(iii)Acceptable Franchise Agreement. Purchaser or its assignee shall have obtained an Acceptable Franchise Agreement acceptable to Seller.

8.2Purchaser’s Closing Conditions.

(a)Satisfaction of Purchaser’s Closing Conditions. In addition to the Mutual Closing Conditions, Purchaser’s obligations to close the transactions described in this Agreement are subject to the satisfaction at or prior to Closing of the following conditions precedent (the “Purchaser Closing Conditions”):

(i)Representations and Warranties. Certification by Seller that each of the representations and warranties made by Seller in this Agreement shall be true and correct in all material respects as of the Closing (or as of such other date to which such representation or warranty expressly is made).

(ii)Covenants and Obligations. Each of the covenants and obligations of Seller in this Agreement shall have been performed in all material respects.

(iii)Additional Documents. Seller shall have executed all documents required under this Agreement, and such further instruments of conveyance, assignments, approvals, waivers, consents, confirmations, releases, entity documentation and other documents as may be reasonably necessary to effectuate the sale and transfer of all title, ownership, and possessory rights in and to the Property to Purchaser, and to otherwise consummate and evidence the capacity and authority of Seller to consummate the transactions contemplated herein.

(iv)Title. Seller shall be ready, willing and able to deliver fee simple title to the Property in accordance with the terms and conditions of this Agreement.

8.3Seller Closing Conditions.

(a)Satisfaction of Seller’s Closing Conditions. In addition to the Mutual Closing Conditions, Seller’s obligations to close the transactions contemplated in this Agreement are subject to the satisfaction at or prior to Closing of the following conditions precedent (the “Seller Closing Conditions”):

(i)Receipt of the Purchase Price. Purchaser shall have (i) paid to Seller or deposited with Escrow Agent with written direction to disburse the same to Seller, the Purchase Price (as adjusted pursuant to Section 3.1), and (ii) delivered written direction to Escrow Agent to disburse the Earnest Money to Seller.

(ii)Representations and Warranties. The representations and warranties of Purchaser in this Agreement shall be true and correct in all material respects as of the Closing (or as of such other date to which such representation or warranty expressly is made).

(iii)Covenants and Obligations. Each of the covenants and obligations of Purchaser in this Agreement shall have been performed in all material respects.

8.4Failure of Closing Conditions. So long as a Party is not in default hereunder, if any condition to such Party’s obligation to proceed with the Closing hereunder has not been satisfied as of the Closing Date (or such earlier date as provided herein), such Party may, in its sole discretion, terminate this Agreement, or elect to close notwithstanding the non-satisfaction of such condition, and in that event said Party shall be deemed to have waived said condition, and there shall be no liability on the part of the other Party hereto. In the event that this Agreement is terminated pursuant to this Article VIII, the Earnest Money shall be transferred in accordance with the terms of Section 3.2 hereof and the Parties shall have no further rights or obligations under this Agreement, except for those which expressly survive such termination.

(60) day period. The Closing shall be an escrow closing and may occur remotely.

9.2Documents to be Delivered by Seller at Closing. Prior to Closing, Seller shall prepare for Purchaser’s approval the Deed, A & A Agreements, Bill of Sale and any other transfer documents identified in this Section 9.2. At Closing, Seller shall execute, acknowledge and/or deliver, as applicable, the following to Purchaser or the Escrow Agent:

(a)A special or limited warranty deed (the “Deed”) conveying title to the Property subject only to the Permitted Exceptions.

(b)An Assignment and Assumption of Leases (the “Assignment of Leases”) assigning from Seller, and assuming by Purchaser, all of Seller’s right, title and interest in and to the Leases.

(c)An Assignment and Assumption of Contracts and Licenses (the “Contract and License Assignments”) assigning from Seller, and assuming by Purchaser, all of Seller’s and Affiliates’ right, title and interest in and to the (i) Licenses and Permits and (ii) Contracts. Furthermore, mutual indemnifications shall be included in the Contract and License Assignments which provide that Seller shall indemnify and hold Purchaser harmless for all liabilities thereunder arising prior to the Closing Date and that Purchaser shall indemnify and hold Seller harmless for all liabilities arising thereunder after the Closing Date.

(d)An Assignment and Assumption of Intangible Property, assigning from Seller, and assuming by Purchaser all of Seller’s right, title and interest, if any, in and to all Intangible Property (the “Intangible Property Assignments”) with Seller’s warranty that all Intangible Property is owned by Seller free and clear of all liens and encumbrances. The Assignment of Leases, Contract and License Assignments and the Intangible Property Assignments are herein referred to collectively as the “A & A Agreements”.

(e)A Bill of Sale (the “Bill of Sale”) conveying, transferring and selling to Purchaser all right, title and interest, if any, of Seller in and to all Personal Property.

(f)To the extent in Seller’s possession and not already located at the Property, keys to all entrance doors to, and equipment and utility rooms located in, the Property.

(g)To the extent in Seller’s possession and not already located at the Property, all Licenses.

(h)The advance Booking deposits.

(i)An inventory of all baggage, valises, packages and trunks checked or left in the care of Seller and the contents of all trunk and storage rooms at the Property, together with all books, records, and keys relating to such items.

(j)All other documents which Seller is required to deliver pursuant to the provisions of this Agreement or which are necessary to carry out the intent and purposes of this Agreement.

(k)All corporate authority and good standing documents and other reasonable documentation as may be reasonably required by the Escrow Agent.

(l)Affidavit reaffirming that all representations and warranties made by Seller under this Agreement are true and correct as of the date of Closing, pursuant to the terms hereof.

(m)All affidavits reasonably required by Escrow Agent to issue the Owner’s Title Policy and endorsements in a form acceptable to Purchaser.

(n)FIRPTA certification.

9.3Documents to be Delivered by Purchaser at Closing. At the Closing, Purchaser shall execute, acknowledge and/or deliver, as applicable, the following to Seller:

(a)The cash portion of the Purchase Price, subject to apportionments, credits and adjustments as provided in this Agreement.

(b)The A & A Agreements.

(c)All other documents which Purchaser is required to deliver pursuant to the provisions of this Agreement or which are necessary to carry out the intent and purpose of this Agreement.

(d)All corporate authority and good standing documents and other reasonable documentation required by the Escrow Agent.

(e)Affidavit reaffirming that all representations and warranties made by Purchaser under this Agreement are true and correct as of the date of Closing, pursuant to the terms hereof.

PRORATIONS AND EXPENSES

16

EXHIBIT 10.22

10.1Prorations. The following accounts shall be prorated as of the Closing Date and purchased in cash by Purchaser or credited against cash due to Seller or due from Purchaser, as applicable:

(a)Real estate, personal property taxes, ad valorem taxes and sanitary sewer assessments and similar impositions on the Property (the “Taxes”) if any, for the period prior to Closing shall be prorated as of the Closing Date. The Taxes for the year in which the Closing occurs shall be prorated as of the Closing Date based on the assessment for that year if the assessed value and applicable rates are known at the time of Closing; otherwise, Taxes shall be prorated on the basis of the most recent ascertainable assessed value and rates.

(b)All prepaid rents and amounts payable under the leases, license agreements, service, operating and maintenance contracts assigned to and assumed by the Purchaser, as set forth herein, to the extent same shall cover periods subsequent to Closing shall be credited to Seller.

(c)Amounts prepaid as fees for business permits and licenses which are permitted by law to be assigned to and credited to Seller.

(d)Refundable deposits paid to Seller as lessor under leases or agreements that Purchaser agrees to assume and advance deposits received by Seller for reservations on and after the date of Closing shall transfer to Purchaser, and Purchaser shall thereupon acquire and assume all of Seller’s rights and obligations, if any, in and to such deposits.

(e)All charges for utilities and telephones shall be prorated as of the Closing Date. Purchaser shall transfer all utilities including telephones into its name as of the Closing Date and shall pay all charges therefor from and after Closing.

(f)All Lender Held Escrows shall be assumed by Purchaser and credited to Seller as of the Closing Date.

10.2Adjustments, Allocation and Settlement. The following adjustments to the income and expenses from the Property and purchases or credits shall be made at Closing or subsequent settlement:

(a)The final night’s room revenue (revenue from rooms occupied on the evening preceding the Closing) including any sales tax, shall belong to Seller including accounts receivable of registered guests who have not checked out and are occupying rooms on the evening preceding the Closing Date (the “Tray Ledger”). On the Closing Date, the Tray Ledger accounts shall be checked out as accounts of Seller and, if any accounts are continuing to occupy rooms, re-checked in as accounts of Purchaser. All other accounts receivable originating for services or room nights sold and occupied and checked out prior to the Closing Date shall belong to and be the responsibility of Seller. Purchaser shall have no obligation to collect any such accounts receivable for Seller, and Purchaser shall promptly remit such amounts collected to Seller. If Purchaser collects any cash from any Tray Ledger accounts that are indebted to Purchaser as well as Seller, Purchaser shall apply such collections on a pro-rata basis between its own accounts receivable and to Seller for any accounts belonging to Seller.

(b)Seller shall be entitled to retain the sum of all cash within the control of Seller at the Property in use at time of the Closing.

(c)At the Closing, Seller shall set over and assign unto the Purchaser to the extent permitted by applicable vending machine agreement(s) any right, title and interest Seller may have in and to any commissions or revenues derived from vending machines after the Closing.

(d)Seller shall be responsible for all hotel employee(s) wages, payroll taxes and benefits through midnight of the day preceding Closing, and Seller shall reimburse or credit Purchaser for such expense. Such employees shall be terminated by Seller effective as of 11:59:59 p.m. (local time) of the day preceding Closing. Purchaser shall not be obligated to re-hire any of Seller’s employees.

(e)Purchaser shall be entitled to advance deposits received by Seller prior to Closing for periods subsequent to 12:00:01 a.m. (local time) on the date of Closing. Advance reservations and bookings shall be provided by the Seller at Closing. Purchaser agrees to provide rooms and services for persons and organizations who made advance reservations, and Purchaser agrees to indemnify and hold Seller harmless from and against any claim brought against Seller as a result of Purchaser’s failure to honor any such reservations and bookings.

(f)Purchaser shall purchase from Seller, at Seller’s invoice price, and in addition to the Purchase Price, the unopened supplies, inventory and F&B located at the Hotel on the Closing Date, if any.

(g)At the closing, if Seller has not replaced the boiler tanks located at the Property, Purchaser shall receive a credit in the amount Fifty Thousand and no/100 Dollars ($50,000.00) to be used for replacing boiler tanks at the Property.

10.3Transaction Costs.

17

(a)Seller’s Transaction Costs. In addition to the other costs and expenses to be paid by Seller as set forth elsewhere in this Agreement, Seller shall pay for the following items in connection with this transaction: (i) one-half (½) of the fees and expenses for the escrow services provided by Escrow Agent, (ii) the fees and expenses of its own attorneys, accountants and consultants and (iii) any fee due to Broker from Seller pursuant to a separate agreement between Seller and Broker.

(b)Purchaser’s Transaction Costs. In addition to the other costs and expenses to be paid by Purchaser as set forth elsewhere in this Agreement, Purchaser shall pay for the following items in connection with this transaction: (i) any stamp taxes, transfer, sales or similar tax payable in connection with the conveyance of the Property, (ii) the fees, costs and expenses for the Title Commitment, Owner’s Title Policy (including endorsements), Survey and Searches, (iii) the fees and expenses incurred by Purchaser for Purchaser’s Inspectors or otherwise in connection with the Inspections, (iv) any mortgage tax, title insurance fees and expenses for any loan title insurance policies or recording charges or other amounts payable in connection with the assumption of the Existing Loan, (v) one half (½) of the fees and expenses for the Escrow Agent, (vi) the fees and expenses of its own attorneys, accountants and consultants, (vii) costs of recording the deed to transfer the Property and (viii) any costs related to the issuance of an Acceptable Franchise Agreement, including , but not limited to all fees and costs, if any, related to the termination of the existing Franchise Agreement (including, but not limited to, any costs charged to Seller to effect the issuance of an Acceptable Franchise Agreement and any termination fees, liquidated damages or other charges accruing or payable as a result of such termination). Purchaser shall indemnify and hold Seller harmless from and against any liens, claims, causes of action, damages, liabilities and expenses related to such costs, which indemnity shall survive the Closing or termination of this Agreement.

(c)Other Transaction Costs. All other fees, costs and expenses not expressly addressed in this Section 10.3 or elsewhere in this Agreement shall be allocated between Seller and Purchaser in accordance with applicable local custom for similar transactions.

(d)True Up. Except as otherwise provided herein, to the extent that the amount of any of the above items shall not be available for exact proration and adjustment as of the Closing Date at Closing, Seller or its representative and Purchaser or its representative shall determine, compute, settle and adjust, or readjust, Closing prorations between the Parties as of the Closing Date. All prorations and adjustments shall be subject to a true up period of ninety (90) days after Closing (the “True Up Period”). All of Seller’s liabilities and obligations which can reasonably be paid and satisfied at or prior to the Closing Date shall be so paid. The Parties acknowledge that such liabilities and obligations which cannot be so paid prior to Closing Date or which have accrued but are then unpaid, including, but not limited to, liabilities for utility expenses, sales taxes, unemployment taxes, social security taxes, income tax withholding and any other federal, state, local and other applicable taxes and fees, all or any of which may not be payable prior to Closing, shall be paid and satisfied by Seller as promptly as such can be determined and are due and payable but under no circumstance should said payments be made more than ten (10) days after Seller receives notice of said payment becoming due and payable.

18

EXHIBIT 10.22

DEFAULT

11.1Seller’s Default. If, at or any time prior to Closing, Seller fails to perform its covenants or obligations under this Agreement in any material respect, which breach or default is not caused by a Purchaser Default and such failure remains uncured (a “Seller Default”), then Purchaser, as its sole and exclusive remedies for such Seller Default, may elect to (a) terminate this Agreement, in which case the Earnest Money shall be refunded to Purchaser in accordance with Section 3.2(d), and the Parties shall have no further rights or obligations under this Agreement, except those which expressly survive such termination or (b) proceed to Closing, in which case Purchaser shall be deemed to have waived such Seller Default; provided, however, that Purchaser shall not be deemed to have waived any Seller Default unless the Closing occurs or Purchaser provides Seller with written notice of such waiver prior to Closing.

11.2Purchaser’s Default. If at any time prior to Closing, Purchaser fails to perform any of its other covenants or obligations under this Agreement in any material respect, which breach or default is not caused by a Seller Default and such failure remains uncured (a “Purchaser Default”), then Seller, as its sole and exclusive remedies for such Purchaser Default, may elect to (a) terminate this Agreement by providing written notice to and Seller may retain the Earnest Money as full liquidated damages (and not as a penalty) for all loss, damage and other expenses suffered by Seller, it being agreed that Seller’s damages are impossible to ascertain and the sum specified as liquidated damages is a reasonable estimation of the probable loss which would be sustained by the Seller by reason of such default or breach, and is not a penalty or forfeiture or (b) proceed to Closing pursuant to this Agreement, in which case Seller shall be deemed to have waived such Purchaser Default; provided, however, that Seller shall not be deemed to have waived any Purchaser Default unless the Closing occurs or Seller provides Purchaser with written notice of such waiver prior to Closing.

RISK OF LOSS

12.1Casualty. If, at any time after the Effective Date and prior to Closing or earlier termination of this Agreement, the Property or any material portion thereof is damaged or destroyed by fire or any other casualty (a “Casualty”), Seller shall give written notice of such Casualty to Purchaser as promptly as practicable after the occurrence of such Casualty, but in any event prior to the Closing.

(a)Material Casualty. If the amount of the repair or restoration of the Property required by a Casualty equals or exceeds twenty percent (20%) of the Purchase Price (a “Material Casualty”), then Purchaser shall have the right to elect, by providing written notice to Seller within fifteen (15) Business Days after Purchaser’s receipt of Seller’s written notice of such Casualty, to (i) terminate this Agreement, in which case the Parties shall have no further rights or obligations under this Agreement, except those which expressly survive such termination, or (ii) proceed to Closing, in which case Seller shall provide Purchaser with a credit against the Purchase Price in an amount equal to the costs and expenses required to repair or restore the Property affected by the Material Casualty as agreed to by the Parties. If Purchaser (1) fails to provide written notice of its election to Seller within such time period, or (2) provides written notice of its election to proceed to Closing, but subsequently the Parties are unable to agree on the amount of the credit to be provided to Purchaser at Closing despite a good faith effort by Purchaser to so agree, Purchaser shall be deemed to have elected to terminate this Agreement pursuant to clause (i) of the preceding sentence. If the Closing is scheduled to occur prior to the expiration of Purchaser’s election period, then the Closing shall be postponed until the date which is five (5) Business Days after the earlier of Purchaser’s delivery of its election notice to Seller or the expiration of Purchaser’s election period.

(b)Non-Material Casualty. In the event of any Casualty other than a Material Casualty, then Purchaser shall not have the right to terminate this Agreement, but shall proceed to Closing, in which case Seller shall (A) provide Purchaser with a credit against the Purchase Price in an amount equal to the applicable insurance deductible, and (B) assign and transfer to Purchaser all of Seller’s right, title and interest in and to all proceeds from all casualty and lost profits insurance policies maintained by Seller with respect to such Casualty by delivering an assignment instrument to Purchaser at

19

EXHIBIT 10.22

Closing in form and substance reasonably satisfactory to Purchaser.

12.2Condemnation. If, at any time after the Effective Date and prior to Closing or the earlier termination of this Agreement, any Governmental Authority commences any condemnation proceeding or other proceeding in eminent domain with respect to all or any material portion of the Real Property (a “Condemnation”), Seller shall give written notice of such Condemnation to Purchaser promptly after Seller receives notice of such Condemnation.

(a)Material Condemnation. If the Condemnation would (i) result in the loss of more than twenty percent (20%) of the fair market value of the Land or Improvements (which shall be deemed to be equal to the Purchase Price), (ii) result in any material restriction in access to the Land or Improvements, or (iii) have a materially adverse effect on the operation of the Hotel or the Business as conducted prior to such Condemnation (a “Material Condemnation”), then Purchaser shall have the right to elect, by providing written notice to Seller within fifteen (15) Business Days after Purchaser’s receipt of Seller’s written notice of such Condemnation, to (A) terminate this Agreement, in which case the Parties shall have no further rights or obligations under this Agreement, except those which expressly survive such termination, or (B) proceed to Closing, without terminating this Agreement, in which case Seller shall assign to Purchaser all of Seller’s right, title and interest in all proceeds and awards from such Condemnation by delivering an assignment instrument to Purchaser at Closing in form and substance reasonably satisfactory to Purchaser. If Purchaser fails to provide written notice of its election to Seller within such time period, then Purchaser shall be deemed to have elected to terminate this Agreement pursuant to clause (A) of the preceding sentence. If the Closing is scheduled to occur within Purchaser’s fifteen (15) Business Day election period, then the Closing shall be postponed until the date which is five (5) Business Days after the Purchaser’s delivery of its election notice to Seller.

(b)Non-Material Condemnation. In the event of any Condemnation other than a Material Condemnation, Purchaser shall not have the right to terminate this Agreement, but shall proceed to Closing, in which case Seller shall assign to Purchaser all of Seller’s right, title and interest in all proceeds and awards from such Condemnation by delivering an assignment instrument to Purchaser at Closing in form and substance reasonably satisfactory to Purchaser.

ARTICLE XIII

SURVIVAL AND INDEMNIFICATION

13.1Survival.

(a)Survival of Representations and Warranties. The representations and warranties of Seller shall survive the Closing or termination of this Agreement for three (3) months (the period any such representation or warranty survives the Closing or termination of this Agreement (as the case may be) is referred to herein as the “Survival Period”). No claim for a breach of any representation or warranty shall be actionable or payable if the breach in question results from or is based on a condition, state of facts or other matter which was known to the other party prior to Closing.

(b)Survival of Covenants and Obligations. If this Agreement is terminated, only those covenants and obligations to be performed by the Parties under this Agreement which expressly survive the termination of this Agreement shall survive such termination. If the Closing occurs, only those covenants and obligations to be performed by the Parties under this Agreement which expressly survive the Closing shall survive the Closing.

(c)Survival of Indemnification. This Article XIII and all other rights and obligations of defense and indemnification as expressly set forth in this Agreement shall survive the Closing or termination of this Agreement.

13.2Indemnification by Seller. Seller shall indemnify and hold harmless the Purchaser Indemnitees from and against any Indemnification Loss incurred by any Purchaser Indemnitee to the extent resulting from (i) the breach of any express representations or warranties of Seller in this Agreement which expressly survives the Closing or termination of this Agreement (as the case may be) and (ii) the breach by Seller of any of its covenants or obligations under this Agreement which expressly survives the Closing or termination of this Agreement (as the case may be).

13.3Indemnification by Purchaser. Purchaser shall indemnify and hold harmless the Seller Indemnitees from and against any Indemnification

20

EXHIBIT 10.22

Loss incurred by any Seller Indemnitee the extent resulting from (i) any breach of any representations or warranties of Purchaser in this Agreement which expressly survives the Closing or termination of this Agreement (as the case may be) and (ii) any breach by Purchaser of any of its covenants or obligations under this Agreement which expressly survives the Closing or termination of this Agreement (as the case may be).

MISCELLANEOUS PROVISIONS

14.1Notices.

(a)Method of Delivery. All notices, requests, demands and other communications required to be provided by any Party under this Agreement (each, a “Notice”) shall be in writing and delivered, at the sending Party’s cost and expense, by (i) personal delivery, (ii) certified U.S. mail, with postage prepaid and return receipt requested, (iii) overnight courier service, (iv) facsimile transmission or (v) electronic mail, with a verification copy sent within three (3) Business Days by any of the methods set forth in clauses (i), (ii) or (iii), to the recipient Party at the following address:

If to Seller:

Louisville Hotel Associates, LLC

c/o Sotherly Hotels Inc.

306 South Henry Street, Suite 100

Williamsburg, Virginia 23185

Attention: Scott M. Kucinski

Email: scottkucinski@sotherlyhotels.com

With Copy to:

Frost Brown Todd LLC

400 West Market Street, Suite 3200

Louisville, Kentucky 40202

Attention: Geoffrey White

Facsimile No.: 502-581-1087

Email: gwhite@fbtlaw.com

If to Purchaser:

Riverside Hotel LLC

60 Service Lane

Ringgold, GA 30736

Attention: Mehul Patel

Email: mehul@phmigroup.com

With Copy to:

KPPB Law

990 Hammond Drive NE, Suite 800

Atlanta, GA 30328

Attention: Asad Ansari, Esq.

Email: aansari@kppblaw.com

(b)Receipt of Notices. All Notices sent by a Party (or its counsel pursuant to Section 14.1(d)) under this Agreement shall be deemed to have been received by the Party to whom such Notice is sent upon (i) delivery to the address, facsimile number or electronic mail address of the recipient Party, provided that such delivery is made prior to 5:00 p.m. (local time for the recipient Party) on a Business Day, otherwise the following Business Day, or (ii) the attempted delivery of such Notice if (A) such recipient Party refuses delivery of such Notice, or (B) such recipient Party is no longer at such address, facsimile number or electronic mail address, and such recipient Party failed to provide the sending Party with its current address or facsimile number pursuant to Section 14.1(c).

(c)Change of Address. The Parties and their respective counsel shall have the right to change their respective address and/or facsimile number for the purposes of this Section 14.1 by providing a Notice of such change in address, facsimile number and/or electronic mail address as required under this Section 14.1.

(d)Delivery by Party’s Counsel. The Parties agree that the attorney for such Party shall have the authority to deliver Notices on such Party’s behalf to the other Party hereto.

14.2Time is of the Essence. Time is of the essence of this Agreement; provided, however, that notwithstanding anything to the contrary in this Agreement, if the time period for the performance of any covenant or obligation, satisfaction of any condition or delivery of any Notice or item required under this Agreement shall expire on a day other than a Business Day, such time period shall be extended automatically to the next Business Day.

EXHIBIT 10.22

14.3Assignment. Seller may not assign this Agreement or any interest therein to any Person,

21

without the prior written consent of Purchaser, which consent may be withheld in its sole discretion. Purchaser shall have the right to assign all of its right, title and interest in this Agreement to any entity that is an Affiliate of Purchaser upon five (5) Business Days’ notice to Seller but without prior consent of Seller.

14.4Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the Parties, and their respective successors and permitted assigns.

14.5Third Party Beneficiaries. This Agreement shall not confer any rights or remedies on any Person other than (i) the Parties and their respective successors and permitted assigns, and (ii) any Indemnitee to the extent such Indemnitee is expressly provided any right of defense or indemnification in this Agreement.

14.6Governing Law. This Agreement shall be governed by the laws of the State of Indiana, without giving effect to any principles regarding conflict of laws.

14.7Rules of Construction. The following rules shall apply to the construction and interpretation of this Agreement:

(a)Singular words shall connote the plural as well as the singular, and plural words shall connote the singular as well as the plural, and the masculine shall include the feminine and the neuter, as the context may require.

(b)All references in this Agreement to particular articles, sections, subsections or clauses (whether in upper or lower case) are references to articles, sections, subsections or clauses of this Agreement, unless otherwise expressly stated or clearly apparent from the context of such reference. All references in this Agreement to particular exhibits or schedules (whether in upper or lower case) are references to the exhibits and schedules attached to this Agreement, unless otherwise expressly stated or clearly apparent from the context of such reference.

(c)The headings in this Agreement are solely for convenience of reference and shall not constitute a part of this Agreement nor shall they affect its meaning, construction or effect.

(d)Each Party and its counsel have reviewed and revised (or requested revisions of) this Agreement and have participated in the preparation of this Agreement, and therefore any rules of construction requiring that ambiguities are to be resolved against the Party which drafted the Agreement or any exhibits hereto shall not be applicable in the construction and interpretation of this Agreement or any exhibits hereto.

(e)The terms “hereby,” “hereof,” “hereto,” “herein,” “hereunder” and any similar terms shall refer to this Agreement, and not solely to the provision in which such term is used.

(f)The terms “include,” “including” and similar terms shall be construed as if followed by the phrase “without limitation.”

(g)The term “sole discretion” with respect to any determination to be made a Party under this Agreement shall mean the sole and absolute discretion of such Party, without regard to any standard of reasonableness or other standard by which the determination of such Party might be challenged.

14.8Severability. If any term or provision of this Agreement is held to be or rendered invalid or unenforceable at any time in any jurisdiction, such term or provision shall not affect the validity or enforceability of any other terms or provisions of this Agreement, or the validity or enforceability of such affected term or provision at any other time or in any other jurisdiction.

14.9Jurisdiction and Venue. ANY LITIGATION OR OTHER COURT PROCEEDING WITH RESPECT TO ANY MATTER ARISING FROM OR IN CONNECTION WITH THIS AGREEMENT SHALL BE CONDUCTED IN THE COURTS IN THE COUNTY AND STATE THE PROPERTY IS LOCATED AND SELLER (FOR ITSELF AND ALL SELLER INDEMNITEES) AND PURCHASER (FOR ITSELF AND ALL PURCHASER INDEMNITEES) HEREBY SUBMIT TO JURISDICTION AND CONSENT TO VENUE IN SUCH COURTS, AND WAIVE ANY DEFENSE BASED ON FORUM NON CONVENIENS.

14.10SERVICE OF pROCESS; Waiver of Trial by Jury. THE PARTIES AGREE THAT, TO THE EXTENT PERMITTED UNDER APPLICABLE LAW, SERVICE OF PROCESS SHALL BE EFFECTIVE AS TO A PARTY IF DELIVERY OF ANY COURT DOCUMENTS TO SUCH PARTY IS EFFECTED IN ACCORDANCE WITH SECTION 14.1.

Each Party hereby waives its right to a trial by jury in any litigation or other court proceeding with respect to any matter arising from or in connection with this Agreement.

14.11Incorporation of Recitals, Exhibits and Schedules. The recitals to this Agreement, and all exhibits and schedules referred to in this Agreement

22

are incorporated herein by such reference and made a part of this Agreement, and the Parties represent, warrant, acknowledge and agree that each of the recitals is true, correct and accurate in all respects.

14.12Entire Agreement. This Agreement sets forth the entire understanding and agreement of the Parties hereto, and shall supersede any other agreements and understandings (written or oral) between the Parties on or prior to the Effective Date with respect to the transaction described in this Agreement.

14.13Amendments, Waivers and Termination of Agreement. No amendment or modification to any terms or provisions of this Agreement, waiver of any covenant, obligation, breach or default under this Agreement or termination of this Agreement (other than as expressly provided in this Agreement), shall be valid unless in writing and executed and delivered by each of the Parties.

14.14Execution of Agreement. A Party may deliver executed signature pages to this Agreement by facsimile or electronic transmission to any other Party, which facsimile or electronic copy shall be deemed to be an original executed signature page. This Agreement may be executed in any number of counterparts, each of which shall be deemed an original and all of which counterparts together shall constitute one agreement with the same effect as if the Parties had signed the same signature page.

14.151031 or 1033 Exchange. In the event that Seller wishes to enter into a tax deferred exchange for the Property described herein, Purchaser agrees to cooperate with Seller in connection with such exchange, including the execution of such documents as may be reasonably necessary to effectuate the same. Provided that: (a) Purchaser shall not be obligated to unreasonably delay the Closing, (b) all additional costs in connection with the exchange shall be borne by Seller, and (c) Purchaser shall not be obligated to execute any note, contract, deed, or other document providing for any personal liability which would survive the exchange, nor shall Purchaser be obligated to take title to any property other than the Property described in this Agreement. Purchaser shall be indemnified and held harmless against any liability which arises or is claimed to have arisen on account of the acquisition of the exchange property.

14.16Master Lease. Notwithstanding anything to the contrary in this Agreement, the Parties acknowledge and agree that the Property is subject to a master lease (the “Master Lease”) between Seller, as landlord, and MHI Louisville TRS, LLC (“Master Tenant”), which is an Affiliate of Seller. Seller will cause Master Tenant to do any and all things necessary for performance of Seller’s obligations under this Agreement and consummation of the transactions contemplated hereby. Any and all revenue that is paid to Master Tenant shall be deemed property of the Seller under this Agreement and shall be transferred in accordance with the terms of this Agreement. Any interest which Master Tenant has in the Property (separate and apart from its leasehold estate) shall be conveyed to Purchaser at Closing. Although the Master Lease constitutes a Lease under this Agreement, it is not being transferred under this Agreement and shall constitute Excluded Property. Seller shall terminate the Master Lease as of Closing by an instrument in recordable form.

[Signatures on following pages]

23

EXHIBIT 10.22

IN WITNESS WHEREOF, each Party has caused this Agreement to be executed and delivered in its name by a duly authorized officer or representative.

SELLER:

LOUISVILLE HOTEL ASSOCIATES, LLC,

a Delaware limited liability company

By: /s/ David R. Folsom

Name: David R. Folsom

Title: Authorized Signatory

PURCHASER:

RIVERSIDE HOTEL, LLC,

an Indiana limited liability company

By: /s/ Mehul Patel

Name: Mehul Patel

Title: Manager

Master Tenant agrees to do all things necessary to enable Seller to perform its obligations under Section 14.16 of this Agreement.

MASTER TENANT:

MHI LOUISVILLE TRS, LLC, a Delaware limited liability company

| By: | MHI Hospitality TRS, LLC, a Delaware limited liability company, Its Sole Member |

| By: | MHI Hospitality TRS Holding, Inc., a Maryland corporation, Its Sole Member |

Name: David R. Folsom

Title: Authorized Signatory

[Louisville Hotel Associates – Louisville Sheraton PSA (2.0)]

EXHIBIT 10.22

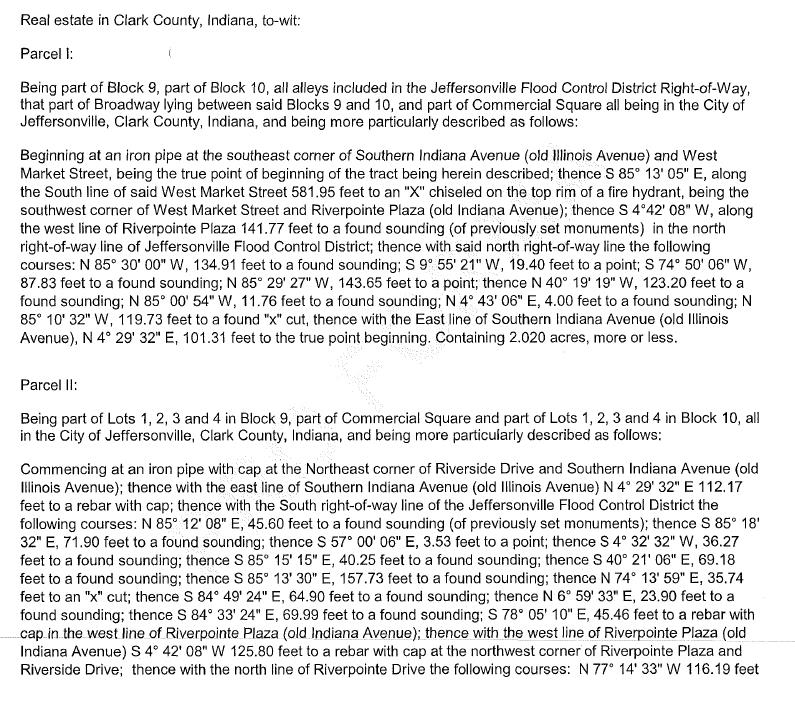

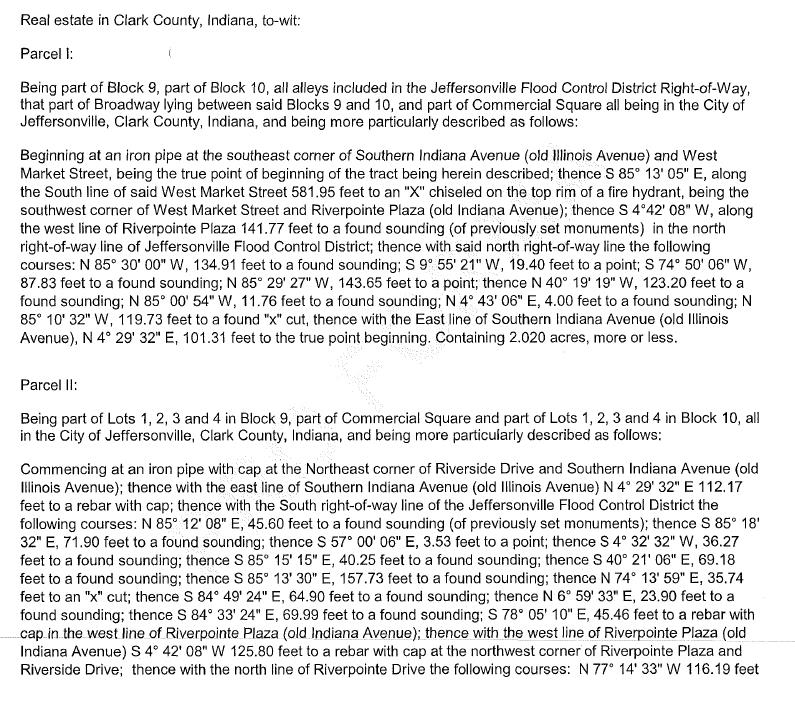

Schedule 2.1(a)

DESCRIPTION OF LAND

i

EXHIBIT 10.22

Schedule 2.1(h)

EQUIPMENT LEASES

| 1. | That certain Phase II Dishmachine Rental Agreement (Agreement Code LSA-000119141) by and between Ecolab Inc. and Bridge and Barrel executed approximately April 2, 2018; |

| 2. | That certain Phase II Dishmachine Rental Agreement (Agreement Code LSA-000120506) by and between Ecolab Inc. and Bridge & Barrel executed approximately April 11, 2018; |

| 3. | That certain Standard DM Rental Program Dishmachine Rental Agreement (Agreement Code: LSA-000191605) by and between Ecolab Inc. and Sheraton Riverside executed approximately September 3, 2019; |

| 4. | The certain Premier Advantage Agreement by and between Konica Minolta Business Solutions U.S.A. and MHI Hospitality TRS, LLC executed approximately May 8, 2017; |

| 5. | That certain Maintenance Agreement by and between Konica Minolta Business Solutions U.S.A. and MHI Hospitality TRS, LLC for Account # 0001199139; and |

| 6. | That certain Rental Agreement (Proposal 119175) by and between PHSI Pure Water Finance and MHI Hospitality TRS, LLC executed as of July 2, 2010. |

ii

Schedule 2.1(i)

OPERATING AGREEMENTS

| 1. | That certain Outdoor Lighting Service Agreement (Agreement Number CLRILCLM0000016211) dated as of December 9, 2019 and executed as of December 10, 2019 by and between Duke Energy Indiana and MHI Hospitality LLC; |

| 2. | That certain Service Agreement dated February 28, 2020 by and between Westrock Recycling and Sheraton Hotel; |

| 3. | That certain Master Professional Services Agreement dated as of April 29, 2015 by and between Elavon, Inc. and Sheraton Louisville Riverside; |

| 4. | That certain Master Services Agreement (Contract # 6855571) by and between TravelClick, Inc and Sheraton Louisville Riverside Hotel dated approximately September 23, 2019; |

| 5. | The certain Sheraton Louisville Riverside Hotel Bronze Fire Service Agreement (Proposal #: 5704200) delivered on March 19, 2021 from Siemens Industry, Inc. to MHI HOSPITALITY TRS LLC; and |

| 6. | That certain Full Maintenance Elevator Contract dated as of January 26, 2018 by and between Sheraton Louisville Riverside Hotel and The Murphy Elevator Company, Inc. |

iii

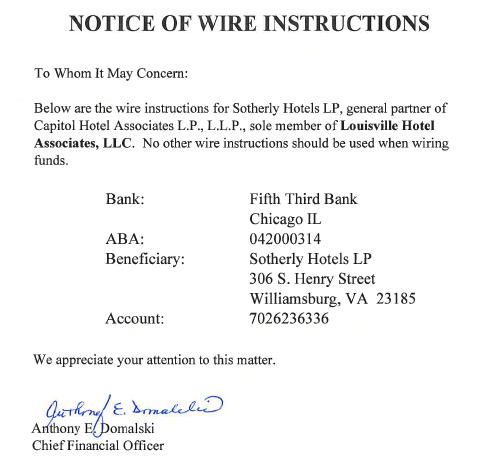

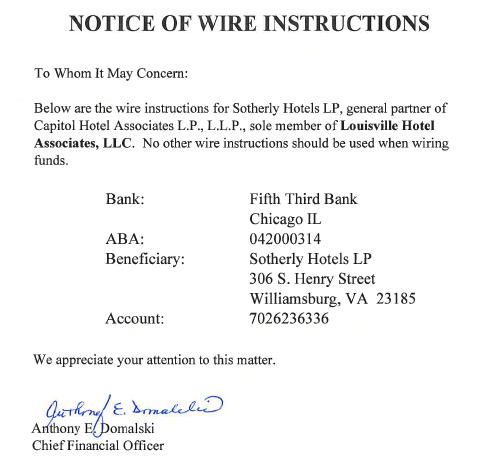

Schedule 3.2(c)

[Seller’s wire instructions]

iv

EXHIBIT 10.22

Schedule 4.1(c)

Seller’s Due Diligence Materials

| 1. | Updated STR and P&L (Oct 2021); |

| 2. | Current Insurance Copy; |

| 3. | Insurance Loss Runs for last 5 Years; |

| 4. | Marriot QA Reports – Last 3 years; |

| 5. | Current Payroll Register; Employee Roster; |

| 6. | Payroll Reports for 2021 all months / Quarters; and |

| 7. | 2022 Budget if available. |

v

Schedule 4.2

[Reserved]

vi

Schedule 4.3

Mortgage Loan Documents

(each dated as of November 3, 2016 unless otherwise noted)

| 1. | Mortgage, Assignment of Rents, Security and Fixture Filing executed by Seller and Master Tenant. |

| 2. | Real Estate Note (with Interest Rate Adjustment) executed by Seller. |

| 3. | Partial Recourse Guaranty executed by Sotherly Hotels LP, a Delaware limited partnership (“Existing Guarantor”). |

| 4. | Environmental Agreement and Indemnity executed by Seller and Existing Guarantor. |

| 5. | Subordination Agreement executed by Seller, the Tenant party thereto, and Lender applicable to operating lease or similar structure. |

| 6. | Subordination of Management Agreement and Consent and Subordination of Manager executed by Seller, Master Tenant, Manager, and Lender. |

0110570.0725634 4886-2353-7157v6