UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO

SECTION 14(A) OF THE SECURITIES EXCHANGE ACT OF 1934

| Filed by the Registrant | ☒ |

| Filed by a party other than the Registrant |

|

| Check the appropriate box: |

|

| ☒ | | Preliminary Proxy Statement |

| | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | Definitive Proxy Statement |

| | | Definitive Additional Materials |

| | | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 |

AMBER ROAD, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| | | | |

| ☒ | | No fee required. |

| | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | |

| | | (1) | Title of each class of securities to which transaction applies: |

| | | | |

| | | (2) | Aggregate number of securities to which transaction applies: |

| | | | |

| | | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | | (4) | Proposed maximum aggregate value of transaction: |

| | | | |

| | | (5) | Total fee paid: |

| | | | |

| | | | |

| | | Fee paid previously with preliminary materials. |

| | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. |

| | | | |

| | | Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | Amount Previously Paid: |

| | | | |

| | | (2) | Form, Schedule or Registration Statement: |

| | | | |

| | | (3) | Filing Party: |

| | | | |

| | | (4) | Date Filed: |

| | | | |

PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION – DATED MARCH 25, 2019

Notice of Annual Meeting of Stockholders

To be held on , 2019

Dear Stockholders of Amber Road, Inc.,

You are cordially invited to attend the 2019 Annual Meeting of Stockholders, (the “Annual Meeting”), of Amber Road, Inc., a Delaware corporation (the “Company”), which is scheduled to be held on [________________], 2019, at [__________] [A.M./P.M.] local time, at [__________], for the following purposes:

| | 1. | To elect three directors to the Board of Directors of Amber Road (the “Board”) for a three-year term of office expiring at the 2022 Annual Meeting of Stockholders (Proposal 1); |

| 2. | To ratify the selection of KPMG LLP (“KPMG”) as our independent registered public accountants for the fiscal year ending December 31, 2019 (Proposal 2); and |

| 3. | To transact such other business as may properly come before the Annual Meeting or any continuation, postponement or adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting of Stockholders. The Board recommends: a vote “FOR” each of the three nominees for director named in the accompanying Proxy Statement and the enclosed WHITE proxy card and a vote “FOR” proposal 2.

The Board has fixed the close of business on [________________], 2019 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, this Annual Meeting. The Annual Meeting may be adjourned from time to time. At any adjourned meeting, action with respect to matters specified in this notice may be taken without further notice to stockholders, unless required by law or the Bylaws.

You are urged to complete and submit the enclosed WHITE proxy card, even if your shares were sold after such date. If your brokerage firm, bank, broker-dealer or other similar organization is the holder of record of your shares (i.e., your shares are held in “street name”), you will receive a voting instruction form from the holder of record. You must provide voting instructions by filling out the voting instruction form in order for your shares to be voted. We recommend that you instruct your broker or other nominee to vote your shares on the enclosed WHITE proxy card.

*********************

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE 2019 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON [________________], 2019

This Notice of Annual Meeting of Stockholders, the accompanying Proxy Statement, the Company’s 2018 Annual Report to Stockholders and form WHITE proxy card are available at: www.cstproxy.com/amberroad/2019.

Your vote will be especially important at the Annual Meeting. As you may know, Altai Capital Osprey, LLC (collectively with its affiliates, “Altai”) has notified the Company that it intends to nominate two individuals for election as directors to the Board in opposition to the nominees recommended by the Board. You may receive proxy solicitation materials from Altai, including proxy statements and proxy cards. The Board recommends that you disregard them. We are not responsible for the accuracy of any information provided by or relating to Altai or the nominees contained in any proxy solicitation materials filed or disseminated by, or on behalf of, Altai or any other statements that Altai or their representatives have made or may otherwise make.

PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION – DATED MARCH 25, 2019

The Board strongly and unanimously recommends that you vote on the enclosed WHITE proxy card or voting instruction form “FOR” the re-election of Rudy Howard and the election of Andre G.F. Toet and Kenneth H. Traub, the nominees proposed by the Board, and in accordance with the Board’s recommendations on the other proposals. The Board does NOT endorse Altai’s nominees and unanimously recommends that you NOT sign or return any proxy card sent to you by Altai even as a protest vote. If you have voted using the proxy card sent to you by Altai, you can subsequently revoke your vote by submitting the WHITE proxy card. If you hold your shares in street name, you may submit new voting instructions by contacting your broker or other nominee. You may also vote in person at the Annual Meeting. Only your latest-dated vote will count: any prior vote may be revoked at any time prior to the Annual Meeting as described in the accompanying Proxy Statement.

The nominees of the Board for election as directors of the Company are listed in the accompanying Proxy Statement and WHITE proxy card. IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE ANNUAL MEETING REGARDLESS OF WHETHER OR NOT YOU PLAN TO ATTEND. ACCORDINGLY, AFTER READING THE ACCOMPANYING PROXY STATEMENT, PLEASE FOLLOW THE INSTRUCTIONS ON THE ENCLOSED WHITE PROXY CARD AND PROMPTLY SUBMIT YOUR PROXY BY INTERNET, TELEPHONE OR MAIL AS DESCRIBED ON THE WHITE PROXY CARD. PLEASE NOTE THAT EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING, WE RECOMMEND THAT YOU VOTE USING THE ENCLOSED WHITE PROXY CARD PRIOR TO THE ANNUAL MEETING TO ENSURE THAT YOUR SHARES WILL BE REPRESENTED. EVEN IF YOU VOTE YOUR SHARES PRIOR TO THE ANNUAL MEETING, IF YOU ARE A RECORD HOLDER OF SHARES, OR A BENEFICIAL HOLDER WHO OBTAINS A “LEGAL” PROXY FROM YOUR BROKER, BANK, TRUSTEE, OR NOMINEE, YOU STILL MAY ATTEND THE ANNUAL MEETING AND VOTE YOUR SHARES IN PERSON.

MacKenzie Partners, Inc. (“MacKenzie”) is assisting us with our effort to solicit proxies. If you have any questions or require assistance in authorizing a proxy or voting your shares of common stock, please contact MacKenzie toll free at 1-800-322-2885 or +1-212-929-5500 or via email at amberroad@mackenziepartners.com. We are not aware of any other business, or any other nominees for election as directors, that may properly be brought before the Annual Meeting.

Whether or not you plan on attending the Annual Meeting, we encourage you to submit your proxy as soon as possible using one of three convenient methods (i) by accessing the Internet site described in the WHITE proxy card or voting instruction form provided to you, (ii) by calling the toll-free number in the WHITE proxy card or voting instruction form provided to you, or (iii) by signing, dating and returning the WHITE proxy card or instruction form provided to you.

Regardless of the number of shares of common stock of the Company that you own, your vote will be important. Thank you for your continued support, interest and investment in Amber Road.

| By Order of the Board of Directors, |

| |

| Barry M.V. Williams |

| | Chairman of the Board |

| East Rutherford, New Jersey |

| [________________], | 2019 |

PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION – DATED MARCH 25, 2019

IMPORTANT

PLEASE SIGN, DATE AND PROMPTLY RETURN THE ENCLOSED WHITE PROXY CARD IN THE ENVELOPE PROVIDED, OR GRANT A PROXY AND GIVE VOTING INSTRUCTIONS BY INTERNET OR TELEPHONE, SO THAT YOU MAY BE REPRESENTED AT THE ANNUAL MEETING. INSTRUCTIONS ARE ON YOUR WHITE PROXY CARD OR ON THE VOTING INSTRUCTION FORM PROVIDED BY YOUR BROKER.

BROKERS CANNOT VOTE ON ANY OF THE PROPOSALS WITHOUT YOUR INSTRUCTIONS.

********************

The accompanying Proxy Statement provides a detailed description of the business to be conducted at the Annual Meeting. We urge you to read the accompanying Proxy Statement, including the annexes, carefully and in their entirety.

If you have any questions concerning the business to be conducted at the Annual Meeting, would like additional copies of the Proxy Statement or need help submitting a proxy for your shares, please contact MacKenzie, the Company’s proxy solicitor:

1407 Broadway

New York, New York 10018

Toll-free: 1-800-322-2885 or +1-212-929-5500

Email:amberroad@mackenziepartners.com

PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION – DATED MARCH 25, 2019

| Proxy Statement Summary | |

| Information Concerning Voting and Solicitation | |

Background of the Solicitation

| 14 |

| Corporate Governance | |

Operating History

| 18 |

| Board of Directors Corporate Governance Highlights | 18

|

| Director Qualifications and Diversity | 20

|

| Leadership Structure | 22

|

| Board Committees and Charters | 22

|

| Board Role in Risk Oversight | 24

|

| Code of Conduct and Business Ethics | 25

|

| Certain Relationships and Related Transactions | 27

|

| Director Independence | 27

|

| Board Meetings | 27

|

| Communication with the Board | 28

|

| Corporate Governance Materials Available on Website | 28

|

| Proposal 1 - Election of Directors | 29

|

| Nominees for Election | 30

|

| Directors Continuing in Office | 31

|

| Executive Compensation Discussion | 33

|

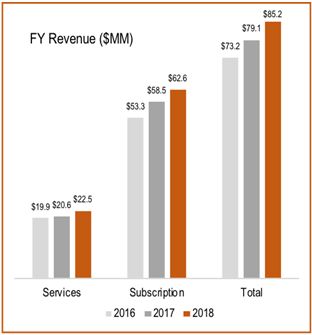

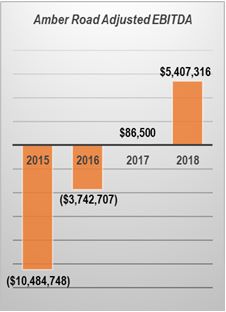

Select Financial Strategic Highlights

| 33 |

| Executive Compensation Policies and Practices | 37

|

Executive Compensation Philosophy

| 38

|

| Elements of Compensation | 42

|

| Other Compensation Agreements and Policies | 45

|

| Section 162(m) of the Internal Revenue Code | 48

|

| Executive Compensation Tables | 49

|

| Director Compensation Discussion | 52

|

| Director Compensation Table | 53

|

| Ownership of Equity Securities of the Company | 54

|

| Security Ownership of Directors and Executive Officers | 54

|

| Security Ownership of Certain Beneficial Owners | 55

|

| Equity Compensation Plan Information | 56

|

| Proposal 2 - Ratification of Independent Registered Public Accountants | 57

|

| Audit Committee Report | 58

|

| Management | 59

|

| Annual Report and Form 10-K | 60

|

| Other Matters | 61

|

Annex A

| 63 |

Annex B

| 68 |

You may vote in the following ways:

You can vote by mail by marking, signing and dating the WHITE proxy card or voting instruction form and returning it in the enclosed post-paid envelope.

You may also vote via internet and telephone, you will need the control number indicated on your WHITE proxy card or voting instruction form that accompanied your proxy materials. Internet and telephone voting is available through 11:59 p.m. ET on [________________], 2019 for all shares.

PRELIMINARY PROXY STATEMENT SUBJECT TO COMPLETION – DATED MARCH 25, 2019

This summary contains highlights about the upcoming 2019 Annual Meeting of Stockholders. This summary does not contain all of the information that you should consider in advance of the meeting and we encourage you to read the entire Proxy Statement before voting.

2019 Annual Meeting of Stockholders

| | | |

| Date and Time: | | [________________], 2019 at [_:__] [A.M./P.M.] local time |

| | | |

| Location: | | |

| | | |

| Record Date: | | [________________], 2019 |

| | | |

| Mail Date: | | The proxy materials are first being made available to our stockholders of record on or about [__________], 2019 |

Voting Matters and Board Recommendations

| | | |

| Matter | | Our Board Vote Recommendation |

Proposal 1: Election of Three Nominees to the Board (page [●]) | | FOR Rudy Howard, Andre G.F. Toet and Kenneth H. Traub |

Proposal 2: Ratification of Selection of Independent Registered Public Accountants (page [●]) | | FOR |

INFORMATION CONCERNING VOTING AND SOLICITATION |

Proxy Statement Information Concerning Voting and Solicitation

The enclosed WHITE proxy card is solicited on behalf of the Board of Directors, (the “Board”), of Amber Road, Inc., a Delaware corporation, for use at our Annual Meeting of Stockholders (the “Annual Meeting”), to be held on [ , ], 2019, at [A.M./P.M.], local time, or at any continuation, postponement or adjournment thereof, for the purposes discussed in this Proxy Statement and any business properly brought before the Annual Meeting. Amber Road, Inc. may also be referred to as Amber Road, the Company, we, us or our in this Proxy Statement. Proxies are solicited to give all stockholders of record an opportunity to vote on matters properly presented at the Annual Meeting. The Annual Meeting will be held at [ ].

The proxy materials are first being made available to stockholders of record beginning [ ] , 2019. Our proxy materials are available electronically free of charge at www.Stockholdersdocs.com/AMBR. At this website, you will find a complete set of the proxy materials including the Proxy Statement, our 2018 Annual Report to Stockholders and a WHITE proxy card. You are encouraged to access and review all of the information contained in the proxy materials before submitting a WHITE proxy or voting at the meeting.

| INFORMATION CONCERNING VOTING AND SOLICITATION |

Questions and Answers About the Annual Meeting

Why am I receiving this Proxy Statement?

The Board is soliciting your proxy to vote at our Annual Meeting because you owned shares of our common stock, $0.001 par value per share (“common stock”), at the close of business on [ ], 2019, (the “Record Date”) for the Annual Meeting, and therefore, are entitled to vote at the Annual Meeting on the following proposals:

| | • | Proposal 1: The election of three directors to serve on our Board for a three-year term of office expiring at the 2022 Annual Meeting of Stockholders; |

| | • | Proposal 2: The ratification of the selection of KPMG LLP (“KPMG”) as our independent registered public accountants for the fiscal year ending December 31, 2019; and |

| | • | Any other business as may properly come before the Annual Meeting or any continuation, postponement or adjournment thereof. |

You are receiving this Proxy Statement as a stockholder of the Company as of the Record Date for purposes of determining the stockholders entitled to receive notice of and vote at the Annual Meeting. As further described below, we request that you promptly use the enclosed WHITE proxy card to vote, by Internet, by telephone or by mail, in the event you desire to express your support of or opposition to the proposals.

THE BOARD UNANIMOUSLY RECOMMENDS VOTING “FOR” THE ELECTION OF EACH

OF THE BOARD’S NOMINEES ON PROPOSAL 1 AND “FOR” PROPOSAL 2

USING THE ENCLOSED WHITE PROXY CARD OR VOTE INSTRUCTION FORM.

THE BOARD URGES YOU NOT TO SIGN, RETURN OR VOTE ANY PROXY CARD SENT TO YOU

BY ALTAI CAPITAL OSPREY, LLC (COLLECTIVELY WITH ITS AFFILIATES, “ALTAI”)

EVEN AS A PROTEST VOTE, AS ONLY YOUR LATEST DATED PROXY CARD WILL BE COUNTED.

Is my vote important?

Your vote will be particularly important at the Annual Meeting. As you may know, the Company has received a notice from Altai regarding its intent to nominate a competing slate of directors (the “Altai Nominees”) at the Annual Meeting.

The Board recommends a vote “FOR” the election of each of the director nominees named in this Proxy Statement on the enclosed WHITE proxy card, and strongly urges you NOT to sign or return any proxy card(s) or voting instruction form(s) that you may receive from Altai.

To vote for all of the Board’s nominees, you must sign, date and return the enclosed WHITE proxy card or follow the instructions provided in the WHITE proxy card for submitting a proxy over the Internet or by telephone or vote in person at the Annual Meeting.

If you have previously signed any proxy card sent to you by Altai in respect of the Annual Meeting, you can revoke it by signing, dating and returning the enclosed WHITE proxy card or by following the instructions provided in the WHITE proxy card for submitting a proxy to vote your shares over the Internet or by telephone or voting in person at the Annual Meeting. Signing, dating and returning any proxy card that Altai may send to you, even with instructions to vote “withhold” with respect to the Altai Nominees as a protest vote, will cancel any proxy you may have previously submitted to have your shares voted for the Company’s Board nominees as only your latest dated proxy card or voting instruction form will be counted. Beneficial holders who hold their shares in “street name” should follow the voting instructions provided by their bank, broker or other nominee to ensure that their shares are represented and voted at the Annual Meeting, or to revoke prior voting instructions.

The Board urges you to sign, date and return only the enclosed WHITE proxy card.

INFORMATION CONCERNING VOTING AND SOLICITATION

|

When and where will the Annual Meeting be held?

The Annual Meeting is scheduled to be held on [ ], [ ], 2019, at[ : ] [A.M./P.M.] local time, at [ ].

Who is soliciting my vote?

The Board, on behalf of the Company, is soliciting your proxy to vote your shares of our common stock on all matters scheduled to come before the Annual Meeting, whether or not you attend in person. By completing, signing, dating and returning the WHITE proxy card or voting instruction form, or by submitting your proxy and voting instructions over the Internet or by telephone, you are authorizing the persons named as proxies to vote your shares of our common stock at the Annual Meeting as you have instructed. Proxies will be solicited on behalf of the Board by the Company’s directors, director nominees and certain executive officers and other employees of the Company. Such persons are listed in Annex A to this Proxy Statement.

Additionally, the Company has retained MacKenzie Partners, Inc. (“MacKenzie”), a proxy solicitation firm, which may solicit proxies on the Board’s behalf. You may also be solicited by press releases issued by us, postings on our corporate website or other websites or otherwise. Unless expressly indicated otherwise, information contained on our corporate website is not part of this Proxy Statement. In addition, none of the information on the other websites, if any, listed in this Proxy Statement is part of this Proxy Statement. Such website addresses are intended to be inactive textual references only.

Will there be a proxy contest at the Annual Meeting?

Altai has nominated a competing slate of two individuals for election at the Annual Meeting. Altai’s nominees have NOT been endorsed by our Board. You may receive proxy solicitation materials from Altai, including proxy statements and proxy cards. The Board recommends that you disregard them. We are not responsible for the accuracy of any information provided by or relating to Altai or the nominees contained in any proxy solicitation materials filed or disseminated by, or on behalf of, Altai or any other statements that Altai or its representatives have made or may otherwise make.

Our Board is pleased to nominate for election as director the following persons—Rudy Howard, Andre G.F. Toet and Kenneth H. Traub—named in this Proxy Statement and on the enclosed WHITE proxy card. We believe our director nominees have the breadth of relevant and diverse experiences, integrity and commitment necessary to continue to grow the Company for the benefit of all of the Company’s stockholders.

What are the Board’s recommendations?

Our Board unanimously recommends that you vote by proxy using the WHITE proxy card with respect to the proposals as follows:

| • | FOR the election of Rudy Howard, Andre G.F. Toet and Kenneth H. Traub to serve on our Board for a three-year term of office expiring at the 2022 Annual Meeting of Stockholders; and |

| • | FOR the ratification of the selection of KPMG as our independent registered public accountants for the fiscal year ending December 31, 2019. |

Why is the Board making such recommendations?

We describe each proposal and the Board’s reason for its recommendation with respect to each proposal on pages [ ] and [ ] and elsewhere in this Proxy Statement.

Who is entitled to vote at the Annual Meeting?

The Board has set [ ] [ ], 2019 as the Record Date for the Annual Meeting. You are entitled to notice and to vote if you were a stockholder of record of our common stock, as of the close of business on [ ] [ ], 2019. You are entitled to one vote on each proposal for each share of common stock you held on the Record Date. Your shares may be voted at the Annual Meeting only if you are present in person or your shares are represented by a valid proxy. At the close of business on the Record Date, there were [______________] shares of our common stock issued, outstanding and entitled to vote at the Annual Meeting.

| INFORMATION CONCERNING VOTING AND SOLICITATION |

What is the difference between a stockholder of “record” and a “street name” holder?

If your shares are registered directly in your name, you are considered the stockholder of record with respect to those shares. The Company sent the proxy materials directly to you.

If your shares are held in a stock brokerage account or by a bank, trust or other nominee, then the broker, bank, trust or other nominee is considered to be the stockholder of record with respect to those shares. You are considered to be the beneficial owner of those shares and your shares are said to be held in “street name,” and the proxy materials are being forwarded to you by that organization. Street name holders generally cannot submit a proxy or vote their shares directly and must instead instruct the broker, bank, trust or other nominee how to vote their shares. If you do not provide that organization specific direction on how to vote, your shares held in the name of that organization may not be voted and will not be considered as present and entitled to vote on any matters to be considered at the Annual Meeting. If you hold your shares in “street name,” please instruct your bank, broker, trust or other nominee how to vote your shares using the WHITE voting instruction form provided by your bank, broker, trust or other nominee so that your vote can be counted. The WHITE voting instruction form provided by your bank, broker or other nominee may also include information about how to submit your voting instructions over the Internet or by telephone, if such options are available. The WHITE proxy card accompanying this Proxy Statement will provide information regarding internet and telephone voting.

What constitutes a quorum?

The presence of the holders of a majority of the outstanding shares of our common stock entitled to vote constitutes a quorum, which is required to hold and conduct business at the Annual Meeting. At the close of business on the Record Date, [______________] shares of our common stock were outstanding and entitled to vote at the Annual Meeting. The Company has no other class of securities outstanding. Shares are counted as present at the Annual Meeting if:

| • | you are present in person at the Annual Meeting; or |

| • | your shares are represented by a properly authorized and submitted proxy (submitted over the Internet, by telephone or by mail). |

If you are a record holder and you submit your proxy, regardless of whether you abstain from voting on one or more matters, your shares will be counted as present at the Annual Meeting for the purpose of determining a quorum. If your shares are held in “street name,” your shares are counted as present for purposes of determining a quorum if your broker, bank, trust or other nominee submits a proxy covering your shares. In the absence of a quorum, the Annual Meeting may be adjourned, from time to time, by the chairman of the Annual Meeting or by vote of the holders of a majority of the shares present in person or represented by proxy at the meeting, without notice other than announcement at the meeting.

Who can attend the Annual Meeting?

Admission to the Annual Meeting is limited to stockholders and their duly appointed proxy holders as of the close of business on the Record Date with proof of ownership of our common stock, as well as valid government-issued photo identification, such as a valid driver’s license or passport. If your shares are held in “street name” and you plan to attend the Annual Meeting, you must present proof of your ownership of our common stock, such as a bank or brokerage account statement, as well as valid government-issued photo identification to be admitted to the Annual Meeting. Any holder of a proxy from a stockholder must present the proxy card, properly executed, and a copy of proof of ownership as well as valid government-issued photo identification.

We will be unable to admit anyone who does not present identification or refuses to comply with our rules of conduct for the Annual Meeting. For security reasons, you and your bags will be subject to search prior to your admittance to the Annual Meeting. These rules provide, among other things, that no cameras, recording equipment, electronic devices, large bags or packages will be permitted at the Annual Meeting. You are encouraged to submit a WHITE proxy card or voting instruction form to have your shares voted regardless of whether or not you plan to attend the Annual Meeting.

Your vote is very important. Please submit your WHITE proxy card today even if you plan to attend the Annual Meeting.

| INFORMATION CONCERNING VOTING AND SOLICITATION |

The process for voting your shares depends on how your common stock is held. Generally, you may hold common stock in your name as a “stockholder of record” or in an account with a broker, bank, trust or other nominee (i.e., in “street name”). If your shares are registered in your name, you may vote your shares in person at the Annual Meeting or by proxy whether or not you attend the Annual Meeting. You may vote using any of the following methods:

| ✓ | By Internet — Stockholders of record may be able to submit their proxies over the Internet by following the instructions described on their WHITE proxy cards. Most Amber Road stockholders who hold shares beneficially in street name may provide voting instructions by accessing the website specified on the voting instruction forms provided by their brokers, banks, trusts or nominees. Please check the voting instruction form for Internet voting availability. |

| ✓ | By Telephone — Stockholders of record may submit proxies by telephone if in the United States or Canada, as described in the telephone voting instructions on their WHITE proxy cards. Most Amber Road stockholders who hold shares beneficially in street name and live in the United States or Canada may provide voting instructions by telephone by calling the number specified on the voting instruction forms provided by their brokers, banks, trusts or nominees. Please check the voting instruction form for telephone voting availability. |

| ✓ | By Mail — Stockholders of record may submit proxies by completing, signing and dating the WHITE proxy cards and mailing them in the accompanying pre-addressed envelopes. Amber Road stockholders who hold shares beneficially in street name may provide voting instructions by mail by completing, signing and dating the voting instruction forms provided by their brokers, banks or other nominees and mailing them in the accompanying pre-addressed envelopes. |

| ✓ | In Person at the Annual Meeting — Shares held in your name as the stockholder of record may be voted in person at the Annual Meeting. Shares held beneficially in street name may be voted in person only if you obtain a legal proxy from the broker, bank, trust or nominee that holds your shares as of the Record Date, indicating that you were a beneficial owner of shares as of the close of business on such date and the number of shares that you beneficially owned at that time. Please allow adequate time to request a legal proxy from your broker, bank, trust or other nominee. |

Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions by Internet, telephone, or mail so that your vote will be counted if you later decide not to attend the Annual Meeting. The Internet and telephone voting facilities will close at11:59 P.M. ET for shares held by both stockholders of record and those who hold beneficially in street name on [ ] [ ], 2019. Stockholders who submit a proxy by Internet or telephone need not return a proxy card or the form forwarded by your broker, bank, trust or other holder of record by mail. As a reminder, only your latest dated proxy card or voting instruction form submitted will be counted at the Annual Meeting.

If you have any questions or require assistance in submitting a proxy for your shares, please call MacKenzie Partners, toll-free at 1-800-322-2885 or +1-212-929-5500.

How can I change my vote or revoke my proxy?

As a stockholder of record, if you submit a proxy, you may revoke that proxy at any time before it is voted at the Annual Meeting. Stockholders of record may revoke a proxy prior to the Annual Meeting by (i) delivering a written notice of revocation that is dated later than the date of your proxy to the attention of the Corporate Secretary at our offices at One Meadowlands Plaza, East Rutherford, New Jersey 07073, (ii) duly submitting a later-dated proxy over the Internet, by telephone or by mail, that we receive no later than , 2019 or (iii) voting at the Annual Meeting in person. Attendance at the Annual Meeting will not, by itself, revoke a proxy.

If your shares are held in the name of a broker, bank, trust or other nominee, you may change your voting instructions by following the instructions of your broker, bank, trust or other nominee. You may also vote in person at the Annual Meeting if you obtain a legal proxy from your bank, broker, trust or other nominee which holds your shares in street name.

If you have previously submitted a proxy card sent to you by Altai, you may change your vote by completing and returning the enclosed WHITE proxy card in the accompanying postage-paid envelope or by voting over the Internet or by telephone by following the instructions on your WHITE proxy card. Submitting a proxy card sent to you by Altai will revoke votes you have previously made via the Company’s WHITE proxy card. You are encouraged to discard any proxy materials sent to you by Altai as only your latest dated vote will be counted at the 2019 Annual Meeting.

| INFORMATION CONCERNING VOTING AND SOLICITATION |

Has the Company received notice from one or more stockholders that they are intending to nominate director candidates or bring proposals at the Annual Meeting?

Yes. Altai has indicated that it beneficially owns an aggregate of 2,430,357 shares of our common stock (representing approximately 8.7% of our outstanding common stock), and has delivered notice to the Company of its intention to nominate two director candidates for election to the Board at the Annual Meeting to serve a three-year term expiring at the 2022 Annual Meeting of Stockholders.

What does it mean if I receive more than one notice from the Company or WHITE proxy card?

Because Altai has submitted alternative director nominees to the Board in opposition to the nominees proposed by our Board, we may conduct multiple mailings prior to the Annual Meeting to ensure stockholders have our latest proxy information and materials to vote. In that event, we will send you a new WHITE proxy card or voting instruction form with each mailing, regardless of whether you have previously voted. You may also receive more than one set of proxy materials, including multiple WHITE proxy cards, if you hold shares that are registered in more than one account‑please vote the WHITE proxy card for every account you own. Only the latest dated proxy you submit will be counted, and IF YOU WISH TO VOTE AS RECOMMENDED BY THE BOARD, THEN YOU SHOULD ONLY SUBMIT WHITE PROXY CARDS.

What should I do if I receive a proxy card from Altai?

Altai has proposed two director nominees for election at the Annual Meeting in opposition to the nominees proposed by our Board. We expect that you may receive proxy solicitation materials from Altai, including opposition proxy statements and proxy cards. The Board strongly urges you NOT to sign or return any proxy cards or voting instruction forms that you may receive from Altai, including to vote “withhold” with respect to the Altai nominees. We are not responsible for the accuracy of any information provided by or relating to Altai or its nominees contained in any proxy solicitation materials filed or disseminated by, or on behalf of, Altai or any other statements that Altai or its representatives have made or may otherwise make. If you have already voted using the proxy card provided by Altai, you have every right to change your vote by completing and returning the enclosed WHITE proxy card or by voting over the Internet or by telephone by following the instructions provided on the enclosed WHITE proxy card or voting instruction form. Only the latest proxy you submit will be counted. If you vote “Withhold” on Altai’s nominees using the proxy card sent to you by Altai, your vote will not be counted as a vote for any of the director nominees recommended by our Board, but will result in the revocation of any previous vote you may have cast on the WHITE proxy card. If you wish to vote pursuant to the recommendation of our Board, you should disregard any proxy card that you receive other than the WHITE proxy card. If you have any questions or need assistance voting, please call MacKenzie Partners toll free at 1-800-322-2885 or +1-212-929-5500.

How will my shares be voted?

Stockholders of record as of the close of business on [________________ ____], the Record Date, are entitled to one vote for each share of our common stock held on each matter to be voted upon at the Annual Meeting. All shares entitled to vote and represented by properly submitted proxies received before the polls are closed at the Annual Meeting, and not revoked or superseded, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxies. Where a choice has been specified on the WHITE proxy card with respect to the proposals, the shares represented by the WHITE proxy card will be voted as you specify. If you return a validly executed WHITE proxy card without indicating how your shares should be voted on a matter and you do not revoke your proxy, your proxy will be voted: “FOR” the election of the director nominees as set forth on the WHITE proxy card (Proposal 1) and “FOR” the ratification of the selection of KPMG as our independent registered public accountants for the fiscal year ending December 31, 2019 (Proposal 2).

What happens if I do not specify how I want my shares voted? What is discretionary voting? What is a broker non-vote?

As a stockholder of record, if you properly complete, sign, date and return a WHITE proxy card or voting instruction form, your shares of common stock will be voted as you specify. However, if you submit a signed WHITE proxy card or submit your proxy by telephone or Internet and do not specify how you want your shares voted, the persons named as proxies will vote your shares:

| INFORMATION CONCERNING VOTING AND SOLICITATION |

| | • | “FOR” the election of the three nominees listed on the WHITE proxy card (i.e., Rudy Howard, Andre G.F. Toet and Kenneth H. Traub) to serve on our Board for a three-year term of office expiring at the 2022 Annual Meeting of Stockholders; and |

| • | “FOR” the ratification of the selection of KPMG as our independent registered public accountants for the fiscal year ending December 31, 2019. |

A “broker non-vote” occurs when a broker nominee holding shares for a beneficial owner has not received voting instructions from the beneficial owner and the broker nominee does not have discretionary authority to vote the shares. If you hold your shares in street name and do not provide voting instructions to your broker or other nominee, your shares will be considered to be broker non-votes and will not be voted on any proposal on which your broker nominee does not have discretionary authority to vote.

To the extent that Altai provides a proxy card to stockholders in street name, none of the proposals at the Annual Meeting are considered a discretionary matter. As a result, if you are a beneficial owner, then we encourage you to provide voting instructions to the bank, broker, trust or other nominee that holds your shares by carefully following the instructions provided in their notice to you.

What is the effect of abstentions and broker non-votes on voting?

Abstentions and shares that constitute broker non-votes will be counted as present at the Annual Meeting for the purpose of determining a quorum. Abstention may not be specified with respect to the election of directors (Proposal 1), and abstention with respect to Proposal 2 will have the same effect as a vote against such proposal.

A broker non-vote occurs when the broker is unable to vote on a proposal because the proposal is not routine and the stockholder who owns the shares in “street name” has not provided any voting instructions to the broker on that matter. New York Stock Exchange (“NYSE”) rules determine whether proposals are routine or not routine. If a proposal is routine, a broker holding shares for an owner in street name may vote for the proposal without voting instructions. The only proposal that would be considered routine if you do not receive proxy materials from Altai would be the ratification of the selection of KPMG as our independent registered public accountants for the fiscal year ended December 31, 2019. If a broker does not receive voting instructions for a non-routine proposal, the broker will return a proxy card without a vote on that proposal, which is usually referred to as a “broker non-vote.” We do not anticipate any of the proposals presented at the Annual Meeting will allow brokers to exercise discretionary voting power. Shares underlying broker non-votes are not counted in the tabulations of shares present at the Annual Meeting and entitled to vote on any of the proposals and, therefore, broker non-votes will have no effect on the outcome of Proposals 1 and 2.

Could other matters be decided at the Annual Meeting?

We do not expect any other items of business will be presented for consideration at the Annual Meeting other than those described in this Proxy Statement. However, by signing, dating and returning a WHITE proxy card or submitting your proxy or voting instructions over the Internet or by telephone, you will give to the persons named as proxies discretionary voting authority with respect to any matter that may properly come before the Annual Meeting, and of which we did not have notice at least by February 2, 2019, which is the date specified in our definitive proxy statement for the 2018 Annual Meeting of Stockholders, and such persons named as proxies intend to vote on any such other matter in accordance with their best judgment.

Who will count the votes?

All votes will be tabulated as required by Delaware law, the state of our incorporation, by the independent inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Shares held by persons attending the Annual Meeting but not voting and shares represented by proxies that reflect abstentions as to one or more proposals and broker non-votes will be counted as present for purposes of determining a quorum.

When will the voting results be announced?

The final voting results will be reported in a Current Report on Form 8-K, which will be filed with the Securities and Exchange Commission (“SEC”) within four business days after the Annual Meeting. If our final voting results are not available within four business days after the Annual Meeting, we will file a Current Report on Form 8-K reporting the preliminary voting results and subsequently file the final voting results in an amendment to the Current Report on Form 8-K within four business days after the final voting results are known to us.

| INFORMATION CONCERNING VOTING AND SOLICITATION |

What vote is required with respect to the proposals?

Election of Directors. Vote by a plurality of the shares present in person (including by remote communication, if applicable) or represented by proxy at the Annual Meeting and entitled to vote thereon is required for the election of directors under Proposal 1. This means that, among the Company’s nominees and the nominees proposed by Altai, the three nominees receiving the highest number of “FOR” votes of the shares entitled to be voted in the election of directors will be elected. You may vote “FOR ALL” nominees, “WITHHOLD” FOR ALL nominees, or “FOR ALL EXCEPT” the specific nominee from whom you “WITHHOLD” your vote. There is no “against” option. A properly executed proxy marked “WITHHOLD” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated. Proxies may not be voted for more than three directors and stockholders may not cumulate votes.

Ratification of Auditors. The ratification of the selection of KPMG requires the affirmative vote of the holders of a majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote on the matter. You may vote “FOR,” “AGAINST” or “ABSTAIN.” If you ABSTAIN from voting on Proposal 2, the abstention will have the same effect as an “AGAINST” vote.

Who will pay for the solicitation of proxies?

The Company will bear the entire cost of solicitation of proxies, including preparation, assembly and mailing of this Proxy Statement, the WHITE proxy card, the Notice of Annual Meeting of Stockholders and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding shares of our common stock in their names that are beneficially owned by others to forward to those beneficial owners. We may reimburse persons representing beneficial owners for their costs of forwarding the solicitation materials to the beneficial owners. Original solicitation of proxies may be supplemented by telephone, facsimile, electronic mail or personal solicitation by our directors, officers or staff members. Other than the persons described in this Proxy Statement, no general class of employee of the Company will be employed to solicit stockholders in connection with this proxy solicitation. However, in the course of their regular duties, employees may be asked to perform clerical or ministerial tasks in furtherance of this solicitation. No additional compensation will be paid to our directors, officers or staff members for such services. We have retained MacKenzie to act as a proxy solicitor in conjunction with the Annual Meeting. We have agreed to pay MacKenzie an amount not to exceed $[225,000], plus reasonable out-of-pocket expenses for proxy solicitation services. MacKenzie expects that approximately 25 of its employees will assist in the solicitation. Our aggregate expenses, including legal fees and the fees and expenses of MacKenzie, are expected to be approximately $[_____________], of which $[_______________] has been incurred as of the date of this Proxy Statement.

Annex A sets forth information relating to our directors and director nominees as well as certain of our officers and employees who are considered “participants” in our solicitation under the rules of the SEC by reason of their position as directors and director nominees of the Company or because they may be soliciting proxies on our behalf.

Do I have appraisal or dissenters’ rights?

None of the applicable Delaware law, our Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) nor our Bylaws provide for appraisal or other similar rights for dissenting stockholders in connection with any of the proposals set forth in this Proxy Statement. Accordingly, you will have no right to dissent and obtain payment for your shares in connection with such proposals.

Whom should I call if I have questions about the Annual Meeting?

MacKenzie is assisting us with our effort to solicit proxies. If you have any questions concerning the business to be conducted at the Annual Meeting, would like additional copies of the Proxy Statement or need help submitting a proxy for your shares, please contact MacKenzie, the Company’s proxy solicitor:

| INFORMATION CONCERNING VOTING AND SOLICITATION |

New York, New York 10018

Toll Free: 1-800-322-2885

+1-212-929-5500

Email:amberroad@mackenziepartners.com

THE BOARD UNANIMOUSLY RECOMMENDS VOTING “FOR” THE ELECTION OF EACH

OF THE BOARD’S NOMINEES ON PROPOSAL 1 AND “FOR” PROPOSAL 2

USING THE ENCLOSED WHITE PROXY CARD OR VOTE INSTRUCTION FORM.

THE BOARD URGES YOU NOT TO SIGN, RETURN OR VOTE ANY PROXY CARD OR VOTE INSTRUCTION FORM SENT TO

YOU BY ALTAI, EVEN AS A PROTEST VOTE, AS ONLY YOUR LATEST DATED PROXY CARD WILL BE COUNTED.

| BACKGROUND OF THE SOLICITATION |

Background of the Solicitation

Throughout 2017 and early 2018, the Company interacted with representatives of both E2open, LLC, a competitor of the Company (“E2open”), and Insight Venture Partners (“Insight”) about their expressions of interest in a potential strategic transaction with the Company. Consistent with its fiduciary duty, the Board of Directors routinely considers strategic options to build and unlock stockholder value and as part of such process periodically reviews and evaluates the Company's long-term strategic plan and the composition of its board.

On February 5, 2018, E2open privately sent an unsolicited offer to the Company to acquire all outstanding shares of the Company’s common stock that E2open did not already own, giving the Company until February 16, 2018 to respond (the “Unsolicited Offer”).

On February 9, 2018, a special meeting of the Board was held to consider the Unsolicited Offer. The Board reviewed the Unsolicited Offer and concluded that execution of the Company’s strategic plan as a standalone business would best maximize long-term stockholder value, although the Board remained open to considering potential improvements to the Unsolicited Offer that E2open or Insight could provide.

On February 12, 2018, four days prior to its expiration, E2open issued a press release publicly disclosing the Unsolicited Offer. Following the E2open press release, the Company sent a private email to E2open stating that, although the Board rejected the Unsolicited Offer, it was committed to considering any credible strategic alternative that would help achieve the objective of maximizing value for stockholders. That afternoon, the Company issued a press release announcing the Board’s rejection of the Unsolicited Offer.

On February 27, 2018, E2open/Insight sent a letter to the Board reaffirming but not improving upon the Unsolicited Offer.

On March 1, 2018, the Board met and concluded that it would reject the Unsolicited Offer given the lack of improvement made by E2open to the Unsolicited Offer.

On March 5, 2018, representatives of the Company and of Insight held a call to discuss the Unsolicited Offer. The Company noted that it remained committed to its strategic plan but was also open to hearing improved offers that would better maximize shareholder value. The representatives of the Company received no response to their invitation to Insight to improve the Unsolicited Offer.

On March 14, 2018, E2open sent a letter to the Board that re-affirmed the Unsolicited Offer and noted that the Unsolicited Offer would expire on March 30, 2018. The following day, on March 15, 2018, E2open issued a press release making its reaffirmation public.

On March 23, 2018, the Company’s senior management team spoke with representatives of Altai to discuss the Unsolicited Offer.

On March 28, 2018, Mr. Rishi Bajaj, Managing Principal of Altai, sent a letter to James Preuninger, Chief Executive Officer of the Company, and the Board, urging the Company to consider the Unsolicited Offer. Also on March 28, 2018, Mr. Preuninger replied to Mr. Bajaj to indicate that his correspondence would be forwarded to the Board. Altai did not disclose on its call or in its correspondence to the Company in March that it owned an equity interest in E2open.

On March 29, 2018, White Hat Capital Partners (“White Hat”), a stockholder of the Company, sent a letter via electronic mail to Mr. Preuninger providing White Hat’s perspective on the Unsolicited Offer.

On March 30, 2018, E2open withdrew the Unsolicited Offer.

On May 11, 2018, Mr. Preuninger and Thomas Conway, Chief Financial Officer of the Company, spoke with representatives of Altai to discuss E2open’s previous unsolicited proposal.

In the summer of 2018, after its 2018 annual meeting of shareholders and as part of its periodic evaluation of Board candidates and continuous Board enhancement process, members of the Nominating and Corporate Governance Committee had ongoing discussions with a number of potential director candidates, similar to its process which resulted in the appointment of Mr. Faison to the Board as an independent director in 2017.

On December 3, 2018, White Hat sent presentation materials to Mr. Preuninger containing White Hat’s view of the Company’s performance.

| BACKGROUND OF THE SOLICITATION |

On December 17, 2018, Altai issued a public letter to the Board demanding that it begin a process to sell the Company to E2open or another credible buyer. Altai disclosed to the Company and to the public for the first time that it owned an equity interest in E2open.

On December 20, 2018, the Company issued an public letter to stockholders acknowledging Altai’s letter and confirming the Board’s commitment to creating value for all stockholders and reviewing strategic priorities and opportunities of the Company.

On January 4, 2019, Altai demanded an inspection under Delaware law of certain books and records of the Company in connection with the Unsolicited Offer.

On January 11, 2019, Dentons US LLP, the Company’s legal counsel (“Dentons”), responded to Altai’s January 4th demand, rejecting the demand for failure to state a proper purpose and correcting Altai’s chronology of events with respect to the Unsolicited Offer.

On January 16, 2019, Barry Williams, Chair of the Board and Nominating and Corporate Governance Committee, as part of the Company’s customary Board enhancement process, conducted a call with Andre G.F. Toet about the possibility of becoming a director of the Company, and after significant discussion Mr. Toet expressed interest. Mr. Toet had been previously identified as a potential director candidate; however, until recently, Mr. Toet’s other professional obligations did not permit him to consider a directorship. Another potential candidate was considered at such time, but due to her professional commitments it was agreed to defer consideration of her candidacy until a later time.

On January 18, 2019, Schulte Roth & Zabel LLP, Altai’s legal counsel (“Schulte”), sent a letter to the Company that Altai was reconsidering whether it needed to pursue its books and records demand further in light of Dentons’ January 11th response, reserving its rights to pursue the demand further.

Also on January 18, 2019, Altai delivered a formal notice to Brad Holmstrom, General Counsel and Corporate Secretary of the Company, of its intent to nominate and solicit proxies in support of Marshall Heinberg and James Watson for election to the Board at the Annual Meeting. According to Altai’s nomination notice, Altai owned approximately 8.74% of the Company’s outstanding shares of common stock. Altai did not reach out to the Board or management team to discuss these candidates, or the composition of the Board more generally, before submitting this notice.

On January 22, 2019, the Company issued a press release confirming receipt of Altai’s nomination notice.

On January 27, 2019, Dentons sent a letter to Schulte, requesting that Altai amend and supplement its nomination notice to address several deficiencies identified therein pursuant to the Bylaws and reiterating the commitment of management and the Board to engage with stockholders.

On January 28, 2019, White Hat and Mr. Preuninger held a phone call in which White Hat advocated for the Board to add Kenneth H. Traub to the Board.

On January 31, 2019, Schulte sent a letter to Dentons to address certain deficiencies identified in Altai’s nomination notice.

Also on January 31, 2019, Jason Aintabi, Managing Partner of Blackwells Capital LLC (collectively with its affiliates, “Blackwells”), sent a letter to the Board describing his belief that Altai had a “predetermined agenda to push for the sale of the Company to a specific buyer” in which Altai had an economic stake and that Altai’s nominees “lack the relevant industry, public board and technology experience” to serve on the Board and, through Thompson Hine LLP, Blackwells’ legal counsel (“Thompson”), delivered a formal notice to Mr. Holmstrom of Blackwells’ intent to nominate and solicit proxies in support of two nominees for election to the Board at the Annual Meeting. Blackwells also notified the Company that it intended to submit certain proposals to be voted on at the Annual Meeting.

On February 1, 2019, Altai sent a supplemental nomination notice to the Company to address the remaining deficiencies previously identified by the Company in its nomination notice.

Also on February 1, 2019, Dentons sent a letter to Thompson requesting Blackwells to amend its nomination notice to address several deficiencies identified therein pursuant to the Bylaws and reiterating the commitment of management and the Board to engage with stockholders.

On February 2, 2019, Dentons sent a letter to Schulte acknowledging receipt of Schulte’s January 31, 2019 letter and Altai’s February 1, 2019 letter and Altai’s effort to bring its nomination notice in compliance with the Bylaws and giving notice that Messrs. Heinberg and Watson would receive a standard form of D&O questionnaire, as is customary to facilitate the nomination process.

Also on February 2, 2019, Thompson sent a letter to Dentons addressing the deficiencies identified in Blackwells’ nomination notice.

On February 5, 2019, Dentons sent a letter to Thompson acknowledging receipt of Thompson’s February 2, 2019 letter and Blackwells’ effort to bring its nomination notice in compliance with the Bylaws and giving notice that Blackwells’ nominees would receive a standard form of D&O questionnaire, as is customary to facilitate the nomination process.

| BACKGROUND OF THE SOLICITATION |

On February 6, 2019, as notified in its February 2, 2019 letter, Dentons sent Schulte D&O questionnaires for Messrs. Heinberg and Watson to complete and asked to schedule interviews with the Company as part of the nomination process.

Also on February 6, 2019, as notified in its February 2, 2019 letter, Dentons sent Thompson D&O questionnaires for Blackwells’ nominees to complete and asked to schedule interviews with the Company as part of the nomination process.

Also on February 6, 2019, Dentons sent David J. Chanley of White Hat Capital Partners a D&O questionnaire for Mr. Traub to complete and asked Mr. Traub to schedule an interview with the Company as part of the nomination process.

On February 8, 2019, Schulte sent a letter to Dentons refusing to have Messrs. Heinberg and Watson complete D&O questionnaires and refusing to schedule interviews with the Company without discussing a settlement agreement between Altai and the Company.

On February 11, 2019, Dentons sent a letter to Schulte expressing the Company’s disappointment at Altai’s refusal to cooperate with the Company’s nomination process by not allowing its nominees answer the Company’s standard D&O questionnaires and be interviewed by the Company’s Nominating and Corporate Governance Committee. The letter also confirmed the Company’s intent to continue to engage with Altai at a meeting scheduled for February 22, 2019.

Also on February 11, 2019, Mr. Aintabi sent a letter to the Board requesting a meeting among Mr. Preuninger, Blackwells representatives and nominees and submitting its own form of D&O questionnaires, in lieu of the D&O questionnaires requested to be completed by the Company, by Blackwells’ nominees.

On February 18, 2019, counsel for Altai and the Company discussed attendance and expectations for the February 22 meeting.

On February 22, 2019, representatives of the Company, including Messrs. Preuninger and Faison met with Altai to discuss Altai’s nomination notice and the Company’s continued plans for stockholder engagement.

On February 24, 2019, Mr. Preuninger sent an email to Altai thanking Altai for sharing its views and noting that Amber Road looked forward to receiving a proposal with mutually agreeable solutions that would benefit all stockholders.

On February 25, 2019, as part of his interview process that began in the summer of 2018, Mr. Toet visited the Company’s offices and was interviewed by Messrs. Preuninger and Conway, who further discussed his professional background and potential service as a member of the Board. Mr. Toet then met with Nathan Pieri, Chief Product Officer, to discuss Company products and technology.

Also on February 25, 2019, Dentons spoke with, and emailed, Michael Ching of Blackwells to confirm the scheduling of an in-person meeting at the offices of the Company between representatives of the Company and of Blackwells, including Messrs. Aintabi and Ching and Blackwells’ nominees.

On February 26, 2019, Dentons discussed with Schulte potential features of a framework for settlement, where Schulte communicated Altai’s demand that the Board agree to add two new directors.

On March 5, 2019, representatives of Amber Road, including Messrs. Preuninger, Faison, Conway and Barry Williams, met with representatives of Blackwells, including Messrs. Aintabi and Ching and Blackwells’ nominees to discuss Blackwells’ nomination notice and stockholder proposals. At the March 5th meeting, Blackwells confirmed it would not solicit proxies for its nominees and proposals.

Also on March 5, 2019, David Chanley of White Hat spoke with Mr. Faison regarding White Hat’s recommendation of, and support for, Kenneth H. Traub as a potential member of the Board.

On March 6, 2019, the Board and the Nominating and Corporate Governance Committee met to discuss the status of potential nominees to the Board.

On March 7, 2019, Dentons presented an updated potential settlement framework to Schulte.

Also on March 7, 2019, Messrs. Faison and Howard, members of the Nominating and Corporate Governance Committee, held a conference call interview with Mr. Toet.

On March 8, 2019, Schulte responded to Dentons’ March 7th proposal.

On March 12, 2019, Altai delivered a letter to the Company demanding an inspection pursuant to applicable Delaware law of the Company’s stockholder lists and certain other related books and records.

On March 19, 2019, Dentons responded to Altai’s demand, stating that the Company was prepared to make available information to which a shareholder is entitled under applicable Delaware law, subject to satisfaction of customary conditions including confidential treatment of the information provided by the Company.

| BACKGROUND OF THE SOLICITATION |

On March 13, 2019, Dentons notified Schulte of the Company’s intent to communicate a potential cooperative framework for settlement discussion purposes.

On March 14, 2019, the Board and the Nominating and Corporate Governance Committee met to discuss the status of potential nominees to the Board in greater detail.

On March 17, 2019, Dentons circulated a term sheet to Schulte containing a potential cooperative framework for settlement discussion purposes, which included agreeing to Altai’s settlement demand to expand the Board by two seats. The term sheet proposed to nominate Messrs. Toet and Traub for election to the Board at the Annual Meeting to fill the vacant seats on the Board as a result of this proposed expansion.

On March 18, 2019, Schulte indicated that it did not accept the previously circulated potential cooperative framework term sheet. Dentons explained to Schulte that the Board welcomed Altai to speak with Messrs. Toet and Traub about their candidacies as potential directors.

On March 21, 2019, the Board and the Nominating and Corporate Governance Committee formally met to discuss the status of potential director nominees and unanimously voted to expand the size of the Board from five to seven directors to be effective as of the date of the Annual Meeting, to approve invitations to Messrs. Toet and Traub to join the Board, to submit their nominations for inclusion in Proposal 1 for the election of directors to be considered at the Annual Meeting and to recommend a vote “FOR” the election of each of the Board’s nominees and “FOR” the ratification of the selection of KPMG as the Company’s independent registered public accountants.

On March 25, 2019, the Company filed a preliminary proxy statement with the SEC.

OUR BOARD STRONGLY URGES YOU NOT TO SIGN OR RETURN ANY PROXY CARD OR VOTING INSTRUCTION FORM THAT YOU MAY RECEIVE FROM ALTAI, EVEN TO VOTE “WITHHOLD” AS A PROTEST VOTE WITH RESPECT TO THE ALTAI NOMINEES, AS DOING SO WILL CANCEL ANY PROXY YOU MAY HAVE PREVIOUSLY SUBMITTED TO HAVE YOUR SHARES VOTED FOR THE BOARD’S NOMINEES ON A WHITE PROXY CARD, AS ONLY YOUR LATEST PROXY CARD OR VOTING INSTRUCTION FORM WILL BE COUNTED.

Corporate Governance

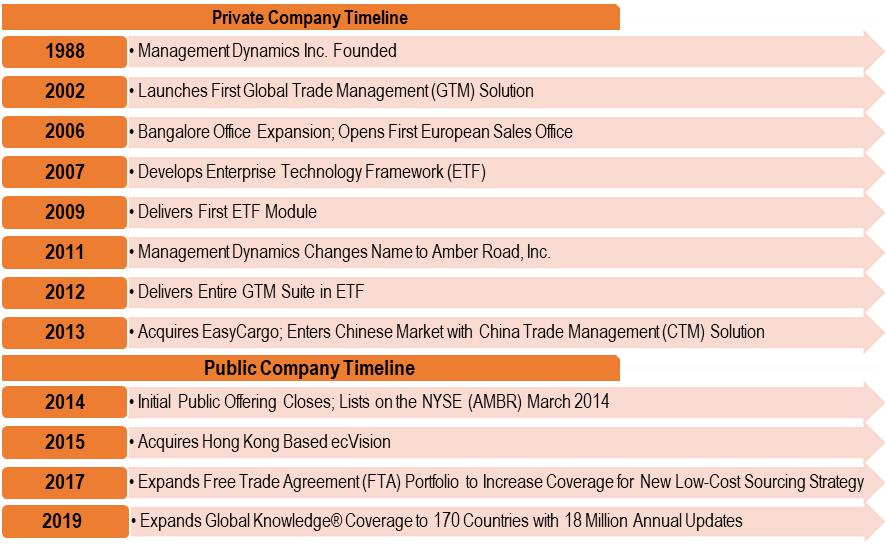

The Company’s history as a private and public company is below:

Board of Directors Corporate Governance Highlights Our Board has adopted, and is governed by, our Corporate Governance Guidelines, which are amended from time to time to incorporate certain current best practices in corporate governance. Our Corporate Governance Guidelines may be found on our website at www.investor.amberroad.com/corporate-governance and are available in print upon written request to the Company’s Corporate Secretary at our principal executive offices at Amber Road, One Meadowlands Plaza, East Rutherford, New Jersey 07073. Highlights of our Corporate Governance Guidelines include the following:

| Ø | Independent Chairman. Although our Corporate Governance Guidelines do not require an independent Chairman, we have maintained an independent Chairman since prior to becoming a public company. |

| Ø | Independent Directors. All of our directors qualify as independent under NYSE regulations, with the exception of our Chief Executive Officer. |

| Ø | Independent Committees. The Board has three standing committees — Audit, Compensation, and Nominating and Corporate Governance. Each committee is comprised solely of independent directors. |

| Ø | Regular Executive Sessions of Independent Directors. Our independent directors meet privately at every regular Board meeting with our independent Chairman presiding over such meetings. |

| | Ø | Board Access to Management. Our directors have ready access to our management. Key members of management attend Board and committee meetings to present information concerning various aspects of the Company, its operations and results. |

| | Ø | Board Authority to Retain Outside Advisors. Our Board and committees have the authority to retain outside advisors. |

| Ø | Board Review of Executive Officer Performance. The Board, on an annual basis, reviews the performance of its Chief Executive Officer and other named executive officers. |

| Ø | Succession Planning. The Board, on an annual basis, reviews and updates the Company’s succession plan. |

| Ø | Director Changes in Circumstances Evaluated. If a director has a substantial change in principal business or professional affiliation or responsibility, including a change in principal occupation, he or she must notify the Chairman and then it is within the decision of the Nominating and Corporate Governance Committee to determine whether resignation is in the best interest of the Company and stockholders. |

| Ø | Director Outside Relationships Require Pre-Approval. Without the prior approval of disinterested members of the Board, directors should not enter into any transaction or relationship with the Company in which they will have a financial or a personal interest or any transaction that otherwise involves a conflict of interest. |

| Ø | Director Conflicts of Interest. If an actual or potential conflict of interest arises for a director or a situation arises giving the appearance of an actual or potential conflict, the director must promptly inform the Chairman. All directors will recuse themselves from any discussion or decision found to affect their personal, business or professional interests. |

| Ø | Regular Board and Committee Evaluations. The Board has an annual evaluation process which focuses on its role and effectiveness, including that of its committees, as well as fulfillment of its fiduciary duties. Our Board believes that a robust annual evaluation process is a critical part of its governance practices. Accordingly, the Nominating and Corporate Governance Committee oversees an annual evaluation of the performance of the Board. The Nominating and Corporate Governance Committee approves written evaluation questionnaires that are distributed to each director. The results of each written evaluation are provided to, and compiled by, the chair of the Nominating and Corporate Governance Committee. The chair of the Nominating and Corporate Governance Committee discusses the results of the performance evaluations with the full Board. Our Board, with the assistance of the Company’s general counsel, utilizes the results of these evaluations in making decisions on director nominees, Board agendas, Board structure, composition and effectiveness and committee assignments. As a result of past Board evaluations, we have made changes to Board meeting agenda and the form and scope of materials provided to directors. The results of the evaluations are reported to and reviewed by the full Board. For 2018, the Nominating and Corporate Governance Committee was satisfied with the Board’s performance and considered the Board to be operating effectively. |

| Ø | Mandatory Retirement Age. No Board member may be nominated to a new term if he or she would be age 75 or older on the date the election is held. |

| Ø | Overboarding. The Company’s policy is that (i) a non-employee Company director may serve on no more than five publicly-traded companies’ boards in addition to the Company’s Board, and (ii) a Company director, who is also a full-time employee of the Company, may serve on no more than one publicly-traded company’s board in addition to the Company’s Board. No director or nominee currently serves on more than three boards in addition to the Company's Board and the Board is considering a revision of its policy from five to four. |

| Ø | Stock Ownership Guidelines. The Company’s Stock Ownership Guidelines provide that our non-employee directors and our Chief Executive Officer shall attain an investment position in our common stock having a value that is at least equal to two times total annual compensation and five times base salary, respectively, within the later of five years of the adoption of the ownership guidelines or from the date of appointment or election. The Board believes that meaningful ownership of the Company’s common stock helps align the interests of the Company’s CEO and directors with those of its stockholders and is consistent with the Company’s commitment to sound corporate governance. |

| Ø | Recoupment Policy. Under our Compensation Recoupment Policy, we expressly reserve the right to claw-back or recoup incentive-based or other compensation (including equity-based compensation) paid to any named executive officer if we are required to prepare an accounting restatement as a result of our material noncompliance with any financial reporting regulations. |

| Ø | Hedging Policy. Under our Insider Trading Policy, we expressly prohibit (i) purchasing any financial instrument that is designed to hedge or offset any decrease in the market value of the Company’s common stock; (ii) engaging in short sales related to the Company’s common stock; or (iii) entering into any other transaction in which such person will profit if the value of the Company’s common stock falls. |

Director Qualifications and Diversity

Our Nominating and Corporate Governance Committee is responsible for identifying, evaluating and recommending candidates to the Board for election as a director of the Company. The Committee may use outside consultants to assist in identifying candidates and will also consider advice and recommendations from stockholders, management, and others as it deems appropriate.

Director candidates are evaluated in light of the then-existing composition of the Board, and the background and areas of expertise of existing directors and potential nominees. The Nominating and Corporate Governance Committee also considers the specific needs of the various Board committees. Our Nominating and Corporate Governance Committee will consider persons recommended by stockholders for inclusion as nominees for election to our Board. Stockholders wishing to recommend director candidates for consideration by the Committee may do so by writing to our Corporate Secretary at our principal executive offices set forth in this Proxy Statement provided that such nominations comply with the requirements of our Bylaws and Corporate Governance Guidelines. The evaluation process for director nominees who are recommended by our stockholders is the same as for any other nominee and is based on numerous factors that our Nominating and Corporate Governance Committee considers appropriate, some of which may include strength of character, mature judgment, career specialization, relevant technical skills, diversity reflecting ethnic background, gender, and professional experience, and the extent to which the nominee would fill a present need on our Board of Directors. The Nominating and Corporate Governance Committee will seek not only to identify potential Board candidates that would bring particular skills and experience to the Board, but also add to the gender and/or ethnic diversity of the Board.

The Nominating and Corporate Governance Committee also evaluates director qualifications on a holistic as well as individual basis. The backgrounds and qualifications of the directors considered as a group should provide a significant breadth of experience, knowledge and abilities that should assist the Board in fulfilling its responsibilities and the Board shall periodically review and update the criteria as deemed necessary. According to the Company’s Corporate Governance Guidelines, personal experience, as well as background, race, gender, age and nationality should be reviewed for the Board as a whole and diversity in these factors should be taken into account in considering individual candidates.

In its evaluation of director candidates, the Nominating and Corporate Governance Committee looks to the “Criteria for Nomination as a Director” as set forth in the Corporate Governance Guidelines, and considers the following:

| • | Nominees should have a reputation for integrity, honesty and adherence to high ethical standards. |

| • | Nominees should have demonstrated business acumen, experience and ability to exercise sound judgments in matters that relate to the current and long-term objectives of the Company, and should be willing and able to contribute positively to the decision-making process of the Company. |

| • | Nominees should have a commitment to understand the Company and its industry and to regularly attend meetings of the Board and its committees. |

| • | Nominees should have the interest and ability to understand the sometimes conflicting interests of the various constituencies of the Company, which include stockholders, employees, customers, creditors and the general public, and to act in the interests of all stockholders. |

| • | Nominees should not have, nor appear to have, a conflict of interest that would impair the nominee’s ability to represent the interests of all the Company’s stockholders and to fulfill the responsibilities of a director. |

| • | Nominees’ contributions to the diversity of the Board, including with respect to background, race, gender, age and nationality, will be considered and nominees will not be discriminated against on the basis of race, religion, national origin, sex, sexual orientation, disability or any other basis proscribed by law. |

The re-nomination of existing directors is not viewed as automatic, but will be based on continuing qualification under the criteria set forth above. In addition, the Committee will consider the existing directors’ performance on the Board and any committee, which may include consideration of the extent to which the directors undertook continuing director education. The backgrounds and qualifications of the directors considered as a group should provide a significant breadth of experience, knowledge and abilities that will assist the Board in fulfilling its responsibilities.

The Nominating and Corporate Governance Committee will also consider (i) any specific minimum qualifications that it believes must be met by a nominee for a position on the Board, (ii) any specific qualities or skills that it believes are necessary for one or more of the Board members to possess, and (iii) the desired qualifications, expertise and characteristics of Board members, with the goal of developing an experienced and highly qualified Board. In making its recommendations, the Committee will consider the number of other public company boards and other boards (or comparable governing bodies) on which a prospective nominee is a member, as well as his or her other professional responsibilities.

Among other things, Board members should possess demonstrated breadth and depth of management and leadership experience, financial and/or business acumen or relevant industry or scientific experience, integrity and high ethical standards, sufficient time to devote to the Company’s business, the ability to oversee, as a director, the Company’s business and affairs for the benefit of our stockholders, and a demonstrated ability to think independently and work collaboratively. In addition, although the Nominating and Corporate Governance Committee does not maintain a formal diversity policy, the Committee considers diversity in its determinations. Diversity includes race, ethnicity, age and gender and is also broadly construed to take into consideration many other factors, including industry knowledge, operational experience, scientific and academic expertise, geography and personal backgrounds. Currently, our Board includes one woman and the members hail from different areas of the United States and one from Europe.

The Nominating and Corporate Governance Committee is responsible for assessing, together with the Board, the appropriate skills, experience and background that we seek in Board members in the context of our business and the existing composition of the Board. This assessment of Board skills, experience and background includes, among other criteria, the factors set forth below. The Board then determines whether a nominee's background, experience, personal characteristics, and skills would advance the Board's goal of creating and sustaining a Board that can support and oversee the Company's complex activities. Our Board is committed, as set forth under our Corporate Governance Guidelines, to considering diversity among directors and director candidates, and the Board reviews and assesses the effectiveness of its practices for consideration of diversity in nominating director candidates.

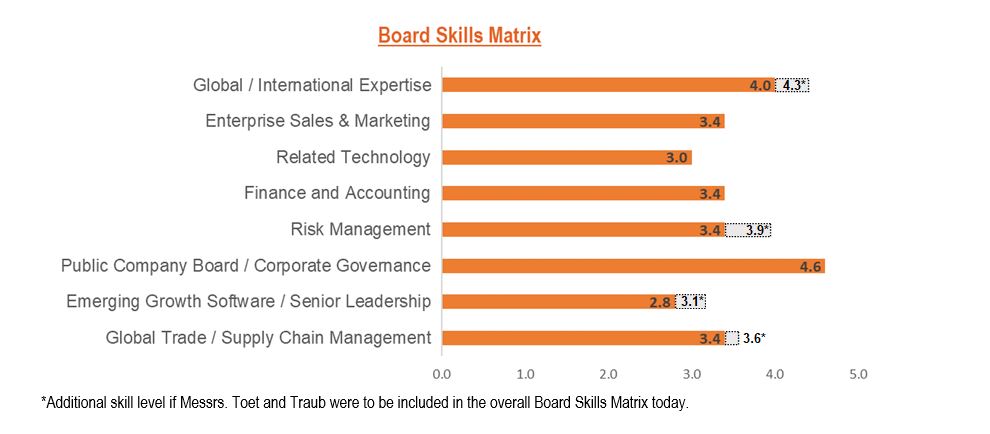

Listed below are the director skills and experience that we consider important in light of our current business and structure. The current directors collectively have a mix of various skills and qualifications, as set forth in the skills matrix below. Each director’s level of experience, on a scale of 5 (high) to 0 (no experience) for each skill, has been compiled below: