esq.

George Ticknor, Esq.

Palmer & Dodge LLP

111 Huntington Avenue

Boston, Massachusetts 02199-7613

(617) 239-0100

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462 (b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462 (d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

(Continued on the following page)

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

ADDITIONAL REGISTRANT(1)

| | | | | | |

Exact Name of Registrant as Specified in its Charter

| | State or Other Jurisdiction of

Incorporation or Organization

| | IRS Employer Identification Number

| | Address of Principal Executive Offices

|

Sand Springs Railway Company | | Oklahoma | | 73-6020739 | | 1650 South 81st West Avenue Tulsa, OK 74127-4833 918-245-8625 |

| (1) | The old notes are, and the new notes will be, unconditionally guaranteed by Sand Springs Railway Company, a wholly owned subsidiary of Sheffield Steel Corporation. |

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED FEBRUARY 8, 2005

PROSPECTUS

SHEFFIELD STEEL CORPORATION

Offer to Exchange

Up to $80,000,000 Principal Amount Outstanding

11 3/8% Senior Secured Notes due 2011

for

a Like Principal Amount of

11 3/8% Senior Secured Notes due 2011

which have been registered under the Securities Act of 1933

We are offering to exchange senior secured notes due 2011 that we have registered under the Securities Act of 1933 for all outstanding 11 3/8% senior secured notes due 2011. We refer to these registered notes as the new notes and all outstanding 11 3/8% senior secured notes due 2011 as the old notes.

The Exchange Offer

| | • | | We will exchange an equal principal amount of new notes that are freely tradeable for all old notes that are validly tendered and not validly withdrawn. |

| | • | | You may withdraw tenders of outstanding old notes at any time prior to the expiration of the exchange offer. |

| | • | | The exchange offer is subject to the satisfaction of limited, customary conditions. |

| | • | | The exchange offer expires at 5:00 p.m., New York City time, on , 2005, unless extended. |

| | • | | The exchange of old notes for new notes in the exchange offer generally will not be a taxable event for U.S. federal income tax purposes. |

| | • | | We will not receive any proceeds from the exchange offer. |

The New Notes

| | • | | We are offering the new notes in order to satisfy our obligations under the registration rights agreement entered into in connection with the private placement of the old notes. |

| | • | | The terms of the new notes to be issued in the exchange offer are substantially identical to the terms of the old notes, except that the new notes are registered under the Securities Act and have no transfer restrictions, rights to additional interest or registration rights except in limited circumstances. |

| | • | | The old notes are, and the new notes will be, unconditionally guaranteed on a senior secured basis by all of our existing and future domestic restricted subsidiaries. |

| | • | | We do not intend to apply for listing of the new notes on any securities exchange or to arrange for them to be quoted on any quotation system. |

See “Risk Factors” beginning on page 13 for a discussion of risks that you should consider in connection with the exchange offer.

If you are a broker-dealer that receives new notes for your own account as a result of market-making or other trading activities, you must acknowledge that you will deliver a prospectus in connection with any resale of the new notes. The letter of transmittal accompanying this prospectus states that by so acknowledging and by delivering a prospectus, you will not be deemed to admit that you are an “underwriter” within the meaning of the Securities Act. You may use this prospectus, as we may amend or supplement it in the future, for your resales of new notes. We will make this prospectus available to any broker-dealer for use in connection with any such resale for a period of 180 days after the date of expiration of this exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the new notes or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is

TABLE OF CONTENTS

WHERE YOU CAN FIND MORE INFORMATION

We have filed this prospectus with the SEC as part of a registration statement on Form S-4 under the Securities Act of 1933. This prospectus does not contain all of the information set forth in the registration statement because some parts of the registration statement are omitted in accordance with the rules and regulations of the SEC.

We “incorporate by reference” into this prospectus certain information filed with the SEC, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is an important part of this prospectus. Certain information that is subsequently filed with the SEC will automatically update and supersede information in this prospectus and in our other filings with the SEC. We incorporate by reference any future filings we may make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, after the date of filing of the registration statement relating to this exchange offer until all the notes offered by this prospectus have been exchanged and all conditions to the consummation of those exchanges have been satisfied,provided, however, that we do not incorporate any information furnished under Item 2.02 (previously Item 12) or Item 7.01 (previously Item 9) of any Current Report on Form 8-K (unless otherwise indicated).

You may request a copy of these filings at no cost, by writing or calling us at the following address: 220 North Jefferson Street, Sand Springs, Oklahoma 74063, Tel: (918) 245-1335, Attention: Stephen R. Johnson.

If you would like to request any documents, you should do so by no later than , 2005 in order to receive them before the expiration of the exchange offer.

The information relating to us contained in this prospectus and any prospectus supplement does not purport to be complete and should be read together with the information contained in the documents incorporated or deemed to be incorporated by reference into this prospectus or any prospectus supplement. Any statements made

i

in this prospectus or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded to the extent that a statement contained in any other subsequently filed document that is also incorporated or deemed to be incorporated by reference into this prospectus modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We are subject to the reporting requirements of the Securities Exchange Act of 1934 and will file annual, quarterly and current reports, and other information with the SEC. These SEC filings will be available to the public over the Internet at the SEC’s website at http://www.sec.gov. You may also read and copy any document we file with the SEC at its public reference facility at 450 Fifth Street, N.W., Washington, D.C. 20459. You can also obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 450 Fifth Street, N.W., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference facility.

If for any reason we become no longer subject to the reporting requirements of the Exchange Act, we will still be required under the indenture governing the notes to furnish the holders of the notes with certain financial and reporting information. See “Description of the Notes–Certain Covenants–Reports to Holders.”

INDUSTRY AND MARKET DATA

Industry and market data presented throughout this prospectus were obtained based on our experience and estimates and from reports by third-parties, such as the Ohio Steel Council, and, in each case, are believed by us to be reasonable. We have not independently verified industry and market data derived from third-party sources. Industry and market data derived from our experience and estimates have not been verified by any independent sources.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into this prospectus contain forward-looking statements within the meaning of the federal securities laws. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. Forward-looking statements include statements preceded by, followed by or that include the words “may,” “could,” “would,” “should,” “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project,” “intend” or similar expressions. Examples of forward-looking statements include, among others, statements regarding trends in the steel industry and economy generally; our business outlook generally; future costs of scrap steel; planned improvements in utilization and efficiency of our plants, including the cost and timing of the installation of a ladle arc furnace; continued steel demand in the United States and China; our ability to reduce our exposure to seasonality; anticipated financial and operating results; and the timing and amount of capital expenditures.

Forward-looking statements are subject to important factors that could cause actual results to differ materially from those contained in any forward-looking statement. Such factors include, but are not limited to, those described under the heading “Risk Factors.” You should keep in mind that any forward-looking statement made by us in this prospectus and the documents incorporated by reference into this prospectus speaks only as of the date on which we make it. New risks and uncertainties come up from time to time, and it is impossible for us to predict these events or how they may affect us. In any event, these and other important factors may cause actual results to differ materially from those indicated by our forward-looking statements. We have no duty to, and do not intend to, update or revise the forward-looking statements made by us in this prospectus and the documents incorporated by reference into this prospectus after the date of this prospectus, except as may be required by law.

ii

PROSPECTUS SUMMARY

This summary highlights certain information concerning our business and this offering. It does not contain all of the information that may be important to you and to your investment decision. The following summary is qualified in its entirety by the more detailed information and financial statements and notes thereto appearing elsewhere in this prospectus. You should read carefully this entire prospectus, particularly “Risk Factors” and the financial statements and related notes to the financial statements contained in this prospectus.

Unless the context otherwise indicates or requires, references in this prospectus to the terms “Sheffield Steel Corporation,” “Sheffield” and the “Company” refer to Sheffield Steel Corporation, the issuer of the notes, and “our company,” “we,” “us” and “our” refer to Sheffield Steel Corporation and its wholly-owned subsidiary, Sand Springs Railway Company. Also, the use of these terms in this prospectus refers to our predecessor, also named Sheffield Steel Corporation, prior to August 14, 2002, the effective date of our plan of reorganization. See “—Summary Historical Financial Data,” “Selected Financial and Operating Data,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our fiscal years end on April 30.

Our Company

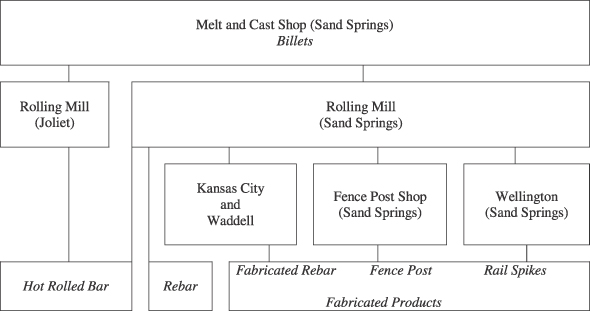

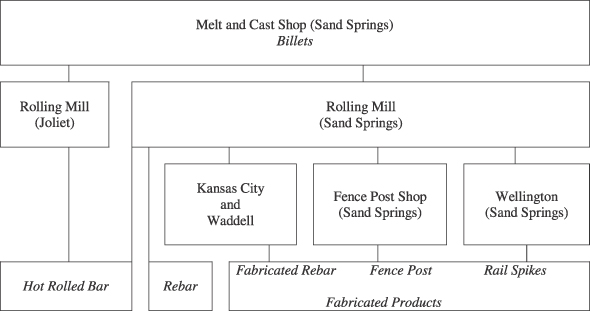

We are a leading regional mini-mill that produces a range of steel products including hot rolled steel bar, concrete reinforcing bar, or “rebar,” and fabricated products. We focus on niche products and target customers with special needs. We believe that our product quality and responsive service are two principal competitive advantages that distinguish us in the market place. Additionally, since our predecessor’s inception almost 75 years ago, we have maintained a competitive cost structure as a result of our efficient melt and cast operations, high productivity levels, low energy costs and competitive steel scrap costs. We focus on building and maintaining long-term relationships with our customers by providing competitive pricing, assured product availability and reliable, prompt delivery and service. This strategy increases the competitiveness of our customers and has significantly contributed to our strong customer relationships, which average over 20 years in duration.

We supply some of the largest independent rebar fabricators in the United States. Our facility located in Sand Springs, Oklahoma provides us with a competitive geographical advantage in the south-central United States and enables our customers to benefit from lower freight costs, shorter lead times and more timely deliveries. We believe that we supply in excess of 50% of the rebar purchased by independent rebar fabricators in markets located in Oklahoma, western Arkansas, western Missouri, Kansas, eastern Colorado, northeastern New Mexico and northern Texas, and have developed significant new customer relationships in Arizona, California and Nevada. Our targeted customer focus often enables us to act as the sole supplier of particular products to our customers.

We have the capacity to produce 600,000 tons of billets and 620,000 tons of finished goods annually. Our primary manufacturing facility is located in Sand Springs, Oklahoma, where we conduct a full range of steel-making activities, including the melting and casting of billets (600,000 tons annually) and the rolling of billets into rebar, steel fence posts and a range of hot rolled bar products (500,000 tons annually). From the Sand Springs facility, we also transfer billets to a rolling mill in Joliet, Illinois, where we have the capacity to produce approximately 120,000 tons of specialty hot rolled bar products annually for sale in markets across the United States. Our Joliet facility can produce these products in a wide variety of grades, including all carbon grades, high manganese carbon steels, high-strength low-alloy, as well as alloy and leaded lines. It can also produce smaller lot sizes and offers a roll and hold program to meet the most demanding just-in-time delivery requirements. Our Joliet facility supplies a diverse base of manufacturers, fabricators and cold finished bar producers throughout the country, and is capable of producing nonstandard, metric and near-net shapes to tolerances more exacting than industry standards. We also own and operate two rebar fabrication plants in Kansas City, Missouri and Independence, Missouri with a combined total capacity of approximately 35,000 tons

1

annually, a railroad spike manufacturing operation in Sand Springs (which we refer to as “Wellington”) and a short line railroad, the Sand Springs Railway Company (which we refer to as the “Railway”).

Business Strategy

Continue to Optimize Product Mix.We intend to continue to utilize our flexible production capabilities to adjust our mix of products in order to respond to changes in demand, margins and throughput potential; to maximize cash flow; and to maintain excellent customer service.

Continue Process and Efficiency Improvements.We intend to continue to focus on routine and preventive maintenance, which has increased the utilization of our Sand Springs rolling mill, reduced the overall amount of equipment-related down time and increased production. We have improved the utilization of our Sand Springs rolling mill from an average monthly utilization rate of approximately 55% in fiscal year 2001 to 72% in fiscal year 2004 and have process improvement teams in place with a goal to increase average monthly utilization to approximately 80%, which we believe is near optimal for our current operating structure. We believe that an 8% increase in efficiency could add as much as $2.0 million annually to our EBITDA and net income. See footnote 1 of “—Summary Historical Financial Data” on page 11 for the definition of EBITDA and a reconciliation of net income to EBITDA.

Reduce Exposure to Seasonality and Cyclicality.We intend to reduce our exposure to seasonality and cyclicality by continuing to selectively penetrate markets in the western United States, expanding the demand base for our products and developing relationships with “all season” customers.

Increase Cash Flow Through Capital Improvements.We intend to make capital improvements that will upgrade our existing equipment and processes and enable us to increase capacity, reduce costs and extend equipment life. Foremost among these capital improvements is the addition of a ladle arc furnace, which will enable us to operate our electric arc furnaces at greater efficiencies by creating a controlled environment that results in less alloy, energy and electric furnace consumables usage, and can accommodate more restrictive chemistries.

Reorganization

During the late 1990s, the U.S. steel industry experienced high energy costs, an increased volume of imported steel due in part to the illegal dumping of steel by foreign producers and a slowdown in the general economy. As a result of these factors and our significant debt service obligations at the time, our predecessor became unable to meet its financial obligations. In December 2001, our predecessor voluntarily filed a petition for relief under Chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the Northern District of Oklahoma. On August 14, 2002, a plan of reorganization was confirmed by the bankruptcy court and we emerged from bankruptcy. Under the plan, we satisfied $110.0 million of our predecessor’s indebtedness related to its 11 1/2% First Mortgage Notes due 2005 in exchange for 4,750,000 shares of our common stock, representing 95% of our current equity interest, valued at $4.1 million, and $30.0 million principal amount of new 10% senior secured notes due 2007. In total, $136.0 million, including $11.6 million of accrued interest on the 11 1/2% First Mortgage Notes and $11.0 million of unsecured payables, was discharged under the plan of reorganization. In addition, our predecessor’s then existing senior credit facility lender was repaid in full with a portion of the proceeds from a new $35.0 million revolving credit facility (which was most recently increased to a $50.0 million commitment in April 2004) and we obtained a $4.5 million working capital term loan. The outstanding amounts of the indebtedness under the 10% senior secured notes, the new senior credit facility and the working capital term loan were repaid on the consummation of the offering of the old notes. See “Capitalization” on page 26.

Our principal executive offices are located at 220 N. Jefferson Street, Sand Springs, Oklahoma 74063, and we can be reached by phone at (918) 245-1335.

2

The Exchange Offer

All capitalized terms used, but not defined, in this section shall have the respective meanings set forth under “Description of the Notes” beginning on page 72.

Summary of Terms of the Exchange Offer

| | |

Background | | We sold the old notes on August 12, 2004 in an unregistered private placement to an investment bank as initial purchaser. In connection with that private placement, we entered into a registration rights agreement in which we agreed to deliver this prospectus to you and to make an exchange offer for the old notes. |

| |

The Exchange Offer | | We are offering to exchange up to $80.0 million aggregate principal amount of our new notes, which have been registered under the Securities Act, for up to $80.0 million aggregate principal amount of our old notes. You may tender old notes only in integral multiples of $1,000 principal amount. |

| |

Resale of New Notes | | Based on interpretive letters of the SEC staff to third parties, we believe that you may resell and transfer the new notes issued pursuant to the exchange offer in exchange for old notes without compliance with the registration and prospectus delivery requirements of the Securities Act, if: |

| |

| | | • you are acquiring the new notes in the ordinary course of your business, |

| |

| | | • you have no arrangement or understanding with any person to participate in the distribution of the new notes, and |

| |

| | | • you are not our affiliate as defined under Rule 405 of the Securities Act. |

| |

| | | If you fail to satisfy any of these conditions, you must comply with the registration and prospectus delivery requirements of the Securities Act in connection with a resale of the new notes. |

| |

| | | Broker-dealers that acquired old notes directly from us, but not as a result of market-making activities or other trading activities, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with a resale of the new notes. See “Plan of Distribution” on page 127. |

| |

| | | Each broker-dealer that receives new notes for its own account pursuant to the exchange offer in exchange for old notes that it acquired as a result of market-making or other trading activities must deliver a prospectus in connection with any resale of the new notes and provide us with a signed acknowledgement of this obligation. |

3

| | |

Consequences If You Do Not | | |

Exchange Your Old Notes | | Old notes that are not tendered in the exchange offer or are not accepted for exchange will continue to bear legends restricting their transfer. You will not be able to offer or sell the old notes unless: |

| |

| | | • an exemption from the requirements of the Securities Act is available to you, |

| |

| | | • we register the resale of old notes under the Securities Act, or |

| |

| | | • the transaction requires neither an exemption from nor registration under the requirements of the Securities Act. |

| |

| | | After the completion of the exchange offer, we will no longer have an obligation to register the old notes, except in limited circumstances. |

| |

Expiration Date | | 5:00 p.m., New York City time, on , 2005, unless we extend the exchange offer. |

| |

Conditions to the Exchange Offer | | The exchange offer is subject to limited, customary conditions, which we may waive. |

| |

Procedures for Tendering Old | | |

Notes | | If you wish to accept the exchange offer, you must deliver to the exchange agent, before the expiration of the exchange offer: |

| |

| | | • either a completed and signed letter of transmittal or, for old notes tendered electronically, an agent’s message from The Depository Trust Company (which we refer to as DTC), Euroclear or Clearstream stating that the tendering participant agrees to be bound by the letter of transmittal and the terms of the exchange offer, |

| |

| | | • your old notes, either by tendering them in physical form or by timely confirmation of book-entry transfer through DTC, Euroclear or Clearstream, and |

| |

| | | • all other documents required by the letter of transmittal. |

| |

| | | If you hold old notes through DTC, Euroclear or Clearstream, you must comply with their standard procedures for electronic tenders, by which you will agree to be bound by the letter of transmittal. |

| |

| | | By signing, or by agreeing to be bound by, the letter of transmittal, you will be representing to us that: |

| |

| | | • you will be acquiring the new notes in the ordinary course of your business, |

| |

| | | • you have no arrangement or understanding with any person to participate in the distribution of the new notes, and |

| |

| | | • you are not our affiliate as defined under Rule 405 of the Securities Act. |

| |

| | | See “The Exchange Offer—Procedures for Tendering” on page 67. |

4

| | |

Guaranteed Delivery Procedures for | | |

Tendering Old Notes | | If you cannot meet the expiration deadline or you cannot deliver your old notes, the letter of transmittal or any other documentation to comply with the applicable procedures under DTC, Euroclear or Clearstream standard operating procedures for electronic tenders in a timely fashion, you may tender your notes according to the guaranteed delivery procedures set forth under “The Exchange Offer—Guaranteed Delivery Procedures” on page 69. |

| |

Special Procedures for Beneficial | | |

Holder | | If you beneficially own old notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender in the exchange offer, you should contact that registered holder promptly and instruct that person to tender on your behalf. If you wish to tender in the exchange offer on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your old notes, either arrange to have the old notes registered in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time. |

| |

Withdrawal Rights | | You may withdraw your tender of old notes at any time before the exchange offer expires. |

| |

Tax Consequences | | The exchange pursuant to the exchange offer generally will not be a taxable event for U.S. federal income tax purposes. See “United States Federal Income Tax Consequences” on page 122. |

| |

Use of Proceeds | | We will not receive any proceeds from the exchange or the issuance of the new notes. |

| |

Accounting Treatment | | We will not recognize any gain or loss for accounting purposes upon the completion of the exchange offer. The expenses that we will pay in connection with the exchange offer will increase our deferred financing costs in accordance with generally accepted accounting principles. See “The Exchange Offer—Accounting Treatment” on page 71. |

| |

Exchange Agent | | U.S. Bank National Association is serving as exchange agent in connection with the exchange offer. The address and telephone number of the exchange agent are set forth under “Exchange Agent” on page 129. |

5

Summary Description of the New Notes

The form and terms of the new notes are the same as the form and terms of the old notes, except that:

| | • | | the new notes will be registered under the Securities Act and therefore will not bear legends restricting their transfer; and |

| | • | | specified rights under the registration rights agreement, including the provisions providing for registration rights and the payment of additional interest in specified circumstances, will be limited or eliminated. |

The new notes will evidence the same debt as the old notes and will rank equally with the old notes. The same indenture will govern both the old notes and the new notes. We refer to the old notes and the new notes together as the “notes.”

| | |

Issuer | | Sheffield Steel Corporation. |

| |

New Notes Offered | | $80,000,000 aggregate principal amount of 11 3/8% Senior Secured Notes due 2011. |

| |

Maturity Date | | August 15, 2011. |

| |

Interest | | 11 3/8% per annum payable semi-annually in arrears on each February 15 and August 15, beginning on February 15, 2005. |

| |

Guarantees | | The notes are unconditionally guaranteed on a senior secured basis by all of our existing and future domestic restricted subsidiaries. |

| |

Ranking | | The notes are our senior secured obligations and rank senior in right of payment to all of our subordinated indebtedness and rankpari passu in right of payment with all of our existing and future senior indebtedness, including the revolving credit facility and the Railway term loan. The guarantees rank senior in right of payment to any future subordinated indebtedness of the guarantors andpari passu in right of payment with all existing and future senior indebtedness of the guarantors, including the revolving credit facility and the Railway term loan. See “Description of Certain Indebtedness” on page 63. |

| |

Security Interest | | The notes and the related guarantees are secured by a lien on substantially all of our assets and the assets of our existing and future domestic restricted subsidiaries, including a pledge of the stock of our existing and future subsidiaries (provided that the pledge of voting stock of any of our future foreign subsidiaries will be limited to 65% of any such subsidiary’s voting stock). Pursuant to the terms of an intercreditor agreement, the security interest in certain assets that secures the notes and the guarantees is subordinated to a lien thereon that secures the revolving credit facility, the Railway term loan and guarantees in respect thereof. See “Description of the Notes — Collateral” on page 73, “—Risks Relating to the Notes — The collateral securing the notes may be insufficient or unavailable in the event of a default” on page 14 and |

6

| | | | | |

| | | “Risk Factors —Risks Relating to the Notes — The lien-ranking provisions set forth in the intercreditor agreement relating to the indenture governing the notes limits the rights of the collateral agent and the holders of the notes with respect to the collateral” on page 15. The security interest is also subordinated to liens securing approximately $33,000 of operating leases. | �� |

| |

Optional Redemption | | Prior to August 15, 2008, we may, at our option, redeem all or a portion of the notes at a make-whole redemption price, plus accrued and unpaid interest, if any, to the date of redemption as more fully described in “Description of the Notes — Redemption — Optional Redemption prior to August 15, 2008” on page 77. On or after August 15, 2008, we may, at our option, redeem some or all of the notes at the following redemption prices, plus accrued and unpaid interest and additional interest, if any, to the date of redemption: | |

| | |

| | | For the period below

| | Percentage

| |

| | | On or after August 15, 2008 | | 105.688 | % |

| | | On or after August 15, 2009 | | 102.844 | % |

| | | On or after August 15, 2010 | | 100.000 | % |

| |

| | | Prior to August 15, 2007, up to 35% of the aggregate principal amount of the notes originally issued may be redeemed at our option with the net proceeds of certain equity offerings at 111.375% of their principal amount, plus accrued and unpaid interest and additional interest, if any, to the date of redemption,provided at least 65% of the aggregate principal amount of the notes originally issued remains outstanding. | |

| |

Change of Control Offer | | If we experience a change of control, each holder of the notes will have the right to require us to repurchase all or any part of their notes at an offer price in cash equal to 101% of the aggregate principal amount thereof, plus accrued and unpaid interest and additional interest, if any, to the date of purchase. | |

| |

Asset Sale Proceeds | | Upon certain asset sales, we may have to use the proceeds to offer to repurchase notes at an offer price in cash equal to 100% of their principal amount, plus accrued and unpaid interest and additional interest, if any, to the date of purchase. | |

| |

Excess Cash Flow Offer | | If we have excess cash flow for any fiscal year (commencing with the fiscal year ending April 30, 2005), within 90 days after the end of such fiscal year we must offer to repurchase a portion of the notes at a price equal to 100% of their principal amount, plus accrued and unpaid interest and additional interest, if any, with 50% of our excess cash flow from such fiscal year, subject to certain exceptions and limitations, including limitations under the revolving credit facility. | |

| |

Certain Indenture Covenants | | The indenture governing the notes contains covenants that, among other things, limit our ability to: | |

| |

| | | • incur or guarantee additional indebtedness or issue certain preferred stock; | |

7

| | |

| | | • pay dividends, redeem subordinated debt or make other restricted payments; |

| |

| | | • issue capital stock of our subsidiaries; |

| |

| | | • transfer or sell assets, including capital stock of our subsidiaries; |

| |

| | | • incur dividend or other payment restrictions affecting certain of our subsidiaries; |

| |

| | | • make certain investments or acquisitions; |

| |

| | | • grant liens on our assets; |

| |

| | | • enter into certain transactions with affiliates; and |

| |

| | | • merge, consolidate or transfer substantially all of our assets. |

| |

| | | These covenants are subject to a number of important limitations and exceptions. See “Description of the Notes — Certain Covenants” on page 81. |

| |

| | | Moreover, any covenant or provision of the indenture may be amended, modified, supplemented or waived without noteholder consent, as long as the trustee, in its sole discretion, determines that the change does not adversely affect the rights of any noteholder in any material respect. A change that adversely affects the rights of any noteholder in any material respect, however, requires the consent of a majority of noteholders or, in some circumstances, each noteholder. See “Description of the Notes — Modification of the Indenture” on page 96. |

| |

No Listing | | There is no public trading market for the notes and we do not intend to apply for listing of the notes on any securities exchange or for quotation through the National Association of Securities Dealers Automated Quotation System. |

For more information about the notes, see “Description of the Notes” on page 72.

For definitions of certain industry and technical terms used in this prospectus, see “Business — Glossary of Terms” on page 55.

8

RISK FACTORS

An investment in the notes involves significant risks relating to the notes, our other indebtedness and liquidity, the steel industry and our business. For example,

| | • | | our substantial debt may adversely affect our financial condition and prevent us from fulfilling our obligations under the notes; |

| | • | | we may not be able to generate sufficient cash flow to meet our debt service and other obligations due to events beyond our control; |

| | • | | the collateral securing the notes may be insufficient or unavailable in the event of a default; |

| | • | | imports of steel into the Unites States may adversely affect U.S. steel prices, which would impact our sales, margins and profitability; |

| | • | | a decrease in the global demand for steel, particularly from China, may negatively impact our sales, margins and profitability; |

| | • | | fluctuations in the relative value of the U.S. dollar and foreign currencies may negatively impact our sales, margins and profitability; and |

| | • | | any decrease in the availability, or increase in the cost, of scrap, other raw materials and energy could materially reduce our earnings. |

You should refer to “Risk Factors” on page 13 for an explanation of these and certain other risks associated with investing in the notes.

9

SUMMARY HISTORICAL FINANCIAL DATA

The following table sets forth summary consolidated financial data. The periods prior to our emergence from Chapter 11 are labeled “predecessor company” and the periods subsequent to that date are labeled “successor company.” The income statement data and the statement of operations data for the fiscal years ended April 30, 2002 and 2004 and the 2003 Combined Period (as defined below) are derived from our audited consolidated financial statements. The income statement data and the statement of operations data for the six months ended October 31, 2003 and October 31, 2004 are derived from our unaudited condensed consolidated financial statements. The balance sheet data as of April 30, 2003 and 2004 are derived from our audited condensed consolidated financial statements. The balance sheet data as of October 31, 2003 and 2004 are derived from our unaudited condensed consolidated financial statements.

On August 14, 2002, we emerged from Chapter 11 bankruptcy. In accordance with AICPA Statement of Position 90-7,Financial Reporting by Entities in Reorganization Under the Bankruptcy Code (“SOP 90-7”), we adopted fresh-start accounting as of August 14, 2002 and our emergence from Chapter 11 resulted in a new reporting entity. Under fresh-start accounting, the reorganization value of the entity is allocated to the entity’s assets based on fair values, and liabilities are stated at the present value of amounts to be paid determined at appropriate current interest rates. The effective date is considered to be the close of business on August 14, 2002 (date of reorganization). For this reason, we use the term “predecessor company” for periods on or prior to August 13, 2002 and “successor company” for periods subsequent to August 13, 2002. For purposes of the discussion below, we have combined the predecessor company’s audited results for the period May 1, 2002 to August 13, 2002 with the successor company’s audited results for the period August 14, 2002 to April 30, 2003 and refer to it as the “2003 Combined Period.” As a result of the implementation of fresh-start accounting as of August 14, 2002, our financial statements after that date are not comparable to our financial statements for prior periods because of the differences in the basis of accounting and the debt and equity structure for the predecessor company and the successor company. The most significant effect of the differences in the basis of accounting on the successor company’s financial statements is lower interest expense as a result of the discharge of $136.0 million of debt upon our emergence from bankruptcy.

The other financial data set forth below include calculations of EBITDA. These data are not required by or presented in accordance with generally accepted accounting principles. Please see footnote 1 below for a discussion of these measures.

The information set forth below should be read in conjunction with “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial statements and the related notes included elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | | |

| | | Successor Company

| | | Predecessor Company

| |

| | | Six Months

Ended

October 31,

2004

| | Six Months

Ended

October 31,

2003

| | Fiscal Year

Ended

April 30, 2004

| | Eight and

One-Half

Months Ended

April 30, 2003

| | | Three and

One-Half

Months Ended

August 13, 2002

| | | Fiscal Year

Ended

April 30, 2002

| |

| | | (In thousands, except per ton data) | |

Income Statement Data: | | | | | | | | | | | | | | | | | | | | | |

Sales, including billed freight | | $ | 152,987 | | $ | 109,918 | | $ | 244,708 | | $ | 121,231 | | | $ | 44,621 | | | $ | 152,636 | |

Gross Profit | | | 29,036 | | | 11,990 | | | 30,089 | | | 9,704 | | | | 4,811 | | | | 21,928 | |

Selling, general and administrative expense | | | 7,135 | | | 6,399 | | | 13,068 | | | 8,816 | | | | 3,952 | | | | 16,346 | |

Depreciation and amortization expense | | | 3,849 | | | 3,988 | | | 7,509 | | | 5,694 | | | | 1,773 | | | | 15,776 | |

Post-retirement benefit expense | | | 1,449 | | | 1,252 | | | 2,715 | | | 1,671 | | | | — | | | | 2,819 | |

Litigation settlement | | | — | | | — | | | — | | | — | | | | — | | | | 1,119 | |

Operating income (loss) | | | 16,603 | | | 351 | | | 6,797 | | | (6,477 | ) | | | (914 | ) | | | (11,894 | ) |

10

| | | | | | | | | | | | | | | | | | | | | |

| | | Successor Company

| | | Predecessor Company

| |

| | | Six Months

Ended

October 31,

2004

| | Six Months

Ended

October 31,

2003

| | Fiscal Year

Ended

April 30, 2004

| | Eight and

One-Half

Months Ended

April 30, 2003

| | | Three and

One-Half

Months Ended

August 13, 2002

| | | Fiscal Year

Ended

April 30, 2002

| |

| | | (In thousands, except per ton data) | |

| | | | | | |

Other Operational Data: | | | | | | | | | | | | | | | | | | | | | |

Tons sold | | | 270,003 | | | 305,527 | | | 616,531 | | | 328,968 | | | | 123,983 | | | | 423,508 | |

Sales per ton | | $ | 566.61 | | $ | 359.77 | | $ | 396.91 | | $ | 368.52 | | | $ | 359.90 | | | $ | 360.41 | |

| | | | | | |

Other Financial Data: | | | | | | | | | | | | | | | | | | | | | |

EBITDA(1) | | | 16,757 | | | 4,339 | | | 14,306 | | | (832 | ) | | | (760 | ) | | | 1,306 | |

Total capital expenditures | | | 12,339 | | | 828 | | | 1,381 | | | 1,103 | | | | 559 | | | | 1,139 | |

Total debt | | | 83,119 | | | 64,784 | | | 70,245 | | | 65,538 | | | | 117,614 | | | | 138,224 | (2) |

Net debt(3) | | | 82,092 | | | 62,590 | | | 66,451 | | | 62,955 | | | | 115,273 | | | | 133,756 | |

| | | | | | | | |

| | | As of October 31,

2004

| | | As of April 30,

2004

| |

| | | (dollars in thousands) | |

Balance Sheet Data: | | | | | | | | |

Cash and cash equivalents | | $ | 1,027 | | | $ | 3,794 | |

Accounts Receivable, net | | | 29,579 | | | | 35,721 | |

Inventory | | | 49,398 | | | | 35,909 | |

Property, plant and equipment, net | | | 54,261 | | | | 45,412 | |

Total assets | | | 145,864 | | | | 123,894 | |

Total debt | | | 83,119 | | | | 70,245 | |

Total shareholders’ equity (deficit) | | | (244 | ) | | | (9,053 | ) |

| (1) | EBITDA, which we define as earnings before interest, taxes, depreciation and amortization, is not a measure of financial performance calculated in accordance with accounting principles generally accepted in the United States (“GAAP”). EBITDA does not represent and should not be considered as an alternative to net income or cash flows from operations, which are determined in accordance with GAAP. The calculation of EBITDA that we use may not be comparable to similarly titled measures of other companies. |

We use EBITDA as a measure of operating performance, but not as a measure of liquidity. It assists us in comparing our performance on a consistent basis as it removes the impact of our capital structure (primarily interest charges from our outstanding debt) and asset base (primarily depreciation and amortization of machinery and equipment) from our operating results. We also use it with respect to compliance with our credit facility, which requires us to maintain certain financial ratios based on annualized EBITDA (as defined in our credit facility).

EBITDA should not be considered in isolation or as a substitute for operating income, net income or loss, cash flows provided by operating, investing and financing activities, or other income or cash flow statement data prepared in accordance with GAAP or as a measure of liquidity.

We believe EBITDA is useful to investors in evaluating our operating performance because:

| | • | | it is widely used in the steel industry to measure a company’s operating performance without regard to items such as depreciation and amortization, which can vary depending upon accounting methods and the book value of assets. We believe that, by eliminating such effects, EBITDA provides a meaningful measure of overall corporate performance exclusive of our capital structure and the method by which our assets were acquired; and |

| | • | | it helps investors more meaningfully evaluate and compare the results of our operations from period to period by removing the impact of our capital structure (primarily interest charges from our outstanding debt) and asset base (primarily depreciation and amortization of machinery and equipment) from our operating results. |

11

Set forth below is a reconciliation of net income to EBITDA:

| | | | | | | | | | | | | | | | | | | | | | |

| | | Successor Company

| | | Predecessor Company

| |

| | | Six Months

Ended

October 31,

2004

| | Six Months

Ended

October 31,

2003

| | | Fiscal Year

Ended

April 30, 2004

| | Eight and

One-Half

Months Ended

April 30, 2003

| | | Three and

One-Half

Months Ended

August 13, 2002

| | | Fiscal Year

Ended

April 30, 2002

| |

Net income (loss) | | $ | 8,809 | | $ | (2,821 | ) | | $ | 416 | | $ | (10,790 | ) | | $ | (3,295 | ) | | $ | (24,205 | ) |

Income tax expense | | | 104 | | | — | | | | — | | | — | | | | — | | | | — | |

Interest expense | | | 3,995 | | | 3,172 | | | | 6,381 | | | 4,264 | | | | 762 | | | | 9,735 | |

Depreciation and amortization expense | | | 3,849 | | | 3,988 | | | | 7,509 | | | 5,694 | | | | 1,773 | | | | 15,776 | |

EBITDA | | | 16,757 | | | 4,339 | | | | 14,306 | | | (832 | ) | | | (760 | ) | | | 1,306 | |

| (2) | Includes $110.0 million of debt allocated to liabilities subject to compromise which amount was subsequently reduced to $30.0 million under our predecessor’s plan of reorganization. |

| (3) | Net debt is defined as total debt less cash and cash equivalents. |

12

RISK FACTORS

An investment in the notes involves a significant degree of risk, including the risks described below. You should carefully consider the following risk factors and the other information in this prospectus and the documents incorporated by reference into this prospectus before deciding to participate in the exchange offer. The risks described below are not the only ones facing us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business. Any of the following risks could materially adversely affect our business, financial condition or results of operations, which in turn could cause you to lose all or part of your investment.

Risks Related to the Exchange Offer

If you fail to exchange your old notes, they will continue to be restricted securities and may become less liquid.

Old notes that you do not tender or that we do not accept will, following the exchange offer, continue to be restricted securities. You may not offer or sell untendered old notes except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. We will issue new notes in exchange for the old notes pursuant to the exchange offer only following the satisfaction of procedures and conditions described elsewhere in this prospectus. These procedures and conditions include timely receipt by the exchange agent of the old notes and of a properly completed and duly executed letter of transmittal.

Because we anticipate that most holders of old notes will elect to exchange their old notes, we expect that the liquidity of the market for any old notes remaining after the completion of the exchange offer may be substantially limited. Any old note tendered and exchanged in the exchange offer will reduce the aggregate principal amount of the old notes outstanding. Following the exchange offer, if you did not tender your old notes you generally will not have any further registration rights and your old notes will continue to be subject to transfer restrictions. Accordingly, the liquidity of the market for any old notes could be adversely affected.

Risks Relating to the Notes, Our Other Indebtedness and Our Liquidity

Our substantial level of indebtedness could adversely affect our financial condition and prevent us from fulfilling our obligations under the notes.

We have a substantial amount of debt. As of October 31, 2004, we had approximately $83.1 million of total indebtedness outstanding and our net debt (total indebtedness less cash and cash equivalents) was approximately $82.1 million.

Our high level of indebtedness could have important consequences to you, including the following:

| | • | | it may make it difficult for us to satisfy our obligations under the notes and our other indebtedness and contractual and commercial commitments; |

| | • | | we must use a substantial portion of our cash flow from operations to pay interest on the notes and our other indebtedness, which will reduce the funds available to us for other purposes; |

| | • | | all of the indebtedness outstanding under the revolving credit facility and the Railway term loan will have a prior ranking claim on certain of our assets and will mature prior to the notes; |

| | • | | the revolving credit facility and the Railway term loan have variable rates of interest, which expose us to the risk of increased interest rates; |

| | • | | our ability to obtain additional debt financing in the future for working capital, capital expenditures, acquisitions or general corporate purposes may be limited; |

13

| | • | | our high level of indebtedness could limit our flexibility in reacting to changes in the industry and make us more vulnerable to adverse changes in our business or economic conditions in general; |

| | • | | our high level of indebtedness could place us at a competitive disadvantage to those of our competitors who operate on a less leveraged basis; and |

| | • | | if we fail to comply with the covenants in the indenture relating to the notes, the revolving credit facility, the Railway term loan or in the instruments governing our other indebtedness, such failure could have a material adverse effect on our business and our ability to repay the notes. |

Our ability to make payments with respect to the notes and to satisfy our other debt obligations will depend on our future operating performance and our ability to refinance our indebtedness, which will be affected by prevailing economic conditions and financial, business and other factors, certain of which are beyond our control.

Despite existing debt levels, we may still be able to incur substantially more debt that would increase the risks associated with our leverage.

We may be able to incur substantial amounts of additional debt in the future, including debt resulting from the issuance of additional notes and borrowings under the revolving credit facility. Although the terms of our current debt, including the notes, limit our ability to incur additional debt, such terms do not prohibit us from incurring substantial amounts of additional debt for specific purposes or under certain circumstances. We have the ability under the revolving credit facility to borrow up to $15.0 million of revolving loans and to obtain letters of credit in an aggregate amount of up to $6.0 million (inclusive of $2.5 million of undrawn letters of credit outstanding thereunder), subject to the conditions contained therein. As a result of an intercreditor agreement, all of those borrowings have a security interest in our inventory, accounts receivable and related assets that is senior to the security interest of the notes in such assets.

We may not be able to generate sufficient cash flow to meet our debt service and other obligations due to events beyond our control.

We have greatly increased interest expense compared to prior years. Our ability to generate cash flows from operations and to make scheduled payments on our indebtedness, including equipment and other leases, will depend on our future financial performance. Our future performance will be affected by a range of economic, competitive and business factors that we cannot control, such as general economic and financial conditions in our industry or the economy at large. A significant reduction in operating cash flows resulting from changes in economic conditions, increased competition, or other events beyond our control could increase the need for additional or alternative sources of liquidity and could have a material adverse effect on our business, financial condition, results of operations, prospects and our ability to service our debt and other obligations. If we are unable to service our indebtedness, we will be forced to adopt an alternative strategy that may include actions such as reducing or delaying capital expenditures, selling assets, restructuring or refinancing our indebtedness or seeking additional equity capital. We cannot assure you that any of these alternative strategies could be affected on satisfactory terms, if at all, or that they would yield sufficient funds to make required payments on the notes and our other indebtedness. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources.”

We urge you to consider the information under “Capitalization,” “Prospectus Summary — Summary Historical Financial Data,” “Description of the Notes” and “Description of Certain Indebtedness” for more information on these matters.

The collateral securing the notes may be insufficient or unavailable in the event of a default.

No appraisal of the value of the collateral securing the notes has been made and the value of the collateral in the event of liquidation will depend on market and economic conditions, the availability of buyers and other

14

factors. Consequently, we cannot assure you that liquidating the collateral securing the notes would produce proceeds in an amount sufficient to pay any amounts due under the notes after also satisfying the obligations to pay any other senior secured creditors. Nor can we assure you that the fair market value of the collateral securing the notes would be sufficient to pay any amounts due under the notes following their acceleration.

The notes and any guarantees related thereto are effectively subordinated to indebtedness that may be incurred under the revolving credit facility and the Railway term loan, to the extent of the value of (i) assets of the Company and its subsidiaries (other than the Railway) consisting of accounts, inventory, general intangibles, documents, chattel paper, instruments (excluding the capital stock of any of the Company’s subsidiaries and rights related thereto), investment property (excluding the capital stock of any of the Company’s subsidiaries and rights related thereto), letter of credit rights, deposit accounts, cash, books and records relating thereto and proceeds thereof and (ii) substantially all of the assets of the Railway. The notes and guarantees are also subordinated to liens securing certain operating leases to the same extent. As of October 31, 2004, we had a total of approximately $3.0 million of indebtedness to which the notes and guarantees were effectively subordinated. In the event of a default under the notes, the proceeds from the sale of the collateral may not be sufficient to satisfy in full our obligations under the notes following the repayment of the revolving credit facility and the Railway term loan with the proceeds from the sale of collateral of (x) the Company and its subsidiaries (other than the Railway) consisting of accounts, inventory, general intangibles, documents, chattel paper, instruments (excluding the capital stock of any of the Company’s subsidiaries and rights related thereto), investment property (excluding the capital stock of any of the Company’s subsidiaries and rights related thereto), letter of credit rights, deposit accounts, cash, books and records relating thereto and proceeds thereof and (y) the Railway consisting of substantially all of the Railway’s assets. The amount to be received upon such a sale would depend upon numerous factors, including the timing and manner of the sale. The book value of the collateral is less than the principal amount of the notes. By its nature, the collateral is illiquid and has no readily ascertainable market value. The right of the collateral agent to foreclose on the collateral is limited under the terms of the intercreditor agreement (as discussed below). Accordingly, there can be no assurance that the collateral can be sold in a short period of time or that the proceeds obtained therefrom will be sufficient to pay all amounts owing to the lenders under the revolving credit facility, the holder of the Railway term loan and the holders of the notes.

In addition, our failure or inability to pay rent under real property leases could cause the loss of certain collateral. To the extent that third parties have prior liens (including the lenders under the revolving credit facility and the holder of the Railway term loan with respect to their liens on the collateral of (i) the Company and its subsidiaries (other than the Railway) consisting of accounts, inventory, general intangibles, documents, chattel paper, instruments (excluding the capital stock of any of the Company’s subsidiaries and rights related thereto), investment property (excluding the capital stock of any of the Company’s subsidiaries and rights related thereto), letter of credit rights, commercial tort claims, deposit accounts, cash, books and records relating thereto or proceeds thereof or (ii) the Railway consisting of substantially all of the Railway’s assets), such third parties may have rights and remedies with respect to the property subject to such liens that, if exercised, could adversely affect the value of the collateral. Additionally, the terms of the indenture governing the notes allow us to issue additional notesprovided that we meet a specified consolidated fixed charge coverage ratio. The indenture governing the notes does not require that we maintain the current level of collateral or maintain a specific ratio of indebtedness to collateral value. Any additional notes issued pursuant to the indenture governing the notes will rankpari passu to the notes and be entitled to the same rights and priority with respect to the collateral. Thus, the issuance of additional notes pursuant to the indenture governing the notes may have the effect of significantly diluting your ability to recover payment in full from the then existing pool of collateral. See “Description of the Notes — Collateral.”

The lien-ranking provisions set forth in the intercreditor agreement relating to the indenture governing the notes limit the rights of the collateral agent and the holders of the notes with respect to the collateral.

The rights of the collateral agent and the holders of the notes with respect to the collateral of (i) the Company and its subsidiaries (other than the Railway) consisting of accounts, inventory, general intangibles,

15

documents, chattel paper, instruments (excluding the capital stock of any of the Company’s subsidiaries and rights related thereto), investment property (excluding the capital stock of any of the Company’s subsidiaries and rights related thereto), letter of credit rights, deposit accounts, cash, books, and records relating thereto and proceeds thereof and (ii) the Railway consisting of substantially all of the Railway’s assets, in each case, that secure the notes and any guarantees are limited pursuant to the terms of the intercreditor agreement with the agent under the revolving credit facility and the holder of the Railway term loan or its agent. The intercreditor agreement limits the actions that may be taken in respect of such collateral, including the ability to cause the commencement of enforcement proceedings against such collateral and to control the conduct of such proceedings, if the revolving credit facility or our obligations thereunder or the Railway term loan is outstanding. In certain cases, these actions may only be able to be taken at the direction of the agent under the revolving credit facility and the holder of the Railway term loan or its agent. The collateral agent, on behalf of itself, the trustee and the holders of the notes, does not under certain circumstances have the ability to control or direct such actions, even if the rights of the holders of the notes are or may be adversely affected. In addition, the collateral agent does not have the right to foreclose upon collateral of (x) the Company and its subsidiaries (other than the Railway) consisting of accounts, inventory, general intangibles, documents, chattel paper, instruments (excluding the capital stock of any of the Company’s subsidiaries and rights related thereto), investment property (excluding the capital stock of any of the Company’s subsidiaries and rights related thereto), letter of credit rights, deposit accounts, cash, books and records relating thereto or proceeds thereof or (y) the Railway consisting of substantially all of the Railway’s assets of the Railway’s assets, in either case, for a period of 90 days following notice to the agent under the revolving credit facility and the holder of the Railway term loan or its agent upon the occurrence of an event of default under the indenture governing the notes. Additional releases of collateral from the liens securing the notes are permitted under some circumstances. See “Description of the Notes — Collateral.”

The ability of the collateral agent to foreclose on the collateral may be limited pursuant to bankruptcy laws.

The right of the collateral agent, as a secured party under the collateral documents for the benefit of itself, the trustee and the holders of the notes, to foreclose upon and sell the collateral upon the occurrence of a payment default is likely to be significantly impaired by applicable bankruptcy laws, including the automatic stay provision contained in Section 362 of the Bankruptcy Code. Under applicable federal bankruptcy laws, a secured creditor is prohibited from repossessing its security from a debtor in a bankruptcy case, or from disposing of security repossessed from such a debtor, without bankruptcy court approval. Moreover, applicable federal bankruptcy laws generally permit a debtor to continue to retain and use collateral even though that debtor is in default under the applicable debt instruments so long as the secured creditor is afforded “adequate protection” of its interest in the collateral. Although the precise meaning of the term “adequate protection” may vary according to circumstances, it is intended in general to protect a secured creditor against any diminution in the value of the creditor’s interest in its collateral. Accordingly, the bankruptcy court may find that a secured creditor is “adequately protected” if, for example, the debtor makes certain cash payments or grants the creditor liens on additional or replacement collateral as security for any diminution in the value of the collateral occurring for any reason during the pendency of the bankruptcy case. In view of the lack of a precise definition of the term “adequate protection” and the broad discretionary powers of a bankruptcy court, we cannot predict whether payments under the notes would be made following commencement of, and during the pendency of, a bankruptcy case, whether or when the collateral agent could foreclose upon or sell the collateral or whether or to what extent holders of notes would be compensated for any delay in payment or loss of value of the collateral. Furthermore, if a bankruptcy court determines that the value of the collateral is not sufficient to repay all amounts due on the notes, holders of notes would hold “under-secured claims.” Applicable federal bankruptcy laws do not permit the payment or accrual of interest, costs and attorney’s fees for “under-secured claims” during a debtor’s bankruptcy case.

If our future unrestricted subsidiaries or foreign subsidiaries, if any, become insolvent, liquidate, reorganize, dissolve or otherwise wind up, holders of their indebtedness and their trade creditors generally will be entitled to

16

payment on their claims from the assets of such subsidiary before any of those assets would be made available to us. Consequently, your claims in respect of the notes effectively would be subordinated to all of the existing and future liabilities of our unrestricted subsidiaries and foreign subsidiaries, if any. In addition, the validity of any pledges of capital stock of any future foreign subsidiaries under local law, if applicable, and the ability of the holders of the notes to realize upon that collateral under local law, to the extent applicable, may be limited by such local law, which limitations may or may not affect such liens.

Finally, the collateral agent’s ability to foreclose on the collateral on your behalf may be subject to lack of, or problems arising from a delay in, perfection, the consent of third parties, prior liens (as discussed above) and practical problems associated with the realization of the collateral agent’s security interest in the collateral.

The indenture governing the notes and the instruments governing our other indebtedness impose significant operating and financial restrictions on us that may prevent us from pursuing certain business opportunities and restrict our ability to operate our business.

The indenture governing the notes, the revolving credit facility and the Railway term loan contain covenants that restrict our ability to take various actions, such as:

| | • | | incur or guarantee additional indebtedness or issue disqualified capital stock; |

| | • | | make investments or acquisitions; |

| | • | | pay dividends, redeem subordinated indebtedness or make other restricted payments; |

| | • | | issue capital stock of certain subsidiaries; |

| | • | | enter into transactions with affiliates; |

| | • | | transfer or sell assets; |

| | • | | incur dividend or other payment restrictions affecting certain subsidiaries; and |

| | • | | consummate a merger, consolidation or sale of all or substantially all of our assets. |

Our ability to comply with these covenants can be affected by events beyond our control and we cannot assure you that we will be able to satisfy those requirements. A breach of any of these provisions could result in a default under these instruments, which could allow all amounts outstanding thereunder to be declared immediately due and payable. Moreover, an event of default under one instrument may give rise to an event of default under another instrument, potentially resulting in much or all of our indebtedness becoming immediately due and payable at the same time. We cannot assure you that our assets would be sufficient to repay such amounts (including amounts due under the notes) in full. We may also be prevented from taking advantage of business opportunities that arise if we fail to meet certain financial ratios or because of the limitations imposed on us by the restrictive covenants under these instruments. We urge you to read the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources,” “Description of Certain Indebtedness” and “Description of the Notes — Certain Covenants” for a more detailed discussion of the substantive requirements of these covenants.

We may be unable to repurchase the notes upon a change of control.

Upon the occurrence of a change of control, we will be required to offer to repurchase all outstanding notes at a price equal to 101% of the principal amount of the notes, together with accrued and unpaid interest, if any, and liquidated damages, if any, to the date of repurchase.

However, it is possible that we will not have sufficient funds at the time of the change of control to make the required repurchase of the notes and the events that constitute a change of control under the indenture may also

17

be events of default under the revolving credit facility or the Railway term loan. These events may permit the lenders under the revolving credit facility and the holder of the Railway term loan to accelerate the indebtedness outstanding under the revolving credit facility and the Railway term loan, respectively. If we are required to repurchase the notes, we would probably require third party financing. We cannot be sure that we would be able to obtain third party financing on acceptable terms, or at all. If the indebtedness under the revolving credit facility or the Railway term loan is not paid, the lenders thereunder or the holder of the Railway term loan, respectively, may seek to enforce their respective security interests in the collateral securing such indebtedness, thereby limiting our ability to raise cash to purchase the notes, and reducing the practical benefit of the offer to purchase provisions to the holders of the notes.

One of the circumstances under which a change of control may occur is upon the sale or disposition of all or substantially all of our capital stock or assets. However, the phrase “all or substantially all” will likely be interpreted under applicable state law and will be dependent upon particular facts and circumstances. As a result, there may be a degree of uncertainty in ascertaining whether a sale or disposition of “all or substantially all” of our capital stock or assets has occurred, in which case, the ability of a holder of the notes to obtain the benefit of an offer to repurchase all of a portion of the notes held by such holder may be impaired. By definition, the term “Change of Control” contains significant exceptions. See “Description of the Notes — Certain Definitions.”

We may not be able to satisfy our obligations to holders of the notes if we have excess cash flow.

If we have at least $2.0 million of excess cash flow in any fiscal year (commencing with the fiscal year ending April 30, 2005), the holders of the notes will have the right, under certain circumstances, to require us to purchase their notes at a price equal to 100% of the principal amount of the notes, together with any accrued and unpaid interest and additional interest, if any, to the date of purchase, with 50% of such excess cash flow, subject to certain exceptions and limitations, including limitations under the revolving credit facility. See “Description of the Notes — Excess Cash Flow Offer.”

However, it is possible that we will not have sufficient funds at the time we are required to consummate an excess cash flow offer to make the required repurchase of the notes tendered in connection therewith. Failure to make such repurchase would result in an event of default under the indenture which would result in events of default under the revolving credit facility and the Railway term loan. These events of default would give the lenders under the revolving credit facility and the holder of the Railway term loan the right to accelerate the indebtedness outstanding under the revolving credit facility and the Railway term loan, respectively. If the indebtedness under the revolving credit facility or the Railway term loan is not paid, the lenders thereunder or the holder of the Railway term loan, respectively, may seek to enforce their respective security interests in the collateral securing such indebtedness, thereby limiting our ability to raise cash to purchase the notes, and reducing the practical benefit of the offer to purchase provisions to the holders of the notes.

A court could cancel the guarantees under fraudulent conveyance laws or certain other circumstances.

All of our existing domestic restricted subsidiaries do, and our future domestic restricted subsidiaries will, guarantee the notes. If, however, such a subsidiary becomes a debtor in a case under the Bankruptcy Code or encounters other financial difficulty, under federal or state laws governing fraudulent conveyance, renewable transactions or preferential payments, a court in the relevant jurisdiction might avoid or cancel its guarantee. The court might do so if it found that, when the subsidiary entered into its guarantee or, in some states, when payments become due thereunder, it received less than reasonably equivalent value or fair consideration for such guarantee and either was or was rendered insolvent, was left with inadequate capital to conduct its business, or believed or should have believed that it would incur debts beyond its ability to pay. The court might also avoid such guarantee, without regard to the above factors, if it found that the subsidiary entered into its guarantee with actual or deemed intent to hinder, delay, or defraud its creditors.

A court would likely find that a subsidiary did not receive reasonably equivalent value or fair consideration for its guarantee unless it benefited directly or indirectly from the issuance of the notes. If a court avoided such

18

guarantee, you would no longer have a claim against such subsidiary or the benefit of the assets of such subsidiary constituting collateral that purportedly secured such guarantee. In addition, the court might direct you to repay any amounts already received from such subsidiary or from the proceeds of any such collateral. If the court were to avoid any guarantee, we cannot assure you that funds would be available to pay the notes from another subsidiary or from any other source.

The indenture states that the liability of each subsidiary on its guarantee is limited to the maximum amount that the subsidiary can incur without risk that the guarantee will be subject to avoidance as a fraudulent conveyance. This limitation may not protect the guarantees from a fraudulent conveyance attack or, if it does, ensure that the guarantees will be in amounts sufficient, if necessary, to pay obligations under the notes when due.

There may be no public market for the new notes, which may significantly impair the liquidity and value of the new notes.

Prior to the exchange and issuance of the new notes, there has been no public market for the new notes and we cannot assure you as to:

| | • | | the liquidity of any market that may develop; |

| | • | | your ability to sell your new notes; or |

| | • | | the price at which you would be able to sell your new notes. |

If a market were to exist for the new notes, the new notes could trade at prices that may be lower than the principal amount or purchase price, depending on many factors, including prevailing interest rates, the market for similar notes and our financial performance. We do not presently intend to apply for listing of the new notes on any securities exchange.

The initial purchaser in the August 2004 private placement of the old notes has advised us that it presently intends to make a market in the new notes. The initial purchaser is not obligated, however, to make a market in these securities, and it may discontinue any such market-making at any time at its sole discretion. In addition, any market-making activity will be subject to the limits imposed by the Securities Act and the Exchange Act. Accordingly, we cannot assure you as to the development or liquidity of any market for the new notes.

In addition, the market for non-investment grade debt historically has been subject to disruptions that have caused substantial volatility in the prices of securities similar to the notes and the exchange notes. The market for the new notes, if any, may be subject to similar disruptions that could adversely affect their value.

Risks Related to Our Industry