BACKGROUND 1 COMPANY PRESENTATION SEPTEMBER 2014

MATTERS DISCUSSED IN THIS PRESENTATION CONTAIN FORWARD - LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. THESE STATEMENTS, WHICH INVOLVE RISKS AND UNCERTAINTIES, RELATE TO THE DISCUSSION OF OUR BUSINESS STRATEGIES AND OUR EXPECTATIONS CONCERNING FUTURE OPERATIONS, MARGINS, PROFITABILITY, LIQUIDITY AND CAPITAL RESOURCES AND ANALYSES AND OTHER INFORMATION THAT ARE BASED ON FORECASTS OF FUTURE RESULTS AND ESTIMATES OF AMOUNTS NOT YET DETERMINABLE. WHEN USED IN THIS PRESENTATION, THE WORDS "ANTICIPATE," "BELIEVE," "ESTIMATE," "MAY," "INTEND," "EXPECT" AND SIMILAR EXPRESSIONS IDENTIFY SUCH FORWARD - LOOKING STATEMENTS. THESE FORWARD - LOOKING STATEMENTS ARE MADE BASED ON EXPECTATIONS AND BELIEFS CONCERNING FUTURE EVENTS AFFECTING US AND ARE SUBJECT TO RISKS, UNCERTAINTIES, ASSUMPTIONS AND OTHER FACTORS RELATING TO OUR OPERATIONS AND BUSINESS ENVIRONMENTS, ALL OF WHICH ARE DIFFICULT TO PREDICT AND MANY OF WHICH ARE BEYOND OUR CONTROL, THAT COULD CAUSE OUR ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS TO DIFFER MATERIALLY FROM THOSE CONTEMPLATED, EXPRESSED OR IMPLIED BY SUCH FORWARD - LOOKING STATEMENTS. THESE FACTORS INCLUDE, BUT ARE NOT LIMITED TO , OUR HISTORY OF LOSSES, OUR ABILITY TO EXPAND OUR OPERATIONS IN BOTH NEW AND EXISTING MARKETS, OUR ABILITY TO DEVELOP OR ACQUIRE NEW BRANDS, OUR RELATIONSHIPS WITH DISTRIBUTORS, THE SUCCESS OF OUR MARKETING ACTIVITIES AND OUR COST REDUCTION EFFORTS, THE EFFECT OF COMPETITION IN OUR INDUSTRY AND ECONOMIC AND POLITICAL CONDITIONS GENERALLY, INCLUDING THE CURRENT ECONOMIC ENVIRONMENT , AND OTHER FACTORS DETAILED IN PERIODIC REPORTS FILED BY CASTLE BRANDS WITH THE SECURITIES AND EXCHANGE COMMISSION. FORWARD LOOKING STATEMENTS NYSE MKT: ROX PAGE 1

▪ Castle Brands produces and markets premium spirits in four major categories : rum, whiskey, liqueurs and vodka. ▪ Over the last few years, Castle Brands has consistently grown its more profitable brands faster than industry norms. ▪ The Company has a strong and supportive shareholder group with officers and directors owning approximately 48% of its shares on a fully diluted basis. ▪ To accelerate growth, a Strategic Planning Committee was established in 2013 and several key initiatives are being implemented. ▪ A brief overview of our company, our brands and the initiatives to accelerate growth is set out on the following pages. COMPANY OVERVIEW NYSE MKT: ROX PAGE 2

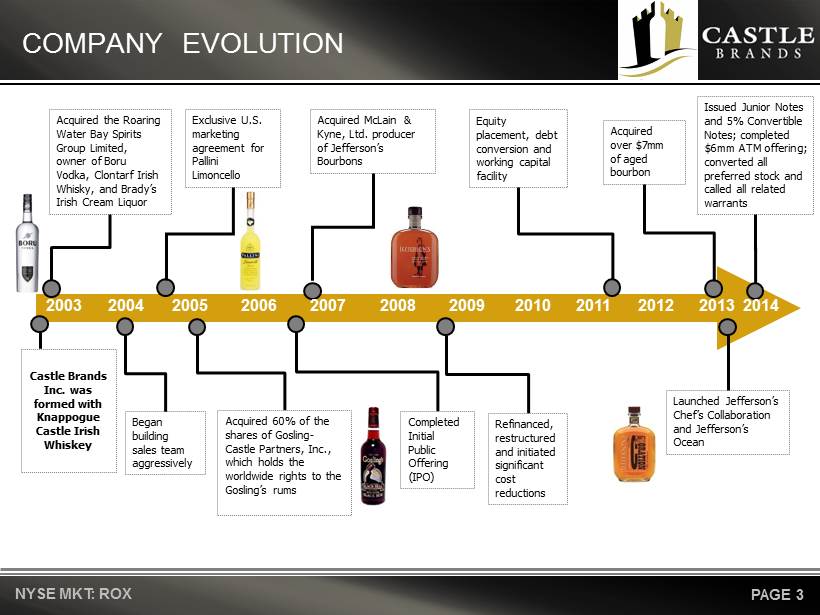

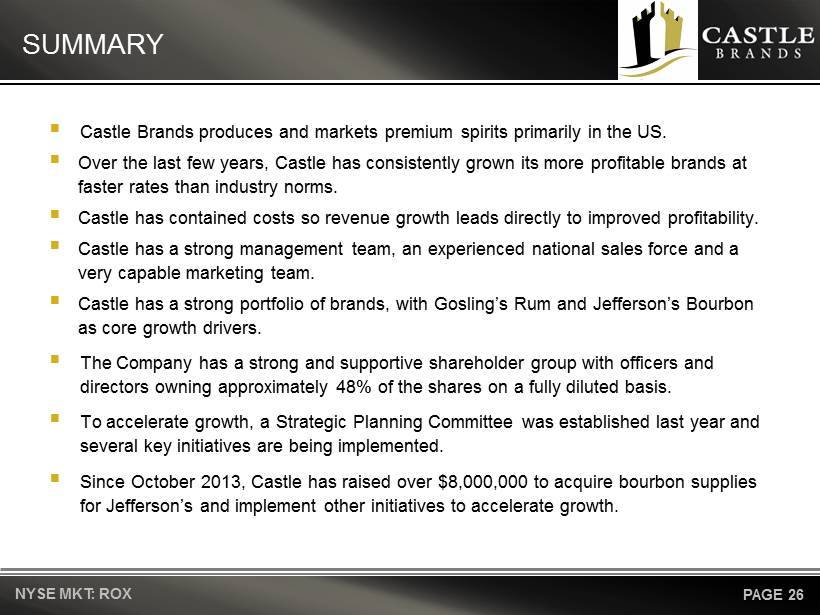

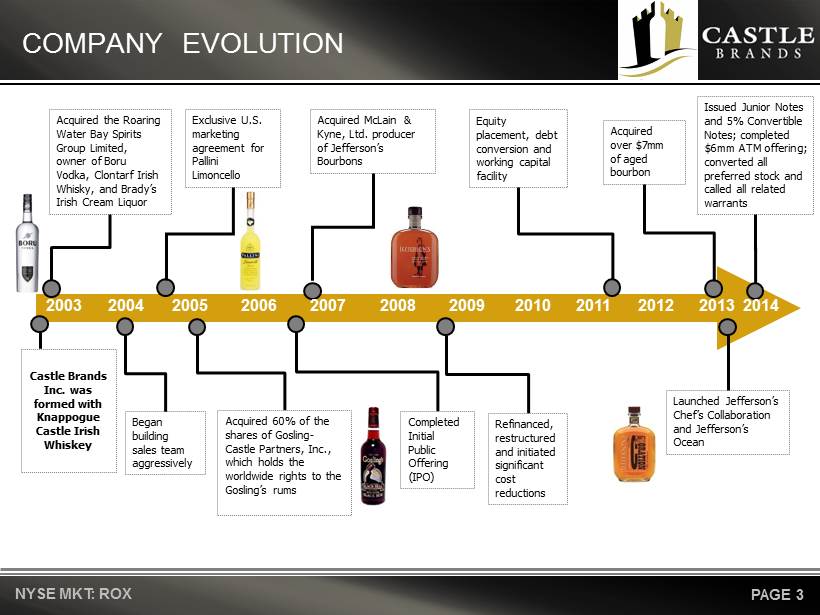

COMPANY EVOLUTION Acquired the Roaring Water Bay Spirits Group Limited, owner of Boru Vodka, Clontarf Irish Whisky, and Brady’s Irish Cream Liquor Began building sales team aggressively Exclusive U.S. marketing agreement for Pallini Limoncello Completed Initial Public Offering (IPO) Refinanced, restructured and initiated significant cost reductions Acquired 60% of the shares of Gosling - Castle Partners, Inc ., which holds the worldwide rights to the Gosling’s rums Acquired McLain & Kyne, Ltd. producer of Jefferson’s Bourbons Castle Brands Inc. was formed with Knappogue Castle Irish Whiskey Equity placement, debt conversion and working capital facility Acquired over $7mm of aged bourbon Launched Jefferson’s Chef’s Collaboration and Jefferson’s Ocean NYSE MKT: ROX PAGE 3 2003 2004 2005 2006 2010 2007 2008 2009 2011 2013 2012 Issued Junior Notes and 5% Convertible Notes; completed $6mm ATM offering; converted all preferred stock and called all related warrants 2014

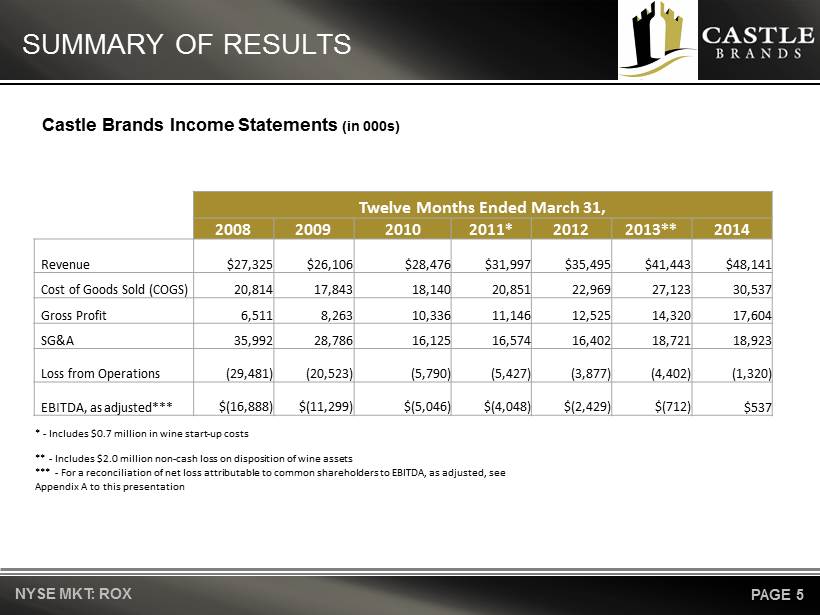

▪ Prior to 2008, Castle Brands raised over $100 million and invested heavily to acquire and build its brands. ▪ In 2008, a new investor group recapitalized the Company and made major strategic changes, which included: • Significant overhead reductions • Reduction in sales and marketing expenditures • Focus on core brands • Emphasis on profitable markets • Path to profitability ▪ Over the next five years, sales of core brands in profitable markets grew. Less profitable sales were discontinued. ▪ The financial results of this strategic change are shown on the next page. STRATEGIC CHANGE NYSE MKT: ROX PAGE 4

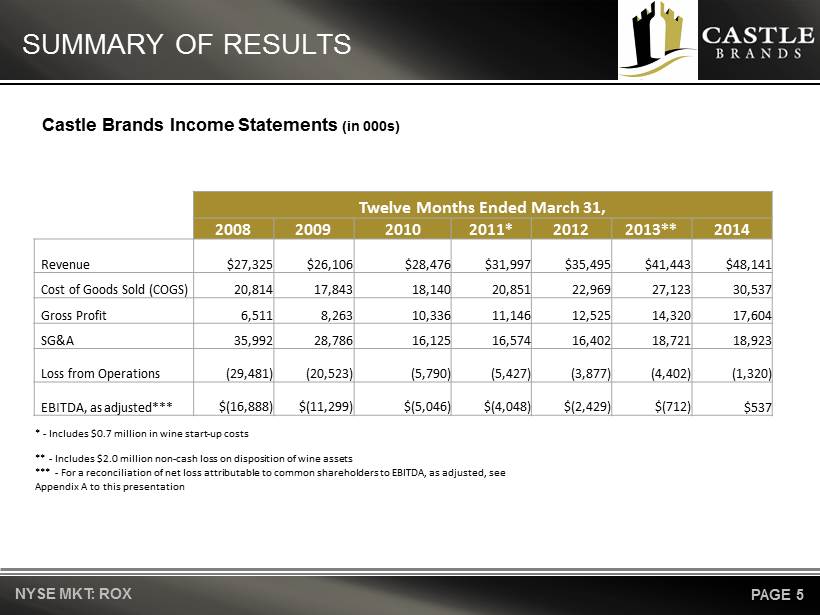

SUMMARY OF RESULTS Twelve Months Ended March 31, 2008 2009 2010 2011* 2012 2013** 2014 Revenue $27,325 $26,106 $28,476 $31,997 $35,495 $41,443 $48,141 Cost of Goods Sold (COGS) 20,814 17,843 18,140 20,851 22,969 27,123 30,537 Gross Profit 6,511 8,263 10,336 11,146 12,525 14,320 17,604 SG&A 35,992 28,786 16,125 16,574 16,402 18,721 18,923 Loss from Operations (29,481) (20,523) (5,790) (5,427) (3,877) ( 4,402 ) (1,320) EBITDA, as adjusted*** $(16,888) $( 11,299) $( 5,046) $( 4,048) $( 2,429) $(712 ) $537 * - Includes $0.7 million in wine start - up costs ** - Includes $2.0 million non - cash loss on disposition of wine assets *** - For a reconciliation of net loss attributable to common shareholders to EBITDA, as adjusted, see Appendix A to this presentation NYSE MKT: ROX PAGE 5 Castle Brands Income Statements (in 000s)

RECENT HIGHLIGHTS NYSE MKT: ROX PAGE 6 ▪ Castle recorded positive EBITDA, as adjusted, for the first time in its history for the year ended March 31, 2014. ▪ Raised approximately $6.0 million of equity capital through the issuance of common stock in an at - the - market (“ATM”) offering. ▪ Raised $3.9 million of additional equity capital through the exercise of warrants issued in the Company’s 2011 PIPE to purchase 10.1 million shares of common stock, which eliminated future non - cash charges related to warrant valuation. ▪ Purchased $7.5 million of aged bourbon to support forecasted needs through 2020. ▪ Due to the increased stock price and volume, Castle was able to force the conversion of all preferred stock into common stock, simplifying the capital structure and eliminating the 10% preferred dividend and its effect on net income attributable to common shareholders going forward.

Mark Andrews – Chairman • Founded Castle Brands in 2003 . • Chairman and CEO of American Exploration (ASE: AX), an oil and gas company, until its sale to Louis Dreyfus Natural Gas. • Former Director of IVAX Corp. from its founding until its sale to Teva Pharmaceutical Industries Limited (NASDAQ : TEVA ). • Life Trustee of New York Presbyterian Hospital. • Bachelor of Arts from Harvard College and MBA from Harvard Business School. Richard Lampen – President and Chief Executive Officer • President and CEO of Ladenburg Thalmann Financial Services Inc. (NYSE MKT: LTS ). • Executive VP, Vector Group Ltd. (NYSE: VGR), holding company with interests in consumer goods and real estate . • Former Managing Director and Senior Member, Leveraged Finance Group, Salomon Brothers Inc . • Former Partner & Co - Chairman of Corporate Department, Steel Hector & Davis, a law firm with headquarters in Miami, FL. • Bachelor of Arts from the Johns Hopkins University and a JD from Columbia Law School. MANAGEMENT TEAM NYSE MKT: ROX PAGE 7

John Glover – Chief Operating Officer • Over 30 years experience in marketing, commercial and general management in the spirits industry. • Former Senior VP Commercial Management of Remy Cointreau USA. • Served in various roles in marketing and management with predecessor companies to Diageo plc (LSE : DGE ). • Bachelor of Arts and MBA from Dartmouth College . Alfred Small – Chief Financial Officer • Over 15 years experience in finance, operations and compliance in the spirits industry. • Senior Accountant at Grodsky Caporrino & Kaufman, practicing in consumer goods, wholesale distribution, and technology. • Bachelor of Science from the State University of New York and a Certified Public Accountant . Kelley Spillane – SVP Global Sales • Over 25 years experience in spirits sales. • Served in several senior sales and management roles at Carillon and was closely involved in the growth of Absolut Vodka and Grand Marnier in the US. • Bachelor of Arts from Ramapo College. MANAGEMENT TEAM CONT’D NYSE MKT: ROX PAGE 8

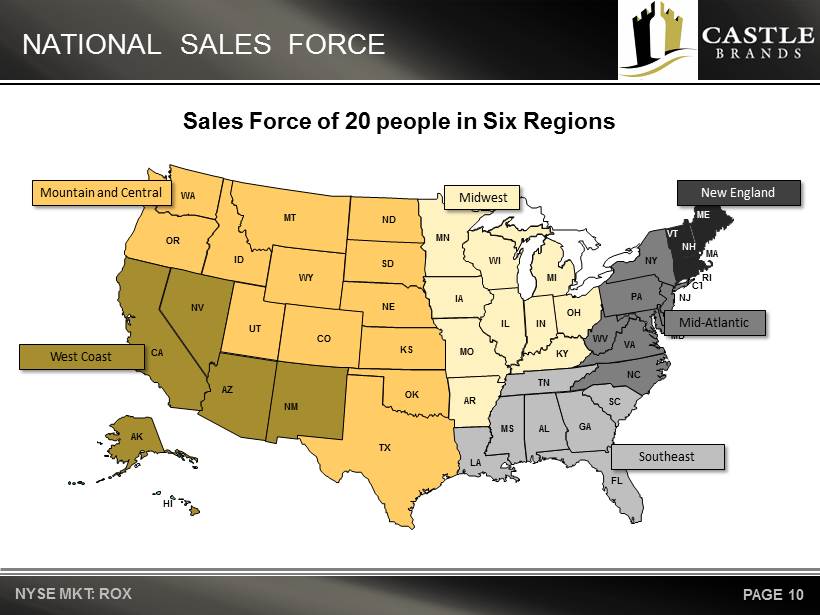

▪ Castle Brands has a 27 person in - house sales and marketing team, with many years of experience with major spirits companies. ▪ Collectively, the sales team sold over 2,000,000 cases per year with their prior companies. ▪ While other costs were significantly reduced beginning in 2008, the sales team was maintained to enable the Company’s core brands to grow. ▪ Castle holds federal importer and wholesaler licenses required by the TTB and the requisite state license in all 50 states and the District of Columbia. ▪ The Company is represented by top - tier distributors across the US. The top three are: • Southern Wine & Spirits • Glazer’s • United Liquors ▪ Castle Brands also has distribution in over 25 other countries. STRONG ROUTE TO MARKET NYSE MKT: ROX PAGE 9

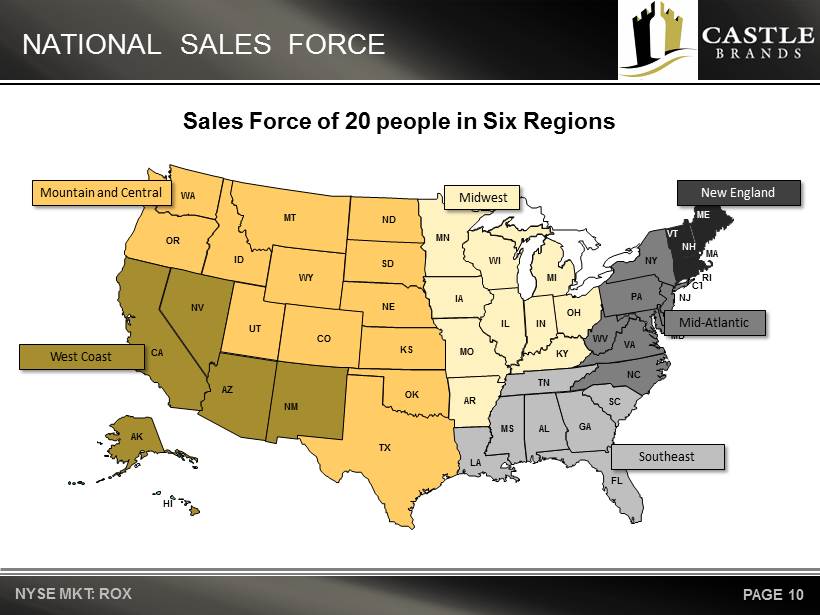

AK MT WY ID WA OR NV UT CA AZ ND SD NE CO NM TX OK KS AR LA MO IA MN WI IL IN KY TN MS AL GA FL SC NC VA WV OH MI NY PA MD DE NJ CT RI MA ME VT NH HI New England Mid - Atlantic Southeast West Coast Midwest Mountain and Central NATIONAL SALES FORCE Sales Force of 20 people in Six Regions NYSE MKT: ROX PAGE 10

New England Mid - Atlantic Region Southeast Region West Coast Region Midwest Region Mountain and Central NATIONAL SALES FORCE Regional Vice President + 1 Area Manager + 2 Brand Managers Regional Vice President + 3 Area Managers + 2 Brand Managers Regional Vice President + 1 Area Manager Regional Vice President + 2 Area Managers + 1 Brand Manager Regional Vice President Regional Vice President + 1 Area Manager + 1 Nat’l Accts Manager NYSE MKT: ROX PAGE 11

MARKETING TEAM ▪ Castle Brands has an experienced marketing team to complement its sales force: • Malcolm Gosling – As CEO of Gosling - Castle Partners, Inc., Malcolm oversees the marketing and promotional activities associated with the Gosling’s brands. Malcolm is based in Boston and works closely with a creative agency based there. • Trey Zoeller – As VP Bourbon Operations, Trey is responsible for Jefferson’s marketing and promotional activities. Trey is based in Kentucky where his family has been active in the bourbon industry for several generations. • Alejandra Pena – As SVP Marketing, Alejandra works closely with Malcolm and Trey. She is also responsible for the marketing and promotional activities associated with Castle’s other brands. Prior to joining Castle in 2010, Alejandra served as Marketing Vice President for liqueurs and spirits for Remy Cointreau USA, where she was responsible for the marketing of Mount Gay Rum and Cointreau Liqueur. • Brand Team – We have a dedicated team of brand managers that focus on the planning and execution of marketing and commercial activities for our Castle Brands portfolio. NYSE MKT: ROX PAGE 12

MARKETING INITIATIVES NYSE MKT: ROX PAGE 13 ▪ Castle has three distinct target audiences for its brands : • Distributor partners across the country • On - premise and off - premise retailers • Consumers ▪ Brand advertising and marketing programs include: • Traditional advertising • Public relations • Event sponsorships and tastings • Consumer promotions • Value - Added packs • Merchandising • Trade outreach ▪ Increasing emphasis on social media to drive awareness and consumer engagement.

PREMIUM BRAND PORTFOLIO NYSE MKT: ROX PAGE 14

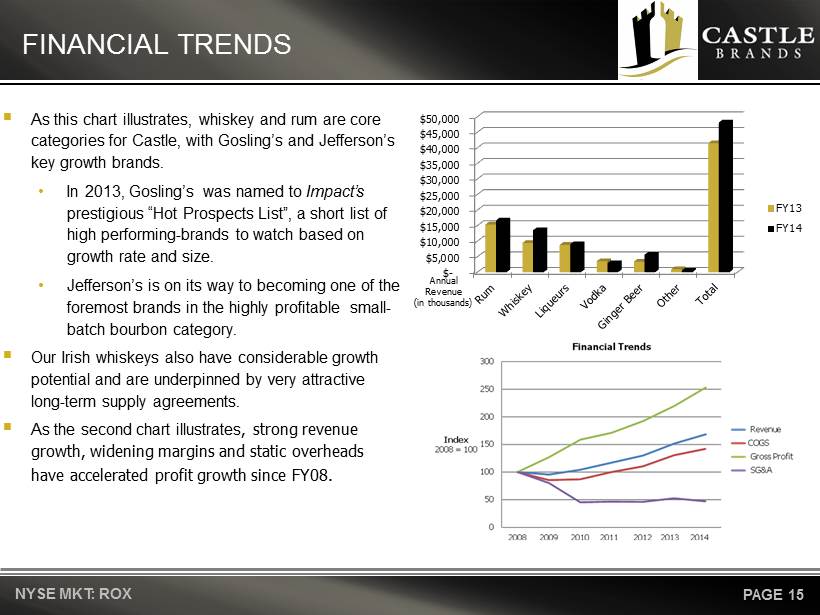

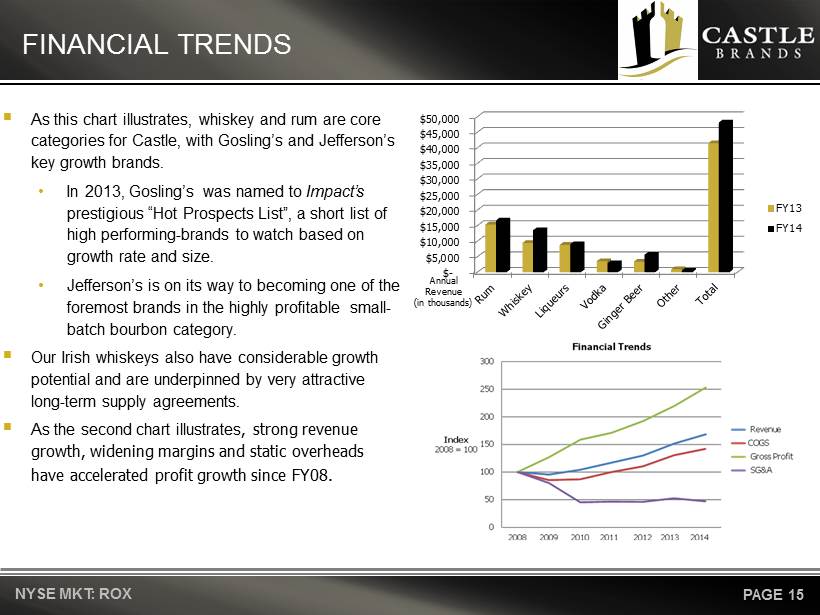

FINANCIAL TRENDS ▪ As this chart illustrates, whiskey and rum are core categories for Castle, with Gosling’s and Jefferson’s key growth brands. • In 2013, Gosling’s was named to Impact’s prestigious “Hot Prospects List”, a short list of high performing - brands to watch based on growth rate and size. • Jefferson’s is on its way to becoming one of the foremost brands in the highly profitable small - batch bourbon category. ▪ Our Irish whiskeys also have considerable growth potential and are underpinned by very attractive long - term supply agreements. ▪ As the second chart illustrates , strong revenue growth, widening margins and static overheads have accelerated profit growth since FY08. NYSE MKT: ROX PAGE 15 $- $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 $50,000 FY13 FY14 Annual Revenue (in thousands)

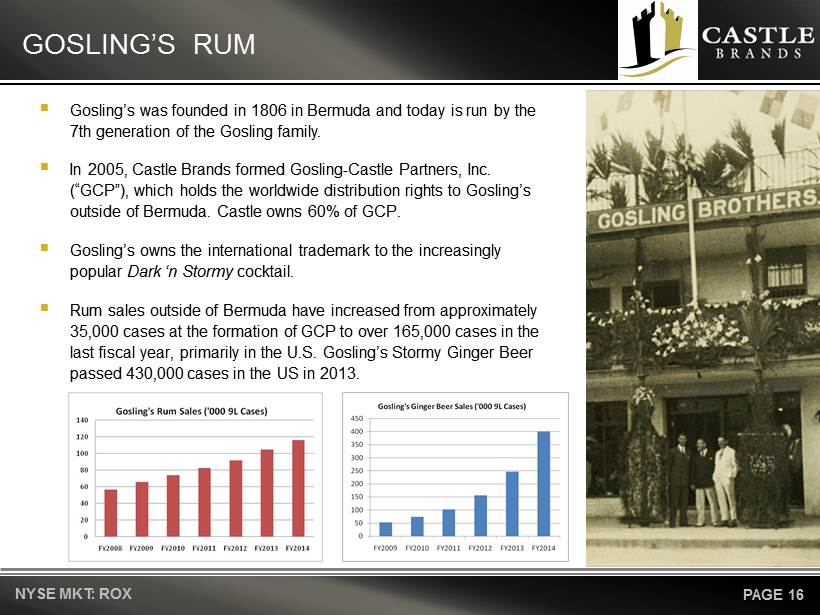

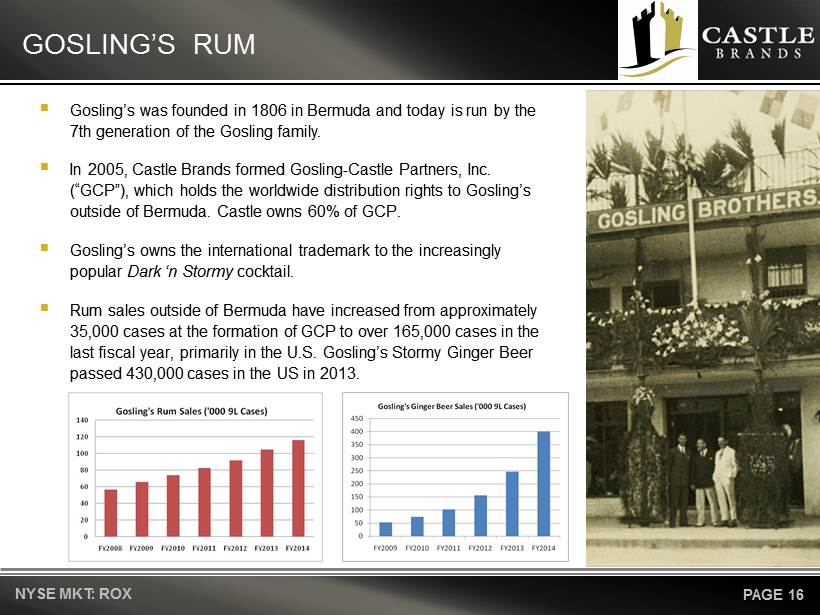

GOSLING’S RUM NYSE MKT: ROX PAGE 16 ▪ Gosling’s was founded in 1806 in Bermuda and today is run by the 7th generation of the Gosling family. ▪ In 2005, Castle Brands formed Gosling - Castle Partners, Inc. (“GCP”), which holds the worldwide distribution rights to Gosling’s outside of Bermuda. Castle owns 60% of GCP. ▪ Gosling’s owns the international trademark to the increasingly popular Dark ‘n Stormy cocktail. ▪ Rum sales outside of Bermuda have increased from approximately 35,000 cases at the formation of GCP to over 165,000 cases in the last fiscal year, primarily in the U.S. Gosling’s Stormy Ginger Beer passed 430,000 cases in the US in 2013.

GOSLING’S RUM NYSE MKT: ROX PAGE 17 ▪ Malcolm Gosling and two brand ambassadors to enhance the impact of live events ▪ Advertising in Golf Magazine ▪ Golf sponsorships: - Honda Classic - US Open - Deutsche Bank ▪ Yachting/Boating sponsorships - Newport to Bermuda race - Charleston Race week - International Boat shows in FL ▪ Wide array of merchandising materials supporting on and off - premise and the Dark ‘n Stormy cocktail ▪ Gosling’s Stormy Ginger Beer: The best ginger beer available ▪ Incentive trips to Bermuda

JEFFERSON’S NYSE MKT: ROX PAGE 18 ▪ Jefferson’s is an umbrella brand that supports line extensions at higher price points: • Jefferson’s Reserve (Older bourbon) • Jefferson’s Presidential Select (Even older bourbon) • Jefferson’s Ocean (Aged at sea) ▪ Jefferson’s has won many awards and high ratings including a 96 rating in Malt Advocate . ▪ Jefferson’s sold over 32 , 000 cases in the last fiscal year with very substantial growth potential . ▪ Aged bourbon acquired to support growth . ▪ Castle Brands owns 100 % of the brand .

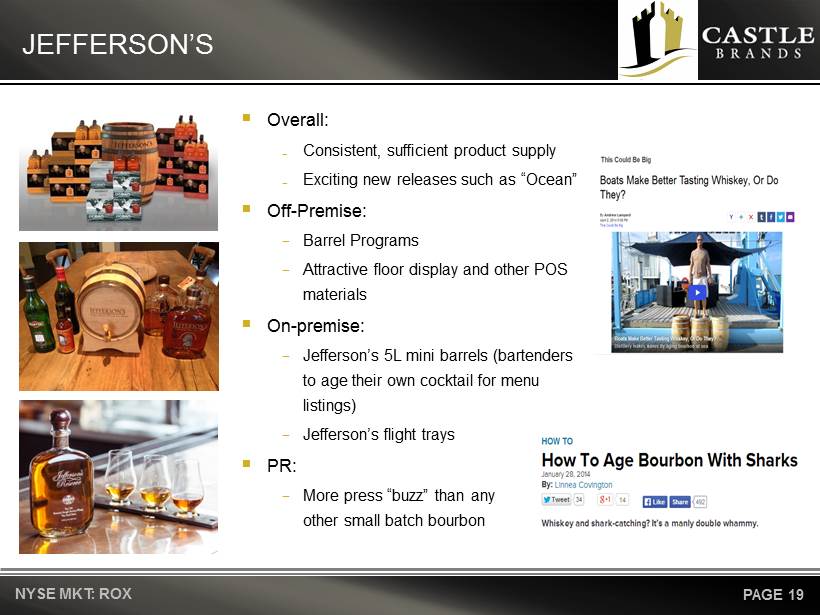

JEFFERSON’S NYSE MKT: ROX PAGE 19 ▪ Overall: ₋ Consistent, sufficient product supply ₋ Exciting new releases such as “Ocean” ▪ Off - Premise: − Barrel Programs − Attractive floor display and other POS materials ▪ On - premise: − Jefferson’s 5L mini barrels (bartenders to age their own cocktail for menu listings) − Jefferson’s flight trays ▪ PR: − More press “buzz” than any other small batch bourbon

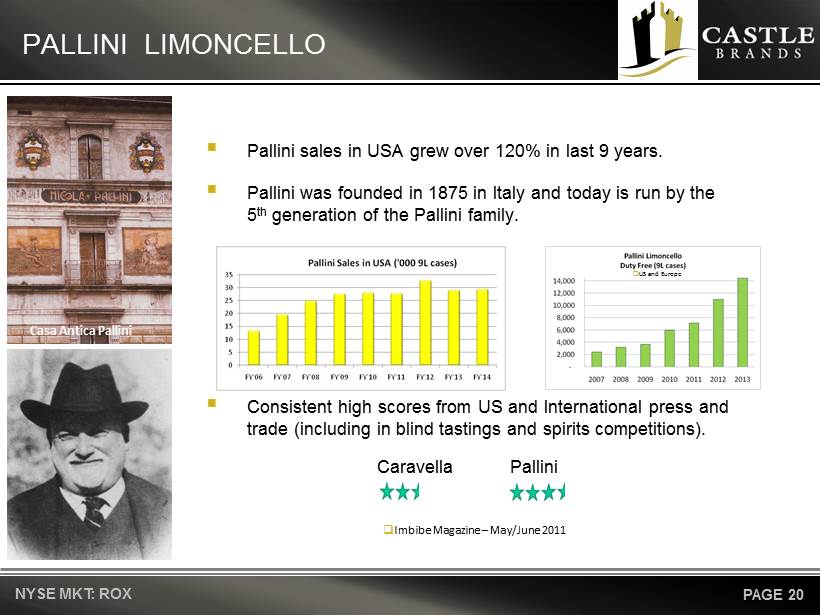

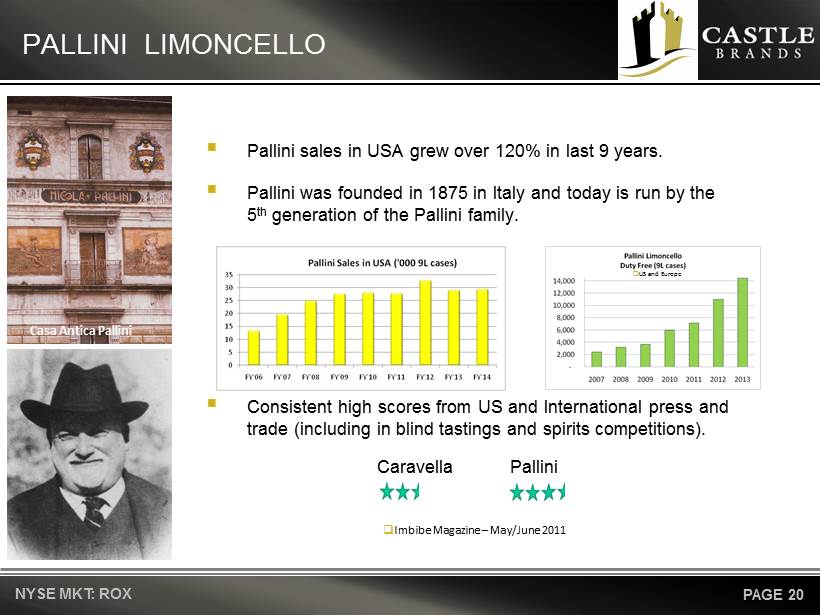

PALLINI LIMONCELLO NYSE MKT: ROX PAGE 20 ▪ Pallini sales in USA grew over 120% in last 9 years. ▪ Pallini was founded in 1875 in Italy and today is run by the 5 th generation of the Pallini family. ▪ Consistent high scores from US and International press and trade (including in blind tastings and spirits competitions). □ US and Europe Caravella Pallini □ Imbibe Magazine – May/June 2011 Casa Antica Pallini

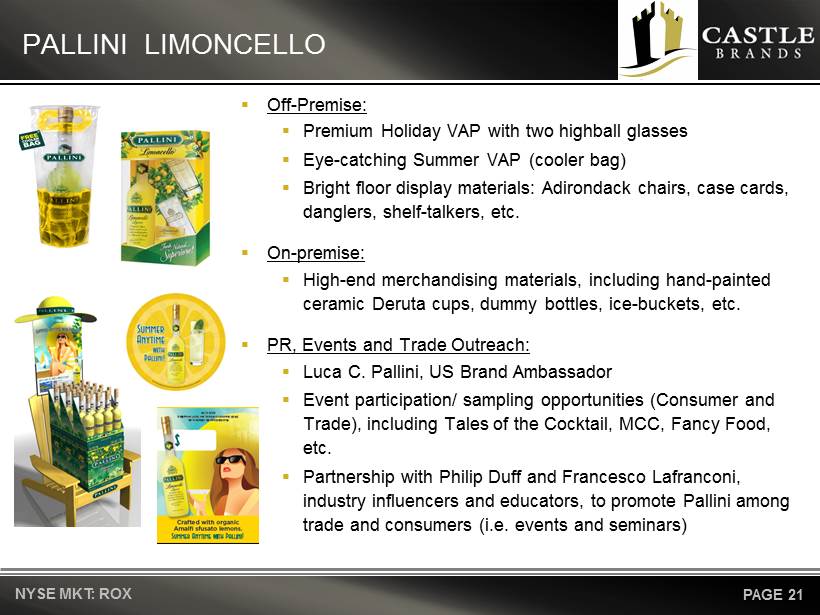

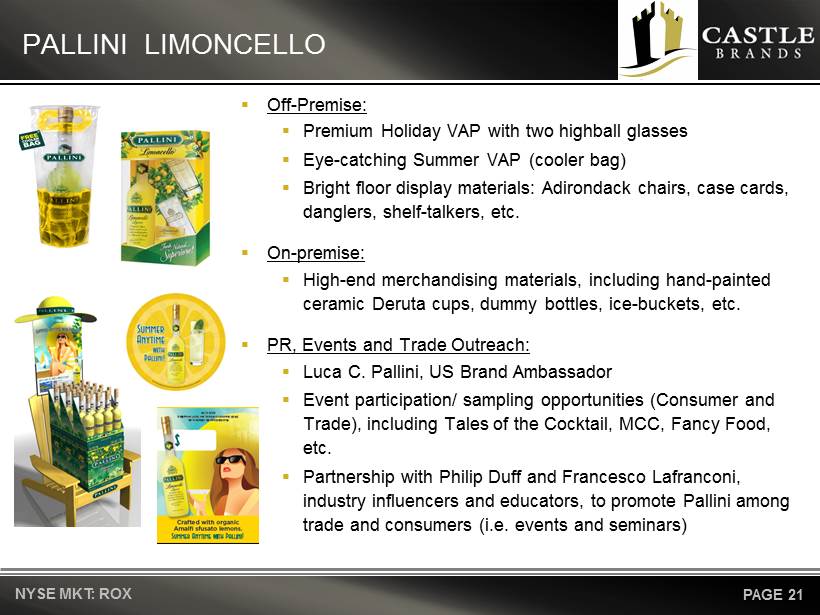

PALLINI LIMONCELLO NYSE MKT: ROX PAGE 21 ▪ Off - Premise: ▪ Premium Holiday VAP with two highball glasses ▪ Eye - catching Summer VAP (cooler bag) ▪ Bright floor display materials: Adirondack chairs, case cards, danglers, shelf - talkers, etc. ▪ On - premise: ▪ High - end merchandising materials, including hand - painted ceramic Deruta cups, dummy bottles, ice - buckets, etc. ▪ PR, Events and Trade Outreach: ▪ Luca C. Pallini, US Brand Ambassador ▪ Event participation/ sampling opportunities (Consumer and Trade), including Tales of the Cocktail, MCC, Fancy Food, etc. ▪ Partnership with Philip Duff and Francesco Lafranconi, industry influencers and educators, to promote Pallini among trade and consumers (i.e. events and seminars)

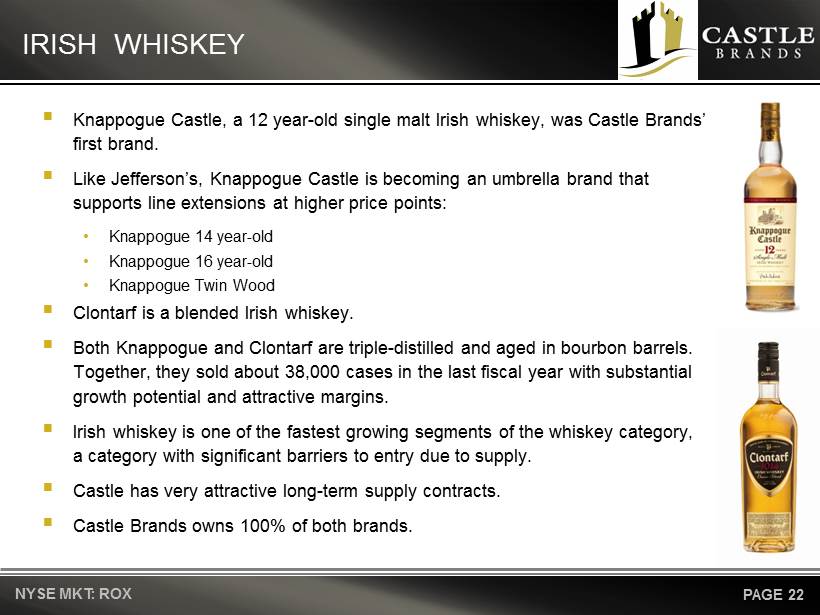

▪ Knappogue Castle, a 12 year - old single malt Irish whiskey, was Castle Brands’ first brand. ▪ Like Jefferson’s, Knappogue Castle is becoming an umbrella brand that supports line extensions at higher price points: • Knappogue 14 year - old • Knappogue 16 year - old • Knappogue Twin Wood ▪ Clontarf is a blended Irish whiskey. ▪ Both Knappogue and Clontarf are triple - distilled and aged in bourbon barrels. Together, they sold about 38,000 cases in the last fiscal year with substantial growth potential and attractive margins. ▪ Irish whiskey is one of the fastest growing segments of the whiskey category, a category with significant barriers to entry due to supply. ▪ Castle has very attractive long - term supply contracts. ▪ Castle Brands owns 100% of both brands. IRISH WHISKEY NYSE MKT: ROX PAGE 22

▪ Boru Vodka, produced in Ireland, is a high quality product that compares well with other premium vodkas. ▪ Boru competes in the rapidly growing branded premium vodka market, a 14 million case subcategory ( US) that contains Smirnoff, Skyy and Svedka. ▪ The brand has won numerous awards including top awards for liquid and for package design. ▪ Since 2008, margins have been increased by concentrating on the most profitable markets and SKUs. ▪ At about 50,000 cases per year, Boru has achieved scale to support growth both in the US and internationally. ▪ Castle Brands owns 100% of the brand. BORU VODKA NYSE MKT: ROX PAGE 23

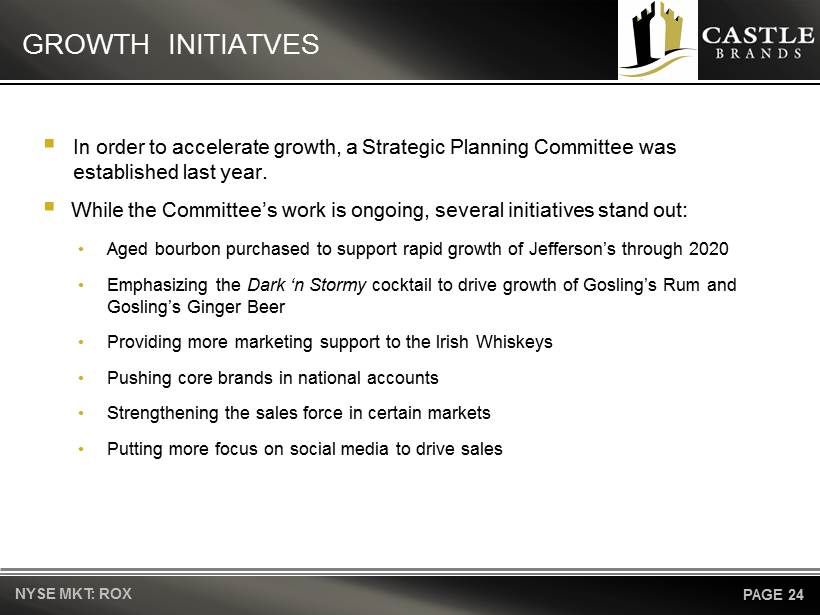

▪ In order to accelerate growth, a Strategic Planning Committee was established last year. ▪ While the Committee’s work is ongoing, several initiatives stand out: • Aged bourbon purchased to support rapid growth of Jefferson’s through 2020 • Emphasizing the Dark ‘n Stormy cocktail to drive growth of Gosling’s Rum and Gosling’s Ginger Beer • Providing more marketing support to the Irish Whiskeys • Pushing core brands in national accounts • Strengthening the sales force in certain markets • Putting more focus on social media to drive sales GROWTH INITIATVES NYSE MKT: ROX PAGE 24

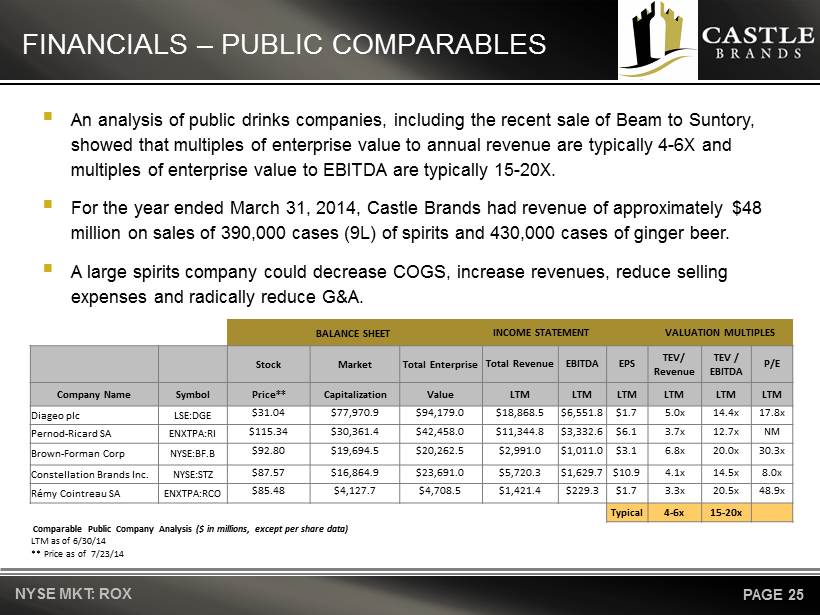

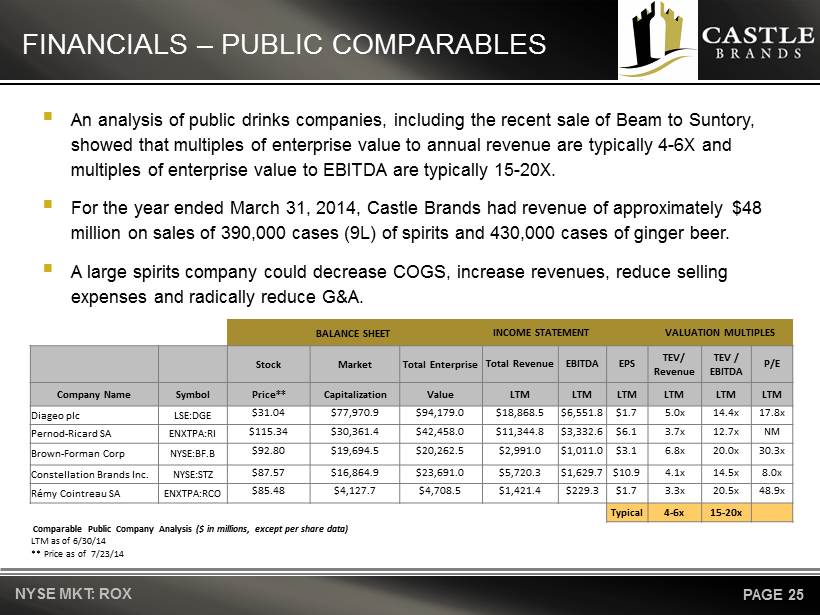

FINANCIALS – PUBLIC COMPARABLES BALANCE SHEET INCOME STATEMENT VALUATION MULTIPLES Stock Market Total Enterprise Total Revenue EBITDA EPS TEV/ Revenue TEV / EBITDA P/E Company Name Symbol Price** Capitalization Value LTM LTM LTM LTM LTM LTM Diageo plc LSE:DGE $31.04 $77,970.9 $94,179.0 $18,868.5 $6,551.8 $1.7 5.0x 14.4x 17.8x Pernod - Ricard SA ENXTPA:RI $115.34 $30,361.4 $42,458.0 $11,344.8 $3,332.6 $6.1 3.7x 12.7x NM Brown - Forman Corp NYSE:BF.B $92.80 $19,694.5 $20,262.5 $2,991.0 $1,011.0 $3.1 6.8x 20.0x 30.3x Constellation Brands Inc. NYSE:STZ $87.57 $16,864.9 $23,691.0 $5,720.3 $1,629.7 $10.9 4.1x 14.5x 8.0x Rémy Cointreau SA ENXTPA:RCO $85.48 $4,127.7 $4,708.5 $1,421.4 $229.3 $1.7 3.3x 20.5x 48.9x Typical 4 - 6x 15 - 20x Comparable Public Company Analysis ($ in millions, except per share data) LTM as of 6/30/14 ** Price as of 7/23/14 NYSE MKT: ROX PAGE 25 ▪ An analysis of public drinks companies, including the recent sale of Beam to Suntory, showed that multiples of enterprise value to annual revenue are typically 4 - 6X and multiples of enterprise value to EBITDA are typically 15 - 20X. ▪ For the year ended March 31, 2014, Castle Brands had revenue of approximately $48 million on sales of 390,000 cases (9L) of spirits and 430,000 cases of ginger beer. ▪ A large spirits company could decrease COGS, increase revenues, reduce selling expenses and radically reduce G&A.

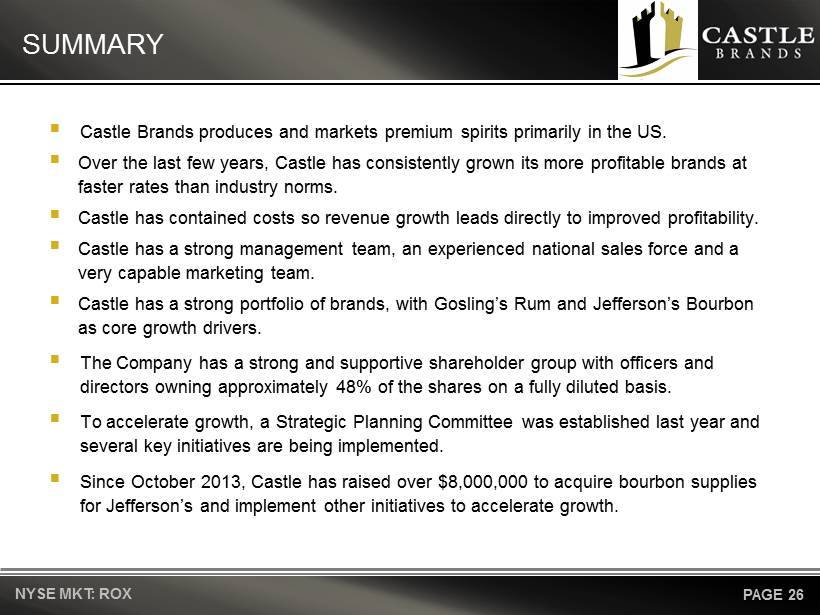

▪ Castle Brands produces and markets premium spirits primarily in the US. ▪ Over the last few years, Castle has consistently grown its more profitable brands at faster rates than industry norms . ▪ Castle has contained costs so revenue growth leads directly to improved profitability. ▪ Castle has a strong management team, an experienced national sales force and a very capable marketing team. ▪ Castle has a strong portfolio of brands, with Gosling’s Rum and Jefferson’s Bourbon as core growth drivers. ▪ The Company has a strong and supportive shareholder group with officers and directors owning approximately 48% of the shares on a fully diluted basis . ▪ To accelerate growth, a Strategic Planning Committee was established last year and several key initiatives are being implemented. ▪ Since October 2013, Castle has raised over $ 8,000,000 to acquire bourbon supplies for Jefferson’s and implement other initiatives to accelerate growth. SUMMARY NYSE MKT: ROX PAGE 26

Castle Brands Inc . 122 East 42 nd Street, Suite 4700 New York, NY 10168 Office: 646.356.0200 Toll Free: 800.882.8140 Fax: 646.356.0222

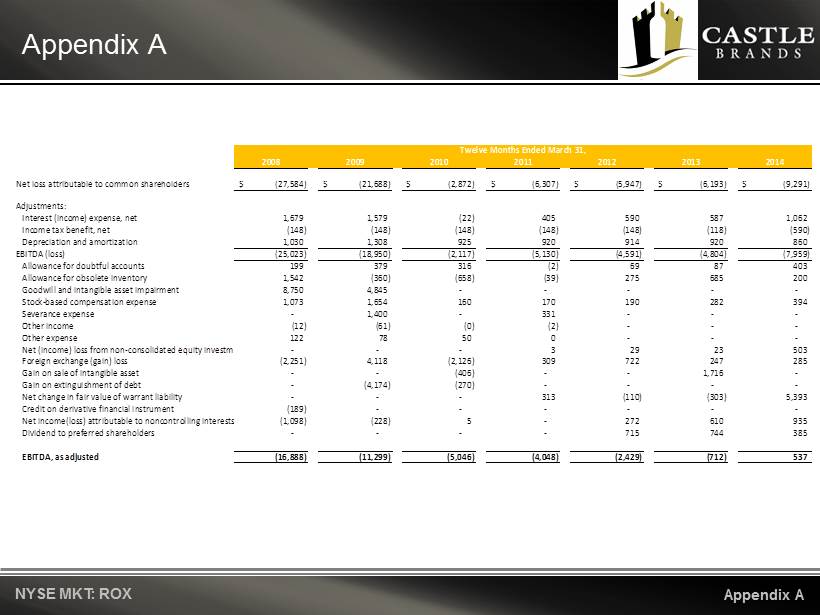

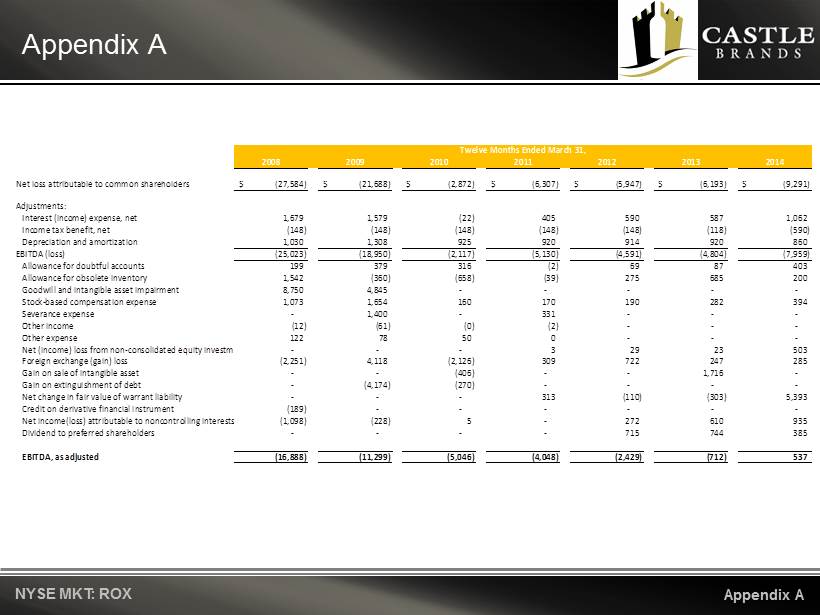

Appendix A NYSE MKT: ROX Appendix A 2008 2009 2010 2011 2012 2013 2014 Net loss attributable to common shareholders (27,584)$ (21,688)$ (2,872)$ (6,307)$ (5,947)$ (6,193)$ (9,291)$ Adjustments: Interest (income) expense, net 1,679 1,579 (22) 405 590 587 1,062 Income tax benefit, net (148) (148) (148) (148) (148) (118) (590) Depreciation and amortization 1,030 1,308 925 920 914 920 860 EBITDA (loss) (25,023) (18,950) (2,117) (5,130) (4,591) (4,804) (7,959) Allowance for doubtful accounts 199 379 316 (2) 69 87 403 Allowance for obsolete inventory 1,542 (360) (658) (39) 275 685 200 Goodwill and intangible asset impairment 8,750 4,845 - - - - - Stock-based compensation expense 1,073 1,654 160 170 190 282 394 Severance expense - 1,400 - 331 - - - Other income (12) (61) (0) (2) - - - Other expense 122 78 50 0 - - - Net (income) loss from non-consolidated equity investment - - - 3 29 23 503 Foreign exchange (gain) loss (2,251) 4,118 (2,126) 309 722 247 285 Gain on sale of intangible asset - - (406) - - 1,716 - Gain on extinguishment of debt - (4,174) (270) - - - - Net change in fair value of warrant liability - - - 313 (110) (303) 5,393 Credit on derivative financial instrument (189) - - - - - - Net income(loss) attributable to noncontrolling interests (1,098) (228) 5 - 272 610 935 Dividend to preferred shareholders - - - - 715 744 385 EBITDA, as adjusted (16,888) (11,299) (5,046) (4,048) (2,429) (712) 537 Twelve Months Ended March 31,