Silvergate Capital Corporation 2Q22 Earnings Presentation July 19, 2022 Exhibit 99.2

1 5 0 41 42 44 221 228 231 146 183 188 0 107 183 0 175 220 2 #010500 #DDE4E7 #919498 #92B7BC #00AFDC #006BB7 #292A2C Forward Looking Statements This presentation contains forward looking statements within the meaning of the Securities and Exchange Act of 1934, as amended, including statements of goals, intentions, and expectations as to future trends, plans, events or results of Company operations and policies and regarding general economic conditions. In some cases, forward-looking statements can be identified by the use of words such as “may,” “will,” “anticipates,” “believes,” “expects,” “plans,” “estimates,” “potential,” “continue,” “should,” and similar words or phrases. These statements are based upon current and anticipated economic conditions, nationally and in the Company’s market, interest rates and interest rate policy, competitive factors and other conditions which by their nature, are not susceptible to accurate forecast and are subject to significant uncertainty. For details on factors that could affect these expectations, see the risk factors and other cautionary language included in the Company’s periodic and current reports filed with the U.S. Securities and Exchange Commission. Because of these uncertainties and the assumptions on which this presentation and the forward-looking statements are based, actual future operations and results may differ materially from those indicated herein. Readers are cautioned against placing undue reliance on any such forward-looking statements. The Company’s past results are not necessarily indicative of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, below are certain factors which could cause actual results to differ materially from those contained or implied in the forward-looking statements: changes in general economic, political, or industry conditions; geopolitical concerns, including the ongoing war in Ukraine; the magnitude and duration of the COVID-19 pandemic and related variants and mutations and their impact on the global economy and financial market conditions and our business, results of operations, and financial condition; uncertainty in U.S. fiscal and monetary policy, including the interest rate policies of the Board of Governors of the Federal Reserve System; inflation/deflation, interest rate, market, and monetary fluctuations; volatility and disruptions in global capital and credit markets; the transition away from USD LIBOR and uncertainty regarding potential alternative reference rates, including SOFR; competitive pressures on product pricing and services; success, impact, and timing of our business strategies, including market acceptance of any new products or services; the impact of changes in financial services policies, laws, and regulations, including those concerning taxes, banking, securities, digital currencies and insurance, and the application thereof by regulatory bodies; cybersecurity threats and the cost of defending against them, including the costs of compliance with potential legislation to combat cybersecurity at a state, national, or global level; and other factors that may affect our future results. The Company does not undertake to publicly revise or update forward-looking statements in this presentation to reflect events or circumstances that arise after the date of this presentation, except as may be required under applicable law. The Company makes no representation that subsequent to delivery of the presentation it was not altered. For the most current, accurate information, please refer to the investor relations section of the Company's website at https://ir.silvergatebank.com. Silvergate “Silvergate Bank” and its logos and other trademarks referred to and included in this presentation belong to us. Solely for convenience, we refer to our trademarks in this presentation without the ® or the ™ or symbols, but such references are not intended to indicate that we will not fully assert under applicable law our trademark rights. Other service marks, trademarks and trade names referred to in this presentation, if any, are the property of their respective owners, although for presentational convenience we may not use the ® or the ™ symbols to identify such trademarks. In this presentation, we refer to Silvergate Capital Corporation as “Silvergate” or the “Company” and to Silvergate Bank as the “Bank”.

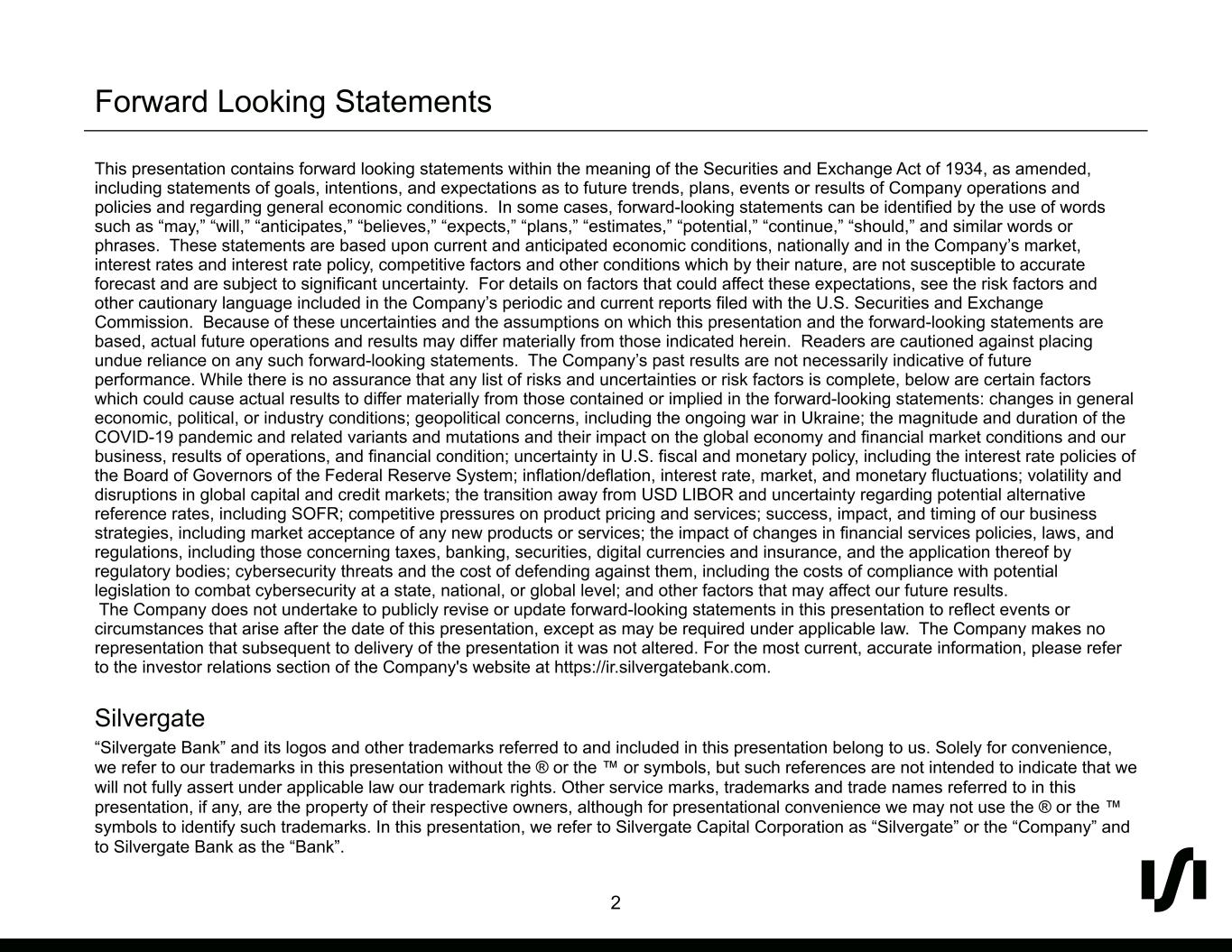

1 5 0 41 42 44 221 228 231 146 183 188 0 107 183 0 175 220 3 #010500 #DDE4E7 #919498 #92B7BC #00AFDC #006BB7 #292A2C Platform Fueled by Powerful Network Effects Digital Currency Customers SEN LeverageTransaction Revenue SEN Transfers 1,224 1,305 1,381 1,503 1,585 2Q21 3Q21 4Q21 1Q22 2Q22 $240 $162 $219 $142 $191 2Q21 3Q21 4Q21 1Q22 2Q22 $11.3 $8.1 $9.3 $8.9 $8.8 2Q21 3Q21 4Q21 1Q22 2Q22 $259 $323 $571 $1,070 $1,367 2Q21 3Q21 4Q21 1Q22 2Q22___________ Note: Transaction revenue represents fee income from digital currency customers. SEN Leverage balances reflect total commitments. ($ in billions) ($ in millions)($ in millions)

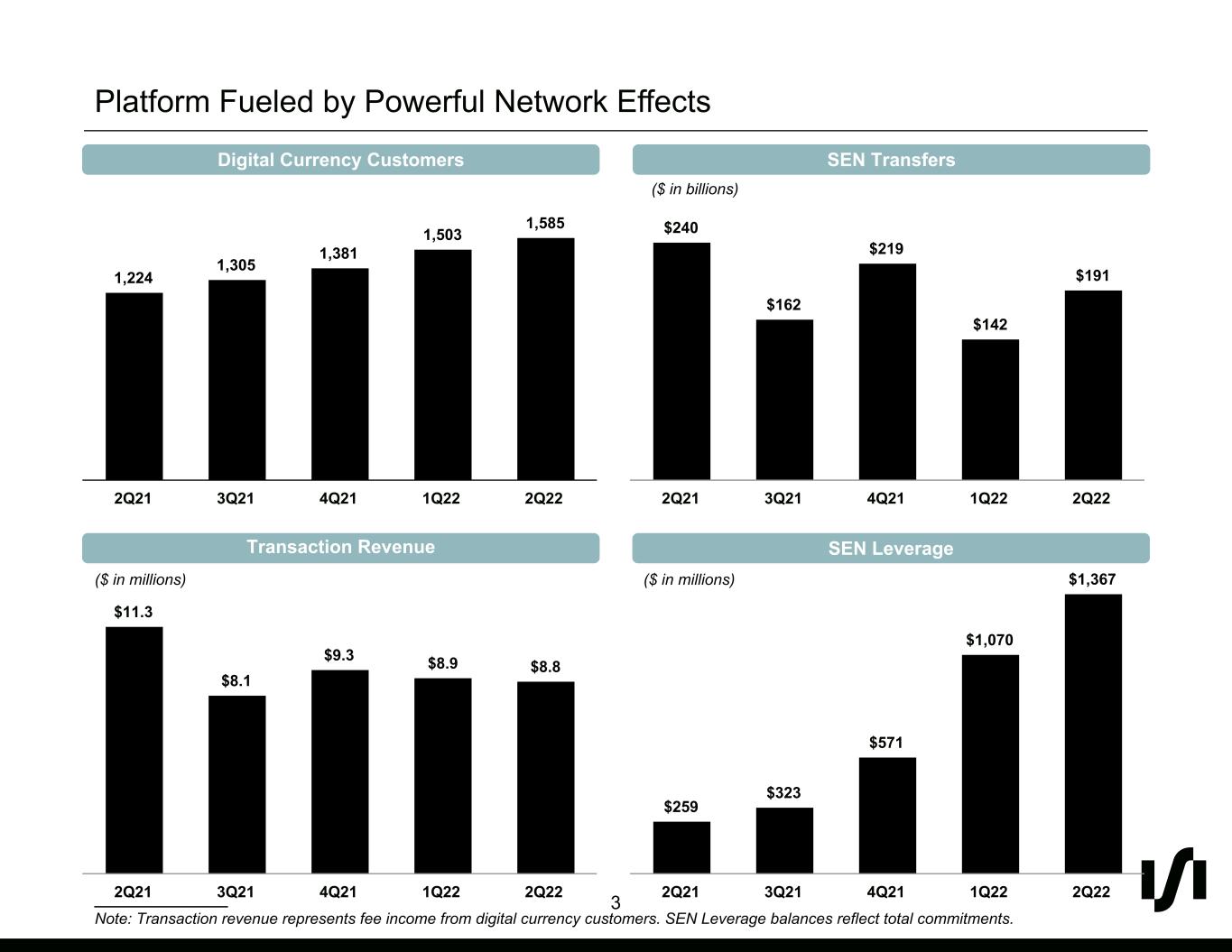

1 5 0 41 42 44 221 228 231 146 183 188 0 107 183 0 175 220 4 #010500 #DDE4E7 #919498 #92B7BC #00AFDC #006BB7 #292A2C Broader Crypto Industry Trends % Change in Dollar Volume by Quarter 24% (44)% 16% (32)% 6% 44% (32)% 35% (35)% 34% BTC and ETH Spot Trading Volume SEN Transfers 2Q21 3Q21 4Q21 1Q22 2Q22 ($ in billions) ___________ Note: Industry data is provided by Coin Metrics (www.coinmetrics.io) as of July 1, 2022. Commentary • Industry volume is based on Bitcoin and Ethereum daily trusted spot volume as defined by Coin Metrics from exchanges that they consider the most accurate and trustworthy • Strong correlation between SEN dollar volume and industry volume by quarter Dollar Trading Volume $2,301 $1,297 $1,510 $1,022 $1,080 $240 $162 $219 $142 $191 BTC and ETH Spot Trading Volume SEN Transfers 2Q21 3Q21 4Q21 1Q22 2Q22

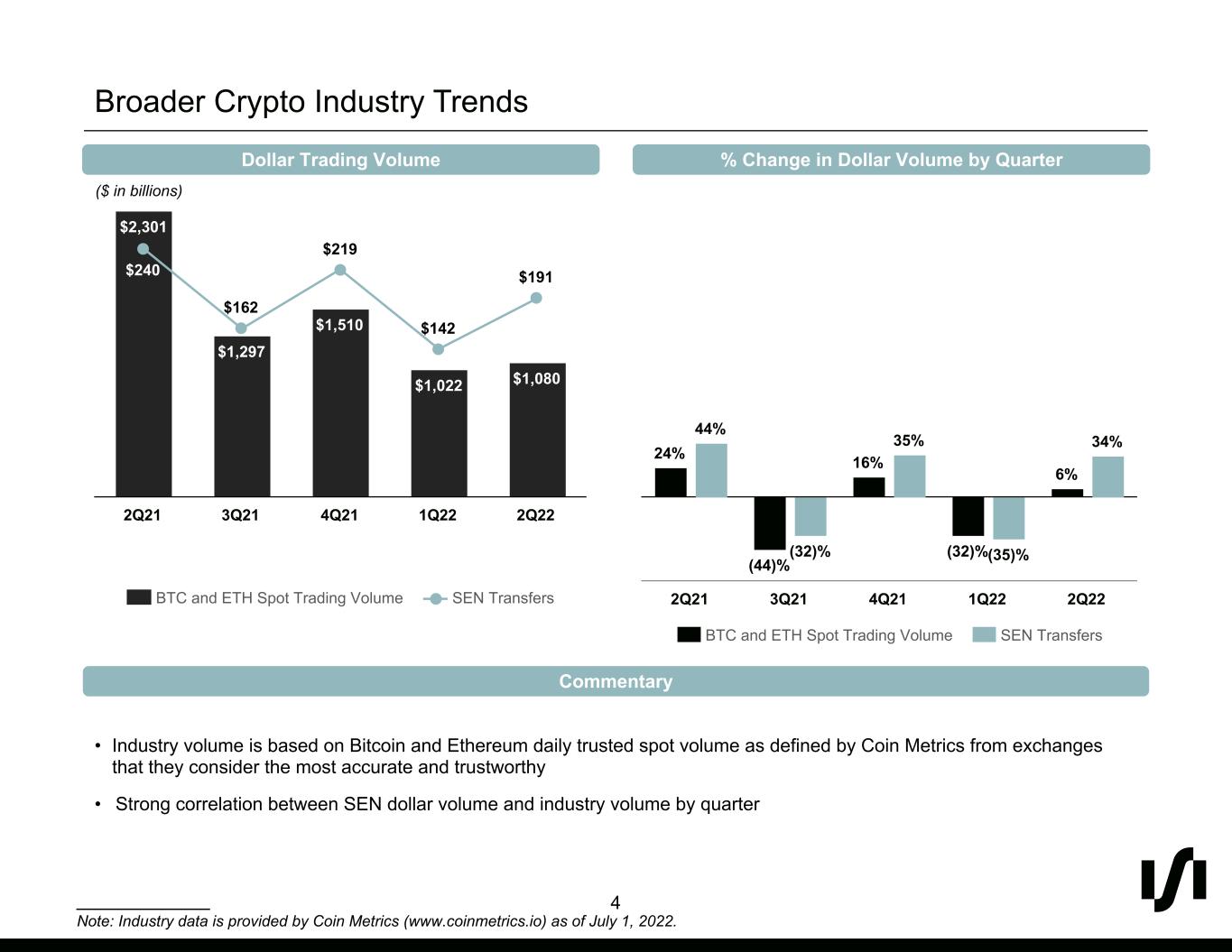

1 5 0 41 42 44 221 228 231 146 183 188 0 107 183 0 175 220 5 #010500 #DDE4E7 #919498 #92B7BC #00AFDC #006BB7 #292A2C 2Q22 Financial Results $35.9M +45% vs PQ +72% vs PY Net Income Available to Common Shareholders $79.8M +33% vs PQ +88% vs PY Revenue 10.10% +4% vs PQ +28% vs PY Tier 1 Leverage Ratio $1.13 +43% vs PQ +41% vs PY Diluted EPS $30.6M +9% vs PQ +42% vs PY Noninterest Expense $15.8B Flat vs PQ +29% vs PY Total Assets ___________ Note: Revenue represents Net Interest Income + Noninterest Income.

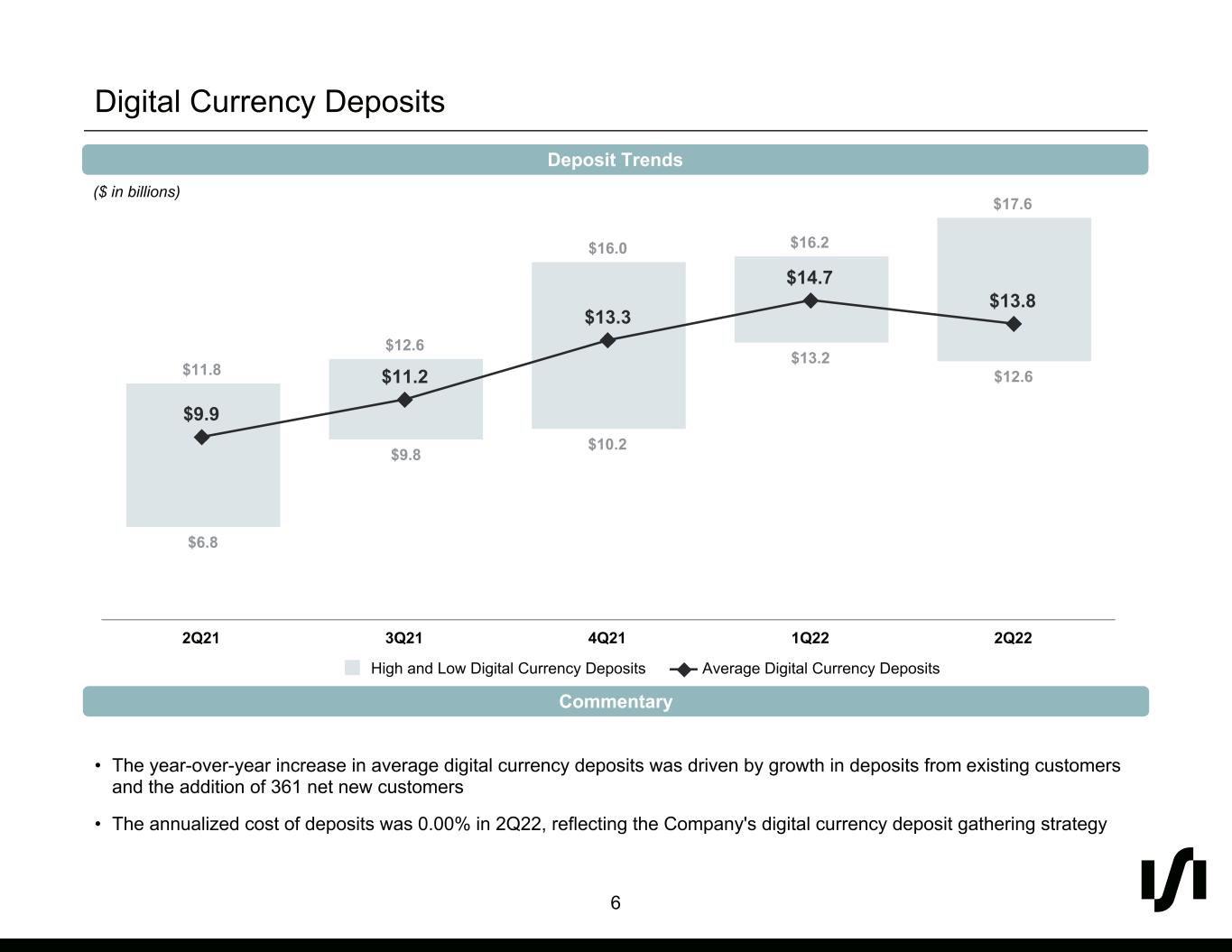

1 5 0 41 42 44 221 228 231 146 183 188 0 107 183 0 175 220 6 #010500 #DDE4E7 #919498 #92B7BC #00AFDC #006BB7 #292A2C Digital Currency Deposits Deposit Trends Commentary • The year-over-year increase in average digital currency deposits was driven by growth in deposits from existing customers and the addition of 361 net new customers • The annualized cost of deposits was 0.00% in 2Q22, reflecting the Company's digital currency deposit gathering strategy $11.8 $12.6 $16.0 $16.2 $17.6 $6.8 $9.8 $10.2 $13.2 $12.6 $9.9 $11.2 $13.3 $14.7 $13.8 High and Low Digital Currency Deposits Average Digital Currency Deposits 2Q21 3Q21 4Q21 1Q22 2Q22 ($ in billions)

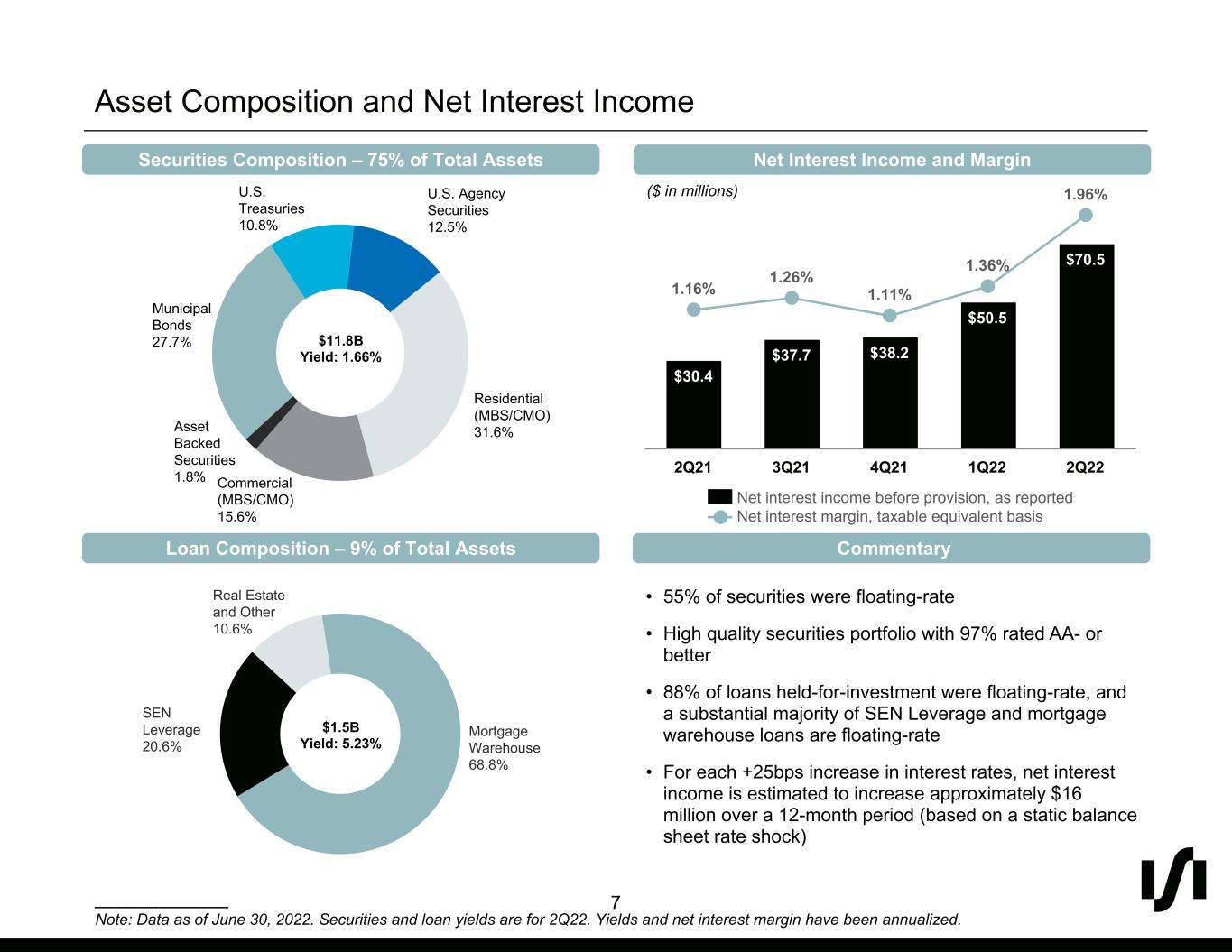

1 5 0 41 42 44 221 228 231 146 183 188 0 107 183 0 175 220 7 #010500 #DDE4E7 #919498 #92B7BC #00AFDC #006BB7 #292A2C Asset Composition and Net Interest Income Securities Composition – 75% of Total Assets Loan Composition – 9% of Total Assets ___________ Note: Data as of June 30, 2022. Securities and loan yields are for 2Q22. Yields and net interest margin have been annualized. • 55% of securities were floating-rate • High quality securities portfolio with 97% rated AA- or better • 88% of loans held-for-investment were floating-rate, and a substantial majority of SEN Leverage and mortgage warehouse loans are floating-rate • For each +25bps increase in interest rates, net interest income is estimated to increase approximately $16 million over a 12-month period (based on a static balance sheet rate shock) Commentary Residential (MBS/CMO) 31.6% Commercial (MBS/CMO) 15.6% Asset Backed Securities 1.8% Municipal Bonds 27.7% U.S. Treasuries 10.8% U.S. Agency Securities 12.5% $11.8B Yield: 1.66% Real Estate and Other 10.6% Mortgage Warehouse 68.8% SEN Leverage 20.6% $1.5B Yield: 5.23% $30.4 $37.7 $38.2 $50.5 $70.5 1.16% 1.26% 1.11% 1.36% 1.96% Net interest income before provision, as reported Net interest margin, taxable equivalent basis 2Q21 3Q21 4Q21 1Q22 2Q22 Net Interest Income and Margin ($ in millions)

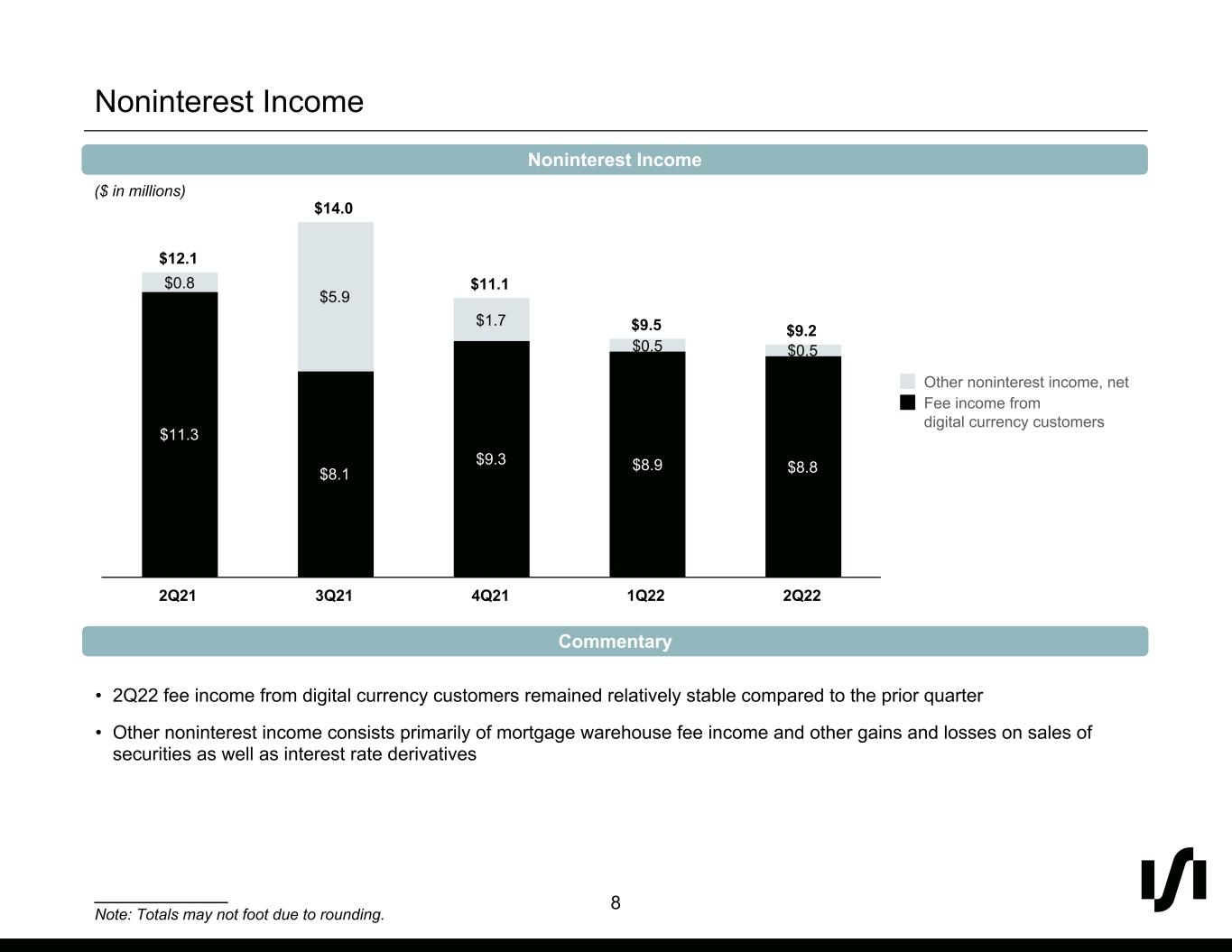

1 5 0 41 42 44 221 228 231 146 183 188 0 107 183 0 175 220 8 #010500 #DDE4E7 #919498 #92B7BC #00AFDC #006BB7 #292A2C Noninterest Income Commentary Noninterest Income • 2Q22 fee income from digital currency customers remained relatively stable compared to the prior quarter • Other noninterest income consists primarily of mortgage warehouse fee income and other gains and losses on sales of securities as well as interest rate derivatives $12.1 $14.0 $11.1 $9.5 $9.2 $11.3 $8.1 $9.3 $8.9 $8.8 $0.8 $5.9 $1.7 $0.5 $0.5 Other noninterest income, net Fee income from digital currency customers 2Q21 3Q21 4Q21 1Q22 2Q22 ($ in millions) ___________ Note: Totals may not foot due to rounding.

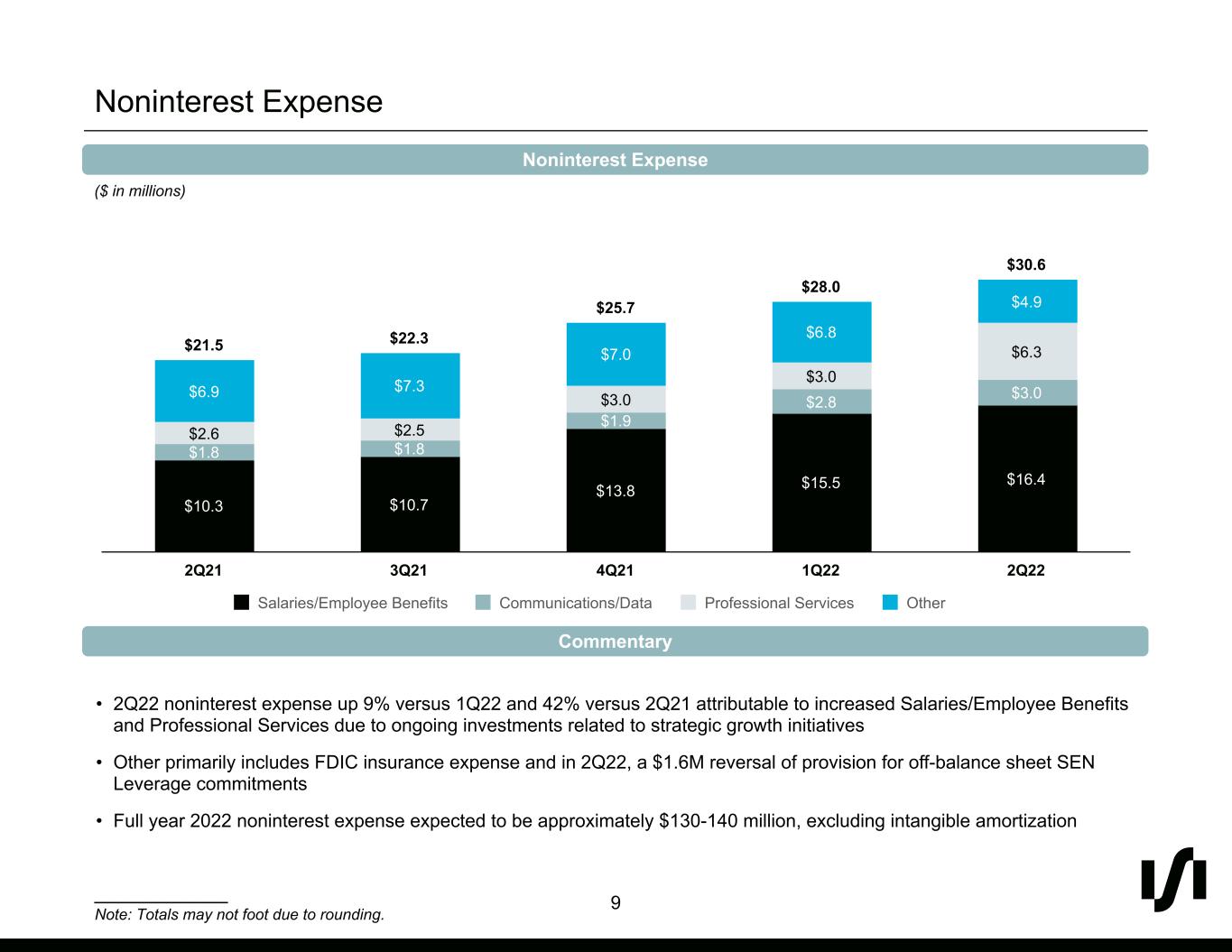

1 5 0 41 42 44 221 228 231 146 183 188 0 107 183 0 175 220 9 #010500 #DDE4E7 #919498 #92B7BC #00AFDC #006BB7 #292A2C Noninterest Expense Noninterest Expense • 2Q22 noninterest expense up 9% versus 1Q22 and 42% versus 2Q21 attributable to increased Salaries/Employee Benefits and Professional Services due to ongoing investments related to strategic growth initiatives • Other primarily includes FDIC insurance expense and in 2Q22, a $1.6M reversal of provision for off-balance sheet SEN Leverage commitments • Full year 2022 noninterest expense expected to be approximately $130-140 million, excluding intangible amortization Commentary $10.3 $10.7 $13.8 $15.5 $16.4 $1.8 $1.8 $1.9 $2.8 $3.0 $2.6 $2.5 $3.0 $3.0 $6.3 $6.9 $7.3 $7.0 $6.8 $4.9 $21.5 $22.3 $25.7 $28.0 $30.6 Salaries/Employee Benefits Communications/Data Professional Services Other 2Q21 3Q21 4Q21 1Q22 2Q22 ($ in millions) ___________ Note: Totals may not foot due to rounding.

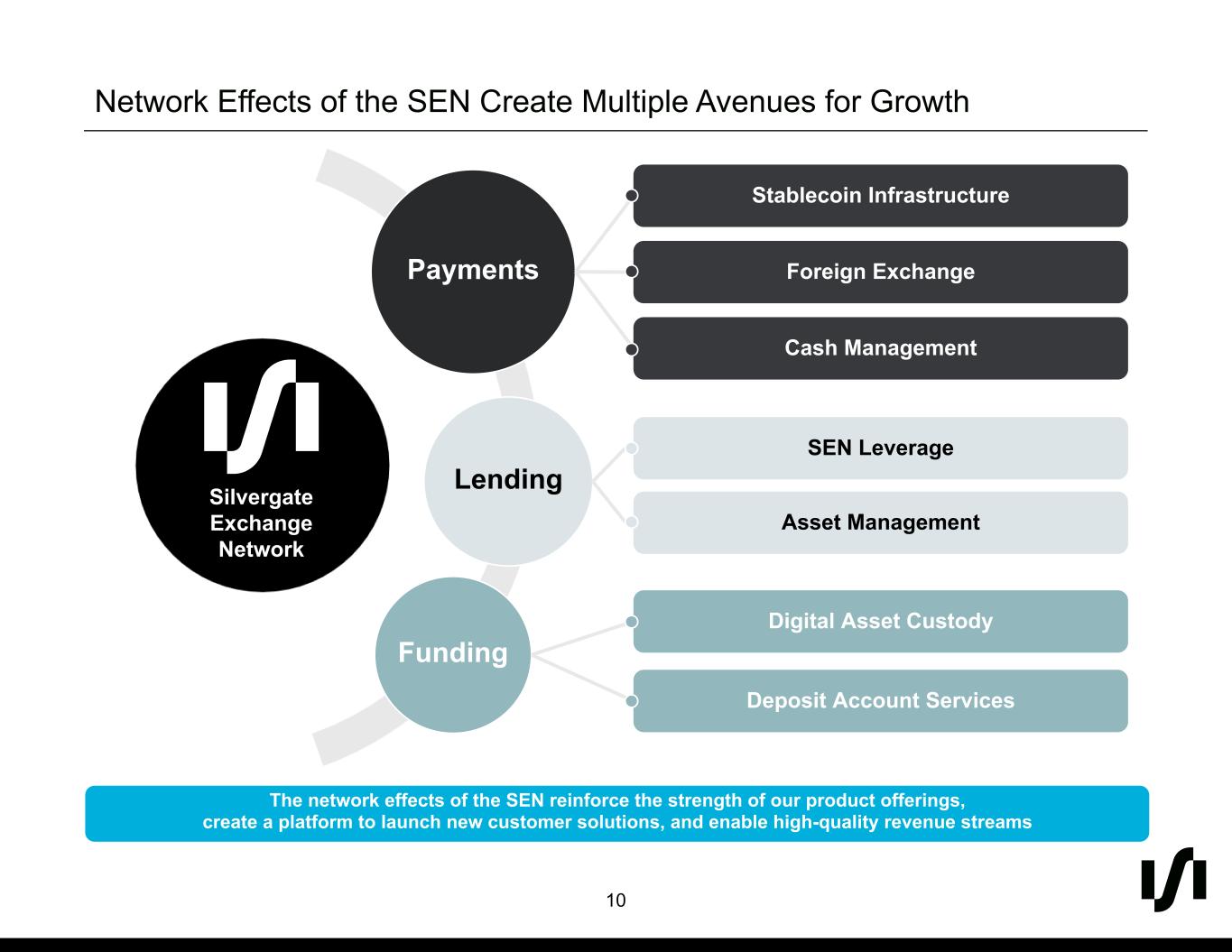

1 5 0 41 42 44 221 228 231 146 183 188 0 107 183 0 175 220 10 #010500 #DDE4E7 #919498 #92B7BC #00AFDC #006BB7 #292A2C The network effects of the SEN reinforce the strength of our product offerings, create a platform to launch new customer solutions, and enable high-quality revenue streams Silvergate Exchange Network Payments Lending Funding Stablecoin Infrastructure Foreign Exchange Cash Management SEN Leverage Digital Asset Custody Deposit Account Services Asset Management Network Effects of the SEN Create Multiple Avenues for Growth