EXHIBIT 99.1

CENTRAL SUN MINING INC.

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2007

March 31, 2008

6 Adelaide Street East, Suite 500

Toronto, Ontario M5C 1H6

CENTRAL SUN MINING INC.

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2007

TABLE OF CONTENTS

INTRODUCTORY NOTES | 1 |

CORPORATE STRUCTURE | 3 |

GENERAL DEVELOPMENT OF THE BUSINESS | 4 |

DESCRIPTION OF THE BUSINESS | 6 |

| Principal Product | 6 |

| Competitive Conditions | 6 |

| Operations | 6 |

| Risk Factors | 7 |

| CIM Standards Definitions | 13 |

| Summary of Mineral Resource and Mineral Reserve Estimates | 15 |

| Mineral Properties | 16 |

DIVIDENDS | 45 |

DESCRIPTION OF CAPITAL STRUCTURE | 45 |

TRADING PRICE AND VOLUME | 46 |

DIRECTORS AND OFFICERS | 47 |

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 50 |

TRANSFER AGENT AND REGISTRAR | 50 |

MATERIAL CONTRACTS | 50 |

INTERESTS OF EXPERTS | 51 |

AUDIT COMMITTEE | 51 |

LEGAL PROCEEDINGS | 53 |

ADDITIONAL INFORMATION | 54 |

| | | | |

SCHEDULE “A” – AUDIT COMMITTEE CHARTER

-i-

INTRODUCTORY NOTES

Cautionary Note Regarding Forward-Looking Statements

This annual information form contains “forward-looking information” which may include, but is not limited to, statements with respect to the future financial or operating performance of the Company, its subsidiaries and its projects, the future price of gold, the expectation that the Orosi mill plan scoping and feasibility studies will be positive, the estimation of mineral reserves and resources, the realization of mineral reserve estimates, the timing and amount of estimated future production timing and cost of the Orosi mill project and availability of financing and equipment for that mill project, costs of production, capital, operating and exploration expenditures, costs and timing of the development of new deposits, costs and timing of future exploration, requirements for additional capital, government regulation of mining operations, environmental risks, reclamation expenses, title disputes or claims, limitations of insurance coverage and the timing and possible outcome of pending litigation and regulatory matters. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company and/or its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, general business, economic, competitive, political and social uncertainties; the actual results of current exploration activities; actual results of reclamation activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of gold; possible variations of ore grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; political instability, insurrection or war; delays in obtaining governmental approvals or financing or in the completion of development or construction activities, as well as those factors discussed in the section entitled “Description of the Business – Risk Factors” in this annual information form. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this annual information form and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Non-GAAP Performance Measures

“Total cash cost” figures and “cash operating cost” figures are calculated in accordance with standards developed by The Gold Institute, which was a worldwide association of suppliers of gold and gold products and included leading North American gold producers. The Gold Institute ceased operations in 2002, but the standard is the accepted standard of reporting cash costs of production in North America. Adoption of the standard is voluntary and the cost measures presented below may not be comparable to other similarly titled measures of other companies. Cash operating costs include mine site operating costs such as mining, processing and administration, but are exclusive of amortization, reclamation, capital, development and exploration costs. These costs are then divided by ounces sold to arrive at the cash operating cost per ounce. Total cash costs include cash operating costs, royalties and production taxes. Total cash costs are then divided by ounces sold to arrive at the total cash costs per ounce. These measures are considered to be a key indicator of a company’s ability to generate operating earnings and cash flow from its mining operations. These data are furnished to provide additional information and is a non-GAAP measure. It should not be considered in isolation as a substitute for measures of performance prepared in accordance with GAAP and is not necessarily indicative of operating costs presented under GAAP.

Currency Presentation and Exchange Rate Information

This annual information form contains references to United States dollars and Canadian dollars. All dollar amounts referenced, unless otherwise indicated, are expressed in United States dollars and Canadian dollars are referred to as “Canadian dollars” or “C$”.

The high, low, average and closing exchange rates for Canadian dollars in terms of the United States dollar for each of the three years ended December 31, 2007, as quoted by the Bank of Canada, were as follows:

| Year ended December 31 |

| 2007 | 2006 | 2005 |

High | C$1.1855 | C$1.1726 | C$1.2841 |

Low | 0.9215 | 1.0990 | 1.1507 |

Average (1) | 1.0750 | 1.1341 | 1.2118 |

Closing | 0.9801 | 1.1653 | 1.1659 |

(1) | Calculated as an average of the daily noon rates for each period. |

On March 28, 2008, the noon exchange rate for Canadian dollars in terms of the United States dollar, as quoted by the Bank of Canada, was US$1.00 = C$1.0181.

Gold Prices

The high, low, average and closing afternoon fixing gold prices in United States dollars per troy ounce for each of the three years ended December 31, 2007, as quoted by the London Bullion Market Association, were as follows:

| Year ended December 31 |

| 2007 | 2006 | 2005 |

High | $841 | $725 | $537 |

Low | 608 | 525 | 411 |

Average | 695 | 604 | 445 |

Closing | 834 | 632 | 513 |

On March 28, 2008, the closing afternoon fixing gold price in United States dollars per troy ounce, as quoted on the London Bullion Market Association, was $934.25.

2

CORPORATE STRUCTURE

Central Sun Mining Inc. (“Central Sun” or the “Company”) was incorporated under the Business Corporations Act (Ontario) by Articles of Incorporation dated April 22, 1987 under the name Glencairn Explorations Ltd. The Company changed its name to Glencairn Gold Corporation pursuant to Articles of Amendment dated September 30, 2002 and was continued under the Canada Business Corporations Act pursuant to Articles of Continuance dated June 8, 2005. Pursuant to Articles of Amendment dated November 29, 2007, the Company changed its name to Central Sun Mining Inc. and the authorized capital of the Company was altered by consolidating all of the then issued and outstanding common shares of the Company on the basis of one new common share for seven then existing common shares (the “Consolidation”). All references to common shares in this annual information form are to post-Consolidation shares, unless otherwise noted.

The Company’s head and registered office is located at 6 Adelaide Street East, Suite 500, Toronto, Ontario, M5C 1H6.

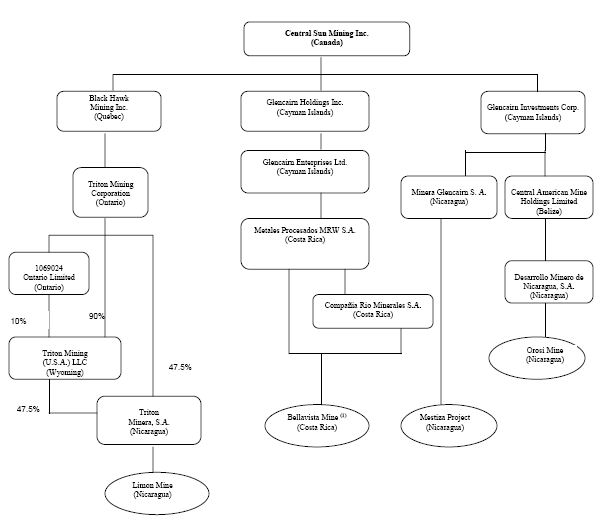

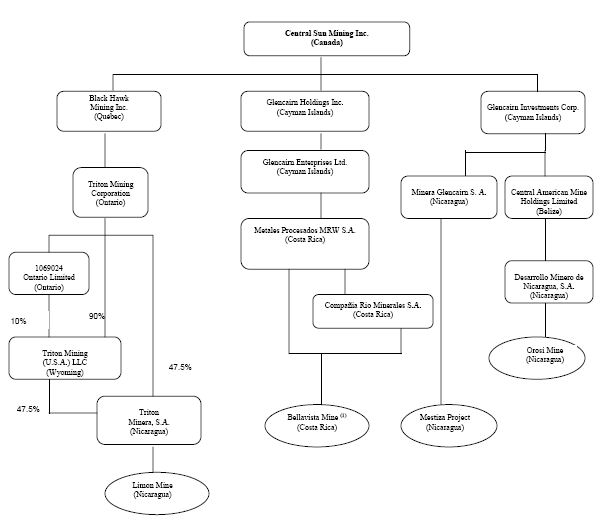

The following chart illustrates the Company’s principal subsidiaries (the “Subsidiaries”), together with the jurisdiction of incorporation of each company and the percentage of voting securities held by the Company. All subsidiaries are wholly-owned, except where indicated otherwise.

_________________

(1) | The Company suspended all mining operations at the Bellavista Mine in July 2007. |

3

As used in this annual information form, except as otherwise required by the context, reference to the “Company” or “Central Sun” means Central Sun Mining Inc. and its Subsidiaries.

GENERAL DEVELOPMENT OF THE BUSINESS

General

Central Sun is a gold producer with mining and exploration activities focused in Nicaragua. The Company operates the Limon gold mine (the “Limon Mine”) in Nicaragua and plans to convert the Orosi gold mine (formerly the Libertad Mine) (the “Orosi Mine”) in Nicaragua to conventional milling and expand annual gold output. It also holds an option to acquire a 100% interest in the Mestiza gold project (the “Mestiza Project”) which is located 70 kilometres from the Limon Mine. The Company focuses on efficient and productive mining practices to establish a firm base of quality operations. Central Sun is committed to growth by optimizing current operations and expanding mineral reserves at existing mines and investigating potential new acquisitions.

Three Year History

On July 6, 2006, the Company completed the acquisition of the Orosi Mine in Nicaragua and a 60% interest in the Cerro Quema advanced gold project (the “Cerro Quema Project”) in Panama fro m Yamana Gold Inc. (“Yamana”). Total consideration for the acquisition was 4,571,000 common s hares (32 million pre-consolidation shares). The acquisition of the Orosi Mine and the Cerro Quema Project brought a significant increase in the Company’s mineral resource base.

Also on July 6, 2006, the Company completed the private placement of 30 million subscription receipts for gross proceeds of C $18 million. Upon completion of the financing, the subscription receipts were automatically exercised into 4,286,000 common s hares (30 million pre consolidation common shares) and 15 million common share purchase warrants. As a result of the Consolidation, seven of such common share purchase warrant s are required to acquire one c ommon s hare at a price of C$5.60 until the earlier of July 6, 2008 and, at the option of the Company, the date that is 30 days following provision of notice to warrantholders from the Company that the closing price of its common shares on the Toronto Stock Exchange (the “TSX”) has been at least C$8.40 for 30 consecutive trading days.

Yamana subscribed for 4.2 million subscription receipts for C $2.5 million under the financing and, following completion of the financing, beneficially owned 6,003,000 common shares (42,022,500 pre consolidation common s hares), representing approximately 17.9% of the then issued and outstanding common shares, and warrants to acquire an additional 2.1 million common s hares.

In September 2006, the Company acquired an option to acquire a 100% interest in the Mestiza Project in Nicaragua. The property is located 70 kilometres by road east of the Limon Mine. The Company has agreed to pay the Mestiza property owners approximately $2.1 million over 42 months if the option is fully exercised. There was also a 1.5% net smelter return royalty granted on gold production from the Mestiza property. Should the Company choose at any time not to pay any of the remaining installments, the property will revert back to the previous owners. The Company also issued 53, 571 common shares in consideration for the removal of liens against the property and consulting services.

On February 21, 2007, the Company announced its plan to upgrade and expand gold production at the Orosi M ine in Nicaragua by converting the heap-leach mine to a conventional milling operation (the “Orosi Mill Plan”) . Mining operations at Orosi were be suspended March 31, 2007 because of very poor recovery from the heap leach operation. A scoping study was undertaken in consultation with engineering firm AMEC Americas Limited (“AMEC”). Scott Wilson Roscoe Postle & Associates Ltd. (“Scott Wilson”) is currently completing a feasibility study on Orosi Mill that is expected to be completed near the end of Q1 2008. The Company purchased the Getchell mill in Nevada, U.S.A. in 2007. This mill has been dismantled and shipped to the Orosi mine site in Nicaragua. Work is currently in progress to build foundations and install the mill. The Company expects that the expansion to be completed in Q1 2009.

4

In January 2007, the Company initiated a C$ 2. 2 million exploration program at its Nicaraguan gold properties, focusing on the Limon Mine, the Orosi Mine and the Mestiza Project however this program was substantially curtailed after the closure of the Orosi Mine at the end of March 2007. In December 2007, the Company announced an exp loration program budgeted at $7 million which will include more than 25,000 m etres of diamond drilling, such drilling having commence d in early January 2008.

In July 2007, the Company suspended mining operations at the Bellavista gold mine (the “Bellavista Mine”) in Costa Rica due to concerns over ground movements. T he Company took the proactive measure of stopping the application of cyanide in July 2007 and rinsing the leach pad. All contaminants were removed from the site and, as a result of rinsing of the leach pad, there was no release of cyanide into the environment. In October 2007, a localized landslide at the Bellavista Mine, resulting from the ground movement and continuing heavy rains, caused significant damage to the structure of its ADR recovery plant. There was no injury to personnel. On March 11, 2008, the Costa Rican government acknowledged receipt of the Company’s proposal to reclaim the mine site.

In October 2007, the Company announced its new strategic plan which included the following:

| • | an underwritten private placement financing; |

| • | the appointment of Messrs. Stan Bharti, George Faught and Joe Milbourne to the Company’s Board of Directors and Mr. Bharti as Chairman of the Board; |

| • | the appointment of Dr. Bill Pearson, P.Geo. as Executive Vice President, Exploration of the Company; |

| • | the 7:1 Share Consolidation; |

| • | a change in the Company’s name; and |

| • | the sale of the Company’s non-core assets, including the interest in the Cerro Quema Project for consideration of $6 million. |

On October 22, 2007, the Company completed a private placement financing for gross proceeds of C$26,050,500. A syndicate of underwriters, led by Macquarie Capital Markets Canada Ltd. (formerly Orion Securities Inc.) and including Dundee Securities Corporation, Blackmont Capital Inc. and Wellington West Capital Markets Inc., purchased 40,000,000 units (the “Units”) and 133,670,000 subscription receipts (the “Subscription Receipts”) at a price of C$0.15 per Unit or Subscription Receipt. Each Unit was comprised of one Common Share and one-half of one common share purchase warrant. As a result of the Consolidation, seven of such common share purchase warrants are required to acquire one common share at a price of C$1.26 until October 22, 2010.

The proceeds from the sale of the Subscription Receipts were held in escrow pending satisfaction of certain conditions, including receipt of disinterested shareholder approval for the issuance of the common shares and common share purchase warrants upon exercise of the Subscription Receipts. Upon satisfaction of such conditions on November 29, 2007, each Subscription Receipt was automatically converted into one Unit (without any further action by the holders thereof, including payment of additional consideration).

The net proceeds from the financing are being used by the Company for development of the Orosi Mine, for exploration at the Company’s mineral properties, and for general working capital purposes. This financing has permitted the Company to begin the conversion of the Orosi Mine from heap leaching to a conventional milling circuit and to focus its exploration efforts along the Nicaraguan Gold Belt where it holds a substantial land package.

As a result of this financing, (i) Yamana owns 7,907,975 post-Consolidation common shares of the Company, representing approximately 13.0% of the issued and outstanding common shares of the Company, and (ii) Aberdeen International Inc. owns 6,619,000 post-Consolidation common shares of the Company, representing approximately 10.9% of the issued and outstanding common shares of the Company.

5

On October 31, 2007, as part of the restructuring program, the Company sold its interest in the Cerro Quema Project to Bellhaven Copper & Gold, Inc. for aggregate consideration of $6 million, $3 million of which has already been paid, $1 million of which will be paid on June 30, 2008, and $2 million of which will be paid on December 31, 2008. The sale of this non-core asset will provide the Company with additional funds to focus on its mining and exploration properties in Nicaragua.

DESCRIPTION OF THE BUSINESS

Central Sun is a gold producer with mining and exploration activities focused in Nicaragua. The Company operates the Limon Mine in Nicaragua and plans to convert the Orosi Mine (formerly the Libertad Mine) in Nicaragua to conventional milling and expand annual gold output. It also holds an option to acquire a 100% interest in the Mestiza Project which is located 70 kilometres from the Limon Mine. The Company focuses on efficient and productive mining practices to establish a firm base of quality operations. Central Sun is committed to growth by optimizing current operations and expanding mineral reserves at existing mines.

Principal Product

Central Sun has been a producing gold company since October 2003. There is a world-wide gold market into which the Company can sell its gold and, as a result, the Company is not dependent on a particular purchaser with regard to the sale of the gold that it produces.

Competitive Conditions

The precious metal mineral exploration and mining business is a competitive business. The Company competes with numerous other companies and individuals in the search for and the acquisition of attractive precious metal mineral properties. The ability of the Company to acquire precious metal mineral properties in the future will depend not only on its ability to operate and develop its present properties, but also on its ability to select and acquire suitable producing properties or prospects for precious metal development or mineral exploration.

Operations

Raw Materials

The Company has gold mineral reserves at the Limon Mine. As at December 31, 2007 no mineral reserves defined at the Orosi Mine, however the feasibility study on the conventional mill installation being completed by Scott Wilson, expected to be completed near the end of Q1 2008, will define mineral reserves at the Orosi Mine.

Environmental Protection Requirements

Central Sun’s properties are affected in varying degrees by government regulations relating, among other things, to the acquisition of land, pollution control and environmental protection, land reclamation, safety and production. Changes in any of these regulations or in the application of the existing regulation are beyond the control of the Company and may adversely affect its operations. Failure to comply with the conditions set out in any permit or failure to comply with the applicable statutes and regulations may result in orders to cease or curtail operations or to install additional equipment. Central Sun may be required to compensate those suffering loss or damage by reason of its activities. The effect of these regulations cannot be accurately predicted.

Employees

As at December 31, 2007, the Company had 9 full-time employees in Canada, 305 employees at the Orosi Mine of which 84 are full time active, 29 part time, 192 on temporary suspension with no additional persons working for contractors at the Orosi Mine, 452 employees at the Limon Mine with no additional persons working for contractors at the Limon Mine, and 39 employees at the Bellavista Mine, with an additional 34 persons working for contractors at the Bellavista Mine.

6

Risk Factors

The operations of the Company are speculative due to the high-risk nature of its business, which is the acquisition, financing, exploration, development and operation of mining properties. These risk factors could materially affect the Company’s future operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the Company.

Exploration, Development and Operating Risks

Mining operations generally involve a high degree of risk. Central Sun’s operations are subject to all the hazards and risks normally encountered in the exploration, development and production of gold, including unusual and unexpected geologic formations, seismic activity, rock bursts, ground failure, flooding and other conditions involved in the drilling, blasting and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Although adequate precautions to minimize risk are taken, milling operations are subject to hazards such as equipment failure or failure of tailing impoundment dams that may result in environmental pollution and consequent liability.

The exploration for and development of mineral deposits involves significant risks that even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. Major expenses may be required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is impossible to ensure that the exploration or development programs planned by Central Sun or any of its joint venture partners will result in a profitable commercial mining operation. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices that are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in Central Sun not receiving an adequate return on invested capital.

There is no certainty that the expenditures made by Central Sun towards the search and evaluation of mineral deposits will result in discoveries of commercial quantities of ore. The Company’s ability to execute its planned exploration and development programs on a timely basis is dependent on a number of factors beyond the Company’s control including availability of drilling services, ground conditions, weather conditions and permitting.

Orosi Mill Plan

The Orosi Mill Plan, to convert the heap-leach mine to a conventional milling operation, is dependent on the announced feasibility study being undertaken by Scott Wilson being positive, favourable financing for the Orosi Mill Plan being available, required equipment being procured on a timely basis, required permitting being obtained in a timely manner and expected mill recovery rates being achieved. Work is continuing on the feasibility study expected to be completed at the end of the first quarter of 2008. Central Sun currently estimates that the expansion can be completed in the first quarter of 2009. Mining operations at the Orosi Mine were suspended during this period commencing at the end of March 2007. There can be no assurance that the feasibility study will be positive, that all of the requirements for the Orosi Mill Plan will be met and that mining operations at the Orosi Mine will resume on schedule.

Insurance and Uninsured Risks

Central Sun’s business is subject to a number of risks and hazards including adverse environmental conditions, industrial accidents, labour disputes, unusual or unexpected geological conditions, ground or slope failures, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to the Company’s properties or the properties of others, delays in mining, monetary losses and possible legal liability.

7

Although Central Sun maintains insurance to protect against certain risks in such amounts as it considers to be reasonable, its insurance will not cover all the potential risks associated with a mining company’s operations. Central Sun may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to Central Sun or to other companies in the mining industry on acceptable terms. Central Sun might also become subject to liability for pollution or other hazards that may not be insured against or that Central Sun may elect not to insure against because of premium costs or other reasons. Losses from these events may cause Central Sun to incur significant costs that could have a material adverse effect upon its financial performance and results of operations.

Environmental Risks and Hazards

All phases of the Company’s operations are subject to environmental regulations in the various jurisdictions in which it operates. Environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that existing or future environmental regulation will not materially adversely affect the Company’s business, financial condition and results of operations. Environmental hazards may exist on the properties on which the Company holds interests. Previous or existing owners or operators may have caused environmental hazards on properties on which the Company holds interests.

Government approvals and permits are currently, or may in the future be, required in connection with the Company’s operations. To the extent such approvals are required and not obtained; the Company may be curtailed or prohibited from proceeding with planned exploration, development or operation of mineral properties.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations and parties that were engaged in mining operations in the past, including the Company, may be required to compensate those suffering loss or damage by reason of such mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Amendments to current laws, regulations and permits governing operations and activities of mining companies, or the more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in exploration expenses, capital expenditures or production costs, reduction in levels of production at producing properties, or abandonment or delays in development of new mining properties.

Infrastructure

Mining, processing, development and exploration activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important determinants, which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect the Company’s operations, financial condition and results of operations.

Uncertainty in the Estimation of Mineral Reserves and Mineral Resources

The figures for mineral reserves and mineral resources contained in this annual information form are estimates only and no assurance can be given that the anticipated tonnages and grades will be achieved, that the indicated level of recovery will be realized or that mineral reserves can be mined or processed profitably. There are numerous uncertainties inherent in estimating mineral reserves and mineral resources, including many factors beyond the Company’s control. Such estimation is a subjective process, and the accuracy of any reserve or resource estimate is a function of the quantity and quality of available data and of the assumptions made and judgments used

8

in engineering and geological interpretation. Short-term operating factors relating to the mineral reserves, such as the need for orderly development of the ore bodies or the processing of new or different ore grades, may cause the mining operation to be unprofitable in any particular accounting period. In addition, there can be no assurance that gold recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

Fluctuation in gold prices, results of drilling, metallurgical testing and production and the evaluation of mine plans subsequent to the date of any estimate may require revision of such estimate. The volume and grade of mineral reserves mined and processed and the recovery rates may not be the same as currently anticipated. Any material reductions in estimates of mineral reserves and mineral resources, or of the Company’s ability to extract these mineral reserves, could have a material adverse effect on the Company’s operations, financial condition and results of operations.

All mineral resource and reserve estimates have been prepared in accordance with Canadian National Instrument 43-101 and the Canadian Institute of Mining and Metallurgy (“CIM”) Definition Standards on Mineral Resources and Reserves adopted by the CIM Council on December 11, 2005. These standards differ significantly from the requirements of the United States Securities and Exchange Commission which do not recognize mineral resources. Mineral resource and reserve information may therefore not be comparable to similar information concerning United States companies.

Need for Additional Reserves

Because mines have limited lives based on proven and probable mineral reserves, the Company must continually replace and expand its mineral reserves as its mines produce gold. The life-of-mine estimates included in this annual information form may not be correct. The Company’s ability to maintain or increase its annual production of gold will be dependent in significant part on its ability to bring new mines into production and to expand mineral reserves at existing mines.

Land Title

The acquisition of title to mineral properties is a very detailed and time-consuming process. Title to, and the area of, mineral concessions may be disputed. Although the Company believes it has taken reasonable measures to ensure proper title to its properties, there is no guarantee that title to any of its properties will not be challenged or impaired. Third parties may have valid claims underlying portions of the Company’s interests, including prior unregistered liens, agreements, transfers or claims, including native land claims, and title may be affected by, among other things, undetected defects. In addition, the Company may be unable to operate its properties as permitted or to enforce its rights with respect to its properties.

Competition

The mining industry is intensely competitive in all of its phases and the Company competes with many companies possessing greater financial and technical resources. Competition in the precious metals mining industry is primarily for mineral rich properties that can be developed and produced economically; the technical expertise to find, develop, and operate such properties; the labour to operate the properties; and the capital for the purpose of funding such properties. Many competitors not only explore for and mine precious metals, but conduct refining and marketing operations on a global basis. Such competition may result in the Company being unable to acquire desired properties, to recruit or retain qualified employees or to acquire the capital necessary to fund its operations and develop its properties. Existing or future competition in the mining industry could materially adversely affect the Company’s prospects for mineral exploration and success in the future.

Additional Capital

The exploration and development of the Company’s properties, including continuing exploration and development projects, the construction of mining facilities and commencement of mining operations and the growth of the Company, may require substantial additional financing. Failure to obtain sufficient financing could result in a delay or indefinite postponement of exploration, development or production on any or all of the Company’s

9

properties or even a loss of a property interest. An important, source of funds available to the Company is through the sale of equity capital, properties, royalty interests or the entering into of joint ventures. Additional financing may not be available when needed or if available, the terms of such financing might not be favourable to the Company and might involve substantial dilution to existing shareholders. Failure to raise capital when needed would have a material adverse effect on the Company’s business, financial condition and results of operations and ability to grow.

Commodity Prices

The profitability of the Company’s operations will be dependent upon the market price of mineral commodities particularly gold. Mineral prices fluctuate widely and are affected by numerous factors beyond the control of the Company. The level of interest rates, the rate of inflation, the world supply of mineral commodities and the stability of exchange rates can all cause significant fluctuations in prices. Such external economic factors are in turn influenced by changes in international investment patterns, monetary systems and political developments. The price of mineral commodities has fluctuated widely in recent years and future price declines could cause commercial production to be impracticable, thereby having a material adverse effect on the Company’s business, financial condition and results of operations. Furthermore, reserve calculations and life-of-mine plans using significantly lower gold prices could result in material write-downs of the Company’s investment in mining properties and increased amortization, reclamation and closure charges.

In addition to adversely affecting the Company’s reserve estimates and its financial condition, declining commodity prices can impact operations by requiring a reassessment of the feasibility of a particular project. Such a reassessment may be the result of a management decision or may be required under financing arrangements related to a particular project. Even if the project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays or may interrupt operations until the reassessment can be completed.

The profitability of the Company’s operations is also dependent on the costs of consumables used in its operations. Profitability will be impacted by the cost of such consumables including fuel, energy, steel, lime and other products used in the operations. During 2007 significant increases in the cost of these materials impacted profitability and further increases in the future may further impact profitability.

Government Regulation of the Mining Industry

The mining and mineral exploration activities of the Company are subject to various laws governing prospecting, development, production, taxes, labour standards and occupational health, mine safety, toxic substances and other matters. Mining and exploration activities are also subject to various laws and regulations relating to the protection of the environment. Although the Company believes that its mining and exploration activities are currently carried out in accordance with all applicable rules and regulations, no assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner that could limit or curtail production or development of the Company’s properties. Amendments to current laws and regulations governing the operations and activities of the Company or more stringent implementation thereof could have a material adverse effect on the Company’s business, financial condition and results of operations.

Foreign Operations

The Company’s activities are currently conducted in Nicaragua and, as such, the Company’s operations are exposed to various levels of political, economic and other risks and uncertainties. These risks and uncertainties vary from country to country and include, but are not limited to, terrorism, hostage taking, military repression, extreme fluctuations in currency exchange rates, high rates of inflation, labour unrest, the risks of war or civil unrest, expropriation and nationalization, uncertainty as to the outcome of any litigation in the foreign jurisdictions, uncertainty as to enforcement of local laws, renegotiation or nullification of existing concessions, licences, permits and contracts, illegal mining, changes in taxation policies, restrictions on foreign exchange and repatriation, and changing political conditions, currency controls and governmental regulations that favour or require the awarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction.

10

Changes, if any, in mining or investment policies or shifts in political attitude in Nicaragua may adversely affect the Company’s operations or profitability. Operations may be affected in varying degrees by government regulations with respect to, but not limited to, restrictions on production, price controls, export controls, currency remittance, income taxes, expropriation of property, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety.

Failure to comply strictly with applicable laws, regulations and local practices relating to mineral right applications and tenure could result in loss, reduction or expropriation of entitlements, or the imposition of additional local or foreign parties as joint venture partners with varied or other interests.

The occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on the Company’s business, financial condition and results of operations.

Income Taxes

The Company’s current tax structure involves significant amounts of inter-company debt that generates interest expense and serves to reduce taxable income and therefore taxes in foreign jurisdictions. While management does not believe that there is a significant risk to the Company’s tax structure, there can be no assurance that taxation authorities will not seek to challenge the structure.

Labour and Employment Matters

Production at its mining operations is dependent upon the efforts of the Company’s employees and the Company’s relations with its unionized and non-unionized employees. In addition, relations between the Company and its employees may be affected by changes in the scheme of labour relations that may be introduced by the relevant governmental authorities in those jurisdictions in which the Company carries on business. Changes in such legislation or in the relationship between the Company and its employees may have a material adverse effect on the Company’s business, financial condition and results of operations.

In October 2002, approximately two-thirds of the unionized employees at the Limon Mine went on illegal strike. On February 11, 2003, the striking workers returned to work and a new collective bargaining agreement was signed resolving the labour disruption. The February 2003 collective bargaining agreement had a two-year term during which a modest wage re-assessment was agreed to in February 2004. A new two-year collective agreement was reached effective May 26, 2005.

In early November 2005, an illegal road blockade by a small group of employees at its Limon Mine in Nicaragua caused the Company to temporarily suspend operations. This blockade, and other intermittent blockades earlier in the year, undermined the Company’s efforts to contain costs at the mine and to put the operation on a solid, long-term footing. Following negotiations with various departments of the Nicaraguan government and the union, an unconditional agreement was reached that future disputes would be resolved according to the resolution mechanisms in the collective agreement between the Company and its unions and operations resumed on November 17, 2005. In December 2005, the Company reduced its workforce by 85 people, or approximately 18%, as part of an overall cost-reduction program at the mine. The termination of these employees was upheld by the Nicaraguan government and their severance has been paid.

On February 14, 2006, the Company again temporarily suspended its operations at the Limon Mine due to another illegal blockade on the road between the mine and the mill site. The blockade was set up by a group of an estimated 17 current and former employees who were demanding that the company rehire a number of former employees who had been terminated in December 2005. The Company appealed to various branches of the Government of Nicaragua and to union executives for help in finding a resolution to this situation. On March 7, 2006, operations resumed as negotiations continued. In total, operations were shutdown for 43 days in the first quarter of 2006.

The Company is continuing to seek a permanent solution to these disruptions; however, there can be no assurance that a permanent solution will be found and the Company will not have to suspend operations again. In

11

January 2007, the Company again experienced road blockades and had to suspend operations at the Limon Mine for three days. The various branches of the Government of Nicaragua were very helpful in concluding a timely resolution of this latest disruption.

On March 31, 2007 the Company suspended mining operations at the Orosi Mine. For care and maintenance of the operation, the Company required approximately 18% of the employees and the remaining employees were suspended in the following months. The Company reached an agreement with the union and the Company agreed to pay the suspended employees 36% of their wages [equivalent to paying for 9 days per month] and maintain all their benefits. When construction of the mill project commenced the employees were to be gradually integrated back into the Company’s work force. Presently approximately 50% of the Company’s employees are assisting with the construction of the mill upgrade project. It is anticipated the majority of employees will be integrated into the construction phase and all employees will be back to work when mining operations resume.

Foreign Subsidiaries

The Company is a holding company that conducts operations through foreign subsidiaries, joint ventures and divisions and substantially all of its assets are held in such entities. Accordingly, any limitation on the transfer of cash or other assets between the parent corporation and such entities, or among such entities, could restrict the Company’s ability to fund its operations efficiently. Any such limitations, or the perception that such limitations may exist now or in the future, could have an adverse impact on the Company’s valuation and stock price.

Market Price of Common Shares

Central Sun common shares are listed on the TSX and the American Stock Exchange (the “AMEX”). Securities of small-cap companies have experienced substantial volatility in the past, often based on factors unrelated to the financial performance or prospects of the companies involved. These factors include macroeconomic developments in North America, and global and market perceptions of the attractiveness of particular industries. The Company’s share price is also likely to be significantly affected by short-term changes in gold prices or in its financial condition or results of operations as reflected in its quarterly earnings reports. Other factors unrelated to the Company’s performance that may affect the price of Central Sun common shares include the following: the extent of analytical coverage available to investors concerning the Company’s business may be limited if investment banks with research capabilities do not continue to follow the Company’s securities; the lessening in trading volume and general market interest in the Company’s securities may affect an investor’s ability to trade significant numbers of Central Sun common shares; and the size of the Company’s public float may limit the ability of some institutions to invest in the Company’s securities.

As a result of any of these factors, the market price of the common shares at any given point in time may not accurately reflect the Company’s long-term value. Securities class action litigation often has been brought against companies following periods of volatility in the market price of their securities. The Company may in the future be the target of similar litigation. Securities litigation could result in substantial costs and damages and divert management’s attention and resources.

Share Bonus Plan

During 2007, shareholders approved a share bonus plan. The Company established the share bonus plan for the purpose of advancing the interests of the Company through the motivation, attraction and retention of directors, officers, employees and consultants. Participants must continue to be employed with the Company during the vesting period otherwise the shares will be returned to treasury and cancelled. There are no voting rights on the shares until issuance to the participant. Effective December 18, 2007, 1,665,000 common shares were issued and placed into escrow under the terms of the share bonus plan. The shares were held subject to an escrow arrangement and to be released and delivered to the participant at 25% on each of June 30, 2008, December 31, 2008, June 30, 2009, and December 31, 2009.

12

Dividend Policy

No dividends on the common shares have been paid by the Company to date. The Company does not anticipate declaring or paying any cash dividends in the foreseeable future. Payment of any future dividends will be at the discretion of the Company’s board of directors after taking into account many factors, including the Company’s earnings, capital requirements and financial conditions.

Dilution to Central Sun Common Shares

As of March 31, 2008, 61,002,000 Central Sun common shares were issued and outstanding and an additional 27,821,000 Central Sun common shares were issuable on exercise of warrants, options or other rights to purchase common shares at prices ranging from C$1.05 to C$8.75.

During the life of the warrants, options and other rights, the holders are given an opportunity to profit from a rise in the market price of the Central Sun common shares with a resulting dilution in the interest of the other shareholders. Central Sun’s ability to obtain additional financing during the period such rights are outstanding may be adversely affected and the existence of the rights may have an adverse effect on the price of the Central Sun common shares. The holders of the warrants, options and other rights may exercise such securities at a time when the Company would, in all likelihood, be able to obtain any needed capital by a new offering of securities on terms more favourable than those provided by the outstanding rights.

The increase in the number of Central Sun common shares in the market and the possibility of sales of such shares may have a depressive effect on the price of the common shares. In addition, as a result of such additional Central Sun common shares, the voting power of the Company’s existing shareholders will be substantially diluted.

Future Sales of Common Shares by Existing Shareholders

Sales of a large number of Central Sun common shares in the public markets, or the potential for such sales, could decrease the trading price of the Central Sun common shares and could impair the Company’s ability to raise capital through future sales of common shares.

Dependence upon Key Management Personnel and Executives

The Company is dependent upon a number of key management personnel. The loss of the services of one or more of such key management personnel could have a material adverse effect on the Company. The Company’s ability to manage its exploration and development activities, and hence its success, will depend in large part on the efforts of these individuals. The Company faces competition for qualified personnel, and there can be no assurance that the Company will be able to attract and retain such personnel.

History of Losses

The Company has experienced operating losses during its last three fiscal years, amounting to $60,924,000 for the year ended December 31, 2007, $7,406,000 for the year ended December 31, 2006 and $4,077,000 for the year ended December 31, 2005. The Company’s ability to operate profitably in the future will depend on the success of its principal properties, its Orosi Mill Plan and on the price of gold. There can be no assurance that the Company will be profitable.

CIM Standards Definitions

The mineral resources and mineral reserves for the Orosi Mine, the Limon Mine and the Mestiza Project have been estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) — Definitions Adopted by CIM Council on December 11, 2005 (the “CIM Standards”) which were adopted by the Canadian Securities Administrators’ National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The following definitions are reproduced from the CIM Standards:

13

The term “Mineral Resource” means a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories.

The term “Inferred Mineral Resource” means that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

The term “Indicated Mineral Resource” means that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing

information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

The term “Measured Mineral Resource” means that part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

The term “Mineral Reserve” means the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.

The term “Probable Mineral Reserve” means the economically mineable part of an Indicated Mineral Resource and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

The term “Proven Mineral Reserve” means the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

This section uses the terms “Measured”, “Indicated” and “Inferred” Resources. United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of pre-feasibility or feasibility studies. United States investors are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves. United States investors are also cautioned not to assume that all or any part of an Inferred Mineral Resource exists, or is economically or legally mineable.

14

Summary of Mineral Resource and Mineral Reserve Estimates

Mineral Resource and Reserve Estimates

The following table sets forth the estimated Mineral Resources and mineral reserves for the Orosi Mine, the Limon Mine and the Mestiza Project as of December 31, 2007:

Central Sun Mining Inc. |

Mineral Reserves and Mineral Resources as at December 31, 20071,2,3,4,5 |

| | | | | |

Mineral Reserves | | | | | |

Zone | Gold Price | Cut-off grade | Tonnes | Gold Grade | Contained Gold |

| | g/t | | g/t | Ounces |

LIMON2 | | | | | |

Proven | $550/oz | 3.8 | 156,400 | 6.04 | 30,400 |

Probable | $550/oz | 3.8 | 1,224,600 | 4.75 | 186,900 |

Total Proven and Probable Mineral Reserves | | | 1,381,000 | 4.89 | 217,200 |

| | | | | |

Measured and Indicated Mineral Resources (excludes Mineral Reserves) | | | | | |

Zone | Gold Price | Cut-off grade | Tonnes | Gold Grade | Contained Gold |

| | g/t | | g/t | Ounces |

LIMON | | | | | |

Measured | | 2.7 | 30,000 | 4.65 | 4,500 |

Indicated | | 2.7 | 354,100 | 5.02 | 57,200 |

Total | | | 384,000 | 4.99 | 61,600 |

OROSI3 | | | | | |

Measured | | 0.6 | 0 | 0.00 | 0 |

Indicated | | 0.6 | 15,280,000 | 1.50 | 735,000 |

Total | | | 15,280,000 | 1.50 | 735,000 |

Total Measured & Indicated Mineral Resources | | | 15,664,000 | 1.58 | 796,600 |

| | | | | |

Inferred Mineral Resources | | | | | |

Zone | Gold Price | Cut-off grade | Tonnes | Gold Grade | Contained Gold |

| | g/t | | g/t | Ounces |

LIMON2 | | | | | |

Total | | | 1,291,000 | 5.91 | 246,000 |

OROSI3 | | | | | |

Total | | | 4,248,000 | 1.68 | 230,000 |

MESTIZA4 | | | | | |

Total | | | 558,000 | 8.80 | 158,600 |

Total Inferred Mineral Resources | | | 6,097,000 | 3.24 | 634,600 |

15

| 1. | The mineral reserves and resources reported herein are based on the CIM Definition Standards for Mineral Resources and Mineral Reserves adopted by the CIM Council on December 11, 2005 ("CIM Standards)". Mineral Resources that are not mineral reserves do not have demonstrated economic viability. Mineral resources are in addition to Mineral Reserves. |

| 2. | Mineral Reserve and Mineral Resource estimates for the Limon mine were prepared by Central Sun mine personnel under the supervision of Dr. William Pearson, P.Geo. and Mr. Graham Speirs, P.Eng. both of whom are qualified persons as defined under National Instrument 43-101. |

| 3. | The Mineral Resource at Orosi (formerly La Libertad) was originally prepared as of June 30, 2006 by Scott Wilson Roscoe Postle & Associates Ltd. (Scott Wilson RPA) and has been adjusted by Central Sun for production from July 2006 to December 31, 2007. Production during this period was 1,013,708 tonnes at 1.82 g Au/t containing 59,476 ounces of gold. Scott Wilson RPA is currently preparing an updated resource estimate expected near the end of Q1 2008. |

| 4. | The Inferred Mineral Resource for Mestiza was prepared by Central Sun exploration personnel under the supervision of Dr. William Pearson, P.Geo. a Qualified Person as defined by NI 43-101. The estimate is based on historical drilling and recent trench sampling and drilling by Central Sun. |

| 5. | Numbers may not add up due to rounding. |

Mineral Properties

Orosi Mine, Nicaragua

Central Sun holds an indirect 100% interest in Desarrollo Minero de Nicaragua (“Desminic”) which owns and operates the Orosi Mine (formerly Libertad Mine) exploitation concession and owns the Buena Ventura I and Extension WC de Oro, early-stage mineral exploration concessions.

Property Description and Location

Location, Title & Permits

The Orosi Mine also known as Cerro Mojón or Mojón, is located approximately 110 km due east of Managua, the capital city of Nicaragua and 32 kilometres northeast of Juigalpa. The property is situated near the town of La Libertad in the La Libertad-Santo Domingo Region of the Department of Chontales in Central Nicaragua. Central Sun, indirectly through its wholly owned subsidiary, Desminic, holds one exploitation concession (The Libertad Exploitation Concession) covering 10,950 hectares, granted in August 31, 1994 for the term of 40 years pursuant to Ministerial Decree No. 032-RN-MC/94. This concession was granted and is regulated under the old, pre-2001 mining law. The principal obligations under the Ministerial Accord include the payment annually of surface taxes, and a net 3.0% royalty on gross production revenues. Desminic also has one exploration concession, called La Buena Ventura I (2,350 ha), granted in July 2002 for a period of 25 years pursuant to Ministerial Decree No. 200-RN-MC/2002. Annual fee payments escalate from $0.25 per hectare to $8.00 per hectare over the first 10 years, and are $12.00 per hectare thereafter. In 2007 Central Sun applied for an additional exploration concession, Extension WC de Oro, which covers 2,704 ha of the potential extension of a mineralized structure northwest of the exploitation concession. The exploitation and exploration concessions form one contiguous block.

Royalties

A royalty interest was granted to a corporation formed by the Orosi Mine workers (IMISA). The Royalty Contract dated September 25, 1996 (Public Deed No. 23) grants a royalty on Net Smelter Returns equal to 2.0 % of the total production of gold and silver from the Orosi Exploitation Concession to IMISA.

Access, Climate, Local Resources, Infrastructure and Physiography

Access

Access to the property is by paved road from Managua to Juigalpa (138 kilometres), the capital city of the Department of Chontales. From Juigalpa, an unsurfaced road leads northeast for 32 kilometres to the town of La Libertad. Access to the mine site is along a five kilometre, secondary unsurfaced road that originates at the entrance

16

to the town of La Libertad. Driving time from Managua to the project is between 2.5 to 3.0 hours.

Climate

The most salient climatic characteristic of the region is a pronounced wet and dry season. The wet season occurs in May through to November, with the highest precipitation occurring usually in September and October. Average monthly rainfall during these months is approximately 270 millimetres. The driest months are generally in February and March, with average monthly rainfalls of approximately 23 millimetres. According to government statistical records, the Department of Chontales has an average annual rainfall of 1,695 millimetres. At the Libertad weather station, the average annual precipitation recorded over a 16-year period (1972 to 1987) was 1,687 millimetres. Temperature variation in Nicaragua is mainly a function of altitude. Nationally, temperature varies between 21°C in the upper parts of the central mountain ranges to 29°C in the Pacific coastal regions. Average temperatures recorded in Chontales region range from 24°C in December to 27°C in May. The average daily temperature is fairly constant at 25°C during the rest of the year. Statistical records indicate an annual average rate of evaporation of approximately 2,050 millimetres, higher than the average annual precipitation of approximately 1,695 millimetres. The highest monthly evaporation rates of approximately 235 mm coincide with the driest and hottest months (March and April).

Local Resources

Most of the non-professional staff at Orosi comes from the surrounding towns in the area. The town of La Libertad, some five kilometres by an unsurfaced secondary road, has a local population just over 2,000. Several other small towns are located within close proximity of the mine. The area has a long history of mining and ranching, and a local labour force skilled in small-scale mining is available. Many of the higher-skilled jobs, such as supervisory and professional designations, are filled by people from Managua as well as elsewhere in Central and South America. Most machinery and equipment required at the mine is imported. The transportation network is well established.

Infrastructure

Until suspension of mining operations at the end of March 2007, the Orosi Mine was an active mining operation. The mine and process facilities operated year round. Road access to the mine provides for overland movement of all required supplies and materials. The mine generates its own electrical power using four on-site diesel generators and has a distribution system, both of which are adequate for current operating needs. The mine uses a local water supply.

Open pit mining of both ore and waste was undertaken by an independent mining contractor using the contractor’s equipment fleet. Drilling and blasting for mining was handled directly by the Company. There is a crushing plant, a heap leach pad, and an ADR plant on site. As part of the conversion to a conventional mill, the crushing and ADR plant will be upgraded. The spent ore on the heap leach pad will be reproduced as part of the new operation plan.. The mine operation maintains a local road system to service the operations needs.

Physiography

The area is characterized by hilly terrain ranging in elevation from 400 m to 835 m above sea level. Many of the old workings in the region are located on hills and ridges. Gold mineralization is associated with quartz veins that support these topographic highs. Cerro El Chamarro, located five kilometres northeast of the town of La Libertad, is the highest point on the concession at 835.2 m above sea level.

The Orosi Mine is situated in the western end of the exploitation concession, approximately four kilometres northwest of the town of La Libertad. The vein outcrops along the Cerro Mojón ridge. It is the highest point in the immediate area at approximately 630 m above sea level. The surrounding topography is characterized by gently sloping terrain, reaching a low of approximately 500 m above sea level. Vegetative cover is primarily second growth shrubs, small trees, and grasses.

17

History

Other than a suspension of operations during 2000 and part of 2001, mining activities for the current heap leach operation were ongoing since 1997 until suspension of mining activities on March 31, 2007.

Since the last century, large companies, small local ventures, and individual miners have developed mines in the La Libertad-Santo Domingo area.

Larger scale mining operations at Orosi started in the middle of the last century at the San Juan and Babilonia areas. From 1900 to 1935, British companies extracted mineral resources from the Santa Elena, Crimea, Santa Mariá, San Juan, Tres Amigos, Zopilote, and Azul areas. Approximately 200,000 tonnes of ore, with an average grade of 15 g/t gold, was mined during this time. The ore was processed at a rate of 20 tpd to 40 tpd using a stamp mill. Gold was recovered by mercury amalgamation techniques. Large scale mining operations in the Santo Domingo area first began in 1862 at the El Jabalí Mine and continued until the mid 1970s. Important mines developed during this period include El Jabalí, Monte Carmelo, and La Tranca. Larger scale mining operations have not existed in the Santo Domingo area for the last 20 years, but small miner activity and arrastra (small primitive mills) operations have continued.

From 1943 to 1945, the Neptune Mining Company conducted geological exploration in the Santa Elena and Santa Mariá areas. No mining took place. From 1956 to 1979, an American company, Lemans Resource, mined the Santa Elena-Crimea deposit. The ore was processed in a mill at a rate of 40 stpd. Gold was recovered through flotation and cyanidation of the concentrate.

In November 1979, the Sandinista government nullified all mining concessions issued by the previous administration and nationalized all mining companies operating in the country. Large-scale mining operations in the area were suspended in November 1979 until the mining industry was nationalized in 1981. In 1982, mining of the Santa Elena deposit resumed under Instituto Nicaragüense de la Minería (INMINE). From 1984 to 1989, a crushing and grinding facility was installed and the capacity of the mill increased from 40 stpd to 120 stpd, using the same flotation/cyanidation technology for gold recovery. Tailings were being dumped directly into the Río El Tigre until a tailings dam was constructed northeast of the mill in 1988. Mining operations at Santa Elena were suspended in 1991 and the San Juan vein became the main source of ore. Throughout the 1980s, the Sandinista government sought assistance for the mining sector in both Western and Eastern Europe. The United Kingdom, the Soviet Union, Sweden, and Bulgaria all provided institutional support to the Nicaraguan mining industry.

In 1991, the Chamorro Administration began its efforts to privatize Nicaraguan mining enterprises as part of an overall plan for economic stabilization and structural reform. It was hoped that foreign investment would boost mining production and provide employment and stability in regions dependent on mining. The Chamorro Administration agreed to privatize 25 percent of the national mineral resources to the Nicaraguan mine workers. This resulted in the formation of Inversiones Mineras S.A. (IMISA), a profit-oriented company privately held by the Nicaraguan mine workers. Technical and administrative assistance for IMISA is contracted from former INMINE officials. The remaining interest in select facilities was put out to international tender.

On April 11, 1994, a Presidential Decree was issued authorizing the privatization of the Orosi mining assets. Effective August 26, 1994, an agreement between Greenstone de Nicaragua S.A. (“Grenica”), a wholly owned subsidiary of Greenstone Resources Canada Ltd., and Inversiones Mineras S.A. (IMISA), a company owned by the members of the mine workers’ union, resulted in the formation of a new company called Minera Nicaraguense S.A. (“MINISA”). In September 1996, Grenica acquired the remaining 25% minority interest from IMISA through the acquisition of all the shares of MINISA held by IMISA. The purchase price consisted of a cash payment of $13,125,000, directed by IMISA to be paid to its individual shareholders; a cash payment of approximately $350,000 in satisfaction of existing obligations to IMISA in connection with GRENICA’s and IMISA’s shareholdings in MINISA; and a 2% net smelter royalty in favour of IMISA on future production from areas within the Orosi mining area.

GRENICA suffered financial difficulties, and Leslie Coe, an individual investor, acquired MINISA by repaying GRENICA’s debt to vendors. The name of the new company was Desminic. In February 2001, Leslie Coe sold 50 percent of DESMINIC to RNC Resources Limited and 40 percent to Auric Resources Corp. Leslie Coe

18

retained a 10 percent interest in Desminic. In early 2001, Desminic rehabilitated the heap leach operation at Orosi. Operations since then have been mostly continuous, with some temporary shutdowns reported as being for maintenance purposes. Mine production has been largely from a series of pits along the main Mojón-Crimea structure. During the past year, there has been significant production also from the Esmeralda structure located parallel to and immediately south of the Mojón pits.

In December 2003, RNC Gold Inc. became the owner of Desminic. Yamana purchased a 100% interest in Desminic from RNC Gold Inc. in early 2006 and Central Sun acquired it from Yamana, effective July 6, 2006.

Geological Setting

The Libertad mining district covers an area of approximately 150 square kilometres, and lies within a broad belt of Tertiary volcanic rocks that have been differentiated into two major units called the Matagalpa and the Coyol Groups. Oligocene to Miocene in age, the Matagalpa Group is the oldest unit and consists of intermediate to felsic pyroclastic rocks. Unconformably overlying the Matagalpa Group are Miocene-aged mafic lavas of the Lower Coyol unit. The rocks of the Lower Coyol unit host the gold-bearing quartz veins in the Libertad district.

Pliocene-aged mafic lavas and ignimbrites, belonging to the 400 m to 600 m thick Upper Coyol unit, form mesa-like erosional remnants in the region. Several small felsic to mafic intrusive bodies of similar Tertiary age are also located in the district and distributed along northeast-southwest structural trends.

At Orosi, epithermal gold-silver deposits are hosted by andesitic volcanic rocks of late Miocene age. Gold mineralization is associated with steeply dipping, structurally controlled quartz veins found within the andesitic rocks over an area of at least 12 square kilometres. Alteration associated with the deposits is typical of a low sulphidation, adularia-sericite epithermal gold-silver deposit. Fracture controlled quartz veining and silicification is haloed by argillic and propylitic alteration zones within a thick sequence of andesitic volcanics.

A one-metre to five-metre thick layer of colluvium and soil covers the Cerro Mojón ridge area. This cover is derived from the weathering and erosion of the Mojón and Esmeralda ridges. The ridges themselves are supported by the gold-bearing quartz veins and the colluvium is, therefore, locally gold bearing, with values of up to 50 g/t Au reported from the drilling program.

Mineralization

Gold mineralization occurs in vein sets along two parallel trends separated by approximately 500 m, the Mojón-Crimea Trend and the Santa Mariá-Esmeralda Trend. The Mojón-Crimea Trend is over 3,500 m long, strikes N60°E and dips -80 degrees to the SE. The massive quartz veins and adjacent mineralized stockwork zones average 25 m in width, narrowing to 15 m at depth. The Santa Mariá-Esmeralda Trend is discontinuous, with the Santa Mariá and Esmeralda veins separated by approximately 1,000 m. The Esmeralda Vein, located at the SW end of the trend, is approximately 20 m wide near surface and pinching to less than 10 m at depth, and is over 1,600 metres long. The Santa Mariá vein, located at the NE end of the trend, averages 10 m wide and is approximately 525 metres long. Both of these veins are near vertical, and they do not have strong stockwork halos.

Gold mineralization is hosted by epithermal quartz and occurs as free particles up to 40 µm in diameter. Average grain sizes are 3 µm to 15 µm in diameter. Gold has a close affinity with pyrite and occurs as both a nucleus for pyrite crystallization and as a coating on pyrite crystals. Subsequent oxidation has destroyed the pyrite and freed the gold to depths of up to 150 m below surface. Mineralization also occurs as native silver and electrum, a gold-silver alloy.

Fluid inclusion studies conducted on samples collected from within the district suggest a multi-phase origin for the formation of the quartz veins. The studies also reveal that there were variations in the fluid temperature from 172° C to 316° C during the mineralizing events. Apart from limonite and hematite, minerals associated with the gold include chalcopyrite, galena, sphalerite, and native silver. The gold to silver ratio is approximately 1:4.5. The abundance of manganese oxides within the veins is also worthy of note.

19

Exploration

The resource estimates for Orosi are based on the drill hole database initially prepared by MINISA. MINISA also prepared a feasibility study for the Cerro Mojon Project in 1998.

Trenches and Adits

Gold mineralization along the Mojon-Crimea and the Esmeralda-Santa Maria structures was exposed at surface in 32 large trenches excavated using a D8 dozer to depths of two to four metres. The trenches varied from 30 to 150 metres long and oriented perpendicular to the strike of the mineralization. Geological mapping and continuous channel sampling were completed on each trench. In 1995, mapping and sampling was completed in two adits of 50 to 60 metres length that were driven perpendicular to mineralization at Mojon. Samples from the second adit (AD-002) were used in support of metallurgical test work.

Both the trench and adit results are still in the property database, but were not used in the 1998, 2002, nor in the June 30, 2006 Scott Wilson RPA mineral resource estimates due to concerns over the surveyed locations of these samples. The geologic data obtained from all of the trenches and the adits were combined with drill hole data to define zone boundaries when constructing the geologic model.

Drilling

The assays generated from exploration drilling (includes reverse circulation (RC) and diamond drilling, incorporated in the June 30, 2006 reserve estimate by Scott Wilson RPA but not blast hole drilling) are derived from 763 drill holes (133,579 m - 78,937 assays). The vast majority of the exploration drilling data was generated from RC drilling programs. RC drilling (PCR-001 to PCR-731, one hole redrilled) accounts for 732 holes (128,311 m - 75,574 assays). Diamond drilling (STD-001 – 028 and PQ-1, 2, and 3) accounts for 31 holes (5,268 m - 3,363 assays). Except for those samples deemed unreliable for modeling, all RC and core sample assays are included in the resource/reserve estimations. Unreliable samples included those with suspected survey errors, strong down-the-hole deviations, or suspected contamination. A total of 3,938 samples from drill holes, trenches, and adits were deemed to be unreliable and excluded from the model.

Scott Wilson RPA was provided with a blast hole assay databases that contained over 85,000 samples in total. The blast hole samples were taken for grade control purposes during the course of mining the Mojón and Esmeralda pits. The database was by no means complete, however, it provided invaluable insight into the grade distribution and spatial continuity at Orosi. While used to develop variogram models and calibrate grade interpolation logic, blast hole sample assays are not included in the resource estimation.

Sample assays generated by drilling other than for production purposes were collected from the following programs:

| • | MINISA’s 1998 diamond drilling program; | |

| • | MINISA’s 1996-1998 RC drilling program; |

| • | MINISA’s 1995 RC drilling program and; | |

| • | Pre-MINISA drill programs. | |