Financial Results for the Quarter Ended October 31, 2011 1 Exhibit 99.2

F O R WAR D - L O O K I N G S TAT E M E N T S Today’s discussion may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements relate to future events and expectations and involve known and unknown risks and uncertainties. VeriFone’s actual results or actions may differ materially from those projected in the forward-looking statements. For a summary of the specific risk factors that could cause results to differ materially from those expressed in the forward-looking statements, please refer to VeriFone’s filings with the Securities and Exchange Commission, including its annual report on Form 10-K and quarterly reports on Form 10-Q. VeriFone is under no obligation to, and expressly disclaims any obligation to, update or alter its forward-looking statements, whether as a result of new information, future events, changes in assumptions or otherwise. 2

N O N - G A A P F I N AN C I A L M E AS U R E S With respect to any Non-GAAP financial measures presented in the information, reconciliations of Non-GAAP to GAAP financial measures may be found in VeriFone’s quarterly earnings release as filed with the Securities and Exchange Commission as well as the Appendix to these slides. Management uses Non-GAAP financial measures only in addition to and in conjunction with results presented in accordance with GAAP. Management believes that these Non-GAAP financial measures help it to evaluate VeriFone’s performance and to compare VeriFone’s current results with those for prior periods as well as with the results of peer companies. These Non-GAAP financial measures contain limitations and should be considered as a supplement to, and not as a substitute for, or superior to, disclosures made in accordance with GAAP. 3

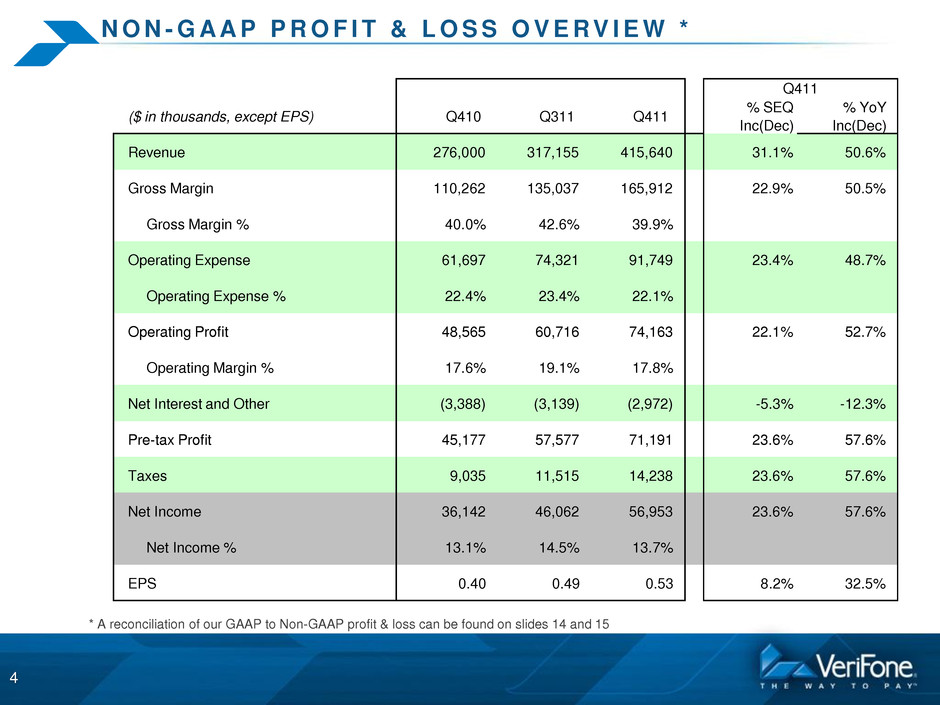

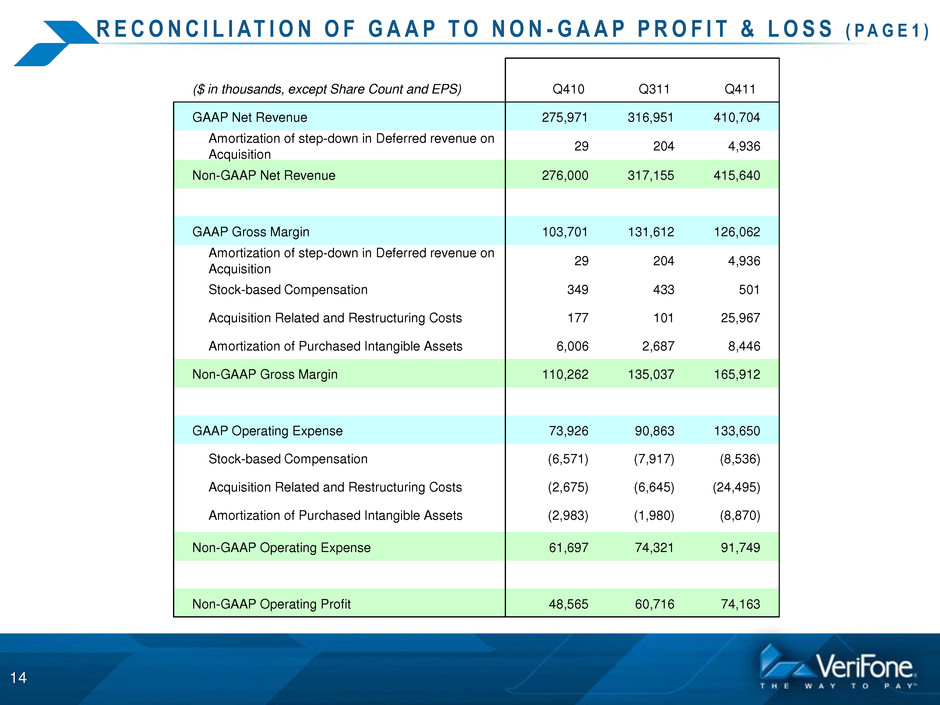

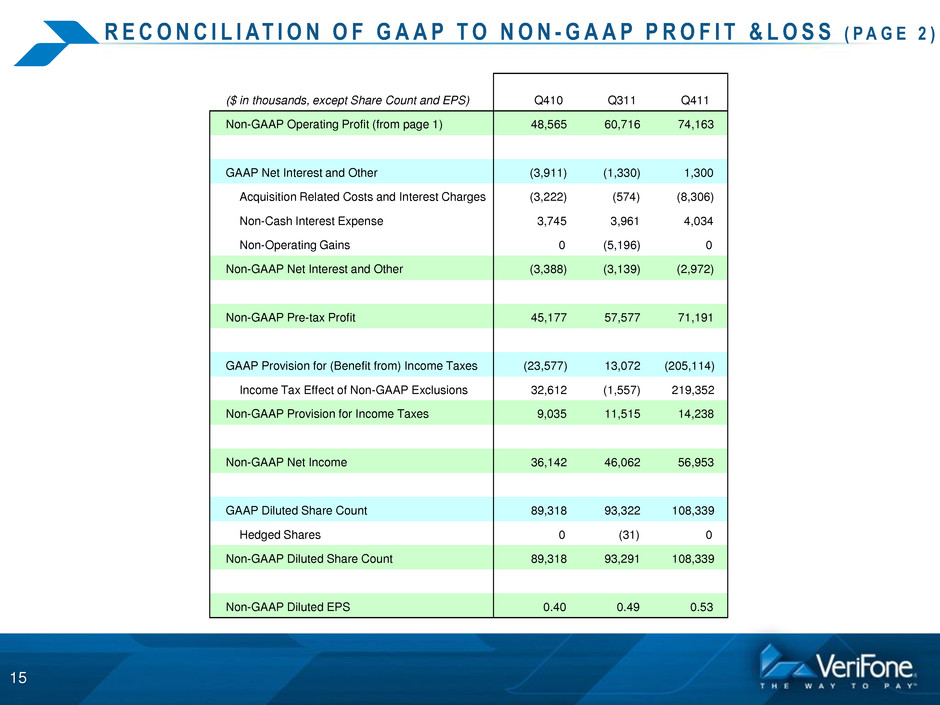

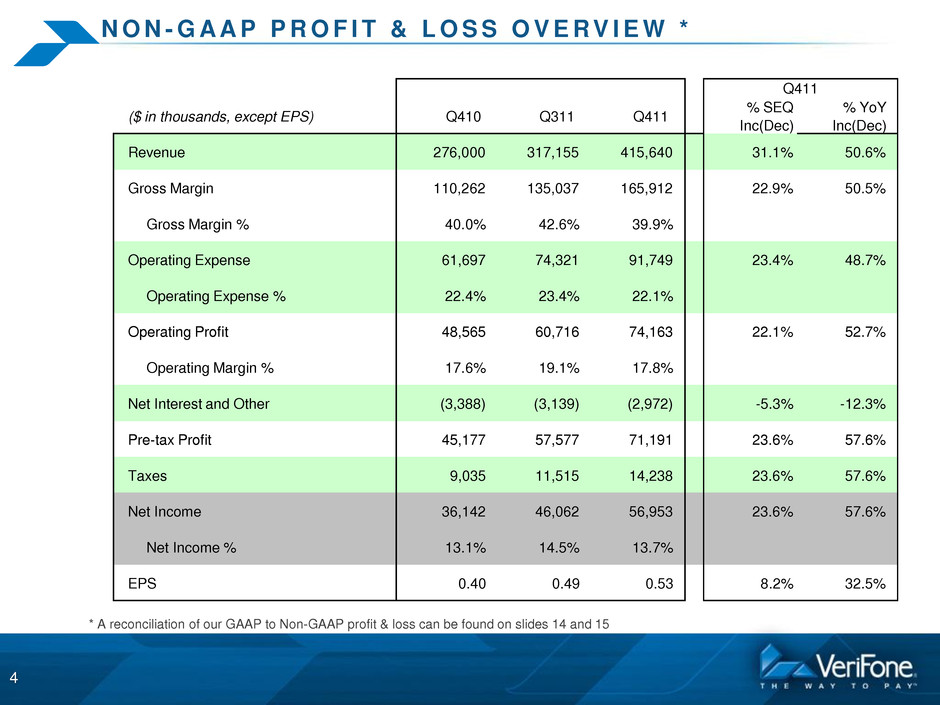

N O N - G A A P P R O F I T & L O S S O V E R V I E W * 4 * A reconciliation of our GAAP to Non-GAAP profit & loss can be found on slides 14 and 15 ($ in thousands, except EPS) Q410 Q311 Q411 % SEQ Inc(Dec) % YoY Inc(Dec) Revenue 276,000 317,155 415,640 31.1% 50.6% Gross Margin 110,262 135,037 165,912 22.9% 50.5% Gross Margin % 40.0% 42.6% 39.9% Operating Expense 61,697 74,321 91,749 23.4% 48.7% Operating Expense % 22.4% 23.4% 22.1% Operating Profit 48,565 60,716 74,163 22.1% 52.7% Operating Margin % 17.6% 19.1% 17.8% Net Interest and Other (3,388) (3,139) (2,972) -5.3% -12.3% Pre-tax Profit 45,177 57,577 71,191 23.6% 57.6% Taxes 9,035 11,515 14,238 23.6% 57.6% Net Income 36,142 46,062 56,953 23.6% 57.6% Net Income % 13.1% 14.5% 13.7% EPS 0.40 0.49 0.53 8.2% 32.5% Q411

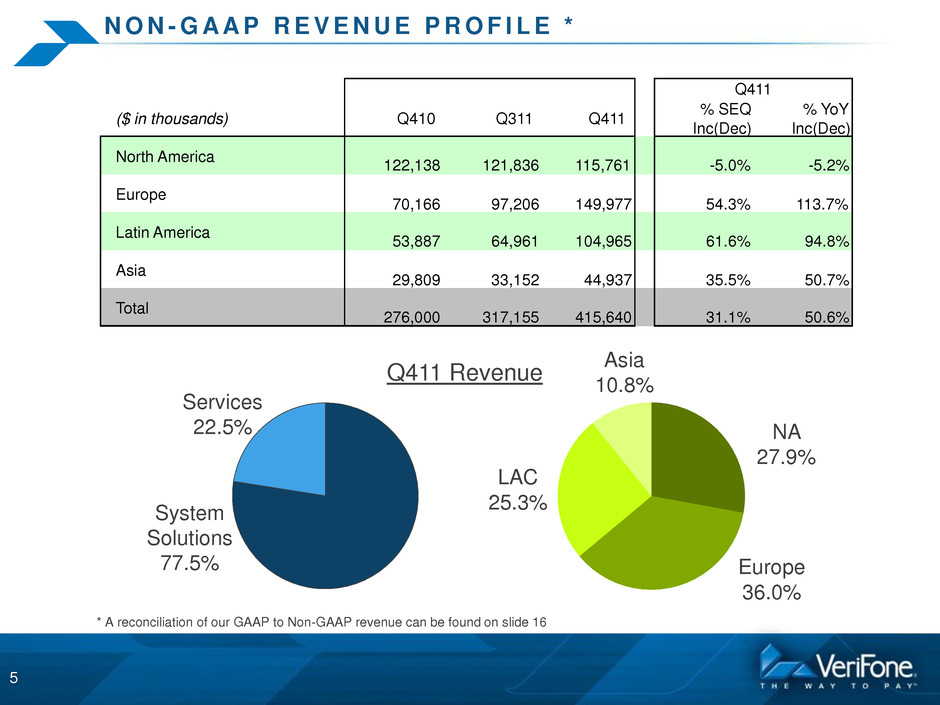

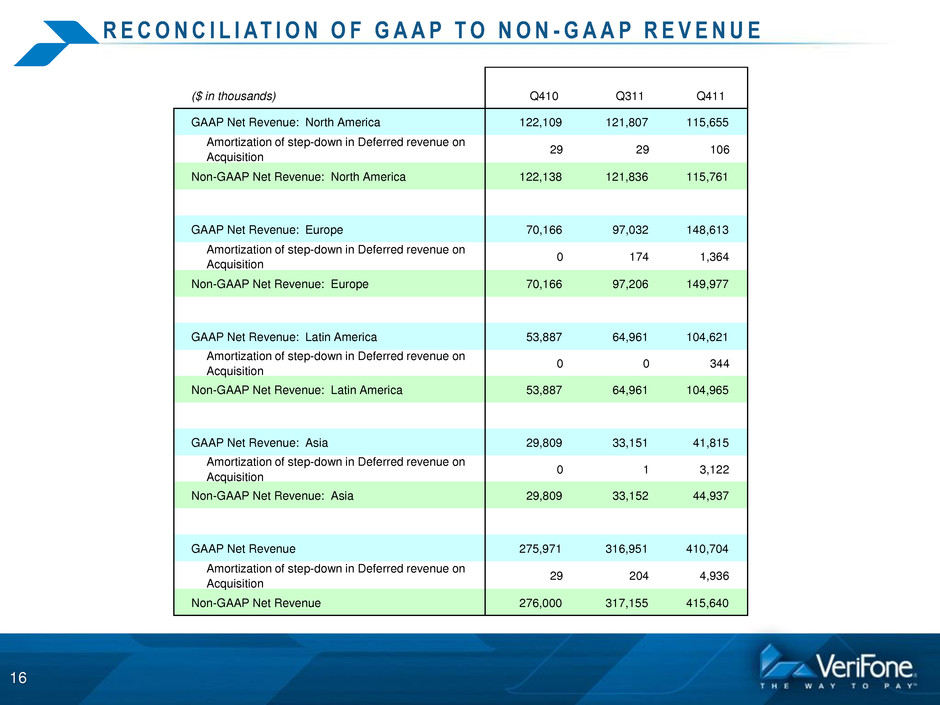

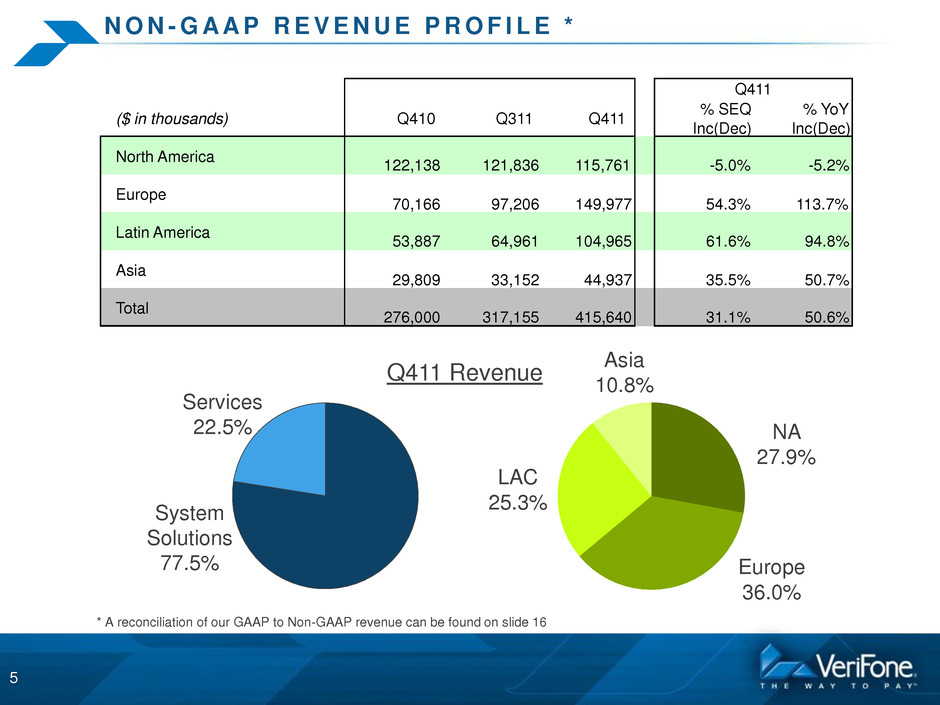

N O N - G A A P R E V E N U E P R O F I L E * Services 22.5% System Solutions 77.5% Q411 Revenue LAC 25.3% NA 27.9% Asia 10.8% Europe 36.0% 5 * A reconciliation of our GAAP to Non-GAAP revenue can be found on slide 16 ($ in thousands) Q410 Q311 Q411 % SEQ Inc(Dec) % YoY Inc(Dec) North America 122,138 121,836 115,761 -5.0% -5.2% Europe 70,166 97,206 149,977 54.3% 113.7% Latin America 53,887 64,961 104,965 61.6% 94.8% Asia 29,809 33,152 44,937 35.5% 50.7% Total 276,000 317,155 415,640 31.1% 50.6% Q411

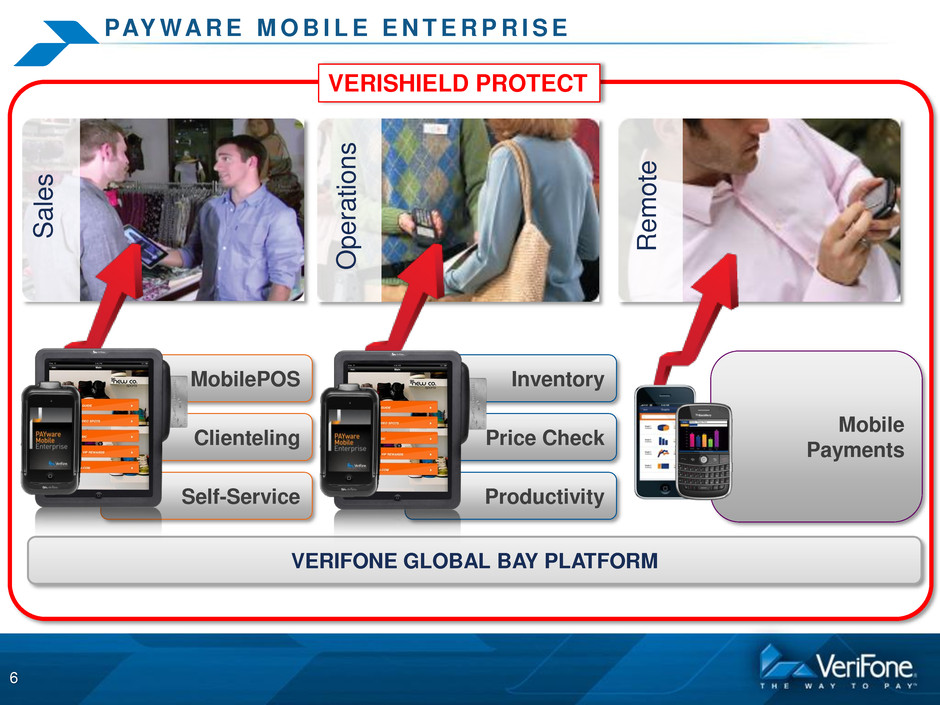

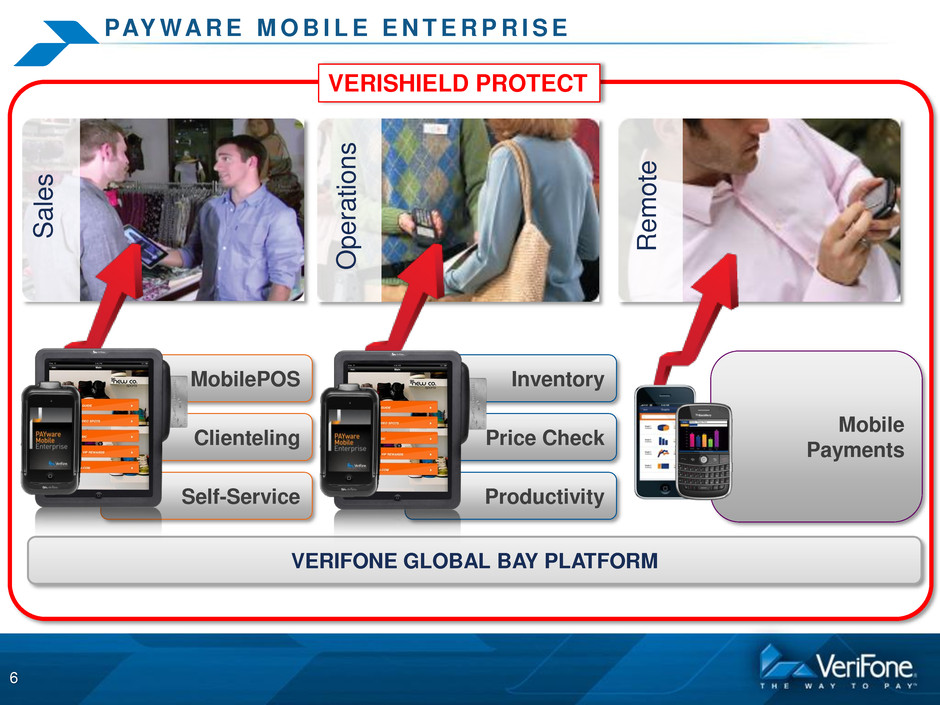

PAY WA R E M O B I L E E N T E R P R I S E VERIFONE GLOBAL BAY PLATFORM Sale s Ope ration s R emot e Mobile Payments Inventory Price Check Productivity MobilePOS Clienteling Self-Service VERISHIELD PROTECT 6

FINANCIAL RESULTS AND GUIDANCE 7

N O N - G A A P G R O S S M A R G I N * 8 * A reconciliation of our GAAP to Non-GAAP gross margin can be found on slide 17 % of Revenue Q410 Q311 Q411 System Solutions 38.7% 41.8% 39.9% Services 46.0% 45.7% 40.0% Total 40.0% 42.6% 39.9%

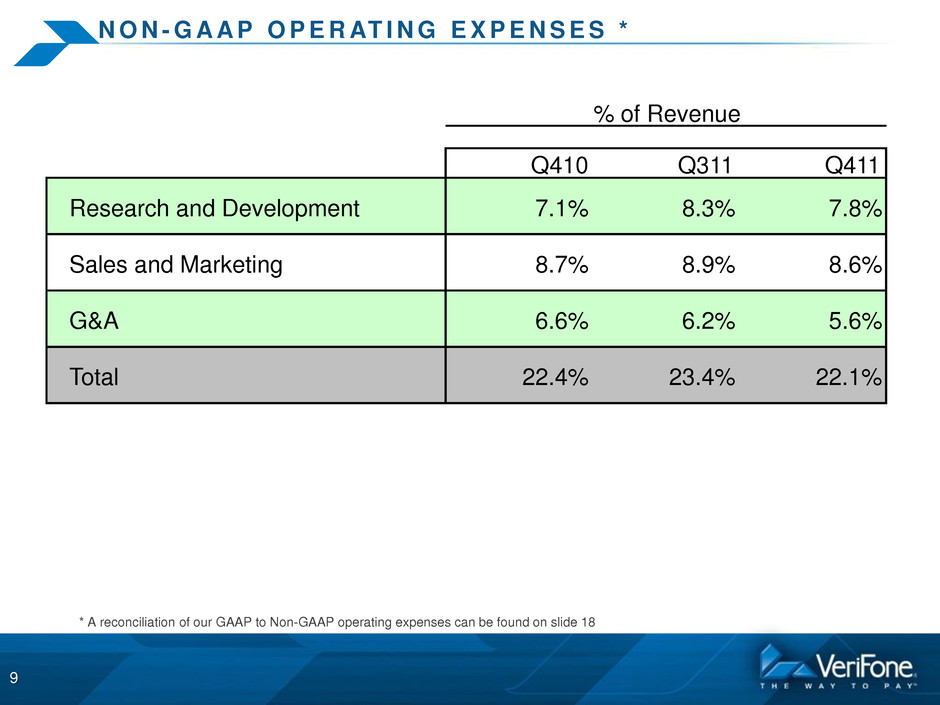

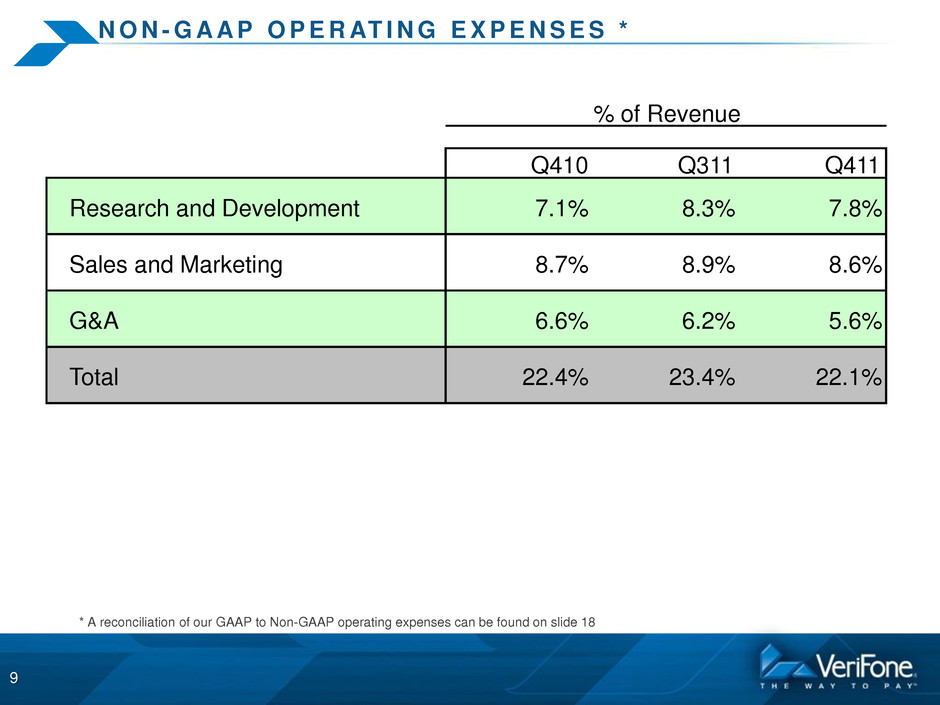

N O N - G A A P O P E R AT I N G E X P E N S E S * 9 * A reconciliation of our GAAP to Non-GAAP operating expenses can be found on slide 18 Q410 Q311 Q411 Research and Development 7.1% 8.3% 7.8% Sales and Marketing 8.7% 8.9% 8.6% G&A 6.6% 6.2% 5.6% Total 22.4% 23.4% 22.1% % of Revenue

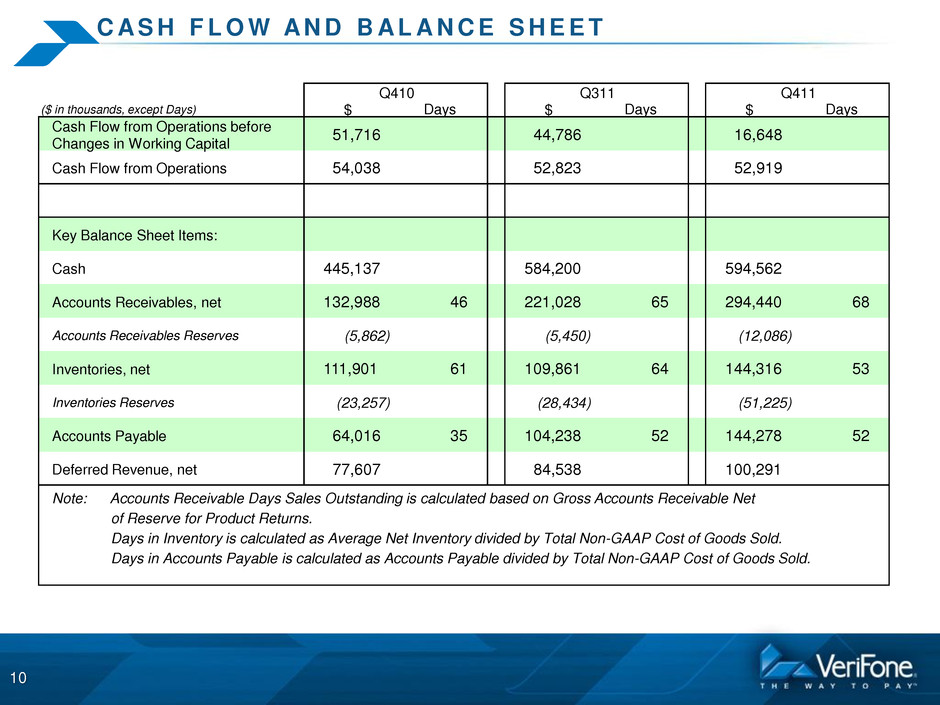

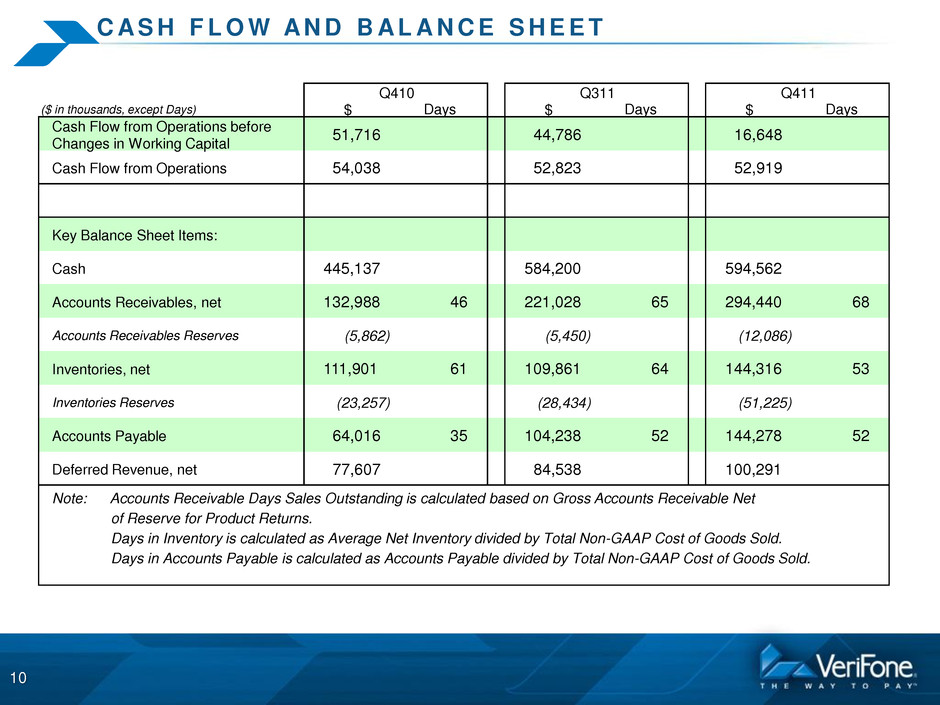

C AS H F L O W AN D B AL A N C E S H E E T 10 ($ in thousands, except Days) $ $ $ Cash Flow from Operations before Changes in Working Capital 51,716 44,786 16,648 Cash Flow from Operations 54,038 52,823 52,919 Key Balance Sheet Items: Cash 445,137 584,200 594,562 Accounts Receivables, net 132,988 46 221,028 65 294,440 68 Accounts Receivables Reserves (5,862) (5,450) (12,086) Inventories, net 111,901 61 109,861 64 144,316 53 Inventories Reserves (23,257) (28,434) (51,225) Accounts Payable 64,016 35 104,238 52 144,278 52 Deferred Revenue, net 77,607 84,538 100,291 Note: Accounts Receivable Days Sales Outstanding is calculated based on Gross Accounts Receivable Net of Reserve for Product Returns. Days in Inventory is calculated as Average Net Inventory divided by Total Non-GAAP Cost of Goods Sold. Days in Accounts Payable is calculated as Accounts Payable divided by Total Non-GAAP Cost of Goods Sold. Q311 Days Q411 Days Q410 Days

G U I D AN C E • For the first quarter ending January 31, 2012, including one month of Point revenue, VeriFone expects to report non-GAAP net revenues in the range of $415 million to $420 million. Non-GAAP net income per diluted share is projected to be in the range of $0.50 to $0.52. • For the full year of fiscal 2012, including ten months of Point revenue, VeriFone expects to report non-GAAP net revenues in the range of $1.90 billion to $1.92 billion. Non-GAAP net income per diluted share is projected to be in the range of $2.53 to $2.60 for the same time period. 11

Q & A SESSION 12

APPENDIX 13

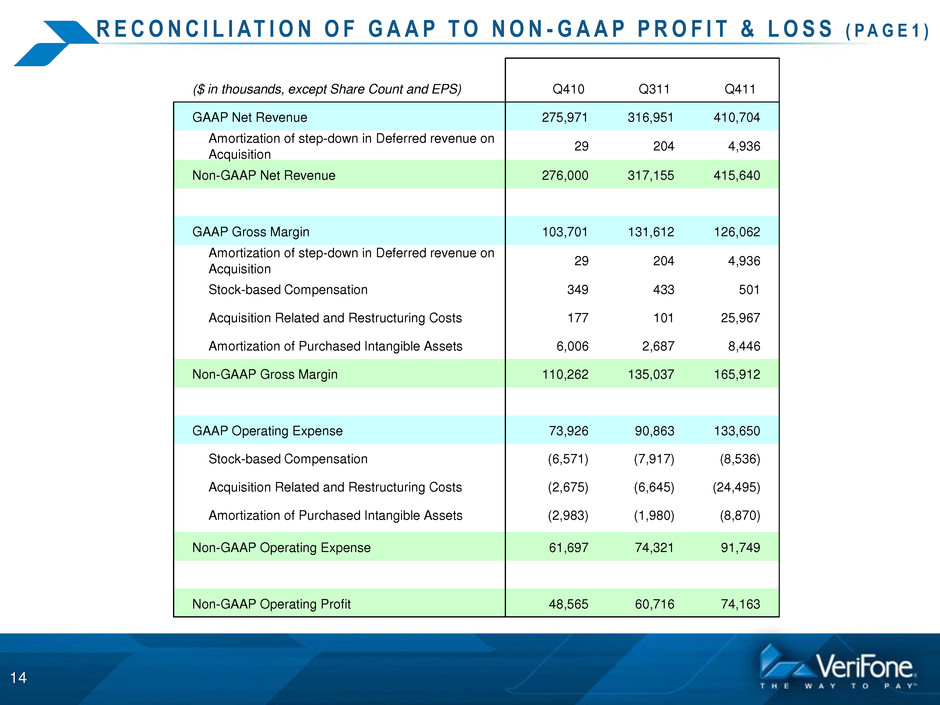

R E C O N C I L I AT I O N O F G A A P T O N O N - G A A P P R O F I T & L O S S ( P A G E 1 ) 14 ($ in thousands, except Share Count and EPS) Q410 Q311 Q411 GAAP Net Revenue 275,971 316,951 410,704 Amortization of step-down in Deferred revenue on Acquisition 29 204 4,936 Non-GAAP Net Revenue 276,000 317,155 415,640 GAAP Gross Margin 103,701 131,612 126,062 Amortization of step-down in Deferred revenue on Acquisition 29 204 4,936 Stock-based Compensation 349 433 501 Acquisition Related and Restructuring Costs 177 101 25,967 Amortization of Purchased Intangible Assets 6,006 2,687 8,446 Non-GAAP Gross Margin 110,262 135,037 165,912 GAAP Operating Expense 73,926 90,863 133,650 Stock-based Compensation (6,571) (7,917) (8,536) Acquisition Related and Restructuring Costs (2,675) (6,645) (24,495) Amortization of Purchased Intangible Assets (2,983) (1,980) (8,870) Non-GAAP Operating Expense 61,697 74,321 91,749 Non-GAAP Operating Profit 48,565 60,716 74,163

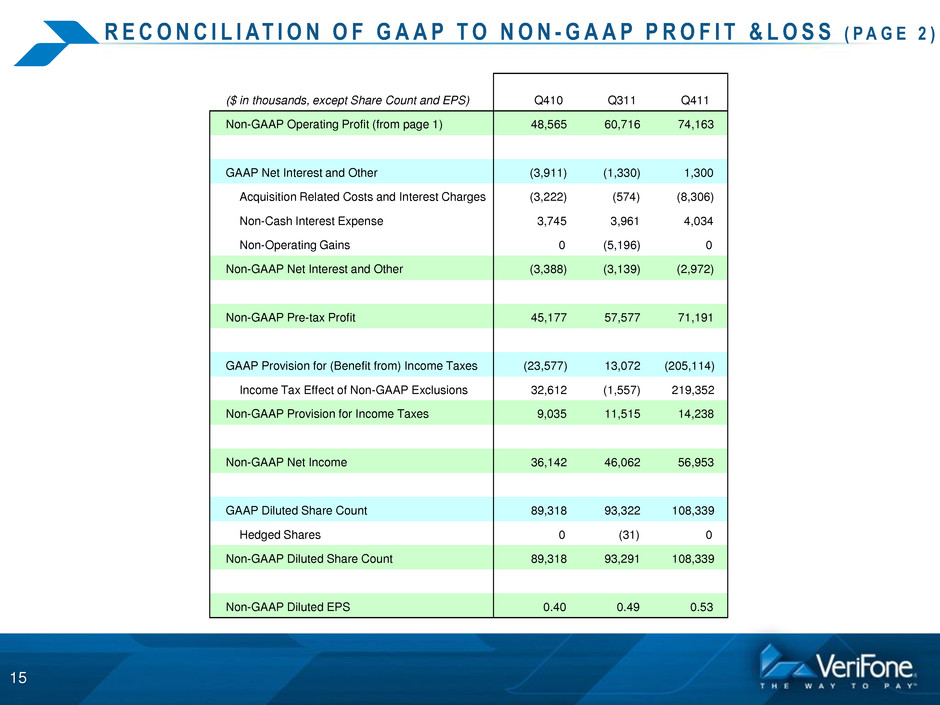

R E C O N C I L I AT I O N O F G A A P T O N O N - G A A P P R O F I T & L O S S ( P A G E 2 ) 15 ($ in thousands, except Share Count and EPS) Q410 Q311 Q411 Non-GAAP Operating Profit (from page 1) 48,565 60,716 74,163 GAAP Net Interest and Other (3,911) (1,330) 1,300 Acquisition Related Costs and Interest Charges (3,222) (574) (8,306) Non-Cash Interest Expense 3,745 3,961 4,034 Non-Operating Gains 0 (5,196) 0 Non-GAAP Net Interest and Other (3,388) (3,139) (2,972) Non-GAAP Pre-tax Profit 45,177 57,577 71,191 GAAP Provision for (Benefit from) Income Taxes (23,577) 13,072 (205,114) Income Tax Effect of Non-GAAP Exclusions 32,612 (1,557) 219,352 Non-GAAP Provision for Income Taxes 9,035 11,515 14,238 Non-GAAP Net Income 36,142 46,062 56,953 GAAP Diluted Share Count 89,318 93,322 108,339 Hedged Shares 0 (31) 0 Non-GAAP Diluted Share Count 89,318 93,291 108,339 Non-GAAP Diluted EPS 0.40 0.49 0.53

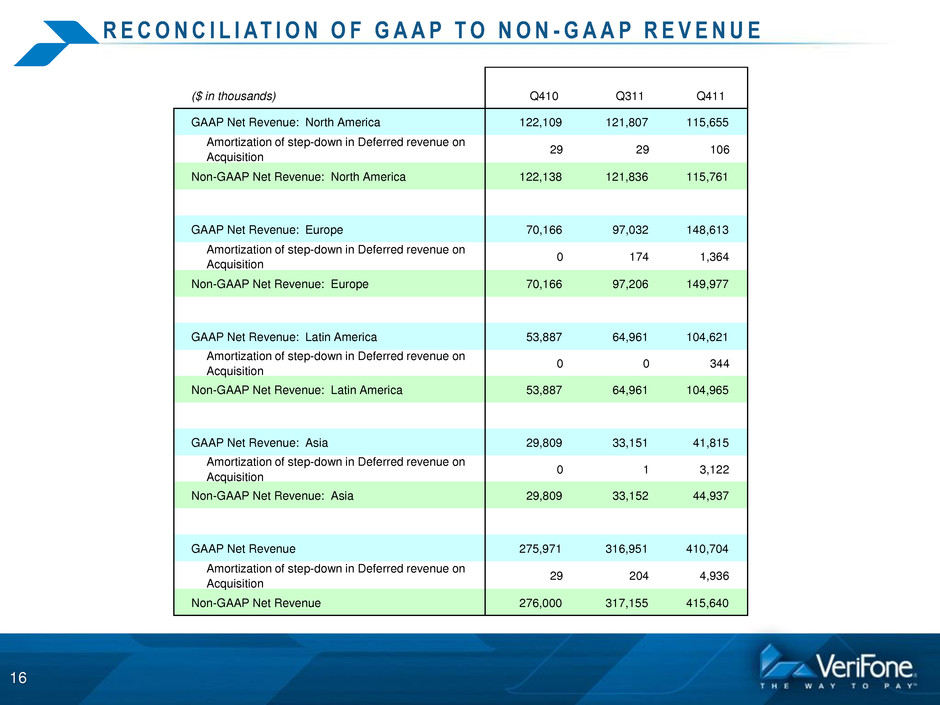

R E C O N C I L I AT I O N O F G A A P T O N O N - G A A P R E V E N U E 16 ($ in thousands) Q410 Q311 Q411 GAAP Net Revenue: North America 122,109 121,807 115,655 Amortization of step-down in Deferred revenue on Acquisition 29 29 106 Non-GAAP Net Revenue: North America 122,138 121,836 115,761 GAAP Net Revenue: Europe 70,166 97,032 148,613 Amortization of step-down in Deferred revenue on Acquisition 0 174 1,364 Non-GAAP Net Revenue: Europe 70,166 97,206 149,977 GAAP Net Revenue: Latin America 53,887 64,961 104,621 Amortization of step-down in Deferred revenue on Acquisition 0 0 344 Non-GAAP Net Revenue: Latin America 53,887 64,961 104,965 GAAP Net Revenue: Asia 29,809 33,151 41,815 Amortization of step-down in Deferred revenue on Acquisition 0 1 3,122 Non-GAAP Net Revenue: Asia 29,809 33,152 44,937 GAAP Net Revenue 275,971 316,951 410,704 Amortization of step-down in Deferred revenue on Acquisition 29 204 4,936 Non-GAAP Net Revenue 276,000 317,155 415,640

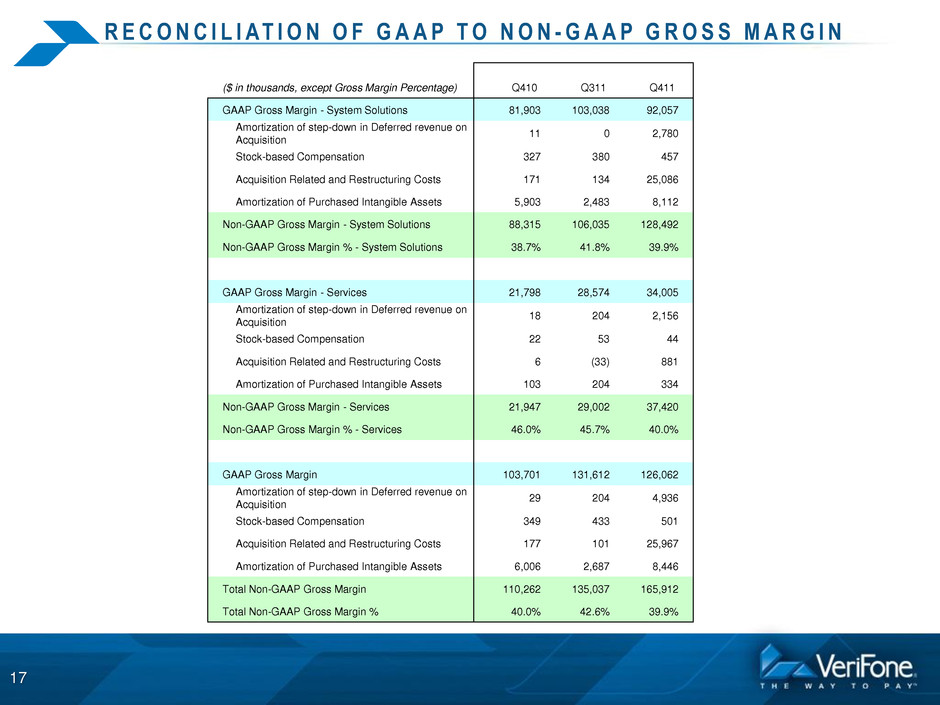

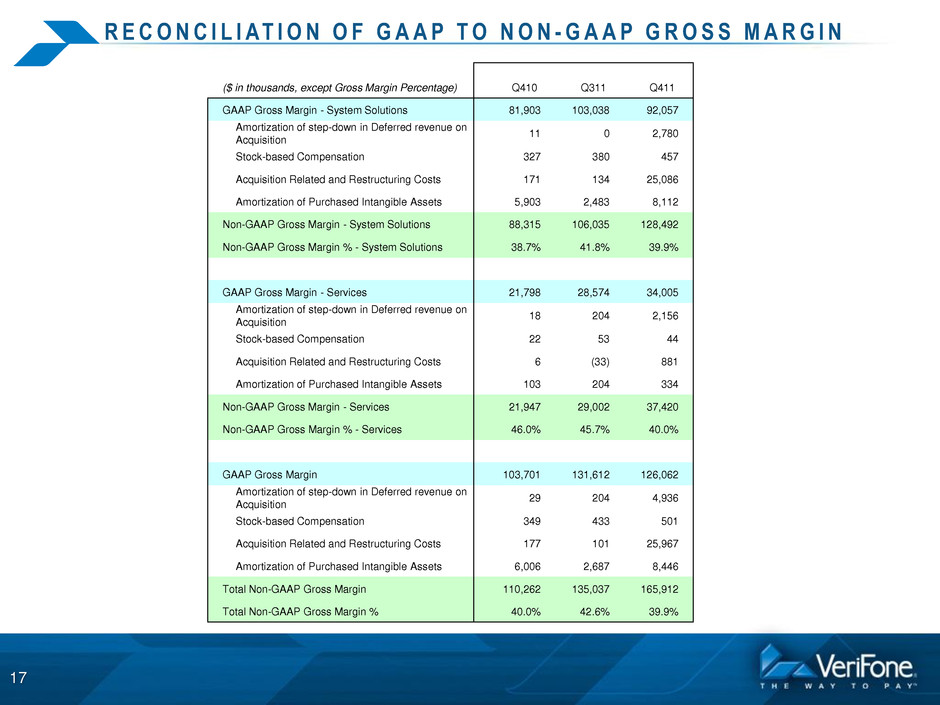

R E C O N C I L I AT I O N O F G A A P T O N O N - G A A P G R O S S M A R G I N 17 ($ in thousands, except Gross Margin Percentage) Q410 Q311 Q411 GAAP Gross Margin - System Solutions 81,903 103,038 92,057 Amortization of step-down in Deferred revenue on Acquisition 11 0 2,780 Stock-based Compensation 327 380 457 Acquisition Related and Restructuring Costs 171 134 25,086 Amortization of Purchased Intangible Assets 5,903 2,483 8,112 Non-GAAP Gross Margin - System Solutions 88,315 106,035 128,492 Non-GAAP Gross Margin % - System Solutions 38.7% 41.8% 39.9% GAAP Gross Margin - Services 21,798 28,574 34,005 Amortization of step-down in Deferred revenue on Acquisition 18 204 2,156 Stock-based Compensation 22 53 44 Acquisition Related and Restructuring Costs 6 (33) 881 Amortization of Purchased Intangible Assets 103 204 334 Non-GAAP Gross Margin - Services 21,947 29,002 37,420 Non-GAAP Gross Margin % - Services 46.0% 45.7% 40.0% GAAP Gross Margin 103,701 131,612 126,062 Amortization of step-down in Deferred revenue on Acquisition 29 204 4,936 Stock-based Compensation 349 433 501 Acquisition Related and Restructuring Costs 177 101 25,967 Amortization of Purchased Intangible Assets 6,006 2,687 8,446 Total Non-GAAP Gross Margin 110,262 135,037 165,912 Total Non-GAAP Gross Margin % 40.0% 42.6% 39.9%

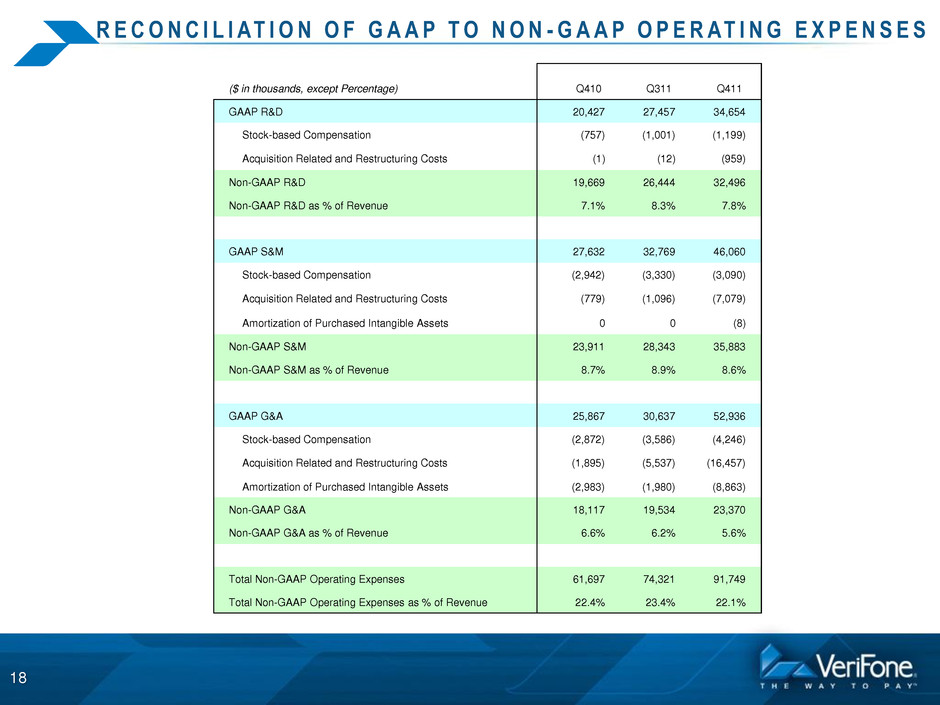

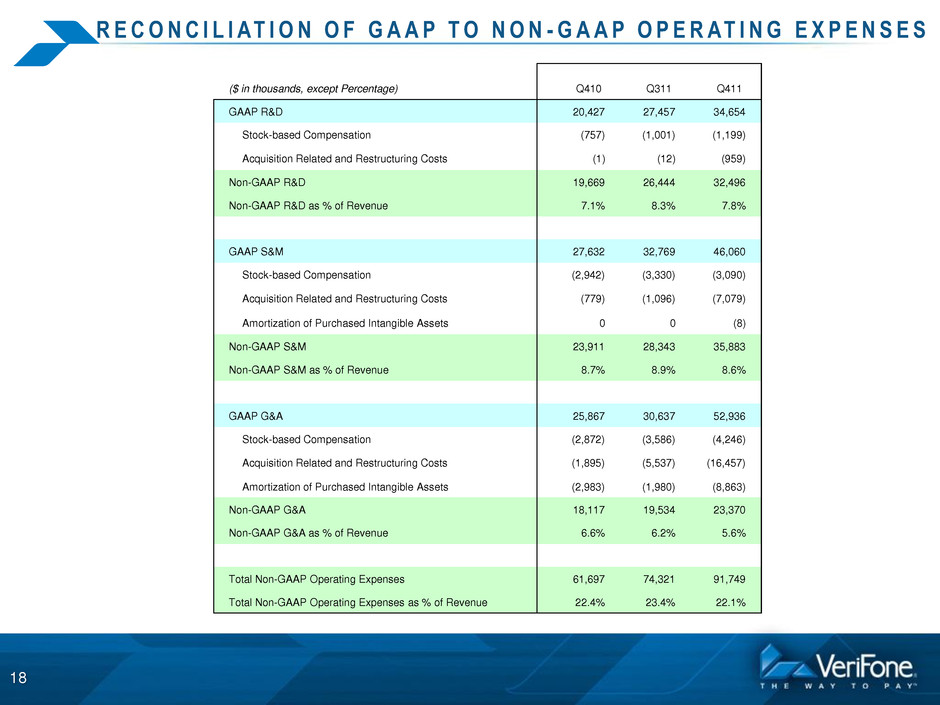

R E C O N C I L I AT I O N O F G A A P T O N O N - G A A P O P E R AT I N G E X P E N S E S 18 ($ in thousands, except Percentage) Q410 Q311 Q411 GAAP R&D 20,427 27,457 34,654 Stock-based Compensation (757) (1,001) (1,199) Acquisition Related and Restructuring Costs (1) (12) (959) Non-GAAP R&D 19,669 26,444 32,496 Non-GAAP R&D as % of Revenue 7.1% 8.3% 7.8% GAAP S&M 27,632 32,769 46,060 Stock-based Compensation (2,942) (3,330) (3,090) Acquisition Related and Restructuring Costs (779) (1,096) (7,079) Amortization of Purchased Intangible Assets 0 0 (8) Non-GAAP S&M 23,911 28,343 35,883 Non-GAAP S&M as % of Revenue 8.7% 8.9% 8.6% GAAP G&A 25,867 30,637 52,936 Stock-based Compensation (2,872) (3,586) (4,246) Acquisition Related and Restructuring Costs (1,895) (5,537) (16,457) Amortization of Purchased Intangible Assets (2,983) (1,980) (8,863) Non-GAAP G&A 18,117 19,534 23,370 Non-GAAP G&A as % of Revenue 6.6% 6.2% 5.6% Total Non-GAAP Operating Expenses 61,697 74,321 91,749 Total Non-GAAP Operating Expenses as % of Revenue 22.4% 23.4% 22.1%

Financial Results for the Quarter Ended October 31, 2011 19