Exhibit 99.1

BACKGROUND 1 COMPANY PRESENTATION September 8, 2016

MATTERS DISCUSSED IN THIS PRESENTATION CONTAIN FORWARD - LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. THESE STATEMENTS, WHICH INVOLVE RISKS AND UNCERTAINTIES, RELATE TO THE DISCUSSION OF OUR BUSINESS STRATEGIES AND OUR EXPECTATIONS CONCERNING FUTURE OPERATIONS, MARGINS, PROFITABILITY, LIQUIDITY AND CAPITAL RESOURCES AND TO ANALYSES AND OTHER INFORMATION THAT ARE BASED ON FORECASTS OF FUTURE RESULTS AND ESTIMATES OF AMOUNTS NOT YET DETERMINABLE. WHEN USED IN THIS PRESENTATION, THE WORDS "ANTICIPATE," "BELIEVE," "ESTIMATE," "MAY," "PREDICT," "WILL," "COULD," "PLAN," "PROJECT," "PRELIMINARY," "INTEND," "EXPECT" AND SIMILAR EXPRESSIONS IDENTIFY SUCH FORWARD - LOOKING STATEMENTS. THESE FORWARD - LOOKING STATEMENTS ARE MADE BASED ON EXPECTATIONS AND BELIEFS CONCERNING FUTURE EVENTS AFFECTING US AND ARE SUBJECT TO RISKS, UNCERTAINTIES, ASSUMPTIONS AND OTHER FACTORS RELATING TO OUR OPERATIONS AND BUSINESS ENVIRONMENTS, ALL OF WHICH ARE DIFFICULT TO PREDICT AND MANY OF WHICH ARE BEYOND OUR CONTROL, THAT COULD CAUSE OUR ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS TO DIFFER MATERIALLY FROM THOSE CONTEMPLATED, EXPRESSED OR IMPLIED BY SUCH FORWARD - LOOKING STATEMENTS. THESE FACTORS INCLUDE, BUT ARE NOT LIMITED TO, OUR HISTORY OF LOSSES, OUR ABILITY TO EXPAND OUR OPERATIONS IN BOTH NEW AND EXISTING MARKETS, OUR DEPENDENCE ON A LIMITED NUMBER OF SUPPLIERS, OUR ABILITY TO DEVELOP OR ACQUIRE NEW BRANDS, OUR RELATIONSHIPS WITH DISTRIBUTORS AND THE SUCCESS OF OUR MARKETING ACTIVITIES, THE EFFECT OF COMPETITION IN OUR INDUSTRY AND ECONOMIC AND POLITICAL CONDITIONS GENERALLY, INCLUDING THE CURRENT ECONOMIC ENVIRONMENT , AND OTHER FACTORS DETAILED IN PERIODIC REPORTS FILED BY CASTLE BRANDS WITH THE SECURITIES AND EXCHANGE COMMISSION. YOU SHOULD NOT PLACE UNDUE RELIANCE ON THESE FORWARD - LOOKING STATEMENTS, WHICH APPLY ONLY AS OF THE DATE OF THIS PRESENTATION. WE UNDERTAKE NO OBLIGATION TO UPDATE OR REVISE ANY FORWARD - LOOKING STATEMENT, WHETHER WRITTEN OR ORAL, RELATING TO MATTERS DISCUSSED IN THIS PRESENTATION, EXCEPT AS MAY BE REQUIRED BY APPLICABLE LAW. This presentation may include industry and market data obtained through research, surveys and studies conducted by third part ies and industry publications. We have not independently verified any such market and industry data from third - party sources. Forward Looking Statements NYSE MKT: ROX PAGE 1

▪ Producer and marketer of premium and super - premium spirits ▪ Focused on two primary categories: • Whiskey • Rum ▪ Markets Goslings Stormy Ginger Beer ▪ Consistently grown core brands faster than industry norms ▪ Clear growth strategy by adding points of distribution for growing brands ▪ Scalable business model – experienced sales team can handle increased volume ▪ Directors and officers own approximately 41% on a fully - diluted basis ▪ Stock currently trades at a significant discount to industry multiples Company Overview NYSE MKT: ROX PAGE 2

Core Categories NYSE MKT: ROX PAGE 3 Whiskey 35% Rum 26% Ginger Beer 24% Liqueur 12% Vodka/Tequila 3% CONSOLIDATED SALES - 12 MO. ENDED JUNE 30, 2016

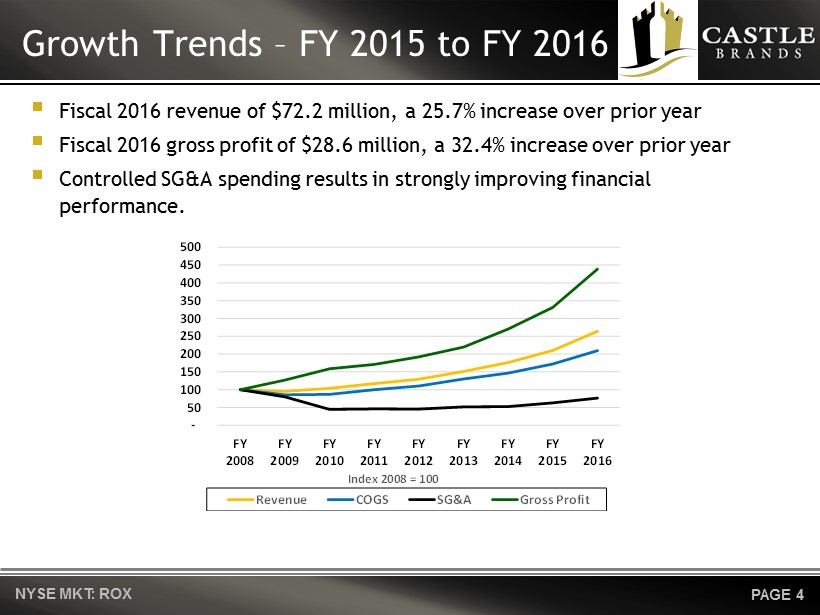

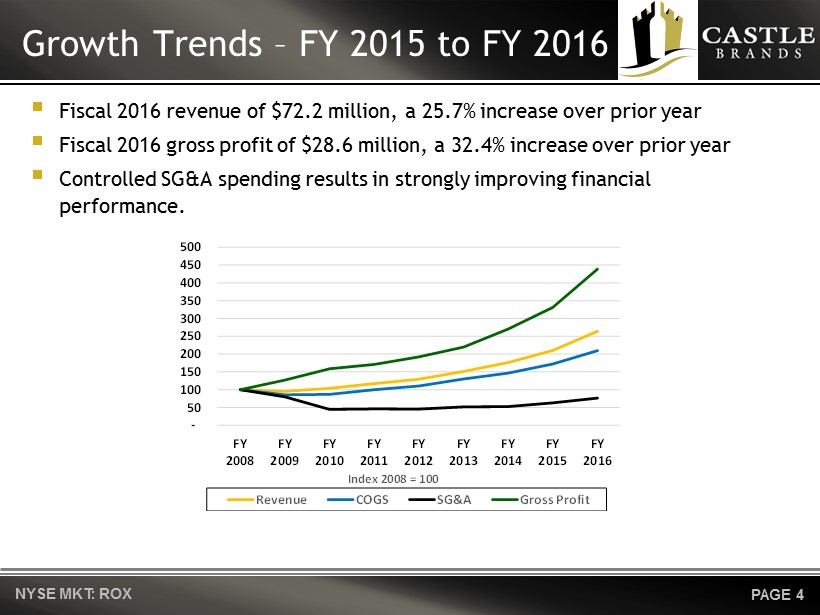

Growth Trends – FY 2015 to FY 2016 ▪ Fiscal 2016 revenue of $72.2 million, a 25.7% increase over prior year ▪ Fiscal 2016 gross profit of $28.6 million, a 32.4% increase over prior year ▪ Controlled SG&A spending results in strongly improving EBITDA, as adjusted.* NYSE MKT: ROX PAGE 4 *For a reconciliation of net loss attributable to common shareholders to EBITDA, as adjusted, see Page F of Appendix - 50 100 150 200 250 300 350 400 450 500 FY 2008 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 Index 2008 = 100 Revenue COGS SG&A Gross Profit

Growth Drivers – FY 2016 NYSE MKT: ROX PAGE 5 * For a reconciliation of net loss attributable to common shareholders to EBITDA, as adjusted, see Page F of Appendix ▪ Shipments of Jefferson’s Bourbon increased 45% to 61,000 cases in fiscal 2016, compared to 42,000 cases in fiscal 2015. ▪ Shipments of Goslings Rums in the U.S. increased 8% to 135,000 cases in fiscal 2016, compared to 125,000 cases in fiscal 2015. ▪ Shipments of Goslings Stormy Ginger Beer increased 56% to 1,115,000 cases in fiscal 2016, compared to 715,000 cases in fiscal 2015. ▪ This growth resulted in significant improvement in financial performance. ▪ EBITDA, as adjusted, for fiscal 2016 was $3.6 million, compared to $1.1 million in fiscal 2015.*

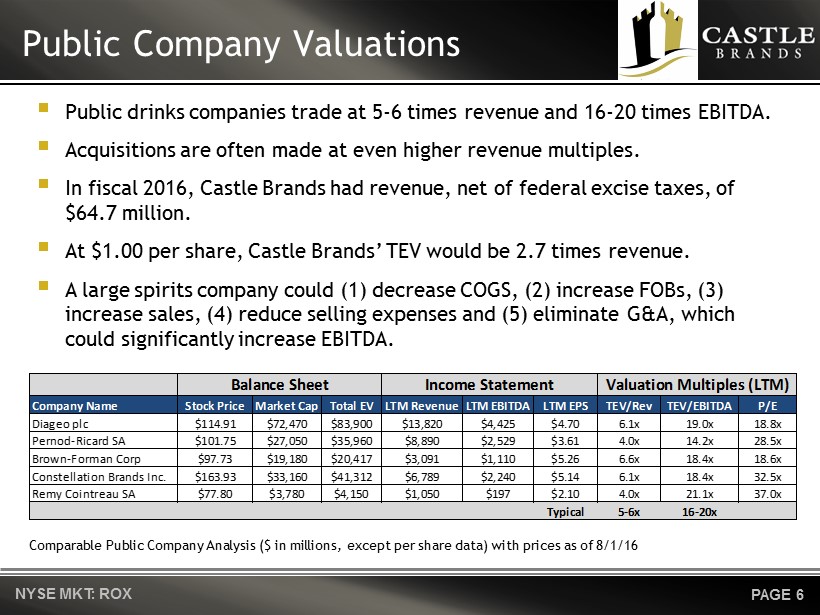

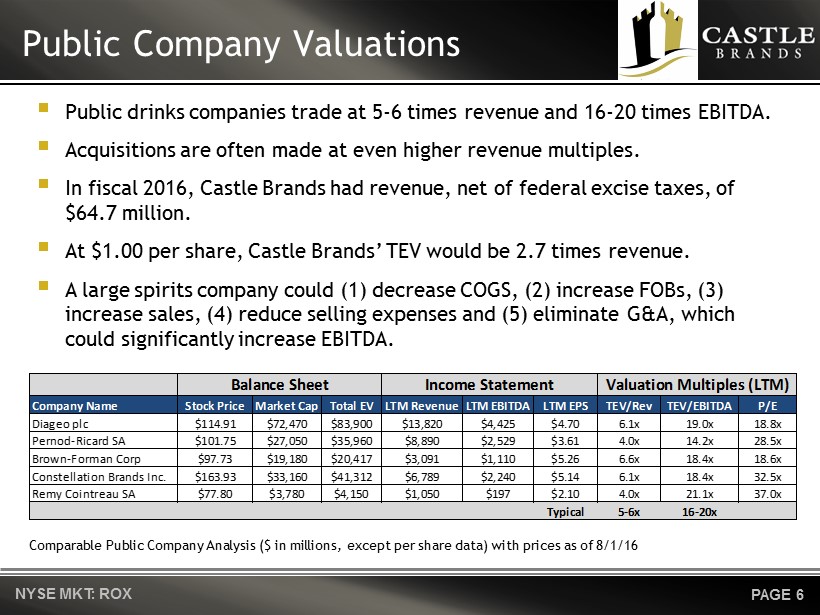

Public Company Valuations NYSE MKT: ROX PAGE 6 ▪ Public drinks companies trade at 5 - 6 times revenue and 16 - 20 times EBITDA. ▪ Acquisitions are often made at even higher revenue multiples. ▪ In fiscal 2016, Castle Brands had revenue, net of federal excise taxes, of $64.7 million. ▪ At $1.00 per share, Castle Brands’ TEV would be 2.7 times revenue. ▪ A large spirits company could (1) decrease COGS, (2) increase FOBs, (3) increase sales, (4) reduce selling expenses and (5) eliminate G&A, which could significantly increase EBITDA. Comparable Public Company Analysis ($ in millions, except per share data) with prices as of 8/1/16 Company Name Stock Price Market Cap Total EV LTM RevenueLTM EBITDA LTM EPS TEV/Rev TEV/EBITDA P/E Diageo plc $114.91 $72,470 $83,900 $13,820 $4,425 $4.70 6.1x 19.0x 18.8x Pernod-Ricard SA $101.75 $27,050 $35,960 $8,890 $2,529 $3.61 4.0x 14.2x 28.5x Brown-Forman Corp $97.73 $19,180 $20,417 $3,091 $1,110 $5.26 6.6x 18.4x 18.6x Constellation Brands Inc. $163.93 $33,160 $41,312 $6,789 $2,240 $5.14 6.1x 18.4x 32.5x Remy Cointreau SA $77.80 $3,780 $4,150 $1,050 $197 $2.10 4.0x 21.1x 37.0x Typical 5-6x 16-20x Balance Sheet Income Statement Valuation Multiples (LTM)

▪ 30 person in - house sales and marketing team with years of experience ▪ Regional VPs from larger spirits companies ▪ Continued substantial growth without proportional increases in SG&A ▪ All necessary federal and state licenses in 50 states and DC ▪ Represented by top - tier distributors across the US such as: • Southern Glazer’s Wine & Spirits • United Liquors • RNDC - USA • Breakthru Beverage ▪ Distribution in over 25 other countries Strong Route to Market NYSE MKT: ROX PAGE 7

Premium Brand Portfolio NYSE MKT: ROX PAGE 8

Jefferson’s Bourbon NYSE MKT: ROX

Jefferson’s Bourbon NYSE MKT: ROX PAGE 9 ▪ Super premium small - batch bourbon brand ▪ Umbrella brand with multiple offerings: ▪ Core SKUs: Jefferson’s and Jefferson’s Reserve ▪ Barrel finishes, such as Groth Reserve ▪ Innovations, such as Jefferson’s Ocean and Jefferson’s Wood Experiments ▪ Sufficient barrel stock of bourbon to support continued growth ▪ Fastest growing, established small - batch bourbon ▪ Recently named as a “Hot Prospect” by Impact ▪ One of the top - 5 small - batch bourbons ▪ Castle Brands owns 100 % of the Jefferson’s brand

Jefferson’s Growth NYSE MKT: ROX PAGE 10 Source: IWSR -

Jefferson’s Market Share NYSE MKT: ROX PAGE 11 Source: IWSR 2010 2011 2012 2013 2014 2015 Woodford Reserve 127 148 190 234 293 353 Knob Creek 144 169 204 225 259 294 Basil Hayden 27 34 44 55 80 121 Buffalo Trace 19 22 25 28 50 65 Jefferson's 8 12 19 29 38 58 Jack Daniels Single Barrel 46 49 53 52 52 54 Angel's Envy - - - - 12 47 Evan Williams Single Barrel 29 30 32 35 39 42 Eagle Rare 7 7 7 18 31 38 Elijah Craig 24 24 25 25 26 31 Booker's 11 13 15 19 24 26 Ridgemont Reserve 17 19 20 22 24 26 Russells Reserve 5 5 6 9 12 26 Blanton's Single Barrel 8 9 9 10 16 21 Wild Turkey Rare Breed 18 20 21 21 20 15 *Jefferson's adjusted from fiscal years to calendar years Top Small Batch Bourbons 9L Shipments (000's)

Jefferson’s Marketing NYSE MKT: ROX PAGE 12 ▪ Brand extensions to drive growth • Jefferson’s Ocean • Jefferson’s Manhattan • Jefferson’s Wine Finishes ▪ Off - Premise • Barrel programs • Value added packaging • Merchandising programs • Shelf glorifiers ▪ On - Premise • Jefferson’s mini barrels for bartenders to age special cocktails for menu listings • Jefferson’s flight trays Jefferson’s Barrel Display

Jefferson’s Marketing NYSE MKT: ROX PAGE 13 ▪ Edgy and impactful trade and consumer advertising. ▪ Strong PR activities resulting in substantial press “buzz”

Goslings NYSE MKT: ROX

Goslings Rum NYSE MKT: ROX PAGE 14 ▪ Goslings Black Seal - blended in Bermuda by Goslings Brothers Ltd., founded in 1806. ▪ In 2005, Castle Brands formed GCP, which holds the exclusive export and distribution rights for Goslings Rum for all countries other than Bermuda. ▪ Castle has a 60% controlling interest in GCP. ▪ Goslings Black Seal is one of the top - 10 premium imported rums in the U.S. ▪ Goslings Stormy Ginger Beer is the largest selling ginger beer in the US

Goslings Growth NYSE MKT: ROX PAGE 15 Source: IWSR 0 50 100 150 200 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 9L Case Sales (000's) Rum Growth Goslings (CAGR 15.7%) Peer Group of Premium Brands (CAGR 9.9%) All Rum (CAGR 1.7%)

Goslings Market Share NYSE MKT: ROX PAGE 16 Source: IWSR 2010 2011 2012 2013 2014 2015 Sailor Jerry 580 650 726 733 738 740 The Kraken 75 150 225 280 395 435 Myer's 271 289 280 252 244 234 Appleton 122 121 132 139 205 219 Goslings (Total ex Bermuda)* 99 115 134 153 152 184 Mount Gay 193 197 191 181 188 177 Goslings (U.S.) 77 88 101 115 112 128 Flor de Cana 80 84 85 94 91 98 Wray & Nephew 35 55 63 65 73 81 Pusser's 18 18 20 30 36 42 Barbancourt 22 25 30 35 37 38 *Goslings adjusted from fiscal years to calendar years Top 10 Premium Rum Brands 9L Shipments (000's)

Goslings Marketing NYSE MKT: ROX PAGE 17 ▪ Focus on “Dark ‘n Stormy®” cocktail ▪ Over 100 events and sponsorships in 2015: ▪ Honda Classic PGA tournament ▪ Deutsche Bank PGA tournament ▪ Charleston Race Week ▪ Expanding reach substantially by sponsoring America’s Cup Challenge (2015 to 2017): ▪ Based in Bermuda ▪ Now an “Extreme Sport” ▪ Broadcast rights: NBC and 40 others ▪ Hours of coverage: 3,000+ ▪ Total global audience: 1 billion+ ▪ Far beyond traditional sailing audience

Goslings Stormy Ginger Beer NYSE MKT: ROX PAGE 18 ▪ Launched in 2009 to reinforce the Dark ‘n Stormy® cocktail. ▪ Sold to bars, liquor stores and supermarkets. ▪ Now the largest selling ginger beer in the U.S. - 200,000 400,000 600,000 800,000 1,000,000 1,200,000 FY 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 Goslings Ginger Beer case sales

Irish Whiskey NYSE MKT: ROX

▪ Knappogue Castle Irish whiskey was Castle Brands’ first brand ▪ Single malt whiskey – triple distilled ▪ Irish is fastest growing segment of the whiskey market ▪ Significant barriers to entry due to limited sources of supply ▪ Castle has very favorable long - term supply contracts ▪ Like Jefferson’s, Knappogue Castle is becoming an umbrella brand with line extensions at higher price points: • Knappogue 14 year - old • Knappogue 16 year - old • Knappogue Special Cask Barrel Program ▪ Meaningful growth potential and high margins ▪ Castle Brands owns 100% of Knappogue Irish Whiskey – Knappogue NYSE MKT: ROX PAGE 19

▪ A blended Irish whiskey ▪ Also triple - distilled and aged in bourbon barrels ▪ Substantial growth potential and attractive margins ▪ Castle has favorable long - term supply contracts ▪ Main markets are Ireland, Scandinavia and traditional Irish whiskey markets in the US ▪ Castle Brands owns 100% of Clontarf ▪ With Knappogue and Clontarf together, Castle Brands sold 42,000 cases of Irish whiskey in 2015 Irish Whiskey – Clontarf NYSE MKT: ROX PAGE 20

▪ Producer and marketer of premium and super - premium spirits ▪ Focused on two major categories: • Whiskey • Rum ▪ Markets Goslings Stormy Ginger Beer ▪ Consistently grown core brands faster than industry norms ▪ Clear growth strategy by adding points of distribution for growing brands ▪ Scalable business model – experienced sales team can handle increased volume ▪ Directors and officers own approximately 41% on a fully - diluted basis ▪ Stock currently trades at a significant discount to industry multiples Summary NYSE MKT: ROX PAGE 21

Castle Brands Inc . 122 East 42 nd Street, Suite 5000 New York, NY 10168 Office: 646.356.0200 Toll Free: 800.882.8140 Fax: 646.356.0222

Appendix NYSE MKT: ROX

Mark Andrews – Chairman • Founded Castle Brands in 2003 • Chairman and CEO of American Exploration (ASE: AX), an oil and gas company, until its sale to Louis Dreyfus Natural Gas • Former Director of IVAX Corp. from its founding until its sale to Teva Pharmaceutical Industries Limited (NASDAQ: TEVA) • Life Trustee of New York Presbyterian Hospital • Bachelor of Arts from Harvard College and MBA from Harvard Business School Richard Lampen – President and Chief Executive Officer • President and CEO of Ladenburg Thalmann Financial Services Inc (NYSE MKT: LTS) • Executive VP, Vector Group Ltd. (NYSE: VGR), holding company with interests in consumer goods and real estate • Former Managing Director and Senior Member, Leveraged Finance Group, Salomon Brothers Inc. • Former Partner & Co - Chairman of Corporate Department, Steel Hector & Davis, a law firm with headquarters in Miami, FL • Bachelor of Arts from the Johns Hopkins University and a JD from Columbia Law School Management Team NYSE MKT: ROX PAGE

John Glover – Chief Operating Officer • Over 30 years experience in marketing, commercial and general management in the spirits industry • Former Senior VP Commercial Management of Remy Cointreau USA • Served in various roles in marketing and management with predecessor companies to Diageo plc (LSE: DGE) • Bachelor of Arts and MBA from Dartmouth College Alfred Small – Chief Financial Officer • Over 15 years experience in finance, operations and compliance in the spirits industry • Former Accountant at Grodsky Caporrino & Kaufman, practicing in consumer goods, wholesale distribution, and technology • Bachelor of Science from the State University of New York and a Certified Public Accountant Kelley Spillane – SVP Global Sales • Over 25 years experience in spirits sales • Served in several senior sales and management roles at Carillon and was closely involved in the growth of Absolut Vodka and Grand Marnier in the U.S. • Bachelor of Arts from Ramapo College Management Team NYSE MKT: ROX PAGE B

Marketing Team ▪ Castle Brands has an experienced marketing team to complement its sales force: • Malcolm Gosling – As CEO of Gosling - Castle Partners, Inc., Malcolm oversees the marketing and promotional activities associated with the Goslings brands. Malcolm is based in Boston and works closely with a creative agency based there. • Alejandra Pe ñ a – As SVP Marketing, Alejandra is responsible for design, planning, marketing and promotional activities associated with Castle’s brands. Prior to joining Castle in 2010, Alejandra served as Marketing Vice President for liqueurs and spirits for Remy Cointreau USA, where she was responsible for the marketing of Mount Gay Rum and Cointreau Liqueur. • Trey Zoeller – The founder of Jefferson’s, Trey is responsible for Jefferson’s marketing and promotional activities. Trey is based in Kentucky where his family has been active in the bourbon industry for several generations. • Brand Team – Castle Brands has a dedicated team of brand managers that focus on the planning and execution of marketing and commercial activities for the Castle Brands portfolio. NYSE MKT: ROX PAGE C

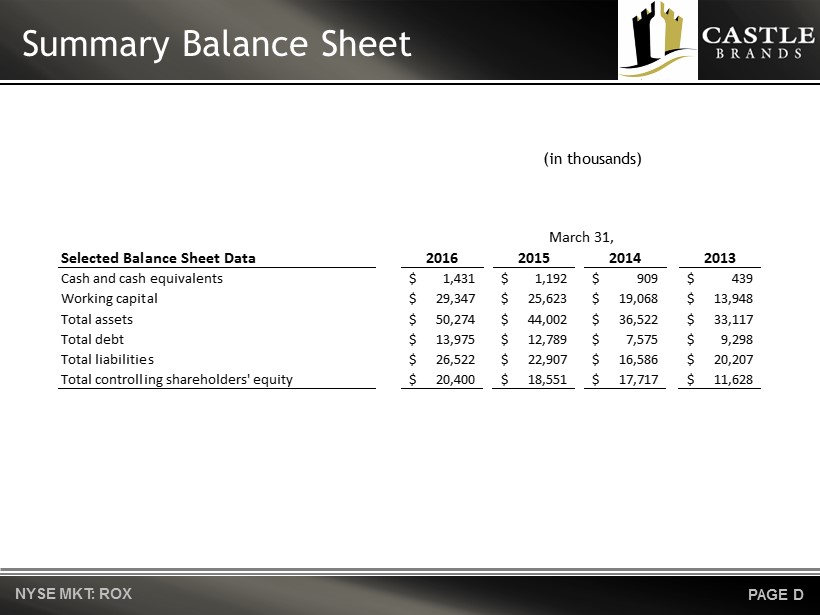

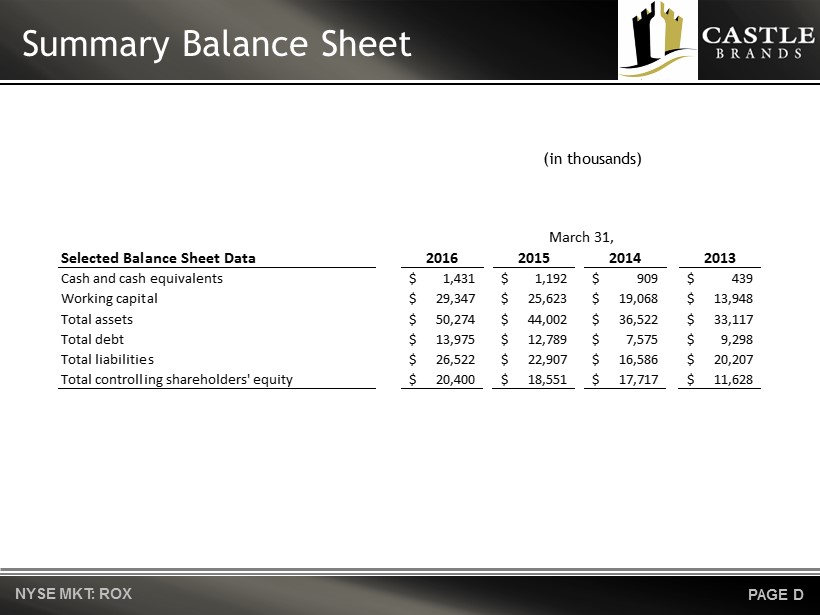

Summary Balance Sheet NYSE MKT: ROX PAGE D (in thousands) Selected Balance Sheet Data 2016 2015 2014 2013 Cash and cash equivalents 1,431$ 1,192$ 909$ 439$ Working capital 29,347$ 25,623$ 19,068$ 13,948$ Total assets 50,274$ 44,002$ 36,522$ 33,117$ Total debt 13,975$ 12,789$ 7,575$ 9,298$ Total liabilities 26,522$ 22,907$ 16,586$ 20,207$ Total controlling shareholders' equity 20,400$ 18,551$ 17,717$ 11,628$ March 31,

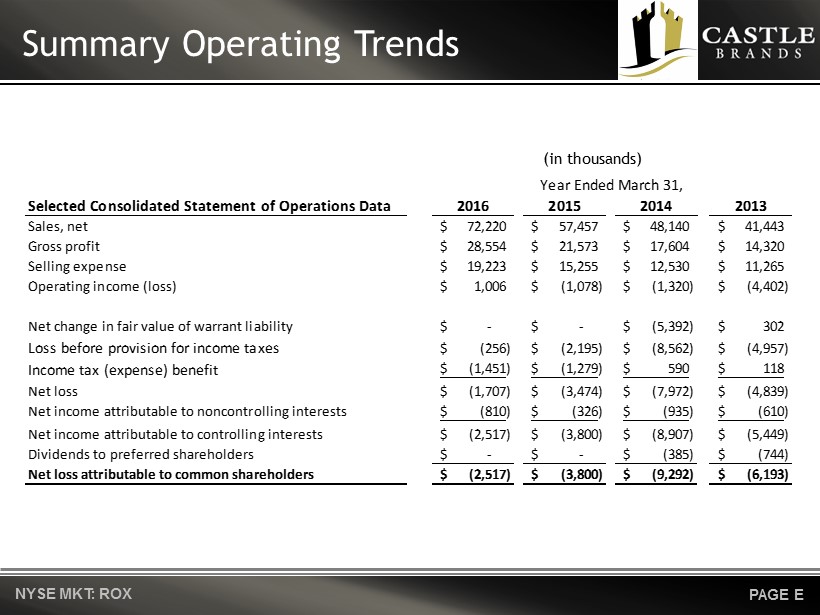

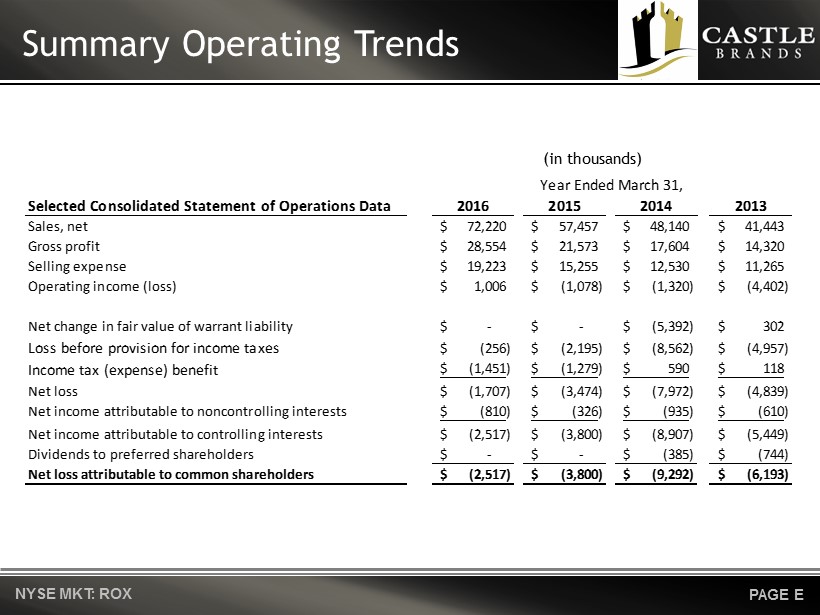

Summary Operating Trends NYSE MKT: ROX PAGE E (in thousands) Selected Consolidated Statement of Operations Data 2016 2015 2014 2013 Sales, net 72,220$ 57,457$ 48,140$ 41,443$ Gross profit 28,554$ 21,573$ 17,604$ 14,320$ Selling expense 19,223$ 15,255$ 12,530$ 11,265$ Operating income (loss) 1,006$ (1,078)$ (1,320)$ (4,402)$ Net change in fair value of warrant liability -$ -$ (5,392)$ 302$ Loss before provision for income taxes (256)$ (2,195)$ (8,562)$ (4,957)$ Income tax (expense) benefit (1,451)$ (1,279)$ 590$ 118$ Net loss (1,707)$ (3,474)$ (7,972)$ (4,839)$ Net income attributable to noncontrolling interests (810)$ (326)$ (935)$ (610)$ Net income attributable to controlling interests (2,517)$ (3,800)$ (8,907)$ (5,449)$ Dividends to preferred shareholders -$ -$ (385)$ (744)$ Net loss attributable to common shareholders (2,517)$ (3,800)$ (9,292)$ (6,193)$ Year Ended March 31,

GAAP to Non - GAAP Reconciliation NYSE MKT: ROX PAGE F (in thousands) 2016 2015 2014 2013 Net loss attributable to common shareholders (2,516)$ (3,800)$ (9,291)$ (6,193)$ Adjustments: Interest expense, net 1,089 1,129 1,062 587 Income tax expense (benefit), net 1,451 1,279 (590) (118) Depreciation and amortization 940 908 860 920 EBITDA income (loss) 963 (484) (7,959) (4,804) Allowance for doubtful accounts 61 236 403 87 Allowance for obsolete inventory 200 281 200 685 Stock-based compensation expense 1,371 788 394 282 Loss on wine assets - - - 1,716 Other expense (income), net 1 (17) - - (Income) loss from non-consolidated equity investment (19) - 503 23 Foreign exchange loss 191 5 285 247 Net change in fair value of warrant liability - - 5,393 (303) Net income attributable to noncontrolling interests 810 326 935 610 Dividend to preferred shareholders - - 385 744 EBITDA, as adjusted 3,577$ 1,134$ 537$ (712)$ Year Ended March 31,

Non - GAAP Financial Measures NYSE MKT: ROX PAGE G Within the information above, Castle Brands provides information regarding EBITDA, as adjusted, which is not a recognized term under GAAP (Generally Accepted Accounting Principles) and does not purport to be an alternative to income (loss) from operations or net income (loss) as a measure of operating performance. Earnings before interest, taxes, depreciation and amortization, or EBITDA, adjusted for allowances for doubtful accounts and obsolete inventory, stock - based compensation expense, other (income) expense, net, loss from equity investment in non - consolidated affiliate, foreign exchange (gain) loss, net change in fair value of warrant liability, net income attributable to noncontrolling interests and dividend to preferred shareholders is a key metric the Company uses in evaluating its financial performance on a consistent basis across various periods. EBITDA, as adjusted, is considered a non - GAAP financial measure as defined by Regulation G promulgated by the SEC under the Securities Act of 1933, as amended. Due to the significance of non - cash and non - recurring items, EBITDA, as adjusted, enables the Company's Board of Directors and management to monitor and evaluate the business on a consistent basis. The Company uses EBITDA, as adjusted, as a primary measure, among others, to analyze and evaluate financial and strategic planning decisions regarding future operating investments and allocation of capital resources. The Company believes that EBITDA, as adjusted, eliminates items that are not indicative of its core operating performance or are based on management's estimates, such as allowance accounts, are due to changes in valuation, such as the effects of changes in foreign exchange or fair value of warrant liability, or do not involve a cash outlay, such as stock - based compensation expense. EBITDA, as adjusted, should be considered in addition to, rather than as a substitute for, income from operations, net income and cash flows from operating activities.