Section 19(a) Notices

Guggenheim Enhanced Equity Income Fund’s (the “Fund”) reported amounts and sources of distributions are estimates and are not being provided for tax reporting purposes. The actual amounts and sources for tax reporting purposes will depend upon the Fund’s investment experience during the year and may be subject to changes based on the tax regulations. The Fund will provide a Form 1099-DIV each calendar year that will explain the character of these dividends and distributions for federal income tax purposes.

| | | | | | | | | | |

June 30, 2020

|

| Total Cumulative Distribution | % Breakdown of the Total Cumulative |

| For the Fiscal Year | Distributions for the Fiscal Year |

| | Net | Net | | | | Net | Net | | |

| | Realized | Realized | | | | Realized | Realized | | |

| Net | Short-Term | Long-Term

| | Total per | Net | Short-Term | Long-Term

| | Total per |

| Investment | Capital | Capital | Return of | Common | Investment | Capital | Capital | Return of | Common |

| Income | Gains | Gains | Capital | Share | Income | Gains | Gains | Capital | Share |

| $0.0000 | $0.0000 | $0.0000 | $0.3600 | $0.3600 | 0.00% | 0.00% | 0.00% | 100.00% | 100.00% |

If the Fund has distributed more than its income and net realized capital gains, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of a shareholder’s investment in a Fund is returned to the shareholder. A return of capital distribution does not necessarily reflect a Fund’s investment performance and should not be confused with “yield” or “income.”

Section 19(a) notices for the Fund are available on the Fund’s website at guggenheiminvestments.com/gpm.

Section 19(b) Disclosure

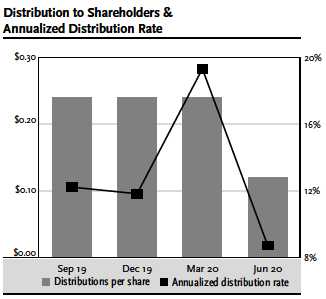

The Fund, acting pursuant to a Securities and Exchange Commission (“SEC”) exemptive order and with the approval of the Fund’s Board of Trustees (the “Board”), has adopted a plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plan, the Fund currently distributes a fixed amount per share, $0.1200, on a quarterly basis.

The fixed amounts distributed per share are subject to change at the discretion of the Fund’s Board. Under its Plan, the Fund will distribute all available investment income to its shareholders, consistent with its primary investment objectives and as required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient investment income is not available on a quarterly basis, the Fund will distribute capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each quarterly distribution to shareholders is expected to be at the fixed amount established by the Board, except for extraordinary distributions and potential distribution rate increases or decreases to enable the Fund to comply with the distribution requirements imposed by the Code.

Shareholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions or from the terms of the Plan. The Fund’s total return performance on net asset value is presented in its financial highlights table.

The Board may amend, suspend or terminate the Fund’s Plan without prior notice if it deems such actions to be in the best interests of the Fund or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Fund’s stock is trading at or above net asset value) or widening an existing trading discount. The Fund is subject to risks that could have an adverse impact on its ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, decreased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code. Please refer to the Fund’s prospectus and its website, guggenheiminvestments.com/gpm for a more complete description of its risks.

GUGGENHEIMINVESTMENTS.COM/GPM

...YOUR LINK TO THE LATEST, MOST UP-TO-DATE INFORMATION ABOUT GUGGENHEIM ENHANCED EQUITY INCOME FUND

The shareholder report you are reading right now is just the beginning of the story.

Online at guggenheiminvestments.com/gpm, you will find:

| • | Daily, weekly and monthly data on share prices, distributions and more |

| • | Portfolio overviews and performance analyses |

| • | Announcements, press releases and special notices |

| • | Fund and adviser contact information |

Guggenheim Partners Investment Management, LLC and Guggenheim Funds Investment Advisors, LLC are constantly updating and expanding shareholder information services on the Fund’s website in an ongoing effort to provide you with the most current information about how your Fund’s assets are managed and the results of our efforts. It is just one more small way we are working to keep you better informed about your investment in the Fund.

| | |

| (Unaudited) | June 30, 2020 |

DEAR SHAREHOLDER:

We thank you for your investment in the Guggenheim Enhanced Equity Income Fund (the “Fund”). This report covers the Fund’s performance for the six-month period ended June 30, 2020. The period was marked by the emergence and spread of a novel and highly contagious form of coronavirus, producing a pandemic that caused a steeper plunge in output and employment in two months than during the first two years of the Great Depression.

A recovery began in May 2020 as states began to reopen, but the subsequent rise in infections showed the difficulty in managing an economic recovery amid a pandemic. We expect the recovery could continue at an uneven pace as households, businesses, and governments gradually learn how to adapt. However, we do not expect a full recovery will be possible until a vaccine has been developed, tested, approved, produced, and administered across the globe. This process may take until mid-2021, or possibly longer. Even after a vaccine is deployed, the recovery could be sluggish due to the long-term damage being done to the economy. The surge in joblessness is damaging household balance sheets, and precautionary saving will further hold back the recovery in consumption.

The impact of these events affected performance of the Fund for the period. To learn more about the Fund’s performance and investment strategy, we encourage you to read the Economic and Market Overview and the Questions & Answers sections of this report, which begin on page 7. You’ll find information on Guggenheim’s investment philosophy, views on the economy and market environment, and detailed information about the factors that impacted the Fund’s performance.

The Fund’s primary investment objective is to seek a high level of current income and gains with a secondary objective of long-term capital appreciation. Guggenheim Partners Investment Management LLC (“GPIM” or the “Sub-Adviser”) seeks to achieve the Fund’s investment objective by obtaining broadly diversified exposure to the equity markets and utilizing an option writing strategy developed by GPIM. The Fund may seek to obtain exposure to equity markets through investments in individual equity securities, through investments in exchange-traded funds (“ETFs”) or other investment funds that track equity market indices, and/or through derivative instruments that replicate the economic characteristics of exposure to equity securities or markets.

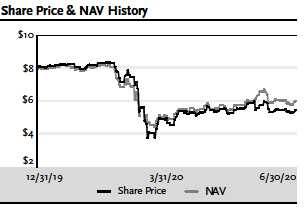

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six-month period ended June 30, 2020, the Fund provided a total return based on market price of -27.66% and a total return net of fees based on NAV of -19.69%. As of June 30, 2020, the Fund’s closing market price of $5.43 per share represented a discount of 9.50% to its NAV of $6.00 per share.

Past performance is not a guarantee of future results. All NAV returns include the deduction of management fees, operating expenses, and all other Fund expenses. The market price of the Fund’s shares fluctuates from time to time, and may be higher or lower than the Fund’s NAV.

GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 5

| | |

| (Unaudited) continued | June 30, 2020 |

The Fund paid a distribution in each quarter of the period. On March 31, 2020, the distribution was $0.24 per share. On June 30, 2020, the distribution was reduced to $0.12 per share. The most recent distribution represents an annualized distribution rate of 8.00% based on the Fund’s NAV of $6.00 per share as of June 30, 2020. There is no guarantee of any future distribution or that the current returns and distribution rate will be maintained. The Fund’s distribution rate is not constant and the amount of distributions, when declared by the Fund’s Board of Trustees, is subject to change based on the performance of the Fund. Please see Note 2(d) on page 44 for more information on distributions for the period.

Guggenheim Funds Investment Advisors, LLC (“GFIA” or the “Adviser”) serves as the investment adviser to the Fund. GPIM serves as the Fund’s Sub-Adviser and is responsible for the management of the Fund’s portfolio of investments. Both the Adviser and the Sub-Adviser are affiliates of Guggenheim Partners, LLC (“Guggenheim”), a global diversified financial services firm.

We encourage shareholders to consider the opportunity to reinvest their distributions from the Fund through the Dividend Reinvestment Plan (“DRIP”), which is described in detail on page 67 of this report. When shares trade at a discount to NAV, the DRIP takes advantage of the discount by reinvesting the monthly distribution in common shares of the Fund purchased in the market at a price less than NAV. Conversely, when the market price of the Fund’s common shares is at a premium above NAV, the DRIP reinvests participants’ distributions in newly-issued common shares at the greater of NAV per share or 95% of the market price per share. The DRIP provides a cost-effective means to accumulate additional shares and enjoy the benefits of compounding returns over time. Since the Fund endeavors to maintain a stable monthly distribution, the DRIP effectively provides an income averaging technique, which causes shareholders to accumulate a larger number of Fund shares when the market price is depressed than when the price is higher.

We appreciate your investment and look forward to serving your investment needs in the future. For the most up-to-date information on your investment, please visit the Fund’s website at guggenheiminvestments.com/gpm.

Sincerely,

Guggenheim Funds Investment Advisors, LLC

Guggenheim Enhanced Equity Income Fund

July 31, 2020

6 l GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

| | |

| ECONOMIC AND MARKET OVERVIEW (Unaudited) | June 30, 2020 |

The six-month period ended June 30, 2020, was an unprecedented time for markets. It was marked by extreme volatility, resulting from the COVID-19 pandemic, tempered by a swift and aggressive monetary policy response by the U.S. Federal Reserve (the “Fed”) and sweeping fiscal support that cushioned downside risk for the economy and especially for markets.

The mere announcement of the Fed’s Primary and Secondary Market Corporate Credit Facilities on March 23, 2020 and June 15, 2020, respectively, caused credit spreads, which had blown out dramatically, to stabilize and then tighten as the market interpreted the move as a backstop against defaults, with most credits trading in their 80th percentile since. With credit markets shored up, equity markets have regained almost all of their lost ground. The Standard & Poor’s 500® (“S&P 500®”) Index, which began the year at 3,230, peaked at 3,386 on February 19, 2020 before plummeting to 2,237 on March 23, 2020, the day of the Fed’s first announced facility. By June 30, 2020, the index had recovered to 3,100. The total return of the S&P 500 Index for the six-months ended June 30, 2020 was -3.08%.

The U.S. budget deficit is approaching 25% of Gross Domestic Product (“GDP”), the highest since World War II, and the Fed has promised to use all available tools, including powerful new emergency credit market facilities, to support the recovery. But even this policy response cannot force consumers to spend, or businesses to invest, amid staggering uncertainty. Moreover, future rounds of fiscal stimulus may be needed to avoid a series of fiscal cliffs as temporary measures expire. Future stimulus could also be more politically contentious, especially with the November election approaching, social unrest increasing and markets cheering sequential improvement in the economic data. And as the events of the global financial crisis and the ensuing European debt crisis illustrated, the persistence of macro stress means the risk of a systemic credit event is elevated. As fragility builds, we are watching developments in emerging markets particularly closely as a potential catalyst for a broader, systemic shock.

Meanwhile, joblessness has surged, with the fall in U.S. employment in April 2020 alone representing a 40 standard deviation shock, erasing jobs gained during the preceding 21 years. Rehiring activity turned the labor market tide in May and June 2020, but as personal, small business and corporate bankruptcies mount, permanent damage is being done to the productive capacity of the economy, which may stunt a recovery.

Overshadowing everything is the COVID-19 pandemic, which caused a steeper plunge in U.S. output and employment in two months (in both cases roughly 16% un-annualized) than during the first two years of the Great Depression. Real GDP leads core inflation by about 18 months, suggesting that inflation may also fall sharply in coming quarters. Reopening measures have supported a strong uptick in economic activity since April, but we do not expect a genuine recovery will be possible until a vaccine has been developed, tested, approved, produced and administered across the globe. In the meantime, keeping the infection rate in check will require social distancing measures that stymie economic activity. Indeed, the premature easing of lockdowns and a lax adherence to social distancing guidelines are resulting in a resurgence of new infections in the United States, reflecting the combination of millions of cases and limited testing and tracing capabilities. Recent trends do not bode well for the fall, when the start of the school year could boost social interactions and the return of flu season might strain healthcare capacity.

GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 7

| | |

| ECONOMIC AND MARKET OVERVIEW (Unaudited) continued | June 30, 2020 |

For the six months ended June 30, 2020, the S&P 500® Index* returned -3.08%. The MSCI Europe-Australasia-Far East (“EAFE”) Index* returned -11.34%. The return of the MSCI Emerging Markets Index* was -9.78%.

In the bond market, the Bloomberg Barclays U.S. Aggregate Bond Index* posted a 6.14% return for the period, while the Bloomberg Barclays U.S. Corporate High Yield Index* returned -3.80%. The return of the ICE Bank of America (“BofA”) Merrill Lynch 3-Month U.S. Treasury Bill Index* was 0.60% for the six-month period.

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

8 l GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) | June 30, 2020 |

The Guggenheim Enhanced Equity Income Fund (the “Fund” or “GPM”) is managed by a team of seasoned professionals at Guggenheim Partners Investment Management, LLC (“GPIM” or the “Sub-Adviser”). This team includes Farhan Sharaff, Assistant Chief Investment Officer, Equities; Qi Yan, Managing Director and Portfolio Manager; and Daniel Cheeseman, Director and Portfolio Manager. In the following interview, the investment team discusses the market environment and the Fund’s performance for the six-month period ended June 30, 2020.

Please describe the Fund’s investment objective and explain how GPIM’s investment strategy seeks to achieve it.

The Fund’s primary investment objective is to seek a high level of current income and gains with a secondary objective of long-term capital appreciation. Under normal market conditions, the Fund invests at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in equity securities. GPIM seeks to achieve the Fund’s investment objective by obtaining broadly diversified exposure to the equity markets and utilizing an option-writing strategy developed by GPIM (the “portable alpha model”). The Fund may seek to obtain exposure to equity markets through investments in individual equity securities, through investments in exchange-traded funds (“ETFs”) or other investment funds that track equity market indices, and/or through derivative instruments that replicate the economic characteristics of exposure to equity securities or markets.

The Fund utilizes leverage to seek to deliver excess returns from the portable alpha model while maintaining a risk profile similar to the large cap U.S. equity market, presenting the potential benefit of greater income and a focus on capital appreciation. Although the use of financial leverage by the Fund may create an opportunity for increased return for the Fund’s common shares, it may also result in additional risks and may magnify the effect of any losses. There can be no assurance that a leveraging strategy will be successful during any period during which it is employed.

Can you describe the options strategy in more detail?

The Fund has the ability to write call options on the ETFs or on indices that the ETFs may track, which will typically be at- or out-of-the-money. GPIM’s strategy typically targets one-month options, although options of any strike price or maturity may be used. The Fund may, but does not have to, write options on 100% of the equity holdings in its portfolio. The typical hedge ratio (i.e., the percentage of the Fund’s equity holdings on which options are written) for the Fund is 67%, which is designed to produce a portfolio that, inclusive of leverage, has a beta of one to broad market indices. The hedge ratio, however, may be adjusted depending on the investment team’s view of the market and GPIM’s macroeconomic views. Changing the hedge ratio will impact the beta (represents the systematic risk of a portfolio and measures its sensitivity to a benchmark) of the portfolio resulting in a portfolio that has either higher or lower risk-adjusted exposure to broad market equities.

GPIM may engage in selling call options on indices, which could include securities that are not specifically held by the Fund. An option on an index is considered covered if the Fund also holds shares

GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 9

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | June 30, 2020 |

of a passively managed ETF that fully replicates the respective index and has a value at least equal to the notional value of the option written.

The Fund may also write call options on securities, including ETFs, that are not held by the Fund, or on indices other than the indices tracked by the ETFs held by the Fund. As such transactions would involve uncovered option writing, they may be subject to more risks compared to the Fund’s covered call option strategies involving writing options on securities, including ETFs, held by the Fund or indices tracked by the ETFs held by the Fund. When the Fund writes uncovered call options, it will earmark or segregate cash or liquid securities in accordance with applicable guidance provided by the staff of the U.S. Securities and Exchange Commission (“SEC”).

The Fund seeks to achieve its primary investment objective of seeking a high level of current income through premiums received from selling options and dividends paid on securities owned by the Fund. Although the Fund will receive premiums from the options written, by writing a covered call option, the Fund forgoes any potential increase in value of the underlying securities above the strike price specified in an option contract through the expiration date of the option.

How are managed assets allocated?

The Fund seeks to have ~67% of total assets (~100% of net assets) invested in the 500 individual stocks comprising the S&P 500 in equal weights (i.e., the S&P 500 Equal Weight Index) and ~33% of total assets (~50% of net assets) invested in a basket of broad index ETFs (S&P 500, Russell 2000, and NASDAQ-100). The hedge ratio remains ~67%, with options primarily written on indexes tracked by the ETFs in which the Fund invests.

The long equity exposure (100% of net assets) comes from an allocation to the stocks, equally weighted and rebalanced quarterly, in the S&P 500 Equal Weight Index (the “Equal Weight Index”). The exposure to the Equal Weight Index usually can be counted on to provide a higher level of beta than the capitalization weighted S&P 500 Index, as the Equal Weight Index has outperformed the market-capitalization weighted S&P 500 Index in most years since its introduction in 1990.

The other 50% of net assets is allocated in accordance with GPIM’s portable alpha model, which in this strategy currently consists of ETFs tracking the S&P 500, Russell 2000, and NASDAQ-100 Indices paired with options written for a notional amount of 100% of net assets against the S&P 500, Russell 2000, and NASDAQ-100 Indices. This portfolio will be actively rebalanced to maintain a constant net market exposure similar to the large cap U.S. equity market, which GPIM believes will allow the Fund to dynamically capture the volatility risk premium in both rising and falling equity markets.

How did the Fund perform for the six-month period ended June 30, 2020?

All Fund returns cited—whether based on net asset value (“NAV”) or market price—assume the reinvestment of all distributions. For the six-month period ended June 30, 2020, the Fund provided a total return based on market price of -27.66% and a total return net of fees based on NAV of -19.69%. As of June 30, 2020, the Fund’s closing market price of $5.43 per share represented a discount of 9.50% to

10 l GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | June 30, 2020 |

its NAV of $6.00 per share. As of December 31, 2019, the Fund’s closing market price of $8.06 per share represented a premium of 1.00% to its NAV of $7.98 per share.

Past performance is not a guarantee of future results. All NAV returns include the deduction of management fees, operating expenses, and all other Fund expenses. The market price of the Fund’s shares fluctuates from time to time, and may be higher or lower than the Fund’s NAV.

What were the Fund’s distributions during the period?

The Fund paid a distribution in each quarter of the period. On March 31, 2020, the distribution was $0.24 per share. On June 30, 2020, the distribution was reduced to $0.12 per share. The most recent distribution represents an annualized distribution rate of 8.00% based on the Fund’s NAV of $6.00 per share as of June 30, 2020. The Fund adopted a managed distribution policy effective with the June 30, 2017 distribution, under which the Fund will pay a quarterly distribution in a fixed amount until such amount is modified by the Fund’s Board of Trustees. If sufficient net investment income is not available, the distribution will be supplemented by capital gains and, to the extent necessary, return of capital. For the six-month period ended June 30, 2020, 100% of the distributions were estimated to be characterized as a return of capital. The Fund will provide a Form 1099-DIV each calendar year that will explain the character of these distributions for federal income tax purposes.

There is no guarantee of any future distribution or that the current returns and distribution rate will be maintained. The Fund’s distribution rate is not constant and the amount of distributions, when declared by the Fund’s Board of Trustees, is subject to change based on the performance of the Fund. Please see Note 2(d) on page 44 for more information on distributions for the period.

How did other markets perform in this environment for the six-month period ended June 30, 2020?

| | |

| Index | Total Return |

Chicago Board Options Exchange Volatility Index (“VIX”) | 144.03% |

Dow Jones Industrial Average | -8.43% |

NASDAQ-100 Index | 16.89% |

Russell 2000 Index | -12.98% |

S&P 500 Equal Weight Index | -10.77% |

S&P 500 Index | -3.08% |

Discuss market volatility over the period.

The difficult market conditions created by the pandemic drove the VIX during the period to its highest level since the Great Recession of 2008. With the VIX gauging the richness of S&P 500 at-the-money puts and calls, the higher the VIX, the more expensive options are on it, which typically reflects uncertainty and fear of future extreme price movement. From a February 2020 low of 15, it shot up to 85 in five weeks, then fell almost as quickly once the Fed and U.S. Treasury introduced their credit market support facilities. It slumped to 24 in mid-June before finding support from the 200-day moving average,

GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 11

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | June 30, 2020 |

rebounded in a matter of days back up to 44, sailing through the 50-day moving average, then retreated again. The Index traded in a fairly tight range just above 25 through the rest of the period. While that level is well below the readings registered in March, it still ranks among the top 10% of historical readings, according to Evercore ISI, implying daily moves of about 1.7%.

The moves in the VIX reflected the continued uncertainty about the recovery of both the economy and the stock market. After a recent peak on June 8, 2020, the S&P 500 was caught in a choppy sideways trading pattern as investors tried to gauge what a reopened economy looks like versus what had already been priced into the markets following the strong gains off the March 23, 2020 lows. Making this task more difficult was the recent uptick in coronavirus cases in the Sun Belt region, which resulted in the reclosing of bars and restaurants in some states and led to other states reviewing their re-opening plans and issuing new restrictions on businesses and public gatherings. The latter efforts were starting to reignite worries that a prolonged shut down could lead to a stalling of the economic recovery. But the development of vaccines and COVID-19 treatments may also help determine major near term moves in the S&P 500 and the VIX.

The positive rate of change in economic data over the past few months has been impressive; Guggenheim notes that that is at least partly a reflection of a very low starting point (i.e., navigating through the easy part of the recovery). In the months ahead, investors are likely to focus less on the direction of the data and more on the level. While there has been a sharp snapback in many economic indicators, they generally remain well below their pre-COVID levels.

What most influenced the Fund’s performance?

During the period, the return on the underlying portfolio holdings detracted most from performance, even with an S&P 500 Index return that held up despite the volatility in the quarter. The Fund was helped from the allocation to ETFs that track NASDAQ-100 Index, which notably outperformed all other major indices. The Fund’s long equity exposure is tied to the Equal Weight Index, which underperformed the market cap-weighted S&P 500 Index.

The Fund’s derivative use, consisting mostly of options sold to generate income and gains, also detracted from return. Before the spell of heightened volatility in March, the VIX traded near historic lows, with realized volatility even lower, as the S&P 500 continued its upward climb. Conditions moderated after the March highs, but it remained challenging to capture the implied-realized volatility spread.

The Fund typically does better in a sustained volatility environment rather than in a sharp market move, such as that in March.

Can you discuss the Fund’s approach to leverage?

Leverage was a detractor to return during the period, as the Fund’s total return was below that of the cost of leverage. Leverage at the end of the period was about 31% of the Fund’s total managed assets.

12 l GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | June 30, 2020 |

There is no guarantee that the Fund’s leverage strategy will be successful, and the Fund’s use of leverage may cause the Fund’s NAV and market price of common shares to be more volatile. Please see Note 7 on page 50 for more information on the Fund’s credit facility agreement.

Our approach to leverage is dynamic, and we tend to have a higher level of leverage when we are more constructive on equity market returns in accordance with our macroeconomic outlook and when we believe volatility is most attractive. As for our macroeconomic outlook: Even though new COVID cases have (re)taken center stage, economic data in recent weeks continues to show a rapid recovery, providing further evidence that the recession that started in February 2020 may have already run its course. The June 2020 payroll report showed the economy adding 4.8 million jobs during the month and the unemployment rate dropping to 11.1% (from 13.3%). In addition, the Institute for Supply Management reported that both manufacturing and services-oriented businesses have rebounded sharply and returned to expansionary levels. At the end of the day, the amount of stimulus being pumped into the economy could continue to act as a safety net under the market.

Index Definitions

Indices are unmanaged, reflect no expenses and it is not possible to invest directly in an index.

CBOE (Chicago Board Options Exchange) Volatility Index, often referred to as the VIX (its ticker symbol), the fear index or the fear gauge, is a measure of the implied volatility of S&P 500 Index options. It represents a measure of the market’s expectation of stock market volatility over the next 30-day period. Quoted in percentage points, the VIX represents the expected daily movement in the S&P 500 Index over the next 30-day period, which is then annualized.

Dow Jones Industrial Average® is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq.

NASDAQ-100® Index includes 100 of the largest domestic and international non-financial securities listed on the Nasdaq Stock Market based on market capitalization. The index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. It does not contain securities of financial companies including investment companies.

Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe.

S&P 500® Equal Weight Index has the same constituents as the S&P 500, but each company is assigned a fixed equal weight.

S&P 500® is an unmanaged, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 13

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | June 30, 2020 |

Risks and Other Considerations

The global ongoing crisis caused by the outbreak of COVID-19 is causing materially reduced consumer demand and economic output, disrupting supply chains, resulting in market closures, travel restrictions and quarantines, and adversely impacting local and global economies. Investors should be aware that in light of the current uncertainty, volatility and distress in economies, financial markets, and labor and health conditions all over the world, the Fund’s investments and a shareholder’s investment in the Fund are subject to sudden and substantial losses, increased volatility and other adverse events. Firms through which investors invest with the Fund, the Fund, its service providers, the markets in which it invests and market intermediaries are also impacted by quarantines and similar measures intended to contain the ongoing pandemic, which can obstruct their functioning and subject them to heightened operational risks.

The views expressed in this report reflect those of the portfolio managers only through the report period as stated on the cover. These views are subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any kind. The material may also include forward looking statements that involve risk and uncertainty, and there is no guarantee that any predictions will come to pass.

There can be no assurance that the Fund will achieve its investment objectives. The value of the Fund will fluctuate with the value of the underlying securities. Risk is inherent in all investing, including the loss of your entire principal. Therefore, before investing you should consider the risks carefully.

The Fund is subject to several risk factors. Certain of these risk factors are described below. Please see the Fund’s Prospectus, Statement of Additional Information (SAI) and guggenheiminvestments.com/gpm for a more detailed description of the risks of investing in the Fund. Shareholders may access the Fund’s Prospectus and SAI on the EDGAR Database on the Securities and Exchange Commission’s website at www.sec.gov.

Investors should be aware that in light of the current uncertainty, volatility and distress in economies, financial markets, and labor and health conditions around the world, the risks below are heightened significantly compared to normal conditions and therefore subject the Fund’s investments and a shareholder’s investment in the Fund to sudden and substantial losses. The fact that a particular risk below is not specifically identified as being heightened under current conditions does not mean that the risk is not greater than under normal conditions.

Covered Call Option Strategy Risk. The ability of the Fund to achieve its investment objective is partially dependent on the successful implementation of its covered call option strategy. The Fund may write call options on individual securities. The buyer of an option acquires the right to buy (a call option) or sell (a put option) a certain quantity of a security (the underlying security) or instrument, at a certain price up to a specified point in time or on expiration, depending on the terms. The seller or writer of an option is obligated to sell (a call option) or buy (a put option) the underlying instrument. A call option is “covered” if the Fund owns the security underlying the call or has an absolute right to acquire the security without additional cash consideration (or, if additional cash consideration is required, cash or cash equivalents in such amount are segregated by the Fund’s custodian). As a seller of covered call

14 l GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | June 30, 2020 |

options, the Fund faces the risk that it will forgo the opportunity to profit from increases in the market value of the security covering the call option during an option’s life. As the Fund writes covered calls over more of its portfolio, its ability to benefit from capital appreciation becomes more limited.

Derivatives Transactions Risk. The Fund may utilize derivatives, including forwards, swaps, futures contracts and other strategic transactions, to seek to earn income, facilitate portfolio management and mitigate risks. Participation in derivatives markets transactions involves investment risks and transaction costs to which the Fund would not be subject absent the use of these strategies (other than its covered call writing strategy and put option writing strategy). If the Sub-Adviser or GPIM is incorrect about its expectations of market conditions, the use of derivatives could also result in a loss, which in some cases may be unlimited.

Forwards Risk. The Fund may enter into forward contracts. A forward contract is an over-the-counter derivative transaction between two parties to buy or sell a specified amount of an underlying reference at a specified price (or rate) on a specified date in the future. Forward contracts are negotiated on an individual basis and are not standardized or traded on exchanges. Forwards used for hedging or to increase income or investment gains may not be successful, resulting in losses to the Fund, and the cost of such strategies may reduce the Fund’s returns. Forwards are subject to the risks associated with derivatives.

Swap Risk. The Fund may enter into swap transactions, including credit default swaps, total return swaps, index swaps, currency swaps, commodity swaps and interest rate swaps, as well as options thereon, and may purchase or sell interest rate caps, floors and collars. Swap transactions are subject to market risk, risk of default by the other party to the transaction and risk of imperfect correlation between the value of derivative instruments and the underlying assets and may involve commissions or other costs. Swaps generally do not involve the delivery of securities, other underlying assets or principal. Accordingly, the risk of loss with respect to swaps generally is limited to the net amount of payments that the Fund is contractually obligated to make, or in the case of the other party to a swap defaulting, the net amount of payments that the Fund is contractually entitled to receive. Total return swaps may effectively add leverage to the Fund’s portfolio because the Fund would be subject to investment exposure on the full notional amount of the swap. Total return swaps are subject to the risk that a counterparty will default on its payment obligations to the Fund thereunder.

Futures Risk. The Fund may invest in futures contracts. Futures and options on futures entail certain risks, including but not limited to the following:

| • | no assurance that futures contracts or options on futures can be offset at favorable prices; |

| • | possible reduction of the return of the Fund due to their use for hedging; |

| • | possible reduction in value of both the securities hedged and the hedging instrument; |

| • | possible lack of liquidity due to daily limits on price fluctuations; |

| • | imperfect correlation between the contracts and the securities being hedged; and |

GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 15

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | June 30, 2020 |

| • | losses from investing in futures transactions that are potentially unlimited and the segregation requirements for such transactions. |

Synthetic Investment Risk. As an alternative to holding investments directly, the Fund may also obtain investment exposure to income securities and common equity securities through the use of customized derivative instruments (including swaps, options, forwards or other financial instruments) to replicate, modify or replace the economic attributes associated with an investment in income securities and common equity securities. The Fund may be exposed to certain additional risks to the extent the Sub-Adviser uses derivatives as a means to synthetically implement the Fund’s investment strategies. If the Fund enters into a derivative instrument whereby it agrees to receive the return of a security or financial instrument or a basket of securities or financial instruments, it will typically contract to receive such returns for a predetermined period of time. During such period, the Fund may not have the ability to increase or decrease its exposure. In addition, such customized derivative instruments will likely be highly illiquid, and it is possible that the Fund will not be able to terminate such derivative instruments prior to their expiration date or that the penalties associated with such a termination might impact the Fund’s performance in a material adverse manner. Furthermore, derivative instruments typically contain provisions giving the counterparty the right to terminate the contract upon the occurrence of certain events. Such events may include a decline in the value of the reference securities and material violations of the terms of the contract or the portfolio guidelines as well as other events determined by the counterparty. If a termination were to occur, the Fund’s return could be adversely affected as it would lose the benefit of the indirect exposure to the reference securities and it may incur significant termination expenses.

Equity Securities Risk. Equity securities include common stocks and other equity and equity-related securities (and securities convertible into stocks) such as limited liability company interests and trust certificates. The prices of equity securities generally fluctuate in value more than fixed-income investments, may rise or fall rapidly or unpredictably and may reflect real or perceived changes in the issuing company’s financial condition and changes in the overall market or economy. Equity securities are currently experiencing heightened volatility and therefore, the Fund’s investments in equity securities are subject to heightened risks related to volatility. A decline in the value of equity securities held by the Fund will adversely affect the value of your investment in the Fund.

Investment Funds Risk/Other Investment Companies Risk. As an alternative to holding investments directly, the Fund may invest in securities of other open- or closed-end investment companies, including exchange-traded funds. Investments in investment funds present certain special considerations and risks not present in making direct investments in credit securities and common equity securities. Investments in other investment companies involve operating expenses and fees that are in addition to the expenses and fees borne by the Fund. Such expenses and fees attributable to the Fund’s investments in other investment companies are borne indirectly by common shareholders. The Fund and its shareholders will incur its pro rata share of the expenses of the underlying investment companies or vehicles in which the Fund invests, such as investment advisory and other management expenses operating expense. To the extent management fees of other investment companies are based on total gross assets, it may create an incentive for such entities’ managers to employ financial leverage, thereby

16 l GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | June 30, 2020 |

adding additional expense and increasing volatility and risk. Investments in other investment companies also expose the Fund to additional management risk; the success of the Fund’s investments in other investment companies will depend in large part on the investment skills and implementation abilities of the advisers or managers of such entities. Decisions made by the advisers or managers of such entities may cause the Fund to incur losses or to miss profit opportunities.

Leverage Risk. The Fund’s use of leverage, through borrowings or instruments such as derivatives, causes the Fund to be more volatile and riskier than if it had not been leveraged. Although the use of leverage by the Fund may create an opportunity for increased return, it also results in additional risks and can magnify the effect of any losses. The effect of leverage in a declining market is likely to cause a greater decline in the net asset value of the Fund than if the Fund were not leveraged, which may result in a greater decline in the market price of the Fund shares. There can be no assurance that a leveraging strategy will be implemented or that it will be successful during any period during which it is employed. Recent economic and market events have contributed to severe market volatility and caused severe liquidity strains in the credit markets. If dislocations in the credit markets continue, the Fund’s leverage costs may increase and there is a risk that the Fund may not be able to renew or replace existing leverage on favorable terms or at all. If the cost of leverage is no longer favorable, or if the Fund is otherwise required to reduce its leverage, the Fund may not be able to maintain distributions at historical levels and common shareholders will bear any costs associated with selling portfolio securities. The Fund’s total leverage may vary significantly over time. To the extent the Fund increases its amount of leverage outstanding, it will be more exposed to these risks.

Management Risk. The Fund is actively managed, which means that investment decisions are made based on investment views. There is no guarantee that the investment views will produce the desired results or expected returns, causing the Fund to fail to meet its investment objective or underperform its benchmark index or funds with similar investment objectives and strategies.

Market Risk. The value of, or income generated by, the investments held by the Fund are subject to the possibility of rapid and unpredictable fluctuation. The value of certain investments (e.g., equity securities) tends to fluctuate more dramatically over the shorter term than do the value of other asset classes. These movements may result from factors affecting individual companies, or from broader influences, including real or perceived changes in prevailing interest rates, changes in inflation or expectations about inflation, investor confidence or economic, political, social or financial market conditions, environmental disasters, governmental actions, public health emergencies (such as the spread of infectious diseases, pandemics and epidemics) and other similar events, each of which may be temporary or last for extended periods. For example, the crisis initially caused by the outbreak of COVID-19 is causing materially reduced consumer demand and economic output, disrupting supply chains, resulting in market closures, travel restrictions and quarantines, and adversely impacting local and global economies. As with other serious economic disruptions, governmental authorities and regulators are responding to this crisis with significant fiscal and monetary policy changes, which could further increase volatility in securities and other financial markets, reduce market liquidity, heighten

GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 17

| | |

| QUESTIONS & ANSWERS (Unaudited) continued | June 30, 2020 |

investor uncertainty and adversely affect the value of the Fund’s investments and the performance of the Fund. Administrative changes, policy reform and/or changes in law or governmental regulations can result in expropriation or nationalization of the investments of a company in which the Fund invests.

Mid-Cap And Small-Cap Company Risk. Investing in the securities of medium-sized or small market capitalizations (“mid-cap” and “small-cap” companies, respectively) presents some particular investment risks. Mid-cap and small-cap companies may have limited product lines and markets, as well as shorter operating histories, less experienced management and more limited financial resources than larger companies, and may be more vulnerable to adverse general market or economic developments. Securities of mid-cap and small-cap companies may be less liquid than those of larger companies, and may experience greater price fluctuations than larger companies. In addition, mid-cap or small-cap company securities may not be widely followed by investors, which may result in reduced demand.

In addition to the foregoing risks, investors should note that the Fund reserves the right to merge or reorganize with another fund, liquidate or convert into an open-end fund, in each case subject to applicable approvals by shareholders and the Fund’s Board of Trustees as required by law and the Fund’s governing documents.

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

18 l GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

| | |

| FUND SUMMARY (Unaudited) | June 30, 2020 |

| | |

| Fund Statistics | |

Share Price | $5.43 |

Net Asset Value | $6.00 |

Discount to NAV | -9.50% |

Net Assets ($000) | $290,284 |

AVERAGE ANNUAL TOTAL RETURNS1

FOR THE PERIOD ENDED JUNE 30, 2020

| | | | | | |

| Six Month | | | | |

| (non- | One | Three | Five | Ten |

| annualized) | Year | Year | Year | Year |

Guggenheim Enhanced | | | | | |

Equity Income Fund | | | | | |

| NAV | (19.69%) | (13.38%) | (0.10%) | 3.92% | 8.27% |

| Market | (27.66%) | (23.81%) | (1.88%) | 3.83% | 8.72% |

Performance data quoted represents past performance, which is no guarantee of future results and current performance may be lower or higher than the figures shown. All NAV returns include the deduction of management fees, operating expenses and all other Fund expenses. The deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares is not reflected in the total returns. For the most recent month-end performance figures, please visit guggenheiminvestments.com/gpm. The investment return and principal value of an investment will fluctuate with changes in market conditions and other factors so that an investor’s shares, when sold, may be worth more or less than their original cost.

1 | Performance prior to June 22, 2010, under the name Old Mutual/Claymore Long-Short Fund was achieved through an investment strategy of a long-short strategy and an opportunistic covered call writing strategy by the previous investment sub-adviser, Analytic Investors, LLC, and factors in the Fund’s fees and expenses.

|

| | | | |

| Portfolio Breakdown | | % of Net Assets | |

Common Stocks | | | |

| Consumer, Non-cyclical | | | 21.4 | % |

| Financial | | | 18.1 | % |

| Industrial | | | 13.9 | % |

| Consumer, Cyclical | | | 13.1 | % |

| Technology | | | 11.1 | % |

| Communications | | | 6.2 | % |

| Utilities | | | 5.4 | % |

| Other | | | 8.6 | % |

Rights | | | 0.0 | %* |

Exchange-Traded Funds | | | 45.0 | % |

Money Market Fund | | | 4.5 | % |

| Total Investments | | | 147.3 | % |

Options Written | | | -3.2 | % |

Other Assets & Liabilities, net | | | -44.1 | % |

| Net Assets | | | 100.0 | % |

GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 19

| | |

| FUND SUMMARY (Unaudited) concluded | June 30, 2020 |

Portfolio breakdown is subject to change daily. For more information, please visit guggenheiminvestments.com/gpm. The above summaries are provided for informational purposes only and should not be viewed as recommendations. Past performance does not guarantee future results. All or a portion of the above distributions may be characterized as a return of capital. For the year ended December 31, 2019, 100% of the distributions were characterized as return of capital. As of June 30, 2020, 100% of the distributions were estimated to be characterized as return of capital. The final determination of the tax character of the distributions paid by the Fund in 2020 will be reported to shareholders in 2021.

20 l GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) | June 30, 2020 |

| | | |

| Shares | Value |

COMMON STOCKS† – 97.8% | | |

| Consumer, Non-cyclical – 21.4% | | |

ResMed, Inc. | 3,528 | $ 677,376 |

Eli Lilly & Co.1 | 3,950 | 648,511 |

Hologic, Inc.*,1 | 11,306 | 644,442 |

West Pharmaceutical Services, Inc. | 2,824 | 641,528 |

Incyte Corp.*,1 | 6,158 | 640,247 |

PayPal Holdings, Inc.*,1 | 3,652 | 636,288 |

DexCom, Inc.* | 1,531 | 620,667 |

Align Technology, Inc.*,1 | 2,255 | 618,862 |

IDEXX Laboratories, Inc.*,1 | 1,872 | 618,060 |

Conagra Brands, Inc.1 | 17,494 | 615,264 |

Illumina, Inc.*,1 | 1,660 | 614,781 |

Amgen, Inc.1 | 2,602 | 613,708 |

IHS Markit Ltd. | 8,122 | 613,211 |

Vertex Pharmaceuticals, Inc.* | 2,111 | 612,844 |

McCormick & Company, Inc.1 | 3,405 | 610,891 |

Perrigo Company plc1 | 11,012 | 608,633 |

Clorox Co.1 | 2,764 | 606,339 |

Thermo Fisher Scientific, Inc. | 1,669 | 604,746 |

Varian Medical Systems, Inc.* | 4,918 | 602,553 |

AmerisourceBergen Corp. — Class A1 | 5,976 | 602,202 |

AbbVie, Inc.1 | 6,132 | 602,040 |

Regeneron Pharmaceuticals, Inc.* | 964 | 601,199 |

Quanta Services, Inc. | 15,303 | 600,337 |

Church & Dwight Company, Inc.1 | 7,758 | 599,693 |

Campbell Soup Co.1 | 12,045 | 597,793 |

Gilead Sciences, Inc.1 | 7,746 | 595,977 |

Danaher Corp.1 | 3,367 | 595,387 |

Kroger Co.1 | 17,576 | 594,948 |

Bristol-Myers Squibb Co.1 | 10,094 | 593,527 |

Verisk Analytics, Inc. — Class A1 | 3,485 | 593,147 |

Kimberly-Clark Corp.1 | 4,171 | 589,571 |

S&P Global, Inc. | 1,789 | 589,440 |

Kellogg Co.1 | 8,916 | 588,991 |

United Rentals, Inc.* | 3,951 | 588,857 |

Becton Dickinson and Co.1 | 2,456 | 587,647 |

McKesson Corp. | 3,824 | 586,678 |

Hormel Foods Corp.1 | 12,149 | 586,432 |

Procter & Gamble Co.1 | 4,904 | 586,371 |

UnitedHealth Group, Inc. | 1,988 | 586,361 |

Teleflex, Inc. | 1,609 | 585,644 |

Henry Schein, Inc.* | 10,012 | 584,601 |

Quest Diagnostics, Inc. | 5,126 | 584,159 |

See notes to financial statements.

GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 21

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | June 30, 2020 |

| | | |

| Shares | Value |

COMMON STOCKS† – 97.8% (continued) | | |

| Consumer, Non-cyclical – 21.4% (continued) | | |

Robert Half International, Inc. | 11,054 | $ 583,983 |

Moody’s Corp.1 | 2,124 | 583,526 |

Constellation Brands, Inc. — Class A1 | 3,330 | 582,584 |

Abbott Laboratories1 | 6,369 | 582,318 |

Alexion Pharmaceuticals, Inc.*,1 | 5,187 | 582,189 |

Centene Corp.*,1 | 9,154 | 581,737 |

Baxter International, Inc.1 | 6,752 | 581,347 |

PepsiCo, Inc. | 4,395 | 581,283 |

General Mills, Inc.1 | 9,426 | 581,113 |

Humana, Inc.1 | 1,497 | 580,462 |

Rollins, Inc.1 | 13,692 | 580,404 |

Equifax, Inc.1 | 3,375 | 580,095 |

Zoetis, Inc. | 4,229 | 579,542 |

IQVIA Holdings, Inc.* | 4,084 | 579,438 |

Gartner, Inc.*,1 | 4,775 | 579,351 |

Intuitive Surgical, Inc.*,1 | 1,015 | 578,377 |

Edwards Lifesciences Corp.* | 8,340 | 576,377 |

MarketAxess Holdings, Inc.1 | 1,150 | 576,058 |

Dentsply Sirona, Inc.1 | 13,070 | 575,864 |

Monster Beverage Corp.* | 8,301 | 575,425 |

Merck & Company, Inc. | 7,431 | 574,639 |

Automatic Data Processing, Inc.1 | 3,857 | 574,269 |

CVS Health Corp.1 | 8,838 | 574,205 |

Archer-Daniels-Midland Co.1 | 14,380 | 573,762 |

DaVita, Inc.*,1 | 7,246 | 573,448 |

STERIS plc | 3,735 | 573,098 |

JM Smucker Co. | 5,415 | 572,961 |

Mylan N.V.*,1 | 35,570 | 571,966 |

Mondelez International, Inc. — Class A | 11,177 | 571,480 |

Sysco Corp. | 10,449 | 571,142 |

Colgate-Palmolive Co.1 | 7,789 | 570,622 |

Bio-Rad Laboratories, Inc. — Class A* | 1,263 | 570,232 |

Avery Dennison Corp.1 | 4,995 | 569,879 |

Hershey Co.1 | 4,391 | 569,162 |

Altria Group, Inc.1 | 14,490 | 568,733 |

Kraft Heinz Co.1 | 17,830 | 568,599 |

Cintas Corp.1 | 2,130 | 567,347 |

ABIOMED, Inc.*,1 | 2,346 | 566,700 |

Philip Morris International, Inc. | 8,052 | 564,123 |

Boston Scientific Corp.*,1 | 16,039 | 563,129 |

Laboratory Corporation of America Holdings*,1 | 3,380 | 561,452 |

Anthem, Inc.1 | 2,134 | 561,199 |

See notes to financial statements.

22 l GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | June 30, 2020 |

| | | |

| Shares | Value |

COMMON STOCKS† – 97.8% (continued) | | |

| Consumer, Non-cyclical – 21.4% (continued) | | |

Johnson & Johnson1 | 3,989 | $ 560,973 |

Cigna Corp.1 | 2,984 | 559,948 |

Cardinal Health, Inc.1 | 10,720 | 559,477 |

Estee Lauder Companies, Inc. — Class A1 | 2,963 | 559,059 |

Lamb Weston Holdings, Inc. | 8,727 | 557,917 |

Medtronic plc1 | 6,083 | 557,811 |

Cooper Companies, Inc.1 | 1,966 | 557,636 |

Nielsen Holdings plc1 | 37,500 | 557,250 |

Coca-Cola Co.1 | 12,434 | 555,551 |

Brown-Forman Corp. — Class B1 | 8,689 | 553,142 |

Corteva, Inc.1 | 20,588 | 551,553 |

Universal Health Services, Inc. — Class B | 5,932 | 551,023 |

FleetCor Technologies, Inc.*,1 | 2,189 | 550,599 |

Pfizer, Inc.1 | 16,800 | 549,360 |

HCA Healthcare, Inc.1 | 5,639 | 547,321 |

Tyson Foods, Inc. — Class A | 9,116 | 544,316 |

Stryker Corp. | 3,019 | 543,994 |

Biogen, Inc.*,1 | 2,030 | 543,126 |

Zimmer Biomet Holdings, Inc.1 | 4,529 | 540,581 |

Global Payments, Inc.1 | 3,175 | 538,543 |

Coty, Inc. — Class A1 | 116,425 | 520,420 |

Molson Coors Beverage Co. — Class B | 14,901 | 511,998 |

H&R Block, Inc.1 | 31,729 | 453,090 |

| Total Consumer, Non-cyclical | | 62,128,261 |

| Financial – 18.1% | | |

Aon plc — Class A1 | 3,116 | 600,142 |

Willis Towers Watson plc1 | 3,036 | 597,940 |

Cincinnati Financial Corp.1 | 9,290 | 594,839 |

Progressive Corp. | 7,402 | 592,974 |

Digital Realty Trust, Inc. REIT1 | 4,169 | 592,457 |

Morgan Stanley | 12,251 | 591,723 |

Invesco Ltd.1 | 54,835 | 590,025 |

Loews Corp.1 | 17,171 | 588,794 |

Equinix, Inc. REIT1 | 838 | 588,527 |

Nasdaq, Inc. | 4,924 | 588,270 |

SVB Financial Group* | 2,719 | 586,026 |

BlackRock, Inc. — Class A1 | 1,076 | 585,441 |

Weyerhaeuser Co. REIT�� | 26,056 | 585,218 |

Marsh & McLennan Companies, Inc.1 | 5,434 | 583,448 |

Ameriprise Financial, Inc.1 | 3,866 | 580,055 |

Arthur J Gallagher & Co.1 | 5,948 | 579,870 |

See notes to financial statements.

GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 23

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | June 30, 2020 |

| | | |

| Shares | Value |

COMMON STOCKS† – 97.8% (continued) | | |

| Financial – 18.1% (continued) | | |

T. Rowe Price Group, Inc. | 4,688 | $ 578,968 |

Alexandria Real Estate Equities, Inc. REIT1 | 3,560 | 577,610 |

Crown Castle International Corp. REIT1 | 3,449 | 577,190 |

Allstate Corp.1 | 5,925 | 574,666 |

Chubb Ltd.1 | 4,511 | 571,183 |

State Street Corp. | 8,983 | 570,870 |

Travelers Companies, Inc. | 5,003 | 570,592 |

Bank of New York Mellon Corp.1 | 14,750 | 570,087 |

W R Berkley Corp. | 9,944 | 569,692 |

Visa, Inc. — Class A | 2,949 | 569,658 |

Healthpeak Properties, Inc. REIT1 | 20,633 | 568,645 |

SBA Communications Corp. REIT | 1,907 | 568,133 |

American Tower Corp. — Class A REIT1 | 2,197 | 568,012 |

Duke Realty Corp. REIT | 16,039 | 567,620 |

First Republic Bank | 5,314 | 563,231 |

Mastercard, Inc. — Class A | 1,904 | 563,013 |

Principal Financial Group, Inc. | 13,538 | 562,368 |

Prologis, Inc. REIT | 6,002 | 560,167 |

Berkshire Hathaway, Inc. — Class B*,1 | 3,129 | 558,558 |

Realty Income Corp. REIT1 | 9,383 | 558,288 |

Aflac, Inc.1 | 15,475 | 557,564 |

Intercontinental Exchange, Inc.1 | 6,080 | 556,928 |

U.S. Bancorp | 15,116 | 556,571 |

Goldman Sachs Group, Inc.1 | 2,810 | 555,312 |

Globe Life, Inc. | 7,470 | 554,498 |

Citigroup, Inc.1 | 10,851 | 554,486 |

Citizens Financial Group, Inc. | 21,959 | 554,245 |

Public Storage REIT | 2,886 | 553,795 |

MetLife, Inc. | 15,140 | 552,913 |

Zions Bancorp North America1 | 16,255 | 552,670 |

Comerica, Inc.1 | 14,486 | 551,917 |

Unum Group | 33,196 | 550,722 |

Assurant, Inc.1 | 5,297 | 547,127 |

Prudential Financial, Inc. | 8,977 | 546,699 |

Hartford Financial Services Group, Inc.1 | 14,164 | 546,022 |

Mid-America Apartment Communities, Inc. REIT | 4,761 | 545,944 |

Franklin Resources, Inc.1 | 26,021 | 545,660 |

Raymond James Financial, Inc. | 7,919 | 545,065 |

Western Union Co. | 25,177 | 544,327 |

Everest Re Group Ltd. | 2,638 | 543,956 |

Bank of America Corp.1 | 22,881 | 543,424 |

Regency Centers Corp. REIT | 11,839 | 543,292 |

See notes to financial statements.

24 l GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | June 30, 2020 |

| | | |

| Shares | Value |

COMMON STOCKS† – 97.8% (continued) | | |

| Financial – 18.1% (continued) | | |

UDR, Inc. REIT | 14,505 | $ 542,197 |

Extra Space Storage, Inc. REIT1 | 5,863 | 541,565 |

Apartment Investment & Management Co. — Class A REIT1 | 14,380 | 541,263 |

M&T Bank Corp.1 | 5,204 | 541,060 |

Truist Financial Corp. | 14,365 | 539,406 |

Vornado Realty Trust REIT | 14,115 | 539,334 |

CBRE Group, Inc. — Class A*,1 | 11,919 | 538,977 |

PNC Financial Services Group, Inc. | 5,119 | 538,570 |

Northern Trust Corp. | 6,781 | 538,004 |

People’s United Financial, Inc. | 46,475 | 537,716 |

Discover Financial Services1 | 10,700 | 535,963 |

SL Green Realty Corp. REIT | 10,862 | 535,388 |

AvalonBay Communities, Inc. REIT1 | 3,462 | 535,364 |

American International Group, Inc.1 | 17,161 | 535,080 |

Federal Realty Investment Trust REIT1 | 6,267 | 534,011 |

JPMorgan Chase & Co.1 | 5,677 | 533,979 |

Iron Mountain, Inc. REIT1 | 20,381 | 531,944 |

Welltower, Inc. REIT1 | 10,264 | 531,162 |

American Express Co.1 | 5,576 | 530,835 |

Boston Properties, Inc. REIT1 | 5,873 | 530,802 |

Regions Financial Corp. | 47,646 | 529,823 |

Cboe Global Markets, Inc.1 | 5,676 | 529,457 |

Kimco Realty Corp. REIT1 | 41,206 | 529,085 |

Synchrony Financial | 23,853 | 528,582 |

CME Group, Inc. — Class A1 | 3,245 | 527,442 |

Ventas, Inc. REIT | 14,387 | 526,852 |

Fifth Third Bancorp1 | 27,253 | 525,438 |

Equity Residential REIT1 | 8,919 | 524,616 |

Charles Schwab Corp. | 15,508 | 523,240 |

KeyCorp1 | 42,889 | 522,388 |

Essex Property Trust, Inc. REIT1 | 2,271 | 520,445 |

Wells Fargo & Co. | 20,271 | 518,938 |

Huntington Bancshares, Inc.1 | 57,359 | 518,239 |

Lincoln National Corp.1 | 13,938 | 512,779 |

Simon Property Group, Inc. REIT | 7,462 | 510,252 |

Capital One Financial Corp.1 | 8,027 | 502,410 |

Host Hotels & Resorts, Inc. REIT1 | 44,857 | 484,007 |

| Total Financial | | 52,464,050 |

See notes to financial statements.

GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 25

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | June 30, 2020 |

| | | |

| Shares | Value |

COMMON STOCKS† – 97.8% (continued) | | |

| Industrial – 13.9% | | |

Howmet Aerospace, Inc.1 | 40,499 | $ 641,909 |

Masco Corp.1 | 12,382 | 621,700 |

United Parcel Service, Inc. — Class B | 5,587 | 621,163 |

Fortune Brands Home & Security, Inc.1 | 9,709 | 620,697 |

Sealed Air Corp. | 18,541 | 609,072 |

Old Dominion Freight Line, Inc. | 3,591 | 608,998 |

Garmin Ltd.1 | 6,185 | 603,038 |

Stanley Black & Decker, Inc. | 4,325 | 602,819 |

Fortive Corp.1 | 8,908 | 602,715 |

Illinois Tool Works, Inc.1 | 3,437 | 600,959 |

FedEx Corp.1 | 4,272 | 599,020 |

J.B. Hunt Transport Services, Inc.1 | 4,969 | 597,969 |

Mettler-Toledo International, Inc.* | 742 | 597,718 |

Jacobs Engineering Group, Inc.1 | 7,044 | 597,331 |

Keysight Technologies, Inc.* | 5,927 | 597,323 |

Martin Marietta Materials, Inc.1 | 2,877 | 594,302 |

Amcor plc | 57,797 | 590,107 |

TE Connectivity Ltd.1 | 7,214 | 588,302 |

IDEX Corp. | 3,716 | 587,277 |

Expeditors International of Washington, Inc.1 | 7,707 | 586,040 |

Vulcan Materials Co. | 5,058 | 585,969 |

Carrier Global Corp. | 26,323 | 584,897 |

Caterpillar, Inc.1 | 4,604 | 582,406 |

Agilent Technologies, Inc.1 | 6,584 | 581,828 |

Snap-on, Inc. | 4,199 | 581,603 |

Rockwell Automation, Inc. | 2,723 | 579,999 |

Waste Management, Inc. | 5,458 | 578,056 |

AMETEK, Inc.1 | 6,468 | 578,045 |

Flowserve Corp.1 | 20,250 | 577,530 |

Union Pacific Corp. | 3,412 | 576,867 |

Parker-Hannifin Corp. | 3,147 | 576,751 |

Eaton Corporation plc1 | 6,592 | 576,668 |

CH Robinson Worldwide, Inc.1 | 7,294 | 576,664 |

Ball Corp.1 | 8,298 | 576,628 |

Otis Worldwide Corp. | 10,117 | 575,253 |

Deere & Co.1 | 3,659 | 575,012 |

Kansas City Southern1 | 3,850 | 574,766 |

Pentair plc1 | 15,120 | 574,409 |

Xylem, Inc.1 | 8,837 | 574,051 |

Emerson Electric Co.1 | 9,242 | 573,281 |

PerkinElmer, Inc. | 5,837 | 572,551 |

Packaging Corporation of America | 5,732 | 572,054 |

See notes to financial statements.

26 l GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | June 30, 2020 |

| | | |

| Shares | Value |

COMMON STOCKS† – 97.8% (continued) | | |

| Industrial – 13.9% (continued) | | |

Amphenol Corp. — Class A1 | 5,968 | $ 571,794 |

3M Co. | 3,661 | 571,079 |

Republic Services, Inc. — Class A | 6,937 | 569,181 |

A O Smith Corp. | 12,076 | 569,021 |

CSX Corp.1 | 8,150 | 568,381 |

Westrock Co. | 20,099 | 567,998 |

General Dynamics Corp.1 | 3,800 | 567,948 |

Honeywell International, Inc. | 3,923 | 567,227 |

Dover Corp.1 | 5,869 | 566,711 |

Allegion plc1 | 5,536 | 565,890 |

Roper Technologies, Inc. | 1,454 | 564,530 |

Johnson Controls International plc1 | 16,458 | 561,876 |

TransDigm Group, Inc. | 1,267 | 560,077 |

Norfolk Southern Corp. | 3,182 | 558,664 |

Trane Technologies plc1 | 6,273 | 558,172 |

FLIR Systems, Inc. | 13,742 | 557,513 |

Waters Corp.* | 3,056 | 551,302 |

Northrop Grumman Corp. | 1,785 | 548,780 |

Boeing Co.1 | 2,992 | 548,434 |

Textron, Inc. | 16,603 | 546,405 |

Huntington Ingalls Industries, Inc.1 | 3,110 | 542,664 |

Lockheed Martin Corp.1 | 1,485 | 541,906 |

Westinghouse Air Brake Technologies Corp.1 | 9,312 | 536,092 |

Raytheon Technologies Corp. | 8,674 | 534,492 |

General Electric Co.1 | 78,206 | 534,147 |

Teledyne Technologies, Inc.* | 1,700 | 528,615 |

Ingersoll Rand, Inc.*,1 | 18,161 | 510,687 |

L3Harris Technologies, Inc. | 2,935 | 497,982 |

| Total Industrial | | 40,241,315 |

| Consumer, Cyclical – 13.1% | | |

Gap, Inc.1 | 53,794 | 678,880 |

Best Buy Company, Inc.1 | 7,292 | 636,373 |

Tractor Supply Co. | 4,787 | 630,879 |

Lowe’s Companies, Inc.1 | 4,498 | 607,770 |

Leggett & Platt, Inc.1 | 17,276 | 607,252 |

Fastenal Co.1 | 14,154 | 606,357 |

Chipotle Mexican Grill, Inc. — Class A*,1 | 572 | 601,950 |

Whirlpool Corp. | 4,644 | 601,537 |

Dollar Tree, Inc.*,1 | 6,460 | 598,713 |

BorgWarner, Inc.1 | 16,900 | 596,570 |

Advance Auto Parts, Inc.1 | 4,177 | 595,014 |

See notes to financial statements.

GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 27

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | June 30, 2020 |

| | | |

| Shares | Value |

COMMON STOCKS† – 97.8% (continued) | | |

| Consumer, Cyclical – 13.1% (continued) | | |

Mohawk Industries, Inc.* | 5,801 | $ 590,310 |

Lennar Corp. — Class A1 | 9,569 | 589,642 |

Newell Brands, Inc. | 37,058 | 588,481 |

Cummins, Inc.1 | 3,393 | 587,871 |

Dollar General Corp.1 | 3,081 | 586,961 |

WW Grainger, Inc.1 | 1,867 | 586,537 |

Home Depot, Inc.1 | 2,339 | 585,943 |

Aptiv plc1 | 7,494 | 583,933 |

O’Reilly Automotive, Inc.* | 1,381 | 582,326 |

DR Horton, Inc.1 | 10,500 | 582,225 |

Target Corp. | 4,850 | 581,660 |

AutoZone, Inc.*,1 | 515 | 580,982 |

Walgreens Boots Alliance, Inc. | 13,695 | 580,531 |

Tiffany & Co.1 | 4,760 | 580,434 |

NVR, Inc.* | 178 | 580,057 |

PACCAR, Inc. | 7,749 | 580,013 |

Walmart, Inc. | 4,815 | 576,741 |

NIKE, Inc. — Class B | 5,880 | 576,534 |

Genuine Parts Co.1 | 6,624 | 576,023 |

Costco Wholesale Corp.1 | 1,898 | 575,493 |

LKQ Corp.*,1 | 21,904 | 573,885 |

Hasbro, Inc.1 | 7,631 | 571,944 |

PulteGroup, Inc. | 16,730 | 569,322 |

Darden Restaurants, Inc.1 | 7,466 | 565,699 |

CarMax, Inc.*,1 | 6,301 | 564,254 |

VF Corp. | 9,257 | 564,122 |

Copart, Inc.* | 6,667 | 555,161 |

Domino’s Pizza, Inc. | 1,499 | 553,790 |

McDonald’s Corp.1 | 2,997 | 552,857 |

Ralph Lauren Corp. — Class A | 7,583 | 549,919 |

PVH Corp. | 11,429 | 549,163 |

TJX Companies, Inc. | 10,808 | 546,452 |

Starbucks Corp.1 | 7,423 | 546,259 |

Hanesbrands, Inc.1 | 48,378 | 546,188 |

L Brands, Inc.1 | 36,229 | 542,348 |

Southwest Airlines Co. | 15,807 | 540,283 |

Yum! Brands, Inc.1 | 6,211 | 539,798 |

Hilton Worldwide Holdings, Inc. | 7,321 | 537,727 |

Alaska Air Group, Inc.1 | 14,738 | 534,400 |

Ford Motor Co.1 | 87,770 | 533,641 |

Marriott International, Inc. — Class A1 | 6,145 | 526,811 |

Delta Air Lines, Inc.1 | 18,633 | 522,656 |

See notes to financial statements.

28 l GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | June 30, 2020 |

| | | |

| Shares | Value |

COMMON STOCKS† – 97.8% (continued) | | |

| Consumer, Cyclical – 13.1% (continued) | | |

Ross Stores, Inc. | 6,131 | $ 522,606 |

Tapestry, Inc. | 39,157 | 520,005 |

Las Vegas Sands Corp. | 11,369 | 517,744 |

General Motors Co.1 | 20,279 | 513,059 |

Live Nation Entertainment, Inc.* | 11,543 | 511,701 |

Ulta Beauty, Inc.* | 2,502 | 508,957 |

Kohl’s Corp.1 | 24,418 | 507,162 |

MGM Resorts International | 29,577 | 496,894 |

United Airlines Holdings, Inc.* | 14,296 | 494,784 |

Royal Caribbean Cruises Ltd. | 9,268 | 466,180 |

Carnival Corp.1 | 28,378 | 465,967 |

Wynn Resorts Ltd.1 | 6,143 | 457,592 |

Norwegian Cruise Line Holdings Ltd.* | 27,658 | 454,421 |

American Airlines Group, Inc.1 | 33,870 | 442,681 |

Under Armour, Inc. — Class A* | 30,363 | 295,736 |

Under Armour, Inc. — Class C* | 31,391 | 277,496 |

| Total Consumer, Cyclical | | 37,953,656 |

| Technology – 11.1% | | |

Lam Research Corp.1 | 1,993 | 644,656 |

Synopsys, Inc.* | 3,157 | 615,615 |

Xilinx, Inc.1 | 6,251 | 615,036 |

Microsoft Corp. | 3,020 | 614,600 |

Electronic Arts, Inc.*,1 | 4,648 | 613,768 |

ANSYS, Inc.*,1 | 2,098 | 612,050 |

Apple, Inc.1 | 1,673 | 610,310 |

Autodesk, Inc.*,1 | 2,543 | 608,260 |

Cadence Design Systems, Inc.* | 6,338 | 608,194 |

Adobe, Inc.* | 1,395 | 607,257 |

HP, Inc.1 | 34,828 | 607,052 |

QUALCOMM, Inc. | 6,652 | 606,729 |

salesforce.com, Inc.*,1 | 3,238 | 606,575 |

Applied Materials, Inc.1 | 10,026 | 606,072 |

Jack Henry & Associates, Inc.1 | 3,292 | 605,827 |

Akamai Technologies, Inc.*,1 | 5,651 | 605,166 |

Oracle Corp. | 10,933 | 604,267 |

Accenture plc — Class A1 | 2,813 | 604,007 |

NVIDIA Corp. | 1,587 | 602,917 |

Maxim Integrated Products, Inc. | 9,921 | 601,312 |

Activision Blizzard, Inc.1 | 7,910 | 600,369 |

Micron Technology, Inc.* | 11,645 | 599,950 |

Microchip Technology, Inc. | 5,691 | 599,319 |

See notes to financial statements.

GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 29

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | June 30, 2020 |

| | | |

| Shares | Value |

COMMON STOCKS† – 97.8% (continued) | | |

| Technology – 11.1% (continued) | | |

Intuit, Inc.1 | 2,020 | $ 598,304 |

Fortinet, Inc.*,1 | 4,350 | 597,125 |

KLA Corp.1 | 3,070 | 597,054 |

ServiceNow, Inc.* | 1,472 | 596,248 |

Broadcom, Inc.1 | 1,888 | 595,872 |

Citrix Systems, Inc.1 | 4,028 | 595,781 |

NetApp, Inc. | 13,354 | 592,517 |

Take-Two Interactive Software, Inc.*,1 | 4,231 | 590,521 |

MSCI, Inc. — Class A | 1,766 | 589,526 |

Broadridge Financial Solutions, Inc. | 4,662 | 588,298 |

Cognizant Technology Solutions Corp. — Class A1 | 10,346 | 587,860 |

Analog Devices, Inc.1 | 4,788 | 587,200 |

Western Digital Corp. | 13,201 | 582,824 |

IPG Photonics Corp.*,1 | 3,631 | 582,376 |

Paychex, Inc. | 7,687 | 582,290 |

Texas Instruments, Inc. | 4,573 | 580,634 |

Cerner Corp.1 | 8,467 | 580,413 |

Paycom Software, Inc.* | 1,872 | 579,815 |

Qorvo, Inc.* | 5,206 | 575,419 |

DXC Technology Co.1 | 34,849 | 575,009 |

Tyler Technologies, Inc.* | 1,654 | 573,739 |

Intel Corp.1 | 9,556 | 571,735 |

Skyworks Solutions, Inc. | 4,468 | 571,278 |

Zebra Technologies Corp. — Class A* | 2,195 | 561,811 |

International Business Machines Corp.1 | 4,651 | 561,701 |

Advanced Micro Devices, Inc.* | 10,598 | 557,561 |

Fidelity National Information Services, Inc.1 | 4,136 | 554,596 |

Fiserv, Inc.*,1 | 5,651 | 551,651 |

Hewlett Packard Enterprise Co.1 | 55,861 | 543,528 |

Seagate Technology plc1 | 11,203 | 542,337 |

Leidos Holdings, Inc.1 | 5,732 | 536,916 |

Xerox Holdings Corp. | 33,235 | 508,163 |

| Total Technology | | 32,389,410 |

| Communications – 6.2% | | |

eBay, Inc.1 | 11,896 | 623,945 |

Netflix, Inc.* | 1,356 | 617,034 |

Amazon.com, Inc.*,1 | 223 | 615,217 |

DISH Network Corp. — Class A*,1 | 17,339 | 598,369 |

E*TRADE Financial Corp. | 11,892 | 591,389 |

Cisco Systems, Inc.1 | 12,580 | 586,731 |

ViacomCBS, Inc. — Class B | 24,759 | 577,380 |

See notes to financial statements.

30 l GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | June 30, 2020 |

| | | |

| Shares | Value |

COMMON STOCKS† – 97.8% (continued) | | |

| Communications – 6.2% (continued) | | |

CDW Corp. | 4,969 | $ 577,298 |

T-Mobile US, Inc.* | 5,542 | 577,199 |

VeriSign, Inc.* | 2,777 | 574,367 |

NortonLifeLock, Inc. | 28,564 | 566,424 |

Motorola Solutions, Inc. | 4,032 | 565,004 |

Expedia Group, Inc.1 | 6,871 | 564,796 |

CenturyLink, Inc.1 | 56,249 | 564,178 |

F5 Networks, Inc.*,1 | 4,041 | 563,639 |

Facebook, Inc. — Class A*,1 | 2,480 | 563,134 |

Interpublic Group of Companies, Inc.1 | 32,812 | 563,054 |

Omnicom Group, Inc. | 10,303 | 562,544 |

AT&T, Inc.1 | 18,590 | 561,976 |

Comcast Corp. — Class A1 | 14,369 | 560,104 |

Booking Holdings, Inc.*,1 | 349 | 555,727 |

Charter Communications, Inc. — Class A*,1 | 1,085 | 553,393 |

Verizon Communications, Inc. | 10,030 | 552,954 |

Walt Disney Co.1 | 4,909 | 547,403 |

Corning, Inc.1 | 21,054 | 545,299 |

Juniper Networks, Inc.1 | 23,733 | 542,536 |

Arista Networks, Inc.*,1 | 2,545 | 534,526 |

Twitter, Inc.*,1 | 16,976 | 505,715 |

News Corp. — Class A | 36,812 | 436,590 |

Fox Corp. — Class A | 13,798 | 370,062 |

Discovery, Inc. — Class C*,1 | 18,834 | 362,743 |

Alphabet, Inc. — Class A*,1 | 201 | 285,028 |

Alphabet, Inc. — Class C*,1 | 200 | 282,722 |

Discovery, Inc. — Class A*,1 | 8,879 | 187,347 |

Fox Corp. — Class B | 6,319 | 169,602 |

News Corp. — Class B | 11,537 | 137,867 |

| Total Communications | | 18,143,296 |

| Utilities – 5.4% | | |

AES Corp.1 | 44,751 | 648,442 |

CenterPoint Energy, Inc.1 | 31,500 | 588,105 |

DTE Energy Co.1 | 5,396 | 580,070 |

American Water Works Company, Inc.1 | 4,454 | 573,051 |

CMS Energy Corp.1 | 9,725 | 568,134 |

Atmos Energy Corp. | 5,646 | 562,229 |

Public Service Enterprise Group, Inc. | 11,406 | 560,719 |

Eversource Energy1 | 6,725 | 559,991 |

Evergy, Inc. | 9,437 | 559,520 |

Alliant Energy Corp.1 | 11,678 | 558,676 |

See notes to financial statements.

GPM l GUGGENHEIM ENHANCED EQUITY INCOME FUND SEMIANNUAL REPORT l 31

| | |

| SCHEDULE OF INVESTMENTS (Unaudited) continued | June 30, 2020 |

| | | |

| Shares | Value |

COMMON STOCKS† – 97.8% (continued) | | |

| Utilities – 5.4% (continued) | | |

Xcel Energy, Inc.1 | 8,908 | $ 556,750 |

Ameren Corp.1 | 7,902 | 555,985 |

NiSource, Inc. | 24,376 | 554,310 |

Dominion Energy, Inc. | 6,819 | 553,566 |

American Electric Power Company, Inc.1 | 6,931 | 551,985 |

PPL Corp. | 21,356 | 551,839 |

Entergy Corp.1 | 5,880 | 551,603 |

NextEra Energy, Inc.1 | 2,296 | 551,430 |

WEC Energy Group, Inc. | 6,278 | 550,267 |

Pinnacle West Capital Corp.1 | 7,500 | 549,675 |