BACKGROUND 1 COMPANY PRESENTATION February 2016

MATTERS DISCUSSED IN THIS PRESENTATION CONTAIN FORWARD - LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. THESE STATEMENTS, WHICH INVOLVE RISKS AND UNCERTAINTIES, RELATE TO THE DISCUSSION OF OUR BUSINESS STRATEGIES AND OUR EXPECTATIONS CONCERNING FUTURE OPERATIONS, MARGINS, PROFITABILITY, LIQUIDITY AND CAPITAL RESOURCES AND TO ANALYSES AND OTHER INFORMATION THAT ARE BASED ON FORECASTS OF FUTURE RESULTS AND ESTIMATES OF AMOUNTS NOT YET DETERMINABLE. WHEN USED IN THIS PRESENTATION, THE WORDS "ANTICIPATE," "BELIEVE," "ESTIMATE," "MAY," "PREDICT," "WILL," "COULD," "PLAN," "PROJECT," "INTEND ," "EXPECT" AND SIMILAR EXPRESSIONS IDENTIFY SUCH FORWARD - LOOKING STATEMENTS. THESE FORWARD - LOOKING STATEMENTS ARE MADE BASED ON EXPECTATIONS AND BELIEFS CONCERNING FUTURE EVENTS AFFECTING US AND ARE SUBJECT TO RISKS, UNCERTAINTIES, ASSUMPTIONS AND OTHER FACTORS RELATING TO OUR OPERATIONS AND BUSINESS ENVIRONMENTS, ALL OF WHICH ARE DIFFICULT TO PREDICT AND MANY OF WHICH ARE BEYOND OUR CONTROL, THAT COULD CAUSE OUR ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS TO DIFFER MATERIALLY FROM THOSE CONTEMPLATED, EXPRESSED OR IMPLIED BY SUCH FORWARD - LOOKING STATEMENTS. THESE FACTORS INCLUDE, BUT ARE NOT LIMITED TO, OUR HISTORY OF LOSSES, OUR ABILITY TO EXPAND OUR OPERATIONS IN BOTH NEW AND EXISTING MARKETS, OUR DEPENDENCE ON A LIMITED NUMBER OF SUPPLIERS, OUR ABILITY TO DEVELOP OR ACQUIRE NEW BRANDS, OUR RELATIONSHIPS WITH DISTRIBUTORS AND THE SUCCESS OF OUR MARKETING ACTIVITIES, THE EFFECT OF COMPETITION IN OUR INDUSTRY AND ECONOMIC AND POLITICAL CONDITIONS GENERALLY, INCLUDING THE CURRENT ECONOMIC ENVIRONMENT , AND OTHER FACTORS DETAILED IN PERIODIC REPORTS FILED BY CASTLE BRANDS WITH THE SECURITIES AND EXCHANGE COMMISSION . YOU SHOULD NOT PLACE UNDUE RELIANCE ON THESE FORWARD - LOOKING STATEMENTS, WHICH APPLY ONLY AS OF THE DATE OF THIS PRESENTATION. WE UNDERTAKE NO OBLIGATION TO UPDATE OR REVISE ANY FORWARD - LOOKING STATEMENT, WHETHER WRITTEN OR ORAL, RELATING TO MATTERS DISCUSSED IN THIS PRESENTATION, EXCEPT AS MAY BE REQUIRED BY APPLICABLE LAW. This presentation may include industry and market data obtained through research, surveys and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third - party sources. Forward Looking Statements NYSE MKT: ROX PAGE 1

▪ Castle Brands produces and markets premium and super premium spirits in four major categories : • Whiskey • Rum • Liqueur • Vodka ▪ Castle Brands also markets Goslings Stormy Ginger Beer, the largest - selling premium ginger beer in the U.S. ▪ Over the last few years, Castle Brands has consistently grown its more profitable brands faster than industry norms. ▪ The Company has a strong and supportive shareholder group, with officers and directors owning approximately 43% on a fully - diluted basis. ▪ A brief overview of the Company, its brands and its initiatives to continue strong growth is set out on the following pages. Introduction NYSE MKT: ROX PAGE 2

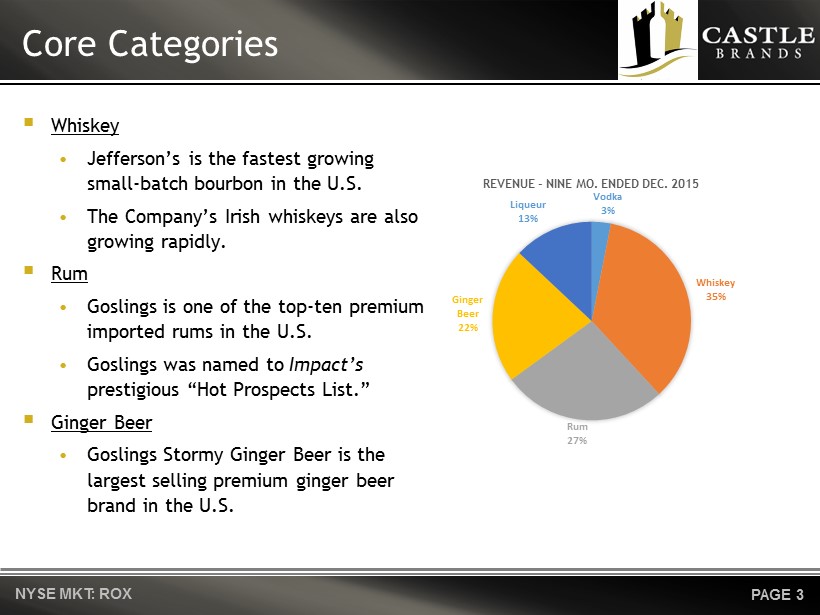

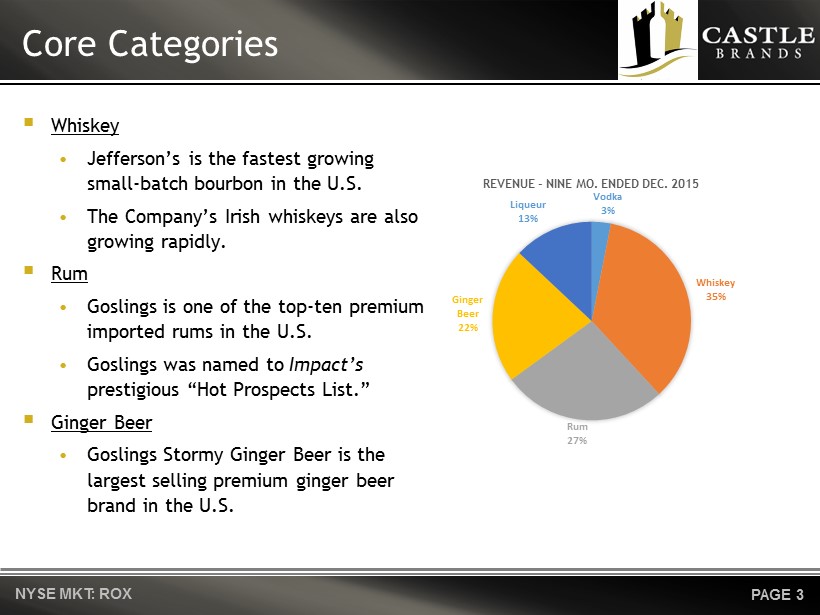

Core Categories ▪ Whiskey • Jefferson’s is the fastest growing small - batch bourbon in the U.S. • The Company’s Irish whiskeys are also growing rapidly. ▪ Rum • Goslings is one of the top - ten premium imported rums in the U.S. • Goslings was named to Impact’s prestigious “Hot Prospects List.” ▪ Ginger Beer • Gosling s Stormy Ginger Beer is the largest selling premium ginger beer brand in the U.S. NYSE MKT: ROX PAGE 3 Vodka 3% Whiskey 35% Rum 27% Ginger Beer 22% Liqueur 13% REVENUE - NINE MO. ENDED DEC. 2015

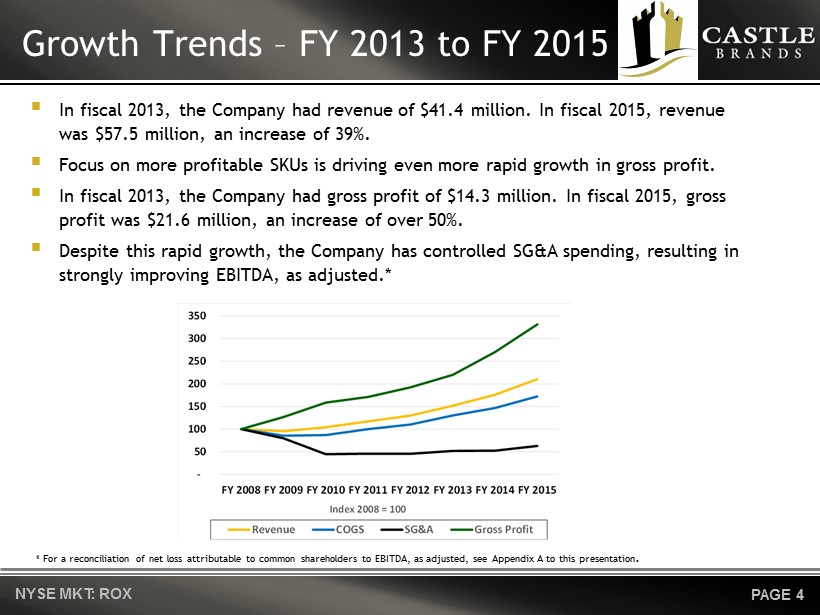

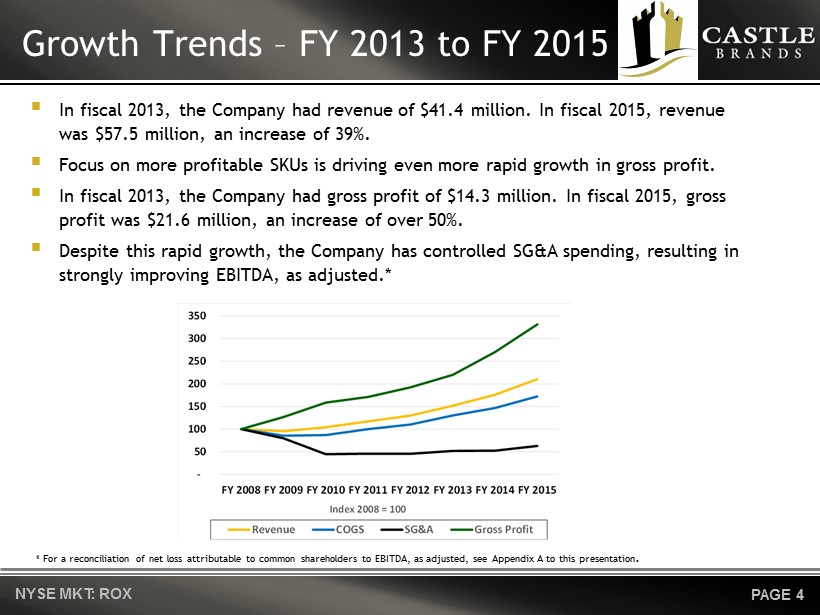

Growth Trends – FY 2013 to FY 2015 ▪ In fiscal 2013, the Company had revenue of $41.4 million. In fiscal 2015, revenue was $57.5 million, an increase of 39%. ▪ Focus on more profitable SKUs is driving even more rapid growth in gross profit. ▪ In fiscal 2013, the Company had gross profit of $14.3 million. In fiscal 2015, gross profit was $21.6 million, an increase of over 50%. ▪ Despite this rapid growth, the Company has controlled SG&A spending, resulting in strongly improving EBITDA, as adjusted.* NYSE MKT: ROX PAGE 4 * For a reconciliation of net loss attributable to common shareholders to EBITDA, as adjusted, see Appendix A to this present ati on .

Growth Trends – FY 2016 NYSE MKT: ROX PAGE 5 * For a reconciliation of net loss attributable to common shareholders to EBITDA, as adjusted, see Appendix A to this present ati on. ▪ The strong growth trends continued through the first nine months of fiscal 2016. ▪ Revenue increased 27% to $52.3 million, compared to $41.3 million in the first nine months of FY 2015. ▪ Total gross profit increased 32% to $20.4 million, compared to $15.4 million in the first nine months of FY 2015. ▪ EBITDA , as adjusted, improved to $2.2 million , compared to $0.7 million in the first nine months of FY 2015*. ▪ Whiskey revenues increased 38%, compared to the first nine months of FY 2015. ▪ Rum sales increased 18%, compared to the first nine months of FY 2015. ▪ Goslings Stormy Ginger Beer case sales increased 53% to approximately 790,000 cases from approximately 517,000 cases in the first nine months of FY 2015.

Public Comparables NYSE MKT: ROX PAGE 6 ▪ For public drinks companies, the multiples of enterprise value to annual revenue are typically 5 - 6X and multiples of enterprise value to EBITDA are typically 16 - 20X. ▪ The recent purchase of Angel’s Envy by Bacardi was at a high valuation. ▪ For the 12 months ended December 31, 2015, Castle Brands had revenue of $68 million on net sales of 421,857 cases (9L) of spirits and 988,424 cases of ginger beer. ▪ At $0.90 per share, Castle Brands’ enterprise value as a multiple of revenue was 2.1X. ▪ A large spirits company could decrease COGS, increase FOBs, increase sales and reduce selling expenses and G&A, which would significantly increase EBITDA. Comparable Public Company Analysis ($ in millions, except per share data) *Price as of 2/22/16 BALANCE SHEET INCOME STATEMENT VALUATION MULTIPLES Stock Market Total Enterprise Total Revenue EBITDA EPS TEV/ Revenue TEV / EBITDA P/E Company Name Symbol Price** Capitalization Value LTM LTM LTM LTM LTM LTM Diageo plc LSE:DGE $26.27 $66,107.9 $82,126.2 $15,512.5 $4,764.8 $1.4 5.3x 17.2x 18.1x Pernod - Ricard SA ENXTPA:RI $108.61 $28,667.1 $38,978.2 $9,660.6 $2,746.7 $3.9 4.0x 14.2x NM Brown - Forman Corporation NYSE:BF.B $102.78 $21,455.2 $23,042.2 $3,103.0 $1,102.0 $3.3 7.4x 20.9x 31.6x Constellation Brands Inc. NYSE:STZ $140.60 $28,040.5 $35,067.9 $6,361.4 $2,013.7 $5.1 5.5x 17.4x 27.8x Rémy Cointreau SA ENXTPA:RCO $69.96 $3,397.1 $3,906.7 $1,109.3 $201.8 $2.2 3.5x 19.4x 31.8x Median 5.3x 17.4x 29.7x

▪ Castle Brands has a 30 person in - house sales and marketing team, with years of experience with major spirits companies. ▪ All Regional Vice Presidents are industry veterans from large spirits companies. ▪ Castle’s business can continue to grow substantially without proportional increases in SG&A. ▪ Castle holds federal importer and wholesaler licenses required by the TTB and the requisite state license in all 50 states and the District of Columbia. ▪ The Company is represented by top - tier distributors across the U.S. The top three are: • Southern Wine & Spirits (22 states) • Glazer’s (8 states) • United Liquors (MA) ▪ Castle Brands also has distribution in over 25 other countries. Strong Route to Market NYSE MKT: ROX PAGE 7

Premium Brand Portfolio NYSE MKT: ROX PAGE 8

Jefferson’s Bourbon NYSE MKT: ROX

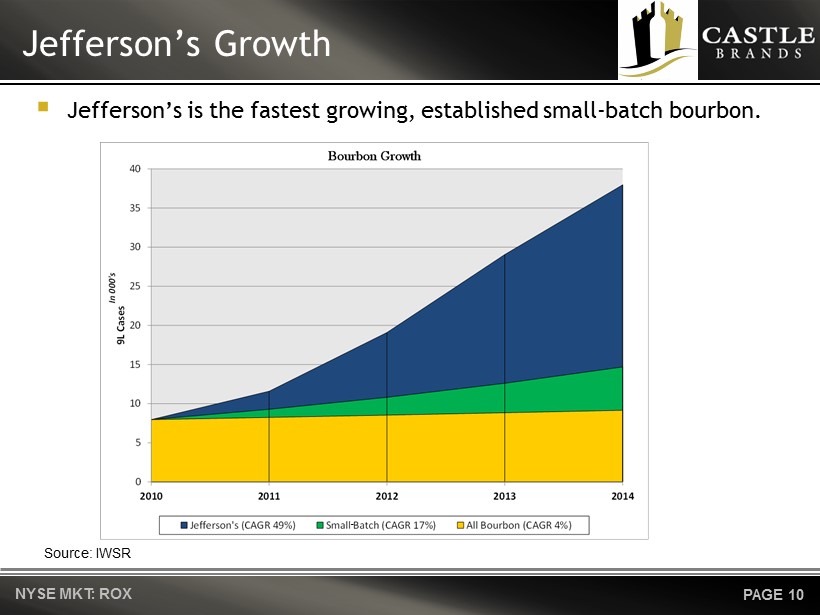

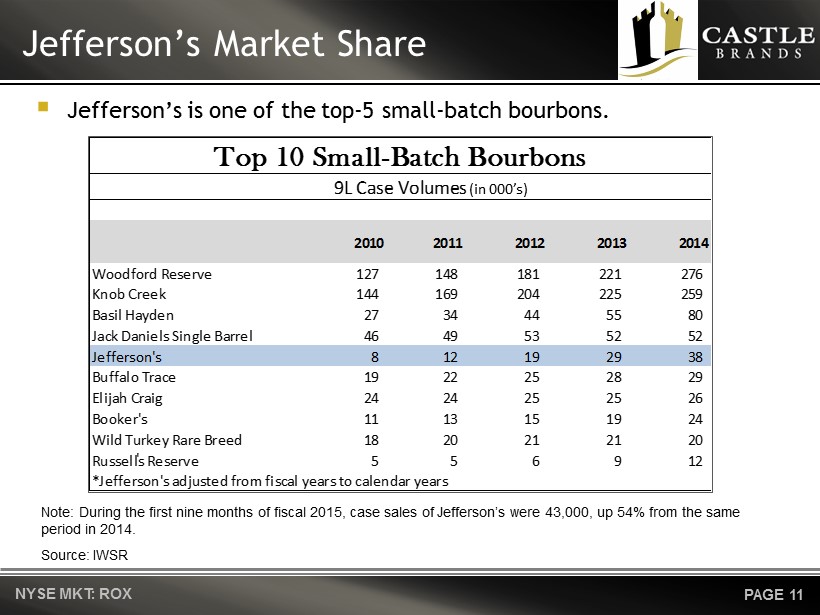

Jefferson’s Summary NYSE MKT: ROX PAGE 9 ▪ Jefferson’s is a super premium small - batch bourbon brand. ▪ Jefferson’s offers various expressions to target different opportunities within the bourbon category. ▪ The small - batch collection includes Jefferson’s, Jefferson’s Reserve and Presidential Select ▪ The barrel finish collection includes Groth Reserve Cask Finish, Barrel Finished Manhattan and additional finishes to be introduced in the future ▪ The Innovation collection includes Chef’s Collaboration bourbon/rye blend, Jefferson’s Ocean Aged at Sea and Jefferson’s Wood Experiments ▪ Castle Brands owns sufficient barrel stock of bourbon to support continued growth . ▪ Jefferson’s is the fastest growing, established small - batch bourbon . ▪ Jefferson’s is one of the top - 5 small - batch bourbons . ▪ Castle Brands owns 100 % of the Jefferson’s brand .

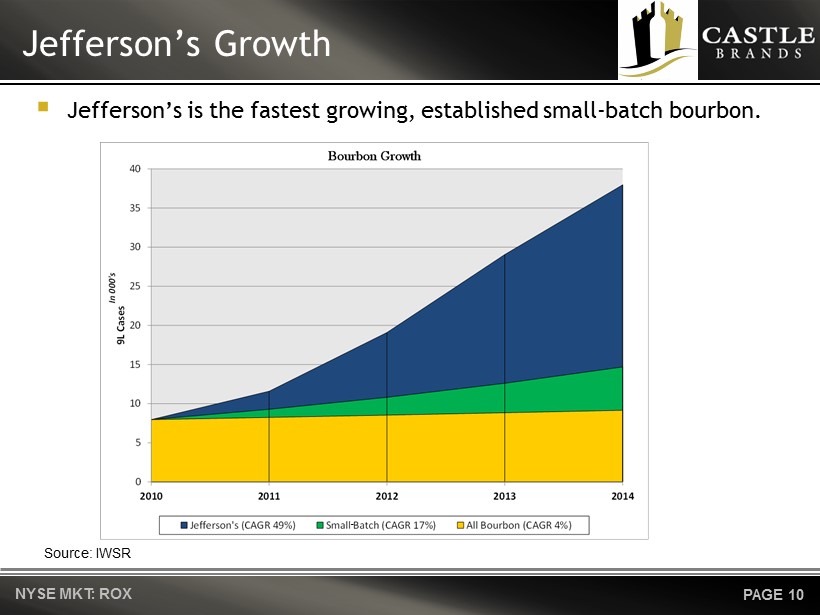

Jefferson’s Growth NYSE MKT: ROX PAGE 10 ▪ Jefferson’s is the fastest growing, established small - batch bourbon. Source: IWSR -

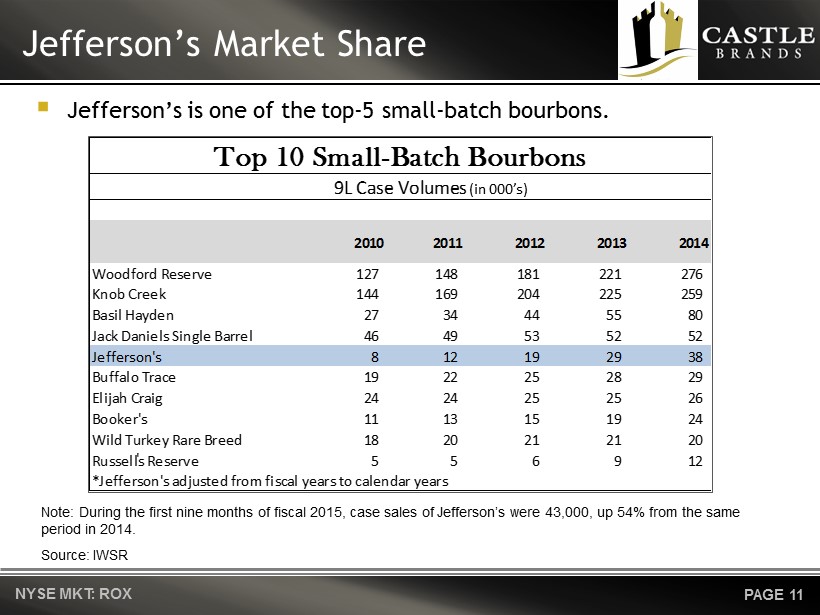

Jefferson’s Market Share NYSE MKT: ROX PAGE 11 Note: During the first nine months of fiscal 2015, case sales of Jefferson’s were 43,000, up 54% from the same period in 2014. Source: IWSR ▪ Jefferson’s is one of the top - 5 small - batch bourbons. 2010 2011 2012 2013 2014 Woodford Reserve 127 148 181 221 276 Knob Creek 144 169 204 225 259 Basil Hayden 27 34 44 55 80 Jack Daniels Single Barrel 46 49 53 52 52 Jefferson's 8 12 19 29 38 Buffalo Trace 19 22 25 28 29 Elijah Craig 24 24 25 25 26 Booker's 11 13 15 19 24 Wild Turkey Rare Breed 18 20 21 21 20 Russells Reserve 5 5 6 9 12 *Jefferson's adjusted from fiscal years to calendar years Top 10 Small Batch Bourbons 9L Case Volumes ' (in 000’s) -

Jefferson’s Marketing NYSE MKT: ROX PAGE 12 ▪ Exciting brand extensions • Jefferson’s Ocean Aged at Sea • Jefferson’s Manhattan (Barrel aged cocktail) • Jefferson’s Groth Wine Finish ▪ Off - Premise • Barrel programs • Value added packaging • Merchandising programs • Shelf glorifiers ▪ On - Premise • Jefferson’s mini barrels for bartenders to age special cocktails for menu listings • Jefferson’s flight trays Jefferson’s Experiments Jefferson’s Barrel Display, Florida

Jefferson’s Marketing NYSE MKT: ROX PAGE 13 ▪ Edgy and impactful trade and consumer advertising. ▪ Strong PR activities resulting in substantial press “buzz”

▪ Provide for longer - term bourbon and rye supplies through new - fill programs ▪ Continue to purchase aged bourbon to support Jefferson’s growth ▪ Reinforce and build Jefferson’s and Reserve as the standards for the brand ▪ Continue the successful Jefferson’s barrel program ▪ Offer a five 200ml bottle multi - pack of Wood Experiments for gift giving ▪ Introduce a special line of Jefferson’s Bourbon aged in wine casks from several of Thomas Jefferson’s favorite chateaux in Bordeaux ▪ Expand the Jefferson’s brand into premium barrel finished cocktails such as “The Manhattan”, co - branded with Esquire Magazine ▪ Offer additional “voyages” of Jefferson’s Ocean Aged at Sea, with different characteristics such as cask strength ▪ Continue innovation to stay top of mind with opinion leaders Jefferson’s Growth Initiatives NYSE MKT: ROX PAGE 14

Goslings NYSE MKT: ROX

Goslings Summary NYSE MKT: ROX PAGE 15 ▪ Goslings Black Seal is the flagship dark rum of Goslings Brothers Ltd., the oldest business in Bermuda, founded in 1806. ▪ Goslings competes in the growing dark rum category and with Navy/English rums such as Appleton and Mount Gay. ▪ In 2005, Castle Brands formed Gosling - Castle Partners Inc. (“GCP”), which holds the exclusive long - term export and distribution rights for Goslings Rum for all countries other than Bermuda. ▪ Castle has a 60% controlling interest in GCP. ▪ Goslings is one of the top - 10 premium imported rums in the U.S. ▪ Goslings Stormy Ginger Beer is the largest selling premium ginger beer in the U.S.

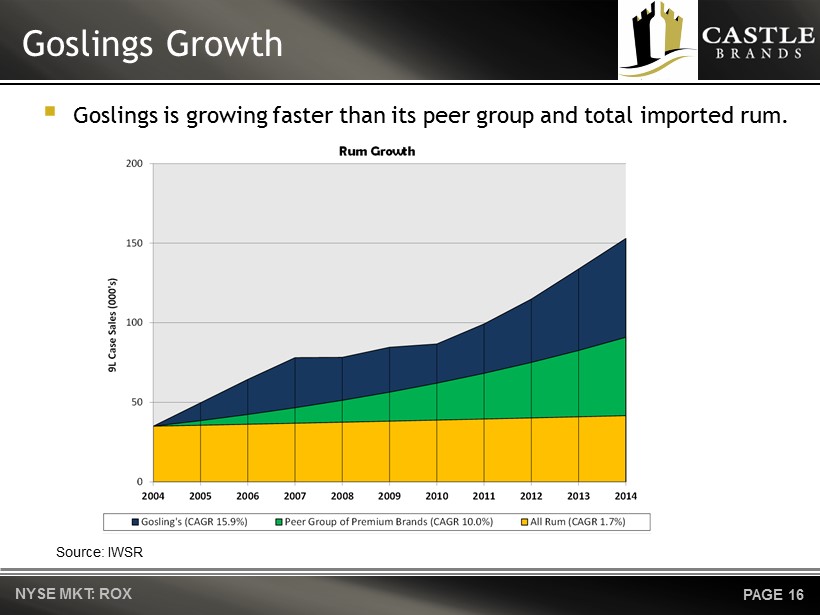

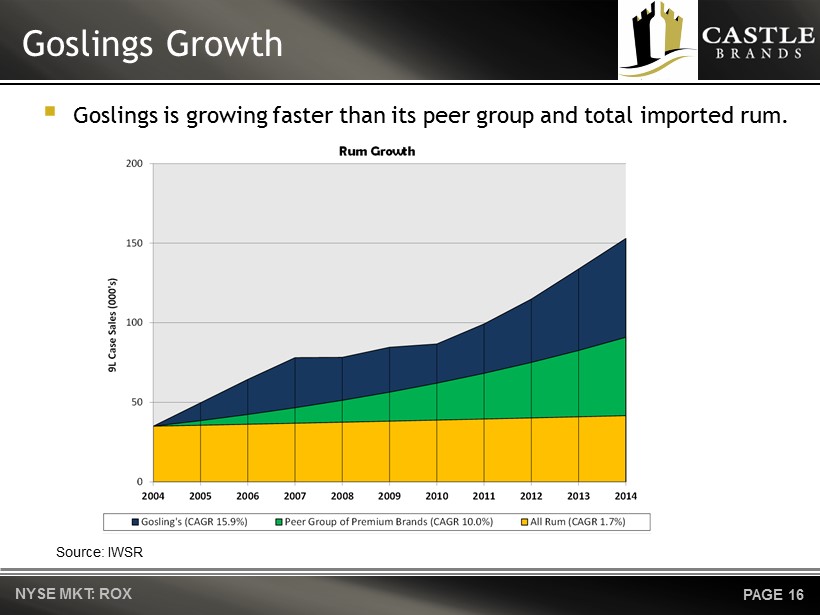

Goslings Growth NYSE MKT: ROX PAGE 16 ▪ Goslings is growing faster than its peer group and total imported rum. Source: IWSR

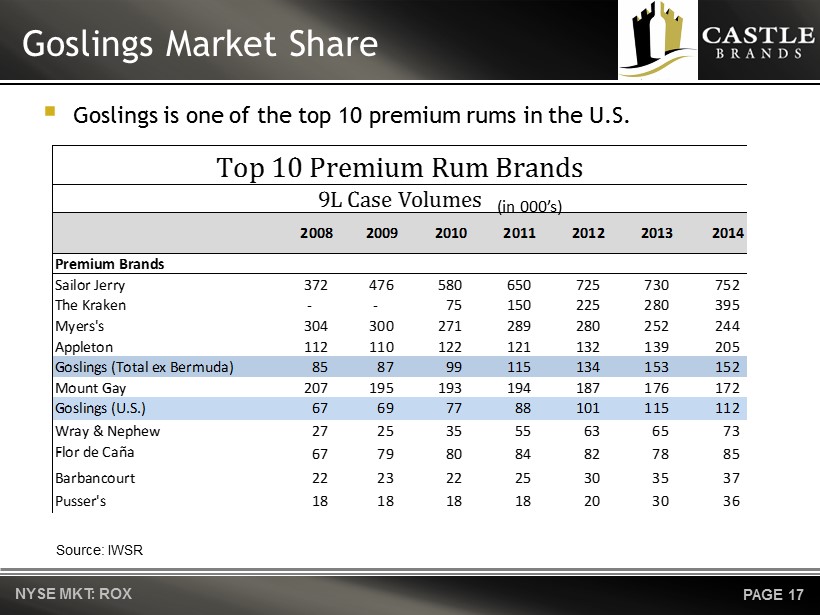

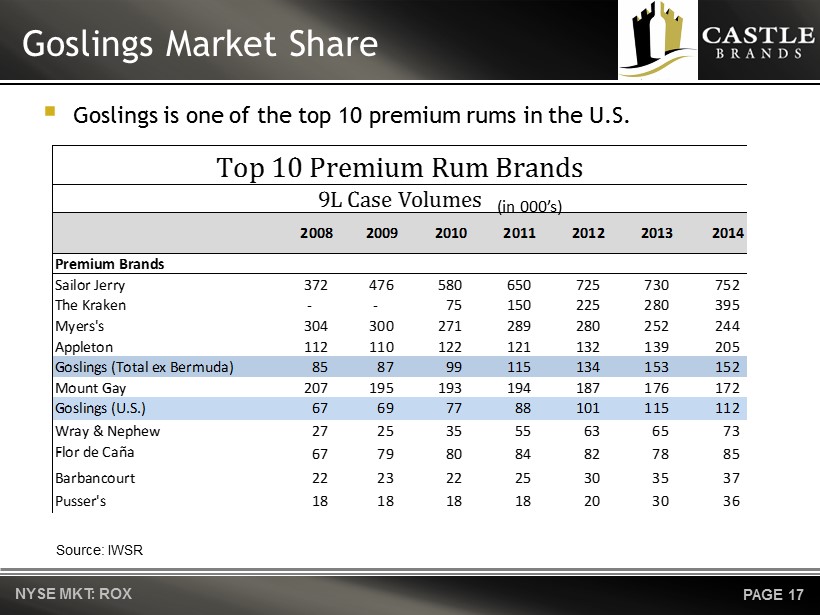

Goslings Market Share NYSE MKT: ROX PAGE 17 Source: IWSR ▪ Goslings is one of the top 10 premium rums in the U.S. 2008 2009 2010 2011 2012 2013 2014 Premium Brands Sailor Jerry 372 476 580 650 725 730 752 The Kraken - - 75 150 225 280 395 Myers's 304 300 271 289 280 252 244 Appleton 112 110 122 121 132 139 205 Goslings (Total ex Bermuda) 85 87 99 115 134 153 152 Mount Gay 207 195 193 194 187 176 172 Goslings (U.S.) 67 69 77 88 101 115 112 Wray & Nephew 27 25 35 55 63 65 73 Flor de Caña 67 79 80 84 82 78 85 Barbancourt 22 23 22 25 30 35 37 Pusser's 18 18 18 18 20 30 36 Top 10 Premium Rum Brands 9L Case Volumes (in 000’s)

Goslings Marketing NYSE MKT: ROX PAGE 18 ▪ Focused on building awareness of the trademarked “Dark ‘n Stormy®” cocktail ▪ Concentrated on golfing and boating audiences ▪ Over 100 events and sponsorships in 2015: ▪ Deutsche Bank PGA tournament ▪ Honda Classic PGA tournament ▪ Charleston Race Week ▪ Expanding reach substantially by sponsoring America’s Cup Challenge (2015 to 2017): ▪ Based in Bermuda ▪ Now an “Extreme Sport” ▪ Broadcast rights: NBC and 40 others ▪ Hours of coverage: 3,000+ ▪ Total global audience : 1 billion+ ▪ Far beyond traditional sailing audience

Goslings Marketing NYSE MKT: ROX PAGE 19 ▪ Goslings packaging significantly upgraded: ▪ Upscale bottle ▪ Premium closure ▪ America’s Cup logo ▪ Cleaner and sharper graphics ▪ Increased marketing of Gold Rum ▪ Wide array of merchandising materials supporting on and off - premise and the Dark ‘n Stormy® cocktail ▪ Continued growth of Goslings Stormy Ginger Beer ▪ Incentive trips to Bermuda

Goslings Stormy Ginger Beer NYSE MKT: ROX PAGE 20 ▪ Goslings Stormy Ginger Beer was launched in 2009 to reinforce the branding of the trademarked Dark ‘n Stormy® cocktail. ▪ The brand is offered in multiple package formats to bars, liquor stores and supermarkets. ▪ Goslings Stormy Ginger Beer is now the largest selling premium ginger beer available in the U.S. ▪ Strong growth continued in the first nine months of FY 2016, with 790,000 cases sold. - 200,000 400,000 600,000 800,000 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 Goslings Ginger Beer case sales

▪ Capitalize on sponsorship of the America’s Cup Challenge – “AC 35” • Tie all regatta activity to the AC 35 sponsorship • Co - sponsor global events leading up to AC 35 ▪ Continue to support golf and sponsor high profile PGA tour events ▪ Emphasize the Dark ‘n Stormy® cocktail to drive growth of Goslings Rum ▪ Continue to aggressively increase sales of Goslings Stormy Ginger Beer • Move more heavily into the chain supermarket channel ▪ Continue to build the Dark ‘n Stormy® Ready - to - Drink to reinforce Goslings’ trademarked Dark ‘n Stormy® drink ▪ Relaunch Goslings Gold Rum as Goslings Gold Seal to capture a share of the gold rum market Goslings Growth Initiatives NYSE MKT: ROX PAGE 21

Irish Whiskey NYSE MKT: ROX

▪ Knappogue Castle, a 12 year - old single malt Irish whiskey, was Castle Brands’ first brand. ▪ Irish whiskey is one of the fastest growing segments of the whiskey market and has significant barriers to entry due to limited sources of supply. ▪ Like Jefferson’s, Knappogue Castle is becoming an umbrella brand with line extensions at higher price points: • Knappogue 14 year - old • Knappogue 16 year - old • Knappogue Special Cask Barrel Program ▪ Knappogue is triple - distilled and aged in bourbon barrels. ▪ Knappogue has meaningful growth potential with high margins. ▪ Castle has favorable long - term supply contracts. ▪ Castle Brands owns 100% of Knappogue. Irish Whiskey – Knappogue NYSE MKT: ROX PAGE 22

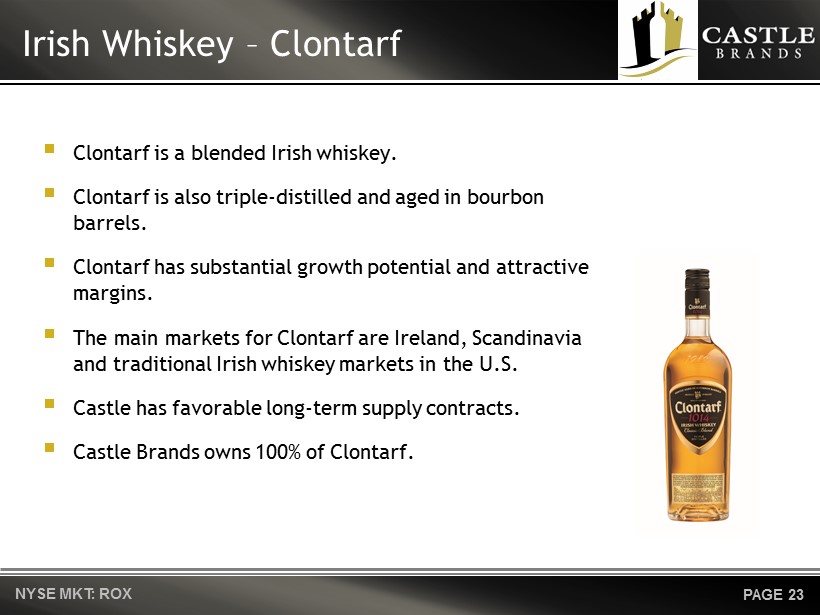

▪ Clontarf is a blended Irish whiskey. ▪ Clontarf is also triple - distilled and aged in bourbon barrels. ▪ Clontarf has substantial growth potential and attractive margins. ▪ The main markets for Clontarf are Ireland, Scandinavia and traditional Irish whiskey markets in the U.S. ▪ Castle has favorable long - term supply contracts. ▪ Castle Brands owns 100% of Clontarf. Irish Whiskey – Clontarf NYSE MKT: ROX PAGE 23

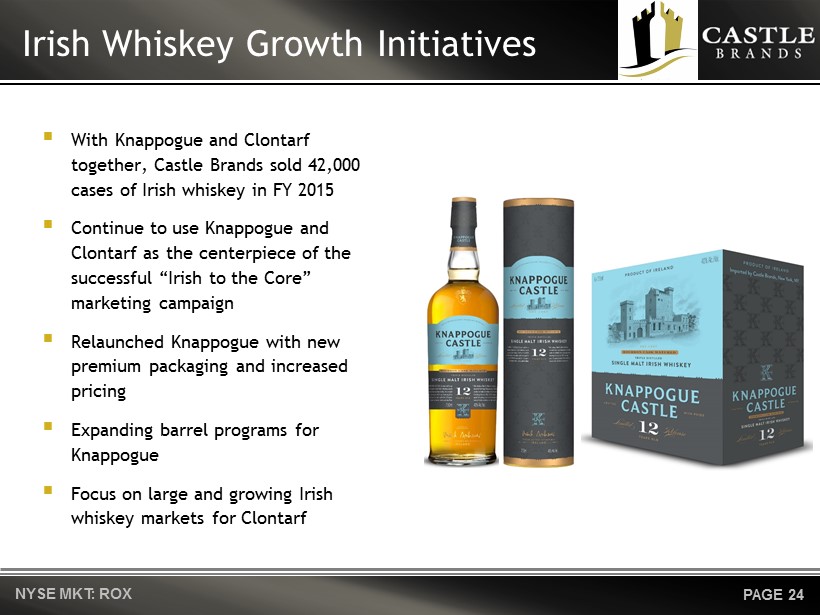

▪ With Knappogue and Clontarf together, Castle Brands sold 42,000 cases of Irish whiskey in FY 2015 ▪ Continue to use Knappogue and Clontarf as the centerpiece of the successful “Irish to the Core” marketing campaign ▪ Relaunched Knappogue with new premium packaging and increased pricing ▪ Expanding barrel programs for Knappogue ▪ Focus on large and growing Irish whiskey markets for Clontarf Irish Whiskey Growth Initiatives NYSE MKT: ROX PAGE 24

▪ Castle Brands develops and markets premium and super premium spirits. ▪ Over the last few years, Castle has consistently grown its more profitable brands at faster rates than industry norms. ▪ Castle has contained costs, so revenue growth leads directly to improved profitability. ▪ Castle has a strong management team, an experienced national sales force and a very capable marketing team. ▪ Castle has a strong portfolio of brands, with Jefferson’s Bourbons, Goslings rums and the Irish Whiskeys as core growth drivers. ▪ The Company has a strong and supportive shareholder group with officers and directors owning approximately 43% on a fully - diluted basis. Summary NYSE MKT: ROX PAGE 25

Castle Brands Inc . 122 East 42 nd Street, Suite 5000 New York, NY 10168 Office: 646.356.0200 Toll Free: 800.882.8140 Fax: 646.356.0222

Appendix NYSE MKT: ROX

GAAP to Non - GAAP Reconciliation NYSE MKT: ROX PAGE A *Q3 FY2015: Nine Months Ended December 31, 2014 (unaudited) **Q3 FY2016: Nine Months Ended December 31, 2015 (unaudited) (in thousands) Q3 FYTD Q3 FYTD 2013 2014 2015 2015* 2016** Net loss attributable to common shareholders (6,193)$ (9,291)$ (3,800)$ (3,167)$ (2,943)$ Adjustments: Interest expense, net 587 1,062 1,129 844 786 Income tax (benefit) expense, net (118) (590) 1,279 682 1,488 Depreciation and amortization 920 860 908 670 697 EBITDA (4,804) (7,959) (484) (972) 28 Allowance for doubtful accounts 87 403 236 77 52 Allowance for obsolete inventory 685 200 281 - 100 Stock-based compensation expense 282 394 788 607 1,036 Other income, net - - (17) (17) 0 Net loss from non-consolidated equity investment 23 503 - - (9) Foreign exchange loss 247 285 5 208 131 Gain on sale of intangible asset 1,716 - - - - Net change in fair value of warrant liability (303) 5,393 - - - Net income attributable to noncontrolling interests 610 935 326 795 815 Dividend to preferred shareholders 744 385 - - - EBITDA, as adjusted (712)$ 537$ 1,134$ 699$ 2,154$ Twelve Months Ended March 31,

Mark Andrews – Chairman • Founded Castle Brands in 2003 • Chairman and CEO of American Exploration (ASE: AX), an oil and gas company, until its sale to Louis Dreyfus Natural Gas • Former Director of IVAX Corp. from its founding until its sale to Teva Pharmaceutical Industries Limited (NASDAQ : TEVA) • Life Trustee of New York Presbyterian Hospital • Bachelor of Arts from Harvard College and MBA from Harvard Business School Richard Lampen – President and Chief Executive Officer • President and CEO of Ladenburg Thalmann Financial Services Inc (NYSE MKT: LTS) • Executive VP, Vector Group Ltd. (NYSE: VGR), holding company with interests in consumer goods and real estate • Former Managing Director and Senior Member, Leveraged Finance Group, Salomon Brothers Inc . • Former Partner & Co - Chairman of Corporate Department, Steel Hector & Davis, a law firm with headquarters in Miami, FL • Bachelor of Arts from the Johns Hopkins University and a JD from Columbia Law School Management Team NYSE MKT: ROX PAGE B

John Glover – Chief Operating Officer • Over 30 years experience in marketing, commercial and general management in the spirits industry • Former Senior VP Commercial Management of Remy Cointreau USA • Served in various roles in marketing and management with predecessor companies to Diageo plc (LSE : DGE) • Bachelor of Arts and MBA from Dartmouth College Alfred Small – Chief Financial Officer • Over 15 years experience in finance, operations and compliance in the spirits industry • Senior Accountant at Grodsky Caporrino & Kaufman, practicing in consumer goods, wholesale distribution, and technology • Bachelor of Science from the State University of New York and a Certified Public Accountant Kelley Spillane – SVP Global Sales • Over 25 years experience in spirits sales • Served in several senior sales and management roles at Carillon and was closely involved in the growth of Absolut Vodka and Grand Marnier in the U.S. • Bachelor of Arts from Ramapo College Management Team NYSE MKT: ROX PAGE C

Marketing Team ▪ Castle Brands has an experienced marketing team to complement its sales force: • Malcolm Gosling – As CEO of Gosling - Castle Partners, Inc., Malcolm oversees the marketing and promotional activities associated with the Goslings brands. Malcolm is based in Boston and works closely with a creative agency based there. • Alejandra Pe ñ a – As SVP Marketing, Alejandra is responsible for design, planning, marketing and promotional activities associated with Castle’s brands . Prior to joining Castle in 2010, Alejandra served as Marketing Vice President for liqueurs and spirits for Remy Cointreau USA, where she was responsible for the marketing of Mount Gay Rum and Cointreau Liqueur. • Trey Zoeller – The founder of Jefferson’s, Trey is responsible for Jefferson’s marketing and promotional activities. Trey is based in Kentucky where his family has been active in the bourbon industry for several generations. • Brand Team – Castle Brands has a dedicated team of brand managers that focus on the planning and execution of marketing and commercial activities for the Castle Brands portfolio. NYSE MKT: ROX PAGE D