QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on March 18, 2005

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NEW SKIES SATELLITES B.V.

(Exact name of Registrant as specified in its charter)

| The Netherlands | | 4899 | | 20-1814083 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

Rooseveltplantsoen 4

2517 KR The Hague

The Netherlands

(31) 70-306-4100

(Address, Including Zip Code, and Telephone Number, Including Area Code,

of Registrant's Principal Executive Offices)

CT Corporation System

111 Eighth Avenue

New York, NY 10011

(212) 894-8400

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

With a copy to:

Risë B. Norman, Esq.

Simpson Thacher & Bartlett LLP

425 Lexington Avenue

New York, New York 10017

(212) 455-2000

Approximate date of commencement of proposed exchange offers: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o ________________

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o ________________

CALCULATION OF REGISTRATION FEE

|

TITLE OF EACH CLASS OF

SECURITIES TO BE REGISTERED

| | AMOUNT TO

BE REGISTERED

| | PROPOSED

MAXIMUM

OFFERING PRICE

PER UNIT(1)

| | PROPOSED

MAXIMUM

AGGREGATE

OFFERING

PRICE(1)

| | AMOUNT OF

REGISTRATION FEE

|

|---|

|

| Senior Floating Rate Notes due 2011 | | $ | 160,000,000 | | 100% | | $ | 160,000,000 | | $ | 18,832 |

|

| 91/8% Senior Subordinated Notes due 2012 | | $ | 125,000,000 | | 100% | | $ | 125,000,000 | | $ | 14,713 |

|

- (1)

- Estimated solely for the purpose of calculating the registration fee under Rule 457(f) under the Securities Act of 1933, as amended (the "Securities Act").

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated March 18, 2005

PROSPECTUS

Offers to Exchange

$160,000,000 principal amount of its Senior Floating Rate Notes due 2011,

which have been registered under the Securities Act of 1933,

for any and all of its outstanding $160,000,000 Senior Floating Rate Notes due 2011

and

$125,000,000 principal amount of its 91/8% Senior Subordinated Notes due 2012,

which have been registered under the Securities Act of 1933,

for any and all of its outstanding $125,000,000 91/8% Senior Subordinated Notes due 2012

We are conducting the exchange offers in order to satisfy certain of our obligations under the registration rights agreements entered into in connection with the placement of the outstanding notes and to provide you with an opportunity to exchange your restricted notes for freely tradeable notes that have been registered under the Securities Act.

The Exchange Offers

- •

- We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that are freely tradeable.

- •

- You may withdraw tenders of outstanding notes at any time prior to the expiration date of the applicable exchange offer.

- •

- The exchange offers expire at 12:00 a.m. midnight, New York City time, on , 2005, unless extended. We do not currently intend to extend the expiration date.

- •

- The exchange of outstanding notes for exchange notes in the exchange offers will not be a taxable event for U.S. federal income tax purposes.

- •

- The terms of the exchange notes to be issued in the exchange offers are substantially identical to the outstanding notes, except that the exchange notes will be freely tradeable.

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the applicable indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offers, we do not currently anticipate that we will register the outstanding notes under the Securities Act.

See "Risk Factors" beginning on page 19 for a discussion of certain risks that you should consider before participating in the exchange offers.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2005.

TABLE OF CONTENTS

| | Page

|

|---|

| Summary | | 1 |

| Risk Factors | | 19 |

| Special Note Regarding Forward Looking Statements | | 36 |

| The Transactions | | 38 |

| Use of Proceeds | | 40 |

| Capitalization | | 40 |

| Unaudited Pro Forma Condensed Consolidated Financial Information | | 41 |

| Selected Consolidated Historical Financial Data | | 46 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 48 |

| Industry | | 71 |

| Business | | 74 |

| Management | | 98 |

| Principal Stockholders | | 102 |

| Certain Relationships and Related Party Transactions | | 103 |

| Description of Other Indebtedness | | 105 |

| The Exchange Offers | | 108 |

| Description of the Notes | | 118 |

| Book-Entry; Delivery and Form | | 181 |

| Certain ERISA Considerations | | 184 |

| United States Federal Income Tax Consequences of the Exchange Offers | | 186 |

| Plan of Distribution | | 187 |

| Service of Process and Civil Liabilities | | 188 |

| Industry and Market Data | | 188 |

| Legal Matters | | 188 |

| Independent Registered Public Accounting Firm | | 189 |

| Where You Can Find Additional Information | | 189 |

| Index to Consolidated Financial Statements | | F-1 |

This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy, any notes offered hereby in any jurisdiction where, or to any person to whom, it is unlawful to make such offer or solicitation. The information contained in this prospectus speaks only as of the date of this prospectus unless the information specifically indicates that another date applies. No dealer, salesperson or other person has been authorized to give any information or to make any representations other than those contained in this prospectus in connection with the offers contained herein and, if given or made, such information or representations must not be relied upon as having been authorized by us. Neither the delivery of this prospectus nor any sales made hereunder shall under any circumstances create an implication that there has been no change in our affairs or that of our subsidiaries since the date hereof.

i

Basis of Presentation

In this prospectus, all references to "New Skies," "the Company," "we," "us," "our" and "ours" refer to New Skies Satellites B.V. and its subsidiaries, unless the context otherwise requires or it is otherwise indicated.

On June 5, 2004, we and Neptune One Holdings Ltd., which are owned by investment funds affiliated with The Blackstone Group (the "investment funds"), entered into a definitive transaction agreement with New Skies Satellites N.V. ("Seller"), providing for our acquisition of substantially all of Seller's assets (including the shares of all of Seller's subsidiaries), and the assumption of substantially all of Seller's liabilities, for an aggregate purchase price of $982.8 million, including direct acquisition costs (the "Acquisition"). Seller is in liquidation as of November 3, 2004.

In connection with the Acquisition, the investment funds contributed $153.0 million in the form of preferred equity certificates, $8.5 million in the form of convertible preferred equity certificates and $1.5 million of equity to New Skies Investments S.a.r.l. New Skies Investments S.a.r.l. subsequently loaned $153.0 million (the "Holding PIK Loan") and contributed $10.0 million of equity to New Skies Holding B.V., our direct parent. New Skies Holding B.V. then loaned $153.0 million (the "Satellites PIK Loan" and, together with the Holding PIK Loan, the "Subordinated Shareholder PIK Loans") and contributed $10.0 million of equity to us. In addition, in November 2004, we:

- •

- entered into senior secured credit facilities, consisting of a $460.0 million term loan facility and a $75.0 million revolving credit facility;

- •

- issued our outstanding $160.0 million aggregate principal amount of Floating Rate Notes due 2011 (the "senior floating rate notes"); and

- •

- issued our outstanding $125.0 million aggregate principal amount of 91/8% Senior Subordinated Notes due 2012 (the "senior subordinated notes" and, together with the senior floating rate notes, the "outstanding notes").

The Acquisition and the related financing transactions, together with Seller's liquidation and the related distributions, are referred to collectively in this prospectus as the "Transactions." For a more detailed description of the Transactions, see "The Transactions."

Initial Public Offering

On January 27, 2005, New Skies Satellites Holdings Ltd. filed a registration statement with the Securities and Exchange Commission, or SEC, relating to a proposed initial public offering of shares of its common stock (the "NSS IPO"). Prior to the consummation of the NSS IPO, New Skies Satellites Holdings Ltd. will become our ultimate parent company.

Concurrent with the NSS IPO, we intend to amend the senior secured credit facilities. The amendment of the senior secured credit facilities and the NSS IPO are conditioned on each other. See "Description of Other Indebtedness."

The Reorganization

Prior to the consummation of the NSS IPO, we will complete an internal restructuring pursuant to which existing shareholders will contribute 100% of the equity and preferred equity certificates of New Skies Investments S.a.r.l. to New Skies Satellites Holdings Ltd., after which existing shareholders will own 100% of the equity of New Skies Satellites Holdings Ltd. (the "Reorganization"). As a result, New Skies Investments S.a.r.l., New Skies Holding B.V. and we will become indirect wholly-owned subsidiaries of New Skies Satellites Holdings Ltd. Although the Reorganization will not be completed until immediately prior to the consummation of the NSS IPO, unless we specifically state otherwise, all information in this prospectus assumes that the Reorganization has occurred as of the date hereof.

ii

Notice to all Offerees

The notes (including rights representing an interest in a note in global form) may not be offered anywhere in the world as part of their initial distribution, or as part of any re-offering in The Netherlands at any time thereafter, directly or indirectly, other than to individuals or legal entities who or which trade or invest in securities in the conduct of their profession or business within the meaning of Section 2 of the Exemption Regulations pursuant to the Securities Market Supervision Act of The Netherlands 1995(Vrijstellingsregeling Wet toezicht effectenverkeer 1995), which includes banks, securities firms, insurance companies, pension funds, investment institutions, other institutional investors, finance companies and treasury departments of large commercial enterprises, which are regularly active in the financial markets in a professional manner.

The NEW SKIES SATELLITES & DESIGN®, NEWSKIES® and IPSYS® registered trademarks and other trade names and service marks of New Skies mentioned in this prospectus are the property of, and are used with the permission of, New Skies and its subsidiaries.

iii

SUMMARY

This summary highlights selected information in this prospectus, but it may not contain all of the information that is important to you. To better understand the exchange offers, and for a more complete description of the exchange offers and related transactions, you should read this entire prospectus carefully, including the "Risk Factors" section and the financial statements, which are included elsewhere in this prospectus.

Our Company

We are a satellite communications company with global operations and service coverage. We operate a network of five fixed satellite services ("FSS") satellites located at different orbital positions above the earth. Our customers can access one or more of our satellites from almost any point around the world using either our global network of ground-based facilities or their own ground-based facilities. At December 31, 2004, we had the youngest of the four global fleets in the FSS industry, based on the average number of years the satellites in each of the global fleets had been in service. We have consistently maintained one of the highest transponder availability rates in the FSS industry. For the year ended December 31, 2004, our availability rate was 99.9999%, based on the total number of hours the transponders in our fleet were available to provide service as compared to the total number of transponder-hours during the year.

Our technically advanced satellite fleet has substantial capacity focused on high growth markets, including India, Africa, the Middle East and Asia. NSS-6 and NSS-7 are among the most powerful and flexible satellites in the FSS industry and enable us to provide highly reliable, high quality services to our customers.

With the launches of NSS-6 and NSS-7 in 2002, we expanded our total transponder capacity available for sale by approximately 67%. Upon the entry into commercial service of NSS-8, which we anticipate will occur in the first half of 2006, we will further expand our available capacity by 28%. We believe that this incremental transponder capacity will enable us to generate additional revenues without significantly increasing our fixed costs, thereby improving our operating margins. The launches of the two satellites, NSS-6 and NSS-7, and the anticipated launch of NSS-8, represent the completion of our committed satellite procurement program initiated in 1999 and, consequently, we anticipate that our future revenues will generate significant cash flow to pay dividends to our shareholder and to finance payments on our debt.

On November 2, 2004, the investment funds indirectly acquired substantially all of the assets, and assumed substantially all of the liabilities, of New Skies Satellites N.V. for an aggregate purchase price of approximately $982.8 million, including direct acquisition costs.

Throughout our six-year history, we have consistently demonstrated our ability to achieve strong financial performance, increasing our revenues through organic growth. For the year ended December 31, 2004, we generated revenues of $242.7 million. Our revenues for this period included the impact of a one-time payment from Intelsat LLC of $32.0 million following the successful resolution of certain longstanding frequency coordination matters. Excluding this amount, we generated revenues of $210.7 million for the year ended December 31, 2004.

Our Customers and Services

We primarily earn our revenues by providing capacity for satellite communications and ground-based services to our customers for contracted periods varying from less than one year to 15 years. Our base of over 200 customers includes established telecommunications carriers, leading broadcasting and video companies, governmental entities and fast-growing smaller companies from around the globe.

1

Our customers use the services we provide for a variety of applications, including data services, such as corporate and governmental data networks; video services, including cable and broadcast television distribution and contribution services and direct-to-home video ("DTH") services; Internet-related services; and voice services.

Data services Our satellites are used to create high-bandwidth private data networks for governments and businesses around the world. Many of these networks use relatively small antennas known as VSATs (very small aperture terminals) to connect geographically dispersed sites into a dedicated, interconnected communications network.

Video services We currently broadcast more than 400 channels of entertainment and news programming to cable networks, broadcast affiliates and consumers' homes around the world. Our video services can be grouped into two types:

- •

- Video distribution—We are a leading provider of satellite capacity for the distribution of international, regional and national television and cable programming to markets around the world, such as Latin America, India and Africa, both to ground-based cable and broadcasting systems and direct to the homes of multi-channel video subscribers; and

- •

- Video contribution—Broadcasters and news programmers who require a reliable transmission link use our satellites to transmit regular television contribution feeds as well as special events, such as the Olympics and fast-breaking news stories, back to their video production facilities. Depending upon their needs, broadcasters and news programmers can obtain our services on a full-time or an occasional use basis.

Internet-related services We offer telecommunications companies, service providers, network integrators, Internet service providers and other resellers high-speed connections directly to the Internet backbone. Our Internet-related service offerings, which we have branded IPsys, include one-way and two-way satellite-based links between an Internet service provider's points of presence or a customer's premises and the global Internet backbone.

Voice services We also provide satellite capacity for voice applications. Historically, we provided most of our voice services to major post, telephone and telegraph administrations, or PTTs. More recently, we have begun to market voice services to governmental users and to newly-authorized mobile telephone, local and long distance service providers in countries undergoing telephony deregulation or where there is a lack of ground-based infrastructure to support voice services.

Our Competitive Strengths

Our business is characterized by the following key strengths:

Stable and predictable cash flow

We have a history of strong cash flow generation. Because we have nearly completed our committed capital investment program, anticipate only limited working capital requirements going forward and have a relatively fixed cost structure, we believe we are well positioned to generate strong cash flow to pay dividends to our shareholder and to finance payments on our debt.

Young satellite fleet

At December 31, 2004, we had the youngest global fleet in the FSS industry, based on the average number of years the satellites in each of the four global fleets had been in service. We believe the technical characteristics of the satellites we have built and launched to date make our capacity attractive to our customers. These satellites' high-powered transponders enable customers to improve the reliability of their service and transmit larger amounts of information within a given amount of

2

satellite transponder capacity and make it possible for them to use smaller and less expensive ground station antennas. Due to the youth of our fleet, other than NSS-8 (which is currently under construction), we do not anticipate that we will need to begin procuring any replacement satellites until approximately 2010.

Strong revenue visibility and diversity

At December 31, 2004, we had a contractual backlog for future services of $517.0 million, which we will recognize as revenue when we actually perform the services. We believe that the size and average duration of our contractual backlog will help ensure that our revenues will remain strong and predictable going forward. $166.9 million of our backlog is contracted for receipt in the 12-month period ending December 31, 2005. This allows us to enter 2005, like each of the years since our inception, with a substantial portion of our anticipated revenues already secured.

High-quality customer base

Since our inception, we have continued to provide services to major telecommunications and broadcasting companies, such as British Telecommunications plc, Embratel and France Telecom. We have also expanded our customer base to include newer entrants to the telecommunications marketplace, particularly in markets undergoing deregulation, and in regions where strong GDP growth is driving demand for new services or where ground-based infrastructure is underdeveloped. Our satellites are used by major broadcasters, Fortune 100 business users and by governments and governmental agencies.

Substantial capacity focused on high growth markets

Communications satellites can be used to provide services anywhere within the geographic areas they cover with their signals. We have created a satellite system with substantial capacity focused on the relatively higher-growth regions of India, Africa, the Middle East and Asia. According to Euroconsult 2004, worldwide unit demand for satellite transponders is projected to grow at an estimated compounded annual growth rate of 4% from 2004 to 2009, while over the same period unit demand for satellite transponders is projected to grow at a compounded annual growth rate of 10% in the Indian subcontinent, 7% in the Middle East and Africa and 4% in Asia-Pacific.

Well positioned for industry consolidation

We believe our entrepreneurial management team, rights to expansion orbital locations, scale and scope place us in a strong position from which to capitalize upon strategic developments in the FSS industry.

Experienced, entrepreneurial management team

Our senior management team collectively has more than 70 years of experience in the FSS industry. In the years since our creation, they have demonstrated their entrepreneurial orientation, ability to build a global business and deliver strong operational and financial performance, even in the face of difficult market conditions.

3

Our Business Strategy

Our goal is to be a commercially agile, technically excellent and profitable provider of global satellite services that meet our customers' requirements for the transmission of their data, video, Internet-related and voice services. Our strategy includes the following initiatives:

Maximizing cash flow

We are focused on disciplined capital expenditures, revenue growth and improving our operating margins in order to maximize cash flow available for dividend payments and to finance payments on our debt.

Emphasizing sales of "space-segment only" services

We focus our sales and marketing efforts principally on selling services that involve solely the provision of satellite transponder capacity. Such "space-segment only" services are our core business, representing approximately 80% of our revenues for the year ended December 31, 2004. Space-segment only services require no meaningful increase in operating expenses, as they require minimal incremental operational support and facilities. Customers of our space-segment only services are more likely to enter into long-term contracts, often for large amounts of satellite capacity, and generally are well-established.

Expanding our presence in core markets

The target markets for the sale of space-segment only services are video distribution service providers, government users and telecommunications services providers. We intend to further develop our position in the video services market by continuing to expand our presence in India and capitalizing on new opportunities in Asian markets. We intend to further develop our government services business by capitalizing on the technical strengths of our satellites, which we believe are particularly well-suited to serving the needs of government users, and by employing a strategy of working with resellers and system integrators, who combine our space-segment services with ground-based services, to provide government users with an end-to-end service.

Providing bundled services

We also provide bundled services in order to derive incremental revenues, optimize fleet utilization and optimize our potential customer base. When we sell our bundled services, we combine our space-segment only services with ground-based services, allowing us to reach customers who lack the scale or technical expertise to operate their own networks and to use satellite capacity that we cannot sell at reasonable rates in a space-segment only configuration.

Disciplined satellite expansion strategy

We have deployed a significant amount of our capacity in regions with high growth rates, including India, Africa, the Middle East and Asia. Satellite industry analysts project that, together, these regions will achieve above-average growth rates in the future. We have one additional satellite under construction, NSS-8, and we do not plan to procure any other satellites until such time as we have a demonstrated need for the additional capacity and a sound business case for a particular satellite, or require a replacement satellite.

4

Entering into strategic transactions

We intend to monitor developments as consolidation within the FSS industry continues to unfold, and may pursue acquisitions, joint ventures or other strategic transactions on an opportunistic basis to enhance our competitive profile, our financial performance and the value of our business.

Risks Relating to Our Business

Our ability to execute our strategy is subject to certain risks, including those that are generally associated with operating in the FSS industry. For example, unforeseen competing technologies may emerge, our satellites may be affected by launch and construction delays, failures or anomalies, demand for our services might not develop as expected, and regulation of the FSS industry may change in a way that is detrimental to our business. In addition, we have a substantial amount of indebtedness (approximately $812.9 million as of December 31, 2004, on a pro forma basis after giving effect to the Transactions, the amended agreement for NSS-8 and the application of the net proceeds therefrom), which may adversely affect our ability to generate cash flow, remain in compliance with debt covenants, make payments on our indebtedness and operate our business. Furthermore, four of our five satellites accounted for 10% or more of our total services and backlog as of December 31, 2004. Any of these factors or other factors described in this prospectus under "Risk Factors" may limit our ability to successfully execute our business strategy.

Recent Developments

In January 2005, we entered into an amended agreement with Boeing Satellite Systems International, Inc. for our NSS-8 satellite, which (among other things) amended the satellite's contractual delivery deadline and the payment terms. Under the terms of the amended agreement, in February 2005 we received a refund of $168.0 million of milestone construction payments made to date. We will pay the entire purchase price of the satellite during the anticipated operational lifetime of NSS-8, subject to satisfactory performance of the satellite during its contractual design life, and we will provide commercially reasonable security to Boeing with respect to the unpaid portion of the purchase price. We currently expect that NSS-8 will be available to enter commercial service during the first half of 2006. We used the $168.0 million refund, along with cash on hand, to pay down approximately $88.8 million under the term loan facility and to pay a dividend of approximately $88.0 million to existing shareholders.

On February 17, 2005, we entered into a capacity restoration framework agreement that will result in the generation of additional revenues for us in 2005 and beyond. Under this agreement, we will provide to certain of Intelsat, Ltd.'s customers telecommunication services on one of our satellites and, in so doing, will provide a restoration service for these customers' transmissions. The agreement also creates a framework under which Intelsat, Ltd. may be requested to restore our services in the event of a significant failure or failures to one of our satellites.

On March 2, 2005, we reached an agreement with SES Global affiliates relating to certain orbital slot coordination matters. Under the terms of the agreement, we agreed not to bring a satellite into use at our 105° west longitude orbital location in order to ensure that SES Global will be able to operate its satellite without interference. In return, SES Global will make a one-time payment to us of $10.0 million. Both parties also committed to negotiate resolution of long-standing issues regarding satellite operations in the Atlantic Ocean region.

Our principal offices are located at Rooseveltplantsoen 4, 2517 KR The Hague, The Netherlands, and our telephone number at that address is +31-70-306-4100. We maintain a website at www.newskies.com.Information contained on our website does not constitute a part of this prospectus and is not being incorporated by reference herein.

5

Corporate Structure

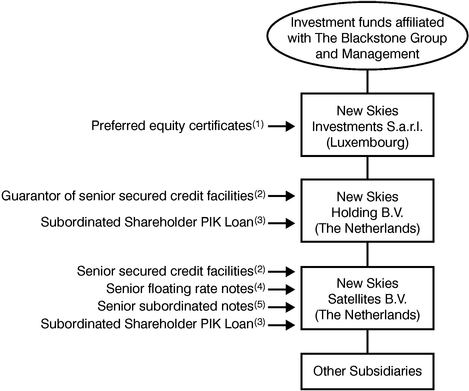

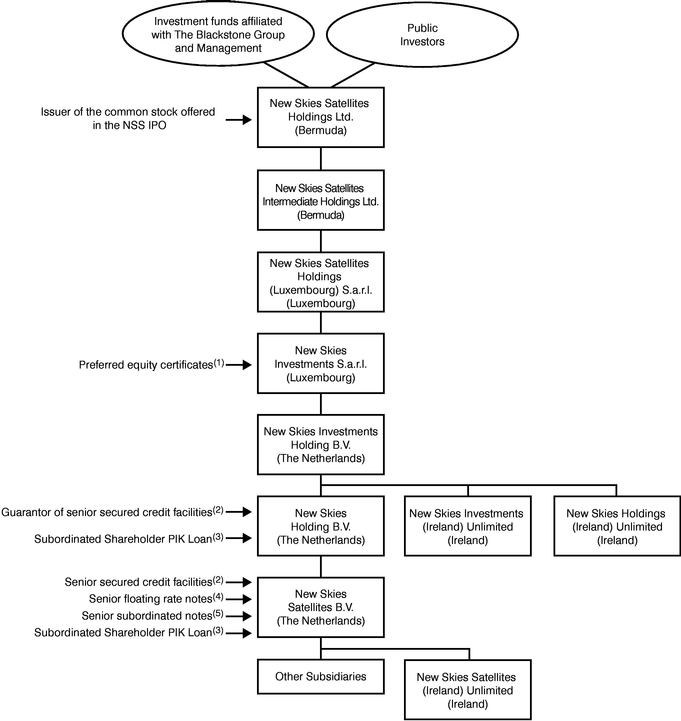

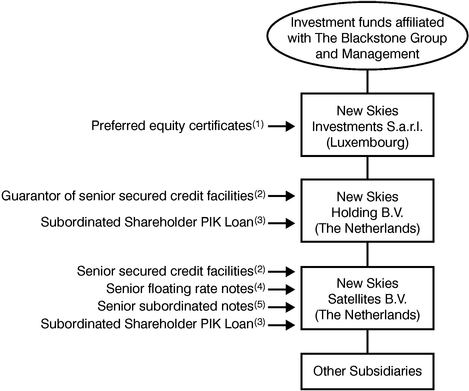

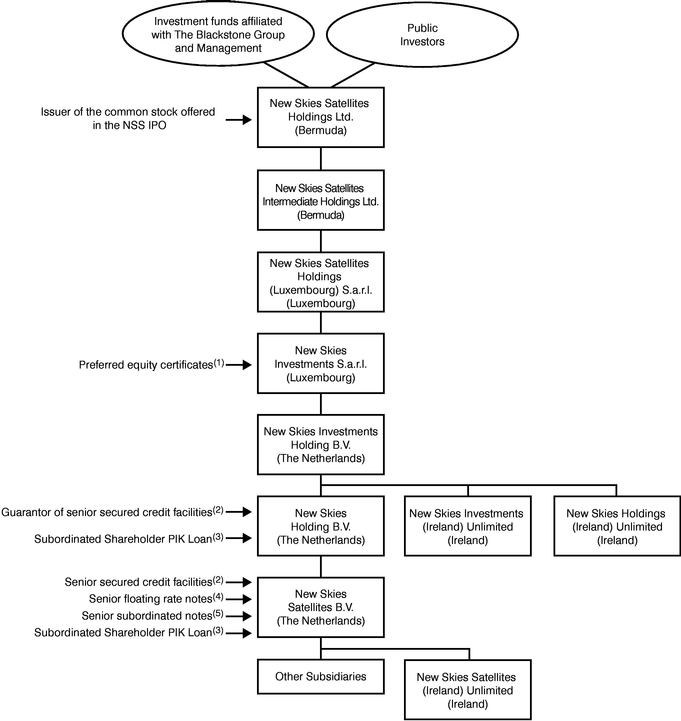

The charts below summarize our ownership structure before and after giving effect to the Reorganization.

Pre-Reorganization Structure

6

Post-Reorganization Structure

- (1)

- On November 2, 2004, the investment funds contributed to New Skies Investments S.a.r.l. aggregate proceeds of approximately $163.0 million in the form of preferred equity certificates, convertible preferred equity certificates and equity. In connection with the internal restructuring, the convertible preferred equity certificates and preferred equity certificates will be exchanged for newly issued convertible preferred equity certificates and preferred equity certificates, and New Skies Satellites Holdings Ltd. will directly and indirectly own 100% of the equity, convertible preferred equity certificates and preferred equity certificates in New Skies Investments S.a.r.l.

- (2)

- The senior secured credit facilities (as amended concurrently with the NSS IPO) consist of a $460.0 million senior secured term loan facility that matures in May 2011 and a $75.0 million senior secured revolving credit facility that matures in November 2010. As of December 31, 2004, there was $460.0 million outstanding under the term loan facility and no

7

outstanding borrowings under the revolving credit facility. As of December 31, 2004, $2.3 million of standby letters of credit were outstanding under the revolving credit facility. We expect to use approximately $178.0 million of the net proceeds from the NSS IPO to repay borrowings under the term loan facility. See "Description of Other Indebtedness—Senior Secured Credit Facilities."

- (3)

- In November 2004, New Skies Holding B.V. entered into a Subordinated Shareholder PIK Loan with New Skies Investments S.a.r.l. in an aggregate principal amount of $153.0 million, with interest accruing on such loan at a rate of 11.375% annually. Also in November 2004, we entered into a Subordinated Shareholder PIK Loan with New Skies Holding B.V. in an aggregate amount of $153.0 million, with interest accruing on such loan at a rate of 11.5% annually. The maturity date of each of the Subordinated Shareholder PIK Loans is April 2014. The Subordinated Shareholder PIK Loans rank subordinate to any of our third-party indebtedness so long as the senior secured credit facilities or the notes remain outstanding and cannot be accelerated while the senior secured credit facilities or the notes remain outstanding. In connection with the NSS IPO, we intend to amend the terms of the Subordinated Shareholder PIK Loans to provide for the option to make payments of principal and interest in cash or in-kind.

- (4)

- In November 2004, we issued $160.0 million aggregate principal amount of Senior Floating Rate Notes due 2011. The senior floating rate notes bear interest at a rate per annum, reset semi-annually, equal to LIBOR plus 51/8%. As of December 31, 2004, the senior floating rate notes accrued interest at the rate of approximately 7.4%. See "Description of the Notes."

- (5)

- In November 2004, we issued $125.0 million aggregate principal amount of 91/8% Senior Subordinated Notes due 2012. See "Description of the Notes."

8

The Exchange Offers

On November 2, 2004, we issued $160,000,000 principal amount of Senior Floating Rate Notes due 2011 and $125,000,000 principal amount of 91/8% Senior Subordinated Notes due 2012 in a private offering. In this prospectus, the term "outstanding notes" refers to both the outstanding senior floating rate notes and the outstanding senior subordinated notes; the term "exchange notes" refers to both the exchange senior floating rate notes and the exchange senior subordinated notes, each as registered under the Securities Act of 1933, as amended (the "Securities Act"); and the term "notes" refers to both the outstanding notes and the exchange notes.

General |

|

In connection with the private offerings, we entered into registration rights agreements with the initial purchasers in which we agreed, among other things, to deliver this prospectus to you and to complete the exchange offers within 240 days after the date of original issuances of the outstanding notes. You are entitled to exchange in the applicable exchange offer your outstanding notes for exchange notes which are identical in all material respects to the outstanding notes except: |

|

|

• |

|

the exchange notes have been registered under the Securities Act; |

|

|

• |

|

the exchange notes are not entitled to any registration rights which are applicable to the outstanding notes under the registration rights agreements; and |

|

|

• |

|

the liquidated damages provisions of the registration rights agreements are no longer applicable. |

The Exchange Offers |

|

We are offering to exchange: |

|

|

• |

|

$160,000,000 principal amount of our exchange senior floating rate notes, which have been registered under the Securities Act, for any and all of our outstanding senior floating rate notes; and |

|

|

• |

|

$125,000,000 principal amount of our exchange senior subordinated notes, which have been registered under the Securities Act, for any and all of our outstanding senior subordinated notes. |

Resale |

|

Based on an interpretation by the staff of the SEC set forth in no-action letters issued to third parties, we believe that the exchange notes issued pursuant to the exchange offers in exchange for outstanding notes may be offered for resale, resold and otherwise transferred by you without compliance with the registration and prospectus delivery provisions of the Securities Act, provided that: |

|

|

• |

|

you are not an affiliate of ours within the meaning of Rule 405 under the Securities Act; |

|

|

• |

|

you are acquiring the exchange notes in the ordinary course of your business; and |

| | | | | |

9

|

|

• |

|

you have not engaged in, do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes. |

|

|

If you are a broker-dealer and receive exchange notes for your own account in exchange for outstanding notes that you acquired as a result of market-making activities or other trading activities, you must acknowledge that you will deliver this prospectus in connection with any resale of the exchange notes. See "Plan of Distribution." |

|

|

Any holder of outstanding notes who: |

|

|

• |

|

is an affiliate of ours within the meaning of Rule 405 under the Securities Act; |

|

|

• |

|

does not acquire exchange notes in the ordinary course of its business; or |

|

|

• |

|

tenders its outstanding notes in the applicable exchange offer with the intention to participate, or for the purpose of participating, in a distribution of exchange notes; |

|

|

cannot rely on the position of the staff of the SEC enunciated inMorgan Stanley & Co. Incorporated (available June 5, 1991) andExxon Capital Holdings Corporation (available May 13, 1988), as interpreted in the SEC's letter toShearman & Sterling, available July 2, 1993, or similar no-action letters and, in the absence of an exemption therefrom, must comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale of the exchange notes. |

Expiration Date |

|

The exchange offers will expire at 12:00 a.m. midnight, New York City time, on , 2005, unless extended by us. We do not currently intend to extend the expiration date. |

Withdrawal |

|

You may withdraw the tender of your outstanding notes at any time prior to the expiration of the applicable exchange offer. We will return to you any of your outstanding notes that are not accepted for any reason for exchange, without expense to you, promptly after the expiration or termination of the applicable exchange offer. |

Conditions to the Exchange Offers |

|

Each exchange offer is subject to customary conditions, which we may waive. See "The Exchange Offers—Material Conditions to the Exchange Offers." |

Procedures for Tendering Outstanding Notes |

|

If you wish to participate in either of the exchange offers, you must: |

|

|

• |

|

complete, sign and date the applicable letter of transmittal, or a facsimile of such letter of transmittal according to the instructions contained in this prospectus and such letter of transmittal; and |

| | | | | |

10

|

|

• |

|

mail or otherwise deliver the applicable letter of transmittal, or a facsimile of such letter of transmittal, together with the outstanding notes and any other required documents, to the exchange agent at the address set forth on the cover page of the letter of transmittal. |

|

|

If you hold outstanding notes through The Depository Trust Company, or DTC, and wish to participate in the exchange offers, you must comply with the Automated Tender Offer Program procedures of DTC, by which you will agree to be bound by the applicable letter of transmittal. |

|

|

By signing, or agreeing to be bound by the applicable letter of transmittal, you will represent to us that, among other things: |

|

|

• |

|

you are not an affiliate of ours within the meaning of Rule 405 under the Securities Act; |

|

|

• |

|

you are acquiring the exchange notes in the ordinary course of your business; |

|

|

• |

|

you have no arrangement or understanding with any person or entity to participate in a distribution of the exchange notes; and |

|

|

• |

|

if you are a broker-dealer that will receive exchange notes for your own account in exchange for outstanding notes that were acquired as a result of market-making activities, that you will deliver a prospectus, as required by law, in connection with any resale of such exchange notes. |

Special Procedures for Beneficial Owners |

|

If you are a beneficial owner of outstanding notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender those outstanding notes in the applicable exchange offer, you should contact that registered holder promptly and instruct the registered holder to tender those outstanding notes on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the applicable letter of transmittal and delivering your outstanding notes, either make appropriate arrangements to register ownership of the outstanding notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed before the expiration date. |

Guaranteed Delivery

Procedures |

|

If you wish to tender your outstanding notes and your outstanding notes are not immediately available or you cannot deliver your outstanding notes, the applicable letter of transmittal or any other required documents, or you cannot comply with the applicable procedures under DTC's Automated Tender Offer Program before the expiration date, you must tender your outstanding notes according to the guaranteed delivery procedures set forth in this prospectus under "The Exchange Offers—Guaranteed Delivery Procedures." |

| | | | | |

11

Effect on Holders of

Outstanding Notes |

|

As a result of the making of, and upon acceptance for exchange of all validly tendered outstanding notes pursuant to the terms of the exchange offers, we will have fulfilled a covenant under the applicable registration rights agreement. Accordingly, there will be no increase in the interest rate on the outstanding notes under the circumstances described in the registration rights agreements. If you do not tender your outstanding notes in the applicable exchange offer, you will continue to be entitled to all the rights and limitations applicable to the outstanding notes as set forth in the applicable indenture, except we will not have any further obligation to you to provide for the exchange and registration of the outstanding notes under the applicable registration rights agreement. To the extent that outstanding notes are tendered and accepted in the applicable exchange offer, the trading market for outstanding notes could be adversely affected. |

Consequences of Failure to Exchange |

|

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the applicable indenture. In general, the outstanding notes may not be offered or sold, unless registered under the Securities Act, except pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offers, we do not currently anticipate that we will register the outstanding notes under the Securities Act. |

United States Federal

Income Tax Considerations |

|

The exchange of outstanding notes for exchange notes in the exchange offers will not be a taxable event for United States federal income tax purposes. See "United States Federal Income Tax Consequences of the Exchange Offers." |

Use of Proceeds |

|

We will not receive any cash proceeds from the issuance of exchange notes in the exchange offers. See "Use of Proceeds." |

Exchange Agent |

|

U.S. Bank National Association is the exchange agent for the exchange offers. The address and telephone number of the exchange agent are provided in the section captioned "The Exchange Offers—Exchange Agent" of this prospectus. |

12

The Exchange Notes

The summary below describes the principal terms of the exchange notes and is not intended to be complete. Some of the terms and conditions described below are subject to important limitations and exceptions. The "Description of the Notes" section of this prospectus contains a more detailed description of the terms and conditions of each issue of exchange notes.

| Issuer | | New Skies Satellites B.V. |

Notes Offered |

|

$160,000,000 aggregate principal amount of Senior Floating Rate Notes due 2011. |

|

|

$125,000,000 aggregate principal amount of 91/8% Senior Subordinated Notes due 2012. |

Maturity Date |

|

Senior floating rate notes: November 1, 2011. |

|

|

Senior subordinated notes: November 1, 2012. |

Interest Rate |

|

The exchange senior floating rate notes bear interest at a rate per annum equal to LIBOR plus 51/8%. Interest on the exchange senior floating rate notes is reset semi-annually. |

|

|

The exchange senior subordinated notes bear interest at a rate of 91/8% per year (calculated using a 360 day year). |

Interest Payment Dates |

|

Interest will be payable in cash on May 1 and November 1 of each year, beginning on May 1, 2005. |

Ranking |

|

The exchange senior floating rate notes will be our unsecured senior obligations and rank equally with all existing and future senior debt. The exchange senior subordinated notes will be our unsecured senior subordinated obligations and will rank junior to our existing and future senior debt, including the exchange senior floating rate notes. |

Guarantees |

|

None of our subsidiaries will guarantee the exchange notes on the exchange date. As of December 31, 2004, our subsidiaries constituted approximately 3% of our total assets and had no debt outstanding. For the year ended December 31, 2004, our subsidiaries constituted approximately 4% of our revenues. |

|

|

In the future, these subsidiaries and any future subsidiaries may guarantee the exchange notes. If any such subsidiary guarantees certain obligations, it will guarantee the exchange notes unless we designate such subsidiary as an "unrestricted subsidiary" under the indentures governing the exchange notes or the subsidiary does not have significant assets. Any such guarantee would be an unsecured senior guarantee with respect to the exchange senior floating rate notes and an unsecured senior subordinated guarantee with respect to the exchange senior subordinated notes. |

Optional Redemption |

|

We may redeem some or all of the exchange senior floating rate notes prior to November 1, 2006 and the senior subordinated notes prior to November 1, 2007 at a price equal to 100% of their principal amount plus a "make-whole" premium as set forth under "Description of the Notes—Optional Redemption." Thereafter, in each case, we may redeem some or all of the exchange notes at the redemption prices listed in the "Description of the Notes" section under the heading "Optional Redemption," plus accrued interest to the date of redemption. |

| | | | | | | |

13

Optional Redemption After Certain Equity Offerings |

|

We may redeem: |

|

|

|

|

• |

|

up to 35% of the exchange senior floating rate notes on or prior to November 1, 2006 from the proceeds of certain equity offerings at a redemption price of 100% of the principal amount of the exchange senior floating rate notes, plus a premium equal to the rate per year on the exchange senior floating rate notes applicable on the date on which notice of redemption is given, plus accrued and unpaid interest, if any, to the date of redemption; and |

|

|

|

|

• |

|

up to 35% of the exchange senior subordinated notes on or prior to November 1, 2007 from the proceeds of certain equity offerings at a redemption price of 109.125% of the principal amount of the exchange senior subordinated notes, plus accrued and unpaid interest, if any, to the date of redemption. |

|

|

We may make these redemptions only if, after the redemption, at least 65% of the aggregate principal amount of the applicable series of exchange notes originally issued remains outstanding and the redemption occurs within 90 days of the date of the closing of such equity offering. See "Description of the Notes—Optional Redemption." |

Change of Control Offer |

|

If a change of control occurs, we must give holders of the exchange notes the opportunity to sell us their some or all of their exchange notes at 101% of their face amount, plus accrued interest. |

|

|

We might not be able to pay you the required price for exchange notes you present to us at the time of a change of control, because: |

|

|

|

|

• |

|

we might not have enough funds at that time; or |

|

|

|

|

• |

|

the terms of our senior debt may prevent us from paying. See "Description of the Notes—Change of Control." |

Asset Sale Proceeds |

|

If we or our subsidiaries engage in asset sales, we generally must either invest the net cash proceeds from such sales in our business within a period of time, prepay senior debt or make an offer to purchase a principal amount of the exchange notes equal to the excess net cash proceeds. The purchase price of the exchange notes will be 100% of their principal amount, plus accrued interest. |

Certain Indenture Provisions |

|

The indentures governing the exchange notes will contain covenants limiting, among other things, our ability and the ability of our restricted subsidiaries to: |

|

|

|

|

• |

|

incur additional debt or issue preferred stock; |

|

|

|

|

• |

|

pay dividends or make distributions on our capital stock or repurchase our capital stock; |

|

|

|

|

• |

|

make certain investments; |

|

|

|

|

• |

|

create liens on our assets to secure debt; |

|

|

|

|

• |

|

enter into transactions with affiliates; |

| | | | | | | |

14

|

|

|

|

• |

|

merge or consolidate with another company; and |

|

|

|

|

• |

|

transfer and sell assets. |

|

|

These covenants are subject to a number of important limitations and exceptions. See "Description of the Notes—Certain Covenants." |

No Public Market |

|

The exchange notes will be freely transferable but will be new securities for which there will not initially be a market. Accordingly, we cannot assure you whether a market for the exchange notes will develop or as to the liquidity of any market. The initial purchasers in the private offering of the outstanding notes have advised us that they currently intend to make a market in the exchange notes. The initial purchasers are not obligated, however, to make a market in the exchange notes, and any such market-making may be discontinued by the initial purchasers in their discretion at any time without notice. |

Use of Proceeds |

|

We will not receive any cash proceeds from the issuance of exchange notes in the exchange offers. See "Use of Proceeds." |

Risk Factors

You should carefully consider all the information in this prospectus prior to exchanging your outstanding notes. In particular, we urge you to consider carefully the factors set forth under the heading "Risk Factors."

15

SUMMARY HISTORICAL AND PRO FORMA FINANCIAL, OPERATING AND OTHER DATA

Set forth below is summary consolidated historical financial and other data of New Skies Satellites B.V. and summary consolidated pro forma financial and other data at the dates and for the periods indicated. The summary consolidated historical statement of operations data and summary consolidated historical statement of cash flow data for the fiscal years ended December 31, 2002 and 2003, the period January 1, 2004 to November 1, 2004 and the period November 2, 2004 to December 31, 2004 and the summary consolidated historical balance sheet data as of December 31, 2003 and 2004 were derived from the audited consolidated historical financial statements of New Skies Satellites B.V. and related notes included elsewhere in this prospectus.

The summary unaudited pro forma consolidated financial and other data for New Skies Satellites B.V. have been prepared to give effect to the Transactions, the amended agreement for NSS-8 and the application of the net proceeds therefrom as if they had occurred on January 1, 2004, in the case of the unaudited pro forma consolidated statement of operations data, and to the amended agreement for NSS-8 and the application of the net proceeds therefrom as if they had occurred on December 31, 2004, in the case of unaudited pro forma consolidated balance sheet data. The proceeds from the amended agreement for NSS-8, along with cash on hand, were used to repay a portion of the outstanding borrowings under the term loan facility and pay a dividend to existing shareholders. Assumptions underlying the pro forma adjustments are described in the notes to the unaudited pro forma condensed consolidated financial statements appearing elsewhere in this prospectus, which should be read in conjunction with these unaudited pro forma condensed consolidated financial statements.

The pro forma adjustments are based upon available information and certain assumptions that we believe are reasonable. Please see the notes to our unaudited pro forma condensed consolidated financial statements for a more detailed discussion of how pro forma adjustments are presented in our unaudited pro forma condensed consolidated financial statements. The unaudited pro forma condensed consolidated financial information is provided for informational purposes only. The summary unaudited pro forma consolidated financial data do not purport to represent what our results of operations or financial position actually would have been if the Transactions, the amended agreement for NSS-8 and the application of the net proceeds therefrom had occurred at any date, nor do such data purport to project the results of operations for any future period.

The summary consolidated historical and pro forma financial, operating and other data should be read in conjunction with "Unaudited Pro Forma Condensed Consolidated Financial Information," "Selected Consolidated Historical Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the audited consolidated financial statements of New Skies Satellites B.V. and related notes included elsewhere in this prospectus.

16

| | Predecessor

| |

| |

| |

|---|

| | Successor

| |

|---|

| | Year Ended

December 31,

| |

| |

|---|

| | Period from

January 1, 2004

to November 1,

2004

| | Period from

November 2, 2004

to December 31,

2004

| | Pro Forma

Year Ended

December 31,

2004

| |

|---|

| | 2002

| | 2003

| |

|---|

| | (In millions (other than per share data, ratios, operating data and percentages))

| |

|---|

| Statement of Operations Data: | | | | | | | | | | | | | | | | |

| Revenues: | | | | | | | | | | | | | | | | |

| | Revenues from telecommunication services | | $ | 200.5 | | $ | 214.9 | | $ | 175.4 | | $ | 35.3 | | $ | 210.7 | |

| | Other revenues(1) | | | — | | | — | | | 32.0 | | | — | | | 32.0 | |

| | |

| |

| |

| |

| |

| |

| | | | 200.5 | | | 214.9 | | | 207.4 | | | 35.3 | | | 242.7 | |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | Cost of operations | | | 50.7 | | | 53.2 | | | 45.4 | | | 10.9 | | | 56.3 | |

| | Selling, general and administrative | | | 39.5 | | | 42.1 | | | 35.8 | | | 18.0 | | | 56.1 | |

| | Transaction related expenses | | | — | | | — | | | 26.4 | | | — | | | 26.4 | |

| | Depreciation | | | 80.6 | | | 99.9 | | | 86.4 | | | 16.0 | | | 96.9 | |

| | |

| |

| |

| |

| |

| |

| Total operating expenses | | | 170.8 | | | 195.2 | | | 194.0 | | | 44.9 | | | 235.7 | |

| | |

| |

| |

| |

| |

| |

| Operating income (loss) | | | 29.7 | | | 19.7 | | | 13.4 | | | (9.6 | ) | | 7.0 | |

| Interest expense, net | | | 0.5 | | | 1.2 | | | 1.4 | | | 9.8 | | | 63.1 | |

| | |

| |

| |

| |

| |

| |

Income (loss) before income tax expense (benefit) |

|

|

29.2 |

|

|

18.5 |

|

|

12.0 |

|

|

(19.4 |

) |

|

(56.1 |

) |

| Income tax expense (benefit) | | | 10.5 | | | 6.7 | | | 4.3 | | | (5.8 | ) | | (19.0 | ) |

| | |

| |

| |

| |

| |

| |

| Income (loss) before cumulative effect of change in accounting principle | | | 18.7 | | | 11.8 | | | 7.7 | | | (13.6 | ) | | (37.1 | ) |

| Cumulative effect of change in accounting principle, relating to goodwill, net of taxes(2) | | | (23.4 | ) | | — | | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| |

| Net income (loss) | | $ | (4.7 | ) | $ | 11.8 | | $ | 7.7 | | $ | (13.6 | ) | $ | (37.1 | ) |

| | |

| |

| |

| |

| |

| |

Net Income (Loss) Per Share Data(3): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net income (loss) per share: | | | | | | | | | | | | | | | | |

| | Net income (loss) per share | | $ | (0.04 | ) | $ | 0.10 | | $ | 0.06 | | $ | (749.29 | ) | $ | (2,038.46 | ) |

| | Weighted average shares—basic (in thousands) | | | 130,342 | | | 119,499 | | | 118,099 | | | 18 | | | 18 | |

| | Weighted average shares—diluted (in thousands | | | 130,342 | | | 120,678 | | | 119,850 | | | 18 | | | 18 | |

Statement of Cash Flow Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities | | $ | 113.0 | | $ | 109.8 | | $ | 111.2 | | $ | 30.0 | | | n/a | |

| Net cash used in investing activities | | | (231.4 | ) | | (43.5 | ) | | (7.7 | ) | | (866.1 | ) | | n/a | |

| Net cash (used in) provided by financing activities | | | (11.7 | ) | | (51.9 | ) | | (6.4 | ) | | 873.7 | | | n/a | |

Balance Sheet Data (end of year): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents | | $ | 8.3 | | $ | 23.3 | | | n/a | | $ | 38.0 | | $ | 30.0 | |

| Total current assets | | | 58.5 | | | 79.9 | | | n/a | | | 84.9 | | | 77.0 | |

| Communications, plant and other property | | | 1,058.1 | | | 1,026.6 | | | n/a | | | 895.9 | | | 727.9 | |

| Total assets | | | 1,128.0 | | | 1,115.8 | | | n/a | | | 1,030.7 | | | 939.2 | |

| Total debt(4) | | | 10.0 | | | — | | | n/a | | | 900.9 | | | 812.9 | |

| Total shareholders' equity (deficiency) | | | 1,019.0 | | | 1,001.8 | | | n/a | | | (2.9 | ) | | (5.2 | ) |

Other Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital expenditures: | | | | | | | | | | | | | | | | |

| | New satellites | | | 210.2 | | | 38.1 | | | 3.3 | | | 3.4 | | | 6.7 | |

| | Non-satellite | | | 21.2 | | | 5.4 | | | 4.4 | | | 1.0 | | | 5.4 | |

| Contractual backlog (at year end)(5) | | | 706.1 | | | 672.1 | | | n/a | | | 517.0 | | | 517.0 | |

| Ratio of earnings to fixed charges(6) | | | 11.9x | | | 5.7x | | | 4.8x | | | — | | | — | |

| | | | | | | | | | | | | | | | | |

17

Operating Data (at end of period): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Number of satellites in commercial operation (station-kept) | | | 4 | | | 5 | | | 5 | | | 5 | | | 5 | |

| Number of transponders(7): | | | | | | | | | | | | | | | | |

| | C-band | | | 123 | | | 178 | | | 178 | | | 178 | | | 178 | |

| | Ku-band | | | 74 | | | 146 | | | 146 | | | 146 | | | 146 | |

| Satellite fleet fill rate(8) | | | 67 | % | | 48 | % | | n/a | | | 55 | % | | 55 | % |

- (1)

- Reflects a one-time payment from Intelsat LLC following the successful resolution of certain longstanding frequency coordination matters.

- (2)

- As of January 1, 2002, we adopted Statement of Financial Accounting Standard ("SFAS") No. 142,Goodwill and Other Intangible Assets ("SFAS No. 142"). This standard eliminates goodwill amortization from the Consolidated Statement of Operations and requires an evaluation of goodwill for impairment upon adoption of this standard, as well as subsequent evaluations on an annual basis, and more frequently if circumstances indicate a possible impairment. Upon adoption of SFAS No. 142, we performed a transitional impairment test on the goodwill resulting from the purchase of New Skies Networks Pty Ltd. in March 2000. As a result of this impairment test, we recorded an impairment charge of approximately $23.4 million, which is classified as a cumulative effect of a change in accounting principle.

- (3)

- Basic net income (loss) per share is calculated by dividing net income (loss) by the weighted average shares outstanding. The computation of diluted net income (loss) per share is similar to basic net income (loss) per share, except that it assumes the potentially dilutive securities were converted to shares as of the beginning of the period.

- (4)

- Total debt is calculated as the sum of short-term and long-term third-party debt (including borrowings under the senior secured credit facilities, fixed and floating rate notes, and the Subordinated Shareholder PIK Loan). We pay a portion of the purchase price for each of our satellites (100% in the case of NSS-8) as in-orbit performance incentives. Our obligation to pay in- orbit performance incentives depends upon the satisfactory performance of each satellite during its contractual design life. Total debt does not include short-term and long-term satellite performance incentives, which liabilities are contingent and were $36.9 million as of December 31, 2004. Pro forma total debt reflects the use of a portion of the refund of milestone construction payments under the amended agreement for NSS-8 to repay $88.8 million of the term loan facility.

- (5)

- Contractual backlog represents the actual dollar amount (without discounting for present value) of the expected future cash payments to be received from customers under all long-term contractual satellite service agreements, which may extend to the end of the life of the satellite or beyond to a replacement satellite. Contractual backlog is attributable to both satellites currently in orbit and those planned for future launch.

- (6)

- For purposes of calculating the ratio of earnings to fixed charges, earnings are defined as income (loss) before income tax expense (benefit) and cumulative effect of a change in accounting principle plus fixed charges less capitalized interest. Fixed charges consist of interest costs on all indebtedness (including amortization of financing costs) plus one-third of rent expense which management believes is representative of the interest component of rent expense. Our earnings were insufficient to cover our fixed charges by approximately $21.4 million and $65.3 million for the period from November 2, 2004 to December 31, 2004 and the pro forma year ended December 31, 2004, respectively.

- (7)

- Number of transponders reflects transponder capacity available for service and is calculated based upon the total number of transponders, stated in 36 MHz equivalents. See "Business—Our Satellites—Overview of satellite fleet" for additional information.

- (8)

- Satellite fleet fill rate is defined as the number of our revenue-generating transponders (expressed in 36 MHz units) divided by our transponder capacity available for service. In April 2002, NSS-7 was launched, and following the transition of traffic from NSS-K and NSS-5, entered commercial service in August 2002. NSS-5 was then drifted to the Pacific Ocean region and entered commercial service in January 2003 at its new orbital location. Following the launch of NSS-6 in December 2002, it entered commercial service in February 2003. Our 2002 and 2003 satellite fleet fill rates do not include our NSS-513 satellite, which we operated in an inclined orbit and removed from service in 2003. See also "Business—Our Satellites—Overview of satellite fleet."

18

RISK FACTORS

You should carefully consider the risks described below, together with the other information in this prospectus, before you make a decision to tender your outstanding notes in the exchange offers. If any of the events described in the risk factors below actually occur, our business, financial condition, operating results and prospects could be materially adversely affected, which in turn could adversely affect our ability to pay interest or principal on the exchange notes. In such case, you may lose all or part of your original investment.

Risks Related To The Exchange Offers

There may be adverse consequences if you do not exchange your outstanding notes.

If you do not exchange your outstanding notes for exchange notes in the applicable exchange offer, you will continue to be subject to restrictions on transfer of your outstanding notes as set forth in the offering memorandum distributed in connection with the private offering of the outstanding notes. In general, the outstanding notes may not be offered or sold unless they are registered or exempt from registration under the Securities Act and applicable state securities laws. Except as required by the registration rights agreements, we do not intend to register resales of the outstanding notes under the Securities Act. You should refer to "Summary—The Exchange Offers" and "The Exchange Offers" for information about how to tender your outstanding notes.

The tender of outstanding notes under the exchange offers will reduce the principal amount of the outstanding notes outstanding, which may have an adverse effect upon, and increase the volatility of, the market prices of the outstanding notes due to a reduction in liquidity.

Risks Relating to Our Indebtedness and the Exchange Notes

We have a substantial amount of indebtedness, which may adversely affect our cash flow and our ability to operate our business, comply with our debt covenants and repay our indebtedness, including the notes.

As of December 31, 2004 on a pro forma basis after giving effect to the Transactions, the amended agreement for NSS-8 and the application of the net proceeds therefrom, we would have had outstanding indebtedness of $812.9 million and availability of $71.9 million (including standby letters of credit of $2.3 million) under the revolving credit facility.

Our substantial indebtedness could have important consequences to you. For example, it could:

- •

- make it more difficult for us to satisfy our obligations with respect to our indebtedness, including the notes, and any failure to comply with the obligations of any of our debt instruments, including financial and other restrictive covenants, could result in an event of default under the indentures governing the notes and the agreements governing such other indebtedness, which could lead to, among other things, cross default and acceleration of our indebtedness;

- •

- require us to dedicate a substantial portion of our cash flow to pay principal and interest on our debt, which will reduce the funds available for working capital, capital expenditures, acquisitions and other general corporate purposes;

- •

- limit our flexibility in planning for and reacting to changes in our business and in the industry in which we operate;

- •

- make us more vulnerable to adverse changes in general economic, industry and competitive conditions and adverse changes in government regulation;

19

- •

- limit our ability to borrow additional amounts for working capital, capital expenditures, acquisitions, debt service requirements, execution of our growth strategy or other purposes; and

- •

- place us at a disadvantage compared to our competitors who have less debt.

Any of the above listed factors could materially and adversely affect our business and results of operations. Furthermore, our interest expense could increase if interest rates increase because the entire amount of debt under the outstanding and exchange senior floating rate notes and the senior secured credit facilities bears interest at floating rates. Based on the outstanding floating rate indebtedness as of December 31, 2004, a 1% increase in the average interest rate would increase future interest expense by approximately $4.5 million per year. If we do not have sufficient earnings to service our debt, we may be required to refinance all or part of our existing debt, sell assets, borrow more money or sell securities, which we may not be able to do.

We will be able to incur significant additional indebtedness in the future. Although the indentures governing the notes and the credit agreement governing the senior secured credit facilities contain restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of important qualifications and exceptions and the indebtedness incurred in compliance with these restrictions could be substantial. If new debt is added to our anticipated debt levels, the related risks that we now face, including those described above, could intensify.

To service our indebtedness, we will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control, and any failure to meet our debt service obligations could harm our business, financial condition and results of operations.

For the year ended December 31, 2004, on a pro forma basis after giving effect to the Transactions, the amended agreement for NSS-8 and the application of the net proceeds therefrom, our payment obligations with respect to our indebtedness (excluding satellite performance incentives) would have consisted of approximately $3.7 million of principal payments. In addition, for the year ended December 31, 2004, we would have had approximately $41.1 million of cash interest payments. Our ability to pay interest on and principal of the notes and to satisfy our other debt obligations principally will depend upon our future operating performance. As a result, prevailing economic conditions and financial, business and other factors, many of which are beyond our control, will affect our ability to make these payments.

If we do not generate sufficient cash flow provided by operating activities to satisfy our debt service obligations, we may have to undertake alternative financing plans, such as refinancing or restructuring our indebtedness, selling assets, reducing or delaying capital investments or seeking to raise additional capital. Our ability to restructure or refinance such debt will depend on the capital markets and our financial condition at such time. Any refinancing of our debt could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. In addition, the terms of existing or future debt instruments, including the senior secured credit facilities and the indentures governing the notes, may restrict us from adopting some of these alternatives. Furthermore, the investment funds do not have any obligation to provide us with debt or equity financing in the future. Our inability to generate sufficient cash flow to satisfy the debt service obligations, or to refinance our obligations on commercially reasonable terms, would have an adverse effect, which could be material, on our business, financial position, results of operations and cash flows, as well as on our ability to satisfy our obligations in respect of the notes and the senior secured credit facilities.

20

The terms of the senior secured credit facilities and the indentures governing the notes may restrict our current and future operations, particularly our ability to respond to changes in our business or to take certain actions.

The senior secured credit facilities and the indentures governing the notes contain, and any future indebtedness would likely contain, a number of restrictive covenants that impose significant operating and financial restrictions on us, including restrictions that may limit our ability to engage in acts that may be in our best long-term interests. The senior secured credit facilities include financial covenants, including requirements that we:

- •

- maintain a minimum interest coverage ratio; and

- •

- not exceed a maximum total leverage ratio.

In addition, the senior secured credit facilities will limit our ability to make capital expenditures and will require that we use proceeds of certain asset sales that are not invested in our business to repay indebtedness under the senior secured credit facilities.

The senior secured credit facilities also include covenants restricting, among other things, our ability to:

- •

- incur liens;

- •

- incur additional debt (including guaranties);

- •

- pay dividends, or make redemptions and repurchases, with respect to capital stock;

- •

- prepay, or make redemptions and repurchases, of subordinated debt;

- •

- make loans and investments;

- •

- reduce our insurance coverage;

- •

- engage in mergers, consolidations, acquisitions, disposition of assets and sale/leaseback transactions;

- •

- change the business conducted by New Skies Holding B.V. and its subsidiaries; and

- •

- amend the terms of subordinated debt.

The indentures relating to the notes contain numerous covenants including, among other things, restrictions on our ability to:

- •

- incur additional debt or issue preferred stock;

- •

- pay dividends or make distributions on capital stock or repurchase capital stock;

- •

- make certain investments;

- •

- create liens on assets to secure debt;

- •

- enter into transactions with affiliates;

- •

- merge or consolidate with another company; and

- •

- transfer and sell assets.

The operating and financial restrictions and covenants in any future financing agreements may adversely affect our ability to finance future operations or capital needs or to engage in other business activities. A breach of any of the restrictive covenants in the senior secured credit facilities could result in a default under the senior secured credit facilities. If any such default occurs, the lenders under the senior secured credit facilities may elect to declare all outstanding borrowings, together with accrued

21

interest and other fees, to be immediately due and payable, enforce their security interest or require us to apply all of our available cash to repay these borrowings, any of which would result in an event of default under the notes. The lenders will also have the right in these circumstances to terminate any commitments they have to provide further borrowings. If we are unable to repay outstanding borrowings when due, the lenders under the senior secured credit facilities will have the right to proceed against the collateral granted to them to secure the debt owed to them. If the debt under the senior secured credit facilities were to be accelerated, our assets may not be sufficient to repay such debt in full or to repay the notes and our other debt. See "Description of Other Indebtedness."

None of our subsidiaries will guarantee the exchange notes, and the assets of our subsidiaries will not be available to make payments on the exchange notes.