- SICLQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

Silvergate Capital (SICLQ) CORRESPCorrespondence with SEC

Filed: 9 Sep 19, 12:00am

800 17th Street N.W., Suite 1100 | Washington, DC 20006 | T 202.955.3000 | F 202.955.5564 Holland & Knight LLP | www.hklaw.com |

Kevin M. Houlihan +1 202-469-5269 Kevin.Houlihan@hklaw.com |

September 9, 2019

VIA EDGAR AND E-MAIL

Erin Purnell Staff Attorney Office of Financial Services Division of Corporation Finance U.S. Securities and Exchange Commission Mail Stop 4720 100 F Street, NE Washington, D.C. 20549 |

| Re: | Silvergate Capital Corporation |

Amendment No. 3 to Registration Statement on Form S-1 |

Filed August 15, 2019 |

File No. 333-228446 |

Dear Ms. Purnell:

On behalf of Silvergate Capital Corporation (the “Company”), we hereby respond to the comment letter, dated August 22, 2019 (the “Comment Letter”), from the staff of the Division of Corporation Finance (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) regarding the above referenced Amendment No. 3 to the Registration Statement on Form S-1 (the “Registration Statement”) filed with the Commission on August 15, 2019. The Company has also revised the Registration Statement in response to the Staff’s comments and is filing with the Commission concurrently with this letter Amendment No. 4 to the Registration Statement (“Amendment No. 4”), which reflects these revisions, via EDGAR. For your convenience, copies of this letter, together with a clean copy of Amendment No. 4 and a copy of Amendment No. 4 marked to show changes from the Registration Statement submitted on August 15, 2019 are being delivered to the Staff under separate cover.

Set forth below are the Company’s responses to the Staff’s comments provided in the Comment Letter. For your convenience, the numbered paragraphs of this letter correspond to the numbered paragraphs of the Comment Letter. To assist your review, we have retyped the text of the Staff’s comments in bold text below.

Anchorage | Atlanta | Austin | Boston | Charlotte | Chicago | Dallas | Denver | Fort Lauderdale | Houston | Jacksonville | Lakeland Los Angeles | Miami | New York | Orlando | Philadelphia | Portland | San Francisco | Stamford | Tallahassee | Tampa | Tysons Washington, D.C. | West Palm Beach

Erin Purnell

September 9, 2019

Page 2

Business

Digital Currency Solutions and Services Drive Our Business Model

Conservative Lending and Niche Asset Growth, page 109

| 1. | Please revise the penultimate paragraph on this page to clarify your reference to “digital currency borrowing facilities.” Please provide more detail regarding such facilities. |

RESPONSE: The “digital currency borrowing facilities” referenced on page 109 are described on page 110 under “—Our Growth Strategy—Develop New Solutions and Services for Our Customers—Credit Products.” We have added a cross reference on page 109 for clarification.

Our Growth Strategy

Develop New Solutions and Services for our Customers, page 110

| 2. | We note your disclosure on page 110 that you may sell digital currency collateral through your exchange clients and on page 111 that you are considering becoming involved in the transfer of digital assets between customers. We note also your general discussion in Risk Factors on page 37 regarding the regulatory issues surrounding your digital currency customers. Since you indicate that you are planning on directly engaging in the secondary selling of digital currency collateral, please revise your disclosure here and in Risk Factors to address the regulatory concerns regarding these planned products. |

RESPONSE: To clarify for the Staff’s information, neither the Company nor the Company’s wholly-owned subsidiary, Silvergate Bank (the “Bank”) intends to sell digital currency. On page 110 under “—Our Growth Strategy—Develop New Solutions and Services for Our Customers—Credit Products,” the Company is summarizing its initiative to make loans to current digital currency investor customers of the Bank to facilitate digital currency trading, such as Bitcoin, on a designated digital currency exchange customer. The loans will be overcollateralized by pledges of customer owned Bitcoin and U.S. dollars, which will be custodied at the exchange customer. The reference in this section to selling digital currency in the event of a collateral deficiency reflects the inherent authority of any bank to foreclose on collateral pledged as security for a loan and does not represent a transfer of digital assets between customers. In the event of such a collateral deficiency, the Bank will instruct the exchange customer where the Bitcoin is held to liquidate the Bitcoin and return such funds back to the Bank’s balance sheet. At no time will the Bank directly hold the pledged Bitcoin. Please see the revisions on page 110 which clarify this point.

On page 111 under “—Our Growth Strategy—Develop New Solutions and Services for Our Customers— Digital Asset Services,” the Company is summarizing its contemplated initiative for the possible custody and transfer of Bitcoin digital assets between customers. These activities might be effected through a formal custody arrangement with a Bank affiliate having trust powers or the Bank acting to develop a new secure digital asset settlement process that does not require formal asset custody.

Erin Purnell

September 9, 2019

Page 3

Regarding the two items above, in the Company’s view (and in the view of its regulatory counsel) both initiatives are well within currently permissible activities for banks or bank affiliates – lending and related asset foreclosures for the first item, and custodial and/or settlement services for the second item. The Bank has already apprised its state and federal banking regulators of the Credit Product Initiative and they have not raised any objections.

| 3. | Please identify each of the digital assets that you will accept as collateral or take into custody. Please clarify if you plan to offer digital wallet services to your customers. If so, please describe the security and custody arrangements with customers and revise to highlight the risk that you may be liable for any cybersecurity breach resulting in the loss of customer assets. |

RESPONSE: The Credit Product Initiative and the potential custody initiative will focus on Bitcoin as the digital asset. If we proceed to implement custodial services, we would engage as a sub-custodian a third party with demonstrated capabilities in successfully maintaining the security of custodied digital currency assets from unauthorized access. Please see the revisions to pages 37, 110 and 111 to clarify this issue. We do not plan to offer digital wallet services for our customers.

| 4. | We note that you have applied to become a New York State licensed limited liability trust company. Please tell us what consideration you have given to whether you will be required to register as a national securities exchange, broker-dealer, money services business, or any other registration as a result of these new products. |

RESPONSE: For the Staff’s information, the Company does not believe that the existing applicable regulatory framework for the potential future services that the Bank has proposed on page 111 under “—Our Growth Strategy—Develop New Solutions and Services for Our Customers— Digital Asset Services” requires that any of the Company, Bank or its potential trust company register as either a national securities exchange, a broker dealer, or a money service business, the latter category as to which we believe the Bank is exempt in any case in the normal conduct of bank-permissible activities. The Company continually monitors and is abreast of developments in this area. We are not aware of any statute, regulation, or current administrative guidance that treats digital currency assets, solely as such, as securities under federal law. As a result, we do not believe any of the proposed activities require such registration.

Please do not hesitate to contact us if you have any questions concerning any aspect of Amendment No. 4 or if we may be of further assistance. You can reach me directly at (202) 469-5269 and William Levay at (202) 469-5271. We appreciate your prompt attention to this matter.

| Sincerely yours, |

| HOLLAND & KNIGHT LLP |

/s/ Kevin M. Houlihan |

| Kevin M. Houlihan |

Risks Related to Regulation

There is substantial legal and regulatory uncertainty regarding the regulation of digital currencies and digital currency activities. This uncertainty or adverse regulatory changes may inhibit the growth of the digital currency industry, including our customers, and therefore have a material adverse effect on the digital currency initiative.

The U.S. Congress, U.S. state legislatures, and a number of U.S. federal and state regulators and law enforcement agencies, including FinCEN, U.S. federal banking regulators, SEC, CFTC, the Financial Industry Regulatory Authority, or FINRA, the Consumer Financial Protection Bureau, or CFPB, the Department of Justice, the Department of Homeland Security, the Federal Trade Commission, the Federal Bureau of Investigation, the Internal Revenue Service, or the IRS, and state banking regulators, state financial services regulators, and states attorney generals, have been examining the operations of digital currency networks, exchanges, and digital currency businesses, with particular focus on the extent to which digital currencies can be used for illegal activities, including but not limited to laundering the proceeds of illegal activities, funding criminal or terrorist enterprises, engaging in fraudulent activities (see “—Risks Related to the Digital Currency Industry”), as well as whether and the extent to which digital currency businesses should be subject to existing or new regulation, including those applicable to banks, securities intermediaries, derivatives intermediaries, or money transmitters.

For example, FinCEN requires firms engaged in the business of administration, exchange, or transmission of a virtual currency to register with FinCEN under its money services business licensing regime. The New York DFS has established a licensing regime for businesses involved in virtual currency business activity in or involving New York, commonly known as BitLicense regime. The SEC and CFTC have each issued formal and informal guidance on the applicability of securities and derivatives regulations to digital currencies and digital currency activities. The SEC has suggested that, depending on the circumstances, an initial coin offering, or ICO, may constitute securities offerings subject to the provisions of the Securities Act of 1933, as amended, or the Securities Act, and the Securities Exchange Act of 1934, as amended, or the Exchange Act, and that some ICOs in the past have been illegal, which could, in turn, result in regulatory actions or other scrutiny against our customers or us. The SEC has also stated that venues that permit trading of tokens that are deemed securities are required to either register as national securities exchanges under Section 6 of the Exchange Act or obtain an exemption. If we or any of our digital currency customers are subject to regulatory actions relating to illegal securities offerings or are required to register as a national securities exchange under the Exchange Act, we may experience a substantial loss of deposits and our business may be materially adversely affected.

Many state and federal agencies have also issued consumer advisories regarding the risks posed to users and investors in digital currencies. U.S. federal and state legislatures, regulators and law enforcement agencies continue to develop views and approaches to a wide variety of digital currencies and activities involved in digital currencies and it is likely that, as the legal and regulatory landscape develops, additional regulatory requirements could apply to digital currency businesses, including our digital currency customers and us. U.S. state and federal, and foreign regulators and legislatures have taken legal actions against digital currency businesses or adopted restrictions in response to adverse publicity arising from hacks, consumer harm, criminal activity, or other activities related to digital currencies. Ongoing and future regulatory actions may alter, perhaps to a materially adverse extent, the nature of the digital currency industry or the ability of our customers to continue to operate. This may significantly impede the viability or growth of our existing funding sources based on deposits from digital currency business as well as our digital currency initiative. In addition, we may become subject to additional regulatory scrutiny as a result of certain aspects of our growth strategy, including our plans to develop credit products for the purchase of digital currency, custodian services and to expand our international customer base.

Digital currencies and digital currency related activities also currently face an uncertain regulatory landscape in many foreign jurisdictions such as the European Union, China, the United Kingdom, Australia, Japan, Russia, Israel, Poland, India, Hong Kong, Canada and Singapore. Various foreign jurisdictions may adopt laws regulations or directives that affect digital currencies. Such laws, regulations or directives may conflict with those of the United States and may negatively impact the acceptance of digital currencies by users, merchants and service providers

37

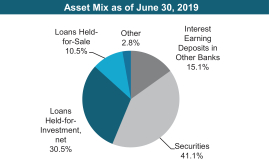

securities, collateralized mortgage obligations and pools of government sponsored student loans. We view our available-for-sale securities as a conservatively managed portfolio which offers a source of additional interest income and provides liquidity management flexibility.

We have more flexibility in deciding how to deploy our deposits attributable to digital currency customer operating funds, which totaled $341.7 million as of June 30, 2019.

Conservative Lending and Niche Asset Growth—We also selectively deploy our funding into specialty lending businesses, including mortgage warehouse lending, commercial real estate lending, correspondent lending, and asset based lending. We have developed underwriting expertise across these asset classes and believe that these loans offer attractive risk-adjusted returns.

We use a portion of our deposits attributable to digital currency exchange and investor funds as the funding source for our mortgage warehouse lending activities. We are comfortable with this strategy because of the short-term nature of our mortgage warehouse assets and because we can access funding at the Federal Home Loan Bank should we experience heightened volatility in the deposit balances related to these digital currency exchange and investor funds.

We use a portion of our deposits attributable to operating funds to make loans across our other lending businesses. A significant portion of our portfolio consists of loans on residential real estate and both owner-occupied and non-owner-occupied commercial real estate. The properties securing these loans are located primarily throughout our markets and, with respect to commercial real estate loans, are generally diverse in terms of type.

As of June 30, 2019 we had net loans (including loans held-for-sale) of $920.2 million compared to $513.3 million as of December 31, 2013. Our yield on loans was 5.60% for the six months ended June 30, 2019 as compared to 4.84% for the year ended December 31, 2013. We believe there may be attractive opportunities to provide digital currency borrowing facilities to deepen our high quality customer relationships and further enhance our interest income. See “—Our Growth Strategy—Develop New Solutions and Services for Our Customers—Credit Products.”

Noninterest Income—For the six months ended June 30, 2019, we had noninterest income of $10.0 million compared to $3.4 million for the six months ended June 30, 2018. Our noninterest income for the 2019 period included a pre-tax gain on sale of $5.5 million for the Bank’s San Marcos branch and business loan portfolio, which was completed in March 2019. Our noninterest income excluding the gain on sale for the six months ended June 30, 2019 was $4.5 million. Our ratio of noninterest income to average assets excluding the gain was 0.46%. Our noninterest income is primarily driven by service fees related to our digital currency customers, mortgage warehouse fee income and other fees. We anticipate an increase in our noninterest income as our customers grow and their needs develop further, and as we continue to develop and deploy fee-based solutions in connection with our digital currency initiative.

109

Our Growth Strategy

We intend to extend our leadership position in the digital currency industry by combining our management team’s industry vision with our strategic focus, market position, and technology platform to grow our existing business lines and develop additional market-leading product offerings. Our strategies to achieve these goals include:

Monetization of the SEN as Platform Matures—The competitive advantage of operating on the SEN is crucial for exchanges and investors participating in the digital currency industry. We believe the SEN can grow to a critical mass of adoption and utilization across the digital currency industry via expansion of our customer base and an increase in the functionality of the SEN that may come as a result of our own internal technology development, strategic relationships, or potential acquisitions. As we continue to enhance the SEN and its customer ecosystem, we believe the value of the network will continue to increase, providing us with the opportunity to earn fees commensurate with the significant value we are providing to our customers.

Broaden Our Digital Currency-Related Customer Base—Our customer growth has primarily been driven by market participants proactively approaching us and by high-quality referrals from existing customers who value our sophisticated and flexible approach to addressing their industry-specific challenges. As of June 30, 2019, we had 655 digital currency customers and 228 prospective customers in various stages of our onboarding process. As we further build out our technology and brand awareness, we expect to more deeply penetrate the universe of existing digital currency-related businesses in need of banking services. By further extending the breadth of our services, we believe we will generate an increasing number of high-quality referrals.

Focus on High-Growth Customers—Our customers have experienced significant growth as the digital currency industry has rapidly expanded. We expect these customers to continue growing, generating additional deposit potential for us and new opportunities for innovation to address customer needs.

Develop New Solutions and Services for Our Customers—We are developing additional products and services to address the digital currency industry’s largest opportunities. We believe we are well positioned to capitalize on these opportunities because of our technology platform and competitive advantages. Our product roadmap includes:

| • | Credit Products—We have identified significant demand from our customers and prospective customers for borrowing for the purposes of buying digital currency. This type of credit is a ubiquitous and financially attractive product in many established markets that is largely absent from the nascent and evolving digital currency industry. For example, unlike in the traditional equity markets, digital currency investors must have funds custodied on the exchange in order to trade on exchange. We believe the SEN could provide the foundational infrastructure for this product in the digital currency industry, creating deeper relationships with our clients and an attractive source of revenue growth. |

In the contemplated structure, the borrower would provide digital currency, initially limited to Bitcoin, or U.S. dollars as collateral in an amount significantly greater than the line of credit. The Bank would initially set a conservative aggregate lending amount to refine the product, and will develop a risk framework to minimize risk and further develop lending models over time.

The SEN would work synergistically with one or more of our exchange clients to implement this solution. For example, an exchange client could hold the digital currency collateral, we could use the SEN to initially fund the loan from our balance sheet, and in the event of a collateral deficiency, we could instruct our exchange customer to immediately liquidate the digital currency collateral through our exchange client and use the SEN to bring the resulting funds back to our balance sheet. In this structure, at no time will the Bank directly hold the pledged digital currency.

This solution provides greater capital efficiency for institutional investor clients that wish to transact without needing to move liquidity on and off different exchanges. Additionally, this will drive increased volumes through the SEN and reinforce Silvergate’s central role in our client’s operations. Offering lines of credit would also improve liquidity within the order book of our exchange clients, enabling

110

additional trading on their platforms, potentially reducing pricing arbitrage across exchanges and improving the stability of digital currencies.

We estimate that demand for this product is significant, and we believe that we can utilize the Bank’s robust credit underwriting and approval process in order to evaluate existing institutional investor deposit clients as borrowers and be appropriately compensated for the risk, earning attractive risk adjusted returns. The Bank anticipates that it will offer this credit product to select institutional clients in the latter part of 2019.

| • | Digital Asset Services—We have identified significant demand for the Bank to be involved in the custody and transfer of digital assets between customers. We continue to believe that the digital currency market lacks sufficient regulated custodians to securely store digital currency to meet the demand of many institutional investors. We believe we are well-positioned to capture market share in this emerging space given our existing investor relationships, our leading brand and reputation, and our ownership of a federally regulated bank. We estimate that there are digital asset services currently being sought with respect to several billions of dollars worth of digital currency-related assets, and that there are limited potential providers of these services because traditional banks, trust companies and broker-dealers lack the infrastructure and expertise to custody, settle and transfer digital currency. Our growth strategy contemplates the establishment of a qualified custodian entity as a Company subsidiary to address this market opportunity. This entity would seek to become a New York State licensed limited liability trust company through which digital currency activities would be conducted. The State of New York was strategically chosen due to its established track record of granting trust charters for digital currency related companies. An application for this new entity has been submitted and is under review. Establishment of a custodian to securely store digital currency, initially limited to Bitcoin, could enhance our ability to offer borrowing facilities for our digital currency customers in the future (see “—Credit Products” above). The Bank does not currently have custody or provide settlement or transfer services of any digital currency assets. |

| • | Stablecoin Transaction Flows and Collateral—We believe that the continuing adoption of stablecoins, as well as our deep relationships with many of the leading developers of stablecoins, presents a large opportunity for our business in several ways. Stablecoins that are backed by U.S. dollars in a one-to-one ratio to their digital representations and that are offered by regulated institutions who agree to third-party audits. At scale, many believe fiat-backed stablecoins will be the catalyst for widespread adoption of digital currencies as a medium of exchange, allowing consumers to purchase goods and services using digital currency without the friction that exists today within the global banking environment and the volatility that exists in the digital currency markets. Additionally, institutional investors are looking for more efficient ways to move capital between global exchanges that are not currently part of the SEN. The Company does not have any direct involvement with stablecoin pricing, transactions or exchanges. |

We participate in this market segment in several ways. We work with all of the U.S. regulated U.S. dollar backed stablecoin issuers, each of which uses the SEN in the issuance and redemption of their respective stablecoin tokens. In addition, we hold U.S. dollar deposits that back multiple stablecoins. In many cases, investors are moving fiat currency onto exchanges in order to buy stablecoins using the SEN, increasing the utility of the network and ultimately expanding the opportunity to earn fees commensurate with the value of our service. In the aggregate, we believe our stablecoin related activities represent growth opportunities that could further increase our deposits and revenue.

| • | Expand Our International Customer Base—Due to the global nature of the digital currency industry and rapid adoption of digital currencies as an asset class, we believe we will have the opportunity to extend the reach of our franchise into international markets. As part of this opportunity, we expect to offer products and services to those markets, as well as to our U.S. customers wishing to access those markets, that will drive additional growth and strategic value in our business. For example, we work with correspondent banking partners, including a leading global investment bank to provide competitive foreign exchange alternatives to our clients. |

111