Fee and Service Schedule for Stock Transfer Services

Between

Each of the Guggenheim

Closed-End Investment Companies Listed on Schedule 1

and

Computershare Inc.

and

Computershare Trust Company, N.A.

This Fee and Service Schedule ("Schedule") is by and between Computershare Inc. ("Computershare") and Computershare Trust Company, N.A. (the "Trust Company") (collectively, "Agent") and each of the Guggenheim closed-end investment companies listed on Schedule 1 of the Agreement (each a "Fund" and collectively the "Funds"), whereby the Agent will perform the following services for each Fund. This Schedule is an attachment to the Agreement. Terms used, but not otherwise defined in this Schedule, shall have the same meaning as those terms in the Agreement.

1. TERM

The fees set forth in this Schedule shall be effective for a period of three (3) years, commencing from the effective date of December 1, 2015 (the "Initial Term"). If no new fee schedule is agreed upon prior to a Renewal Term, provided that service mix and volumes remain constant, the fees listed in the Schedule shall be increased by the accumulated change in the National Employment Cost Index for Service Producing Industries (Finance, Insurance, Real Estate) for the preceding years of the expiring term, as published by the Bureau of Labor Statistics of the United States Department of Labor. Fees will be increased on this basis for each successive Renewal Term.

2. FEES

Ongoing Account Management*, Per Fund

This fee covers the administration of the services listed in Section 3, except as noted otherwise. Out-of-pocket expenses associated with providing these services will be charged separately.

| $2,500 | Initial Fund Set-Up Fee |

| | |

| $1,500 | Per Month |

| | * | If the average volume of transactions or inquiries significantly increases during the term of this Agreement, as a result of outside factors or unforeseen circumstances for which the Agent is not the proximate cause, the Agent and the Fund shall negotiate an additional fee. |

Direct Filing of Unclaimed Property

| • | Annual administration fee | Included |

| • | Due Diligence | $4.00 per Account |

| • | State report fee | $125 per positive report |

| • | Negative (nil) report fee | $ 25 per negative report (maximum $500 per year) |

| • | Account processed | $1.25 per Account escheated |

Page 1

Lost Shareholder Search Services

| • | SEC Electronic Database Search | $2.00 per Account searched |

Dividend Reinvestment

| • | Administer plan services | Included |

| • | Each dividend disbursement reinvested | Included |

| • | Each optional cash transaction | Included |

| • | Each withdrawal or liquidation of shares from the plan | Included |

| • | Service fee-includes brokerage commission (per share purchased/sold)* | $ 0.03 |

3. SERVICES (per Fund)

| | • | Annual administrative services as Transfer Agent and Registrar for the common stock of each Fund |

| | • | Provide management and board report information as requested |

| | • | Assignment of relationship manager |

Account Maintenance

| | • | Maintain 1,000 registered Shareholder Accounts per Fund (additional Accounts to be billed at $6.00 each per year) |

| | • | Create new Shareholder Accounts |

| | • | Post and acknowledge address changes |

| | • | Process other routine file maintenance adjustments |

| | • | Post all transactions, including debit and credit certificates, to the Shareholder file |

| | • | Provide confirmation of authorized and issued capital amounts to Fund, upon request |

| | • | Perform OFAC (Office of Foreign Asset Control) and Patriot Act reporting |

| | • | Obtain tax certifications for companies who are tax resident in the United States |

| | • | If any Fund is tax resident in a country other than the United States, such Fund shall advise Agent Additional fees may apply under such circumstance. |

Share Issuance

| | • | Issue, cancel and register Shares |

| | • | Process all legal transfers as appropriate |

| | • | Place, maintain and remove stop-transfer notations |

Shareholder Communications

| | • | Provide Fund-specific Shareholder contact number |

| | • | Provide IVR 24/7 (subject to system maintenance) |

| | • | Respond to Shareholder inquiries (written, e-mail and web) |

| | • | Record Shareholder calls |

| | • | Scan and image incoming correspondence from Shareholders |

Direct Registration System ("DRS")

| | • | Register, issue and transfer DRS book-entry Shares |

| | • | Issue DRS statements of holding |

| | • | Provide Shareholders with the ability to sell Shares in accordance with the terms and conditions, including applicable fees, of the DRS Sales Facility |

| | • | Process sales requests within the appropriate timeframe based on the type of service requested, in accordance with the terms of the DRS sales facility |

| | • | Coordinate the issuance, payment and reconcilement for any proceeds stemming from the use of the DRS sales facility, in accordance with the terms and conditions of the facility |

| | • | Coordinate the mailing of advices to Shareholders |

Page 2

| | • | Accept and cancel certificated Shares and credit such Shares into a DRS position |

Online Access

| | • | Provide availability to "Issuer Online," which provides access to Fund and Shareholder information administered by Agent, which permits data management including accessing standard reports such as Top 10 - 200 Shareholder lists, submitting real-time inquiries such as an issued capital query, and reporting by holding range |

| | • | Provide availability to "Investor Centre," which provides Shareholder Account information, transaction capabilities, downloadable forms and FAQs |

| | • | Provide on-demand reporting to allow Fund to generate non-standard reports at Transfer Agent's standard fee for such reports |

Dividend Services

| | • | Receive full funding on payable date by 11:00 a.m., Eastern Time via Federal Funds Wire, ACH or Demand Deposit Account debit |

| | • | Coordinate the mailing of dividends with an additional enclosure with each dividend check |

| | • | Prepare and file federal information returns (Form 1099) of dividends paid in a year |

| | • | Prepare and file state information returns of dividends paid in a year to Shareholders resident within such state |

| | • | Prepare and file annual withholding return (Form 1042) and payments to the government of income taxes withheld from non-resident aliens |

| | • | Coordinate the mailing of Form 1099 to Shareholders |

| | • | Coordinate the email notification to Shareholders of the online availability of Form 1099 |

| | • | Replace lost dividend checks |

| | • | Reconcile paid and outstanding checks |

| | • | Code "undeliverable" Accounts to suppress mailing dividend checks to same |

| | • | Keep records of accumulated uncashed dividends |

| | • | Withhold tax from Shareholder Accounts as required by United States government regulations Reconcile and report taxes withheld, including additional Form 1099 reporting requirements, to the Internal Revenue Service |

| | • | Mail to new Accounts who have had taxes withheld, to inform them of procedures to be followed to curtail subsequent back-up withholding |

| | • | Perform Shareholder file adjustments to reflect certification of Accounts |

| | • | If Fund is not tax resident in the United States, Fund shall advise Agent. Dividend withholding tax services are subject to additional fees. |

Automated Clearinghouse (ACH) Services

| | • | Review data for accuracy and completeness |

| | • | Mall cure letter to Shareholders with incomplete information |

| | • | Code Accounts for ACH and performing pre-note test |

| | • | Identify rejected ACH transmissions, mail dividend check and explanation letter to Shareholders with rejected transmissions |

| | • | Respond to Shareholder inquiries concerning the ACH Program |

| | • | Calculate on a quarterly basis the Share breakdown for ACH vs. other dividend payments and notifying the Fund of funding amount for ACH transmissions and other payable date funds |

| | • | Credit ACH designated bank accounts automatically on dividend payable date |

| | • | Maintenance of ACH participant file, including coding new ACH Accounts |

| | • | Process termination requests |

| | • | Keep adequate records including retention of ACH documents |

Investment Plan Services

| | • | Maintain Plan Accounts and establish new participant Accounts |

| | • | As requested, invest dividend monies purchases per the Plan document |

Page 3

| | • | Coordinate the distribution of statements and/or transaction advices to Plan participants when activity occurs |

| | • | Coordinate an email notification to requesting Plan participants of the online availability of their Plan statements |

| | • | Process automatic investments |

| | • | Process termination and withdrawal requests |

| | • | Provide Plan participants with the ability to sell Shares in accordance with the terms of the Plan |

| | • | Process sale requests within the appropriate timeframe based on the type of service requested and the stipulations of the Plan |

| | • | Coordinate the issuance, payment and reconcilement for any proceeds stemming from the use of the Plan sales facility, in accordance with the terms and conditions of the Plan |

| | • | Issue the proper tax forms and perform the required reporting to the IRS |

| | • | Accept and cancel certificated Shares and credit such Shares In book-entry form into the Plan |

| | • | Coordinate the mailing of Form 1099 to participants, including Plan participants and perform related filings with the IRS |

| | • | Supply summary reports for each reinvestment/investment to client if requested |

| | • | Coordinate the mailing of annual privacy notice to Plan participants, as required, at Fund's expense |

International Currency Exchange Services

| | • | Allow Shareholders to elect to receive sale proceeds, dividend payments and other payment types in foreign currencies (subject to certain geographic restrictions) by check or by electronic funds transfer in accordance with Agent's guidelines (fees paid by Shareholders) |

Annual Meeting Services (includes one annual meeting per year, per Fund, excludes annual meetings conducted through consent)

| | • | Provide a proxy record date list through Issuer Online's FileShare; includes Shareholder name, address and Share amount (additional fees assessed for paper requests or other file delivery mechanisms) |

| | • | Address proxy cards for all registered Shareholders |

| | • | Coordinate the mailing of the proxy package |

| | • | Receive, open and examine returned paper proxies |

| | • | Tabulate returned paper proxies |

| | • | Provide the company vote status via online web portal |

| | • | Attend Annual Meeting and provide one Inspector of Election for Annual Meeting (travel expenses billed as incurred) |

| | • | Prepare a final voted/unvoted list through online web portal |

| | • | Coordinate the return/destruction of excess materials |

Direct Filing of Unclaimed Property

| | • | Coordinate the mailing of due diligence notices to all qualifying Shareholder Accounts as defined by the state filing matrix |

| | • | Process returned due diligence notices and remitting property to Shareholders prior to escheatment |

| | • | Prepare and file required preliminary and final unclaimed property reports |

| | • | Prepare and file checks/wires for each state covering unclaimed funds as per state requirements |

| | • | Retain, as required by law or otherwise, records of property escheated to the states and responding, after appropriate research, to Shareholder Inquiries relating to same |

Lost Shareholder Search Services

| | • | Identify Accounts eligible for SEC Mandated Searches |

| | • | Perform electronic database searches in accordance with SEC requirements |

| | • | Update new addresses provided by search firm |

| | • | Send verification form to Shareholder to validate address |

| | • | Reissue unclaimed property held to Shareholders upon receipt of signed verification form |

Page 4

4. Additional Services

Services not specifically listed in Section 3 in this Schedule ("Additional Services") may be subject to additional fees as agreed by the parties. Additional Services include, but are not limited to: services associated with the payment of a stock dividend, a stock split, a corporate reorganization, mass issuance, or an unvested stock program; audit services; regulatory reports; services provided to a vendor of the Fund; services related to special meetings; virtual Shareholder meeting services; or any services associated with a special project.

Services required by legislation or regulatory fiat which become effective after the date of acceptance of this Schedule shall not be a part of the Services and may be subject to additional fees.

DWAC services provided to broker dealers are not included in the ongoing account management fee. DWAC fees are charged directly to broker dealers.

5. Billing Definition of Number of Accounts

For billing purposes, the number of Accounts will be based on open Accounts on file at the beginning of each billing period, plus any new Accounts added during that period. An open Account shall mean the Account of each Shareholder which Account shall hold any full or fractional Shares held by such Shareholder, outstanding funds, or reportable tax Information.

6. Out-of-Pocket Expenses

In addition to the fees above, the Fund agrees to reimburse the Agent for reasonable documented out-of-pocket expenses, including but not limited to postage, forms, envelopes, printing, enclosing, fulfillment, NCOA searches, telephone, taxes, records storage, exchange and broker fees. In addition, any other expenses incurred by the Transfer Agent at the request or with the consent of the Fund, will be reimbursed by the Fund.

Postage expenses in excess of $5,000 for Shareholder mailings must be received in full by 12:00 p.m. Eastern Time on the scheduled mailing date. Postage expenses less than $5,000 will be billed as incurred.

Fund will be responsible for overtime charges assessed in the event of a late delivery to the Agent of Fund material for mailings to Shareholders, unless the mail date is rescheduled. Such material includes, but is not limited to, proxy statements, quarterly and annual reports and news releases.

Page 5

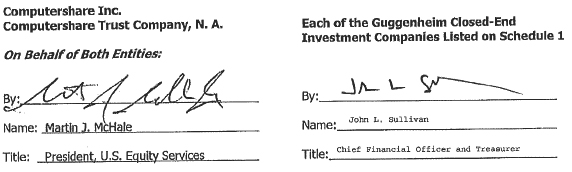

In WITNESS WHEREOF, each of the parties hereto has caused this Schedule to be executed by one of its officers thereunto duly authorized, all as of the effective date hereof.

[SIGNATURE PAGE TO FEE AND SERVICE SCHEDULE FOR STOCK TRANSFER SERVICES]

Page 6