UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 11, 2008

LEARNING QUEST TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

Nevada | 000-51081 | 88-0485183 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

(Address of principal executive offices)

Room 42, 4F, New Henry House, 10 Ice House Street, Central, Hong Kong

Registrant’s telephone number, including area code: (011) 852-2530 0222

1065 West 1150 South, Provo, UT 84601

(Former Name or Former Address if Changed Since Last Report)

(Name, address and telephone number of agent for service)

Interwest Transfer Company, Inc.

1981 East Murray Holladay Road, Suite 100, P.O. Box 17136

Salt Lake City, UT 84117

Telephone: (801) 272-9294 Fax: (801) 277-3147

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01. Entry into a Material Definitive Agreement.

See Items 2.01 and 5.01 herein below.

Item 2.01. Completion of Acquisition or Disposition of Assets.

On February 8, 2008 (the “Closing Date”), Learning Quest Technologies, Inc. (“Learning Quest” or the “Registrant”) entered into a Share Exchange Agreement (the “Exchange Agreement”) with Color Man Holdings Limited, a British Virgin Islands company (“CMH” or the “Company”) and Joylink Holdings Limited, a British Virgin Islands company and the sole stockholder of CMH (the “Stockholder”). As a result of the share exchange, Learning Quest acquired all of the issued and outstanding securities of CMH, an inactive holding company, from the Stockholder in exchange for Fifty-Four Million Four Hundred Thousand (54,400,000) newly-issued shares of Learning Quest’s common stock, par value $0.001 per share (“Common Stock”), representing sixty-eight percent (68)% of Learning Quest’s issued and outstanding Common Stock (the “Exchange”) as of the Closing Date and as of the date of this Report. The Exchange is intended to constitute a tax-free reorganization pursuant to the provisions of Section 368(a)(1)(B) of the Internal Revenue Code of 1986, as amended. As a result of the Exchange, CMH became a wholly-owned subsidiary of Learning Quest.

On the Closing Date, Learning Quest filed with the U.S. Securities and Exchange Commission (the “SEC”) an Information Statement complying with Rule 14f-1 under the Securities Exchange Act of 1934, as amended (hereinafter, the “Exchange Act”) that describes a change in a majority of Learning Quest’s Board of Directors (the “Board”) that shall, not earlier than ten (10) days following the date of such filing, occur in connection with the change of control of Learning Quest described in this Report. For further detail on the change of control, please see Item 5.02 herein below.

The following is disclosure regarding Learning Quest, CMH, Wise On China Limited, an inactive holding company formed under the laws of Hong Kong and the wholly-owned subsidiary of CMH (“WOC”) and Pingdingshan Pinglin Expressway Co., Ltd., a company organized under the laws of the People’s Republic of China (the “PRC”) and doing business in the PRC as the wholly-owned and chief operating subsidiary of WOC (“Ping”). From and after the Closing Date, the operations of Ping are the only operations of Learning Quest.

Of the ten (10) shares of capital stock currently issued and outstanding of the Stockholder, all are held in trust by Siu Choi Fat, the Stockholder’s sole officer and director. Siu Choi Fat holds five (5) shares in trust for Li Xipeng, Learning Quest’s Chairman of the Board and proposed Chief Executive Officer and he holds one (1) share in trust for each of (a) Lin Jie, a propose Vice President of Learning Quest, (b) Zhang Chunxian, the proposed Chief Financial Officer and Director of Learning Quest, (c) Shu Hongying, (d) Sun Jianhao, a proposed Director of Learning Quest and (e) Wu Lei, a proposed Vice President of Learning Quest.

DESCRIPTION OF BUSINESS

Except as otherwise indicated by the context, references in this Report to “we”, “us”, “our”, the “Company”, “CMH”, “WOC” or “Ping” are to the consolidated business of Learning Quest, CMH, WOC and Ping (as defined herein below).

Prior Operations of Learning Quest

Learning Quest was formed as a Nevada corporation on January 11, 2001, originally under the name of “Learning Quest Technologies, Inc.” We were in the business of developing, licensing and marketing educational products and services. Our business model centered on the development and distribution of high quality, educational tools and solutions for creating, authoring, publishing, presenting and selling education and training materials and content via the Internet. We commenced limited operations but were unsuccessful in fully implementing our business plan. We ceased operations and focused our efforts on seeking a business opportunity. Prior to the Exchange, we were considered a “blank check” company with zero assets and a net loss of approximately $25,000 for the year ending December 31, 2006. As of September 30, 2007, the Company had approximately $27,000 in liabilities.

2

Current Operations of Learning Quest

History and Organizational Structure of CMH and WOC

CMH was formed on April 11, 2005 as a British Virgin Islands company with authorized capital of US$50,000 divided into 50,000 shares, each having a par value of US$1.00. Upon the consummation of the Exchange, Learning Quest acquired Ten (10) shares of CMH’s capital stock, representing one hundred percent (100%) of the total issued and outstanding shares of capital stock of CMH. WOC was established and incorporated on November 2, 2005 with authorized share capital of HK$10,000 (approximately US$1,279.44) divided into 10,000 shares, each having a par value of HK$1.00 (approximately US$0.13). CMH’s sole business is to act as a holding company for WOC, and WOC’s sole business is to act as a holding company for Ping. CMH owns one (1) share of WOC approximately equal to US$0.13 in registered capital. Neither CMH nor WOC have a Board of Directors, however each company has one (1) Executive Director that serves as the legal representative and which may appoint a General Manager to lead each company’s routine operations. CMH’s current Executive Director is RCD (Nominee) Limited and WOC’s current Executive Director is Siu Choi Fat. Both CMH and WOC have their office located at Room 42, 4F, New Henry House, 10 Ice House Street, Central, Hong Kong.

History of Ping and the Pinglin Expressway

In accordance with the PRC’s National Expressway Network Plan formulated by the State and “the Tenth Five-Year Plan” of Henan Province on the Comprehensive Traffic System Development Plan formulated by the Henan government for the purpose of completing the Pingdingshan-Linru portion of the Nanjing-Luoyang expressway (also referred to herein as the “Nanluo Expressway”), Ping competed in and won an open bid to fund, operate and manage such Pingdingshan-Linru portion in early 2003.

Thereafter, Ping was incorporated under the laws of the PRC on May 12, 2003 by four (4) investors, Henan Shengrun Venture Investment Management Co., Ltd. (“HSV”), Henan Pingdingshan Zhongya Road and Bridge Construction Co., Ltd. (“HPZ”), Pingdingshan Expressway Construction Co., Ltd. (“PECC”) and Zhongyuan Trust & Investment Co., Ltd. (“ZTI”). At establishment, the percentage of each party’s equity interest was 46%, 18%, 18% and 18%, respectively. In May 21, 2007, PECC, HPZ and ZTI transferred all of their shares to HSV and Li Xipeng. After the transfer, Ping was held by HSV and Li Xipeng with equity interests of 95% and 5%, respectively. On June 18, 2007 (effective July 30, 2007), HSV and Li Xipeng entered into an equity transfer agreement pursuant to which they transferred all of their shares to WOC. The Company’s approved operation tenure is thirty (30) years.

Currently, Ping is wholly-owned by WOC. WOC has contributed RMB 260,000,000 (US$33,090,802) in registered capital of Ping with a total investment equal to RMB 750,000,000 (US$95,454,237). Ping’s office is located at Pinglin Toll Road Station, New District, Pingdingshan City, Henan Province, the PRC.

Current Business of Ping

Ping was founded with the purpose of providing to society high quality infrastructure services and to promote regional economic development by investing in, constructing, operating and managing an expressway property from the cities of Linru to Pingdingshan in Luoyang-Nanjing, the PRC referred to hereinafter as the “Pinglin Expressway” or the “Expressway” and the rental of patrol stations and service districts along the toll roads thereon.

With the approval from Henan Communications Bureau and the State Development and Reform Committee of China [NO. 2003-1784], the Company is permitted to construct and operate the Pinglin Expressway in Henan Province for thirty (30) years from 2003. Pursuant to the permission from Henan Communications Bureau and Henan Development and Reform Committee [NO. 2005-1885], the Company is entitled to operate six (6) toll gates. All the rates applicable to the automobiles are defined by the Henan Communications Bureau and Henan Development and Reform Committee.

3

The location of the Expressway is in Henan Province in central China, and is a hinge terminal of the traffic backbone throughout China. The “five (5) longitudinal roads and seven (7) transverse roads” in the national expressway network plan are intercrossed with each other in Henan, extending more than 1,000 km, and more than sixty percent (60%) of vehicles are those passing through Henan from other provinces.

The Pinglin Expressway is a significant part of the Nanluo Expressway, a national trunk in the expressway network in China. The Nanluo Expressway links the northwestern regions to the southeastern coastal regions of the PRC. The construction of Pinglin Expressway started from October 23, 2003 and completed in two (2) phases. The first phase of the construction which covered the part with a length of approximately 86 kilometers, linking Ruzhou and Pingdingshan in Henan Province, commercially opened on December 31, 2005. On May 31, 2006, the second phase of the construction, with the length of approximately 21 kilometers, linking Pingdingshan and Yexian in Henan Province was completed. With the operation of Pinglin Expressway, the key transport artery, national trunk Nanluo Expressway was entirely opened to traffic.

Today, the Pinglin Expressway is a dual carriageway four (4) lane expressway, the toll section of which is 106 km in length. Toll revenue from the passing vehicles through the Expressway’s six (6) toll gates (South Pingdingshan, Pingdingshan New Town, Baofeng, Xiaotun, Ruzhou and Wenquan) is the primary source of the Company’s earnings. The Expressway is also located between two (2) key cities, Luoyang and Luohe. The Expressway extends from east to west, from Shilipu (the end of the Luohe-Pingdingsha expressway), through Yexian and Pingdingshan and then to New Xiying village at the joint of Pingdingshan and Luoyang. The road is lined with the Lianhuo (Lianyungang-Huoerguosi) national highway through the ringroad in Luoyang, and then extends to the southeast of Luohe City and connects with the Beijing-Zhuhai national highway into a network to form a convenient channel between Luoyang and Luohe. In addition to the traffic flow of the line itself, we believe it also attracts the traffic flow from Lianhuo high way to Zhengzhou then to Beijing-Zhuhai national highway to alter to Luoyang-Luohe section of Luonan route. Furthermore, the Expressway extends east to link the highway network of the Jiangsu and Anhui provinces and also links the sea ports, including Shanghai.

The Company’s operating income is achieved through toll charges on vehicles passing through the Expressway’s toll gates. The standard of toll charges is approved and set by the provincial price administrative bureau. The Company's revenue equals the relevant standard toll rate of the type of vehicles multiplies the relative miles of travel through the expressway which the Company is operating, and is cleared by the Henan Expressway System Toll Collection Center each month (Henan Expressway has a charges system and clearing center which calculates and allocates toll charge income according to the charge standards and the miles of travel of vehicles in the expressway). The Company is specialized in the operation and management of expressways. The maintenance projects are outsourced to professional road construction enterprises.

The Company began generating operating revenue in January 2006. The Company had not yet started full operation of the expressway prior to June 2006, therefore the operating income was at low level and the growth was moderate; with the full operation of the expressway in June, the operating income saw sustained rapid growth. On profit, as the loan interest of the Company was included in the expenses, and the depreciation of fixed assets was accounted at the current period, the Company had seen a temporary loss in June. But with the increase of revenue, the Company crossed the profit and loss balance and achieved sustained increase in profit. Income in December was the same as in November on the whole, because of the seasonal winter impact on the traffic flow in December.

After several months of operations, the social awareness of the expressway gradually increased, and the number of passenger and commercial vehicles increased rapidly. We believe that along with income growth in the future, the profit earning capacity of the Company will improve steadily.

4

Enterprise Strategy

Henan is a province with the largest population in China. However, its urbanization rate is far below the national average level. With rapid economic and social development and the accelerated process of urbanization in Henan, demands for infrastructure, the expressway and other transportation infrastructure, urban facilities such as heating, water supply, and sewage treatment are also growing rapidly. The existing infrastructure can no longer meet the needs of social development.

Because the Chinese government’s financial revenue growth is limited, the financial investment of the government alone is unable to build huge infrastructure projects in a relatively short period. In order to attract social funds, local governments are willing to grant to commercial companies the right to invest in the construction and operation of projects, or directly sell the equity of the established enterprise to recover their early input. In addition, the government will also give preferential treatment on charges.

To seize the historic opportunity of rapid development of infrastructure of China and Henan, to rapidly strengthen and expand the Company's infrastructure industries, to create certain advantages of scale to further reduce the cost of the Company’s operations, the Company plans to invest in construction or purchase additional expressways, thermoelectricity, water supply or sewage treatment facilities and other infrastructure assets with good profit prospects in the next few years. Because the amount of investment in infrastructure is often relatively large, and the investment funds need to be in position within two (2) or three (3) years, the accumulated capital from the Company’s operation alone cannot meet the demand for investment in the future. The Company desires to actively participate in the capital markets, to use various channels of financing to enhance its ability to raise funds, thus to promote and achieve these long-term development strategies.

Based on the operation and management of the Pinglin Expressway, the Company desires to take full advantage of free cash flow and capital market instruments to invest in construction or purchase of infrastructure assets and to exploit all the advantages in management, government relationship and stockholder support to make the Company a professional, continuously-growing infrastructure investment operator.

In addition, the Company will energetically push forward the standard management, human-based services, establish an information management platform and continue to improve the road condition and traffic capacity so as to provide the traveler with a smooth, safe and comfortable running environment. With the increasing influence of the Pinglin Expressway on the substitution and division of other transportation lines and the projected continuous and rapid growth in China and the specific area where the roads are located, we believe that the Company’s income from toll and profits will continue to increase.

General Overview on Industry and Market

General

With efforts to advance China’s expressway system out of its developmental stages, the PRC issued a series of polices to lead the development of expressway through increasing the investment amount. China’s main objectives of road construction during the “Tenth Five-Year Plan” are (a) that total road mileage will reach 2.1~2.3 million km in 2010, (b) that the main national highways with “five (5) in longitudinal direction and seven (7) in transverse ” will be built across China, (c) that eight (8) interprovincial roads will be built in the west area where the expressway will connect ninety percent (90%) of the cities with more than 200,000 population and (d) that the expressway network will be formed in the eastern parts of China. In 2020, the PRC estimates that China’s total road mileage will extend more than 70,000 km, connecting all cities with more than 200,000 in population and forming a nationwide expressway network.

5

Compared with common roads, the expressways have distinct economic and technical characteristics and are a central representation of the advanced productivity in road transportation. According to the Pingdingshan-Linru Expressway Project Feasibility Study Report, although expressways only account for approximately 1.4% and 1.72% of the total road mileage in China, the traffic volume undertaken thereby is a quarter of the total volume. At present, the running speed of China’s motor vehicles in the expressways are two (2) times that of secondary roads; a two-way expressway with four (4) lanes covers an area 2.5 times that of a common secondary road, and its traffic capacity is eight (8) to ten (10) times that of the latter (as such figures are represented in the aforementioned Report). We believe that once the expressways are connected with each other, it will have an immense opportunity for economic growth.

We believe that as a result of recent progress in the social and economic development in China, road transportation has taken on an important position among the five (5) areas constituting the comprehensive transportation system (road, railway, airway, watercourse and pipeline). We believe that expressway as a modern traffic infrastructure have become a backbone channel due to their many characteristics such as large traffic volume, high speed, far-reaching influence and extensive penetration, thus establishing its crucial position in China’s comprehensive transportation system. We believe that expressways highlight the road grade standard and running speed and thus effectively improve the “bottleneck” situation with traffic transportation in some areas as well as promote the optimization and upgrade of the road network. Along with national economic development, we believe China’s passenger and freight transportation will continue to rise. We believe that demand for special transportation, land development, regional economic development and an increase in people’s travel demands have resulted from an increase in economic income and a change in life style, and that such demands will require continued development of expressways to satisfy such demands.

Socio-Economic Conditions of Henan Province and Pingdingshan

Henan Province has the largest population in China and its GDP in 2005 ranked fifth (5th) in the whole country. In 2005, Henan’s GDP growth increased by 13.7% up from the previous year, higher than the national growth rate of 9.9%. Pingdingshan is an important energy base and industrial city in Henan Province, which has abundant coal and salt resources. Coal mining, electricity, chemicals, steel and mechanical industry are the pillar industries of the city. In 2005, Pingdingshan’s GDP ranked sixth (6th) in Henan Province and its growth rate was higher than the average level of the whole province. Pingdingshan had a population of 4.93 million in 2005.

The Road Network Conditions of Henan Province and Pingdingshan City

Henan Province, which we believe has unique road advantages, is located in the central part of China. There are nine (9) national planned expressways including Lianhuo and Beijing-Hong Kong-Macao, and nine (9) national ways including No.107 and No.310, both of which pass through Henan. At the end of 2005, the total provincial traffic mileage had achieved 79,506 km, of which roads of second grade or above account for 30.8% of the total. The density of the road network reached 47.6 km per hundred square kilometer and with the rapid development of expressways, traffic mileage had reached 2,678 km by the end of 2005, ranking fourth (4th) in the country (these figures have been quoted from the 2005 Annual Report of the PRC listed company Central Expressway (symbol: 600020).

According to the PL Report, there are currently two (2) expressways, two (2) national roads and four (4) provincial roads which pass through Pingdingshan. However, the proportion of high-grade roads mileage is very low. The comprehensive technical level of the city road network ranges between level three (3) and level four (4), and it is accompanied with serious problems such as disorderly traffic, accidents and traffic jams. The average speed of the road network is only 37.61 km and the integrated saturation is 1.5, fifty percent (50%) over the normal capacity. As expressways under-construction will be open to traffic in succession, we believe the road network condition will gradually improve.

6

Main Advantages

Geographic Location

The infrastructure has a natural characteristic of regional monopolization, and there is no other resource to replace it within a specific region. Therefore, the geographic location decides the market space of infrastructure assets and has a substantial influence on the profit-earning capability of such assets, and so does the expressway industry. The Pinglin Expressway is located between Luoyang and Pingdingshan, two (2) major industrial cities among the city group in central China and Henan Province. In the north, the Expressway connects with the northwest area through the Lianyungang-Huo’erguosi expressway in Luoyang, and in the east connects to Anhui, Jiangsu, Zhejiang and Shanghai through Luohe city. In the south, the Expressway connects with the Beijing-Zhuhai expressway through Luohe City. With the gradual emergence of the effects produced by China’s initialization of its domestic demand policy, we believe the logistics between the coastal areas and inland China will result in further growth.

Corporate Governance Structure

The Company has a standard and highly effective corporate governance structure. Ping intends to implement a management system of responsibility by the General Manager under the leadership of its Board of Directors and establish an internal control system. Ping currently implements a series of incentive and binding policies to encourage management to create value for its stockholder, thus avoiding the defects commonly encountered in state-owned enterprises such as internally-connected person control and absence of the owners. We believe these standards and practices will ensure that the Company’s operating activities will not deviate from the track of healthy development.

Governmental Relationship

The operation of the infrastructure industry will not be separated from the support and cooperation of the governmental departments. Whether the infrastructure is working at optimum levels is associated with the integral competitiveness of a city and even a district. Therefore, each local government attaches great importance to the construction and operation of the infrastructure and provides a strategic priority to its development. Henan is located in central China, and has been positioned as an agricultural province for a long time, where the urbanization rate is lower than the average level of the whole country, the infrastructures are backward and the local governments have more eagerness to advance the infrastructure. However, due to certain restrictions on local finance, it is impossible to complete such a significant project only by depending on the investment from the government. During the construction of Pinglin Expressway, the Company experienced many links such as project examination and approval, bank funding, license authorization, charging approval and governmental custody and high efficiency management. As a result, we believe Ping has achieved recognition from the various governmental departments and has established a good cooperative relationship with them. We believe this will also establish a solid basis for long-term development of the Company.

Financial Advantages

We believe the Company's major financial advantages to be (a) sound operation, (b) stable growth of operating income, (c) low market risk, (d) no cyclical fluctuation, (e) strong capacity of cash flow from operation, (f) large free cash flow and (g) strong solvency and capital accumulation capacity. Furthermore, infrastructure industries are in line with the state’s industrial policy and concessions on charge standards and interest rates on bank loans.

Qualifications

The Company entered into that certain Chartered Right Agreement on Pingdingshan-Linru Expressway Project on April 10, 2003 with the Pingdingshan Communications Bureau (authorized by Pingdingshan People’s Government), upon which, the Company is entitled to the rights of construction, operation and toll collection. A copy of such Agreement is attached to this Report as Exhibit 10.2.

7

In accordance with Y. F. G. S. F. [2006] No. 1460 filed jointly by Henan Provincial Development and Reform Commission and Henan Provincial Department of Communications, the toll collection standard of Pingdingshan-Linru expressway was specially increased on Oct. 20, 2006, and the charging standard after the adjustment is as follows:

Type of Vehicle | Charging: RMB: Yuan/car km | ||

| Type A | Small passenger car, truck loaded below 2 tons | 0.55 | |

| Type B | Middle-sized passenger car, truck loaded 2-5 tons | 0.75, 0.80 | |

| Type C | Large-sized passenger car, truck loaded 5-8 tons | 1.10, 1.40 | |

| Type D | Truck loaded 8-20 tons l | 1.75 | |

| Type E | Truck loaded 20-40 tons | 2.10 | |

| Type F | Truck loaded more than 40 tons | RMB0.08/ton. km |

Technical Information

According to the rules in “Road Engineering Technical Standard” issued by Ministry of Communications of PRC, the main technical indexes of Pinglin Expressway are in the table as follows:

| Construction mileage | 107km |

| Grade of the Road | Dual-carriageway with two (2) lanes each direction |

| Design Speed | 120km/h |

| Road Surface Type | Asphalt concrete |

| Design Load for Bridge/Culvert | Automobile - S 20, Trailer-120 |

| Terrain | Plain lightly undulate area |

8

Employees

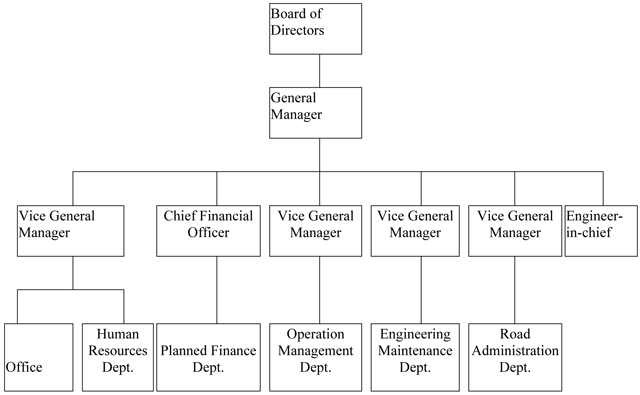

Ping attaches great importance to the cultivation of professional managerial persons and pursues a talent policy of retaining professionals by undertaking an enterprise culture. Through continuously improving its corporate governance structure, management system and talent introduction and incentive system, Ping has created an excellent working atmosphere and development opportunity, which integrates the individual occupational plan with the Company’s development and reduces the turnover of the employees, especially the core technicians, thus forming a relatively stable and high-quality employee team. Figure 1 below sets forth the current institutional structure of Ping:

As of the date of this Report, Ping employs three hundred sixty (360) full-time employees, including forty (40) institutional management and technical staff, four (4) comprising Ping’s financial management staff, one hundred seventy-two (172) toll collectors, thirty-seven (37) comprising Ping’s control staff and forty (40) individuals comprising Ping’s road administrative staff. None of our employees are covered by a collective bargaining agreement. We believe we have good relations with our employees.

Institutional Structure

There are six (6) departments in the Company, and the main function of each department is as follows:

Operation and Management Department: This Department is responsible for toll collection management, routine maintenance of operating facilities and statistics of traffic volume.

Engineering Maintenance Department: This Department is responsible for the organization of Expressway maintenance, for managing infrastructure and maintenance projects, for coordinating the relationship between the parties participating in the projects, for managing project quality and for selecting and purchasing fixed assets and project materials.

9

Road Administration Department: This Department is responsible for implementing national laws and regulations on the expressways, maintaining road assets and property rights according to the law, supervising and investigating expressway cases and other road administration such as comprehensive management and special treatment and supervising the maintenance work.

Planned Finance Department: This Department is responsible for setting and optimizing the financial system and flow, conducting basic accounting checks, controlling and managing financial matters, managing capital plans, managing contracts, researching and preparing mid and long term development plans, conducting internal audits and other matters related to industry, commerce and taxation.

Human Resources Department: This Department is responsible for drafting human resources plans and allocating the staff, organizing and implementing staff training and career development, providing performance and salary management as well as other personnel services.

Office Department: This Department is responsible for managing administrative affairs, drafting the Company’s systems and documents, managing the archives, stamps and vehicles and organizing and administrating conference-related matters.

Intellectual Property

We currently do not own any copyrights, trademarks or patents.

Competition

Our competition consists of other expressways. As newly-constructed expressways continue to open, the expressway network improves and the density of road network increases, a portion of traffic flow will change whereby travelers will opt for shorter traveling routes, while the expressway network has the clustering effect on traffic flow. Thus, relevant expressways will form competition against each other. The Pinglin Expressway has its competitive advantage in route; according to China’s expressway general plan, it will be the shortest route in the province.

Secondly, the common roads have competition between each other. Although on the common roads there are some problems such as low velocity, high oil consumption and low safety, the charges for the vehicle are inexpensive so that some of the traffic flow may be attracted. However, as the economy grows and people’s income rises, we believe time and safety factors will be more of a priority, especially in long distance road transportation, and the advantage of expressways will be prominent.

Thirdly, there are competitions from railways and air transportation. The capacity of air-express is limited, and it costs much more than expressways do, so it is restrained in its availability to the general public. The railway transportation has a lower cost, but it is different from the road transportation due to different service objects. Moreover, the total social demand for passenger and freight transportation is increasing, so the increase in the railway transportation capacity can’t completely offset by the growth in demand for expressways.

10

RISK FACTORS

The financial condition, business, operations, and prospects of the Company involve a high degree of risk. You should carefully consider the risks and uncertainties described below, which constitute the material risks relating to the Company, and the other information in this report. If any of the following risks are realized, the Company’s business, operating results and financial condition could be harmed and the value of the Company’s stock could suffer. This means that investors and stockholders of the Company could lose all or a part of their investment.

RISKS RELATING TO THE PEOPLE’S REPUBLIC OF CHINA

Certain Political and Economic Considerations Relating to China Could Adversely Affect Our Company.

The PRC is transitioning from a planned economy to a market economy. While the PRC government has pursued economic reforms since its adoption of the open-door policy in 1978, a large portion of the PRC economy is still operating under five-year plans and annual state plans. Through these plans and other economic measures, such as control on foreign exchange, taxation and restrictions on foreign participation in the domestic market of various industries, the PRC government exerts considerable direct and indirect influence on the economy. Many of the economic reforms carried out by the PRC government are unprecedented or experimental, and are expected to be refined and improved.

Other political, economic and social factors can also lead to further readjustment of such reforms. This refining and readjustment process may not necessarily have a positive effect on our operations or future business development. Our operating results may be adversely affected by changes in the PRC’s economic and social conditions as well as by changes in the policies of the PRC government, such as changes in laws and regulations (or the official interpretation thereof), measures which may be introduced to control inflation, changes in the interest rate or method of taxation, and the imposition of additional restrictions on currency conversion.

The Chinese Government Exerts Substantial Influence Over The Manner In Which We Must Conduct Our Business Activities Which Could Adversely Affect Our Company.

China only recently has permitted provincial and local economic autonomy and private economic activities. The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and State ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to toll collection standards, taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

The Chinese Legal System Has Inherent Uncertainties That Could Limit The Legal Protections Available To You.

Our contractual arrangements are governed by the laws of the People’s Republic of China. China’s legal system is based upon written statutes. Prior court decisions may be cited for reference but are not binding on subsequent cases and have limited value as precedents. Since 1979, the Chinese legislative bodies have promulgated laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published decisions and their non-binding nature, the interpretation and enforcement of these laws and regulations involve uncertainties, and therefore you may not have legal protections for certain matters in China.

11

All Of Our Assets Are Located In China, Any Dividends Of Proceeds From Liquidation Is Subject To The Approval Of The Relevant Chinese Government Agencies.

Our assets are located inside China. Under the laws governing foreign invested enterprises in China, dividend distribution and liquidation are allowed but subject to special procedures under the relevant laws and rules. Any dividend payments will be subject to the decision of our Board of Directors and subject to foreign exchange rules governing such repatriation. Any liquidation is subject to both the relevant government agency’s approval and supervision as well the foreign exchange control. This may generate additional risk for our investors in case of dividend payments and liquidation.

Future Inflation In China May Inhibit Our Activity To Conduct Business In China.

In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. During the past ten (10) years, the rate of inflation in China has been as high as 20.7% and as low as 2.2%. These factors have led to the adoption by Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. While inflation has been more moderate since 1995, high inflation may in the future cause Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China and thereby harm our business operations.

Currency Conversion And Exchange Rate Volatility Could Adversely Affect Our Financial Condition.

The PRC government imposes control over the conversion of Renminbi into foreign currencies. Under the current unified floating exchange rate system, the People’s Bank of China (PBOC) publishes an exchange rate, which we refer to as the PBOC exchange rate, based on the previous day’s dealings in the inter-bank foreign exchange market. Financial institutions authorized to deal in foreign currency may enter into foreign exchange transactions at exchange rates within an authorized range above or below the PBOC exchange rate according to market conditions.

Pursuant to the Foreign Exchange Control Regulations of the PRC issued by the State Council which came into effect on April 1, 1996, and the Regulations on the Administration of Foreign Exchange Settlement, Sale and Payment of the PRC which came into effect on July 1, 1996, regarding foreign exchange control, conversion of Renminbi into foreign exchange by Foreign Investment Enterprises (“FIEs”), for use on current account items, including the distribution of dividends and profits to foreign investors, is permissible. FIEs are permitted to convert their after-tax dividends and profits to foreign exchange and remit such foreign exchange to their foreign exchange bank accounts in the PRC. Conversion of Renminbi into foreign currencies for capital account items, including direct investment, loans, and security investment, is still under certain restrictions. On January 14, 1997, the State Council amended the Foreign Exchange Control Regulations and added, among other things, an important provision, which provides that the PRC government shall not impose restrictions on recurring international payments and transfers under current account items.

Enterprises in the PRC (including FIEs) which require foreign exchange for transactions relating to current account items, may, without approval of the State Administration of Foreign Exchange, or SAFE, effect payment from their foreign exchange account or convert and pay at the designated foreign exchange banks by providing valid receipts and proofs.

Convertibility of foreign exchange in respect of capital account items, such as direct investment and capital contribution, is still subject to certain restrictions, and prior approval from the SAFE or its relevant branches must be sought.

12

Since 1994, the exchange rate for Renminbi against the United States dollars has remained relatively stable, most of the time in the region of approximately RMB8.28 to US$1.00. However, in 2005, the Chinese government announced that would begin pegging the exchange rate of the Chinese Renminbi against a number of currencies, rather than just the U.S. Dollar. As our operations are primarily in China, any significant revaluation of the Chinese Renminbi may materially and adversely affect our cash flows, revenues and financial condition. For example, to the extent that we need to convert United States dollars into Chinese Renminbi for our operations, appreciation of this currency against the United States dollar could have a material adverse effect on our business, financial condition and results of operations. Conversely, if we decide to convert Chinese Renminbi into United States dollars for other business purposes and the United States dollar appreciates against this currency, the United States dollar equivalent of the Chinese Renminbi we convert would be reduced.

The Value Of Our Securities Will Be Affected By The Foreign Exchange Rate Between U.S. Dollars And Renminbi.

The value of Learning Quest’s Common Stock will be affected by the foreign exchange rate between U.S. dollars and Renminbi, and between those currencies and other currencies in which our sales may be denominated. For example, to the extent that we need to convert U.S. dollars into Renminbi for our operational needs and should the Renminbi appreciate against the U.S. dollar at that time, our financial position, the business of the Company, and the price of our Common Stock may be harmed. Conversely, if we decide to convert our Renminbi into U.S. dollars for the purpose of declaring dividends on our Common Stock or for other business purposes and the U.S. dollar appreciates against the Renminbi, the U.S. dollar equivalent of our earnings from our China operations would be reduced.

You May Experience Difficulties In Effecting Service Of Legal Process, Enforcing Foreign Judgments Or Bringing Original Actions In China Based On United States Or Other Foreign Laws Against Us.

We conduct our operations in China and a significant portion of our assets is located in China. In addition, our directors and executive officers reside within China, and substantially all of the assets of these persons are located within China. As a result, it may not be possible to effect service of process within the United States or elsewhere outside China upon those directors or executive officers, including with respect to matters arising under U.S. federal securities laws or applicable state securities laws. Moreover, our Chinese counsel has advised us that China does not have treaties with the U.S. and many other countries that provide for the reciprocal recognition and enforcement of judgment of courts. As a result, recognition and enforcement in China of judgments of a court of the U.S. or any other jurisdiction in relation to any matter may be difficult or impossible.

Our Significant Amount Of Deposits In Certain Banks In China May Be At Risk If These Banks Go Bankrupt During Our Deposit Period.

As of December 31, 2007, we had approximately RMB35.2 million (approximately US$4.8 million) in banks in China, which almost constitute all of our total cash. The terms of these deposits are, in general, up to twelve (12) months. Historically, deposits in Chinese banks are secure due to the state policy on protecting depositors’ interests. However, China promulgated a new Bankruptcy Law in August 2006, which has come into effect on June 1, 2007, which contains a separate article expressly stating that the State Council may promulgate implementation measures for the bankruptcy of Chinese banks based on the Bankruptcy Law. Under the new Bankruptcy Law, a Chinese bank may go bankrupt. In addition, since China’s concession to WTO, foreign banks have been gradually permitted to operate in China and have been severe competitors against Chinese banks in many aspects, especially since the opening of Renminbi business to foreign banks in late 2006. Therefore, the risk of bankruptcy of those banks in which we have deposits has increased. In the event of bankruptcy of one of the banks which holds our deposits, we are unlikely to recover our deposits back in full since we are unlikely to be classified as a secured creditor based on PRC laws.

13

RISKS RELATING TO OUR BUSINESS

Because Our Operating History Is Limited And The Revenue And Income Potential Of Our Business And Markets Are Unproven, We Cannot Predict Whether We Will Meet Internal or External Expectations Of Future Performance.

We believe that our future success depends on our ability to significantly increase revenue from toll collections, of which we have a limited history. The Expressway marketplace features high investment and a long recovery period. The main market risk in connection with our Company is the future traffic volume less than the predicted amount. Accordingly, our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by companies with a limited operating history. These risks include our ability to:

| · | offer new and innovative services on the Expressway; |

| · | attract advertisers; |

| · | attract more travelers; |

| · | respond effectively to competitive pressures and address the effects of strategic relationships or corporate combinations; |

| · | maintain our current, and develop new, strategic relationships; |

| · | increase awareness of the Expressway and continue to build traveler loyalty; |

| · | attract and retain qualified management and employees; and |

| · | upgrade our technology to support increased traffic and expanded services. |

Our Business And Growth Could Suffer If We Are Unable To Hire And Retain Key Personnel That Are In High Demand.

We depend upon the continued contributions of our senior management and other key personnel, including Li Xipeng and Zhang Chunxian. The loss of the services of any of our executive officers or other key employees could have a material adverse effect on our business, operations, revenues or prospects. We do not maintain key man insurance on the lives of these individuals at present. As we plan to expand, we will have to attract managerial staff. We may not be able to identify and retain qualified personnel due to our lack of understanding of different cultures and lack of local contacts. This may impede any potential expansion. Our future success will also depend on our ability to attract and retain highly skilled and qualified technical, engineering, managerial, finance, marketing, security and customer service personnel in China. Qualified individuals are in high demand, and we may not be able to successfully attract, assimilate or retain the personnel we need to succeed.

If We Need Additional Capital To Fund Our Growing Operations, We May Not Be Able To Obtain Sufficient Capital And May Be Forced To Limit The Scope Of Our Operations.

We may experience increased capital needs and we may not have enough capital to fund our future operations without additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the success of our competitors; (iii) the amount of our capital expenditures; and (iv) new infrastructure project investment. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

If we cannot obtain additional funding, we may be required to:

| · | reduce our investments in infrastructure industry; |

14

| · | limit our expansion efforts; and |

| · | decrease or eliminate capital expenditures. |

Such reductions could materially adversely affect our business and our ability to compete. Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are acceptable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing stockholders. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

Competition With The Railways and Airways in China May Have A Negative Impact On Our Business

With the rapid development of the domestic expressway, China is also giving great support to the development of railways and airways. The construction of a special passenger railway and the speed-up of railways in general will be able to greatly improve the transport capacity of passengers and freight by railway and bring about a division of the target clients of the Expressway which could be an impediment to our growth and have a negative impact on our revenues.

RISKS RELATING TO OUR COMMON STOCK

Our Common Stock Price Is Volatile And Could Decline In The Future.

The stock market in general and the market price for other companies based in the PRC have experienced extreme stock price fluctuations. In some cases, these fluctuations have been unrelated to the operating performance of the affected companies. Many companies in the toll road industry have experienced dramatic volatility in the market prices of their common stock. We believe that a number of factors, both within and outside of our control, could cause the price of our Common Stock to fluctuate, perhaps substantially. Factors such as the following could have a significant adverse impact on the market price of our Common Stock:

| · | announcements of technological innovations by us or our competitors; |

| · | our ability to obtain additional financing and, if available, the terms and conditions of the financing; |

| · | our financial position and results of operations; |

| · | litigation; |

| · | period-to-period fluctuations in our operating results; |

| · | changes in estimates of our performance by any securities analysts; |

| · | new regulatory requirements and changes in the existing regulatory environment; |

| · | the issuance of new equity securities in a future offering; |

| · | changes in interest rates; |

| · | changes in toll road standards; |

| · | market conditions of securities traded on the OTC Bulletin Board; |

| · | investor perceptions of us and the toll road industry generally; and |

| · | general economic and other national conditions. |

15

The Trading Market In Learning Quest’s Common Stock Is Limited And May Cause Volatility In The Market Price.

Learning Quest’s Common Stock is currently traded on a limited basis on the Over-The-Counter Bulletin Board under the symbol “LQTI.OB”. The Over-The-Counter Bulletin Board is an inter-dealer, over-the-counter market that provides significantly less liquidity than the NASD’s automated quotation system, or the NASDAQ Stock Market. Quotes for stocks included on the Over-The-Counter Bulletin Board are not listed in the financial sections of newspapers as are those for the NASDAQ Stock Market. Therefore, prices for securities traded solely on the Over-The-Counter Bulletin Board may be difficult to obtain.

The quotation of our Common Stock on the Over-The-Counter Bulletin Board does not assure that a meaningful, consistent and liquid trading market currently exists, and in recent years such market has experienced extreme price and volume fluctuations that have particularly affected the market prices of many smaller companies like us. Thus, the market price for our Common Stock is subject to volatility and holders of Common Stock may be unable to resell their shares at or near their original purchase price or at any price. In the absence of an active trading market:

| · | investors may have difficulty buying and selling or obtaining market quotations; |

| · | market visibility for our Common Stock may be limited; and |

| · | a lack of visibility for our Common Stock may have a depressive effect on the market for our Common Stock. |

We May Have Difficulty Raising Necessary Capital To Fund Operations As A Result Of Market Price Volatility For Our Shares Of Common Stock.

In recent years, the securities markets in the United States have experienced a high level of price and volume volatility, and the market price of securities of many companies have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values or prospects of such companies. For these reasons, our shares of Common Stock can also be expected to be subject to volatility resulting from purely market forces over which we will have no control. If our business development plans are successful, we may require additional financing to continue to develop and exploit existing and new technologies and to expand into new markets. The exploitation of our technologies may, therefore, be dependent upon our ability to obtain financing through debt and equity or other means.

Our Common Stock Is Considered A “Penny Stock” And As A Result, Related Broker-Dealer Requirements Affect Its Trading And Liquidity.

Our Common Stock is considered to be a “penny stock” since it meets one or more of the definitions in Rules 15g-2 through 15g-6 promulgated under Section 15(g) of the Exchange Act. These include but are not limited to the following: (i) the common stock trades at a price less than $5.00 per share; (ii) the common stock is not traded on a “recognized” national exchange; (iii) the common stock is not quoted on the NASDAQ Stock Market, or (iv) the common stock is issued by a company with average revenues of less than $6.0 million for the past three (3) years. The principal result or effect of being designated a “penny stock” is that securities broker-dealers cannot recommend our Common Stock to investors, thus hampering its liquidity.

Section 15(g) and Rule 15g-2 require broker-dealers dealing in penny stocks to provide potential investors with documentation disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the documents before effecting any transaction in a penny stock for the investor’s account. Potential investors in our Common Stock are urged to obtain and read such disclosure carefully before purchasing any of our shares.

16

Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects the investor’s financial situation, investment experience and investment objectives.

Compliance with these requirements may make it more difficult for holders of our Common Stock to resell their shares to third parties or to otherwise dispose of them in the market or otherwise.

Shares Eligible For Future Sale May Adversely Affect The Market Price Of Our Common Stock.

From time to time, certain of our stockholders may be eligible to sell all or some of their shares of Common Stock by means of ordinary brokerage transactions in the open market pursuant to Rule 144, promulgated under the Securities Act of 1933, as amended, subject to certain limitations. In general, effective February 15, 2008, pursuant to Rule 144, a stockholder (or stockholders whose shares are aggregated) who has satisfied a six (6) months holding period may, under certain circumstances, sell within any three (3) month period a number of securities which does not exceed one percent (1%) of the then outstanding shares of common stock. In addition, effective February 15, 2008, Rule 144 also permits, under certain circumstances, the sale of securities, without any limitations, by a non-affiliate of our company that has satisfied a one (1) year holding period. Any substantial sale of common stock pursuant to Rule 144 may have an adverse effect on the market price of our Common Stock.

One Stockholder Which is 50% Controlled By Our Chief Executive Officer and Chairman of the Board of Learning Quest Exercises Significant Control Over Matters Requiring Stockholder Approval.

After giving effect to the issuance of all the shares of Common Stock, the Stockholder has voting power equal to sixty-eight percent (68)% of our voting securities as of the date of this Report. Moreover, the Stockholder is fifty percent (50%) controlled by Li Xipeng, Learning Quest’s Chief Executive Officer and Chairman of the Board. As a result, the Stockholder and our CEO, through such stock ownership, exercises control over all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. This concentration of ownership in the Stockholder may also have the effect of delaying or preventing a change in control of us that may be otherwise viewed as beneficial by stockholders other than the Stockholder.

We May Incur Significant Costs To Ensure Compliance With U.S. Corporate Governance And Accounting Requirements.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the SEC. We expect all of these applicable rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

17

We May Be Required To Raise Additional Financing By Issuing New Securities With Terms Or Rights Superior To Those Of Our Shares Of Common Stock, Which Could Adversely Affect The Market Price Of Our Shares Of Common Stock.

We may require additional financing to fund future operations, including expansion in current and new markets, programming development and acquisition, capital costs and the costs of any necessary implementation of technological innovations or alternative technologies. We may not be able to obtain financing on favorable terms, if at all. If we raise additional funds by issuing equity securities, the percentage ownership of our current stockholders will be reduced, and the holders of the new equity securities may have rights superior to those of the holders of shares of Common Stock, which could adversely affect the market price and the voting power of shares of our Common Stock. If we raise additional funds by issuing debt securities, the holders of these debt securities would similarly have some rights senior to those of the holders of shares of Common Stock, and the terms of these debt securities could impose restrictions on operations and create a significant interest expense for us.

Standards For Compliance With Section 404 Of The Sarbanes-Oxley Act Of 2002 Are Uncertain, And If We Fail To Comply In A Timely Manner, Our Business Could Be Harmed And Our Stock Price Could Decline.

Rules adopted by the SEC, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of our internal control over financial reporting, and attestation of our assessment by our independent registered public accountants. The standards that must be met for management to assess the internal control over financial reporting as effective are new and complex, and require significant documentation, testing and possible remediation to meet the detailed standards and will impose significant additional expenses on us. We may encounter problems or delays in completing activities necessary to make an assessment of our internal control over financial reporting. In addition, the attestation process by our independent registered public accountants is new and we may encounter problems or delays in completing the implementation of any requested improvements and receiving an attestation of our assessment by our independent registered public accountants. If we cannot assess our internal control over financial reporting as effective, or our independent registered public accountants are unable to provide an unqualified attestation report on such assessment, investor confidence and share value may be negatively impacted.

We Do Not Foresee Paying Cash Dividends In The Foreseeable Future.

We have not paid cash dividends on our stock and we do not plan to pay cash dividends on our stock in the foreseeable future.

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

Forward Looking Statements

The following discussion of our financial condition and results of operations is based upon and should be read in conjunction with our consolidated financial statements and their related notes included in this Report. This report contains forward-looking statements. Generally, the words “believes”, ”anticipates”, “may”, “will”, “should”, “expect”, “intend”, “estimate”, “continue” and similar expressions or the negative thereof or comparable terminology are intended to identify forward-looking statements. Such statements are subject to certain risks and uncertainties, including the matters set forth in this report or other reports or documents we file with the SEC from time to time, which could cause actual results or outcomes to differ materially from those projected. Undue reliance should not be placed on these forward-looking statements which speak only as of the date hereof. We undertake no obligation to update these forward-looking statements.

Business Overview

We are engaged in the investment, construction, operation and management of the Pinglin Expressway toll road and the rental of petrol stations and service districts along the toll roads.

18

With the approval from Henan Communications Bureau and the State Development and Reform Committee of China [NO. 2003-1784], the Company is permitted to construct and operate the Pinglin Expressway in Henan, China for thirty (30) years from 2003. Pursuant to the permission from Henan Communications Bureau and Henan Development and Reform Committee [NO. 2005-1885], the Company is entitled to operate six (6) toll gates. All the rates applicable to the automobiles are defined by the Henan Communications Bureau and Henan Development and Reform Committee.

The Pinglin Expressway is a significant part of the national trunk, the Nanjing to Luoyang expressway (also referred to herein as the Nanluo Expressway). The Nanluo Expressway links the north-western regions to the south-eastern coastal regions of the PRC. The construction of Pinglin Expressway started in October 23, 2003 and was completed in two (2) phases. The first phase of the construction which covered the part with a length of approximately 86 kilometers, linking Ruzhou and Pingdingshan in Henan Province, began commercial operations in December 31, 2005. On May 31, 2006, the second phase of the construction, with the length of approximately 21 kilometers, linking Pingdingshan and Yexian in Henan Province was completed. With the operation of Pinglin Expressway, the key transport artery, national trunk Nanluo Expressway was entirely put into operations.

The Pinglin Expressway is a dual carriageway four (4) lane expressway, the toll section of which is 106 km in length. Toll revenue from the passing vehicles through the Expressway’s six (6) toll gates (South Pingdingshan, Pingdingshan New Town, Baofeng, Xiaotun, Ruzhou and Wenquan) is the primary source of the Company’s earnings. The Expressway is also located between two (2) key cities, Luoyang and Luohe. The Expressway extends from east to west, from Shilipu (the end of the Luohe-Pingdingsha expressway), through Yexian and Pingdingshan and then to New Xiying village at the joint of Pingdingshan and Luoyang. The road is lined with the Lianhuo (Lianyungang-Huoerguosi) national highway through the ringroad in Luoyang, and then extends to the southeast of Luohe City and connects with the Beijing-Zhuhai national highway into a network to form a convenient channel between Luoyang and Luohe. In addition to the traffic flow of the line itself, we believe it also attracts the traffic flow from Lianhuo high way to Zhengzhou then to Beijing-Zhuhai national highway to alter to Luoyang-Luohe section of Luonan route. Furthermore, the Expressway extends east to link the highway network of the Jiangsu and Anhui provinces and also links the sea ports, including Shanghai.

The Company’s operating income is achieved through toll charges on vehicles that go through the toll gate. The standard of toll charges is approved and set by the provincial price administrative bureau. The Company's revenue is equal to the relevant standard toll rate for the types of vehicles multiplied by the relative miles of travel through the expressway which the Company is operating, and is cleared by the Henan Expressway System Toll Collection Center each month (Henan Expressway has a charges system and clearing center which calculates and allocates toll charge income according to the charge standards and the miles of travel of vehicles in the expressway). The Company is specialized in the operation and management of expressways. The maintenance projects are outsourced to professional road construction enterprises.

The Company began generating operating revenue in January 2006. The Company had not yet started full operation of the expressway prior to June 2006, therefore the operating income was at a low level and the growth was moderate. With the full operation of the Expressway in June 2006, the operating income had seen sustained rapid growth. With respect to profit, as the loan interest of the Company was included in the expenses, and the depreciation of fixed assets was accounted in the current period, the Company incurred a temporary loss in June. But with the increase of revenue, the Company has generated a profit and has achieved sustained increases in profit for the past several months. Income in December was the same as in November on the whole, because of the seasonal winter impact on the traffic flow in December.

After several months of operations, the social awareness of the Expressway gradually increased, and passenger and commercial vehicles is increasing rapidly. We believe that along with income growth in the future, the profit earning capacity of the Company will improve steadily.

19

Enterprise Strategy

Henan is a province with the largest population in China. However, its urbanization rate is far below the national average level. With rapid economic and social development and the accelerated process of urbanization in Henan, demands for infrastructure, the expressway and other transportation infrastructure, urban facilities such as heating, water supply, and sewerage treatment are also growing rapidly. The existing infrastructure can no longer meet the needs of social development.

Because the Chinese government’s financial revenue growth is limited, the financial investment of the government alone is unable to build huge infrastructure projects in a relatively short period. In order to attract social funds, local governments are willing to grant to commercial companies the right to invest in the construction and operation of projects, or directly sell the equity of the established enterprise to recover their early input. In addition, the government will also give preferential treatment on charges.

To seize the historic opportunity of rapid development of infrastructure of China and Henan, to rapidly strengthen and expand the Company's infrastructure industries, to create advantages on scale, thereby to further reduce the cost of operation, the Company plans to invest in construction of purchase additional expressways, thermoelectricity, water supply or sewage treatment facilities and other infrastructure assets with good profit prospects in the next few years. Because the amount of investment in infrastructure is often relatively large, and the investment funds need to be in position within two (2) or three (3) years, the accumulated capital from the Company’s operation alone cannot meet the demand for investment in the future. The Company desires to actively participate in the capital markets, to use various channels of financing to enhance its ability to raise funds, thus to promote and achieve these long-term development strategies.

Based on the operation and management of the Expressway, the Company desires to take full advantage of free cash flow and capital market instruments to invest in construction or purchase of infrastructure assets and to exploit all the advantages in management, government relationship and stockholder support to make the Company a professional, continuously-growing infrastructure investment operator.

In addition, the Company intends to energetically push forward the standard management, human-based services, establish an information management platform and continue to improve the road condition and traffic capacity so as to provide the traveler with a smooth, safe and comfortable running environment. With the increasing influence of the Expressway on the substitution and division of other transportation lines and under the great macroeconomic environment providing continuous and rapid growth in China and the specific area where the roads are located, we believe that the Company’s income from toll and profits will continue to increase.

Significant Accounting Policies

We prepare our financial statement in accordance with generally accepted accounting principles in the United States, which requires us to make estimates and assumptions that affect the reported amounts of our assets and liabilities, to disclose contingent assets and liabilities on the date of the financial statements, and to disclose the reported amounts of revenues and expenses incurred during the financial reporting period. We continue to evaluate these estimates and assumptions that we believe to be reasonable under the circumstances. We rely on these evaluations as the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Since the use of estimates is an integral component of the financial reporting process, actual results could differ from those estimates. Some of our accounting policies require higher degrees of judgment than other in their application.

This section should be read together with the Summary of Significant Accounting Policies included as Note 2 to the consolidated financial statements included herein.

20

We determine the estimated useful lives and related depreciation charges for our toll road infrastructures, property, plant and equipment. This estimate is based on the historical experience of the actual useful lives of toll road infrastructures, property, plant and equipment of similar nature and functions and the practice in similar industry. Toll road infrastructures, property, plant and equipment are carried at cost less accumulated depreciation and amortization. Depreciation and amortization of the toll road infrastructures are calculated to write off their cost, commencing from the date of commencement of commercial operations of the toll roads, based on the ratio of actual traffic volume compared to the total expected traffic volume of the toll roads as estimated by reference to traffic projection reports prepared by an independent PRC organization each year. It could change significantly as a result of technical innovations and competitor actions in response to severe industry cycles. Other properties, plant and equipment are depreciated or amortized over their estimated useful lives, using the straight-line method. Our Directors will increase the depreciation charge where useful lives are less than previously estimated lives, or we will write-off or write-down technically obsolete or non-strategic assets that have been abandoned or sold.

Revenue Recognition

The Company’s revenue represents toll revenue net of business tax, and is recognized when all of the following criteria are met:

| · | The amount of revenue can be measured reliably; |

| · | It is probable that the economic benefits associated with the transaction will flow to the enterprise; |

| · | The costs incurred or to be incurred in respect of the transaction can be measured reliably; and |

| · | Collectibility is reasonably assured. |

The rental income is measured at the fair value of the consideration receivable and represents amounts receivable for services provided in the normal course of business, net of discounts and sales tax.

Fair Value of Financial Instruments

The Company’s financial instruments include restricted cash, accounts receivable, note receivable, due from related parties, other receivables, other payables and accrued liabilities, short-term bank loans, payable to contractors, other current liabilities and deferred taxes. We estimated that the carrying amount approximates fair value due to their short-term nature. The fair value of the Company’s long-term bank loans, deferred revenue and payables to contractors are estimated based on the current rates offered to the Company for debt of similar terms and maturities. The Company’s fair value of long-term bank loans, deferred revenue and payables to contractors was not significantly different from the carrying value at June 30, 2007 and 2006, and September 30, 2007 and 2006 as well.

Impairment of Long-Lived Assets

We review periodically the carrying amounts of long-lived assets including toll road infrastructures, property, plant and equipment, land use rights, construction in progress, long-term investment and long-term deferred assets with finite useful lives or beneficial periods, to assess whether they are impaired. We evaluate these assets for impairment whenever events or changes in circumstances indicate that their carrying amounts may not be recoverable such as a change of business plan or a period of continuous losses. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to the estimated undiscounted future cash flows expected to be generated by the asset. If the carrying amount of an asset exceeds its projected future cash flows, an impairment charge is recognized by the amount by which the carrying amount of the asset exceeds the fair value of the assets. In determining estimates of future cash flows, significant judgment in terms of projection of future cash flows and assumptions is required. There were no impairments for the fiscal years ended June 30, 2007 and 2006 and for the three (3) month periods ended September 30, 2007 and 2006 as well.

21

Contingencies

In normal course of business, we are subject to contingencies, including, legal proceedings and claims arising out of the business that relate to a wide range of matters. We recognize a liability for such contingency if we determine that it is probable that a loss has incurred and a reasonable estimate of the loss can be made. We may consider many factors in making these assessments, including past history and the specifics of each matter. As we have not become aware of any toll related claim since operations commenced, we have not recognized such a liability for the fiscal years ended June 30, 2007 and 2006 and for the three (3) month periods ended September 30, 2007 and 2006 as well.

Recent Accounting Pronouncements