Silvergate Capital Corporation Investor Presentation May 2022

2 Forward Looking Statements This presentation contains forward looking statements within the meaning of the Securities and Exchange Act of 1934, as amended, including statements of goals, intentions, and expectations as to future trends, plans, events or results of Company operations and policies and regarding general economic conditions. In some cases, forward-looking statements can be identified by the use of words such as “may,” “will,” “anticipates,” “believes,” “expects,” “plans,” “estimates,” “potential,” “continue,” “should,” and similar words or phrases. These statements are based upon current and anticipated economic conditions, nationally and in the Company’s market, interest rates and interest rate policy, competitive factors and other conditions which by their nature, are not susceptible to accurate forecast and are subject to significant uncertainty. For details on factors that could affect these expectations, see the risk factors and other cautionary language included in the Company’s periodic and current reports filed with the U.S. Securities and Exchange Commission. Because of these uncertainties and the assumptions on which this presentation and the forward-looking statements are based, actual future operations and results may differ materially from those indicated herein. Readers are cautioned against placing undue reliance on any such forward-looking statements. The Company’s past results are not necessarily indicative of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political, or industry conditions; geopolitical concerns, including the ongoing war in Ukraine; the magnitude and duration of the COVID-19 pandemic and related variants and mutations and their impact on the global economy and financial market conditions and our business, results of operations, and financial condition; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Board of Governors of the Federal Reserve System; inflation/deflation, interest rate, market, and monetary fluctuations; volatility and disruptions in global capital and credit markets; the transition away from USD LIBOR and uncertainty regarding potential alternative reference rates, including SOFR; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services; the impact of changes in financial services policies, laws, and regulations, including those concerning taxes, banking, securities, digital currencies and insurance, and the application thereof by regulatory bodies; cybersecurity threats and the cost of defending against them, including the costs of compliance with potential legislation to combat cybersecurity at a state, national, or global level; and other factors that may affect our future results. The Company does not undertake to publicly revise or update forward-looking statements in this presentation to reflect events or circumstances that arise after the date of this presentation, except as may be required under applicable law. The Company makes no representation that subsequent to delivery of the presentation it was not altered. For the most current, accurate information, please refer to the investor relations section of the Company's website at https://ir.silvergatebank.com. Silvergate “Silvergate Bank” and its logos and other trademarks referred to and included in this presentation belong to us. Solely for convenience, we refer to our trademarks in this presentation without the ® or the ™ or symbols, but such references are not intended to indicate that we will not fully assert under applicable law our trademark rights. Other service marks, trademarks and trade names referred to in this presentation, if any, are the property of their respective owners, although for presentational convenience we may not use the ® or the ™ symbols to identify such trademarks. In this presentation, we refer to Silvergate Capital Corporation as “Silvergate” or the “Company” and to Silvergate Bank as the “Bank”.

ibdroot\projects\IBD-NY\powder2020\665198_1\Investor Presentation\Project Reload_Investor Presentation_Wall Cross.pptx 3 Increasing Institutional Demand for Digital Currencies ImpactCatalysts • Sudden and significant expansion of the US and global money supply • Buildout of institutional-grade market infrastructure • Increasing regulatory clarity • Large institutional investors are increasingly incorporating digital currencies into their portfolios • Corporate treasuries are beginning to own bitcoin • Accelerating capital flows into digital currency infrastructure companies Select Large Institutional Participants Institutional Investor Commentary “One of the things that’s interesting about bitcoin is that it gets less risky the higher it goes. That’s the opposite of what happens with most stocks.” - Bill Miller, Miller Value Funds “This is a portable and modern way to store capital. The more likely trajectory [of bitcoin] is that people can make a monumental amount of money. Bitcoin is unfettered by Federal Reserve policy or gold supply issues.” - Anthony Scaramucci, Skybridge Capital

4 Silvergate is Critical to the Continuing Expansion of the Digital Currency Industry Companies developing new protocols, platforms, and applications; mining operations; and providers of other services 96 Customers 441 Customers Available 24/7, the SEN is a global payments platform that enables real-time transfer of USD between our digital currency exchange customers and our institutional investor customers Collateralized Lending SEN Leverage provides secure, institutional-grade access to capital through USD loans collateralized by bitcoin Stablecoin Infrastructure Digital Asset Custody Safeguards and stores bitcoin and other digital assets Exchanges through which digital currencies are bought and sold; includes OTC trading desks and digital-first retail platforms 966 Customers Hedge funds, venture capital funds, private equity funds, family offices, and traditional asset managers investing in digital currencies as an asset class Silvergate Exchange Network Digital Currency Exchanges Institutional Investors Other Customers Enables 24/7 real-time conversion of USD into and out of digital dollars on the blockchain ___________ Note: Customer data as of March 31, 2022.

5 Our Proprietary Technology Platform: Silvergate Exchange Network (“SEN”) The value of the SEN to our customers increases with each incremental participant and broadens the opportunity for further adoption of Silvergate’s services 24/7 real-time transfers of USD between exchanges and investors using our proprietary API Fuels zero-cost funding strategy Network effects create value and moat Efficient customer acquisition tool Enables multiple growth vectors Beachhead product for portfolio of services

6 SEN Leverage: The Next Step in Driving Capital Efficiency Institutional investors seeking greater capital efficiency 24/7 API-enabled loan funding and monitoring Zero cumulative losses Massive potential market creates opportunity for recurring, asset management revenue Delete Delete Delete SEN Trader enters into an Agreement with Silvergate to borrow USD to deposit at Exchange Exchange uses the SEN to transfer USD to Trader’s leverage account on its platform Mid-single digit spreads USD lines-of-credit collateralized by bitcoin TRADER EXCHANGE

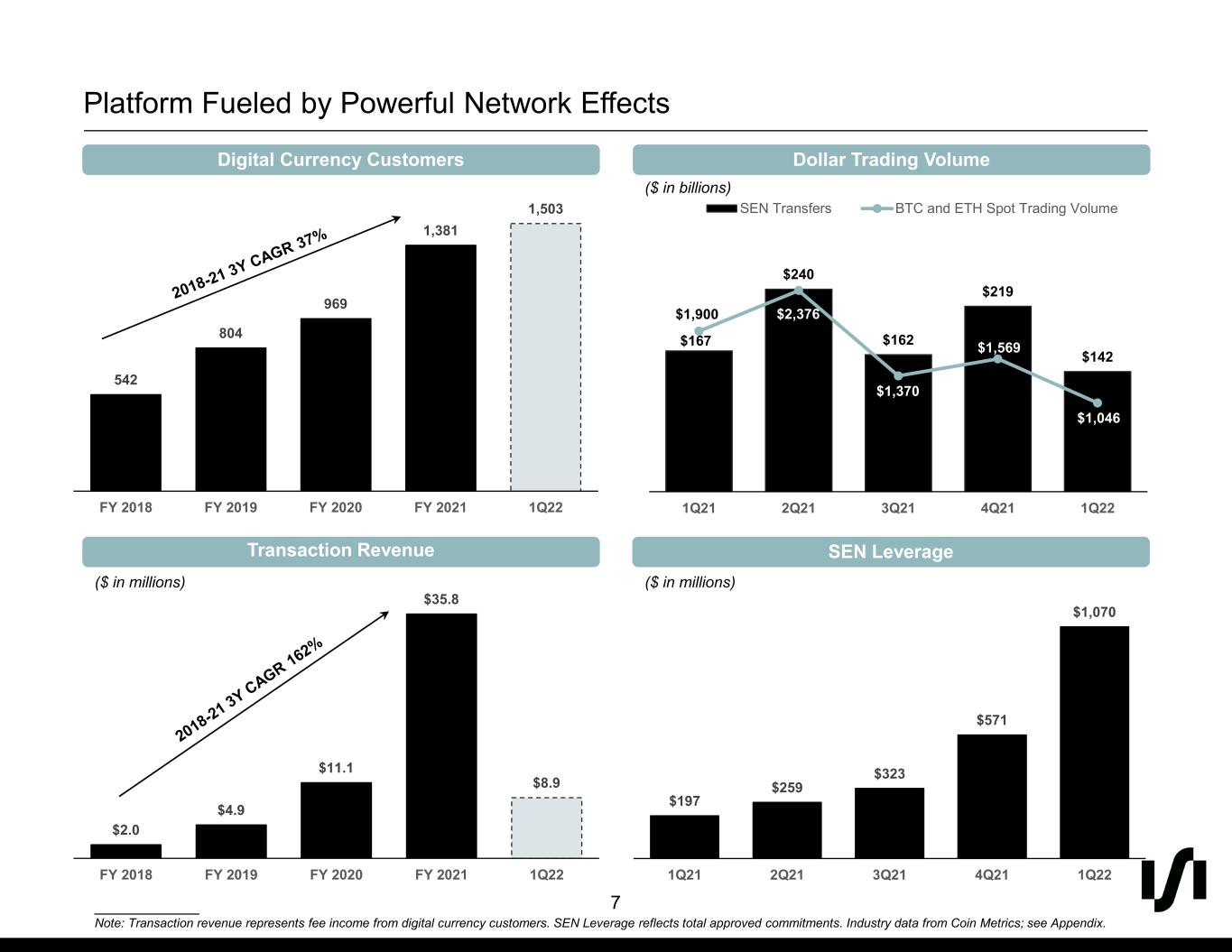

7 $2.0 $4.9 $11.1 $35.8 $8.9 FY 2018 FY 2019 FY 2020 FY 2021 1Q22 Platform Fueled by Powerful Network Effects Digital Currency Customers SEN LeverageTransaction Revenue Dollar Trading Volume ($ in millions) ($ in millions) ___________ Note: Transaction revenue represents fee income from digital currency customers. SEN Leverage reflects total approved commitments. Industry data from Coin Metrics; see Appendix. $240 bn $197 $259 $323 $571 $1,070 1Q21 2Q21 3Q21 4Q21 1Q22 542 804 969 1,381 1,503 FY 2018 FY 2019 FY 2020 FY 2021 1Q22 $167 $240 $162 $219 $142 $1,900 $2,376 $1,370 $1,569 $1,046 1Q21 2Q21 3Q21 4Q21 1Q22 SEN Transfers BTC and ETH Spot Trading Volume ($ in billions)

8 Cash 9% Other 3% Securities 77% Loans 11% $ 0.8 bn $ 1.8 bn $ 2.1 bn $ 10.4 bn $ 14.9 bn YE 2016 YE 2018 YE 2020 YE 2021 Q1 2022 Our Zero-Cost Funding from Customers is a Strategic Advantage Asset Allocation $14.9 bn Funding from Customers Highly liquid asset strategy Significant capacity to grow SEN Leverage Optimized to facilitate customer flows Zero-Cost Funding from Customers 99% $15.8 bn ___________ Note: Funding from customers is total average deposits. Data as of March 31, 2022 unless otherwise noted. Market Expansion Driving Increased Value to the Platform SEN Adoption Providing Capital Efficiency for Customers

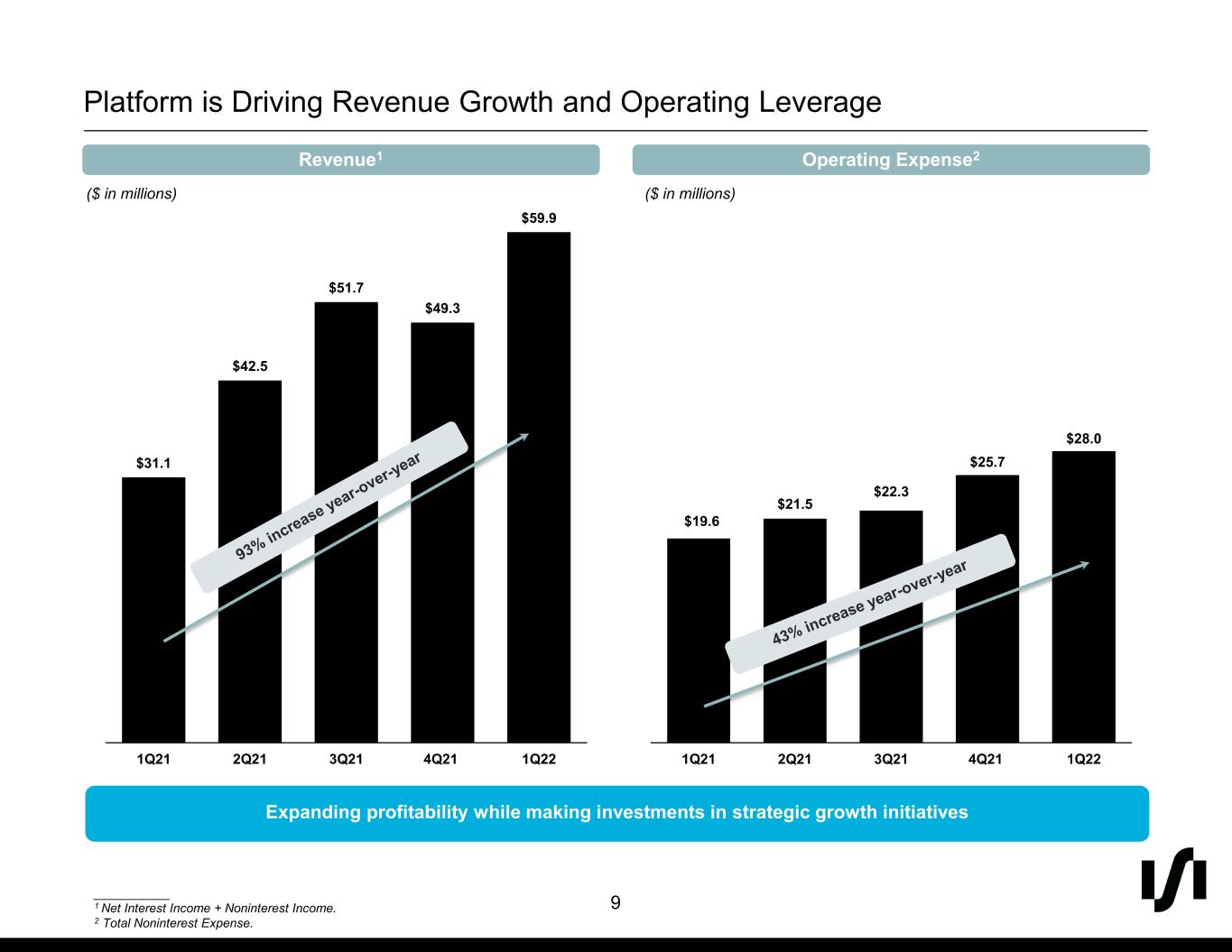

9 Platform is Driving Revenue Growth and Operating Leverage Revenue1 Operating Expense2 ___________ 1 Net Interest Income + Noninterest Income. 2 Total Noninterest Expense. ($ in millions) Expanding profitability while making investments in strategic growth initiatives ($ in millions) $31.1 $42.5 $51.7 $49.3 $59.9 1Q21 2Q21 3Q21 4Q21 1Q22 $19.6 $21.5 $22.3 $25.7 $28.0 1Q21 2Q21 3Q21 4Q21 1Q22

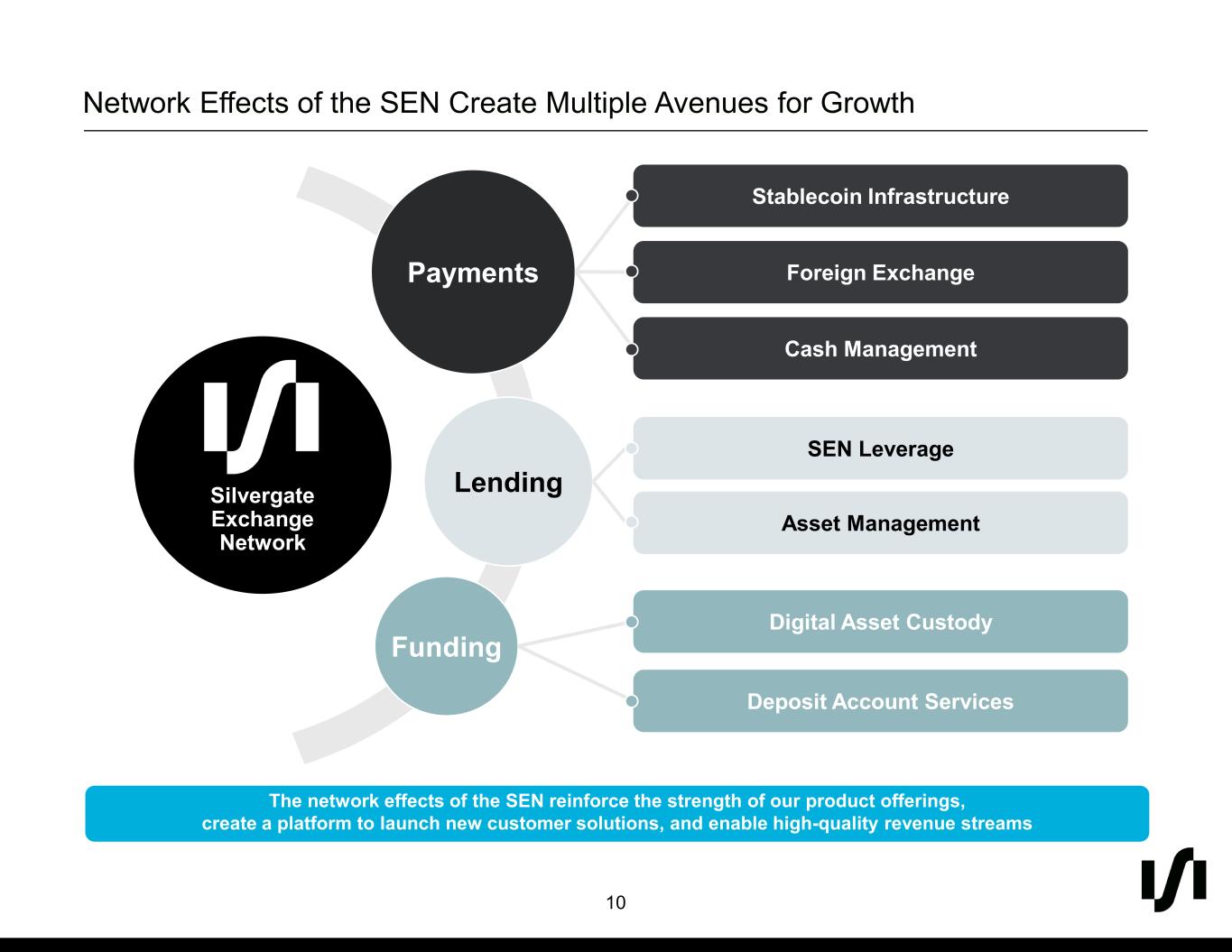

10 Network Effects of the SEN Create Multiple Avenues for Growth The network effects of the SEN reinforce the strength of our product offerings, create a platform to launch new customer solutions, and enable high-quality revenue streams Silvergate Exchange Network Payments Lending Funding Stablecoin Infrastructure Foreign Exchange Cash Management SEN Leverage Digital Asset Custody Deposit Account Services Asset Management

11 Investment Highlights Established and Rapidly Growing Customer Network Expanding SEN Platform Enabling High-Growth, High-Quality Revenue Streams Robust Compliance Framework Innovative Technology with Multiple Growth Vectors The Payment Rails Enabling the Digital Currency Markets

Appendix

13 Broader Crypto Industry Trends % Change in Dollar Volume by Quarter ($ in billions) ___________ Note: Industry data is provided by Coin Metrics (www.coinmetrics.io) as of April 5, 2022. Commentary • Industry volume is based on Bitcoin and Ethereum daily trusted spot volume as defined by Coin Metrics from exchanges that they consider the most accurate and trustworthy • Strong correlation between SEN dollar volume and industry volume by quarter Dollar Trading Volume

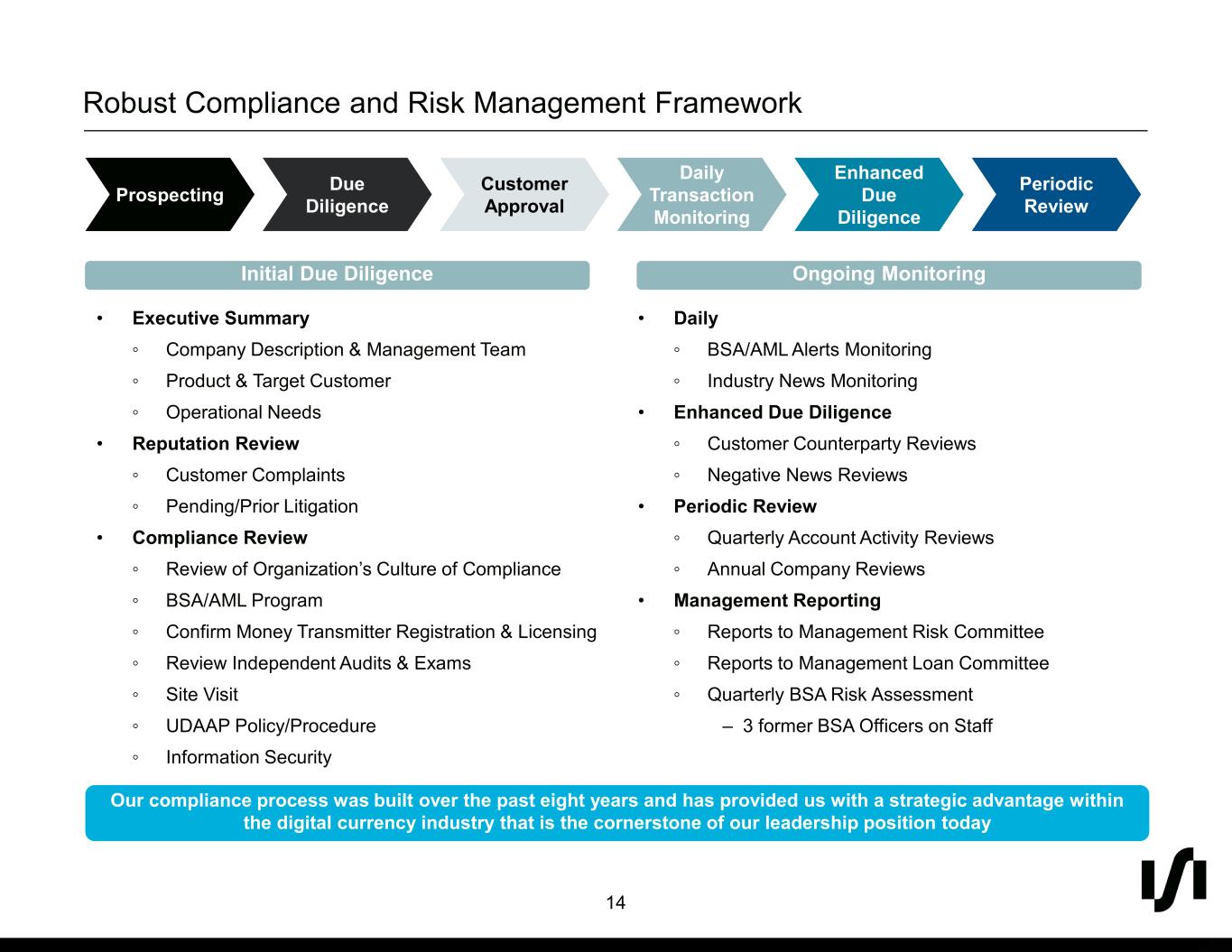

14 Robust Compliance and Risk Management Framework Initial Due Diligence Ongoing Monitoring Our compliance process was built over the past eight years and has provided us with a strategic advantage within the digital currency industry that is the cornerstone of our leadership position today Daily Transaction Monitoring Customer Approval Due DiligenceProspecting Enhanced Due Diligence Periodic Review • Daily ◦ BSA/AML Alerts Monitoring ◦ Industry News Monitoring • Enhanced Due Diligence ◦ Customer Counterparty Reviews ◦ Negative News Reviews • Periodic Review ◦ Quarterly Account Activity Reviews ◦ Annual Company Reviews • Management Reporting ◦ Reports to Management Risk Committee ◦ Reports to Management Loan Committee ◦ Quarterly BSA Risk Assessment ‒ 3 former BSA Officers on Staff • Executive Summary ◦ Company Description & Management Team ◦ Product & Target Customer ◦ Operational Needs • Reputation Review ◦ Customer Complaints ◦ Pending/Prior Litigation • Compliance Review ◦ Review of Organization’s Culture of Compliance ◦ BSA/AML Program ◦ Confirm Money Transmitter Registration & Licensing ◦ Review Independent Audits & Exams ◦ Site Visit ◦ UDAAP Policy/Procedure ◦ Information Security

15 1Q22 Financial Results $24.7M +34% vs PQ +94% vs PY Net Income Available to Common Shareholders $59.9M +22% vs PQ +93% vs PY Revenue 9.68% -13% vs PQ Flat vs PY Tier 1 Leverage Ratio $0.79 +20% vs PQ +44% vs PY Diluted EPS $28.0M +9% vs PQ +43% vs PY Noninterest Expense $15.8B -1% vs PQ +104% vs PY Total Assets ___________ Note: Revenue represents Net Interest Income + Noninterest Income.