Exhibit 99.1

INFORMATION STATEMENT

[SunGard Data Systems Inc. Letterhead]

, 2005

Dear SunGard Data Systems Inc. Stockholder:

In October 2004, we announced a plan to spin off our availability services business into a separate publicly traded company. We will continue to operate our software and processing business — which includes both our investment support systems business and our higher education and public sector systems business. Before the spin-off is completed, the spun-off company, SunGard Availability Inc., will change its name to “SunGard Inc.,” and our company, SunGard Data Systems Inc., will change its name to .

We expect to complete the spin-off on March 31, 2005. The spin-off will be accomplished through a pro rata dividend of the common stock of SunGard Availability to the stockholders of SunGard Data Systems. As a result, you will own shares in both companies.

At the time of the spin-off, you will receive shares of SunGard Availability common stock for each share of SunGard Data Systems common stock that you hold at 5:00 p.m., New York City time, on , 2005. You will not need to take any action to receive SunGard Availability shares, nor will you be required to pay anything for the new shares or surrender any of your SunGard Data Systems shares. If you are a United States taxpayer, your receipt of SunGard Availability shares in the spin-off is intended to be tax-free for United States federal income tax purposes, except for the receipt of cash in lieu of fractional shares, and we have applied to the Internal Revenue Service for a private letter ruling to that effect. You should, of course, consult your own tax advisor as to the particular tax consequences of the spin-off to you including potential tax consequences under state, local and non-U.S. tax laws.

Our board of directors has determined that a strategic separation of our two businesses is in the best interests of our stockholders. Our software and processing business and our availability services business have operated quite independently from each other, with separate sales forces, different types of customers, distinct strategies and limited operating overlap. We anticipate that, by separating the businesses, each will be able to better focus on its distinct type of business and better pursue its own growth opportunities. Additionally, we also believe that the separation of the two businesses will simplify the profile of each company, allowing investors to more easily evaluate each.

Shares of SunGard Availability common stock are expected to trade on the New York Stock Exchange or the Nasdaq National Market. Shares of SunGard Data Systems will either continue to be listed on the New York Stock Exchange or will be listed on the Nasdaq National Market when the spin-off is completed. In either case, we expect our trading symbol to change.

Enclosed please find an information statement that describes the spin-off and the business of SunGard Availability. We encourage you to read this information carefully. Please note that stockholder approval is not required for the spin-off, so we are not asking you for a proxy.

If you have any questions regarding the spin-off, please contact our investor relations department by calling 484-582-5505 or sending a letter to: Investor Relations, SunGard Data Systems Inc., 680 East Swedesford Road, Wayne, PA 19087.

|

Sincerely, |

|

| |

Cristóbal Conde President and Chief Executive Officer SunGard Data Systems Inc. |

[SunGard Availability Inc. Letterhead]

, 2005

Dear Future SunGard Availability Inc. Stockholder:

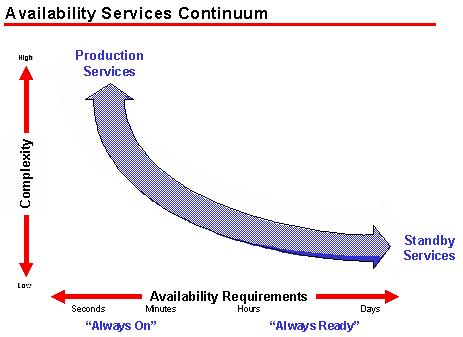

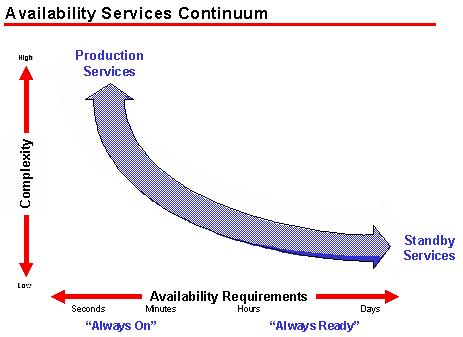

It is my pleasure to welcome you as a stockholder of SunGard Availability Inc. (to be renamed “SunGard Inc.” prior to the spin-off) and introduce you to our company. We pioneered the disaster recovery business twenty-five years ago and have become an industry leader in information availability. We help enterprises build and maintain uninterrupted access to critical systems, data and people that run their businesses by providing a complete range of availability services, from “always on” production services to “always ready” standby services, all in a cost-effective manner.

As you know, the board of directors of our parent company, SunGard Data Systems Inc., has approved a plan to spin off SunGard Availability into a separate public company. We expect that the spin-off will be completed on March 31, 2005.

With our experienced management team, established brand, and solid track record, we believe that we will begin our future as an independent public company from a position of considerable strength. This spin-off should enable us to operate our business with even greater focus and agility, and manage our resources to better serve our customers. Additionally, we should be better able to pursue acquisitions and strategic alliances that will enhance our business. We also believe that, as an independent public company, we will be better able to capitalize on our position as an industry leader and on our consistent, long-term operating performance.

SunGard Availability has distinguished itself as a premier provider of availability solutions through continued investment in infrastructure, service excellence, focused leadership and flexibility in meeting the evolving requirements of our customers. As a SunGard Availability Inc. stockholder, you can share in our progress as we strive to continue strengthening and growing our business. I invite you to learn more about SunGard Availability and our opportunity as a soon-to-be independent public company by reading the attached information statement.

|

Sincerely, |

|

| |

James C. Simmons President and Chief Executive Officer |

| SunGard Availability Inc. |

Information contained herein is subject to completion or amendment. A Registration Statement on Form 10 relating to these securities has been filed with the Securities and Exchange Commission.

Preliminary and Subject to Completion, dated December 30, 2004

INFORMATION STATEMENT

SUNGARD AVAILABILITY INC.

DISTRIBUTION OF APPROXIMATELY SHARES OF COMMON STOCK

We are furnishing this information statement to the stockholders of SunGard Data Systems Inc., or SDS, in connection with SDS’ distribution to holders of its common stock of all outstanding shares of common stock of SunGard Availability Inc., which is referred to herein as “SunGard Availability.” At this time, SunGard Availability is a wholly owned subsidiary of SDS. After the spin-off is completed, SunGard Availability will be a separate company and will own and operate the availability services business currently owned and operated by SDS. SDS will continue to own and operate its software and processing business, which includes both its investment support systems business and its higher education and public sector systems business. Before the completion of the spin-off, SunGard Availability expects to change its name to “SunGard Inc.” SDS expects to change its name to .

If you are a holder of record of SDS common stock at 5:00 p.m., New York City time, on , 2005, which will be the record date for the distribution, you will be entitled to receive shares of our common stock for each share of SDS common stock that you hold on the record date. Immediately after the distribution is completed on the distribution date, we will be an independent public company. We expect the distribution to occur on March 31, 2005.

We expect that, at the time of the distribution, each share of our common stock will have attached to it one preferred stock purchase right, the principal terms of which are described under “Description of Capital Stock — Antitakeover Provisions — Share Purchase Rights Plan.” Where appropriate, references in this information statement to our common stock include the associated preferred share purchase rights.

No stockholder vote is required for the spin-off to occur. No stockholder action is necessary for you to receive the shares of our common stock to which you are entitled in the spin-off. This means that:

| | • | you do not need to pay any consideration to SunGard Availability or to SDS; and |

| | • | you do not need to surrender or exchange any shares of SDS common stock to receive your shares of our common stock. |

Currently, there is no public trading market for our common stock, although we expect that a “when-issued” trading market will develop on or shortly before the record date for the distribution. We expect to apply to have our common stock traded on the New York Stock Exchange or the Nasdaq National Market.

As you review this information statement, you should carefully consider the matters described in “Risk Factors” beginning on page 9.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

If you have inquiries related to the distribution, you should contact SDS’ transfer agent, Wells Fargo Bank, N.A., at 161 N. Concord Exchange Street, St. Paul, MN 55075-1139, 800-468-9716.

The date of this information statement is , 2005.

TABLE OF CONTENTS

2

EXPLANATORY NOTE

This information statement is being furnished to you by SunGard Availability solely to provide you with information regarding both the spin-off and our company. It is not, and should not be construed as, an inducement or encouragement to buy or sell any securities of SunGard Availability or SDS.

You should rely only on the information contained in this information statement. We have not authorized any other person to provide you with information different from that contained in this information statement. The information contained in this information statement is believed by us to be accurate as of its date. Therefore, you should assume that the information contained in this information statement is accurate only as of the date on the front cover of this information statement or other date stated in this information statement, regardless of the time of delivery of this information statement. Our business, financial condition, results of operations and prospects may have changed since that date, and neither we nor SDS will update the information except in the normal course of our respective public disclosure obligations and practices or as specifically indicated in this information statement.

All references to “SunGard Availability Inc.,” “SunGard Availability,” “we,” “our,” “us” or “our company” and similar terms in this information statement refer to SunGard Availability Inc., together with its subsidiaries, the newly spun-off entity. All references to “SunGard Data Systems Inc.” or “SDS” in this information statement refer to SunGard Data Systems Inc., together with its subsidiaries.

SUNGARD and the SunGard logo are trademarks or registered trademarks of SDS or its subsidiaries in the United States and other countries and are expected to be transferred to our company prior to the spin-off.

3

SUMMARY

This summary highlights information relating to our company and the common stock being distributed in the spin-off. More detailed discussions of this information are contained in this information statement. You should read the entire information statement carefully, including the “Risk Factors” section and our combined historical and pro forma financial statements and the notes to those statements appearing elsewhere in this information statement.

Our Company

We are a global leader in information availability services. We help our customers maintain uninterrupted access to the information and computer systems they need to run their businesses by providing them with cost-effective resources to keep their information technology, or IT, reliable and secure. We pioneered commercial disaster recovery in the late 1970s and over the past 25 years have consistently expanded our business to incorporate new technologies and meet evolving customer demands. We believe that our dedicated focus on information availability, together with our experience, vendor neutrality and diverse service offerings, uniquely position us to meet customer needs in an environment where business functions are critically dependent on availability of information.

Because data and business applications can vary significantly in importance, there is a need for a broad range of information availability services. We offer a continuum of availability services from “always on” production services to “always ready” standby solutions. Availability services currently account for over 90% of our revenue. We also provide professional services to help our customers design, implement and maintain information availability solutions. We serve more than 10,000 customers, primarily in North America and Europe, using our extensive infrastructure that includes more than 3,000,000 square feet of hardened, secure facilities at over 60 locations in more than ten countries, and a global network of approximately 25,000 miles.

Our business has been operated as part of SunGard Data Systems Inc., or SDS, a publicly traded corporation. SDS will change its name to at the time of or before the completion of the spin-off. For a discussion of various intercompany arrangements and agreements with SDS, please refer to the section “Certain Relationships and Related Transactions” appearing in this information statement.

Our Strategy

We are focused on expanding our position as the leading independent provider of availability services to a broad range of information-dependent enterprises. We will continue to grow our business by refining our ability to deliver better availability solutions at a lower cost than organizations could otherwise achieve on their own. Our target clientele for these solutions includes our current customer base as well as new prospects that we will continue to actively pursue. Our approach includes:

| | • | exploiting our full range of availability services, |

| | • | capitalizing on our focus, scale and infrastructure, |

| | • | optimizing our direct sales capability, and |

| | • | growing through acquisitions. |

Principal Executive Offices

Our principal executive offices are located at 680 East Swedesford Road, Wayne, Pennsylvania 19087, and our telephone number is 484-582-2000.

4

The Spin-Off

The following is a brief summary of the terms of the spin-off.

| | |

| Distributing Company | | SunGard Data Systems Inc., or SDS, which will change its name to before the spin-off is completed. After the spin-off, SDS will not own any shares of our common stock. |

| |

| Spun-Off Company | | SunGard Availability Inc., or SunGard Availability, which will change its name to SunGard Inc. before the spin-off is completed. Currently, SunGard Availability is a subsidiary of SDS. After the spin-off, SunGard Availability will be an independent public company. |

| |

| Securities to Be Distributed | | shares of our common stock will be distributed, which will be all of the shares of SunGard Availability common stock owned by SDS and will constitute all of our common stock outstanding immediately before the distribution. We expect that, at the time of the distribution, each share of our common stock will have attached to it one preferred share purchase right. |

| |

| Distribution Ratio | | shares of our common stock for each share of SDS common stock that you hold on the record date. |

| |

| Fractional Shares | | We will not distribute fractional shares of our common stock in the distribution. Rather, as soon as practicable after the distribution, the distribution agent will aggregate all fractional shares into whole shares and then sell the whole shares in the open market at prevailing market prices. The distribution agent, in its sole discretion, without influence from SDS or us, will determine when, how, through which broker-dealer and at what price to sell the whole shares. Any broker-dealer selected by the distribution agent will not be an affiliate of SDS or us. Following the sale, the distribution agent will distribute a pro rata portion of the aggregate net cash proceeds to you if you otherwise would have received fractional shares of our common stock. These sale proceeds generally will be taxable to you. |

| |

| Distribution Agent | | Wells Fargo Bank, N.A. |

| |

| Record Date | | 5:00 p.m., New York City time, on , 2005. |

| |

| Distribution Date | | March 31, 2005. The distribution is expected to be effective at 5:00 p.m., New York City time, on the distribution date. |

| |

| New York Stock Exchange or Nasdaq National Market Symbol | | We intend to file an application to have our common stock traded on the New York Stock Exchange or the Nasdaq National Market. |

5

| | |

| Trading Market | | No public market for our common stock currently exists. On or about the record date, we anticipate that shares of our common stock will begin trading on a “when-issued” basis. When-issued trading refers to a transaction made subject to later issuance and delivery of the shares, because the security has been authorized but not yet issued. On the first trading day following the distribution date, when-issued trading of our common stock will end, and “regular-way” trading will begin. |

| |

| United States Federal Income Tax Consequences | | SDS has applied to the Internal Revenue Service, or IRS, for a private letter ruling to the effect that for U.S. taxpayers the distribution will qualify as a transaction that is generally tax-free to SDS and its stockholders under Section 355 of the Internal Revenue Code. See “The Spin-Off — Material United States Federal Income Tax Consequences of the Distribution.” |

| |

| Relationship between SunGard Availability and SDS | | Before the distribution, we will enter into a separation and distribution agreement and several ancillary agreements with SDS to establish the terms and conditions upon which SDS will contribute its availability services business to us and subsequently distribute all shares of our common stock to its stockholders. After the distribution, these agreements also will govern the relationship between SDS and us, as two independent public companies, including: • the allocation of employee benefits, tax and other liabilities and obligations; • the services to be provided by us to SDS and by SDS to us during a transition period after the distribution; • our indemnification of SDS against liabilities arising out of the availability services business and SDS’ indemnification of us against liabilities arising out of SDS’ retained software and processing business; and • the provision of availability services by us to SDS pursuant to a master services agreement. |

| |

| Certain Restrictions | | In general, under the tax-sharing and indemnification agreement to be entered into between SDS and us, we may not take any action that would jeopardize the favorable tax treatment of the distribution and, except in certain specified transactions, we may not during a period of two years following the distribution sell, issue or redeem our equity securities or sell or dispose of a substantial portion of our assets or liquidate, merge or consolidate with any other person unless we obtain the written approval of SDS or we provide SDS with an IRS ruling or an unqualified opinion of tax counsel acceptable to SDS, to the effect that such a sale, issue, redemption or other identified transaction during this two-year period will not affect the tax-free nature of the distribution. |

6

| | |

| Book-Entry Shareholding | | On or shortly after the distribution date: • holders of record of or more shares of SDS common stock on the record date will have credited to a book-entry account established for them by and maintained at Wells Fargo Bank, N.A. (the distribution agent) their proportionate number of shares of SunGard Availability common stock; • holders of record of fewer than shares of SDS common stock on the record date, which would entitle them to receive less than one whole share of SunGard Availability common stock, will receive a check for the cash value of any such fractional shares; and • beneficial owners of SDS common stock on the record date should have credited to their brokerage, custodian or similar account through which they own their SDS stock their proportionate number of shares of SunGard Availability common stock or cash in lieu of a fractional share of SunGard Availability common stock. |

| |

| Termination of the Spin-Off | | SDS has reserved the right to terminate its distribution of shares of our common stock at any time before the distribution date. See “Arrangements Between SDS and SunGard Availability — Separation and Distribution Agreement.” |

| |

| Risk Factors | | The distribution and ownership of our common stock involves various risks. You should carefully consider the matters discussed under “Risk Factors.” |

7

Summary Historical and Pro Forma Financial Information

The following table sets forth summary historical financial information and has been derived from the audited combined financial statements as of and for the years ended December 31, 2003, 2002 and 2001, and the unaudited combined financial statements as of and for the nine months ended September 30, 2004 and September 30, 2003. The summary pro forma financial information presented has been derived from the unaudited pro forma financial statements for the year ended December 31, 2003 and the unaudited pro forma financial statements as of and for the nine months ended September 30, 2004 appearing elsewhere in this information statement. The summary financial information may not be indicative of our future performance as an independent company. It should be read in conjunction with “Selected Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Unaudited Pro Forma Financial Statements” and related notes, and the combined financial statements and related notes included elsewhere in this information statement.

The pro forma adjustments are based upon available information and assumptions that we believe are reasonable. Please see the notes to the Unaudited Pro Forma Financial Statements included elsewhere in this information statement for a discussion of how these adjustments are presented in the pro forma financial statements.

| | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

| | Nine Months Ended

September 30,

|

| | | 2003

| | 2002

| | 2001

| | 2000

| | 1999

| | 2004

| | 2003

|

| | | (in thousands) | | | | |

Income Statement Data | | | | | | | | | | | | | | | | | | | | | |

Revenue | | $ | 1,136,138 | | $ | 1,008,963 | | $ | 482,922 | | $ | 375,571 | | $ | 325,379 | | $ | 866,318 | | $ | 841,143 |

Income from operations | | | 314,382 | | | 215,270 | | | 119,293 | | | 102,760 | | | 81,585 | | | 250,990 | | | 217,169 |

Net income | | | 161,005 | | | 104,199 | | | 60,107 | | | 60,471 | | | 47,194 | | | 136,565 | | | 110,878 |

| | | | | | | |

Balance Sheet Data | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 1,739,213 | | $ | 1,792,789 | | $ | 1,549,390 | | $ | 282,708 | | $ | 277,615 | | $ | 1,706,711 | | $ | 1,700,151 |

Total notes to affiliated company | | | 522,927 | | | 790,150 | | | 610,653 | | | 40,676 | | | 40,676 | | | 522,442 | | | 741,570 |

Invested equity | | | 712,936 | | | 487,945 | | | 616,993 | | | 162,451 | | | 125,956 | | | 726,327 | | | 469,850 |

| | | | | | | |

Pro Forma Income Statement Data | | | | | | | | | | | | | | | | | | | | | |

Revenue | | $ | 1,136,138 | | | | �� | | | | | | | | | | $ | 866,318 | | | |

Income from operations | | | 314,382 | | | | | | | | | | | | | | | 250,990 | | | |

Net income | | | 176,208 | | | | | | | | | | | | | | | 141,207 | | | |

| | | | | | | |

Pro Forma Balance Sheet Data | | | | | | | | | | | | | | | | | | | | | |

Total assets | | | | | | | | | | | | | | | | | $ | 1,913,576 | | | |

Notes payable | | | | | | | | | | | | | | | | | | 250,000 | | | |

Invested equity | | | | | | | | | | | | | | | | | | 1,205,634 | | | |

8

RISK FACTORS

You should carefully consider the risks described below and all the other information contained in this information statement in evaluating our company and common stock. Any of the following risks, as well as additional risks and uncertainties not currently known to us or that we currently deem immaterial, could materially and adversely affect our business and operations. This information statement also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks faced by us described below or elsewhere in this information statement.

Risks Related to Our Spin-Off from SDS

When we operate as a stand-alone company after the spin-off, our results may be substantially different from those indicated by our historical and pro forma financial statements.

The historical financial information we have included in this information statement may not reflect what our results of operations, financial position and cash flows would have been had we been an independent company during the periods presented or what our results of operations, financial position and cash flows will be in the future, for the following reasons:

| | • | While we operated with a substantial amount of autonomy within SDS during the historical periods presented, we did not operate as a stand-alone company, and our historical financial statements reflect allocations for services provided to us by SDS. These allocations will differ from the costs we will incur for these services as an independent company. |

| | • | We have not made adjustments to our historical financial information to reflect changes that will occur in our cost structure, financing and operations as a result of our spin-off from SDS. These changes include potentially increased costs associated with reduced economies of scale and less purchasing power. |

| | • | Our historical effective tax rate may not be indicative of our future effective tax rate due to changes in the mix of our earnings in the various states and countries where we operate. |

| | • | Our historical financial information reflects estimated costs associated with being a publicly traded, independent company and actual costs could differ. |

Therefore, our historical financial statements may not be indicative of our future performance as an independent company.

We have no history operating as an independent company upon which you can evaluate us.

We do not have an operating history as a stand-alone entity. Historically, our availability services business was operated by SDS as a part of its broader corporate organization, rather than as a stand-alone company. Following the spin-off, as an independent company, our ability to satisfy our obligations and maintain profitability will be solely dependent upon the future performance of the businesses we own and operate, and we will not be able to rely upon the capital resources and cash flows of those business lines remaining with SDS. In addition, SDS has historically performed or assisted in the performance of many corporate functions for us, including:

9

| | • | certain public company accounting and financial reporting functions, |

| | • | employee compensation and benefits administration, |

| | • | insurance administration, |

| | • | treasury administration. |

Following the spin-off, SDS will have no obligation to perform these functions for us, except to the extent that SDS will be obligated to provide transition services pursuant to our transition services agreement with SDS, as described in “Arrangements Between SDS and SunGard Availability.” If we do not have in place our own systems and business functions, or if we do not have agreements with other providers of these services once our transition services agreement with SDS expires, we may not be able to operate our business effectively and our profitability may decline. In addition, if SDS does not perform the transition services it has agreed to provide us at the same level as when we were part of SDS, these services may not be sufficient to meet our needs and we may not be able to operate our business effectively after the spin-off. We are in the process of creating our own, or engaging third parties to provide, corporate functions to replace many of the corporate functions SDS currently provides us. We may not be successful in fully implementing these corporate functions or in transitioning data from SDS’ systems to ours. In addition, we may incur costs for these functions that are higher than the amounts reflected in our historical financial statements.

Covenants under our credit facility may limit our ability to withstand a future downturn in our business or to engage in activities that could otherwise benefit our company.

In connection with our spin-off from SDS, we expect to enter into a credit facility, the expected material terms of which are described under “Description of Certain Indebtedness.” Under this credit facility, we expect to become subject to various debt covenants that may limit our ability to engage in activities that could otherwise benefit our company, including restrictions on our ability to:

| | • | incur additional indebtedness; |

| | • | enter into transactions with affiliates; |

| | • | declare or pay dividends or other distributions to stockholders; and |

| | • | consolidate, merge or transfer all or substantially all of our assets and the assets of our subsidiaries. |

These restrictions could limit our ability to make acquisitions or needed capital expenditures, withstand a future downturn in our business or the economy in general, or otherwise take advantage of business opportunities that may arise. In addition, as a stand-alone company our ability to borrow funds may be more limited and costly than it was when our business was operated by SDS as a part of its broader corporate organization, and the covenants in our credit facility could further limit our ability to obtain future financing. We expect that our credit facility will also require us to maintain specific leverage and interest coverage ratios. Our ability to comply with these provisions will be dependent on our future performance, which will be subject to many factors, some of which are beyond our control. A failure to comply with the covenants in our credit facility could result in a default, which could permit the lenders thereunder to accelerate any indebtedness outstanding under the facility.

10

Our ability to engage in acquisitions and other strategic transactions is subject to limitations because we are agreeing to certain restrictions to comply with United States federal income tax requirements for a tax-free spin-off.

We have applied for a private letter ruling from the Internal Revenue Service to the effect that subject to certain assumptions and representations the distribution of our common stock will qualify as a transaction that is generally tax free under Sections 355 and/or 368(a)(1)(D) of the Internal Revenue Code of 1986, as amended. Current U.S. tax law that applies to spin-offs generally creates a presumption that the distribution would be taxable to SDS but not to its stockholders if we engage in, or enter into an agreement to engage in, a transaction that would result in a 50% or greater change by vote or by value in our stock ownership during the four-year period beginning on the date that begins two years before the distribution date, unless it is established that the transaction is not pursuant to a plan or series of transactions related to the distribution. Temporary United States Treasury regulations currently in effect generally provide that whether an acquisition transaction and a spin-off transaction are part of a plan is determined based on all of the facts and circumstances, including specific factors listed in the regulations. In addition, the temporary regulations provide several “safe harbors” for acquisition transactions that are not considered to be part of a plan.

There are other restrictions imposed on us under current U.S. tax laws for spin-offs and with which we will need to comply in order to preserve the favorable tax treatment of the distribution, such as continuing to own and manage our availability services business and limitations on sales or redemptions of our common stock for cash or other property following the distribution, except in connection with certain stock-for-stock acquisitions and other permitted transactions. If these restrictions are not followed, the distribution could be taxable to you and SDS.

We will enter into a tax-sharing and indemnification agreement with SDS under which we will allocate between SDS and ourselves responsibility for federal, state, local and foreign income and other taxes relating to taxable periods before and after the distribution and provide for computing and apportioning tax liabilities and tax benefits between the parties. In the tax-sharing and indemnification agreement, we also will represent that certain materials relating to us submitted to the IRS in connection with the ruling request are complete and accurate in all material respects, and we will agree that, among other things, we may not (1) take any action that would cause such materials (or representations included therein) to be untrue or the spin-off to lose its tax-free status under Code section 355 and (2) during the two-year period following the spin-off, except in certain specified transactions, sell, issue or redeem our equity securities (or those of certain of our subsidiaries) or liquidate, merge or consolidate with another person or sell or dispose of a substantial portion of our assets (or those of certain of our subsidiaries). During that two-year period, we may take certain actions prohibited by these covenants if we obtain the written approval of SDS or we provide SDS with an IRS ruling or an unqualified opinion of tax counsel, acceptable to SDS, to the effect that these actions will not affect the tax-free nature of the spin-off. During the two-year period, these restrictions could substantially limit our strategic and operational flexibility, including our ability to finance our operations by issuing equity securities, make acquisitions using equity securities, repurchase our equity securities, raise money by selling assets or enter into business combination transactions.

We are agreeing to indemnify SDS for taxes and related losses resulting from actions we take that cause the spin-off to fail to qualify as a tax-free transaction.

Pursuant to our tax-sharing and indemnification agreement with SDS, we will agree to indemnify SDS for any taxes and related losses resulting from (1) any breach of the covenants described above, (2) certain acquisitions of our equity securities or assets or those of certain of our subsidiaries, and (3) any breach by us or any member of our group of certain of our representations in the documents submitted to the IRS and the separation documents between SDS and us. The amount of SDS’ taxes for which we are agreeing to indemnify SDS will be based on the excess of the aggregate fair market value of our stock over SDS’ tax basis in our stock at the time of the spin-off. In addition, if the spin-off fails to qualify as a tax-free transaction for reasons other than those specified in the spin-off tax indemnification provisions, liability for any resulting taxes will be apportioned between SDS and us based on actions or inactions taken by SDS or us that contributed to such failure and, if neither SDS nor we contributed to such failure, liability for taxes will be apportioned based on average market capitalizations. The amount of any future indemnification payments could be substantial and could exceed our net equity value at that time.

11

If the spin-off does not qualify as a tax-free distribution at the stockholder level, you will be taxed on your receipt of our stock.

The IRS could determine the spin-off to be taxable even if we receive a private letter ruling. In addition, certain future events that may or may not be within the control of SDS or our company, including certain extraordinary purchases of SDS common stock or our common stock, could cause the distribution not to qualify as tax-free. If the spin-off does not qualify as a tax-free distribution at the stockholder level, you will be taxed on the full value of our shares that you receive (without reduction for any portion of your basis in your SDS shares) as a dividend for U.S. federal income tax purposes and possibly for purposes of state and local tax law to the extent of your pro rata share of SDS’ current and accumulated earnings and profits (including SDS’ taxable gain on the spin-off).

We may be required to satisfy certain indemnification obligations to SDS or may not be able to collect on indemnification rights from SDS.

Under the terms of the separation and distribution agreement, we and SDS each have agreed to indemnify each other from and after the distribution with respect to the indebtedness, liabilities and obligations that will be retained by our respective companies. These indemnification obligations could be significant. The ability to satisfy these indemnities if called upon to do so will depend upon the future financial strength of each of our companies. We cannot determine whether we will have to indemnify SDS for any substantial obligations after the distribution. We also cannot assure you that, if SDS has to indemnify us for any substantial obligations, SDS will have the ability to satisfy those obligations.

Concerns about our prospects as a stand-alone company could affect our ability to attract and retain customers and employees.

Our customers and employees may have concerns about our prospects as a stand-alone company, including our ability to maintain our independence after the spin-off. If we are not successful in assuring our customers and employees of our prospects as an independent company, our customers may choose other providers when their contracts with us expire, or otherwise allow for termination, and our employees may seek other employment, which could materially adversely affect our business.

Risks Related to Our Business

The trend toward “always on” production services will likely lower our margins and create pressure on our internal revenue growth.

There is an increasing preference for “always on” production services instead of “always ready” standby services. The primary reason for this trend is that production services, although more costly, provide greater control and quicker responses to business interruptions. Production solutions can be provided by commercial vendors such as us or by our customers in-house. Our production services allow customers to take advantage of our business-continuity expertise and resource-management capabilities. When an existing customer moves from one of our standby solutions to one of our production solutions, there is generally an increase in our revenue from that customer, but usually at a lower margin. Other customers, especially among the very largest having significant information technology resources, often prefer to develop and maintain their own production solutions, which can result in a loss of revenue from those customers. Technological advances in recent years have significantly reduced the cost yet not the complexity of developing internal production solutions, and a significant shift toward internal solutions could adversely affect our growth prospects and future revenues. Although we cannot predict whether we will have a net gain or net loss of customers as a result of the general trend toward production solutions, we expect that overall this trend will continue to create pressure on our internal revenue growth rate and serve to reduce our operating margin.

12

Rapid changes in technology and our customers’ businesses could adversely affect our business and financial results.

Changes in technology and in our customers’ businesses can occur rapidly and at unpredictable intervals. We may find it difficult or costly to update our services to keep pace with:

| | • | advancements in hardware, software and telecommunications technology; and |

| | • | business, regulatory and other developments in the various industries in which our customers operate. |

Some technological changes in particular, such as advancements that have facilitated the ability of our customers to develop their own production and standby solutions, may render some of our services less valuable or obsolete. If we do not successfully adapt to technological and business changes, or if we do not successfully develop new services needed by our customers to keep pace with these changes, our business and financial results could suffer. In addition, because of ongoing, rapid technological changes, the useful lives of some technology assets have become shorter and customers are therefore replacing these assets more often. As a result, our customers are increasingly expressing a preference for contracts with shorter terms, which could make our revenue less predictable in the future.

Three of our facilities are particularly important to our operations, and a major disruption at one or more of those facilities could impair our ability to provide services to our customers and adversely affect our business and financial results.

Although we have facilities at over 60 locations in more than ten countries, our three largest facilities are particularly important to our ability to provide our availability services. We have contingency plans in place to protect against both human and natural threats at these facilities, but it is impossible to anticipate fully and protect against all potential catastrophes. A catastrophic event at one or more of these three facilities, whether due to a major system failure, significant power or communication outage, security breach, computer virus, criminal act, terrorist attack, fire, flood or natural disaster, could result in service interruptions and data losses for our customers, which could have a material adverse effect on our business and financial results. Although we believe we currently have adequate insurance coverage for these facilities, we may not be able to maintain adequate coverage at a reasonable cost in the future.

Our business depends on the state of the economy, and a slowdown or downturn in general economic conditions could adversely affect our business and results of operations.

When there is a slowdown or downturn in the economy, our business and financial results may suffer for a number of reasons. Customers may react to worsening conditions by reducing their capital expenditures in general or by specifically reducing their spending on information technology. In addition, customers may delay or cancel information-technology projects, or seek to lower their costs by renegotiating vendor contracts. Also, customers with excess data-center capacity may choose to develop and use their own in-house solutions rather than obtain solutions from us. Moreover, competitors may respond to market conditions by lowering prices and attempting to lure away our customers to lower cost solutions. If any of these circumstances remain in effect for an extended period of time, there could be a material adverse effect on our financial results. Because we provide services under multiyear contracts, there is a lag in time between changes in the level of technology spending and changes in our internal revenue growth.

Our acquisition program is an important element of our growth strategy, and if we are unable to identify suitable acquisition candidates our growth could be slowed and our financial results may be adversely affected.

Our growth has depended in part on our ability to identify and acquire similar or complementary businesses on favorable terms. In the last three years, virtually all of our growth was from acquired businesses. We expect to continue to seek acquisition opportunities, particularly with respect to complementary businesses that allow us to expand our service offerings.

Our strategy to grow partly through acquisitions is subject to a number of risks that could adversely affect our business and financial results, including the following:

| | • | an inability to find suitable businesses to acquire at affordable purchase prices or on other acceptable terms; |

13

| | • | competition for acquisitions; |

| | • | having to borrow money from a bank or sell equity or debt securities to the public to finance future acquisitions; and |

| | • | finding it more difficult or costly to complete acquisitions due to changes in accounting, tax, securities or other regulations. |

In addition, as a result of the spin-off, there will be restrictions on our ability to engage in acquisitions and other strategic transactions for some time, and our credit facility may limit our ability to borrow for acquisitions as discussed above under “Risks Related to Our Spin-off from SDS — Covenants” and may limit our ability to withstand a future downturn in our business or to engage in activities that could otherwise benefit our company.” We cannot assure you that we will continue to identify and acquire suitable acquisition candidates in pursuit of our growth strategy.

If we are unable to successfully integrate and manage acquired businesses, or if acquired businesses perform poorly, our business and financial results may suffer.

Our acquisition program is an important element of our growth strategy. It is possible that the businesses we have acquired and businesses that we may acquire in the future will prove to be more difficult to integrate and manage than expected or perform worse than expected. If that happens, there may be a material adverse effect on our business and financial results for a number of reasons, including the following:

| | • | having to devote unanticipated financial and management resources to acquired businesses; |

| | • | not being able to realize expected operating efficiencies from our acquisitions; and |

| | • | having to write off goodwill or other intangible assets. |

We cannot assure you that we will be successful in managing and integrating acquired businesses or that those businesses will perform as expected.

We are subject to the risks of doing business internationally.

During 2003, approximately 24% of our revenue was generated outside the United States. Approximately 75% of this revenue was from customers located in the United Kingdom. Because we sell our services outside the United States, our business is subject to risks associated with doing business internationally. Accordingly, our business and financial results could be adversely affected due to a variety of factors, including:

| | • | changes in a specific country’s or region’s political climate or economic condition; |

| | • | unexpected changes in foreign laws and regulatory requirements; |

| | • | difficulty of effective enforcement of contractual provisions in local jurisdictions; |

| | • | trade-protection measures and import or export licensing requirements; |

| | • | potentially adverse tax consequences; and |

| | • | significant adverse changes in foreign currency exchange rates. |

14

If we are unable to retain or attract customers, our business and financial results will be adversely affected.

If we are unable to keep existing customers satisfied, sell additional services to existing customers or attract new customers, our business and financial results will suffer. A variety of factors could affect our ability to successfully retain and attract customers, including the level of demand for our services, the level of customer spending for information technology, the level of competition from internal customer solutions and from other vendors, the quality of our customer service, our ability to update our services and develop new services needed by customers, and our ability to integrate and manage acquired businesses. Our revenue, which has been largely recurring, comes from the sale of our services under fixed-term contracts. We do not have a unilateral right to extend these contracts when they expire. If customers cancel or refuse to renew their contracts, or if customers only partially renew their contracts, there could be a material adverse effect on our business and financial results.

If we fail to retain key employees, our business may be harmed.

Our success depends on the skill, experience and dedication of our employees. If we are unable to retain and attract sufficiently experienced and capable personnel, especially in technical operations, sales and management, our business and financial results may suffer. For example, if we are unable to retain and attract a sufficient number of skilled technical personnel, our ability to provide high-quality customer service may be impaired. Experienced and capable personnel in the technology industry remain in high demand, and there is continual competition for their talents. When talented employees leave, we may have difficulty replacing them and our business may suffer. There can be no assurance that we will be able to successfully retain and attract the personnel that we need.

If we are unable to maintain our partner, distributor and reseller relationships, our business and financial results may be adversely affected.

While we sell predominantly through our direct sales force, we also sell our services through a variety of third-party partners, distributors and resellers. A significant loss of relationships with these third parties, or changes in the financial or business condition of these third parties, could have an adverse effect on our business and financial results.

We face intense competition, and our failure to compete effectively could have a material adverse effect on our profitability and results of operations.

Our greatest source of competition is in-house dedicated solutions, which are production or standby solutions that customers or prospective customers develop and maintain internally instead of purchasing these solutions from a commercial vendor such as our company. If we are unable to provide availability services that are competitive with internally developed solutions, in terms of both performance and pricing, our business could suffer. Historically, our single largest commercial competitor has been IBM Corporation, which offers a wide range of availability services. In addition, we compete against more specialized vendors, including hardware manufacturers, data replication software companies, outsourcers, managed-hosting companies, information-technology services companies and telecommunications companies. Some of our competitors may have greater financial resources than we do or may have the ability to bundle availability services with hardware or other products and services so that the availability services appear to be provided for little or no additional cost to the customer. If we are unable to compete effectively against our competitors’ services and pricing, our profitability and results of operations could be adversely affected.

Risks Related to Ownership of Our Common Stock

Our common stock has no prior trading market, and it is not possible to predict how our stock will perform after the distribution.

There has been no prior trading market for our stock, and we cannot give you any assurance about the prices at which our common stock will trade. Until our common stock is fully distributed and an orderly market develops, the prices at which our stock trades may fluctuate significantly. Prices for our common stock will be determined in the trading markets and may be influenced by many factors, including:

| | • | the depth and liquidity of the market for our common stock; |

15

| | • | investor perceptions of our business; and |

| | • | general economic and industry conditions. |

In addition, the stock market often experiences substantial volatility that is seemingly unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock.

Almost all of our shares are or will be eligible for future sale, which may cause our stock price to decline.

Any sales of substantial amounts of our common stock in the public market or the exercise of substantial amounts of options or the perception that such sales or exercises might occur, whether as a result of the distribution or otherwise, may cause the market price of our common stock to decline. Upon completion of the distribution, we will have outstanding an aggregate of approximately shares of our common stock based upon the shares of SDS common stock outstanding on December 15, 2004, assuming no exercise of options. All of these shares will be freely tradable without restriction or further registration under the Securities Act unless the shares are owned by one of our “affiliates,” as that term is defined in Rule 405 under the Securities Act. We are unable to predict whether large amounts of common stock will be sold in the open market following the distribution. We are also unable to predict whether a sufficient number of buyers would be in the market at that time.

The terms of our spin-off from SDS, antitakeover provisions of our certificate of incorporation, by-laws, our rights agreement and provisions of Delaware law could delay or prevent a change of control that you may favor.

The terms of our spin-off from SDS could delay or prevent a change of control that our stockholders may favor. Any acquisitions of our stock or any issuances of our stock that represent 50% or more of our stock in the aggregate, and, in each case, that were part of a plan that included the distribution of our common stock would cause the distribution to be a taxable transaction to SDS. Under the tax-sharing and indemnification agreement, we would be required to indemnify SDS for the resulting tax, and we would be required to meet various requirements, including obtaining the written approval of SDS, before engaging in specified transactions that involve the acquisition of our stock or the issuance of our stock or other equity securities. See “Arrangements Between SDS and SunGard Availability — Tax-Sharing and Indemnification Agreement.” These obligations might discourage, delay or prevent a change of control that our stockholders may consider favorable.

Provisions of our certificate of incorporation, by-laws and our rights agreement also may discourage, delay or prevent a merger or other change of control that our stockholders may consider favorable or may impede the ability of the holders of our common stock to change the composition of our board of directors. The provisions of our certificate of incorporation, among other things, will:

| | • | authorize our board of directors to establish one or more series of undesignated preferred stock, the terms of which can be determined by the board of directors at the time of issuance; |

| | • | divide our board of directors into three classes of directors, with each class serving a staggered three-year term. Because the classification of the board of directors generally increases the difficulty of replacing a majority of the directors, it both may tend to discourage a third party from making a tender offer or otherwise attempting to obtain control of us and may make it difficult to change the composition of the board of directors; |

| | • | provide that directors may be removed by stockholders only for cause; |

| | • | not provide for cumulative voting in the election of directors, which, if allowed, could enable a minority stockholder holding a sufficient percentage of a class of shares to ensure the election of one or more directors; |

| | • | require that any action required or permitted to be taken by our stockholders must be effected at a duly called annual or special meeting of stockholders and may not be effected by any consent in writing; |

16

| | • | state that special meetings of our stockholders may be called only by our board of directors or the chair of the board of directors; |

| | • | provide that certain provisions of our certificate of incorporation can be amended only by supermajority vote of 80% of the outstanding shares; |

| | • | allow only incumbent directors, not our stockholders, to fill vacancies on our board of directors; and |

| | • | provide that the authorized number of directors may be changed only within a permitted range by resolution of the board of directors. |

The provisions of our by-laws, among other things, will establish advance notice requirements for submitting nominations for election to the board of directors and for proposing matters that can be acted upon by stockholders at a meeting.

In addition, pursuant to our share purchase rights plan, our board of directors plans to declare a dividend of one preferred share purchase right for each share of common stock outstanding. Once declared, a right would also attach to each share of common stock subsequently issued. The rights will have certain antitakeover effects. If triggered, the rights will cause substantial dilution to a person or group that attempts to acquire us on terms not approved by our board of directors. See “Description of Capital Stock — Antitakeover Provisions — Share Purchase Rights Plan.”

Furthermore, because we are subject to Section 203 of the Delaware General Corporation Law, this provision could also delay or prevent a change of control that you may favor. Section 203 provides that, subject to limited exceptions, any person that acquires, or is affiliated with a person that acquires, more than 15% of the outstanding voting stock of a Delaware corporation shall not engage in any business combination with that corporation, including by merger, consolidation or acquisitions of additional shares, for a three-year period following the date on which that person or its affiliate becomes a 15% stockholder without having received the approval of our board of directors.

17

FORWARD-LOOKING STATEMENTS

We have made forward-looking statements in this information statement, including the sections entitled “Summary,” “Risk Factors,” “The Spin-Off,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Our Business.” Forward-looking statements include the information concerning our expected future prospects as an independent company, the expected effects, timing and completion of the spin-off, our outlook for 2004 and our outlook for internal revenue growth in 2004 and 2005. Forward-looking statements include all statements that are not historical facts. You can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “will,” “would,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” or “anticipates” or similar expressions which concern our strategy, plans or intentions. All statements we make relating to estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results are forward-looking statements. All of these forward-looking statements are subject to risks and uncertainties that may change at any time, and, therefore, our actual results may differ materially from those we expected. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations, which include, but are not limited to:

| | • | the trend toward “always on” production services; |

| | • | rapid technological and business changes; |

| | • | catastrophic events at our major facilities; |

| | • | the state of the economy; |

| | • | our ability to identify suitable acquisition candidates and successfully complete, integrate and manage acquisitions; |

| | • | risks relating to the foreign countries where we transact business; |

| | • | the inability to retain or attract customers; |

| | • | the failure to retain key employees; |

| | • | an inability to maintain our partner, distributor and reseller relationships; and |

| | • | our ability to compete successfully in our industry. |

We derive most of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, including the risks identified under the heading “Risk Factors” in this information statement. There may also be other risks that we are unable to identify at this time.

We do not have any intention, nor do we assume any obligation to update any forward-looking statements after we distribute this information statement, even if new information becomes available in the future.

18

THE SPIN-OFF

Background

SunGard Data Systems Inc.’s original software and processing business and availability services business were started in the 1970s and were brought together in the leveraged buyout that created SDS in 1983. Since that time, SDS has grown both businesses to become a global leader in integrated software and processing, primarily for financial services and higher education, as well as a leading provider of availability services. In 2003, SDS’ software and processing business represented approximately 60% of SDS total revenue, and its availability services business represented approximately 40% of total revenue.

While both businesses have grown as part of SDS, they have remained substantially independent with separate sales forces, different types of customers, distinct marketing strategies and limited operating overlap. The diverging needs of each business have made it more difficult for SDS to take full advantage of the opportunities available to each business. Accordingly, at meetings of SDS’ board of directors on May 14, 2004, July 6, 2004, August 9, 2004 and October 1, 2004, the board explored, in consultation with its financial and legal advisers, strategic alternatives available for resolving the difficulties created by the diverging characteristics of the software and processing business and the availability services business. After careful consideration, on October 1, 2004, the board decided to pursue the separation of the two businesses through the spin-off.

Reasons for the Spin-Off

The decision of SDS’ board of directors to pursue the spin-off was based, primarily, on the following considerations:

| | • | to enable the management of each business to focus its full efforts and attention on its own business and to have increased strategic flexibility and decision-making power to pursue its own strategic objectives, coupled with increased accountability for its decisions; |

| | • | to allow each business to provide more effective equity-based compensation arrangements to its key employees by providing incentives that are tailored to a single core business, and also to more closely align the interests of key employees with the interests of public investors; |

| | • | to eliminate the systemic and other issues arising from the operation of the two businesses within a single corporate structure, including competing for access to limited capital resources and the attention of senior management; |

| | • | to facilitate the ability of each business to pursue future acquisitions using stock and other equity-based consideration tied to a single core business; |

| | • | to allow each business to enter into strategic alliances, joint ventures and similar transactions with third parties that may have concerns regarding competition or other conflicts with the other business; and |

| | • | to offer a more focused investment opportunity in each business and thereby promote a more efficient equity valuation of each business as a stand-alone company. |

The Spin-Off of SunGard Availability from SDS

Contribution of SDS’ Availability Services Business

We are currently a wholly owned subsidiary of SDS. We were incorporated on December 17, 2004 in preparation for our spin-off from SDS. On the terms and conditions to be set forth in the separation and distribution agreement between SDS and us, SDS will agree to contribute or otherwise transfer to us generally all of the assets, and we will have agreed to assume generally all of the liabilities, comprising the availability services business of SDS.

19

The information included in this information statement, including our combined financial statements, assumes the completion of the spin-off.

Incurrence of Debt

In connection with the spin-off of SunGard Availability from SDS, we expect that a portion of the existing notes payable to SDS will be replaced with bank debt and the remaining portion will be converted to capital. The capitalization of our business has not yet been finalized, but it is expected that the allocation of total SDS cash and debt to SDS and us will permit each company to have an investment-grade rating.

For purposes of preparing the pro forma financial information contained elsewhere in this information statement, we have assumed that the total SDS cash will be split approximately equally between SDS and us and that we will, through a dividend, repayment of intercompany debt or otherwise, pay to SDS sufficient cash to enable it to repay approximately half of its existing indebtedness. Please see “Unaudited Pro Forma Financial Information” and “Description of Certain Indebtedness.”

Description of the Spin-Off

On October 1, 2004, the board of directors of SDS approved proceeding with the spin-off of SunGard Availability from SDS. To effect the spin-off, on , 2005, the SDS board of directors will declare a dividend to holders of record of SDS common stock at 5:00 p.m., New York City time, on , 2005, the record date, of all the shares of our common stock that SDS will own on the date of the distribution of our common stock. These shares will represent 100% of our outstanding common stock immediately before the distribution. The distribution is expected to be effective at 5:00 p.m., New York City time, on March 31, 2005. After the distribution, holders of record on the record date will own SunGard Availability common stock as well as continue to own SDS common stock.

The Number of Shares You Will Receive

For each share of SDS common stock that you own on the record date, you will receive shares of SunGard Availability common stock.

Please note that if you sell your shares of SDS Common Stock between the record date and the distribution date in the “regular-way” market, you will be selling your right to receive the dividend of shares of SunGard Availability common stock in the distribution. Please see “Listing and Trading of Our Common Stock” in the section below.

When and How You Will Receive the Dividend

You must be a stockholder of SDS on the record date or have acquired shares of SDS common stock in the “regular-way” market between the record date and the distribution date in order to participate in the distribution. No other action is necessary on your part in order to receive the shares of our common stock and associated preferred share purchase rights in the distribution. You do not need to pay any consideration to SDS or us, and you do not need to surrender or exchange any shares of SDS stock in order to receive your shares of our common stock in the distribution. The distribution will not affect the number of outstanding shares of SDS stock or the number of shares of SDS stock that you own. DO NOT SEND YOUR STOCK CERTIFICATES TO SDS, THE DISTRIBUTION AGENT OR US.

As part of the spin-off, we will adopt a book-entry share-transfer and registration system for our common stock. Book-entry refers to a method of recording stock ownership in our records in which no physical certificates are used. Therefore, SDS will pay the dividend on , 2005 by releasing its shares of our common stock to be distributed in the spin-off to Wells Fargo Bank, N.A., the distribution agent.

20

If you own SDS common stock in registered form on the record date, instead of receiving physical share certificates our distribution agent will credit your shares of our common stock to book-entry accounts established to hold your SunGard Availability common stock and will send you a statement reflecting your ownership of our common stock. Any time after the distribution, you may request from the distribution agent, without charge by us or SDS:

| | • | a transfer of all or a portion of your SunGard Availability shares to a brokerage or other account; and/or |

| | • | delivery of physical stock certificates representing your shares. |

If you own SDS common stock through a broker or other nominee, your shares of our common stock will be credited to your account by the broker or other nominee.

The distribution agent will not deliver any fractional shares of our common stock in connection with the distribution. Instead, the distribution agent will, as soon as is practicable on or after the distribution date, aggregate into whole shares the fractional shares of our common stock that otherwise would have been distributed and sell them in the open market at the prevailing market prices. The distribution agent, in its sole discretion, without any influence by SDS or us, will determine when, how, through which broker-dealer and at what price to sell the whole shares. Any broker-dealer used by the distribution agent will not be an affiliate of either SDS or us. Following the sale, the distribution agent will distribute the aggregate sale proceeds ratably to you, assuming you otherwise were entitled to receive fractional shares. The amount of this payment will depend on the prices at which the aggregated fractional shares of our common stock are sold by the distribution agent in the open market. We will be responsible for any payment of brokerage fees. We do not expect that the amount of these brokerage fees will be material to us. The receipt of cash in lieu of fractional shares of our common stock will generally be taxable to you. Neither SDS, the distribution agent nor we guarantee that you will receive any minimum sale price for your fractional shares of our common stock. Neither we nor SDS will pay any interest on the proceeds of the sale of fractional shares.

Results of the Distribution

After the distribution, we will be an independent public company owning and operating what has previously been SDS’ availability services business. Immediately after the distribution, we expect to have approximately 9,000 holders of record of our common stock and approximately shares of our common stock outstanding, based on the number of record stockholders and outstanding shares of SDS common stock on December 15, 2004, excluding treasury stock and assuming no exercise of outstanding options. The actual number of shares to be distributed will be determined on the record date.

For a more detailed explanation of the terms and conditions of the spin-off and distribution, please see “Arrangements between SDS and SunGard Availability — Separation and Distribution Agreement.” Before the distribution, we will enter into several agreements with SDS in connection with, among other things, transition services that will be provided to us by SDS or to SDS by us. For a more detailed description of these agreements, please see “Arrangements Between SDS and SunGard Availability.”

Treatment of Options and Restricted Stock

Stock Options. Before the distribution, employees of SDS were granted stock options under the equity plans of SDS. Under the SDS equity plans, the distribution would have been considered a change in control, and all options issued under the plans would have vested, unless at least 75% of SDS’ board of directors had voted to determine that the distribution is not a change in control. SDS’ board of directors has determined that the distribution will not be considered a change in control for purposes of the SDS equity plans. Furthermore, under the SDS equity plans, an SDS employee who becomes our employee in connection with the distribution would be considered to have terminated employment, and therefore have 90 days to exercise any vested options. SDS has amended the equity plans to provide that the distribution will not be considered a termination of employment for our employees, and our employees will continue to participate in the SDS equity plans as described below.

21

In connection with the distribution, each stock option held by an SDS employee that is vested as of the distribution date will be converted into two options, one to purchase one share of SDS common stock and one to purchase shares of our common stock. Stock options held by employees of SDS other than corporate staff before the distribution that are unvested as of the distribution will be converted into options to purchase shares in the corresponding employer of the employee after the distribution. In addition, stock options issued before October 1, 2004 and held by corporate staff employees of SDS before the distribution that are unvested as of the distribution will be converted into options to purchase shares in both SDS and us, regardless of whether the employee becomes our employee or remains an employee of SDS after the distribution.

In all cases, the exercise price of each new option will be adjusted based upon the respective market values of the two companies at the time the spin-off is completed so that the aggregate exercise price of the options, as well as the ratio of the per-share fair market value of the shares to the per-share exercise price of the options, remain the same.

Restricted Stock. Outside directors of SDS currently hold restricted stock under the SDS Restricted Stock Award Plan for Outside Directors. Under the plan, the distribution would be considered a change in control and all restrictions would be removed. The directors have waived their right to have the restrictions removed, so that the distribution will not be considered a change in control. In addition, former SDS directors who leave the SDS board and become our directors after the distribution will forfeit any SDS shares that remain subject to the restrictions. We expect to issue restricted stock awards for our common stock under our equity plan to these directors. One outside director is expected to serve on both the SDS and SunGard Availability boards and therefore will not forfeit his SDS restricted awards and will also receive a restricted stock award under our new plan.

For a more detailed explanation of the treatment of options and restricted stock that are held by our employees and directors after the distribution, please see “Arrangements between SDS and SunGard Availability — Employee Matters Agreement” and “Management — Director Compensation.”

Listing and Trading of Our Common Stock

No public market for our common stock currently exists. We intend to apply to have our common stock traded on the New York Stock Exchange or the Nasdaq National Market.

Trading Between the Record Date and Distribution Date

Between the record date and the distribution date, there will be two markets in SDS common stock: a “regular-way” market and an “ex-dividend” market. Shares of SDS common stock that trade on the regular-way market will trade with an entitlement to shares of our common stock to be distributed pursuant to the distribution. Shares that trade on the ex-dividend market will trade without an entitlement to shares of our common stock to be distributed pursuant to the distribution and will trade on a “when-issued” basis. “When-issued” trading refers to a sale or purchase made subject to later issuance of the security, because the security has been authorized but not yet issued. Therefore, if you owned shares of SDS common stock at 5:00 p.m., New York City time, on the record date and sell those shares on the regular-way market before the distribution date, you will also be trading the shares of our common stock that would have been distributed to you on the distribution date. On the other hand, if you sell your shares of SDS common stock on the ex-dividend market before the distribution date, you will retain the right to receive the shares of our common stock distributed to you with respect to the shares of SDS common stock you owned on the record date.

Furthermore, between the record date and the distribution date, there will be a “when-issued” trading market in our common stock. The when-issued trading market will be a market for shares of our common stock that will be distributed to SDS stockholders on the distribution date. If you owned shares of SDS common stock on the record date, then you will be entitled to shares of our common stock pursuant to the distribution. You may trade this entitlement to shares of our common stock, without the shares of SDS common stock you own, on the when-issued trading market. On the first trading day following the distribution date, when-issued trading with respect to our common stock will end and regular-way trading will begin.

22

Trading Price

We cannot assure you of the price at which our common stock will trade before, on or after the distribution date. Although the price at which our stock trades may fluctuate significantly until our common stock is fully distributed and an orderly market develops, we believe the presence of a when-issued trading market may have a stabilizing effect on the price of our common stock following the distribution. In addition, the combined trading prices of our common stock and SDS common stock held by stockholders after the distribution may be less than, equal to or greater than the trading price of SDS common stock before the distribution.

Affiliates of SunGard Availability