UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[ X ] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended May 31, 2012

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________to _____________

OR

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

COMMISSION FILE No.00051303

Grandview Gold Inc.

(Exact name of Registrant as specified in its charter)

GRANDVIEW GOLD INC.

(Translation of Registrant's name into English)

Province of Ontario, Canada

(Jurisdiction of incorporation or organization)

330 Bay Street, Suite 820, Toronto, Ontario, M5H 2S8, Canada

(Address of principal executive offices)

Paul Sarjeant, T: +1 416 486 3444, F: +1 416 486 9577, 330 Bay Street, Suite 820, Toronto, Ontario, M5H 2S8, Canada

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:None

Securities registered or to be registered pursuant to Section 12(g) of the Act:common shares

- i -

(Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

__________________________________None__________________________________

(Title of Class)

Number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: 81,163,032.

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [ X ]

If this report is an annual or transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes [ ] No [ X ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [ X ] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [ X ] |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP [ ] | International Financial Reporting Standards as issued by the International AccountingStandards Board [ X ] | Other [ ] |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 [ ] Item 18 [ ]

If this is an annual report indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [ X ]

- ii -

TABLE OF CONTENTS

| FORM 20-F | I |

| TABLE OF CONTENTS | III |

| GLOSSARY | V |

| PART I | | 1 |

| | | |

| ITEM 1: | Identity of Directors, Senior Management and Advisors | 1 |

| ITEM 2: | Offer Statistics and Expected Timetable | 1 |

| ITEM 3: | Key Information | 1 |

| | A. Selected Financial Data | 1 |

| | B.Capitalization and Indebtedness | 2 |

| | C. Reasons For The Offer and Use Of Proceeds | 2 |

| | D.Risk Factors | 2 |

| ITEM 4: | Information on the Company | 11 |

| | A.Unresolved Staff Comments | 11 |

| | B. History and Development of the Company | 11 |

| | C.Business Overview | 13 |

| | D. Organizational Structure | 16 |

| | E. Property, Plants and Equipment | 16 |

| ITEM 5: | Operating and Financial Review and Prospects | 30 |

| | A.Operating Results | 36 |

| | B. Liquidity and Capital Resources | 45 |

| | C.Research and Development, Patents and Licenses, Etc. | 46 |

| | D.Trend Information | 46 |

| | E. Off-Balance Sheet Arrangements | 46 |

| | F. Tabular Disclosure of Contractual Obligations | 46 |

| ITEM 6: | Directors, Senior Management, and Employees | 47 |

| | A.Directors and Senior Management | 47 |

| | B.Board Practices | 52 |

| | C.Employees | 53 |

| | D.Share Ownership | 53 |

| ITEM 7: | Major Shareholders and Related Party Transactions | 54 |

| | A.Major Shareholders | 54 |

| | B. Related Party Transactions | 55 |

| | C.Interests of Experts and Counsel | 55 |

| ITEM 8: | Financial Information | 56 |

| | A.Consolidated Statements and Other Financial Information | 56 |

| | B. Significant Changes | 56 |

| ITEM 9: | The Offering and Listing. | 56 |

| | A.Offer and Listing Details | 56 |

- iii -

| | B.Plan of Distribution | 58 |

| | C. Markets | 58 |

| | D.Selling Shareholders | 58 |

| | E. Dilution | 59 |

| | F. Expenses of the Issue | 59 |

| ITEM10: | Additional Information | 59 |

| | A.Share Capital | 59 |

| | B. Memorandum and Articles of Association | 59 |

| | C.Material Contracts | 59 |

| | D.Exchange Controls | 60 |

| | E. Taxation | 62 |

| | F. Dividends and Paying Agents | 68 |

| | G.Statements by Experts | 68 |

| | H.Documents on Display | 68 |

| | I. Subsidiary Information | 69 |

| ITEM11: | Quantitative and Qualitative Disclosures about Market Risk | 69 |

| ITEM12: | Description of Securities other than Equity Securities | 69 |

| | | |

| PARTII | | 70 |

| | | |

| ITEM13: | Defaults, Dividend Arrearages and Delinquencies | 70 |

| ITEM14: | Material Modifications to the Rights of Security Holders and Use of Proceeds | 70 |

| ITEM15: | Controls and Procedures | 70 |

| ITEM16: | Reserved | 71 |

| | A. Audit Committee Financial Expert | 71 |

| | B. Code of Ethics | 71 |

| | C. Principal Accountant Fees and Services | 71 |

| D. Exemptions From the Listing Standards for Audit Committees | 72 |

| E. Purchases of Equity Services by the Issuer and Affiliated Purchasers | 72 |

| PARTIII | | 73 |

| | | |

| ITEM18: | Financial Statements | 73 |

| A. Audited Annual Financial Statements, May 31, 2012 prepared in accordance with IFRS as issued by the IASB | 74 |

| ITEM19: | Exhibits | 104 |

| SIGNATURES | 106 |

- iv -

GLOSSARY

Following is a glossary of terms used throughout this Annual Report.

| Assay | a precise and accurate analysis of the metal contents in an ore or rock sam |

| cut-off grade | deemed grade of mineralization, established by reference to economic factors, above which material is considered ore and below which is considered waste. |

| development stage | includes all companies engaged in the preparation of an established commercially mineable deposit (reserves) for its extraction which are not in the production stage. |

| dilution | the contamination of ore with barren wall rock; this means that in extracting ore, rock is also extracted, which contains a lesser amount of the mineral than the ore, effectively reducing the grade of the ore. |

| exploration stage | All companies engaged in the search for mineral deposits (reserves) which are not in either the development or production stage. |

| feasibility study | a detailed report assessing the feasibility, economics and engineering of placing a mineral deposit into commercial production. |

| gold deposit | means a mineral deposit mineralized with gold. |

| Inferred mineral resource | that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings, and drill holes. |

| lode mining | mining of gold bearing rocks, typically in the form of veins or stockworks |

| mineral resource | a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such grade or quality that it has reasonable prospects of economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. |

| ore | a naturally occurring rock or material from which minerals, such as gold, can be extracted at a profit; a determination of whether a mineral deposit contains ore is often made by a feasibility study. |

| ounce or oz. | a troy ounce or 20 pennyweights or 480 grains or 31.103 grams |

| patented mining claim | a claim to which a patent has been obtained from the government by compliance with laws relating to such claims. |

- v -

| prospect | an area prospective for economic minerals based on geological, geophysical, geochemical and other criteria |

| Probable (indicated) reserves | Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measure) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. |

| proven (measured) reserves | Reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. |

| reserve | that part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination. Reserves are customarily stated in terms of "ore" when dealing with metalliferous minerals such as gold or silver |

| reverse circulation drill | a large machine that produces a continuous chip sample of the rock or material being drilled |

| shaft | a vertical or inclined tunnel in an underground mine driven downward from surface |

| Ton | short ton (2,000 pounds). |

| tonne | metric tonne (2,204.6 pounds). |

| trenching | The surface excavation of a linear trench to expose mineralization for sampling |

| unpatented mining claim | mining claims to which a deed from the United States government has not been received, and which are subject to annual assessment work in order to maintain ownership. |

For ease of reference, the following conversion factors are provided:

| 1mile (mi) | = 1.609 kilometres | | 2,204 pounds (lbs) | = 1 tonne |

| 1yard (yd) | = 0.9144 meter (m) | | 2,000 pounds/1 short ton | = 0.907 tonne |

| 1acre | = 0.405 hectare (ha) | | 1 troy ounce | = 31.103 grams |

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING RESOURCE AND RESERVE ESTIMATES – MINING PROPERTIES

This Annual Report on Form 20-F has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in United States Securities and Exchange Commission (“SEC”) Industry Guide 7 under the United States Securities Act of 1993, as amended (the “Securities Act”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this Annual Report on Form 20-F and the documents incorporated by reference herein may contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F and the exhibits attached hereto contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements concern our anticipated results and developments in our operations in future periods, planned exploration and development of its properties, plans related to its business and other matters that may occur in the future. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Statements concerning reserves and mineral resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the property is developed, and in the case of mineral reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” (or the negative and grammatical variations of any of these terms and similar expressions) be taken, occur or be achieved,) are not statements of historical fact and may be forward-looking statements. Such statements are included, among other places in this Annual Report on Form 20-F, in the sections entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations”, "Description of Business" and "Description of Property." Forward-looking statements are subject to a variety of known and unknown risks and should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether or not such results will be achieved. Uncertainties and other factors which could cause actual events or results to differ from those expressed or implied by the forward-looking statements, including, without limitation:

• risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits;

• results of initial feasibility, pre-feasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations;

• mining exploration risks, including risks related to accidents, equipment breakdowns or other unanticipated difficulties with or interruptions in production;

• the potential for delays in exploration activities or the completion of feasibility studies;

• risks related to the inherent uncertainty of exploration and cost estimates and the potential for unexpected costs and expenses;

• risks related to commodity price fluctuations;

• the uncertainty of profitability based upon the Company's history of losses;

• risks related to failure of the Company to obtain adequate financing on a timely basis and on acceptable terms;

• risks related to environmental regulation, permitting and liability;

• political and regulatory risks associated with mining and exploration;

• other risks and uncertainties related to the Company's prospects, properties and business strategy.

This list is not exhaustive of the factors that may affect our forward-looking statements. Some of the important risks and uncertainties that could affect forward-looking statements are described further in the sections entitled “Risk Factors”, “Information on the Company” and “Operating and Financial Review and Prospects” and in the exhibits attached to this Annual Report on Form 20-F. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking statements. Although the forward-looking information contained in this Annual Report is based upon what the Company’s management believes to be reasonable assumptions, the Company cannot assure investors that actual results will be consistent with such information. Forward-looking information reflects management’s current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this Annual Report. The Company does not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions change, except as required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

- vi -

PART I

ITEM1: Identity of Directors, Senior Management and Advisors

Not Applicable.

ITEM2:Offer Statistics and Expected Timetable

Not Applicable.

ITEM3:Key Information

Unless expressed otherwise, all dollar amounts in this Annual Report are expressed in Canadian dollars.

Since June 1, 1970, the Government of Canada adopted a floating exchange rate to determine the value of the Canadian dollar as compared to the US dollar. On August 27, 2012, the exchange rate in effect for Canadian dollars exchanged for US dollars, expressed in terms of Canadian dollars was $0.9892. This exchange rate is based on the noon buying rates of the Bank of Canada, as obtained from the website www.bankofcanada.ca.

For the past five fiscal years ended May 31, 2012, and for the six month period between March 31, 2012 and August 24, 2012 the following exchange rates were in effect for Canadian dollars exchanged for US dollars, calculated in the same manner as above:

| Period | | Average | | | | |

| Year ended May 31, 2008 | $ | 1.0142 | | | | |

| Year ended May 31, 2009 | $ | 1.1575 | | | | |

| Year ended May 31, 2010 | $ | 1.0629 | | | | |

| Year ended May 31, 2011 | $ | 1.0065 | | | | |

| Year ended May 31, 2012 | $ | 0.9994 | | | | |

| Period | | Low | | | High | |

| Month ended March 31, 2012 | $ | 0.9849 | | | 1.0015 | |

| Month ended April 30, 2012 | $ | 0.9807 | | | 1.0039 | |

| Month ended May 31, 2012 | $ | 0.9839 | | | 1.0349 | |

| Month ended June 30, 2012 | $ | 1.0178 | | | 1.0418 | |

| Month ended July 31, 2012 | $ | 1.0014 | | | 1.0214 | |

| Period ended August 27, 2012 | $ | 0.9864 | | | 1.0062 | |

A. Selected Financial Data

Following is selected financial data of the Company, expressed in Canadian dollars, for the fiscal years ended May 31, 2012 (“2012”) and May 31, 2011 (“2011”), derived from the consolidated annual financial statements of the Company, prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). The consolidated financial statements for the year ended May 31, 2012 and its comparative periods were prepared in accordance with IFRS as issued by the IASB. Subject to certain transition elections disclosed in note 15 of these statements, the company has consistently applied the same accounting policies in its opening IFRS statement of financial position at June 1, 2010 and throughout all periods presented, as if these policies had always been in effect. Note 15 of these statements further discloses the impact of the transition to IFRS on the company's reported financial position, financial performance and cash flows, including the nature and effect of significant changes in accounting policies from those used in the company’s consolidated financial statements for the year ended May 31, 2011.

1

The selected financial data should be read in conjunction with the consolidated financial statements and other financial information included elsewhere in the Annual Report.

The selected financial data below, derived from the consolidated annual financial statements of the Company, is presented in accordance with IFRS as issued by the IASB.

| | | Year | | | Year | |

| | | Ended May 31, | | | Ended May 31, | |

| (CAD$) | | 2012 | | | 2011 | |

IFRS | | | | | | |

Revenue | $ | Nil | | $ | Nil | |

Net Loss and Comprehensive Loss | $ | (248,817 | ) | $ | (408,907 | ) |

Loss Per Share – Basic and Diluted | $ | (0.00 | ) | $ | (0.01 | ) |

Dividends Per Share | $ | Nil | | $ | Nil | |

Period-end Shares | | 81,163,032 | | | 76,271,891 | |

Share Capital | $ | 16,533,842 | | $ | 16,533,842 | |

| | As at

May 31, 2012 | | | As at

May 31, 2011 | |

Cash and cash equivalents | $ | 137,752 | | $ | 1,177,679 | |

Short term investments | $ | 25,537 | | $ | 25,286 | |

Working Capital | $ | 168,570 | | $ | 1,155,078 | |

Mining Interests | $ | 5,225,781 | | $ | 4,568,757 | |

Long-term Debt | $ | Nil | | $ | Nil | |

Shareholders’ Equity | $ | 5,394,351 | | $ | 5,643,168 | |

Total Assets | $ | 5,501,613 | | $ | 5,865,572 | |

| | As at

June 1, 2010 | | | | |

Cash and cash equivalents | $ | 1,432,824 | | | | |

Short term investments | $ | 25,037 | | | | |

Working Capital | $ | 1,407,869 | | | | |

Mining Interests | $ | 4,149,771 | | | | |

Long-term Debt | $ | Nil | | | | |

Shareholders’ Equity | $ | 5,557,640 | | | | |

Total Assets | $ | 5,660,623 | | | | |

B. Capitalization and Indebtedness

Not Applicable.

C. Reasons For The Offer and Use Of Proceeds

Not Applicable.

D. Risk Factors

An investment in our common shares (the “Shares”) is highly speculative and subject to a number of known and unknown risks. Only those persons who can bear the risk of the entire loss of their investment should purchase our securities. An investor should carefully consider the risks described below and the other information that we file with the SEC and with Canadian securities regulators before investing in our common shares. The risks described below are not the only ones faced. Additional risks that we are not currently aware of or that we currently believe are immaterial may become important factors that affect our business. If any of these risks occur, operating results and financial conditions could be seriously harmed, the market price of our common shares could decline and the investor may lose all of their investment. The risk factors set forth below and elsewhere in this Annual Report, and the risks discussed in our other filings with the SEC and Canadian securities regulators may have a significant impact on our business, operating results and financial condition and could cause actual results to differ materially from those projected in any forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements”.

In addition to other information in this Annual Report, you should carefully consider the following risk factors in evaluating our business.

2

We Have No Ongoing Mining Operations, None of our Mineral Properties Contain a Known Commercially Mineable Mineral Deposit, We Have Never Received Any Revenues From Mining Operations, and Our Chances of Reaching the Development Stage on Any of our Properties is Remote.Since our inception, we have never engaged in any mining operations and the Company has not generated any revenues from mining operations. Our activities have been limited to the highly speculative business of acquiring and exploring properties in the hope that commercial quantities of gold will be discovered. At the present time, none of our properties contain a known commercially mineable mineral deposit. We believe that the probability of our reaching the development stage on any of our properties is remote for a number of reasons. The exploration for and development of mineral deposits involves significant risks, which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties, which are explored, are ultimately developed into producing mines. Major expenses may be required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. Whether a mineral deposit will be commercially viable depends on a number of factors, including, but not limited to the following: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. Because exploration properties rarely become producing mines, investors must be prepared for the possibility that we will be unsuccessful and that they could lose their entire investment.

In the remote possibility that we place any of our properties into production, of which there can be no assurance, we would face numerous risks associated with mining operations. These risks include adverse environmental conditions, industrial accidents, labor disputes, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods and earthquakes, and the inability to maintain the infrastructure for our production activities. Mining and mining exploration is risky, presenting potentially dangerous conditions for workers. Large, heavy equipment and machinery is used and toxic substances are utilized and encountered in exploration, extraction, and processing. Misuse and accidents could result in serious injury and death to personnel. Such events could be caused by numerous factors including faulty equipment, unsafe practices, explosions, fires, natural phenomenon (such as lightening, mudslides, cave-ins, etc.), which may be impossible to avoid and protect against. In the event of any such misuse, accidents or natural disasters, personnel could be injured and killed, and mining operations suspended or terminated. In addition, any future development activities, of which there can be no assurance, would depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important factors, which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could make it very difficult, if not impossible, to engage in any development activities and force us to incur expenses that we had not planned on spending.

Calculations of Mineral Reserves and of Mineralized Material are Estimates Only, Subject to Uncertainty Due to Factors Including Metal Prices, Inherent Variability of the Ore, and Recoverability of Metal in the Mining Process.There is a degree of uncertainty attributable to the calculation of reserves and corresponding grades dedicated to future production. Until mineral reserves are actually mined and processed, the quantity of ore and grades must be considered as an estimate only. In addition, the quantity of mineral reserves and ore may vary depending on metal prices. Estimates of mineral resources under Canadian guidelines are subject to uncertainty as well. The estimating of mineral reserves and mineral resources under Canadian guidelines is a subjective process and the accuracy of such estimates is a function of the quantity and quality of available data and the assumptions used and judgments made in interpreting engineering and geological information. There is significant uncertainty in any reserve or estimate of mineral resources under Canadian guidelines, and the actual deposits encountered and the economic viability of mining a deposit may differ materially from our estimates. Estimated mineral reserves or mineral resources under Canadian guidelines may have to be recalculated based on changes in metal prices, further exploration or development activity or actual production experience. This could materially and adversely affect estimates of the volume or grade of mineralization, estimated recovery rates or other important factors that influence estimates of mineral reserves or mineral resources under Canadian guidelines. Any material change in the quantity of mineral reserves, mineralization, grade or stripping ratio may affect the economic viability of our properties. In addition, there can be no assurance that metal recoveries in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

Because We Have No Revenue Producing Operations, We are Dependent Upon Our Ability to Raise Funds In Order to Continue Our Exploration Activities.Since inception, the Company has not generated any revenues from mining operations. As of May 31, 2012, the Company had an accumulated deficit of approximately $21.6 million. With limited cash resources, it will be necessary in the near and over the long term to raise substantial funds from external sources to maintain our interests in our various properties in the United States, Canada and Peru, to acquire, explore, and if warranted, develop other mineral properties, participate in other projects and provide sufficient cash to fund operations. In order to meet future expenditures and cover administrative and exploration costs beyond May 31, 2013, the Company will need to raise additional financing. There is no assurance that we will be able to raise the funds on acceptable terms, or at all. The uncertainties related to raising additional financing cast substantial doubt upon the Company’s ability to continue as a going concern. If we do not raise these funds, we would be unable to pursue our planned business operations and investors could lose their investment. If we are able to raise these funds, it is likely that investors will experience dilution of their interests, which could result in a decrease in the value of their Shares.

3

Title to Our Mining Properties Has Not Been Verified so Such Properties may be Subject to Prior Unregistered Liens, Agreements, Transfers or Claims, and may be Affected by Undetected Defects.

Although the title to the properties in which the Company holds interests were reviewed by or on behalf of us, and title opinions were delivered to us, no assurances can be given that there are no title defects affecting such properties. Our ability to ensure that we have obtained secure claim to individual mineral properties or mining concessions may be severely constrained. The Company has not conducted surveys of the claims in which it holds direct or indirect interests; therefore, the precise area and location of such claims may be in doubt. Accordingly, the properties may be subject to prior unregistered liens, agreements, transfers or claims, including native land claims, and title may be affected by, among other things, undetected defects. In addition, the Company may be unable to operate its properties as permitted or to enforce its rights with respect to its properties.

The Value of our Mineral Properties is Dependent Upon Commodity Prices Which Can Fluctuate Widely.The price of our Shares, our financial results and exploration, development and mining activities may in the future be significantly adversely affected by declines in the price of gold, copper, or other minerals.Gold and other mineral prices fluctuate widely and are affected by numerous factors beyond the Company’s control such as the sale or purchase of such commodities by various central banks and financial institutions, interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, and the political and economic conditions of major gold or other mineral-producing countries throughout the world. The prices of gold or other minerals have fluctuated widely in recent years, and future serious price declines could cause continued exploration of our properties to be impracticable. Depending on the price of gold or other minerals, in the remote possibility that any of our properties enter commercial production, cash flow from such mining operations may not be sufficient and the Company could be forced to discontinue production and may lose its interest in, or may be forced to sell, some of its properties. Future production from the Company’s mining properties is dependent on gold or other mineral prices that are adequate to make these properties economic.

In addition to adversely affecting the Company’s reserve estimates, its ability to obtain financing, and its financial condition, declining commodity prices can impact operations by requiring a reassessment of the feasibility, and operational requirements, of a particular project. Such a reassessment may be the result of a management decision or may be required under financing arrangements related to a particular project. Even if the project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays or may interrupt operations until the reassessment can be completed.

We Are Not Engaged in Mining Operations; In the Event We Engage in Mining Operations in the Future, We Would Face Substantial Regulation Which Would be Very Costly to Comply With.We are not engaged in any mining operations at the present time and there can be no assurance we will ever engage in any mining operations in the future. All of our current activities are exploratory in nature. If our exploration activities uncover a commercially mineable mineral deposit, of which there can be no assurance, we plan to take the necessary steps to commence mining operations. Mining operations in the Canada and Peru are subject to federal, provincial, state and local laws relating to the protection of the environment, including laws regulating the removal of natural resources from the ground and the discharge of materials into the environment. Mining operations are also subject to federal, provincial and local laws, which seek to maintain health and safety standards by regulating the design and use of mining methods and equipment. Various permits from government bodies are required for mining operations to be conducted; no assurance can be given that such permits will be received. No assurance can be given that environmental standards imposed by federal, provincial or local authorities will not be changed with material adverse effect on the Company's activities. Moreover, compliance with such laws may cause substantial delays and require capital outlays in excess of those anticipated, thus causing an adverse effect on the Company. Additionally, the Company may be subject to liability for pollution or other environmental damage, which it may elect not to insure against due to prohibitive premium costs and other reasons.

4

The Company operates in foreign countries and is subject to currency fluctuations which could have a negative effect on its operating results.A portion of the Company’s operations are located in foreign countries, which makes it subject to foreign currency fluctuations. Future costs in Peru, if we continue with the project may increase due to exchange rate fluctuations.

There is a Risk that we will be Unable to Compete for Mineral Properties, Investment Funds and Technical Expertise. Significant and increasing competition exists for the limited number of gold and other precious metal acquisition opportunities available in North, South and Central America and elsewhere in the world. As a result of this competition, some of which is with large, established mining companies with substantially greater financial and technical resources than us, we may be unable to acquire additional attractive precious metal mining properties on terms we consider acceptable. Moreover, this competition makes it more difficult for us to attract and retain mining experts, and to secure financing for our operations. Accordingly, there can be no assurance that our exploration and acquisition programs will be successful or result in any commercial mining operations.

We Do Not Have Insurance; We Will Not Be Able to Insure Against All Possible Risks. The Company’s business is subject to a number of risks and hazards generally, including adverse environmental conditions, industrial accidents, labor disputes, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to the Company’s properties or the properties of others, delays, monetary losses and possible legal liability. If any such catastrophic event occurs, investors could lose their entire investment. Although the Company intends to obtain insurance to protect against certain risks in such amounts as it considers to be reasonable, it does not have any insurance at the present time. If and when insurance is obtained, of which there can be no assurance, the insurance will not cover all the potential risks associated with a mining Company’s operations. Moreover, the Company may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to the Company or to other companies in the mining industry on acceptable terms. The Company might also become subject to liability for pollution or other hazards which may not be insured against or which the Company may elect not to insure against because of premium costs or other reasons. Losses from these events may cause the Company to incur significant costs that could have a material adverse effect upon its financial performance and results of operations. Should a catastrophic event arise, investors could lose their entire investment.

5

Adverse Government Policies and Environmental Risks Could Harm Our Business; The Amount of Capital Necessary to Meet All Environmental Regulations Associated with Our Exploration Programs Could Be In An Amount Great Enough to Force the Company to Cease Operations. Reference is made to “Item 4.Information onthe Company. B.Business Overview.” for a discussion of the regulatory issues facing the Company. The current and anticipated future operations of the Company, including further exploration activities require permits from various Canadian and Peru governmental authorities. Such operations are subject to various laws governing land use, the protection of the environment, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, mine safety and other matters. We may not be able to obtain all necessary licenses and permits required to carry out exploration at, and developments of, our projects. Unfavorable amendments to current laws, regulations and permits governing operations and activities of resource exploration companies, or more stringent implementation thereof, could have a materially adverse impact on the Company and cause increases in capital expenditures which could result in a cessation of operations by the Company.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions there under, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in resource exploration may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violation of applicable laws or regulations. Large increases in capital expenditures resulting from any of the above factors could force the Company to cease operations.

6

The enactment of this legislation, or parts of it, or even the possibility of its enactment in the future, into law would have a substantial adverse effect on our ability to conduct our business. This is because of the uncertainty of the economic viability of a project it would cause and well as the uncertainty and concern over unquantifiable future costs, which must now be considered. This, in turn, could likely increase our cost of capital, and have a chilling effect on our projects on federal lands.

Management May Be Subject to Conflicts of Interest Due to Affiliations with Other Resource Companies.

Because some of our directors and officers have private mining interests and also serve as officers and/or directors of other public mining companies, their personal interests are continually in conflict with the interests of the Company. Situations will arise where these persons are presented with mining opportunities, which may be desirable for the Company, as well as other companies in which they have an interest, to pursue. There can be no assurance that the Company will be able to pursue such opportunities because of our officers and directors’ conflicts. In addition to competition for suitable mining opportunities, the Company competes with these other companies for investment capital, and technical resources, including consulting geologists, metallurgists, engineers and others. Similarly, there can be no assurance that the Company will be able to obtain necessary investment capital and technical resources because of our officers and directors’ conflicts. Such conflict of interests are permitted under Canadian regulations and will continue to subject the Company to the continuing risk that it may be unable to acquire certain mining opportunities, investment capital and the necessary technical resources because of competing personal interests of some of our officers and directors.

Our Management May Not Be Subject to U.S. Legal Process Making it Very Difficult for Investors to Sue in the United States. The enforcement by investors of civil liabilities under the United States federal securities laws may be adversely affected by the fact that all of our officers and directors are neither citizens nor residents of the United States. There can be no assurance that (a) U.S. stockholders will be able to effect service of process within the United States upon such persons, (b) U.S. stockholders will be able to enforce, in United States courts, judgments against such persons obtained in such courts predicated upon the civil liability provisions of United States federal securities laws, (c) appropriate foreign courts would enforce judgments of United States courts obtained in actions against such persons predicated upon the civil liability provisions of the federal securities laws, and (d) the appropriate foreign courts would enforce, in original actions, liabilities against such persons predicated solely upon the United States federal securities laws.

However, U.S. laws would generally be enforced by a Canadian court provided that those laws are not contrary to Canadian public policy, are not foreign penal laws or laws that deal with taxation or the taking of property by a foreign government and provided that they are in compliance with applicable Canadian legislation regarding the limitation of actions. Also, a Canadian court would generally recognize a judgment obtained in a U.S. Court except, for example:

(a) Where the U.S. court, where the judgment was rendered, had no jurisdiction according to applicable Canadian law;

7

(b) The judgment was subject to ordinary remedy (appeal, judicial review and any other judicial proceeding which renders the judgment not final, conclusive or enforceable under the laws of the applicable state) or not final, conclusive or enforceable under the laws of the applicable state;

(c) The judgment was obtained by fraud or in any manner contrary to natural justice or rendered in contravention of fundamental principles of procedure;

(d) A dispute between the same parties, based on the same subject matter has given rise to a judgment rendered in a Canadian court or has been decided in a third country and the judgment meets the necessary conditions for recognition in a Canadian court;

(e) The outcome of the judgment of the U.S. court was inconsistent with Canadian public policy;

(f) The judgment enforces obligations arising from foreign penal laws or laws that deal with taxation or the taking of property by a foreign government; or

(g) There has not been compliance with applicable Canadian law dealing with the limitation of actions.

Gold Prices are Volatile and Could Decline in which case Our Properties May Not be Economically Viable. Gold prices fluctuate so that there is no assurance, even if substantial quantities of gold are discovered, that our properties will, in the future, prove to be economically viable. The prices of precious and base metals fluctuate on a daily basis and have experienced volatile and significant price movements over short periods of time. Prices are affected by numerous factors beyond our control, including international economic and political trends, expectations of inflation, currency exchange fluctuations (specifically, the U.S. dollar relative to other currencies), interest rates, central bank transactions, world supply for precious and base metals, international investments, monetary systems, and global or regional consumption patterns (such as the development of gold coin programs), speculative activities and increased worldwide production due to improved mining and production methods. The effect of these factors cannot be accurately predicted, and the combination of these factors may result in us not receiving adequate returns on invested capital or the investments retaining their respective values. There is no assurance that the price of gold (and of other precious and base metals) will be high enough so that our properties, assuming that we ever discover substantial quantities of gold, could be mined at a profit.

There is a Risk that Our Rights to Conduct Mining Explorations and Operations Could be Challenged by Third Parties Claiming Rights to Our Properties. We do not insure against third party actions claiming rights to explore and mine our properties. Accordingly, in the event that such a claim is made against us or our properties, our activities could be adversely affected. The costs of defending our title could be very time consuming and expensive with no guarantee that we would win. If such a claim is made, it may become difficult or impossible to either continue operations, if any, on the property being challenged and secure investment funds.

Our Stock is a Penny Stock which Imposes Significant Restrictions on Broker-Dealers Recommending the Stock For Purchase. The SEC has adopted Rule 15g-9 which generally defines "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our Shares are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC, which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our Shares. We believe that the penny stock rules may discourage investor interest in and limit the marketability of our Shares.

8

Our Stock Is Thinly Traded.The trading market for our shares is not always liquid. The market price of our Shares has ranged from a high of $0.08 and a low of $0.03 during the twelve month period ended May 31, 2012. Although our Shares trade on the Toronto Stock Exchange, the volume of Shares traded at any one time can be limited, and, as a result, there may not be a liquid trading market for our Shares.

Our Stock Price Could be Volatile Causing Investors to Suffer Significant Losses If the Shares are Depressed or Illiquid when an Investor Desires to Sell his Shares.The market price of a publicly-traded stock, especially that of a mining exploration Company such as ours, is affected by many variables in addition to those directly related to exploration successes or failures. Such factors include the general condition of markets for mining exploration stocks, the strength of the economy generally, the availability of alternative investments, and the breadth of the public market for the stock. The market price of our Shares on the Toronto Stock Exchange in Canada has been, and is likely to continue to be, volatile. Therefore, investors could suffer significant losses if our Shares are depressed or illiquid when an investor desires to sell Shares.

We Do Not Plan to Pay Any Dividends in the Foreseeable Future. The Company has never paid a dividend and it is unlikely that the Company will declare or pay a dividend until warranted based upon the factors outlined below. The declaration, amount and date of distribution of any dividends in the future will be decided by the Board of Directors from time-to-time, based upon, and subject to, the Company’s earnings, financial requirements and other conditions prevailing at the time.

In the Event Mr. Paul Sarjeant, our President and Chief Executive Officer Leaves the Company, Grandview would be Adversely Affected.In the event that Mr. Paul Sarjeant, our President and Chief Executive Officer, ceases to be employed by the Company, we would be materially and adversely affected. We are heavily dependent upon him. In the event his employment ceases, there is no assurance that a suitable replacement could be employed. The Company has no key-man life insurance with any of its senior officers or directors.

Future Sales of Common Shares by Existing Shareholders Could Cause the Price of our Shares to Decline. Sales of a large number of our Shares in the public markets, or the potential for such sales, could decrease the trading price of the Shares and could impair the Company’s ability to raise capital through future sales of Shares. The Company has previously issued Shares at effective prices per share, which are lower than what the Company’s Shares currently trade. Accordingly, certain shareholders of the Company have an investment profit in the Shares that they may seek to liquidate. These sales of our Shares could cause the price of our Shares to decline.

Dilution Through Exercise of Employee/Director/Consultant Options Could Adversely Affect Grandview Stockholders Through the Dilution of their Interests.Because the success of the Company is highly dependent upon its employees, the Company has granted to some or all of its Directors, consultants, and sole employee options to purchase common-voting shares as non-cash incentives. To the extent that significant numbers of such options may be exercised, the interests of the other stockholders of the Company may be diluted.

9

The Company believes it is likely a "passive foreign investment company" which may have adverse U.S. federal income tax consequences for U.S. shareholders.U.S. shareholders should be aware that the Company believes it was classified as a passive foreign investment company (“PFIC”) during the tax year ended May 31, 2012, and may be a PFIC in future tax years. If the Company is a PFIC for any year during a U.S. shareholder’s holding period, then such U.S. shareholder generally will be required to treat any gain realized upon a disposition of common shares, or any so-called “excess distribution” received on its common shares, as ordinary income, and to pay an interest charge on a portion of such gain or distributions, unless the shareholder makes a timely and effective "qualified electing fund" election (“QEF Election”) or a "mark-to-market" election with respect to the common shares. A U.S. shareholder who makes a QEF Election generally must report on a current basis its share of the Company's net capital gain and ordinary earnings for any year in which the Company is a PFIC, whether or not the Company distributes any amounts to its shareholders. However, U.S. shareholders should be aware that there can be no assurance that the Company will satisfy record keeping requirements that apply to a qualified electing fund, or that the Company will supply U.S. shareholders with information that such U.S. shareholders require to report under the QEF Election rules, in the event that the Company is a PFIC and a U.S. shareholder wishes to make a QEF Election. Thus, U.S. shareholders may not be able to make a QEF Election with respect to their common shares. A U.S. shareholder who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the common shares over the taxpayer’s basis therein. This paragraph is qualified in its entirety by the discussion below under the heading “Certain United States Federal Income Tax Considerations.” Each U.S. shareholder should consult its own tax advisor regarding the PFIC rules and the U.S. federal income tax consequences of the acquisition, ownership, and disposition of common shares.

As a "foreign private issuer”, Grandview is Exempt from the Section 14 Proxy Rules and Section 16 of the Securities Exchange Act of 1934, Possibly Resulting in Shareholders Having Less Complete and Timely Data. The submission of proxy and annual meeting of shareholder information (prepared to Canadian standards) on Form 6-K may result in shareholders having less complete and timely data. The exemption from Section 16 rules regarding sales of common-voting shares by insiders may result in shareholders having less data than would be provided for United States issuers, not exempt from such statues.

Foreign Operations.At present, a portion of the operations of Grandview are located in Peru, as a result, our operations are exposed to various levels of political, economic and other risks and uncertainties associated with operating in foreign jurisdiction. These risks and uncertainties include, but are not limited to, currency exchange rates, import or export controls, local political and economic developments, including expropriation, nationalization, invalidation of government orders, permits or agreements pertaining to property rights, political unrest, labor disputes, limitations on repatriation of earnings, limitations on mineral exports, limitations on foreign ownership, inability to obtain or delays in obtaining necessary mining permits, opposition to mining from local, environmental or other non-governmental organizations, government participation, royalties, duties, rates of exchange, high rates of inflation, price controls, exchange controls, currency remittance, taxation, governmental regulations that may require the awarding of contracts of local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction, changes, if any, in mining or investment policies or shifts in political attitudes in Peru and changes in laws, regulations or policies as well as by laws and policies of Canada affecting foreign trade, investment and taxation, which may adversely affect our operations. Additionally, any local political unrest could have debilitating impact on operations, and at its extreme, could result in damage and injury to personnel and site infrastructure.

Failure to comply with applicable laws and regulations may result in enforcement actions and include corrective measures requiring capital expenditures, installing of additional equipment or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

10

ITEM 4: Information on the Company

A. Unresolved Staff Comments

None.

B. History and Development of the Company

Grandview Gold Inc. (the “Company” or “Grandview”) was originally incorporated under the Corporation Act of Ontario on November 23, 1945 as Loisan Red Lake Gold Mines Limited. Grandview was primarily engaged in the mineral exploration and resource sector until April 27, 1987, when trading of the Company’s securities was ceased by the Ontario Securities Commission, and the Company remained primarily inactive until November 1998. At that time, the Company decided to invest in the common shares of Navitrak International, a company involved in high-technology products involving global positioning systems (GPS). During the next three years, Grandview found this initiative to be unfavorable and spent the period between November 2001 and November 2003 reevaluating the prospects of re-entering the mineral exploration and mining sector.

Articles of Amendment were filed in the Province Ontario effective November 6, 1979, changing the name to Grandview Energy Resources Incorporated. On September 22, 1983, further Article of Amendment were filed to change the Company’s name to Consolidated Grandview Inc.

Consolidated Grandview Inc. (the predecessor of Grandview Gold Inc.) was issued a temporary cease trade order by the Ontario Securities Commission on April 16, 1987, which was subsequently extended by a Cease Trade Order (CTO) issued by the OSC on April 29, 1987. The CTO was issued because the Company failed to file financial statements in accordance with the required timing deadlines. At the time of the CTO, the common shares of the Company were quoted on the Over-the-Counter Automated Quotation System, a predecessor of the Canadian Dealer Network (“CDN”). Subsequent to the CTO, the Company remained more or less inactive until 2003.

11

During 1998, the Company shifted its business focus from mineral exploration to operating as a merchant bank with a business plan to acquire significant equity in high technology companies with prospects for exceptional growth. At the time, the Company’s management team was better suited toward this type of initiative. In November 1998 an initial investment was carried out with Navitrak International Corporation (“Navitrak”), a public company whose common shares were quoted on the Canadian Dealing Network (“CDN”).

On November 2, 2000, the cease trade order referenced above was lifted and on February 4, 2003 the cease trade order was re-issued for late filing of financial statements. During this same period, the Company determined that the initiative to invest in high technology companies was unfavorable, as much of the technology industry became mired in a well-documented ‘tech burst’ that bottomed out in late 2001. As such, the Company decided to re-instate the original business mandate and build a team focused on mineral exploration and development.

During 2003, the Company attracted a new management team including a new board of directors and prepared to seek out a viable exploration property beyond its existing patented mining claims located in the Red Lake Mining Area of northwestern Ontario. The Company also addressed all outstanding financial matters and prepared to submit a request to the OSC to lift the existing cease trade order.

The cease trade order was lifted on May 6, 2004 and subsequently, on July 6, 2004, the Company filed Articles of Amendment changing its corporate name to Grandview Gold Inc.

The Company’s executive office is located at:

330 Bay Street, Suite 820 Toronto, Ontario, M5H 2S8 Canada

Its registered and records office is located at Suite 1000, 36 Toronto Street, Toronto, Ontario, Canada. Its telephone number is (416) 486-3444.

12

Capital Expenditures

The table below shows historical capital expenditures incurred before write-downs:

| Fiscal Year | | Expenditures | |

| Fiscal 2001(1) | $ | 0 | |

| Fiscal 2002(1) | $ | 0 | |

| Fiscal 2003(1) | $ | 0 | |

| Fiscal 2004(1) | $ | 562 | |

| Fiscal 2005(1) | $ | 407,899 | |

| Fiscal 2006(1) | $ | 2,556,530 | |

| Fiscal 2007(1) | $ | 3,447,602 | |

| Fiscal 2008(1) | $ | 3,037,694 | |

| Fiscal 2009(1) | $ | 620,297 | |

| Fiscal 2010(1) | $ | 706,978 | |

| Fiscal 2011(2) | $ | 418,986 | |

| Fiscal 2012(2) | $ | 657,024 | |

__________________

(1) Under Canadian Generally Accepted Accounting Principles (“CGAAP”)

(2) Under International Financial Reporting Standards (“IFRS”)

C. Business Overview

General

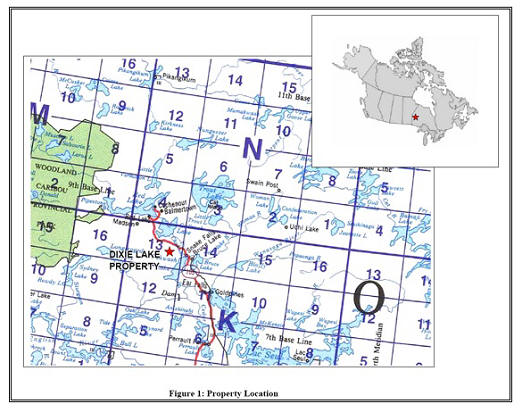

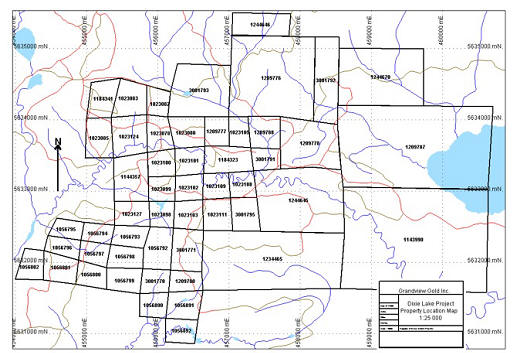

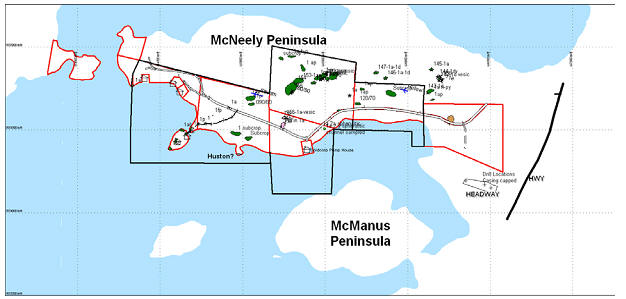

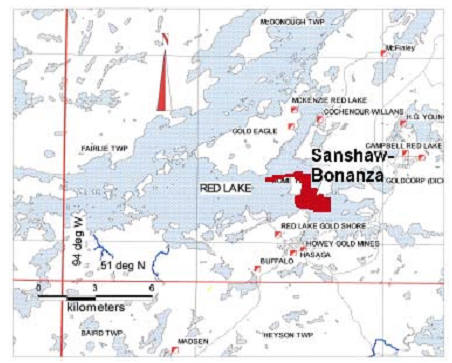

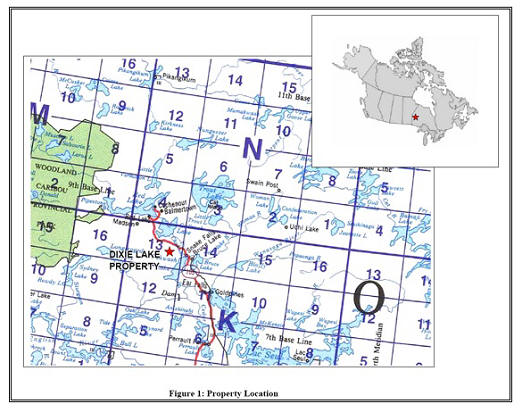

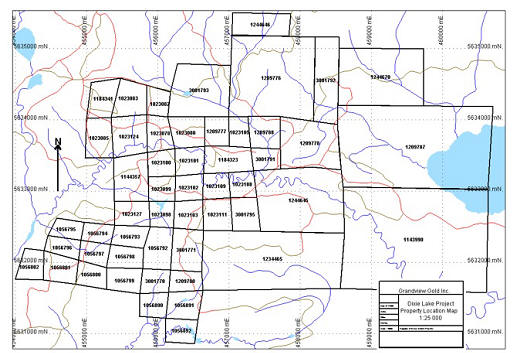

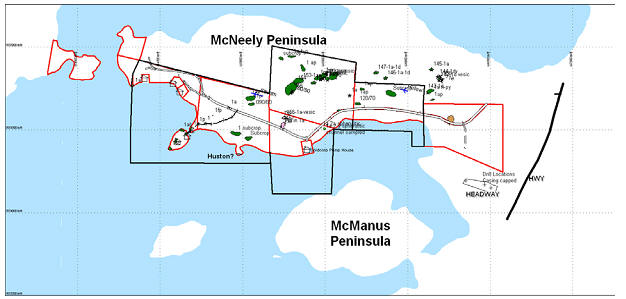

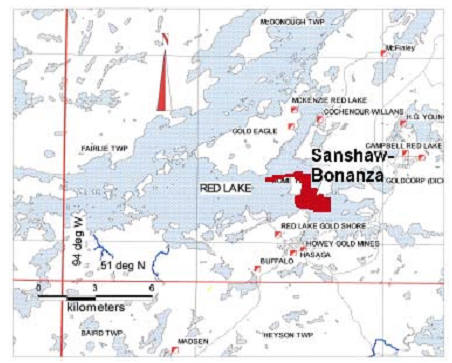

The Company is engaged in the exploration and, if warranted, development of mineral properties in Canada and Peru. The Company is an exploration stage company and is not currently engaged in any mining operations, and there can be no assurance it will ever engage in mining operations. To date, its only mining interests are (i) a 67% interest in the Dixie Lake Property, located in the Red Lake Mining District, Ontario, Canada (“Dixie Lake”) (ii) a 100% interest in eight mining claims in the Red Lake Mining District, Ontario, Canada (the “Loisan Property”), (iii) a 100% interest in 12 unpatented claims and 2 patented claims located in the Red Lake Mining District, Ontario, Canada (the “Sanshaw-Bonanza Property”), (iv) a 100% interest in one unpatented mineral claim located in Manitoba, Canada, (the "Bissett Gold Camp Claim"), and (v) an option to acquire up to a 100% interest in two mineral claims covering 400 hectares (“Giulianita Property”) near Suyo District, Ayabaca Province, Piura Department, Peru. Based on management's assessment, there are no impairment indicators of non-financial assets that have been noted for the year ended May 31, 2012.

During Fiscal 2012 the Company completed a 9 hole, 2021.79 metre drill program at Dixie Lake in an attempt to verify historic drill results from previous operators and combine that data with more recent work to produce a NI 43-101 compliant resource estimate for the 88-4 mineralized zone. Final results of the program and report are not complete at the time of this filing. At Sanshaw-Bonanza a limited deep IP program was carried out over the ice on Red Lake in an attempt to identify potential drill targets on the property. The results indicate that several anomalies require follow up, including possible diamond drilling. The Company will continue to evaluate future work programs at both Dixie Lake and Sanshaw-Bonanza based on these recent programs. No work was carried out at Loisan, however it remains a key property holding as it lies contiguous with GoldCorp's mine property in Red Lake.

At Giulianita the Company continues to work with local community leaders, mining groups and other leaders to reach a resolution to the surface access rights impasse that has thwarted exploration and development. Recent changes in Peruvian tax law and efforts by the Peruvian government to eliminate illegal mining and processing of gold ores throughout the country have led to significant changes to the political and economic situation in the region over the past 6 months. The Company has increased efforts to gain surface access rights with the community and a number of meetings have been held and are also planned over the next quarter. Though the Company has not secured it's rights, we remain confident that we will be given the opportunity to explore and develop the project in the near future.

There has been no work on the Bissett Gold Camp Claim, but the claim remains in good standing. There are no plans for future work at this time.

13

Effective November 30, 2010, Grandview entered into two agreements in respect of the sale of four mining claims owned by it and located in Manitoba, being the Packsak, Clapelou Patent Claims, CUPP2 Frac and CUPP3 Frac (collectively, the "Claims"). Two of the four Claims were transferred to Centerpoint Resources Inc. ("Centerpoint") and the remaining two were transferred to Centershield Gold Mines Inc., a subsidiary of Centerpoint. The Claims are not material to Grandview's exploration programs or strategy moving forward. Grandview received nominal cash consideration on closing and retained a 1% NSR over the Claims. Centerpoint is a related party of Grandview, and the agreement for Grandview to transfer the Claims constituted a related party transaction under Multilateral Instrument 61-101Take-Over Bids and Special Transactions ("MI 61-101"). There had been no prior valuation in respect of the Claims and the transaction was not subject to the formal valuation requirements of MI 61-101 by virtue of subsection 5.5(a) thereof and was also exempt from minority shareholder approval requirements by virtue of subsection 5.7(1)(a) thereof, as at the relevant time neither the fair market value of the Claims nor the fair market value of the consideration being paid for the Claims exceeded 25% of Grandview's market capitalization as calculated in compliance with MI 61-101. The independent members of Grandview's Board considered and approved the sale transaction.

On July 15, 2009 the Corporation announced the signing of a Binding Memorandum of Understanding through its wholly-owned subsidiary Recuperación Realzada S.A.C., with a private Peruvian Group which grants a two-stage option (the "Option") to acquire up to a 100% interest in a 400 hectare property located in the Suyo District, Ayabaca Province, Piura Department, Peru.

On June 28th, 2011 the Company issued a press release announcing that the Company would cease funding work efforts at the Guilianita Property until such time as the local community was able to deliver the necessary documentation and permissions for the Company to carry out unfettered exploration and development work. Work and payment commitments under the Option agreement were also suspended. The Company intends to fully protect its mineral titles in Peru and remains committed to honor the community proposal that has been in the hands of the community executive for many months. In March 2012 the Peruvian government announced a series of new taxation and legal laws to reduce or eliminate illegal small-scale mining and processing throughout Peru. In the Department of Piura, the new efforts by the Peruvian government had an immediate effect on the local itinerant miners and the Company renewed more intensive discussions with local community representatives and political leaders in an attempt to gain the surface access rights that it has sought since signing the agreement in 2009.

Due to past exploration results and lack of interested parties, the Company decided to let claims reaching expiry period lapse over the past year and will not expend any further exploration dollars to maintain existing claim packages within the Province of Manitoba.

In fiscal 2012, the Company concentrated most of its exploration effort on a summer drill program at Dixie Lake and a short geophysical program during the winter at Bonanza. Drilling at Dixie focused on twinning historical holes and new holes designed to fill gaps in the database that would facilitate the evaluation of the historic resource and bring it to NI 43-101 standard. At Bonanza the Company completed a deep 3D IP survey over the central portion of the claims groups in an attempt to identify any deep-seated drill targets previously undetected.

There is no known commercially mineable mineral deposit on any of these properties, and there can be no assurance that a commercially mineable mineral deposit exists on any of these properties.

Our business is highly speculative. We are exploring for base and precious metals. Ore is rock containing particles of a particular mineral (and possibly other minerals which can be recovered and sold), which rock can be legally extracted, and then processed to recover the minerals, which can be sold at a profit.

Although mineral exploration is a time consuming and expensive process with no assurance of success, the process is straightforward. First, we acquire the rights to enable us to explore for, and if warranted, extract and remove ore so that it can be refined and sold on the open market to dealers. Second, we explore for precious and base metals by examining the soil, rocks on the surface, and by drilling into the ground to retrieve underground rock samples, which can then be analyzed. This work is undertaken in staged programs, with each successive stage built upon the information gained in prior stages.

If exploration programs discover what appears to be an area, which may be able to be profitably mined, we will focus our activities on determining whether that is feasible, while at the same time continuing the exploratory activities to further delineate the location and size of this potential ore body.

Things that will be analyzed by us in making a determination of whether we have a deposit, which can be feasibly mined at a profit, include:

| (a) | the amount of mineralization, which has been established, and the likelihood of increasing the size of the mineralized deposit through additional drilling; |

| (b) | the expected mining dilution; |

| | |

| (c) | the expected recovery rates in processing; |

| | |

| (d) | the cost of mining the deposit; |

14

| (e) | the cost of processing the ore to separate the gold from the host rocks, including refining the precious or base metals; |

| | |

| (f) | the costs to construct, maintain, and operate mining and processing activities; |

| | |

| (g) | other costs associated with operations including permit and reclamation costs upon cessation of operations; |

| | |

| (h) | the costs of capital; |

| | |

| (i) | the costs involved in acquiring and maintaining the property; and |

| | |

| (j) | the price of the precious or base minerals. For example, the price of one ounce of gold for the years 2007 to 2012 (London Fixed price reported in $US) ranged from a low of $US 608 on January 10, 2011 to a high of $US 1,895 on September 6, 2011. As at August 21, 2012 the closing price of gold was $US 1,639.50 per ounce. Our analysis ill rely upon the estimates and plans of geologists, mining engineers, metallurgists and other experts. |

If we determine that we have a feasible mining project, we will consider pursuing alternative courses of action, including:

| (a) | placing the property into production ourselves; |

| | |

| (b) | entering into a joint venture with larger mining company to mine the deposit; or |

| | |

| (c) | seeking to sell the deposit or the Company to third parties. |

There can be no assurance, that we will discover any precious or base metals, establish the feasibility of mining a deposit, or, if warranted, develop a property to production and maintain production activities, either alone or as a joint venture participant. Furthermore, there can be no assurance that we would be able to sell either the deposit or the Company on acceptable terms, or at all, enter into such a joint venture on acceptable terms, or be able to place a property into production ourselves. If we do enter actual mining operations, which is unlikely in the near future, our operations will be subject to various factors and risks generally affecting the mining industry, many of which are beyond our control. These include the price of precious or base metals declining, the possibility that a change in laws respecting the environment could make operations unfeasible, or our ability to conduct mining operations could be adversely affected by government regulation. Reference is made toItem 3D. Key Information: Risk Factors.

Prior to commencing any exploration activities in any of the Province of Manitoba, or the Province of Ontario, Canada or Peru the Company or the party intending to carry out a work program on a mineral property is required to apply to the appropriate local government agencies for a number of permits or licenses related to mineral exploration activities. These permits or licenses may include water and surface use permits, occupation permits, fire permits, and timber permits. Prior to being issued the various permits or licenses, the applicant must file a detailed work plan with the applicable government agency. Permits are issued on the basis of the work plan submitted and approved by the governing agency. Additional work on a given mineral property or a significant change in the nature of the work to be completed would require an amendment to the original permit or license.

15

As part of the permit or licensing requirements, the applicant may be required to post an environmental reclamation bond in respect to the work to be carried out on the mineral property. The amount of such bond is determined by the amount and nature of the work proposed by the applicant. The amount of a bond may also be increased with increased levels of development on the property.

The Company has or will make application to the appropriate agencies for permits and licenses relating to those properties upon which the Company intends to carry out work. For those mineral properties in which the Company has an interest but is not the operator of the work programs, application for the required permits and licenses and the posting of the reclamation bonds will be made by the party entitled to carry out exploration work on the property. The Company believes that it is currently in compliance with all applicable environmental laws and regulations in the Provinces of Manitoba and Ontario, Canada and in Peru.

D. Organizational Structure